Guidance Update Call NEED NEW IMAGE THAT WE SENT June 27, 2022 Exhibit 99.1

2 Forward-Looking Statements This presentation includes information that may constitute “forward-looking statements” made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements generally relate to future events and relationships, plans, future growth, and future performance, including, but not limited to, statements about future financial and operational performance, the expected effects and benefits of the acquisition of Cloudmed, the strategic direction of the combined company, the Company’s other strategic initiatives, capital plans, costs, ability to successfully implement new technologies, and liquidity. These statements are often identified by the use of words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “designed,” “may,” “plan,” “predict,” “project,” “target,” “contemplate,” “would,” “seek,” “see,” and similar expressions or variations or negatives of these words, although not all forward-looking statements contain these identifying words. These statements are based on various assumptions, whether or not identified in this presentation, and on the current expectations of the Company’s management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, assurance, prediction or definitive statement of fact or probability. Actual outcomes and results may differ materially from those contemplated by these forward-looking statements as a result of uncertainties, risks, and changes in circumstances, including but not limited to risk and uncertainties related to: (i) the Company’s ability to timely and successfully achieve the anticipated benefits and potential synergies from the acquisition of Cloudmed; (ii) the Company's ability to retain existing customers or acquire new customers; (iii) the development of markets for the Company's revenue cycle management offering; (iv) variability in the lead time of prospective customers; (v) competition within the market; (vi) breaches or failures of the Company's information security measures or unauthorized access to a customer's data; (vii) delayed or unsuccessful implementation of the Company's technologies or services, or unexpected implementation costs; (viii) disruptions in or damages to the Company's global business services centers and third-party operated data centers; and (ix) the impact of the COVID-19 pandemic on the Company's business, operating results, and financial condition. Additional risks and uncertainties that could cause actual outcomes and results to differ materially from those contemplated by the forward-looking statements are included under the heading “Risk Factors” in the Company’s annual report on Form 10-K for the year ended December 31, 2021, quarterly reports on Form 10-Q, the proxy statement relating to the Company’s annual meeting and the acquisition of Cloudmed, and any other periodic reports that the Company may file with the United States Securities and Exchange Commission (the “SEC”). The foregoing list of factors is not exhaustive. All forward-looking statements included herein are expressly qualified in their entirety by these cautionary statements as of the date hereof and involve many risks and uncertainties that could cause the Company’s actual results to differ materially from those expressed or implied in the Company’s forward-looking statements. Subsequent events and developments, including actual results or changes in the Company’s assumptions, may cause the Company’s views to change. The Company assumes no obligation and does not intend to update these forward-looking statements, except as required by law. You are cautioned not to place undue reliance on such forward-looking statements. Non-GAAP Financial Information Some of the financial information and data contained in this presentation, including Adjusted EBITDA (and related measures), have not been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). Adjusted EBITDA may be calculated differently from, and therefore may not be comparable to, similarly titled measures used by other companies. This non-GAAP financial measure should not be considered in isolation or as a substitute for analysis of our results of operations as reported under GAAP. Please refer to the Appendix located at the end of this presentation for a reconciliation of non-GAAP financial measures to their most directly comparable GAAP financial measure.

3 Lee Rivas President Presenters Joseph Flanagan Chief Executive Officer Rachel Wilson Chief Financial Officer & Treasurer

4 Transaction Recap and Cloudmed Update

5 Leading data and analytics-driven revenue intelligence platform Leading end-to-end technology- driven platform to manage healthcare provider revenue Powerful Combination of Market-leading Platforms ▪ Accelerates growth by unlocking full market potential ▪ Extends leadership in revenue cycle automation ▪ Enables significant future innovation fueled by data footprint ▪ Flexible engagement models across all care settings ▪ Significant revenue and cost synergies ▪ Accretive to EPS and cash flow per share in 2023 Strategic and Financial Highlights

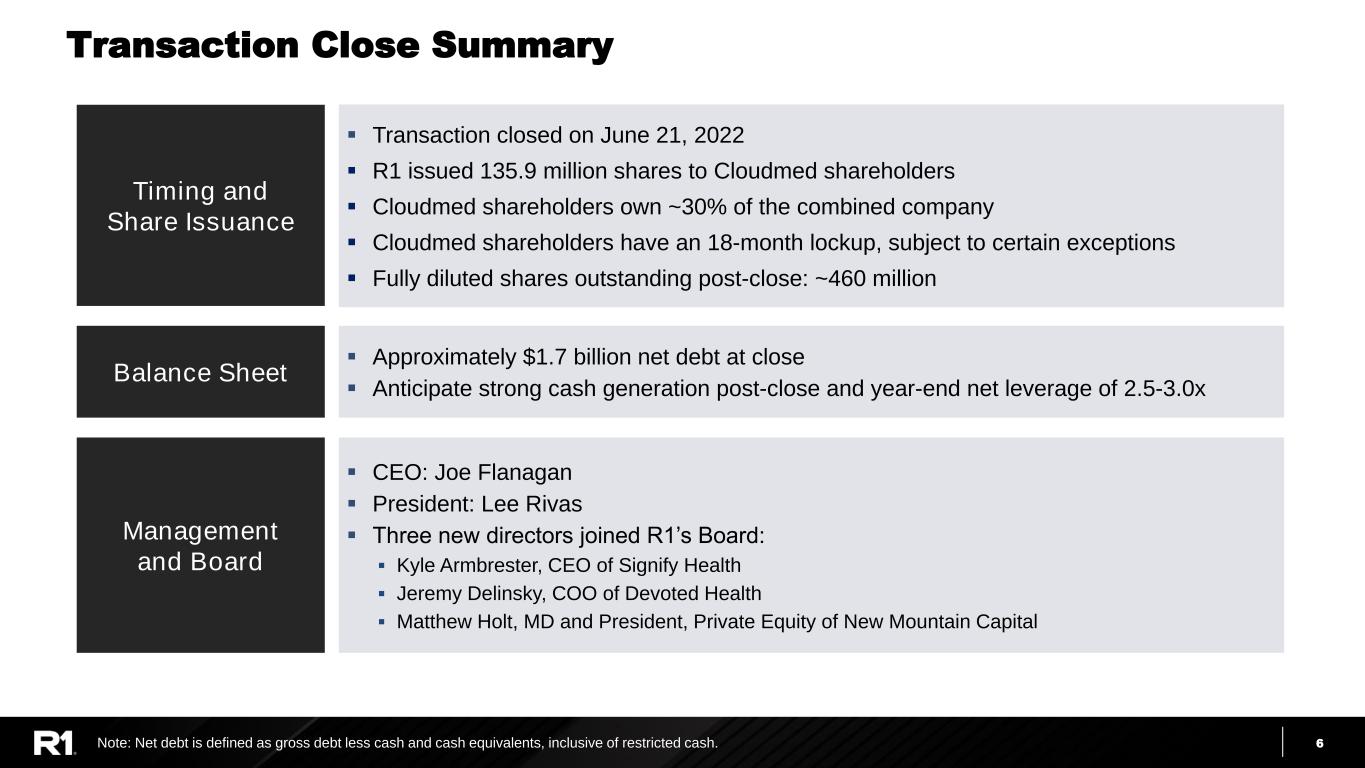

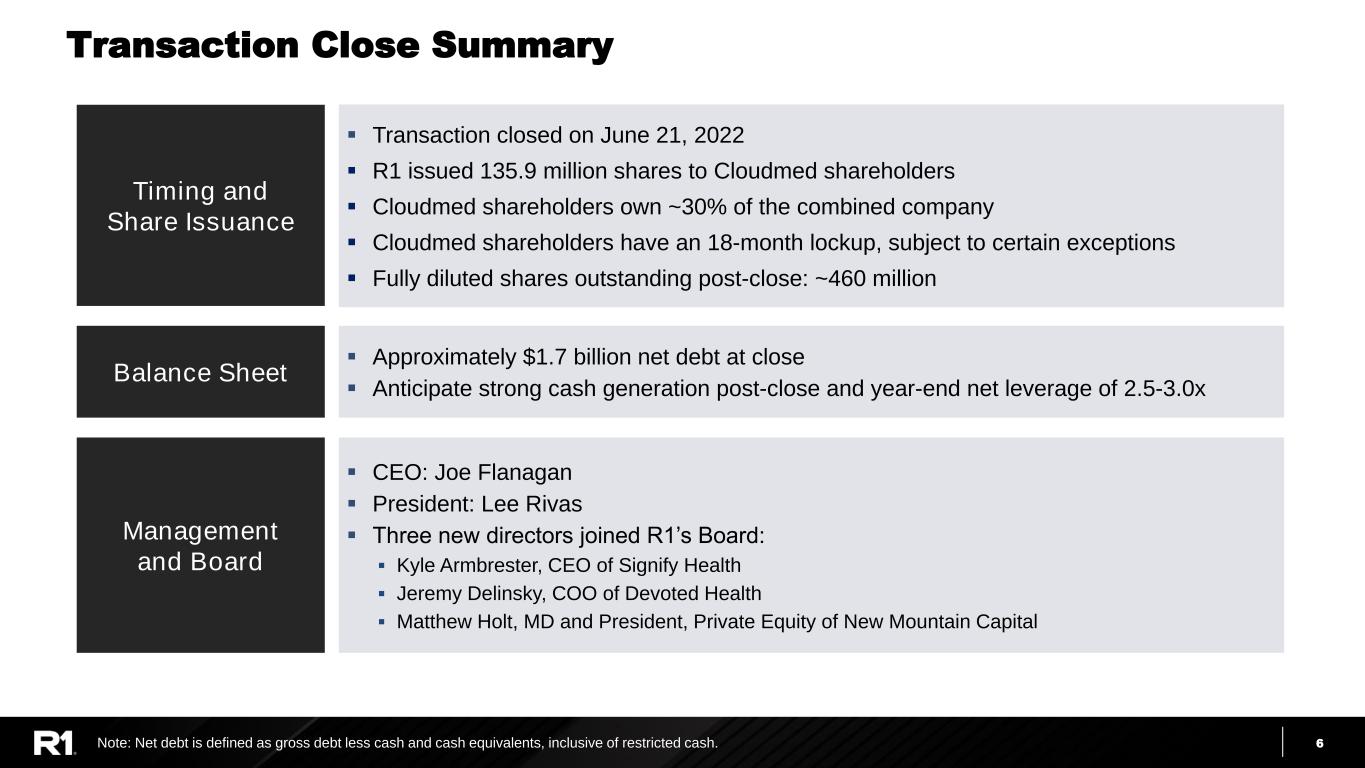

6 Management and Board ▪ CEO: Joe Flanagan ▪ President: Lee Rivas ▪ Three new directors joined R1’s Board: ▪ Kyle Armbrester, CEO of Signify Health ▪ Jeremy Delinsky, COO of Devoted Health ▪ Matthew Holt, MD and President, Private Equity of New Mountain Capital Timing and Share Issuance ▪ Transaction closed on June 21, 2022 ▪ R1 issued 135.9 million shares to Cloudmed shareholders ▪ Cloudmed shareholders own ~30% of the combined company ▪ Cloudmed shareholders have an 18-month lockup, subject to certain exceptions ▪ Fully diluted shares outstanding post-close: ~460 million Balance Sheet ▪ Approximately $1.7 billion net debt at close ▪ Anticipate strong cash generation post-close and year-end net leverage of 2.5-3.0x Transaction Close Summary Note: Net debt is defined as gross debt less cash and cash equivalents, inclusive of restricted cash.

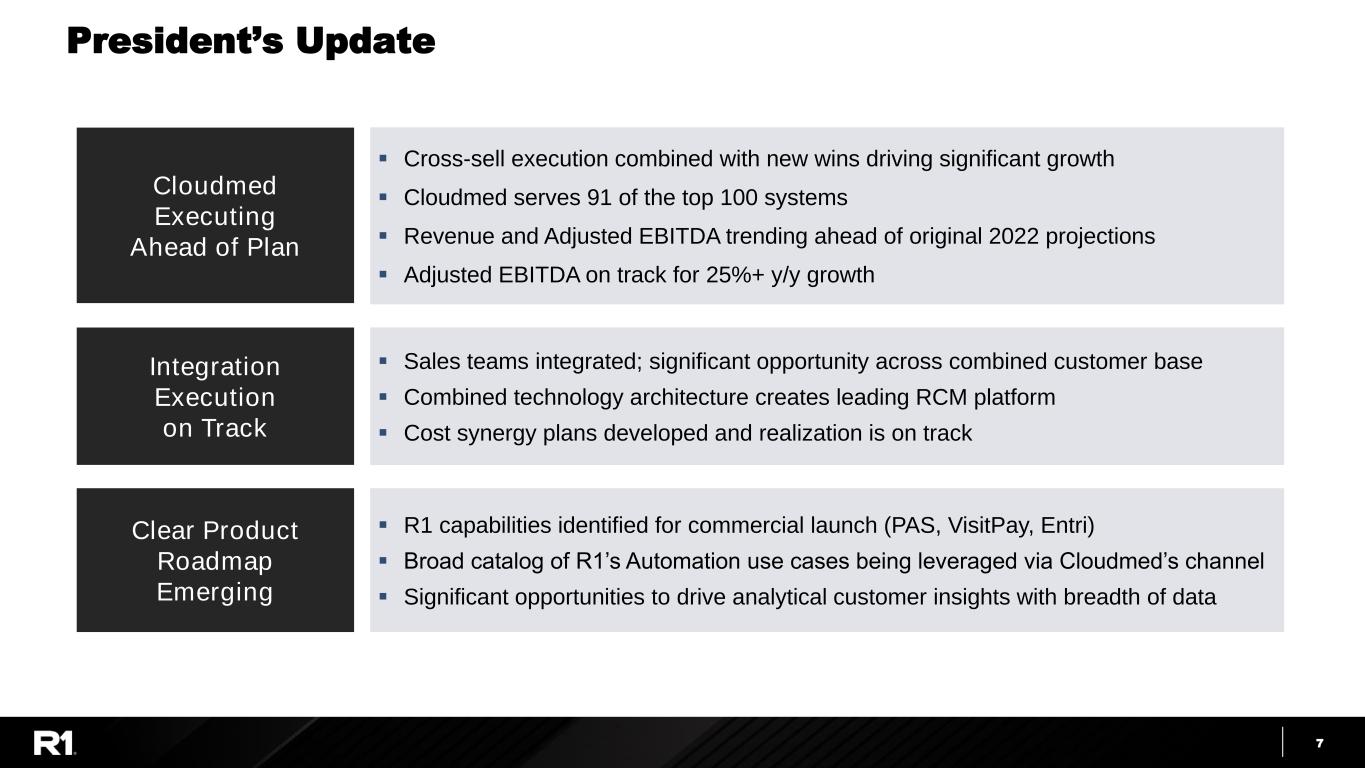

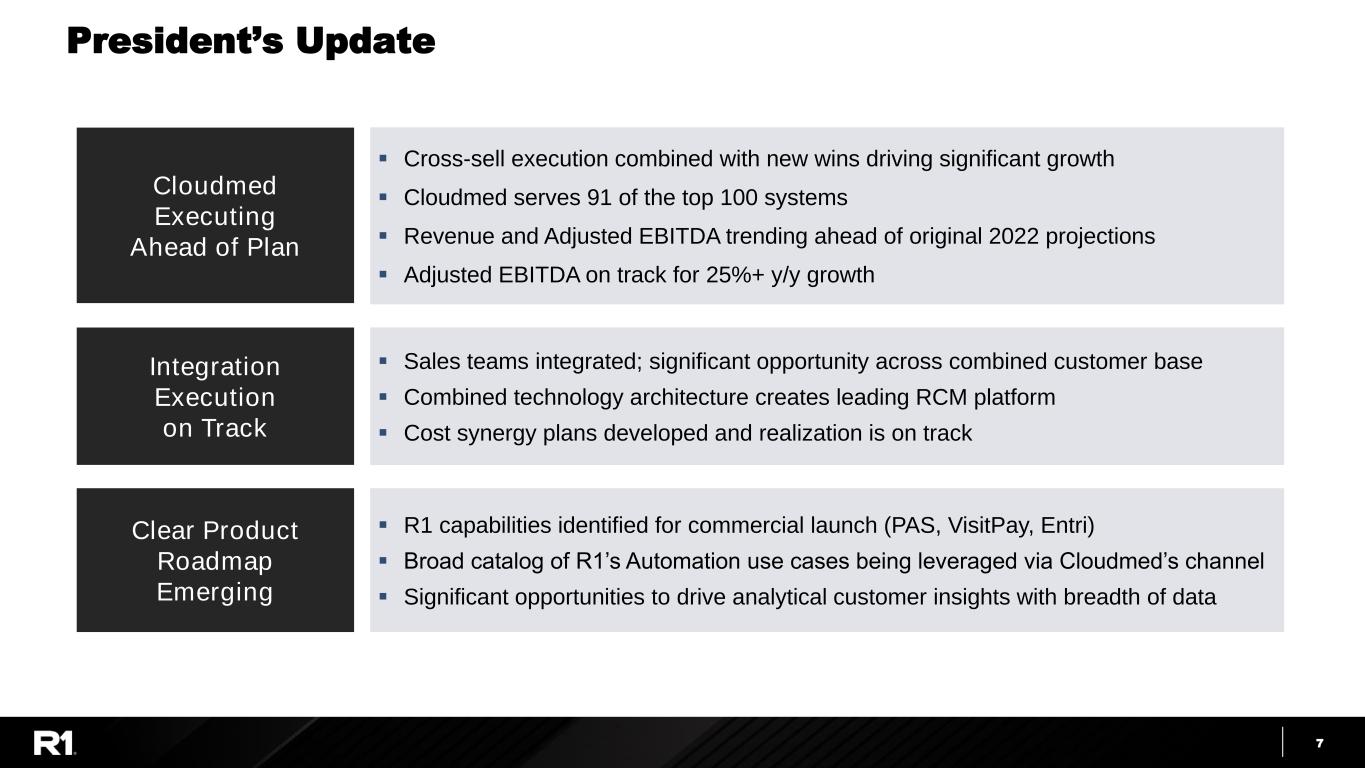

7 Integration Execution on Track ▪ Sales teams integrated; significant opportunity across combined customer base ▪ Combined technology architecture creates leading RCM platform ▪ Cost synergy plans developed and realization is on track Cloudmed Executing Ahead of Plan ▪ Cross-sell execution combined with new wins driving significant growth ▪ Cloudmed serves 91 of the top 100 systems ▪ Revenue and Adjusted EBITDA trending ahead of original 2022 projections ▪ Adjusted EBITDA on track for 25%+ y/y growth Clear Product Roadmap Emerging ▪ R1 capabilities identified for commercial launch (PAS, VisitPay, Entri) ▪ Broad catalog of R1’s Automation use cases being leveraged via Cloudmed’s channel ▪ Significant opportunities to drive analytical customer insights with breadth of data President’s Update

8 Guidance Update

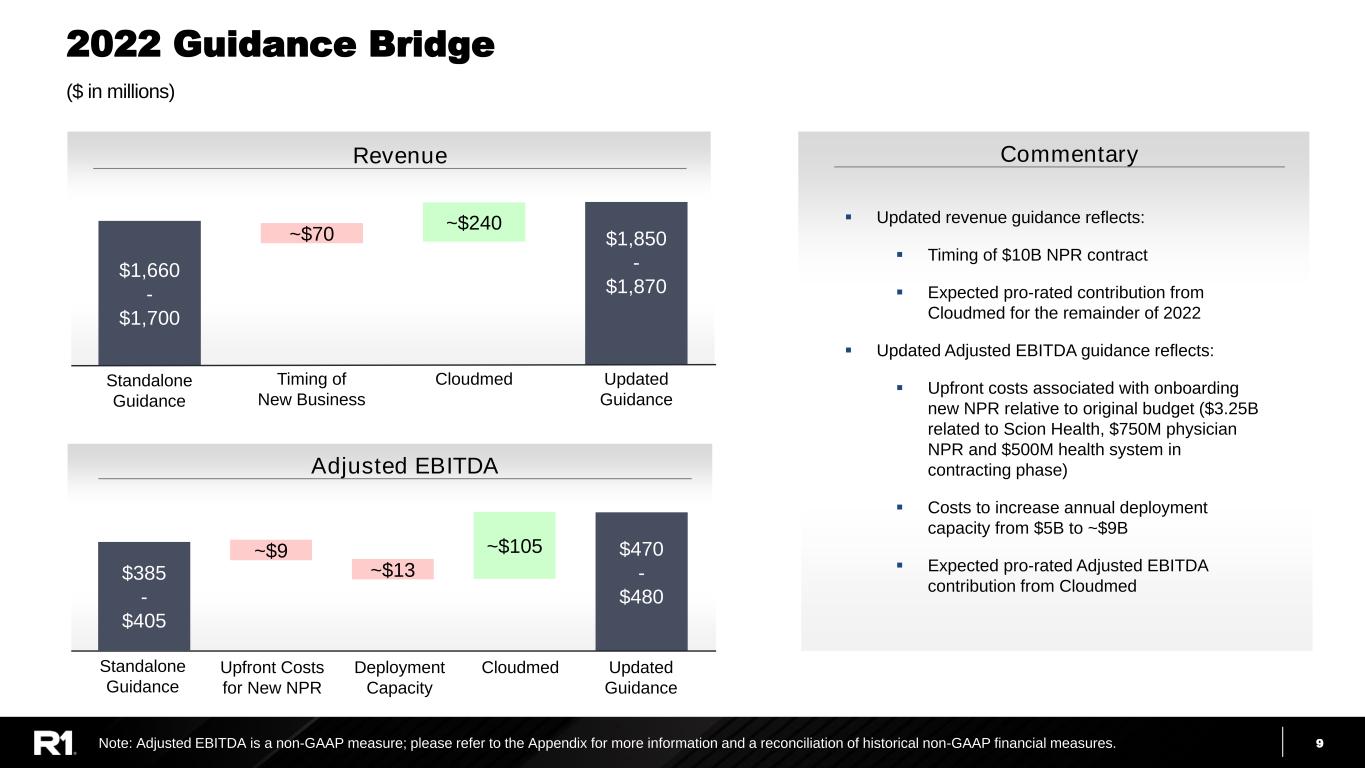

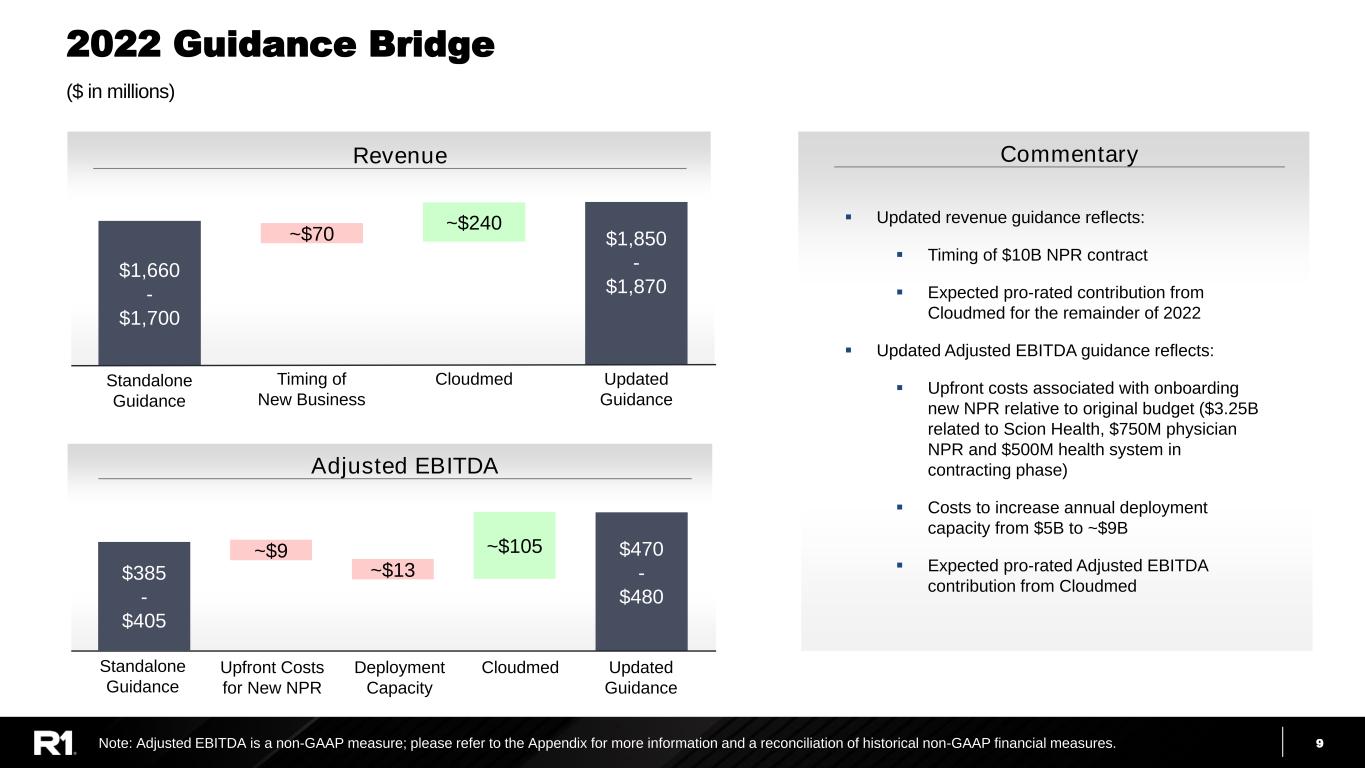

9 2022 Guidance Bridge Note: Adjusted EBITDA is a non-GAAP measure; please refer to the Appendix for more information and a reconciliation of historical non-GAAP financial measures. $1,660 - $1,700 $1,850 - $1,870 $470 - $480 ($ in millions) $385 - $405 ~$70 ~$240 ~$9 ~$13 ~$105 Standalone Guidance Timing of New Business Cloudmed Updated Guidance Standalone Guidance Upfront Costs for New NPR Cloudmed Updated Guidance Deployment Capacity ▪ Updated revenue guidance reflects: ▪ Timing of $10B NPR contract ▪ Expected pro-rated contribution from Cloudmed for the remainder of 2022 ▪ Updated Adjusted EBITDA guidance reflects: ▪ Upfront costs associated with onboarding new NPR relative to original budget ($3.25B related to Scion Health, $750M physician NPR and $500M health system in contracting phase) ▪ Costs to increase annual deployment capacity from $5B to ~$9B ▪ Expected pro-rated Adjusted EBITDA contribution from Cloudmed Revenue Adjusted EBITDA Commentary

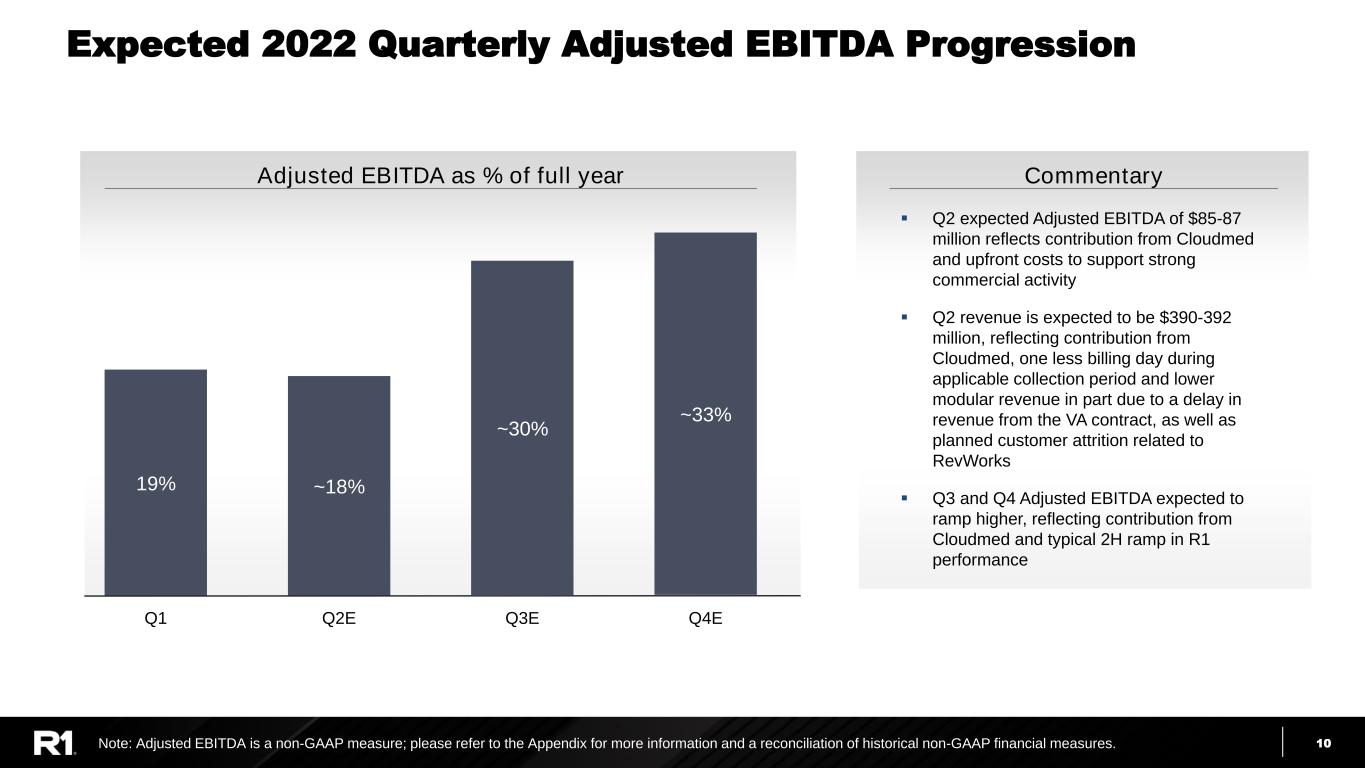

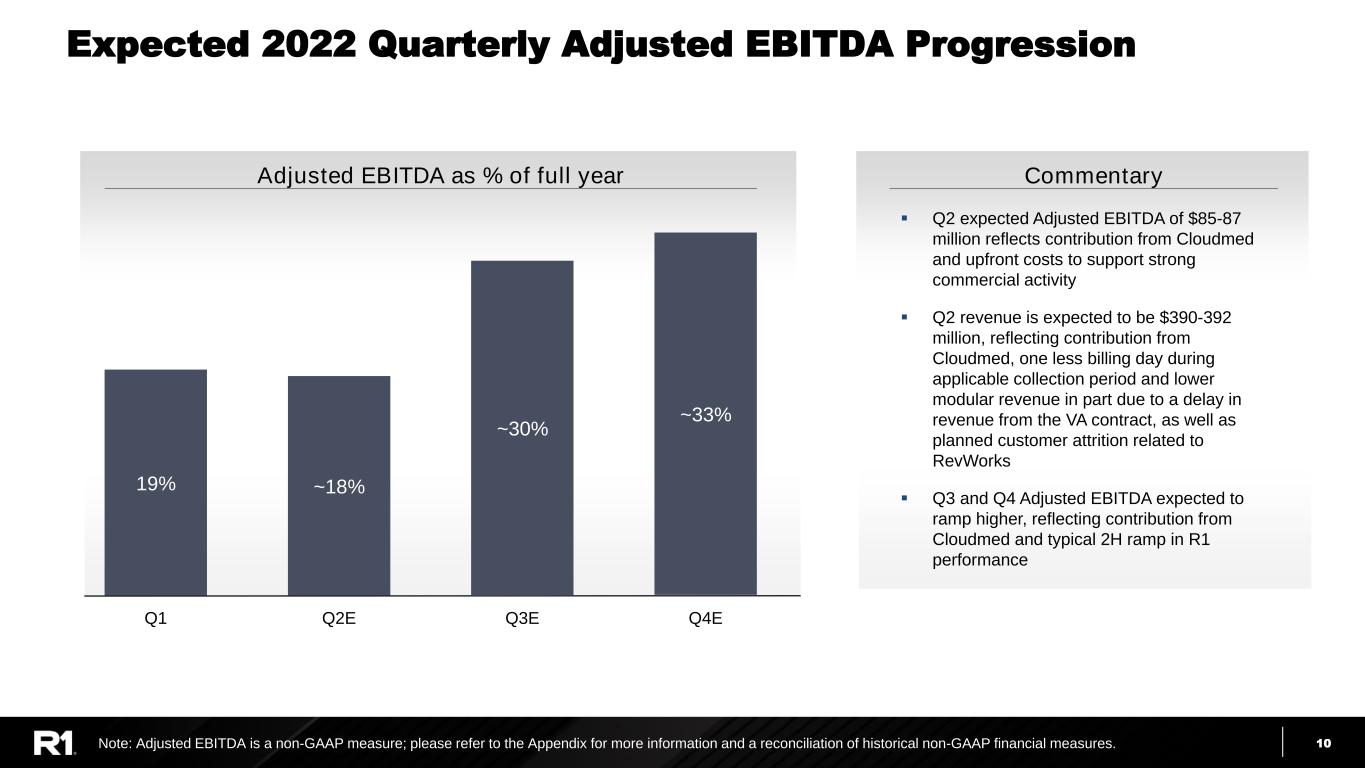

10 Expected 2022 Quarterly Adjusted EBITDA Progression Note: Adjusted EBITDA is a non-GAAP measure; please refer to the Appendix for more information and a reconciliation of historical non-GAAP financial measures. ▪ Q2 expected Adjusted EBITDA of $85-87 million reflects contribution from Cloudmed and upfront costs to support strong commercial activity ▪ Q2 revenue is expected to be $390-392 million, reflecting contribution from Cloudmed, one less billing day during applicable collection period and lower modular revenue in part due to a delay in revenue from the VA contract, as well as planned customer attrition related to RevWorks ▪ Q3 and Q4 Adjusted EBITDA expected to ramp higher, reflecting contribution from Cloudmed and typical 2H ramp in R1 performance 19% ~33% Q1 Q2E Q3E Q4E ~18% ~30% CommentaryAdjusted EBITDA as % of full year

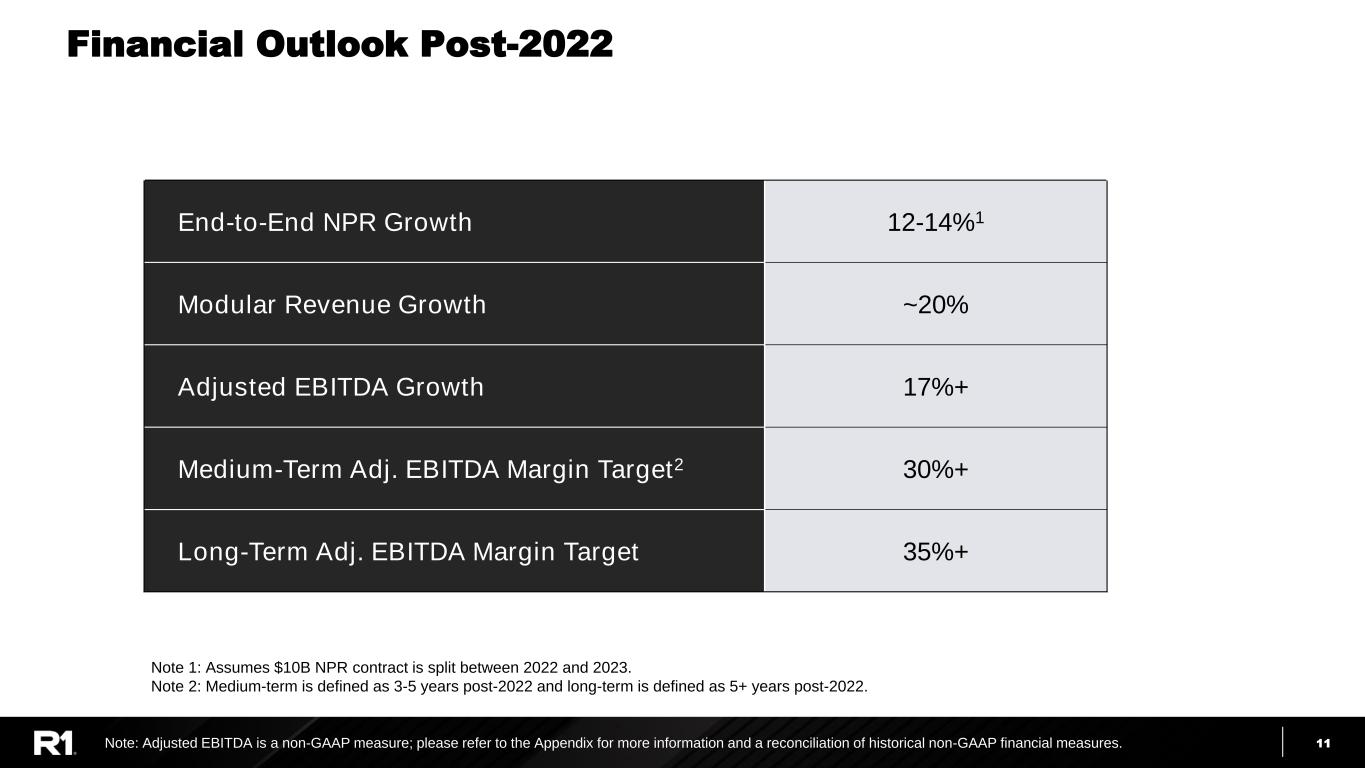

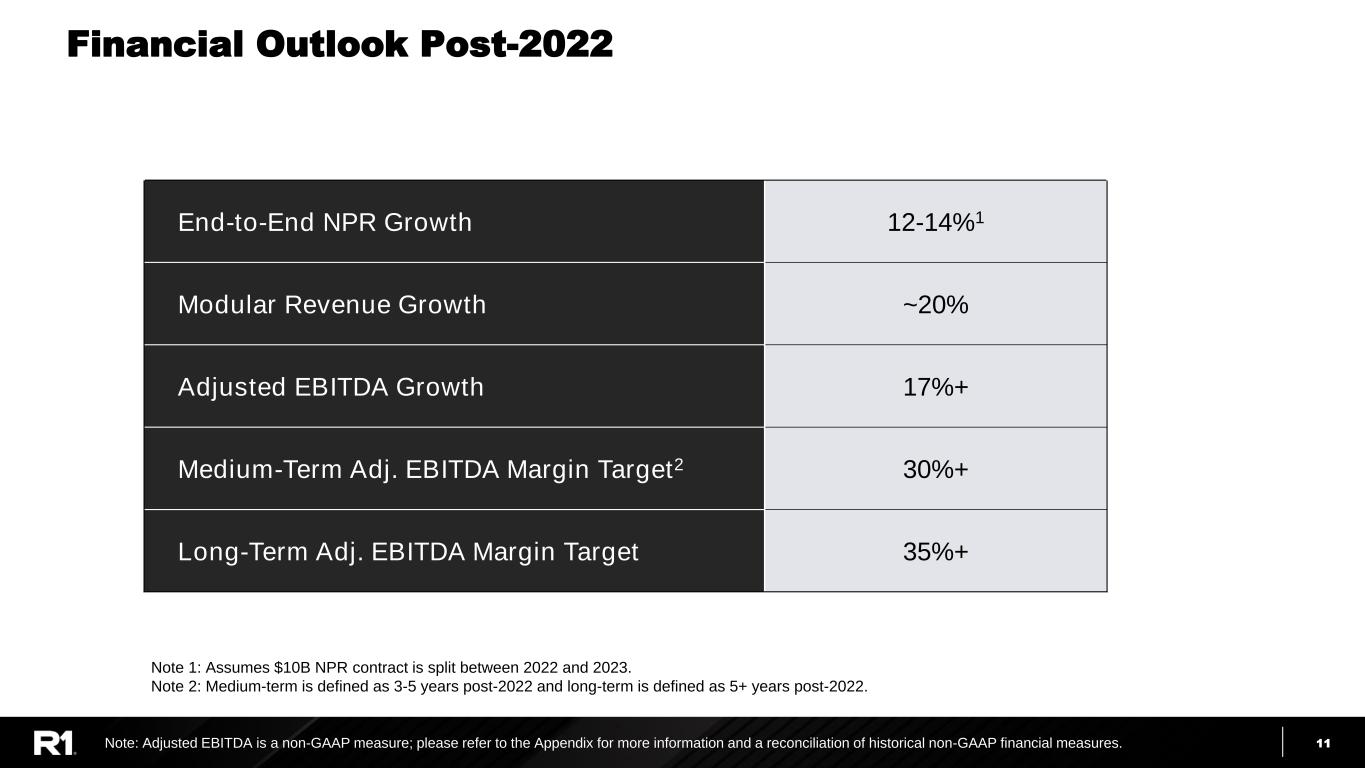

11 Financial Outlook Post-2022 End-to-End NPR Growth 12-14%1 Modular Revenue Growth ~20% Adjusted EBITDA Growth 17%+ Medium-Term Adj. EBITDA Margin Target2 30%+ Long-Term Adj. EBITDA Margin Target 35%+ Note 1: Assumes $10B NPR contract is split between 2022 and 2023. Note 2: Medium-term is defined as 3-5 years post-2022 and long-term is defined as 5+ years post-2022. Note: Adjusted EBITDA is a non-GAAP measure; please refer to the Appendix for more information and a reconciliation of historical non-GAAP financial measures.

12 Appendix

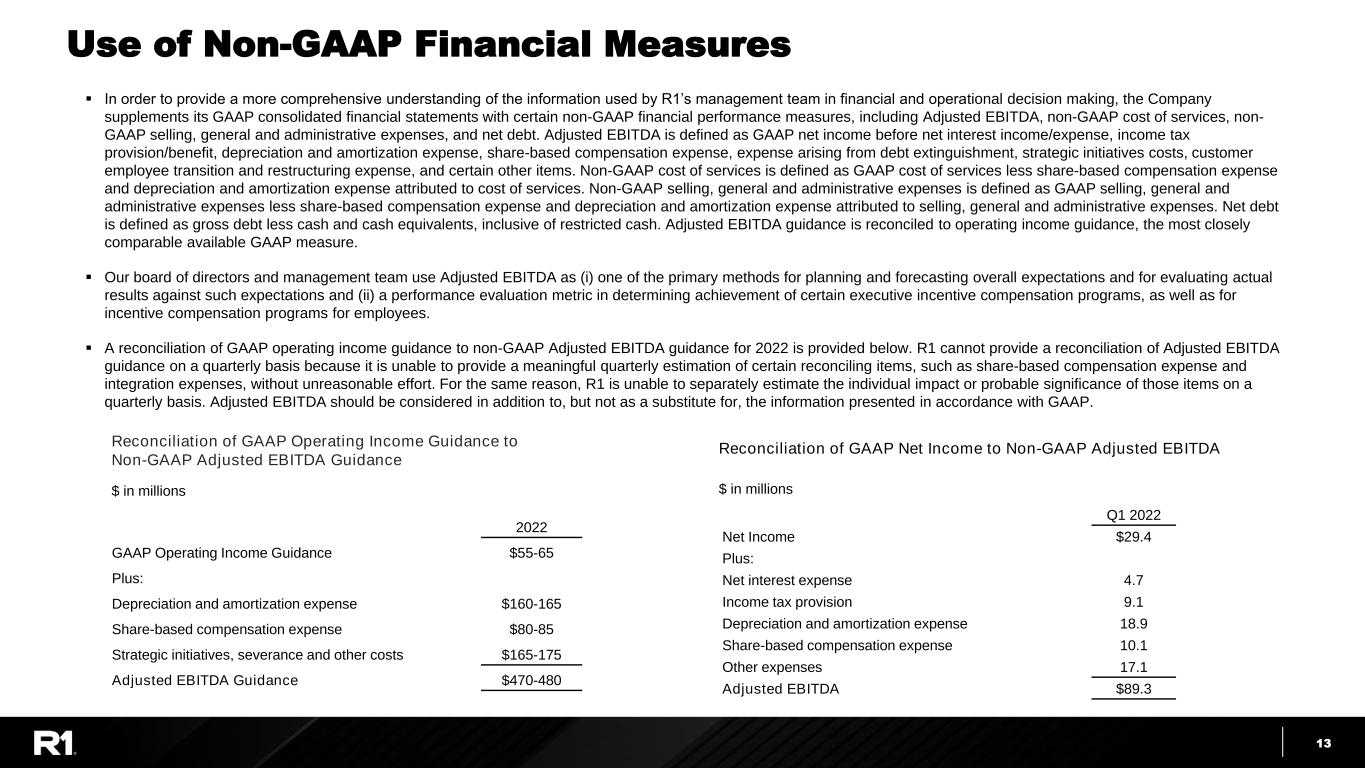

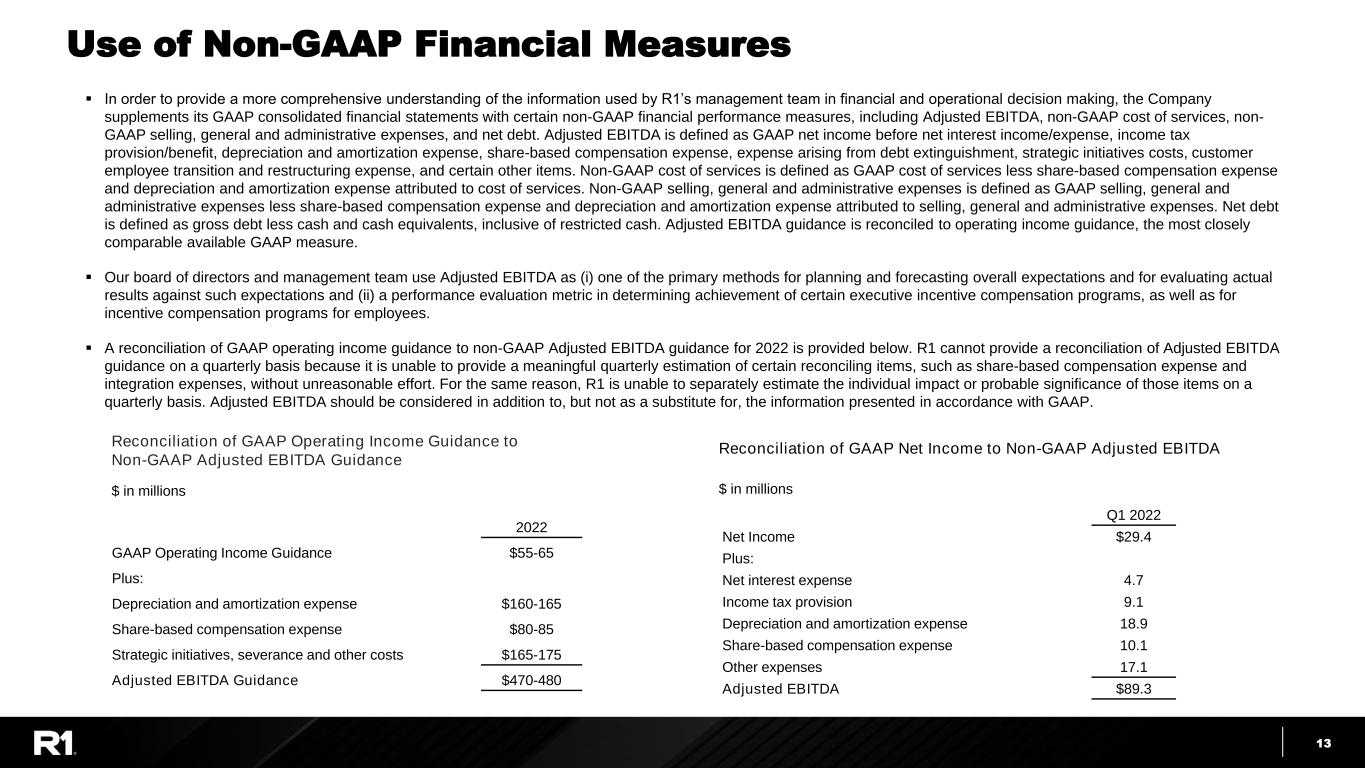

13 Use of Non-GAAP Financial Measures ▪ In order to provide a more comprehensive understanding of the information used by R1’s management team in financial and operational decision making, the Company supplements its GAAP consolidated financial statements with certain non-GAAP financial performance measures, including Adjusted EBITDA, non-GAAP cost of services, non- GAAP selling, general and administrative expenses, and net debt. Adjusted EBITDA is defined as GAAP net income before net interest income/expense, income tax provision/benefit, depreciation and amortization expense, share-based compensation expense, expense arising from debt extinguishment, strategic initiatives costs, customer employee transition and restructuring expense, and certain other items. Non-GAAP cost of services is defined as GAAP cost of services less share-based compensation expense and depreciation and amortization expense attributed to cost of services. Non-GAAP selling, general and administrative expenses is defined as GAAP selling, general and administrative expenses less share-based compensation expense and depreciation and amortization expense attributed to selling, general and administrative expenses. Net debt is defined as gross debt less cash and cash equivalents, inclusive of restricted cash. Adjusted EBITDA guidance is reconciled to operating income guidance, the most closely comparable available GAAP measure. ▪ Our board of directors and management team use Adjusted EBITDA as (i) one of the primary methods for planning and forecasting overall expectations and for evaluating actual results against such expectations and (ii) a performance evaluation metric in determining achievement of certain executive incentive compensation programs, as well as for incentive compensation programs for employees. ▪ A reconciliation of GAAP operating income guidance to non-GAAP Adjusted EBITDA guidance for 2022 is provided below. R1 cannot provide a reconciliation of Adjusted EBITDA guidance on a quarterly basis because it is unable to provide a meaningful quarterly estimation of certain reconciling items, such as share-based compensation expense and integration expenses, without unreasonable effort. For the same reason, R1 is unable to separately estimate the individual impact or probable significance of those items on a quarterly basis. Adjusted EBITDA should be considered in addition to, but not as a substitute for, the information presented in accordance with GAAP. 2022 GAAP Operating Income Guidance $55-65 Plus: Depreciation and amortization expense $160-165 Share-based compensation expense $80-85 Strategic initiatives, severance and other costs $165-175 Adjusted EBITDA Guidance $470-480 Reconciliation of GAAP Operating Income Guidance to Non-GAAP Adjusted EBITDA Guidance $ in millions Q1 2022 Net Income $29.4 Plus: Net interest expense 4.7 Income tax provision 9.1 Depreciation and amortization expense 18.9 Share-based compensation expense 10.1 Other expenses 17.1 Adjusted EBITDA $89.3 Reconciliation of GAAP Net Income to Non-GAAP Adjusted EBITDA $ in millions