united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-23780

CrowdStreet REIT I, Inc.

(Exact name of registrant as specified in charter)

98 San Jacinto Blvd, 4th Floor, Austin TX 78701

(Address of principal executive offices)

The Corporation Trust Company

Corporation Trust Center

1209 Orange Street

Wilmington, Delaware 19801

(Name and Address of Agent for Service)

Copy to:

Shaun Reader

Curtis, Mallet-Prevost, Colt & Mosle LLP

101 Park Avenue

New York, New York 10178

(212) 696-6000

Registrant's telephone number, including area code: (971) 803-3110

Date of fiscal year end: 12/31

Date of reporting period: 12/31/2022

Item 1. Reports to Stockholders.

(a)

CROWDSTREET REIT I, INC.

Annual Report

December 31, 2022

CrowdStreet Advisors, LLC

98 San Jacinto Blvd, 4th Floor

Austin, TX 78701

(971) 803-3110

funds@crowdstreet.com

CROWDSTREET REIT I, INC.

MANAGEMENT’S DISCUSSION OF

FUND PERFORMANCE (Unaudited) |

Dear Shareholders,

We created CrowdStreet REIT I, Inc. (“C-REIT” or “Fund”) in April 2022 to provide investors easier access to private commercial real estate projects and help build better investment portfolios. We believe C-REIT is a truly unique fund that offers a new vehicle to target capital appreciation by investing in value-add and opportunistic real estate investment strategies.

C-REIT ’s mission is to capture attractive investment returns, supported by our thematic investing approach and projects managed by multiple sponsors. Our strategy has proven to be timely as market conditions are driving a re-pricing of real estate assets. As market conditions evolved over the balance of 2022, we selectively allocated capital to attractively priced assets in sectors that are potentially well-positioned to achieve our capital appreciation investment objectives. As of the year-end, the majority of our portfolio has been invested in multifamily assets, both existing assets and development projects located in high-growth sunbelt markets. Importantly, these markets have been outpacing the US national averages in terms of job and population growth1. We continue to believe that housing shortages and home affordability challenges for buyers across the US will support growing demand for multifamily assets.

The balance of our portfolio is predominantly invested in the industrial sector with a focus on distribution. We have seen e-commerce continue to drive industrial demand with vacancy rates that remain below long-term trends across the country, particularly for distribution centers. We believe that the continued growth in e-commerce, inventory onshoring, and “friendshoring” may continue to drive user demand for US industrial assets. Finally, C-REIT has dry powder, which we are beginning to allocate towards opportunistically-priced deals where sponsors are leveraging specific elements of market dislocation to their advantage.

We acknowledge that interest rate hikes can impact the broader economy, including commercial real estate. We have witnessed how these hikes ultimately led to a decline in transaction volume, and as a result, a reduction in liquidity that has induced upward pressure on capitalization rates. Since all of our acquisitions to date occurred after April 2022, we believe the acquisition cost to be the best estimate of fair market value. Our net asset value per share is currently $990.67, a decline of (0.93)% from the purchase price, with the decline attributed to fund expenses offset by interest income. We will continue to monitor market dynamics and value our assets every quarter.

As we look ahead in 2023, we are encouraged by the burgeoning opportunity to further pursue capital market dislocations, which we believe could lead to attractive entry points in high-quality assets. We believe this type of market dislocation aligns well with our fund

1 | U.S. Census Bureau, 2020 Census |

1

CROWDSTREET REIT I, INC.

MANAGEMENT’S DISCUSSION OF

FUND PERFORMANCE (Unaudited) (Continued) |

investment strategy as our primary focus is on acquiring value-add and opportunistic assets. We remain confident in our ability to execute our investment strategy and deliver strong performance over the life of the fund.

Thank you for entrusting us with your capital. We are grateful for the opportunity.

Thomas McDonald | Sheldon Chang |

Director, Investment Product Development & Portfolio Management | President, CrowdStreet Advisors, LLC |

In addition to more general risks such as high vacancy rates, oversupply of product in the market, and credit quality of tenants, some of the factors that can impact the success or failure of multifamily investments include competition from single-family homes, fluctuations in the average occupancy rate, and increases in mortgage rates that can make debt financing more expensive.

In addition to more general risks such as high vacancy rates, oversupply of product in the market, and credit quality of tenants, some of the factors that can impact the success or failure of industrial investments include declines in manufacturing activity due to reduced demand or trade agreements that outsource manufacturing efforts.

2

CROWDSTREET REIT I, INC.

PERFORMANCE INFORMATION (Unaudited)

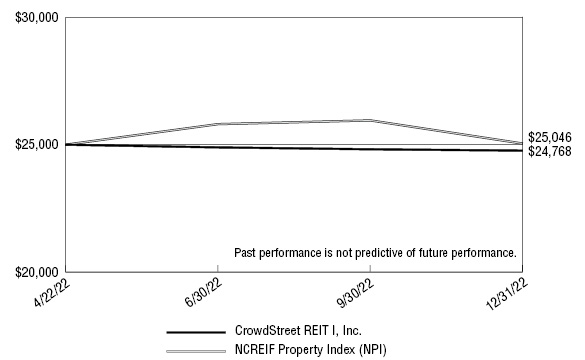

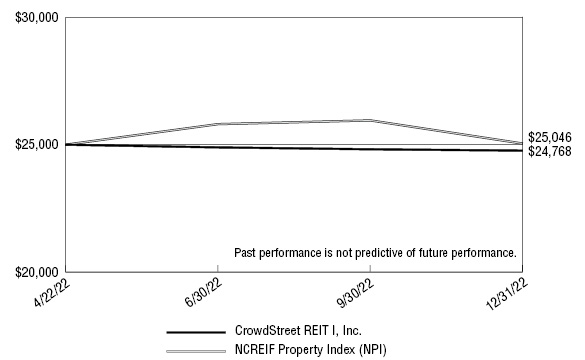

Comparison of the Change in Value of a $25,000 Investment in

CrowdStreet REIT, Inc. versus the NCREIF Property Index (NPI)

Average Annual Total Returns (for the period ended December 31, 2022) |

| | Since

Inception

(4/22/22) | |

CrowdStreet REIT I, Inc. | (0.93%) | |

NCREIF Property Index (NPI) | 0.18% | |

The NCREIF Property Index (NPI) is a quarterly, unleveraged composite total return for private commercial real estate properties held for investment purposes only. All properties in the NPI have been acquired, at least in part, on behalf of tax-exempt institutional investors and held in a fiduciary environment. Investors cannot invest directly in an index or benchmark.

The performance shown represents past performance and does not guarantee future results. Investment return and principal value will fluctuate so that an investor’s shares when redeemed may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Please read the Fund’s Prospectus carefully before investing.

3

CROWDSTREET REIT I, INC.

SCHEDULE OF INVESTMENTS

December 31, 2022 |

PRIVATE REAL ESTATE INVESTMENTS — 52.30% | | Shares | | | Value | |

Multi-Family Residential — 42.29% | | | | | | | | |

Kernan Partners, LLC (a)(b)(c)(d) | | | N/A | | | $ | 5,400,000 | |

Locale Investor, LLC (a)(b)(c)(d) | | | N/A | | | | 2,000,000 | |

915 Division CrowdStreet Investors, LLC (a)(b)(c)(d)(e) | | | N/A | | | | 5,400,000 | |

North Park Titleholder, LLC (a)(b)(c)(d) | | | N/A | | | | 4,100,000 | |

| | | | | | | | 16,900,000 | |

Industrial — 10.01% | | | | | | | | |

HIP CS Investors, LLC (a)(b)(c)(d) | | | N/A | | | | 4,000,000 | |

| | | | | | | | | |

TOTAL PRIVATE REAL ESTATE INVESTMENTS (Cost $20,900,000) | | | | | | | 20,900,000 | |

| | | | | | | | | |

TOTAL INVESTMENTS (Cost $20,900,000) — 52.30% | | | | | | $ | 20,900,000 | |

| | | | | | | | | |

Other Assets in Excess of Other Liabilities — 47.70% | | | | | | | 19,065,141 | |

| | | | | | | | | |

NET ASSETS — 100.00% | | | | | | $ | 39,965,141 | |

(a) | Non-income producing security. |

(b) | Level 3 security fair valued using significant unobservable inputs. |

(c) | Restricted security. |

(d) | Investment does not issue shares. |

(e) | CrowdStreet Inc. and subsidiaries do not have an economic interest in this entity. |

See accompanying notes to financial statements. |

4

CROWDSTREET REIT I, INC.

STATEMENT OF ASSETS AND LIABILITIES

December 31, 2022 |

ASSETS | | | | |

Investments in securities: | | | | |

At cost | | $ | 20,900,000 | |

At value | | $ | 20,900,000 | |

Cash | | | 19,910,725 | |

Interest receivable | | | 63,021 | |

TOTAL ASSETS | | | 40,873,746 | |

| | | | | |

LIABILITIES | | | | |

Deferred subscriptions (a) | | | 75,000 | |

Accrued management fees | | | 419,470 | |

Accrued investor servicing fees | | | 139,823 | |

Payable to Directors | | | 51,667 | |

Other accrued expenses | | | 222,645 | |

TOTAL LIABILITIES | | | 908,605 | |

| | | | | |

NET ASSETS | | $ | 39,965,141 | |

| | | | | |

NET ASSETS CONSIST OF: | | | | |

Paid-in capital | | $ | 40,515,000 | |

Accumulated deficit | | | (549,859 | ) |

NET ASSETS | | $ | 39,965,141 | |

| | | | | |

NET ASSET VALUE: | | | | |

Net assets | | $ | 39,965,141 | |

Common shares outstanding | | | 40,341 | |

Net Asset Value Per Share (“NAV”) (b) | | $ | 990.67 | |

(a) | Deferred Subscriptions relate to cash received in the amount of $75,000 from a prospective investor after the close of the December 2022 subscription process. Shares were issued to this investor as part of the January 2023 subscription process. |

(b) | NAV amount may not recalculate due to rounding of net assets and/or shares outstanding. |

See accompanying notes to financial statements. |

5

CROWDSTREET REIT I, INC.

STATEMENT OF OPERATIONS

For the Period Ended December 31, 2022(a) |

INVESTMENT INCOME | | | | |

Interest | | $ | 283,746 | |

TOTAL INVESTMENT INCOME | | | 283,746 | |

| | | | | |

EXPENSES | | | | |

Management fees | | | 419,470 | |

Investor service fees | | | 139,823 | |

Legal fees | | | 80,110 | |

Administration and fund accounting fees | | | 54,398 | |

Directors’ fees | | | 51,667 | |

Compliance service fees | | | 34,668 | |

Custodian fees | | | 19,580 | |

Tax services fees | | | 18,240 | |

Other expenses | | | 15,649 | |

TOTAL EXPENSES | | | 833,605 | |

NET EXPENSES | | | 833,605 | |

| | | | | |

NET INVESTMENT LOSS | | | (549,859 | ) |

| | | | | |

NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | (549,859 | ) |

(a) | Represents the period from the commencement of operations (April 22, 2022) through December 31, 2022. |

See accompanying notes to financial statements. |

6

CROWDSTREET REIT I, INC.

STATEMENT OF CHANGES IN NET ASSETS |

| | For the

Period Ended

December 31,

2022 (a) | |

FROM OPERATIONS: | | | | |

Net investment loss | | $ | (549,859 | ) |

Net decrease in net assets resulting from operations | | | (549,859 | ) |

| | | | | |

CAPITAL TRANSACTIONS: | | | | |

Proceeds from sales of shares | | $ | 40,515,000 | |

Net increase in net assets resulting from capital activity | | | 40,515,000 | |

| | | | | |

TOTAL INCREASE IN NET ASSETS | | | 39,965,141 | |

| | | | | |

NET ASSETS | | | | |

Beginning of period | | | — | |

End of period | | $ | 39,965,141 | |

| | | | | |

CAPITAL SHARE ACTIVITY | | | | |

Shares outstanding, beginning of period | | | — | |

Proceeds from sales of shares | | | 40,341 | |

Shares outstanding, end of period | | | 40,341 | |

(a) | Represents the period from the commencement of operations (April 22, 2022) through December 31, 2022. |

See accompanying notes to financial statements. |

7

CROWDSTREET REIT I, INC.

STATEMENT OF CASH FLOWS |

| | For the

Period Ended

December 31,

2022 (a) | |

Cash flows from operating activities | | | | |

Net decrease in net assets resulting from operations | | $ | (549,859 | ) |

Adjustments to reconcile net increase in net assets resulting from operations to net cash used in operating activities: | | | | |

Purchase of investments | | | (20,900,000 | ) |

(Increase)/Decrease in Assets: | | | | |

Increase interest receivable | | | (63,021 | ) |

Increase/(Decrease) in Liabilities: | | | | |

Increase in deferred subscriptions | | | 75,000 | |

Increase in accrued management fees | | | 419,470 | |

Increase in accrued investor servicing fees | | | 139,823 | |

Increase in payable to Directors | | | 51,667 | |

Increase to other accrued expenses | | | 222,645 | |

Net cash used in operating activities | | $ | (20,604,275 | ) |

| | | | | |

Cash flows from financing activities | | | | |

Proceeds from issuance of shares, net of change in receivable for capital shares sold | | | 40,515,000 | |

Net cash provided by financing activities | | $ | 40,515,000 | |

| | | | | |

Net change in cash | | | 19,910,725 | |

Beginning of period | | | — | |

End of period | | $ | 19,910,725 | |

(a) | Represents the period from the commencement of operations (April 22, 2022) through December 31, 2022. |

See accompanying notes to financial statements. |

8

CROWDSTREET REIT I, INC.

FINANCIAL HIGHLIGHTS |

Per Share Data for a Share Outstanding Throughout the Period |

| | For the

Period Ended

Dec. 31,

2022(a) | |

Net asset value at beginning of period | | $ | 1,000.00 | |

| | | | | |

Income (loss) from investment operations: | | | | |

Net investment loss (b) | | | (9.33 | ) |

Total from investment operations | | | (9.33 | ) |

| | | | | |

Net asset value at end of period | | $ | 990.67 | |

| | | | | |

Total return (c) | | | (0.93 | %)(d) |

| | | | | |

Net assets at end of period (000’s) | | $ | 39,965 | |

| | | | | |

Ratios/supplementary data: | | | | |

Ratio of total expenses to average net assets | | | 3.76 | %(e) |

Ratio of net investment income (loss) to average net assets | | | (2.48 | %)(e) |

Portfolio turnover rate | | | 0 | %(d) |

(a) | Represents the period from the commencement of operations (April 22, 2022) through December 31, 2022. |

(b) | Based on average shares outstanding. |

(c) | Total return is a measure of the change in value of an investment in the Fund over the period covered, which assumes any dividends and capital gain distributions are reinvested in shares of the Fund. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions. |

(d) | Not annualized. |

(e) | Annualized. |

See accompanying notes to financial statements. |

9

CROWDSTREET REIT I, INC.

NOTES TO FINANCIAL STATEMENTS

December 31, 2022

1. Organization

CrowdStreet REIT I, Inc. (the “Fund”) was organized as a Delaware corporation that is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a non-diversified, closed-end management investment company. The Fund intends to elect to be taxed as a real estate investment trust (a “REIT”) under the Internal Revenue Code of 1986, as amended (the “Code”). The Fund’s primary investment objective is generating capital appreciation with a secondary objective of generating income to provide investors with attractive risk-adjusted returns available from investing in the equity of private real estate projects. The Fund commenced operations on April 22, 2022.

The investment adviser of the Fund is CrowdStreet Advisors, LLC, an investment adviser registered with the U.S. Securities and Exchange Commission (“SEC”) under the Investment Advisers Act of 1940, as amended and a Delaware limited liability company (the “Investment Manager”). The Investment Manager is a wholly owned subsidiary of CrowdStreet, Inc. (“CrowdStreet”). Subject to the supervision of the Board of Directors of the Fund (the “Board”), the Investment Manager is responsible for directing the management of the Fund’s business and day-to-day affairs and implementing the Fund’s investment strategy.

The Fund is a specialized investment vehicle that incorporates features of both a private investment fund that is not registered under the Investment Company Act and a closed-end investment company that is registered under the Investment Company Act. Private investment funds (such as private equity limited partnership funds) are collective asset pools that typically offer their securities privately, without registering them under the Securities Act of 1933, as amended (the “Securities Act”). Registered closed-end investment companies, such as the Fund, are typically managed more conservatively than private investment funds because of the requirements and restrictions imposed on them by the Investment Company Act. By combining certain features from non-registered and registered funds, the Investment Manager believes it can offer “accredited investors”, within the meaning of Regulation D under the Securities Act, access to the long-term investment return benefits of private equity real estate opportunities at a much lower investment minimum and with the convenience of Form 1099-DIV tax reporting.

2. Significant Accounting Policies

The following is a summary of the Fund’s significant accounting policies.

Basis of Presentation and Use of Estimates – The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”)Topic 946, Financial Services – Investment Companies.

10

CROWDSTREET REIT I, INC.

NOTES TO FINANCIAL STATEMENTS (Continued) |

The financial statements are prepared in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”), which requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amount of increases and decreases in net assets from operations during the period. The estimates and assumptions underlying these financial statements are based on information available as of December 31, 2022, including judgments about the financial market and economic conditions which may change over time. Actual results could differ from those estimates and those differences could be material.

Cash and Cash Equivalents – Cash and cash equivalents may consist of money market funds, demand deposits and highly liquid investments with original maturities of three months or less and are held at cost which approximates fair value. The Fund may invest its cash in institutional money market funds, which are stated at fair value. Cash equivalents are classified as Level 1 assets and included on the Fund’s Schedule of Investments. The Fund’s uninvested cash is held in a bank account at a high-quality financial institution, and at times, cash held in bank accounts may exceed the Federal Deposit Insurance Corporation (“FDIC”) insured limit.

Valuation Oversight – The Board has approved procedures pursuant to which the Fund values its Portfolio Investments, and it has designated to the Investment Manager the general responsibility for determining the value of such investments. Generally, portfolio securities and other assets for which market quotations are readily available are valued at market value, which is ordinarily determined based on official closing prices or the last reported sales prices. If market quotations are not readily available or are deemed unreliable, the Fund will use the fair value of the securities or other assets as determined by the Investment Manager in good faith, taking into consideration all available information and other factors that the Investment Manager deems pertinent, in each case subject to the overall supervision and responsibility of the Board.

Such determinations may be made based on data and valuations obtained from independent third-party valuation agents, pricing services or other third-party sources (“Pricing Services”). The Investment Manager is responsible for ensuring that any Pricing Service engaged to provide data and valuations discharges its responsibilities in accordance with the Fund’s valuation procedures and will periodically receive and review such information about the valuation of the Fund’s securities or other assets as it deems necessary to exercise its oversight responsibility.

Rule 2a-5 under the 1940 Act was adopted by the SEC and establishes requirements for determining fair value in good faith for purposes of the 1940 Act. The Fund adopted Rule 2a-5 in September 2022 and determined that there was no material impact to the Fund from the adoption of Rule 2a-5.

11

CROWDSTREET REIT I, INC.

NOTES TO FINANCIAL STATEMENTS (Continued) |

Valuation of Securities – The Fund calculates the net asset value (“NAV”) as of the close of business on each calendar quarter. The Fund’s NAV per share is calculated by dividing the value of the Fund’s total assets (including interest and dividends accrued, but not yet received) minus liabilities (including accrued expenses) by the total number of shares outstanding.

In calculating NAV, the Fund applies FASB ASC Topic 820, Fair Value Measurement, as amended, which established a framework for measuring fair value in accordance with U.S. GAAP and required disclosures of fair market value measurement. U.S. GAAP defines fair value as the price that the Fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date.

The Fund determines the fair value of investments and categorizes the assets or liabilities for which fair value is being measured and reported in accordance with the fair value hierarchy. The fair value hierarchy requires an entity to maximize the use of observable inputs and includes the following three levels based on the objectivity of inputs that were used by the Fund:

| | ● | Level 1 – Quoted prices in active markets for identical assets |

| | ● | Level 2 – Other significant observable inputs (e.g., quoted prices of similar securities in active markets, quoted prices for similar items in markets that are not active, inputs other than quoted prices that are observable such as interest rates, occupancy rates, rental rates) |

| | ● | Level 3 – Valuations generated from model-based techniques that use inputs that are significant, unobservable in the market, or observable for similar items in the market that are not active. The inputs reflect estimates that market participants would use in pricing the asset (e.g., occupancy rates, rental rates, market capitalization rates, indices for similar sales, inflation rates). |

Inputs are used in applying the various valuation techniques and broadly refer to the assumptions that market participants use to make valuation decisions, including assumptions about risk. An investment’s level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement. The determination of what constitutes “observable” requires significant judgment by the Investment Manager. The Investment Manager considers observable data to be that market data which is readily available, regularly distributed or updated, reliable and verifiable, not proprietary, or provided by multiple independent sources that are actively involved in the relevant market.

All the Fund’s investments have been classified within Level 3 as they trade infrequently or not at all and use unobservable inputs to estimate fair value. When observable prices are not available for these securities, the Investment Manager uses one or more valuation techniques (e.g., the market approach, the income approach, or the asset approach) for which sufficient and reliable data is available. Within Level 3, the use of the market

12

CROWDSTREET REIT I, INC.

NOTES TO FINANCIAL STATEMENTS (Continued) |

approach generally consists of using comparable market transactions with adjustments made for dissimilarities between properties, while the use of the income approach generally consists of the net present value of estimated future cash flows plus a reversion (presumed sale), adjusted as appropriate for liquidity, credit, market and/or other risk factors. The income approach may also include the direct capitalization method, which estimates a stabilized net operating income and applies a capitalization rate to estimate fair value. The cost approach estimates the replacement cost of the building less physical depreciation, plus the land value. Generally, this approach provides a check on the value derived using the income approach. The terminal cap rate, direct capitalization rate, growth rate, and discount rate are some of the significant inputs to these valuations. These rates are based on the location, type, and nature of each property, and current and anticipated market conditions.

The selection of appropriate valuation techniques may be affected by the availability of relevant inputs as well as the relative reliability of the inputs. In some cases, one valuation technique may provide the best indication of fair value while in other circumstances, multiple valuation techniques may be appropriate. The results of the application of the various techniques may not be equally representative of fair value, due to factors such as assumptions made in the valuation. In some situations, the Investment Manager may determine it appropriate to evaluate and weigh the results, as appropriate, to develop a range of possible values, with the fair value based on the Investment Manager’s assessment of the most representative point within the range.

The fair value measurement of Level 3 investments does not include transaction costs that may have been capitalized as part of the security’s cost basis. Due to the inherent uncertainty of determining the fair value of investments that do not have a readily available market value, the fair value of the Funds investment may differ significantly from the values that would have been used had a readily available market value existed for such investments, and the differences could be material.

The following is a summary of the inputs used to value the Fund’s investments, by security type, as of December 31, 2022:

Investments in Securities | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Private Real Estate Investments | | $ | — | | | $ | — | | | $ | 20,900,000 | | | $ | 20,900,000 | |

Total | | $ | — | | | $ | — | | | $ | 20,900,000 | | | $ | 20,900,000 | |

13

CROWDSTREET REIT I, INC.

NOTES TO FINANCIAL STATEMENTS (Continued) |

The following is a roll-forward of the activity in investments in which significant unobservable inputs (Level 3) were used in determining fair value on a recurring basis:

| | Private Real Estate

Investments | |

Beginning Balance April 22, 2022 | | $ | — | |

Transfers into Level 3 during the period | | | — | |

Transfers out of Level 3 during the period | | | — | |

Purchases or Conversions | | | 20,900,000 | |

Sales or Distributions | | | — | |

Net realized gain (loss) | | | — | |

Change in net unrealized Appreciation (Depreciation) | | | — | |

Ending Balance December, 2022 | | $ | 20,900,000 | |

There was no change in net unrealized appreciation/(depreciation) included in the Statement of Operations attributable to Level 3 investments that were held as of December 31, 2022.

The following is a summary of quantitative information about significant unobservable valuation inputs for Level 3 Fair Value Measurements for investments held as of December 31, 2022:

Type of Level 3 Investment | | Fair Value

as of

December 31,

2022 | | | Valuation

Technique | | | Unobservable

Inputs | | | Discount

Rate/Price | | | Impact to

Valuation from

an Increase in

Input | |

Private Real Estate Investments | | | | | | | | | | | | | | | | | | | | |

Kernan Partners, LLC | | $ | 5,400,000 | | | | Market | | | | Transaction Price | | | | Not applicable | | | | Not applicable | |

Locale Investor, LLC | | | 2,000,000 | | | | Market | | | | Transaction Price | | | | Not applicable | | | | Not applicable | |

915 Division CrowdStreet Investors, LLC | | | 5,400,000 | | | | Market | | | | Transaction Price | | | | Not applicable | | | | Not applicable | |

North Park Titleholder, LLC | | | 4,100,000 | | | | Market | | | | Transaction Price | | | | Not applicable | | | | Not applicable | |

HIP CS Investors, LLC | | | 4,000,000 | | | | Market | | | | Transaction Price | | | | Not applicable | | | | Not applicable | |

Total Level 3 Investments | | $ | 20,900,000 | | | | | | | | | | | | | | | | | |

Organizational and Offering Costs – The Investment Manager paid $419,000 of expenses relating to the Fund’s organization and offering, including but not limited to legal fees and regulatory filing fees (“Organizational Expenses”). The Fund will become liable for $250,000 of the Organizational Expenses, if and when, the Fund accepts $60 million in subscription amounts, and the remainder if and when the Fund accepts $100 million in Subscription Amounts. Organization costs will be expensed when incurred by the

14

CROWDSTREET REIT I, INC.

NOTES TO FINANCIAL STATEMENTS (Continued) |

Fund. Offering costs will be accounted for as a deferred charge once incurred by the Fund and will be amortized over twelve months on a straight-line basis from the Fund’s commencement of operations.

Investment Income and Securities Transactions – Real estate investment acquisitions, sales and dispositions are recorded as of the date of the closing. Distributions from real estate equity investments are recognized as income when earned to the extent such amounts are paid from earnings and profits of the underlying investee. Interest income is recognized when earned.

Distributions to Shareholders – The Fund intends to make distributions necessary to qualify as a REIT and expects to declare and make distributions on a quarterly basis, or more or less frequently as determined by the Board, in arrears. Any distribution the Fund makes will be at the discretion of the Board, and will be based on, among other factors, the Fund’s present and reasonably projected future cash flow. The Fund expects that the Board will set the rate of distributions at a level that will be reasonably consistent and sustainable over time. Distributions to shareholders of the Fund will be recorded on the ex-dividend date.

Income Tax – The Fund intends to elect to be taxed as a REIT under the Code, and intends to operate as such, commencing with the taxable year ending December 31, 2022. While REITs are subject to Federal income taxes, they are allowed a deduction for ordinary and capital gains dividends paid, generally resulting in the elimination of all or substantially all income tax at the entity level. Additionally, most states follow the rules related to REITs as contained within the Code. This generally results in no state income taxes being paid by the Fund; however, due to the number of states in which the Fund holds, either directly or indirectly, interests in real estate, it is likely that some measure of the Fund’s operating and/or sale income will be taxed at the state level. To maintain qualification under the Code as a REIT, the Fund must distribute at least 90% of its taxable ordinary income to its shareholders and meet certain other requirements related to organization, management, assets, liabilities, and operations. Additionally, the Fund may choose to pass through any capital gains realized to its shareholders by distributing cash proceeds representative of the net capital gains. The Fund is permitted to deduct both ordinary and capital gain dividends paid to its shareholders, generally eliminating REIT-level Federal taxation of income represented by such dividends paid to the shareholders. REITs are subject to several organizational and operational requirements. If the Fund fails to qualify as a REIT in any taxable year, it will be subject to federal and state income tax on its taxable income at regular corporate rates. In addition to income taxes, the Fund may also be subject to certain state, local, and franchise taxes. Under certain circumstances, Federal income and excise taxes may be due on the Fund’s undistributed taxable income.

Certain of the Fund’s investments may be held through Single-Member Limited Liability Companies (“SMLLCs”) that have been formed by the respective single member to facilitate the ownership of particular investments. Under the default “check-the-box” rules

15

CROWDSTREET REIT I, INC.

NOTES TO FINANCIAL STATEMENTS (Continued) |

established by the Code, SMLLCs are disregarded as separate entities and therefore all items of income, deduction, loss, credit, asset, and liability from the SMLLC are reported directly on the Federal income tax return of the single member. Certain states have not adopted the check-the-box rules and therefore, do not respect the disregarded nature of SMLLC entities. In these cases, the SMLLC entity must file either income or franchise tax returns and, in some cases, may be liable for income or franchise taxes at the entity level.

Management evaluates the uncertainties of tax positions taken or expected to be taken based on the probability of whether it is more likely than not that the positions will be sustained upon audit based on technical merit for open tax years. Management believes it has no uncertain tax positions to be accrued or disclosed.

Issuance of Shares – The Fund is conducting a private offering to sell common shares only to individuals and entities qualifying as “accredited investors” within the meaning of Regulation D under the Securities Act. The Fund’s shares will not be registered with the SEC or listed on an exchange. The Fund’s shares are designed for long-term investors. The Fund is seeking to raise up to approximately $200 million of subscription amounts from prospective investors; provided that, the Investment Manager may accept a greater or lesser than $200 million in its sole discretion. The Fund is offering shares at the initial closing at $1,000.00 per share, and thereafter each share is offered at $1,000.00 plus a “make-up” amount calculated by applying an annualized rate of 3.0% to such investor’s subscription amount applied over the period since April 22, 2022.

3. Investment Management Fee and Other Related Party Transactions

Under the terms of the Investment Management Agreement between the Fund and the Investment Manager, the Investment Manager manages the Fund’s investments subject to oversight by the Board. The Fund pays to the Investment Manager an annual Management Fee, quarterly in arrears. The Management Fee will be equal to an annual rate of 1.50% of the Fund’s NAV; provided that to the extent the Fund accepts subscriptions from investors after April 22, 2022, the Fund will pay to the Investment Manager the Management Fee that would have been paid had such investors subscribed at April 22, 2022.

The Fund will pay a fee to the Investment Manager for administrative services (the “Investor Servicing Fee”) at an annual rate of 0.50% of the NAV; provided that to the extent the Fund accepts subscriptions from investors after April 22, 2022, the Fund will pay to the Investment Manager the Investor Servicing Fee that would have been paid had such investors subscribed at April 22, 2022. The Investor Servicing Fee may be used by the Investment Manager to pay placement agent fees, commissions or other brokerage fees relating to the offering and sale of shares. The Investor Servicing Fee will be charged quarterly in arrears.

The Investment Management Agreement provides that the Investment Manager will waive its Management Fee and/or pay or reimburse the Fund for Annual Expenses (as defined below) more than 1.00% per annum of the Fund’s average quarterly NAV (“Operating

16

CROWDSTREET REIT I, INC.

NOTES TO FINANCIAL STATEMENTS (Continued) |

Expense Limit”). Annual Expenses are the ordinary annual operating expenses of the Fund, including, without limitation, third-party fees and expenses for accounting, administration, valuation, tax compliance, custody, banking, brokerage, depository, insurance premiums, reporting, Investor meetings, and preparation of tax returns and determinations, but excluding fees and expenses for legal, audit, taxes, indemnifications, litigations, interest, Management Fees, Investor Servicing Fees and Board fees, extraordinary or non-routine matters, and Organizational Expenses. If the Fund’s Annual Expenses are below the Operating Expense Limit in any fiscal year, the Investment Manager may be entitled to be reimbursed in whole or in part for fees or expenses waived or reduced by the Investment Manager during the prior three year-period pursuant to the Operating Expense Limit. During the period ended December, 2022, no expenses were waived and or reimbursed by the Investment Manager.

During 2022 CrowdStreet paid $39,167 of Directors Fees and $95,293 of other expenses behalf of the Fund. As of December 31, 2022, the total amount due to CrowdStreet is $134,460. Also, four employees of the Investment Manager invested $195,000 in the Fund.

4. Concentration of Risk

Investing in the Fund involves risks, including, but not limited to, those set forth below. The risks described below are not, and are not intended to be, a complete enumeration or explanation of the risks involved in an investment in the Fund. For a more complete discussion of the risks of investing in the Fund, see the section entitled “Risk Factors and Certain Conflicts of Interest” in the Fund’s Registration Statement filed on April 21, 2022 and the Fund’s other filings with the SEC.

Non-Diversification Risk: As a “non-diversified” fund, the Fund may invest more than 5% of its total assets in the securities of one or more issuers. Therefore, the Fund may be more susceptible than a diversified fund to being adversely affected by events impacting a single borrower, geographic location, security, or investment type.

Investment and Market Risk: An investment in the Fund is subject to investment risk, including the possible loss of the entire amount that a shareholder invests. The value of the Fund’s investments may move up or down, sometimes rapidly and unpredictably. At any point in time, shares may be worth less than the original investment, even after considering the reinvestment of Fund dividends and distributions. Global economic, political and market conditions and economic uncertainty, including those caused by the ongoing COVID-19 pandemic, may adversely affect the Fund’s business, results of operations and financial condition.

Risks Related to the Commercial Real Estate Market: The Fund will concentrate its investments in commercial real estate, its portfolio will be significantly impacted by the performance of the commercial real estate market and may experience more volatility and be exposed to greater risk than a diversified portfolio.

17

CROWDSTREET REIT I, INC.

NOTES TO FINANCIAL STATEMENTS (Continued) |

Risks Related to the Fund’s Tax Status as a REIT: The Fund intends to elect to be taxed as and to qualify for treatment each year as a REIT under the Code. However, qualification as a REIT for tax purposes involves the application of highly technical and complex Code provisions for which only a limited number of judicial or administrative interpretations exist. Notwithstanding the availability of cure provisions in the Code, various compliance requirements could be failed and could jeopardize the Fund’s REIT tax status. Failure to qualify for taxation as a REIT would cause the Fund to be taxed as a regular corporation, which would substantially reduce funds available for distributions to Shareholders. In addition, complying with the requirements to maintain its REIT tax status may cause the Fund to forego otherwise attractive opportunities or to liquidate otherwise attractive investments, adversely affect the Fund’s liquidity and force the Fund to borrow funds during unfavorable market conditions, and/or limit the Fund’s ability to hedge effectively and cause the Fund to incur tax liabilities.

5. Tax Basis Information

As of December 31, 2022, the Fund’s most recent tax year end, the tax basis of distributable earnings (accumulated deficit) were as follows:

| | | | | |

| Undistributed ordinary income (loss) | | $ | (549,859 | ) |

| Other book tax temporary differences | | | 11,680 | |

| Total Accumulated Deficit | | $ | (538,179 | ) |

6. Subsequent Events

In connection with the preparation of the accompanying financial statements, the Fund has evaluated events and transactions occurring through the issuance of these financial statements.

On January 18, 2023, the Fund made an additional investment for $1.75 million. As of March 1, 2023, the Fund had raised additional gross offering proceeds of approximately $2.1 million since December 31, 2022.

18

CROWDSTREET REIT I, INC.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the shareholders and the Board of Directors of CrowdStreet REIT I, Inc.

Opinion on the Financial Statements and Financial Highlights

We have audited the accompanying statement of assets and liabilities of CrowdStreet REIT I, Inc. (the “Fund”), including the schedule of investments, as of December 31, 2022, the related statement of operations, statement of changes in net assets, statement of cash flows and financial highlights for the period April 22, 2022 (commencement date) through December 31, 2022, and the related notes. In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2022, and the results of its operations, its cash flows, the changes in its net assets, and the financial highlights for the period April 22, 2022 through December 31, 2022, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements and financial highlights based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audit, we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audit included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audit also included

19

CROWDSTREET REIT I, INC.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM (Continued)

evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

Portland, OR

March 1, 2023

We have served as the Company’s auditor since 2022.

20

CROWDSTREET REIT I, INC.

ADDITIONAL INFORMATION (Unaudited)

1. Disclosure of Portfolio Holdings

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Fund’s Form N-PORT reports will be available (1) without charge, upon request, by calling (971) 803-3110, (2) on the Fund’s website at www.funds@crowdstreet.com and (3) on the SEC’s website at http://www.sec.gov.

2. Proxy Voting Policies and Procedures

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities and, once available, information regarding how the Fund voted those proxies (if any) during the most recent twelve month period ended June 30, is available (1) without charge, upon request, by calling (971) 803-3110, (2) on the Fund’s website at www.funds@crowdstreet.com and (3) on the SEC’s website at http://www.sec.gov. During the period ended December 31, 2022, the Fund did not have any investments that required the Fund to vote proxies, and therefore did not vote any proxies during such period.

3. Compensation of Directors

Each Director who is not an “interested person” of the Fund (i.e., an “Independent Director”) receives an annual retainer of $25,000 plus reimbursement of related expenses in connection with his or her service on the Board of the Fund, as such amount may be updated by the Board. The Fund’s Statement of Additional Information includes additional information about the Directors and is available (1) without charge, upon request, by calling (971) 803-3110, (2) on the Fund’s website at www.funds@crowdstreet.com and (3) on the SEC’s website at http://www.sec.gov.

21

CROWDSTREET REIT I, INC.

ADDITIONAL INFORMATION (Unaudited) (Continued)

4. Information About the Directors and Executive Officers

Information regarding the directors and executive officers of the Fund, including their positions with the Fund and principal occupations for the past five years, as well as the directors’ other board memberships for the past five years, is set forth in the following table. As referenced below, “Fund Complex” means two or more registered investment companies that (1) hold themselves out to investors as related companies or (2) have a common investment advisor or have an investment adviser that is an affiliated person of the investment adviser of any other registered investment companies. Unless otherwise indicated, the address of all persons is c/o CrowdStreet Advisors, LLC, 98 San Jacinto Blvd., 4th Floor, Austin, TX. 78701.

INDEPENDENT DIRECTORS |

Name, Birth Year, and

Positions(s) with Fund | Term of Office

and Length of

Time Served | Principal Occupation(s)

During Past 5 Years | Number of

Portfolios

in Fund

Complex

Overseen

by Director | Other

Directorships/

Trusteeships

Held by

Director Outside

Fund Complex |

Kevin K. Albert (1952) | March 2022 to Present | Advisory Board Member at Nettwerk Music Group (2021 – present), Board of Directors, Slang Worldwide, Inc. (2021 – present) Advisory Board Member at Harborside Inc. (2020 – Present), Managing Director at Pantheon Ventures (2010 – 2019) | 1 | 2 |

Nancy Grady (1962) | January 2022 to Present | Advisory Board ETC ACtion (2021 – present) NEGrady Consulting Services, LLC (2018 – present), Senior Vice President at Northern Trust (2012 – 2018) | 1 | None |

22

CROWDSTREET REIT I, INC.

ADDITIONAL INFORMATION (Unaudited) (Continued)

INTERESTED DIRECTORS |

Name, Birth Year, and

Positions(s) with Fund | Term of Office

and Length of

Time Served | Principal Occupation(s)

During Past 5 Years | Number of

Portfolios

in Fund

Complex

Overseen

by Director | Other

Directorships/

Trusteeships

Held by

Director Outside

Fund Complex |

Sheldon Chang (1965)

Chair of the Board | January 2022 to Present | President, CrowdStreet Advisors (2021 – present) Senior Vice President, CrowdStreet Inc. (2021 – present) Head of Product & Distribution Strategy, Artivest Inc. (2017 – 2020) Partner, Pantheon Ventures (2013 – 2017) | 29 | None |

Thomas McDonald (1982)

Treasurer | January 2022 to Present | Director, Investment Product Development & Portfolio Management, CrowdStreet, Inc. (2018 – present) Consulting (2017) | 29 | None |

Kristen Howell (1972)

Secretary | January 2022 to Present | General Counsel & Chief Compliance Officer, CrowdStreet, Inc. (2021 – present); President CrowdStreet Capital, LLC (2022 – present) Chief Compliance Officer, CrowdStreet Advisors (2021 – November 2022); Partner, Chair Investment Funds Practice, Fox Rothschild, LLP (2016 – 2021) | 29 | None |

OFFICER(S) WHO ARE NOT DIRECTORS |

Name, Birth Year, and

Positions(s) with Fund | Term of Office

and Length of

Time Served | Principal Occupation(s)

During Past 5 Years | Number of

Portfolios

in Fund

Complex

Overseen

by Director | Other

Directorships/

Trusteeships

Held by

Director Outside

Fund Complex |

Tyler Levy (1989)

Chief Compliance Officer | November 2022 to Present | Associate General Counsel, CrowdStreet, Inc. (February 2022 – present); Corporate Counsel, CrowdStreet, Inc. (March 2021 – February 2022); Chief Compliance Officer, CrowdStreet Advisors (November 2022 – present); Attorney, Hesse & Hesse, PC (June 2015 – February 2021) | 29 | None |

23

This page intentionally left blank.

This page intentionally left blank.

(b) Not applicable

Item 2. Code of Ethics.

As of the end of the period covered by this report, the registrant has adopted a code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party. Pursuant to Item 13(a)(1), a copy of registrant’s code of ethics will be provided at no charge by sending a request to funds@crowdstreet.com. During the period covered by this report, the code of ethics has not been amended, and the registrant has not granted any waivers, including implicit waivers, from the provisions of the code of ethics.

Item 3. Audit Committee Financial Expert.

The registrant’s board of directors has not designated an audit committee financial expert, although at least one independent committee member likely would qualify as an expert. The audit committee determined that it has sufficient financial expertise to adequately perform its duties under the audit committee’s designation of duties in the Company’s bylaws. The audit committee will assess its financial expert designation in 2023.

Item 4. Principal Accountant Fees and Services.

(a) Audit Fees: Audit fees billed to the Registrant were $87,380 for the year ended December 31, 2022.

(b) Audit-Related Fees: No audit-related fees were billed to the Registrant for the year ended December 31, 2022.

(c) Tax Fees: No tax fees were billed to the Registrant for the year ended December 31, 2022 for professional services rendered by the Accountant for tax compliance, tax advice, or tax planning.

(d) All Other Fees: No aggregate fees were billed for products and services provided by the Accountant, other than the services reported in paragraphs (a) through (c) of this Item for the year ended December 31, 2022.

(e)(1) The Audit Committee specifically approves the Registrant’s engagement of an auditor to perform audit, audit-related, tax and other services for the Registrant pursuant to Rule 2-01 of Regulation S-X.

(e)(2) Not applicable.

(f) Not applicable.

(g) Non-Audit Fees: No non-audit fees were billed by the Accountant for services rendered to the Registrant’s investment adviser for the year ended December 31, 2022.

(h) Not applicable, all non-audit services that were rendered to the Registrant's investment adviser were pre-approved as required.

Item 5. Audit Committee of Listed Companies.

Not applicable.

Item 6. Schedule of Investments.

| (a) | Schedule filed with Item 1. |

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

In general, the Portfolio Companies do not typically convey traditional voting rights, and the occurrence of corporate governance or other consent or voting matters for this type of investment is substantially less than that encountered in connection with registered equity securities. On occasion, however, the Fund may receive notices or proposals from one or more Portfolio Companies seeking the consent of or voting by holders (“proxies”). The Fund has delegated any voting of proxies in respect of portfolio holdings to the Investment Manager to vote the proxies in accordance with the Investment Manager’s proxy voting guidelines and procedures. In general, the Investment Manager believes that voting proxies in accordance with the policies described below will be in the best interests of the Fund.

The Investment Manager generally will vote to support management recommendations relating to routine matters, such as the election of board members (where no corporate governance issues are implicated) or the selection of independent auditors. The Investment Manager generally will vote in favor of management or investor proposals that the Investment Manager believes will maintain or strengthen the shared interests of investors and management, increase value for investors and maintain or increase the rights of investors. On non-routine matters, the Investment Manager generally will vote in favor of management proposals for mergers or reorganizations and investor rights plans, so long as it believes such proposals are in the best economic interests of the Fund. In exercising its voting discretion, the Investment Manager will seek to avoid any direct or indirect conflict of interest presented by the voting decision. If any substantive aspect or foreseeable result of the matter to be voted on presents an actual or potential conflict of interest involving the Investment Manager, the Investment Manager will make written disclosure of the conflict to the Independent Directors indicating how the Investment Manager proposes to vote on the matter and its reasons for doing so.

Item 8. Portfolio Managers of Closed-End Investment Companies.

(a)(1) As of the date of this filing, Jack Chandler, Sheldon Chang, Ian Formigle, Charles George, and Thomas McDonald are the Registrant’s portfolio managers and are primarily responsible for day-to-day management of the Registrant’s investment portfolio.

Jack Chandler

Jack Chandler serves on CrowdStreet’s Board of Advisors and is an independent voting member of the CrowdStreet Fund Investment Committee. He is the Founder of Majesteka Investments Holdings, a private firm providing integrated strategic leadership and capital for emerging disruptive companies at the intersection of real estate, asset management, and technology. Since its founding in 2017, Majesteka has made investments and is serving in either a Board capacity or as Senior Advisor to a half dozen technology-enabled real estate firms in the direct lending, crowdfunding, software, data and communications, and single-family rental sectors.

Before forming Majesteka, Jack was Chairman of BlackRock's Global Real Estate business with a focus on the strategic development of the platform and investment and client activities. He served as a member of the BlackRock Real Estate Global Executive Committee, the BlackRock Alternative Investment Executive Committee, and the BlackRock Alternative Investment Committee. He joined BlackRock in 2011 as a Managing Director and Global Head of Real Estate with responsibilities for the business and investment performance of the platform and for developing and executing a strategic plan that resulted in doubling the platform AUM during his tenure.

Prior to joining BlackRock in 2011, Jack held various positions with LaSalle Investment Management during his 25-year tenure, most recently as the Global Chief Investment Officer and Executive Chairman for Asia Pacific, where he oversaw the firm's principal investment activities, risk management process, investment strategy, and investor relations. In addition, he oversaw LaSalle’s capital raising team which created and raised capital for new products and vehicles to expand LaSalle's investors' access to attractive investment opportunities around the globe.

From 2000 until 2010, Jack was based in Singapore as the Chief Executive Officer for LaSalle Investment Management - Asia Pacific, the platform he founded on behalf of the firm. During his tenure, he built the business into a US$7.4 billion AUM enterprise with six private equity commingled funds and more than 200 employees based in six offices across the region. Prior to relocating to Asia in 2000, he was Managing Director for the firm's direct investment activities in the U.S.

Jack is former Chairman of the ULI Americas Executive Committee, Treasurer, and ULI’s Global Board of Trustees and a founding member of ULI Technology Council.

Sheldon Chang

Sheldon is a financial services executive with over 30 years of experience in leading alternative investment product and distribution businesses and investment banking. Sheldon joined CrowdStreet in 2021 and is the President of CrowdStreet Advisors, is a member of CrowdStreet’s Executive Management Team and leads CrowdStreet’s Investment & Wealth Solutions (IWS) division, the firm’s investment management and advisory services, including investment funds, private managed accounts and wealth management. Sheldon also serves as a voting member of the CrowdStreet Funds Investment Committee.

Prior to joining CrowdStreet, Sheldon led over $50bn in institutional and retail offerings and product development, including corporate debt and equity and private alternative investment funds for high-net-worth investors. He was the Head of Product & Distribution Strategy at Artivest, an alternative investments fintech platform and, before that, he established the Private Wealth unit as a Partner at Pantheon Ventures, a private equity and real assets investment manager with over $50bn in AUM. Sheldon built and led the private equity, infrastructure, real assets and debt products platform at Bank of America Merrill Lynch Wealth Management, managing over 70 private alternative investment funds and $12bn in client assets. Prior to that, he was an investment banker at Merrill Lynch, UBS and Goldman Sachs serving corporate and government clients in North America, Asia and Latin America. Sheldon received his MBA from Northwestern University’s Kellogg School of Management and a BS in Economics from Cornell University.

Ian Formigle

Ian is a real estate professional and serial entrepreneur with over 24 years of experience in real estate private equity, startups, and equity and options trading. At CrowdStreet, Ian leads the Office of the CIO division, responsible for the overall investment strategy of the firm. Ian serves as a member of the CrowdStreet Executive Management Team and the Chairman of the CrowdStreet Funds Investment Committee. He joined CrowdStreet in 2014 as the Vice President of Investments with responsibility for the business and investment performance of the Marketplace, leading a 29-member team of commercial real estate investment professionals. As of January 2022, Ian was responsible for the approval of 593 investment offerings, with a total commercial real estate value of $24bn, resulting in $2.9bn raised on the platform by third-party sponsors. Since 2014, 95 of those investment offerings have been realized, with an average net IRR of 19%, returning over $460mm of distributions back to investors.

Prior to joining CrowdStreet, Ian was Vice President of Business Development for ScanlanKemperBard Companies, where he managed the firm’s alternative investment platform and served as a senior acquisitions officer on a team that acquired some $500mm of commercial real estate assets during his tenure. Previously, Ian co-founded and served as CEO of Clarus Property Ventures, a regional real estate private equity firm that focused on multifamily acquisitions. Ian began his career as an equity options market maker and member of the Pacific Exchange.

Ian contributes to the real estate industry as a thought-leader, serving as a member of ULI’s Technology Council, and contributing as an author at Forbes.com and in his latest book, “The Comprehensive Guide to Commercial Real Estate Investing.” Ian holds a BA in Economics and a BA in Political Science from the University of California at Berkeley.

Charles (Chip) George

Chip has over 30 years of experience in real estate private equity management with exposure to core, value-add, opportunistic and development investments across the country. He joined CrowdStreet in 2021 as a Portfolio Manager and is responsible for monitoring and facilitating peak investment performance and improving the quality of the CrowdStreet sponsor and investor experience. Chip also serves as a voting member of the CrowdStreet Funds Investment Committee.

Prior to joining CrowdStreet, Chip was a director and senior portfolio manager for Harrison Street Real Estate Capital and RREEF America (DWS Investments), managing their respective flagship funds, each of which had asset values of over $10bn. In this role, he was responsible for evaluating investment opportunities to ensure compliance with the fund investment strategy. Chip was also responsible for overseeing and managing the operations of hundreds of real estate investments nationally in all major product types as well as niche products such as student housing, senior housing, medical office, storage and life science.

Prior to his portfolio manager roles, Chip was an asset manager with responsibility for investment performance with Harbor Group, Banyan Management and Amli Realty. Chip is a graduate of Miami University, Oxford, OH with a Bachelor of Science degree in Accounting and is a Certified Public Accountant.

Thomas McDonald

Thomas McDonald is a real estate professional with over 15 years of experience in real estate and investments. Thomas leads, manages and coordinates all aspects of new investment product and service development, launch, and ongoing portfolio management for CrowdStreet’s Investment and Wealth Solutions (IWS) division. Thomas serves as a voting member of the CrowdStreet Funds Investment Committee. He joined CrowdStreet in 2018, contributing to the growth of CrowdStreet’s managed fund solutions. As of January 2022, Thomas was responsible for the development of 20 managed funds that have raised $225mm, investing across 135 commercial real estate projects with a total capitalization over $1 billion.

Thomas started his career at Trefethen and Company, an independent financial and strategic advisory firm, where he supported the firm’s investment management and M&A service activities. Prior to CrowdStreet, Thomas consulted in the real estate industry, advising real estate operators in various capacities, including capital raising and strategy. Thomas earned a Master of Science in Finance with Honors from Georgetown University and a Bachelor of Science in Finance from Portland State University.

(a)(2) The portfolio managers primarily responsible for the day-to-day management of the Registrant’s portfolio also manage other pooled investment vehicles, as indicated below. The following table identifies, as of December 31, 2022: (i) the number of other registered investment companies, other pooled investment vehicles and other accounts managed by each portfolio manager; (ii) the total assets of such companies, vehicles and accounts; and (iii) the number and total assets of such companies, vehicles and accounts that are subject to an advisory fee based on performance, unless otherwise noted:

Portfolio

Manager | | Registered

Investment Companies | | | Pooled

Investment Vehicles | | Other

Accounts |

| | | | Number of

Accounts | | | | Assets

Managed | | | | Number of

Accounts | | | | Assets

Managed | | | Number of

Accounts | | Assets

Managed |

| Jack Chandler | | | 0 | | | $ | 0 | | | | 28 | | | $ | 351,935,337 | | | None | | N/A |

| Sheldon Chang | | | 0 | | | $ | 0 | | | | 28 | | | $ | 351,935,337 | | | None | | N/A |

| Ian Formigle | | | 0 | | | $ | 0 | | | | 28 | | | $ | 351,935,337 | | | None | | N/A |

| Charles George | | | 0 | | | $ | 0 | | | | 28 | | | $ | 351,935,337 | | | None | | N/A |

| Thomas McDonald | | | 0 | | | $ | 0 | | | | 28 | | | $ | 351,935,337 | | | None | | N/A |

____________________

Conflicts of Interest

Actual or apparent conflicts of interest may arise when a portfolio manager has day-to-day management responsibilities with respect to other investment companies, pooled investment vehicles, and/or other accounts (collectively “Client Accounts”). Portfolio managers who manage Client Accounts in addition to a Registrant may be presented with the potential conflicts. For example, the Investment Manager may, directly or indirectly, receive fees from a Client Account that are higher than the fee it receives from the Fund, or it may, directly or indirectly, receive a performance-based fee on a Client Account. In those instances, the portfolio managers may have an incentive to not favor the Fund over the Client Accounts. The Investment Manager has adopted trade allocation and other policies and procedures that it believes are reasonably designed to address these and other conflicts of interest.

(a)(3) Each of the Registrant’s portfolio managers receives compensation for his services, including services performed for the Registrant on behalf of the Investment Manager, from the Investment Manager’s parent company and not by the Fund. The portfolio managers’ compensation consists of a fixed annual salary and bonus (or fixed monthly fee).

(a)(4) The following table discloses the dollar range of equity securities beneficially owned by the portfolio managers of the Fund as of December 31, 2022.

| Name of Portfolio Manager | | Dollar Range of

Equity

Securities in the

Fund | |

| Jack Chandler | | None | |

| Sheldon Chang | | $110,000 – $110,000 | |

| Ian Formigle | | None | |

| Charles George | | $25,000 - $25,000 | |

| Thomas McDonald | | None | |

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

As of the date of this filing, there have been no material changes in the procedures by which shareholders may recommend nominees to the Board of Directors.

Item 11. Controls and Procedures.

(a) Based on their evaluation of the registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940, as amended (the “Act”)) as of a date within 90 days of the filing date of this report, the registrant’s principal executive officer and principal financial officer have concluded that such disclosure controls and procedures are reasonably designed and are operating effectively to ensure that material information relating to the registrant is made known to them by others within those entities, particularly during the period in which this report is being prepared, and that the information required in filings on Form N-CSR is recorded, processed, summarized, and reported on a timely basis.

(b) There were no changes in the registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Investment Company Act of 1940) that occurred during the period covered by this report that have materially affected, or are reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies.

Not applicable.

Item 13. Exhibits.

(a)(1) Not applicable

(a)(2) A separate certification for each principal executive officer and principal financial officer of the registrant as required by Rule 30a-2(a) under the Act (17 CFR 270.30a-2(a)): Attached hereto

(a)(3) Not applicable

(a)(4) Not applicable

(b) Certification required by Rule 30a-2(b) under the Act (17 CFR 270.30a-2(b)): Attached hereto

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| (Registrant) | CrowdStreet REIT I, Inc. | |

| | | |

| By: | /s/ Sheldon Chang | |

| | Sheldon Chang, President | |

| | | |

| Date: | 3/9/2023 | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By | /s/ Sheldon Chang | |

| | Sheldon Chang, President | |

| | | |

| Date: | 3/9/2023 | |

| | | |

| By: | /s/ Thomas McDonald | |

| | Thomas McDonald, Treasurer | |

| | | |

| Date: | 3/9/2023 | |