Confidential Treatment Requested by Hanryu Holdings, Inc. Pursuant to 17 C.F.R. Section 200.83

This Draft Registration Statement Has Not Been Publicly Filed with the United States Securities and Exchange Commission, and All Information Herein Remains Strictly Confidential.

Confidential Draft #4, as Confidentially Submitted to the Securities and Exchange Commission on October 28, 2022

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

HANRYU HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

Delaware | 7370 | 88-1368281 | ||

(State or other jurisdiction of incorporation or organization) | (Primardy Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

160, Yeouiseo-ro, Yeongdeungpo-gu, Seoul, Republic of Korea 07231

+82-2-564-8588

(Address, including zip code, and telephone number, including

area code, of registrant's principal executive offices)

Chang-Hyuk Kang

Chief Executive Officer

Hanryu Holdings, Inc.

160, Yeouiseo-ro, Yeongdeungpo-gu, Seoul, Republic of Korea 07231

+82-2-564-8588

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Daniel W. Rumsey, Esq. Jack P. Kennedy, Esq. Disclosure Law Group, A Professional Corporation 655 West Broadway, Suite 870 San Diego, California 92101 (619) 272-7050 | Anthony W. Basch, Esq. Yan (Natalie) Wang, Esq. Alexander W. Powell, Esq. Kaufman & Canoles, P.C. Two James Center, 14th Floor 1021 East Cary St. Richmond, Virginia 23219 (804) 771-5700 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ | Accelerated filer ☐ | Non-accelerated filer ☐ | Smaller reporting company ☒ | ||||

Emerging growth company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment that specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted. | ||

PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED OCTOBER 28, 2022 |

[●] Shares of Common Stock

HANRYU HOLDINGS, INC.

We are offering [●] shares of our common stock, par value $0.001 per share (“common stock”). This is our initial public offering and no public market currently exists for our common stock. The initial public offering price of our common stock is expected to be between $[●] and $[●] per share. We intend to list our common stock on the Nasdaq Capital Market under the symbol “HRYU��.

We are an “emerging growth company” as the term is used in the Jumpstart Our Business Startups Act of 2012 and, as such, have elected to comply with certain reduced public company reporting requirements for this prospectus and future filings. See “Prospectus Summary – Implications of Being an Emerging Growth Company.”

Investing in our common stock involves a high degree of risks beginning on page 14 of this prospectus for a discussion of the risks that you should consider in connection with an investment in our securities.

Per Share | Total | ||

Initial public offering price | $ | $ | |

Underwriting discounts and commissions (1) | $ | $ | |

Proceeds, before expenses, to us | $ | $ |

(1) | In addition, we have agreed to issue a warrant to purchase up to [●] shares of our common stock to the underwriter, which equates to 5% of the number of shares of our common stock to be issued and sold in the offering, and to pay the underwriter for certain expenses. See “Underwriting” for additional information regarding this warrant and underwriting compensation generally. |

We have granted the underwriter an option to buy up to an additional [●] shares of our common stock to cover over-allotments, if any. The underwriter may exercise this option at any time during the 45-day period from the date of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Delivery of the shares will be made on or about [●], 2022, subject to customary closing conditions.

Aegis Capital Corp.

The date of this prospectus is [●], 2022

You should rely only on the information contained in this prospectus or in any free writing prospectus we or the underwriter may authorize to be delivered or made available to you. Neither we nor the underwriter have authorized anyone to provide you with different information. We are offering to sell, and seeking offers to buy, shares of common stock only in jurisdictions where offers and sales are permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of shares of our common stock. Our business, financial condition, operating results and prospects may have changed since that date.

For investors outside of the United States: No action is being taken in any jurisdiction outside of the United States that would permit a public offering of the shares of our common stock or possession or distribution of this prospectus in any such jurisdiction. Persons outside of the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of common stock and the distribution of this prospectus outside of the United States.

In this prospectus, unless the context indicates otherwise, references to “Hanryu Holdings,” “Hanryu,” “we,” the “Company,” “our” and “us” refer to Hanryu Holdings, Inc., a Delaware corporation, and its subsidiaries, and references to the “Board” or the “Board of Directors” means the Board of Directors of the Company. References to “Korea” or “ROK” refer to the Republic of Korea, all references to “Korean Won” or “KRW” are to the legal currency of Korea, and all references to “U.S. dollars”, “USD”, and “$” are to the legal currency of the United States.

TRADEMARKS, TRADE NAMES AND SERVICE MARKS

We use various trademarks, trade names and service marks in our business, including “FANTOO” and associated marks. For convenience, we may not include the SM, ® or ™ symbols, but such omission is not meant to indicate that we would not protect our intellectual property rights to the fullest extent allowed by law. Any other trademarks, trade names or service marks referred to in this prospectus are the property of their respective owners.

INDUSTRY AND MARKET DATA

This prospectus includes market and industry data that we have obtained from third party sources, including industry publications, as well as industry data prepared by our management on the basis of its knowledge of and experience in the industries in which we operate (including our management’s estimates and assumptions relating to such industries based on that knowledge). Management has developed its knowledge of such industries through its experience and participation in these industries. While our management believes the third-party sources referred to in this prospectus are reliable, neither we nor our management have independently verified any of the data from such sources referred to in this prospectus or ascertained the underlying economic assumptions relied upon by such sources. Furthermore, references in this prospectus to any publications, reports, surveys or articles prepared by third parties should not be construed as depicting the complete findings of the entire publication, report, survey or article. The information in any such publication, report, survey or article is not incorporated by reference in this prospectus. While we believe that all such information contained in this prospectus is accurate and complete, nonetheless such data involve uncertainties and risks, including risks from errors, and is subject to change based on various factors, including those discussed under “Risk Factors” and “Cautionary Statement Regarding Forward-Looking Statements.”

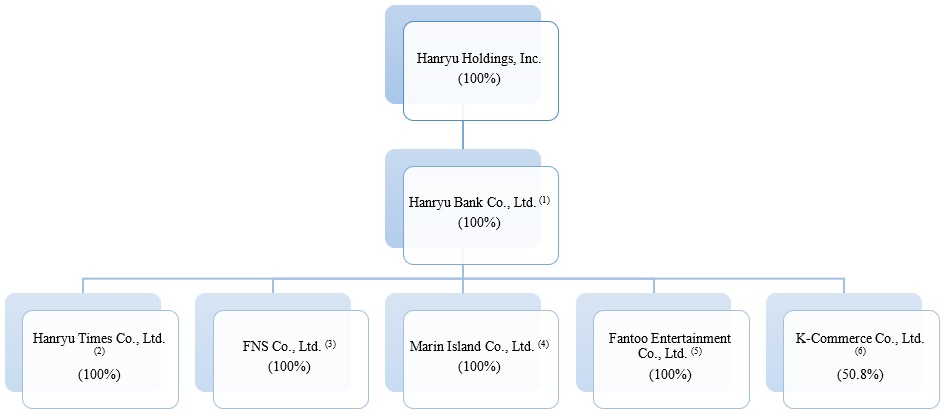

This summary highlights information appearing elsewhere in this prospectus. This summary is not complete and does not contain all of the information that you should consider before investing in our common stock. You should carefully read the entire prospectus, including the information presented under “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and the consolidated financial statements and notes related thereto included elsewhere in this prospectus before making an investment decision. Unless the context requires otherwise, references to the "Company", “we”, “us”, or “our”, refer to Hanryu Holdings, Inc., a Delaware corporation, and its wholly-owned subsidiaries Hanryu Bank Co., LTD., FNS Co., Ltd., Hanryu Times Co., Ltd., Marine Island Co., Ltd., FANTOO Entertainment Co., Ltd., and our majority owned subsidiary, K-Commerce Co., Ltd., all of which were incorporated under the laws of the Republic of Korea.

Our Mission

We aim to provide an all-inclusive online global playground for fans, where they can consume, create, and get rewarded for all things related to their fandom within our FANTOO platform, an engaging and innovative social media platform that connects users around the world that share similar interests.

Our Company

We created FANTOO to provide distinctive service offerings, technology, applications and websites, through a multi-media global platform for our users to interact with other like-minded users, and share their appreciation as fans of various types of entertainment and cultures, create their own content, enjoy other user's content, engage in e-commerce, and experience a community we believe is unlike any other.

Our current users are enthusiasts of South Korean culture (“K-Culture”), also known as the “Korean Wave,” or "Hanryu". Though we anticipate expanding into additional entertainment genres, the Korean Wave is the current basis of FANTOO. The growing popularity of the Korean Wave has historically been driven by social networking services and online video sharing platforms. Through these channels, the dispersion and export of South Korean arts, music and entertainment has grown rapidly from a regional influence into a global appreciation of K-Culture. The expansion of the Korean Wave into a global phenomenon provides a significant opportunity to unite fans across the globe within the FANTOO platform.

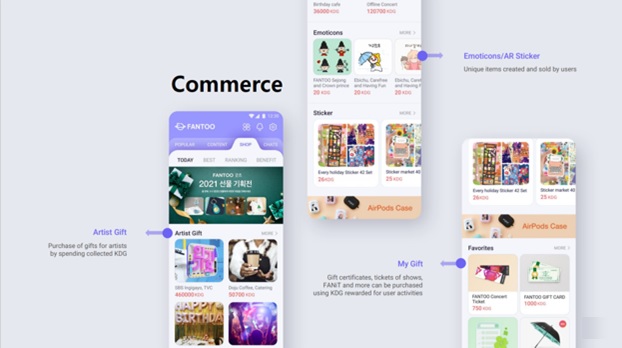

FANTOO leverages the growing groups of fans with similar interests, known as "fandoms," in order to tap into the "Fandom Economy" and monetize the growing fandom community. Through fandoms, fans have expanded the scope of their spending in a variety of ways, including paying for advertisements, production of products that promote or express their adulation for their favorite entertainers, and purchasing merchandise, as well as supporting the activities related to their interests by enthusiastically promoting them online through social media. With the rise of social media platforms, fans are no longer passive consumers of content, but are actively sharing ideas and acting as producers and content creators. Fans' connectivity to fandoms is extremely high due to the ease of access allowed by mobile devices and applications. FANTOO allows for fans to be proactive in their fandoms, and rewards users for their activity.

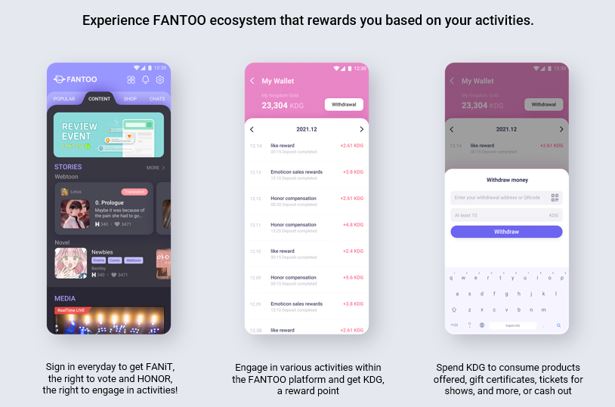

We believe an opportunity exists for FANTOO to become an industry leader in fandom platforms and content creation by exploiting the current market sentiment that we believe treats fandoms and fans only as a group of passive consumers, despite the fans’ contributions. Other existing platforms and social networks often fail to meet the needs of their users, as such platforms offer limited products and services, causing their users to look elsewhere for the products and services that reflect their interests. In addition, most other platforms and applications either do not provide rewards for user contributions, or do not reward users simply for daily activity within the application or platform. FANTOO is an all-in-one platform that fills this void. Through its well-designed ecosystem, FANTOO not only supports fans’ interests in entertainment and entertainers, but also provides in-platform economic rewards in return for users' contributions. These in-platform rewards, called "Kingdom Gold" (“KDG”), can then be accumulated in the user’s account and used to pay other users for goods and services within the FANTOO platform. We believe the services and offerings within the FANTOO platform will result in a growing “Fandom Economy,” that benefits both our Company and fans across the globe.

FINANCIAL

As of June 30, 2022, we had not yet generated revenue from the FANTOO platform, have had recurring losses since inception, have not achieved profitable operations, and we intend to continue to invest substantially in our business, all which raises substantial doubt about our ability to continue as a going concern.

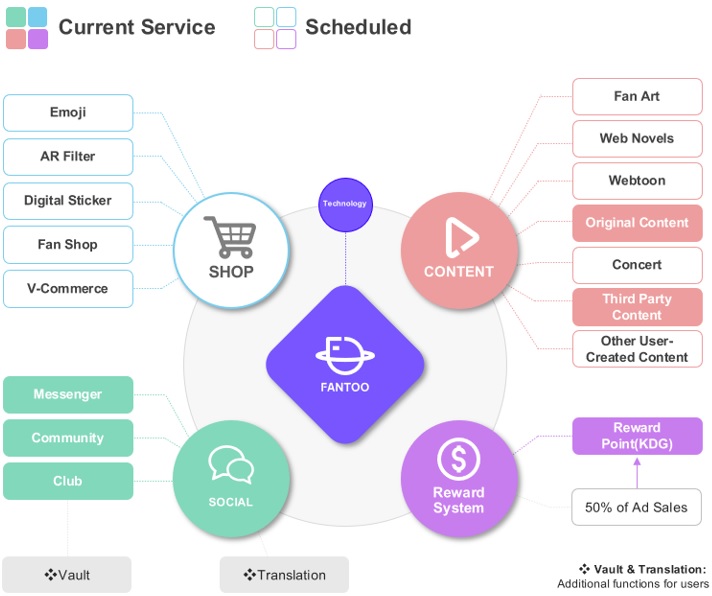

FANTOO Offerings

Reward System

The FANTOO application includes a user-reward system, which is the basis of the FANTOO ecosystem. Users earn KDG based on: (i) the level of each user's activity within the FANTOO platform; and (ii) the revenue we derive from FANTOO's advertising sales. At midnight of each day, all advertising revenue for that day is accumulated, and 50% of that day's total net advertising profits are distributed as KDG to users, based upon their level of contribution within the FANTOO platform. From the 50% of profits that are distributed to users as KDG, approximately 30% of the distribution of rewards will go to users who are content creators, and the remaining 20% will be issued to general users who participate on the platform. For the purposes of calculating advertising profits allocated for user rewards, the amount of KDG issued will be exchanged at a ratio of one KDG for every 100 Korean Won.

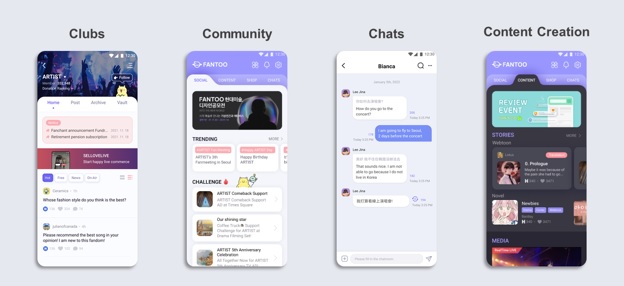

Socialization on FANTOO

Our objective is to facilitate numerous ways for our user to socialize within the FANTOO platform. Socialization is built into all aspects of the FANTOO platform, including: (i) “Messenger/Chat” which supports automatic and secure live translation in 17 languages; (ii) “Clubs” which are private groups managed by users with similar interests; and (iii) “Community” which provides a public forum for users to freely express themselves and discuss any number of topics.

Content

Users can enjoy FANTOO original content, user-generated content, and concert feeds of concerts of all sizes, from stadiums to small stages, in all genres such as K-pop to Indie. Users can create, sell, and/or purchase fan art, web novels, webtoons, and other forms of user-generated content.

Shop

Users can purchase Kpop CDs, and K-culture fandom items such as photo books, DVDs, dolls, stationaries, clothing etc.

KDG and Divestiture of Kingdom Coin (“KDC”)

KDG earned by users can only be exchanged within the FANTOO platform for content, goods and services offered on the platform. Due to this closed network nature of the platform, we initially created KDC, a public digital cryptocurrency separate and apart from the FANTOO platform, as a method of onboarding and offboarding KDG to and from the FANTOO platform through a separate application previously known as the FANTOO Wallet Application (“Fantoo Wallet”).

However, on June 22, 2022, the Company divested itself of all KDC assets and operations. The Company no longer mines, issues or maintains KDC. This shift in our business plan was undertaken both to protect our users from potential risks associated with speculators betting on the value of KDC, and because of the recent market and regulatory conditions surrounding cryptocurrency in general. As such, the Company no longer supports or operates Fantoo Wallet, and no longer allows the conversion of KDG into KDC (and vice-versa). KDG operates as a reward point that circulates solely within the FANTOO platform. Neither Hanryu Holdings nor its subsidiaries have any affiliation with the acquirer of the KDC assets and operations.

Our Opportunity

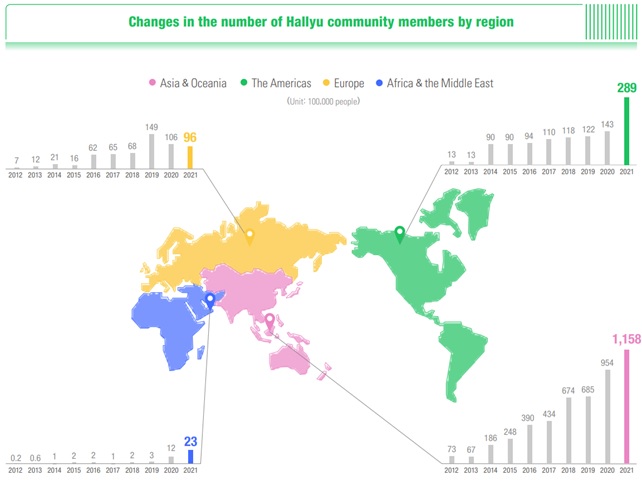

Our primary opportunity comes from the growing global interest in the Korean Wave and expanding influence of K-Culture. According to a study undertaken by the Korea Institute, K-Culture influence was ranked No.7 worldwide in 2021 among country cultures with the most worldwide influence, and the number of Korean Wave fans increased from approximately 35.0 million in 2015 to approximately 156.6 million in 2021 across 116 countries. The countries with a significant number of K-Culture fans include China with 86.32 million fans, the United States with 16.69 million fans, Thailand with 14.8 million fans, Russia with 5.69 million fans, Vietnam with 4.12 million fans, Argentina with 2.9 million fans, Canada with 1.96 million fans, India with 1.35 million fans, Chile with 1.12 million fans, Turkey with 0.98 million fans, Jordan with 0.98 million fans, Australia with 0.93 million fans, Italy with 0.75 million fans, France with 0.57 million fans, Egypt with 0.55 million fans, Japan with 0.34 million fans, Saudi Arabia with 0.30 million fans, and remaining 16.2 million fans spread across the remaining 99 countries.

Along with the growth of the Korean Wave, online and mobile platforms were the most common channels for fans to access content representing K-Culture. This places the FANTOO platform in an ideal position as a mobile application for fans to access Korean Wave content. Due to global conditions arising from COVID-19, FANTOO is well positioned to take advantage of the growth in the Korean Wave due to FANTOO's ability to provide services such as virtual events and online concerts, within the FANTOO platform.

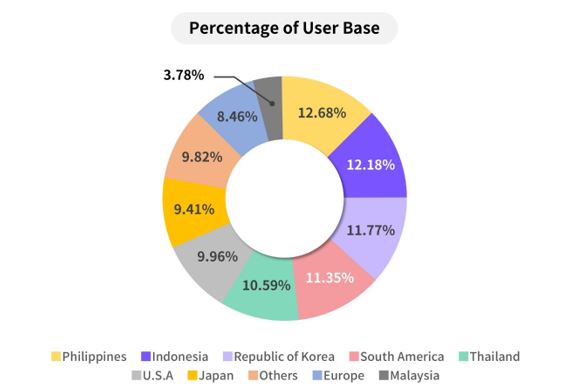

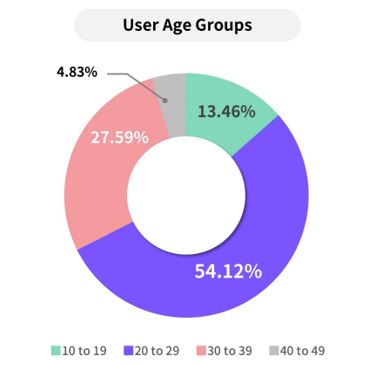

Currently, our user base is: (A) geographically located in the following areas, 12.68% in the Philippines, 12.18% in Indonesia, 11.77% in South Korea, 11.35% in South America, 10.59% in Thailand, 9.96% in United States of America, 9.41% in Japan, 8.46% in Europe, 3.78% in Malaysia, and 9.82% in various regions (each of which constitutes less than 1% of our user base); and (B) is spread among the following age demographics, 13.46% are 12 to 19 years old, 54.12% are 20 to 29 years old, 27.59% are 30 to 39 years old, and 4.83% are 40 to 49 years old. The age demographic between 20 to 39 years, which makes up over 80% of the FANTOO platform’s users, generally has the highest purchasing power among commercial and entertainment industries, creating an opportunity for the FANTOO platform to capture revenue from this demographic. As such, the Company intends to use funds received from the offering to expand the reach of the platform primarily across the Americas and Europe within the age bracket of 20 to 39 years old.

Our Value

We focus on providing user-centric services to provide a single platform that can address and satisfy the needs of fans within that platform. FANTOO will enrich users' fandom experience by providing an all-in-one platform for fandom content, including news, popular culture, discussions, live shows, and fan creativity. FANTOO is currently available in 17 languages, with real-time translation services. These real time translation services enable our users to communicate with each other across the globe without language barriers. For languages that are not available for real-time translation, the FANTOO platform provides a solution through the use of translation matching services among users. Through the translation matching services, the FANTOO platform ensures that content is available to a greater number of global fans in their own languages. In addition, the FANTOO platform allows users to freely create and monetize their own content, and enables fast and secure user-to-user sales on the FANTOO platform. Within FANTOO, fans are rewarded with KDG, a reward token issued within the platform intended to keep current users active, as well as attract new users. The more KDG a user earns, the more purchasing power the user has within the FANTOO platform to purchase goods and/or services within the FANTOO platform, either directly from us, or from other users utilizing KDG.

Integrated Technology and Infrastructure

Technology

FANTOO is built to connect people across the globe. With that in mind, FANTOO was designed to specifically address the numerous challenges that accompany providing a global service through its technology offerings within the FANTOO platform, including: (i) content delivery curation using artificial intelligence ("AI"); (ii) AI speech synthesis; (iii) AI-powered nudity detection and blocking; and (iv) AI deepfake detection and blocking.

Infrastructure

Our current headquarters and production facilities are located at the Seoul Marina, the largest Korean Wave culture center in Korea. With large outdoor stages, sculpture gardens, and broadcast studios, the Seoul Marina is used for hosting FANTOO’s concerts and other user events.

Our Strengths

Multiple Potential Revenue Streams

One of our strengths will be our ability to derive revenue from multiple sources, including (1) direct sales revenue, driven by advertisement, content, and e-commerce sales; and (2) revenue derived from collecting a percentage of user-to-user sales of emojis, online stickers, web novels, webtoons, translation matching, and other user-to-user transactions.

Direct Advertising Platform

We operate our own direct advertising platform on FANTOO, which connects us directly with advertisers, as opposed to utilizing third party advertising services, which is common on other social media platforms. This allows us to better understand and customize advertising products, resulting in higher engagement and advertising efficiency, as well as increasing advertising revenue.

Secure and Safe Platform

The FANTOO platform's security and compliance protocols utilize AI technology, allowing for a secure user interface.

High User Engagement

FANTOO's one-stop fandom platform, paired with its in-platform reward system utilizing KDG, is intended to keep users highly engaged, active, and brand-loyal. This brand loyalty is intended to facilitate promotion of FANTOO, resulting in lower costs to promote the platform.

Our Growth Strategy

Our core strategy is to pursue initiatives that promote the viral growth of our fandom base, and in doing so drive user-growth, content creation, user-to-user transactions, advertising sales, and other new revenue streams utilizing the following levers:

● | attracting fans to FANTOO on a global basis; |

● | advertising branded content; |

● | broadening our offerings within the FANTOO platform; |

● | continuous investment in research and development in our technologies; |

● | development of our intellectual property portfolio; and |

● | expanding FANTOO beyond Korean Wave fandoms to other global fandoms. |

Selected Risks Related to our Business

Our business is subject to numerous risks, including risks that may prevent us from achieving our business objectives or may adversely affect our business, financial condition, results of operations, cash flows and prospects, that you should consider before making an investment decision. Some of the more significant risks and uncertainties relating to an investment in our Company follow. These risks are more fully described in “Risk Factors” below immediately following this prospectus summary:

Risks Related to our Business

| ● | We have incurred significant losses since our inception, and we intend to continue to invest substantially in our business. As a result, we may continue to experience losses in the future; |

| ● | Our results of operations may fluctuate significantly, which makes our future results of operations difficult to predict and could cause our results of operations to fall below expectations; |

| ● | We may be unable to effectively manage the continued growth of our workforce and operations, including the development and management of new business initiatives; |

| ● | Our business is rapidly evolving, and we plan to continue to forgo short-term financial performance for long-term growth, which makes it difficult to evaluate our future prospects and predict our future results of operations, including our revenue growth rate; |

| ●

| As a startup, we have a history of net losses, including $(3.5) million and $(14.9) million for the six months ended June 30, 2022 and 2021, respectively, as well as an accumulated deficit of $(26.5) million as of June 30, 2022, and net losses of $(12.5) million and $(9.6) million for the years ended December 31, 2021, and 2020, respectively, as well as an accumulated deficit of $(23) million as of December 31, 2021. We may not be able to generate sufficient revenue to achieve or maintain profitability in future periods; |

| ● | If we were to lose the services of members of our senior management team, we may not be able to execute our business strategy; |

| ● | The COVID-19 pandemic may adversely affect our business, operations, and the markets and communities in which we, our customers, suppliers, merchants, and advertisers operate; |

| ● | We face intense competition and could lose market share to our competitors if we do not innovate or compete effectively; |

| ● | Liability and expenses based on the nature and content of the materials that we create or distribute, including materials provided by third parties; |

| ● | Our dependence on third-party relationships with content producers and distribution channels; and |

| ● | As of June 30, 2022, we had not yet generated revenue from the FANTOO platform, have had recurring losses since inception and have not achieved profitable operations, which raises substantial doubt about our ability to continue as a going concern. |

Risks Related to Government Regulation

| ● | Because some of our operations are subject to Korean law, there are circumstances in which certain of our Korean affiliates’ executive officers may be held either directly or vicariously liable for the actions of our Korean affiliates or our Korean affiliates’ executives and employees; |

| ●

| Some of our operations are subject to certain detailed and complex fair trade, labor, employment, and workplace safety laws and regulations, which continue to evolve and have and will continue to affect our operations and financial performance, could subject us to costs and penalties, and may affect our reputation; |

| ● | Our business is subject to regulation, and changes in applicable regulations may negatively impact our business; |

| ● | Decreased levels of traffic due to intensified government regulation of the Internet industry; |

| ● | Liability in the event of a violation of privacy regulations, data privacy laws, and/or child protection laws; |

| ● | Lawsuits or liability arising as a result of the Company providing its products and/or services; and |

| ● | Lawsuits or liability as a result of content published through our products and services. |

Risks Related to Doing Business in Korea

| ● | Fluctuations in exchange rates could result in foreign currency exchange losses to us; | |

| ● | International relations, including escalations in tensions with North Korea, could adversely affect the Korean or global economies and demand for our products and services; | |

| ●

| There are special risks involved with investing in Korean companies, including the possibility of restrictions being imposed by the Korean government in emergency circumstances, accounting and corporate disclosure standards that differ from those in other jurisdictions, and the risk of direct or vicarious criminal liability for executive officers of our Korean affiliates; | |

| ● | HBC's transactions with its subsidiaries and affiliates may be restricted under Korean fair trade regulations; | |

| ● | We may be subject to certain requirements and restrictions under Korean law that may, in certain circumstances, require it to act in a manner that may not be in our or our stockholders’ best interest; | |

| ● | A focus on regulating copyright and patent infringement by the Korean government subjects us to extra scrutiny in our operations and could subject us to sanctions, fines, or other penalties, which could adversely affect our business and operations in Korea; and | |

| ● | Our business may be adversely affected by developments that negatively impact the Korean economy and uncertainties in economic conditions that impact spending patterns of our customers in Korea. |

Risks Related to Our Technology

| ●

| Harm to our FANTOO brand or our associated brands and marks or reputation may occur if our suppliers or merchants use unethical or illegal business practices, such as the sale of counterfeit or fraudulent products, or if our protocols with respect to such sales are perceived or found to be inadequate, which may also subject us to possible sanctions or penalties; | |

| ● | Any significant interruptions or delays in service on our apps or websites, or any undetected errors or design faults, could result in limited capacity, reduced demand, processing delays, and loss of customers, suppliers, or merchants; | |

| ● | Any failure to protect our apps, websites, networks, and systems against security breaches or otherwise protect our confidential information could damage our reputation and brand and may subject us to possible sanctions or penalties; | |

| ● | Growth of our client base depends upon effective interoperability with mobile operating systems, networks, mobile devices and standards that we do not control; | |

| ● | Cyber incidents, including security breaches, improper access, other hacking and phishing attacks on our system; | |

| ● | Errors, bugs, or vulnerabilities in these systems, or failures to address or mitigate technical limitations in our systems; and | |

| ● | Any failure to comply with privacy laws or regulations, or to fulfill privacy-related customer expectations in the jurisdictions where we operate, could damage our reputation and brand and business and may subject us to possible sanctions or penalties. |

Risks Related to our Digital Assets

| ● | Regulatory changes or actions may restrict the use of digital assets; | |

| ● | Our rewards system may be subject to various regulations in South Korea that restrict or limit the use of such rewards; and | |

● | We may have securities laws exposure relating to the previous issuances of Kingdom Coin; |

Risks Related to Intellectual Property

| ● | We may be subject to claims of infringement of third-party intellectual property rights; | |

| ● | Current and future litigation related to intellectual property rights; | |

| ● | Our failure to protect our intellectual property rights; and | |

| ● | Piracy, unauthorized copying, and other forms of intellectual property infringement. |

Governance Risks and Risks Related to Our Common Stock

| ● | Provisions of Delaware law and our certificate of incorporation and bylaws could limit our stockholders’ ability to obtain a favorable judicial forum for disputes with us; | |

| ● | Low trading volume of our common stock; | |

| ● | The volatility of the trading price of our common stock; | |

| ● | Our policy of not paying cash dividends on our common stock; | |

| ● | Lessened disclosure requirements due to our status as an emerging growth company; and | |

| ● | Increased share-based compensation expense due to granted equity awards. |

Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our business operations. You should be able to bear a complete loss of your investment.

Implications of Being an Emerging Growth Company

As a company with less than $1.235 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). An emerging growth company may take advantage of specified reduced reporting and other burdens that are otherwise applicable generally to public companies. These provisions include:

● | a requirement to have only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations; |

● | an exemption from the auditor attestation requirement on the effectiveness of our internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act of 2002, as amended (the “Sarbanes-Oxley Act”); |

● | an extended transition period for complying with new or revised accounting standards; |

● | reduced disclosure about our executive compensation arrangements; and |

● | no non-binding advisory votes on executive compensation or golden parachute arrangements. |

We may take advantage of these provisions from the JOBS Act until the end of the fiscal year in which the fifth anniversary of the offering occurs, or such earlier time when we no longer qualify as an emerging growth company. We would cease to be an emerging growth company on the earlier of (i) the last day of the fiscal year (a) in which we have more than $1.235 billion in annual revenue or (b) in which we have more than $700 million in market value of our capital stock held by non-affiliates, or (ii) the date on which we issue more than $1.0 billion of non-convertible debt over a three-year period. We may choose to take advantage of some but not all of these reduced burdens under the JOBS Act. To the extent we do, the information that we provide stockholders may be different than you might get from other public companies in which you hold equity interests.

Corporate History

Since the inception of Hanryu Bank Co., Ltd. in 2018, we have accomplished a number of key objectives, as follows:

Date | Event / Milestone | |

October 18, 2018 | HBC is incorporated under the laws of the ROK with the idea of creating an all-in-one product to capture the growing global momentum and popularity of K-Culture. | |

October 29, 2020 | HBC establishes FNS, and begins the initial stages of designing and implementing a platform that can create a fandom networking system. | |

March 11, 2021 | HBC establishes Hanryu Times. Hanryu Times begins operations as HBC’s media outlet, reporting on and providing up-to-date K-Culture news within the FANTOO platform, across a number of languages, including English, Japanese, Chinese (simplified/traditional), Indonesian, Spanish, Russian, and Portuguese. | |

March 31, 2021 | HBC consummates an agreement and plan of merger (the “Merger Agreement”) with RnDeep, Co. Ltd, a Korean corporation (“RnDeep”), pursuant to which RnDeep merged with and into HBC, with HBC continuing as the surviving corporation (the “RnDeep Acquisition”). As consideration for the RnDeep Acquisition, HBC ratably issued a total 4,150,000 HBC common shares, par value $0.45 per share (“Common Shares”), to the former shareholders of RnDeep.

As a result of the RnDeep Acquisition, HBC acquired the underlying technologies that the Company plans on utilizing in the future development of new functions and integrations within the FANTOO platform. Once the FANTOO platform is ready to integrate the technology acquired, this technology will support new functions and integrations including, without limitation, the Company’s enterprise resource planning solution, and its artificial intelligence (“AI”), which the Company plans on using to power many of FANTOO’s upcoming features such as speech synthesis, curated content delivery, deepfake detection and blocking, and nudity detection and blocking. | |

May 17, 2021 | The FANTOO platform is launched and made available to the public. | |

June 30, 2021 | HBC enters into an agreement to acquire all the issued and outstanding common shares of Marine Island (the “Marine Island Acquisition”), which owns the right to use and occupy 19,200 square-feet of office space within the iconic Seoul Marina, located at 160 Yeouiseo-ro, Yeungdeungpo-gu, Seoul, Korea (the “Seoul Marina”) from Sewang Co., Ltd. (“Sewang”), for the purchase price of 3,500,000,000 Korean Won (“KRW”), along with the assumption of all Marine Island’s liabilities. | |

August 30, 2021 | HBC establishes FANTOO Entertainment. FANTOO Entertainment provides a variety of content to the Company’s FANTOO platform, which contributes to the spread of the Korean Wave by promoting new entertainers and artists. | |

October 3, 2021 | HBC consummates the Marine Island Acquisition, making it the owner of 100% of the issued and outstanding common shares of Marine Island. | |

October 3, 2021 | HBC consummates a strategic acquisition of 50.8% of the outstanding common shares of K-Commerce. In consideration for the shares of K-Commerce, HBC forgave a short-term loan of $270,530 (KRW 309,600,000) owed to HBC by K-Commerce.

HBC’s investment into K-Commerce was a strategic acquisition in order to integrate K-Commerce’s retail platform, “SelloveLive” into the FANTOO ecosystem as the FANTOO Fanshop. When launched as the FANTOO Fanshop, K-Commerce’s platform will offer combined services of shopping and live broadcasting, allowing users to easily live-stream travel and share local attractions, local festivals, cultures, and news from around the world.

Prior to HBC’s acquisition of its shares in K-Commerce, K-Commerce was 100% owned by Changhyuk Kang, the Company's Chief Executive Officer and Donghoon Park, the Company’s Chief Marketing Officer. | |

October 20, 2021 | Hanryu Holdings is incorporated in the State of Delaware. | |

February 25, 2022 through May 10, 2022 | Hanryu Holdings, HBC, and the shareholders of HBC (the “HBC Shareholders”) enter into a share exchange agreement (the “Share Exchange Agreement”), pursuant to which the HBC Shareholders agreed to assign, transfer, and deliver, free and clear of all liens, 100% of the issued and outstanding Common Shares, representing 100% of the voting securities in HBC, to the Company in exchange for the Company issuing 42,565,786 restricted shares of the Company’s common stock, par value $0.001 per share (“Common Stock”) to the HBC Shareholders (the “Share Exchange”).

Concurrently with entering into the Share Exchange Agreement, the Company, HBC, and the holders (the “HBC Warrantholders”) of all outstanding warrants to purchase Common Shares (“HBC Warrants”) enter into a warrant exchange agreement, pursuant to which the HBC Warrantholders agreed to assign, transfer, and delivery, free and clear of any liens, 100% of the outstanding HBC Warrants to the Company in exchange for the Company issuing to the HBC Warrantholders 10,046,666 warrants to purchase restricted shares of Common Stock (the “Warrant Exchange”).

The Warrants and Common Shares of HBC transferred to the Company in the Share Exchange and the Warrant Exchange constituted 100% of the outstanding equity securities of HBC. | |

June 16, 2022 | Hanryu Holdings, HBC, the HBC Shareholders, and the HBC Warrantholders consummate the Share Exchange and Warrant Exchange concurrently, pursuant to which HBC became a wholly owned subsidiary of the Company, and the HBC Stockholders and HBC Warrantholders, collectively, acquired a controlling interest in the Company. | |

June 22, 2022 | The Company divests itself of all Kingdom Coin (“KDC”) holdings and terminates all crypto-currency-related activity, including, without limitation, the operation of the MainNet (FandomChain) and the mobile application known as FANTOO Wallet (“Fantoo Wallet”), pursuant to a Business Transfer Agreement (the “Divestiture Agreement”) between HBC and an unaffiliated and unrelated third party, Kingdom Coin Holdings, a Cayman Islands Foundation Company (the “KDC Foundation”) (the “KDC Divestiture”), to substantially reduce its involvement with blockchain technologies. Pursuant to the Divestiture Agreement, as of June 22, 2022, the Company no longer owns any KDC, and no longer conducts or controls the operations, issuances, or sales of KDC. In connection with the KDC Divestiture, the Company revised its procedures regarding KDG and no longer allows, nor has the technology to allow, for the transfer of KDG outside of the FANTOO platform or the exchange of KDG and KDC. |

Corporate Information

Our principal executive offices are located at 160, Yeouiseo-ro, Yeongdeungpo-gu, Seoul, Republic of Korea, and our telephone number is +82-2-564-8588. Our corporate website address is www.hanryuholdings.com/en. Information contained in, or accessible through, our website is not a part of this prospectus, and the inclusion of our website address in this prospectus is an inactive textual reference only.

The Offering

The following summary is provided solely for your convenience and is not intended to be complete. You should read the full text and more specific details contained elsewhere in this prospectus. | |

Common stock offered by us | [●] shares of common stock (or [•] shares if the underwriter’s over-allotment option is exercised in full) |

Over-allotment option Underwriter’s Warrants | The underwriter has an option for a period of 45 days from the date of this prospectus to purchase up to [●] additional shares of our common stock to cover over-allotments, if any.

We will issue to the underwriter, or its permitted designee, warrants to purchase up to [●] shares of our common stock (equal to 5% of the shares sold in the offering). The underwriter’s warrants will have an exercise price of $[●], or 125% of the per share offering price, and will be exercisable during the four-year sixth-month period beginning on a date which is six months from the commencement of sales under the registration statement of which this prospectus forms a part, and will expire five years from such commencement of sales. For additional information regarding our arrangement with the underwriter, please see “Underwriting.” |

Common stock outstanding immediately before the offering | [●] shares |

Common stock to be outstanding after the offering | [●] shares, or [●] shares if the underwriter exercises its option to purchase additional shares in full. |

Use of proceeds | We estimate that the net proceeds from the offering, after deducting underwriting discounts and commissions and estimated offering expenses payable by us, will be approximately $[●] million, or approximately $[●] million if the underwriter exercises its option to purchase additional shares from us in full, assuming an initial public offering price of $[●] per share, which is the midpoint of the price range set forth on the cover page of this prospectus. We intend to use the net proceeds of the offering for working capital and general corporate purposes, including engineering and technology, sales and marketing, and capital expenditures. See “Use of Proceeds” for a more complete description of the intended use of proceeds from the offering. |

Risk factors | You should read the “Risk Factors” section of this prospectus and the other information in this prospectus for a discussion of factors to consider carefully before deciding to invest in shares of our common stock. |

Lock-ups | We, our directors, executive officers, and certain shareholders have agreed not to offer, issue, sell, contract to sell, encumber, grant any option for the sale of or otherwise dispose of any of our securities for a period of 180 days after the date of this prospectus. See “Underwriting” on page 98 for more information. |

Proposed listing | We intend to list our common stock listed on the Nasdaq Capital Market in connection with the offering. No assurance can be given that such listing will be approved. |

Proposed Nasdaq Capital Market symbol | HRYU |

The number of shares of our common stock to be outstanding after the offering is based on [●] shares of our common stock outstanding as of [●], 2022, and excludes:

● [●] shares of common stock issuable upon exercise of warrants to purchase our common stock;

● [●] shares of common stock reserved for issuance pursuant to the Plan (as defined herein); and

● [●] shares of common stock issuable upon the exercise of the warrant to be issued to the underwriter, which equates to [●] % of the number of shares of our common stock to be issued and sold in the offering.

Except as otherwise indicated, all information in this prospectus assumes the following:

● issuance of [●] share of common stock assuming exercise of all issued and outstanding warrants; and

● no exercise by the underwriter of its option to purchase up to [•] additional shares of common stock from us in the offering to cover over-allotments, if any. |

The following tables set forth a summary of our historical financial data as of, and for the periods ended on, the dates indicated. We have derived the statements of operations data for the years ended December 31, 2021 and 2020 from our audited financial statements included elsewhere in this prospectus. The statements of operations data for the six months ended June 30, 2022 and 2021 and the balance sheet data as of June 30, 2022 have been derived from our unaudited financial statements included elsewhere in this prospectus and have been prepared on the same basis as the audited financial statements. In the opinion of our management, the unaudited data reflects all adjustments, consisting of normal and recurring adjustments, necessary for a fair presentation of results as of and for these periods. You should read this data together with our financial statements and related notes included elsewhere in this prospectus and the sections in this prospectus entitled “Selected Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Our historical results for any prior period are not indicative of our future results, and our results for the six months ended June 30, 2022 may not be indicative of our results for the year ending December 31, 2022.

Six Months Ended June 30, (unaudited) | Year Ended December 31, | |||||||||||||||

2022 | 2021 | 2021 | 2020 | |||||||||||||

Statements of Operations Data: | ||||||||||||||||

Revenue | $ | 117,964 | $ | - | $ | 480,224 | $ | - | ||||||||

Cost of revenue | 50,239 | - | 559,419 | - | ||||||||||||

Gross profit (loss) | 67,725 | - | (79,195 | ) | - | |||||||||||

Operating expense: | ||||||||||||||||

Goodwill impairment loss | - | 12,028,192 | 12,293,276 | - | ||||||||||||

Marketing and Advertising expense | 184,457 | 121,383 | 542,671 | 678 | ||||||||||||

Research and Development | 79,485 | 504,150 | 561,218 | - | ||||||||||||

General and Administrative expense | 3,530,820 | 1,430,208 | 6,675,197 | 636,829 | ||||||||||||

Total operating expenses | 37,794,762 | 14,083,933 | 20,072,362 | 637,507 | ||||||||||||

Total other Income (Expense) | 243,137 | (782,963 | ) | 7,689,311 | (8,990,012 | ) | ||||||||||

Net loss | $ | (3,483,900 | ) | $ | (14,866,896 | ) | $ | (12,462,246 | ) | $ | (9,627,519 | ) | ||||

Net income (loss) per share attributable to common stockholders(1) | ||||||||||||||||

Basic and Diluted | $ | (0.08 | ) | $ | (5.14 | ) | $ | (1.30 | ) | (11.83 | ) | |||||

| Weighted average shares outstanding used in computing net income (loss) per share attributable to common stockholders(1) | ||||||||||||||||

| Basic and Diluted | 41,796,583 | 2,893,923 | 9,605,025 | 813,934 | ||||||||||||

(1) | See Note 1 to our audited financial statements included elsewhere in this prospectus for an explanation of the methods used to calculate the historical net income (loss) per share, basic and diluted, and the number of shares used in the computation of the per share amounts. |

As of June 30, 2022 | |||||

Actual | Pro Forma (1) | ||||

Balance Sheet Data: | (unaudited) | ||||

Cash and cash equivalents | $ | 11,756 | |||

Working capital | (580,998 | ) | |||

Total assets | 5,943,473 | ||||

Additional paid-in capital | 25,263,819 | ||||

Accumulated deficit | (26,451,411 | ) | |||

Total stockholders’ deficit | (387,224 | ) | |||

Investing in our common stock involves a high degree of risk. You should carefully consider the risks described below, as well as the other information in this prospectus, including our financial statements and the related notes thereto and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” before deciding whether to invest in our common stock. The occurrence of any of the events or developments described below could harm our business, financial condition, operating results, and growth prospects. In such an event, the market price of our common stock could decline, and you may lose all or part of your investment. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may impair our business operations.

SUMMARY RISK FACTORS

Investing in our common stock involves a high degree of risk because our business is subject to numerous risks and uncertainties, as further described below. The occurrence of any such risks could adversely affect our business, financial condition, results of operations, and prospects. The principal factors and uncertainties that make investing in our common stock speculative or risky include, among others:

Risks Related to Our Business

● | We have incurred significant losses since our inception, and we intend to continue to invest substantially in our business. As a result, we may continue to experience losses in the future; |

● | Our results of operations may fluctuate significantly, which makes our future results of operations difficult to predict and could cause our results of operations to fall below expectations; |

● | We may be unable to effectively manage the continued growth of our workforce and operations, including the development and management of new business initiatives; |

● | Our business is rapidly evolving, and we plan to continue to forgo short-term financial performance for long-term growth, which makes it difficult to evaluate our future prospects and predict our future results of operations, including our revenue growth rate; |

● | As a startup, we have a history of net losses, including $(3.5) million and $(14.9) million for six months ended June 30, 2022 and 2021, respectively, as well as an accumulated deficit of $(26.5) million as of June 30, 2022, and net losses of $(12.5) million and $(9.6) million for fiscal years ended December 31, 2021 and 2020, respectively, as well as an accumulated deficit of $(23) million as of December 31, 2021. We may not be able to generate sufficient revenue to achieve or maintain profitability in future periods; |

● | If we were to lose the services of members of our senior management team, we may not be able to execute our business strategy; |

● | The COVID-19 pandemic may adversely affect our business, operations, and the markets and communities in which we, our customers, suppliers, merchants, and advertisers operate; |

● | We face intense competition and could lose market share to our competitors if we do not innovate or compete effectively; |

● | Liability and expenses based on the nature and content of the materials that we create or distribute, including materials provided by third parties; and |

● | Our dependence on third-party relationships with content producers and distribution channels. |

Risks Related to Government Regulation

● | Because some of our operations are subject to Korean law, there are circumstances in which certain of our Korean affiliates’ executive officers may be held either directly or vicariously liable for the actions of our Korean affiliates or our Korean affiliates’ executives and employees; |

● | Some of our operations are subject to certain detailed and complex fair trade, labor, employment, and workplace safety laws and regulations, which continue to evolve and have and will continue to affect our operations and financial performance, could subject us to costs and penalties, and may affect our reputation; |

● | Our business is subject to regulation, and changes in applicable regulations may negatively impact our business; |

● | Decreased levels of traffic due to intensified government regulation of the Internet industry; |

● | Liability in the event of a violation of privacy regulations, data privacy laws, and/or child protection laws; |

● | Lawsuits or liability arising as a result of the Company providing its products and/or services; and |

● | Lawsuits or liability as a result of content published through our products and services. |

Risks Related to Doing Business in Korea

● | Fluctuations in exchange rates could result in foreign currency exchange losses to us; |

● | International relations, including escalations in tensions with North Korea, could adversely affect the Korean or global economies and demand for our products and services; |

● | There are special risks involved with investing in Korean companies, including the possibility of restrictions being imposed by the Korean government in emergency circumstances, accounting and corporate disclosure standards that differ from those in other jurisdictions, and the risk of direct or vicarious criminal liability for executive officers of our Korean affiliates; |

● | HBC's transactions with its subsidiaries and affiliates may be restricted under Korean fair trade regulations; |

● | We may be subject to certain requirements and restrictions under Korean law that may, in certain circumstances, require it to act in a manner that may not be in our or our stockholders’ best interest; |

● | A focus on regulating copyright and patent infringement by the Korean government subjects us to extra scrutiny in our operations and could subject us to sanctions, fines, or other penalties, which could adversely affect our business and operations in Korea; and |

● | Our business may be adversely affected by developments that negatively impact the Korean economy and uncertainties in economic conditions that impact spending patterns of our customers in Korea. |

Risks Related to Our Technology

● | Harm to our FANTOO brand or our associated brands and marks or reputation may occur if our suppliers or merchants use unethical or illegal business practices, such as the sale of counterfeit or fraudulent products, or if our protocols with respect to such sales are perceived or found to be inadequate, which may also subject us to possible sanctions or penalties; |

● | Any significant interruptions or delays in service on our apps or websites, or any undetected errors or design faults, could result in limited capacity, reduced demand, processing delays, and loss of customers, suppliers, or merchants; |

● | Any failure to protect our apps, websites, networks, and systems against security breaches or otherwise protect our confidential information could damage our reputation and brand and may subject us to possible sanctions or penalties; |

● | Growth of our client base depends upon effective interoperability with mobile operating systems, networks, mobile devices and standards that we do not control; |

● | Cyber incidents, including security breaches, improper access, other hacking and phishing attacks on our system; |

● | Errors, bugs, or vulnerabilities in these systems, or failures to address or mitigate technical limitations in our systems; and |

● | Any failure to comply with privacy laws or regulations, or to fulfill privacy-related customer expectations in the jurisdictions where we operate, could damage our reputation and brand and business and may subject us to possible sanctions or penalties. |

Risks Related to our Digital Assets

● | Regulatory changes or actions may restrict the use of digital assets; |

● | Our rewards system may be subject to various regulations in South Korea that restrict or limit the use of such rewards; and |

● | We may have securities laws exposure relating to the previous issuances of Kingdom Coin. |

Risks Related to Intellectual Property

● | We may be subject to claims of infringement of third-party intellectual property rights; |

● | Current and future litigation related to intellectual property rights; |

● | Our failure to protect our intellectual property rights; and |

● | Piracy, unauthorized copying, and other forms of intellectual property infringement. |

Governance Risks and Risks Related to Our Common Stock

● | Provisions of Delaware law and our certificate of incorporation and bylaws could limit our stockholders’ ability to obtain a favorable judicial forum for disputes with us; |

● | Low trading volume of our common stock; |

● | The volatility of the trading price of our common stock; |

● | Our policy of not paying cash dividends on our common stock; |

● | Lessened disclosure requirements due to our status as an emerging growth company; and |

● | Increased share-based compensation expense due to granted equity awards. |

RISKS RELATED TO OUR BUSINESS

We have incurred significant losses since our inception, and we intend to continue to invest substantially in our business. As a result, we may continue to experience losses in the future.

We incurred a net loss of approximately $(3.5) million and $(14.9) million during the six months ended June 30, 2022 and 2021, respectively, and $(12.5) million and $(9.6) million during the years ended December 31, 2021 and 2020, respectively. As of June 30, 2022, we had an accumulated deficit of approximately $(26.5) million, and $(23) million as of December 31, 2021. The unaudited report of our independent registered public accounting firm to the financial statements for our six months ended June 30, 2022 and 2021, and audited report of our independent registered public accounting firm to the financial statements for the years ended December 31, 2021, and 2020, included elsewhere in the prospectus, contains an explanatory paragraph stating that our recurring losses from operations, accumulated deficit and negative working capital raise substantial doubt about our ability to continue as a going concern.

We expect to continue to invest heavily in our product development and operations, to focus on our FANTOO platform to increase our userbase to support future growth, and to meet our expanded reporting and compliance obligations as a public company. We may not generate sufficient revenue to offset such costs to achieve or sustain profitability in the future.

We believe our current cash, net proceeds from debt issuances and the amount available from future issuances of common stock will be sufficient to fund our working capital requirements beyond the next 12 months. This belief assumes, among other things, that we will be able to raise additional equity financing, will continue to be successful in implementing our business strategy and that there will be no material adverse developments in the business, liquidity or capital requirements. If one or more of these factors do not occur as expected, it could have a material adverse impact on our activities, including (i) reduction or delay of our business activities, (ii) forced sales of material assets, (iii) defaults on our obligations, or (iv) insolvency. Our planned investments may not result in increased revenue or growth of our business. We cannot assure you that we will be able to generate revenue sufficient to offset our expected cost increases and planned investments in our business and platform. As a result, we may incur significant losses for the foreseeable future, and may not be able to achieve and/or sustain profitability. If we fail to achieve and sustain profitability, then we may not be able to achieve our business plan, fund our business or continue as a going concern. The financial statements included in this prospectus do not contain any adjustments which might be necessary if we were unable to continue as a going concern.

We are a development stage company, and we may not be able to sustain our rapid growth, effectively manage our anticipated future growth or implement our business strategies.

We have a limited operating history. Although we have experienced significant growth since FANTOO was launched, our historical growth rate may not be indicative of our future performance due to our limited operating history and the rapid evolution of our business model, including a focus on the FANTOO application. We may not be able to achieve similar results or accelerate growth at the same rate as we have historically. As our application offerings continue to develop, we may adjust our strategy and business model to adapt. These adjustments may not achieve expected results and may have a material and adverse impact on our financial condition and results of operations.

In addition, our rapid growth and expansion have placed, and continue to place, significant strain on our management and resources. This level of significant growth may not be sustainable or achievable at all in the future. We believe that our continued growth will depend on many factors, including our ability to develop new sources of revenues, diversify monetization methods including advertising revenue, attract and retain users, increase engagement on our FANTOO platform, continue developing innovative technologies and application uses in response to shifting demand in the market, increase brand awareness, and expand into new markets. We cannot assure you that we will achieve any of the above, and our failure to do so may materially and adversely affect our business and results of operations.

Hanryu Holdings is a holding company with no business operations of its own and manages a network of South Korean subsidiaries, subject to South Korean regulation. Further, as we have no business operations of our own, we will depend on the cash flow and business of our subsidiaries to make payments to us and meet our obligations.

Hanryu Holdings is a holding company with no independent operations of our own. Our South Korean subsidiaries, including HBC, conduct substantially all of Hanryu Holdings’ business operations. Managing the regulatory compliance activities for each of these subsidiaries is a complicated task, and we may expend significant resources doing so. However, we cannot guarantee that we will be able to keep abreast of the changing legal and regulatory landscapes for each of the jurisdictions in which our subsidiaries exist. If any of the regulatory environments applicable to our subsidiaries change materially, and we fail to adapt to such change, our business and financial results may be harmed. Applicable tax laws may also subject such payments to us by our subsidiaries to further taxation.

Additionally, as a holding company, we may rely on our operating subsidiaries for distributions or payments for cash flow. Therefore, our ability to fund and conduct our business, service any debt, and pay dividends, if any, in the future may depend on the ability of our South Korean subsidiaries to make upstream cash distributions or payments to us, which may be impacted, for example, by their ability to generate sufficient cash flow or limitations on the ability to repatriate funds, whether as a result of currency liquidity restrictions, monetary or exchange controls, regulatory restrictions, or otherwise. Further, our subsidiaries’ ability to make payments to us will depend on:

| ● | their earnings; |

| ● | covenants contained in any debt agreements to which we may then be subject, including any debt agreements of our subsidiaries; |

| ● | covenants contained in other agreements to which we or our subsidiaries are or may become subject; |

| ● | business and tax considerations; and |

| ● | applicable law, including any restrictions under South Korean law that may be imposed on our subsidiaries, including HBC or its subsidiaries and affiliates, that would restrict its ability to make payments to Hanryu Holdings. |

We cannot assure that the operating results of our subsidiaries at any given time will be sufficient to make distributions or other payments to us.

We are subject to risks associated with operating in a rapidly developing industry and a relatively new market.

Many elements of our business are unique, evolving and relatively unproven. Our business and prospects depend on the continuing development of the social media market, which is relatively new, rapidly developing and subject to significant challenges. Our business relies upon our ability to cultivate and grow an active online community, and our ability to successfully monetize such community through methods that include, without limitation, advertising revenue. In addition, our continued growth depends, in part, on our ability to respond to constant changes in the industry, including rapid technological evolution, continued shifts in user trends. Developing and integrating new content, products, services or infrastructure could be expensive and time-consuming, and these efforts may not yield the benefits we expect to achieve at all. We cannot assure you that we will succeed in any of these aspects or that the industry will continue to grow as rapidly as it has in the past.

Our success depends on our ability to develop products and services to address the rapidly evolving market for the content creation and social media platform industry, and, if we are not able to implement successful enhancements and new features for our products and services, our business could be materially and adversely affected.

We expect that new services and technologies applicable to the content creation and social media platform industry in which we operate will continue to emerge and evolve. Rapid and significant technological changes continue to confront the industries in which we operate, including developments in the social media platform and content creation industry. Incorporating new technologies into our products and services may require substantial expenditures and take considerable time, and we may not be successful in realizing a return on these development efforts in a timely manner or at all. There can be no assurance that any new products or services we develop and offer to our customers will achieve significant commercial acceptance. Our ability to develop new products and services may be inhibited by industry-wide standards, laws and regulations, resistance to change from buyers or sellers, or third parties’ intellectual property rights. Our success will depend on our ability to develop new technologies and to adapt to technological changes and evolving industry standards. If we are unable to provide enhancements and new features for our products and services or to develop new products and services that achieve market acceptance or that keep pace with rapid technological developments and evolving industry standards, our business would be materially and adversely affected.

The success of enhancements, new features, and products and services depends on several factors, including the timely completion, introduction, and market acceptance of the enhancements or new features or services. We often rely not only on our own initiatives and innovations, but also on third parties, including some of our competitors, for the development of and access to new technologies.

In addition, because our products and services are designed to operate with a variety of systems, infrastructures, and devices, we need to continuously modify and enhance our products and services to keep pace with changes in mobile, software, communication, and database technologies. We may not be successful in either developing these modifications and enhancements or in bringing them to market in a timely and cost-effective manner. Any failure of our products and services to continue to operate effectively with third-party infrastructures and technologies could reduce the demand for our products and services, result in dissatisfaction of our sellers or their customers, and materially and adversely affect our business.

As a creator and a distributor of digital media content, we face liability and expenses for legal claims based on the nature and content of the materials that we create or distribute, including materials provided by third parties. If we are required to pay damages or expenses in connection with these legal claims, our business and results of operations may be harmed.

We display original content and third-party content on our websites and in our marketing messages. As a result, we have faced and will continue to face potential liability based on a variety of theories, including deceptive advertising and copyright or trademark infringement. We generally rely on the “fair use” exception for our use of third-party brand names and marks, but these third parties may disagree, and the laws governing the fair use of these third-party materials are imprecise and adjudicated on a case-by-case basis. We also create content we believe to be original for our websites. While we do not believe that this content infringes on any third-party copyrights or other intellectual property rights, owners of competitive websites that present similar content have taken and may take the position that our content infringes on their intellectual property rights. We are also exposed to risk that content provided by third parties is inaccurate or misleading, and for material posted to our websites by users and other third parties. These claims could divert management time and attention away from our business and result in significant costs to investigate and defend, regardless of the merit of these claims. The general liability insurance we maintain may not cover potential claims of this type or may not be adequate to indemnify us for all liability that may be imposed. Any imposition of liability that is not covered by insurance, or is in excess of insurance coverage, could materially adversely affect our business, financial condition and results of operations.

Our dependence on third-party relationships with content producers and distribution channels to develop and distribute entertainment content is critical to the success of the FANTOO Platform.

We rely on third party relationships with content producers and distribution channels to develop and distribute entertainment content. Our financial performance may be adversely affected by our relationships with content producers and distribution channels. Some of our content producers may have their own or other distribution capabilities in the markets in which we operate. These third-party content producers and distribution channels may decide, or be required by their respective parent companies, to use their intracompany distribution or content production capabilities rather than posting such content with us. Our business may be harmed if the content producers and distribution channels with which we work stop or reduce the amount of content they produce for us, or otherwise demand less favorable terms to us.

If our content streaming initiatives are unsuccessful, our business, financial condition or results of operations could be adversely affected

Content streaming is intensely competitive and cash intensive and there can be no assurance that our content creation initiatives will be profitable or otherwise successful. Our ability to attract, engage and retain users within the FANTOO platform, as well as the corresponding advertising revenues they generate, will depend on our ability to consistently provide appealing and differentiated content globally, effectively market our content and services and provide a quality experience for selecting and viewing that content. Our success will require significant investments to produce original content and acquire the rights to third-party content, as well as the establishment and maintenance of key content and distribution partnerships.

We must continually add new users and meaningfully engage with existing users to manage turnover, or “churn,” to grow our business. If we are unable to successfully compete with competitors in attracting, engaging with and retaining users as well as creative talent, our business, financial condition or results of operations could be adversely affected. The relative service levels, content offerings, promotions and pricing and related features of our competitors’ services may adversely impact our ability to attract, engage and retain users. If consumers do not consider our platform to be of value compared to our competitors’ platforms, including because we fail to introduce attractive new content and features, do not maintain competitive pricing, terminate or modify promotional or trial period offerings, experience technical issues, or change the mix of content in a manner that is unfavorably received, we may not be able to attract, engage and retain users. If we are not able to attract new users, or our existing users decide to not continue using our services for any reason, including a perception that they do not use our platform sufficiently, the need to cut household expenses, unsatisfactory content, promotions or offers expire or are modified, competitive platforms provide a better value or experience or customer service or technical issues are not satisfactorily resolved, our business, financial condition or results of operations could be adversely affected.

We are dependent on the continued services and on the performance of key third party content contributors, the loss of which could adversely affect our business.

We rely on content contributed by third party providers, which has in turn attracted users that drive advertising revenue. The loss of the services of any of such key contributors could have a material adverse effect on our business, operating results, and financial condition. We also depend on our ability to identify, attract, and retain other highly skilled third-party content contributors. Competition for such contributors is intense, and there can be no assurance that we will be able to successfully attract, assimilate or retain them. The loss or limitation of the services of any of our key third party contributors, or the inability to attract and retain additional qualified key contributors, could have a material adverse effect on our business, financial condition or results of operations.

Substantial and increasingly intense competition in the social media platform and content creation industry may harm our business.

We compete in markets characterized by vigorous competition, changing technology, evolving industry standards, and frequent introductions of new products and services. We expect competition to intensify in the future as existing and new competitors introduce new services or enhance existing services. We compete against many companies to attract customers, and some of these companies have greater financial resources and substantially larger bases of customers than we do, which may provide them with significant competitive advantages. These companies may devote greater resources to the development, promotion, and sale of products and services, and they may introduce their own innovative products and services that adversely impact our growth. Mergers and acquisitions by these companies may lead to even larger competitors with more resources. We also expect new entrants to offer competitive products and services. If we are unable to differentiate ourselves from and successfully compete with our competitors, our business will be materially and adversely affected.