Filed by Coincheck Group B.V.

pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Thunder Bridge Capital Partners IV, Inc.

(Commission File No.: 001-40555)

Date: March 22, 2022

Coincheck Group B.V. to become public on the Nasdaq through a De-SPAC with Thunder Bridge Capital Partners IV, Inc.

TOKYO, March 22, 2022 - Monex Group, Inc. (headquarters: Tokyo, Japan; Representative Executive Officer and CEO: Oki Matsumoto; “the Company”) announces that its Board of Directors passed a resolution today approving a business combination agreement (the “Agreement”) among Coincheck, Inc. (headquarters: Tokyo, Japan; Representative Director & President: Satoshi Hasuo; “Coincheck”), Coincheck Group B.V. (headquarters: Amsterdam, Netherlands; Managing Director: Akira Inoue; “CCG”), which will be a holding company of Coincheck, Thunder Bridge Capital Partners Ⅳ, Inc. (headquarters: Virginia, United States; President & CEO: Gary Simanson; “THCP”), a publicly listed special purpose acquisition company (“SPAC”) on the Nasdaq Global Market (Nasdaq), and others, with the aim of CCG becoming a publicly traded company on Nasdaq (the “Transaction”). CCG will apply to be listed on Nasdaq under the ticker symbol “CNCK” in 2022 and expects to have an estimated implied equity value before the Transaction of approximately US$1.25 billion (the total market value of the shares of Coincheck, which will be a wholly-owned subsidiary of CCG, the “Pre-Money Equity Valuation”) plus potential earn-out (price adjustment) consideration equal to a maximum of 50 million shares, which is valued at US$500 million (assume US$10 per share, which will be the initial share price for CCG shares).

CCG becomes a consolidated subsidiary of the Company, and Coincheck will be a wholly-owned subsidiary of CCG. The continued growth of Coincheck and expansion of CCG will accelerate the group strategy of the Company.

| 1. | Purpose of the Merger |

To fulfill the Company’s goal to provide global financial products and advanced services to individuals, the Company has developed a business portfolio that extends beyond domestic and international online brokerage to include blockchain and digital assets. With these technological innovations and new products and services, the Company aims to support various activities of individuals in the new era. Under the corporate mission of facilitating the exchange of new values, Coincheck has been creating services that are easy to use so that users can feel more familiar with the exchange of new values created by the latest technology in digital assets and blockchain. With the foundation of the digital asset trading service named Coincheck, Coincheck is also expanding its business scope with the NFT marketplace Coincheck NFT (β version), and Coincheck IEO, a platform which supports Initial Exchange Offerings (IEO), a community building and fundraising method using digital assets. With the steady growth of the blockchain and digital asset market in Japan, Coincheck has been a leader in the industry as an innovator with a strong customer base and brand recognition, and is recently actively working on the creation of a digital economic sphere in the “Web 3”.

The society and economy related to blockchain and digital assets are still in the stage of significant growth, and the world of token-based services, and NFTs, is expected to expand as a new economic sphere in various forms and areas around the world. Coincheck will continue to grow its customer base and revenue base in Japan and maintain its leading position, while providing various service platforms as a gateway to the digital economic sphere and offering an “exchange of new values.” Further, to accelerate the growth of the Company and Coincheck, we believe it is vital to pursue a broader growth strategy, with new capabilities in the areas of digital assets, NFTs, blockchain, and international coverage. To that end, we have decided to establish CCG (which will become the intermediate holding company of Coincheck in the future through intra group reorganization that is described in “2. Overview of the Transaction”), and to make CCG a publicly traded company on Nasdaq, a U.S. stock exchange, through a merger with a U.S.-based SPAC (a “De-SPAC” transaction). Working together with THCP, we will secure capital in the United States, the largest capital market in the world, and recruit talent globally to realize our global growth strategy and take Coincheck to the next stage.

1

Since Coincheck’s acquisition in April 2018, the Company has been working to increase its enterprise value in various ways. The Pre-Money Equity Valuation at present is approximately US$1.25 billion plus earn-out of 50 million shares (US$500 million assuming US$10 per share) as described in “4. Valuation of CCG”. Through an intra group reorganization, Coincheck will become a wholly-owned subsidiary of CCG, and CCG is expected to be listed on Nasdaq through the De-SPAC transaction. We believe that we can further enhance the corporate value of CCG and Coincheck as we realize our global growth strategy with CCG at the core. After the listing of CCG, the Company will hold approximately 70% of CCG’s shares (assuming no redemptions) and will position CCG and Coincheck as important subsidiaries in the Company’s group strategy, aiming to continuously improve the Group’s corporate value over the mid- to long-term.

| 2. | Overview of the Transaction |

The first step of the Transaction is for Coincheck and CCG’s wholly-owned subsidiary, M1 Co G.K., a godo kaisha (“M1 Co”), to conduct a share exchange under Japanese law to make Coincheck a direct and wholly-owned subsidiary of M1 Co and CCG (the “Share exchange”). Further, to become a publicly listed company, Coincheck Group B.V. through an organization change, will become Coincheck Group N.V., a public limited company (the “Intra group reorganization” including the Share exchange). For the Transaction, CCG’s direct and wholly-owned subsidiary (formed for the sole purpose of the Merger), Coincheck Merger Sub, Inc. (headquarters: Delaware, United States; “Merger Sub”), and THCP will then conduct a reverse triangular merger, in which Merger Sub will merge with and into THCP (the “Merger”), and THCP will be the surviving corporation in the Merger. Shareholders of THCP will receive CCG shares as consideration in the Merger, and any warrants to acquire THCP shares will be converted into warrants to acquire CCG shares. As a result of the Merger, THCP will become a wholly-owned subsidiary of CCG. Meanwhile, the Company, other persons holding Coincheck shares immediately before the Share Exchange and THCP shareholders will all receive CCG shares. The Transaction is expected to be consummated in 2022. In connection with the Merger, CCG will apply to be listed for trading on Nasdaq under ticker symbol “CNCK”.

(Step 1)

M1 Co and Coincheck will conduct a share exchange in which M1 Co will exchange shares of CCG for the outstanding shares of Coincheck, making Coincheck a wholly-owned indirect subsidiary of CCG. Through an organization change, Coincheck Group B.V. will become Coincheck Group N.V., a public limited liability company.

(Step 2)

Merger Sub (a wholly-owned subsidiary of CCG) and THCP will conduct the Merger under Delaware law, in which THCP will be the surviving corporation. As the result of the Merger, THCP shareholders will receive CCG shares as consideration in the Merger, and any THCP warrants held by holders thereof will be converted to warrants of CCG. In connection with the Merger, CCG will apply to be listed for trading on Nasdaq.

2

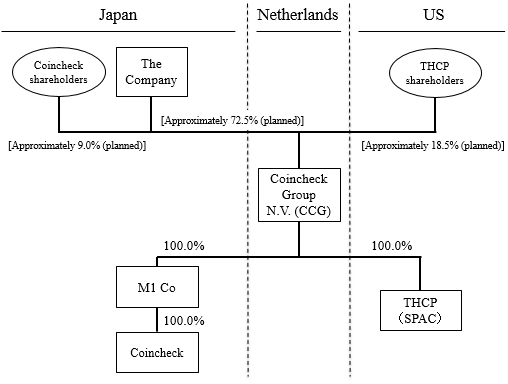

Structure post-closing of the Merger

*1 As we expect already issued and allocated share options to be exercised prior to Step 1 of the Merger, as of the effective time of the Merger, there will be Coincheck shareholders other than the Company. Coincheck shareholders will also receive CCG shares through the Merger and at the timing of the Merger close, they will hold approximately 9% of the CCG shares.

*2 The aggregate amount of cash held in THCP’s trust account was approximately US$237 million as of September 30, 2021. CCG’s assets will increase by this aggregate amount less amounts used to pay expenses related to the Transaction. The aggregate amount of cash held will increase, when THCP gain additional funds, and will decrease when THCP’s shareholders request redemption.

*3 The above structure illustrates the CCG ownership ratio as of post-closing of the Merger and does not reflect dilution due to share redemption by THCP shareholders, additional funds by new THCP investors, earn-out provisions described below nor exercise of warrants. If we assume all earn-out provisions described below are met and all warrants are exercised without share redemption by THCP shareholders nor additional funds by new THCP shareholders, CCG ownership ratio would be approximately 74.0%, other Coincheck shareholders approximately 9.1%, and THCP shareholders approximately 16.9%.

*4 THCP will remain as a subsidiary of CCG for a period of time, and may be liquidated in the future. Similarly, M1 Co will remain as a subsidiary of CCG for a period of time and may extinguish due to a merger with and into Coincheck or by any other means, in the future.

| 3. | Description of THCP |

The Thunder Bridge team is well known for its deep knowledge and experience working in the financial services industry, as well as investing in fintech and other highly disruptive technologies. With extensive experience in the U.S. capital markets and high level of enthusiasm for blockchain and digital assets, THCP is a good match for Coincheck, CCG and the Company as CCG aims to grow globally.

3

“I have a deep respect for Oki Matsumoto and for what he has achieved in his career. He has always been a leader and at the forefront of the financial services industry. We are not only excited to be partnering with Monex to bring CCG into the public markets to facilitate the next stage of growth and to further unlock the digital asset economy for consumers and institutions in Japan, we are also excited to partner with Oki Matsumoto to build a global digital platform under the Coincheck Group name, This business combination and holding company structure makes it all possible” said Gary Simanson, President & CEO of THCP.

| 4. | Valuation of CCG |

The Pre-Money Equity Valuation of CCG calculated based on its wholly-owned subsidiary Coincheck’s business description, customer base, profit base and future prospect, is approximately US$1.25 billion plus earn-out of 50 million shares (US$500 million assuming US$10 per share).

As described in “2. Overview of the Transaction”, the Merger will be effective through a reverse triangular merger between Merger Sub, a wholly-owned subsidiary of CCG, and THCP, using CCG shares as consideration. Assuming none of the existing shareholders of THCP call for redemption of THCP’s shares, the number of outstanding shares of CCG will be 150.4 million shares, excluding earn-outs and warrants, etc., as described below. Therefore, the estimated post-Merger equity valuation of CCG will be approximately US$1.50 billion as CCG’s share will be issued at US$10 per share.

Based on the above assumptions, the Company’s interest in CCG shares after closing of the Merger is expected to be approximately 72.5%, without taking into account any dilution due to additional funds by THCP’s investors, the issuance of earn-out shares or the exercise of warrants as described below. If the warrants are exercised, then the Company’s interest in CCG shares could decline as much as approximately 70%, and if all earn-out provisions are met, interest could increase as much as 74%.

For the purpose of making adjustments to the consideration payable to the Company and the other shareholders of Coincheck right after the share exchange after the closing of the Merger (Earn Out clause), the Company and the other shareholders of Coincheck right after the share exchange will receive earn-out consideration equal to a maximum of 50,000,000 shares of CCG, in each case upon the following “triggering events”:

| · | prior to the fifth anniversary of the closing of the Merger, if CCG’s closing stock price equal or exceeds US$12.50 over any twenty (20) trading days within the preceding thirty (30) consecutive trading days, 25,000,000 shares is granted. |

| · | prior to the fifth anniversary of the closing of the Merger, if CCG’s closing stock price equals or exceeds US$15.00 over any twenty (20) trading days within the preceding thirty (30) consecutive trading days, 25,000,000 shares is granted. |

TBCP IV, LLC, THCP sponsors, will receive earn-out consideration equal to a maximum of 2,365,278 shares of CCG, in each case upon the following “triggering events”:

| · | prior to the fifth anniversary of the closing of the Merger, if CCG’s closing stock price equals or exceeds US$12.50 over any twenty (20) trading days within the preceding thirty (30) consecutive trading days, 1,182,639 shares is granted. |

| · | prior to the fifth anniversary of the closing of the Merger, if CCG’s closing stock price equals or exceeds US$15.00 over any twenty (20) trading days within the preceding thirty (30) consecutive trading days, 1,182,639 shares is granted. |

4

With regard to the warrants of CCG that will be held by the warrant holders of THCP (4,860,168 warrants in total), the relevant warrant holders will have the right to acquire 1 share of CCG stock per excise of a warrant (exercise price: US$11.50 per whole share, subject to adjustment under the terms of the warrants). The warrants are not exercisable until the later of July 2, 2022 or the date that is 30 days after the closing of the Merger.

CCG shares held by the Company are subject to one year lock-up covenants from the closing of the Merger, and will be released in accordance with the following terms and conditions:

| a) | The lock-up for one third (1/3) of CCG shares held by the Company will be released on the first date on which the last reported price of CCG shares over any twenty (20) trading days within the preceding thirty (30) consecutive trading days after the closing of the Merger is greater than or equal to US$15.00, and the sales thereof can be made thereinafter; |

| b) | The lock-up for one third (1/3) of CCG shares held by the Company, in addition to (a), will be released on the first date on which the last reported price of CCG shares over any twenty (20) trading days within the preceding thirty (30) consecutive trading days after the closing of the Merger is greater than or equal to US$17.50, and the sales thereof can be made thereinafter; |

| c) | The lock-up for remaining CCG shares (one third of the original possession) held by the Company will be released on the first date on which the last reported price of CCG shares over any twenty (20) trading days within the preceding thirty (30) consecutive trading days after the closing of the Merger is greater than or equal to US$20.00, and the sales thereof can be made thereinafter. |

However, the Company cannot sell CCG shares during the period when trading is not permitted under the law or CCG’s insider trading regulations.

| 5. | Use of proceeds |

As described in “2. Overview of the Transaction”, THCP has cash of US$237 million as of September 30, 2021. The amount of cash held by THCP will decline due to the payment of expenses related to the Transaction and the amount may further decrease depending on redemption requests from existing THCP shareholders, while the amount may increase from additional funds from new investors while CCG considers its business plan with THCP. THCP plans to use the cash held (excluding the payment of expense related to the Transaction and redemption request from THCP shareholders), to strengthen Coincheck’s system infrastructure, develop new businesses, and conduct marketing. We also consider M&A as one of the options to add new capabilities to our platform and realize our growth strategy, and will continue to search for opportunities globally.

| 6. | CCG and Coincheck’s future position within the Company |

The Company plans to continue to hold a majority of CCG shares at least and support its growth as an important subsidiary.

Upon closing of the Transaction, the Company will have a subsidiary that is publicly listed. For effective and required corporate governance of CCG as a Nasdaq-listed company, CCG will have an audit committee consisting of three independent directors that will focus on CCG’s financial disclosures, internal controls, audit and other matters, including helping to ensure that related-party transactions between the Company and CCG are fair and do not create inappropriate conflicts of interest for CCG as a company that will have shareholders other than the Company.

5

| 7. | Closing conditions for the Merger |

The closing of the Merger is subject to (i) the expiration of the restricted period under the Foreign Exchange and Foreign Trade Act, (ii) no Governmental Order enjoining or prohibiting the consummation of the Transaction and no Governmental Authority having the power to regulate Coincheck having opposed, and failed to withdraw its opposition to, the Transaction, (iii) THCP having net tangible assets of at least US$5,000,001, (iv) approval of the Merger by the existing shareholders of THCP, (v) approval of the Intra-group reorganization, the amendments to the governing documents of CCG, and the Merger by the Company as the sole shareholder of CCG, (vi) approval of the Merger by CCG as the sole shareholder of Merger Sub, (vii) approval of CCG ordinary shares to be issued in connection with the Merger to be listed on the Nasdaq, (viii) the effectiveness of the registration statement under the Securities Act with respect to the shares of CCG ordinary stock and other securities to be issued in connection with the Merger, and the satisfaction of other general closing conditions. Further Coincheck has a right to terminate the Merger in case THCP does not have minimum total cash of US$100,000,000.

| 8. | Impact on Financial Results |

The Company and its related parties are studying the impact that the Transaction may have on each line item of the Company’s consolidated balance sheet and consolidated income statement and will announce detailed figures as soon as they reasonably become available.

| 9. | Schedule of the Transaction |

March 22, 2022 The Company’s Board resolution regarding the Transaction

March 22, 2022 The execution by the Company of relevant agreements regarding the Transaction

Future dates, such as the date of the SPAC’s shareholders’ meeting for the approval of the Merger and the date for closing of the Transaction and listing on Nasdaq are not yet determined.

| 10. | Overview of Coincheck Group B.V. (CCG) and Coincheck |

| Name | Coincheck Group B.V. |

| Headquarters | Amsterdam, Netherlands |

| Representative | Managing Director, Akira Inoue |

| Business | Holding company |

| Capital | EUR€0.01 |

| Established | February 18, 2022 |

| Accounting period | March 31 |

| Number of employees | 0 |

| Major customer | Not applicable |

| Major bank | Not applicable |

| Major shareholders and holding ratio | Monex Group, Inc. 100% (as of March 22, 2022) |

| Relationship between the Company | A wholly-owned subsidiary |

6

| Name | Coincheck, Inc. |

| Headquarters | Tokyo Japan |

| Representative | Satoshi Hasuo, Representative Director & President |

| Business | Cryptocurrency exchange and R&D on new financial services |

| Capital | JPY100 million |

| Established | August 28, 2012 |

| Accounting period | March 31 |

| Number of employees | 186 (as of December 31, 2021) |

| Major customer | Not applicable |

| Major bank | Not applicable |

| Major shareholders and holding ratio | Monex Group, Inc. 99.5% (as of June 28, 2021) M1 Co G.K. 100% through the Merger |

| Relationship between the Company | A wholly-owned subsidiary |

| 11. | Overview of the related parties of the Merger (THCP and Merger Sub) |

| Name | Thunder Bridge Capital Partners IV, Inc. |

| Headquarter | 9912 Georgetown Pike Suite D203 Great Falls, Virginia 22066 |

| Representative | Gary Simanson, CEO |

| Business | A blank check company for the purpose of effecting a merger, share exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more businesses. |

| Capital | US$656 (as of September 30, 2021) |

| Established | January 7, 2021 |

| Number of shares of common stock issued | 24,300,840 (as of September 30, 2021) *Only Class A |

| Accounting period | December 31 |

| Number of employees | Undisclosed |

| Major customer | Not applicable |

| Major bank | J.P. Morgan Chase Bank, N.A. |

| Major shareholders and holding ratio | TBCP IV, LLC 21.7% (as of June 21, 2021) Note: Gary Simanson additionally serves as the Managing Member of TBCP IV |

| Relationship between the Company | No capital relations |

7

| Name | Coincheck Merger Sub, Inc. |

| Headquarter | Delaware, United States |

| Representative | Director, Akira Inoue |

| Business | Established for the sole purpose of the Transaction |

| Capital | $10 |

| Established | February 25, 2022 |

| Number of shares issued | 1,000 |

| Accounting period | March 31 |

| Number of employees | 0 |

| Major customer | Not applicable |

| Major bank | Not applicable |

| Major shareholders and holding ratio | Coincheck Group B.V. 100% |

| Relationship between the Company | Indirectly owned subsidiary |

| 12. | Financial position and operating results of the related parties to the Transaction in the immediately preceding fiscal year |

| (1) | CCG |

No ended fiscal year yet as it was established in February, 2022.

| (2) | Coincheck (J-GAAP, JPY Million Yen) |

| March 2019 | March 2020 | March 2021 | |

| Total Asset | 72,834 | 75,678 | 485,777 |

| Net Asset | 2,540 | 2,827 | 13,150 |

| Total Revenue | 2,115 | 3,814 | 20,825 |

| Operating Profit | △2,636 | 369 | 13,772 |

| Profit before income tax | △2,640 | 340 | 13,859 |

| Net Profit | △2,743 | 285 | 10,305 |

| (3) | THCP (US-GAAP, U.S. dollar) |

| March 2019 | March 2020 | March 2021 | |

| Total Asset | - | - | 237,667,213 |

| Net Asset | - | - | (12,017,302) |

| Total Revenue | - | - | 0 |

| Operating Profit | - | - | (503,494) |

| Profit before income tax | - | - | (500,652) |

| Net Profit | - | - | (500,652) |

8

| (4) | Coincheck Merger Sub, Inc. |

No ended fiscal year yet as it was established in February, 2022.

| 13. | Status after the Merger |

| Name | Coincheck Group B.V. Note: Coincheck Group B.V. will become Coincheck Group N.V. by conducting an organizational change after the Merger. |

| Location | Amsterdam, the Netherlands |

| Representative | Not confirmed |

| Business | Holding company |

| Additional Capital | Approximately US$1.5 billion |

| Accounting period | March |

| 14. | Advisors |

Simpson Thacher & Bartlett LLP, Anderson Mori & Tomotsune and De Brauw Blackstone Westbroek N.V. are acting as legal advisors and JPMorgan Securities LLC is acting as sole financial advisor to the Company.

| Contact: | Akiko Kato Corporate Communications Office Monex Group, Inc., +81-3-4323-8698 | Yuki Nakano, Minaka Aihara Investor Relations, Financial Control Department Monex Group, Inc., +81-3-4323-8698 |

9

Important Information About the Business Combination and Where to Find It

In connection with the proposed business combination, CCG intends to file a registration statement on Form F-4 that will include a preliminary proxy statement to be distributed to stockholders of THCP in connection with THCP’s solicitation of proxies for the vote by its stockholders with respect to the proposed business combination. After the registration statement has been filed and declared effective by the U.S. Securities and Exchange Commission (“SEC”), THCP will mail a definitive proxy statement / prospectus to its stockholders as of the record date established for voting on the proposed business combination and the other proposals regarding the proposed business combination set forth in the proxy statement. CCG or THCP may also file other documents with the SEC regarding the proposed business combination. Before making any investment or voting decision, stockholders and other interested persons are advised to read, when available, the registration statement and preliminary proxy statement / prospectus and any amendments thereto, and the definitive proxy statement / prospectus in connection with THCP’s solicitation of proxies for the special meeting to be held to approve the transactions contemplated by the proposed business combination because these materials will contain important information about CCG, Coincheck, THCP and the proposed transaction. Stockholders will also be able to obtain a copy of the preliminary proxy statement / prospectus and the definitive proxy statement / prospectus once they are available, without charge, at the SEC’s website at www.sec.gov, or by directing a request to: Thunder Bridge Capital Partners IV, Inc., 9912 Georgetown Pike, Suite D203, Great Falls, VA 22066.

Participants in the Solicitation

CCG, Coincheck and THCP and their respective directors and officers may be deemed participants in the solicitation of proxies of THCP’s stockholders in connection with the proposed business combination. THCP’s stockholders and other interested persons may obtain, without charge, more detailed information regarding the directors and officers of Coincheck and THCP at Coincheck’s website at corporate.coincheck.com, or in THCP’s registration statement on Form S-1 filed on June 21, 2021, respectively.

Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies to THCP’s stockholders in connection with the proposed transaction will be set forth in the proxy statement / prospectus for the transaction when available. Additional information regarding the interests of participants in the solicitation of proxies in connection with the proposed transaction will be included in the proxy statement / prospectus filed with the SEC in connection with the proposed business combination.

10

Forward-Looking Statements

This document includes “forward looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995, that reflects the current views with respect to, among other things, the future operations and financial performance of the Company, THCP, Coincheck and CCG. Forward-looking statements may be identified by the use of words such as “forecast,” “intend,” “seek,” “target,” “anticipate,” “believe,” “could,” “continue,” “expect,” “estimate,” “may,” “plan,” “outlook,” “future,” and “project” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. Such forward looking statements include, but not limited to, estimated financial information. Such forward looking statements with respect to revenues, earnings, performance, strategies, prospects and other aspects of the businesses of the Company, THCP, Coincheck, or CCG after completion of the proposed business combination are based on current expectations that are subject to risks and uncertainties. No assurance can be given that future developments affecting Company, THCP, Coincheck or CCG will be those that are anticipated. Actual results may differ materially from current expectations due to changes in global, regional or local economic, business, competitive, market, regulatory and other factors, many of which are beyond the control of the Company, CCG, THCP and Coincheck. Should one or more of these risks or uncertainties materialize, or should any of the assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. A number of factors could cause actual results or outcomes to differ materially from those indicated by such forward looking statements. These factors include, but are not limited to: (1) the occurrence of any event, change or other circumstances that could give rise to the termination of the Business Combination Agreement (the “Agreement”) and the proposed business combination contemplated thereby; (2) the inability to complete the transactions contemplated by the Agreement due to the failure to obtain approval of the stockholders of THCP or other conditions to closing in the Agreement; (3) the ability to meet Nasdaq’s listing standards following the consummation of the transactions contemplated by the Agreement; (4) the risk that the proposed transaction disrupts current plans and operations of Coincheck as a result of the announcement and consummation of the transactions described herein; (5) the ability to recognize the anticipated benefits of the proposed business combination, which may be affected by, among other things, competition, the ability of CCG to grow and manage growth profitably, maintain relationships with customers and business partners and retain its management and key employees; (6) costs related to the proposed business combination; (7) changes in applicable laws or regulations; (8) the possibility that Coincheck may be adversely affected by other economic, business, and/or competitive factors; and (9) other risks and uncertainties indicated from time to time in other documents filed or to be filed with the SEC by THCP or CCG. The Company cautions that the foregoing list of factors is not exhaustive. The recipient of this material should not place undue reliance upon any forward-looking statements, which speak only as of the date made. The Company, CCG, THCP and Coincheck undertake no commitment to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law.

This material is an English translation of a Japanese announcement made on the date above. Although the Company intended to faithfully translate the Japanese document into English, the accuracy and correctness of this English translation is not guaranteed and thus you are encouraged to refer to the original Japanese document. This translation was made as a matter of record only and does not constitute an offer to sell or to solicit an offer to buy securities in the U.S.

11