UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

(Mark One)

☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☐ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

OR

☒ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report: December 10, 2024

Commission file number: 001-42438

COINCHECK GROUP N.V.

(Exact Name of Registrant as Specified in Its Charter)

For Co-Registrant, see “Table of Co-Registrant”

| Not applicable | | The Netherlands |

| (Translation of Registrant’s name into English) | | (Jurisdiction of incorporation or organization) |

Coincheck Group N.V.

Hoogoorddreef 15, 1101 BA

Amsterdam, Netherlands

Jason Sandberg, Chief Financial Officer

coincheckIR@icrinc.com

+31 20-522-2555

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of Each Class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Ordinary shares | | CNCK | | The Nasdaq Stock Market LLC |

| Warrants, each exercisable to purchase one ordinary share at an exercise price of $11.50 per share | | CNCKW | | The Nasdaq Stock Market LLC |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the shell company report: On December 10, 2024, the issuer had 129,703,076 ordinary shares and 4,860,148 warrants to purchase ordinary shares.

Below checkboxes pertain to registrant and co-registrant:

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ☐ No ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☐ No ☒

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☐ No ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | Non-accelerated filer | ☒ |

| | | | |

| | | Emerging growth company | ☐ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

†The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting over Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☐ | International Financial Reporting Standards as issued | | Other ☐ |

| | by the International Accounting Standards Board | ☒ | |

If “Other” has been checked in response to the previous question indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☐

TABLE OF CO-REGISTRANT

| Exact Name of Co-Registrant as Specified in its Charter | | Jurisdiction of

Incorporation or

Organization | | Commission File Number | | I.R.S. Employer

Identification Number | | Primary

Standard

Industrial

Classification

Code Number | | Address of principal executive office |

| Coincheck, Inc.(1) | | Japan | | 333-279165(1) | | Not Applicable | | 6199 | | Coincheck, Inc. SHIBUYA SAKURA STAGE SHIBUYA SIDE 27F

1-4 Sakuragaokacho, Shibuya-ku, Tokyo

150-6227 Japan

Telephone: +81-3-6416-5370 |

| (1) | Coincheck, Inc. is filing this Shell Company Report on Form 20-F as co-registrant solely in connection with its co-registrant status in the Registration Statement on Form F-4, related to the Business Combination (as defined and described herein). |

TABLE OF CONTENTS

EXPLANATORY NOTE

On December 10, 2024 (the “Closing Date”), Coincheck Group N.V., a Dutch public limited liability company (naamloze vennootschap) (“Coincheck Group” or “PubCo”), consummated the previously announced business combination pursuant to the Business Combination Agreement (the “Business Combination”), dated as of March 22, 2022, as amended from time to time (the “Business Combination Agreement”), by and among Thunder Bridge Capital Partners IV, Inc., a Delaware corporation (“Thunder Bridge”), Coincheck Group B.V., a Dutch private limited liability company (besloten vennootschap met beperkte aansprakelijkheid) (which was converted into a Dutch public limited liability company (naamloze vennootschap) and renamed Coincheck Group N.V. immediately prior to the Business Combination), M1 Co G.K., a Japanese limited liability company (godo kaisha) (“M1 GK”), Coincheck Merger Sub, Inc., a Delaware corporation and a wholly owned subsidiary of PubCo (“Merger Sub”) and Coincheck, Inc., a Japanese joint stock company (kabushiki kaisha) (“Coincheck”). Pursuant to the terms set forth in the Business Combination Agreement, (i) PubCo issued ordinary shares in its share capital (the “Ordinary Shares”) to M1 GK and, pursuant to a share exchange, M1 GK, at that time a wholly owned subsidiary of PubCo, exchanged all of its shares of PubCo for all of the outstanding common shares of Coincheck (the “Share Exchange”), resulting in Coincheck becoming a direct wholly owned subsidiary of M1 GK and an indirect wholly-owned subsidiary of PubCo. Immediately after giving effect to the Share Exchange, PubCo changed its legal form from a Dutch private limited liability company (besloten vennootschap met beperkte aansprakelijkheid) to a Dutch public limited liability company (naamloze vennootschap); (ii) Merger Sub merged with and into Thunder Bridge on the Closing Date, with Thunder Bridge continuing as the surviving corporation (the “Merger”); (iii) as a result of the Merger, each outstanding Thunder Bridge share sold as part of a unit in Thunder Bridge’s initial public offering (the “IPO” or “Thunder Bridge’s IPO”; each unit, a “Thunder Bridge Unit”; and each Thunder Bridge share, a “Thunder Bridge Public Share”), for the avoidance of doubt, not including any Thunder Bridge Shares held by TBCP IV, LLC, Thunder Bridge’s sponsor (the “Thunder Bridge Sponsor”), as of the date of the Business Combination Agreement (the “Sponsor Shares”), was exchanged for one Ordinary Share; (iv) as a result of the Merger, each Sponsor Share was exchanged for one Ordinary Share and (v) as a result of the Merger, each outstanding private warrant exercisable for Thunder Bridge shares (a “Thunder Bridge Private Warrant”) and each outstanding public warrant exercisable for Thunder Bridge shares sold as part of a unit in Thunder Bridge’s IPO (a “Thunder Bridge Public Warrant” and the Thunder Bridge Public Warrants together with the Private Warrants, the “Thunder Bridge Warrants”) became a warrant exercisable for such number of Ordinary Shares per Thunder Bridge Warrant that the holder thereof was entitled to acquire if such Thunder Bridge Warrant was exercised prior to the Business Combination (each such private and public warrant exercisable for Ordinary Shares, a “Private Warrant” and “Public Warrant,” respectively).

The Business Combination was consummated on the Closing Date. The transaction was unanimously approved by Thunder Bridge’s Board of Directors and was approved at the special meeting of Thunder Bridge’s shareholders held on December 5, 2024, or the “Special Meeting.” Thunder Bridge’s shareholders also voted to approve all other proposals presented at the Special Meeting. As a result of the Business Combination, Thunder Bridge, M1 GK and Coincheck have become wholly-owned subsidiaries of Coincheck Group. On December 11, 2024, Ordinary Shares and Public Warrants commenced trading on the Nasdaq Stock Market, or “NASDAQ,” under the symbols “CNCK” and “CNCKW,” respectively.

Certain amounts that appear in this Shell Company Report on Form 20-F (including information incorporated by reference herein, this “Report”) may not sum due to rounding.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Report includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about trading, future financial and operating results, plans, objectives, expectations and intentions with respect to future operations, products and services; and other statements identified by words such as “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimated,” “believe,” “intend,” “plan,” “projection,” “outlook” or words of similar meaning or the negative thereof. These forward-looking statements include, but are not limited to, statements regarding Coincheck Group’s trading, industry and market sizes, future opportunities for Coincheck Group, Coincheck Group’s future results and the Business Combination. Such forward-looking statements are based upon the current beliefs and expectations of our management and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are difficult to predict and generally beyond our control, which could cause actual results or events to differ materially from those presently anticipated including (i) a delay or failure to realize the expected benefits from the Business Combination, (ii) risks related to disruption of management’s time from ongoing business operations due to the Business Combination, (iii) changes in the cryptocurrency and digital asset markets in which Coincheck Group competes, including with respect to its competitive landscape, technology evolution or regulatory changes, (iv) changes in domestic and global general economic conditions, (v) risk that Coincheck Group may not be able to execute its growth strategies, including identifying and executing acquisitions, (vi) risk that Coincheck Group may not be able to develop and maintain effective internal controls and (vii) and other risks and uncertainties discussed in Coincheck Group’s filings with the U.S. Securities and Exchange Commission, including the matters identified in the section titled “Risk Factors” of the Coincheck Group’s proxy statement/prospectus, dated November 12, 2024 (the “Proxy Statement/Prospectus”), related to Coincheck Group’s Registration Statement on Form F-4 (Registration No. 333-279165) (the “Form F-4”) filed with the U.S. Securities and Exchange Commission (the “SEC”), which are incorporated by reference into this Report. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this Report. Although we believe that the expectations reflected in such forward-looking statements are reasonable, there can be no assurance that such expectations will prove to be correct. Coincheck Group undertakes no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments, or otherwise, except as required by law.

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

| A. | Directors and Senior Management |

The directors and executive officers of Coincheck Group upon the consummation of the Business Combination are as set forth below. The business address for each of Coincheck Group’s directors and executive officers is at Coincheck Group’s Dutch registered office address at Hoogoorddreef 15, 1101 BA, Amsterdam, the Netherlands.

| Name | | Position |

| Oki Matsumoto | | Executive director with the title Executive Chairperson |

| Gary A. Simanson | | Executive director with the title Chief Executive Officer |

| Yo Nakagawa | | Executive director |

| Takashi Oyagi | | Non-executive director with the title Lead Non-Executive Director |

| Allerd Derk Stikker | | Non-executive director |

| David Burg | | Non-executive director |

| Toshihiko Katsuya | | Non-executive director |

| Yuri Suzuki | | Non-executive director |

| Jessica Sinyin Tan | | Non-executive director |

| Jason Sandberg | | Chief Financial Officer |

| Satoshi Hasuo | | Chief Operating Officer |

See Item 6.A below for biographical information of Coincheck Group’s directors and executive officers.

Simpson Thacher & Bartlett LLP, Ark Hills Sengokuyama Mori Tower, 41F, 1-9-10, Roppongi, Minato-ku, Tokyo 106-0032, Japan and De Brauw Blackstone Westbroek N.V., Burgerweeshuispad 201, 1076 GR, Amsterdam, the Netherlands have acted as counsel for Coincheck Group and will act as counsel to Coincheck Group upon and following the consummation of the Business Combination.

KPMG AZSA LLC is the independent auditor for Coincheck Group as of and for the year ending March 31, 2025 and acted as the independent auditor for its predecessor, Coincheck, as of March 31, 2024 and March 31, 2023 and for each of the three years in the period ended March 31, 2024.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

| B. | Capitalization and Indebtedness |

The following table sets forth the capitalization of Coincheck Group on an unaudited pro forma combined basis as of September 30, 2024 after giving effect to the Business Combination.

| As of September 30, 2024 (pro forma) | | ($ in millions) | |

| Cash and cash equivalents | | | 10,279 | |

| Total equity | | | 7,559 | |

| Liabilities: | | | | |

| Liabilities (current) | | | 680,937 | |

| Liabilities (non-current) | | | 1,518 | |

| Total liabilities | | | 682,455 | |

| Total capitalization | | | 679,735 | |

| C. | Reasons for the Offer and Use of Proceeds |

Not applicable.

Except as supplemented below, the risk factors associated with Coincheck Group are described in the Proxy Statement/Prospectus in the sections titled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements and Risk Factor Summary” which is incorporated herein by reference.

We are subject to the Dutch Corporate Governance Code but do not comply with all of the suggested governance provisions of the Dutch Corporate Governance Code, which may affect your rights as a shareholder.

As a Dutch company, we are subject to the Dutch Corporate Governance Code (“DCGC”). The DCGC contains both principles and suggested governance provisions for management boards, supervisory boards, shareholders and general meetings, financial reporting, auditors, disclosure, compliance and enforcement standards. The DCGC is based on a “comply or explain” principle. Accordingly, public companies are required to disclose in their annual reports, filed in the Netherlands, whether they comply with the suggested governance provisions of the DCGC. If they do not comply with those provisions, such as because of a conflicting requirement, companies are required to give the reasons for such noncompliance. The DCGC applies to all Dutch companies listed on a government-recognized stock exchange, whether in the Netherlands or elsewhere, including Nasdaq. The principles and suggested governance provisions apply to our board of directors (in relation to role and composition, conflicts of interest and independence requirements, board committees and remuneration), shareholders and the general meeting (for example, regarding anti-takeover protection and our obligations to provide information to our shareholders) and financial reporting (such as external auditor and internal audit requirements). We aim to comply with all applicable provisions of the DCGC except where such provisions conflict with U.S. exchange listing requirements or with market practices in the United States or the Netherlands. This compliance position may affect your rights as a shareholder, and you may not have the same level of protection as a shareholder in a Dutch company that fully complies with the suggested governance provisions of the DCGC.

ITEM 4. INFORMATION ON COINCHECK GROUP

| A. | History and Development of Coincheck Group |

Coincheck Group B.V. was incorporated by Monex Group, Inc. (“Monex”) under the laws of the Netherlands as a Dutch private limited liability company (besloten vennootschap met beperkte aansprakelijkheid) in February 2022 for the purpose of effectuating the Business Combination. Thunder Bridge Capital Partners IV, Inc. was incorporated as a Delaware corporation on January 7, 2021 and, as a result of the Merger on December 10, 2024, was renamed Coincheck Merger Sub, Inc., a Delaware corporation. Coincheck Group B.V. has been the consolidating entity for purposes of Thunder Bridge’s financial statements since the consummation of the Business Combination on December 10, 2024. The history and development of Coincheck Group and the material terms of the Business Combination are described in the Proxy Statement/Prospectus under the headings “Summary of the Proxy Statement/Prospectus,” “The Business Combination Agreement,” “Information about PubCo” and “Description of the Post-Combination Company’s Securities,” which are incorporated herein by reference.

Coincheck Group’s registered and principal executive office is Hoogoorddreef 15, 1101 BA, Amsterdam, the Netherlands. Coincheck Group’s principal website address is https://coincheckgroup.com/. Coincheck Group uses its website to distribute company information and makes available free of charge a variety of information for investors, including its filings with the SEC, as soon as reasonably practicable after electronically filing that material with, or furnishing it, to the SEC. The information that Coincheck Group posts on its website may be deemed material. Accordingly, investors should monitor Coincheck Group’s website, in addition to following its press releases, filings with the SEC, and public conference calls and webcasts. In addition, investors may opt in to automatically receive email alerts and other information about Coincheck Group when enrolling their email address by visiting the “Email Alerts” section of the Coincheck Group website. Coincheck Group does not incorporate the information contained on, or accessible through, Coincheck Group’s website or related social media channels into this Report, and you should not consider it a part of this Report. Additionally, the SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The SEC’s website is http://www.sec.gov.

Following and as a result of the Business Combination, all of Coincheck Group’s business is conducted through Coincheck. A description of the business is included in the Proxy Statement/Prospectus in the sections entitled “Information About Coincheck” and “Coincheck Management’s Discussion and Analysis of Financial Condition and Results of Operations,” which are incorporated herein by reference.

| C. | Organizational Structure |

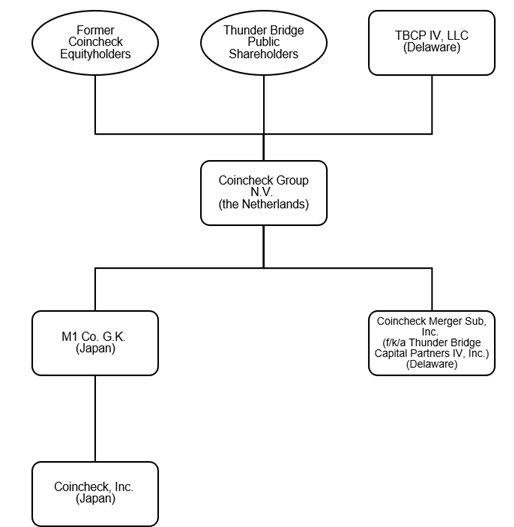

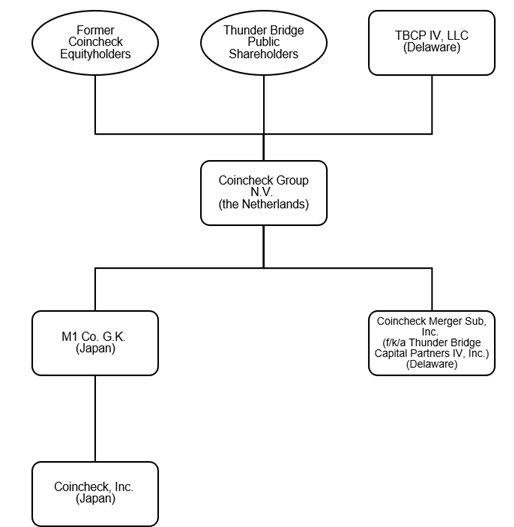

Upon consummation of the Business Combination, M1 GK, Coincheck and Coincheck Merger Sub, Inc. (formerly known as Thunder Bridge Capital Partners IV, Inc.) became wholly-owned subsidiaries of Coincheck Group. The following diagram depicts a simplified organizational structure of Coincheck Group as of the date hereof.

| D. | Property, Plants and Equipment |

Coincheck Group’s property, plants and equipment are held through its wholly-owned subsidiary, Coincheck. Information regarding Coincheck’s property, plants and equipment is described in the Proxy Statement/Prospectus under the section entitled “Information About Coincheck—Facilities,” which is incorporated herein by reference.

ITEM 4A. UNRESOLVED STAFF COMMENTS

None / Not applicable.

ITEM 5. OPERATING AND FINANCIAL REVIEW AND PROSPECTS

The discussion and analysis of the financial condition and results of operation of Coincheck is included in the Proxy Statement/Prospectus in the sections titled “Coincheck Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Information about Coincheck—Intellectual Property” and in the Proxy Statement/Prospectus Supplement No. 2 in the section titled “Coincheck Management’s Discussion and Analysis of Financial Condition and Results of Operations,” which information is incorporated herein by reference.

ITEM 6. DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES

| A. | Directors and Senior Management |

Oki Matsumoto (60) is an executive director with the title Executive Chairperson of Coincheck Group and is the founder of Monex, and Chairman of the Board and the Representative Executive Officer of Monex Group, Inc., and currently serves as an outside director of Mastercard, Incorporated (since 2016), and a Board member emeritus of Human Rights Watch. He is also an Executive director of Coincheck, Inc. and 3iQ Digital Holdings Inc. and Chairman of the Board of Directors of TradeStation Group, Inc., each a subsidiary of Monex. Mr. Matsumoto served as an outside director of the Tokyo Stock Exchange from 2008 to 2013 and as a former member, Financial Counsel to the Prime Minister of Japan. He began his career at Salomon Brothers, then joined Goldman, Sachs & Co. (1990-1998), where he held several leadership positions, including General Partner (1994-1998) before he founded Monex, Inc., a Japanese online brokerage firm, in 1999. Mr. Matsumoto has a bachelor’s degree in Law from the University of Tokyo.

Gary A. Simanson (64) is an executive director with the title Chief Executive Officer of Coincheck Group and has been the President, Chief Executive Officer and Director of Thunder Bridge since its inception. Mr. Simanson is founder of Thunder Bridge Capital, LLC and has served as its Chief Executive Officer since 2017. In addition to serving in that capacity, Mr. Simanson serves as head of its Investment Committee, Credit Committee, Enterprise Risk Committee, Loan Review and other executive committees and is responsible for sourcing and establishing strategic loan asset purchase relationships and equity opportunities within the financial services and FinTech industries. Since 2020 he has been an executive officer and director of Thunder Bridge Capital Partners III Inc. From 2019 until 2021, he was an executive officer and director of Thunder Bridge Acquisition II, Ltd. (NASDAQ: THBR). From 2018 to 2019 he was an officer and director of Thunder Bridge Acquisition, Ltd. (NASDAQ: TBRG), a blank check company which in July 2019 consummated its initial business combination with Hawk Parent Holdings, LLC, or Repay, an omnichannel payments technology provider. From 2015 through June 2017, Mr. Simanson founded and managed Endeavor Capital Management, L.L.C., Endeavor Capital Advisors, L.L.C., Endeavor Capital Fund, LP, and Endeavor Equity Fund, LP (collectively, “Endeavor”), targeting debt and equity investments in the marketplace lending industry. Prior to founding Endeavor, Mr. Simanson served as an advisor and then as a Director, President and Chief Executive Officer of First Avenue National Bank from 2013 to 2015, restructuring its balance sheet, lending practices, underwriting procedures, special credits, ALCO, corporate governance, enterprise risk, IT, retail delivery, and achieving strong regulatory results. He has been Managing Director of First Capital Group, L.L.C., an investment banking advisory firm specializing in the financial industry and bank mergers and acquisitions, strategic planning, capital raising and enterprise risk management from 1997 to the present. In such capacity, Mr. Simanson has both initiated and advised on bank mergers and acquisitions, capital raising transactions, enterprise risks and strategic initiatives around the country and has spoken nationally and internationally on enterprise risk, bank mergers and acquisitions, and also on the emerging marketplace lending and global FinTech industry, including the uses of blockchain for international asset selection and verification and income stream allocation and treasury management. Mr. Simanson previously served as the financial expert for the Audit Committee and as a member of the board of directors of First Guaranty Bancshares, Inc., with $1.4 billion in assets, and its wholly-owned subsidiary First Guaranty Bank and as a Senior Advisor to the Chairman of Alpine Capital Bank and its related companies, operating in the commercial banking, investment advisory, merchant banking and portfolio investment areas. He was Founder, Vice Chairman and Chief Strategic Officer of Community Bankers Trust Corporation, a $1.2 billion in assets bank holding company for Essex Bank (NASDAQ NMS “ESXB”) and previously served as its President, Chief Executive and Chief Financial Officer, and as a Director since its inception in 2005 to 2011, overseeing its public offering in 2006 as a special purpose acquisition company, Community Bankers Acquisition Corp, its bank acquisitions and shareholder reformulation in 2008, and its failed bank acquisitions from the FDIC in 2008 and 2009. In addition to serving as managing director of First Capital Group, Mr. Simanson also served as Senior Vice President concentrating in bank mergers and acquisitions and capital markets with FTN Financial Capital Markets, a wholly-owned investment banking and financial services subsidiary of First Horizon National Corporation (NYSE: FHS) from 1998 to 1999. From 1992 to 1995, Mr. Simanson was Associate General Counsel at Union Planters Corporation, then a NYSE-traded bank holding company (presently Regions Financial Corporation (NYSE: RF)), where his duties included the negotiation and preparation of all bank merger and acquisition transaction documents, transaction due diligence, member of integration committee, preparation of all regulatory filings, registration statements and other securities filings and other bank regulatory matters. From 1989 to 1992, he was a practicing attorney, beginning his career with Milbank, Tweed, Hadley & McCloy, LLP, specializing in the securities, bank regulatory and bank merger and acquisition areas. Mr. Simanson is licensed to practice law in the states of New York and Colorado. Mr. Simanson received his B.A. degree, majoring in Economics, from George Washington University. He earned his M.B.A., majoring in Finance, from George Washington University and holds a J.D. from Vanderbilt University. Mr. Simanson is well-qualified to serve as a member of our Board of Directors due to his extensive banking, financial and advisory experience.

Yo Nakagawa (59) is an executive director of Coincheck Group and a Senior Executive Director of Monex Group, Inc., Expert Director of Coincheck, Inc. He is a Director of Monex International Limited (Hong Kong) (2013-now), as a Director at Mimura Strategic Partners (2005-2011) and as the Chief Operating Officer at Fujimaki Japan (2003-2004). Mr. Nakagawa began his career at JP Morgan in 1988. He has a bachelor’s degree in Economics from Keio University.

Takashi Oyagi (55) is a non-executive director with the title Lead Non-Executive Director of Coincheck Group and is a founding member of Monex, Executive Officer and Chief Financial Officer of Monex Group, Inc. (and also serves on Monex’s board of directors) and is a Director and the Chief Strategic Officer of TradeStation Group, Inc. as well as the Chairman of the board of directors of 3iQ Digital Holdings Inc. Mr. Oyagi served as a Director in the Global Markets Division of Deutsche Bank Securities, Inc., in New York (2004-2007), and in the Asian Special Situation Group at Goldman Sachs (Japan) Ltd. (1998-1999). He began his career in finance in 1991 at Bank of Japan. Mr. Oyagi has a bachelor’s degree in Law from the University of Tokyo and an MBA degree from the University of Chicago.

Allerd Derk Stikker (62) is a non-executive director of Coincheck Group and is an advisor of BXR Group and is a director of a number of portfolio companies of BXR Group. Mr. Stikker joined BXR Group in 2008, initially as Chief Financial Officer of its real estate division. From 2011 to 2014 Mr. Stikker served as Chief Operating Officer and from 2014 until 2018 Chief Executive Officer of BXR Group. He started his career as a banking consultant in the United States and became the Chief Financial Officer of IMC, a Dutch financial institution, after returning to Europe. A Dutch citizen, Mr. Stikker holds an MBA and a B.A. in Business Administration from the George Washington University.

David Burg (55) is a non-executive director of Coincheck Group and is Global Group Head, Cyber and Digital Trust at Kroll, LLC after joining in March 2024. At Kroll, LLC, he is primarily responsible for leading a team of professionals with P&L responsibility and also overseas overhauls of group strategy to enable entrance into new markets and segments. Mr. Burg previously worked at Ernst & Young LLP from April 2018 to February 2024 as Principal and Americas Cyber Leader. From 1998 to 2018 Mr. Burg served in a variety of positions at PricewaterhouseCoopers LLP (Pwc) in the United States, including Principal and Global Cyber Security Leader and Principal and U.S. and Global Advisory Cyber Leader among other positions. Mr. Burg started his career as Project Specialist to Assistance Director of Financial Systems at the University of Pennsylvania Health System from 1993 to 1998. Mr. Burg holds an MBA from William and Mary – Raymond A. Mason School of Business and a B.S. from the University of Pennsylvania.

Toshihiko Katsuya (58) is a non-executive director of Coincheck Group and served as President & CEO at Aruhi Corporation (currently SBI Aruhi Corporation), a leading Japanese mortgage bank listed on the Tokyo Stock Exchange from April 2022 until June 2024 after he joined Aruhi in 2021. He worked for Monex Beans Holdings, Inc. (currently Monex Group, Inc.) for 15 years from 2006 to 2020 in various positions including President of Monex FX, Inc. in 2010, President of Monex Securities in 2015, COO of Monex Group, Inc. in 2017, President of Coincheck, Inc. from 2018 to 2020, and CFO of Monex Group, Inc. in 2019. Previously, he worked for The Mitsubishi Bank, Ltd. (currently MUFG Bank, Ltd.) for 17 years from 1989 to 2006, where he held various positions, including senior manager of Corporate Planning Division and VP of Investment Banking Division for the Americas. He assumed the positions of Director of Financial Futures Association of Japan in 2017 and Director of Japan Virtual and Crypto Assets Exchange Association in 2019. Mr. Katsuya holds an MBA from the University of California at Berkeley and a B.A. in Law from the University of Tokyo.

Yuri Suzuki (56) is a non-executive director of Coincheck Group and is a senior partner at the Tokyo office of the Japanese law firm, Atsumi & Sakai. Ms. Suzuki is an audit & supervisory board member at both Yayoi Co., Ltd. and CAMPFIRE, Inc and was an outside director at Coincheck, Inc. She also serves as an audit & supervisory board member at FinCity.Tokyo, the Organization of Global Financial City Tokyo. Ms. Suzuki served as a visiting attorney at Kirkland & Ellis LLP from September 2005 to July 2006 and as a director of the Japan Institute of Life Insurance from 2015 to 2023. She was admitted to the bar in Japan in 2001 and to the New York State Bar in 2006. She is a member of the Japan Federation of Bar Associations and the Daini Tokyo Bar Association. Ms. Suzuki has an LLM in Corporation Law from New York University School of Law and a bachelor’s degree in law from Waseda University.

Jessica Sinyin Tan (47) is a non-executive director of Coincheck Group and currently serves on the strategy and consumer protection committee of PingAn Bank. She was with PingAn Group for 11 years and was PingAn Group co-CEO and Executive Director between 2018-2023, leading its insurance, digital banking, healthcare, and technology businesses; she also served on the related party transactions and consumer protection committee of PingAn Group between 2020 and 2024. Before that, Ms. Tan was a global Partner at McKinsey & Company, working in its U.S. and Asia offices for 13 years. She is currently on several government advisory committees, including the World Bank Private Sector Investment Lab (for sustainable investments), the Monetary Authority of Singapore (MAS), as well as three Singapore non-profit boards (Singapore pensions, healthcare, and elderly care). Ms. Tan graduated from the Massachusetts Institute of Technology (MIT) with a Master’s degree in Electrical Engineering & Computer Science, as well as two Bachelor’s degrees in Electrical Engineering and Economics.

Jason Sandberg (46) is Chief Financial Officer of Coincheck Group and has served as a Managing Director at Thunder Bridge Capital, LLC since 2021. At Thunder Bridge Capital, LLC, he is primarily responsible for the evaluation and analysis of equity investment opportunities for the Thunder Bridge platform as well as providing transaction support from a regulatory, compliance and due diligence perspective for merger candidates. Mr. Sandberg previously worked as a Partner with Grant Thornton, LLP from 2013 through 2021. He served as an Audit Partner and was the Atlantic Coast Financial Services Practice leader. He also spent time as a Partner in the Firm’s National Professional Standards Group, focused on risk management for the firm’s high-profile public and private clients. He is a Certified Public Accountant and holds an MBA from Temple University and a Bachelor’s of Science in Accounting from the University of Delaware.

Satoshi Hasuo (54) is Chief Operating Officer of Coincheck Group and Chairman, Representative Director and Executive Director of Coincheck, Inc., a leading crypto exchange in Japan. He started his career at The Long-Term Credit Bank of Japan in 1993. After working at UBS Securities Japan Co., Ltd. and Mitsubishi Securities Co., Ltd., he joined Monex Group, Inc. (formerly Monex Beans Holdings, Inc.) in May 2005 where he was appointed as Chief Financial Officer in October 2017. In November 2019, he joined Coincheck, Inc., and was appointed as Representative Director & President. In June 2024, he was named Chairman, Representative Director & Executive Officer (current position), and Executive Officer to Monex Group, Inc. (current position).

Information pertaining to the compensation of the directors and executive officers of Coincheck Group is set forth in the Proxy Statement/Prospectus, in the sections titled “Management of the Post-Combination Company following the Business Combination—Compensation of Directors and Officers,” “Management of the Post-Combination Company following the Business Combination—Employment Agreements and Indemnification Agreements” and “Management of the Post-Combination Company following the Business Combination—Share Incentive Plans,” which are incorporated herein by reference.

In connection with the closing of the Business Combination, Coincheck Group entered into compensatory agreements with executive directors and non-executive directors, along with indemnification agreements, the forms of which are attached hereto as exhibits 4.16, 4.17 and 4.18, and incorporated herein by reference. Additionally. Coincheck Group’s Remuneration Policy for the board of directors and Coincheck Group’s Omnibus Incentive Plan are filed as exhibits as exhibit 4.19 and exhibit 4.15, and the terms set forth therein are incorporated by reference herein.

Information pertaining to Coincheck Group’s board practices is set forth in the Proxy Statement/Prospectus, in the section titled “Management of the Post-Combination Company following the Business Combination,” which is incorporated herein by reference.

For a description of Coincheck Group’s directors and senior management, please see Item 1.A. “Directors and Senior Management” and Item 6 A. “Directors and Senior Management” herein. Additionally, Coincheck Group’s other employees consist of employees in its wholly-owned subsidiary, Coincheck. Information pertaining to Coincheck Group’s other employees is set forth in the Proxy Statement/Prospectus, in the section titled “Information About Coincheck—Employees,” which is incorporated herein by reference.

Ownership of Coincheck Group’s Ordinary Shares by its directors and executive officers upon consummation of the Business Combination is set forth in Item 7.A of this Report.

ITEM 7. MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS

The following table sets forth information regarding the beneficial ownership of Ordinary Shares as of the date hereof by:

| | ● | each person known by us to be the beneficial owner of more than 5% of Ordinary Shares; |

| | ● | each of our directors and executive officers; and |

| | ● | all our directors and executive officers as a group. |

Beneficial ownership is determined according to the rules of the SEC, which generally provide that a person has beneficial ownership of a security if that person possesses sole or shared voting or investment power over that security. A person is also deemed to be a beneficial owner of securities that person has a right to acquire within 60 days including, without limitation, through the exercise of any option, warrant or other right or the conversion of any other security. Such securities, however, are deemed to be outstanding only for the purpose of computing the percentage beneficial ownership of that person but are not deemed to be outstanding for the purpose of computing the percentage beneficial ownership of any other person. Under these rules, more than one person may be deemed to be a beneficial owner of the same securities.

As of the date hereof, there are 129,703,076 Ordinary Shares issued and outstanding and 2,365,278 Ordinary Shares held in treasury.

Unless otherwise indicated, we believe that all persons named in the table below have sole voting and investment power with respect to all Ordinary Shares beneficially owned by them.

| | | Ordinary

Shares | | | % of Total

Ordinary

Shares / Voting Power | |

| Directors and Executive Officers | | | | | | |

| Oki Matsumoto(1) | | | ¾ | | | | ¾ | |

| Gary A. Simanson(2) | | | 4,195,973 | | | | 3.2 | % |

| Yo Nakagawa | | | ¾ | | | | ¾ | |

| Takashi Oyagi | | | ¾ | | | | ¾ | |

| Allerd Derk Stikker | | | ¾ | | | | ¾ | |

| David Burg | | | ¾ | | | | ¾ | |

| Toshihiko Katsuya | | | ¾ | | | | ¾ | |

| Yuri Suzuki | | | ¾ | | | | ¾ | |

| Jessica Sinyin Tan | | | ¾ | | | | ¾ | |

| Jason Sandberg | | | ¾ | | | | ¾ | |

| Satoshi Hasuo | | | ¾ | | | | ¾ | |

| All executive officers and directors as a group (eleven individuals) | | | 4,195,973 | | | | 3.2 | % |

| Principal Shareholders | | | | | | | | |

| Monex Group, Inc. | | | 109,097,910 | | | | 84.1 | % |

| Koichiro Wada | | | 9,700,464 | | | | 7.5 | % |

| | | | | | | | | |

| (1) | As of September 30, 2024, Mr. Matsumoto held a total of 23,190,700 shares, or approximately 9.03%, of Monex, 1,110,500 shares directly and 22,080,200 shares indirectly through Matsumoto Co., Ltd. Notwithstanding his ownership in Monex (a publicly traded company on the Tokyo Stock Exchange) and his role as Chairman of the Board and the Representative Executive Officer of Monex, Mr. Matsumoto disclaims the beneficial ownership of Ordinary Shares held by Monex as he does not exercise voting and investment discretion with respect to such shares. |

| | |

| (2) | Does not include 129,611 Ordinary Shares issuable upon the exercise of Private Warrants held by TBCP IV, LLC, which Private Warrants are not presently exercisable within 60 days of the date hereof. Mr. Simanson may be deemed to beneficially own Ordinary Shares held by TBCP IV, LLC, which are reported in the table above, by virtue of his control over TBCP IV, LLC, as its managing member. Mr. Simanson disclaims beneficial ownership of Ordinary Shares held by TBCP IV, LLC other than to the extent of his pecuniary interest in such shares. |

| B. | Related Party Transactions |

The balance of the WCL Promissory Note (as defined in the Proxy Statement/Prospectus) due to the Thunder Bridge Sponsor or an affiliate of the Thunder Bridge Sponsor, as of December 10, 2024 was $869,000.00. At the closing of the Business Combination, the WCL Promissory Note remained outstanding. Such WCL Promissory Note amount may be convertible into Ordinary Shares and Private Warrants at a price of $10.00 per one Ordinary Share and one-fifth Private Warrant at the option of the lender.

Additional information pertaining to Coincheck Group’s related party transactions is set forth in the Proxy Statement/Prospectus, in the section titled “Certain Coincheck Relationships and Related Party Transactions” and “Certain Thunder Bridge Relationships and Related Party Transactions,” which are incorporated herein by reference.

On December 4, 2024, PubCo and Thunder Bridge entered into a non-redemption and share forward agreement (the “Non-Redemption Agreement”) with Ghisallo Master Fund LP (“Ghisallo”), pursuant to which Ghisallo agreed not to redeem (or to validly rescind any redemption requests on) an aggregate of 973,000 Thunder Bridge Public Shares (the “Non-Redemption Shares”), in connection with Thunder Bridge’s Special Meeting. In exchange for the foregoing commitments not to redeem Thunder Bridge Public Shares, Thunder Bridge paid Ghisallo an amount equal to the product of (x) the number of Non-Redemption Shares and (y) the price at which each Thunder Bridge Public Share was redeemed in connection with the Special Meeting (the “Redemption Price”). For 90 days following the closing of the Business Combination (the “Maturity Date”), if Ghisallo sells any Non-Redemption Shares, Ghisallo agrees to pay to Thunder Bridge an amount equal to the Redemption Price multiplied by the number of such Non-Redemption Shares sold. On the Maturity Date, Ghisallo agreed to transfer to Pubco, at no cost to PubCo and free and clear of any liens or encumbrances, any Non-Redemption Shares still retained by it.

| C. | Interests of Experts and Counsel |

None / Not applicable.

ITEM 8. FINANCIAL INFORMATION

| A. | Statements and Other Financial Information |

Financial Statements

Financial statements have been filed as part of this Report. See Item 18 “Financial Statements.”

Pro Formas

The unaudited pro forma condensed combined financial information of Coincheck and Thunder Bridge is attached as Exhibit 15.1 to this Report. See Item 18 “Financial Statements.”

Legal Proceedings

Legal or arbitration proceedings are described in the Proxy Statement/Prospectus under the heading “Information About PubCo—Legal Proceedings,” “Information About Coincheck—Legal Proceedings” and “Information About Thunder Bridge—Legal Proceedings,” which are incorporated herein by reference.

Dividend Policy

Coincheck Group’s policy on dividend distributions is described in the Proxy Statement/Prospectus under the heading “Price Range of Securities and Dividends—Dividends,” which is incorporated herein by reference.

None / Not applicable.

ITEM 9. THE OFFER AND LISTING

| A. | Offer and Listing Details |

Ordinary Shares and Public Warrants are listed on NASDAQ under the symbols “CNCK” and “CNCKW,” respectively. Holders of Ordinary Shares and Public Warrants should obtain current market quotations for their securities.

Not applicable.

Ordinary Shares and Public Warrants are listed on NASDAQ under the symbols “CNCK” and “CNCKW,” respectively.

Not applicable.

Not applicable.

Not applicable.

ITEM 10. ADDITIONAL INFORMATION

As of the date hereof, subsequent to the closing of the Business Combination, there were 129,703,076 Ordinary Shares issued and outstanding. There are 2,365,278 Ordinary Shares held in treasury. There are also 4,860,148 warrants outstanding, each exercisable at $11.50 per one Ordinary Share, of which 4,730,537 are Public Warrants listed on Nasdaq and 129,611 are Private Warrants held by TBCP IV, LLC.

Additional information regarding the securities of Coincheck Group is set forth in the Proxy Statement/Prospectus in the section entitled “Description of the Post-Combination Company’s Securities” which is incorporated herein by reference.

| B. | Memorandum and Articles of Association |

The Unofficial Translation of Deed of Conversion and Amendment of the Articles of Association of Coincheck Group B.V. into Coincheck Group N.V. as of December 10, 2024 is filed as Exhibit 1.1 to this Report.

The description of the articles of association of Coincheck Group contained in the Proxy Statement/Prospectus in the section titled “Description of the Post-Combination Company’s Securities” is incorporated herein by reference.

Material Contracts Relating to Coincheck Group’s Operations

Information pertaining to Coincheck Group’s material contracts is set forth in the Proxy Statement/Prospectus, in the section titled “Coincheck Management’s Discussion and Analysis of Financial Condition and Results of Operations— Contractual Obligations and Commitments,” “Information About Coincheck,” “Risk Factors—Risks Relating to Coincheck’s Business and Industry,” “Certain Coincheck Relationships and Related Party Transactions” and “Certain Thunder Bridge Relationships and Related Party Transactions,” each of which is incorporated herein by reference.

Material Contracts Relating to the Business Combination

Business Combination Agreement

The description of the Business Combination Agreement in the Proxy Statement/Prospectus in the sections titled “Proposal No. 1 —The Business Combination Proposal” and “The Business Combination Agreement” are incorporated herein by reference.

Related Agreements

The description of the material provisions of certain additional agreements entered into pursuant to the Business Combination Agreement in the Proxy Statement/Prospectus in the sections titled “Proposal No. 1 — The Business Combination Proposal” and “Certain Agreements Related to the Business Combination” are incorporated herein by reference.

There are no governmental laws, decrees, regulations or other legislation in the Netherlands that may affect the import or export of capital, including the availability of cash and cash equivalents for use by Coincheck Group, or that may affect the remittance of dividends, interest, or other payments by Coincheck Group to non-resident holders of its ordinary shares, other than potential withholding taxes. There is no limitation imposed by Dutch laws or in Coincheck’s articles of association on the right of non-residents to hold or vote shares.

Information pertaining to tax considerations is set forth in the Proxy Statement/Prospectus, in the sections titled “Material U.S. Federal Income Tax Considerations of the Redemption Rights and the Business Combination,” “Material Japanese Tax Considerations of Acquiring, Owning or Disposing of PubCo Ordinary Shares or PubCo Warrants” and “Material Dutch Tax Considerations of Acquiring, Owning or Disposing of PubCo Ordinary Shares or PubCo Warrants” which are incorporated herein by reference.

| F. | Dividends and Paying Agents |

Information regarding Coincheck Group’s policy on dividends is described in the Proxy Statement/Prospectus under the heading “Price Range of Securities and Dividends—Dividends,” which is incorporated herein by reference. Coincheck Group has not identified a paying agent.

The financial statements of Coincheck as of March 31, 2024 and March 31, 2023 and for each of the three years in the period ended March 31, 2024, incorporated herein by reference to the Form F-4 have been so incorporated in reliance on the report of KPMG AZSA LLC, an independent registered public accounting firm, as set forth in their report thereon, given upon the authority of said firm as experts in auditing and accounting.

The financial statements of Thunder Bridge incorporated herein by reference in this Form 20-F have been so incorporated by reference in reliance upon the report of Grant Thornton LLP, independent registered public accountants, upon the authority of said firm as experts in auditing and accounting.

We are subject to certain of the informational filing requirements of the Securities Exchange Act of 1934 (as amended, the “Exchange Act”). Since we are a “foreign private issuer,” we are exempt from the rules and regulations under the Exchange Act prescribing the furnishing and content of proxy statements, and our officers, directors and principal shareholders are exempt from the reporting and “short-swing” profit recovery provisions contained in Section 16 of the Exchange Act, with respect to their purchase and sale of our shares. In addition, we are not required to file reports and financial statements with the SEC as frequently or as promptly as U.S. companies whose securities are registered under the Exchange Act. However, we are required to file with the SEC an Annual Report on Form 20-F, containing financial statements audited by an independent accounting firm. We may, but are not required, to furnish to the SEC, on Form 6-K, unaudited financial information after each of our first three fiscal quarters. The SEC also maintains a website at http://www.sec.gov that contains reports and other information that we file with or furnish electronically with the SEC.

Not applicable.

ITEM 11. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

The information set forth in the section titled “Coincheck Management’s Discussion and Analysis of Financial Condition and Results of Operations—Quantitative and Qualitative Disclosure about Market Risks” in the Proxy Statement/Prospectus and in the Proxy Statement/Prospectus Supplement No. 2 in the section titled “Coincheck Management’s Discussion and Analysis of Financial Condition and Results of Operations” is incorporated herein by reference.

ITEM 12. DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES

Warrants

Upon the completion of the Business Combination, there were 4,730,537 Public Warrants outstanding. The Public Warrants, which each entitle the holder to purchase one Ordinary Share at an exercise price of $11.50 per share, will become exercisable on the later of January 9, 2025, which is 30 days after the completion of the Business Combination, and the date that the issuance of the underlying ordinary shares is registered on an effective registration statement of PubCo. The Public Warrants will terminate at 5:00 p.m., Eastern Time on the earlier to occur of: (i) the date that is five (5) years after the date on which the Business Combination is completed, (ii) the liquidation of PubCo, or (iii) the redemption date as provided in the warrant agreement dated June 29, 2021 by and between Thunder Bridge and Continental Stock Transfer & Trust Company, as warrant agent (as amended). Upon the completion of the Business Combination, there were also 129,611 Private Warrants held by Thunder Bridge Sponsor. The Private Warrants are identical to the Public Warrants in all material respects, except that so long as the Private Warrants are held by the Thunder Bridge Sponsor or its permitted transferees, the Private Warrants (and the Ordinary Shares issuable upon exercise of these warrants) may not be transferred, assigned or sold until March 10, 2025 subject to certain limited exceptions. Additionally, the Private Warrants may be exercised by the holders on a cashless basis and will not be redeemable (subject to certain limited exceptions), so long as they are held by the Thunder Bridge Sponsor or its permitted transferees. If the Private Warrants are held by someone other than the Thunder Bridge Sponsor or its permitted transferees, such warrants will be redeemable and exercisable by such holders on the same basis as the Public Warrants.

PART II

Not applicable.

PART III

ITEM 17. FINANCIAL STATEMENTS

Not applicable.

ITEM 18. FINANCIAL STATEMENTS

The audited financial statements of Coincheck contained in the Proxy Statement/Prospectus between pages F-67 and F-115 are incorporated herein by reference.

The audited financial statements of Thunder Bridge contained in the Proxy Statement/Prospectus between pages F-27 and F-51 are incorporated herein by reference.

The unaudited condensed interim financial statements of Coincheck for the quarterly period ended September 30, 2024 are incorporated herein by reference to pages F-2 through F-16 of the Proxy Statement/Prospectus Supplement No. 2, filed with the SEC on November 22, 2024 by Coincheck.

The unaudited condensed interim financial statements of Thunder Bridge for the quarterly period ended September 30, 2024 are incorporated herein by reference to Item 1 of Form 10-Q, filed with the SEC on November 14, 2024 by Thunder Bridge.

The unaudited pro forma condensed combined financial information of Coincheck and Thunder Bridge is attached as Exhibit 15.1 to this Report.

ITEM 19. EXHIBITS

EXHIBIT INDEX

| Exhibit No. | | Description |

| 1.1 | | Unofficial Translation of Deed of Conversion and Amendment of the Articles of Association of Coincheck Group B.V. (after conversion and amendment named, Coincheck Group N.V.) |

| 2.1 | | Specimen Warrant certificate of Thunder Bridge Capital Partners IV, Inc. (incorporated by reference to Exhibit 4.3 of Form S-1/A, filed by Thunder Bridge Capital Partners IV, Inc. with the SEC on June 21, 2021). |

| 2.2 | | Warrant Agreement, dated June 29, 2021, between Thunder Bridge Capital Partners IV, Inc. and Continental Stock Transfer & Trust Company (incorporated by reference to Exhibit 4.1 of Form 8-K, filed by Thunder Bridge Capital Partners IV, Inc. with the SEC on July 2, 2021). |

| 2.3 | | Warrant Assumption and Amendment Agreement, dated December 10, 2024, by and among Thunder Bridge Capital Partners IV, Inc., Coincheck Group N.V. and Continental Stock Transfer & Trust Company. |

| 4.1 | | Business Combination Agreement, dated as of March 22, 2022, by and among Thunder Bridge Capital Partners IV, Inc., Coincheck Group B.V., M1 Co G.K., Coincheck Merger Sub, Inc., and Coincheck, Inc. (incorporated by reference to Exhibit 2.1 of Form 8-K filed with the SEC on March 22, 2022). |

| 4.2 | | Amendment to Business Combination Agreement, dated as of May 31, 2023, by and among Thunder Bridge Capital Partners IV, Inc., Coincheck Group B.V., M1 Co G.K., Coincheck Merger Sub, Inc., and Coincheck, Inc. (incorporated by reference to Exhibit 2.1 of Form 8-K filed by Thunder Bridge with the SEC on May 31, 2023). |

| 4.3 | | Second Amendment to Business Combination Agreement, dated as of May 28, 2024, by and among Thunder Bridge Capital Partners IV, Inc., Coincheck Group B.V., M1 Co G.K., Coincheck Merger Sub, Inc., and Coincheck, Inc. (incorporated by reference to Exhibit 2.1 of Form 8-K filed by Thunder Bridge with the SEC on May 30, 2024). |

| 4.4 | | Third Amendment to Business Combination Agreement, dated as of October 8, 2024, by and among Thunder Bridge Capital Partners IV, Inc., Coincheck Group B.V., M1 Co G.K., Coincheck Merger Sub, Inc., and Coincheck, Inc. (incorporated by reference to Exhibit 2.1 of Form 8-K filed by Thunder Bridge with the SEC on October 11, 2024). |

| 4.5 | | Business Combination Waiver, dated as of December 6, 2024, by and among Thunder Bridge Capital Partners IV, Inc, Coincheck Group B.V, M1 Co G.K., Coincheck Merger Sub, Inc. and Coincheck, Inc. (incorporated by reference to Exhibit 2.1 of Form 8-K, filed by Thunder Bridge Capital Partners IV, Inc. with the SEC on December 6, 2024). |

| 4.6 | | Registration Rights Agreement, dated June 29, 2021, between Thunder Bridge Capital Partners IV, Inc., TBCP IV, LLC and the holders party thereto (incorporated by reference to Exhibit 10.5 of Form 8-K, filed by Thunder Bridge with the SEC on July 2, 2021). |

| 4.7 | | Placement Unit Purchase Agreement, dated June 29, 2021, between Thunder Bridge Capital Partners IV, Inc. and TBCP IV, LLC (incorporated by reference to Exhibit 10.6 of Form 8-K, filed by Thunder Bridge with the SEC on July 2, 2021). |

| 4.8 | | Form of Indemnity Agreement (incorporated by reference to Exhibit 10.7 of Form S-1/A, filed by Thunder Bridge Capital Partners IV, Inc. with the SEC on June 21, 2021). |

| 4.9 | | Sponsor Support Agreement by and among Thunder Bridge Capital Partners IV, Inc., TBCP IV, LLC, Gary A. Simanson, as manager of TBCP IV, LLC and Coincheck Group N.V., dated March 22, 2022 (incorporated by reference to Exhibit 10.1 of Form 8-K filed by Thunder Bridge Capital Partners IV, Inc. with the SEC on March 22, 2022). |

| 4.10 | | Company Support Agreement by and among Thunder Bridge Capital Partners IV, Inc., Monex Group, Inc., Coincheck Group N.V. and the other parties thereto, dated March 22, 2022 (incorporated by reference to Exhibit 10.2 of Form 8-K filed by Thunder Bridge with the SEC on March 22, 2022). |

| 4.11 | | Amendment to Company Support Agreement by and among Thunder Bridge Capital Partners IV, Inc., Monex Group, Inc., Coincheck Group N.V. and the other parties thereto, dated as of December 6, 2024 (incorporated by reference to Exhibit 10.2 of Form 8-K, filed by Thunder Bridge Capital Partners IV, Inc. with the SEC on December 6, 2024). |

| 4.12 | | Form of Lock-Up Agreement, dated March 22, 2022, by and among Coincheck Group N.V., Coincheck, Inc. and the individuals named therein (incorporated by reference to Exhibit 10.3 of Form 8-K filed by Thunder Bridge with the SEC on March 22, 2022). |

| 4.13 | | Form of Amendment to Lock-Up Agreement, dated as of October 8, 2024, by and among Coincheck Group B.V., Coincheck, Inc., and the individuals named therein (incorporated by reference to Annex G-1 of the proxy statement/prospectus filed by Coincheck Group B.V. with the SEC on November 12, 2024). |

| 4.14 | | Registration Rights Agreement, dated as of December 10, 2024, by and among Coincheck Group N.V., Thunder Bridge Capital Partners IV, Inc., Monex Group, Inc., and the persons named therein. |

| 4.15+ | | Coincheck Group N.V. Omnibus Incentive Plan |

| 4.16+ | | Form of Director Indemnification Agreement, by and between Coincheck Group N.V. and the individual named therein. |

| 4.17+ | | Form of Executive Director Agreement, by and between Coincheck Group N.V. and the individual named therein. |

| 4.18+ | | Form of Non-Executive Director Agreement, by and between Coincheck Group N.V. and the individual named therein. |

| 4.19+ | | Remuneration Policy for the Board of Directors of Coincheck Group N.V., dated December 10, 2024. |

| 4.20 | | Non-Redemption and Share Forward Agreement, dated as of December 4, 2024, by and between Thunder Bridge Capital Partners IV, Coincheck Group N.V. and Ghisallo Master Fund LP (incorporated by reference to Exhibit 10.1 of Form 8-K, filed by Thunder Bridge Capital Partners IV, Inc. with the SEC on December 6, 2024). |

| 4.21 | | Nomination and Voting Agreement, dated as of December 10, 2024, by and among Monex Group, Inc., TBCP IV, LLC and Coincheck Group N.V. |

| 8.1 | | List of Subsidiaries of Coincheck Group N.V. |

| 15.1 | | Unaudited Pro Forma Condensed Combined Financial Information of Coincheck, Inc. and Thunder Bridge Capital Partners IV, Inc. |

| 15.2 | | Consent of Grant Thornton LLP |

| 15.3 | | Consent of KPMG AZSA LLC |

| + | Indicates a management or compensatory plan. |

SIGNATURES

The registrant hereby certifies that it meets all of the requirements for filing on Form 20-F and that it has duly caused and authorized the undersigned to sign this report on its behalf.

| | COINCHECK GROUP N.V. |

| | | |

| December 16, 2024 | By: | /s/ Oki Matsumoto |

| | | Name: | Oki Matsumoto |

| | | Title: | Executive Chairperson |

The co-registrant hereby certifies that it meets all of the requirements for filing on Form 20-F and that it has duly caused and authorized the undersigned to sign this report on its behalf.

| | COINCHECK INC. |

| | | |

| December 16, 2024 | By: | /s/ Satoshi Hasuo |

| | | Name: | Satoshi Hasuo |

| | | Title: | Chairman, Representative Director and

Executive Director |

15