- DINO Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

HF Sinclair (DINO) DEF 14ADefinitive proxy

Filed: 4 Apr 24, 4:16pm

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 | |

☑ | No fee required | |||

☐ | Fee paid previously with preliminary materials | |||

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||

2024

NOTICE OF ANNUAL MEETING

AND PROXY STATEMENT

Wednesday, May 22, 2024, 8:30 a.m. Central Daylight Time

http://www.virtualshareholdermeeting.com/DINO2024

Dear Fellow Stockholders,

On behalf of our Board of Directors (the “Board”), I am pleased to invite you to the HF Sinclair Corporation (“HF Sinclair” or the “Company”) 2024 Annual Stockholders’ Meeting (the “Annual Meeting”), which will be held on Wednesday, May 22, 2024 at 8:30 a.m., Central Daylight Time. The Annual Meeting will be held in a virtual meeting format only, via webcast at http://www.virtualshareholdermeeting.com/DINO2024.

Cash Return to Stockholders

2023 was a year of strong results driven by solid performance across our Refining, Marketing, Renewables, Lubricants & Specialties and Midstream segments and is reflective of the tireless efforts of our dedicated employees. We made great progress towards the three priorities I laid out when I assumed the CEO role in May 2023: to drive operational excellence, to optimize and integrate our portfolio of new businesses, and to generate strong cash flows to advance our cash return strategy. Our performance allowed us to return approximately $1.3 billion to stockholders through dividends and share repurchases during 2023. I encourage you to read the 2023 Annual Report that accompanies this Proxy Statement to learn more about what we did as a company to create compelling value for our stockholders in 2023.

Corporate Changes

In 2023, we completed our acquisition of all of the common units of Holly Energy Partners, L.P. (“HEP”) not already owned by HF Sinclair and its subsidiaries, which simplified our corporate structure and reduced costs as a combined company (the “HEP Merger Transaction”). This strategic acquisition supports the integration and optimization of our assets. Following the closing of the HEP Merger Transaction, our HEP segment was renamed the Midstream segment.

Board Changes

In February 2024, we announced the appointment of Jeanne M. Johns to our Board. Ms. Johns brings to the Board executive management and board experience, as well as significant corporate and international business experience across a broad range of industries. Her extensive experience in refining and the oil and gas industry brings insight and relevant technical expertise. With Ms. Johns’ appointment, 55% of our director nominees at the Annual Meeting represent diversity of gender and/or race/ethnicity.

Executive Compensation

Since 2012, we have included environmental, health and safety performance measures as part of our annual incentive cash compensation program. For the 2023 annual incentive plan, the Compensation Committee of the Board expanded the environmental, health and safety performance measures to include a metric tied to our achievement of the greenhouse gas (“GHG”) emissions reduction target that we announced in 2022, which we believe appropriately ties incentives to execute on our strategic business priorities related to environmental sustainability.

| 2024 Proxy Statement (i) |

Environmental, Social and Governance

In addition to making progress towards achieving our GHG goal, we took great strides towards making our business more sustainable for the future in 2023, which marked the first full year of operations at all three of our renewable diesel facilities. Being an engaged member of our communities also continued to be important to HF Sinclair. Throughout the year, we fostered transparent and collaborative discussions and through our philanthropic endeavors, contributed to many charitable organizations through volunteer efforts and financial donations. These efforts are supported by our commitment to good governance practices which align our ethics and behaviors.

Inclusion and Diversity

Our leadership is committed to attracting, retaining and developing a highly engaged, high-performing, diverse workforce and cultivating an inclusive workplace where all employees feel valued and have a sense of belonging. Throughout 2023, we held Inclusion and Diversity workshops for frontline, senior and executive leadership roles. To help foster a culture of inclusion, we have five voluntary employee resource groups (“ERGs”) open to all employees: Women in Energy, Veterans in Energy, Family Caregivers in Energy, Toastmasters in Energy and Cultural Awareness in Energy.

Safety

We are grounded by our “Goal Zero” vision, which reflects our belief that safe production can be achieved each and every day. In an effort to achieve Goal Zero, our employee and contractor safety education and training programs are conducted on an ongoing basis. We set specific goals for workplace safety and measure attainment of those goals. Over the past five years ended December 31, 2023, our Occupational Safety and Health Administration’s total recordable incident rate has declined by 52%.

Your Vote Matters

We remain committed to the long-term interests of our stockholders. We hope your shares will be represented at the Annual Meeting, and I encourage you to vote early. This proxy statement provides important information regarding our Board and our governance and compensation practices to inform your vote.

On behalf of our Board and our employees, thank you for your trust and investment in HF Sinclair.

Timothy Go

Chief Executive Officer and President

| 2024 Proxy Statement (ii) |

April 4, 2024

NOTICE OF 2024 ANNUAL MEETING

AND PROXY STATEMENT

Dear Stockholder:

You are invited to attend the Annual Meeting of stockholders of HF Sinclair Corporation (the “Company” or “HF Sinclair”). The 2024 Annual Stockholders’ Meeting (the “Annual Meeting”) will be held in a virtual meeting format only, via live audio webcast as shown below.

When: |

8:30 a.m. Central Daylight Time Wednesday, May 22, 2024

| Items of Business

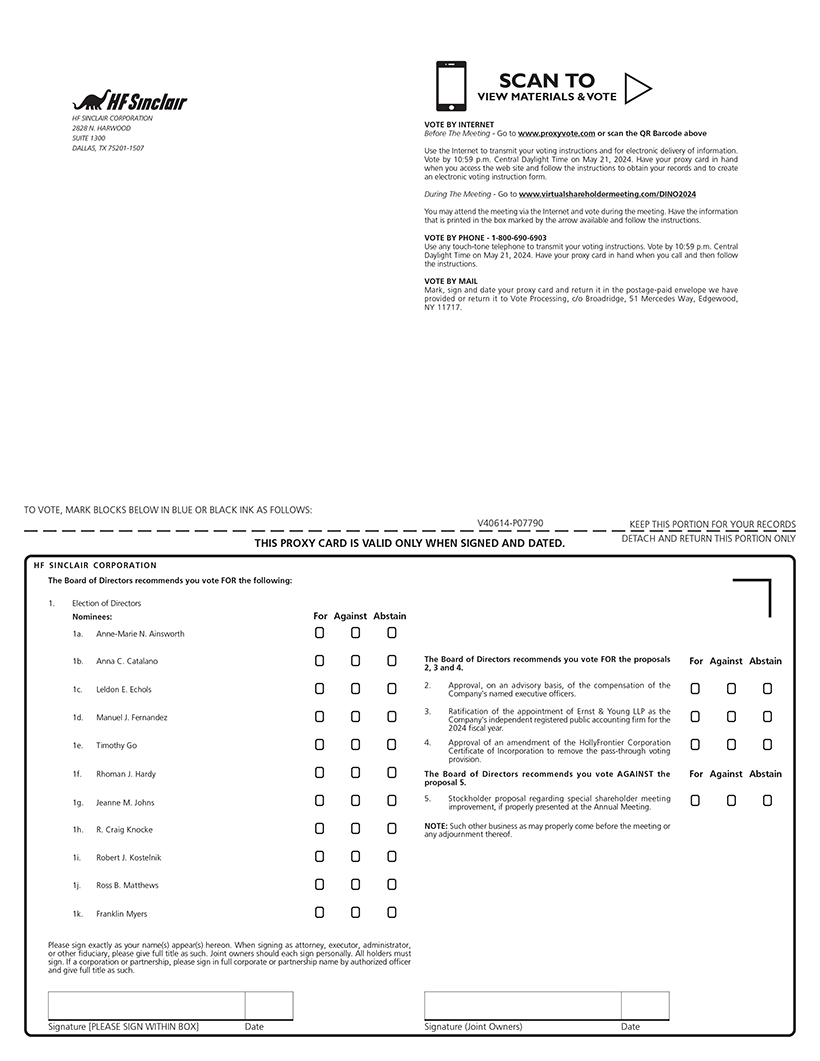

• Election of 11 directors to hold office until the 2025 annual meeting of stockholders

• Approval, on an advisory basis, of the compensation of the Company’s named executive officers

• Ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the 2024 fiscal year

• Amendment to HollyFrontier Corporation’s Certificate of Incorporation to remove the pass-through voting provision

• Consideration of a stockholder proposal regarding special shareholder meeting improvement, if properly presented at the Annual Meeting

| ||||

Where: | Online at www.virtualshareholdermeeting.com /DINO2024

| |||||

Who Can Vote

Stockholders of record at the close of business on March 25, 2024 are entitled to receive notice of, and vote at, the Annual Meeting.

|

Information about the meeting is presented in the following proxy statement. The proxy statement and the form of proxy are being first made available to stockholders on or about April 4, 2024. Please read the enclosed information and our 2023 Annual Report carefully before voting your proxy.

The Annual Meeting will be held in a virtual meeting format only, via webcast at www.virtualshareholdermeeting.com/DINO2024. You will not be able to attend the Annual Meeting physically in person. You will be able to attend and listen to the Annual Meeting online, submit questions and vote your shares electronically during the virtual Annual Meeting. As always, we encourage you to vote your shares prior to the virtual Annual Meeting. In order to attend and vote or submit questions at the Annual Meeting, please follow the instructions in the section titled “General Information—Additional Information About the Virtual Annual Meeting” on page 97.

| 2024 Proxy Statement (iii) |

To participate in the virtual Annual Meeting, you will need the 16-digit control number included on your proxy card, voting instruction form or notice of internet availability. The virtual Annual Meeting will begin promptly at 8:30 a.m., Central Daylight Time, on May 22, 2024. We encourage you to access the virtual Annual Meeting prior to the start time. Online access and check-in will begin at 8:15 a.m., Central Daylight Time. Participants should allow plenty of time to log in and to make sure that they can hear streaming audio prior to the start of the virtual Annual Meeting.

Your vote is important to us. Whether or not you plan to attend the virtual Annual Meeting, please sign, date and return the proxy card (if you have requested a paper copy of the proxy materials) or vote using the internet or telephone voting procedures described on the Notice of Internet Availability.

Thank you for your continued support of the Company. We look forward to your participation at our virtual Annual Meeting.

|

| |

| Franklin Myers | Timothy Go | |

| Chairperson of the Board | Chief Executive Officer and President |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 22, 2024. We have elected to take advantage of the U.S. Securities and Exchange Commission (“SEC”) rules that allow companies to furnish proxy materials to their stockholders on the internet. These rules allow us to provide information our stockholders need while lowering the costs of delivery and reducing the environmental impact of our annual meeting. The Company’s Notice of Annual Meeting, proxy statement and 2023 Annual Report to stockholders are available on the internet at www.proxyvote.com.

| 2024 Proxy Statement (iv) |

TABLE OF CONTENTS

| CEO Letter | (i | ) | ||

| Notice of 2024 Annual Meeting and Proxy Statement | (iii | ) | ||

| Proxy Statement Summary | 1 | |||

| 2 | ||||

| 3 | ||||

| 5 | ||||

| 5 | ||||

| 7 | ||||

| 7 | ||||

| 8 | ||||

| Election of Directors (Proposal 1) | 9 | |||

| 10 | ||||

| Corporate Governance | 18 | |||

| 18 | ||||

| 19 | ||||

| 19 | ||||

| 20 | ||||

| 21 | ||||

| 22 | ||||

| 23 | ||||

| The Board, Its Committees and Its Compensation | 24 | |||

| 24 | ||||

| 24 | ||||

| 28 | ||||

| 31 | ||||

| Advisory Vote on the Compensation of Our Named Executive Officers (Proposal 2) | 32 | |||

| Executive Officers | 33 | |||

| Compensation Discussion and Analysis | 34 | |||

| 34 | ||||

| 36 | ||||

Components of our Executive Compensation Program During 2023 | 37 | |||

| 38 | ||||

| 38 | ||||

Role of the Compensation Committee Consultant in Establishing Compensation | 39 | |||

| 39 | ||||

| 40 | ||||

| 57 | ||||

| Compensation Committee Report | 60 | |||

| Executive Compensation | 61 | |||

| 61 | ||||

| 63 | ||||

| 64 | ||||

| 66 | ||||

| 67 | ||||

| 68 | ||||

| 68 | ||||

| 70 | ||||

| 77 | ||||

| 78 | ||||

| 79 | ||||

PROXY STATEMENT SUMMARY

This summary highlights information contained elsewhere in this proxy statement. This summary does not include all of the information you should consider, and we encourage you to read the entire proxy statement and our 2023 Annual Report carefully before voting. The proxy statement and the form of proxy are being first made available to stockholders on or about April 4, 2024.

Annual Meeting of Stockholders

Date: |

Wednesday May 22, 2024

| Who Can Vote:

Stockholders of record at the close of business on March 25, 2024 (the “Record Date”) are entitled to receive notice of, and vote at, the virtual Annual Meeting.

How to Vote:

If you are a stockholder of record, you may vote electronically during the Annual Meeting or by proxy using any of the following methods:

| ||||||||

Time: | 8:30 a.m. Central Daylight Time

| |||||||||

Place: | Online at www.virtualshareholdermeeting.com /DINO2024

| |||||||||

By Internet Visit www.proxyvote.com |

By Telephone Call toll-free 1-800-690-6903 within the U.S. or Canada |

By Mail Complete, sign and date the proxy card and return the proxy card in the prepaid envelope | ||||||||

Record Date: | March 25, 2024

| |||||||||

| 2024 Proxy Statement 1 |

Agenda and Voting Recommendations

Proposal | Voting Standard | Effect of Broker Non-Votes and Abstentions | Board’s Recommendation | Page | ||||||

| 1 | Elect 11 directors to hold office until the Company’s 2025 annual meeting of stockholders | Affirmative vote of a majority of the votes cast on the matter | Abstentions and broker non-votes are not considered votes cast and will have no effect | FOR all nominees | 9 | |||||

| 2 | Approve, on an advisory basis, the compensation of the Company’s named executive officers | Affirmative vote of a majority of the votes cast on the matter | Abstentions and broker non-votes are not considered votes cast and will have no effect | FOR | 32 | |||||

| 3 | Ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the 2024 fiscal year | Affirmative vote of a majority of the votes cast on the matter | Abstentions are not considered votes cast and will have no effect | FOR | 88 | |||||

| 4 | Approve amendment of the HollyFrontier Corporation Certificate of Incorporation to Remove the Pass-Through Voting Provision | Affirmative vote of a majority of the outstanding shares of the Company’s common stock entitled to vote thereon | Abstentions and broker non-votes will have the same effect as a vote against the proposal | FOR | 91 | |||||

| 5 | Consider stockholder proposal regarding special shareholder meeting improvement, if properly presented at the Annual Meeting | Affirmative vote of a majority of the votes cast on the matter | Abstentions and broker non-votes are not considered votes cast and will have no effect | AGAINST | 93 | |||||

| 2 HF Sinclair Corporation |

Board Nominees

For the 2024 Annual Meeting of Stockholders (“Annual Meeting”), our Board recommends the eleven Board nominees listed below. Our Board takes into account many factors when assessing the qualifications for each Board nominee. Please see the section titled “Corporate Governance—Director Nominations—Qualifications” on page 20 for a discussion of factors considered, as well as the “Director Nominee Skills, Experience and Diversity Matrix” on page 10. All references to a director’s service on the Board or its committees, or employment with the Company, prior to March 14, 2022 shall mean service on HollyFrontier Corporation’s (“HollyFrontier”) Board of Directors or committees, or employment with HollyFrontier, as applicable. At the market open on March 15, 2022, the Company replaced HollyFrontier as the public company trading on the New York Stock Exchange (“NYSE”) under the ticker symbol “DINO”.

Director Nominee Facts

9 out of 11 director nominees are independent | 6 out of 11 director nominees | 7.07 years* average tenure of independent director nominees

| 63.6* average age of director nominees |

| * | As of March 15, 2024. |

| Committee Memberships(2) | ||||||||||||||||||||||

Name(1) | Age | Director Since | Independent | Audit | Compensation | Nominating, and Social | Environmental, Health, Safety, and Public Policy | Finance | Executive | |||||||||||||

Franklin Myers Senior Advisor of Quantum Energy Partners and Chairperson of the Board of HF Sinclair Corporation | 71 | 2011 | ✓ | ✓ | ✓ | Chairperson | ||||||||||||||||

Timothy Go Chief Executive Officer and President of HF Sinclair Corporation | 57 | 2023 | ✓ | |||||||||||||||||||

Anne-Marie N. Ainsworth Former President and Chief Executive Officer of the general partner of Oiltanking Partners, L.P. and of Oiltanking Holding Americas, Inc. | 67 | 2017 | ✓ | Chairperson | ✓ | |||||||||||||||||

Anna C. Catalano Former Group Vice President, Marketing, for BP plc | 64 | 2017 | ✓ | ✓ | ✓ | |||||||||||||||||

Leldon E. Echols Former Executive Vice President and Chief Financial Officer of Centex Corporation | 68 | 2009 | ✓ | Financial Expert | Chairperson | ✓ | ||||||||||||||||

Manuel J. Fernandez Former Managing Partner of KPMG’s Dallas office | 62 | 2020 | ✓ | Chairperson, Financial | ✓ | |||||||||||||||||

Rhoman J. Hardy Former Senior Vice President, Shell Chemicals and Products, U.S. Gulf Coast for Shell USA, Inc. | 55 | 2022 | ✓ | ✓ | ✓ | |||||||||||||||||

Jeanne M. Johns Former Chief Executive Officer and a Managing Director of Incitec Pivot Ltd. | 61 | 2024 | ✓ | |||||||||||||||||||

| 2024 Proxy Statement 3 |

| Committee Memberships(2) | ||||||||||||||||||||||

Name(1) | Age | Director Since | Independent | Audit | Compensation | Nominating, and Social | Environmental, Health, Safety, and Public Policy | Finance | Executive | |||||||||||||

R. Craig Knocke Director of Turtle Creek Trust Company, Chief Investment Manager and Portfolio Manager of Turtle Creek Management, LLC, Principal and a non-controlling manager and member of TCTC Holdings, LLC | 54 | 2019 | ✓ | ✓ | ✓ | |||||||||||||||||

Robert J. Kostelnik Principal at Glenrock Recovery Partners, LLC | 72 | 2011 | ✓ | Chairperson | ✓ | |||||||||||||||||

Ross B. Matthews Chief Operating Officer of REH Company (formerly known as The Sinclair Companies) | 69 | 2022 | ✓ | |||||||||||||||||||

| 2023 Meetings | 8 | 6 | 4 | 4 | 4 | 3 | ||||||||||||||||

| (1) | James H. Lee, who serves as a member of the Audit Committee and is the Chairperson of the Finance Committee of the Board, will not stand for re-election at the Annual Meeting. See “Election of Directors.” |

Norman J. Szydlowski, who serves as a member of the Nominating, Governance and Social Responsibility Committee and the Environmental, Health, Safety and Public Policy Committee of the Board, has resigned as a member of the Board pursuant to Section 2(b) of the Stockholders Agreement (as defined below), such resignation is effective as of the Annual Meeting. See “Election of Directors.”

| (2) | Board committee composition as of March 15, 2024. The Board expects to refresh its committee memberships in connection with the Annual Meeting to address the committee vacancies resulting from the above noted departures of Mr. Lee and Mr. Szydlowski, respectively. |

| 4 HF Sinclair Corporation |

Governance Highlights

| ✓ | All of our directors stand for election annually |

| ✓ | Majority voting and director resignation policy in uncontested elections |

| ✓ | Proxy access (3% for three years, up to the greater of two individuals or 20% of the Board) |

| ✓ | Stockholder right to call a special meeting (25% ownership threshold) |

| ✓ | Independent Chairperson, separate from CEO |

| ✓ | Independent committee chairs |

| ✓ | Regular executive sessions of independent directors at Board and committee meetings |

| ✓ | Annual Board and committee self-evaluations |

| ✓ | Active Board refreshment, with seven new independent directors joining since 2017, including three women directors and three racially/ethnically diverse directors |

| ✓ | Mandatory retirement age of 75 for our directors |

| ✓ | No restrictions on directors’ access to management or employees |

| ✓ | Board involvement in CEO succession planning and risk management |

| ✓ | All of our directors attended at least 75% of the meetings of the Board and committees on which they served during 2023 |

| ✓ | None of our directors sit on the board of more than three other public companies in addition to our Board |

| ✓ | Company policy prohibits hedging and pledging of Company stock |

| ✓ | Directors are subject to stock ownership requirements equal to five times the annual Board cash retainer paid to them |

| ✓ | No poison pill |

| ✓ | No supermajority voting provisions |

Commitment to ESG & Sustainability

The Board and senior management recognize that the long-term success of the Company is tied to creating a positive impact on the careers of our people, by supporting the communities in which we operate, with the products we produce for our customers, and by reducing our impact on the environment through our processes.

| • | Sustainability Report. In 2023, we published our 2022 Sustainability Report, which contains new and updated disclosures on a variety of Environmental, Social and Governance (“ESG”) topics, including, among others, climate, our product innovation, our greenhouse gas (“GHG”) emissions target, energy efficiency, water conservation and recycling projects, safety and our risk management oversight, corporate governance framework, global ethics and compliance program, employee development programs, inclusion and diversity efforts, community and stakeholder engagement, and environmental and safety performance metrics. |

| • | GHG Emissions Reduction Target. In 2021, we launched an internal initiative led by senior management to evaluate the establishment of a company-wide GHG emissions intensity reduction goal. We have implemented a variety of initiatives, overseen by the Environmental, Health, Safety, and Public Policy Committee, designed to reduce our GHG emissions, and our 2021 Sustainability Report announced that we have achieved a 35% reduction in criteria pollutants since 2011. In our 2021 Sustainability Report, we also set forth our goal of decreasing our Scope 1 and Scope 2 GHG emissions intensity by 25% by 2030 versus 2020 levels. We plan to achieve this target through a combination of reductions in our Scope 1 and Scope 2 GHG emission intensity and offsets available under certain regulatory programs from producing and blending lower-carbon renewable fuels. |

| • | ESG Component of Annual Bonus. Since 2012, we have historically included environmental, health and safety performance measures as part of our annual incentive cash compensation program. In 2022, when setting the annual incentive plan for the 2023 performance period, the Compensation Committee of the Board (the “Compensation Committee”) expanded the environmental, health and safety performance measures to include a metric tied to our achievement of the GHG emissions reduction target discussed above, which we believe appropriately ties incentives to execute against our strategic business priorities related to |

| 2024 Proxy Statement 5 |

environmental sustainability. This metric is equally weighted with the existing environmental, health and safety metrics. The expanded environmental, health and safety performance measures, now referred to as the ESG performance measures, applied to the 2023 performance period and are equally weighted with the other operational performance measures. See “2023 Executive Compensation Decisions—Annual Incentive Cash Compensation” on page 42 for additional details on the ESG performance measures. |

| • | Renewables Segment. In 2022, we established Renewables as a standalone business segment, as our Cheyenne, Wyoming renewable diesel unit and Artesia, New Mexico renewable diesel and pre-treatment units all commenced operations that same year. We also added a third renewable diesel unit in Sinclair, Wyoming to our asset base in March 2022 through the Company’s acquisition of Sinclair Oil Corporation (now known as Sinclair Oil LLC) and Sinclair Transportation Company (the “Sinclair Transactions”) from The Sinclair Companies (now known as REH Company). Our organic investments in renewables, combined with our recent acquisition, are expected to have the capacity to produce 380 million gallons of renewable diesel per year. Renewable diesel produces 50% to 80% less GHG emissions than petroleum diesel does. Our investment in pre-treatment is expected to provide flexibility among feedstocks such as distillers corn oil, tallow and degummed soybean oil, allowing us to minimize single feedstock risk and generate value through the use of lower carbon intensity feed. |

| • | Renewables Segment Component of Annual Bonus. In connection with the establishment of Renewables as a distinct business segment as discussed above, the Renewables segment was added to the EBITDA component of our annual incentive cash compensation program financial performance measures starting in the 2022 performance period. |

| • | Board Diversity & Refreshment. 55% of our director nominees represent diversity of gender and/or race/ethnicity. Since 2017, we have added seven new independent directors, of which five, or 71%, are diverse in terms of gender or race/ethnicity. Our Board regularly evaluates the skills, backgrounds, needs of our business and strategy, as well as the contributions and time commitments of our existing Board members in its efforts to refresh the Board so that it has a well-balanced Board that appropriately considers and oversees the Company’s enterprise risks and opportunities as our business evolves. When the Nominating, Governance and Social Responsibility Committee conducts a formal search to recruit director candidates from outside the Company as potential nominees to join the Board, the Nominating, Governance and Social Responsibility Committee Charter requires that the committee endeavor to include, and instruct any third-party search firm engaged to assist in seeking candidates for the Board to include, a diverse range of highly qualified candidates, including candidates of diverse background, knowledge, experience and viewpoints, as well as demographic traits such as race, gender expression and identity, age, sexual orientation and ethnicity in any initial pool of candidates from which director nominees may be chosen. The scope of information solicited by our annual director questionnaires includes the diversity attributes of our directors, which we incorporated in the enhanced Director Nominee Skills, Experience and Diversity Matrix set forth below. |

| • | Inclusion & Diversity. Throughout 2023, we held Inclusion and Diversity workshops for frontline, senior and executive leadership roles. To help foster a culture of inclusion, we have five voluntary employee resource groups (“ERGs”) open to all employees: Women in Energy, Veterans in Energy, Family Caregivers in Energy, Toastmasters in Energy and Cultural Awareness in Energy. Each of the ERGs focuses on supporting our employees and developing talent at HF Sinclair by fostering relationships through education, networking and leadership development opportunities. |

| • | Community and Stakeholder Engagement. Our relationships with our stakeholders are essential to our success and our ability to operate. We strive to be a good neighbor by engaging in dialogue with communities in which we operate so we understand what’s important to stakeholders and respond to feedback. |

| • | Business Conduct & Ethics. Our Global Ethics and Compliance program, led by our Chief Compliance Officer, establishes and reinforces our ethical standards through our Code of Business Conduct and Ethics, among our other policies, including the Global Anti-Corruption and Third Party Due Diligence policies, the Global Privacy Policy and the Human Rights and Modern Slavery Policy. In 2023, 99.8% of active employees were trained and certified against our Code. We also provide a confidential means for stakeholders to report suspected violations of law or company policies through our Speak and Be Heard reporting line. |

| 6 HF Sinclair Corporation |

2023 Business Highlights

The following is a summary of key results in 2023:

| • | Full year 2023 net income attributable to HF Sinclair stockholders of approximately $1.6 billion, or $8.29 per diluted share, and adjusted net income of $1.8 billion, or $9.51 per diluted share |

| • | Operating cash flow of approximately $2.3 billion |

| • | Ended the year with a strong balance sheet, including approximately $1.35 billion in cash and cash equivalents and approximately $2.7 billion in long-term debt |

| • | Returned approximately $1.3 billion to stockholders through dividends and share repurchases |

| • | Simplified corporate structure through the buy-in of Holly Energy Partners, L.P. (“HEP”), which closed on December 1, 2023 (the “HEP Merger Transaction”) |

Named Executive Officers

For 2023, our named executive officers (our “NEOs”) were as follows:

Name | Position as of December 31, 2023 | |

Timothy Go (1) | Chief Executive Officer and President | |

Atanas H. Atanasov | Executive Vice President and Chief Financial Officer | |

Vaishali S. Bhatia (2) | Executive Vice President, General Counsel and Secretary | |

Valerie Pompa (3) | Executive Vice President, Operations | |

Steven C. Ledbetter (4) | Executive Vice President, Commercial | |

Michael C. Jennings (5) | Former Chief Executive Officer; Former Executive Vice President, Corporate |

| (1) | Mr. Go was promoted to Chief Executive Officer and President, effective May 9, 2023. |

| (2) | Ms. Bhatia resigned as Executive Vice President, General Counsel and Secretary, effective March 15, 2024. |

| (3) | Ms. Pompa was appointed Executive Vice President, Operations, effective March 31, 2023. |

| (4) | Mr. Ledbetter was appointed Executive Vice President, Commercial, effective March 31, 2023. |

| (5) | Mr. Jennings retired as Chief Executive Officer, effective May 8, 2023, and was appointed and served as Executive Vice President, Corporate, from May 9, 2023 until his retirement from the Company on November 9, 2023. See “Compensation Discussion and Analysis—2023 Executive Compensation Decisions—Succession Arrangements with Mr. Jennings and Mr. Go” below for additional information regarding his retirement. Although he was no longer employed at the end of the 2023 year, he is still deemed to be a named executive officer pursuant to SEC rules. |

| 2024 Proxy Statement 7 |

Executive Compensation Program

| ✓ | A significant portion of the total compensation paid to our executive officers is performance-based, at-risk pay |

| ✓ | For 2023, 89% of our current CEO’s target compensation and approximately 76% of our other average NEO target compensation was variable and paid based upon attainment of pre-established financial and operational performance objectives and, in certain circumstances, the performance of our common stock relative to our industry peers (1) |

| ✓ | For 2023, 75% of our current CEO’s target compensation and approximately 57% of our other average NEO target compensation was equity-based awards, of which 50% vest based on the Company’s stock and financial performance relative to that of our industry peers over a three-year performance period (1) |

| ✓ | In 2023, 85% of our current CEO’s and our other NEOs’ annual bonus was based on the Company’s financial and operational performance as measured against pre-established goals and, in certain circumstances, relative to our industry peers |

| ✓ | The annual bonus paid to our executive officers may be capped at 50% of the individual’s target bonus if the Company does not achieve positive operating income on a consolidated basis |

| ✓ | None of our executive officers have employment agreements |

| ✓ | “Double-trigger” change in control provisions |

| ✓ | Limited perquisites for our executive officers |

| ✓ | Company policy prohibits hedging and pledging of Company stock |

| ✓ | Executive officers are subject to significant stock ownership requirements |

| ✓ | No tax reimbursement provisions in the change in control agreements with our executive officers |

| ✓ | Clawback policies allow for recoupment of annual and long-term incentive compensation upon the occurrence of an accounting restatement resulting from material noncompliance with any financial reporting requirement or upon certain acts of misconduct |

| ✓ | Annual advisory vote on executive officer compensation |

| (1) | Target compensation is comprised of our three main compensation elements: base salary, annual incentive cash bonuses and equity incentive awards. Percentages will not tie to the Summary Compensation Table since the majority of equity incentive awards for 2023 were granted in November 2022. CEO target compensation is based on the approximate 2023 target compensation of our current CEO, Timothy Go, who was promoted to the position on May 9, 2023. Other average NEO target compensation does not include the compensation of Michael C. Jennings, who retired from the CEO role on May 8, 2023 and served as Executive Vice President, Corporate from May 9, 2023 to November 9, 2023 and was compensated pursuant to the terms of his Letter Agreement and Successor Transition Agreement. |

At our 2023 annual meeting of stockholders, over 96% of the votes cast by our stockholders were voted in support of our named executive officer pay program.

| 8 HF Sinclair Corporation |

Election of Directors

(Proposal 1)

Currently, the Board consists of thirteen directors. Each of the Company’s directors stands for election each year at the annual meeting. In accordance with the Company’s director retirement policy, which provides that the Nominating, Governance and Social Responsibility Committee will not recommend to the Board the nomination of any director or nominee who has attained or will attain the age of 75 prior to the annual meeting of stockholders, James H. Lee will not stand for re-election at the Annual Meeting. Additionally, under the Stockholders Agreement (as defined below), the REH Parties (as defined below) are entitled to nominate (i) two persons to the Board for so long as the REH Parties beneficially own common stock constituting not less than 15% of all outstanding HF Sinclair common stock and (ii) one person to the Board for so long as the REH Parties beneficially own less than 15% but more than or equal to 5% of all outstanding HF Sinclair common stock. Accordingly, since the REH Parties beneficially owned less than 15% but more than 5% of all outstanding HF Sinclair common stock as of the 2024 Sinclair Designee Calculation Date (as defined in the Stockholders Agreement), on February 14, 2024, the Board accepted Norman Szydlowski’s offer to resign, effective as of the Annual Meeting. Following the Annual Meeting, the size of the Board will be reduced from thirteen to eleven directors.

Each director nominee identified below currently serves on the Board and all were elected at the 2023 annual meeting of stockholders, except for Jeanne M. Johns, who was nominated and appointed to the Board, effective February 13, 2024. Ms. Johns was recommended to the Nominating, Governance and Social Responsibility Committee by non-management members of the Company’s Board. Upon the recommendation of our Nominating, Governance and Social Responsibility Committee, our Board has nominated the eleven individuals identified below to serve as directors. The director nominees, if elected, will serve until the 2025 annual meeting of stockholders, or until their earlier resignation or removal. Each director nominee has indicated a willingness to serve if elected.

For each of the eleven director nominees standing for election, the following pages set forth certain biographical information, including a description of their principal occupation, business experience, and the primary qualifications that the Nominating, Governance and Social Responsibility Committee considered in recommending them as director nominees, as well as the Board committees on which each director nominee will serve as of the Annual Meeting.

Required Vote and Recommendation

In uncontested elections, the election of directors requires the approval of a majority of the votes cast for each director.

|

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ELECTION OF EACH OF THE DIRECTOR NOMINEES LISTED BELOW. |

| 2024 Proxy Statement 9 |

Director Nominee Facts

9 out of 11 director nominees are independent | 6 out of 11 director nominees are gender and/or ethnically/racially diverse

| 7.07 years* average tenure of independent director nominees | 63.6* average age of director nominees |

| * | As of March 15, 2024 |

Director Nominee Skills, Experience and Diversity Matrix

The Board believes that the director nominees are highly qualified and bring a collective balance of relevant knowledge, skills and viewpoints, together with an effective mix of leadership, professional experiences and diversity, to the boardroom. The Board views and defines diversity in its broadest sense, which includes background, knowledge, experience, viewpoints, geography and other demographics. The Director Nominee Skills, Experience and Diversity Matrix set forth below illustrates the experience, skills and qualifications the Board has identified as important for determining whether each director should serve on the Board in light of the Company’s business and strategic direction, and it highlights each director’s skills, knowledge and experience that uniquely qualify such director to serve on the Board. The lack of a checkmark for a particular item does not mean that the director does not possess that qualification or skill. Rather, a checkmark indicates that the item is a particularly prominent qualification, skill or expertise that the director brings to the Board. All the director nominees satisfy the criteria set forth in our Corporate Governance Guidelines and possess the characteristics that are essential for the proper and effective functioning of the Board.

The Board believes that all director nominees exhibit:

✓ High Integrity

✓ Leadership Experience

✓ Commitment to Ethics | ✓ Commitment to the Long-Term Interests of our Stockholders

✓ Strong Business Judgement

✓ Commitment to Safety and Diversity in the Workplace |

DIRECTOR NOMINEE SKILLS, EXPERIENCE AND DIVERSITY MATRIX

| ||||||||||||||||||||||

|  |  |  |  |  |  |  |  |  |  | ||||||||||||

Skill(s), Experience and Demographics | ||||||||||||||||||||||

EXECUTIVE/CEO LEADERSHIP Experience serving in a significant leadership position, such as a CEO, CFO or other senior leadership position |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ | |||||||||||||

PUBLIC COMPANY BOARD SERVICE/GOVERNANCE Experience serving on public company boards and/or advising on public company corporate governance issues, polices and best practices |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ | |||||||||||||

FINANCIAL EXPERTISE Significant experience in positions requiring financial knowledge and analysis, such as corporate finance, financial accounting and reporting, or treasury functions |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ | |||||||||||||||

M&A & CAPITAL MARKETS Experience evaluating and executing potential acquisitions and strategic investment opportunities and/or experience evaluating capital structure and overseeing various types of capital markets transactions |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ | |||||||||||||

INDUSTRY BACKGROUND & OPERATIONS MANAGEMENT Significant experience in and/or knowledge of the oil and gas industry and/or significant experience overseeing or managing the operations of an organization of a similar size, structure or business as the Company |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ | |||||||||||||

MARKETING/SALES Experience with the marketing or branding of products and/or in executing commercial and/or marketing strategies and initiatives |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ | ||||||||||||||||

| 10 HF Sinclair Corporation |

DIRECTOR NOMINEE SKILLS, EXPERIENCE AND DIVERSITY MATRIX

| ||||||||||||||||||||||

|  |  |  |  |  |  |  |  |  |  | ||||||||||||

INTERNATIONAL Experience as a senior executive working for an international company or working or living in countries outside the U.S. |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ | |||||||||||||

RISK MANAGEMENT Experience in enterprise risk management or in the oversight of key financial, operational, strategic or compliance risk |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ | |||||||||||||||

HUMAN CAPITAL MANAGEMENT Experience in executive compensation design and the management of human capital, including talent acquisition, development, retention, succession planning, diversity, equity and inclusion and/or corporate culture |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ | |||||||||||||

HEALTH/SAFETY/ENVIRONMENT Experience in the management of health, safety and environmental matters in the oil and gas industry |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ | ||||||||||||||||

SUSTAINABILITY / ESG Educational or career experience in the areas of corporate or social responsibility, environmental impact and/ or sustainability strategies, including with respect to climate change |

✓ |

✓ |

✓ | |||||||||||||||||||

LEGAL & REGULATORY Experience in highly regulated businesses, government relations or public policy, and/or familiarity with management of legal and regulatory issues facing the oil and gas industry |

✓ |

✓ | ||||||||||||||||||||

GENDER | ||||||||||||||||||||||

FEMALE |

✓ |

✓ |

✓ | |||||||||||||||||||

MALE |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ | ||||||||||||||

AGE |

67 |

64 |

68 |

62 |

57 |

55 |

61 |

54 |

72 |

69 |

71 | |||||||||||

RACE/ETHNICITY | ||||||||||||||||||||||

AFRICAN-AMERICAN |

✓ | |||||||||||||||||||||

ASIAN |

✓ |

✓ | ||||||||||||||||||||

HISPANIC OR LATINX |

✓ | |||||||||||||||||||||

WHITE |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ | |||||||||||||||

Our director nominees have a wide range of additional skills and experience not mentioned above, which they will bring to their role as directors. The skills and experience of our director nominees are further described in their biographies on the following pages.

| 2024 Proxy Statement 11 |

Franklin Myers | ||||

Director Since: 2011

Age: 71

Committees: • Executive Committee, Chairperson • Compensation Committee • Nominating, Governance and Social Responsibility Committee |

Principal Occupation: Senior Advisor of Quantum Energy Partners and Chairperson of the Board of the Company

Business Experience: Mr. Myers has served as the Chairperson of the Board of the Company since February 2019. He has served as a senior advisor of Quantum Energy Partners, a private equity firm, since February 2013. Mr. Myers served as an operating advisor to Paine & Partners, LLC, a private equity firm, from 2009 through 2012 and as Senior Advisor to Cameron International Corporation, a publicly traded provider of flow equipment products, from 2008 until 2009. He served Cameron in various other capacities, including as Senior Vice President and Chief Financial Officer from 2003 through 2008, President of Cameron’s compression business from 1998 through 2001 and Senior Vice President and General Counsel from 1995 through 1999. In addition, Mr. Myers served as Senior Vice President and General Counsel of Baker Hughes Incorporated from 1988 through 1995 and as an associate and then a partner at Fulbright & Jaworski (now Norton Rose Fulbright) from 1978 through 1988.

Additional Directorships: Mr. Myers currently serves as a director of Comfort Systems USA, Inc. Mr. Myers served as a director of Frontier Oil Corporation from 2009 until the merger of Frontier Oil Corporation and Holly Corporation in July 2011, as a director of ION Geophysical Corporation from 2001 to June 2019, and as a director of NCS Multistage Holdings, Inc. from February 2017 to June 2020.

Qualifications: Mr. Myers’ experience in senior finance and legal positions at publicly traded energy companies provides him with significant insight into operations, management and finance. In addition, Mr. Myers brings to the Board a broad range of experiences and skills as a result of his service as a director of other public and private companies.

| |||

Timothy Go | ||||

Director Since: 2023

Age: 57

Committee: • Executive Committee |

Principal Occupation: Chief Executive Officer and President of the Company

Business Experience: Mr. Go has served as Chief Executive Officer and President since May 2023. He previously served as President and Chief Operating Officer from November 2021 to May 2023 and as Executive Vice President, Chief Operating Officer from June 2020 to November 2021. Prior to joining the Company, he served as Chief Executive Officer of the general partner of Calumet Specialty Products Partners, L.P., an independent producer of specialty hydrocarbon products, from January 2016 to April 2020 and retired from Calumet in June 2020. Prior to joining Calumet, Mr. Go served in various leadership roles at Koch Industries, Inc. and Flint Hills Resources, LP, a wholly-owned subsidiary of Koch Industries, Inc. from August 2008 to September 2015, including having most recently served as Vice President, Operations of Flint Hills Resources, LP from July 2012 to September 2015. Prior to joining Koch Industries, Mr. Go held various roles of increasing responsibility in downstream operations during his 18 years at ExxonMobil Corporation.

Additional Directorships: Mr. Go currently serves as a director of Celanese Corporation.

Qualifications: Mr. Go brings to the Board extensive industry experience and familiarity with the day-to-day operations of the Company. He provides a significant resource for the Board and facilitates communication between management and the Board.

| |||

| 12 HF Sinclair Corporation |

Anne-Marie N. Ainsworth | ||||

Director Since: 2017

Age: 67

Committees: • Environmental, Health, Safety, and Public Policy Committee, Chairperson • Finance Committee |

Principal Occupation: Former President and Chief Executive Officer of the general partner of Oiltanking Partners, L.P. and of Oiltanking Holding Americas, Inc.

Business Experience: Ms. Ainsworth served as President and Chief Executive Officer of the general partner of Oiltanking Partners, L.P. and of Oiltanking Holding Americas, Inc., companies engaged in the terminaling, storage and transportation by pipeline of crude oil, refined petroleum products and liquefied petroleum gas, from 2012 until her retirement in 2014, Senior Vice President, Manufacturing of Sunoco Inc. from 2009 to 2012, and General Manager of the Motiva Enterprises, LLC Norco, Louisiana Refinery from 2006 to 2009. Prior to joining Motiva, Ms. Ainsworth served in various capacities at Royal Dutch Shell. Ms. Ainsworth is a graduate of the Institute of Corporate Directors Education Program (Rotman School of Management, University of Toronto and Haskayne School of Business, University of Calgary) and holds the ICD.D. designation.

Additional Directorships: Ms. Ainsworth currently serves as a director of Pembina Pipeline Corporation, Archrock, Inc. and Kirby Corporation.

Qualifications: Ms. Ainsworth brings to the Board extensive experience in the oil and gas industry and strong business, operational and financial acumen from her leadership roles at other public companies.

| |||

Anna C. Catalano | ||||

Director Since: 2017

Age: 64

Committees: • Compensation Committee • Nominating, Governance and Social Responsibility Committee

|

Principal Occupation: Former Group Vice President, Marketing, for BP plc

Business Experience: Ms. Catalano served in various capacities for BP plc, and its predecessor Amoco Corporation, from 1979 until her retirement in 2003, including serving as Group Vice President, Marketing, for BP plc from 2000 to 2003 and as SVP, Sales Operations from 1996 to 1999. During her executive career, Ms. Catalano had extensive experience in downstream retail marketing, and as SVP, Sales Operations was responsible for Amoco’s portfolio of retail facilities across the U.S., including direct and distributor channels and product terminal operations.

Additional Directorships: Ms. Catalano currently serves as a director of Ecovyst Inc. and Frontdoor, Inc. She served as a director of Kraton Corporation from 2011 until March 2022 and Willis Towers Watson plc (having previously served as a director of Willis Group from 2006 until the merger of Willis Group and Towers Watson & Co. in 2016) until June 2022.

Qualifications: Ms. Catalano brings to the Board significant corporate and international business and marketing experience.

| |||

| 2024 Proxy Statement 13 |

Leldon E. Echols | ||||

Director Since: 2009

Age: 68

Committees: • Compensation Committee, Chairperson • Audit Committee • Executive Committee |

Principal Occupation: Former Executive Vice President and Chief Financial Officer of Centex Corporation

Business Experience: Mr. Echols served as Executive Vice President and Chief Financial Officer of Centex Corporation from 2000 until his retirement in 2006. Before joining Centex, Mr. Echols held various positions, including managing partner, at Arthur Andersen LLP from 1978 until 2000.

Additional Directorships: Mr. Echols currently serves as a director of Trinity Industries, Inc. and EnLink Midstream Manager, LLC, the managing member of EnLink Midstream, LLC. Prior to the closing of the January 2019 simplification transaction between EnLink Midstream Partners, LP (formerly known as Crosstex Energy, L.P.), Mr. Echols served on the board of EnLink Midstream GP, LLC, the general partner of EnLink Midstream Partners, LP.

Qualifications: Mr. Echols brings to the Board executive management and board experience with other public companies. Mr. Echols has extensive financial and management experience as well as financial reporting expertise and a level of financial sophistication that qualifies him as an audit committee financial expert.

| |||

Manuel J. Fernandez | ||||

Director Since: 2020

Age: 62

Committees: • Audit Committee, Chairperson • Compensation Committee |

Principal Occupation: Former Managing Partner of the Dallas office and Market Leader for the Southwest Region of KPMG

Business Experience: Mr. Fernandez joined KPMG LLP in 1984 and served in a number of leadership positions until his retirement in September 2020, including most recently as Managing Partner of the Dallas office and market leader for KPMG’s Southwest region across audit, tax and consulting services from October 2009 to September 2020. During his career at KPMG, he also served as National Managing Partner for Talent Acquisition, member of the National Inclusion and Diversity Board, and as Co-Chair of the National Hispanic/Latino employee resource group.

Additional Directorships: Mr. Fernandez currently serves as a director of Jacobs Solutions Inc.

Qualifications: Mr. Fernandez brings to the Board extensive financial and management experience as well as financial reporting expertise and a level of financial sophistication that qualifies him as an audit committee financial expert.

| |||

| 14 HF Sinclair Corporation |

Rhoman J. Hardy | ||||

Director Since: 2022

Age: 55

Committees: • Environmental, Health, Safety, and Public Policy Committee • Finance Committee

|

Principal Occupation: Former Senior Vice President, Shell Chemicals and Products, U.S. Gulf Coast, Shell USA, Inc.

Business Experience: Mr. Hardy founded HardLine Consulting LLC in July 2022, providing expertise in strategy and leadership to companies focused on energy, technical services and infrastructure. Prior to then, he served in various leadership positions with Shell USA, Inc., having most recently served as Senior Vice President, Shell Chemicals and Products, for the U.S. Gulf Coast from December 2018 until his retirement in May 2022 and General Manager, Shell Geismar Chemical Site from June 2015 to December 2018. Mr. Hardy first joined Shell in 1988.

Additional Directorships: Mr. Hardy currently serves as a director of Comfort Systems USA, Inc.

Qualifications: Mr. Hardy brings to the Board significant insight in the development of energy infrastructure and extensive technical and operational expertise, as well as executive and general management experience.

| |||

Jeanne M. Johns | ||||

Director Since: 2024

Age: 61

|

Principal Occupation: Former Chief Executive Officer and Managing Director of Incitec Pivot Ltd.

Business Experience: Ms. Johns served as Chief Executive Officer and as a Managing Director of Incitec Pivot Ltd., an Australian listed multinational manufacturer and distributor of fertilizers, civil explosives and chemicals, from November 2017 until June 2023. Prior to joining Incitec, Ms. Johns held several executive leadership roles in the U.S., UK/Europe and Asia/China during her 30 years with BP plc, including serving as Head of Safety & Operational Risk, Downstream from 2011 until 2015, Head of BP Group Operating Management System Excellence from 2013 until 2015, President, Asian Olefins and Derivatives from 2008 until 2010, President, BP North America Natural Gas Liquids from 2004 until 2007, Technical Vice President of Health, Safety & Environmental, Manufacturing Excellence, Engineering and Projects, Global Petrochemicals from 2002 until 2003, and Refinery Manager and Business Unit Leader, Toledo Refinery from 1999 until 2001.

Additional Directorships: Ms. Johns previously served on the board of directors of Incitec Pivot Ltd. from November 2017 until June 2023 in conjunction with her Chief Executive Officer position.

Qualifications: Ms. Johns brings to the Board executive management and board experience, as well as significant corporate and international business experience across a broad range of industries. Her extensive experience in refining and the oil and gas industry brings insight and relevant technical expertise.

| |||

| 2024 Proxy Statement 15 |

R. Craig Knocke | ||||

Director Since: 2019

Age: 54

Committees: • Finance Committee • Nominating, Governance and Social Responsibility Committee

|

Principal Occupation: Director of Turtle Creek Trust Company, Chief Investment Manager and Portfolio Manager of Turtle Creek Management, LLC, Principal and a non-controlling manager and member of TCTC Holdings, LLC

Business Experience: Mr. Knocke is a co-founder and has served as director of Turtle Creek Trust Company, a private trust and investment management firm, since 2009. He currently serves as the Chief Investment Officer and has served as a Portfolio Manager at Turtle Creek Management, LLC, a registered investment advisory firm based in Dallas, Texas, since 2007. Since 2009, Mr. Knocke has served as a Principal and a non-controlling manager and member of TCTC Holdings, LLC (“TCTC”), a bank holding company that is a banking, securities, and investment management firm. He previously held positions as Vice President and Portfolio Manager at Brown Brothers Harriman & Co., and served in various positions at Salomon Brothers and Texas Instruments.

Qualifications: Mr. Knocke brings to the Board executive and general management experience as well as significant financial expertise.

| |||

Robert J. Kostelnik | ||||

Director Since: 2011

Age: 72

Committees: • Nominating, Governance and Social Responsibility Committee, Chairperson • Environmental, Health, Safety, and Public Policy Committee |

Principal Occupation: Principal at Glenrock Recovery Partners, LLC

Business Experience: Mr. Kostelnik has served as a principal of Glenrock Recovery Partners since January 2012. Glenrock Recovery Partners assists energy, pipeline and terminal companies with maximizing the value of non-fungible liquid hydrocarbons and provides health, safety and environmental compliance and project management consulting services. He served as the President and Chief Executive Officer of Cinatra Clean Technologies, Inc. from 2008 to 2011. Cinatra provides tank cleaning systems to refining pipelines and terminals. Prior to his retirement in 2007, Mr. Kostelnik served in a number of senior positions during his 16 years with CITGO Petroleum Corporation, including as Vice President of Refining. During that time, he was responsible for, among other things, the creation and implementation of the Health, Safety & Environmental Management System as well as environmental compliance and improvement. CITGO is engaged in the refining and marketing of petro-chemical products.

Additional Directorships: Mr. Kostelnik currently serves as a director of Methanex Corporation. He served as a director of Frontier Oil Corporation from 2010 until the merger of Frontier Oil Corporation and Holly Corporation in July 2011.

Qualifications: Mr. Kostelnik brings to the Board significant experience and insight into the Company’s industry through his extensive experience in the refining industry.

| |||

| 16 HF Sinclair Corporation |

Ross B. Matthews | ||||

Director Since: 2022

Age: 69

Committee: • Finance Committee |

Principal Occupation: Chief Operating Officer of REH Company (formerly known as The Sinclair Companies)

Business Experience: Mr. Matthews currently serves as Chief Operating Officer of REH Company and served as the Chairman and Chief Executive Officer of Sinclair Oil (formerly known as Sinclair Oil Corporation), which was comprised of the refining, marketing and renewables business the Company acquired from The Sinclair Companies (now known as REH Company), from October 2009 until March 2022. Mr. Matthews joined Sinclair Oil in June 2000, initially serving as Vice President of Exploration and Production.

Additional Directorships: Mr. Matthews served as a director of Sinclair Oil from January 2006 until March 2022.

Qualifications: Mr. Matthews brings to the Board significant experience and insight into the development of energy infrastructure through his extensive experience in the oil and gas industry.

| |||

None of our director nominees reported any litigation for the period from 2014-2024 that is required to be reported in this proxy statement. There are no family relationships among any of our directors or executive officers.

| 2024 Proxy Statement 17 |

Corporate Governance

The Board and senior management believe that one of their primary responsibilities is to promote a corporate culture of accountability, responsibility and ethical conduct throughout the Company. The Company is committed to maintaining the highest standard of business conduct and corporate governance, which we believe is essential to operating our business efficiently, maintaining our integrity in the marketplace and serving our stockholders.

Consistent with these principles, the Company has adopted a Code of Business Conduct and Ethics and Corporate Governance Guidelines. These documents, together with our amended and restated certificate of incorporation (the “Certificate of Incorporation”), amended and restated by-laws (the “By-Laws”) and the Board committee charters, form the framework for our governance. Copies of the Code of Business Conduct and Ethics, Corporate Governance Guidelines, Certificate of Incorporation, By-Laws, Audit Committee Charter, Compensation Committee Charter, Environmental, Health, Safety, and Public Policy Committee Charter, Finance Committee Charter and Nominating, Governance and Social Responsibility Committee Charter are publicly available on our website at www.hfsinclair.com and may also be obtained free of charge upon written request to HF Sinclair Corporation, 2828 North Harwood, Suite 1300, Dallas, Texas 75201, Attention: Vice President, Investor Relations.

Board Leadership Structure

In accordance with our Corporate Governance Guidelines, our Board is responsible for selecting the Board leadership structure that is in the best interests of the Company. Our Board, at this time, has determined that a leadership structure consisting of separate Chief Executive Officer and Chairperson of the Board roles is appropriate for the Company. Currently, Mr. Myers serves as our independent Chairperson of the Board. Mr. Jennings served as our Chief Executive Officer through May 8, 2023, and Mr. Go has served as our Chief Executive Officer and President since May 9, 2023.

Given the complexity of the Company’s business model, the Board believes that at this time the separation of these positions enhances both the oversight of management by the Board and the Company’s overall leadership structure. As a result of his experience at publicly traded energy companies, Mr. Myers has industry-specific experience and expertise and as Chairperson of the Board can identify strategic priorities, lead the discussion and execution of key components of the Company’s business strategy and facilitate the flow of information between management and the Board.

The Company’s Corporate Governance Guidelines provide for the appointment of a lead director in the event the roles of Chairperson of the Board and Chief Executive Officer are combined. The lead director’s responsibilities are set forth in the Company’s Corporate Governance Guidelines and include coordinating with the independent directors in respect of each of the following:

| • | presiding over executive sessions of the Board’s independent directors and at all meetings of the Board at which the Chairperson of the Board is not present; |

| • | communicating matters discussed at the executive session to the Chairperson of the Board and Chief Executive Officer, as appropriate; |

| • | serving as a liaison between the Chief Executive Officer, the Chairperson of the Board and the independent directors; |

| • | advising and consulting with the Chairperson of the Board, the Chief Executive Officer and the chairperson of each committee regarding Board and committee meetings, as necessary, desirable or appropriate; |

| • | calling meetings of the independent directors and encouraging or facilitating discussion among the directors to ensure the views of every director are heard and to achieve consensus; |

| • | maintaining regular contact with the Chairperson of the Board and Chief Executive Officer to provide access for any issue that may arise and assist in communication, if appropriate, and to ensure that there is a steady, relevant, meaningful and effective information flow from management to the Board; |

| 18 HF Sinclair Corporation |

| • | approving in advance, in consultation with the Chairperson of the Board and Chief Executive Officer, agendas, schedules and related information for all meetings of the Board; and |

| • | advising and consulting with the Chairperson of the Board and Chief Executive Officer as to the quality, quantity and timeliness of the information submitted by the Company’s management to, and other communications with, the independent directors. |

Since the positions of Chairperson of the Board and Chief Executive Officer are separate, the Board has not appointed a separate lead director. The Chairperson of the Board fulfills the above-noted responsibilities of the independent lead director to serve as a liaison between the Chief Executive Officer and the independent directors.

The Board has established a policy that its directors who are not our officers or employees (“non-management directors”) regularly meet in executive session, without members of management present. The Chairperson of the Board, or the lead director if the Chairperson of the Board is a member of management, presides at meetings of the non-management directors. In the event the Chairperson of the Board is a member of management and, if there is no lead director or the lead director is unable to attend, the non-management directors will designate an independent director to preside at the meeting. In the event the Company’s non-management directors include directors who are not independent under the NYSE listing requirements, then an executive session including only the independent directors will be held at least once per year. We believe that the foregoing structure, policies and practices, when combined with the Company’s other governance policies and procedures, provide appropriate opportunities for oversight, discussion and evaluation of decisions and direction from the Board, and are in the best interest of our stockholders.

Board and Committee Evaluations

The Board, acting through the Nominating, Governance and Social Responsibility Committee, conducts a self-evaluation at least annually to determine whether it is functioning effectively. The evaluation includes periodically considering the mix of skills and experience that directors bring to the Board to assess whether the Board has the necessary tools and background to perform its oversight function effectively.

The Nominating, Governance and Social Responsibility Committee has undertaken an effort to identify relevant skills, expertise, knowledge and diversity of opinion required of members of the Board to deliver long-term value to the stockholders of the Company. From that list, the Board developed a skills matrix as part of its efforts to represent each of the Company’s Directors’ identified skills, expertise, knowledge and diversity of opinion. See the “Director Nominee Skills, Experience and Diversity Matrix” on page 10. The Nominating, Governance and Social Responsibility Committee and the Board review the matrix on an annual basis to confirm that it appropriately supports the Company’s long-term strategy.

Each committee of the Board also conducts a self-evaluation at least annually and reports the results to the Board. The Nominating, Governance and Social Responsibility Committee may engage a third-party evaluator to assist with the evaluation process from time to time.

Board Oversight of Risk Management

The Board oversees management of risk and receives a report from management on at least a quarterly basis. The Board regularly reviews information regarding the Company’s credit, liquidity, business, operations and cybersecurity, including the key risks associated with each of the foregoing. As described below, consistent with SEC regulations and NYSE requirements, the Board committees are also engaged in overseeing risk associated with the Company.

| • | The Audit Committee oversees management of exposure to financial reporting and control risks, including, among others, reviewing the results of internal audit assessments and tests related to cybersecurity. |

| • | The Compensation Committee oversees the management of risks relating to the Company’s human capital management, executive compensation plans and incentive structure. |

| • | The Environmental, Health, Safety, and Public Policy Committee oversees the management of risks associated with the environment, health, safety and public policy. |

| 2024 Proxy Statement 19 |

| • | The Finance Committee oversees the management of risks relating to the Company’s capital investment strategies. |

| • | The Nominating, Governance and Social Responsibility Committee oversees the Company’s governance, ethics and compliance programs and the management of risks relating to the Company’s policies and practices regarding human rights in its operations and supply chain, environmentally sustainable practices and strategy, and strategy and performance in assessing and responding to climate-related risks and opportunities. |

While each committee is responsible for evaluating certain risks and overseeing the management of those risks, the full Board is ultimately responsible for overseeing the Company’s risk exposures and management thereof, and the Board is regularly informed on these matters through committee and senior management presentations.

The Board also receives input from the Company’s Risk Management Oversight Committee on management’s views of the risks facing the Company. This committee is made up of management personnel and monitors the risk environment for the Company as a whole. This committee also supports the efforts of the Board and the Board committees to monitor and evaluate guidelines and policies governing the Company’s risk assessment and management.

Director Independence

Board of Directors. NYSE listing requirements and our Corporate Governance Guidelines require that at least a majority of the Board meet the NYSE criteria for independence. The Board has determined that each of Mses. Ainsworth, Catalano and Johns and Messrs. Echols, Fernandez, Hardy, Knocke, Kostelnik, Lee, Myers and Szydlowski is “independent” under the NYSE independence standards. Mr. Go is not independent because he is an employee of the Company. Mr. Matthews is not independent due to his continued service as Chief Operating Officer of REH Company following the closing of the Sinclair Transactions and the fact that members of his immediate family control REH Company, which received more than five percent of HF Sinclair’s common stock as purchase consideration at the closing of the Sinclair Transactions. Please see “Certain Relationships and Related Person Transactions” on page 85 for a more detailed description of the ongoing relationship between the Company and REH Company in which Mr. Matthews may have a material interest.

Audit Committee. The Board has determined each member of the Audit Committee is “independent” as defined by the NYSE listing standards and Rule 10A-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Compensation Committee. The Board has determined each member of the Compensation Committee is “independent” as defined by the NYSE listing standards. For each member of the Compensation Committee, the Board considered all factors specifically relevant to determining whether a director has a relationship to the Company that is material to that director’s ability to be independent from management in connection with the duties of a Compensation Committee member, including the sources of such director’s compensation, such as any consulting, advisory or other compensatory fees paid by the Company, and whether the director has an affiliate relationship with the Company, a subsidiary of the Company or an affiliate of a subsidiary of the Company.

Nominating, Governance and Social Responsibility Committee. The Board has determined each member of the Nominating, Governance and Social Responsibility Committee is “independent” as defined by the NYSE listing standards.

Environmental, Health, Safety, and Public Policy Committee. The Board has determined each member of the Environmental, Health, Safety, and Public Policy Committee is “independent” as defined by the NYSE listing standards.

Finance Committee. The Board has determined each member of the Finance Committee, other than Mr. Matthews, is “independent” as defined by the NYSE listing standards.

Independence Determination. In making its independence determinations, the Board considered certain transactions, relationships and arrangements. In determining Mr. Knocke’s independence, the Board considered that Mr. Knocke is a non-controlling manager and member of TCTC, and Mr. Knocke is also a Principal of TCTC (which, as of the Record Date, may be deemed to beneficially own 6.37% of the Company’s common stock) and holds various other positions with TCTC’s subsidiaries. The Board determined that this relationship does not impair the independence of Mr. Knocke.

| 20 HF Sinclair Corporation |

Director Nominations

Qualifications

The Nominating, Governance and Social Responsibility Committee may engage a search firm to assist with identifying qualified nominees for the Board. In considering nominees for election as director, the Nominating, Governance and Social Responsibility Committee considers a number of criteria approved by the Board and related to relevant skills, expertise, knowledge and diversity of opinion that may be desired, necessary or appropriate for inclusion on the Board. The Nominating, Governance and Social Responsibility Committee is also responsible for recommending the nomination of incumbent directors it deems appropriate for re-election to the Board and, if applicable, reappointment to any committees of the Board on which such director serves. Pursuant to our Corporate Governance Guidelines, the Nominating, Governance and Social Responsibility Committee will not recommend to the Board the nomination of any director or nominee who has attained or will attain the age of 75 prior to the annual meeting at which he or she would be elected or re-elected. The Board may approve an exception to this policy on a case-by-case basis.

Characteristics expected of all directors include integrity, exceptional talent and judgment, and the ability and willingness to commit adequate time to the Board. In evaluating the suitability of individual board members, the Nominating, Governance and Social Responsibility Committee takes into account many factors, including the candidate’s independence, the skills enumerated in the Director Nominee Skills, Experience and Diversity Matrix, knowledge of the communities in which the Company does business, the Company’s industry, or other industries relevant to the Company’s business or other organizations of comparable size and personal qualities, such as background and reputation. The Board also considers the diversity of background, knowledge, experience, viewpoints, geography and other demographics when evaluating candidates and is committed to, when conducting a formal search to recruit director candidates from outside the Company as potential nominees to join the Board, endeavoring to include, and instructing any third-party search firm engaged to assist in seeking candidates for the Board to include, highly qualified candidates, including candidates of diverse background, knowledge, experience and viewpoints, as well as demographic traits such as race, gender expression and identity, age, sexual orientation and ethnicity, in any initial pool from which director candidates are selected.

Our Corporate Governance Guidelines require an annual review by the Nominating, Governance and Social Responsibility Committee of each director’s commitments on other public company boards. Following its review in 2024, the Nominating, Governance and Social Responsibility Committee has determined that, in its view, no director currently has time commitments that would prevent such director from properly discharging his or her duties as a director.

Pursuant to that certain Stockholders Agreement by and among HF Sinclair, REH Company and the stockholders of REH Company entered into in connection with the closing of the Sinclair Transactions (the “Stockholders Agreement”), REH Company and the stockholders of REH Company (collectively, the “REH Parties”) were granted the right to nominate, and have nominated, (i) two persons (the “Designees”) to the Board at the closing of the Sinclair Transactions and for so long as the REH Parties beneficially own common stock constituting not less than 15% of all outstanding HF Sinclair common stock and (ii) one person to the Board for so long as the REH Parties beneficially own less than 15% but more than or equal to 5% of all outstanding HF Sinclair common stock. All Designees must possess the director characteristics and qualifications contained in the By-Laws and Corporate Governance Guidelines and expected of all other directors of the Board, as described in the immediately preceding paragraph above. In addition, at all times at least one Designee, if there is any, shall possess significant management experience in the refining industry, as determined by the Board in its reasonable discretion.

Stockholder Director Nominations to be Presented at the Annual Meeting

The Nominating, Governance and Social Responsibility Committee will consider recommendations of potential director candidates from stockholders based on the same criteria as a candidate identified by the Nominating, Governance and Social Responsibility Committee. Stockholders may submit such a recommendation by sending a letter to the Secretary of the Company at the Company’s principal executive offices. The mailing envelope must contain a clear notation indicating that the enclosed letter is a “Director Nominee Recommendation.”

| 2024 Proxy Statement 21 |

To be considered, recommendations must be submitted in writing no less than 90 days and no more than 120 days prior to the anniversary date of the immediately preceding annual meeting of stockholders in compliance with the notice procedures and informational requirements set forth in Article III, Section 12 of the By-Laws. A stockholder’s notice must include the following:

| • | the name of the stockholder recommending the director candidate and the class and number of shares of common stock which are directly or indirectly, held of record or beneficially owned by the stockholder, the dates on which the stockholder acquired such securities and documentary evidence of such record or beneficial ownership; |

| • | a written statement by the director candidate agreeing to being named in the Company’s proxy materials and to serve a full term as a member of the Board if nominated and elected; |