NYSE: DINO INVESTOR PRESENTATION September 2022

2 Disclosure Statement Statements made during the course of this presentation that are not historical facts are “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Words such as “anticipate,” “project,” “will,” “expect,” “plan,” “goal,” “forecast,” “strategy,” “intend,” “should,” “would,” “could,” “believe,” “may,” and similar expressions and statements regarding our plans and objectives for future operations are intended to identify forward-looking statements. Forward- looking statements are inherently uncertain and necessarily involve risks that may affect the business prospects and performance of HF Sinclair Corporation (“HF Sinclair”) and/or Holly Energy Partners, L.P. (“HEP”), and actual results may differ materially from those discussed during the presentation. These statements are based on management’s beliefs and assumptions using currently available information and expectations as of the date thereof, are not guarantees of future performance and involve certain risks and uncertainties. All statements concerning HF Sinclair’s expectations for future results of operations are based on forecasts for our existing operations and do not include the potential impact of any future acquisitions. Although we believe that the expectations reflected in these forward- looking statements are reasonable, we cannot assure you that our expectations will prove to be correct. Therefore, actual outcomes and results could materially differ from what is expressed, implied or forecast in such statements. Any differences could be caused by a number of factors, including, but not limited to, the ability of HF Sinclair and HEP to successfully integrate the operations of the Sinclair Oil Corporation (now known as Sinclair Oil LLC) and Sinclair Transportation Company LLC businesses acquired from The Sinclair Companies (now known as REH Company) (such transactions, the “Sinclair Transactions”) with their existing operations and fully realize the expected synergies of the Sinclair Transactions or on the expected timeline, the ability of HF Sinclair to successfully integrate the operation of the Puget Sound refinery with its existing operations, the demand for and supply of crude oil and refined products, including uncertainty regarding the effects of the continuing coronavirus (“COVID-19”) pandemic on future demand and increasing societal expectations that companies address climate change, risks and uncertainties with respect to the actions of actual or potential competitive suppliers and transporters of refined petroleum products or lubricant and specialty products in HF Sinclair’s and HEP’s markets, the spread between market prices for refined products and market prices for crude oil, the possibility of constraints on the transportation of refined products or lubricant and specialty products, the possibility of inefficiencies, curtailments or shutdowns in refinery operations or pipelines, whether due to infection in the workforce or in response to reductions in demand, accidents, unexpected leaks or spills, unscheduled shutdowns, weather events, civil unrest, expropriation of assets, and other economic, diplomatic, legislative, or political events or developments, terrorism, cyberattacks, or other catastrophes or disruptions affecting the operations of HF Sinclair and HEP, production facilities, machinery, pipelines and other logistics assets, equipment, or information systems, or any of the foregoing of our suppliers, customers, or third-party providers, the effects of current and/or future governmental and environmental regulations and policies, including the effects of current and/or future restrictions on various commercial and economic activities in response to the COVID-19 pandemic and increases in interest rates, the availability and cost of financing to HF Sinclair and HEP, the effectiveness of HF Sinclair’s and HEP’s capital investments and marketing strategies, HF Sinclair's and HEP’s efficiency in carrying out and consummating construction projects, including HF Sinclair’s and HEP’s ability to complete announced capital projects on time and within capital guidance, HF Sinclair’s and HEP’s ability to timely obtain or maintain permits, including those necessary for operations or capital projects, the ability of HF Sinclair to acquire refined or lubricant product operations or pipeline and terminal operations on acceptable terms and to integrate any existing or future acquired operations, the possibility of terrorist or cyberattacks and the consequences of any such attacks, uncertainty regarding the effects and duration of global hostilities, including the Russia-Ukraine war, and any associated military campaigns which may disrupt crude oil supplies and markets for our refined products and create instability in the financial markets that could restrict our ability to raise capital, general economic conditions, including uncertainty regarding the timing, pace and extent of an economic recovery in the United States, a prolonged economic slowdown due to the COVID-19 pandemic, inflation and labor costs, which could result in an impairment of goodwill and/or long-lived asset impairments, and other financial, operational and legal risks. Additional information on risks and uncertainties that could affect the business prospects and performance of HF Sinclair and HEP is provided in the most recent reports of HF Sinclair and HEP filed with the Securities and Exchange Commission. All forward-looking statements included in this presentation are expressly qualified in their entirety by the foregoing cautionary statements. The forward-looking statements speak only as of the date made and, other than as required by law, HF Sinclair and HEP undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

3 Executive Summary Positioned for Value Across All Segments 1. BPD: Barrels per day 2. As of June 30, 2022 YTD. See definition and reconciliation in Appendix. REFINING MARKETING RENEWABLES SPECIALTY LUBRICANTS MIDSTREAM 7 refineries in the Mid- Continent, West and Pacific Northwest regions 678,000 BPD1 of refining capacity Flexible refining system with fleet wide discount to WTI Premium product markets versus Gulf Coast Organic initiatives to drive growth and enhance returns Operate crude and product pipelines, loading racks, processing units, terminals and tanks in and around HF Sinclair’s refining assets HF Sinclair owns 47% of the LP Interest in HEP and the non- economic GP interest Eliminated IDRs in 2017 to simplify structure Approximately 70% of Total Tariffs and Fees2 tied to long-term contracts and minimum volume commitments Integrated specialty lubricants producer with 34,000 BPD1 of production capacity Sells finished lubricants & products in >80 countries under Petro- Canada Lubricants, Sonneborn, Red Giant Oil & HollyFrontier product lines Production facilities in Mississauga, Ontario; Tulsa, Oklahoma; Petrolia, Pennsylvania; & the Netherlands One of the largest North American white oil & group III base oil producers Iconic DINO brand and customer loyalty Over 300 distributors and over 1,300 branded retail sites located across 30 states from coast to coast ~300 branded sites under license program outside of supply footprint Sinclair branded wholesale business generates an uplift versus unbranded sales 10,000 BPD1 Renewable Diesel Unit at Sinclair, WY Refinery 6,000 BPD1 Renewable Diesel Unit at Cheyenne, WY Refinery mechanically complete in Q4 2021 and fully operational in Q1 2022 9,000 BPD1 Renewable Diesel Unit at Artesia, NM Refinery completed and fully operational in Q2 2022 Pre-Treatment Unit at Artesia, NM Refinery completed and fully operational in Q1 2022

4 HF Sinclair Asset Footprint Note: Cheyenne Renewable Diesel facility mechanically complete in Q4 2021 and fully operational in Q1 2022. Artesia Renewable Diesel facility completed and fully operational in Q2 2022.

5 Environmental, Social and Governance (ESG)1 1. Please see HF Sinclair 2021 Sustainability Report for additional ESG related information. https://www.hfsinclair.com/sustainability/sustainability-report/default.aspx GHG Intensity Target Established goal to reduce net emissions intensity by 25% by 2030, through offsets and reductions versus 2020 levels Renewable Fuels Investments Made significant investments in 3 renewable diesel projects in Artesia, NM, Cheyenne, WY and Sinclair, WY Renewable diesel is a cleaner burning fuel with 50% to 80% (results dependent upon the feedstock) lower lifecycle GHG emissions than conventional diesel Recycling and Water Conservation Our Navajo refinery implemented a project to sell wastewater from its operations to upstream operators to reduce the amount of freshwater used in upstream operations in Artesia, NM, a high-risk region for water scarcity Product Innovation Developed SonneNatural, a line of 100% natural plant-based products, ENVIRON™ MV, a line of biodegradeable hydraulic oils, and other oils and lubricants designed to promote improved fuel economy, higher energy efficiency and support alternative energy systems GovernanceSocialEnvironmental “One HF Sinclair Culture” program instilled at every level with focus and commitment to safety, integrity, teamwork, ownership and inclusion Our combined Total Recordable Incident Rate for 2021 was 0.27 versus an industry benchmark of 0.41 Active volunteering and philanthropic involvement in communities where we operate Commitment to attracting, retaining and developing a diverse and inclusive workforce, including through partnerships with historically Black colleges and universities to offer full-time and summer internship opportunities Supporting our employees and communities by investing in racially and ethnically underrepresented groups, women, and veterans through program sponsorships Investing in professional development programs, scholarship programs and education assistance programs that enable employees of all levels to enhance their skills and grow professionally Board leadership provides significant industry expertise, alongside diverse business, financial and environmental, health and safety expertise Board level committees with specific oversight over ESG matters include the Compensation Committee, Environmental, Health, Safety, and Public Policy Committee and the Nominating, Governance and Social Responsibility Committee 10 of 12 directors independent, including chair 2 female board members 3 ethnically diverse board members Long standing commitment to ethical behavior is inherently tied to how we do business Code of Business Conduct and Ethics among governing principles Executive compensation strongly aligned with shareholders and long-term performance ROCE, TSR, Operational Efficiency, and Safety drive performance pay

6 Refining Overview Expanded Footprint centered around Mid-Continent, Southwest, Rocky Mountain and Pacific Northwest with 678,000 BPD oil processing capacity West Region Puget Sound Refinery (Anacortes, WA) 149,000 BPD capacity Crude slate: Canadian mixed sweet and sour and Alaskan North Slope crude Distributes to high-margin markets in WA, OR, and British Columbia Navajo Refinery (Artesia, NM) 100,000 BPD capacity Crude slate: Permian sweet and sour crude Distributes to high-margin markets in AZ, NM, and west TX Sinclair Refinery (Sinclair, WY) 94,000 BPD capacity Crude slate: Canadian heavy and Rockies sweet crude Distributes to high-margin markets in greater Rocky Mountain region Woods Cross Refinery (Salt Lake City, UT) 45,000 BPD capacity Crude slate: Regional sweet and heavy crude Distributes to high-margin markets in UT, ID, NV, WY, and eastern WA Casper Refinery (Casper, WY) 30,000 BPD capacity Crude slate: Rockies sweet Distributes to high-margin markets in greater Rocky Mountain region Mid-Continent Region El Dorado Refinery (El Dorado, KS) 135,000 BPD capacity Crude slate: WCS, Bakken and Permian sour crude Distributes to high-margin markets in CO, and Mid- Continent states Tulsa Refinery (Tulsa, OK) 125,000 BPD capacity Crude slate: Domestic sweet with up to 10,000 BPD of WCS crude Distributes to Mid-Continent states Integrated refinery with base oil and lubricant production

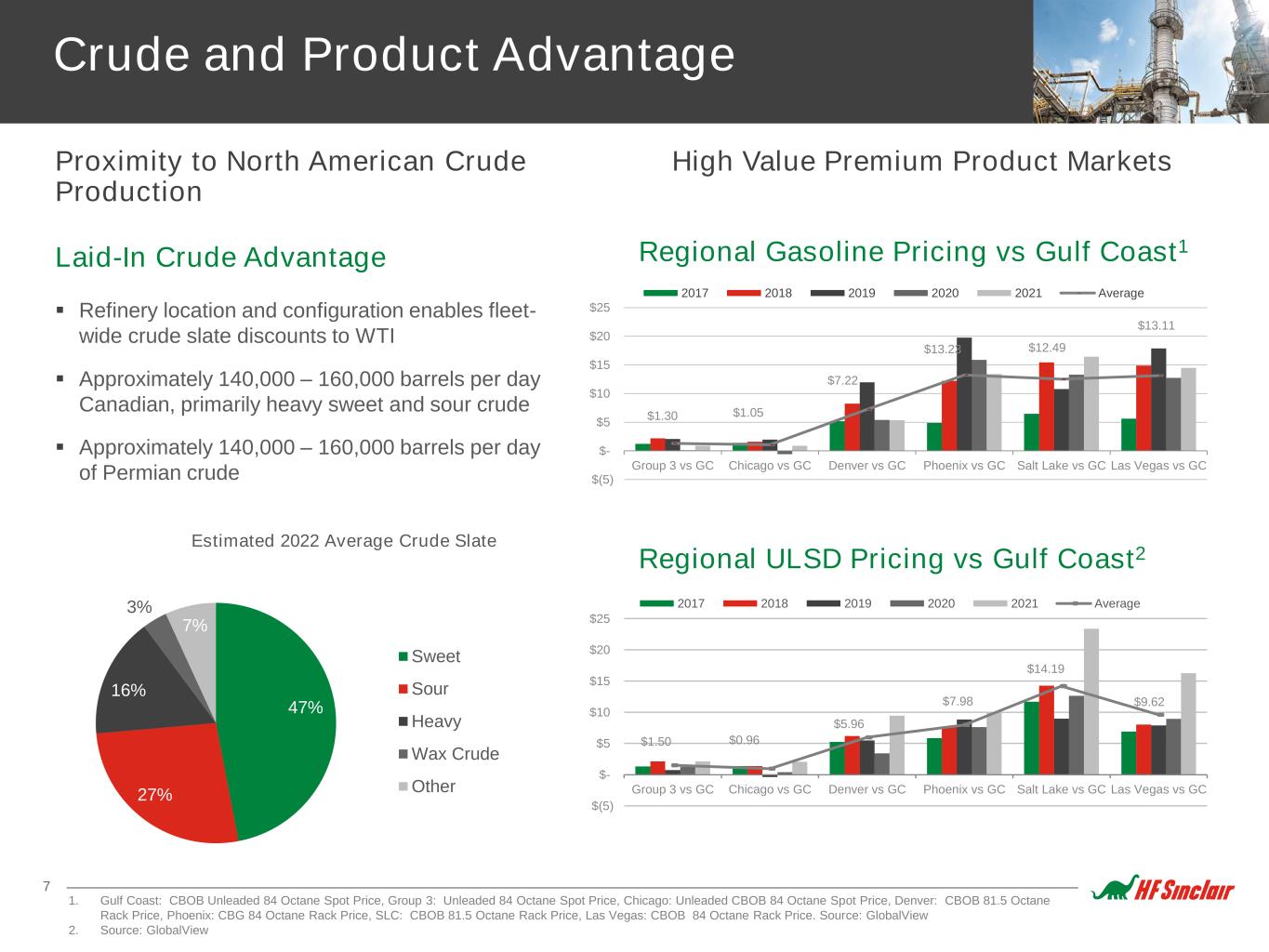

7 Crude and Product Advantage Proximity to North American Crude Production High Value Premium Product Markets Laid-In Crude Advantage Refinery location and configuration enables fleet- wide crude slate discounts to WTI Approximately 140,000 – 160,000 barrels per day Canadian, primarily heavy sweet and sour crude Approximately 140,000 – 160,000 barrels per day of Permian crude 47% 27% 16% 3% 7% Estimated 2022 Average Crude Slate Sweet Sour Heavy Wax Crude Other Regional Gasoline Pricing vs Gulf Coast1 $1.50 $0.96 $5.96 $7.98 $14.19 $9.62 $(5) $- $5 $10 $15 $20 $25 Group 3 vs GC Chicago vs GC Denver vs GC Phoenix vs GC Salt Lake vs GC Las Vegas vs GC 2017 2018 2019 2020 2021 Average $1.30 $1.05 $7.22 $13.23 $12.49 $13.11 $(5) $- $5 $10 $15 $20 $25 Group 3 vs GC Chicago vs GC Denver vs GC Phoenix vs GC Salt Lake vs GC Las Vegas vs GC 2017 2018 2019 2020 2021 Average 1. Gulf Coast: CBOB Unleaded 84 Octane Spot Price, Group 3: Unleaded 84 Octane Spot Price, Chicago: Unleaded CBOB 84 Octane Spot Price, Denver: CBOB 81.5 Octane Rack Price, Phoenix: CBG 84 Octane Rack Price, SLC: CBOB 81.5 Octane Rack Price, Las Vegas: CBOB 84 Octane Rack Price. Source: GlobalView 2. Source: GlobalView Regional ULSD Pricing vs Gulf Coast2

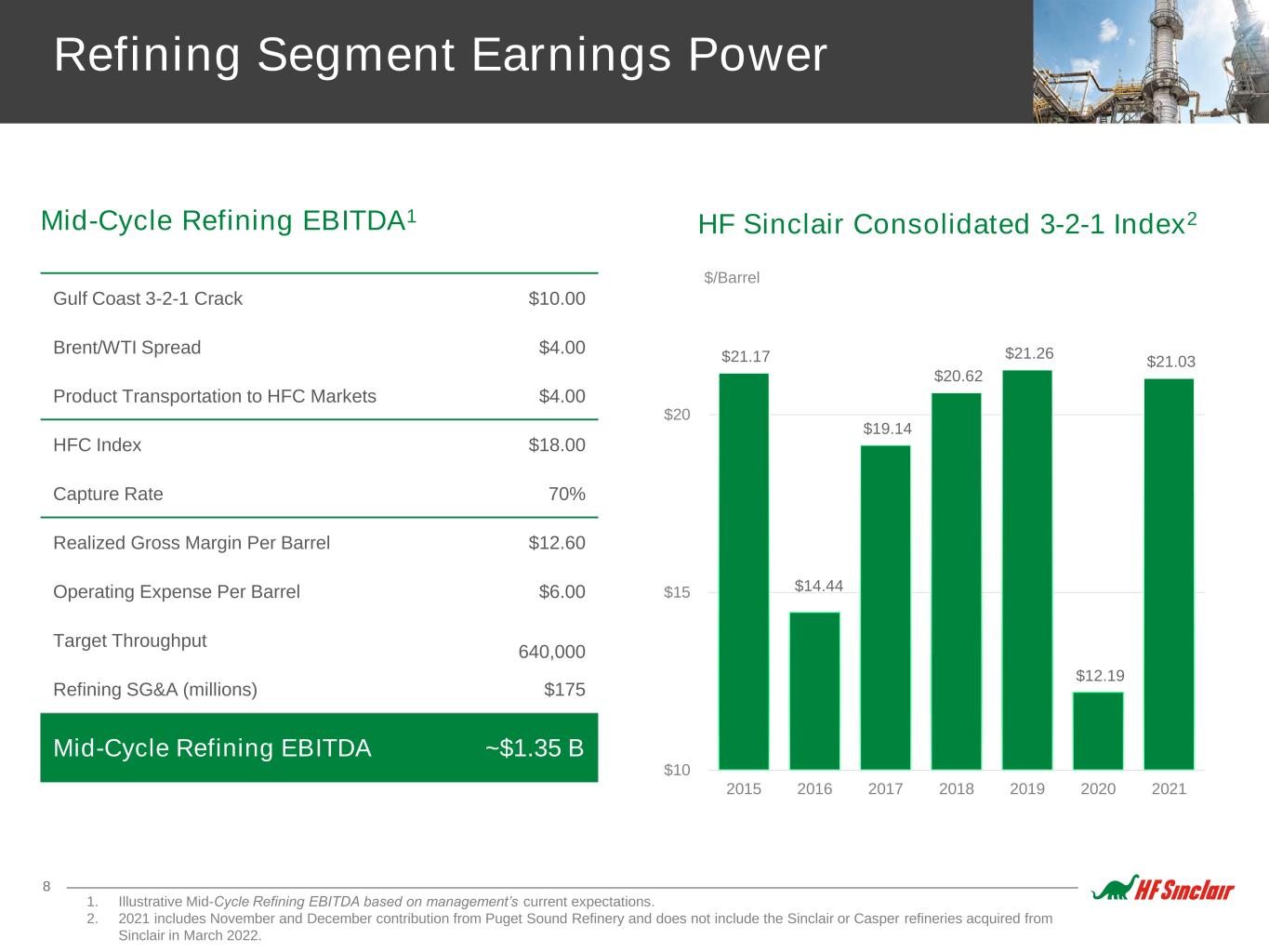

8 Refining Segment Earnings Power Mid-Cycle Refining EBITDA1 Gulf Coast 3-2-1 Crack $10.00 Brent/WTI Spread $4.00 Product Transportation to HFC Markets $4.00 HFC Index $18.00 Capture Rate 70% Realized Gross Margin Per Barrel $12.60 Operating Expense Per Barrel $6.00 Target Throughput 640,000 Refining SG&A (millions) $175 Mid-Cycle Refining EBITDA ~$1.35 B $21.17 $14.44 $19.14 $20.62 $21.26 $12.19 $21.03 $10 $15 $20 2015 2016 2017 2018 2019 2020 2021 HF Sinclair Consolidated 3-2-1 Index2 $/Barrel 1. Illustrative Mid-Cycle Refining EBITDA based on management’s current expectations. 2. 2021 includes November and December contribution from Puget Sound Refinery and does not include the Sinclair or Casper refineries acquired from Sinclair in March 2022.

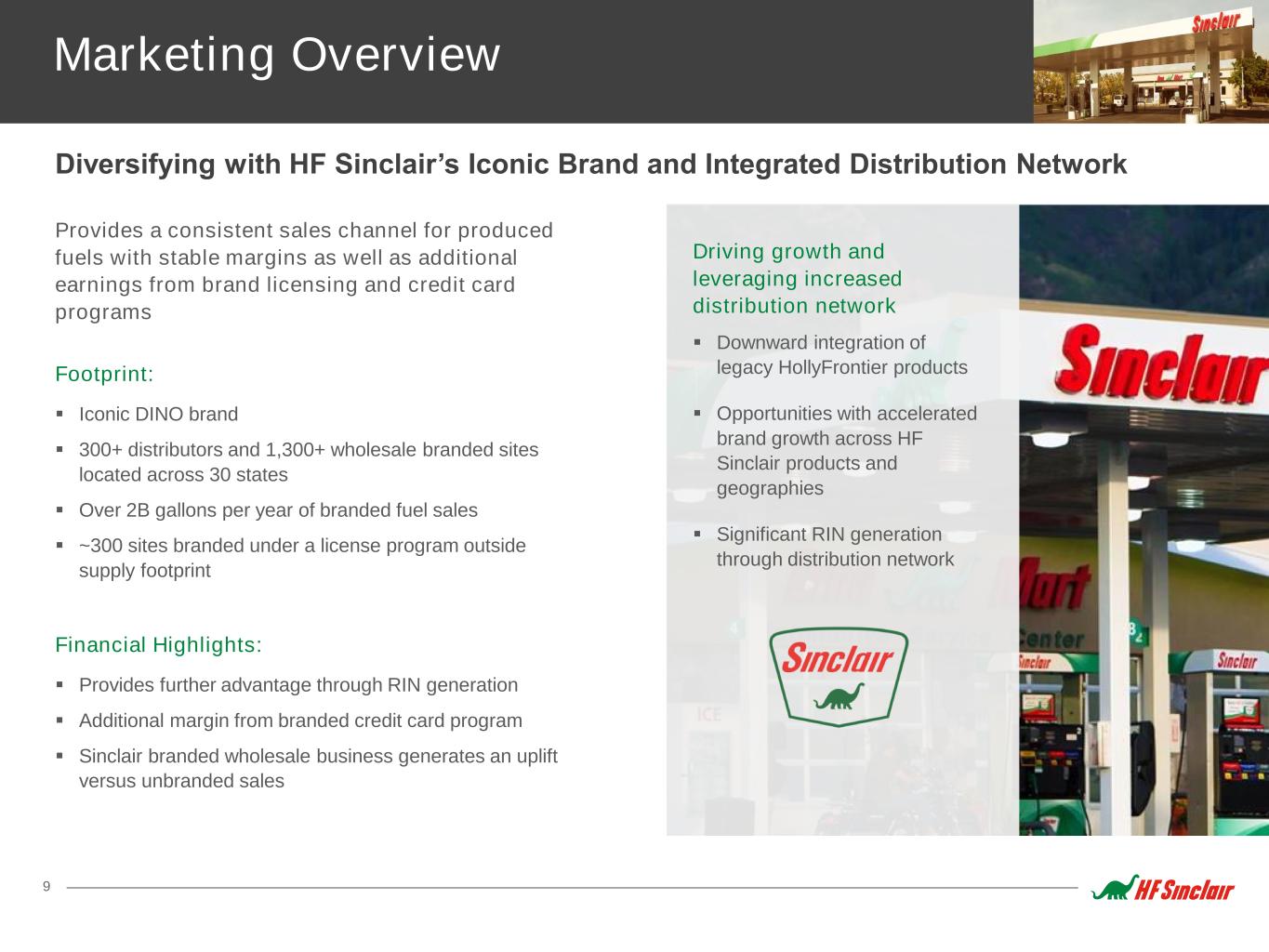

9 Marketing Overview Diversifying with HF Sinclair’s Iconic Brand and Integrated Distribution Network Provides a consistent sales channel for produced fuels with stable margins as well as additional earnings from brand licensing and credit card programs Footprint: Iconic DINO brand 300+ distributors and 1,300+ wholesale branded sites located across 30 states Over 2B gallons per year of branded fuel sales ~300 sites branded under a license program outside supply footprint Financial Highlights: Provides further advantage through RIN generation Additional margin from branded credit card program Sinclair branded wholesale business generates an uplift versus unbranded sales Driving growth and leveraging increased distribution network Downward integration of legacy HollyFrontier products Opportunities with accelerated brand growth across HF Sinclair products and geographies Significant RIN generation through distribution network

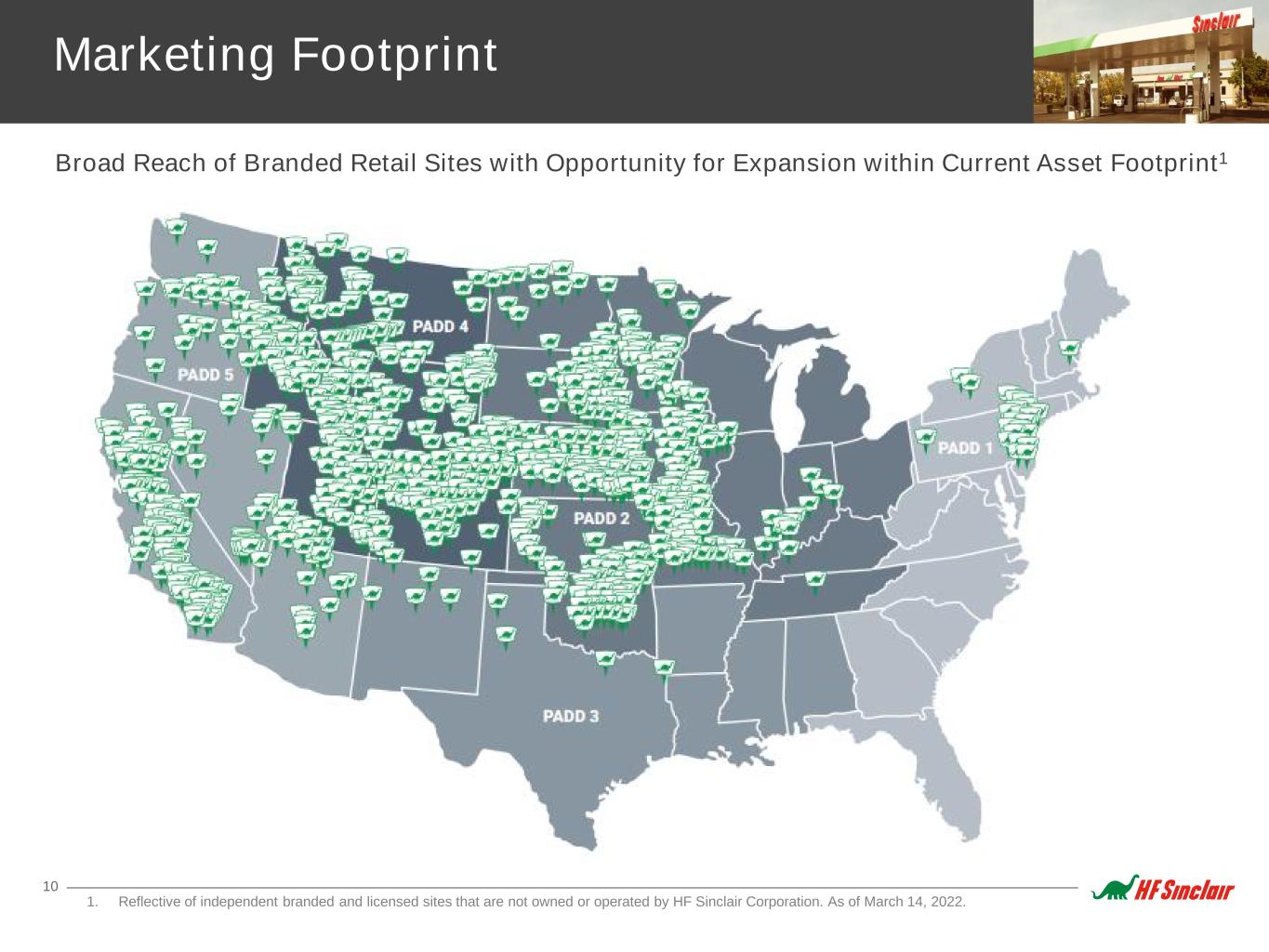

10 Marketing Footprint Broad Reach of Branded Retail Sites with Opportunity for Expansion within Current Asset Footprint1 1. Reflective of independent branded and licensed sites that are not owned or operated by HF Sinclair Corporation. As of March 14, 2022.

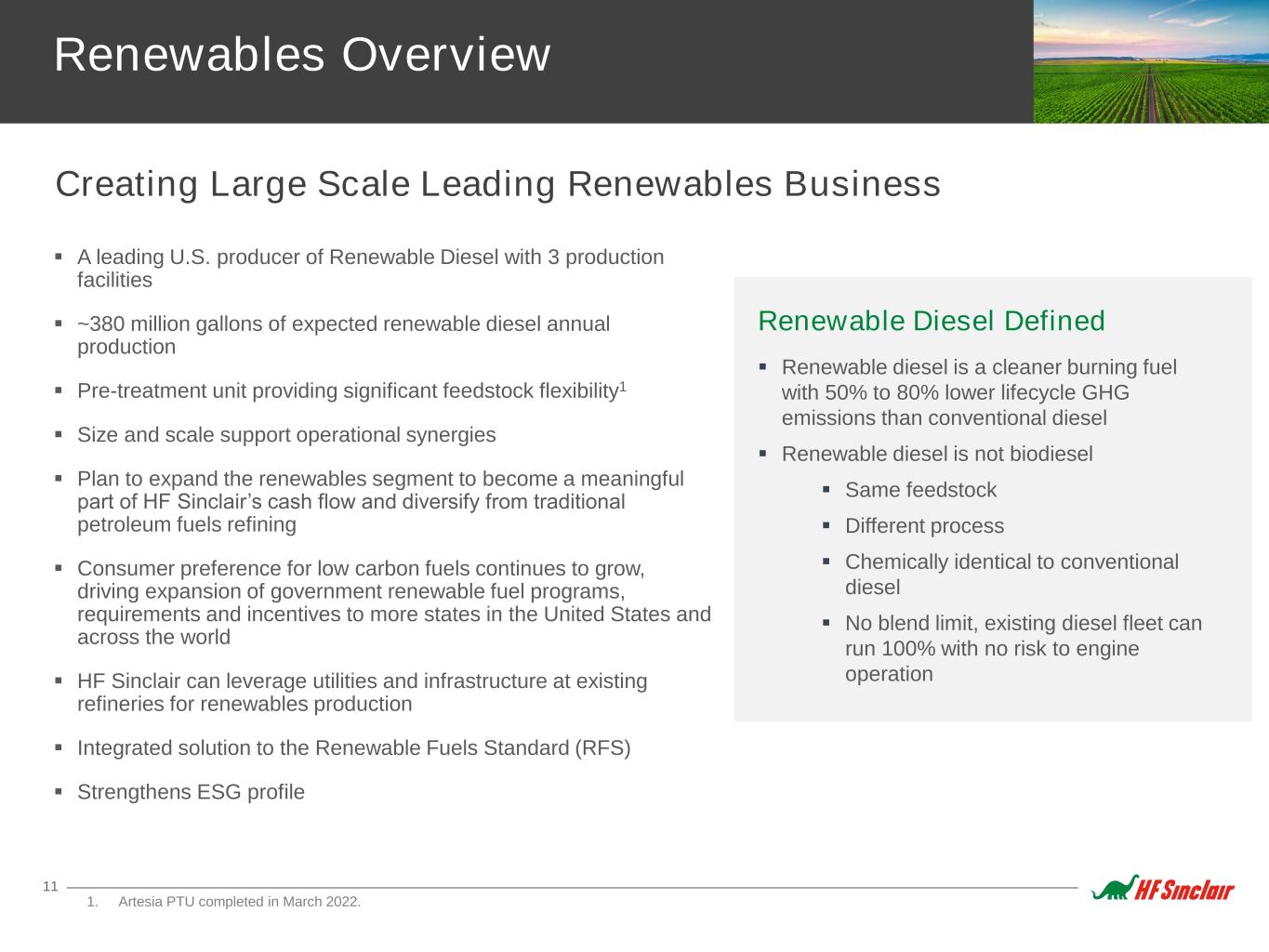

11 Renewables Overview Creating Large Scale Leading Renewables Business A leading U.S. producer of Renewable Diesel with 3 production facilities ~380 million gallons of expected renewable diesel annual production Pre-treatment unit providing significant feedstock flexibility1 Size and scale support operational synergies Plan to expand the renewables segment to become a meaningful part of HF Sinclair’s cash flow and diversify from traditional petroleum fuels refining Consumer preference for low carbon fuels continues to grow, driving expansion of government renewable fuel programs, requirements and incentives to more states in the United States and across the world HF Sinclair can leverage utilities and infrastructure at existing refineries for renewables production Integrated solution to the Renewable Fuels Standard (RFS) Strengthens ESG profile Renewable Diesel Defined Renewable diesel is a cleaner burning fuel with 50% to 80% lower lifecycle GHG emissions than conventional diesel Renewable diesel is not biodiesel Same feedstock Different process Chemically identical to conventional diesel No blend limit, existing diesel fleet can run 100% with no risk to engine operation 1. Artesia PTU completed in March 2022.

12 Renewable Diesel Asset Profile HF Sinclair expected to produce ~380 million gallons of renewable diesel annually Renewable Diesel Units Sinclair Renewable Diesel Unit 10,000 BPD RDU co-located at Sinclair, WY refinery Operational since 2018 LCFS program pathways in California and British Columbia Cheyenne Renewable Diesel Unit 6,000 BPD RDU HF Sinclair converted existing hardware to produce renewable diesel Completed: Q4 2021 Artesia Renewable Diesel Unit 9,000 BPD RDU co-located at Navajo refinery Includes rail infrastructure and storage tanks Existing hydrogen and utilities provided by the refinery Completed: Q2 2022 Pre-Treatment Unit Pre-treatment capacity allows our Renewable Diesel Units to process a variety of feedstocks Target the processing of lower CI distillers corn oil, tallow and lower priced degummed soybean Artesia Pre-Treatment Unit Completed: March 2022 Co-located at Artesia, NM Refinery

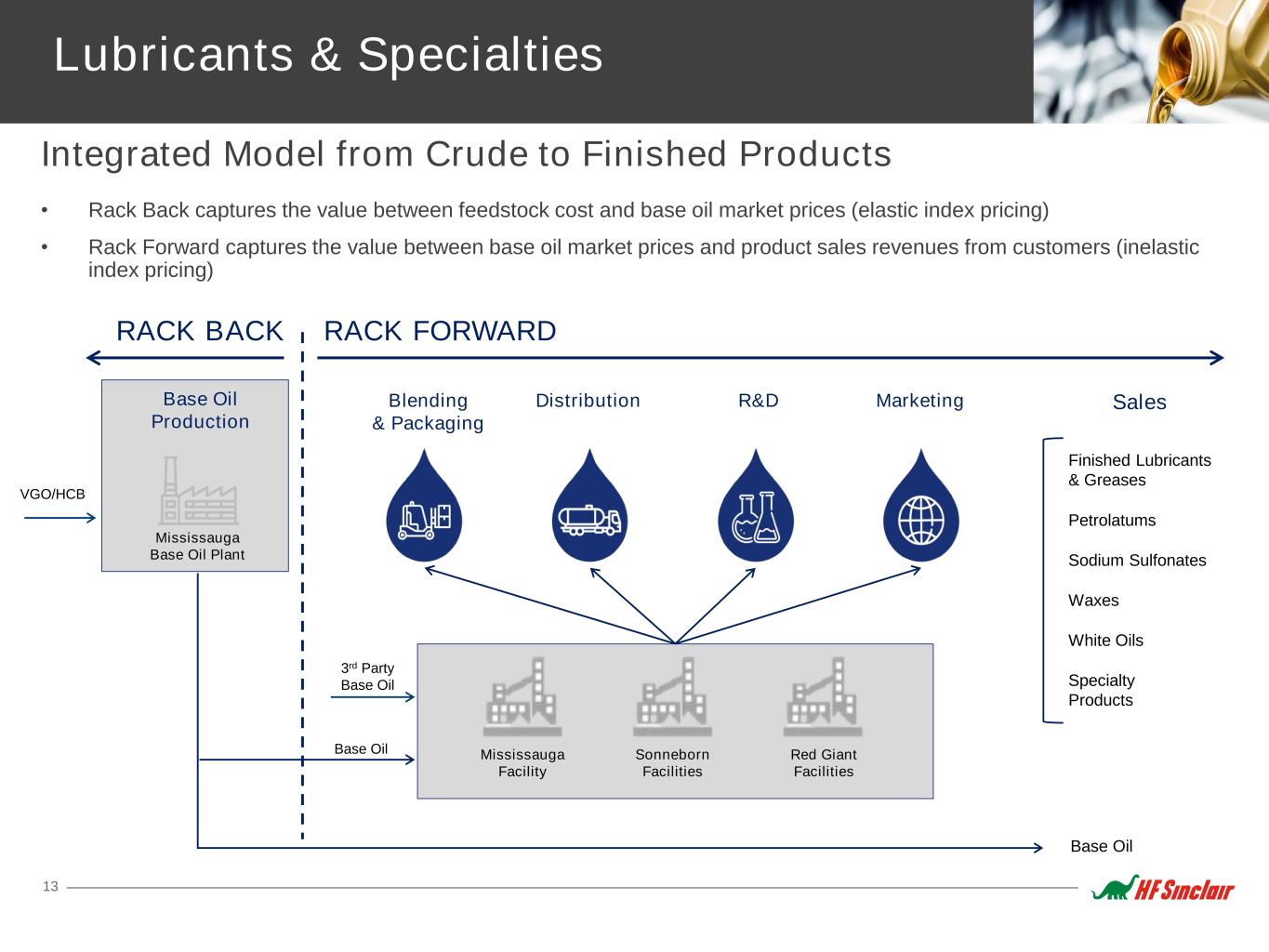

13 Lubricants & Specialties Integrated Model from Crude to Finished Products • Rack Back captures the value between feedstock cost and base oil market prices (elastic index pricing) • Rack Forward captures the value between base oil market prices and product sales revenues from customers (inelastic index pricing) Mississauga Base Oil Plant Base Oil Production Blending & Packaging RACK BACK MarketingDistribution R&D RACK FORWARD VGO/HCB Base Oil White Oils Specialty Products Waxes Finished Lubricants & Greases Sales Base Oil Petrolatums Sodium Sulfonates 3rd Party Base Oil Red Giant Facilities Sonneborn Facilities Mississauga Facility

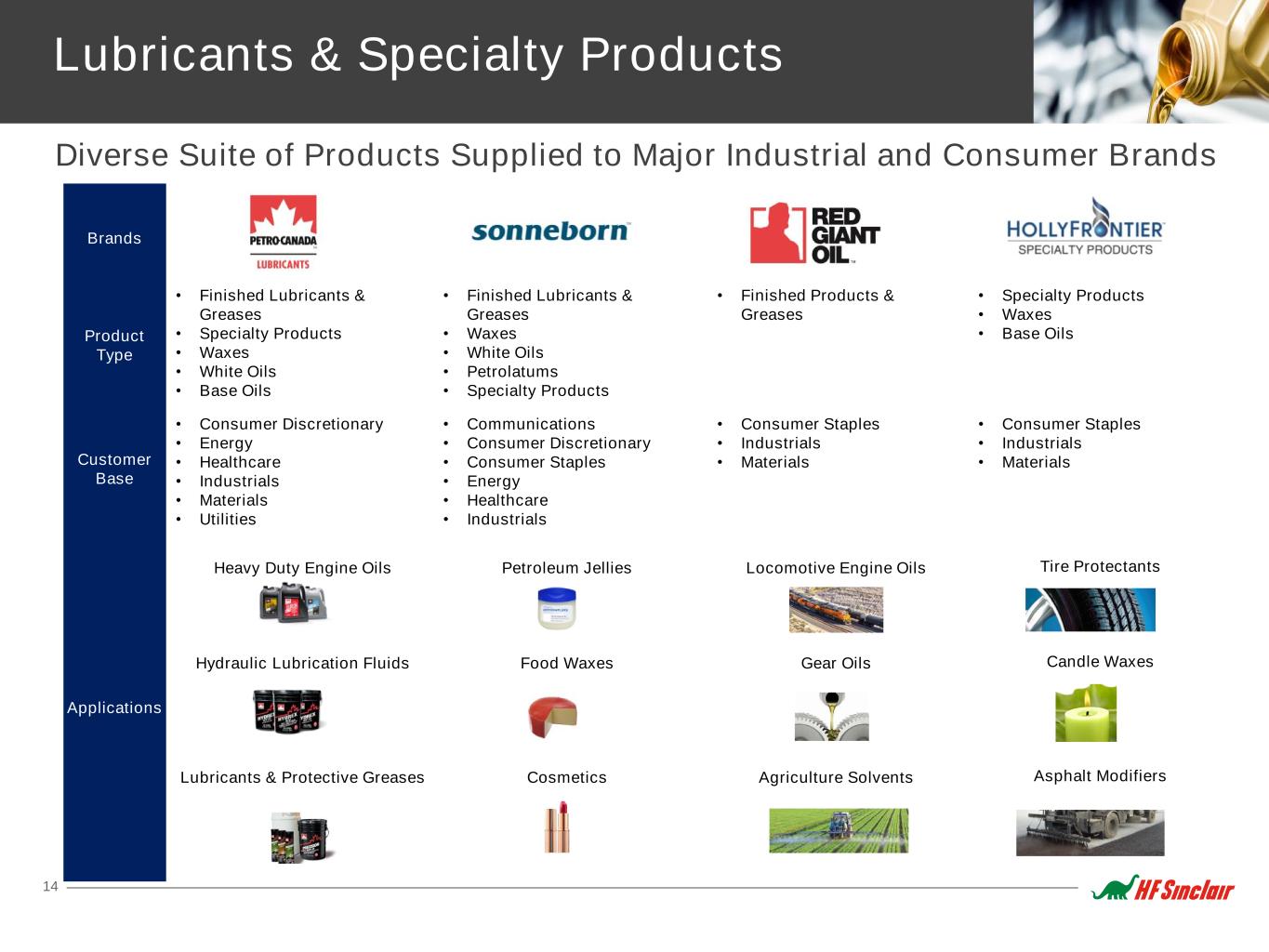

14 Lubricants & Specialty Products Diverse Suite of Products Supplied to Major Industrial and Consumer Brands Brands Product Type • Finished Lubricants & Greases • Specialty Products • Waxes • White Oils • Base Oils • Finished Lubricants & Greases • Waxes • White Oils • Petrolatums • Specialty Products • Finished Products & Greases • Specialty Products • Waxes • Base Oils Customer Base • Consumer Discretionary • Energy • Healthcare • Industrials • Materials • Utilities • Communications • Consumer Discretionary • Consumer Staples • Energy • Healthcare • Industrials • Consumer Staples • Industrials • Materials • Consumer Staples • Industrials • Materials Applications Heavy Duty Engine Oils Hydraulic Lubrication Fluids Lubricants & Protective Greases Petroleum Jellies Food Waxes Cosmetics Locomotive Engine Oils Gear Oils Agriculture Solvents Tire Protectants Candle Waxes Asphalt Modifiers

15 Opportunity Across the Value Chain Upgrade Existing Base Oils into Finished Products Converting one barrel of Base Oil sales into Finished Product sales results in an average margin uplift of ~$50/bbl 2021 Product Slate by Volume Finished Lubricants & Greases Petrolatums Waxes White Oils Specialty Products Base Oils Margin Value $/bbl Base Oils 27% Specialty Products 15% Finished Lubes & Greases 17% White Oils 10% Waxes 5% Petrolatums 3% Coproducts 23% Note: Coproducts consist of Distillates, Intermediates and LPGs.

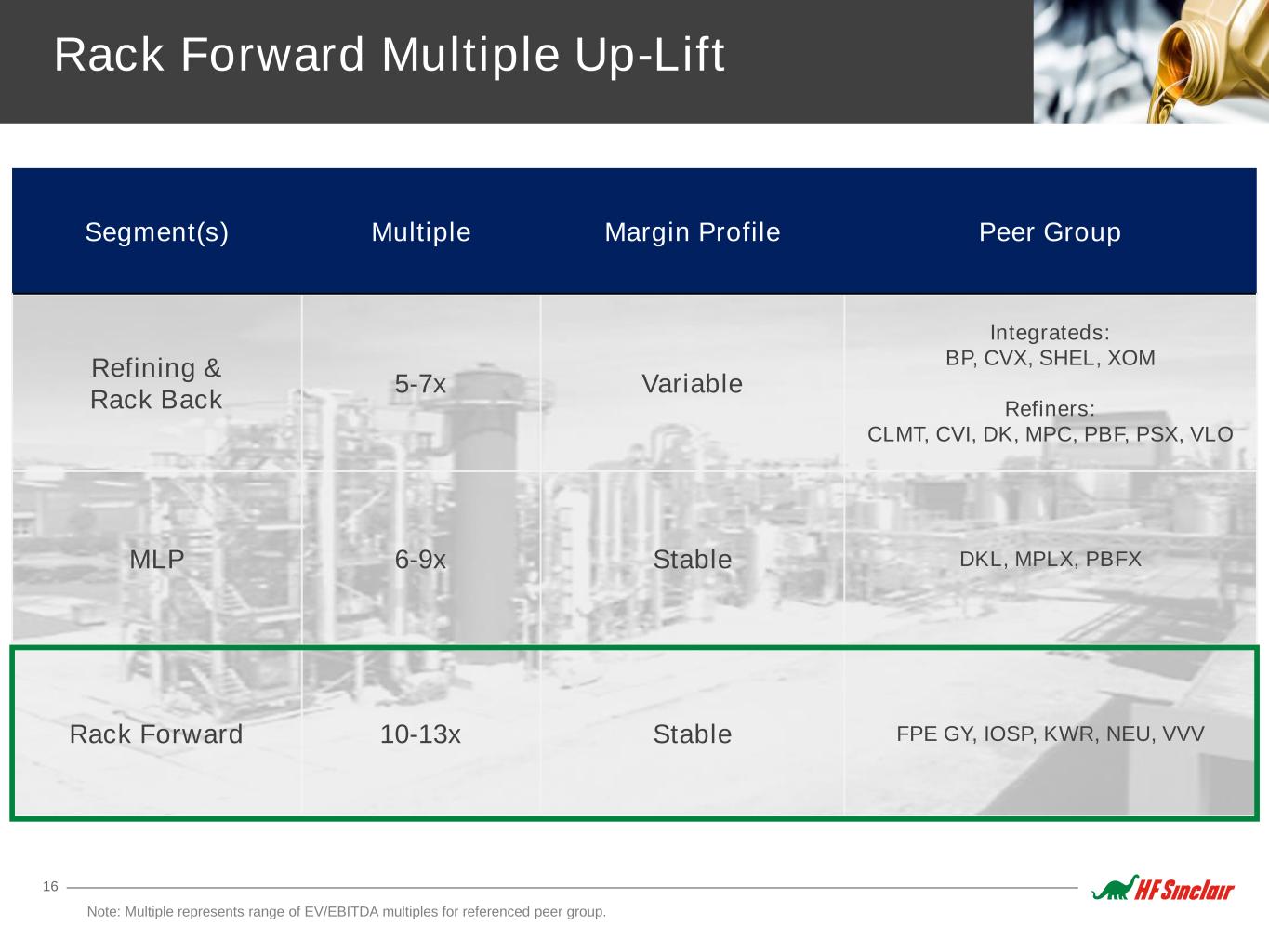

16 Rack Forward Multiple Up-Lift Note: Multiple represents range of EV/EBITDA multiples for referenced peer group. Segment(s) Multiple Margin Profile Peer Group Refining & Rack Back 5-7x Variable Integrateds: BP, CVX, SHEL, XOM Refiners: CLMT, CVI, DK, MPC, PBF, PSX, VLO MLP 6-9x Stable DKL, MPLX, PBFX Rack Forward 10-13x Stable FPE GY, IOSP, KWR, NEU, VVV

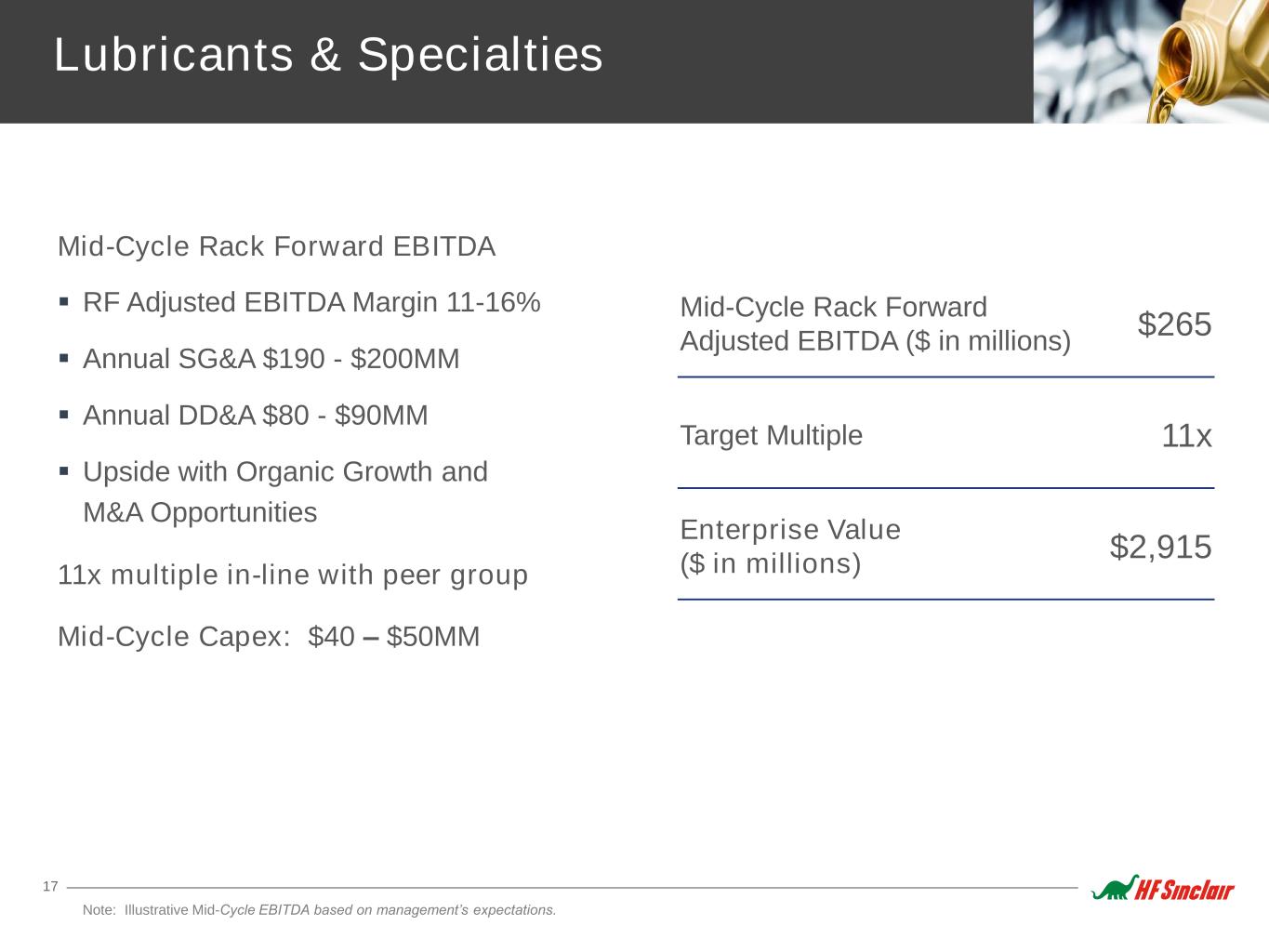

17 Lubricants & Specialties Mid-Cycle Rack Forward Adjusted EBITDA ($ in millions) $265 Target Multiple 11x Enterprise Value ($ in millions) $2,915 Mid-Cycle Rack Forward EBITDA RF Adjusted EBITDA Margin 11-16% Annual SG&A $190 - $200MM Annual DD&A $80 - $90MM Upside with Organic Growth and M&A Opportunities 11x multiple in-line with peer group Mid-Cycle Capex: $40 – $50MM Note: Illustrative Mid-Cycle EBITDA based on management’s expectations.

18 Holly Energy Partners (HEP) Company Profile STABLE EARNINGS FINANCIAL TARGETS & GUIDANCE BALANCE SHEET HIGHLIGHTS Revenues are nearly 100% fee-based with de minimis commodity risk Customer base consisting of refining companies (contracts not with E&Ps) Minimum Volume Commitments (MVCs) comprise approximately 70% of Total Tariffs and Fees1 Substantially all MVC revenues tied to PPI or FERC COMPANY OVERVIEW (NYSE: HEP) Maintain Balance Sheet flexibility Operate within free cash flow while reducing leverage HEP Corporate Credit Ratings: S&P BB+, Moody’s Ba2, Fitch BB+ Earliest maturity in 2025 Integrated systems of petroleum product and crude pipelines, storage tanks, distribution terminals, loading racks and processing units located at or near HF Sinclair’s refining assets in high growth markets Assets strategically located in core growth areas in the Mid-Continent, Southwest and Northwest regions of the United States 47% owned by refining parent HF Sinclair Corporation (NYSE:DINO) Target distribution coverage of at least 1.3x Target leverage: 3.0-3.5x Self-funding model to cover all capital expenditures and distributions with cash flow from operations Maintain distribution of $1.40 (annualized) per unit for 2022 1. As of June 30, 2022 YTD, Total Tariffs and Fees are calculated as revenues plus tariffs and fees not included in revenues due to impacts from lease accounting for certain tariffs and fees. See definition and reconciliation in Appendix.

19 HEP Assets Holly Energy Partners owns and operates substantially all of the refined product pipeline and terminalling assets that support HF Sinclair’s refining and marketing operations in the Mid- Continent, Southwest and Northwest regions of the United States Approximately 4,400 miles of crude oil and petroleum product pipelines Approximately 18.5 million barrels of refined product and crude oil storage with 19 terminals and 7 loading rack facilities in 13 western and mid-continent states Refinery processing units in Woods Cross, UT and El Dorado, KS 50% joint venture interest in Cheyenne Pipeline LLC – the owner of an 87-mile crude oil pipeline from Fort Laramie, Wyoming to Cheyenne, Wyoming. 50% joint venture interest in Osage Pipe Line Company, LLC – the owner of a 135-mile crude oil pipeline from Cushing, Oklahoma to El Dorado, Kansas 50% joint venture interest in Cushing Connect Pipeline & Terminal LLC – the owner of a 50- mile, 160,000 barrel per day crude oil pipeline from Cushing, Oklahoma to Tulsa, Oklahoma and 1.5 million barrels of crude oil storage in Cushing, Oklahoma 49.995% joint venture interest in Pioneer Investments Corp. – the owner of a 310-mile, 65,000 barrel per day refined product pipeline from Sinclair, Wyoming to the North Salt Lake Terminal with 655,000 barrels of refined product storage capacity 25.06% joint venture interest in Saddle Butte Pipeline III, LLC – the owner of a 220 mile, 60,000 barrel per day crude oil pipeline from the Powder River Basin in Wyoming to Casper, Wyoming and 160,000 barrels of crude oil storage at the Highland Flats Terminal in Wyoming

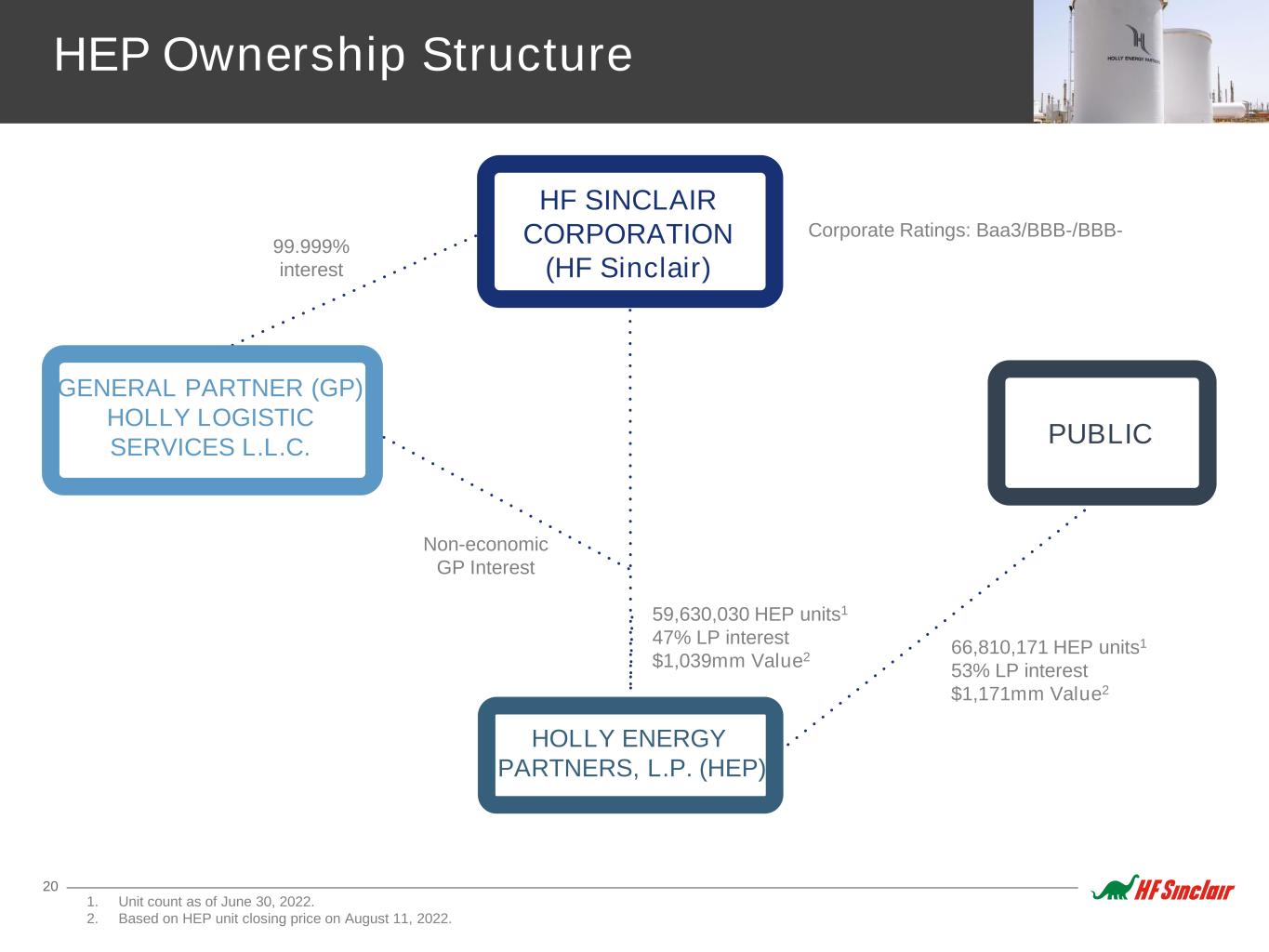

20 HEP Ownership Structure 99.999% interest 66,810,171 HEP units1 53% LP interest $1,171mm Value2 59,630,030 HEP units1 47% LP interest $1,039mm Value2 HF SINCLAIR CORPORATION (HF Sinclair) GENERAL PARTNER (GP) HOLLY LOGISTIC SERVICES L.L.C. HOLLY ENERGY PARTNERS, L.P. (HEP) PUBLIC Non-economic GP Interest Corporate Ratings: Baa3/BBB-/BBB- 1. Unit count as of June 30, 2022. 2. Based on HEP unit closing price on August 11, 2022.

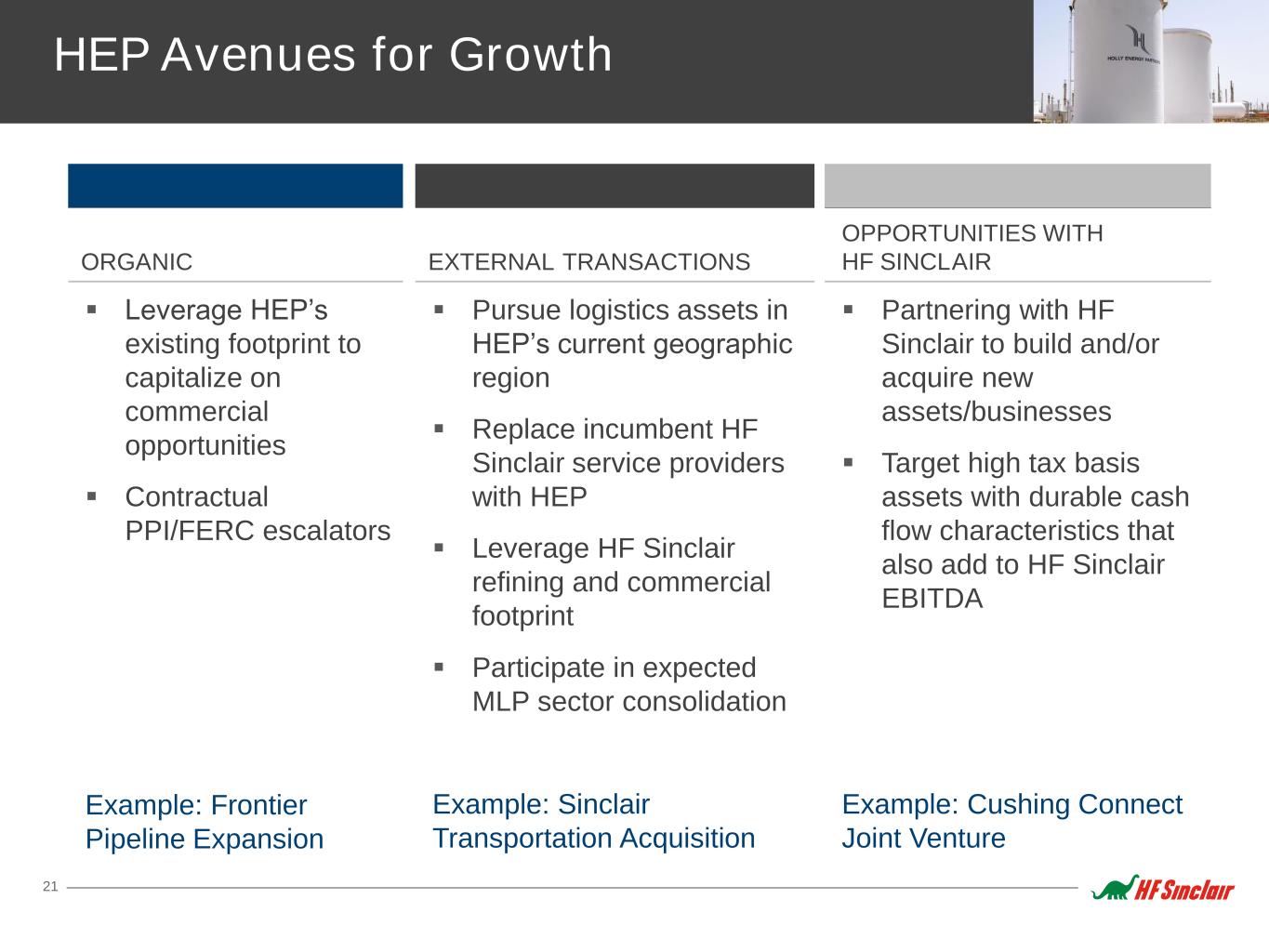

21 HEP Avenues for Growth ORGANIC EXTERNAL TRANSACTIONS OPPORTUNITIES WITH HF SINCLAIR Leverage HEP’s existing footprint to capitalize on commercial opportunities Contractual PPI/FERC escalators Example: Frontier Pipeline Expansion Pursue logistics assets in HEP’s current geographic region Replace incumbent HF Sinclair service providers with HEP Leverage HF Sinclair refining and commercial footprint Participate in expected MLP sector consolidation Example: Sinclair Transportation Acquisition Partnering with HF Sinclair to build and/or acquire new assets/businesses Target high tax basis assets with durable cash flow characteristics that also add to HF Sinclair EBITDA Example: Cushing Connect Joint Venture

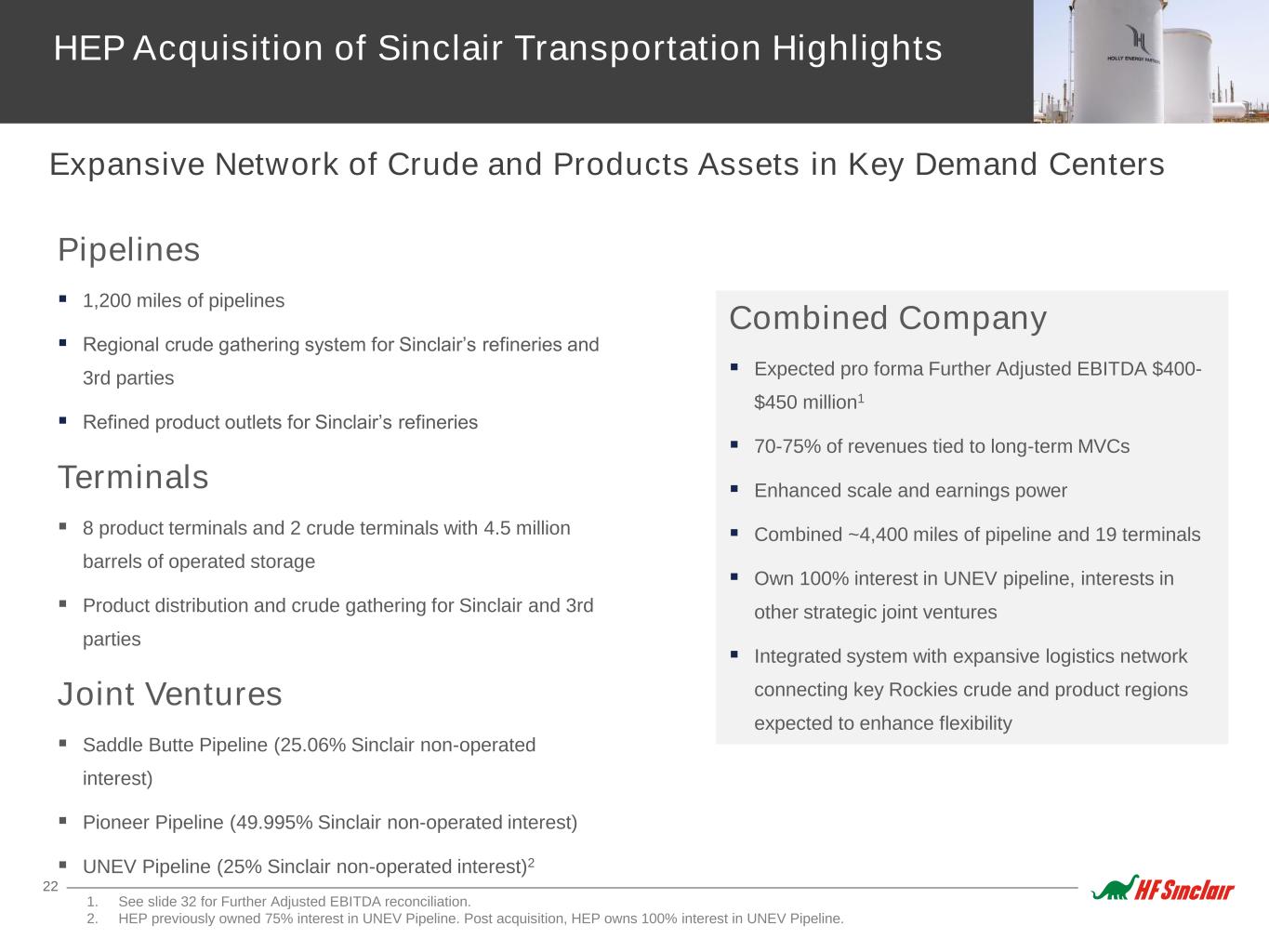

22 HEP Acquisition of Sinclair Transportation Highlights Expansive Network of Crude and Products Assets in Key Demand Centers Pipelines 1,200 miles of pipelines Regional crude gathering system for Sinclair’s refineries and 3rd parties Refined product outlets for Sinclair’s refineries Terminals 8 product terminals and 2 crude terminals with 4.5 million barrels of operated storage Product distribution and crude gathering for Sinclair and 3rd parties Joint Ventures Saddle Butte Pipeline (25.06% Sinclair non-operated interest) Pioneer Pipeline (49.995% Sinclair non-operated interest) UNEV Pipeline (25% Sinclair non-operated interest)2 Combined Company Expected pro forma Further Adjusted EBITDA $400- $450 million1 70-75% of revenues tied to long-term MVCs Enhanced scale and earnings power Combined ~4,400 miles of pipeline and 19 terminals Own 100% interest in UNEV pipeline, interests in other strategic joint ventures Integrated system with expansive logistics network connecting key Rockies crude and product regions expected to enhance flexibility 1. See slide 32 for Further Adjusted EBITDA reconciliation. 2. HEP previously owned 75% interest in UNEV Pipeline. Post acquisition, HEP owns 100% interest in UNEV Pipeline.

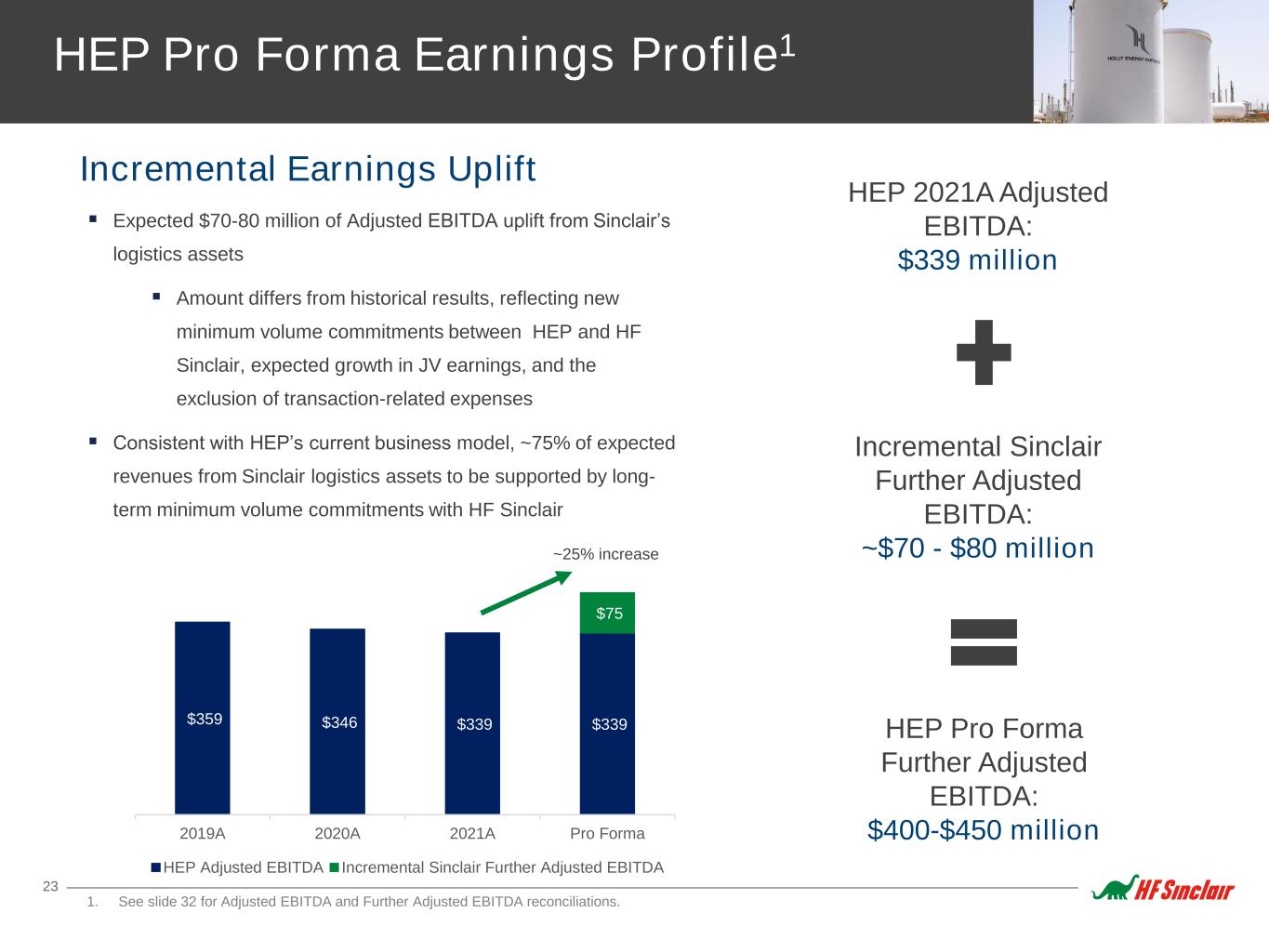

23 HEP Pro Forma Earnings Profile1 Expected $70-80 million of Adjusted EBITDA uplift from Sinclair’s logistics assets Amount differs from historical results, reflecting new minimum volume commitments between HEP and HF Sinclair, expected growth in JV earnings, and the exclusion of transaction-related expenses Consistent with HEP’s current business model, ~75% of expected revenues from Sinclair logistics assets to be supported by long- term minimum volume commitments with HF Sinclair Incremental Earnings Uplift HEP 2021A Adjusted EBITDA: $339 million Incremental Sinclair Further Adjusted EBITDA: ~$70 - $80 million HEP Pro Forma Further Adjusted EBITDA: $400-$450 million 1. See slide 32 for Adjusted EBITDA and Further Adjusted EBITDA reconciliations. $359 $346 $339 $339 $75 2019A 2020A 2021A Pro Forma HEP Adjusted EBITDA Incremental Sinclair Further Adjusted EBITDA ~25% increase

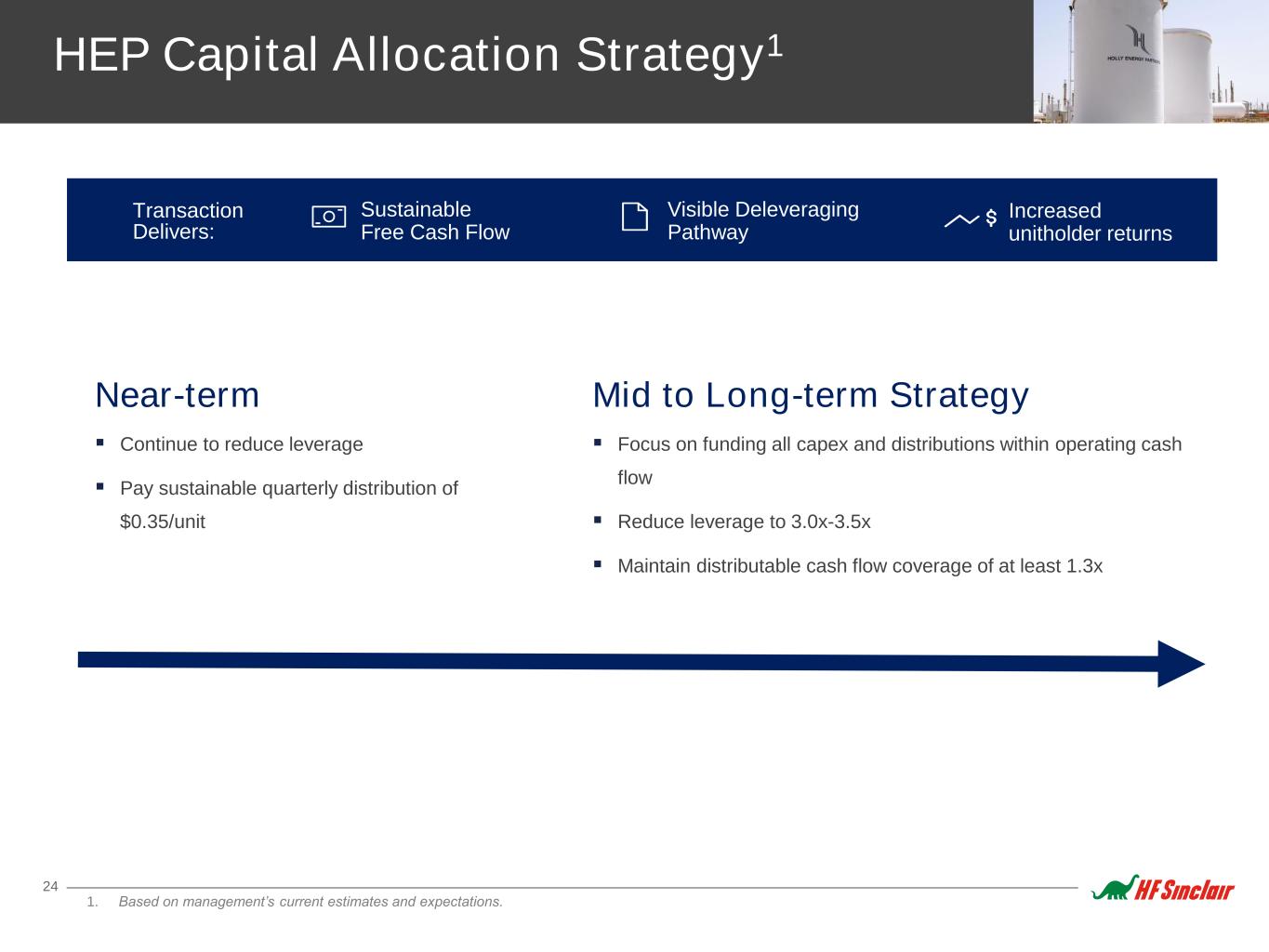

24 Visible Deleveraging Pathway Increased unitholder returns Sustainable Free Cash Flow Transaction Delivers: HEP Capital Allocation Strategy1 Near-term Continue to reduce leverage Pay sustainable quarterly distribution of $0.35/unit Mid to Long-term Strategy Focus on funding all capex and distributions within operating cash flow Reduce leverage to 3.0x-3.5x Maintain distributable cash flow coverage of at least 1.3x 1. Based on management’s current estimates and expectations.

FINANCIAL STRATEGY RATEGY

Driving Significant Uplift to Free Cash Flow Mid-Cycle Adjusted EBITDA Uplift1: 26 ($mm's) HFC PSR Sinclair HF Sinclair REFINING $1,000 $175 $175 $1,350 MIDSTREAM $350 $75 $425 RENEWABLES $250 $150 $400 MARKETING $50 $50 LUBRICANTS $250 $250 EXPECTED ANNUAL SYNERGIES $100 TOTAL ADJUSTED EBITDA2 $1,850 $175 $450 $2,575 (DEPRECIATION AND AMORTIZATION3) $(375) $(40) $(175) $(590) PRE-TAX INCOME $1,475 $135 $275 $1,985 (INCOME TAX PROVISION4) $(354) $(32) $(66) $(476) FREE CASH FLOW $1,121 $103 $209 $1,509 1. Mid-cycle Adjusted EBITDA and Depreciation and Amortization based on management’s current estimates and expectations. Please see appendix for Non-GAAP definitions. 2. Adjusted EBITDA is the equivalent of pre-tax Cash Flow from Operations. 3. Depreciation and Amortization is equal to estimated mid-cycle capital expenditures. 4. Based on a 24% corporate tax rate.

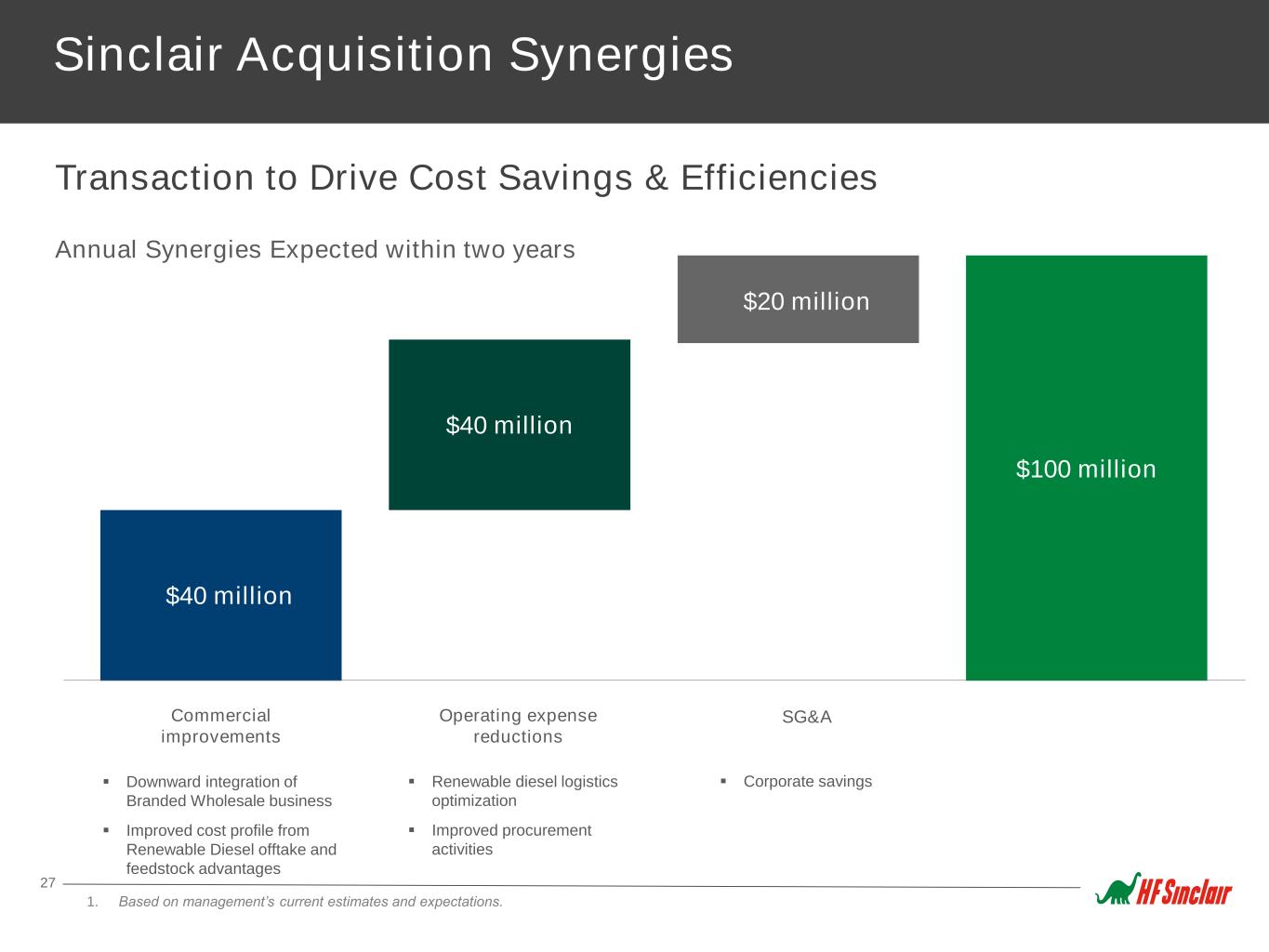

Sinclair Acquisition Synergies Transaction to Drive Cost Savings & Efficiencies 27 $100 million Annual Synergies Expected within two years SG&AOperating expense reductions Commercial improvements Downward integration of Branded Wholesale business Improved cost profile from Renewable Diesel offtake and feedstock advantages Renewable diesel logistics optimization Improved procurement activities Corporate savings $40 million $20 million $40 million 1. Based on management’s current estimates and expectations.

Capital Allocation Strategy1 Free Cash Flow Drives Capital Returns & Balanced Capital Allocation 28 2023 and Beyond 50% Payout Ratio (dividends + repurchases) of Adjusted Net Income2 2022 Pay $0.40 regular quarterly dividend (reinstated Q2 2022) Resumed repurchases in Q2 2022 by Q1 2023 $1 Billion of cash return (both dividends and repurchases) Near-term Long-termMid-term Visible Deleveraging Pathway Increase shareholder returns Sustainable Free Cash Flow Transaction Delivers: Maintain Investment Grade Credit Ratings S&P (BBB-), Moody’s (Baa3) and Fitch (BBB-) 1. Based on management’s current estimates and expectations. 2. See definition in Appendix.

APPENDIX RATEGY

HF Sinclair Capital Structure Strengthening Credit Profile through Reduced Leverage, Increased Scale and Portfolio Diversification 30 ($mm's) HF Sinclair Cash and Cash Equivalents $1,702 HF SINCLAIR CORPORATION1 2.625% Senior Notes due 2023 $350 5.875% Senior Notes due 2026 $1,000 4.500% Senior Notes due 2030 $400 HF SINCLAIR LONG-TERM DEBT $1,750 HOLLY ENERGY PARTNERS 6.375% Senior Notes due 2027 $400 5.000% Senior Notes due 2028 $500 Credit Agreement (matures 7/2025) $721 HEP LONG-TERM DEBT $1,621 Consolidated Debt1 $3,371 Stockholders Equity (includes NCI) $9,875 Total Capitalization $13,246 Consolidated Debt / Capitalization 25% Consolidated Net Debt2 / Capitalization 13% CONSOLIDATED TOTAL LIQUIDITY3 $3,831 HF Sinclair Consolidated Capital Structure: as of 6/30/2022 1. Excludes unamortized discount and debt issuance costs and includes subsidiary debt of HollyFrontier Corporation. 2. See definition in Appendix. 3. Includes availability from $1.65B HF Sinclair revolving credit facility and $1.2B HEP revolving credit facility.

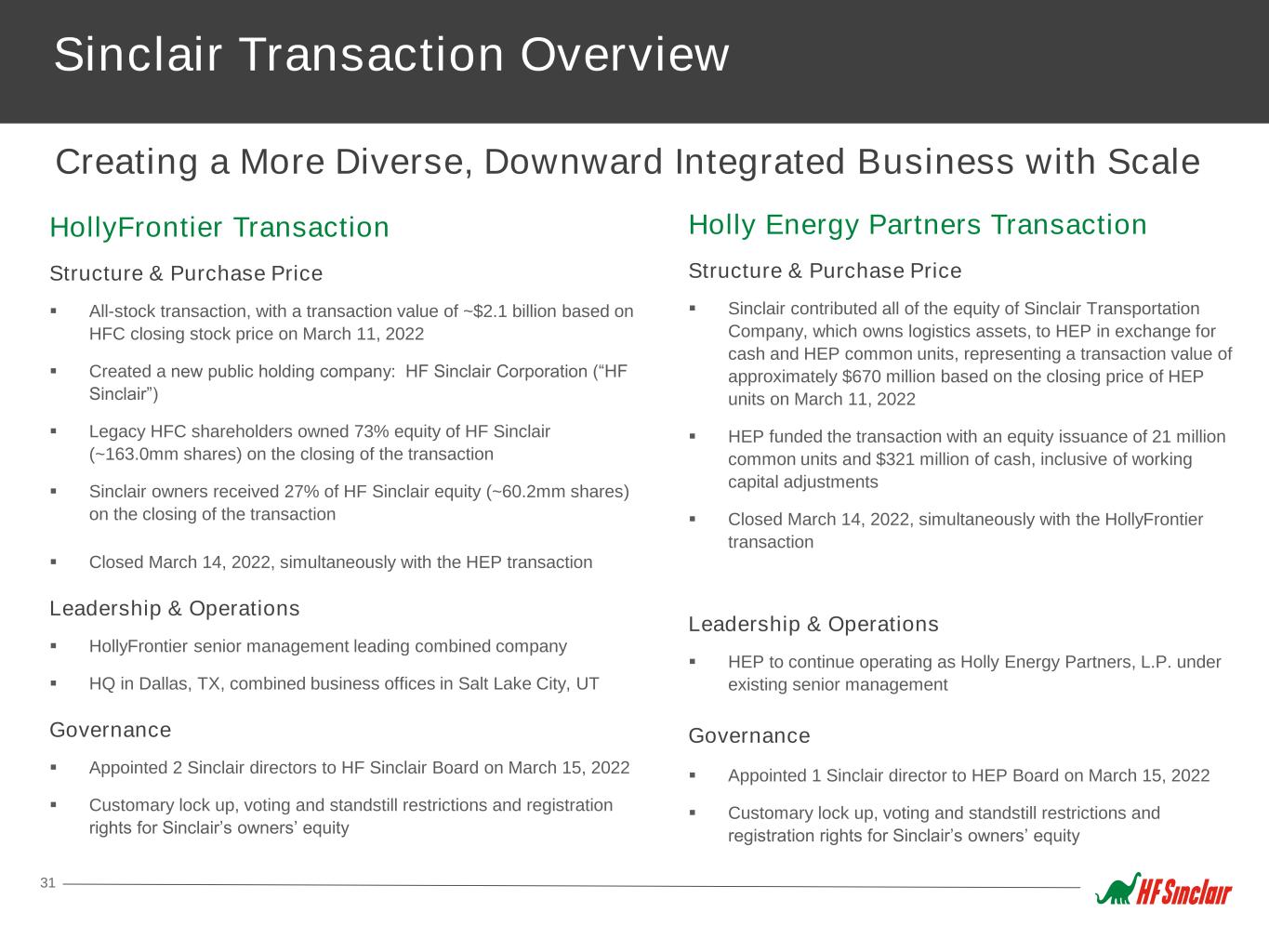

Sinclair Transaction Overview Creating a More Diverse, Downward Integrated Business with Scale 31 HollyFrontier Transaction Structure & Purchase Price All-stock transaction, with a transaction value of ~$2.1 billion based on HFC closing stock price on March 11, 2022 Created a new public holding company: HF Sinclair Corporation (“HF Sinclair”) Legacy HFC shareholders owned 73% equity of HF Sinclair (~163.0mm shares) on the closing of the transaction Sinclair owners received 27% of HF Sinclair equity (~60.2mm shares) on the closing of the transaction Closed March 14, 2022, simultaneously with the HEP transaction Leadership & Operations HollyFrontier senior management leading combined company HQ in Dallas, TX, combined business offices in Salt Lake City, UT Governance Appointed 2 Sinclair directors to HF Sinclair Board on March 15, 2022 Customary lock up, voting and standstill restrictions and registration rights for Sinclair’s owners’ equity Holly Energy Partners Transaction Structure & Purchase Price Sinclair contributed all of the equity of Sinclair Transportation Company, which owns logistics assets, to HEP in exchange for cash and HEP common units, representing a transaction value of approximately $670 million based on the closing price of HEP units on March 11, 2022 HEP funded the transaction with an equity issuance of 21 million common units and $321 million of cash, inclusive of working capital adjustments Closed March 14, 2022, simultaneously with the HollyFrontier transaction Leadership & Operations HEP to continue operating as Holly Energy Partners, L.P. under existing senior management Governance Appointed 1 Sinclair director to HEP Board on March 15, 2022 Customary lock up, voting and standstill restrictions and registration rights for Sinclair’s owners’ equity

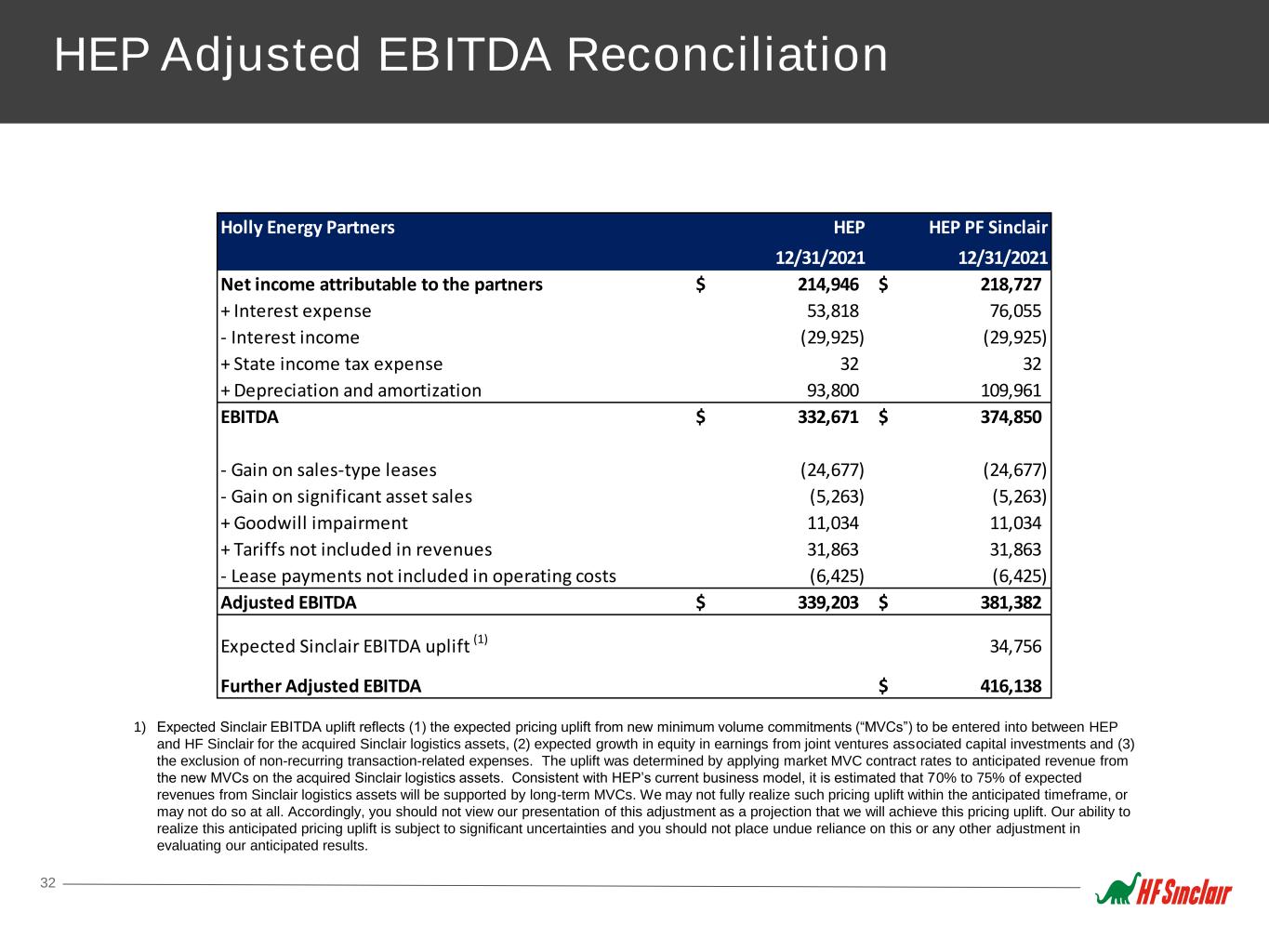

HEP Adjusted EBITDA Reconciliation 32 Holly Energy Partners HEP HEP PF Sinclair 12/31/2021 12/31/2021 Net income attributable to the partners 214,946$ 218,727$ + Interest expense 53,818 76,055 - Interest income (29,925) (29,925) + State income tax expense 32 32 + Depreciation and amortization 93,800 109,961 EBITDA 332,671$ 374,850$ - Gain on sales-type leases (24,677) (24,677) - Gain on significant asset sales (5,263) (5,263) + Goodwill impairment 11,034 11,034 + Tariffs not included in revenues 31,863 31,863 - Lease payments not included in operating costs (6,425) (6,425) Adjusted EBITDA 339,203$ 381,382$ Expected Sinclair EBITDA uplift (1) 34,756 Further Adjusted EBITDA 416,138$ 1) Expected Sinclair EBITDA uplift reflects (1) the expected pricing uplift from new minimum volume commitments (“MVCs”) to be entered into between HEP and HF Sinclair for the acquired Sinclair logistics assets, (2) expected growth in equity in earnings from joint ventures associated capital investments and (3) the exclusion of non-recurring transaction-related expenses. The uplift was determined by applying market MVC contract rates to anticipated revenue from the new MVCs on the acquired Sinclair logistics assets. Consistent with HEP’s current business model, it is estimated that 70% to 75% of expected revenues from Sinclair logistics assets will be supported by long-term MVCs. We may not fully realize such pricing uplift within the anticipated timeframe, or may not do so at all. Accordingly, you should not view our presentation of this adjustment as a projection that we will achieve this pricing uplift. Our ability to realize this anticipated pricing uplift is subject to significant uncertainties and you should not place undue reliance on this or any other adjustment in evaluating our anticipated results.

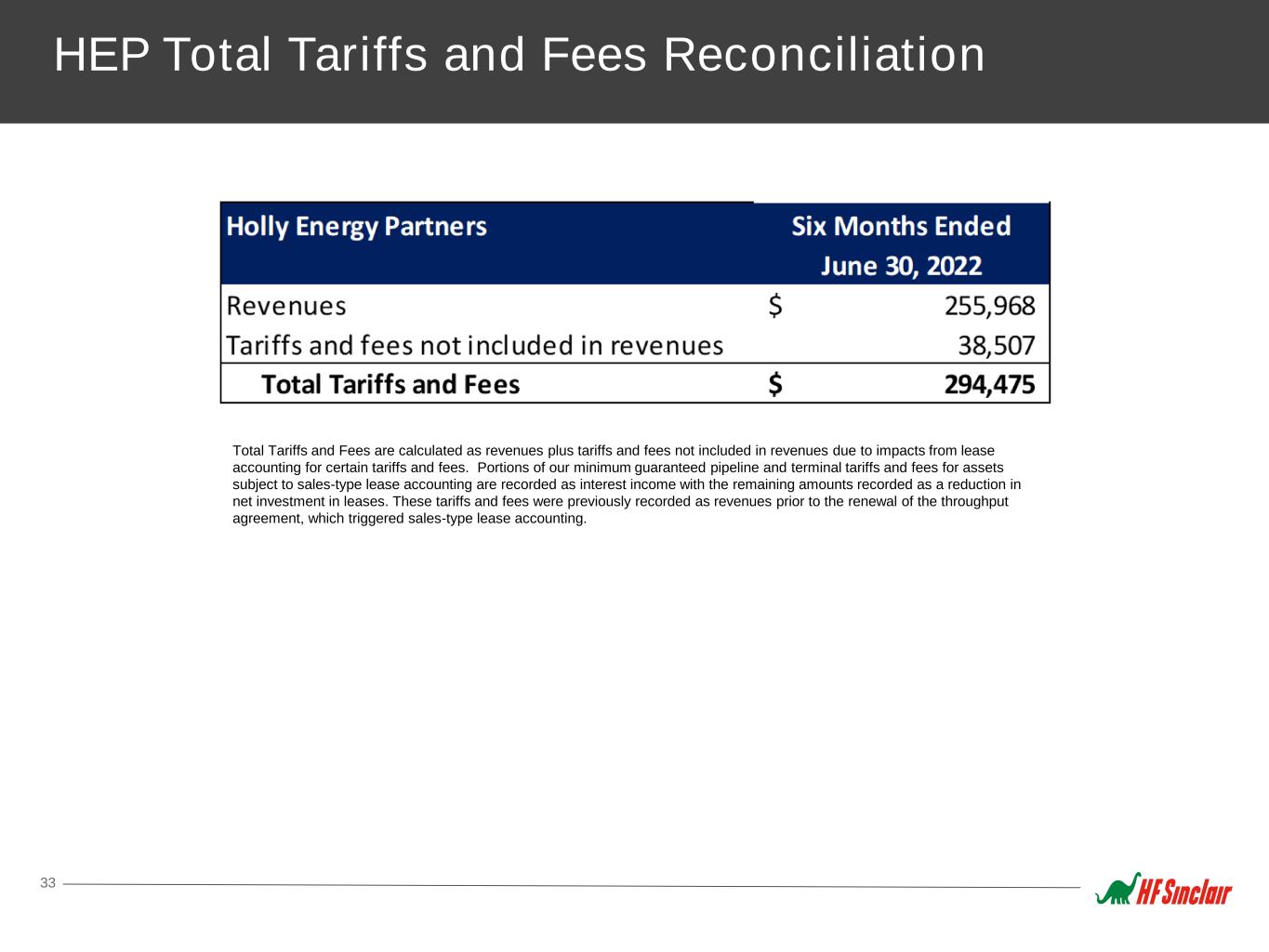

HEP Total Tariffs and Fees Reconciliation 33 Total Tariffs and Fees are calculated as revenues plus tariffs and fees not included in revenues due to impacts from lease accounting for certain tariffs and fees. Portions of our minimum guaranteed pipeline and terminal tariffs and fees for assets subject to sales-type lease accounting are recorded as interest income with the remaining amounts recorded as a reduction in net investment in leases. These tariffs and fees were previously recorded as revenues prior to the renewal of the throughput agreement, which triggered sales-type lease accounting.

Definitions 34 BPD: the number of barrels per calendar day of crude oil or petroleum products. Blenders Tax Credit (BTC): Federal tax credit where qualified biodiesel blenders are eligible for an income tax credit of $1.00 per gallon of biodiesel or renewable diesel that is blended with petroleum diesel. Biodiesel (FAME): a fuel derived from vegetable oils or animal fats that meet the requirements of ASTM D 6751. Biodiesel is made through a chemical process called transesterification where glycerin is separated from the fat or vegetable oil leaving behind methyl esters (biodiesel) and byproduct glycerin. In the presentation we also refer to this as traditional biodiesel. California’s Low Carbon Fuel Standard (LCFS): California program that mandates the reduction in the carbon intensity of transportation fuels by 20% by 2030 Carbon Intensity (CI): the amount of carbon emitted per unit of energy consumed, under LCFS it is a “well-to-wheels” analysis of greenhouse gas emissions in transportation fuel, meaning emissions are quantified from feedstock cultivation through combustion. California Air Resources Board (CARB): California’s clean air agency that administers the LCFS program. California Reformulated Gasoline Blend stock for Oxygenate Blending (CARBOB): a petroleum-derived liquid which is intended to be, or is represented as, a product that will constitute California gasoline upon the addition of a specified type and percentage (or range of percentages) of oxygenate to the product after the product has been supplied from the production or import facility at which it was produced or imported. CAGR: the compound annual growth rate is calculated by dividing the ending value by the beginning value, raise the result to the power of one divided by the period length, and subtract one from the subsequent result. CAGR is the mean annual growth rate of an investment over a specified period of time longer than one year. Consolidated Net Debt: Consolidated net debt is calculated as total long-term debt minus unamortized discount and debt issuance costs and cash and cash equivalents. Consolidated Net Debt is not a calculation based upon GAAP. However, the amounts included in the Consolidated Net Debt calculation are derived from amounts included in our consolidated financial statements. Debt-To-Capital: A measurement of a company's financial leverage, calculated as the company's long term debt divided by its total capital. Debt includes all long-term obligations. Total capital includes the company's debt and shareholders' equity. Distributable Cash Flow: Distributable cash flow (DCF) is not a calculation based upon GAAP. However, the amounts included in the calculation are derived from amounts separately presented in HEP’s consolidated financial statements, with the general except ion of maintenance capital expenditures. Distributable cash flow should not be considered in isolation or as an alternative to net income or operating income as an indication of HEP’s operating performance or as an alternative to operating cash flow as a measure of liquidity. Distributable cash flow is not necessarily comparable to similarly titled measures of other companies. Distributable cash flow is presented here because it is a widely accepted financial indicator used by investors to compare partnership performance. It is also used by HEP management for internal analysis and HEP’s performance units. We believe that this measure provides investors with an enhanced perspective of the operating performance of HEP’s assets and the cash HEP is generating. HEP’s historical distributable cash flow for prior years and fiscal quarters is reconciled to net income in a footnote to the table in “Item 6. Selected Financial Data” in HEP’s 10-Ks prior to the 10-K for the year ended December 31, 2021 and in a footnote to the “Income, Distributable Cash Flow, Volumes and Balance Sheet Data” table in “Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations” in HEP’s 10-Qs and in “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” in HEP’s 10-Ks for the year ended December 31, 2021, available at www.hollyenergy.com. EBITDA: Earnings before interest, taxes, depreciation and amortization, is calculated as net income attributable to HF Sinclair stockholders plus (i) interest expense net of interest income, (ii) income tax provision, and (iii) depreciation and amortization. EBITDA is not a calculation provided for under GAAP; however, the amounts included in the EBITDA calculation are derived from amounts included in our consolidated financial statements. EBITDA should not be considered as an alternative to net income or operating income as an indication of our operating performance or as an alternative to operating cash flow as a measure of liquidity. EBITDA is not necessarily comparable to similarly titled measures of other companies. EBITDA is presented here because it is a widely used financial indicator used by investors and analysts to measure performance. EBITDA is also used by our management for internal analysis and as a basis for financial covenants. Our historical EBITDA is reconciled to net income under the section entitled “Reconciliation to Amounts Reported Under Generally Accepted Accounting Principles” in “Item 7A. Quantitative and Qualitative Disclosures About Market Risk” in HollyFrontier’s Form 10-K for the year ended December 31, 2021. Our historical EBITDA for the prior fiscal quarters is reconciled to net income under the section entitled “Reconciliations to Amounts Reported Under Generally Accepted Accounting Principles” in “Item 3. Quantitative and Qualitative Disclosures About Market Risk” in HF Sinclair’s Form 10-Qs, all of which are or will be available on our website, www.hfsinclair.com. Adjusted EBITDA: Adjusted EBITDA is calculated as EBITDA plus adjustments for extraordinary items, other unusual or non- recurring items, each as determined in accordance with GAAP and identified in the financial statements, such as lower of cost or market inventory valuation adjustments, severance costs, restructuring charges, Cheyenne refinery LIFO inventory liquidation costs, decommissioning costs, acquisition integration and regulatory costs and gain on tariff settlement. Adjusted EBITDA is not a calculation based upon GAAP. However, the amounts included in the Adjusted EBITDA calculation are derived from amounts included in our consolidated financial statements. Adjusted EBITDA should not be considered as an alternative to net income or operating income, as an indication of our operating performance or as an alternative to operating cash flow as a measure of liquidity. Adjusted EBITDA is not necessarily comparable to similarly titled measures of other companies. Adjusted EBITDA is presented here because it is a widely used financial indicator used by investors and analysts to measure performance. Adjusted EBITDA is reconciled to net income under the section entitled “Reconciliations to Amounts Reported Under Generally Accepted Accounting Principles” in HollyFrontier’s quarterly earnings releases furnished on Form 8-K for all periods prior to the first quarter of 2022 and in HF Sinclair’s quarterly earnings releases furnished on Form 8-K for all periods starting with and occurring after the first quarter of 2022, each of which are or will be available on our website, www.hfsinclair.com. FURTHER ADJUSTED EBITDA: Further Adjusted EBITDA is calculated as Adjusted EBITDA plus Expected Sinclair EBITDA uplift. Further Adjusted EBITDA is not a calculation based upon GAAP. However, the amounts included in the Further Adjusted EBITDA calculation are derived from amounts included in our consolidated financial statements. Further Adjusted EBITDA should not be considered as an alternative to net income or operating income, as an indication of our operating performance or as an alternative to operating cash flow as a measure of liquidity. Further Adjusted EBITDA is not necessarily comparable to similarly titled measures of other companies. Further Adjusted EBITDA is presented here because it is a widely used financial indicator used by investors and analysts to measure performance. Earnings Per Share (EPS): earnings per share is calculated as net income (loss) attributable to stockholders divided by the average number of shares of common stock outstanding. Free Cash Flow: Free cash flow is calculated by taking operating cash flow and subtracting capital expenditures. IDR: Incentive Distribution Rights Internal Rate of Return (IRR): a metric used in capital budgeting to estimate the profitability of potential investments. The internal rate of return is a discount rate that makes the net present value (NPV) of all cash flows from a particular project equal to zero. Includes management’s assumption Lubricant: a solvent neutral paraffinic product used in commercial heavy duty engine oils, passenger car oils and specialty products for industrial applications such as heat transfer, metalworking, rubber and other general process oil. Adjusted Net Income: Adjusted Net Income (also referred to as Adjusted Net Income attributable to HF Sinclair stockholders) is net income (loss) attributable to HF Sinclair stockholders adjusted to reflect the after-tax effect of special items that HF Sinclair believes are not indicative of its core operating performance that may obscure HF Sinclair’s underlying business results and trends. Adjusted Net Income attributable to HF Sinclair stockholders is reconciled to net income under the section entitled “Reconciliations to Amounts Reported Under Generally Accepted Accounting Principles” in HollyFrontier’s quarterly earnings releases furnished on Form 8-K for all periods prior to the first quarter of 2022 and in HF Sinclair’s quarterly earnings releases furnished on Form 8-K for all periods starting with and occurring after the first quarter of 2022, each of which are or will be available on our website, www.hfsinclair.com. Non GAAP measurements: we report certain financial measures that are not prescribed or authorized by U. S. generally accepted accounting principles ("GAAP"). We discuss management's reasons for reporting these non-GAAP measures below. Although management evaluates and presents these non- GAAP measures for the reasons described below, please be aware that these non-GAAP measures are not alternatives to revenue, operating income, income from continuing operations, net income, or any other comparable operating measure prescribed by GAAP. In addition, these non-GAAP financial measures may be calculated and/or presented differently than measures with the same or similar names that are reported by other companies, and as a result, the non-GAAP measures we report may not be comparable to those reported by others. Also, we have not reconciled to non-GAAP forward-looking measures or guidance to their corresponding GAAP measures because certain items that impact these measures are unavailable or cannot be reasonably predicted without unreasonable effort. Rack Backward: business segment of HF LSP that captures the value between feedstock cost and base oil market prices (transfer prices to rack forward). Rack Forward: business segment of HF LSP that captures the value between bas oil market prices and product sales revenue from customers. RBOB: Reformulated Gasoline Blendstock for Oxygen Blending Refined Bleached Deodorized Soybean Oil (RBD SBO): primary feedstock for FAME Biodiesel currently in the U.S. accounting for 50% of biodiesel production. Soybean Oil is produced by crushing Soybeans which yield 20% Oil and 80% meal. Crude Soybean Oil is then processed (refined) removing impurities, color and odor. Renewable Diesel (RD): a fuel derived from vegetable oils or animal fats that meets the requirements of ASTM 975. Renewable diesel is distinct from biodiesel. It is produced through various processes, most commonly through hydrotreating, reacting the feedstock with hydrogen under temperatures and pressure in the presence of a catalyst. Renewable Diesel is chemically identical to petroleum based diesel and therefore has no blend limit. Renewable Fuel Standard (RFS): national policy administered by EPA requiring a specified volumes of different renewable fuels (primary categories are ethanol and biodiesel) that must replace petroleum-based transportation fuel. Renewable Identification Number (RIN): a serial number assigned to each batch of biofuel produced until that gallon is blended with gasoline or diesel resulting in the separation of the RIN to be used for compliance. RIN category (D-code) is assigned for each renewable fuel pathway determined by feedstock, production process and fuel type. D6 RIN (Renewable Fuel) – corn based ethanol, must reduce lifecycle greenhouse gas emissions by at least 20% D5 RIN (Advanced Biofuel) – any renewable biomass except corn ethanol that reduces lifecycle greenhouse gas emissions by at least 50% D4 RIN (Biomass-based Diesel) – biodiesel and renewable diesel, must reduce lifecycle greenhouse gas emissions by at least 50% Renewable Volume Obligation (RVO): the required volume in gallons of biofuel refiners are obligated to blend into the gasoline and diesel pool. EPA sets volumetric standard which are then converted to percent standards based on EIA’s projected gasoline and diesel consumption. Equivalence Value (EV): a number used to determine how many RINs can be generated from one gallon of renewable fuel based on the energy content (Btu/gallon) and renewable content of a fuel compared to Ethanol. Ethanol EV is 1.0 RIN per gallon. Biodiesel is 1.5 RINs per gallon and Renewable Diesel is 1.7 RINs per gallon. Sour Crude: crude oil containing quantities of sulfur greater than 0.4 percent by weight, while “sweet crude oil” means crude oil containing quantities of sulfur equal to or less than 0.4 percent by weight. Total Tariffs and Fees: Total Tariffs and Fees are calculated as revenues plus tariffs and fees not included in revenues due to impacts from lease accounting for certain tariffs and fees. Portions of our minimum guaranteed pipeline and terminal tariffs and fees for assets subject to sales-type lease accounting are recorded as interest income with the remaining amounts recorded as a reduction in net investment in leases. These tariffs and fees were previously recorded as revenues prior to the renewal of the throughput agreement, which triggered sales-type lease accounting. WCS: Western Canada Select crude oil, made up of Canadian heavy conventional and bitumen crude oils blended with sweet synthetic and condensate diluents. WTI: West Texas Intermediate, a grade of crude oil used as a common benchmark in oil pricing. WTI is a sweet crude oil and has a relatively low density. WTS: West Texas Sour, a medium sour crude oil.

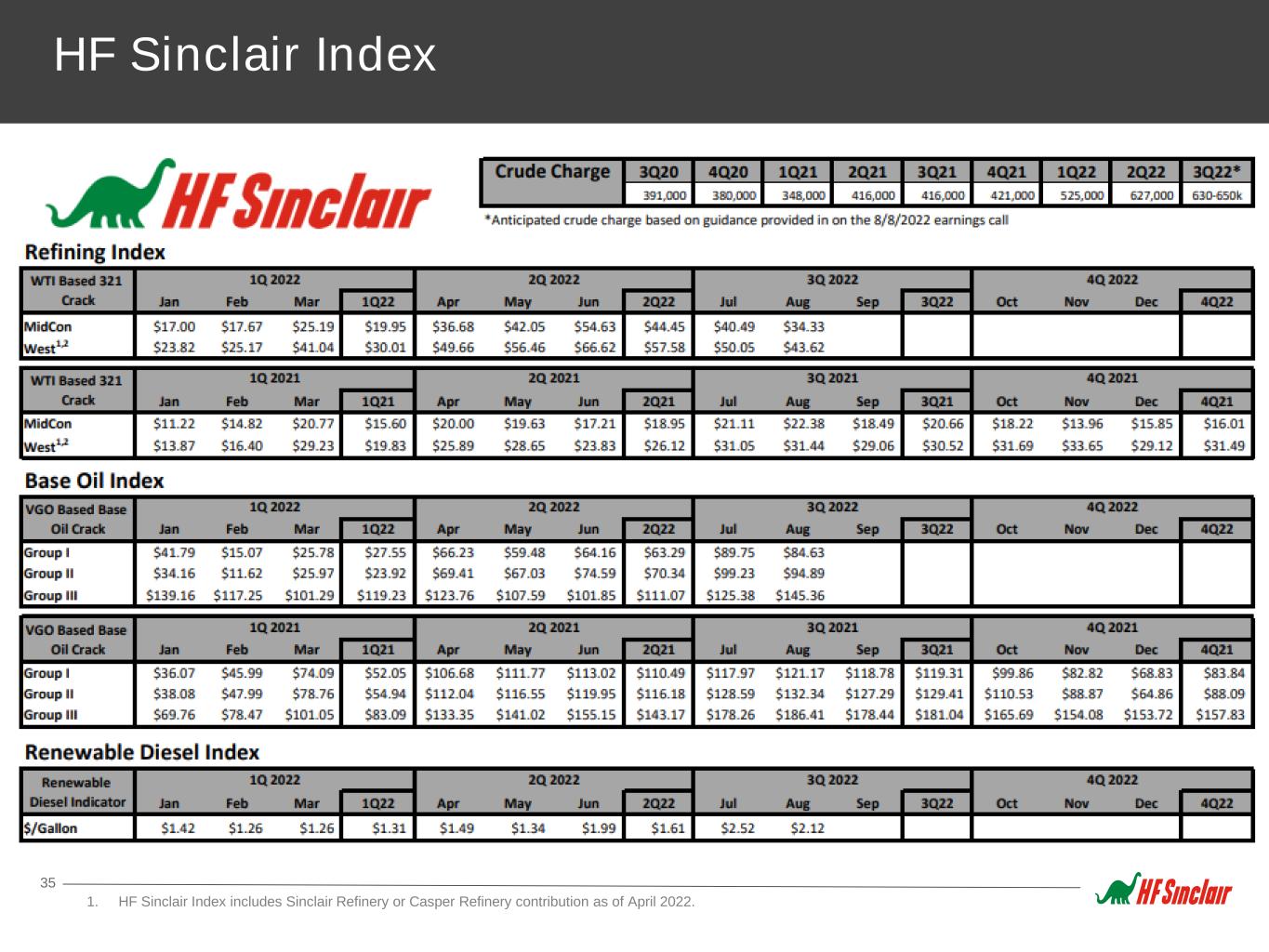

HF Sinclair Index 35 1. HF Sinclair Index includes Sinclair Refinery or Casper Refinery contribution as of April 2022.

HF Sinclair Disclosure 36 Light Product Index Appendix HF Sinclair's actual pricing and margins may differ from benchmark indicators due to many factors. For example: - Crude Slate differences – HF Sinclair runs a wide variety of crude oils across its refining system and crude slate may vary quarter to quarter. - Product Yield differences – HF Sinclair’s product yield differs from indicator and can vary quarter to quarter as a result of changes in economics, crude slate, and operational downtime. - Other differences including but not limited to secondary costs such as product and feedstock transportation costs, purchases of environmental credits, quality differences, location of purchase or sale, and hedging gains/losses. Moreover, the presented indicators are generally based on spot sales, which may differ from realized contract prices. Market prices are available from a variety of sources, each of which may vary slightly. Please note that this data may differ from other sources due to adjustments made by data providers and due to differing data definitions. Below are indicator definitions used for purposes of this data. MidCon Indicator: (100% Group 3: Sub octane and ULSD) – WTI West Indicator: 34% Puget Sound: (100% Pacific Northwest Sub-octane Gasoline; 100% Pacific Northwest ULSD) – WTI 28% Navajo: (50% El Paso Subgrade, 50% Phoenix CBG; 50% El Paso ULSD, 50% Phoenix ULSD) – WTI 20% Sinclair: (70% Denver Regular Gasoline, 30% Salt Lake City Regular Gasoline; 60% Denver ULSD, 40% Salt Lake City ULSD) – WTI 10% Woods Cross: (60% Salt Lake City Regular Gasoline, 40% Las Vegas Regular Gasoline; 80% Salt Lake City ULSD, 20% Las Vegas ULSD) – WTI 8% Casper: (70% Denver Regular Gasoline, 30% Salt Lake City Regular Gasoline; 60% Denver ULSD, 40% Salt Lake City ULSD) – WTI Lubricants Index Appendix HF Sinclair's actual pricing and margins differ from benchmark indicators due to many factors. For example: - Feedstock differences – HF Sinclair runs a variety of vacuum gas oil streams and hydrocracker bottoms across its refining system and feedstock slate may vary quarter to quarter. - Product Yield differences – HF Sinclair’s product yield differs from indicator and can vary quarter to quarter as a result of changes in economics and feedstocks. - Other differences including, but not limited to secondary costs such as product and feedstock transportation costs, quality differences and location of purchase or sale. Moreover, the presented indicators are generally based on spot commodity base oil sales, which may differ from realized contract prices. Market prices are available from a variety of sources, each of which may vary slightly. Please note that this data may differ from other sources due to adjustments made by data providers and due to differing data definitions. Below are indicator definitions used for purposes of this data. Group I Base Oil Indicator: (50% Group I SN150, 50% Group I SN500) – VGO Group II Base Oil Indicator: (33.3% Group II N100, 33.3% Group II N220, 33.3% Group II N600) – VGO Group III Base Oil Indicator: (33.3% Group III 4cst, 33.3% Group III 6cst, 33.3% Group III 8cst) – VGO VGO: (US Gulf Coast Low Sulfur Vacuum Gas Oil) Renewable Diesel Index Appendix HF Sinclair's actual pricing and margins differ from benchmark indicators due to many factors. For example: - Feedstock differences – HF Sinclair runs a variety feedstocks across its renewable diesel units and feedstock slate may vary quarter to quarter. - Product Yield differences – HF Sinclair’s product yield differs from indicator and can vary quarter to quarter as a result of changes in economics, feedstocks and operational downtime. - Other differences including, but not limited to secondary costs such as product and feedstock transportation costs, quality differences and location of purchase or sale. Moreover, the presented indicators are generally based on spot sales, which may differ from realized contract prices. Market prices are available from a variety of sources, each of which may vary slightly. Please note that this data may differ from other sources due to adjustments made by data providers and due to differing data definitions. Below are indicator definitions used for purposes of this data. Renewable Diesel Indicator: NYMEX NY Harbor ULSD + (1.7 * D4 RIN) + (0.0044 * California LCFS Credit) – (8.5 * CBOT Soybean Oil Month 1) + BTC BTC: (Blender's Tax Credit of $1.00 per gallon through December 31, 2022) California LCFS Credit: (California's Low Carbon Fuel Standard Credit) D4 RIN: (Bio-mass based Diesel Renewable Identification Number) Note: HF Sinclair Index includes Sinclair Refinery or Casper Refinery weighting contribution as of April 2022.

NYSE: DINO 2828 N. Harwood, Suite 1300 Dallas, TX 75201 214-954-6510 HFSinclair.com Craig Biery | VP, Investor Relations Trey Schonter | Manager, Investor Relations investors@hfsinclair.com 214-954-6510