NYSE: DINO INVESTOR PRESENTATION November 2023

2 Disclosure Statement Statements made during the course of this presentation that are not historical facts are “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Words such as “anticipate,” “project,” “will,” “expect,” “plan,” “goal,” “forecast,” “strategy,” “intend,” “should,” “would,” “could,” “believe,” “may,” and similar expressions and statements regarding our plans and objectives for future operations are intended to identify forward-looking statements. Forward-looking statements are inherently uncertain and necessarily involve risks that may affect the business prospects and performance of HF Sinclair Corporation (“HF Sinclair”) and/or Holly Energy Partners, L.P. (“HEP”), and actual results may differ materially from those discussed during the presentation. These statements are based on management’s beliefs and assumptions using currently available information and expectations as of the date thereof, are not guarantees of future performance and involve certain risks and uncertainties. All statements concerning HF Sinclair’s expectations for future results of operations are based on forecasts for our existing operations and do not include the potential impact of any future acquisitions, including the HEP Merger Transaction (as defined below). Although we believe that the expectations reflected in these forward-looking statements are reasonable, we cannot assure you that our expectations will prove to be correct. Therefore, actual outcomes and results could materially differ from what is expressed, implied or forecast in such statements. Any differences could be caused by a number of factors, including, but not limited to, the risk that the transactions contemplated by the Agreement and Plan of Merger, dated August 15, 2023 (the “Merger Agreement”), which provides for the merger of a subsidiary of HF Sinclair with and into HEP, with HEP surviving as an indirect wholly-owned subsidiary of HF Sinclair (such merger, together with the other transactions contemplated by the Merger Agreement, being referred to herein as the “HEP Merger Transaction”), are not consummated during the expected timeframe, failure to obtain the required approvals for the HEP Merger Transaction, including the ability to obtain the requisite approvals from HF Sinclair stockholders or HEP unitholders, the substantial transaction-related costs that may be incurred by HF Sinclair and HEP in connection with the HEP Merger Transaction, the risk that the market value of HF Sinclair common stock will decline, potential dilution on HF Sinclair’s earnings per share of HF Sinclair common stock, the possibility that financial projections by HF Sinclair and HEP may not prove to be reflective of actual future results, the focus of management time and attention on the HEP Merger Transaction and other disruptions arising from the HEP Merger Transaction, which may make it more difficult to maintain relationships with customers, employees or suppliers, legal proceedings that may be instituted against HF Sinclair or HEP in connection with the HEP Merger Transaction, limitations on HF Sinclair’s ability to effectuate share repurchases due to market conditions and corporate, tax, regulatory and other considerations, HF Sinclair’s and HEP’s ability to successfully integrate the Sinclair Oil Corporation (now known as Sinclair Oil LLC) and Sinclair Transportation Company LLC businesses acquired from The Sinclair Companies (now known as REH Company) (collectively, the “Sinclair Transactions”) with their existing operations and fully realize the expected synergies of the Sinclair Transactions or on the expected timeline, the ability of HF Sinclair to successfully integrate the operation of the Puget Sound refinery with its existing operations, the demand for and supply of crude oil and refined products, including uncertainty regarding the increasing societal expectations that companies address climate change, risks and uncertainties with respect to the actions of actual or potential competitive suppliers and transporters of refined petroleum products or lubricant and specialty products in HF Sinclair’s and HEP’s markets, the spread between market prices for refined products and market prices for crude oil, the possibility of constraints on the transportation of refined products or lubricant and specialty products, the possibility of inefficiencies, curtailments or shutdowns in refinery operations or pipelines, whether due to reductions in demand, accidents, unexpected leaks or spills, unscheduled shutdowns, infection in the workforce, weather events, global health events, civil unrest, expropriation of assets, and other economic, diplomatic, legislative, or political events or developments, terrorism, cyberattacks, or other catastrophes or disruptions affecting the operations of HF Sinclair and HEP, production facilities, machinery, pipelines and other logistics assets, equipment, or information systems, or any of the foregoing of our suppliers, customers, or third-party providers, and any potential asset impairments resulting from, or the failure to have adequate insurance coverage for or receive insurance recoveries from, such actions, the effects of current and/or future governmental and environmental regulations and policies, including increases in interest rates, the availability and cost of financing to HF Sinclair and HEP, the effectiveness of HF Sinclair’s and HEP’s capital investments and marketing strategies, HF Sinclair’s and HEP’s efficiency in carrying out and consummating construction projects, including HF Sinclair’s and HEP’s ability to complete announced capital projects on time and within capital guidance, HF Sinclair’s and HEP’s ability to timely obtain or maintain permits, including those necessary for operations or capital projects, the ability of HF Sinclair to acquire refined or lubricant product operations or pipeline and terminal operations on acceptable terms and to integrate any existing or future acquired operations, the possibility of terrorist or cyberattacks and the consequences of any such attacks, uncertainty regarding the effects and duration of global hostilities, including the Israel-Gaza conflict, the Russia-Ukraine war, and any associated military campaigns which may disrupt crude oil supplies and markets for our refined products and create instability in the financial markets that could restrict our ability to raise capital, general economic conditions, including economic slowdowns caused by a local or national recession or other adverse economic condition, such as periods of increased or prolonged inflation and other business, financial, operational and legal risks. Additional information on risks and uncertainties that could affect the business prospects and performance of HF Sinclair and HEP is provided in the reports filed by HF Sinclair and HEP with the Securities and Exchange Commission. All forward-looking statements included in this presentation are expressly qualified in their entirety by the foregoing cautionary statements. The forward-looking statements speak only as of the date made and, other than as required by law, HF Sinclair and HEP undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

3 Executive Summary Positioned for Value Across All Segments 1. BPD: Barrels per day 2. Includes non-Sinclair branded sites from legacy HollyFrontier agreements. REFINING MARKETING RENEWABLES SPECIALTY LUBRICANTS MIDSTREAM 7 refineries in the Mid- Continent, West and Pacific Northwest regions 678,000 BPD1 of refining capacity Flexible refining system with fleet wide discounts to WTI Premium product markets versus Gulf Coast Organic initiatives to drive growth and enhance returns Operate crude and product pipelines, loading racks, processing units, terminals and tanks in and around HF Sinclair’s refining assets HF Sinclair owns 47% of the LP interest in HEP and the non- economic GP interest3 Eliminated IDRs in 2017 to simplify structure Approximately 73% of Total Tariffs and Fees tied to long-term contracts and minimum volume commitments4 Integrated specialty lubricants producer with 34,000 BPD1 of production capacity Sells finished lubricants & products in >80 countries under Petro- Canada Lubricants, Sonneborn, Red Giant Oil & HollyFrontier product lines Production facilities in Mississauga, Ontario; Tulsa, Oklahoma; Petrolia, Pennsylvania; & the Netherlands One of the largest North American white oil & group III base oil producers Iconic DINO brand and customer loyalty Over 1,5002 branded retail sites Over 300 branded sites under license program outside of supply footprint Sinclair branded wholesale business generates an uplift versus unbranded sales 10,000 BPD1 Renewable Diesel Unit capacity at Sinclair, WY Refinery 6,000 BPD1 Renewable Diesel Unit capacity at Cheyenne, WY Refinery 9,000 BPD1 Renewable Diesel Unit capacity at Artesia, NM Refinery Pre-Treatment Unit at Artesia, NM Refinery 3. On August 16, 2023, HF Sinclair and HEP announced that they have entered into a definitive merger agreement for HF Sinclair to acquire all of the publicly held LP interests in HEP in exchange for a combination of common stock of HF Sinclair and cash. The transaction is expected to close in the fourth quarter of 2023, assuming the satisfaction or waiver of all the conditions pursuant to the merger agreement. 4. As of the nine months ended September 30, 2023.

4 HF Sinclair Asset Footprint

5 Environmental, Social and Governance (ESG)1 1. Please see HF Sinclair 2022 Sustainability Report for additional ESG related information. https://www.hfsinclair.com/sustainability/sustainability-report/default.aspx 2. OSHA: Occupational Safety and Health Act Scope 1 and Scope 2 GHG Intensity Target Established goal to reduce Scope 1 and Scope 2 net emissions intensity by 25% by 2030, through offsets and reductions versus 2020 levels Renewable Fuels Investments Made significant investments in 3 renewable diesel projects in Artesia, NM, Cheyenne, WY and Sinclair, WY Renewable diesel is a cleaner burning fuel and, depending on the feedstock, can have 50% to 80% lower lifecycle GHG emissions compared to conventional diesel Recycling and Water Conservation Our Navajo refinery implemented a project to sell wastewater from its operations to upstream operators to reduce the amount of freshwater used in upstream operations in Artesia, NM, a high-risk region for water scarcity Product Innovation Developed SonneNatural, a line of 100% natural plant-based products, ENVIRON™ MV, a line of biodegradeable hydraulic oils, and other oils and lubricants designed to promote improved fuel economy, higher energy efficiency and support alternative energy systems GovernanceSocialEnvironmental “One HF Sinclair Culture” program instills integrity, teamwork and ownership at every level, as well as a focus and commitment to safety, human capital management and community relations, teamwork, ownership and inclusion Safety “Goal Zero” Over the past five years ended December 31, 2022, our OSHA2 total recordable incident rate declined by 45% Inclusion Commitment to attracting, retaining and developing a diverse and inclusive workforce, including through partnerships with historically Black colleges to offer summer internship opportunities Supporting our employees and communities by investing in racially and ethnically underrepresented groups, women, and veterans through program sponsorships Human Capital Management Invested in professional development scholarships and education assistance programs that enable employees of all levels to enhance their skills and grow professionally Community Relations Active volunteering and philanthropic involvement in communities where we operate Board leadership provides significant industry expertise, alongside diverse business, financial and environmental, health and safety experience Board level committees with specific oversight over ESG matters include the Compensation Committee, Environmental, Health, Safety, and Public Policy Committee and the Nominating, Governance and Social Responsibility Committee 10 of 12 directors independent, including chair 2 board members are women 4 racially/ethnically diverse board members Long standing commitment to ethical behavior is inherently tied to how we do business Code of Business Conduct and Ethics among governing principles Executive compensation strongly aligned with shareholders and long-term performance ROCE, TSR, Operational Efficiency, and Safety drive performance pay Performance measures expanded in 2022 to include an ESG metric to be applied to the 2023 performance period

6 Refining Overview Expanded Footprint centered around Mid-Continent, Southwest, Rocky Mountain and Pacific Northwest with 678,000 BPD oil processing capacity West Region Puget Sound Refinery (Anacortes, WA) 149,000 BPD capacity Crude slate: Canadian mixed sweet and sour and Alaskan North Slope crude Distributes to high-margin markets in WA, OR, and British Columbia Navajo Refinery (Artesia, NM) 100,000 BPD capacity Crude slate: Permian sweet and sour crude Distributes to high-margin markets in AZ, NM, and west TX Parco Refinery (Sinclair, WY) 94,000 BPD capacity Crude slate: Canadian heavy and Rockies sweet crude Distributes to high-margin markets in greater Rocky Mountain region Woods Cross Refinery (Salt Lake City, UT) 45,000 BPD capacity Crude slate: Regional sweet and heavy crude Distributes to high-margin markets in UT, ID, NV, WY, and eastern WA Casper Refinery (Casper, WY) 30,000 BPD capacity Crude slate: Rockies sweet Distributes to high-margin markets in greater Rocky Mountain region Mid-Continent Region El Dorado Refinery (El Dorado, KS) 135,000 BPD capacity Crude slate: WCS, Bakken and Permian sour crude Distributes to high-margin markets in CO, and Mid- Continent states Tulsa Refinery (Tulsa, OK) 125,000 BPD capacity Crude slate: Domestic sweet with up to 10,000 BPD of WCS crude Distributes to Mid-Continent states Integrated refinery with base oil and lubricant production

7 Crude and Product Advantage Proximity to North American Crude Production High Value Premium Product Markets Laid-In Crude Advantage Refinery location and configuration enables fleet- wide crude slate discounts to WTI Approximately 140,000 – 160,000 barrels per day Canadian, primarily heavy sweet and sour crude Approximately 140,000 – 160,000 barrels per day of Permian crude 42% 36% 13% 3% 6% 2022 Average Crude Slate Sweet Sour Heavy Wax Crude Other Regional Gasoline Pricing vs Gulf Coast1 $1.42 $6.25 $0.47 $6.39 $8.81 $15.28 $10.38 $(5) $- $5 $10 $15 $20 $25 Group 3 vs GC PNW vs GC Chicago vs GC Denver vs GC Phoenix vs GC Salt Lake vs GC Las Vegas vs GC 2018 2019 2020 2021 2022 Average $1.44 $10.10 $1.70 $6.74 $17.29 $14.69 $16.06 $(5) $- $5 $10 $15 $20 $25 Group 3 vs GC PNW vs GC Chicago vs GC Denver vs GC Phoenix vs GC Salt Lake vs GC Las Vegas vs GC 2018 2019 2020 2021 2022 Average 1. Gulf Coast: CBOB Unleaded 84 Octane Spot Price, Group 3: Unleaded 84 Octane Spot Price, PNW: Sub-octane Spot Price, Chicago: Unleaded CBOB 84 Octane Spot Price, Denver: CBOB 81.5 Octane Rack Price, Phoenix: CBG 84 Octane Rack Price, SLC: CBOB 81.5 Octane Rack Price, Las Vegas: CBOB 84 Octane Rack Price. Source: MarketView 2. Source: MarketView Regional ULSD Pricing vs Gulf Coast2

8 Refining Segment Earnings Power Illustrative Mid-Cycle Refining EBITDA1 Gulf Coast 3-2-1 Crack $10.00 Brent/WTI Spread $4.00 Product Transportation to HF Sinclair Markets $4.00 HF Sinclair Index $18.00 Capture Rate 70% Realized Gross Margin Per Barrel $12.60 Operating Expense Per Barrel $6.00 Target Throughput 640,000 Refining SG&A (millions) $175 Mid-Cycle Refining EBITDA ~$1.35 B $19.14 $20.62 $21.26 $12.19 $21.03 $39.57 $10 $15 $20 $25 $30 $35 $40 2017 2018 2019 2020 2021 2022 HF Sinclair Consolidated 3-2-1 Index2 $/Barrel 1. Illustrative Mid-Cycle Refining EBITDA based on management’s current expectations. See definition in Appendix. Because Illustrative Mid-Cycle Refining EBITDA is based in part on management’s current expectations, we cannot provide a reconciliation to the most closely comparable GAAP metric without unreasonable effort. 2. 2021 includes November and December contribution from Puget Sound Refinery and does not include the Parco or Casper refineries acquired from Sinclair in March 2022. 2022 includes the contribution from the Parco and Casper refineries starting from the date of their acquisition on March 14, 2022.

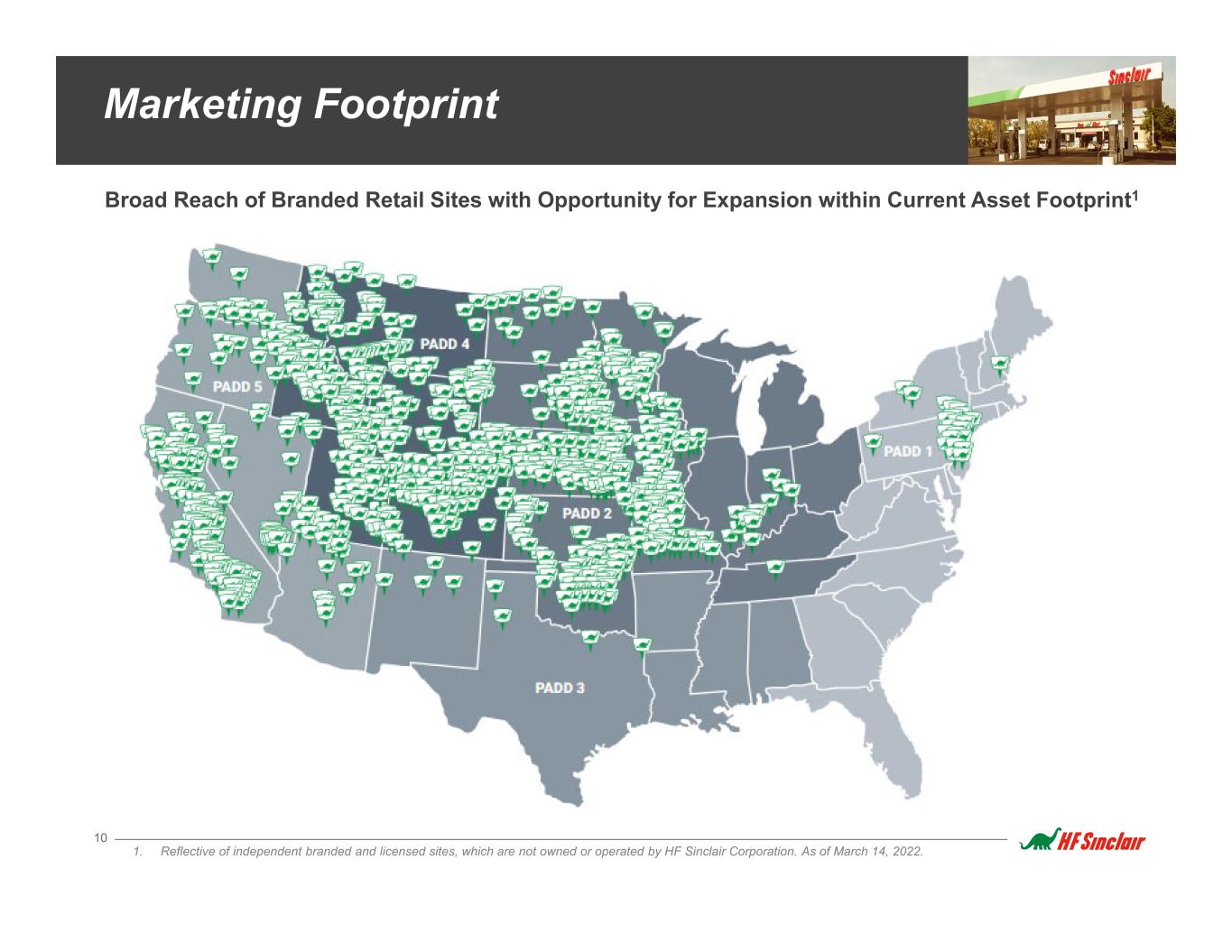

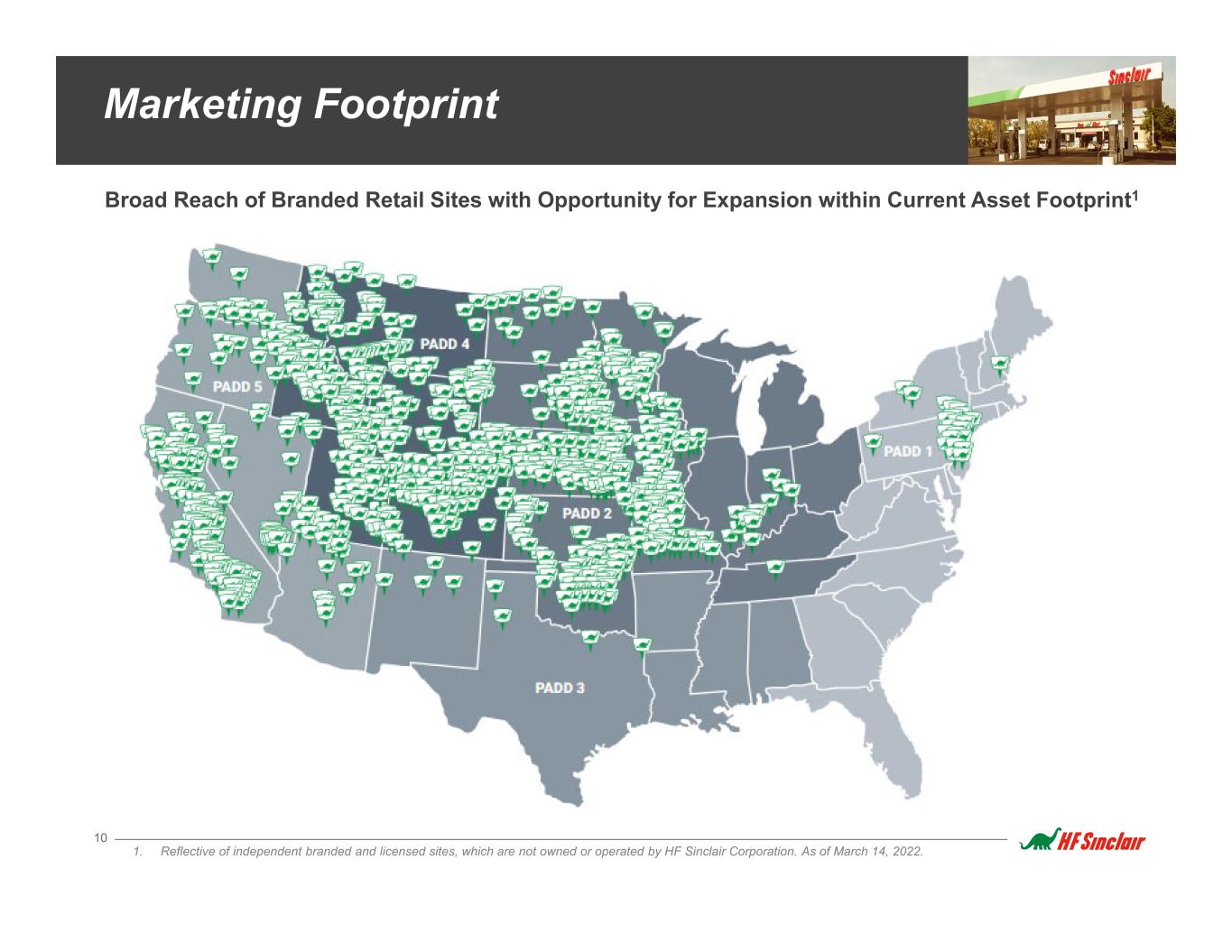

9 Marketing Overview Diversifying with HF Sinclair’s Iconic Brand and Integrated Distribution Network Provides a consistent sales channel for produced fuels with stable margins as well as additional earnings from brand licensing and credit card programs Footprint1: Iconic DINO brand 1,500+2 wholesale branded sites Over 2B gallons per year of branded fuel sales 300+ sites branded under a license program outside supply footprint Financial Highlights: Provides further advantage through RIN generation Additional margin from branded credit card program Sinclair branded wholesale business generates an uplift versus unbranded sales Driving growth and leveraging increased distribution network Downward integration of legacy HollyFrontier products Opportunities with accelerated brand growth across HF Sinclair products and geographies Significant RIN generation through distribution network 1. As of September 30, 2023. 2. Includes non-Sinclair branded sites from legacy HollyFrontier agreements.

10 Marketing Footprint Broad Reach of Branded Retail Sites with Opportunity for Expansion within Current Asset Footprint1 1. Reflective of independent branded and licensed sites, which are not owned or operated by HF Sinclair Corporation. As of March 14, 2022.

11 Renewables Overview Creating Large Scale Leading Renewables Business A leading U.S. producer of Renewable Diesel with 3 production facilities ~380 million gallons of renewable diesel annual capacity Pre-treatment unit providing significant feedstock flexibility Size and scale support operational synergies Plan to expand the renewables segment to become a meaningful part of HF Sinclair’s cash flow and diversify from traditional petroleum fuels refining Consumer preference for low carbon fuels continues to grow, driving expansion of government renewable fuel programs, requirements and incentives to more states in the United States and across the world HF Sinclair can leverage utilities and infrastructure at existing refineries for renewables production Integrated solution to the Renewable Fuels Standard (RFS) Strengthens ESG profile Renewable Diesel Defined Renewable diesel is a cleaner burning fuel with 50% to 80% lower lifecycle GHG emissions than conventional diesel Renewable diesel is not biodiesel Same feedstock Different process Chemically identical to conventional diesel No blend limit, existing diesel fleet can run 100% with no risk to engine operation

12 Renewable Diesel Asset Profile ~380 million gallons of renewable diesel annual capacity Renewable Diesel Units Sinclair Renewable Diesel Unit 10,000 BPD RDU co-located at Sinclair, WY refinery Operational since 2018 LCFS program pathways in California and British Columbia Cheyenne Renewable Diesel Unit 6,000 BPD RDU HF Sinclair converted existing hardware to produce renewable diesel Completed: Q4 2021 Artesia Renewable Diesel Unit 9,000 BPD RDU co-located at Navajo refinery Includes rail infrastructure and storage tanks Existing hydrogen and utilities provided by the refinery Completed: Q2 2022 Pre-Treatment Unit Pre-treatment capacity allows our Renewable Diesel Units to process a variety of feedstocks Target the processing of lower CI distillers corn oil, tallow and lower priced degummed soybean Artesia Pre-Treatment Unit Completed: Q1 2022 Co-located at Artesia, NM Refinery

13 Lubricants & Specialty Products Integrated Model from Crude to Finished Products Mississauga Base Oil Plant Base Oil Production Blending & Packaging MarketingDistribution R&D VGO/HCB Base Oil White Oils Specialty Products Waxes Finished Lubricants & Greases Sales Base Oil Petrolatums Sodium Sulfonates 3rd Party Base Oil Red Giant Facilities Sonneborn Facilities Mississauga Facility

14 Lubricants & Specialty Products Diverse Suite of Products Supplied to Major Industrial and Consumer Brands Brands Product Type • Finished Lubricants & Greases • Specialty Products • Waxes • White Oils • Base Oils • Finished Lubricants & Greases • Waxes • White Oils • Petrolatums • Specialty Products • Finished Products & Greases • Specialty Products • Waxes • Base Oils Customer Base • Consumer Discretionary • Energy • Healthcare • Industrials • Materials • Utilities • Communications • Consumer Discretionary • Consumer Staples • Energy • Healthcare • Industrials • Consumer Staples • Industrials • Materials • Consumer Staples • Industrials • Materials Applications Heavy Duty Engine Oils Hydraulic Lubrication Fluids Lubricants & Protective Greases Petroleum Jellies Food Waxes Cosmetics Locomotive Engine Oils Gear Oils Agriculture Solvents Tire Protectants Candle Waxes Asphalt Modifiers

15 Opportunity Across the Value Chain Upgrade Existing Base Oils into Finished Products Converting one barrel of Base Oil sales into Finished Product sales results in an average margin increase of ~$50/bbl1 2022 Product Slate by Volume Finished Lubricants & Greases Petrolatums Waxes White Oils Specialty Products Base Oils Margin Value $/bbl 1. Margin per barrel is a measure of value contribution per unit of output. Margin per barrel means the difference between average net sales price and average cost per barrel sold calculated on a per-barrel sold basis. Finished Products 51% Base Oils 28% Other 21%

16 Lubricants & Specialty Products Multiple Up-Lift Note: Multiple represents range of Enterprise Value (EV) / EBITDA multiples for the referenced peer group, which are sourced from Bloomberg. EV / EBITDA is not a financial measure prepared in accordance with GAAP and should not be viewed as an alternative to GAAP measures of performance. See definition in Appendix. Segment(s) Multiple (EV / EBITDA) Margin Profile Peer Group Integrateds & Refiners 5-7x Variable Integrateds: BP, CVX, SHEL, XOM Refiners: CLMT, CVI, DK, MPC, PBF, PSX, VLO MLP 6-9x Stable DKL, MPLX Lubricants & Specialty Products 10-13x Stable FPE GY, IOSP, KWR, NEU, VVV

17 Holly Energy Partners (HEP) Company Profile STABLE EARNINGS FINANCIAL TARGETS & GUIDANCE BALANCE SHEET HIGHLIGHTS Revenues are nearly 100% fee-based with de minimis commodity risk Customer base consisting of refining companies (contracts not with E&Ps) Minimum Volume Commitments (MVCs) comprise approximately 73% of Total Tariffs and Fees2 Substantially all MVC revenues tied to PPI or FERC COMPANY OVERVIEW (NYSE: HEP) Maintain Balance Sheet flexibility Operate within free cash flow3 while reducing leverage HEP Corporate Credit Ratings: S&P BB+, Moody’s Ba2, Fitch BB+ Earliest maturity in 2025 Integrated systems of petroleum product and crude pipelines, storage tanks, distribution terminals, loading racks and processing units located at or near HF Sinclair’s refining assets in high growth markets Assets strategically located in core growth areas in the Mid-Continent, Southwest and Northwest regions of the United States 47% owned by refining parent HF Sinclair Corporation (NYSE:DINO)1 Target distribution coverage3 of at least 1.3x Target leverage3: 3.0-3.5x Self-funding model to cover all capital expenditures and distributions with cash flow from operations Current quarterly distribution of $0.35 per unit4 1. On August 16, 2023, HF Sinclair and HEP announced that they have entered into a definitive merger agreement for HF Sinclair to acquire all of the publicly held LP interests in HEP in exchange for a combination of common stock of HF Sinclair and cash. The transaction is expected to close in the fourth quarter of 2023, assuming the satisfaction or waiver of all the conditions pursuant to the merger agreement. 2. As of the nine months ended September 30, 2023. Total Tariffs and Fees are calculated as revenues plus tariffs and fees not included in revenues due to impacts from lease accounting for certain tariffs and fees. 3. Distribution coverage ratio, leverage ratio and free cash flow are not financial measures prepared in accordance with GAAP. Please see definitions in the Appendix. 4. Consistent with the terms of the definitive merger agreement with HF Sinclair, HEP expects its future cash distribution will continue as long as it remains a public company.

18 HEP Assets Holly Energy Partners owns and operates substantially all of the refined product pipeline and terminalling assets that support HF Sinclair’s refining and marketing operations in the Mid- Continent, Southwest and Northwest regions of the United States Approximately 4,400 miles of crude oil and petroleum product pipelines Approximately 17.8 million barrels of refined product and crude oil storage with 19 terminals and 7 loading rack facilities in 13 western and mid-continent states Refinery processing units in Woods Cross, UT and El Dorado, KS 50% joint venture interest in Cheyenne Pipeline LLC – the owner of an 87-mile crude oil pipeline from Fort Laramie, Wyoming to Cheyenne, Wyoming. 50% joint venture interest in Osage Pipe Line Company, LLC – the owner of a 135-mile crude oil pipeline from Cushing, Oklahoma to El Dorado, Kansas 50% joint venture interest in Cushing Connect Pipeline & Terminal LLC – the owner of a 50- mile, 160,000 barrel per day crude oil pipeline from Cushing, Oklahoma to Tulsa, Oklahoma and 1.5 million barrels of crude oil storage in Cushing, Oklahoma 49.995% joint venture interest in Pioneer Investments Corp. – the owner of a 310-mile, 65,000 barrel per day refined product pipeline from Sinclair, Wyoming to the North Salt Lake Terminal with 655,000 barrels of refined product storage capacity 25.06% joint venture interest in Saddle Butte Pipeline III, LLC – the owner of a 220 mile, 60,000 barrel per day crude oil pipeline from the Powder River Basin in Wyoming to Casper, Wyoming and 160,000 barrels of crude oil storage at the Highland Flats Terminal in Wyoming

19 HEP Ownership Structure1 99.999% interest 66,810,171 HEP units2 53% LP interest $1,426mm Value3 59,630,030 HEP units2 47% LP interest $1,273mm Value3 HF SINCLAIR CORPORATION (HF Sinclair) GENERAL PARTNER (GP) HOLLY LOGISTIC SERVICES L.L.C. HOLLY ENERGY PARTNERS, L.P. (HEP) PUBLIC Non-economic GP interest Corporate Ratings: Baa3/BBB-/BBB- 1. On August 16, 2023, HF Sinclair and HEP announced that they have entered into a definitive merger agreement for HF Sinclair to acquire all of the publicly held LP interests in HEP in exchange for a combination of common stock of HF Sinclair and cash. The transaction is expected to close in the fourth quarter of 2023, assuming the satisfaction or waiver of all the conditions pursuant to the merger agreement. 2. Unit count as of October 31, 2023. 3. Based on HEP unit closing price on November 6, 2023.

FINANCIAL STRATEGY RATEGY

Capital Allocation Strategy1 Free Cash Flow2 Drives Capital Returns & Balanced Capital Allocation 21 2023 and Beyond Target 50% Payout Ratio1,3 (dividends + repurchases) of Adjusted Net Income2 Pay $0.45 regular quarterly dividend New $1 billion share repurchase program authorized on August 15, 20233 Pay $0.45 regular quarterly dividend (increased quarterly dividend to $0.45 in Q1 2023) Returned over $1.1 billion through dividends and share repurchases in 2023 YTD3 Near-term Mid to Long-term Maintain Investment Grade Credit Ratings S&P (BBB-), Moody’s (Baa3) and Fitch (BBB-) 1. Based on management’s current estimates and expectations and subject to market conditions, corporate tax, regulatory and other relevant considerations. 2. Adjusted Net Income, Payout Ratio and Free Cash Flow are not financial measures prepared in accordance with GAAP and should not be viewed as an alternative to GAAP measures of performance. See definitions in Appendix. 3. As of October 20, 2023, the remaining authorization under the new $1.0 billion share repurchase program authorized by the Board of Directors on August 15, 2023 was approximately $750 million.

APPENDIX RATEGY

HF Sinclair Capital Structure Strengthening Credit Profile through Reduced Leverage, Increased Scale and Portfolio Diversification 23 ($ in millions) Cash and Cash Equivalents $2,215 HF SINCLAIR CORPORATION 2.625% Senior Notes due 20231 $308 5.875% Senior Notes due 2026 $1,000 4.500% Senior Notes due 2030 $400 HF Sinclair Total Debt2 $1,708 HOLLY ENERGY PARTNERS 6.375% Senior Notes due 2027 $400 5.000% Senior Notes due 2028 $500 Credit Agreement (matures 7/2025) $579 HEP Total Debt2 $1,479 Consolidated Debt2 $3,187 Stockholders’ Equity (includes NCI) $10,615 Total Capitalization $13,802 Consolidated Debt / Capitalization3 23% Consolidated Net Debt3 / Capitalization3 7% CONSOLIDATED TOTAL LIQUIDITY4 $4,486 HF Sinclair Consolidated Capital Structure: as of 9/30/2023 1. In October 2023, we repaid at maturity our $308 million aggregate principal amount of 2.625% Senior Notes. 2. Includes current and long-term debt, excluding unamortized discount and debt issuance costs and, in the case of HF Sinclair Corporation, includes subsidiary debt of HollyFrontier Corporation. 3. See definition in Appendix. 4. Includes Cash and Cash Equivalents of $2.215 billion, $1.65 billion of availability under the HF Sinclair revolving credit facility and $621 million of availabiity under the $1.2 billion HEP revolving credit facility.

Note: Reflective of Capex expectations provided in 3Q 2023 10-Q filing. Refining - $250 – $270 million Renewables - $25 – $30 million Lubricants & Specialty Products - $35– $45 million Marketing - $20 – $30 million Corporate - $40 – $60 million Turnarounds & Catalysts - $500 – $585 million HEP - $30 – $40 million Refining 27% Renewables 3% Lubricants & Specialty Products 4% Marketing 3% Corporate 5% Turnarounds & Catalysts 55% HEP 4% 2023 Expected Capex Allocation 2023 Capex Guidance 24

Business Definitions 25 BPD: the number of barrels per calendar day of crude oil or petroleum products. Blenders Tax Credit (BTC): Federal tax credit where qualified biodiesel blenders are eligible for an income tax credit of $1.00 per gallon of biodiesel or renewable diesel that is blended with petroleum diesel. Biodiesel (FAME): a fuel derived from vegetable oils or animal fats that meet the requirements of ASTM D 6751. Biodiesel is made through a chemical process called transesterification where glycerin is separated from the fat or vegetable oil leaving behind methyl esters (biodiesel) and byproduct glycerin. In the presentation we also refer to this as traditional biodiesel. California’s Low Carbon Fuel Standard (LCFS): California program that mandates the reduction in the carbon intensity of transportation fuels by 20% by 2030 Carbon Intensity (CI): the amount of carbon emitted per unit of energy consumed, under LCFS it is a “well-to-wheels” analysis of greenhouse gas emissions in transportation fuel, meaning emissions are quantified from feedstock cultivation through combustion. California Air Resources Board (CARB): California’s clean air agency that administers the LCS program. California Reformulated Gasoline Blend stock for Oxygenate Blending (CARBOB): a petroleum-derived liquid which is intended to be, or is represented as, a product that will constitute California gasoline upon the addition of a specified type and percentage (or range of percentages) of oxygenate to the product after the product has been supplied from the production or import facility at which it was produced or imported. IDR: Incentive Distribution Rights Lubricant: a solvent neutral paraffinic product used in commercial heavy duty engine oils, passenger car oils and specialty products for industrial applications such as heat transfer, metalworking, rubber and other general process oil. RBOB: Reformulated Gasoline Blendstock for Oxygen Blending Refined Bleached Deodorized Soybean Oil (RBD SBO): primary feedstock for FAME Biodiesel currently in the U.S. accounting for 50% of biodiesel production. Soybean Oil is produced by crushing Soybeans which yield 20% Oil and 80% meal. Crude Soybean Oil is then processed (refined) removing impurities, color and odor. Renewable Diesel (RD): a fuel derived from vegetable oils or animal fats that meets the requirements of ASTM 975. Renewable diesel is distinct from biodiesel. It is produced through various processes, most commonly through hydrotreating, reacting the feedstock with hydrogen under temperatures and pressure in the presence of a catalyst. Renewable Diesel is chemically identical to petroleum based diesel and therefore has no blend limit. Renewable Fuel Standard (RFS): national policy administered by EPA requiring a specified volumes of different renewable fuels (primary categories are ethanol and biodiesel) that must replace petroleum-based transportation fuel. Renewable Identification Number (RIN): a serial number assigned to each batch of biofuel produced until that gallon is blended with gasoline or diesel resulting in the separation of the RIN to be used for compliance. RIN category (D-code) is assigned for each renewable fuel pathway determined by feedstock, production process and fuel type. D6 RIN (Renewable Fuel) – corn based ethanol, must reduce lifecycle greenhouse gas emissions by at least 20% D5 RIN (Advanced Biofuel) – any renewable biomass except corn ethanol that reduces lifecycle greenhouse gas emissions by at least 50% D4 RIN (Biomass-based Diesel) – biodiesel and renewable diesel, must reduce lifecycle greenhouse gas emissions by at least 50% Renewable Volume Obligation (RVO): the required volume in gallons of biofuel refiners are obligated to blend into the gasoline and diesel pool. EPA sets volumetric standard which are then converted to percent standards based on EIA’s projected gasoline and diesel consumption. Equivalence Value (EV): a number used to determine how many RINs can be generated from one gallon of renewable fuel based on the energy content (Btu/gallon) and renewable content of a fuel compared to Ethanol. Ethanol EV is 1.0 RIN per gallon. Biodiesel is 1.5 RINs per gallon and Renewable Diesel is 1.7 RINs per gallon. Sour Crude: crude oil containing quantities of sulfur greater than 0.4 percent by weight, while “sweet crude oil” means crude oil containing quantities of sulfur equal to or less than 0.4 percent by weight. WCS: Western Canada Select crude oil, made up of Canadian heavy conventional and bitumen crude oils blended with sweet synthetic and condensate diluents. WTI: West Texas Intermediate, a grade of crude oil used as a common benchmark in oil pricing. WTI is a sweet crude oil and has a relatively low density. WTS: West Texas Sour, a medium sour crude oil.

Non-GAAP Definitions Non GAAP measurements: We report certain financial measures that are not prescribed or authorized by U. S. generally accepted accounting principles ("GAAP"). We discuss management's reasons for reporting these non-GAAP measures below. Although management evaluates and presents these non-GAAP measures for the reasons described below, please be aware that these non-GAAP measures are not alternatives to revenue, operating income, income from continuing operations, net income, or any other comparable operating measure prescribed by GAAP. In addition, these non-GAAP financial measures may be calculated and/or presented differently than measures with the same or similar names that are reported by other companies, and as a result, the non- GAAP measures we report may not be comparable to those reported by others. Also, we have not reconciled to non-GAAP forward-looking measures, estimations or guidance, including Illustrative Mid-Cycle Refining EBITDA and Illustrative Free Cash Flow, to their corresponding GAAP measures because certain items that impact these measures are unavailable or cannot be reasonably predicted without unreasonable effort. Adjusted EBITDA: HF Sinclair Adjusted EBITDA is calculated as EBITDA plus adjustments for extraordinary items, other unusual or non-recurring items, each as determined in accordance with GAAP and identified in the financial statements, such as lower of cost or market inventory valuation adjustments, gain on sale of real property, severance costs, restructuring charges, Cheyenne refinery LIFO inventory liquidation costs, decommissioning costs, HF Sinclair’s pro-rata share of HEP’s Osage environmental remediation costs, net of insurance recoveries, acquisition integration and regulatory costs and gain on tariff settlement. HEP Adjusted EBITDA is calculated as EBITDA plus adjustments for extraordinary items, other unusual or non-recurring items, each as determined in accordance with GAAP and identified in the financial statements, such as gain on sales-type leases, gain on significant asset sales, goodwill impairment, share of Osage environmental remediation costs, net of insurance recoveries, acquisition integration and regulatory costs, tariffs and fees not included in revenues due to impacts from lease accounting for certain tariffs and fees, lease payments not included in operating costs and expenses. Adjusted EBITDA is not a calculation based upon GAAP. However, the amounts included in the Adjusted EBITDA calculation are derived from amounts included in our consolidated financial statements. Adjusted EBITDA should not be considered as an alternative to net income or operating income, as an indication of our operating performance or as an alternative to operating cash flow as a measure of liquidity. Adjusted EBITDA is not necessarily comparable to similarly titled measures of other companies. Adjusted EBITDA is presented here because it is a widely used financial indicator used by investors and analysts to measure performance. HF Sinclair Adjusted EBITDA is reconciled to net income under the section entitled “Reconciliations to Amounts Reported Under Generally Accepted Accounting Principles” in HollyFrontier Corporation’s quarterly earnings releases furnished on Form 8-K for all periods prior to the first quarter of 2022 and in HF Sinclair’s quarterly earnings releases furnished on Form 8-K for all periods starting with and occurring after the first quarter of 2022, each of which are or will be available on our website, www.hfsinclair.com. HEP Adjusted EBITDA is reconciled to net income attributable to the partners in a footnote to the “Income, Distributable Cash Flow and Volumes” table in “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” in HEP’s Form 10-K for the year ended December 31, 2022 or in a footnote to the “Income, Distributable Cash Flow and Volumes” table in HEP’s quarterly earnings releases, available on our website, www.hollyenergy.com. Adjusted Net Income: Adjusted Net Income (also referred to as Adjusted Net Income attributable to HF Sinclair stockholders) is net income (loss) attributable to HF Sinclair stockholders adjusted to reflect the after-tax effect of special items that HF Sinclair believes are not indicative of its core operating performance that may obscure HF Sinclair’s underlying business results and trends. Adjusted Net Income attributable to HF Sinclair stockholders is reconciled to net income under the section entitled “Reconciliations to Amounts Reported Under Generally Accepted Accounting Principles” in HollyFrontier’s quarterly earnings releases furnished on Form 8-K for all periods prior to the first quarter of 2022 and in HF Sinclair’s quarterly earnings releases furnished on Form 8-K for all periods starting with and occurring after the first quarter of 2022, each of which are or will be available on our website, www.hfsinclair.com. Capitalization: Capitalization is calculated as Stockholder’s Equity, inclusive of non-controlling interest, plus consolidated total debt. Consolidated Net Debt: Consolidated net debt is calculated as total debt, excluding unamortized discount and debt issuance costs, less cash and cash equivalents. Consolidated Net Debt is not a calculation based upon GAAP. However, the amounts included in the Consolidated Net Debt calculation are derived from amounts included in our consolidated financial statements. Debt-To-Capital: Debt-to-Capital is a measurement of financial leverage, calculated as long-term debt divided by total capital. Debt includes all long-term obligations. Total capital includes the debt and shareholders' equity. Distributable Cash Flow: Distributable cash flow (DCF) is not a calculation based upon GAAP. However, the amounts included in the calculation are derived from amounts separately presented in HEP’s consolidated financial statements, with the general exception of maintenance capital expenditures. Distributable cash flow should not be considered in isolation or as an alternative to net income or operating income as an indication of HEP’s operating performance or as an alternative to operating cash flow as a measure of liquidity. Distributable cash flow is not necessarily comparable to similarly titled measures of other companies. Distributable cash flow is presented here because it is a widely accepted financial indicator used by investors to compare partnership performance. It is also used by HEP management for internal analysis and HEP’s performance units. We believe that this measure provides investors with an enhanced perspective of the operating performance of HEP’s assets and the cash HEP is generating. HEP’s historical distributable cash flow for prior years and fiscal quarters is reconciled to net income in a footnote to the table in “Item 6. Selected Financial Data” in HEP’s 10-Ks prior to the 10-K for the year ended December 31, 2021 and in a footnote to the “Income, Distributable Cash Flow, Volumes and Balance Sheet Data” table in “Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations” in HEP’s 10-Qs and in “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” in HEP’s 10-Ks starting with the year ended December 31, 2021, available at www.hollyenergy.com. 26

Non-GAAP Definitions Distribution Coverage Ratio: Distribution coverage ratio is the ratio of distributable cash flow attributable to GP and LP unitholders to total GP and LP distributions declared. Earnings Per Share (EPS): earnings per share is calculated as net income (loss) attributable to stockholders divided by the average number of shares of common stock outstanding. EBITDA: Earnings before interest, taxes, depreciation and amortization, is calculated as net income attributable to HF Sinclair stockholders plus (i) interest expense net of interest income, (ii) income tax provision, and (iii) depreciation and amortization. EBITDA is not a calculation provided for under GAAP; however, the amounts included in the EBITDA calculation are derived from amounts included in our consolidated financial statements. EBITDA should not be considered as an alternative to net income or operating income as an indication of our operating performance or as an alternative to operating cash flow as a measure of liquidity. EBITDA is not necessarily comparable to similarly titled measures of other companies. EBITDA is presented here because it is a widely used financial indicator used by investors and analysts to measure performance. EBITDA is also used by our management for internal analysis and as a basis for financial covenants. Our historical EBITDA is reconciled to net income under the section entitled “Reconciliations to Amounts Reported Under Generally Accepted Accounting Principles” in “Item 7A. Quantitative and Qualitative Disclosures About Market Risk” in HF Sinclair’s Form 10-K for the year ended December 31, 2022. Our historical EBITDA for the prior fiscal quarters is reconciled to net income under the section entitled “Reconciliations to Amounts Reported Under Generally Accepted Accounting Principles” in “Item 3. Quantitative and Qualitative Disclosures About Market Risk” in HF Sinclair’s Form 10-Qs, all of which are or will be available on our website, www.hfsinclair.com. Enterprise Value: Enterprise value is a measure of a company’s total market capitalization, plus outstanding debt, minus cash and cash equivalents. Free Cash Flow: Free cash flow is calculated by taking operating cash flow and subtracting capital expenditures. Illustrative Mid-Cycle Refining EBITDA: Illustrative Mid-Cycle Refining EBITDA means, at any time, management’s good faith estimate of the EBITDA of the Refining segment based on an estimate of average historical peak and trough prices through the economic cycle. Leverage Ratio: Leverage ratio is the ratio of consolidated debt to last twelve months Adjusted EBITDA. Payout Ratio: Payout ratio is the sum of dividends and stock buybacks divided by the Adjusted Net Income. 27

HF Sinclair Index 28 1. West region includes Puget Sound Refinery starting November 1, 2021. 2. West region includes Parco and Casper Refineries acquired March 14, 2022 starting April 1, 2022. Note: Updates to this index are published on a monthly basis on the first day of each month under the “HF Sinclair Index” tab of the HF Sinclair Investor Relations website at https://investor.hfsinclair.com/investor-relations/default.aspx

HF Sinclair Disclosure 29 Light Product Index Appendix HF Sinclair's actual pricing and margins may differ from benchmark indicators due to many factors. For example: - Crude Slate differences – HF Sinclair runs a wide variety of crude oils across its refining system and crude slate may vary quarter to quarter. - Product Yield differences – HF Sinclair’s product yield differs from indicator and can vary quarter to quarter as a result of changes in economics, crude slate, and operational downtime. - Other differences including, but not limited to, secondary costs such as product and feedstock transportation costs, purchases of environmental credits, quality differences, location of purchase or sale, and hedging gains/losses. Moreover, the presented indicators are generally based on spot sales, which may differ from realized contract prices. Market prices are available from a variety of sources, each of which may vary slightly. Please note that this data may differ from other sources due to adjustments made by data providers and due to differing data definitions. Below are indicator definitions used for purposes of this data. MidCon Indicator: (100% Group 3: Sub octane and ULSD) – WTI West Indicator: 34% Puget Sound: (100% Pacific Northwest Sub-octane Gasoline; 100% Pacific Northwest ULSD) – WTI 28% Navajo: (50% El Paso Subgrade, 50% Phoenix CBG; 50% El Paso ULSD, 50% Phoenix ULSD) – WTI 20% Sinclair: (70% Denver Regular Gasoline, 30% Salt Lake City Regular Gasoline; 60% Denver ULSD, 40% Salt Lake City ULSD) – WTI 10% Woods Cross: (60% Salt Lake City Regular Gasoline, 40% Las Vegas Regular Gasoline; 80% Salt Lake City ULSD, 20% Las Vegas ULSD) – WTI 8% Casper: (70% Denver Regular Gasoline, 30% Salt Lake City Regular Gasoline; 60% Denver ULSD, 40% Salt Lake City ULSD) – WTI Lubricants Index Appendix HF Sinclair's actual pricing and margins differ from benchmark indicators due to many factors. For example: - Feedstock differences – HF Sinclair runs a variety of vacuum gas oil streams and hydrocracker bottoms across its refining system and feedstock slate may vary quarter to quarter. - Product Yield differences – HF Sinclair’s product yield differs from indicator and can vary quarter to quarter as a result of changes in economics and feedstocks. - Other differences including, but not limited to, secondary costs such as product and feedstock transportation costs, quality differences and location of purchase or sale. Moreover, the presented indicators are generally based on spot commodity base oil sales, which may differ from realized contract prices. Market prices are available from a variety of sources, each of which may vary slightly. Please note that this data may differ from other sources due to adjustments made by data providers and due to differing data definitions. Below are indicator definitions used for purposes of this data. Group I Base Oil Indicator: (50% Group I SN150, 50% Group I SN500) – VGO Group II Base Oil Indicator: (33.3% Group II N100, 33.3% Group II N220, 33.3% Group II N600) – VGO Group III Base Oil Indicator: (33.3% Group III 4cst, 33.3% Group III 6cst, 33.3% Group III 8cst) – VGO VGO: (US Gulf Coast Low Sulfur Vacuum Gas Oil) Renewable Diesel Index Appendix HF Sinclair's actual pricing and margins differ from benchmark indicators due to many factors. For example: - Feedstock differences – HF Sinclair runs a variety feedstocks across its renewable diesel units and feedstock slate may vary quarter to quarter. - Product Yield differences – HF Sinclair’s product yield differs from indicator and can vary quarter to quarter as a result of changes in economics, feedstocks and operational downtime. - Other differences including, but not limited to, secondary costs such as product and feedstock transportation costs, quality differences and location of purchase or sale. Moreover, the presented indicators are generally based on spot sales, which may differ from realized contract prices. Market prices are available from a variety of sources, each of which may vary slightly. Please note that this data may differ from other sources due to adjustments made by data providers and due to differing data definitions. Below are indicator definitions used for purposes of this data. Renewable Diesel Indicator: NYMEX NY Harbor ULSD + (1.7 * D4 RIN) + (0.0043 * California LCFS Credit) – (8.5 * CBOT Soybean Oil Month 1) + BTC BTC: (Blender's Tax Credit of $1.00 per gallon through December 31, 2022) California LCFS Credit: (California's Low Carbon Fuel Standard Credit) D4 RIN: (Bio-mass based Diesel Renewable Identification Number) Note: HF Sinclair Index includes Parco Refinery and Casper Refinery weighting contribution as of April 2022.

NYSE: DINO 2828 N. Harwood, Suite 1300 Dallas, TX 75201 214-954-6510 HFSinclair.com Craig Biery | VP, Investor Relations, FP&A Trey Schonter | Sr. Manager, Investor Relations investors@hfsinclair.com 214-954-6510