UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 1-SA

SEMIANNUAL REPORT PURSUANT TO REGULATION A

or

SPECIAL FINANCIAL REPORT PURSUANT TO REGULATION A

For the fiscal semi-annual period ended October 31, 2024

LGX Energy Corp.

(Exact name of issuer as specified in its charter)

| Nevada | | 87-3497563 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

6 ½ N. 2nd Ave

Suite 201

Walla Walla, Washington 99362

(Address, including zip code of principal executive office)

(509) 460-2518

(Issuer’s telephone number, including area code)

Series A 10% Convertible Preferred Stock

(Title of each class of securities issued pursuant to Regulation A)

LGX ENERGY CORP.

FOR THE SIX MONTHS ENDED OCTOBER 31, 2024 AND 2023 (Unaudited)

TABLE OF CONTENTS

Item 1. Management’s Discussion and Analysis of Financial Condition and Results of Operations

In this report, the terms “LGX Energy”, “we”, “us”, “our” or “the Company” refers to LGX Energy Corp. The following discussion of our financial condition and results of operations should be read in conjunction with our financial statements and the related notes included in this semi-annual report. The following discussion contains forward-looking statements that reflect our plans, estimates, and beliefs. Our actual results could differ materially from those discussed in the forward-looking statements.

Forward-Looking Statements

The following information contains certain forward-looking statements. Forward-looking statements are statements that estimate the happening of future events and are not based on historical fact. Forward-looking statements may be identified by the use of forward-looking terminology, such as “may,” “could,” “expect,” “estimate,” “anticipate,” “plan,” “predict,” “probable,” “possible,” “should,” “continue,” or similar terms, variations of those terms or the negative of those terms. The forward-looking statements specified in the following information have been compiled by our management on the basis of assumptions made by management and considered by management to be reasonable. Our future operating results, however, are impossible to predict and no representation, guaranty, or warranty is to be inferred from those forward-looking statements.

Results of Operations

For the Six Months Ended October 31, 2024 and the Six Months Ended October 31, 2023

| | | For the Six Months Ended | |

| | | October 31, | |

| | | 2024 | | | 2023 | |

| Revenues | | $ | 112,956 | | | $ | 110,089 | |

| | | | | | | | | |

| Operating expenses: | | | | | | | | |

| Total operating expenses | | | 863,760 | | | | 489,341 | |

| Operating loss | | | (740,804 | ) | | | (379,252 | ) |

| | | | | | | | | |

| Other income (expenses): | | | | | | | | |

| Total other income (expenses) | | | 2,372,753 | | | | (31,359 | ) |

| Income (loss) before income taxes | | | 1,631,949 | | | | (410,611 | ) |

| Income tax expense | | | - | | | | - | |

| Net Income (loss) | | $ | 1,631,949 | | | $ | (410,611 | ) |

Revenues

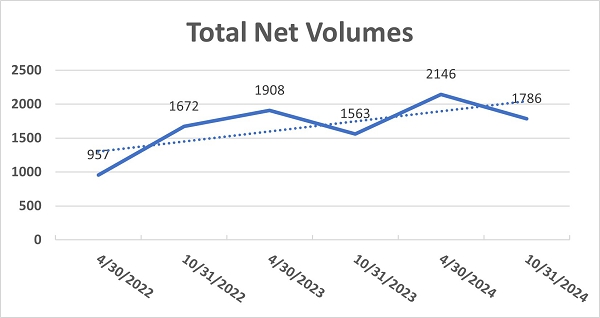

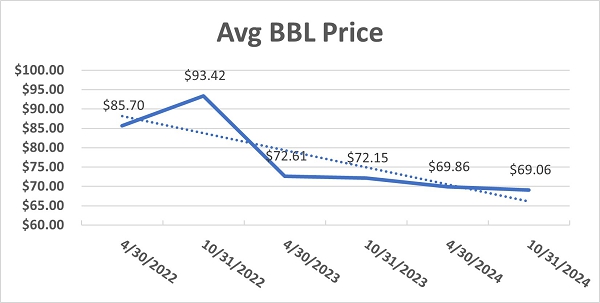

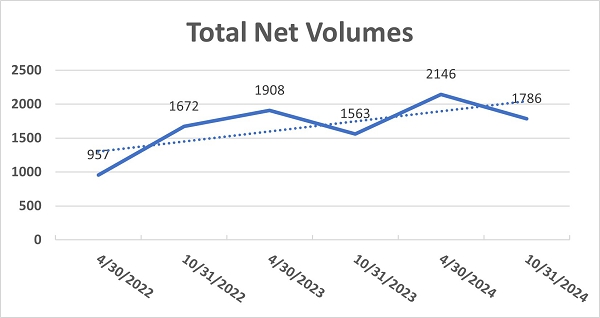

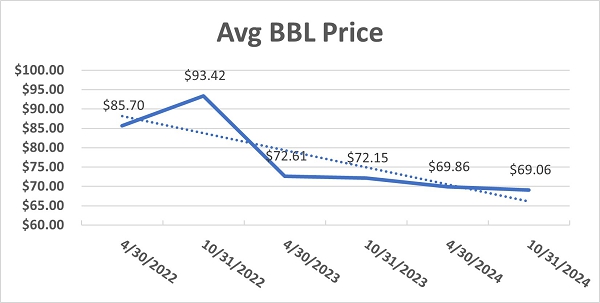

For the six months ended October 31, 2024 and 2023, revenues were $112,956 and $110,089, respectively. The Company’s revenue for both years was derived from oil sales, which were subject to changing prices, through its subsidiary Adler Energy.

Operating Expenses

Operating expenses were $863,760 and $489,341 for the six months ended October 31, 2024 and 2023, respectively. Operating expenses consisted mainly of professional fees, management fees, exploration, lease operating, and general and administrative expenses for the six months ended October 31, 2024 and 2023.

Loss from Operations

Loss from operations was $740,804 and $379,252 for the six months ended October 31, 2024 and 2023, respectively.

Other Income (Expenses)

Other income (expenses) was $2,372,753 and ($31,359) for the six months ended October 31, 2024 and 2023, respectively. Other income consisted mainly from a sale of working interest. Other expenses consisted mainly of interest expense.

Net Income/Loss

Net income for the six months ended October 31, 2024 was $1,631,949. Net loss for the six months ended October 31, 2023 was $410,611.

Liquidity and Capital Resources

The following table summarizes the cash flows for the six months ended October 31, 2024 and for the six months ended October 31, 2023:

| | | For the Six Months Ended October 31, | |

| | | 2024 | | | 2023 | |

| Cash Flows: | | | | | | | | |

| | | | | | | | | |

| Net cash (used in) operating activities | | $ | (956,189 | ) | | $ | (275,323 | ) |

| Net cash (used in) investing activities | | | (192,604 | ) | | | (327,833 | ) |

| Net cash provided by financing activities | | | 1,031,964 | | | | 703,048 | |

| Net increase (decrease) in cash | | | (116,829 | ) | | | 99,892 | |

| Cash at beginning of period | | | 288,732 | | | | 232,894 | |

| | | | | | | | | |

| Cash at end of period | | $ | 171,903 | | | $ | 332,786 | |

During the six months ended October 31, 2024, net cash used in operating activities was $956,189 compared to $275,323 for the six months ended October 31, 2023. The increase for the six months ended October 31, 2024 is largely attributable to an increase in net loss and a paydown of current liabilities for the six months ended October 31, 2024 versus October 31, 2023.

During the six months ended October 31, 2024, net cash used in investing activities was $192,604 compared to $327,833 for the six months ended October 31, 2023. The decrease for the six months ended October 31, 2024 is largely attributable to the decrease in the acquisition of oil and gas leasehold assets.

During the six months ended October 31, 2024, net cash provided by financing activities was $1,031,964 compared to $703,048 for the six months ended October 31, 2023. The increase in cash provided from financing activities largely attributable to the proceeds from the sale of preferred stock through the Company’s Regulation A and D offerings.

At October 31, 2024, we had current assets of $394,294, current liabilities of $216,313, working capital of $177,981 and an accumulated deficit of $1,522,370.

At April 30, 2024, we had current assets of $500,832, current liabilities of $411,405, working capital of $89,427 and an accumulated deficit of $3,030,154.

We presently have limited and expensive available credit, and do not have bank financing or other external sources of liquidity. We will need to obtain additional capital in order to expand operations and become profitable. In order to obtain capital, we may need to sell additional shares of our common stock or borrow funds from private lenders. There can be no assurance that we will be successful in obtaining additional funding. We will still need additional capital in order to continue operations until we are able to achieve positive operating cash flow. Additional capital is being sought, but we cannot guarantee that we will be able to obtain such investments. Financing transactions may include the issuance of equity or debt securities, obtaining credit facilities, or other financing mechanisms. However, even if we are able to raise the funds required, it is possible that we could incur unexpected costs and expenses, fail to collect significant amounts owed to us, or experience unexpected cash requirements that would force us to seek alternative financing. Furthermore, if we issue additional equity or debt securities, stockholders may experience additional dilution or the new equity securities may have rights, preferences or privileges senior to those of existing holders of our common stock. If additional financing is not available or is not available on acceptable terms, we will have to curtail our operations.

Critical Oil & Gas Accounting

The Company utilizes the successful efforts method of accounting for oil and gas producing activities. The Company believes that net assets and net income are more conservatively measured under the successful efforts method of accounting for oil and gas producing activities than under the full cost method, particularly during periods of active exploration. This requires management’s assessment of proper designation of wells and associated costs. This designation is dependent on the determination and existence of proved reserves. Development property/wells are always capitalized. Costs associated with drilling an exploratory well are initially capitalized, pending a determination as to whether proved reserves have been found. Management reviews the status of all exploratory drilling costs to determine whether the costs should continue to remain capitalized or shall be expensed. Under successful efforts, exploratory dry holes, annual leasehold rentals, and geological and geophysical exploration costs are expensed as incurred.

OFF-BALANCE SHEET ARRANGEMENTS

The Company does not have any off-balance sheet arrangements.

Item 2. Other Information

None.

Item 3. Financial Statements

The accompanying semiannual consolidated financial statements are unaudited and have been prepared in accordance with the instructions to Form 1-SA. Therefore, they do not include all information and footnotes necessary for a complete presentation of financial position, results of operations, cash flows, and stockholders’ equity in conformity with accounting principles generally accepted in the United States of America. Except as disclosed herein, there has been no material change in the information disclosed in the notes to the consolidated financial statements included in the Company’s Annual Report on Form 1-K for the year ended April 30, 2024. In the opinion of management, all adjustments considered necessary for a fair presentation of the results of operations and financial position have been included, and all such adjustments are of a normal recurring nature. Operating results for the six months ended October 31, 2024 are not necessarily indicative of the results that can be expected for the year ending April 30, 2025.

LGX ENERGY CORP.

Consolidated Financial Statements

Table of Contents

LGX ENERGY CORP.

CONSOLIDATED BALANCE SHEETS

| | | 31-Oct-24 | | | 30-Apr-24 | |

| | | (Unaudited) | | | (Audited) | |

| ASSETS | | | | | | | | |

| CURRENT ASSETS | | | | | | | | |

| Cash and cash equivalents | | $ | 171,903 | | | $ | 288,732 | |

| Accounts receivable | | | 68,325 | | | | 7,907 | |

| Accounts receivable–related party | | | - | | | | - | |

| Product sales receivable | | | 20,303 | | | | 24,848 | |

| Other receivable | | | 900 | | | | 900 | |

| Material Supply Inventory | | | 90,803 | | | | 162,637 | |

| Prepaid expense | | | 42,059 | | | | 15,828 | |

| Total Current Assets | | | 394,294 | | | | 500,832 | |

| | | | | | | | | |

| PPE ASSETS | | | | | | | | |

| Oil & gas well equipment, net | | | 177,866 | | | | 278,622 | |

| Other Equipment | | | 38,708 | | | | - | |

| Total PPE Assets | | | 216,574 | | | | 278,622 | |

| OTHER ASSETS | | | | | | | | |

| Proved Properties | | | | | | | | |

| Oil & Gas Properties | | | 6,870 | | | | 6,870 | |

| Developed Leasehold | | | 33,115 | | | | 33,000 | |

| Unproved Properties | | | | | | | | |

| Intangible Costs | | | 408,932 | | | | 233,325 | |

| Tangible Costs | | | 114,806 | | | | - | |

| Undeveloped Leasehold | | | 911,754 | | | | - | |

| LT Marketable Securities | | | 2,400,000 | | | | - | |

| Mineral Deeds | | | 3,500,090 | | | | - | |

| Patent License | | | 25,000 | | | | - | |

| ARO asset | | | 39,396 | | | | 58,632 | |

| Total Other Assets | | | 7,089,873 | | | | 540,823 | |

| | | | | | | | | |

| TOTAL ASSETS | | $ | 7,700,741 | | | $ | 1,712,918 | |

| | | | | | | | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | | | | |

| CURRENT LIABILITIES | | | | | | | | |

| Accounts payable | | $ | 32,609 | | | $ | 187,251 | |

| Accrued expense-related party | | | - | | | | 57,000 | |

| Accrued interest | | | - | | | | 139 | |

| ARO liability | | | 183,704 | | | | 172,014 | |

| Convertible Bridge loans | | | - | | | | 25,000 | |

| Notes payable | | | - | | | | - | |

| Total Current Liabilities | | | 216,313 | | | | 441,405 | |

| | | | | | | | | |

| TOTAL LIABILITIES | | $ | 216,313 | | | $ | 441,405 | |

| | | | | | | | | |

| STOCKHOLDERS’ EQUITY | | | | | | | | |

| Series A Preferred stock, $0.001 par value, 10,000,000 shares authorized, 199,377 and 96,150 issued and outstanding, respectively | | $ | 199 | | | $ | 96 | |

| Series B Preferred stock, $0.001 par value, 10,000,000 shares authorized, 451,655 and 244,500 issued and outstanding, respectively | | | 452 | | | | 245 | |

| Common stock, $0.001 par value, 80,000,000 shares authorized; 22,798,665 and 20,928,665 shares issued and outstanding | | | 22,799 | | | | 20,929 | |

| Additional paid-in capital | | | 8,802,440 | | | | 4,219,999 | |

| Warrants on Common stock | | | 180,908 | | | | - | |

| Common stock to be issued | | | - | | | | 19,000 | |

| Preferred stock to be issued | | | - | | | | 41,400 | |

| Accumulated deficit | | | (1,522,370 | ) | | | (3,030,154 | ) |

| Total Stockholders’ Equity | | | 7,484,428 | | | | 1,271,513 | |

| | | | | | | | | |

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | | $ | 7,700,741 | | | $ | 1,712,918 | |

See the accompanying notes to the consolidated financial statements.

LGX ENERGY CORP.

CONSOLIDATED STATEMENT OF OPERATIONS

| | | For the Six Months Ended | | | For the Six Months Ended | |

| | | 31-Oct-24 | | | 31-Oct-23 | |

| | | | | | | |

| REVENUES | | | | | | | | |

| Oil sales | | $ | 112,956 | | | $ | 110,089 | |

| TOTAL REVENUE | | | 112,956 | | | | 110,089 | |

| | | | | | | | | |

| OPERATING EXPENSES | | | | | | | | |

| Professional fees | | | 472,119 | | | | 82,009 | |

| General and administrative expenses | | | 70,307 | | | | 128,229 | |

| Management fees | | | 80,000 | | | | 156,000 | |

| Severance tax | | | 1,230 | | | | 1,094 | |

| Production expense | | | 57,137 | | | | 61,032 | |

| Exploration expense | | | 134,753 | | | | 28,727 | |

| Accretion expense | | | 11,690 | | | | 1,461 | |

| Depreciation and amortization expense | | | 36,524 | | | | 30,789 | |

| TOTAL OPERATING EXPENSES | | | 863,760 | | | | 489,341 | |

| | | | | | | | | |

| LOSS FROM OPERATIONS | | | (740,804 | ) | | | (379,252 | ) |

| | | | | | | | | |

| OTHER INCOME (EXPENSES) | | | | | | | | |

| Interest expense | | | (779 | ) | | | (17,996 | ) |

| Lower of Cost or Market | | | (38,317 | ) | | | - | |

| Gain (loss) on sale of asset | | | 2,400,000 | | | | (7,130 | ) |

| Other income (expense) | | | 11,849 | | | | (6,233 | ) |

| TOTAL OTHER INCOME (EXPENSES) | | | 2,372,753 | | | | (31,359 | ) |

| | | | | | | | | |

| INCOME BEFORE TAXES | | | 1,631,949 | | | | (410,611 | ) |

| | | | | | | | | |

| INCOME TAXES | | | - | | | | - | |

| | | | | | | | | |

| NET INCOME (LOSS) | | $ | 1,631,949 | | | $ | (410,611 | ) |

| | | | | | | | | |

| NET INCOME PER COMMON SHARE, BASIC | | $ | 0.07 | | | $ | (0.02 | ) |

| WEIGHTED AVERAGE NUMBER OF COMMON STOCK SHARES OUTSTANDING, BASIC | | | 22,798,665 | | | | 20,630,339 | |

| NET INCOME PER COMMON SHARE, DILUTED | | $ | 0.06 | | | $ | (0.02 | ) |

| WEIGHTED AVERAGE NUMBER OF COMMON STOCK SHARES OUTSTANDING, DILUTED | | | 25,600,730 | | | | 20,630,339 | |

See the accompanying notes to the consolidated financial statements.

LGX ENERGY CORP.

CONSOLDIATED STATEMENT OF STOCKHOLDERS’ EQUITY

For the Six Months Ended October 31, 2024 and October 31, 2023

| | | Preferred Stock | | | Common Stock | | | Additional Paid-in | | | Accumulated | | | Common stock to be | | | Total Stockholders’ | |

| | | Shares | | | Amount | | | Shares | | | Amount | | | Capital | | | Deficit | | | Issued | | | Equity | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Balances, April 30, 2023 | | | | | | | | | | | 20,476,666 | | | $ | 20,477 | | | $ | 2,767,791 | | | $ | (1,893,169 | ) | | $ | 60,000 | | | $ | 955,099 | |

| Common stock issued for inducement to convertible debt | | | - | | | | - | | | | 122,000 | | | | 122 | | | | - | | | | - | | | | - | | | | 122 | |

| Common stock issued for inducement to note payable | | | - | | | | - | | | | 125,000 | | | | 125 | | | | - | | | | - | | | | - | | | | 125 | |

| Net loss for the six months ended October 31, 2023 | | | - | | | | - | | | | - | | | | - | | | | - | | | | (410,611 | ) | | | - | | | | (410,611 | ) |

| Balances, October 31, 2023 | | | 68,200 | | | | 69 | | | | 20,723,665 | | | $ | 20,724 | | | $ | 3,040,523 | | | $ | (2,351,889 | ) | | $ | 60,000 | | | $ | 817,536 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balances, April 30, 2024 | | | 339,325 | | | | 341 | | | | 20,928,665 | | | $ | 20,929 | | | $ | 4,219,999 | | | $ | (3,030,154 | ) | | $ | 60,400 | | | $ | 1,271,513 | |

| Series A Preferred Stock issued for cash | | | 92,877 | | | | 93 | | | | - | | | | - | | | | 371,415 | | | | - | | | | - | | | | 371,508 | |

| Series B Preferred Stock issued for cash | | | 207,155 | | | | 207 | | | | - | | | | - | | | | 828,413 | | | | - | | | | - | | | | 828,620 | |

| Common stock issued for purchase of Mineral Deed | | | - | | | | - | | | | 1,750,000 | | | | 1,750 | | | | 3,498,250 | | | | - | | | | - | | | | 3,500,000 | |

| Common stock issued for inducement to bridge loan/note payable | | | - | | | | - | | | | 25,000 | | | | 25 | | | | 4,975 | | | | - | | | | - | | | | 5,000 | |

| Common stock to be issued for bridge loan | | | | | | | | | | | 95,000 | | | | 95 | | | | 18,905 | | | | - | | | | (19,000 | ) | | | - | |

| Series A Preferred Stock issued for cash | | | 10,350 | | | | 10 | | | | - | | | | - | | | | 41,390 | | | | - | | | | (41,400 | ) | | | - | |

| Preferred stock dividends | | | - | | | | - | | | | - | | | | - | | | | - | | | | (124,165 | ) | | | - | | | | (124,165 | ) |

| Net income for the six months ended October 31, 2024 | | | - | | | | - | | | | - | | | | - | | | | - | | | | 1,631,949 | | | | - | | | | 1,631,949 | |

| Balances, October 31, 2024 | | | 651,032 | | | $ | 651 | | | | 22,798,665 | | | $ | 22,799 | | | $ | 8,983,348 | | | $ | (1,522,370 | ) | | $ | - | | | $ | 7,484,426 | |

See the accompanying notes to the consolidated financial statements.

CONSOLIDATED STATEMENT OF CASH FLOWS

For the Six Months Ended October 31, 2024 and October 31, 2023

| | | For the Six Months Ended | | | For the Six Months Ended | |

| | | 31-Oct-24 | | | 31-Oct-23 | |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | | | | | | |

| Net income (loss) | | $ | 1,631,949 | | | $ | (410,611 | ) |

| Adjustments to reconcile net income (loss) to net cash provided (used) by operating activities: | | | | | | | | |

| Depreciation and amortization expense | | | 36,524 | | | | 30,789 | |

| Accretion expense | | | 11,690 | | | | 1,461 | |

| Gain on sale of working interest | | | 2,400,000 | | | | - | |

| Lower of cost or market | | | 38,317 | | | | - | |

| Changes in assets and liabilities: | | | | | | | | |

| Decrease (increase) in accounts receivable | | | (60,418 | ) | | | (20,231 | ) |

| Decrease (increase) in accounts receivable – related party | | | - | | | | 15,052 | |

| Decrease (increase) in prepaid expense | | | (26,231 | ) | | | - | |

| Decrease (increase) in accrued revenue | | | 4,525 | | | | - | |

| Decrease (increase) in ARO asset | | | 19,236 | | | | - | |

| Increase (decrease) in accounts payable | | | (154,642 | ) | | | 80,668 | |

| Increase (decrease) in accrued expense | | | (57,000 | ) | | | 17,549 | |

| Increase (decrease) in accrued interest | | | (139 | ) | | | 10,000 | |

| Net cash used by operating activities | | | (956,189 | ) | | | (275,323 | ) |

| | | | | | | | | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | | | | | | |

| Oil & gas well equipment | | | 83,041 | | | | (101,787 | ) |

| Oil & gas leasehold asset | | | (275,645 | ) | | | (226,046 | ) |

| Net cash used by investing activities | | | (192,604 | ) | | | (327,833 | ) |

| | | | | | | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | | | | | | |

| Proceeds from sale of common stock | | | - | | | | 247 | |

| Proceeds from sale of preferred stock | | | 310 | | | | 272,801 | |

| Proceeds from addtl paid in capital | | | 1,241,219 | | | | - | |

| Payment of Dividends | | | (124,165 | ) | | | - | |

| Proceeds from common stock to be issued | | | (19,000 | ) | | | 305,000 | |

| Proceeds from preferred stock to be issued | | | (41,400 | ) | | | - | |

| Proceeds from notes payable | | | (25,000 | ) | | | 125,000 | |

| Net cash provided by financing activities | | | 1,031,964 | | | | 703,048 | |

| | | | | | | | | |

| INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS | | | (116,829 | ) | | | 99,892 | |

| | | | | | | | | |

| Cash, beginning of period | | | 288,732 | | | | 232,894 | |

| Cash, end of period | | $ | 171,903 | | | $ | 332,786 | |

| | | | | | | | | |

| SUPPLEMENTAL CASH FLOW INFORMATION: | | | | | | | | |

| Interest paid | | $ | 754 | | | $ | - | |

| Income taxes paid | | $ | - | | | $ | - | |

Noncash Investing & Financing item:

Purchase of Mineral Deeds financed with common stock (transaction recorded at $3,500,000)

See the accompanying notes to the consolidated financial statements.

LGX ENERGY CORP.

NOTES TO FINANCIAL STATEMENTS

For the Six Months Ended October 31, 2024 and October 31, 2023

NOTE 1 - ORGANIZATION AND DESCRIPTION OF BUSINESS

LGX Energy Corp. (“the Company”, “LGX Energy”, “we” and “us”) was incorporated under the laws of the State of Nevada on November 3, 2021. The Company was incorporated for the purpose of exploration and development of oil and gas properties.

The Company has one wholly-owned subsidiary, Adler Energy, LLC (“Adler Energy”). Adler Energy was acquired by LGX Energy on January 31, 2022. The acquisition included the Thomas Field in Clay County, Indiana, with 7 producing oil wells, a disposal well and over 300 miles of 2D seismic with undrilled prospects, acquired by Adler Energy over a ten-year period across 5 counties in the state of Indiana. All operations of LGX Energy are conducted through Adler Energy, including field operations, engineering, geology, seismic processing and the sale of oil and gas.

On March 28, 2023, the Company filed Restated Articles of Organization with the State of Michigan for its wholly owned subsidiary, Adler Energy, LC, to change its name to Adler Energy, LLC.

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The condensed consolidated financial statements and notes are representations of the Company’s management, which is responsible for their integrity and objectivity. These accounting policies conform to accounting principles generally accepted in the United States (“U.S. GAAP”) and have been consistently applied in the preparation of the consolidated financial statements. The Company has adopted an April 30 fiscal year end. These unaudited interim consolidated financial statements do not include all of the disclosures required by generally accepted accounting principles in the United States of America for complete financial statements. These unaudited interim condensed consolidated financial statements should be read in conjunction with the Company’s audited consolidated financial statements for the year ended April 30, 2024.

In the opinion of management, the interim unaudited condensed consolidated financial statements furnished herein include all adjustments, all of which are of a normal recurring nature, necessary for a fair statement of the results for the interim periods presented. Operating results for the six-month period ended October 31, 2024 are not necessarily indicative of the results that may be expected for the year ending April 30, 2025.

Basis of Presentation

The Company’s financial statements are prepared using the accrual basis of accounting in accordance with generally accepted accounting principles in the United States of America.

Principles of Consolidation – The consolidated financial statements include the accounts of the Company and its wholly-owned or controlled operating subsidiary, Adler Energy. All intercompany accounts and transactions have been eliminated.

Earnings (Losses) Per Share

Basic earnings per share is computed by dividing net income (loss) by the weighted-average number of common shares outstanding during the year. Fully-diluted earnings per share is computed by dividing net income (loss) by the sum of the weighted-average number of common shares outstanding and the additional common shares that would have been outstanding if potential common shares had been issued. Potential common shares are not included in the computation of fully diluted earnings per share if their effect is anti-dilutive. The computation of earnings per share of common stock is based on the weighted average number of shares outstanding at the date of the financial statements.

Cash Equivalents

The Company considers cash, certificates of deposit, and debt instruments with a maturity of three months or less when purchased to be cash equivalents. The Company maintains its cash in bank deposit accounts, which at times, may exceed federally insured limits. As of October 31, 2024, the Company had $-0- in excess of federally-insured limits.

Estimates

The preparation of financial statements in accordance with generally accepted accounting principles in the United States of America requires the use of estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities known to exist as of the date the financial statements are published, and the reported amounts of revenues and expenses during the reporting period. Uncertainties with respect to such estimates and assumptions are inherent in the preparation of the Company’s financial statements; accordingly, it is possible that the actual results could differ from these estimates and assumptions and could have a material effect on the reported amounts of the Company’s financial position and results of operations.

LGX ENERGY CORP.

NOTES TO FINANCIAL STATEMENTS

For the Six Months Ended October 31, 2024 and October 31, 2023

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Fair Value of Financial Instruments

The Company’s financial instruments as defined by ASC 825-10-50, include cash, receivables, accounts payable and accrued expenses. All instruments are accounted for on a historical cost basis, which, due to the short maturity of these financial instruments, approximates fair value at October 31, 2024 and April 30, 2024.

The standards under ASC 820 define fair value, establishes a framework for measuring fair value in accordance with generally accepted accounting principles, and expands disclosures about fair value measurements. FASB ASC 820 establishes a three-tier fair value hierarchy which prioritizes the inputs used in measuring fair value as follows:

Level 1. Observable inputs such as quoted prices in active markets;

Level 2. Inputs, other than the quoted prices in active markets, that are observable either directly or indirectly; and

Level 3. Unobservable inputs in which there is little of no market data, which require the reporting entity to develop its own assumptions.

Accounts Receivable

The Company routinely assesses the recoverability of all material trade and other receivables. The Company accrues a reserve on a receivable when, based on the judgment of management, it is probable that a receivable will not be collected and the amount of any reserve may be reasonably estimated. Actual write-offs may exceed the recorded allowance. Substantially all of the Company’s trade accounts receivable result from crude oil in Indiana, to one customer, or joint interest billings to its working interest partners in Indiana, some of which are related parties. This concentration of customers and joint interest owners may impact the Company’s overall credit risk as these entities could be affected by similar changes in economic conditions as well as other related factors. Trade accounts receivable are generally not collateralized. There were no allowances for doubtful accounts for the Company’s trade accounts receivable at October 31, 2024 and April 30, 2024.

Going Concern

As shown in the accompanying financial statements, the Company has incurred cumulative operating losses since inception. As of October 31, 2024, the Company has limited financial resources with which to achieve its objectives and attain profitability and positive cash flows from operations. As shown in the accompanying balance sheets and statements of operations, the Company has an accumulated deficit of $1,522,370 at October 31, 2024.

Achievement of the Company’s objectives will depend on its ability to obtain additional financing to generate revenue from current and planned business operations.

The Company plans to fund its future operations by potential sales of its common stock, preferred stock or by issuing debt securities. However, there is no assurance that the Company will be able to achieve these objectives, therefore substantial doubt about its ability to continue as a going concern exists.

Provision for Taxes

Income taxes are provided based upon the liability method of accounting pursuant to ASC 740-10-25 Income Taxes – Recognition. Under the approach, deferred income taxes are recorded to reflect the tax consequences in future years of differences between the tax basis of assets and liabilities and their financial reporting amounts at each year-end. A valuation allowance is recorded against deferred tax assets if management does not believe the Company has met the “more likely than not” standard imposed by ASC 740-10-25-5 to allow recognition of such an asset. See Note 14.

Revenue Recognition

The Company recognizes revenue under ASC 606, Revenue from Contracts with Customers (“Topic 606”). Under Topic 606, revenue will generally be recognized upon delivery of our produced crude oil and natural gas volumes to our customers. Our customer sales contracts include only crude oil sales in Indiana. Under Topic 606, each unit (crude oil barrel) of commodity product represents a separate performance obligation which is sold at variable prices, determinable on a monthly basis. The pricing provisions of our crude oil contracts are primarily tied to a market index with certain adjustments based on factors such as delivery, product quality and prevailing supply and demand conditions in the geographic areas in which we operate. We will allocate the transaction price to each performance obligation and recognize revenue upon delivery of the commodity product when the customer obtains control. Control of our produced crude oil volumes passes to our customers when the oil is measured by a trucking oil ticket. The Company has no control over the crude oil after this point and the measurement at this point dictates the amount on which the customer’s payment is based. Our crude oil revenue stream includes volumes burdened by royalty and other joint owner working interests. Our revenues are recorded and presented on our financial statements net of the royalty and other joint owner working interests. Our revenue stream does not include any payments for services or ancillary items other than sale of crude oil. We record revenue in the month our crude oil production is delivered to the purchaser. The customer has the right to refuse to purchase any oil containing impurities, and treatment of any refused oil is at the Company’s expense.

LGX ENERGY CORP.

NOTES TO FINANCIAL STATEMENTS

For the Six Months Ended October 31, 2024 and October 31, 2023

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

New Accounting Pronouncements

FASB issued ASU No. 2016-02, Leases (Topic 842), which establishes a comprehensive new lease accounting model. The new standard: (a) clarifies the definition of a lease; (b) requires a dual approach to lease classification similar to current lease classifications; and (c) causes lessees to recognize leases on the balance sheet as a lease liability with a corresponding right-of-use asset for leases. The standard became effective for non-public companies for years beginning after December 15, 2021.

The Company has made an accounting policy election not to recognize right of use assets and lease liabilities that arise from short term leases for any class of asset.

This topic does not apply to leases to explore for natural resources and rights to use the land in which those natural resources are contained.

Accounting standards that have been issued or proposed by the Financial Accounting Standards Board (“FASB”) that do not require adoption until a future date are not expected to have a material impact on the financial statements upon adoption. The Company does not discuss recent pronouncements that are not anticipated to have an impact on or are unrelated to its financial condition, results of operations, cash flows or disclosures.

Fixed Assets, Intangibles and Long-Lived Assets

The Company records its fixed assets at historical cost. The Company expenses maintenance and repairs as incurred. Upon disposition of fixed assets, the gross cost and accumulated depreciation are written off and the difference between the proceeds and the net book value is recorded as a gain or loss on sale of assets. The Company depreciates its fixed assets over their respective estimated useful lives ranging from three to fifteen years.

The Company follows FASB ASC 360-10, “Property, Plant, and Equipment,” which established a “primary asset” approach to determine the cash flow estimation period for a group of assets and liabilities that represents the unit of accounting for a long-lived asset to be held and used. Long-lived assets to be held and used are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. The carrying amount of a long-lived asset is not recoverable if it exceeds the sum of the undiscounted cash flows expected to result from the use and eventual disposition of the asset. Long-lived assets to be disposed of are reported at the lower of carrying amount or fair value less cost to sell. From inception to April 30, 2023, the Company had not experienced impairment losses on its long-lived assets.

Oil & Gas Assets

Proved oil and natural gas properties. The Company follows the successful efforts method of accounting for its oil and gas properties. Under this method, drilling and completion costs, including oil and gas well equipment, intangible development costs, and operational support facilities in the field, associated with development wells are capitalized to proved oil and gas properties and are depleted on an asset group basis (properties aggregated based on geographical and geological characteristics) using the units-of-production method based on estimated proved developed oil and gas reserves. The calculation of depletion expense takes into consideration estimated asset retirement costs, net of estimated salvage values.

Proved oil and gas properties are assessed for impairment on an asset group basis whenever events and circumstances indicate that there could be a possible decline in the recoverability of the net book value of such property. The Company estimates the expected future net cash flows of its proved oil and gas properties and compares these undiscounted cash flows to the net book value of the proved oil and gas properties to determine if the net book value is recoverable. If the net book value exceeds the estimated undiscounted future net cash flows, the Company will recognize an impairment to reduce the net book value of the proved oil and gas properties to fair value. The factors used to determine fair value include, but are not limited to, estimates of reserves, future commodity prices, future production estimates, estimated future development costs and operating costs, and discount rates, which are based on a weighted average cost of capital. There were no impairments of proved oil and gas properties for the six months ended October 31, 2024 and for the year ended April 30, 2024.

The partial sale of a proved property within an existing asset group is accounted for as a normal retirement and no net gain or loss on divestiture is recognized as long as the treatment does not significantly alter the units-of-production depletion rate. The sale of a partial interest in an individual proved property is accounted for as a recovery of cost. A net gain or loss on divestiture is recognized in the consolidated statements of operations for all other sales of proved properties.

LGX ENERGY CORP.

NOTES TO FINANCIAL STATEMENTS

For the Six Months Ended October 31, 2024 and October 31, 2023

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Unproved oil and natural gas properties. Unproved oil and gas properties consist of capitalized costs incurred in obtaining a mineral interest or a right in a property such as a lease, in addition to broker fees, recording fees and other similar costs. Leasehold costs are classified as unproved until proved reserves are discovered on or otherwise attributed to the property, at which time the related unproved oil and gas property costs are reclassified to proved oil and gas properties and depleted on an asset group basis using the units-of-production method based on estimated total proved oil and gas reserves.

The Company evaluates significant unproved oil and gas property costs for impairment based on remaining lease term, drilling results, reservoir performance, seismic interpretation or changes in future plans to develop acreage. Unproved oil and gas properties that are not individually significant are aggregated by asset group, and the portion of such costs estimated to be nonproductive prior to lease expiration is amortized over the average holding period. The estimate of what could be nonproductive is based on the Company’s historical experience or other information, including current drilling plans and existing geological data. Impairment and amortization of unproved oil and gas properties are recognized as “Impairment of oil and gas properties” in the consolidated statements of operations.

Exploratory. Exploratory costs, including personnel and other internal costs, geological and geophysical expenses and delay rentals for oil and gas leases, are expensed as incurred. Exploratory well costs are initially capitalized pending the determination of whether proved reserves have been discovered. If proved reserves are discovered, exploratory well costs are capitalized as proved oil and gas properties. If proved reserves are not found, exploratory well costs are expensed as dry holes. The application of the successful efforts method of accounting requires management’s judgment to determine the proper designation of wells as either development or exploratory, which will ultimately determine the proper accounting treatment of costs of dry holes.

Capitalized interest. The Company capitalizes interest on expenditures made in connection with exploration and development projects that meet certain thresholds and are not subject to current amortization. For projects that meet these thresholds, interest is capitalized only for the period that activities are in process to bring the projects to their intended use. Capitalized interest cannot exceed interest expense for the period capitalized. During the six months ended October 31, 2024 and for the year ended April 30, 2024, the Company did not have any projects that met the thresholds, therefore, had no capitalized interest.

Asset Retirement Obligations and Environmental Costs. The fair value of legal obligations to retire and remove long-lived assets are recorded in the period in which the obligation is incurred (typically when the asset is installed at the production location). When the liability is initially recorded, we capitalize this cost by increasing the carrying amount of the Asset Retirement Obligation Asset. If, in subsequent periods, our estimate of this liability changes, we will record an adjustment to both the liability and asset. Over time the liability is increased for the change in its present value, and the capitalized cost is depreciated over the useful life of the related asset. See NOTE 10.

NOTE 3 – ACQUISITION OF ADLER ENERGY, LLC

On January 31, 2022, the Company purchased all of the membership interest of Adler Energy, LLC (“Adler Energy”), pursuant to a Membership Interest Purchase Agreement. Adler Energy is a Michigan limited liability company engaged in the oil and gas development and production business.

NOTE 4 – ACCOUNTS & PRODUCT SALES RECEIVABLE

Accounts receivable consist primarily of receivables from our working interest partners for their share of the Thomas Field. The sale of crude oil production by the Company to be received as of October 31, 2024 and April 30, 2024, respectively, were $20,303 and $24,828.

NOTE 5 – OIL & GAS WELL EQUIPMENT

Oil and gas well equipment, recorded at cost, consisted of the following at October 31, 2024 and April 30, 2024:

| | | October 31, 2024 | | | April 30, 2024 | |

| Oil & gas well equipment | | $ | 270,556 | | | $ | 392,731 | |

| Less: accumulated depreciation | | | (92,690 | ) | | | (114,109 | ) |

| Oil & gas well equipment, net | | $ | 177,866 | | | $ | 278,622 | |

Other equipment was purchased for our operations team to use during drilling operations. Use of the equipment will be allocated to each well or project per our Joint Operating Agreements.

NOTE 6 – PROVED PROPERTIES

The Company developed leasehold held by Thomas Field production and purchase of an overriding royalty interest within the same field are reflected in our Proved Properties. The leases have an indefinite life while under production. The asset was reviewed for impairment and none was found to exist.

NOTE 7 – UNPROVED PROPERTIES

The Company has accumulated unproved oil and gas property intangible and tangible costs for future wells and projects. Once a determination of commercially viable proved reserve is completed, the related property costs will be reclassified to proved oil and gas properties and depleted on an asset group basis using the units-of-production method based on estimated total proved oil and gas reserves. If determination concludes the wells or projects are not commercially viable and useful for future operations, the related property costs will be expensed under the successful efforts method.

LGX ENERGY CORP.

NOTES TO FINANCIAL STATEMENTS

For the Six Months Ended October 31, 2024 and October 31, 2023

NOTE 8 – UNDEVELOPED LEASEHOLD

In the acquisition of Adler Energy, the Company acquired eight oil and gas leases comprising approximately 579 acres located in Clay County, Indiana. The leases had an original term of five years and as long thereafter as operations are conducted upon said land with no cessation for more than ninety consecutive days. There are no lease payments associated with said leases. The leases contain an 1/8th net production royalty.

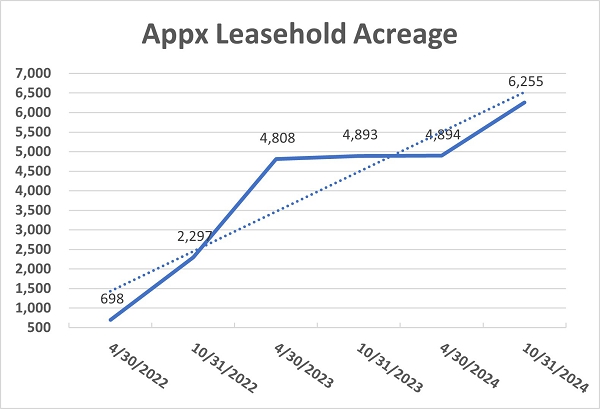

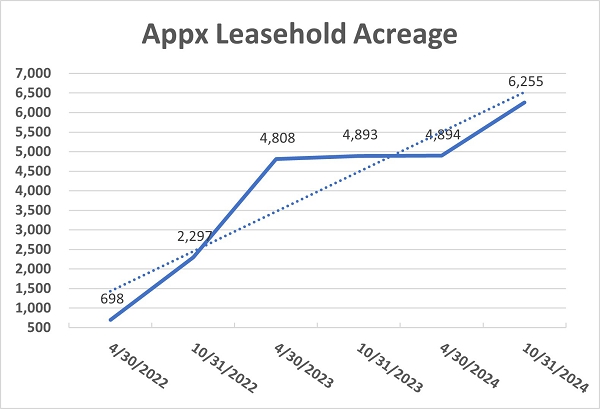

During the six months ended October 31, 2024, the Company signed an additional 23 oil and gas leases resulting in a total of approximately 7,021 leased acres located in Clay and Vigo County, Indiana. The leases had an original lease term of three years with a two-year optional extension, and as long thereafter as operations are conducted upon said land with no cessation for more than ninety consecutive days. The leases contain an 1/8th net production royalty. Related leasehold costs capitalized in accordance with ASC 932 Extractive Activities-Oil and Gas as Unproved oil and natural gas properties recorded were $911,754 and $601,637 as of October 31, 2024 and April 30, 2024, respectively.

NOTE 9 - INVESTMENTS

A Lease Purchase and Sale Agreement and Participation Agreement was signed on July 1, 2024 between Energy Holding Americas 1 Inc and the Company. Later amended on September 12, 2024 to include Black Gold Exploration Corp (BGX) as Purchaser. A 30% Working Interest in Leases and future wells, and 2D seismic survey data within an Area of Mutual Interest (AMI) located in Vigo and Clay County, Indiana, in exchange for 102 shares in Energy Holding Americas 1 Inc. These shares were then converted to 480,000 common shares of BGX, issued at a deemed issue price of $5.40 per share or an aggregate value of $2,400,000.

The Company has acquired additional investments. The Board approved the purchase of two Mineral Deeds in exchange for 1,750,000 common shares on July 19, 2024. The mineral deeds contain the rights to 7,230.2535 acres, more or less, located in Presque Isle County, State of Michigan.

A Patent License Agreement was entered into on September 17, 2024, between Think Energy Holdings Ltd and the Company to deploy the Think Energy Processing Plant. This international patent grants the Company exclusive right to deploy, utilize, and employ the patent and technology. Additional to make, use, and sell licensed products. The exclusive right applies within the states of Indiana, Illinois, & Kentucky.

NOTE 10 – ASSET RETIREMENT OBLIGATION

The company records the fair value of a liability for an asset retirement obligation (ARO) as an asset and liability when there is a legal obligation associated with the retirement of a tangible long-lived asset and the liability can be reasonably estimated. The legal obligation to perform the asset retirement activity is unconditional, even though uncertainty may exist about the timing and/or method of settlement that may be beyond the company’s control. This uncertainty about the timing and/or method of settlement is factored into the measurement of the liability when sufficient information exists to reasonably estimate fair value. Recognition of the ARO includes: (1) the present value of a liability and offsetting asset, (2) the subsequent accretion of that liability and depreciation of the asset, and (3) the periodic review of the ARO liability estimates and discount rates.

AROs are primarily recorded for the company’s crude oil and natural gas producing assets. No significant AROs associated with any legal obligations to retire downstream long-lived assets have been recognized, as indeterminate settlement dates for the asset retirement prevent estimation of the fair value of the associated ARO. The company performs periodic reviews of its downstream long-lived assets for any changes in facts and circumstances that might require recognition of a retirement obligation.

The following table indicates the changes to the company’s before-tax asset retirement obligations at October 31, 2024 and April 30, 2024:

| | | October 31, 2024 | | | April 30, 2024 | |

| Balance at May 1, 2024 and 2023, respectively | | $ | 148,634 | | | $ | - | |

| Liabilities incurred | | | 35,070 | | | | 172,014 | |

| Liabilities settled | | | - | | | | - | |

| Accretion expense | | | (11,690 | ) | | | (23,380 | ) |

| Revisions in estimated cash flows | | | - | | | | - | |

| Balance | | $ | 172,014 | | | $ | 148,634 | |

LGX ENERGY CORP.

NOTES TO FINANCIAL STATEMENTS

For the Six Months Ended October 31, 2024 and October 31, 2023

NOTE 11 –BORROWINGS

Convertible Bridge Loans

All convertible Bridge Loans were paid in full.

| | | October 31, 2024 | | | April 30, 2024 | |

| Convertible bridge loans | | $ | - | | | $ | 25,000 | |

| Total | | $ | - | | | $ | 25,000 | |

Notes Payable

On August 16, 2023, the Company entered into a Loan Agreement and Promissory Note (the “Agreement” or, the “Note”) with Sean O’Connor (the “Lender”). Under the terms of the Agreement, Lender loaned the Company the principal amount of $75,000. The Note shall accrue interest at a rate of 15% and matures 120 days after the draw of the loan. The Note must be prepaid prior to the Company drilling any new wells in the State of Indiana. In addition, the Company shall issue to the Lender one share of its common stock for each dollar loaned to the Company.

On September 12, 2023, the Company entered into a Loan Agreement and Promissory Note (the “Agreement” or, the “Note”) with John Peterson (the “Lender”). Under the terms of the Agreement, Lender loaned the Company the principal amount of $20,000. The Note shall accrue interest at a rate of 15% and matures 120 days after the draw of the loan. The Note must be prepaid prior to the Company drilling any new wells in the State of Indiana. In addition, the Company shall issue to the Lender one share of its common stock for each dollar loaned to the Company.

On May 3, 2024, the Company entered into a Loan Agreement and Promissory Note with Allalee Bubeck. Under the terms of the Agreement, Lendor loaned the Company the principal amount of $62,000. The Note shall accrue interest at a rate of 12% and matures 120 days after the draw of the loan. In addition, the Company shall issue to the Lender 25,000 shares of its common stock.

All Notes Payable were paid in full.

NOTE 12 – STOCKHOLDERS’ EQUITY

As of October 31, 2024 and April 30, 2024, the authorized capital of the Company was 100,000,000 shares consisting of 80,000,000 shares of common stock, par value $0.001 per share, and 20,000,000 shares of preferred stock, par value $0.001 per share.

Preferred Stock

The Preferred stock may be issued in one or more series as determined by the Board of Directors. The designations, voting rights, amounts of preference upon distribution of assets, rates of dividends, premiums of redemption, conversion rights and other variations, if any, the qualifications, limitations or restrictions thereof, if any, of the Preferred Stock, and of each series thereof, are fixed by the Board of Directors in a resolution or resolutions adopted by the Board of Directors providing for the issue of such series of Preferred Stock.

On February 24, 2023, the Company filed a Certificate of Designation (the “Designation”) with the Secretary of State of Nevada, which designates 10,000,000 shares of the Company’s preferred stock, par value $0.001 per share, as Series A 10% Convertible Preferred Stock (“Series A Preferred Stock”). Pursuant to the terms of the Designation, holders of the Series A Preferred Stock shall be entitled to dividends, a liquidation preference and shall have conversion rights. Each share of Series A Preferred Stock shall be convertible into 2 shares of Common Stock, for a total not to exceed 20,000,000 shares of Common Stock. The holders of the Series A Preferred Stock shall have voting rights equal to two shares of Common Stock per one share of Series A Preferred Stock held.

As of October 31, 2024 and April 30, 2024, there were 199,377 and 96,150 shares of Series A Preferred Stock outstanding, respectively.

On August 7, 2023, the Company filed a Certificate of Designation (the “Designation”) with the Secretary of State of Nevada, which designates 10,000,000 shares of the Company’s preferred stock, par value $0.001 per share, as Series B 12% Convertible Preferred Stock (“Series B Preferred Stock”). Pursuant to the terms of the Designation, holders of the Series B Preferred Stock shall be entitled to dividends, a liquidation preference and shall have conversion rights. Each share of Series B Preferred Stock shall be convertible into 2 shares of Common Stock, for a total not to exceed 20,000,000 shares of Common Stock. The holders of the Series B shall have voting rights equal to two shares of Common Stock per one share of Series B Preferred Stock held.

As of October 31, 2024 and April 30, 2024, there were 451,655 and 244,500 shares of Series B Preferred Stock outstanding, respectively.

Common Stock

For the Six Months Ended October 31, 2024:

As of October 31, 2024, the Company issued 120,000 shares of common stock for inducement for convertible debt and 120,000 shares of common stock as inducement for notes payable. The Company issued 1,750,000 shares of common stock for the purchase of Presque Isle Mineral Deeds.

For the year ended April 30, 2024:

The Company issued 122,000 shares of common stock for bridge loans, 70,000 purchased through bridge loan convertible option, and 125,000 shares of common stock for notes payable.

The Company to be issued Common Stock shares were issued for 300,000 shares of common stock for the $60,000.

As of October 31, 2024 and April 30, 2024, there were 22,798,665 and 20,928,665 shares of Common Stock outstanding, respectively.

Warrants

On February 22, 2023, the Company issued four Warrants to Holders granting the Holders the right to purchase a total of 1,500,000 shares of common stock at an exercise price of $0.25 with an expiration date of three years. The fair value of warrants is estimated on the grant date using the Black-Scholes option pricing model, with a stock price of $0.20, risk-free interest rate of 4.43% and volatility of 101.44%. The risk-free interest rate is based on the government security rate with an equivalent term in effect as of the date of the issuance. The estimated option lives are based on management’s expectation of when grantees would exercise the options. Volatility is based on historical data of the peer companies that are similar in nature to the Company.

LGX ENERGY CORP.

NOTES TO FINANCIAL STATEMENTS

For the Six Months Ended October 31, 2024 and October 31, 2023

NOTE 13 – SUPPLEMENTAL INFORMATION ON OIL OPERATIONS

Supplemental information pertaining to the Company’s oil properties and activities for the six months ended October 31, 2024 and 2023:

Costs Incurred

The following tables reflect the costs incurred in oil and gas property acquisition, exploration and development activities.

| | | October 31, 2024 | | | October 31, 2023 | |

| Property acquisition/development costs | | $ | 747,554 | | | $ | 279,161 | |

| Exploration costs | | | 134,753 | | | | 76,835 | |

| Total Costs Incurred | | $ | 882,307 | | | $ | 355,996 | |

Acquisition costs for the six months ended October 31, 2024 consist of $795,897 in proved and unproved properties and $(48,343) adjustment in oil and gas well equipment. Acquisition costs for the six months ended October 31, 2023 consist of $82,509 in oil and gas well equipment and $196,652 in undeveloped leasehold. Exploration costs for six months ended October 31, 2024 and the year ended April 30, 2024 consist of geophysical costs.

Results of Operations

The following table includes revenues and expenses associated with the Company’s oil producing activities for the six months ended October 31, 2024 and 2023. It does not include any allocation of the Company’s interest costs or general corporate overhead and, therefore, are not necessarily indicative of the contribution to net earnings of the Company’s oil operations. Severance tax expense has been calculated by applying Indiana production tax rate to oil sales.

| | | October 31, 2024 | | | October 31, 2023 | |

| Oil sales | | $ | 112,956 | | | $ | 110,089 | |

| Production and severance expenses | | | (58,367 | ) | | | (62,126 | ) |

| Exploration expenses | | | (134,753 | ) | | | (28,727 | ) |

| Depreciation, depletion, and amortization | | | (36,524 | ) | | | (30,789 | ) |

| Results of operations | | $ | (116,688 | ) | | $ | (11,553 | ) |

NOTE 14 – INCOME TAXES

Income taxes are provided based upon the liability method of accounting pursuant to ASC 740-10-25 Income Taxes – Recognition. Under this approach, deferred income taxes are recorded to reflect the tax consequences in future years of differences between the tax basis of assets and liabilities and their financial reporting amounts at each year-end. A valuation allowance is recorded against deferred tax assets if management does not believe the Company has met the “more likely than not” standard imposed by ASC 740-10-25-5.

LGX ENERGY CORP.

NOTES TO FINANCIAL STATEMENTS

For the Six Months Ended October 31, 2024 and October 31, 2023

NOTE 14 – INCOME TAXES (continued)

Topic 740 in the Accounting Standards Codification (ASC 740) prescribes recognition threshold and measurement attribute for the financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. ASC 740 also provides guidance on de-recognition, classification, interest and penalties, accounting in interim periods, disclosure and transition. At October 31, 2024 and April 30, 2024, the Company had taken no tax positions that would require disclosure under ASC 740.

The Company files income tax returns in the U.S. federal jurisdiction and in the State of Indiana.

Deferred income taxes reflect the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amount used for income tax purposes.

Significant components of the deferred tax assets at an anticipated tax rate of 21% for the six months ending October 31, 2024 and year ended April 30, 2024:

| | | October 31, 2024 | | | April 30, 2024 | |

| Net operating loss carryforwards | | | 1,349,150 | | | | 2,935,854 | |

| Deferred tax asset | | | 283,322 | | | | 616,529 | |

| Valuation allowance for deferred asset | | | (283,322 | ) | | | (616,529 | ) |

| Net deferred tax asset | | | - | | | | - | |

As of October 31, 2024 and April 30, 2024, the Company has net operating loss carryforward of approximately $1,349,150 and $2,935,854, respectively. The change in the allowance account from April 30, 2024 to October 31, 2024 was $333,207.

NOTE 15 – RELATED PARTY TRANSACTIONS

No related party transactions took place during our reporting period.

NOTE 16 – SUBSEQUENT EVENTS

Subsequent to October 31, 2024:

| | ● | LGX created a 210A AMI, located in Clay County, Indiana. LGX expects to retain 20% working interest in the initial well within the AMI. LGX will be carried in full through to production. |

| | ● | Additional leasehold was acquired bringing our total to approximately 7,099 acres. |

| | ● | Sold 291,386 shares of Series B Preferred shares for cash of $1,165,544. |

| | ● | A Noncompliance notice for the Saatkamp 7-17 well was received from the Indiana Department of Natural Resources, dated December 23, 2024. The Saatkamp 7-17 re-completion began on January 27, 2025. |

Item 4. Exhibits

None

SIGNATURES

Pursuant to the requirements of Regulation A, the issuer certifies that it has reasonable grounds to believe the information contained within this Form 1-SA is true and correct to the best of its knowledge and belief and has duly signed this Form 1-SA in Walla Walla, Washington on January 29, 2025.

| | LGX Energy Corp. |

| | |

| | By: | /s/ Howard Crosby |

| | | Chief Executive Officer/Chief Financial Officer |

Pursuant to the requirements of Regulation A, this report has been signed below by the following persons on behalf of the issuer and in the capacities and on the dates indicated.

| /s/ Howard Crosby | |

Howard Crosby, Chief Executive Officer, Principal Financial Officer, Director | |

| Date: January 29, 2025 | |

| | |

| /s/ John Ryan | |

John Ryan, Vice President Secretary, Director | |

| Date: January 29, 2025 | |