UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. [ ])

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

TCW Star Direct Lending LLC

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

TCW Star Direct Lending LLC

200 Clarendon Street – 51st Floor

Boston, MA 02116

NOTICE OF 2023 ANNUAL MEETING OF MEMBERS

April 13, 2023

To the Unitholders:

Notice is hereby given that the 2023 Annual Meeting of Members (the “Meeting”) of TCW Star Direct Lending LLC, a limited liability company organized under Delaware law (the “Company”), will be held in virtual format only by conference call on May 10, 2023 at 3:00 p.m. Eastern Standard Time. We are not conducting an in-person Annual Meeting this year. For those who wish to attend via conference call, please send an email to the Company at attendameeting@astfinancial.com and provide us with your full name and address in order to receive the conference call dial-in information. At the Annual Meeting, you will be asked to consider and vote on the following matters:

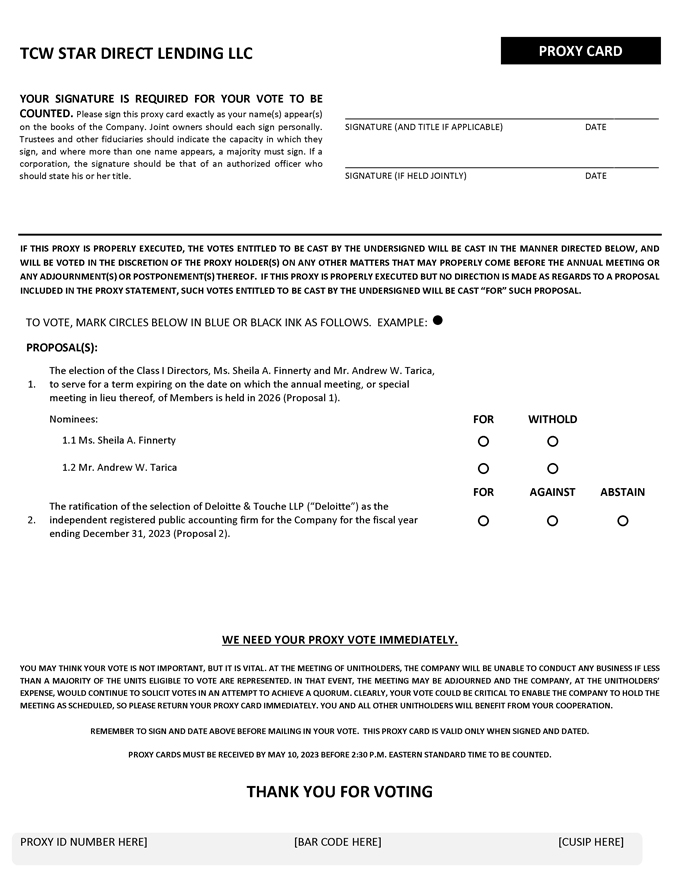

| 1. | The election of the Class I Directors, Ms. Sheila A. Finnerty and Mr. Andrew W. Tarica, to serve for a term expiring on the date on which the annual meeting, or special meeting in lieu thereof, of Members is held in 2026 (Proposal 1). |

| 2. | The ratification of the selection of Deloitte & Touche LLP (“Deloitte”) as the independent registered public accounting firm for the Company for the fiscal year ending December 31, 2023 (Proposal 2). |

The Board of Directors recommends that you vote (i) FOR the nominees named in the proxy statement and (ii) FOR the ratification of the selection of Deloitte as the independent registered public accounting firm for the Company for the period noted in the proxy statement.

Unitholders of record as of the close of business on April 3, 2023 (the “Record Date”) are entitled to notice of and to vote at the Meeting or any adjournment or postponement thereof. Regardless of whether you plan to attend the Meeting, please complete, date, sign and return promptly the accompanying proxy. This is important to ensure a quorum at the Meeting.

To vote by email:

Send a scanned copy of the completed and signed card (in .pdf format) to tabulation@astfundsolutions.com.

To vote by Internet:

| (i) | Read the proxy statement and have the enclosed proxy card at hand. |

| (ii) | Go to the website that appears on the enclosed proxy card. |

| (iii) | Enter the control number set forth on the enclosed proxy card and follow the simple instructions. |

To vote by telephone:

| (i) | Read the proxy statement and have the enclosed proxy card at hand. |

| (ii) | Refer to the toll-free number that appears on the enclosed proxy card. |

| (iii) | Follow the instructions. |

We encourage you to authorize a proxy to vote your units via the Internet using the control number that appears on your enclosed proxy card. Use of Internet will reduce the time and costs associated with this proxy solicitation. Whichever method you choose, please read the enclosed proxy statement carefully before you vote. If you should have any questions about this Notice of 2023 Annual Meeting of Members or the proxy materials, we encourage you to call us at (877) 896-3191.

By Order of the Board of Directors,

/s/ Gayle Espinosa

Gayle Espinosa

Secretary

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF MEMBERS TO BE HELD ON MAY 10, 2023

You should have received, together with this proxy statement, our annual report for the fiscal period ended December 31, 2022. If you would like another copy of the annual report, please write us at the address shown on the following page or call us at (877) 896-3191. The annual report will be sent to you without charge. Our annual reports can be accessed on the Securities and Exchange Commission’s website (www.sec.gov). The Company’s Notice of 2023 Annual Meeting of Members, Proxy Statement and Form of Proxy are available on the Internet at https://vote.proxyonline.com/tcw/docs/star.pdf.

WE NEED YOUR PROXY VOTE IMMEDIATELY.

YOU MAY THINK YOUR VOTE IS NOT IMPORTANT, BUT IT IS VITAL. AT THE 2023 ANNUAL MEETING OF MEMBERS (THE “MEETING”), THE COMPANY WILL BE UNABLE TO CONDUCT ANY BUSINESS IF LESS THAN A MAJORITY OF THE UNITS ELIGIBLE TO VOTE ARE REPRESENTED. IN THAT EVENT, THE MEETING MAY BE ADJOURNED AND THE COMPANY, AT THE MEMBERS’ EXPENSE, WOULD CONTINUE TO SOLICIT VOTES IN AN ATTEMPT TO ACHIEVE A QUORUM. CLEARLY, YOUR VOTE COULD BE CRITICAL TO ENABLE THE COMPANY TO HOLD THE MEETING AS SCHEDULED, SO PLEASE RETURN YOUR PROXY CARD IMMEDIATELY. YOU AND ALL OTHER MEMBERS WILL BENEFIT FROM YOUR COOPERATION.

Instructions for Signing Proxy Cards

The following general rules for signing proxy cards may be of assistance to you and avoid the time and expense involved in validating your vote if you fail to sign your proxy card properly.

| 1. | Individual Accounts. Sign your name exactly as it appears in the registration on the proxy card. |

| 2. | Joint Accounts. Either party may sign, but the name of the party signing should conform exactly to the name shown in the registration. |

| 3. | All Other Accounts. The capacity of the individual signing the proxy card should be indicated unless it is reflected in the form of registration. For example: |

| | |

Registration | | Valid Signature |

| Corporate Accounts | | |

(i) ABC Corp. | | ABC Corp. (by John Doe, Treasurer) |

(ii) ABC Corp. | | John Doe, Treasurer |

(iii) ABC Corp. c/o John Doe, Treasurer | | John Doe |

(iv) ABC Corp. Profit Sharing Plan | | John Doe, Director |

| |

| Trust Accounts | | |

(i) ABC Trust | | Jane B. Doe, Director |

(ii) Jane B. Doe, Director u/t/d 12/28/78 | | Jane B. Doe |

| |

| Custodial or Estate Accounts | | |

(i) John B. Smith, Cust. f/b/o John B. Smith, Jr. UGMA | | John B. Smith |

(ii) John B. Smith | | John B. Smith, Jr., Executor |

YOUR VOTE IS IMPORTANT. PLEASE AUTHORIZE A PROXY TO VOTE YOUR

UNITS PROMPTLY, NO MATTER HOW MANY UNITS YOU OWN.

TCW STAR DIRECT LENDING LLC

200 Clarendon Street, 51st Floor

Boston, MA 02116

PROXY STATEMENT

This proxy statement is furnished to unitholders in connection with a solicitation by the Board of Directors (the “Board” and each member thereof, a “Director” and collectively, the “Directors”) of TCW Star Direct Lending LLC, a limited liability company organized under Delaware law (the “Company”), of proxies to be used at the 2023 Annual Meeting of Members (the “Meeting”) of the Company to be held virtually, either telephonically or by other means of electronic communication, on May 10, 2023 at 3:00 p.m. Eastern Standard Time (and at any adjournment or postponement thereof) for the purposes set forth in the accompanying Notice of 2023 Annual Meeting of Members (the “Notice”). This proxy statement and the accompanying form of proxy are first being mailed to unitholders on or about April 13, 2023.

The persons named as proxy holders on the proxy card will vote in accordance with your instructions and, unless specified to the contrary, will vote FOR the election of the Class I Director nominees, Ms. Sheila A. Finnerty and Mr. Andrew W. Tarica (“Proposal 1”), and FOR the ratification of the selection of Deloitte & Touche LLP (“Deloitte”) as the independent registered public accounting firm for the Company for the fiscal year ending December 31, 2023 (“Proposal 2”). The close of business on April 3, 2023 has been fixed as the record date (the “Record Date”) for the determination of unitholders entitled to receive notice of, and to vote at, the Meeting. Each outstanding common unit of the Company is entitled to one vote, and each outstanding fractional unit thereof is entitled to a proportionate fractional unit of one vote for as many individuals as there are directors to be elected at the Meeting, and one vote (or, in the case of fractional units, a proportionate fractional unit) for the ratification of the selection of Deloitte. Votes may not be cumulated. The number of outstanding common units of the Company as of the Record Date is 3,753,190.

Under the Amended and Restated Limited Liability Company Agreement of the Company (as amended from time to time, the “LLC Agreement”), the presence (telephonically or by proxy) of unitholders holding a majority of the outstanding units entitled to vote at the Meeting constitutes a quorum. In the event that a quorum is not present at the Meeting or otherwise, the chairman of the Meeting has the power to adjourn the Meeting from time to time, to a date not more than 120 days after the Record Date without notice other than announcement at the Meeting.

For purposes of determining the presence of a quorum for transacting business at the Meeting, abstentions and broker “non-votes,” if any, will be treated as units that are present, but not as votes cast, at the Meeting. For purposes of Proposal 1, abstentions and broker “non-votes,” if any, will have the same effect as votes against Proposal 1, as the required vote is a plurality of the votes entitled to be cast at the Meeting at which a quorum is present. For purposes of Proposal 2, abstentions and broker “non-votes,” if any, will have no effect on the proposal, as the required vote is a majority of the votes cast at the Meeting at which a quorum is present. Since banks and brokers will have discretionary authority to vote units in the absence of voting instructions from unitholders with respect to Proposal 2, we expect that there will be no broker “non-votes” regarding Proposal 2 (that is, proxies from brokers or nominees indicating that such persons have not received instructions from the beneficial owner or other persons entitled to vote units on a particular matter with respect to which the brokers or nominees do not have discretionary power).

Unitholders who execute proxies retain the right to revoke them by (i) written notice received by the Secretary of the Company at any time before your proxy is exercised; (ii) signing a proxy bearing a later date; or (iii) attending the Meeting and voting telephonically. However, attendance at the Meeting will not, by itself, revoke a properly executed proxy). If you hold your units in “street name” (that is, through a broker or other nominee), you should instruct your broker or nominee how to vote your units by following the voting instructions provided by your broker or nominee.

Unitholders may request copies of the Company’s most recent annual and quarterly reports, including the financial statements, without charge, by writing to Investor Relations, TCW Star Direct Lending LLC, 200 Clarendon Street – 51st Floor, Boston, MA 02116. These documents have been filed with the Securities and Exchange Commission (the “SEC”) and are available at www.sec.gov. The Company’s most recent annual report accompanies this proxy statement.

1

GENERAL INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

In this section of the proxy statement, we answer some common questions regarding the Meeting and voting at the Meeting.

| Q. | WHAT AM I BEING ASKED TO CONSIDER AND VOTE ON AT THE MEETING? |

| A. | The matters to be considered and voted upon at the Meeting are: |

| | • | | The election of Class I Directors, Ms. Sheila A. Finnerty and Mr. Andrew W. Tarica, to serve until the Company’s 2026 annual meeting of Members and until their successors are duly elected and qualified; and |

| | • | | The ratification of the selection of Deloitte as the independent registered public accounting firm for the Company for the fiscal year ending December 31, 2023. |

| Q. | WHO MAY VOTE AT THE MEETING? |

| A. | You may vote if you were the record owner of common units at the close of business on the Record Date. You are entitled to cast one vote for as many individuals as there are directors to be elected at the Meeting and to cast one vote for the ratification of the selection of Deloitte at the Meeting, or any postponement or adjournment thereof, for each common unit you owned of record as of the close of business on the Record Date. |

As of the close of business on April 3, 2023, the Record Date, there are 3,753,190 common units issued and outstanding and entitled to vote at the Meeting.

| Q. | HOW DOES THE BOARD OF DIRECTORS SUGGEST THAT I VOTE? |

| A. | The Board unanimously recommends that you vote FOR the election of its nominees for two Class I Directors, Ms. Sheila A. Finnerty and Mr. Andrew W. Tarica, and FOR the ratification of the selection of Deloitte as the independent registered public accounting firm for the Company for the fiscal year ending December 31, 2023. |

| A. | If you plan to attend the Meeting and wish to vote telephonically, we will provide instructions at the Meeting. |

There are three ways for you to authorize a proxy:

| | • | | Sign, date and return the enclosed proxy card by emailing a scanned copy of the completed proxy card (in .pdf format) to tabulation@astfundsolutions.com; |

| | • | | Call (888) 227-9349; or |

| | • | | Log on to the Internet at www.proxyonline.com and follow the instructions at that site. |

Telephone and Internet proxy authorizations will close at 2:30 p.m. Eastern Standard Time on May 10, 2023. Unless you indicate otherwise, the persons named as your proxies will vote your units FOR the election of Ms. Finnerty and Mr. Tarica as Class I Directors and FOR the ratification of the selection of Deloitte as the independent registered public accounting firm for the Company for the fiscal year ending December 31, 2023.

If your units are held in the name of your broker, bank or other nominee, or “street name,” you should receive separate instructions from the holder of your units describing how to provide voting instructions.

Even if you plan to attend the Meeting, we request that you authorize a proxy in advance as described above so that your vote will be counted if you later decide not to attend the Meeting.

2

| Q. | HOW WILL PROXIES BE VOTED? |

| A. | All proxies solicited by the Board that are properly authorized (whether by Internet, telephone or email) at or prior to the Meeting, and that are not revoked, will be voted at the Meeting. Votes will be cast in accordance with the instructions specified. If no instructions are specified, the persons named as proxies will cast such votes FOR the election of the Class I Director nominees and FOR the ratification of the selection of Deloitte as the independent registered public accounting firm for the Company for the fiscal year ending December 31, 2023. |

| A. | Yes. At any time before it has been voted, you may revoke your proxy by |

| | • | | sending a letter revoking your proxy to the Secretary of the Company at the Company’s offices located at 200 Clarendon Street – 51st Floor, Boston, MA 02116; |

| | • | | properly executing and sending a later-dated proxy; or |

| | • | | attending the Meeting using the conference dial-in information, revoking any previously delivered proxy, and voting at the Meeting. Attendance at the Meeting will not, by itself, revoke your proxy. |

| Q. | WHAT CONSTITUTES A QUORUM? |

| A. | The presence (telephonically or by proxy) of unitholders holding a majority of the outstanding units entitled to vote at the Meeting constitutes a quorum for the purposes of the Meeting. No business may be conducted at the Meeting if a quorum is not present. Abstentions and broker “non-votes” will be counted as present for purposes of determining a quorum. A broker non-vote is a vote that is not cast on a non-routine matter because the units entitled to cast the vote are held in “street name,” the broker lacks discretionary authority to vote the units and the broker has not received voting instructions from the beneficial owner. |

If a quorum is not present in person or by proxy at the Meeting, the chairman of the Meeting may adjourn the Meeting to a date not more than 120 days after the original Record Date without notice other than announcement at the Meeting.

| Q. | WHAT IS THE REQUIRED VOTE FOR APPROVAL OF EACH PROPOSAL PROPERLY PRESENTED AT THE MEETING? |

| A. | Proposal One. The election of Ms. Finnerty and Mr. Tarica as Class I Directors requires the affirmative vote of a plurality of the votes entitled to be cast at the Meeting. Each common unit is entitled to one vote for each director to be elected at the Meeting. |

Proposal Two. The ratification of the selection of Deloitte as the independent registered public accounting firm for the Company for the fiscal year ending December 31, 2023 requires the affirmative vote of a majority of the votes cast at the Meeting. Each common unit is entitled to one vote for the ratification of the selection of the independent registered public accounting firm at the Meeting.

| Q. | WHAT IF OTHER MATTERS COME UP AT THE MEETING? |

| A. | The Board does not know of any matters to be properly presented at the Meeting other than those referred to in this proxy statement. If other matters are properly presented at the Meeting (or any postponement or adjournment thereof) for consideration, the persons named as proxy holders will not have the discretion to vote on those matters for you. |

| Q. | WHO IS SOLICITING MY VOTE? |

| A. | In this proxy statement, the Board is soliciting your vote with respect to the matters described in this proxy statement to be submitted for unitholder consideration at the Meeting. |

3

| Q. | WHO PAYS FOR THIS SOLICITATION OF PROXIES? |

| A. | The expenses of preparing, printing and delivering the enclosed proxy card, the accompanying Notice and this proxy statement, tabulation expenses, and all other costs, in connection with this solicitation of proxies, will be borne by the Company. We may also reimburse banks, brokers and others for their reasonable expenses in forwarding proxy solicitation material to the beneficial owners of the Company’s units. In order to obtain the necessary quorum at the Meeting, additional solicitation may be made by email, mail, telephone, telegraph, facsimile or personal interview by representatives of the Company, or by brokers, or their representatives or by a solicitation firm that may be engaged by the Company to assist in proxy solicitations. We will not pay any of the Company’s representatives any additional compensation for their efforts to supplement proxy solicitation. |

| Q. | CAN I VIEW THE PROXY STATEMENT ON THE INTERNET? |

| A. | Yes. The proxy statement is available on the Internet at https://vote.proxyonline.com/tcw/docs/star.pdf. |

This information summarizes information that is

included in more detail in the proxy statement.

We urge you to read the proxy statement carefully.

If you have questions, call (877) 896-3191.

4

PROPOSAL 1: ELECTION OF CLASS I DIRECTORS

The Board is divided into three classes: Class I, Class II and Class III. The terms of office of the present Directors in each class expire at the annual meeting in the year indicated and when their respective successors are duly elected and qualified: Class I, 2023; Class II, 2024; Class III, 2025. Directors elected to succeed those whose terms are expiring will be identified as being of that same class and will be elected until the third annual meeting after their election and until their successors are duly elected and qualified.

The persons named in the accompanying form of proxy intend to vote at the Meeting (unless directed not to so vote) for the election of Ms. Sheila A. Finnerty and Mr. Andrew W. Tarica as Class I Director nominees for the Company. Ms. Finnerty and Mr. Tarica have indicated that they will serve if elected, but if they should be unable to serve, the proxy or proxies will be voted for any other persons determined by the persons named in the proxy in accordance with their discretion. If elected, Ms. Finnerty and Mr. Tarica will serve until the 2026 annual meeting of Members and until their respective successors are duly elected and qualified.

As described above, there are two nominees for election to the Board at this time. The affirmative vote of a plurality of the votes entitled to be cast at the Meeting, if a quorum is present, is sufficient to elect a director.

The Board recommends that the unitholders vote “FOR” the election of each nominee listed above to serve as a Director until the annual meeting of Members in 2026 and until her or his respective successor has been duly elected and qualified.

Information Concerning Nominees and Directors

The following table provides information concerning each of the Directors and the Class I Director nominees of the Board, as of the date of this proxy statement. The nominees are listed first in the table under “Class I Director Nominees.” The terms of the Class II and the Class III Directors do not expire this year.

| | | | | | | | |

Name, Address and Year of Birth | | Position(s) Held with Company, Length of Time Served and Term of Office | | Principal Occupation(s)

During Past 5 Years | | Number of Portfolios in Fund Complex(1) Overseen by Director | | Other Directorships Held by Director During Past Five Years |

| Class I Director Nominees – Term Expires at the 2023 Annual Meeting of Members |

| | | | |

Sheila A. Finnerty (born 1965) | | Director since August 2022 | | Presently retired. Previously Executive Managing Director at Liberty Mutual Insurance.. | | 2 | | None |

| | | | |

| Andrew W. Tarica (born 1959) | | Director since August 2022 | | Chief Executive Officer of Meadowbrook Capital Management since 2001. Also acts as head of fixed income proprietary trading for Cowen Prime Services. | | 33 | | None |

|

| Class II Directors – Term Expires at the 2024 Annual Meeting of Members |

| | | | |

Saverio M. Flemma (born 1962) | | Director since August 2022 | | Founder and President of SF Advisors LLC. Previously, a Senior Banker at Drexel Hamilton, LLC commencing 2016. | | 3 | | None |

5

| | | | | | | | |

| Richard T. Miller* (born 1962) | | President and Director since August 2022 | | Group Managing Director, Head of Private Credit of TCW (since 2012). | | 4 | | None |

|

| Class III Directors – Term Expires at the 2025 Annual Meeting of Members |

| | | | |

R. David Kelly (born 1964) | | Director since August 2022 | | Chairman and CEO of Croesus & Company. | | 3 | | 3 |

| | | | |

| Laird R. Landmann* (born 1964) | | Director since August 2022 | | Group Managing Director, Co-Director of Fixed Income of TCW (since 2009). | | 14 | | None |

| (1) | “Fund Complex” is defined to include registered investment companies that hold themselves out to investors as related companies for purposes of investment and investor services, or registered investment companies advised by the Company’s investment adviser, TCW Asset Management Company LLC (the “Adviser”), or that have an investment adviser that is an affiliated person of the Adviser. As a result, the Fund Complex includes the Company, TCW Direct Lending LLC, TCW Direct Lending VII LLC, TCW Direct Lending VIII LLC, the TCW Funds, the TCW Strategic Income Fund and the Metropolitan West Funds. |

| * | Designates individuals who are “interested persons” of the Company, as defined by the Investment Company Act of 1940, as amended (the “1940 Act”), because of affiliations with the Adviser. |

Officers of the Company

The officers of the Company are appointed and elected by the Board either at its annual meeting or at any subsequent regular or special meeting of the Board. The Board of the Company has elected six officers to hold office at the discretion of the Board until their successors are duly elected and qualified or until her or his resignation or removal. Except where dates of service are noted, all officers listed below served the Company as such throughout the fiscal period ended December 31, 2022. The following table sets forth information concerning each officer of the Company as of the date of this proxy statement:

| | | | | | |

Name, Address and Year of Birth | | Position(s) Held with Company | | Length of Time Served | | Principal Occupation(s) During Past 5 Years |

Richard T. Miller* (born 1962) | | President | | Since May 2021 | | Group Managing Director, Head of Private Credit of TCW. |

| | | |

Andrew Kim* (born 1978) | | Chief Financial Officer and Treasurer | | Since May 2021 | | Managing Director of TCW, in charge of Client and Fund Reporting (since 2020). Previously, Vice President of Finance at Tennenbaum Capital Partners. |

| | | |

Gayle Espinosa* (born 1981) | | Secretary | | Since May 2021 | | Managing Director of TCW, in charge of Financial Reporting. |

| | | |

Joseph Magpayo* (born 1964) | | Assistant Secretary | | Since May 2021 | | Managing Director of TCW’s Client Services Group. |

| | | |

David Wang* (born 1976) | | Chief Operating Officer | | Since May 2021 | | Managing Director and Chief Operating Offering of TCW’s Private Credit Group. |

| | | |

Gladys Xiques* (born 1973) | | Chief Compliance Officer | | Since May 2021 | | Global Chief Compliance Officer of TCW (since January 2021). |

| * | Designates individuals who are “interested persons” of the Company, as defined by the 1940 Act, because of affiliations with the Adviser. |

6

Compensation of Executive Officers and Directors

Compensation of Executive Officers

The Company does not currently have any employees and does not expect to have any employees. Services necessary for the Company’s business, including such services provided by the Company’s executive officers, are provided by individuals who are employees of the Adviser, pursuant to the terms of the Company’s Advisory Agreement with the Adviser (the “Advisory Agreement”). Therefore, the Company’s day-to-day investment operations are managed by the Adviser, and most of the services necessary for the origination and administration of the Company’s investment portfolio are provided by investment professionals employed by the Adviser.

None of the Company’s executive officers receive direct compensation from the Company. Subject to the cap described below under Management and Service Providers—Organizational and Operating Expenses, under the Administration Agreement with the Adviser (the “Administration Agreement”), the Company reimburses the Company’s Administrator, TCW Asset Management Company LLC (the “Administrator”) for expenses incurred by it on the Company’s behalf in performing its obligations under the Administration Agreement. Certain of the Company’s executive officers, through their ownership interest in or management positions with the Adviser, may be entitled to a portion of any profits earned by the Adviser, which includes any fees payable to the Adviser under the terms of the Advisory Agreement, less expenses incurred by the Adviser in performing its services under the Advisory Agreement. The Adviser may pay additional salaries, bonuses, and individual performance awards and/or individual performance bonuses to the Company’s executive officers in addition to their ownership interest.

Compensation of Independent Directors

Each of the Company’s Directors who are not “interested persons” of the Company, as that term is defined in the 1940 Act (“Independent Directors”), receives an annual retainer fee of $56,250, payable once per year, if the Independent Director attends at least 75% of the meetings held during the previous year. In addition, each Independent Director receives $1,875 for each Board meeting in which he or she participates. Each Independent Director is also reimbursed for all reasonable out-of-pocket expenses incurred in connection with participating in each Board meeting.

Each Independent Director also receives $750 for each meeting of the Company’s Audit Committee (the “Audit Committee”) in which he or she participates. With respect to each Audit Committee meeting not held concurrently with a Board meeting, each Independent Director is reimbursed for all reasonable out-of-pocket expenses incurred in connection with participating in such Audit Committee meeting. In addition, the lead Independent Director of the Board and the chairman of the Audit Committee each received an annual retainer fee of $11,250.

The following table sets forth the compensation paid by the Company, during the fiscal period ended December 31, 2022, to the Independent Directors. No compensation is paid to Directors who are “interested persons” of the Company. The Company has no retirement or pension plans or any compensation plans under which the Company’s equity securities were authorized for issuance.

| | | | |

Name of Independent Director | | Fees Earned or Paid

in Cash (Total

Compensation) | |

Sheila A. Finnerty | | $ | 30,750 | |

Saverio M. Flemma | | $ | 36,375 | |

R. David Kelly | | $ | 36,375 | |

Andrew W. Tarica | | $ | 30,750 | |

7

Unit Ownership

The following table sets forth the aggregate dollar range of equity securities owned by each Director of the Company and of all funds overseen by each Director in the Fund Complex. The cost of each Director’s investment in the Fund Complex may vary from the current dollar range of equity securities shown below, which is calculated on an appraised value basis as of December 31, 2022. The information as to beneficial ownership is based on statements furnished to the Company by each Director.

| | | | | | |

Name of Nominee/Director | | Dollar Range of Equity Securities

Held in the Company | | Aggregate Dollar Range of

Equity Securities Held in Fund

Complex | |

Independent Director Nominees | | | | | | |

Sheila A. Finnerty | | 0 | | | Over $100,000 | |

Andrew W. Tarica | | 0 | | | Over $100,000 | |

Interested Directors | | | | | | |

Laird R. Landmann | | 0 | | | Over $100,000 | |

Richard T. Miller | | 0 | | | Over $100,000 | |

Independent Directors | | | | | | |

Saverio M. Flemma | | 0 | | | Over $100,000 | |

R. David Kelly | | 0 | | | Over $100,000 | |

Information about Each Director’s Qualification, Experience, Attributes or Skills

The Board believes that each of the Directors, including the Class I Director nominees, has the qualifications, experience, attributes and skills (“Director Attributes”) appropriate to serve as a Director of the Company, in light of the Company’s business and structure. Certain of these business and/or professional experiences are set forth in detail in the table above under “—Information Concerning Nominees and Directors.” The Directors have substantial board experience or other professional experience and have demonstrated a commitment to discharging their oversight responsibilities as Directors. The Board annually conducts a “self-assessment” wherein the performance of the Board and the Audit Committee are reviewed.

In addition to the information provided in the table above, below is certain additional information regarding each Director, including the Class I Director nominees, and certain of their Director Attributes. Although the information provided herein is not all-inclusive, the information describes some of the specific experiences, qualifications, attributes or skills that each Director possesses to demonstrate that the Directors have the appropriate Director Attributes to serve effectively as Directors of the Company. Many Director Attributes involve intangible elements, such as intelligence, integrity and work ethic, the ability to work together, the ability to communicate effectively, the ability to exercise judgment and ask incisive questions, and commitment to unitholder interests. In conducting its self-assessment, the Board determines whether the Directors have the appropriate Director Attributes and experience to serve effectively as Directors of the Company.

Independent Directors

Sheila A. Finnerty

Ms. Finnerty, served as an Executive Managing Director at Liberty Mutual Insurance, a Fortune 100 Company, until her retirement. She has 34 years of experience and is widely respected as a successful investor and strong partner both in the financial markets and in business strategy. As an investor at both Liberty Mutual Investments and Morgan Stanley Investment Management, Sheila successfully managed leveraged finance and alternative credit portfolios as well as being an active member of the internal Investment Committee and the leadership teams that oversaw asset allocation and strategy for these businesses. Prior to joining Liberty Mutual, Sheila held several roles at Morgan Stanley Investment Management (MSIM) including Managing Director as Global Head of High Yield Investments as well as Head of Leveraged Loan Investments. Ms. Finnerty serves as an Independent Board Member for Lakemore

8

Partners, she is a member of the Board of Trustees of Manhattanville College and serves on the Philanthropy Committee of the May Institute. Sheila is a strong proponent of diversity and inclusion initiatives and is a founding member of Women in Alternative Debt. Ms. Finnerty is a 1988 graduate of The New York University Stern School of Business and a 1986 graduate of Manhattanville College. She is a Charter Holder of the CFA Institute. She is a member of the Board of Directors of the Company and TCW Direct Lending VIII LLC.

Saverio M. Flemma

Mr. Flemma is the founder and President of SF Advisors LLC, a financial advisory firm. He advises companies and business owners on capital structure and financing-related issues as well as company sales. Prior to SF Advisors, Mr. Flemma was a Senior Banker at Drexel Hamilton, LLC, an investment banking and securities brokerage firm. Mr. Flemma joined Drexel Hamilton in 2016 and was responsible for advising on mergers and acquisitions and capital raising transactions. Previously, Mr. Flemma served as a Managing Director in Investment Banking at Deutsche Bank Securities, Chase Securities and Banc of America Securities. Mr. Flemma earned a B.A. in Economics from Rollins College. He is a member of the Board of Directors of the Company, TCW Direct Lending VII LLC and TCW Direct Lending VIII LLC.

R. David Kelly

Mr. Kelly has investment experience serving both public companies and private companies in the financial advisory, real estate development and operating company sectors. Mr. Kelly has served as the Chief Executive Officer and Chairman of the board of directors of Croesus and Company, a real estate investment and advisory firm, since 2014. Mr. Kelly is the managing partner of StraightLine Realty Partners, LLC, an alternative investment platform with investments in real estate financial services and venture capital, which he founded in 2010. Mr. Kelly serves as Lead Independent Director on the Board of Directors of the Company, TCW Direct Lending VII LLC and TCW Direct Lending VIII LLC. He also serves as Lead Director on the Board of Directors of Invesco’s INREIT and is an at large director of Ashton Woods Homes. He also serves as an Independent Director of Acadia Healthcare. Mr. Kelly serves on the Governing Body of the Children’s Medical Center of Dallas, serving on the Finance Operating and Investment Committees. Mr. Kelly served as Chairman of the Teacher’s Retirement System of Texas from 2007 to 2017. He also served as Chairman of the Texas Public Finance Authority from 2002 to 2006 as a gubernatorial appointee. Mr. Kelly earned a B.A. in Economics from Harvard University and an M.B.A. from Stanford University.

Andrew W. Tarica

Mr. Tarica is the founder and CEO of Meadowbrook Capital Management (“MCM”), a fixed income credit asset management business he founded in 2001. Prior to founding MCM, he was the global head of the high-grade corporate bond department at Donaldson, Lufkin & Jenrette from 1992 to 1999. From 1990 to 1992 he ran the investment grade sales and trading department at Kidder Peabody. He began his career at Drexel Burnham in 1983 in the investment grade trading area, where he eventually became the head of trading. He is a member of the Board of Directors of TCW Funds, Inc., TCW Strategic Income Fund, the Company, TCW Direct Lending VII LLC, TCW Direct Lending VIII LLC, and Chairman of the TCW/MetWest Mutual Funds board. Mr. Tarica is a graduate of Northeastern University.

Interested Directors

Laird R. Landmann, Group Managing Director, Co-Director of Fixed Income of TCW

Mr. Landmann is a Generalist Portfolio Manager in TCW’s Fixed Income Group. He joined TCW in 2009 during the acquisition of Metropolitan West Asset Management LLC (MetWest). Mr. Landmann currently serves on the boards of the TCW and Metropolitan West Mutual Funds. Mr. Landmann currently co-manages many of TCW and MetWest’s mutual funds, including the MetWest Total Return Bond Fund, the MetWest High Yield Bond Fund and the TCW Core Fixed Income Fund, and leads the fixed income group’s risk management efforts. He is a leader of the MetWest investment team that was recognized as Morningstar’s Fixed Income Manager of the Year for 2005 and has been nominated for the award eight times. Prior to founding MetWest in 1996, Mr. Landmann was a principal and the co-director of fixed income at Hotchkis and Wiley. He also served as a portfolio manager and vice president at PIMCO. Mr. Landmann holds a B.A. in Economics from Dartmouth College and an MBA from the University of Chicago Booth School of Business.

9

Richard T. Miller, Group Managing Director, Private Credit Group at TCW

Mr. Miller serves as Group Managing Director, Chief Investment Officer and Chairman of the Investment Committee of the Private Credit Group and Co-Portfolio Manager of the direct lending strategy (the “Direct Lending Strategy”). Mr. Miller joined TCW in 2013 with the acquisition of the Special Situations Funds Group from Regiment Capital Advisors, LP which he led since the group’s inception in 2001. Mr. Miller has over 30 years of experience in the capital markets and previously was ranked on the Institutional Investor “All American High Yield Research Team” for six consecutive years, focusing primarily on the Metals and Mining sector. Prior to his involvement in high yield research, he was at Chase Manhattan Bank in the Mergers & Acquisitions Group. He then moved on to become a Managing Director with the High Yield Group. Subsequently, he became the Head of High Yield Research at BankBoston Securities and in 1999, Mr. Miller joined UBS as a Managing Director and Head of the Global High Yield Research Group. Mr. Miller currently serves as an ex officio Trustee of the University of Rochester Endowment and is a former Trustee of the Nativity Preparatory School and the Dexter Southfield School. Mr. Miller received his BS from Syracuse University and his MBA from the University of Rochester.

Information Regarding the Board and its Committees

Pursuant to the LLC Agreement, the Board has established an Audit Committee. The Board has also established a Special Transactions Committee. The Board has the authority to form additional committees of the Board from time to time to the extent that it determines that it is appropriate to do so.

Board Leadership Structure

The Company’s business and affairs are managed under the direction of its Board, including the responsibilities performed for the Company pursuant to the Advisory Agreement. Among other things, the Board sets broad policies for the Company, approves the appointment of the Company’s investment adviser, administrator and officers, and approves the engagement, and reviews the performance of, the Company’s independent registered public accounting firm. The role of the Board and of any individual director is one of oversight, and not of management, of the day-to-day affairs of the Company.

The Board currently consists of six Directors, four of whom are Independent Directors. As part of each regular Board meeting, the Independent Directors meet separately from management. The Board reviews its leadership structure periodically as part of its annual self-assessment process and believes that its structure is appropriate to enable the Board to exercise its oversight of the Company.

The Independent Directors have designated a lead Independent Director who has authority and specific responsibilities regarding (i) meetings and executive sessions; (ii) liaison between the Independent Directors and management; (iii) oversight of information provided to the Board; (iv) legal advisors and consultants retained by the Independent Directors; (v) Board evaluation and leadership; and (vi) investor communication. R. David Kelly is the lead Independent Director.

Board Oversight of Risk Management

The Board oversees the services provided by the Adviser, including certain risk management functions. Risk management is a broad concept composed of many disparate elements (such as, for example, investment risk, issuer and counterparty risk, compliance risk, operational risk, and business continuity risk). Consequently, Board oversight of different types of risks is handled in different ways, and the Board implements its risk oversight function both as a whole and through Board committees. In the course of providing oversight, the Board and its committees receive reports on the Company’s activities, including regarding the Company’s investment portfolio and its financial accounting and reporting. The Audit Committee’s meetings with the Company’s independent registered public accounting firm also contribute to its oversight of certain internal control risks. In addition, the Board meets periodically with representatives of the Company and the Adviser to receive reports regarding the management of the Company, including certain investment and operational risks, and the Independent Directors are encouraged to communicate directly with senior management.

10

The Company believes that the Board’s role in risk oversight must be evaluated on a case-by-case basis and that its existing role in risk oversight is appropriate. Management believes that the Company has robust internal processes in place and a strong internal control environment to identify and manage risks. However, not all risks that may affect the Company can be identified or processes and controls developed to eliminate or mitigate their occurrence or effects, and some risks are beyond any control of the Company or the Adviser, its affiliates, or other service providers.

Member Meetings

The Company will hold an annual meeting of Members for the purposes of electing directors, offering the Members the opportunity to review and discuss the Company’s investment activity and portfolio, and for such other business as may lawfully come before the Members. The annual meetings shall be held on such date and at such time as may be designated from time to time by the Board and stated in the notice of the annual meeting. A quorum of the Members at an annual meeting shall consist of Members holding a majority of the outstanding units entitled to vote on the matter in question.

Audit Committee

The Company has a standing Audit Committee, which currently consists of Ms. Finnerty and Messrs. Flemma, Kelly and Tarica, all of whom are Independent Directors. The principal functions of the Audit Committee are to select, engage and discharge the Company’s independent registered public accounting firm, review the plans, scope and results of the audit engagement with the Company’s independent registered public accounting firm, approve professional services provided by the Company’s independent registered public accounting firm (including compensation therefor), review the independence of the Company’s independent registered public accounting firm, review the adequacy of the Company’s internal control over financial reporting, establish guidelines and make recommendations to the Board regarding the valuation of the Company’s loans and investments, and take any other actions consistent with the Audit Committee charter or as may be authorized by the Board. Mr. Flemma serves as Chairman of the Audit Committee, and has been designated as an “audit committee financial expert,” as defined in Item 401(h) of Regulation S-K promulgated by the SEC.

The Board has adopted a written charter for its Audit Committee, which is attached hereto as Appendix A.

Nominating Committee

The Company does not have a nominating committee or a charter relating to the nomination of directors. Decisions on director nominees are made through consultation among the Independent Directors. The Independent Directors consider possible candidates to fill vacancies on the Board, review the qualifications of candidates recommended by unitholders and others, and recommend the slate of director nominees to be proposed for election by unitholders at each annual meeting. The Independent Directors believe that they can adequately fulfill the functions of a nominating committee without having to appoint an additional committee to perform that function. The Independent Directors have not adopted any specific policies or practices to determine nominations for the Company’s directors other than as described herein and as set forth in the LLC Agreement. The Independent Directors have not utilized the services of any third party to assist in identifying and evaluating director nominees.

Compensation Committee

The Company does not have a compensation committee because its executive officers do not receive any direct compensation from the Company. However, the compensation payable to the Company’s Adviser, pursuant to the Advisory Agreement, has been separately approved by a majority of the Independent Directors. In addition, the compensation paid to the Independent Directors is established and approved by the Independent Directors.

Special Transactions Committee

The Company has a standing Special Transactions Committee, which currently consists of Ms. Finnerty and Messrs. Flemma, Kelly and Tarica, all of whom are Independent Directors. The principal functions of the Special Transactions Committee are to review and approve potential co-investment transactions as defined by and subject to the exemptive order that the Adviser received from the SEC (Investment Company Act Rel. No. 31649, May 27, 2015) (the “Exemptive Order”).

11

Board of Director and Committee Meetings Held

The following table shows the number of Board and committee meetings held for the Company, and the number of times the Board and each committee acted by written consent, during the fiscal period ended December 31, 2022:

| | | | |

| | | Meetings Held | | Actions by

Written Consent |

Board of Directors | | 2 | | 0 |

Audit Committee | | 2 | | 0 |

Special Transactions Committee | | 0 | | 2 |

All Directors attended at least 75% of the aggregate of (i) the total number of meetings of the Board and (ii) the total number of meetings held by all committees of the Board on which they served. The Company does not currently have a policy with respect to Board member attendance at annual meetings.

Code of Ethics

The Company has adopted the code of ethics of the Adviser (the “Code of Ethics”) pursuant to Rule 17j-1 under the 1940 Act and Rule 204A-1 under the Investment Advisers Act of 1940, as amended (the “Advisers Act”), respectively, that establishes procedures for personal investments and restricts certain transactions by the Company’s personnel. The Code of Ethics generally contains restrictions on investments by the Company’s employees in securities that may be purchased or held by the Company. This information will be available on the SEC’s website at www.sec.gov. You may also obtain copies of the Code of Ethics by written request addressed to the following: Investor Relations, TCW Asset Management Company LLC, 865 S. Figueroa Street, Los Angeles, California 90017.

There is no family relationship between any of the Company’s current officers or Directors. There are no orders, judgments, or decrees of any governmental agency or administrator, or of any court of competent jurisdiction, revoking or suspending for cause any license, permit or other authority to engage in the securities business or in the sale of a particular security or temporarily or permanently restraining any of the Company’s officers or Directors from engaging in or continuing any conduct, practice or employment in connection with the purchase or sale of securities, or convicting such person of any felony or misdemeanor involving a security, or any aspect of the securities business or of theft or of any felony, nor are any of the officers or Directors of any corporation or entity affiliated with the Company so enjoined.

Unitholder Communications with Board of Director and Board Attendance at Annual Meetings

Unitholders may send communications to the Board. Communications should be addressed to the Secretary of the Company at the Company’s principal offices at TCW Star Direct Lending LLC, 200 Clarendon Street – 51st Floor, Boston, MA 02116. The sender should indicate in the address whether it is intended for the entire Board, the Independent Directors as a group or an individual Director. The Secretary will forward any communications received directly to the intended recipient in accordance with the instructions.

Required Vote

The election of each listed nominee for Director requires the approval of a plurality of all the votes entitled to be cast at the Meeting, telephonically or by proxy, at which a quorum is present. The Board of Directors of the Company recommends a vote “For” the election of each nominee to the Company’s Board of Directors.

12

PROPOSAL 2: RATIFICATION OF THE SELECTION OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Company’s Auditor

At a meeting held on March 28, 2023, the Audit Committee of the Company unanimously recommended the selection of Deloitte as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023. While the Audit Committee is responsible for the appointment, compensation, retention, termination and oversight of the independent auditor, the Company is requesting, as a matter of good corporate governance, that the Members ratify the selection of Deloitte as the Company’s independent registered public accounting firm. If the Members fail to ratify the selection, the Audit Committee will reconsider whether to retain Deloitte and may retain that firm or another without re-submitting the matter to Members. Even if the appointment is ratified, the Audit Committee may, in its discretion, direct the appointment to a different independent registered public accounting firm at any time during the year.

Representatives of Deloitte are expected to be available telephonically for the Meeting and thus, will have an opportunity to make a statement, if they so desire, and be available to respond to appropriate questions asked by the unitholders.

Principal Accountant Fees and Services

Set forth in the table below are audit fees and non-audit related fees billed to the Company and payable to Deloitte for professional services performed for the Company’s fiscal period ended December 31, 2022.

| | | | | | | | | | | | | | | | |

Fiscal Year/Period | | Audit Fees | | | Audit-Related Fees(1) | | | Tax Fees(2) | | | All Other Fees(3) | |

2022 | | $ | 102,048 | | | $ | –– | | | $ | –– | | | $ | –– | |

| (1) | “Audit-Related Fees” are those fees billed to the Company relating to audit services provided by Deloitte. |

| (2) | “Tax Fees” are those fees billed to the Company in connection with tax consulting services performed by Deloitte, including primarily the review of the Company’s income tax returns. |

| (3) | “All Other Fees” are those fees billed to the Company in connection with permitted non-audit services performed by Deloitte. |

The Audit Committee reviews, negotiates and approves in advance the scope of work, any related engagement letter and the fees to be charged by the independent registered public accounting firm for audit services and permitted non-audit services for the Company and for permitted non-audit services for the Company’s service providers, including the Adviser and its affiliates, if such non-audit services have a direct impact on the operations or financial reporting of the Company. All of the audit and non-audit services described above, for which fees were incurred by the Company for the fiscal period ended December 31, 2022, were pre-approved by the Audit Committee, in accordance with its pre-approval policy.

Audit Committee Report

As part of its oversight of the Company’s financial statements, the Audit Committee reviewed and discussed with both management and the Company’s independent registered public accounting firm the Company’s financial statements filed with the SEC for the fiscal period ended December 31, 2022. Management advised the Audit Committee that all financial statements were prepared in accordance with accounting principles generally accepted in the United States, and reviewed significant accounting issues with the Audit Committee. The Audit Committee also discussed with the independent registered public accounting firm the matters required to be discussed by the standards of the Public Company Accounting Oversight Board (United States) (the “PCAOB”).

The Audit Committee has pre-approved, in accordance with its pre-approval policy, the permitted audit, audit-related, tax, and other services to be provided by Deloitte, the Company’s independent registered public accounting firm, in order to assure that the provision of such service does not impair the firm’s independence.

13

Any requests for audit, audit-related, tax and other services that have not received general pre-approval must be submitted to the Audit Committee for specific pre-approval in accordance with its pre-approval policy, irrespective of the amount, and cannot commence until such approval has been granted. Normally, pre-approval is provided at regularly scheduled meetings of the Audit Committee. However, the Audit Committee has delegated pre-approval authority to the Chairman of the Audit Committee, Saverio M. Flemma, who will report any pre-approval decisions to the Audit Committee at its next scheduled meeting. The Audit Committee does not delegate its responsibilities to pre-approve services performed by Deloitte to management.

The Audit Committee received and reviewed the written disclosures from Deloitte required by the applicable PCAOB rule regarding the independent registered public accounting firm’s communications with audit committees concerning independence, and has discussed with Deloitte its independence. The Audit Committee has reviewed the audit fees paid by the Company to Deloitte. It has also reviewed non-audit services and fees to assure compliance with the Company’s and the Audit Committee’s policies restricting Deloitte from performing services that might impair its independence.

Based on the reviews and discussions referred to above, the Audit Committee recommended to the Board that the financial statements as of and for the fiscal period ended December 31, 2022 be included in the Company’s annual report on Form 10-K for 2022, for filing with the SEC. The Audit Committee also recommended the appointment of Deloitte to serve as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2023.

Audit Committee Members

Sheila A. Finnerty

Saverio M. Flemma, Chairman

R. David Kelly

Andrew W. Tarica

The material in this report is not “soliciting material,” is not deemed “filed” with the SEC, and is not to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended (the “Exchange Act”), whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.”

Required Vote

The ratification of the selection of Deloitte as the independent registered public accounting firm for the Company requires the affirmative vote of a majority of all the votes cast at the Meeting, telephonically or by proxy, at which a quorum is present. The Board of Directors of the Company recommends a vote “For” the ratification of the selection of Deloitte as the independent registered public accounting firm for the Company.

14

MANAGEMENT AND SERVICE PROVIDERS

The Adviser

The Adviser and Advisory Agreement

The Company’s investment activities are managed by the Adviser, which is registered as an investment adviser under the Advisers Act. Subject to the overall supervision of the Board, the Adviser manages the Company’s day-to-day operations of, and provides investment advisory and management services to, the Company, pursuant to the Advisory Agreement.

The Adviser is a Delaware limited liability company registered with the SEC under the Advisers Act, and has been since 1970. The Adviser is a wholly owned subsidiary of The TCW Group, Inc. and, together with its affiliated companies, manages or has committed to manage approximately $205 billion of assets as of December 31, 2022. Such assets are managed in various formats, including managed accounts, funds, structured products and other investment vehicles.

The Adviser is responsible for sourcing investment opportunities, conducting industry research, performing diligence on potential investments, structuring the Company’s investments and monitoring the Company’s portfolio companies on an ongoing basis.

Under the Advisory Agreement, the Adviser:

| | • | | determines the composition of the Company’s portfolio, the nature and timing of the changes to the portfolio and the manner of implementing such changes; |

| | • | | identifies, evaluates and negotiates the structure of the Company’s investments (including performing due diligence on prospective portfolio companies); |

| | • | | determines the assets the Company will originate, purchase, retain or sell; |

| | • | | closes, monitors and administers the investments the Company makes, including the exercise of any rights in the Company’s capacity as a lender; and |

| | • | | provides the Company such other investment advice, research and related services as it may, from time to time, require. |

The Adviser’s services under the Advisory Agreement are not exclusive, and the Adviser is free to furnish similar or other services to others so long as its services to the Company are not impaired.

Under the Advisory Agreement, the Adviser receives a management fee and an incentive fee from the Company as described below.

Unless earlier terminated as described below, the Advisory Agreement will remain in effect for a period of two years from its effective date and will remain in effect from year to year thereafter if approved annually by (i) the vote of the Company’s Board, or by the vote of a majority of the Company’s outstanding voting securities, and (ii) the vote of a majority of the Company’s Independent Directors. The Advisory Agreement will automatically terminate in the event of an assignment by the Adviser. The Advisory Agreement may be terminated by either party, or by a vote of the majority of the Company’s outstanding voting units, without penalty upon not less than 60 days’ prior written notice to the applicable party.

15

Management Fee

Under the Advisory Agreement, the Company will pay to the Adviser, quarterly in arrears, a management fee in cash (the “Management Fee”) calculated as follows: 0.3125% (i.e., 1.25% per annum) of the average gross assets of the Company on a consolidated basis, with the average determined based on the gross assets of the Company as of the end of the three most recently completed calendar months. “Gross assets” means the amortized cost of portfolio investments of the Company (including portfolio investments purchased with borrowed funds and other forms of leverage, such as Preferred Units, public and private debt issuances, derivative instruments, repurchase agreements and other similar instruments or arrangements) that have not been sold, distributed to the members, or written off for tax purposes (but reduced by any portion of such cost basis that has been written down to reflect a permanent impairment of value of any portfolio investment), and excluding cash and cash equivalents. The Management Fee payable for any partial month or quarter will be appropriately pro-rated.

The “Commitment Period” of the Company began on September 15, 2022 (the “Initial Closing Date”) and is scheduled to end four years from the later of (a) the Initial Closing Date and (b) the date on which the Company first completes an investment. The Company completed its first investment on December 21, 2022. Accordingly, the Commitment Period is scheduled to end on December 2026. However, unless otherwise terminated as described below, the Commitment Period will be automatically extended for successive one-year periods beginning one year prior to each scheduled expiration of the Commitment Period (so that, immediately following any such extension, the Commitment Period will expire two years from that date). A supermajority in interest of all Members may terminate the Commitment Period at any time upon 90 days written notice to the Company.

The total Management Fee earned by the Adviser for 2022 was $3,752.

Incentive Fee

In addition, the Adviser will receive an incentive fee (the “Incentive Fee”) as follows:

| | (i) | First, no Incentive Fee will be owed until the unitholders have collectively received cumulative distributions pursuant to this clause (i) equal to their aggregate capital contributions to the Company in respect of all units; |

| | (ii) | Second, no Incentive Fee will be owed until the unitholders have collectively received cumulative distributions equal to a 6.5% internal rate of return on their aggregate capital contributions to the Company in respect of all units (the “Hurdle”); |

| | (iii) | Third, the Adviser will be entitled to an Incentive Fee out of 100% of additional amounts otherwise distributable to unitholders until such time as the cumulative Incentive Fee paid to the Adviser is equal to 15% of the sum of (a) the amount by which the Hurdle exceeds the aggregate capital contributions of the unitholders in respect of all Units and (b) the amount of Incentive Fee being paid to the Adviser pursuant to this clause (iii); and |

| | (iv) | Thereafter, the Adviser will be entitled to an Incentive Fee equal to 15% of additional amounts otherwise distributable to unitholders, with the remaining 85% distributed to the unitholders. |

The Incentive Fee will be calculated on a cumulative basis and the amount of the Incentive Fee payable in connection with any distribution (or deemed distribution) will be determined and, if applicable, paid in accordance with the foregoing formula each time amounts are to be distributed to the unitholders.

If the Advisory Agreement terminates early for any reason other than (i) the Adviser voluntarily terminating the agreement or (ii) the Company terminating the agreement for cause (as set out in the Advisory Agreement), the Company will be required to pay the Adviser a final incentive fee payment (the “Final Incentive Fee Payment”). The Final Incentive Fee Payment will be calculated as of the date the Advisory Agreement is so terminated and will equal the amount of Incentive Fee that would be payable to the Adviser if (a) all the Company’s investments were liquidated for their current value (but without taking into account any unrealized appreciation of any portfolio investment), and any unamortized deferred portfolio investment-related fees would be deemed accelerated, (b) the proceeds from such liquidation were used to pay all the Company’s outstanding liabilities, and (c) the remainder were distributed to unitholders and paid as Incentive Fee in accordance with the Incentive Fee waterfall described above for determining the amount of the Incentive Fee. The Company will make the Final Incentive Fee Payment in cash on or immediately following the date the Advisory Agreement is so terminated. Further, in the case of an early termination, the Adviser Return Obligation (defined below) will not apply in connection with a Final Incentive Fee Payment.

16

Adviser Return Obligation

After the Company has made its final distribution of assets in connection with the Company’s dissolution, if the Adviser has received aggregate payments of Incentive Fees in excess of the amount the Adviser was entitled to receive pursuant to “Incentive Fee” above, then the Adviser will return to the Company, on or before 90 days after such final distribution of assets by the Company, an amount equal to such excess (the “Adviser Return Obligation”). Notwithstanding the preceding sentence, in no event will the Adviser be required to return to the Company an amount greater than the aggregate Incentive Fees paid to the Adviser, reduced by the excess (if any) of (i) the aggregate federal, state and local income tax liability the Adviser incurred in connection with the payment of such Incentive Fees, over (ii) an amount equal to the United States federal and state tax benefits available to the Adviser by virtue of the payment made by the Adviser pursuant to its Adviser Return Obligation.

Administration Agreement

The Company has entered into an Administration Agreement with the Administrator under which the Administrator (or one or more delegated service providers) oversees the maintenance of the Company’s financial records and otherwise assists on the Company’s compliance with business development company and registered investment company rules, prepares reports to the Company’s Unitholders, monitors the payment of the Company’s expenses and the performance of other administrative or professional service providers, and generally provides the Company with administrative and back office support. The Company will reimburse the Administrator for expenses incurred by it on the Company’s behalf in performing its obligations under the Administration Agreement. Amounts paid pursuant to the Administration Agreement are subject to the annual cap on operating expenses described below.

Organizational and Operating Expenses

All investment professionals and staff of the Adviser, when and to the extent engaged in providing the Company investment advisory and management services (which exclude services provided pursuant to the Administration Agreement), and the base compensation, bonus and benefits, and the routine overhead expenses, of such personnel allocable to such services, will be provided and paid for by the Adviser.

The Company, and indirectly the Unitholders, will bear (including by reimbursing the Adviser or Administrator) all other costs and expenses of the Company’s operations, administration and transactions, including, without limitation, organizational and offering expenses (up to 10 basis points of capital commitments), management fees, costs of reporting required under applicable securities laws, legal fees of the Company’s counsel and accounting fees. All expenses that the Company will not bear will be borne by the Adviser or its affiliates.

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Pursuant to Section 16(a) of the Exchange Act, the Company’s Directors and executive officers, and any persons holding more than 10% of the Company’s common units, are required to report their beneficial ownership in the Company’s securities and any changes therein to the SEC and to the Company. We are required to report herein any failure to file such reports by applicable due dates for filings. Based on the Company’s review of any Forms 3, 4 and 5 filed by such persons, the Company believes that, during the fiscal period ended December 31, 2022, all Section 16(a) filing requirements applicable to such persons were met in a timely manner.

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

Relationship with the Adviser and Potential Conflicts of Interest

The Company, the Adviser and the Company’s respective direct or indirect Members, partners, officers, Directors, employees, agents and affiliates may be subject to certain potential conflicts of interest in connection with the Company’s activities and investments. For example, the terms of the Adviser’s management and incentive fees may create an incentive for the Adviser to approve and cause the Company to make more speculative investments than it would otherwise make in the absence of such fee structure.

17

The Adviser’s Private Credit Team is separated from those partners and employees of the Adviser and its affiliates involved in the management of the investments of other funds and other accounts (the “Other Employees”) by an ethical wall, and accordingly, the Other Employees may be unable to make certain material information available to the Private Credit Team. In addition, the Adviser’s other funds and separate accounts may take positions in securities and/or issuers that are in a different part of the capital structure of an issuer or adverse to the Company.

The members of the senior management and investment teams and the investment committee of the Adviser serve or may serve as officers, directors or principals of entities that operate in the same or a related line of business as the Company, or of investment funds managed by the Adviser or its affiliates. In serving in these multiple capacities, they may have obligations to other clients or investors in those entities, the fulfillment of which may not be in the Company’s best interests or in the best interest of the unitholders. For example, Mr. Miller and the other members of the investment committee have management responsibilities for other investment funds, accounts or other investment vehicles managed by the Adviser or its affiliates.

The Company’s investment objective may overlap with the investment objectives of such investment funds, accounts or other investment vehicles. For example, the Adviser concurrently manages accounts that are pursuing an investment strategy similar to the Company’s strategy, and the Company may compete with these and other entities managed by affiliates of the Adviser for capital and investment opportunities. As a result, those individuals at the Adviser may face conflicts in the allocation of investment opportunities between the Company and other investment funds or accounts advised by principals of, or affiliated with, the Adviser. The Adviser has agreed with the Board that, when the Company is able to co-invest with other investment funds or accounts managed by the Adviser, allocations among the Company and other investment funds or accounts will generally be made based on capital available for investment in the asset class being allocated to the extent consistent with the 1940 Act. The Company expects that available capital for its investments will be determined based on the amount of cash on-hand, existing commitments and reserves, if any, the targeted leverage level, targeted asset mix and diversification requirements and other investment policies and restrictions set by the Board or as imposed by applicable laws, rules, regulations or interpretations. In situations where the Company cannot co-invest with other investment funds managed by the Adviser due to the restrictions contained in the 1940 Act, the investment policies and procedures of the Adviser generally require that such opportunities be offered to the Company and such other investment funds on an alternating basis. However, there can be no assurance that the Company will be able to participate in all investment opportunities that are suitable to it. The Adviser has received the Exemptive Order from the SEC that permits the Company to co-invest with affiliates of the Adviser, including private funds managed by the Adviser, if the Board determines that it would be advantageous for the Company to co-invest with other funds managed by the Adviser or its affiliates in a manner consistent with the Company’s investment objective, positions, policies, strategies and restrictions, as well as regulatory requirements and other pertinent factors.

Certain Business Relationships

Certain of the Company’s current Directors and officers are directors or officers of the Adviser.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following sets forth, as of the Record Date, the beneficial ownership of Company units by directors, officers and persons owning beneficially 5% or more of the units of the Company:

18

| | | | | | | | |

Name and Address | | Amount of Units

Beneficially Owned

and Nature of

Ownership1 | | | Percentage of

Class Owned1 | |

Independent Directors | | | | | | | | |

Sheila A. Finnerty | | | 0 | | | | * | |

Saverio M. Flemma | | | 0 | | | | * | |

R. David Kelly | | | 0 | | | | * | |

Andrew W. Tarica | | | 0 | | | | * | |

Interested Directors | | | | | | | | |

Richard T. Miller | | | 0 | | | | * | |

Laird R. Landmann | | | 0 | | | | * | |

Officers | | | | | | | | |

Andrew Kim | | | 0 | | | | * | |

Gayle Espinosa | | | 0 | | | | * | |

Joseph Magpayo | | | 0 | | | | * | |

David Wang | | | 0 | | | | * | |

Gladys Xiques | | | 0 | | | | * | |

Other Beneficial Owners | | | | | | | | |

NLGI US Private Debt Fund II(2) | | | 3,753,190 | | | | 100 | % |

| (1) | The number of units are those beneficially owned as determined under the rules of the SEC, and such information is not necessarily indicative of beneficial ownership for any other purpose. Under such rules, beneficial ownership includes any units as to which a person has sole or shared voting power or investment power and any units which the person has the right to acquire within 60 days through the exercise of any option, warrant or right, through conversion of any security or pursuant to the automatic termination of a power of attorney or revocation of a trust, discretionary account or similar arrangement. The percentages used herein are calculated based upon 3,753,190common units outstanding, which reflects the number of common units issued and outstanding as of the Record Date. |

| (2) | The unitholder’s address is c/o MUFG Fund Services (Cayman) Limited, MUFG House, 227 Elgin Ave, P.O. Box 609, Grand Cayman, KY1-1107, Cayman Islands. NLGI US Private Debt Fund II (the “Fund”) directly owns 3,753,190 Common Units (the “Subject Units”). Nippon Life Global Investors Americas, Inc. (“NLGIA”) serves as the investment manager of the Fund, and by virtue of its role as the investment manager, may be deemed to share voting and dispositive power over the Subject Units and thereby may be deemed to be a beneficial owner of the Subject Units. Taiju Life Insurance Company Limited (“Taiju”) owns 6.5% of the equity interest of the Fund and thereby may be deemed to be the indirect beneficial owner of the Subject Units. Nippon Life Insurance Company owns 100% of the equity interest of NLGIA, 93.5% of the Fund, and 82.6% of the equity interest of Taiju, and by virtue of its ownership of NLGIA and Taiju, may be deemed to share voting and dispositive power over the Subject Units and thereby may be deemed to be a beneficial owner of the Subject Units |

LEGAL PROCEEDINGS

The Company is not currently subject to any material legal proceedings, nor, to its knowledge, is any material legal proceeding threatened against it. From time to time, the Company may be a party to certain legal proceedings in the ordinary course of business, including proceedings relating to the enforcement of the Company’s rights under loans to or other contracts with portfolio companies. While the outcome of these legal proceedings cannot be predicted with certainty, the Company does not expect that these proceedings will have a material effect upon its financial condition or results of operations.

OTHER BUSINESS

The Board of Directors of the Company does not know of any other matter which may come before the Meeting or any postponement or adjournment thereof. If any other matter properly comes before the Meeting, or any postponement or adjournment thereof, the persons named in the proxy to vote the proxies will not have authority to vote on your behalf on that matter.

PROPOSALS TO BE SUBMITTED BY MEMBERS

Under the LLC Agreement, Member action can be taken only at an annual or special meeting of Members, or by written consent in lieu of a meeting, by Members representing at least the number of units required to approve the matter in question. These provisions, combined with the requirements of the LLC Agreement regarding the calling of a Member-requested special meeting of Members discussed below, may have the effect of delaying consideration of a Member proposal until the next annual meeting.

19

In order for any matter to be considered “properly brought” before a meeting, a Member must comply with requirements regarding advance notice to the Company. These provisions could delay until the next Members’ meeting Member actions which are favored by the holders of a majority of the Company’s outstanding voting securities.

The LLC Agreement provides that, with respect to an annual meeting of Members, nominations of persons for election to the Board and the proposal of business to be considered by Members may be made only pursuant to the Company’s notice of the meeting.