UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement.

☐ Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e)(2)).

☒ Definitive Proxy Statement.

☐ Definitive Additional Materials.

☐ Soliciting Material Pursuant to § 240.14a-12.

StepStone Private Venture and Growth Fund

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

☐ Fee paid previously with preliminary materials:

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

StepStone Private Venture and Growth Fund

128 S Tryon St., Suite 1600

Charlotte, North Carolina 28202

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To Be Held March 28, 2024

February 29, 2024

Dear Shareholders:

The Board of Trustees of StepStone Private Venture and Growth Fund (the “Fund”) is holding a special meeting (“Special Meeting”) of shareholders of the Fund on March 28, 2024 at 12:00 p.m. Eastern time. The meeting will be held at the offices of the Adviser, StepStone Group Private Wealth LLC, located at 128 S Tryon St., Suite 1600, Charlotte, North Carolina 28202.

The Special Meeting is being held to obtain shareholder approval of the following proposal (the “Proposal”) and to transact such other business as may properly come before the Special Meeting or any adjournments or postponements thereof:

| | |

PROPOSAL: | | To approve an amendment to the Fund’s fundamental investment policy regarding concentration of investments whereby the Fund will invest more than 25% of its total assets (measured at the time of purchase) in the securities of issuers engaged in the information technology group of industries. |

The Fund has fixed the close of business on February 26, 2024 as the record date (the “Record Date”) for determining shareholders entitled to notice of and to vote at the Special Meeting.

If you are a shareholder of record as of the close of business on the Record Date, you are entitled to vote at the Special Meeting and at any adjournment thereof. While you are welcome to join us at the Special Meeting, most shareholders will cast their votes by filling out and signing the enclosed proxy card. The Fund’s Board of Trustees has recommended and encourages you to vote “FOR” the Proposal. If you have any questions regarding the issues to be voted on, please do not hesitate to call Broadridge Investor Communication Solutions, Inc. toll-free at 1- 833-782-7146.

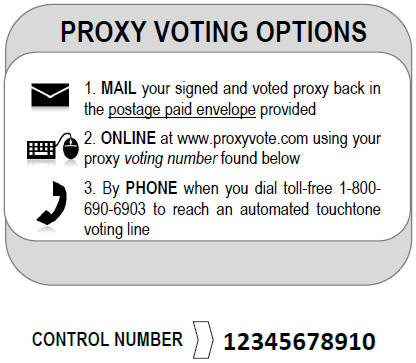

Whether or not you are planning to attend the Special Meeting, we need your vote prior to March 28, 2024. Voting is quick and easy. Everything you need is enclosed. To vote, you may use any of the following methods:

MAIL: Please mark, sign, and date the enclosed proxy card and promptly return it in the enclosed, postage-paid envelope. BE SURE TO SIGN EACH CARD BEFORE MAILING IT.

PHONE: Please call the toll-free number on your proxy card. Enter the control number on your proxy card and follow the instructions.

INTERNET: Visit the web site shown on your proxy card. Enter the control number on your proxy card and follow the instructions.

Voting by proxy will not prevent you from voting your shares in person at the Special Meeting. You may revoke your proxy before it is exercised at the Special Meeting, either by writing to the Secretary of the Fund at the Fund’s address noted in the Proxy Statement or in person at the time of the Special Meeting. A prior proxy can also be revoked by voting again through the web site or toll-free number listed on the enclosed proxy card.

Thank you for taking the time to consider this important proposal and for your continuing investment in the Fund.

The Fund��s Board of Trustees has carefully reviewed the Proposal and recommends that you vote “FOR” the Proposal.

By Order of the Fund,

| | |

| | |

Dean Caruvana | | |

Secretary of the Fund | | |

February 29, 2024 | | |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD ON MARCH 28, 2024:

This Notice and Proxy Statement are available on the internet at www.proxyvote.com.

The Fund’s most recent Annual Report and Semi-Annual Report to shareholders are available on the internet at:

| | • | | Annual Report: https://www2.stepstonegroup.com/spring-annual-report-3-31-23 |

| | • | | Semi-Annual Report: https://www2.stepstonegroup.com/spring-semi-annual-report-2023 |

At your request, the Fund will send you a free copy of the most recent audited annual report for the Fund, and the most recent semi-annual report for the Fund, or the Fund’s current prospectus and statement of additional information (“SAI”).

Please call the Fund at 704-215-4300 or email SPWOperations@StepStoneGroup.com to request an annual report, semi-annual report, a prospectus, a statement of additional information or with any questions you may have relating to the Proxy Statement. Important information to help you understand and vote on the Proposal.

By its very nature, the following “Questions and Answers” section is a summary and is not intended to be as detailed as the discussion found later in the proxy materials, including the enclosed proxy statement to shareholders (“Proxy Statement”).

Questions and Answers

Question: What is this document and why did you send it to me?

Answer: The attached document is a Proxy Statement for the StepStone Private Venture and Growth Fund (the “Fund”). The purpose of this Proxy Statement is to solicit votes from shareholders of the Fund to approve the proposed amendment to the Fund’s fundamental investment policy regarding concentration of investments (the “Proposal”). The Proposal would enable StepStone Group LP, the Fund’s sub-adviser (“StepStone” or the “Sub-Adviser”), to “concentrate” (i.e., invest more than 25% of the Fund’s total assets) the Fund’s portfolio investments in the securities of issuers engaged in the information technology group of industries. Specifically, the Proposal is as follows:

| | |

PROPOSAL: | | To approve an amendment to the Fund’s fundamental investment policy regarding concentration of investments whereby the Fund will invest more than 25% of its total assets (measured at the time of purchase) in the securities of issuers engaged in the information technology group of industries. |

The Proxy Statement contains information that shareholders of the Fund should know before voting on the Proposal. The Proxy Statement should be reviewed and retained for future reference.

Question: Why is the Board recommending approval of the Proposal?

Answer: The Fund’s current policy prohibits the Fund from concentrating its investments in any particular industry or group of related industries. The Fund seeks long term capital appreciation by offering investors access to a venture capital and growth equity investment portfolio focused on the “innovation economy”. The Fund seeks to achieve its investment objective by investing directly in the equity and debt of operating companies, as well as by investing in underlying private funds (“Underlying Funds”) that invest primarily in venture and growth assets. To the extent the Fund has the available information to look through its Underlying Funds, the Fund will include the underlying portfolio companies in its industry concentration analysis. Because the Underlying Funds provide information regarding their portfolio companies to their investors, including the Fund, at different times, it is often difficult for the Fund to look through all of its Underlying Funds for industry concentration purposes. StepStone Private Wealth LLC (the “Adviser”), the Fund’s investment adviser, believes it is in the Fund’s best interests to revise its fundamental policy on industry concentration to enable the Fund to invest, directly and indirectly through its Underlying Funds, more than 25% of its total assets (measured at the time of purchase) in the securities of issuers engaged in the information technology group of industries, which is a key area of focus for venture and growth investing.

At a meeting of the Fund’s Board of Trustees (the “Board”) on February 21, 2024, StepStone Group Private Wealth LLC (the “Adviser”), the Fund’s investment adviser, recommended that the Board approve the Proposal given the number of investment opportunities – both direct investments and Underlying Fund investments – in the information technology group of industries that the Fund would forego. The Adviser reported that it believes that there are currently many attractive investment opportunities for the Fund in the information technology group of industries, including through direct investments in information technology services, software, technology hardware and equipment and semi-conductor companies, as well as secondary and primary fund investments in Underlying Funds that focus on companies in the information technology group of industries. The Adviser reported that it believes there will continue to be sufficient attractive investment opportunities for the Fund in this area in the future and that the amended policy will better enable the Fund to pursue its investment objective, even though, by concentrating the Fund’s investments in the information technology group of industries, the Fund will be more exposed to the risks associated with this group of industries. The Adviser reported that the Proposal would not change how the Fund is managed, other than that the Proposal would enable the Fund to gain additional exposure to investments in the information technology group of industries than under its current investment policy. The Fund’s Board carefully reviewed the Proposal and recommends that you vote “FOR” the Proposal.

Question: What will happen if the Proposal is not approved by shareholders?

Answer: Any change to a fundamental investment policy requires shareholder approval and therefore, if the Proposal is not approved by shareholders, the Fund’s existing fundamental policy regarding concentration of investments will remain in effect.

Question: Why do I need to vote?

Answer: Your vote is needed to ensure that a quorum and sufficient votes are present at the special meeting of shareholders (“Special Meeting”) so that the Proposal can be acted upon. Your immediate response on the enclosed proxy card will help prevent the need for any further solicitations for a shareholder vote, which will result in additional expenses. Your vote is very important to us regardless of the number of shares you own.

Question: Who is paying for expenses related to the Special Meeting?

Answer: The Adviser will pay all the costs relating to the Special Meeting and the Proxy Statement.

Question: How do I vote my shares?

Answer: Although you may attend the Special Meeting and vote in person, you do not have to do so. You can vote your shares by completing and signing the enclosed proxy card(s) and mailing it in the enclosed postage-paid envelope. You may also vote by touch-tone telephone by calling the toll-free number printed on your proxy card(s) and following the recorded instructions.

In addition, you may vote through the internet by visiting www.proxyvote.com and following the on-line instructions. If you need any assistance, or have any questions regarding the proposals or how to vote your shares, please call 1- 833-782-7146.

If you simply sign and date the proxy card, but do not indicate a specific vote for a proposal, your shares will be voted “FOR” the Proposal and to grant discretionary authority to the persons named in the card as to any other matters that properly come before the Special Meeting. Shares represented by proxies that are returned unsigned or improperly marked (e.g., indicating a vote “FOR” and “AGAINST” the Proposal”) will be treated as abstentions for voting purposes. Abstentions will be treated as present for determining whether a quorum is present with respect to a particular matter, but will not be counted as voting on any matter at the Special Meeting when the voting requirement is based on achieving a percentage of the “voting securities present.”

Shareholders who execute proxies may revoke them at any time before they are voted by (1) filing with the Fund a written notice of revocation, (2) timely voting (e.g., by mail, telephone, or internet prior to March 28, 2024) a proxy bearing a later date or (3) by attending the Special Meeting and voting in person.

Question: If I vote by mail, how do I sign the proxy card?

Answer: Individual Accounts: Shareholders should sign exactly as their names appear on the account registration shown on the proxy card.

Joint Accounts: Either owner may sign, but the name of the person signing should conform exactly to a name shown on the account registration shown on the proxy card.

All Other Accounts: The person signing must indicate his or her capacity. For example, a trustee for a trust or other entity should sign, “Ann B. Collins, Trustee.”

Question: Who do I call if I have questions?

Answer: If you have any questions about the proposal or the proxy card, please do not hesitate to call 1-833-782-7146 to speak with representatives of the Fund’s proxy tabulation agent, Broadridge Investor Communication Solutions, Inc. (“Broadridge”).

Please complete, sign, and return the enclosed proxy card in the enclosed envelope. You may proxy vote by internet or telephone in accordance with the instructions set forth on the enclosed proxy card. No postage is required if mailed in the United States.

[THIS PAGE INTENTIONALLY LEFT BLANK]

StepStone Private Venture and Growth Fund

128 S Tryon St., Suite 1600

Charlotte, North Carolina 28202

PROXY STATEMENT

SPECIAL MEETING OF SHAREHOLDERS

To Be Held March 28, 2024

Introduction

StepStone Private Venture and Growth Fund (the “Fund”) has called a special meeting (the “Special Meeting”) of the shareholders of the Fund to seek shareholder approval of a proposal to amend the Fund’s fundamental investment policy regarding concentration of investments.

The Special Meeting will be held at the offices of StepStone Group Private Wealth LLC (the “Adviser”), located at 128 S Tryon St., Suite 1600, Charlotte, NC 28202 at 12:00 p.m. Eastern time, on March 28, 2024. This Proxy Statement and form of proxy are being mailed to shareholders on or about March 1, 2024.

Items for Consideration

The Special Meeting has been called by the Board of Trustees of the Fund to consider and vote on the proposal (the “Proposal”) described below and to transact such other business as may properly come before the Special Meeting or any adjournments or postponements thereof:

| | |

PROPOSAL: | | To approve an amendment to the Fund’s fundamental investment policy regarding concentration of investments whereby the Fund will invest more than 25% of its total assets (measured at the time of purchase) in the securities of issuers engaged in the information technology group of industries. |

Only shareholders of record at the close of business on February 26, 2024 (the “Record Date”) are entitled to notice of, and to vote at, the Special Meeting and any adjournments or postponements thereof. In the event sufficient votes to approve the Proposal are not received prior to the Special Meeting, a majority of those shares represented at the Special Meeting may approve one or more adjournments of the Special Meeting to a future date to permit further solicitation of proxies. If the Special Meeting is adjourned, then it will be reconvened at the same or some other place, to be announced at the meeting at which the adjournment is taken.

At your request, the Fund will send you a free copy of the most recent audited annual report for the Fund, the most recent semi-annual report for the Fund, or the Fund’s current prospectus and statement of additional information (“SAI”). Please call the Fund at 704-215-4300 or email SPWOperations@StepStoneGroup.com to request an annual report, semi-annual report, a prospectus, a statement of additional information or with any questions you may have relating to the Proxy Statement.

1

PROPOSAL

To approve an amendment to the Fund’s fundamental investment policy regarding concentration of investments whereby the Fund will invest more than 25% of its total assets (measured at the time of purchase) in the securities of issuers engaged in the information technology group of industries.

SUMMARY OF PROPOSAL

Below is a brief summary of the Proposal and how it will affect the Fund and its shareholders. We urge you to read the full text of the Proxy Statement.

The Fund, like all registered funds, is required by the Investment Company Act of 1940, as amended (the “1940 Act”), to adopt fundamental investment policies governing its practices with respect to concentration of investments, which policies may only be changed with the affirmative vote of a majority of the outstanding shares of the Fund. As defined by the 1940 Act, the vote of a “majority of the outstanding voting securities of the Fund” means the vote, at an annual or special meeting of the Fund’s Shareholders duly called, (a) of 66-2/3% or more of the voting securities present at such meeting, if the holders of more than 50% of the outstanding voting securities of the Fund are present or represented by proxy; or (b) of more than 50% of the outstanding voting securities of the Fund, whichever is less.

If a fund has stated that it will be concentrated in an industry (or a group of industries), it must maintain at least 25% of its total assets invested in that industry (or group of industries). Similarly, if a fund has not stated that it will be concentrated in an industry, it may not invest more than 25% of its total assets in that industry, although the holdings in that industry may increase to above 25% due to market action and in certain other cases.

The Fund’s current fundamental investment policy regarding concentration of investments is as follows:

The Fund may not…invest 25% or more of the value of its total assets in the securities, other than U.S. Government securities, of issuers engaged in any single industry (for purposes of this restriction, the Fund’s investments in Private Market Assets are not deemed to be investments in a single industry). To the extent that the Fund’s investments in Private Market Assets are investments in a single industry, such investments will comply with this restriction.

In the Proposal, shareholders of the Fund are being asked to approve an amendment to the Fund’s fundamental investment policy regarding concentration of investments whereby the Fund will invest more than 25% of its total assets (measured at the time of purchase) in the securities of issuers engaged in the information technology group of industries. If shareholders of the Fund approve the Proposal, the Fund’s fundamental investment policy regarding concentration of investments will be revised to provide as follows (new language underlined):

The Fund may not…invest 25% or more of the value of its total assets in the securities, other than U.S. Government securities, of issuers engaged in any single industry, except that the Fund will invest 25% or more of the value of its total assets (measured at the time of purchase) in the securities of issuers engaged in the information technology group of industries (for purposes of this restriction, the Fund’s investments in Private Market Assets are not deemed to be investments in a single industry). To the extent that the Fund’s investments in Private Market Assets are investments in a single industry, such investments will comply with this restriction.

REASON FOR THE FUNDAMENTAL INVESTMENT POLICY CHANGE

The Fund seeks long-term capital appreciation by offering investors access to a venture capital and growth equity investment portfolio focused on the “innovation economy,” the most dynamic companies, technologies, and sectors identified by StepStone as benefiting from attractive secular trends. The portfolio currently seeks to be diversified by industry sector, investment stage and size and geography and allocated strategically by StepStone, one of the largest investment firms that focuses exclusively on the private markets. The Fund currently invests across a range of sectors, including enterprise information technology, technology-enabled products and services, consumer internet, healthcare, branded consumer/consumer packaged goods, and other sectors benefiting from attractive secular trends. These secular trends include digital integration and technology adoption across numerous industries, the continued shift from on-premise to cloud computing and the emergence and rapid growth of blockchain technologies. The Fund makes these investments through: (i) secondary investments in individual operating companies or assets and private

2

investment funds sponsored by unaffiliated managers (“Investment Managers”); (ii) primary direct investments in operating companies, often as a lead investor or syndicate partner to historically top-performing Investment Managers; and (iii) primary Underlying Funds actively fundraising that are sponsored by historically top-performing Investment Managers.

In light of the fact that the Fund invests both directly in operating companies and through Underlying Funds, where information on the underlying portfolio companies may be difficult to obtain from time to time, the Adviser has recommended the proposed amendment to the Fund’s policy so that the Fund can take advantage of additional investment opportunities – both direct investments and Underlying Fund investments – in the information technology group of industries, which the Adviser believes will continue in the future. The Adviser believes that enabling the Fund to concentrate its investment in the information technology group of industries will help the Fund pursue its investment objective.

The Adviser believes that investments in the information technology group of industries will serve as an important driver to achieving the Fund’s primary investment objective of long-term capital appreciation in the future. If approved, the Fund will gain exposure to the information technology group of industries through various types of investments, including direct investments in information technology services, software, technology hardware and equipment and semi-conductor companies, as well as secondary and primary fund investments in Underlying Funds that focus on companies in the information technology group of industries.

By concentrating the Fund’s investments in the information technology group of industries, the Fund’s performance will be more closely impacted by the performance of a particular market segment than if the Fund was not concentrated in the information technology group of industries. The Fund’s concentration in these investments may present more risks than if it were more broadly diversified over numerous industries and sectors of the economy. A broad downturn in investments tied to this group of industries would have a larger impact on the Fund than on a fund that does not concentrate in such investments. The investment risks associated with investing in the information technology group of industries include: the intense competition to which information technology companies may be subject; the dramatic and often unpredictable changes in growth rates and competition for qualified personnel among information technology companies; effects on profitability from being heavily dependent on patent and intellectual property rights and the loss or impairment of those rights; obsolescence of existing technology or competition from more innovative technology; general economic conditions; and government regulation. At times, the performance of investments in the information technology group of industries may lag the performance of investments in other industries or the broader market as a whole.

In order to pursue its investment objective during the period of proxy solicitation, the Fund will continue to make investments across various industries and sectors, including in enterprise information technology, technology-enabled products and services, consumer internet, healthcare, branded consumer/consumer packaged goods, and other sectors benefiting from attractive secular trends, consistent with the Fund’s investment objective and investment strategy.

If the Proposal is approved by shareholders, the proposed change will take effect on the date of the Special Meeting or as soon as reasonably practicable thereafter.

If the Proposal is not approved by shareholders, the Fund’s existing fundamental policy regarding concentration of investments will remain in effect.

The Board, including the Trustees who are not “interested persons” of the Adviser or the Fund, as defined in the 1940 Act, unanimously recommends that you vote “FOR” the Proposal.

ADDITIONAL INFORMATION

Proxy Solicitation

This proxy solicitation is being made primarily by mail but may also be made by employees of the Adviser and its affiliates as well as dealers or their representatives in person or by mail, telephone, electronic mail, facsimile or oral communication. The Fund has retained Broadridge Investor Communications Solutions, Inc. (“Broadridge”), a proxy

3

solicitation firm, to assist with the solicitation and tabulation of proxies. The Adviser will bear the costs of printing, mailing and soliciting proxies, including the costs of Broadridge.

Investment Adviser, Distributor, and Administrator

StepStone Group Private Wealth LLC, located at 128 S Tryon St., Suite 1600, Charlotte, North Carolina 28202, serves as the Fund’s investment adviser and the Fund’s administrator. UMB Distribution Services, LLC, 235 West Galena Street, Milwaukee, Wisconsin 53212, serves as the Fund’s distributor.

VOTING INFORMATION

Voting Securities and Required Vote

As of the Record Date, there were 2,996.01 Class T shares, 1,272,547.99 Class S shares, 87,215.43 Class D Shares and 11,062,368.10 Class I Shares of beneficial interest of the Fund issued and outstanding.

All shareholders of record of the Fund on the Record Date are entitled to vote at the Special Meeting on the Proposal. Each shareholder is entitled to one vote per share held, and fractional votes for fractional shares held, on any matter submitted to a vote at the Special Meeting. Shareholders of the Fund will vote as a single class.

One-third (1/3) of the Fund’s outstanding shares entitled to vote on the Proposal present in person or by proxy shall constitute a quorum at the Special Meeting. Proxies returned for shares whose proxies reflect an abstention on a proposal, are all counted as shares present and entitled to vote for purposes of determining whether the required quorum of shares exists. However, since such shares are not voted in favor of a proposal, they have the effect of counting as a vote AGAINST the proposal. Since the Proposal is non-routine, there will not be any broker non-votes. An affirmative vote of the holders of (a) of 66-2/3% or more of the voting securities present at such meeting, if the holders of more than 50% of the outstanding voting securities of the Fund are present or represented by proxy; or (b) of more than 50% of the outstanding voting securities of the Fund, whichever is less, is required for the approval of a proposal.

You may attend the Special Meeting and vote in person or you can vote your shares by completing and signing the enclosed proxy card(s) and mailing it in the enclosed postage-paid envelope. You may also vote by touch-tone telephone by calling the toll-free number printed on your proxy card(s) and following the recorded instructions. In addition, you may vote through the internet by visiting www.proxyonline.com and following the on-line instructions.

If you simply sign and date the proxy card, but do not indicate a specific vote for the Proposal, your shares will be voted FOR the Proposal and to grant discretionary authority to the persons named in the card as to any other matters that properly come before the Special Meeting.

Shareholders who execute proxies may revoke them at any time before they are voted by (1) filing with the Fund a written notice of revocation, (2) timely voting a proxy bearing a later date or (3) by attending the Special Meeting and voting in person.

The Fund is not required, and does not intend, to hold regular annual meetings of shareholders. Shareholders wishing to submit proposals for consideration for inclusion in the Fund’s proxy statement for any future meeting of shareholders should send their written proposals to the principal executive offices of the Fund at 128 S Tryon St., Suite 1600, Charlotte, North Carolina 28202. Under the proxy rules of the SEC, particularly Rule 14a-8 under the Securities Exchange Act of 1934, shareholder proposals may, under certain conditions, be included in the Fund’s Proxy Statement and proxy for a particular meeting. Under these rules, proposals submitted for inclusion in the Fund’s proxy materials must be received by the Fund within a reasonable time before the solicitation is made. Shareholder proposals must meet certain requirements, such as being a proper matter for consideration under Delaware law, and there is no guarantee that any proposal will be presented at a shareholders’ meeting. No business other than the Proposal is expected to come before the Special Meeting. If any other matters arise requiring a vote of shareholders, including any question as to an adjournment or postponement of the Special Meeting, the persons named on the enclosed proxy card will vote on such matters according to his or her best judgment in the interests of the Fund.

4

Adjournments

It is important that we receive your signed proxy card to ensure that there is a quorum for the Special Meeting. If we do not receive your vote, you may be contacted by a representative of Broadridge or the Adviser, who will remind you to vote your shares and help you return your proxy. In the event a quorum is present at the Special Meeting but sufficient votes to approve the Proposal are not received, the persons named as proxies may propose one or more adjournments of the Special Meeting to permit further solicitation of proxies.

Any such adjournment will require the affirmative vote of a majority of those shares represented at the Special Meeting in person or by proxy and entitled to vote at the Special Meeting.

Effect of Abstentions

All proxies voted, including abstentions, will be counted toward establishing a quorum.

Abstentions will be treated as shares voted against a proposal. Treating abstentions as votes against a proposal can have the effect of causing shareholders who choose not to participate in the proxy vote to prevail over shareholders who cast votes or provide voting instructions to their brokers or nominees. The Fund may request that selected brokers or nominees return proxies on behalf of shares for which voting instructions have not been received if doing so is necessary to obtain a quorum. Abstentions will not be voted “FOR” or “AGAINST” any adjournment.

Notice to Banks, Broker-Dealers and Voting Trustees and Their Nominees

Banks, broker-dealers, voting trustees and their nominees should advise the Fund, in care of UMB Fund Services, Inc., located at 235 West Galena Street, Milwaukee, Wisconsin 53212, whether other persons are beneficial owners of shares held in their names for which proxies are being solicited and, if so, the number of copies of the Proxy Statement they wish to receive in order to supply copies to the beneficial owners of the respective shares.

Householding

As permitted by law, only one copy of this Proxy Statement is being delivered to shareholders residing at the same address, unless such shareholders have notified the Fund of their desire to receive multiple copies of the reports and proxy statements the Fund sends. If you would like to receive an additional copy, please contact the Fund by calling 704-215-4300 or email SPWOperations@StepStoneGroup.com. The Fund will then promptly deliver a separate copy of the Proxy Statement to any shareholder residing at an address to which only one copy was mailed. Shareholders wishing to receive separate copies of the Fund’s reports and proxy statements in the future, and shareholders sharing an address that wish to receive a single copy if they are receiving multiple copies should also direct requests as indicated.

SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN BENEFICIAL OWNERS

To the best knowledge of the Fund, except as listed below, there were no Trustees or executive officers of the Fund or other shareholders who were the beneficial owners of more than 5% of the outstanding shares of any class of the Fund on the Record Date. As of the Record Date, the Fund knows of no other person (including any “group” as that term is used in Section 13(d)(3) of the Securities Exchange Act of 1934, as amended) that beneficially owns more than 5% of the outstanding shares of any class of the Fund.

The record owners of more than 5% of the outstanding shares of any class of the Fund are listed in the following tables.

5

StepStone Private Venture and Growth Fund - Class T Shares

| | |

| | |

| Name and Address | | % Ownership |

NFS LLC FBO, Auburndale, MA | | 66.62% |

| | |

StepStone Group LP, LaJolla CA | | 33.38% |

StepStone Private Venture and Growth Fund - Class S Shares

| | |

| | |

| Name and Address | | % Ownership |

TFS-WBF Trust LLC, Greenville, DE | | 7.26% |

| | |

Timothy C Klag, Westfield, NJ | | 6.76% |

StepStone Private Venture and Growth Fund - Class D Shares

| | |

| | |

| Name and Address | | % Ownership |

| | |

NFS LLC FBO, Redmond, WA | | 8.21% |

| | |

Charles Schwab & Co Inc. FBO, Washington DC | | 7.06% |

| | |

Charles Schwab & Co Inc. FBO, Medera, CA | | 6.05% |

| | |

NFS LLC FBO, Lake Worth, FL | | 6.02% |

| | |

NFS LLC FBO, Concord, MA | | 5.89% |

| | |

NFS LLC FBO, Orlando, FL | | 5.58% |

| | |

Charles Schwab & Co Inc. FBO, Washington DC | | 5.30% |

| | |

Charles Schwab & Co Inc. FBO, South Lyon, MI | | 5.27% |

StepStone Private Venture and Growth Fund - Class I Shares

| | |

| | |

| Name and Address | | % Ownership |

| | |

Felicitas SPV I LP, Pasadena, CA | | 14.28% |

OTHER BUSINESS

The Board of Trustees of the Fund knows of no business to be brought before the meeting other than the matters set forth in this Proxy Statement. Should any other matter requiring a vote of the shareholders of the Fund arise, however, the proxies will vote thereon according to their best judgment in the interests of the Fund and the shareholders of the Fund.

EDGAR IDENTIFICATION INFORMATION

6

The Fund’s EDGAR identification number is 0001918642.

7

| | | | | | |

| | | | | | | PROXY CARD

|

YOUR VOTE IS IMPORTANT NO MATTER HOW MANY SHARES YOU OWN. PLEASE VOTE ALL BALLOTS. PLEASE CAST YOUR PROXY VOTE TODAY! | | | |

|

| | | | | |

| | |

| | |

| | |

| | |

| | |

| | | | |

STEPSTONE PRIVATE VENTURE AND GROWTH FUND

PROXY FOR SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON March 28, 2024

The undersigned hereby appoints Dean Caruvana and Kimberly Zeitvogel as Proxy of the undersigned, with full power of substitution, and hereby authorizes each of them to vote on behalf of the undersigned all shares of the Fund listed on the following page that the undersigned is entitled to vote at the Special Meeting of Shareholders of the Fund to be held at 12:00 p.m. Eastern time, on March 28, 2024, at the offices of StepStone Private Venture and Growth Fund at 128 S Tryon St., Suite 1600, Charlotte, NC 28202, and at any postponements or adjournments thereof, as fully as the undersigned would be entitled to vote if personally present. This proxy will be governed by and construed in accordance with the laws of the State of Delaware and applicable federal securities laws. The execution of this proxy is not intended to, and does not, revoke any prior proxies or powers of attorney other than the revocation, in accordance with the laws of the State of Delaware and applicable federal securities laws, of any proxy previously granted specifically in connection with the voting of the shares subject hereto. This proxy may be revoked at any time prior to the exercise of the powers conferred thereby.

Do you have questions? If you have any questions about how to vote your proxy or about the meeting in general, please call toll-free 1- 833-782-7146. Representatives are available to assist you Monday through Friday 9 a.m. to 10 p.m. Eastern time.

Important Notice Regarding the Availability of Proxy Materials for this Special Meeting of Shareholders to Be Held on March 28, 2024.

The proxy statement for this meeting is available at: www.proxyvote.com

| | | | | | |

| | | | PROXY CARD |

| STEPSTONE PRIVATE VENTURE AND GROWTH FUND | | | | |

YOUR SIGNATURE IS REQUIRED FOR YOUR VOTE TO BE COUNTED. Please sign exactly as your name appears on this Proxy. If joint owners, EITHER may sign this Proxy. When signing as attorney, executor, administrator, trustee, guardian or corporate officer, please give your full title. | | | | |

| | | | SIGNATURE (AND TITLE IF APPLICABLE) | | DATE |

| | | | |

| | | | SIGNATURE (IF HELD JOINTLY) | | DATE |

This proxy is solicited on behalf of the Fund’s Board of Trustees, and the Proposal has been unanimously approved by the Board of Trustees and recommended for approval by shareholders. This proxy, when properly executed, will be voted in the manner directed herein by the undersigned shareholder. If no direction is made, this proxy will be voted FOR the proposal. In his/her discretion, the Proxy is authorized to vote upon such other matters as may properly come before the meeting.

THE BOARD OF TRUSTEES UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE PROPOSAL.

TO VOTE, MARK CIRCLES BELOW IN BLUE OR BLACK INK AS FOLLOWS. Example: ●

| | | | | | | | | | |

| | | | | | FOR | | AGAINST | | ABSTAIN |

1) | | To approve an amendment to the Fund’s fundamental investment policy regarding concentration of investments whereby the Fund will invest more than 25% of its total assets (measured at the time of purchase) in the securities of issuers engaged in the information technology group of industries. | | | | O | | O | | O |

THANK YOU FOR VOTING