UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

----------------------------------------------------------------

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-23786

----------------------------------------------------------------

StepStone Private Venture and Growth Fund

(Exact name of registrant as specified in charter)

----------------------------------------------------------------

128 S Tryon St., Suite 1600

Charlotte, NC 28202

(Address of principal executive offices) (Zip code)

Robert W. Long

Chief Executive Officer

StepStone Group Private Wealth LLC

128 S Tryon St., Suite 1600

Charlotte, NC 28202

(Name and address of agent for service)

----------------------------------------------------------------

Registrant’s telephone number, including area code: (704) 215-4300

Date of fiscal year end: March 31

Date of reporting period: March 31, 2023

ITEM 1. REPORTS TO STOCKHOLDERS.

(a) The Report to Shareholders is attached herewith.

StepStone Private Venture and Growth Fund |

Consolidated Financial Statements

For the Period November 1, 2022 (commencement of operations)

through March 31, 2023

Annual Report

Beginning on March 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by contacting the Fund or your financial intermediary. You may elect to receive all future reports, including your shareholder reports, in paper free of charge by contacting the Fund at 704-215-4300. Your election to receive reports in paper will apply to all funds held with your financial intermediary or all StepStone Funds.

StepStone Private Venture and Growth Fund |

Table of Contents For the Period November 1, 2022 (commencement of operations) through March 31, 2023 |

The Fund files its complete schedule of investments with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Fund’s Form N-PORT reports are available on the Commission’s website at http://www.sec.gov.

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities, as well as information relating to how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, is available (i) without charge, upon request, by calling (704) 215-4300; or through the Fund’s website at https://www.stepstonepw.com/spring-documents; or both; and (ii) on the Commission’s website at http://www.sec.gov.

1

StepStone Private Venture and Growth Fund |

Manager’s Discussion and Analysis of Fund Performance March 31, 2023 |

Introduction

StepStone Private Venture and Growth Fund (“SPRING” or the “Fund”) is a newly launched, broadly diversified venture and growth strategy. The Fund launched in November 2022 and leverages an open architecture approach, emphasizing best-in-class managers via secondary purchases, direct investments and fund investments. SPRING offers qualified clients global access to top-tier venture and growth managers, diversified exposure across the innovation economy and targets attractive risk-adjusted returns.

Designed specifically for individual investors and small institutions, SPRING’s investor-centric structure emphasizes convenience, efficiency and transparency. An evergreen fund, SPRING raises capital monthly while providing liquidity through quarterly redemptions. There are no ongoing investor capital calls. Investors will receive regular distributions, and tax reporting is provided via Form 1099.

Investment Activity, Performance and Benchmark

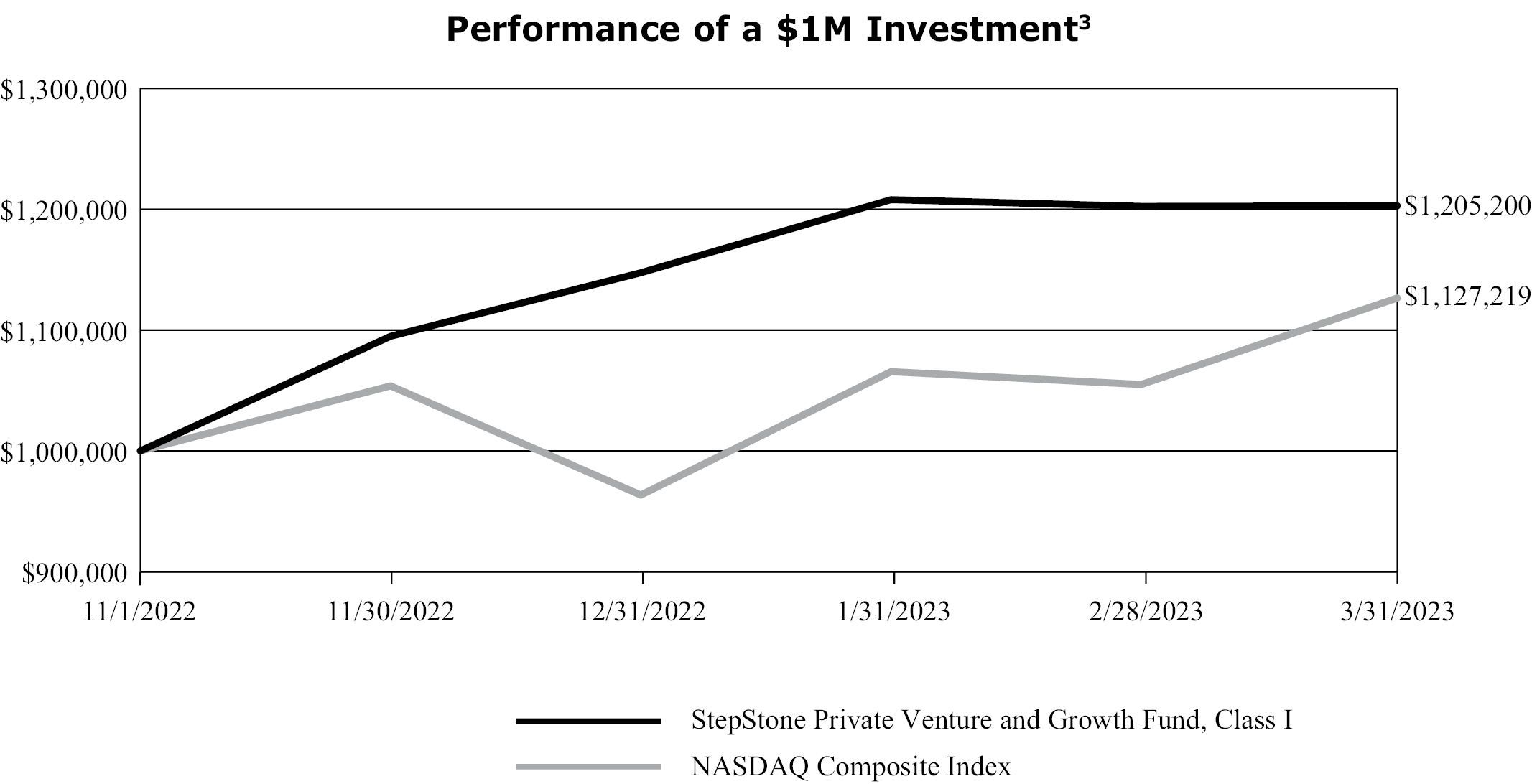

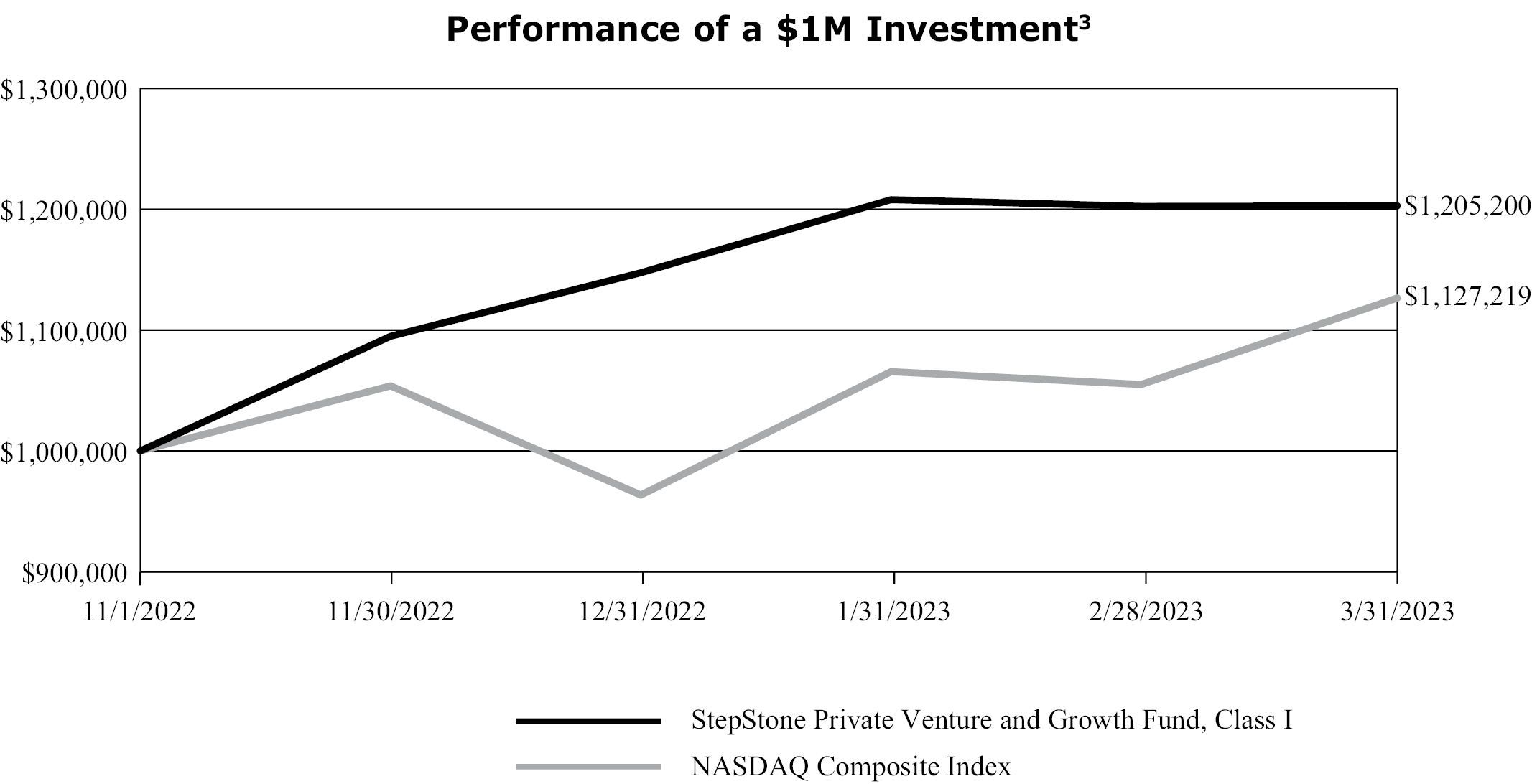

During the period ended March 31, 2023, the Fund made direct and indirect investments in over 500 portfolio companies and reached total assets under management of $187M. We are pleased to report that SPRING generated a net return of 20.5% for the period ending March 31, 2023,1 substantially outpacing the NASDAQ Composite Index,2 SPRING’s primary benchmark, which reported a 12.7% increase during the same period.

The Fund deploys capital monthly, allowing it to invest in a constantly evolving market. This strategy includes taking advantage of market dislocation to purchase assets managed by historically top tier managers at discounted prices compared to NAV. Unrealized gains from secondary discounts totaled approximately $29M for the period ended March 31, 2023 and were the primary driver of the Fund’s net return.

Investment Approach

SPRING seeks favorable opportunities in the innovation economy, the most dynamic companies, technologies, and sectors identified by StepStone as benefiting from attractive secular trends. The Fund employs a distinctive approach to venture capital and growth equity investments, combining direct, secondary and fund investments under a single platform. Each capability informs the other, enhancing relationships globally, and this active approach to direct and secondary investment enables the capture of powerful proprietary data and the creation of strong alignment with both fund managers and company management teams. The Fund believes that these synergies ultimately enable it to focus on the highest potential opportunities and make better informed decisions.

This commentary reflects the viewpoints of StepStone Group Private Wealth LLC as of March 31, 2023 and is not intended as a forecast or guarantee of future results.

2

StepStone Private Venture and Growth Fund |

Manager’s Discussion and Analysis of Fund Performance March 31, 2023 (Continued) |

Annual Total Returns

Cumulative Total Return as of March 31, 2023 |

| | | Since Inception |

StepStone Private Venture and Growth Fund, Class I | | 20.5% |

StepStone Private Venture and Growth Fund, Class D | | 20.3% |

StepStone Private Venture and Growth Fund, Class S | | 20.3% |

StepStone Private Venture and Growth Fund, Class T | | 20.3% |

NASDAQ Composite Index2 | | 12.7% |

The chart above represents the hypothetical growth of a $1,000,000 investment in Class I shares. Returns for the Fund’s other classes will vary from what is seen above due to differences in fee structures, specifically the distribution and shareholder servicing fees associated with brokers, dealers and certain RIAs and other financial intermediaries.

The performance data quoted herein represents past performance, and the return and value of an investment in the Fund will fluctuate so that, when redeemed, it may be worth less than its original cost. Past performance does not predict future performance.

The Fund’s performance assumes the reinvestment of dividends. Index returns assume reinvestment of dividends and, unlike a portfolio’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives. The Fund’s holdings and allocations are subject to change because it is actively managed and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

3

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and Board of Trustees of

StepStone Private Venture and Growth Fund

Opinion on the Financial Statements

We have audited the accompanying consolidated statement of assets and liabilities of StepStone Private Venture and Growth Fund (the “Fund”), including the consolidated schedule of investments, as of March 31, 2023, and the related consolidated statements of operations, changes in net assets and cash flows and financial highlights for the period from November 1, 2022 (commencement of operations) through March 31, 2023, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the consolidated financial position of the Fund at March 31, 2023, and the consolidated results of its operations, the changes in its net asset, its cash flows and financial highlights for the period from November 1, 2022 (commencement of operations) through March 31, 2023, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of the Fund’s internal control over financial reporting. As part of our audit, we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audit included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of investments owned as of March 31, 2023, by correspondence with the custodians, investment funds or portfolio company investees; when replies were not received from investment funds or portfolio company investees, we performed other auditing procedures. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

We have served as the auditor of one or more of the StepStone Group LP investment companies since 2020.

New York, New York

May 30, 2023

4

StepStone Private Venture and Growth Fund |

Consolidated Schedule of Investments March 31, 2023 |

Investments — 52.6%^ | | Asset Class | | Acquistion

Date | | Fair Value |

Primary Direct Investments — 4.4% | | | | | | | |

North America — 4.4% | | | | | | | |

Overhaul Group, Inc.*1,2,3 | | | | | | | |

(332,376 preferred shares) | | Venture Capital | | 2/1/2023 | | $ | 4,166,499 |

RPIII FB Co-Invest LLC*1,2,3,4 | | Growth Equity | | 3/2/2023 | | | 4,000,000 |

Total North America Investments | | | 8,166,499 |

Total Primary Direct Investments (Cost $8,166,499) | | | 8,166,499 |

| | | | | | | | |

Secondary Investments — 48.2% | | | | | | | |

North America — 48.2% | | | | | | | |

Betaworks Ventures 1.0, L.P.*2,3,5 | | Venture Capital | | 1/24/2023 | | | 15,739,237 |

Betaworks Ventures 2.0, L.P.*2,3,5 | | Venture Capital | | 1/24/2023 | | | 2,577,136 |

Betaworks Ventures 3.0, L.P.*2,3,5 | | Venture Capital | | 1/24/2023 | | | — |

Felicis Ventures VI, L.P.*2,3,5,6 | | Venture Capital | | 11/4/2022 | | | 24,855,943 |

Felicis Ventures VII, L.P.*2,3,5 | | Venture Capital | | 11/4/2022 | | | 16,514,381 |

Insight Partners Continuation Fund II, L.P.*1,2,3,5 | | Growth Equity | | 3/31/2023 | | | 3,750,000 |

Lightspeed Venture Partners Select II, L.P.*2,3,5,7 | | Venture Capital | | 12/30/2022 | | | 1,300,514 |

Lightspeed Venture Partners Select IV, L.P.*2,3,5,7 | | Venture Capital | | 12/30/2022 | | | 1,716,400 |

Lightspeed Venture Partners X, L.P.*2,3,5,7 | | Venture Capital | | 12/30/2022 | | | 4,218,432 |

Lightspeed Venture Partners XI, L.P.*2,3,5,7 | | Venture Capital | | 12/30/2022 | | | 3,198,856 |

Lightspeed Venture Partners XII, L.P.*2,3,5,7 | | Venture Capital | | 12/30/2022 | | | 2,985,476 |

Lightspeed Venture Partners XIII, L.P.*2,3,5,7 | | Venture Capital | | 12/30/2022 | | | 2,245,277 |

Thrive Capital Partners VIII Growth-B, LLC*1,2,3 | | Growth Equity | | 3/17/2023 | | | 10,888,611 |

Total North America Investments | | | 89,990,263 |

Total Secondary Investments (Cost $62,367,390) | | | 89,990,263 |

Total Investments (Cost $70,533,889) | | | 98,156,762 |

Other assets in excess of liabilities — 47.4% | | | 88,501,947 |

Total Net Assets — 100.0% | | $ | 186,658,709 |

The accompanying notes are an integral part of these consolidated financial statements.

5

StepStone Private Venture and Growth Fund |

Consolidated Schedule of Investments March 31, 2023 (Continued) |

Summary of Investments by Strategy (as a percentage of total investments) |

Primary Direct Investments | | 8.3 | % |

Secondary Investments | | 91.7 | |

Total Investments | | 100.0 | % |

The accompanying notes are an integral part of these consolidated financial statements.

6

StepStone Private Venture and Growth Fund |

Consolidated Statement of Assets and Liabilities March 31, 2023 |

Assets | | | | |

Investments, at fair value (cost $70,533,889) | | $ | 98,156,762 | |

Cash | | | 118,755,172 | |

Cash held in escrow | | | 12,165,000 | |

Due from Adviser | | | 305,536 | |

Interest receivable | | | 427,580 | |

Deferred offering costs | | | 220,666 | |

Prepaid expenses and other assets | | | 33,657 | |

Total Assets | | | 230,064,373 | |

| | | | | |

Liabilities | | | | |

Revolving credit facility | | | 30,000,000 | |

Less deferred debt issuance costs | | | (437,734 | ) |

Revolving credit facility less deferred debt issuance costs | | | 29,562,266 | |

Subscriptions received in advance | | | 12,165,000 | |

Incentive fees payable | | | 1,271,865 | |

Professional fees payable | | | 159,950 | |

Management fees payable | | | 118,987 | |

Revolving credit facility fees payable | | | 45,504 | |

Other accrued expenses | | | 82,092 | |

Total Liabilities | | | 43,405,664 | |

| | | | | |

Commitments and contingencies (see Note 8) | | | | |

| | | | | |

Net Assets | | $ | 186,658,709 | |

| | | | | |

Composition of Net Assets: | | | | |

Paid-in capital | | $ | 162,601,088 | |

Total distributable earnings | | | 24,057,621 | |

Net Assets | | $ | 186,658,709 | |

| | | | | |

Net Assets Attributable to: | | | | |

Class I Shares | | $ | 185,844,254 | |

Class D Shares | | | 754,287 | |

Class S Shares | | | 30,084 | |

Class T Shares | | | 30,084 | |

| | | $ | 186,658,709 | |

| | | | | |

Shares of Beneficial Interest Outstanding: | | | | |

Class I Shares | | | 6,167,112 | |

Class D Shares | | | 25,073 | |

Class S Shares | | | 1,000 | |

Class T Shares | | | 1,000 | |

| | | | 6,194,185 | |

| | | | | |

Net Asset Value per Share: | | | | |

Class I Shares | | $ | 30.13 | |

Class D Shares | | $ | 30.08 | |

Class S Shares | | $ | 30.08 | |

Class T Shares | | $ | 30.08 | |

The accompanying notes are an integral part of these consolidated financial statements.

7

StepStone Private Venture and Growth Fund |

Consolidated Statement of Operations For the Period November 1, 2022* through March 31, 2023 |

Investment Income | | | | |

Interest income | | $ | 1,529,763 | |

Total Investment Income | | | 1,529,763 | |

| | | | | |

Expenses | | | | |

Incentive fees | | | 4,244,117 | |

Management fees | | | 959,675 | |

Professional fees | | | 316,070 | |

Trustees’ fees and expenses | | | 160,000 | |

Amortization of offering costs | | | 155,704 | |

Administration fees | | | 139,495 | |

Revolving credit facility fees and expenses1 | | | 70,856 | |

Distribution and servicing fees (Class D) | | | 136 | |

Other operating expenses | | | 216,286 | |

Total Expenses | | | 6,262,339 | |

Adviser expense reimbursement | | | (676,564 | ) |

Management fees voluntarily waived | | | (479,838 | ) |

Net Expenses | | | 5,105,937 | |

Net Investment Loss | | | (3,576,174 | ) |

| | | | | |

Net Realized Gain (Loss) and Change in Unrealized Appreciation (Depreciation) on Investments | | | | |

Net realized gain distributions from investments | | | 10,922 | |

Net change in unrealized appreciation (depreciation) on investments | | | 27,622,873 | |

Net Realized Gain (Loss) and Change in Unrealized Appreciation (Depreciation) on Investments | | | 27,633,795 | |

| | | | | |

Net Increase in Net Assets Resulting from Operations | | $ | 24,057,621 | |

The accompanying notes are an integral part of these consolidated financial statements.

8

StepStone Private Venture and Growth Fund |

Consolidated Statement of Changes in Net Assets |

| | For the Period

November 1,

2022*

through

March 31, 2023 |

Change in Net Assets Resulting from Operations | | | | |

Net investment loss | | $ | (3,576,174 | ) |

Net realized gain distributions from investments | | | 10,922 | |

Net change in unrealized appreciation (depreciation) on investments | | | 27,622,873 | |

Net Increase in Net Assets Resulting from Operations | | | 24,057,621 | |

| | | | | |

Change in Net Assets Resulting from Capital Share Transactions | | | | |

Class I | | | | |

Proceeds from issuance of shares | | | 161,808,088 | |

Total Class I Transactions | | | 161,808,088 | |

| | | | | |

Class D | | | | |

Proceeds from issuance of shares | | | 743,000 | |

Total Class D Transactions | | | 743,000 | |

| | | | | |

Class S | | | | |

Proceeds from issuance of shares | | | 25,000 | |

Total Class S Transactions | | | 25,000 | |

| | | | | |

Class T | | | | |

Proceeds from issuance of shares | | | 25,000 | |

Total Class T Transactions | | | 25,000 | |

| | | | | |

Net Change in Net Assets Resulting from Capital Share Transactions | | | 162,601,088 | |

| | | | | |

Total Net Increase in Net Assets | | | 186,658,709 | |

| | | | | |

Net Assets | | | | |

Beginning of period | | | — | |

End of period | | $ | 186,658,709 | |

The accompanying notes are an integral part of these consolidated financial statements.

9

StepStone Private Venture and Growth Fund |

Consolidated Statement of Changes in Net Assets (continued) |

| | For the Period

November 1,

2022*

through

March 31, 2023 |

Shareholder Activity | | |

Class I Shares | | |

Shares sold | | 6,167,112 |

Net Change in Class I Shares Outstanding | | 6,167,112 |

| | | |

Class D Shares | | |

Shares sold | | 25,073 |

Net Change in Class D Shares Outstanding | | 25,073 |

| | | |

Class S Shares | | |

Shares sold | | 1,000 |

Net Change in Class S Shares Outstanding | | 1,000 |

| | | |

Class T Shares | | |

Shares sold | | 1,000 |

Net Change in Class T Shares Outstanding | | 1,000 |

The accompanying notes are an integral part of these consolidated financial statements.

10

StepStone Private Venture and Growth Fund |

Consolidated Statement of Cash Flows For the Period November 1, 2022* through March 31, 2023 |

Cash Flows From Operating Activities | | |

Net increase in net assets resulting from operations | | $ | 24,057,621 | |

Adjustments to reconcile net increase in net assets resulting from operations to net cash used in operating activities: | | | | |

Purchases of investments | | | (70,549,491 | ) |

Distributions received from investments | | | 26,524 | |

Net realized gain distributions from investments | | | (10,922 | ) |

Net change in unrealized (appreciation) depreciation on investments | | | (27,622,873 | ) |

(Increase)/Decrease in Assets: | | | | |

Increase in deferred offering costs | | | (220,666 | ) |

Increase in prepaid expenses and other assets | | | (33,657 | ) |

Increase in interest receivable | | | (427,580 | ) |

Increase in due from Adviser | | | (305,536 | ) |

Increase/(Decrease) in Liabilities: | | | | |

Increase in subscriptions received in advance | | | 12,165,000 | |

Increase in incentive fees payable | | | 1,271,865 | |

Increase in professional fees payable | | | 159,950 | |

Increase in management fees payable | | | 118,987 | |

Increase in revolving credit facility fees payable | | | 45,504 | |

Increase in other accrued expenses | | | 82,092 | |

Net Cash Used in Operating Activities | | | (61,243,182 | ) |

| | | | | |

Cash Flows from Financing Activities | | | | |

Proceeds from issuance of shares | | | 162,601,088 | |

Proceeds from revolving credit facility | | | 30,000,000 | |

Additions to debt issuance costs | | | (463,086 | ) |

Amortization of debt issuance costs | | | 25,352 | |

Net Cash Provided by Financing Activities | | | 192,163,354 | |

| | | | | |

Cash and Cash Held in Escrow | | | | |

Beginning of Period | | | — | |

End of Period | | $ | 130,920,172 | |

| | | | | |

End of period balances | | | | |

Cash | | | 118,755,172 | |

Cash held in escrow | | | 12,165,000 | |

End of period balance | | $ | 130,920,172 | |

The accompanying notes are an integral part of these consolidated financial statements.

11

StepStone Private Venture and Growth Fund |

Consolidated Financial Highlights Class I Shares |

Per share operating performance.

For a capital share outstanding throughout each period.

| | For the Period

November 1,

2022*

through

March 31, 2023 |

Per Share Operating Performance: | | | | |

Net Asset Value per share, beginning of period | | $ | 25.00 | |

Activity from investment operations: | | | | |

Net investment loss1 | | | (0.70 | ) |

Net realized gains and change in unrealized appreciation on investments | | | 5.83 | |

Total from investment operations | | | 5.13 | |

| | | | | |

Net Asset Value per share, end of period | | $ | 30.13 | |

| | | | | |

Net Assets, end of period (in thousands) | | $ | 185,844 | |

| | | | | |

Ratios to average shareholders’ equity: | | | | |

Net investment loss2,3 | | | (1.74 | )% |

| | | | | |

Gross expenses4 | | | 6.18 | % |

Adviser expense reimbursement | | | (1.12 | )%5 |

Management fees voluntarily waived | | | (0.79 | )%5 |

Net expenses4 | | | 4.27 | % |

| | | | | |

Total Return6 | | | 20.52 | %7 |

| | | | | |

Portfolio turnover rate | | | 0.05 | %7 |

| | | | | |

Senior Securities | | | | |

Total borrowings (000s) | | $ | 30,000 | |

Asset coverage per $1,000 unit of senior indebtedness8 | | $ | 7,222 | |

The accompanying notes are an integral part of these consolidated financial statements.

12

StepStone Private Venture and Growth Fund |

Consolidated Financial Highlights Class D Shares |

Per share operating performance.

For a capital share outstanding throughout each period.

| | For the Period

November 1,

2022*

through

March 31, 2023 |

Per Share Operating Performance: | | | | |

Net Asset Value per share, beginning of period | | $ | 25.00 | |

Activity from investment operations: | | | | |

Net investment loss1 | | | (0.19 | ) |

Net realized gains and change in unrealized appreciation on investments | | | 5.27 | |

Total from investment operations | | | 5.08 | |

| | | | | |

Net Asset Value per share, end of period | | $ | 30.08 | |

| | | | | |

Net Assets, end of period (in thousands) | | $ | 754 | |

| | | | | |

Ratios to average shareholders’ equity: | | | | |

Net investment loss2,3 | | | (0.33 | )% |

| | | | | |

Gross expenses4 | | | 4.92 | % |

Adviser expense reimbursement | | | (0.75 | )%5 |

Management fees voluntarily waived | | | (0.88 | )%5 |

Net expenses4 | | | 3.28 | % |

| | | | | |

Total Return6 | | | 20.32 | %7 |

| | | | | |

Portfolio turnover rate | | | 0.05 | %7 |

| | | | | |

Senior Securities | | | | |

Total borrowings (000s) | | $ | 30,000 | |

Asset coverage per $1,000 unit of senior indebtedness8 | | $ | 7,222 | |

The accompanying notes are an integral part of these consolidated financial statements.

13

StepStone Private Venture and Growth Fund |

Consolidated Financial Highlights Class S Shares |

Per share operating performance.

For a capital share outstanding throughout each period.

| | For the Period

November 1,

2022*

through

March 31, 2023 |

Per Share Operating Performance: | | | | |

Net Asset Value per share, beginning of period | | $ | 25.00 | |

Activity from investment operations: | | | | |

Net investment loss1 | | | (0.83 | ) |

Net realized gains and change in unrealized appreciation on investments | | | 5.91 | |

Total from investment operations | | | 5.08 | |

| | | | | |

Net Asset Value per share, end of period | | $ | 30.08 | |

| | | | | |

Net Assets, end of period (in thousands) | | $ | 30 | |

| | | | | |

Ratios to average shareholders’ equity: | | | | |

Net investment loss2,3 | | | (2.49 | )% |

| | | | | |

Gross expenses4 | | | 7.80 | % |

Adviser expense reimbursement | | | (2.09 | )%5 |

Management fees voluntarily waived | | | (0.78 | )%5 |

Net expenses4 | | | 4.94 | % |

| | | | | |

Total Return6 | | | 20.32 | %7 |

| | | | | |

Portfolio turnover rate | | | 0.05 | %7 |

| | | | | |

Senior Securities | | | | |

Total borrowings (000s) | | $ | 30,000 | |

Asset coverage per $1,000 unit of senior indebtedness8 | | $ | 7,222 | |

The accompanying notes are an integral part of these consolidated financial statements.

14

StepStone Private Venture and Growth Fund |

Consolidated Financial Highlights Class T Shares |

Per share operating performance.

For a capital share outstanding throughout each period.

| | For the Period

November 1,

2022*

through

March 31, 2023 |

Per Share Operating Performance: | | | | |

Net Asset Value per share, beginning of period | | $ | 25.00 | |

Activity from investment operations: | | | | |

Net investment loss1 | | | (0.83 | ) |

Net realized gains and change in unrealized appreciation on investments | | | 5.91 | |

Total from investment operations | | | 5.08 | |

| | | | | |

Net Asset Value per share, end of period | | $ | 30.08 | |

| | | | | |

Net Assets, end of period (in thousands) | | $ | 30 | |

| | | | | |

Ratios to average shareholders’ equity: | | | | |

Net investment loss2,3 | | | (2.49 | )% |

| | | | | |

Gross expenses4 | | | 7.80 | % |

Adviser expense reimbursement | | | (2.09 | )%5 |

Management fees voluntarily waived | | | (0.78 | )%5 |

Net expenses4 | | | 4.94 | % |

| | | | | |

Total Return6 | | | 20.32 | %7 |

| | | | | |

Portfolio turnover rate | | | 0.05 | %7 |

| | | | | |

Senior Securities | | | | |

Total borrowings (000s) | | $ | 30,000 | |

Asset coverage per $1,000 unit of senior indebtedness8 | | $ | 7,222 | |

The accompanying notes are an integral part of these consolidated financial statements.

15

StepStone Private Venture and Growth Fund |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS March 31, 2023 |

1. Organization |

StepStone Private Venture and Growth Fund (the “Fund”) (formerly known as Conversus StepStone Private Venture and Growth Fund) was organized as a Delaware statutory trust under the Delaware Statutory Trust Act on March 4, 2022 (“Inception”) and is registered under the Investment Company Act of 1940, as amended, as a non-diversified, closed-end management investment company. The Fund is offered to investors who are qualified clients within the meaning of Rule 205-3 under the Investment Advisers Act of 1940 and are accredited investors within the meaning of Rule 501(a) of Regulation D promulgated under the Securities Act of 1933, as amended. The Fund commenced operations on November 1, 2022 (“Commencement of Operations”). Effective November 14, 2022, the Fund was renamed StepStone Private Venture and Growth Fund.

The Fund offers Class I shares, Class D shares, Class S shares and Class T shares (together, the “Shares”) to eligible investors (“Shareholders”). The Shares are continuously offered with subscriptions accepted on a monthly basis at the then-current-month net asset value (“NAV”) per share, adjusted for sales load, if applicable. The Fund may, from time to time, offer to repurchase Shares pursuant to written tender offers by Shareholders. Repurchases will be made at such times, in such amounts and on such terms as determined by the Fund’s Board of Trustees (“Board”).

The Board provides broad oversight over the Fund’s investment program, management and operations and has the right to delegate management responsibilities. StepStone Group Private Wealth LLC (formerly known as StepStone Conversus LLC) serves as the Fund’s investment adviser (“Adviser”). The Adviser oversees the management of the Fund’s day-to-day activities including structuring, governance, distribution, reporting and oversight. StepStone Group LP (“StepStone”) serves as the Fund’s investment sub-adviser (“Sub-Adviser”) and is responsible for the day-to-day management of the Fund’s assets. StepStone Group Private Wealth LLC is a wholly owned subsidiary of StepStone.

The Fund’s investment objective is to achieve long-term capital appreciation by investing in venture capital and growth equity assets, along with other private assets, (“Private Market Assets”) focused on the innovation economy, the most dynamic companies, technologies and sectors identified by StepStone as benefiting from attractive secular trends.

2. Summary of Significant Accounting Policies

The accompanying consolidated financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”) and are presented in U.S. dollars which is the functional currency of the Fund. The Fund is an investment company and therefore applies the accounting and reporting guidance issued by the U.S. Financial Accounting Standards Board (“FASB”) in Accounting Standards Codification (“ASC”) Topic 946, Financial Services — Investment Companies. The following are significant accounting policies which are consistently followed in the preparation of the consolidated financial statements.

Basis of Consolidation

The consolidated financial statements include the accounts of subsidiaries wholly-owned by the Fund: SPRING I LLC (Series A and Series B), a Delaware limited liability company, as well as SPRING Cayman LLC and SPRING Cayman II LLC (together, “SPRING Cayman”), which are limited liability companies registered in the Cayman Islands. All intercompany accounts and transactions have been eliminated in consolidation.

Use of Estimates

The preparation of consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of income and expenses during the reporting period. Changes in the economic environment, financial markets, and any other factors or parameters used in determining these estimates could cause actual results to differ materially.

Net Asset Value Determination

The NAV of the Fund is determined as of the close of business on the last business day of each calendar month, each date the Shares are offered or repurchased, as of the date of any distribution and at such other times as the Board determines (each, a “Determination Date”). In determining NAV, the Fund’s investments are valued as of the relevant

16

StepStone Private Venture and Growth Fund |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS March 31, 2023 (Continued) |

2. Summary of Significant Accounting Policies (continued) |

Determination Date. The NAV of the Fund will equal, unless otherwise noted, the value of the total assets of the Fund, less all of its liabilities, including accrued fees and expenses allocated to Shares based on the relative net assets of each class to the total net assets of the Fund, each determined as of the relevant Determination Date.

Valuation of Investments

The Fund’s investments are valued as of each Determination Date at fair value consistent with the principles of ASC Topic 820, Fair Value Measurements (“ASC 820”). The Board has adopted valuation policies and procedures (“Valuation Procedures”) and has appointed a pricing committee (“Pricing Committee”) to manage the valuation process of the Fund. The Pricing Committee utilizes the resources and personnel of the Adviser, the Sub-Adviser and the Fund’s sub-administrator in carrying out its responsibilities. The Board must determine fair value in good faith for all Fund investments and has chosen to designate the Adviser to perform the fair value determinations.

Investments held by the Fund in Private Market Assets may include secondary purchases of existing investments in (i) individual operating companies or assets and (ii) private investment funds (together, “Secondary Investments”), investments in private funds actively fundraising (“Primary Fund Investments”) and investments in individual operating companies (“Primary Direct Investments”). These types of investments normally do not have readily available market prices and therefore will be fair valued according to the Valuation Procedures at each Determination Date. The Valuation Procedures require evaluation of all relevant information reasonably available to the Adviser at the time the Fund’s investments are valued. Valuations of Private Market Assets are inherently subjective and at any point in time may differ materially from the ultimate value, if any, realized on the investment.

Ordinarily, the fair value of the Fund’s investment in a Secondary Investment or Primary Fund Investment is based on the net asset value of the investment reported by its investment manager. If the Adviser determines that the most recent net asset value reported by the investment manager does not represent fair value or if the investment manager fails to report a net asset value to the Fund, a fair value determination is made by the Adviser in accordance with the Valuation Procedures. In making that determination, the Adviser will consider whether it is appropriate, in light of all relevant circumstances, to value such investment at the net asset value last reported by its investment manager, or whether to adjust such net asset value to reflect a premium or discount (adjusted net asset value). The net asset values or adjusted net asset values are net of management fees and performance/incentive fees or allocations (or carried interest) payable pursuant to the respective organizational documents of the investment.

In assessing the fair value of the Fund’s Primary Direct Investments in accordance with the Valuation Procedures, the Adviser uses a variety of methods such as earnings and multiple analysis, discounted cash flow analysis and market data from third party pricing services. The Adviser takes into account the following factors in determining the fair value of a Primary Direct Investment: latest round of financing, company operating performance, market-based multiples, potential merger and acquisition activity and any other material information that may impact investment fair value.

In certain circumstances, the Adviser may determine that cost best approximates the fair value of a particular Private Market Asset. The Fund will generally value its investments that are traded or dealt in upon one or more securities exchanges and for which market quotations are readily available at the last quoted sales price on the primary exchange, or at the mean between the current bid and ask prices on the primary exchange, as of the Determination Date.

The Sub-Adviser and one or more of its affiliates acts as investment adviser to clients other than the Fund. However, the value attributed to a Private Market Asset held by the Fund and the value attributed to the same Private Market Asset held by another client of the Sub-Adviser or one of its affiliates might differ as a result of differences in accounting, regulatory, timing and other factors applicable to the Fund when compared to such other client.

Foreign Currency Translation

The books and records of the Fund are maintained in U.S. dollars. The value of investments, assets and liabilities denominated in currencies other than U.S. dollars are translated into U.S. dollars based upon current foreign exchange rates on the Determination Date. Purchases and sales of foreign investments, income and expenses are converted into

17

StepStone Private Venture and Growth Fund |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS March 31, 2023 (Continued) |

2. Summary of Significant Accounting Policies (continued) |

U.S. dollars based on currency exchange rates prevailing on the date of the relevant transaction. The Fund does not isolate the net realized and unrealized gain or loss resulting from changes in exchange rates from fluctuations in the fair value of investments. Such fluctuations are included within the net realized gain distributions from investments and foreign currency transactions and the net change in unrealized appreciation (depreciation) on investments and foreign currency translation in the Consolidated Statement of Operations. As of March 31, 2023, the Fund did not hold any investments in Secondary Investments, Primary Fund Investments or Primary Direct Investments that were denominated in foreign currencies.

Realized Gain (Loss) on Investments, Interest Income and Dividend Income

Distributions received from Secondary Investments, Primary Fund Investments and Primary Direct Investments occur at irregular intervals and the exact timing of the distributions cannot be determined. The classification of distributions received, including return of capital, realized gains, dividend income and interest income, is based on information received from the investment manager of the Secondary Investments, Primary Fund Investments or Primary Direct Investments. Dividend income and interest income are recorded on an accrual basis.

Fund Expenses

The Fund bears all expenses incurred in the course of its operations, including, but not limited to, the following: all fees and expenses of the Private Market Assets in which the Fund invests (“Acquired Fund Fees”), management fees, fees and expenses associated with a credit facility, legal fees, administrator fees, audit and tax preparation fees, custodial fees, transfer agency fees, registration expenses, expenses of the Board and other administrative expenses. Certain of these operating expenses are subject to an expense limitation agreement (the “Expense Limitation and Reimbursement Agreement” as further discussed in Note 4). Expenses are recorded on an accrual basis and allocated pro-rata to Shares based upon ownership percentage. Closing costs associated with the purchase of secondary investments, primary fund investments and primary direct investments are included in the cost of the investment.

Federal Income Taxes

For U.S. federal income tax purposes, the Fund has elected to be treated, and intends to qualify annually, as a Regulated Investment Company (“RIC”) under Subchapter M of the Internal Revenue Code by distributing substantially all of its taxable net investment income and net realized capital gains to Shareholders each year and by meeting certain diversification and income requirements with respect to investments. If the Fund were to fail to meet the requirements to qualify as a RIC, and if the Fund were ineligible to or otherwise unable to cure such failure, the Fund would be subject to tax on its taxable income at corporate rates, whether or not distributed to Shareholders, and all distributions of earnings and profits would be taxable to Shareholders as ordinary income.

The Fund’s tax year is the 12-month period ending September 30. In accounting for income taxes, the Fund follows the guidance in ASC Topic 740, Accounting for Uncertainty in Income Taxes (“ASC 740”). ASC 740 prescribes the minimum recognition threshold a tax position must meet in connection with accounting for uncertainties in income tax positions taken or expected to be taken by an entity before being measured and recognized in the consolidated financial statements. Management has concluded there were no uncertain tax positions as of March 31, 2023 for federal income tax purposes or in the Fund’s state and local tax jurisdictions. The Fund will recognize interest and penalties, if any, related to unrecognized tax benefits as tax expense in the Consolidated Statement of Operations. For the period November 1, 2022 through March 31, 2023, the Fund did not incur any interest or penalties. The Fund did not have any unrecognized tax benefits as of March 31, 2023.

The Fund files tax returns as prescribed by the tax laws of the jurisdictions in which it operates. In the normal course of business, the Fund is subject to examination by federal, state, local and foreign jurisdictions, where applicable. Given the recent Commencement of Operations, the Fund has no tax years subject to examination by the major tax jurisdictions under the statute of limitations (generally, the three prior taxable years) as of March 31, 2023.

18

StepStone Private Venture and Growth Fund |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS March 31, 2023 (Continued) |

2. Summary of Significant Accounting Policies (continued) |

Distributions are determined in accordance with federal income tax regulations, which may differ from net investment income and net realized capital gains for financial statement purposes (U.S. GAAP). Differences may be permanent or temporary. Permanent differences, including book/tax differences relating to Shareholder distributions, are reclassified among capital accounts in the consolidated financial statements to reflect the applicable tax characterization. Temporary differences arise when certain items of income, expense, gain or loss are recognized in different periods for financial statement and tax purposes; these differences will reverse in the future. The tax basis components of distributable earnings differ from the amounts reflected in the Consolidated Statement of Assets and Liabilities due to temporary book/tax differences. These amounts will be finalized before filing the Fund’s federal tax return.

SPRING I LLC, a wholly-owned subsidiary of the Fund, is a domestic limited liability company that has elected to be treated as a C-corporation for federal and state income tax purposes and is required to account for its estimate of income taxes through the establishment of a deferred tax asset or liability. The Fund recognizes deferred income taxes for temporary differences in the basis of assets and liabilities for financial and income tax purposes. Deferred tax assets are recognized for deductible temporary differences, tax credit carryforwards or net operating loss carryforwards and deferred tax liabilities are recognized for taxable temporary differences. To the extent SPRING I LLC has a deferred tax asset, consideration is given to whether or not a valuation allowance is required.

The SPRING Cayman subsidiaries, wholly-owned by the Fund, are not subject to U.S. federal and state income taxes and will be treated as entities disregarded as separate from their sole owner, the Fund, for U.S. federal income tax purposes.

Organizational and Offering Costs

During the period from Inception through the Commencement of Operations, the Fund incurred organizational costs of $0.1 million. The organizational costs were paid by the Adviser and will be reimbursed by the Fund, subject to recoupment in accordance with the Expense Limitation and Reimbursement Agreement (see Note 4). Organizational costs consist primarily of costs to establish the Fund and enable it to legally conduct business. The Fund expensed organizational costs as incurred.

During the period from Inception through the Commencement of Operations, the Fund incurred offering costs of $0.3 million. These costs were treated as deferred charges and, upon Commencement of Operations, are being amortized into expense over a 12-month period using the straight-line method. During the period from Commencement of Operations to March 31, 2023, the Fund amortized offering costs of $0.2 million which is included in the Consolidated Statement of Operations. Offering costs incurred prior to the Commencement of Operations were paid by the Adviser and will be reimbursed by the Fund, subject to recoupment in accordance with the Expense Limitation and Reimbursement Agreement. Offering costs consist primarily of legal fees, filing fees and printing costs in connection with the preparation of the registration statement and related filings. The Fund will continue to incur offering costs subsequent to the Commencement of Operations due to its continuously offered status. These costs will be treated as deferred charges and amortized over the subsequent 12-month period using the straight-line method.

Cash

Cash includes monies on deposit with UMB Bank N.A. (”UMB Bank”), the Fund’s custodian, and in UMB Bank Demand Deposit (“SMMFIDU”). SMMFIDU acts as a bank deposit for the Fund, providing an interest-bearing account for short-term investment purposes. Deposits, at times, may exceed the insurance limit guaranteed by the Federal Deposit Insurance Corporation. The Fund has not experienced any losses on deposits and does not believe it is exposed to significant credit risk on such deposits. There are no restrictions on the cash held by UMB Bank on the Fund’s behalf.

Cash Held in Escrow

Cash held in escrow represents restricted monies received in advance of the effective date of a Shareholder’s subscription. The monies are on deposit with UMB Bank under the authorization of UMB Fund Services, Inc. (the Fund’s transfer agent, as described in Note 5) and are released from escrow upon the determination of NAV as of the effective date of the subscription. The liability for subscriptions received in advance is included in the Consolidated Statement of Assets and Liabilities.

19

StepStone Private Venture and Growth Fund |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS March 31, 2023 (Continued) |

2. Summary of Significant Accounting Policies (continued) |

Recently Adopted Regulatory Matters

On October 28, 2020, the Securities and Exchange Commission (the “SEC”) adopted regulations governing the use of derivatives by registered investment companies (“Rule 18f-4”). Rule 18f-4 imposes limits on the amount of derivatives a fund can enter into, eliminates the asset segregation framework currently used by funds to comply with Section 18 of the 1940 Act, treats derivatives as senior securities and requires funds whose use of derivatives is more than a limited specified exposure amount to establish and maintain a comprehensive derivatives risk management program and appoint a derivatives risk manager. The Fund is a limited user of derivatives as specified in the rule.

In December 2020, the SEC adopted a new rule providing a framework for fund valuation practices (“Rule 2a-5”). Rule 2a-5 establishes requirements for determining fair value in good faith for purposes of the 1940 Act. Rule 2a-5 permits fund boards to designate certain parties to perform fair value determinations, subject to board oversight and certain other conditions. Rule 2a-5 also defines when market quotations are “readily available” for purposes of the 1940 Act and the threshold for determining whether a fund must fair value a security. In connection with Rule 2a-5, the SEC also adopted related recordkeeping requirements and is rescinding previously issued guidance, including with respect to the role of a board in determining fair value and the accounting and auditing of fund investments. The Fund has implemented Rule 2a-5. The Board designated the Adviser to perform fair value determinations relating to any or all Fund investments.

3. Fair Value Measurements

U.S. GAAP, ASC Topic 820, Fair Value Measurements, (“ASC 820”) defines fair value as the value that the Fund would receive to sell an investment or pay to transfer a liability in a timely transaction with an independent buyer in the principal market, or in the absence of a principal market, the most advantageous market for the asset or liability. ASC 820 establishes a three-level hierarchy for fair value measurements based upon the transparency of inputs to the valuation of an asset or liability. Inputs may be observable or unobservable and refer broadly to the assumptions that market participants would use in pricing the asset or liability. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from sources independent of the Fund. Unobservable inputs reflect the Fund’s own assumptions about the assumptions that market participants would use in valuing the asset or liability developed based on the best information available in the circumstances. Each investment is assigned a level based upon the observation of the inputs which are significant to the overall valuation. The three-tier hierarchy of inputs is summarized below:

Level 1: Quoted prices are available in active markets for identical investments as of the reporting date. The types of investments which would generally be included in Level 1 include listed equities, registered money market funds and short-term investment vehicles.

Level 2: Pricing inputs are other than quoted prices in active markets, which are either directly or indirectly observable as of the reporting date, and fair value is determined through the use of models or other valuation methodologies. The types of investments which would generally be included in Level 2 include corporate bonds and loans, and less liquid and restricted equity securities.

Level 3: Pricing inputs are unobservable for the investment and include situations where there is little, if any, market activity for the investment. The inputs into the determination of fair value require significant management judgment and/or estimation. Those unobservable inputs, that are not corroborated by market data, generally reflect the reporting entity’s own assumptions about the assumptions market participants would use in determining the fair value of the investment. The types of investments which would generally be included in Level 3 are equity and/or debt securities issued by private entities.

In accordance with ASC 820, certain portfolio investments fair valued using net asset value or adjusted net asset value (or its equivalent), adjusted for cash flows, as a practical expedient are not included in the fair value hierarchy. As such, investments in securities with a fair value of $75.4 million are excluded from the fair value hierarchy as of March 31, 2023.

20

StepStone Private Venture and Growth Fund |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS March 31, 2023 (Continued) |

3. Fair Value Measurements (continued) |

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities. The following is a summary of the inputs used, as of March 31, 2023, in valuing the Fund’s investments at fair value:

| | Level 1 | | Level 2 | | Level 3 | | Investments

Valued at

NAV or

Adjusted

NAV | | Total |

Primary Direct Investments | | $ | — | | $ | — | | $ | 8,166,499 | | $ | — | | $ | 8,166,499 |

Secondary Investments | | | — | | | — | | | 14,638,611 | | | 75,351,652 | | | 89,990,263 |

Total Investments | | $ | — | | $ | — | | $ | 22,805,110 | | $ | 75,351,652 | | $ | 98,156,762 |

The following is a reconciliation of assets in which significant unobservable inputs (Level 3) were used in determining value:

| | Primary Direct

Investments | | Secondary

Investments | | Total

Investments |

Balance as of November 1, 2022 | | $ | — | | $ | — | | $ | — |

Transfers into Level 3 | | | — | | | — | | | — |

Purchases | | | 8,166,499 | | | 14,638,611 | | | 22,805,110 |

Distributions from Investments | | | — | | | — | | | — |

Net Realized Gain (Loss) | | | — | | | — | | | — |

Net Change in Unrealized Appreciation | | | — | | | — | | | — |

Transfers out of Level 3 | | | — | | | — | | | — |

Balance as of March 31, 2023 | | $ | 8,166,499 | | $ | 14,638,611 | | $ | 22,805,110 |

| | | | | | | | | | |

Net Change in Unrealized Appreciation on investments held at the end of the reporting period | | $ | — | | $ | — | | $ | — |

Changes in inputs or methodologies used for valuing investments, including timing of reported net asset values of Secondary Investments and Primary Direct Investments reported by their investment managers, may result in transfers in or out of levels within the fair value hierarchy. The inputs or methodologies used for valuing investments may not necessarily be an indication of the risk associated with investing in those investments. Transfers between levels of the fair value hierarchy are reported at the beginning of the reporting period in which they occur.

The following table presents additional quantitative information about valuation methodologies and inputs used for investments that are measured at fair value and categorized within Level 3 as of March 31, 2023:

Investment

Type | | Fair Value as

of March 31,

2023 | | Valuation

Technique(s) | | Unobservable

Input(1) | | Single Input

or Range of Inputs | | Weighted

Average of

Input(2) | | Impact to

Valuation

from an

Increase in

Input(3) |

Primary Direct Investments | | $8,166,499 | | Recent Transaction | | Recent transaction price | | N/A | | N/A | | N/A |

Secondary Investments | | $14,638,611 | | Recent Transaction | | Recent transaction price | | N/A | | N/A | | N/A |

21

StepStone Private Venture and Growth Fund |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS March 31, 2023 (Continued) |

3. Fair Value Measurements (continued) |

4. Investment Adviser and Transactions with Affiliates

In consideration of its services to the Fund, the Adviser is entitled to a management fee (“Management Fee”), which is paid monthly in arrears, at an annual rate of 1.50%, based on the Fund’s month-end net assets. The Adviser pays the Sub-Adviser 50% of the Management Fee monthly in arrears.

The Adviser has voluntarily agreed to waive (i) 0.75% of its 1.50% Management Fee, thereby reducing the Management Fee to an annualized rate of 0.75% of the Fund’s net asset value, effective from November 1, 2022 until April 30, 2023; (ii) 0.50% of its 1.50% Management Fee, thereby reducing the Management Fee to an annualized rate of 1.00% of the Fund’s net asset value, effective from May 1, 2023 until July 31, 2023; and (iii) 0.25% of its 1.50% Management Fee, thereby reducing the Management Fee to an annualized rate of 1.25% of the Fund’s net asset value, effective from August 1, 2023 until October 31, 2023. The Adviser may, in its sole discretion and at any time (including prior to October 31, 2023), elect to extend, terminate or modify its temporary waiver upon written notice to the Fund. For the period November 1, 2022 through March 31, 2023, the Adviser earned $1.0 million in Management Fees of which $0.5 million was waived and $0.1 million was payable as of March 31, 2023.

At the end of each calendar month, the Adviser is entitled to accrue an incentive fee (“Incentive Fee”) in an amount equal to 15% of the excess, if any, of (i) the net profits of the Fund for the relevant month over (ii) the then balance, if any, of the loss recovery account. The Incentive Fee will be incorporated in the Fund’s monthly NAV and paid annually at the end of the calendar year to the Adviser to the extent it is earned. The Adviser will pay 60% of the Incentive Fee to the Sub-Adviser each year. For the period November 1, 2022 through March 31, 2023, the Adviser accrued $4.2 million in Incentive Fees of which $1.3 million was payable to the Adviser as of March 31, 2023.

For the purposes of the Incentive Fee, net profits (Net Profits”) means the amount by which the NAV of the Fund on the last day of the relevant month exceeds the NAV of the Fund as of the beginning of the same month, including any net change in unrealized appreciation or depreciation of investments, realized income and gains or losses, expenses (including offering and organizational expenses) and excluding Shareholder subscriptions and repurchases. The Fund maintains a memorandum account (“Loss Recovery Account”) which will have an initial balance of zero and will be increased upon the close of each calendar month by the amount of the net losses of the Fund for the month and decreased (but not below zero) upon the close of each calendar month by the amount of the Net Profits of the Fund for the month. The Loss Recovery Account takes into account the Fund’s performance since inception and is also referred to as a life-to-date high-water mark. Shareholders will benefit from the Loss Recovery Account in proportion to their holdings.

The Adviser has entered into an Expense Limitation and Reimbursement Agreement with the Fund for a one-year term beginning with the Commencement of Operations and ending on the one-year anniversary thereof (“Limitation Period”). The Adviser may extend the Limitation Period for a period of one year on an annual basis. The Expense Limitation and Reimbursement Agreement limits the amount of the Fund’s aggregate monthly ordinary operating expenses, excluding certain specified expenses (“Specified Expenses”), borne by the Fund during the Limitation Period to an amount not to exceed 0.50% for Class I Shares and 1.00% for Class D, S and T Shares, on an annualized basis, of the Fund’s month-end net assets (the “Expense Cap”). Specified Expenses that are not covered by the Expense Limitation and Reimbursement Agreement include: (i) the Management Fee; (ii) all fees and expenses of Private Market Assets and other investments in which the Fund invests (including the underlying fees of the Private Market Assets and other investments); (iii) the Incentive Fee; (iv) transactional costs, including legal costs and brokerage commissions, associated with the acquisition and disposition of Private Market Assets and other investments; (v) interest payments incurred on borrowing by the Fund; (vi) fees and expenses incurred in connection with a credit facility, if any, obtained by the Fund; (vii) distribution and shareholder servicing fees, as applicable; (viii) taxes; and (ix) extraordinary expenses resulting from events and transactions that are distinguished by their unusual nature and by the infrequency of their occurrence.

22

StepStone Private Venture and Growth Fund |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS March 31, 2023 (Continued) |

4. Investment Adviser and Transactions with Affiliates (continued) |

If the Fund’s aggregate monthly ordinary operating expenses, in respect of any Class of Shares for any month exceeds the Expense Cap applicable to that Class of Shares, the Adviser will waive its Management Fee, Incentive Fee and/or reimburse the Fund for expenses to the extent necessary to eliminate such excess. The Adviser may also directly pay expenses on behalf of the Fund and waive reimbursement under the Expense Limitation and Reimbursement Agreement. To the extent that the Adviser waives its Management Fee and/or Incentive Fee, reimburses expenses to the Fund or pays expenses directly on behalf of the Fund, it is permitted to recoup from the Fund any such amounts for a period not to exceed three years from the month in which such fees and expenses were waived, reimbursed, or paid, even if such recoupment occurs after the termination of the Limitation Period. However, the Adviser may only recoup the waived fees, reimbursed expenses or directly paid expenses in respect of the applicable Class of Shares if the ordinary operating expenses have fallen to a level below the relevant Expense Cap and the recouped amount does not raise the level of ordinary operating expenses in respect of a Class of Shares in the month of recoupment to a level that exceeds any Expense Cap applicable at that time.

For the period from the Commencement of Operations through March 31, 2023, expenses in excess of the Expense Cap subject to recoupment under the Expense Limitation and Reimbursement Agreement were $0.7 million. The Consolidated Statement of Assets and Liabilities includes a Due from Adviser of $0.3 million as of March 31, 2023 for the net of expenses paid by the Adviser and expenses in excess of the Expense Cap.

5. Administrator, Custodian and Transfer Agent

The Adviser serves as the Fund’s administrator (the “Administrator”) pursuant to an administration agreement (the “Administration Agreement”) under which the Administrator provides administrative, accounting and other services. Pursuant to the Administration Agreement, the Fund pays the Administrator an administration fee equal to 1/12th of an applicable annual fee between 0.08% to 0.23%, based upon the Fund’s net assets as of each month-end, payable monthly in arrears. For the period November 1, 2022 through March 31, 2023, the Administrator earned $0.1 million in administration fees of which $0.0 million was payable as of March 31, 2023.

From the proceeds of the administration fee, the Administrator pays UMB Fund Services, Inc. (the “Sub-Administrator”) a sub-administration fee to perform certain administrative and accounting services for the Fund on behalf of the Administrator. The sub-administration fee, pursuant to a sub-administration agreement and a fund accounting agreement, is paid monthly by the Administrator and is based upon the NAV of the Fund, subject to an annual minimum. For the period November 1, 2022 through March 31, 2023, the Administrator paid $0.1 million in fees of which $0.0 million was payable to the Sub-Administrator on behalf of the Fund as of March 31, 2023.

UMB Bank serves as the Fund’s custodian (the “Custodian”) pursuant to a custody agreement. As the Custodian, UMB Bank holds the Fund’s domestic assets. Foreign assets are held by sub-custodians. For the period November 1, 2022 through March 31, 2023, the Custodian earned $0.0 million in custody fees of which $0.0 million was payable as of March 31, 2023.

UMB Fund Services, Inc. serves as the Fund’s transfer agent (the “Transfer Agent”) pursuant to a transfer agency agreement. The Transfer Agent, among other things, receives and processes purchase orders, effects issuance of Shares, prepares and transmits payments for distributions, receives and processes tender offers and maintains records of account. For the period November 1, 2022 through March 31, 2023, the Transfer Agent earned $0.0 million in transfer agent fees of which $0.0 million was payable as of March 31, 2023.

23

StepStone Private Venture and Growth Fund |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS March 31, 2023 (Continued) |

6. Distribution and Shareholder Servicing Plan |

Foreside Financial Services, LLC serves as the Fund’s distributor (the “Distributor”) pursuant to a distribution agreement. The Distributor distributes the Shares of the Fund, in compliance with Rule 12b-1 under the Investment Company Act. The Distributor is authorized to enter into Sub-Distribution Agreements with brokers, dealers and certain RIAs and other financial intermediaries to effect the distribution of Shares of the Fund. The Fund pays a monthly distribution and shareholder services fee out of the net assets of Class S Shares and Class T Shares at the annual rate of 0.85% of the aggregate NAV of Class S Shares and Class T Shares, determined and accrued as of the last day of each calendar month (before any repurchases of Shares). The Fund pays a monthly shareholder services fee out of the net assets of Class D Shares at the annual rate of 0.25% of the aggregate NAV of Class D Shares. Class I Shares are not subject to a distribution and shareholder servicing fee. For the period November 1, 2022 through March 31, 2023, distribution and shareholder servicing fees incurred are disclosed on the Consolidated Statement of Operations.

7. Revolving Credit Facility

Effective February 6, 2023, the Fund entered into a revolving credit agreement, as amended from time to time (“Credit Facility”), with Texas Capital Bank allowing the Fund to borrow up to $40.0 million (the “Commitment”). The purpose of the Credit Facility is to provide short-term working capital, primarily to bridge the timing of the Fund’s acquisition of Private Market Assets in advance of the receipt of monthly subscriptions. The Commitment termination date is February 6, 2026. When borrowing on the Credit Facility, the Fund can select a “Base Rate Borrowing” or “Term SOFR Borrowing” (each a “Loan Type”). The interest rate associated with each Loan Type will be determined at the time of such borrowing and is comprised of a reference rate plus an applicable margin of 2.0% for Base Rate Borrowings or 3.0% for Term SOFR Borrowings. The average interest rate on short-term borrowings during the period November 1, 2022 through March 31, 2023 was 7.8%. The Credit Facility has a minimum interest requirement of the average daily Term SOFR during the period from February 6, 2023 to the first anniversary thereof on 12.5% of the maximum principal amount. The Credit Facility has a commitment fee of 0.25% per annum on the average daily unused balance. In conjunction with the Credit Facility, the Fund incurred an upfront fee of 0.60% which is being amortized in the Consolidated Statement of Operations over the three-year term of the Credit Facility. For the period November 1, 2022 through March 31, 2023, expenses charged to the Fund related to the Credit Facility were $0.1 million. The average daily short-term borrowings outstanding during the period November 1, 2022 through March 31, 2023 were $3.2 million.

The following table provides a summary of the key characteristics of the Credit Facility as of March 31, 2023:

Current Balance (in millions) | | $ | 30.0 |

Maximum Principal Amount Available (in millions) | | $ | 40.0 |

Inception Date | | | February 6, 2023 |

Maturity Date | | | February 6, 2026 |

Commitment Fee(1) | | | 0.25% per annum |

8. Commitments and Contingencies

As of March 31, 2023, the Fund has contractual unfunded commitments to provide additional funding of $25.4 million to certain investments. The aforementioned commitments to investments are subject to certain terms and conditions prior to closing of the relevant transactions. There can be no assurance that such transactions will close as expected or at all.

ASC 460-10, Guarantees — Overall, requires entities to provide disclosure and, in certain circumstances, recognition of guarantees and indemnifications. In the normal course of business, the Fund enters into contracts that contain a variety of indemnification arrangements. The Fund’s exposure under these arrangements, if any, cannot be quantified. However, the Fund has not had claims or losses pursuant to these indemnification arrangements and expects the potential for a material loss to be remote.

24

StepStone Private Venture and Growth Fund |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS March 31, 2023 (Continued) |

8. Commitments and Contingencies (continued) |

The Fund may, from time to time, be party to various legal matters arising in the ordinary course of business, including claims and litigation proceedings. Although the ultimate outcome of the foregoing matters, if any, cannot be ascertained at this time, it is the opinion of the Adviser, after consultation with counsel, that the resolution of such matters would not have a material adverse effect on the Fund’s consolidated financial statements.

9. Capital Share Transactions

The Fund offers four separate classes of shares of beneficial interest (“Shares”) designated as Class I Shares, Class D Shares, Class S Shares and Class T Shares. Each class of Shares is subject to different fees and expenses.

The minimum initial investment in Class I Shares by an investor in the Fund is $1.0 million, the minimum initial investment in Class D Shares, Class S Shares and Class T Shares by an investor is $50,000. However, the Fund, in its sole discretion, may accept investments below these minimums, but no lower than $25,000 for any individual investor. Investors purchasing Class S Shares and Class T Shares may be charged a sales load up to a maximum of 3.5% and investors purchasing Class D Shares may be charged a sales load up to a maximum of 1.5%. Investors purchasing Class I Shares are not charged a sales load. The Fund accepts initial and additional purchases of Shares as of the first business day of each calendar month at the Fund’s then-current NAV per share (determined as of the close of business on the last business day of the immediately preceding month).

The following table summarizes the Capital Share transactions for the period November 1, 2022 through March 31, 2023:

| | For the Period

November 1, 2022

through

March 31, 2023 |

| | | Shares | | Dollar

Amounts |

Class I | | 6,167,112 | | $ | 161,808,088 |

Class D | | 25,073 | | | 743,000 |

Class S | | 1,000 | | | 25,000 |

Class T | | 1,000 | | | 25,000 |

Increase in Shares and Net Assets | | 6,194,185 | | $ | 162,601,088 |

Beginning no later than the first calendar quarter of 2024, it is expected that the Adviser will recommend to the Board, subject to the Board’s discretion, that the Fund commence a quarterly share repurchase program where the total amount of aggregate repurchases of Shares will be up to 2.5% of the Fund’s outstanding Shares per quarter. Any repurchase of Shares which have been held for less than one year by a Shareholder, as measured through the date of redemption, will be subject to an early repurchase fee equal to 2% of the NAV of the Shares repurchased by the Fund. The Fund has no obligation to repurchase Shares at any time; any such repurchases will only be made at such times, in such amounts and on such terms as may be determined by the Board of Trustees, in its sole discretion.

10. Investment Transactions

Purchases of Primary Direct Investments and Secondary Investments for the period November 1, 2022 through March 31, 2023, excluding short-term investments, totaled $8.2 million and $62.4 million, respectively, and total proceeds received from investments that represented return of capital distributions were $0.0 million.

25

StepStone Private Venture and Growth Fund |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS March 31, 2023 (Continued) |

11. Risk Factors |

An investment in the Fund involves material risks, including performance risk, liquidity risk, business and financial risk, risks associated with the use of leverage, valuation risk, tax risk and other risks that should be carefully considered prior to investing and investing should only be considered by persons financially able to maintain their investment and who can afford a loss of a substantial part or all of such investment.

12. Counterparty Insolvency or Failure

There is a risk that any of the Fund’s counterparties could become insolvent or fail. For example, in March 2023, Silicon Valley Bank and Signature Bank were closed by their chartering state regulators and the United States Federal Deposit Insurance Corporation appointed as receiver. If one or more of the Fund’s counterparties were to become insolvent or the subject of liquidation or other insolvency proceedings, there is a risk that the recovery of the Fund’s securities and other assets from such counterparty would be delayed or be of a value less than the value of the securities or assets originally entrusted to such counterparty.

In addition, the Fund may use counterparties located in various jurisdictions around the world. Such local counterparties are subject to various laws and regulations in various jurisdictions that are designed to protect their customers in the event of their insolvency. However, the practical effect of these laws and their application to the Fund’s assets will be subject to substantial limitations and uncertainties. As a result of the large number of entities and jurisdictions involved and the range of possible factual scenarios involving the insolvency of a counterparty, it is very difficult to generalize about the effect of their insolvency on the Fund and their respective assets. Investors should assume that the insolvency of any counterparty would result in a loss to the Fund which could be material.

13. Activities Prior to Commencement of Operations

The Fund prepared its seed financial statements for the period from Inception to June 24, 2022. During the period from June 25, 2022 through the Commencement of Operations, the Fund engaged in various activities in preparation for the offering of Shares and incurred further costs in relation to the offering, including various legal expenses and printing costs as disclosed in Note 2.

14. Subsequent Events

Effective April 3, 2023 and May 1, 2023, there were additional subscriptions into the Fund in the amounts of $12.1 million and $7.1 million, respectively.

The Fund has adopted financial reporting rules regarding subsequent events which require an entity to recognize in the financial statements the effects of all subsequent events that provide additional evidence about conditions that existed at the date of the balance sheet. The Adviser has evaluated the Fund’s related events and transactions that occurred through the date of issuance of the Fund’s financial statements. There were no other events or transactions that occurred during this period that materially impacted the amounts or disclosures in the Fund’s consolidated financial statements or the accompanying notes.

26

StepStone Private Venture and Growth Fund |

Trustees and Officers March 31, 2023 (Unaudited) |

The identity of the Trustees and executive officers of the Fund and brief biographical information regarding each such person during the past five years is set forth below. The Fund’s Statement of Additional Information includes additional information about the membership of the Board and is available, without charge, upon request, by calling the Fund toll-free at (704) 215-4300.

INDEPENDENT TRUSTEES |

NAME, ADDRESS

AND BIRTH

YEAR | POSITION(S)

HELD WITH

REGISTRANT | LENGTH

OF TIME

SERVED* | PRINCIPAL

OCCUPATION(S)

DURING PAST

5 YEARS | NUMBER OF

PORTFOLIOS

OVERSEEN

IN FUND

COMPLEX | OTHER

TRUSTEESHIPS/

DIRECTORSHIPS

HELD OUTSIDE

THE FUND

COMPLEX** |

Harold Mills c/o StepStone Group Private Wealth LLC 128 S Tryon St.,

Suite 1600

Charlotte, NC 28202 Birth Year: 1970 | Trustee | Indefinite

Length – Since

Inception | CEO, VMD Ventures (since 2016); CEO, ZeroChaos (2000 – 2017) | 2 | None |

Tracy Schmidt c/o StepStone Group Private Wealth LLC 128 S Tryon St.,

Suite 1600

Charlotte, NC 28202 Birth Year: 1957 | Trustee | Indefinite

Length – Since

Inception | Founder, Morning Star Advisory, LLC (consulting and advisory services) (since 2018), Enterprise Chief Financial Officer, Group President of Alternative Investments and Chief Operating Officer, CNL Financial Group (2004 – 2018) | 2 | None |

Ron Sturzenegger c/o StepStone Group Private Wealth LLC 128 S Tryon St.,

Suite 1600

Charlotte, NC 28202 Birth Year: 1960 | Trustee | Indefinite

Length – Since

Inception | Enterprise Business & Community Engagement Executive, Bank of America (2014 – 2018) | 2 | Director of KBS Real Estate Investment Trust II, Inc. (since 2019), and KBS Real Estate Investment Trust III, Inc.

(since 2019) |

_______________________

27

StepStone Private Venture and Growth Fund |

Trustees and Officers March 31, 2023 (Unaudited) (Continued) |

INTERESTED TRUSTEES |

NAME, ADDRESS

AND BIRTH

YEAR | POSITION(S)

HELD WITH

REGISTRANT | LENGTH

OF TIME

SERVED* | PRINCIPAL

OCCUPATION(S)