UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23789

Touchstone ETF Trust

(Exact name of registrant as specified in charter)

303 Broadway, Suite 1100

Cincinnati, Ohio 45202-4203

(Address of principal executive offices) (Zip code)

E. Blake Moore Jr.

303 Broadway, Suite 1100

Cincinnati, Ohio 45202-4203

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-638-8194

Date of fiscal year end: December 31

Date of reporting period: December 31, 2022

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

| (a) | The Report to Shareholders is attached herewith. |

| Touchstone ETF Trust |

| Touchstone Dividend Select ETF |

| Touchstone Strategic Income Opportunities ETF |

| Touchstone Ultra Short Income ETF |

| Touchstone US Large Cap Focused ETF |

This report identifies the Funds' investments on December 31, 2022. These holdings are subject to change. Not all investments in each Fund performed the same, nor is there any guarantee that these investments will perform as well in the future. Market forecasts provided in this report may not occur.

Letter from the President

Dear Shareholder:

We are pleased to provide you with the Touchstone ETF Trust Annual Report. Inside you will find key financial information, as well as manager commentaries for the Funds, from the Funds’ inception dates through the period ended December 31, 2022.

For the calendar year 2022, the U.S. Federal Reserve (Fed) initiated a series of Fed Funds rate hikes to combat persistent inflation. Over the course of the year, the Fed raised overnight rates by over 4 percent in an effort to slow down economic growth. The Fed’s attempt to engineer a “soft landing” for the economy created uncertainty at times throughout the year. This uncertainty contributed to a selloff in nearly every major asset class in the capital markets, a rare negative annual return for both U.S. equities and fixed income markets. Outside the U.S., global economic growth slowed due to various reasons such as the unexpected Russian invasion of Ukraine in February, disrupted supply chains and trade from continued COVID-related lockdowns in China, and political turbulence in the U.K. However, the capital markets absorption of the Russian-Ukrainian conflict by mid-year and the loosening of China’s COVID lockdowns later in the year, were not enough to squelch economic headwinds that had been occurring since the beginning of 2022 including higher rates of inflation, slowing demand and higher energy prices.

U.S. equity markets reported negative results for the year. The equity style shift from Growth to Value that began in late 2020 continued throughout 2022. Within the domestic markets, large cap value stocks outperformed their growth counterparts on a relative basis. The aforementioned Fed rate hikes disproportionately impacted growth stocks due to their higher implied growth rates and longer duration of earnings growth included in their valuation multiples. Value stocks generally benefit from higher commodity costs (e.g. Energy sector) and when equity investors seek refuge in defensive sectors such as Consumer Staples and Health Care – both of which occurred during 2022.

In the fixed income markets, Fed rate hikes and persistent inflation pushed shorter maturity yields up compared to longer maturities on the yield curve, providing a headwind for the investment grade bonds. Over the full year, credit spreads did not widen significantly despite slowing economic growth, hence below investment grade bonds outperformed their investment grade peers due to their yield advantage.

We are reminded especially in periods like these of the importance of the steady hands of financial professionals, trust in your investment strategy, and the risks of trying to time the market. Additionally, we believe that environments that are more volatile create more opportunity for active managers to add value, especially those that are Distinctively Active with high Active Share. We greatly value your continued support. Thank you for including Touchstone as part of your investment plan.

Sincerely,

E. Blake Moore Jr.

President

Touchstone ETF Trust

Management's Discussion of Fund Performance (Unaudited)

Touchstone Dividend Select ETF

Sub-Advised by Fort Washington Investment Advisors, Inc.

Investment Philosophy

The Touchstone Dividend Select ETF (the "Fund") seeks current income and capital appreciation by investing primarily in a portfolio of 40-55 dividend-paying large-capitalization equities.

Fund Performance

The Touchstone Dividend Select ETF outperformed its benchmark, the Russell 1000® Value Index, since its inception on August 2, 2022 through December 31, 2022. The Fund’s total return was 1.94 percent compared to the benchmark’s total return of 0.52 percent.

Market Environment

The period was characterized by increased volatility and high uncertainty amid persistently high inflation, tightening financial conditions, and increased geopolitical conflicts. Inflation remained elevated in the period and the U.S. Federal Reserve (Fed) solidified its hawkish stance, but the end of the period represented an important transition for markets. Data indicated slower growth and signs that inflation is beginning to ease, and the Fed slowed the pace of hikes.

Treasury yields moved sharply higher during the second half of the year, with short-term rates moving along with Fed hikes and at a faster pace than long-term rates. Following a 0.75% rate increase in November, the Fed stepped down the rate of increase to 0.50% in December, for a cumulative total of 4.25% of rate increases in 2022. Current expectations are for the Fed Funds rate to reach 4.75-5.00% in early-2023 and remain above 4.50% for the entire year. Credit spreads were somewhat volatile during the period but ended relatively unchanged to slightly tighter.

US economic growth (GDP) in the third quarter 2022 was 3.2%, a rebound from prior quarters. The headline growth number was positively impacted by an outsized change in net exports which is unlikely to repeat, and the rest of the details indicated slower, near-trend growth. Consumer and business demand rebounded from prior quarters, while residential investment (housing) and inventories subtracted from growth. This report, along with several other indicators, continues to signal that tighter financial conditions are having the desired effect of slowing the economy.

While other economic indicators show weakness, job gains and wages have remained solid, supporting spending. Higher consumer income, along with accumulated savings from pandemic-era programs, have enabled consumers to maintain solid levels of spending.

Business spending rebounded somewhat during the period, but forward-looking data indicates further softening and represents another downside risk. The downshift in global growth has negatively impacted demand and various surveys of business confidence have fallen sharply over the past several months. Importantly, inventories are plentiful and supply chains have largely normalized, contributing to reduced inflation pressures from this sector of the economy.

U.S. equities declined over the period as investors grappled with tight financial conditions and the looming possibility of an economic slowdown. The worst performing sectors in the Index for the period were Real Estate, Communication Services, and Information Technology. The benchmark sectors that outperformed the most during the period were Energy, Materials, and Consumer Staples.

Portfolio Review

The Fund’s outperformance was driven by positive stock selection within the Consumer Discretionary, Communication Services, and Materials sectors. Sectors where the Fund underperformed were Utilities, Energy, and Information Technology. The Fund’s overweight in Information Technology was a headwind which partially offset the Fund’s positive stock selection. Information Technology underperformed as higher interest rates and slowing economic growth pressured valuations for higher growth, long duration stocks.

Among the individual contributors to relative performance were overweight positions in Caterpillar Inc. (Industrials sector) ("Caterpillar"), and Merck & Co. Inc. (Health Care sector), and an underweight position to Starbucks Corp. (Consumer Discretionary sector) ("Starbucks").

Caterpillar outperformed during the period and added to performance. The company reported strong third quarter results on better than expected equipment demand, a welcomed change in tone from prior quarters. A zero weight exposure to Meta Platforms Inc. ("Meta") contributed to relative performance during the period. Meta fell nearly 25% after reporting quarterly

Management's Discussion of Fund Performance (Unaudited) (Continued)

results that missed expectations on advertising revenue and increased spending on the Metaverse. Meta does not pay a dividend, resulting in an underweight position for the Fund.

Starbucks also contributed to relative returns. Starbucks had been a relative underperformer for much of 2022 until the third quarter. Headwinds from lingering effects from the global pandemic, unionization efforts, and CEO uncertainty has pressured the stock for much of the past year. The third quarter brought a shift in tone as the company announced its new CEO while also providing an update on strategic guidance that impressed investors.

Outlook and Conclusion

Looking ahead, the key issue for investors is whether Fed tightening will spawn a U.S. recession, and if so, how severe it will be.

The consensus among economists is that a recession will unfold in 2023, as aggressive interest rate hikes by the Fed have resulted in a substantial tightening of financial market conditions. The positive aspect is that most forecasters envision a recession that is short and mild.

Another consideration for investors is where the Fed Funds Rate will peak and when the Fed will relax policy. In this regard, Fed officials have emphasized their commitment to bring inflation back to the 2% average annual target. Fed chair Jerome Powell stated at the December Federal Open Markets Committee (FOMC) meeting that there is still work to do to ensure this goal is attained. The median forecast of FOMC members is the Fed funds rate will peak at 5.0%-5.25% early this year and remain there for the balance of 2023.

Our take is the outcome hinges on how high the unemployment rate increases. Because Fed officials anticipate only a modest rise in unemployment to 4.6%, they are focusing on bringing inflation down. However, should unemployment rise to 5% or higher, we believe the Fed is more likely to lower rates.

Finally, another consideration is that conditions abroad are worse than in the U.S. Europe already may be in recession as policymakers face the daunting task of alleviating shortages in natural gas stemming from Russia’s invasion of Ukraine. A spike in consumer price inflation in the Eurozone to 10% is further exacerbating the situation.

At the same time, the Chinese government confronts its biggest challenge since the COVID-19 pandemic struck three years ago. It recently had to scrap its zero tolerance policy in the wake of national protests, but it lacked a strategy to limit the fallout, and the country now faces a massive outbreak.

Our view is that if a U.S. recession were to materialize, it is likely to be less severe than recent recessions for two reasons: there are no major sectoral imbalances and consumer fundamentals remain healthy and have shown resilience to tightening financial conditions. Furthermore, we do not believe a recession is necessary to control inflation. Recent inflation data has continued to trend downward and forward-looking expectations remain anchored, both encouraging signs of progress and confidence in the Fed’s ability to control inflation.

Within the Fund, we are maintaining a cautious stance but are selectively finding bottom-up opportunities while reducing outperforming defensive names where valuations have become stretched. Earnings expectations remain elevated and are at risk to fall amid slowing economic growth. Despite most equity indices ending the year near or in a bear market, downside still remains should equity earnings deteriorate.

Although risks have risen, valuations have adjusted to reasonable levels and the long-term economic outlook is still promising. As such, we remain constructive on U.S. equities. As investors seek to avoid the risks of inflation, higher interest rates, and recession, dividend strategies are a compelling option. Dividend strategies have the potential to provide both capital appreciation and a growing stream of income while also providing a cushion through lower volatility during times of distress.

Management's Discussion of Fund Performance (Unaudited) (Continued)

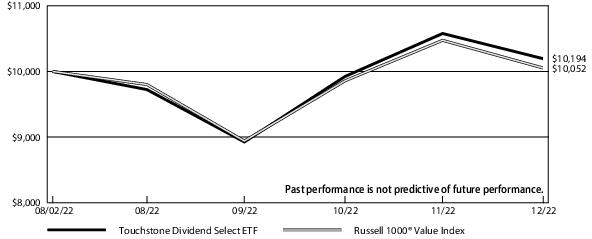

Comparison of the Change in Value of a $10,000 Investment in the Touchstone Dividend Select ETF and the Russell 1000® Value Index

| Cumulative Total Returns** |

| Touchstone Dividend Select ETF | Since

Inception* |

| NAV | 1.94% |

| Market Price | 1.94% |

| Russell 1000® Value Index | 0.52% |

| * | The inception date of the Fund was August 2, 2022. The returns of the index listed above are based on the inception date of the Fund. |

| ** | Not annualized. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Investors buy and sell shares of an exchange-traded fund (“ETF”) at market price (not NAV) in the secondary market throughout the trading day. Shares of an ETF are not individually available for direct purchase from or direct redemption to the ETF. The ETF’s per share NAV is the value of one share of the ETF and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. Market price returns are typically based upon the official closing price of the ETF’s shares. These returns do not represent investors’ returns had they traded shares at other times. NAV and market price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessment of the underlying value of the Fund’s portfolio securities.

Information showing the Fund’s net asset value, market price, premiums and discounts, and bid-ask spreads for various time periods is available by visiting the Fund’s website at TouchstoneInvestments.com/ETFs.

Notes to Chart

Russell 1000® Value Index measures those Russell 1000 companies with lower price-to-book ratios and lower expected growth values.

The Frank Russell Company (FRC) is the source and owner of the data contained or reflected in this material and all trademarks and copyrights related thereto. The material may contain confidential information and unauthorized use, disclosure, copying, dissemination or redistribution is strictly prohibited. This is a Touchstone Investments presentation of the data, and FRC is not responsible for the formatting or configuration of this material or for any inaccuracy in the presentation thereof.

Management's Discussion of Fund Performance (Unaudited)

Touchstone Strategic Income Opportunities ETF

Sub-Advised by Fort Washington Investment Advisors, Inc.

Investment Philosophy

The Touchstone Strategic Income Opportunities ETF (the "Fund") seeks a high level of current income with a focus on capital preservation by investing primarily in income producing fixed income securities.

Fund Performance

The Touchstone Strategic Income Opportunities ETF outperformed its benchmark, the Bloomberg U.S. Aggregate Bond Index, since the Fund’s inception on July 21, 2022 through December 31, 2022. The Fund’s total return was -0.03 percent compared to the benchmark’s total return of -3.93 percent.

Market Environment

The second half of 2022 was characterized by increased volatility and high uncertainty amid persistently high inflation, tightening financial conditions, and increased geopolitical conflicts. Inflation remained elevated in the third quarter and the U.S. Federal Reserve (“Fed”) solidified its hawkish stance, but the fourth quarter represented an important transition for markets. Data indicated slower growth and signs that inflation is beginning to ease, and the Fed slowed the pace of hikes.

Treasury yields moved sharply higher during the second half of 2022, with short-term rates moving along with Fed hikes and at a faster pace than long-term rates. Following a 0.75% rate increase in November, the Fed stepped down the rate of increase to 0.50% in December, for a cumulative total of 4.25% of rate increases in 2022. Current expectations are for the Fed Funds rate to reach 4.75-5.00% in early-2023 and remain above 4.50% for the entire year. Credit spreads were somewhat volatile during the period but ended relatively unchanged to slightly tighter.

U.S. economic growth (GDP) in third quarter 2022 was 3.2%, a rebound from prior quarters. The headline growth number was positively impacted by an outsized change in net exports which is unlikely to repeat, and the rest of the details indicated slower, near-trend growth. Consumer and business demand rebounded from prior quarters, while residential investment (housing) and inventories subtracted from growth. This report, along with several other indicators, continues to indicate that tighter financial conditions are having the desired effect of slowing the economy.

Business spending rebounded somewhat in the period, but forward-looking data indicates further softening and represents another downside risk. The downshift in global growth has negatively impacted demand and various surveys of business confidence have fallen sharply over the past several months. Importantly, inventories are plentiful and supply chains have largely normalized, contributing to reduced inflation pressures from this sector of the economy.

An improvement in the inflation picture was a key driver of markets in the period, and will remain crucially important into 2023. During the period, inflation data decelerated notably, driven by declining commodity and other goods prices. Services inflation remained strong, but forward-looking data indicates it will also move lower in mid-2023. Along with slower growth, the improvement in inflation data allowed the Fed to downshift to a 0.50% rate increase in December. Further progress is needed to confidently say that inflation is heading back to 2.0%, but we believe recent optimism is justified and expect inflation to drift lower in 2023. For their part, we believe the Fed will continue to indicate tighter policy as inflation will remain well above target for the next several months. However, in our view, the path of policy priced into markets is appropriate and slower growth/lower inflation will put downward pressure on rates in 2023.

Credit spreads across sectors and quality ranges are generally in the 50-60 percentile relative to history after the recovery late in the period. Credit spreads reflect some uncertainty, but are not indicating significant concern of an imminent or deep recession. If the economy slows more/faster than expected, credit spreads are likely to widen. However, if a soft landing is achieved or a recession is shallow, the current level of spreads is compelling. As a result, we believe current valuations support a modest overweight to risk in portfolios.

Portfolio Review

The Fund’s outperformance during the period occurred as interest rate positioning added to relative performance versus the benchmark. The portfolio maintained a duration between 4 and 5 years during the period, compared to 6 to 6.5 years for the benchmark. Interest rates rose materially during the period, resulting in outperformance as the portfolio was positioned with a shorter duration compared to the benchmark. The yield curve moved materially higher and the curve flattened as short-term rates moved higher than long-term rates.

Management's Discussion of Fund Performance (Unaudited) (Continued)

Sector allocation added to relative performance during the period. An overweight allocation to High Yield and Emerging Market Debt were the primary drivers of positive sector allocation. The sectors outperformed as credit spreads tightened.

Security selection was also a positive factor for relative performance. All sectors generated positive security selection during the period, including Investment Grade Credit, Securitized, High Yield, and Emerging Markets Debt.

The Fund reduced its exposure to Investment Grade Credit and High Yield during the period, and modestly increased Emerging Markets Debt. Spreads were volatile but tightened during the period and valuations became less compelling, presenting an opportunity to modestly reduce exposure to spread sectors.

Outlook and Conclusion

Overall growth has slowed to below-trend pace, but expected softening in job growth is a downside risk over coming months. Inflation has declined from recent highs, a welcome signal for markets. However, further deceleration is needed throughout 2023 to move inflation back toward 2.0 percent. The Fed has aggressively raised rates to combat inflation and we believe will continue to indicate restrictive policy until they see a string of data that confirms a lower inflation trajectory. We believe slowing growth and tight monetary policy represents the biggest risk to markets, but we do not believe a hard recession is necessary to control inflation. As our view of the economy and monetary policy changes, we will adjust positioning as these risks evolve.

We believe the Fund is positioned to perform well in a stable to improving market environment. We believe an overweight to credit sectors should benefit investors as valuations are generally fair at current levels. The Fund had previously and currently continues to generate an above average yield through a high conviction multi-sector approach, and we believe should also perform well in a stable environment through its excess carry. The portfolio's yield rose to historically high levels during the period and we believe should help offset potential risks. In today’s volatile and uncertain environment, we believe the Fund provides a compelling solution for fixed income investors due to its flexible and risk-oriented approach.

Management's Discussion of Fund Performance (Unaudited) (Continued)

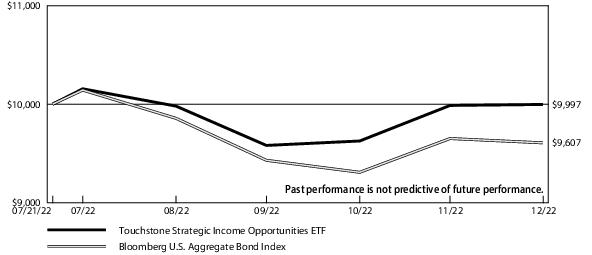

Comparison of the Change in Value of a $10,000 Investment in the Touchstone Strategic Income Opportunities ETF and the Bloomberg U.S. Aggregate Bond Index

| Cumulative Total Returns** |

| Touchstone Strategic Income Opportunities ETF | Since

Inception* |

| NAV | -0.03% |

| Market Price | 0.25% |

| Bloomberg U.S. Aggregate Bond Index | -3.93% |

| * | The inception date of the Fund was July 21, 2022. The returns of the index listed above are based on the inception date of the Fund. |

| ** | Not annualized. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Investors buy and sell shares of an exchange-traded fund (“ETF”) at market price (not NAV) in the secondary market throughout the trading day. Shares of an ETF are not individually available for direct purchase from or direct redemption to the ETF. The ETF’s per share NAV is the value of one share of the ETF and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. Market price returns are typically based upon the official closing price of the ETF’s shares. These returns do not represent investors’ returns had they traded shares at other times. NAV and market price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessment of the underlying value of the Fund’s portfolio securities.

Information showing the Fund’s net asset value, market price, premiums and discounts, and bid-ask spreads for various time periods is available by visiting the Fund’s website at TouchstoneInvestments.com/ETFs.

Note to Chart

Bloomberg U.S. Aggregate Bond Index is an unmanaged index comprised of U.S. investment grade, fixed rate bond market securities, including government, government agency, corporate and mortgage-backed securities between one and ten years.

Management's Discussion of Fund Performance (Unaudited)

Touchstone Ultra Short Income ETF

Sub-Advised by Fort Washington Investment Advisors, Inc.

Investment Philosophy

The Touchstone Ultra Short Income ETF (the “Fund”) seeks maximum total return consistent with the preservation of capital by primarily investing in a diversified portfolio of fixed income securities of different maturities, including U.S. Treasury securities, U.S. government agency and U.S. government-sponsored enterprise securities, corporate bonds, mortgage-backed securities, commercial mortgage-backed securities, asset-backed securities, municipal bonds, collateralized loan obligations and cash equivalent securities including repurchase agreements and commercial paper. While the Fund may invest in securities of any maturity or duration, interest rate risk is managed by seeking to maintain an effective duration of one year or less under normal market conditions.

Fund Performance

The Touchstone Ultra Short Income ETF underperformed its primary benchmark, the ICE BofA 3-Month U.S. Treasury Bill Index, and outperformed its secondary benchmark, the ICE BofA 1-Year U.S. Treasury Note Index, since its inception on August 4, 2022 through December 31, 2022. The Fund’s total return was 0.87 percent while the total returns of its benchmarks were 1.22 percent and 0.20 percent, respectively.

Market Environment

The third quarter 2022 began on an optimistic note, as moderating energy and commodity prices fueled investor optimism that inflation may have peaked, and that the U.S. Federal Reserve (Fed) might soon be able to pare back its monetary tightening efforts and achieve the elusive soft landing. Risk markets enjoyed a brief rally—a welcomed reprieve from the steady negativity of the first half of the year. Optimism faded quickly, however, when Federal Reserve Chairman Jerome Powell delivered the annual speech at the Jackson Hole, Wyoming conference on August 26, 2022. While markets’ momentary optimism implied some expectation of a pivot to dovishness, Powell instead delivered a strong hawkish message. He reiterated the urgency of the Fed getting inflation under control at all costs, and conveyed his view that we were still a long way away from achieving that mandate.

August consumer price index (CPI) data was released in mid-September, showing worse-than expected persistence across all key segments—even acceleration in some areas. This undoubtedly contributed to the Fed’s decision to hike rates by 75 basis points in September (the third consecutive rate hike of that magnitude), bringing cumulative year-to-date Fed hikes to 300 basis points. In spite of this strong degree of monetary tightening, the labor market remained resilient, posting solid job gains throughout the quarter, and even a slight decline in the unemployment rate—back to the mid-summer low of 3.5%

The fourth quarter started with continued volatility across all markets and a divergence in spread movements across the fixed income sectors. With the Fed raising rates at the end of the third quarter, markets continued to process whether a soft landing might actually be achievable, or alternatively how soon a recession might start. Corporate spreads generally trended tighter during the quarter, while securitized spreads spent the first half of fourth quarter widening. That changed mid-November as buyer demand shifted into securitized, driving spreads in tighter throughout the remainder of the quarter. The Treasury curve was dynamic throughout the quarter, with movements divisible into three parts: during October, the entire curve shifted higher, as the short end (6 months and in) moved +60-90 basis points (bps) and the long end rose by 20-40 bps. A dramatic reversal occurred in November, as the front end 3 months and in rose by 25-30 bps, while the 3+year rallied 20-45 bps. December saw reversal again, as the longer part of the curve (5 years and longer) moved 20-25 bps higher and shorter tenors moved 10-15 bps higher. All-in for the quarter, markets saw short rates (1 year and in) rise 75-130 bps and longer rates move 5-10 bps in either direction.

The Fed raised rates twice in the period—75 bps in November and 50 basis points in December. After the November meeting, markets processed the possibility that the economy was slowing, and that we could see a hard landing. Markets began anticipating that the Fed would soon be pivoting from its hawkish tone, which helped drive the rally in longer treasury rates. The momentum was disrupted in December, however, as the Fed doubled down on its hawkish tone, reiterating the need to drag inflation down to the 2% target. This contrasted sharply with the September CPI of 7.7 and the October CPI at 7.1, although higher rates are certainly starting to have an effect on inflation. The Fed dots plot from the December meeting shows the Fed expecting no rate cuts until at least 2024, after rates topping off just above 5% in 2023.

The Fed ended the period maintaining their hawkish bias. Markets still generally believe there will be a recession, but are also expecting that rates will need to remain “higher for longer” in order to get inflation down to the target level. The Russian/Ukrainian war continues to threaten not just geopolitical stability but also energy and commodity markets, although a milder winter is helping by softening demand on the energy front. China is rescinding COVID restrictions to open up markets and manufacturing, while domestically we are starting to see large corporate layoffs being announced. Gross domestic product consensus forecast for 2023 is a soft 0.3%.

Management's Discussion of Fund Performance (Unaudited) (Continued)

Portfolio Review

The largest driver of performance was carry. Real short rates increased. While spreads tightened overall for the quarter, this was not enough to offset the movements in rates. Floating rate assets provided significant income, as coupons continued to reset at the higher rates.

Spreads across ultra short duration subsectors were volatile during the period. Markets stabilized toward period-end, especially at the top of the capital structure (AAA/AA). The strongest nominal subsector returns in the fund for the period were Collateralized Loan Obligations, Corporates, and Residential Mortgage-Backed Securities, while the lowest-returning subsectors were Commercial Mortgage-Backed Securities, and Asset- Backed Securities.

The Fund’s duration positioning at period end remained at the short end of our historical range for Ultra Short portfolios at 0.46 years. Given the rise in rates on the short end, it detracted from performance as longer duration 2.5-3 year assets tightened and yield curve was lower.

The rise in rates in the front end added to the carry on the portfolio. The reset to higher rates for floating rate assets also increased investment income in the portfolio. Carry offset the move in short rates, resulting in a positive return for the fourth quarter.

Outlook and Conclusion

We expect to see continued volatility to start the year but more stabilization in fund outflows. We also expect spreads to tighten given slower new issue pipeline for structured products. We believe the key driver for markets will continue to be the Fed as markets anticipate how high rates will go, and how long they will have to remain elevated in order to tame inflation. Financial conditions are tightening, given the higher rate environment, and consumers have continued to increase their overall debt load with higher credit card utilization rates. Nonetheless, most consumer and corporate balance sheets seem to be in good shape heading into this higher rate environment.

With the Fed keeping close watch on the markets, and our expectation for volatility to remain elevated, we continue to favor floating rate assets and shorter duration on our fixed rate securities. Although we increased cash equivalents during the fourth quarter as a defensive measure for potential seasonal outflows, we expect to reduce that to a normalized 7-10% range going forward. We continue to favor structured products over corporates given the pickup in spread and quality.

Going forward we believe the Fund is positioned well. The portfolio holds most securities marked at a discount, and will benefit from a “pull to par” as those bonds amortize and mature. We believe the higher yields from the move in rates and spreads should provide a higher carry than we have seen in quite a while, and we look to take advantage of that opportunity by reinvesting portfolio cash flow into higher-yielding assets. We still expect volatility to remain elevated, and we do expect to see some degree of recession in the near-term. With overall fund credit quality of AA-, we believe the Fund is positioned well to withstand that type of environment.

Management's Discussion of Fund Performance (Unaudited) (Continued)

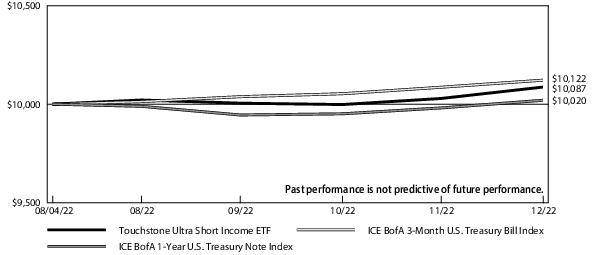

Comparison of the Change in Value of a $10,000 Investment in the Touchstone Ultra Short Income ETF, the ICE BofA 3-Month U.S. Treasury Bill Index and the ICE BofA 1-Year U.S. Treasury Note Index

| Cumulative Total Returns** |

| Touchstone Ultra Short Income ETF | Since

Inception* |

| NAV | 0.87% |

| Market Price | 0.90% |

| ICE BofA 3-Month U.S. Treasury Bill Index | 1.22% |

| ICE BofA 1-Year U.S. Treasury Note Index | 0.20% |

| * | The inception date of the Fund was August 4, 2022. The returns of the index listed above are based on the inception date of the Fund. |

| ** | Not annualized. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Investors buy and sell shares of an exchange-traded fund (“ETF”) at market price (not NAV) in the secondary market throughout the trading day. Shares of an ETF are not individually available for direct purchase from or direct redemption to the ETF. The ETF’s per share NAV is the value of one share of the ETF and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. Market price returns are typically based upon the official closing price of the ETF’s shares. These returns do not represent investors’ returns had they traded shares at other times. NAV and market price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessment of the underlying value of the Fund’s portfolio securities.

Information showing the Fund’s net asset value, market price, premiums and discounts, and bid-ask spreads for various time periods is available by visiting the Fund’s website at TouchstoneInvestments.com/ETFs.

Notes to Chart

ICE BofA 3-Month U.S. Treasury Bill Index is an unmanaged index of Treasury securities maturing in 90 days that assumes reinvestment of all income.

ICE BofA 1-Year U.S. Treasury Note Index is an unmanaged index comprised of a single issue purchased at the beginning of the month and held for a full month. The issue selected at each month-end rebalancing is the outstanding two-year Treasury Note Bill that matures closest to, but, not beyond one year from the rebalancing date.

Management's Discussion of Fund Performance (Unaudited)

Touchstone US Large Cap Focused ETF

Sub-Advised by Fort Washington Investment Advisors, Inc.

Investment Philosophy

The Touchstone US Large Cap Focused ETF (the "Fund") seeks to provide investors with capital appreciation by investing in 25-45 U.S. companies of capitalizations above $5 billion at time of purchase that are trading below what is believed to be the estimate of their intrinsic value and have a sustainable competitive advantage or a high barrier to entry in place. The barrier(s) to entry can be created through a cost advantage, economies of scale, high customer loyalty or a government barrier (e.g. license or subsidy). Fort Washington believes that the strongest barrier to entry is the combination of economies of scale and high customer loyalty.

Fund Performance

The Touchstone US Large Cap Focused ETF outperformed its benchmark, the S&P 500® Index, since its inception on July 27, 2022 through December 31, 2022. The Fund’s total return was -3.25 percent compared to the benchmark’s total return of -3.82 percent.

Market Environment

U.S. equities declined over the five month period as investors grappled with tight financial conditions and the looming possibility of an economic slowdown. The worst performing sectors in the index for the period were Consumer Discretionary, Communication Services, and Real Estate. The benchmark sectors that outperformed the most during the period were Energy, Health Care, and Industrials.

Portfolio Review

Within the Fund’s holdings, sectors in which the Fund outperformed the benchmark include Energy, Materials, Industrials, Consumer Staples, Communication Services, Information Technology, and Health Care. Sectors where the Fund underperformed were Consumer Discretionary, Real Estate, and Financials. Sector allocation had a slightly negative impact to performance for the period.

Among the stocks that contributed to performance were Schlumberger Ltd. (Energy) ("Schlumberger"), Biomarin Pharmaceutical (Health Care) ("Biomarin"), and Hubbell Inc. (Industrials) ("Hubbell"). Schlumberger outperformed due to strong earnings and forward guidance as the company benefited from international oil and gas companies mobilizing rigs to capitalize on tight supply. Biomarin outperformed primarily due to third quarter results that surprised to the upside and promising activity in its pipeline. Hubbell outperformed primarily due to strong earnings results re-affirming that the company is a beneficiary of the need to improve the grid with the global energy transition.

Among the stocks that detracted the most from performance were Alphabet Inc. (Communication Services) ("Alphabet"), Amazon.com Inc. (Consumer Discretionary) ("Amazon"), and Salesforce Inc. (Information Technology) ("Salesforce"). Alphabet underperformed as online advertising has been under pressure for several reasons including consumer spending shifting toward offline channels post-COVID, inflationary pressures limiting discretionary spending, and Apple privacy changes impacting advertisers’ return on investment. Amazon underperformed due to pull forward of demand and overbuilding of fulfillment capacity. Salesforce underperformed primarily due to concerns that macroeconomic headwinds would expand the length of its sales cycle and reduce deal sizes.

Outlook and Conclusion

Despite the fourth quarter rally in equities, the path for a soft landing remains narrow and we continue to see indications of the slowdown we thought was likely in the back half of 2022 and into 2023 mainly due to the lag effects of higher interest rates and higher prices. The labor market and consumer spending have been resilient buoyed by elevated pandemic savings. But with sustained tight financial conditions, we see additional downside risk to growth.

Based on our outlook, we have been mitigating risk through a combination of long standing elements of our process and gradual shifts in portfolio positioning. Several components seek to mitigate the impact of higher inflation and interest rates. First, we believe focusing on barriers to entry in fundamental analysis, specifically businesses with pricing power, is especially important today as companies look to pass on cost pressures. Second, consistently using conservative discount rates provides a cushion as rates rise. Last, prioritizing a margin of safety with each holding provides additional risk mitigation for challenging market environments. Additionally, we seek to gradually reduce portfolio risk in terms of both sector weights and exposures within sectors. Within sectors,

Management's Discussion of Fund Performance (Unaudited) (Continued)

we also take opportunities to swap out of positions in favor of new positions that come with some combination of fundamental risk reduction and higher margin of safety in valuation.

The Fund continues to emphasize businesses with higher barriers to entry and returns on capital. Portfolio positioning is fairly defensive as we look for opportunities that fit our framework through the volatility. We believe this risk posture combined with continued disciplined execution of our process will benefit the portfolio going forward.

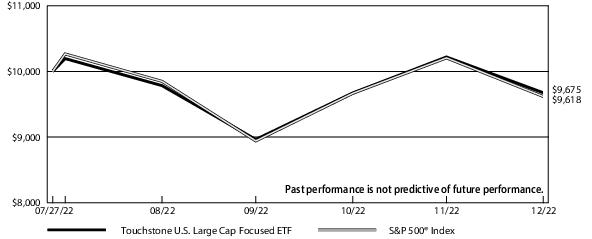

Comparison of the Change in Value of a $10,000 Investment in the Touchstone US Large Cap Focused ETF and the S&P 500® Index

| Cumulative Total Returns** |

| Touchstone US Large Cap Focused ETF | Since

Inception* |

| NAV | -3.25% |

| Market Price | -3.29% |

| S&P 500® Index | -3.82% |

| * | The inception date of the Fund was July 27, 2022. The returns of the index listed above are based on the inception date of the Fund. |

| ** | Not annualized. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Investors buy and sell shares of an exchange-traded fund (“ETF”) at market price (not NAV) in the secondary market throughout the trading day. Shares of an ETF are not individually available for direct purchase from or direct redemption to the ETF. The ETF’s per share NAV is the value of one share of the ETF and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. Market price returns are typically based upon the official closing price of the ETF’s shares. These returns do not represent investors’ returns had they traded shares at other times. NAV and market price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessment of the underlying value of the Fund’s portfolio securities.

Information showing the Fund’s net asset value, market price, premiums and discounts, and bid-ask spreads for various time periods is available by visiting the Fund’s website at TouchstoneInvestments.com/ETFs.

Note to Chart

S&P 500® Index is a group of 500 widely held stocks and is commonly regarded to be representative of the large capitalization stock universe.

Tabular Presentation of Portfolios of Investments (Unaudited)

December 31, 2022

The tables below provide each Fund’s credit quality and/or sector allocation. We hope it will be useful to shareholders as it summarizes key information about each Fund’s investments.

Touchstone Dividend Select ETF

| Sector Allocation*(% of Net Assets) |

| Information Technology | 23.2% |

| Health Care | 13.6 |

| Industrials | 11.1 |

| Consumer Discretionary | 10.2 |

| Financials | 10.1 |

| Consumer Staples | 7.3 |

| Communication Services | 6.3 |

| Energy | 4.4 |

| Materials | 4.1 |

| Utilities | 3.2 |

| Real Estate | 2.7 |

| Other Assets/Liabilities (Net) | 3.8 |

| Total | 100.0% |

Touchstone Strategic Income Opportunities ETF

| Credit Quality**(% of Fixed Income Securities) |

| AAA/Aaa | 21.7% |

| AA/Aa | 4.5 |

| A/A | 7.6 |

| BBB/Baa | 41.7 |

| BB/Ba | 14.5 |

| B/B | 8.1 |

| CCC | 1.7 |

| CC | 0.2 |

| Total | 100.0% |

| Sector Allocation*(% of Net Assets) |

| Corporate Bonds | 48.0% |

| U.S. Treasury Obligations | 19.6 |

| Asset-Backed Securities | 11.9 |

| Commercial Mortgage-Backed Securities | 7.3 |

| Common Stocks | |

| Industrials | 0.8 |

| Information Technology | 0.8 |

| Financials | 0.7 |

| Consumer Staples | 0.4 |

| Health Care | 0.4 |

| Materials | 0.4 |

| Energy | 0.4 |

| Communication Services | 0.4 |

| Sovereign Government Obligations | 3.9 |

| Non-Agency Collateralized Mortgage Obligations | 2.0 |

| Preferred Stocks | |

| Financials | 0.3 |

| Short-Term Investment Fund | 1.0 |

| Other Assets/Liabilities (Net) | 1.7 |

| Total | 100.0% |

* Sector classifications are based upon the Global Industry Classification Standard (GICS®).

** Credit quality ratings are from S&P Global Ratings ("S&P") and Moody's Investors Service (“Moody's”). If agency ratings differ, the higher rating will be used. Where no rating has been assigned, it may be for reasons unrelated to the creditworthiness of the issuer.

Tabular Presentation of Portfolios of Investments (Unaudited) (Continued)

Touchstone Ultra Short Income ETF

| Credit Quality*(% of Fixed Income Securities) |

| AAA/Aaa | 46.4% |

| AA/Aa | 13.7 |

| A/A | 13.2 |

| BBB/Baa | 18.4 |

| BB/Ba | 1.3 |

| Cash Equivalents | 7.0 |

| Total | 100.0% |

Touchstone US Large Cap Focused ETF

| Sector Allocation**(% of Net Assets) |

| Information Technology | 27.3% |

| Health Care | 17.9 |

| Financials | 11.9 |

| Communication Services | 11.0 |

| Industrials | 8.6 |

| Consumer Discretionary | 6.6 |

| Consumer Staples | 4.8 |

| Energy | 4.4 |

| Materials | 1.7 |

| Real Estate | 1.2 |

| Other Assets/Liabilities (Net) | 4.6 |

| Total | 100.0% |

* Credit quality ratings are from S&P Global Ratings ("S&P") and Moody's Investors Service (“Moody's”). If agency ratings differ, the higher rating will be used. Where no rating has been assigned, it may be for reasons unrelated to the creditworthiness of the issuer.

** Sector classifications are based upon the Global Industry Classification Standard (GICS®).

Portfolio of Investments

Touchstone Dividend Select ETF – December 31, 2022

| Shares | | | | Market

Value |

| | Common Stocks — 96.2% | |

| | Information Technology — 23.2% | |

| 4,032 | Apple, Inc. | $ 523,878 |

| 966 | Broadcom, Inc. | 540,120 |

| 10,290 | Cisco Systems, Inc. | 490,216 |

| 14,226 | Intel Corp. | 375,993 |

| 4,032 | International Business Machines Corp. | 568,068 |

| 1,470 | KLA Corp. | 554,234 |

| 3,738 | Microsoft Corp. | 896,447 |

| 8,106 | Oracle Corp. | 662,584 |

| 3,822 | QUALCOMM, Inc. | 420,191 |

| 3,066 | Texas Instruments, Inc. | 506,565 |

| 2,978 | Visa, Inc. - Class A | 618,709 |

| | | | | 6,157,005 |

| | Health Care — 13.6% | |

| 2,856 | AmerisourceBergen Corp. | 473,268 |

| 3,226 | Bristol-Myers Squibb Co. | 232,111 |

| 5,154 | CVS Health Corp. | 480,301 |

| 3,528 | Johnson & Johnson | 623,221 |

| 7,301 | Medtronic PLC | 567,434 |

| 5,670 | Merck & Co., Inc. | 629,086 |

| 1,128 | UnitedHealth Group, Inc. | 598,043 |

| | | | | 3,603,464 |

| | Industrials — 11.1% | |

| 2,968 | 3M Co. | 355,922 |

| 2,184 | Caterpillar, Inc. | 523,199 |

| 2,502 | Eaton Corp. PLC | 392,689 |

| 1,302 | Lockheed Martin Corp. | 633,410 |

| 5,964 | Raytheon Technologies Corp. | 601,887 |

| 5,967 | Stanley Black & Decker, Inc. | 448,241 |

| | | | | 2,955,348 |

| | Consumer Discretionary — 10.2% | |

| 1,882 | Dollar General Corp. | 463,442 |

| 1,680 | Home Depot, Inc. (The) | 530,645 |

| 2,065 | McDonald's Corp. | 544,189 |

| 6,300 | Starbucks Corp. | 624,960 |

| 4,284 | Yum! Brands, Inc. | 548,695 |

| | | | | 2,711,931 |

| | Financials — 10.1% | |

| 15,116 | Bank of America Corp. | 500,642 |

| 939 | BlackRock, Inc. | 665,404 |

| 1,764 | Goldman Sachs Group, Inc. (The) | 605,722 |

| 3,444 | JPMorgan Chase & Co. | 461,840 |

| 10,836 | Wells Fargo & Co. | 447,419 |

| | | | | 2,681,027 |

| | Consumer Staples — 7.3% | |

| 7,056 | Coca-Cola Co. (The) | 448,832 |

| 2,646 | PepsiCo, Inc. | 478,026 |

| 5,513 | Philip Morris International, Inc. | 557,971 |

| 3,318 | Walmart, Inc. | 470,459 |

| | | | | 1,955,288 |

| Shares | | | | Market

Value |

| | | |

| | Communication Services — 6.3% | |

| 21,079 | AT&T, Inc. | $ 388,065 |

| 13,198 | Comcast Corp. - Class A | 461,534 |

| 10,878 | Fox Corp. - Class A | 330,365 |

| 12,883 | Verizon Communications, Inc. | 507,590 |

| | | | | 1,687,554 |

| | Energy — 4.4% | |

| 5,931 | Exxon Mobil Corp. | 654,190 |

| 4,077 | Valero Energy Corp. | 517,208 |

| | | | | 1,171,398 |

| | Materials — 4.1% | |

| 1,620 | Air Products & Chemicals, Inc. | 499,381 |

| 8,728 | DuPont de Nemours, Inc. | 599,003 |

| | | | | 1,098,384 |

| | Utilities — 3.2% | |

| 6,300 | Dominion Energy, Inc. | 386,316 |

| 4,410 | Duke Energy Corp. | 454,186 |

| | | | | 840,502 |

| | Real Estate — 2.7% | |

| 1,919 | American Tower Corp. REIT | 406,559 |

| 2,562 | Simon Property Group, Inc. REIT | 300,984 |

| | | | | 707,543 |

| | Total Common Stocks | $25,569,444 |

| | Total Investment Securities—96.2%

(Cost $25,198,627) | $25,569,444 |

| | Other Assets in Excess of Liabilities — 3.8% | 1,000,816 |

| | Net Assets — 100.0% | $26,570,260 |

| Portfolio Abbreviations: |

| PLC – Public Limited Company |

| REIT – Real Estate Investment Trust |

Other Information:

The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the security valuation section in the accompanying Notes to Financial Statements.

| Valuation Inputs at Reporting Date: |

| Description | Level 1 | Level 2 | Level 3 | Total |

| Common Stocks | $25,569,444 | $— | $— | $25,569,444 |

See accompanying Notes to Financial Statements.

Portfolio of Investments

Touchstone Strategic Income Opportunities ETF – December 31, 2022

Principal

Amount | | | | Market

Value |

| | Corporate Bonds — 48.0% | |

| | Financials — 10.3% | |

| $ 800,000 | Allstate Corp. (The), Ser B, 5.750%, 8/15/53 | $ 752,000 |

| 826,000 | Bank of Nova Scotia (The) (Canada), 3.625%, 10/27/81 | 602,567 |

| 831,000 | Barclays PLC (United Kingdom), 2.894%, 11/24/32 | 635,350 |

| 363,000 | Charles Schwab Corp. (The), 5.000%(A) | 331,418 |

| 363,000 | Charles Schwab Corp. (The), Ser H, 4.000%(A) | 289,474 |

| 576,000 | Citigroup, Inc., Ser W, 4.000%(A) | 501,765 |

| 412,000 | Corestates Capital III, 144a, (3M LIBOR +0.570%), 5.176%, 2/15/27(B) | 383,740 |

| 327,000 | Credit Acceptance Corp., 6.625%, 3/15/26 | 309,878 |

| 561,000 | First Maryland Capital II, (3M LIBOR +0.850%), 5.290%, 2/1/27(B) | 518,603 |

| 230,000 | FirstCash, Inc., 144a, 4.625%, 9/1/28 | 201,931 |

| 898,000 | Golub Capital BDC, Inc., 2.050%, 2/15/27 | 731,248 |

| 422,000 | Icahn Enterprises LP / Icahn Enterprises Finance Corp., 5.250%, 5/15/27 | 386,383 |

| 650,000 | JPMorgan Chase & Co., 5.717%, 9/14/33 | 639,171 |

| 538,000 | Morgan Stanley, 5.297%, 4/20/37 | 493,522 |

| 611,000 | PNC Capital Trust, (3M LIBOR +0.570%), 5.331%, 6/1/28(B) | 563,270 |

| 604,000 | Prudential Financial, Inc., 5.125%, 3/1/52 | 549,640 |

| 419,000 | Sabra Health Care LP REIT, 3.900%, 10/15/29 | 351,455 |

| 815,000 | Sixth Street Specialty Lending, Inc., 2.500%, 8/1/26† | 713,832 |

| 832,000 | Truist Bank, Ser A, (3M LIBOR +0.670%), 5.320%, 5/15/27(B) | 771,041 |

| 508,000 | Truist Financial Corp., Ser Q, 5.100%(A) | 469,900 |

| | | | | 10,196,188 |

| | Consumer Discretionary — 7.2% | |

| 783,000 | Brunswick Corp., 4.400%, 9/15/32 | 663,241 |

| 385,000 | Carriage Services, Inc., 144a, 4.250%, 5/15/29 | 305,564 |

| 413,000 | Churchill Downs, Inc., 144a, 4.750%, 1/15/28 | 369,635 |

| 369,000 | Coty, Inc. / HFC Prestige Products, Inc. / HFC Prestige International US LLC, 144a, 4.750%, 1/15/29 | 333,945 |

| 727,000 | Ferguson Finance PLC, 144a, 4.650%, 4/20/32 | 663,827 |

| 204,000 | Ford Motor Co., 4.750%, 1/15/43 | 146,520 |

| 227,000 | Ford Motor Credit Co. LLC, 4.125%, 8/17/27 | 203,165 |

| 310,000 | GEMS MENASA Cayman Ltd. / GEMS Education Delaware LLC (United Arab Emirates), 7.125%, 7/31/26 | 297,850 |

| 1,173,000 | General Motors Financial Co., Inc., 3.100%, 1/12/32 | 922,368 |

| 525,000 | GENM Capital Labuan Ltd. (Malaysia), 144a, 3.882%, 4/19/31 | 393,333 |

| 831,000 | Imperial Brands Finance PLC (United Kingdom), 144a, 3.500%, 7/26/26 | 764,654 |

| 395,000 | Royal Caribbean Cruises Ltd., 144a, 5.375%, 7/15/27 | 319,832 |

| 722,000 | Toll Brothers Finance Corp., 3.800%, 11/1/29 | 617,163 |

| 168,000 | Warnermedia Holdings, Inc., 144a, 4.279%, 3/15/32 | 138,578 |

| 727,000 | Warnermedia Holdings, Inc., 144a, 5.141%, 3/15/52 | 531,086 |

| 529,000 | Wynn Macau Ltd. (Macao), 144a, 4.875%, 10/1/24† | 499,449 |

| | | | | 7,170,210 |

| | Industrials — 6.8% | |

| 377,000 | ADT Security Corp. (The), 144a, 4.875%, 7/15/32 | 320,385 |

| 425,000 | American Axle & Manufacturing, Inc., 6.500%, 4/1/27 | 383,435 |

| 367,000 | Amsted Industries, Inc., 144a, 4.625%, 5/15/30 | 312,868 |

| 267,000 | Boeing Co. (The), 5.805%, 5/1/50 | 248,585 |

| 381,000 | Canpack SA / Canpack US LLC (Poland), 144a, 3.125%, 11/1/25 | 333,825 |

| 415,000 | Cimpress PLC (Ireland), 144a, 7.000%, 6/15/26 | 286,890 |

| 458,000 | Fortress Transportation & Infrastructure Investors LLC, 144a, 6.500%, 10/1/25 | 430,613 |

| 634,000 | General Electric Co., Ser D, (3M LIBOR +3.330%), 8.099%(A) | 622,869 |

| 453,000 | Granite US Holdings Corp., 144a, 11.000%, 10/1/27 | 477,349 |

| 783,000 | Mohawk Industries, Inc., 3.625%, 5/15/30† | 676,507 |

| 782,000 | Oshkosh Corp., 3.100%, 3/1/30 | 661,555 |

Principal

Amount | | | | Market

Value |

| | | |

| | Industrials — (Continued) | |

| $ 434,000 | Pactiv Evergreen Group Issuer, Inc. / Pactiv Evergreen Group Issuer LLC, 144a, 4.000%, 10/15/27 | $ 384,675 |

| 392,000 | Seaspan Corp. (Hong Kong), 144a, 5.500%, 8/1/29 | 297,058 |

| 363,000 | Stericycle, Inc., 144a, 3.875%, 1/15/29 | 316,717 |

| 322,000 | TransDigm, Inc., 144a, 6.250%, 3/15/26 | 317,553 |

| 753,000 | Weir Group PLC (The) (United Kingdom), 144a, 2.200%, 5/13/26 | 668,580 |

| | | | | 6,739,464 |

| | Energy — 4.9% | |

| 502,000 | Cenovus Energy, Inc. (Canada), 5.250%, 6/15/37 | 459,354 |

| 344,000 | CQP Holdco LP / BIP-V Chinook Holdco LLC, 144a, 5.500%, 6/15/31 | 300,487 |

| 408,000 | DCP Midstream Operating LP, 144a, 5.850%, 5/21/43 | 398,012 |

| 218,000 | Genesis Energy LP / Genesis Energy Finance Corp., 5.625%, 6/15/24 | 210,369 |

| 158,000 | Genesis Energy LP / Genesis Energy Finance Corp., 6.500%, 10/1/25 | 150,068 |

| 382,000 | Hilcorp Energy I LP / Hilcorp Finance Co., 144a, 6.000%, 2/1/31 | 329,497 |

| 430,000 | MC Brazil Downstream Trading SARL (Brazil), 144a, 7.250%, 6/30/31 | 354,679 |

| 536,000 | Murphy Oil Corp., 6.375%, 7/15/28 | 515,927 |

| 596,000 | NGPL PipeCo LLC, 144a, 7.768%, 12/15/37 | 622,675 |

| 371,000 | Parkland Corp. (Canada), 144a, 4.500%, 10/1/29 | 309,559 |

| 770,000 | Petroleos Mexicanos (Mexico), 6.625%, 6/15/35 | 558,944 |

| 371,000 | Precision Drilling Corp. (Canada), 144a, 6.875%, 1/15/29 | 345,404 |

| 340,000 | YPF SA (Argentina), 9.000%, 2/12/26 | 325,658 |

| | | | | 4,880,633 |

| | Utilities — 4.7% | |

| 727,000 | CMS Energy Corp., 4.750%, 6/1/50 | 628,825 |

| 598,000 | Edison International, 4.125%, 3/15/28 | 555,713 |

| 452,000 | Edison International, Ser B, 5.000%(A) | 379,680 |

| 450,000 | Eskom Holdings SOC Ltd. (South Africa), 144a, 8.450%, 8/10/28 | 394,023 |

| 513,000 | FirstEnergy Transmission LLC, 144a, 5.450%, 7/15/44 | 480,025 |

| 515,000 | Minejesa Capital BV (Indonesia), 4.625%, 8/10/30 | 450,728 |

| 598,000 | Pacific Gas & Electric Co., 2.500%, 2/1/31 | 467,270 |

| 658,000 | PPL Capital Funding, Inc., Ser A, (3M LIBOR +2.665%), 7.395%, 3/30/67(B) | 565,551 |

| 844,000 | WEC Energy Group, Inc., (3M LIBOR +2.112%), 6.719%, 5/15/67(B) | 706,040 |

| | | | | 4,627,855 |

| | Communication Services — 3.9% | |

| 379,000 | Arches Buyer, Inc., 144a, 4.250%, 6/1/28 | 296,416 |

| 155,000 | Belo Corp., 7.750%, 6/1/27 | 151,319 |

| 472,000 | British Telecommunications PLC (United Kingdom), 5.125%, 12/4/28 | 459,138 |

| 341,000 | British Telecommunications PLC (United Kingdom), 144a, 3.250%, 11/8/29 | 291,301 |

| 597,000 | CCO Holdings LLC / CCO Holdings Capital Corp., 144a, 4.250%, 2/1/31 | 478,863 |

| 591,000 | Charter Communications Operating LLC / Charter Communications Operating Capital, 6.484%, 10/23/45 | 535,229 |

| 362,000 | Connect Finco SARL / Connect US Finco LLC (United Kingdom), 144a, 6.750%, 10/1/26 | 335,487 |

| 429,000 | CSC Holdings LLC, 144a, 4.625%, 12/1/30 | 237,046 |

| 374,000 | Gray Escrow II, Inc., 144a, 5.375%, 11/15/31 | 269,523 |

| 450,000 | Paramount Global, 4.200%, 5/19/32 | 369,608 |

Touchstone Strategic Income Opportunities ETF (Continued)

Principal

Amount | | | | Market

Value |

| | Corporate Bonds — 48.0% (Continued) | |

| | Communication Services — (Continued) | |

| $ 330,000 | Stagwell Global, 144a, 5.625%, 8/15/29 | $ 272,111 |

| 177,000 | TEGNA, Inc., 5.000%, 9/15/29 | 167,938 |

| | | | | 3,863,979 |

| | Materials — 3.1% | |

| 890,000 | Braskem Netherlands Finance BV (Brazil), 144a, 5.875%, 1/31/50 | 689,407 |

| 781,000 | Celanese US Holdings LLC, 6.165%, 7/15/27 | 771,438 |

| 500,000 | Freeport Indonesia PT (Indonesia), 144a, 5.315%, 4/14/32 | 458,617 |

| 760,000 | GCC SAB de CV, 144a, 3.614%, 4/20/32 | 632,500 |

| 116,000 | Hudbay Minerals, Inc. (Canada), 144a, 4.500%, 4/1/26 | 105,367 |

| 550,000 | OCP SA (Morocco), 3.750%, 6/23/31 | 459,800 |

| | | | | 3,117,129 |

| | Consumer Staples — 2.3% | |

| 285,000 | Coruripe Netherlands BV (Brazil), 144a, 10.000%, 2/10/27 | 228,000 |

| 571,000 | JBS USA LUX SA / JBS USA Food Co. / JBS USA Finance, Inc., 144a, 6.500%, 12/1/52 | 543,344 |

| 415,000 | QVC, Inc., 4.375%, 9/1/28 | 247,963 |

| 500,000 | Turning Point Brands, Inc., 144a, 5.625%, 2/15/26 | 431,255 |

| 450,000 | Ulker Biskuvi Sanayi AS (Turkey), 144a, 6.950%, 10/30/25 | 377,303 |

| 515,000 | United Rentals North America, Inc., 3.750%, 1/15/32 | 420,152 |

| | | | | 2,248,017 |

| | Health Care — 1.9% | |

| 519,000 | CVS Health Corp., 5.050%, 3/25/48 | 468,185 |

| 361,000 | Medline Borrower LP, 144a, 3.875%, 4/1/29 | 290,562 |

| 368,000 | MEDNAX, Inc., 144a, 5.375%, 2/15/30 | 319,781 |

| 569,000 | Mylan, Inc., 4.550%, 4/15/28 | 527,994 |

| 369,000 | US Acute Care Solutions LLC, 144a, 6.375%, 3/1/26 | 327,459 |

| | | | | 1,933,981 |

| | Real Estate — 1.9% | |

| 383,000 | Iron Mountain, Inc. REIT, 144a, 4.875%, 9/15/27 | 352,207 |

| 421,000 | RHP Hotel Properties LP / RHP Finance Corp. REIT, 144a, 4.500%, 2/15/29 | 363,152 |

| 703,000 | SBA Tower Trust REIT, 144a, 6.599%, 1/15/28 | 705,231 |

| 222,000 | STORE Capital Corp. REIT, 4.500%, 3/15/28 | 200,558 |

| 258,000 | STORE Capital Corp. REIT, 4.625%, 3/15/29 | 231,829 |

| | | | | 1,852,977 |

| | Information Technology — 1.0% | |

| 372,000 | Clarivate Science Holdings Corp., 144a, 4.875%, 7/1/29 | 316,330 |

| 589,000 | Micron Technology, Inc., 2.703%, 4/15/32 | 444,002 |

| 258,000 | Micron Technology, Inc., 6.750%, 11/1/29 | 262,969 |

| | | | | 1,023,301 |

| | Total Corporate Bonds | $47,653,734 |

| | U.S. Treasury Obligations — 19.6% |

| 1,273,609 | U.S. Treasury Bond, 0.125%, 2/15/52 | | | 824,712 |

| 2,925,000 | U.S. Treasury Bond, 2.375%, 2/15/42 | | | 2,249,279 |

| 1,285,000 | U.S. Treasury Bond, 3.250%, 5/15/42 | | | 1,134,213 |

| 3,600,000 | U.S. Treasury Note, 0.500%, 11/30/23 | | | 3,463,594 |

| 4,950,000 | U.S. Treasury Note, 0.750%, 5/31/26 | | | 4,420,002 |

| 8,015,000 | U.S. Treasury Note, 2.750%, 8/15/32 | | | 7,324,959 |

| | Total U.S. Treasury Obligations | $19,416,759 |

| | Asset-Backed Securities — 11.9% |

| 900,000 | AMMC CLO 16 Ltd. (Cayman Islands), Ser 2015-16A, Class CR2, 144a, (3M LIBOR +1.950%), 5.961%, 4/14/29(B) | | | 873,498 |

| 1,000,000 | CFIP CLO Ltd. (Cayman Islands), Ser 2014-1A, Class BR, 144a, (3M LIBOR +1.850%), 5.791%, 7/13/29(B) | | | 978,926 |

| 1,000,000 | CFIP CLO Ltd. (Cayman Islands), Ser 2018-1A, Class D, 144a, (3M LIBOR +3.240%), 7.434%, 7/18/31(B) | | | 884,882 |

Principal

Amount | | | | Market

Value |

| | Asset-Backed Securities — 11.9% (Continued) |

| $1,099,688 | Driven Brands Funding LLC, Ser 2020-1A, Class A2, 144a, 3.786%, 7/20/50 | | | $ 942,763 |

| 1,080,000 | FOCUS Brands Funding LLC, Ser 2018-1, Class A2, 144a, 5.184%, 10/30/48 | | | 989,385 |

| 1,000,000 | Franklin Park Place CLO I LLC (Cayman Islands), Ser 2022-1A, Class B, 144a, (TSFR3M +2.000%), 5.827%, 4/14/35(B) | | | 935,881 |

| 1,000,000 | Golub Capital Partners CLO 25M Ltd. (Cayman Islands), Ser 2015-25A, Class BR, 144a, (3M LIBOR +1.900%), 6.432%, 5/5/30(B) | | | 955,122 |

| 1,019,738 | Hardee's Funding LLC, Ser 2018-1A, Class A2II, 144a, 4.959%, 6/20/48 | | | ��� 957,556 |

| 1,000,000 | NBC Funding LLC, Ser 2021-1, Class B, 144a, 4.970%, 7/30/51 | | | 856,073 |

| 1,182,000 | Neighborly Issuer LLC, Ser 2021-1A, Class A2, 144a, 3.584%, 4/30/51 | | | 945,211 |

| 685,000 | Prestige Auto Receivables Trust, Ser 2019-1A, Class E, 144a, 3.900%, 5/15/26 | | | 672,422 |

| 1,075,000 | Tesla Auto Lease Trust, Ser 2021-A, Class E, 144a, 2.640%, 3/20/25 | | | 1,006,038 |

| 987,500 | Zaxby's Funding LLC, Ser 2021-1A, Class A2, 144a, 3.238%, 7/30/51 | | | 794,323 |

| | Total Asset-Backed Securities | $11,792,080 |

| | Commercial Mortgage-Backed Securities — 7.3% |

| 2,000,000 | BBCMS Mortgage Trust, Ser 2022-C17, Class XD, 144a, 3.040%, 9/15/55(B)(C)(D) | | | 408,010 |

| 800,000 | Benchmark Mortgage Trust, Ser 2020-B18, Class AGND, 144a, 3.744%, 7/15/53 | | | 679,253 |

| 752,659 | BX Commercial Mortgage Trust, Ser 2019-XL, Class A, 144a, (1M LIBOR +0.920%), 5.370%, 10/15/36(B) | | | 743,380 |

| 1,250,000 | BX Commercial Mortgage Trust, Ser 2020-VIV2, Class C, 144a, 3.542%, 3/9/44(B)(D) | | | 979,261 |

| 992,505 | CHC Commercial Mortgage Trust 2019 - CHC, Ser 2019-CHC, Class D, 144a, (1M LIBOR +2.050%), 6.368%, 6/15/34(B) | | | 911,947 |

| 1,125,000 | Citigroup Commercial Mortgage Trust, Ser 2013-375P, Class C, 144a, 3.518%, 5/10/35(B)(D) | | | 1,036,013 |

| 1,100,000 | Citigroup Commercial Mortgage Trust, Ser 2014-GC25, Class D, 144a, 3.548%, 10/10/47 | | | 957,289 |

| 1,250,000 | Citigroup Commercial Mortgage Trust, Ser 2017-P8, Class D, 144a, 3.000%, 9/15/50 | | | 896,761 |

| 600,000 | WFRBS Commercial Mortgage Trust, Ser 2013-C13, Class D, 144a, 4.147%, 5/15/45(B)(D) | | | 580,636 |

| | Total Commercial Mortgage-Backed Securities | $7,192,550 |

| Shares | | | | |

| | Common Stocks — 4.3% | |

| | Industrials — 0.8% | |

| 802 | Lockheed Martin Corp. | 390,165 |

| 4,080 | Raytheon Technologies Corp. | 411,753 |

| | | | | 801,918 |

| | Information Technology — 0.8% | |

| 2,668 | International Business Machines Corp. | 375,895 |

| 2,333 | Texas Instruments, Inc. | 385,458 |

| | | | | 761,353 |

| | Financials — 0.7% | |

| 10,569 | Bank of America Corp. | 350,045 |

| 1,036 | Goldman Sachs Group, Inc. (The) | 355,742 |

| | | | | 705,787 |

| | Consumer Staples — 0.4% | |

| 4,457 | Philip Morris International, Inc. | 451,093 |

Touchstone Strategic Income Opportunities ETF (Continued)

| Shares | | | | MarketValue |

| | Common Stocks — 4.3% (Continued) | |

| | Health Care — 0.4% | |

| 2,326 | Johnson & Johnson | $ 410,888 |

| | Materials — 0.4% | |

| 5,690 | DuPont de Nemours, Inc. | 390,505 |

| | Energy — 0.4% | |

| 3,501 | Exxon Mobil Corp. | 386,160 |

| | Communication Services — 0.4% | |

| 20,709 | AT&T, Inc. | 381,253 |

| | Total Common Stocks | $4,288,957 |

Principal

Amount | | | | |

| | Sovereign Government Obligations — 3.9% |

| $ 590,000 | Angolan Government International Bond, 144a, 8.000%, 11/26/29 | | | 516,581 |

| 350,000 | Bahamas Government International Bond, 144a, 6.000%, 11/21/28 | | | 266,913 |

| 350,000 | Chile Government International Bond, 3.100%, 5/7/41 | | | 250,942 |

| 450,000 | Colombia Government International Bond, 3.250%, 4/22/32 | | | 327,157 |

| 550,000 | Dominican Republic International Bond, 144a, 4.875%, 9/23/32 | | | 456,541 |

| 420,000 | Ecuador Government International Bond, 2.500%, 7/31/35 | | | 193,090 |

| 190,000 | Ecuador Government International Bond, 144a, 5.500%, 7/31/30 | | | 122,088 |

| 610,000 | Egypt Government International Bond, 144a, 8.500%, 1/31/47 | | | 405,452 |

| 290,000 | Gabon Government International Bond, 144a, 6.625%, 2/6/31 | | | 236,785 |

| 580,000 | Ghana Government International Bond, 144a, 8.627%, 6/16/49 | | | 199,810 |

| 490,000 | Nigeria Government International Bond, 144a, 7.625%, 11/28/47 | | | 314,394 |

| 290,000 | Republic of Uzbekistan International Bond, 144a, 3.700%, 11/25/30 | | | 242,303 |

| 400,000 | Serbia International Bond, 2.125%, 12/1/30 | | | 286,880 |

| 400,000 | Ukraine Government International Bond, 144a, 7.253%, 3/15/35* | | | 71,994 |

| | Total Sovereign Government Obligations | $3,890,930 |

| | Non-Agency Collateralized Mortgage Obligations — 2.0% |

| 1,000,000 | Fannie Mae Connecticut Avenue Securities, Ser 2017-C06, Class 1B1, (1M LIBOR +4.150%), 8.539%, 2/25/30(B) | | | 1,029,533 |

| 1,000,000 | Freddie Mac STACR REMIC Trust, Ser 2022-DNA3, Class M1B, 144a, (SOFR30A +2.900%), 6.828%, 4/25/42(B) | | | 988,133 |

| | Total Non-Agency Collateralized Mortgage Obligations | $2,017,666 |

| Shares | | | | |

| | Preferred Stocks — 0.3% | |

| | Financials — 0.3% | |

| 18,000 | First Republic Bank, Ser K, 4.125%(A) | 288,000 |

| | Total Preferred Stocks | $288,000 |

| Shares | | | | MarketValue |

| | Short-Term Investment Fund — 1.0% | |

| 941,841 | Dreyfus Institutional Preferred Government Plus Money Market, Institutional Class, 4.19%∞Ω** | $ 941,841 |

| | Total Investment Securities—98.3%

(Cost $99,572,524) | $97,482,517 |

| | Other Assets in Excess of Liabilities — 1.7% | 1,717,845 |

| | Net Assets — 100.0% | $99,200,362 |

| (A) | Perpetual Bond - A bond or preferred stock with no definite maturity date. |

| (B) | Variable rate security - Rate reflected is the rate in effect as of December 31, 2022. |

| (C) | Interest only security - This type of security represents the right to receive the monthly interest payments on an underlying pool of mortgages. Payments of principal on the pool reduce the value of the “interest only” holding. |

| (D) | Certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions. These securities do not indicate a reference rate and spread in their description. |

| * | Non-income producing security. |

| ** | Represents collateral for securities loaned. |

| † | All or a portion of the security is on loan. The total market value of the securities on loan as of December 31, 2022 was $906,812. |

| ∞ | Open-End Fund. |

| Ω | Represents the 7-Day SEC yield as of December 31, 2022. |

| Portfolio Abbreviations: |

| CLO – Collateralized Loan Obligation |

| LIBOR – London Interbank Offered Rate |

| LLC – Limited Liability Company |

| LP – Limited Partnership |

| PLC – Public Limited Company |

| REIT – Real Estate Investment Trust |

| REMIC – Real Estate Mortgage Investment Conduit |

| SOC – State-Owned Company |

| SOFR30A – Secured Overnight Financing Rate 30 Day Average |

| TSFR3M – Three Month Term Secured Overnight Financing Rate |

| 144a - This is a restricted security that was sold in a transaction qualifying for the exemption under Rule 144a of the Securities Act of 1933. This security may be sold in transactions exempt from registration, normally to qualified institutional buyers. At December 31, 2022, these securities were valued at $43,713,334 or 44.1% of net assets. These securities were deemed liquid pursuant to procedures approved by the Board of Trustees. |

Other Information:

The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the security valuation section in the accompanying Notes to Financial Statements.

| Valuation Inputs at Reporting Date: |

| Description | Level 1 | Level 2 | Level 3 | Total |

| Corporate Bonds | $— | $47,653,734 | $— | $47,653,734 |

| U.S. Treasury Obligations | — | 19,416,759 | — | 19,416,759 |

| Asset-Backed Securities | — | 11,792,080 | — | 11,792,080 |

| Commercial Mortgage-Backed Securities | — | 7,192,550 | — | 7,192,550 |

| Common Stocks | 4,288,957 | — | — | 4,288,957 |

| Sovereign Government Obligations | — | 3,890,930 | — | 3,890,930 |

| Non-Agency Collateralized Mortgage Obligations | — | 2,017,666 | — | 2,017,666 |

| Preferred Stocks | 288,000 | — | — | 288,000 |

| Short-Term Investment Fund | 941,841 | — | — | 941,841 |

| Total | $5,518,798 | $91,963,719 | $— | $97,482,517 |

See accompanying Notes to Financial Statements.

Portfolio of Investments

Touchstone Ultra Short Income ETF – December 31, 2022

Principal

Amount | | | | Market

Value |

| | Asset-Backed Securities — 47.2% |

| $ 900,000 | American Credit Acceptance Receivables Trust, Ser 2019-1, Class E, 144a, 4.840%, 4/14/25 | | | $ 899,006 |

| 1,000,000 | American Credit Acceptance Receivables Trust, Ser 2019-2, Class E, 144a, 4.290%, 6/12/25 | | | 993,987 |

| 715,137 | American Credit Acceptance Receivables Trust, Ser 2020-2, Class C, 144a, 3.880%, 4/13/26 | | | 711,879 |

| 1,000,000 | Americredit Automobile Receivables Trust, Ser 2019-1, Class D, 3.620%, 3/18/25 | | | 983,839 |

| 800,000 | Barings CLO Ltd. (Cayman Islands), Ser 2013-IA, Class BR, 144a, (3M LIBOR +1.250%), 5.493%, 1/20/28(A) | | | 786,278 |

| 837,022 | CarNow Auto Receivables Trust, Ser 2021-2A, Class B, 144a, 1.300%, 1/15/26 | | | 822,120 |

| 1,000,000 | CFIP CLO Ltd. (Cayman Islands), Ser 2014-1A, Class BR, 144a, (3M LIBOR +1.850%), 5.791%, 7/13/29(A) | | | 978,926 |

| 618,441 | Dell Equipment Finance Trust, Ser 2021-2, Class A2, 144a, 0.330%, 12/22/26 | | | 611,041 |

| 955,000 | Driven Brands Funding LLC, Ser 2018-1A, Class A2, 144a, 4.739%, 4/20/48 | | | 886,848 |

| 758,716 | DT Auto Owner Trust, Ser 2018-3A, Class E, 144a, 5.330%, 11/17/25 | | | 758,533 |

| 1,000,000 | DT Auto Owner Trust, Ser 2019-1A, Class E, 144a, 4.940%, 2/17/26 | | | 996,029 |

| 900,000 | First Investors Auto Owner Trust, Ser 2018-2A, Class E, 144a, 5.360%, 1/15/25 | | | 899,977 |

| 635,020 | First Investors Auto Owner Trust, Ser 2019-1A, Class D, 144a, 3.550%, 4/15/25 | | | 632,214 |

| 890,981 | GLS Auto Receivables Issuer Trust, Ser 2020-4A, Class C, 144a, 1.140%, 11/17/25 | | | 875,920 |

| 1,000,000 | Golub Capital Partners CLO 34M Ltd. (Cayman Islands), Ser 2017-34A, Class AR, 144a, (3M LIBOR +1.7000%), 6.232%, 3/14/31(A) | | | 978,139 |

| 301,327 | GreatAmerica Leasing Receivables Funding LLC Series, Ser 2021-2, Class A2, 144a, 0.380%, 3/15/24 | | | 296,163 |

| 1,000,000 | HPEFS Equipment Trust, Ser 2020-1A, Class D, 144a, 2.260%, 2/20/30 | | | 989,786 |

| 864,233 | JFIN CLO 2017 Ltd. (Cayman Islands), Ser 2017-1A, Class A1R, 144a, (3M LIBOR +1.000%), 5.325%, 4/24/29(A) | | | 853,556 |

| 865,079 | LCM XIII LP (Cayman Islands), Ser 13A, Class AR3, 144a, (3M LIBOR +0.870%), 5.097%, 7/19/27(A) | | | 855,456 |

| 433,691 | MVW Owner Trust, Ser 2017-1A, Class A, 144a, 2.420%, 12/20/34 | | | 423,813 |

| 1,000,000 | Prestige Auto Receivables Trust, Ser 2019-1A, Class D, 144a, 3.010%, 8/15/25 | | | 989,575 |

| 1,000,000 | Prestige Auto Receivables Trust, Ser 2020-1A, Class D, 144a, 1.620%, 11/16/26 | | | 976,552 |

| 626,731 | SCF Equipment Leasing LLC, Ser 2020-1A, Class A3, 144a, 1.190%, 10/20/27 | | | 614,450 |

| 971,856 | Shackleton CLO Ltd. (Cayman Islands), Ser 2015-8A, Class A1R, 144a, (3M LIBOR +0.920%), 5.163%, 10/20/27(A) | | | 962,951 |

| 905,333 | Sierra Timeshare Receivables Funding LLC, Ser 2018-2A, Class B, 144a, 3.650%, 6/20/35 | | | 871,714 |

| 825,934 | Sierra Timeshare Receivables Funding LLC, Ser 2018-3A, Class B, 144a, 3.870%, 9/20/35 | | | 809,601 |

| 733,763 | Sierra Timeshare Receivables Funding LLC, Ser 2019-1A, Class D, 144a, 4.750%, 1/20/36 | | | 691,248 |

| 1,000,000 | STWD Ltd. (Cayman Islands), Ser 2019-FL1, Class B, 144a, (TSFR1M +1.714%), 6.040%, 7/15/38(A) | | | 939,109 |

| 1,050,000 | Tesla Auto Lease Trust, Ser 2020-A, Class D, 144a, 2.330%, 2/20/24 | | | 1,038,792 |

| | Total Asset-Backed Securities | $24,127,502 |

Principal

Amount | | | | Market

Value |

| | Commercial Mortgage-Backed Securities — 21.6% |

| $1,000,000 | ACRE Commercial Mortgage Ltd., Ser 2021-FL4, Class B, 144a, (1M LIBOR +1.400%), 5.739%, 12/18/37(A) | | | $ 968,329 |

| 500,000 | BFLD Trust, Ser 2020-OBRK, Class A, 144a, (1M LIBOR +2.050%), 6.368%, 11/15/28(A) | | | 494,152 |

| 95,000 | BPR Trust, Ser 2021-KEN, Class A, 144a, (1M LIBOR +1.250%), 5.568%, 2/15/29(A) | | | 92,399 |

| 1,009,316 | BX Commercial Mortgage Trust, Ser 2019-XL, Class A, 144a, (1M LIBOR +0.920%), 5.370%, 10/15/36(A) | | | 996,872 |

| 992,505 | CHC Commercial Mortgage Trust 2019 - CHC, Ser 2019-CHC, Class A, 144a, (1M LIBOR +1.120%), 5.438%, 6/15/34(A) | | | 968,533 |

| 1,000,000 | Citigroup Commercial Mortgage Trust, Ser 2013-GC11, Class B, 3.732%, 4/10/46(A)(B) | | | 992,583 |

| 1,000,000 | COMM Mortgage Trust, Ser 2013-CR7, Class B, 144a, 3.613%, 3/10/46 | | | 986,324 |

| 606,000 | Great Wolf Trust, Ser 2019-WOLF, Class B, 144a, (1M LIBOR +1.334%), 5.652%, 12/15/36(A) | | | 584,104 |

| 1,000,000 | GS Mortgage Securities Trust, Ser 2018-HART, Class A, 144a, (1M LIBOR +1.090%), 5.410%, 10/15/31(A) | | | 947,888 |

| 1,000,000 | JP Morgan Chase Commercial Mortgage Securities Trust, Ser 2018-WPT, Class BFX, 144a, 4.549%, 7/5/33 | | | 888,424 |

| 1,000,000 | JPMBB Commercial Mortgage Securities Trust, Ser 2013-C12, Class AS, 4.052%, 7/15/45(A)(B) | | | 986,732 |

| 1,000,000 | PFP Ltd. (Cayman Islands), Ser 2019-6, Class D, 144a, (1M LIBOR +2.450%), 6.776%, 4/14/37(A) | | | 983,184 |

| 859,544 | ReadyCap Commercial Mortgage Trust, Ser 2018-4, Class A, 144a, 3.390%, 2/27/51 | | | 814,674 |

| 336,357 | Slide, Ser 2018-FUN, Class C, 144a, (1M LIBOR +1.800%), 6.118%, 6/15/31(A) | | | 332,024 |

| | Total Commercial Mortgage-Backed Securities | $11,036,222 |

| | Corporate Bonds — 19.9% | |

| | Financials — 4.9% | |

| 500,000 | Allstate Corp. (The), (3M LIBOR +0.630%), 5.356%, 3/29/23(A) | 500,553 |

| 500,000 | Metropolitan Life Insurance Co., 144a, 7.875%, 2/15/24 | 511,047 |

| 1,000,000 | Retail Opportunity Investments Partnership LP REIT, 5.000%, 12/15/23 | 988,684 |