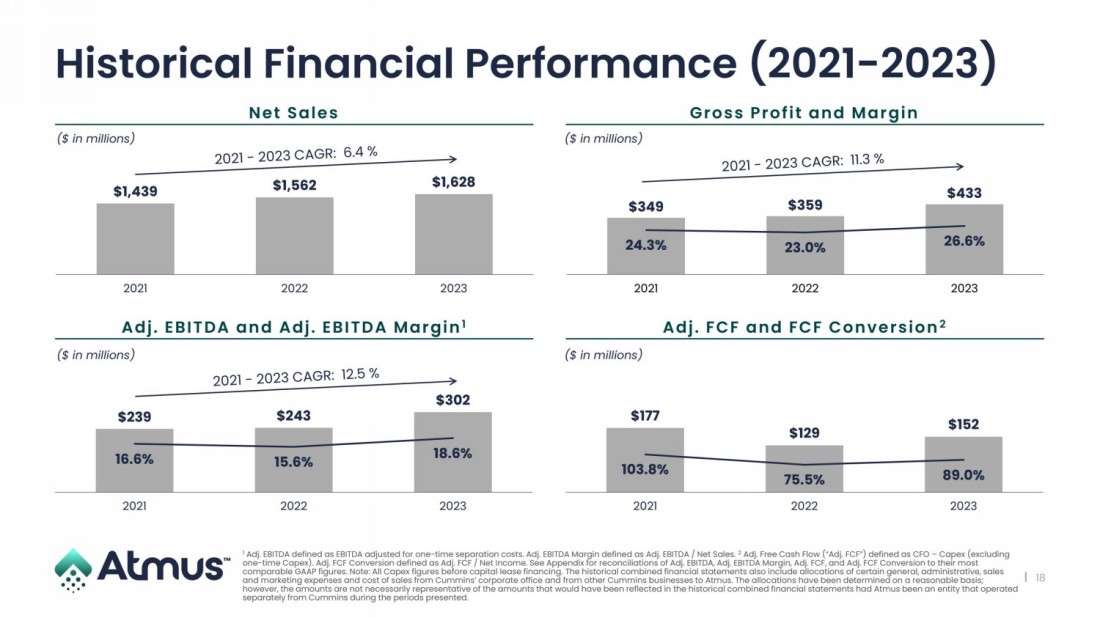

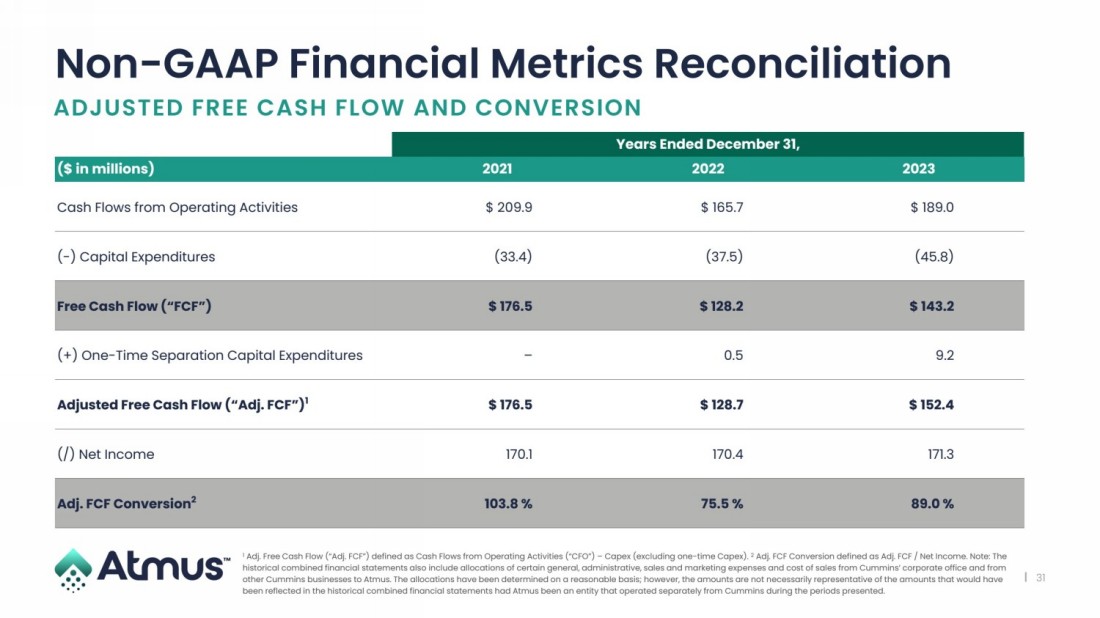

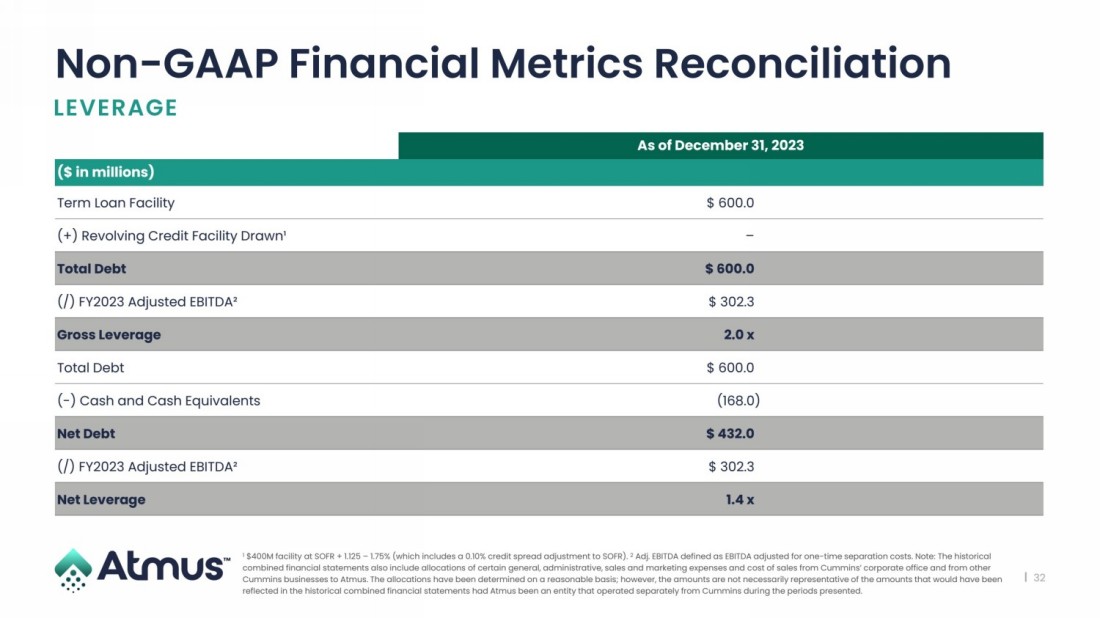

| | 2 Disclaimer The information contained in this presentation is not investment or financial product advice and is not intended to be used as the basis for making an investment decision. Neither Cummins Inc. (“Cummins”) nor Atmus Filtration Technologies Inc. (the “Company”, “we”, or “Atmus”) or any of its affiliates make any representation or warranty, express or implied as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of any of the information or opinions contained in this presentation. This presentation has been prepared without taking into account the investment objectives, financial situation or particular needs of any particular person. Additional Information and Where to Find It This presentation is for informational purposes only and is not an offer to sell or exchange, a solicitation of an offer to buy or exchange any securities and a recommendation as to whether investors should participate in the exchange offer. Atmus has filed with the SEC a registration statement on Form S-4 (the "Registration Statement") that includes a prospectus (the "Prospectus"). The exchange offer will be made solely by the Prospectus. The Prospectus contains important information about the exchange offer, Cummins, Atmus and related matters, and Cummins will deliver the Prospectus to holders of Cummins common stock. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROSPECTUS, AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, WHEN THEY BECOME AVAILABLE AND BEFORE MAKING ANY INVESTMENT DECISION, BECAUSE THEY CONTAIN IMPORTANT INFORMATION. None of Cummins, Atmus or any of their respective directors or officers or the dealer managers appointed with respect to the exchange offer makes any recommendation as to whether you should participate in the exchange offer. Cummins has filed with the SEC a Schedule TO, which contains important information about the exchange offer. Holders of Cummins common stock may obtain copies of the Prospectus, the Registration Statement, the Schedule TO and other related documents, and any other information that Cummins and Atmus file electronically with the SEC free of charge at the SEC’s website at http://www.sec.gov. Holders of Cummins common stock will also be able to obtain a copy of the Prospectus by clicking on the appropriate link on www.okapivote.com/CumminsAtmusExchange. Cummins has retained Okapi Partners LLC as the information agent for the exchange offer. To obtain copies of the exchange offer Prospectus and related documents, or for questions about the terms of the exchange offer or how to participate, you may contact the information agent at 1-877-279-2311 (in the U.S., including Puerto Rico, and Canada) or 1-917-484-4425 (all other areas). Forward-Looking Statements This presentation contains forward-looking statements, including, without limitation, those that are based on current expectations, estimates and projections about the industries in which the Company operates and management’s beliefs and assumptions. Forward-looking statements are generally accompanied by words such as “anticipates,” “expects,” “forecasts,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “could,” “should,” “may” or words of similar meaning. Examples of forward-looking statements include, but are not limited to, statements the Company makes regarding the outlook for its future business and financial performance and the anticipated timing or benefits of the exchange offer. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions which are difficult to predict and are detailed more fully in Cummins’ and Atmus’ respective periodic reports filed from time to time with the SEC, the registration statement referred to above, including the prospectus forming a part thereof, the Schedule TO and other exchange offer documents filed by Cummins and Atmus. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements. You are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date hereof. None of Cummins or the Company undertakes any obligation to publicly update or to revise any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law. Comparisons of results for current and any prior periods are not intended to express any future trends or indications of future performance, unless specifically expressed as such, and should be viewed as historical data. Use of Non-GAAP Financial Measures We have provided in this presentation information regarding Adjusted Free Cash Flow, Adjusted Free Cash Flow Conversion, EBITDA, EBITDA Margin, Adjusted EBITDA, and Adjusted EBITDA Margin, which are measures that have not been prepared in accordance with generally accepted accounting principles in the United States (“GAAP”) and are the key measures we use for determining how our business is performing. We believe Adjusted Free Cash Flow, Adjusted Free Cash Flow Conversion, EBITDA, EBITDA Margin, Adjusted EBITDA, and Adjusted EBITDA Margin are useful measures of our operating performance as they assist investors and debt holders in comparing our performance on a consistent basis without regard to financing methods, capital structure, income taxes or depreciation and amortization methods, which can vary significantly depending upon many factors. Additionally, we believe these metrics are widely used by investors, securities analysts, ratings agencies and others in our industry in evaluating performance. Adjusted Free Cash Flow, Adjusted Free Cash Flow Conversion, EBITDA, EBITDA Margin, Adjusted EBITDA, and Adjusted EBITDA Margin are not in accordance with, or alternatives for, U.S. GAAP financial measures and may not be consistent with measures used by other companies. They should be considered supplemental data. We do not consider our non-GAAP financial measures as superior to, or a substitute for, the equivalent measures calculated and presented in accordance with GAAP. A reconciliation of Adjusted Free Cash Flow, Adjusted Free Cash Flow Conversion, EBITDA, EBITDA Margin, Adjusted EBITDA, and Adjusted EBITDA Margin to the most directly comparable GAAP financial measure can be found in the Appendix at the end of this presentation. Market and Industry Information Unless otherwise indicated, information contained in this presentation concerning our industry and the markets in which we operate, including our general expectations and market position, market opportunity and market share, is based on information from third-party sources and management estimates. Our management estimates have not been verified by any independent source. In addition, assumptions and estimates of our and our industry’s future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors. These and other factors could cause future performance to differ materially from our assumptions and estimates. Trademarks and Trade Names All third-party trademarks, including names, logos and brands, referenced by us in this presentation are property of their respective owners. All references to third-party trademarks are for identification purposes only. Such use should not be construed as an endorsement of the products or services of us or this offering. |