UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number (811-23793)

Tidal Trust II

(Exact name of registrant as specified in charter)

234 West Florida Street, Suite 203

Milwaukee, Wisconsin 53204

(Address of principal executive offices) (Zip code)

Eric W. Falkeis

Tidal Trust II

234 West Florida Street, Suite 203

Milwaukee, Wisconsin 53204

(Name and address of agent for service)

(844) 986-7700

Registrant’s telephone number, including area code

Date of fiscal year end: April 30

Date of reporting period: October 31, 2024

Item 1. Reports to Stockholders.

Defiance Daily Target 2X Long AVGO ETF Tailored Shareholder Report

semi-annual Shareholder Report October 31, 2024 Defiance Daily Target 2X Long AVGO ETF Ticker: AVGX (Listed on The Nasdaq Stock Market, LLC) |

This semi-annual shareholder report contains important information about the Defiance Daily Target 2X Long AVGO ETF (the "Fund") for the period May 1, 2024 to October 31, 2024. You can find additional information about the Fund at www.defianceetfs.com/avgx/. You can also request this information by contacting us at (833) 333-9383 or by writing to the Defiance Daily Target 2X Long AVGO ETF c/o U.S. Bank Global Fund Services, P.O. Box 701, Milwaukee, Wisconsin 53201-0701.

What were the Fund costs for the past six months?

(based on a hypothetical $10,000 investment)

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Defiance Daily Target 2X Long AVGO ETF | $26 | 1.33% |

The Fund commenced operations on August 21, 2024. Expenses for a full reporting period would be higher than the figures shown.

Key Fund Statistics

(as of October 31, 2024)

| |

|---|

Fund Size (Thousands) | $19,286 |

Number of Holdings | 5 |

Portfolio Turnover | 396% |

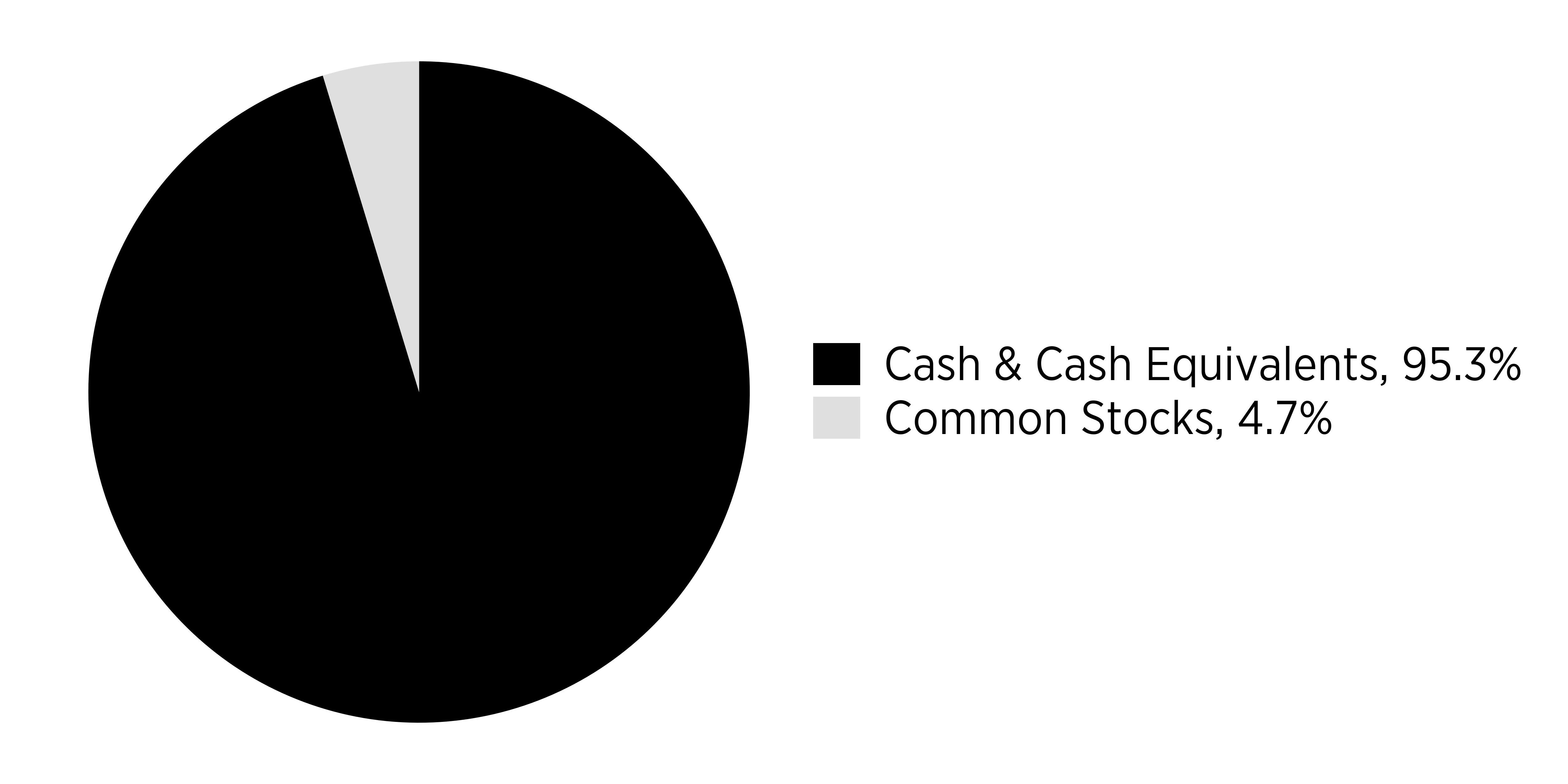

Security Type

(% of net assets)

Sector/Security Type | % of Total Portfolio |

Cash & Cash Equivalents | 0.953 |

Common Stocks | 0.047 |

Percentages are based on total net assets. Cash & Cash Equivalents represents short-term investments, total return swaps and other assets in excess of liabilities.

What did the Fund invest in?

(as of October 31, 2024)

Top Holdings | (% of net assets) |

|---|

First American Government Obligations Fund - Class X, 4.78% | 21.2 |

Broadcom, Inc. Swap, Maturity: 09/19/2025 | 7.9 |

Broadcom, Inc. | 4.7 |

Broadcom, Inc. Swap, Maturity: 10/28/2025 | -0.1 |

Broadcom, Inc. Swap, Maturity: 11/10/2025 | -0.3 |

How has the Fund changed?

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants.

Householding

Householding is an option available to certain investors of the Fund. Householding is a method of delivery, based on the preference of the individual investor, in which a single copy of certain shareholder documents can be delivered to investors who share the same address, even if their accounts are registered under different names. Householding for the Fund is available through certain broker-dealers. If you are interested in enrolling in householding and receiving a single copy of prospectuses and other shareholder documents, please contact your broker-dealer. If you are currently enrolled in householding and wish to change your householding status, please contact your broker-dealer.

For additional information about the Fund, including its prospectus, financial information, holdings and proxy voting information, visit www.defianceetfs.com/avgx/.

Defiance Daily Target 2X Long AVGO ETF Tailored Shareholder Report

Defiance Daily Target 2X Long LLY ETF Tailored Shareholder Report

semi-annual Shareholder Report October 31, 2024 Defiance Daily Target 2X Long LLY ETF Ticker: LLYX (Listed on NYSE Arca, Inc.) |

This semi-annual shareholder report contains important information about the Defiance Daily Target 2X Long LLY ETF (the "Fund") for the period May 1, 2024 to October 31, 2024. You can find additional information about the Fund at www.defianceetfs.com/llyx/. You can also request this information by contacting us at (833) 333-9383 or by writing to the Defiance Daily Target 2X Long LLY ETF c/o U.S. Bank Global Fund Services, P.O. Box 701, Milwaukee, Wisconsin 53201-0701.

What were the Fund costs for the past six months?

(based on a hypothetical $10,000 investment)

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Defiance Daily Target 2X Long LLY ETF | $32 | 1.30% |

The Fund commenced operations on August 7, 2024. Expenses for a full reporting period would be higher than the figures shown.

Key Fund Statistics

(as of October 31, 2024)

| |

|---|

Fund Size (Thousands) | $9,004 |

Number of Holdings | 4 |

Portfolio Turnover | 397% |

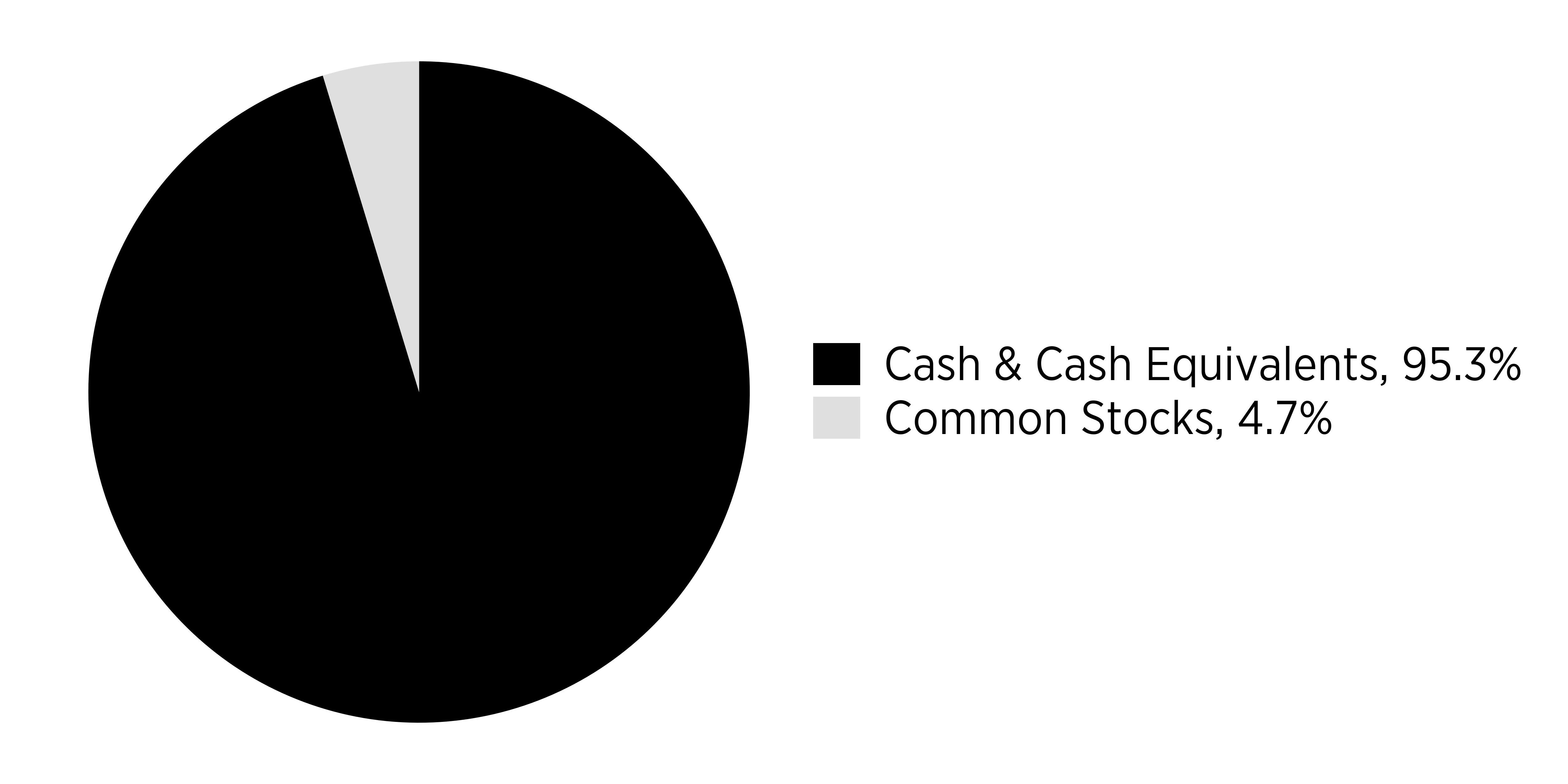

Security Type

(% of net assets)

Sector/Security Type | % of Total Portfolio |

Cash & Cash Equivalents | 0.95 |

Common Stocks | 0.05 |

Percentages are based on total net assets. Cash & Cash Equivalents represents short-term investments, total return swaps and other assets in excess of liabilities.

What did the Fund invest in?

(as of October 31, 2024)

Top Holdings | (% of net assets) |

|---|

Eli Lilly & Co. | 5.0 |

First American Government Obligations Fund - Class X, 4.78% | 4.7 |

Eli Lilly & Co. Swap, Maturity: 11/10/2025 | -0.1 |

Eli Lilly & Co. Swap, Maturity: 09/05/2025 | -7.1 |

How has the Fund changed?

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants.

Householding

Householding is an option available to certain investors of the Fund. Householding is a method of delivery, based on the preference of the individual investor, in which a single copy of certain shareholder documents can be delivered to investors who share the same address, even if their accounts are registered under different names. Householding for the Fund is available through certain broker-dealers. If you are interested in enrolling in householding and receiving a single copy of prospectuses and other shareholder documents, please contact your broker-dealer. If you are currently enrolled in householding and wish to change your householding status, please contact your broker-dealer.

For additional information about the Fund, including its prospectus, financial information, holdings and proxy voting information, visit www.defianceetfs.com/llyx/.

Defiance Daily Target 2X Long LLY ETF Tailored Shareholder Report

Defiance Daily Target 2X Long MSTR ETF Tailored Shareholder Report

semi-annual Shareholder Report October 31, 2024 Defiance Daily Target 2X Long MSTR ETF Ticker: MSTX (Listed on The Nasdaq Stock Market, LLC) |

This semi-annual shareholder report contains important information about the Defiance Daily Target 2X Long MSTR ETF (the "Fund") for the period May 1, 2024 to October 31, 2024. You can find additional information about the Fund at www.defianceetfs.com/mstx/. You can also request this information by contacting us at (833) 333-9383 or by writing to the Defiance Daily Target 2X Long MSTR ETF c/o U.S. Bank Global Fund Services, P.O. Box 701, Milwaukee, Wisconsin 53201-0701.

What were the Fund costs for the past six months?

(based on a hypothetical $10,000 investment)

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Defiance Daily Target 2X Long MSTR ETF | $50 | 1.30% |

The Fund commenced operations on August 14, 2024. Expenses for a full reporting period would be higher than the figures shown.

Key Fund Statistics

(as of October 31, 2024)

| |

|---|

Fund Size (Thousands) | $549,416 |

Number of Holdings | 5 |

Portfolio Turnover | 666% |

Security Type

(% of net assets)

Sector/Security Type | % of Total Portfolio |

Cash & Cash Equivalents | 0.937 |

Common Stocks | 0.063 |

Percentages are based on total net assets. Cash & Cash Equivalents represents short-term investments, total return swaps and other assets in excess of liabilities.

What did the Fund invest in?

(as of October 31, 2024)

Top Holdings | (% of net assets) |

|---|

MicroStrategy, Inc. - Class A Swap, Maturity: 09/12/2025 | 14.1 |

First American Government Obligations Fund - Class X, 4.78% | 10.2 |

MicroStrategy, Inc. - Class A | 6.3 |

MicroStrategy, Inc. - Class A Swap, Maturity: 09/19/2025 | (0.0)* |

MicroStrategy, Inc. - Class A Swap, Maturity: 10/22/2025 | -0.1 |

| * | | Less than -0.05% of net assets. |

How has the Fund changed?

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants.

Householding

Householding is an option available to certain investors of the Fund. Householding is a method of delivery, based on the preference of the individual investor, in which a single copy of certain shareholder documents can be delivered to investors who share the same address, even if their accounts are registered under different names. Householding for the Fund is available through certain broker-dealers. If you are interested in enrolling in householding and receiving a single copy of prospectuses and other shareholder documents, please contact your broker-dealer. If you are currently enrolled in householding and wish to change your householding status, please contact your broker-dealer.

For additional information about the Fund, including its prospectus, financial information, holdings and proxy voting information, visit www.defianceetfs.com/mstx/.

Defiance Daily Target 2X Long MSTR ETF Tailored Shareholder Report

Defiance Daily Target 2X Long SMCI ETF Tailored Shareholder Report

semi-annual Shareholder Report October 31, 2024 Defiance Daily Target 2X Long SMCI ETF Ticker: SMCX (Listed on The Nasdaq Stock Market, LLC) |

This semi-annual shareholder report contains important information about the Defiance Daily Target 2X Long SMCI ETF (the "Fund") for the period May 1, 2024 to October 31, 2024. You can find additional information about the Fund at www.defianceetfs.com/smcx/. You can also request this information by contacting us at (833) 333-9383 or by writing to the Defiance Daily Target 2X Long SMCI ETF c/o U.S. Bank Global Fund Services, P.O. Box 701, Milwaukee, Wisconsin 53201-0701.

What were the Fund costs for the past six months?

(based on a hypothetical $10,000 investment)

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Defiance Daily Target 2X Long SMCI ETF | $15 | 1.35% |

The Fund commenced operations on August 21, 2024. Expenses for a full reporting period would be higher than the figures shown.

Key Fund Statistics

(as of October 31, 2024)

| |

|---|

Fund Size (Thousands) | $32,932 |

Number of Holdings | 4 |

Portfolio Turnover | 400% |

Security Type

(% of net assets)

Sector/Security Type | % of Total Portfolio |

Cash & Cash Equivalents | 0.92 |

Common Stocks | 0.08 |

Percentages are based on total net assets. Cash & Cash Equivalents represents short-term investments, total return swaps and other assets in excess of liabilities.

What did the Fund invest in?

(as of October 31, 2024)

Top Holdings | (% of net assets) |

|---|

Super Micro Computer, Inc. | 8.0 |

First American Government Obligations Fund - Class X, 4.78% | 6.9 |

Super Micro Computer, Inc. Swap, Maturity: 10/15/2025 | -14.8 |

Super Micro Computer, Inc. Swap, Maturity: 09/26/2025 | -48.9 |

* Less than -0.05% of net assets.

How has the Fund changed?

After the close of trading on November 15, 2024, the Fund executed a 1:20 reverse stock split of its issued and outstanding shares.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants.

Householding

Householding is an option available to certain investors of the Fund. Householding is a method of delivery, based on the preference of the individual investor, in which a single copy of certain shareholder documents can be delivered to investors who share the same address, even if their accounts are registered under different names. Householding for the Fund is available through certain broker-dealers. If you are interested in enrolling in householding and receiving a single copy of prospectuses and other shareholder documents, please contact your broker-dealer. If you are currently enrolled in householding and wish to change your householding status, please contact your broker-dealer.

For additional information about the Fund, including its prospectus, financial information, holdings and proxy voting information, visit www.defianceetfs.com/smcx/.

Defiance Daily Target 2X Long SMCI ETF Tailored Shareholder Report

Defiance Daily Target 2X Long Uranium ETF Tailored Shareholder Report

semi-annual Shareholder Report October 31, 2024 Defiance Daily Target 2X Long Uranium ETF Ticker: URAX (Listed on NYSE Arca, Inc.) |

This semi-annual shareholder report contains important information about the Defiance Daily Target 2X Long Uranium ETF (the "Fund") for the period May 1, 2024 to October 31, 2024. You can find additional information about the Fund at www.defianceetfs.com/urax/. You can also request this information by contacting us at (833) 333-9383 or by writing to the Defiance Daily Target 2X Long Uranium ETF c/o U.S. Bank Global Fund Services, P.O. Box 701, Milwaukee, Wisconsin 53201-0701.

What were the Fund costs for the past six months?

(based on a hypothetical $10,000 investment)

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Defiance Daily Target 2X Long Uranium ETF | $38 | 0.95% |

The Fund commenced operations on May 23, 2024. Expenses for a full reporting period would be higher than the figures shown.

Key Fund Statistics

(as of October 31, 2024)

| |

|---|

Fund Size (Thousands) | $4,054 |

Number of Holdings | 4 |

Portfolio Turnover | 791% |

Security Type

(% of net assets)

Sector/Security Type | % of Total Portfolio |

Cash & Cash Equivalents | 0.941 |

Common Stocks | 0.059 |

Percentages are based on total net assets. Cash & Cash Equivalents represents short-term investments, total return swaps and other assets in excess of liabilities.

What did the Fund invest in?

(as of October 31, 2024)

Top Holdings | (% of net assets) |

|---|

First American Government Obligations Fund - Class X, 4.78% | 25.5 |

Global X Uranium ETF | 5.9 |

Global X Uranium ETF Swap, Maturity: 11/10/2025 | -0.2 |

Global X Uranium ETF Swap, Maturity: 05/27/2025 | -0.4 |

How has the Fund changed?

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants.

Householding

Householding is an option available to certain investors of the Fund. Householding is a method of delivery, based on the preference of the individual investor, in which a single copy of certain shareholder documents can be delivered to investors who share the same address, even if their accounts are registered under different names. Householding for the Fund is available through certain broker-dealers. If you are interested in enrolling in householding and receiving a single copy of prospectuses and other shareholder documents, please contact your broker-dealer. If you are currently enrolled in householding and wish to change your householding status, please contact your broker-dealer.

For additional information about the Fund, including its prospectus, financial information, holdings and proxy voting information, visit www.defianceetfs.com/urax/.

Defiance Daily Target 2X Long Uranium ETF Tailored Shareholder Report

Defiance Daily Target 2X Short MSTR ETF Tailored Shareholder Report

semi-annual Shareholder Report October 31, 2024 Defiance Daily Target 2X Short MSTR ETF Ticker: SMST (Listed on The Nasdaq Stock Market, LLC) |

This semi-annual shareholder report contains important information about the Defiance Daily Target 2X Short MSTR ETF (the "Fund") for the period May 1, 2024 to October 31, 2024. You can find additional information about the Fund at www.defianceetfs.com/smst/. You can also request this information by contacting us at (833) 333-9383 or by writing to the Defiance Daily Target 2X Short MSTR ETF c/o U.S. Bank Global Fund Services, P.O. Box 701, Milwaukee, Wisconsin 53201-0701.

What were the Fund costs for the past six months?

(based on a hypothetical $10,000 investment)

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Defiance Daily Target 2X Short MSTR ETF | $17 | 1.29% |

The Fund commenced operations on August 20, 2024. Expenses for a full reporting period would be higher than the figures shown.

Key Fund Statistics

(as of October 31, 2024)

| |

|---|

Fund Size (Thousands) | $6,730 |

Number of Holdings | 3 |

Portfolio Turnover | 0% |

Sector Breakdown

(% of total portfolio)

Sector/Security Type | % of Total Portfolio |

Cash & Cash Equivalents | 1 |

Percentages are based on total net assets. Cash & Cash Equivalents represents short-term investments, total return swaps and other assets in excess of liabilities.

What did the Fund invest in?

(as of October 31, 2024)

Top Holdings | (% of net assets) |

|---|

First American Government Obligations Fund - Class X, 4.78% | 24.0 |

MicroStrategy, Inc. - Class A Swap, Maturity: 11/25/2025 | 1.4 |

MicroStrategy, Inc. - Class A Swap, Maturity: 09/18/2025 | -2.1 |

How has the Fund changed?

After the close of trading on November 15, 2024, the Fund executed a 1:5 reverse stock split of its issued and outstanding shares.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants.

Householding

Householding is an option available to certain investors of the Fund. Householding is a method of delivery, based on the preference of the individual investor, in which a single copy of certain shareholder documents can be delivered to investors who share the same address, even if their accounts are registered under different names. Householding for the Fund is available through certain broker-dealers. If you are interested in enrolling in householding and receiving a single copy of prospectuses and other shareholder documents, please contact your broker-dealer. If you are currently enrolled in householding and wish to change your householding status, please contact your broker-dealer.

For additional information about the Fund, including its prospectus, financial information, holdings and proxy voting information, visit www.defianceetfs.com/smst/.

Defiance Daily Target 2X Short MSTR ETF Tailored Shareholder Report

Item 2. Code of Ethics.

Not applicable for semi-annual reports.

Item 3. Audit Committee Financial Expert.

Not applicable for semi-annual reports.

Item 4. Principal Accountant Fees and Services.

Not applicable for semi-annual reports.

Item 5. Audit Committee of Listed Registrants.

Not applicable for semi-annual reports.

Item 6. Investments.

| (a) | Schedule of Investments is included within the financial statements filed under Item 7 of this Form. |

Item 7. Financial Statements and Financial Highlights for Open-End Investment Companies.

Financial Statements

October 31, 2024 (Unaudited)

Tidal Trust II

| • Defiance Daily Target 2X Long AVGO ETF | | AVGX | | Nasdaq Stock Market, LLC |

| • Defiance Daily Target 2X Long LLY ETF | | LLYX | | NYSE Arca, Inc. |

| • Defiance Daily Target 2X Long MSTR ETF | | MSTX | | Nasdaq Stock Market, LLC |

| • Defiance Daily Target 2X Long SMCI ETF | | SMCX | | Nasdaq Stock Market, LLC |

| • Defiance Daily Target 2X Long Uranium ETF | | URAX | | NYSE Arca, Inc. |

| • Defiance Daily Target 2X Short MSTR ETF | | | SMST | | Nasdaq Stock Market, LLC |

Defiance ETFs

Table of Contents

| Schedule of Investments & Total Return Swap Contracts | Defiance ETFs |

October 31, 2024 (Unaudited)

| Defiance Daily Target 2X Long AVGO ETF |

| Schedule of Investments |

| | | | | | | |

| COMMON STOCKS - 4.7% | | Shares | | | Value | |

| Information Technology - 4.7% | | | | | | | | |

| Broadcom, Inc. | | | 5,386 | | | $ | 914,382 | |

| TOTAL COMMON STOCKS (Cost $926,703) | | | | | | | 914,382 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENTS - 21.2% | | | | | | | | |

| Money Market Funds - 21.2% | | | | | | | | |

| First American Government Obligations Fund - Class X, 4.78% (a) | | | 4,087,215 | | | | 4,087,215 | |

| TOTAL SHORT-TERM INVESTMENTS (Cost $4,087,215) | | | | | | | 4,087,215 | |

| | | | | | | | | |

| TOTAL INVESTMENTS - 25.9% (Cost $5,013,918) | | | | | | | 5,001,597 | |

| Other Assets in Excess of Liabilities - 74.1% | | | | | | | 14,284,291 | |

| TOTAL NET ASSETS - 100.0% | | | | | | $ | 19,285,888 | |

Percentages are stated as a percent of net assets.

| (a) | The rate shown represents the 7-day annualized effective yield as of October 31, 2024. |

Defiance Daily Target 2X Long AVGO ETF

Schedule of Total Return Swap Contracts

| Reference Entity | | Counterparty | | Pay/

Receive

Reference

Entity | | Financing Rate | | Payment

Frequency | | Maturity

Date | | Notional Amount | | | Value/ Unrealized

Appreciation

(Depreciation) | |

| Broadcom, Inc. | | Cantor Fitzgerald & Co. | | Receive | | OBFR + 2.50% | | Termination | | 09/19/2025 | | $14,869,475 | | $ | 1,525,756 | |

| Broadcom, Inc. | | Clear Street LLC | | Receive | | OBFR + 1.25% | | Monthly | | 10/28/2025 | | 2,869,113 | | | (15,263) | |

| Broadcom, Inc. | | Marex Capital Markets, Inc. | | Receive | | OBFR + 2.00% | | Monthly | | 11/10/2025 | | 17,342,006 | | | (58,598) | |

| Net Unrealized Appreciation (Depreciation) | | | | | | | | | | | | $ | 1,451,895 | |

There are no upfront payments or receipts associated with total return swaps in the Fund as of October 31, 2024.

OBFR - Overnight Bank Funding Rate

1

| The accompanying notes are an integral part of these financial statements. | |

| Schedule of Investments & Total Return Swap Contracts | Defiance ETFs |

October 31, 2024 (Unaudited)

| Defiance Daily Target 2X Long LLY ETF |

| Schedule of Investments |

| | | | | | | |

| COMMON STOCKS - 5.0% | | Shares | | | Value | |

| Pharmaceuticals - 5.0% | | | | | | | | |

| Eli Lilly & Co. | | | 545 | | | $ | 452,208 | |

| TOTAL COMMON STOCKS (Cost $463,018) | | | | | | | 452,208 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENTS - 4.7% | | | | | | | | |

| Money Market Funds - 4.7% | | | | | | | | |

| First American Government Obligations Fund - Class X, 4.78% (a) | | | 418,690 | | | | 418,690 | |

| TOTAL SHORT-TERM INVESTMENTS (Cost $418,690) | | | | | | | 418,690 | |

| | | | | | | | | |

| TOTAL INVESTMENTS - 9.7% (Cost $881,708) | | | | | | | 870,898 | |

| Other Assets in Excess of Liabilities - 90.3% | | | | | | | 8,132,908 | |

| TOTAL NET ASSETS - 100.0% | | | | | | $ | 9,003,806 | |

Percentages are stated as a percent of net assets.

(a) The rate shown represents the 7-day annualized effective yield as of October 31, 2024.

Defiance Daily Target 2X Long LLY ETF

Schedule of Total Return Swap Contracts

| Reference Entity | Counterparty | Pay/

Receive

Reference

Entity | Financing Rate | Payment

Frequency | Maturity

Date | Notional Amount | Value/

Unrealized

Appreciation

(Depreciation) | |

| Eli Lilly & Co. | Cantor Fitzgerald & Co. | Receive | OBFR + 2.50% | Termination | 09/05/2025 | $8,855,815 | $ | (639,401) | |

| Eli Lilly & Co. | Marex Capital Markets, Inc. | Receive | OBFR + 2.00% | Monthly | 11/10/2025 | 8,069,222 | | (6,571) | |

| Net Unrealized Appreciation (Depreciation) | | | | | | $ | (645,972) | |

There are no upfront payments or receipts associated with total return swaps in the Fund as of October 31, 2024.

OBFR - Overnight Bank Funding Rate

2

| The accompanying notes are an integral part of these financial statements. | |

| Schedule of Investments & Total Return Swap Contracts | Defiance ETFs |

October 31, 2024 (Unaudited)

| Defiance Daily Target 2X Long MSTR ETF |

| Schedule of Investments |

| | | | | | | |

| COMMON STOCKS - 6.3% | | Shares | | | Value | |

| Software - 6.3% | | | | | | | | |

| MicroStrategy, Inc. - Class A (a) | | | 141,795 | | | $ | 34,668,877 | |

| TOTAL COMMON STOCKS (Cost $31,330,993) | | | | | | | 34,668,877 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENTS - 10.2% | | | | | | | | |

| Money Market Funds - 10.2% | | | | | | | | |

| First American Government Obligations Fund - Class X, 4.78 % (b) | | | 56,217,445 | | | | 56,217,445 | |

| TOTAL SHORT-TERM INVESTMENTS (Cost $56,217,445) | | | | | | | 56,217,445 | |

| | | | | | | | | |

| TOTAL INVESTMENTS - 16.5% (Cost $87,548,438) | | | | | | | 90,886,322 | |

| Other Assets in Excess of Liabilities - 83.5% | | | | | | | 458,529,824 | |

| TOTAL NET ASSETS - 100.0% | | | | | | $ | 549,416,146 | |

Percentages are stated as a percent of net assets.

| (a) | Non-income producing security. |

| (b) | The rate shown represents the 7-day annualized effective yield as of October 31, 2024. |

Defiance Daily Target 2X Long MSTR ETF

Schedule of Total Return Swap Contracts

| Reference Entity | Counterparty | Pay/

Receive

Reference

Entity | Financing Rate | Payment

Frequency | Maturity

Date | Notional Amount | Value/

Unrealized

Appreciation

(Depreciation) | |

| | | | | | | | | | |

| MicroStrategy, Inc. | Cantor Fitzgerald | Receive | OBFR + 8.50% | Termination | 09/19/2025 | $516,436,568 | $ | (191,225) | |

| | | | | | | | | | |

| MicroStrategy, Inc. | Clear Street LLC | Receive | OBFR + 8.00% | Monthly | 10/22/2025 | 119,316,000 | | (676,161) | |

| | | | | | | | | | |

| MicroStrategy, Inc. | Marex Capital Markets, Inc. | Receive | OBFR + 4.00% | Termination | 09/12/2025 | 485,668,199 | | 77,631,119 | |

| Net Unrealized Appreciation (Depreciation) | | | | | | $ | 76,763,733 | |

There are no upfront payments or receipts associated with total return swaps in the Fund as of October 31, 2024.

OBFR - Overnight Bank Funding Rate

3

| The accompanying notes are an integral part of these financial statements. | |

| Schedule of Investments & Total Return Swap Contracts | Defiance ETFs |

October 31, 2024 (Unaudited)

| Defiance Daily Target 2X Long SMCI ETF |

| Schedule of Investments |

| | | | | | | |

| COMMON STOCKS - 8.0% | | Shares | | | Value | |

| Computers - 8.0% | | | | | | | | |

| Super Micro Computer, Inc. (a) | | | 89,677 | | | $ | 2,610,497 | |

| TOTAL COMMON STOCKS (Cost $2,989,047) | | | | | | | 2,610,497 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENTS - 6.9% | | | | | | | | |

| Money Market Funds - 6.9% | | | | | | | | |

| First American Government Obligations Fund - Class X, 4.78% (b) | | | 2,280,502 | | | | 2,280,502 | |

| TOTAL SHORT-TERM INVESTMENTS (Cost $2,280,502) | | | | | | | 2,280,502 | |

| | | | | | | | | |

| TOTAL INVESTMENTS - 14.9% (Cost $5,269,549) | | | | | | | 4,890,999 | |

| Other Assets in Excess of Liabilities - 85.1% | | | | | | | 28,041,448 | |

| TOTAL NET ASSETS - 100.0% | | | | | | $ | 32,932,447 | |

Percentages are stated as a percent of net assets.

| (a) | Non-income producing security. |

| (b) | The rate shown represents the 7-day annualized effective yield as of October 31, 2024. |

Defiance Daily Target 2X Long SMCI ETF

Schedule of Total Return Swap Contracts

| Reference Entity | Counterparty | Pay/

Receive

Reference

Entity | Financing Rate | Payment

Frequency | Maturity

Date | Notional Amount | Value/

Unrealized

Appreciation

(Depreciation) | |

| | | | | | | | | | |

| Super Micro Computer, Inc. | Cantor Fitzgerald & Co. | Receive | OBFR + 5.50% | Termination | 10/15/2025 | $33,728,593 | $ | (4,889,055) | |

| Super Micro Computer, Inc. | Marex Capital Markets, Inc. | Receive | OBFR + 3.00% | Termination | 09/26/2025 | 11,905,990 | | (16,112,857) | |

| Net Unrealized Appreciation (Depreciation) | | | | | | $ | (21,001,912) | |

There are no upfront payments or receipts associated with total return swaps in the Fund as of October 31, 2024.

OBFR - Overnight Bank Funding Rate

4

| The accompanying notes are an integral part of these financial statements. | |

| Schedule of Investments & Total Return Swap Contracts | Defiance ETFs |

October 31, 2024 (Unaudited)

| Defiance Daily Target 2X Long Uranium ETF |

| Schedule of Investments |

| | | | | | | |

| EXCHANGE TRADED FUNDS - 5.9% | | Shares | | | Value | |

| Global X Uranium ETF | | | 7,704 | | | $ | 236,743 | |

| TOTAL EXCHANGE TRADED FUNDS (Cost $205,521) | | | | | | | 236,743 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENTS - 25.5% | | | | | | | | |

| Money Market Funds - 25.5% | | | | | | | | |

| First American Government Obligations Fund - Class X, 4.78% (a) | | | 1,035,174 | | | | 1,035,174 | |

| TOTAL SHORT-TERM INVESTMENTS (Cost $1,035,174) | | | | | | | 1,035,174 | |

| | | | | | | | | |

| TOTAL INVESTMENTS - 31.4% (Cost $1,240,695) | | | | | | | 1,271,917 | |

| Other Assets in Excess of Liabilities - 68.6% | | | | | | | 2,782,074 | |

| TOTAL NET ASSETS - 100.0% | | | | | | $ | 4,053,991 | |

Percentages are stated as a percent of net assets.

(a) The rate shown represents the 7-day annualized effective yield as of October 31, 2024.

Defiance Daily Target 2X Long Uranium ETF

Schedule of Total Return Swap Contracts

| Reference Entity | Counterparty | Pay/

Receive

Reference

Entity | Financing Rate | Payment

Frequency | Maturity

Date | Notional Amount | Value/

Unrealized

Appreciation

(Depreciation) | |

| Global X Uranium ETF | Clear Street LLC | Receive | OBFR + 1.25% | Monthly | 05/27/2025 | $ 3,328,059 | $ | (16,222) | |

| Global X Uranium ETF | Marex Capital Markets, Inc. | Receive | OBFR + 2.00% | Monthly | 11/10/2025 | 4,587,989 | | (9,940) | |

| Net Unrealized Appreciation (Depreciation) | | | | | | $ | (26,162) | |

There are no upfront payments or receipts associated with total return swaps in the Fund as of October 31, 2024.

OBFR - Overnight Bank Funding Rate

5

| The accompanying notes are an integral part of these financial statements. | |

| Schedule of Investments & Total Return Swap Contracts | Defiance ETFs |

October 31, 2024 (Unaudited)

| Defiance Daily Target 2X Short MSTR ETF |

| Schedule of Investments |

| | | | | | | |

| SHORT-TERM INVESTMENTS - 24.0% | | | | | Value | |

| Money Market Funds - 24.0% | | | Shares | | | | | |

| First American Government Obligations Fund - Class X, 4.78% (a) | | | 1,614,446 | | | $ | 1,614,446 | |

| TOTAL SHORT-TERM INVESTMENTS (Cost $1,614,446) | | | | | | | 1,614,446 | |

| | | | | | | | | |

| TOTAL INVESTMENTS - 24.0% (Cost $1,614,446) | | | | | | | 1,614,446 | |

| Other Assets in Excess of Liabilities - 76.0% | | | | | | | 5,115,187 | |

| TOTAL NET ASSETS - 100.0% | | | | | | $ | 6,729,633 | |

Percentages are stated as a percent of net assets.

(a) The rate shown represents the 7-day annualized effective yield as of October 31, 2024.

Defiance Daily Target 2X Short MSTR ETF

Schedule of Total Return Swap Contracts

| Reference Entity | | Counterparty | | Pay/ Receive

Reference

Entity | | Financing Rate | | Payment

Frequency | | Maturity

Date | | Notional Amount | | | Value/

Unrealized

Appreciation

(Depreciation) | |

| | | | | | | | | | | | | | | | | |

| MicroStrategy, Inc. | | Cantor Fitzgerald & Co. | | Pay | | OBFR + 4.00% | | Termination | | 11/25/2025 | | $(5,887,071) | | $ | 92,144 | |

| MicroStrategy, Inc. | | Marex Capital Markets LLC | | Pay | | OBFR + 1.80% | | Termination | | 09/18/2025 | | (7,749,428) | | | (144,246) | |

| Net Unrealized Appreciation (Depreciation) | | | | | | | | | | | | $ | (52,102) | |

There are no upfront payments or receipts associated with total return swaps in the Fund as of October 31, 2024.

OBFR - Overnight Bank Funding Rate

6

| The accompanying notes are an integral part of these financial statements. | |

| Statements of Assets and Liabilities | Defiance ETFs |

| October 31, 2024 (Unaudited) | |

| | | Defiance Daily

Target 2X Long

AVGO ETF | | Defiance Daily

Target 2X Long

LLY ETF | | Defiance Daily

Target 2X Long

MSTR ETF | | Defiance Daily

Target 2X Long

SMCI ETF | | Defiance Daily

Target 2X Long

Uranium ETF |

| ASSETS: | | | | | | | | | | | | | | | |

| Investments, at value (Note 2) | | $ | 5,001,597 | | | $ | 870,898 | | | $ | 90,886,322 | | | $ | 4,890,999 | | | $ | 1,271,917 | |

| Deposit at broker for swap contracts | | | 12,969,781 | | | | 8,412,543 | | | | 381,139,899 | | | | 76,875,970 | | | | 2,287,577 | |

| Receivable for swap contracts | | | 2,155,854 | | | | – | | | | 221,960,256 | | | | – | | | | 229,596 | |

| Receivable for fund shares sold | | | 486,935 | | | | 3,967,127 | | | | 14,209,525 | | | | 271,150 | | | | – | |

| Receivable for investments sold | | | 42,609 | | | | 382,495 | | | | 72,903,517 | | | | 70,627 | | | | 534,456 | |

| Interest receivable | | | 7,607 | | | | 1,230 | | | | 86,278 | | | | 14,559 | | | | 1,708 | |

| Deposit at broker for option contracts | | | – | | | | – | | | | 9,977 | | | | 1,111 | | | | – | |

| Prepaid expenses and other assets | | | 12,035 | | | | 5,281 | | | | 77,078 | | | | 3,615 | | | | 486 | |

| Total assets | | | 20,676,418 | | | | 13,639,574 | | | | 781,272,852 | | | | 82,128,031 | | | | 4,325,740 | |

| | | | | | | | | | | | | | | | | | | | | |

| LIABILITIES: | | | | | | | | | | | | | | | | | | | | |

| Due to broker | | | 1,323,651 | | | | 3,967,127 | | | | 196,777,229 | | | | – | | | | – | |

| Payable for investments purchased | | | 48,754 | | | | – | | | | 1,781,495 | | | | 17,766,817 | | | | 12,858 | |

| Payable to adviser (Note 4) | | | 18,125 | | | | 6,070 | | | | 465,219 | | | | 33,727 | | | | 3,133 | |

| Interest payable | | | – | | | | – | | | | – | | | | 370 | | | | – | |

| Payable for capital shares redeemed | | | – | | | | – | | | | – | | | | 10,168,125 | | | | – | |

| Payable for swap contacts | | | – | | | | 662,571 | | | | 32,832,763 | | | | 21,226,545 | | | | 255,758 | |

| Total liabilities | | | 1,390,530 | | | | 4,635,768 | | | | 231,856,706 | | | | 49,195,584 | | | | 271,749 | |

| NET ASSETS | | $ | 19,285,888 | | | $ | 9,003,806 | | | $ | 549,416,146 | | | $ | 32,932,447 | | | $ | 4,053,991 | |

| | | | | | | | | | | | | | | | | | | | | |

| NET ASSETS CONSISTS OF: | | | | | | | | | | | | | | | | | | | | |

| Paid-in capital | | $ | 17,447,135 | | | $ | 9,861,648 | | | $ | 227,024,903 | | | $ | 72,204,362 | | | $ | 4,061,167 | |

| Total distributable earnings/(accumulated losses) | | | 1,838,753 | | | | (857,842 | ) | | | 322,391,243 | | | | (39,271,915 | ) | | | (7,176 | ) |

| Total net assets | | $ | 19,285,888 | | | $ | 9,003,806 | | | $ | 549,416,146 | | | $ | 32,932,447 | | | $ | 4,053,991 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net assets | | $ | 19,285,888 | | | $ | 9,003,806 | | | $ | 549,416,146 | | | $ | 32,932,447 | | | $ | 4,053,991 | |

| Shares issued and outstanding(a) | | | 925,000 | | | | 400,000 | | | | 11,200,000 | | | | 12,150,000 | | | | 250,000 | |

| Net asset value per share | | $ | 20.85 | | | $ | 22.51 | | | $ | 49.06 | | | $ | 2.71 | | | $ | 16.22 | |

| | | | | | | | | | | | | | | | | | | | | |

| COST: | | | | | | | | | | | | | | | | | | | | |

| Investments, at cost | | $ | 5,013,918 | | | $ | 881,708 | | | $ | 87,548,438 | | | $ | 5,269,549 | | | $ | 1,240,695 | |

(a) Unlimited shares authorized without par value.

7

| The accompanying notes are an integral part of these financial statements. | |

| Statements of Assets and Liabilities | Defiance ETFs |

October 31, 2024 (Unaudited)

| | | Defiance Daily

Target 2X Short

MSTR ETF |

| ASSETS: | | | |

| Investments, at value (Note 2) | | $ | 1,614,446 | |

| Deposit at broker for other investments | | | 8,587,559 | |

| Receivable for investments sold | | | 220,495 | |

| Receivable for swap contracts | | | 87,267 | |

| Interest receivable | | | 9,082 | |

| Total assets | | | 10,518,849 | |

| | | | | |

| LIABILITIES: | | | | |

| Payable for capital shares redeemed | | | 2,274,300 | |

| Payable for investments purchased | | | 1,279,740 | |

| Payable for swap contacts | | | 229,500 | |

| Payable to adviser (Note 4) | | | 5,676 | |

| Total liabilities | | | 3,789,216 | |

| NET ASSETS | | $ | 6,729,633 | |

| | | | | |

| NET ASSETS CONSISTS OF: | | | | |

| Paid-in capital | | $ | 10,956,347 | |

| Total accumulated losses | | | (4,226,714 | ) |

| Total net assets | | $ | 6,729,633 | |

| | | | | |

| Net assets | | $ | 6,729,633 | |

| Shares issued and outstanding(a) | | | 1,125,000 | |

| Net asset value per share | | $ | 5.98 | |

| | | | | |

| COST: | | | | |

| Investments, at cost | | $ | 1,614,446 | |

(a) Unlimited shares authorized without par value.

8

| The accompanying notes are an integral part of these financial statements. | |

| Statements of Operations | Defiance ETFs |

For the Period Ended October 31, 2024

| | | Defiance Daily

Target 2X Long

AVGO ETF | | Defiance Daily

Target 2X Long

LLY ETF | | Defiance Daily

Target 2X Long

MSTR ETF | | Defiance Daily

Target 2X Long

SMCI ETF | | Defiance Daily

Target 2X Long

Uranium ETF |

| INVESTMENT INCOME: | | | | | | | | | | | | | | | |

| Dividend income | | $ | 321 | | | $ | 165 | | | $ | – | | | $ | – | | | $ | 26 | |

| Interest income | | | 10,317 | | | | 2,950 | | | | 254,396 | | | | 16,946 | | | | 4,182 | |

| Total investment income | | | 10,638 | | | | 3,115 | | | | 254,396 | | | | 16,946 | | | | 4,208 | |

| | | | | | | | | | | | | | | | | | | | | |

| EXPENSES: | | | | | | | | | | | | | | | | | | | | |

| Investment advisory fee (Note 4) | | | 28,452 | | | | 12,918 | | | | 755,067 | | | | 46,554 | | | | 8,572 | |

| Interest expense | | | 837 | | | | 86 | | | | 4,432 | | | | 2,009 | | | | – | |

| Total expenses | | | 29,289 | | | | 13,004 | | | | 759,499 | | | | 48,563 | | | | 8,572 | |

| NET INVESTMENT LOSS | | | (18,651 | ) | | | (9,889 | ) | | | (505,103 | ) | | | (31,617 | ) | | | (4,364 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| REALIZED AND UNREALIZED | | | | | | | | | | | | | | | | | | | | |

| GAIN/(LOSS) | | | | | | | | | | | | | | | | | | | | |

| Net realized gain/(loss) from: | | | | | | | | | | | | | | | | | | | | |

| Investments | | | (85,468 | ) | | | (59,494 | ) | | | 7,092,365 | | | | (75,925 | ) | | | (25,907 | ) |

| Swap contracts | | | 505,406 | | | | (131,677 | ) | | | 234,366,441 | | | | (17,546,201 | ) | | | 18,035 | |

| Net realized gain/(loss) | | | 419,938 | | | | (191,171 | ) | | | 241,458,806 | | | | (17,622,126 | ) | | | (7,872 | ) |

| Net change in unrealized appreciation/(depreciation) on: | | | | | | | | | | | | | | | | | | | | |

| Investments | | | (12,321 | ) | | | (10,810 | ) | | | 3,337,884 | | | | (378,550 | ) | | | 31,222 | |

| Swap contracts | | | 1,449,787 | | | | (645,972 | ) | | | 78,099,656 | | | | (21,239,622 | ) | | | (26,162 | ) |

| Net change in unrealized appreciation/(depreciation) | | | 1,437,466 | | | | (656,782 | ) | | | 81,437,540 | | | | (21,618,172 | ) | | | 5,060 | |

| Net realized and unrealized gain/(loss) | | | 1,857,404 | | | | (847,953 | ) | | | 322,896,346 | | | | (39,240,298 | ) | | | (2,812 | ) |

| NET INCREASE/(DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 1,838,753 | | | $ | (857,842 | ) | | $ | 322,391,243 | | | $ | (39,271,915 | ) | | $ | (7,176 | ) |

9

| The accompanying notes are an integral part of these financial statements. | |

| Statements of Operations | Defiance ETFs |

For the Period Ended October 31, 2024

| | | Defiance Daily

Target 2X Short

MSTR ETF |

| INVESTMENT INCOME: | | | |

| Interest income | | $ | 14,120 | |

| Total investment income | | | 14,120 | |

| | | | | |

| EXPENSES: | | | | |

| Investment advisory fee (Note 4) | | | 9,001 | |

| Total expenses | | | 9,001 | |

| NET INVESTMENT INCOME | | | 5,119 | |

| | | | | |

| REALIZED AND UNREALIZED LOSS | | | | |

| Net realized loss from: | | | | |

| Swap contracts | | | (4,179,267 | ) |

| Net realized loss | | | (4,179,267 | ) |

| Net change in unrealized depreciation on: | | | | |

| Swap contracts | | | (52,566 | ) |

| Net change in unrealized depreciation | | | (52,566 | ) |

| Net realized and unrealized loss | | | (4,231,833 | ) |

| NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | (4,226,714 | ) |

10

| The accompanying notes are an integral part of these financial statements. | |

| Statements of Changes in Net Assets | Defiance ETFs |

| | | Defiance Daily

Target 2X Long

AVGO ETF | | Defiance Daily

Target 2X Long

LLY ETF | | Defiance Daily

Target 2X Long

MSTR ETF | | Defiance Daily

Target 2X Long

SMCI ETF |

| | | Period ended

October 31,

2024(a) | | Period ended

October 31,

2024(b) | | Period ended

October 31,

2024(c) | | Period ended

October 31,

2024(a) |

| OPERATIONS: | | | | | | | | | | | | |

| Net investment loss | | $ | (18,651 | ) | | $ | (9,889 | ) | | $ | (505,103 | ) | | $ | (31,617 | ) |

| Net realized gain/(loss) | | | 419,938 | | | | (191,171 | ) | | | 241,458,806 | | | | (17,622,126 | ) |

| Net change in unrealized appreciation/(depreciation) | | | 1,437,466 | | | | (656,782 | ) | | | 81,437,540 | | | | (21,618,172 | ) |

| Net increase/(decrease) in net assets from operations | | | 1,838,753 | | | | (857,842 | ) | | | 322,391,243 | | | | (39,271,915 | ) |

| | | | | | | | | | | | | | | | | |

| CAPITAL TRANSACTIONS: | | | | | | | | | | | | | | | | |

| Subscriptions | | | 33,938,005 | | | | 11,360,381 | | | | 446,569,493 | | | | 93,338,512 | |

| Redemptions | | | (16,490,870 | ) | | | (1,498,733 | ) | | | (219,544,590 | ) | | | (21,134,150 | ) |

| Net increase in net assets from capital transactions | | | 17,447,135 | | | | 9,861,648 | | | | 227,024,903 | | | | 72,204,362 | |

| | | | | | | | | | | | | | | | | |

| NET INCREASE IN NET ASSETS | | | 19,285,888 | | | | 9,003,806 | | | | 549,416,146 | | | | 32,932,447 | |

| | | | | | | | | | | | | | | | | |

| NET ASSETS: | | | | | | | | | | | | | | | | |

| Beginning of the period | | | – | | | | – | | | | – | | | | – | |

| End of the period | | $ | 19,285,888 | | | $ | 9,003,806 | | | $ | 549,416,146 | | | $ | 32,932,447 | |

| | | | | | | | | | | | | | | | | |

| SHARES TRANSACTIONS | | | | | | | | | | | | | | | | |

| Subscriptions | | | 1,775,000 | | | | 450,000 | | | | 17,925,000 | | | | 17,100,000 | |

| Redemptions | | | (850,000 | ) | | | (50,000 | ) | | | (6,725,000 | ) | | | (4,950,000 | ) |

| Total increase in shares outstanding | | | 925,000 | | | | 400,000 | | | | 11,200,000 | | | | 12,150,000 | |

| (a) | Inception date of the Fund was August 21, 2024. |

| (b) | Inception date of the Fund was August 7, 2024. |

| (c) | Inception date of the Fund was August 14, 2024. |

11

The accompanying notes are an integral part of these financial statements.

| Statements of Changes in Net Assets | Defiance ETFs |

| | | Defiance Daily

Target 2X Long

Uranium ETF | | Defiance Daily

Target 2X Short

MSTR ETF |

| | | Period ended

October 31,

2024(a) | | Period ended

October 31,

2024(b) |

| OPERATIONS: | | | | | | |

| Net investment income/(loss) | | $ | (4,364 | ) | | $ | 5,119 | |

| Net realized loss | | | (7,872 | ) | | | (4,179,267 | ) |

| Net change in unrealized appreciation/(depreciation) | | | 5,060 | | | | (52,566 | ) |

| Net decrease in net assets from operations | | | (7,176 | ) | | | (4,226,714 | ) |

| | | | | | | | | |

| CAPITAL TRANSACTIONS: | | | | | | | | |

| Subscriptions | | | 4,061,167 | | | | 16,338,670 | |

| Redemptions | | | – | | | | (5,382,323 | ) |

| Net increase in net assets from capital transactions | | | 4,061,167 | | | | 10,956,347 | |

| | | | | | | | | |

| NET INCREASE IN NET ASSETS | | | 4,053,991 | | | | 6,729,633 | |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of the period | | | – | | | | – | |

| End of the period | | $ | 4,053,991 | | | $ | 6,729,633 | |

| | | | | | | | | |

| SHARES TRANSACTIONS | | | | | | | | |

| Subscriptions | | | 250,000 | | | | 1,700,000 | |

| Redemptions | | | – | | | | (575,000 | ) |

| Total increase in shares outstanding | | | 250,000 | | | | 1,125,000 | |

| (a) | Inception date of the Fund was May 23, 2024. |

| (b) | Inception date of the Fund was August 20, 2024. |

12

| The accompanying notes are an integral part of these financial statements. | |

| Financial Highlights | Defiance ETFs |

For a share outstanding throughout the period presented

| Defiance Daily Target 2X Long AVGO ETF | |

| | | Period ended

October 31,

2024(a)

(Unaudited) |

| PER SHARE DATA: | | |

| | | |

| Net asset value, beginning of period | | $20.00 |

| | | |

| INVESTMENT OPERATIONS: | | |

| Net investment loss(b) | | (0.03) |

| Net realized and unrealized gain on investments(c) | | 0.88 |

| Total from investment operations | | 0.85 |

| Net asset value, end of period | | $20.85 |

| | | |

| TOTAL RETURN(d) | | 4.25% |

| | | |

| SUPPLEMENTAL DATA AND RATIOS: | | |

| Net assets, end of period (in thousands) | | $19,286 |

| Ratio of expenses to average net assets(e) | | 1.33% |

| Ratio of interest expense to average net assets(e) | | 0.04% |

| Ratio of operational expenses to average net assets excluding interest expense(e) | | 1.29% |

| Ratio of net investment loss to average net assets(e) | | (0.85)% |

| Portfolio turnover rate(d)(f) | | 396% |

| (a) | Inception date of the Fund was August 21, 2024. |

| (b) | Net investment income per share has been calculated based on average shares outstanding during the period. |

| (c) | Realized and unrealized gains and losses per share in the caption are balancing amounts necessary to reconcile the change in net asset value per share for the period, and may not reconcile with the aggregate gains and losses in the Statement of Operations due to share transactions for the period. |

| (d) | Not annualized for periods less than one year. |

| (e) | Annualized for periods less than one year. |

| (f) | Portfolio turnover rate excludes in-kind transactions. |

13

| The accompanying notes are an integral part of these financial statements. | |

| Financial Highlights | Defiance ETFs |

For a share outstanding throughout the period presented

| Defiance Daily Target 2X Long LLY ETF | |

| | | Period ended

October 31,

2024(a)

(Unaudited) |

| PER SHARE DATA: | | |

| | | |

| Net asset value, beginning of period | | $20.00 |

| | | |

| INVESTMENT OPERATIONS: | | |

| Net investment loss(b) | | (0.06) |

| Net realized and unrealized gain on investments(c) | | 2.57 |

| Total from investment operations | | 2.51 |

| Net asset value, end of period | | $22.51 |

| | | |

| TOTAL RETURN(d) | | 12.55% |

| | | |

| SUPPLEMENTAL DATA AND RATIOS: | | |

| Net assets, end of period (in thousands) | | $9,004 |

| Ratio of expenses to average net assets(e) | | 1.30% |

| Ratio of interest expense to average net assets(e) | | 0.01% |

| Ratio of operational expenses to average net assets excluding interest expense(e) | | 1.29% |

| Ratio of net investment loss to average net assets(e) | | (0.99)% |

| Portfolio turnover rate(d)(f) | | 397% |

| (a) | Inception date of the Fund was August 7, 2024. |

| (b) | Net investment income per share has been calculated based on average shares outstanding during the period. |

| (c) | Realized and unrealized gains and losses per share in the caption are balancing amounts necessary to reconcile the change in net asset value per share for the period, and may not reconcile with the aggregate gains and losses in the Statement of Operations due to share transactions for the period. |

| (d) | Not annualized for periods less than one year. |

| (e) | Annualized for periods less than one year. |

| (f) | Portfolio turnover rate excludes in-kind transactions. |

14

| The accompanying notes are an integral part of these financial statements. | |

| Financial Highlights | Defiance ETFs |

For a share outstanding throughout the period presented

| Defiance Daily Target 2X Long MSTR ETF | |

| | | Period ended

October 31,

2024(a)

(Unaudited) |

| PER SHARE DATA: | | |

| | | |

| Net asset value, beginning of period | | $20.00 |

| | | |

| INVESTMENT OPERATIONS: | | |

| Net investment loss(b) | | (0.05) |

| Net realized and unrealized gain on investments(c) | | 29.11 |

| Total from investment operations | | 29.06 |

| Net asset value, end of period | | $49.06 |

| | | |

| TOTAL RETURN(d) | | 145.30% |

| | | |

| SUPPLEMENTAL DATA AND RATIOS: | | |

| Net assets, end of period (in thousands) | | $549,416 |

| Ratio of expenses to average net assets(e) | | 1.30% |

| Ratio of interest expense to average net assets(e) | | 0.01% |

| Ratio of operational expenses to average net assets excluding interest expense(e) | | 1.29% |

| Ratio of net investment loss to average net assets(e) | | (0.86)% |

| Portfolio turnover rate(d)(f) | | 666% |

| (a) | Inception date of the Fund was August 14, 2024. |

| (b) | Net investment income per share has been calculated based on average shares outstanding during the period. |

| (c) | Realized and unrealized gains and losses per share in the caption are balancing amounts necessary to reconcile the change in net asset value per share for the period, and may not reconcile with the aggregate gains and losses in the Statement of Operations due to share transactions for the period. |

| (d) | Not annualized for periods less than one year. |

| (e) | Annualized for periods less than one year. |

| (f) | Portfolio turnover rate excludes in-kind transactions. |

15

The accompanying notes are an integral part of these financial statements.

| Financial Highlights | Defiance ETFs |

For a share outstanding throughout the period presented

| Defiance Daily Target 2X Long SMCI ETF | |

| | | Period

ended

October 31,

2024(a)

(Unaudited) |

| PER SHARE DATA: | | |

| | | |

| Net asset value, beginning of period | | $20.00 |

| | | |

| INVESTMENT OPERATIONS: | | |

| Net investment loss(b) | | (0.02) |

| Net realized and unrealized loss on investments(c) | | (17.27) |

| Total from investment operations | | (17.29) |

| Net asset value, end of period | | $2.71 |

| | | |

| TOTAL RETURN(d) | | -86.45% |

| | | |

| SUPPLEMENTAL DATA AND RATIOS: | | |

| Net assets, end of period (in thousands) | | $32,932 |

| Ratio of expenses to average net assets(e) | | 1.35% |

| Ratio of interest expense to average net assets(e) | | 0.06% |

| Ratio of operational expenses to average net assets excluding interest expense(e) | | 1.29% |

| Ratio of net investment loss to average net assets(e) | | (0.88)% |

| Portfolio turnover rate(d)(f) | | 400% |

| (a) | Inception date of the Fund was August 21, 2024. |

| (b) | Net investment income per share has been calculated based on average shares outstanding during the period. |

| (c) | Realized and unrealized gains and losses per share in the caption are balancing amounts necessary to reconcile the change in net asset value per share for the period, and may not reconcile with the aggregate gains and losses in the Statement of Operations due to share transactions for the period. |

| (d) | Not annualized for periods less than one year. |

| (e) | Annualized for periods less than one year. |

| (f) | Portfolio turnover rate excludes in-kind transactions. |

16

The accompanying notes are an integral part of these financial statements.

| Financial Highlights | Defiance ETFs |

For a share outstanding throughout the period presented

Defiance Daily Target 2X Long Uranium ETF

| | | Period

ended

October 31,

2024(a)

(Unaudited) |

| PER SHARE DATA: | | |

| | | |

| Net asset value, beginning of period | | $20.00 |

| | | |

| INVESTMENT OPERATIONS: | | |

| Net investment loss(b)(c) | | (0.03) |

| Net realized and unrealized loss on investments(d) | | (3.75) |

| Total from investment operations | | (3.78) |

| Net asset value, end of period | | $16.22 |

| | | |

| TOTAL RETURN(e) | | -18.90% |

| | | |

| SUPPLEMENTAL DATA AND RATIOS: | | |

| Net assets, end of period (in thousands) | | $4,054 |

| Ratio of expenses to average net assets(f)(g) | | 0.95% |

| Ratio of net investment loss to average net assets(f)(g) | | (0.47)% |

| Portfolio turnover rate(e)(h) | | 791% |

| (a) | Inception date of the Fund was May 23, 2024. |

| (b) | Net investment income per share has been calculated based on average shares outstanding during the period. |

| (c) | Recognition of net investment income by the Fund is affected by the timing of the declaration of dividends by the underlying exchange traded funds in which the Fund invests. The ratio does not include net investment income of the exchange traded funds in which the Fund invests. |

| (d) | Realized and unrealized gains and losses per share in the caption are balancing amounts necessary to reconcile the change in net asset value per share for the period, and may not reconcile with the aggregate gains and losses in the Statement of Operations due to share transactions for the period. |

| (e) | Not annualized for periods less than one year. |

| (f) | Annualized for periods less than one year. |

| (g) | These ratios exclude the impact of expenses of the underlying exchange traded funds as represented in the Schedule of Investments. |

| (h) | Portfolio turnover rate excludes in-kind transactions. |

17

The accompanying notes are an integral part of these financial statements.

| Financial Highlights | Defiance ETFs |

For a share outstanding throughout the period presented

| Defiance Daily Target 2X Short MSTR ETF | |

| | | Period

ended

October 31,

2024(a)

(Unaudited) |

| PER SHARE DATA: | | |

| | | |

| Net asset value, beginning of period | | $20.00 |

| | | |

| INVESTMENT OPERATIONS: | | |

| Net investment income(b) | | 0.01 |

| Net realized and unrealized loss on investments(c) | | (14.03) |

| Total from investment operations | | (14.02) |

| Net asset value, end of period | | $5.98 |

| | | |

| TOTAL RETURN(d) | | -70.10% |

| | | |

| SUPPLEMENTAL DATA AND RATIOS: | | |

| Net assets, end of period (in thousands) | | $6,730 |

| Ratio of expenses to average net assets(e) | | 1.29% |

| Ratio of net investment income to average net assets(e) | | 0.73% |

| Portfolio turnover rate(d)(f) | | 0% |

| (a) | Inception date of the Fund was August 20, 2024. |

| (b) | Net investment income per share has been calculated based on average shares outstanding during the period. |

| (c) | Realized and unrealized gains and losses per share in the caption are balancing amounts necessary to reconcile the change in net asset value per share for the period, and may not reconcile with the aggregate gains and losses in the Statement of Operations due to share transactions for the period. |

| (d) | Not annualized for periods less than one year. |

| (e) | Annualized for periods less than one year. |

| (f) | Portfolio turnover rate excludes in-kind transactions. |

18

The accompanying notes are an integral part of these financial statements.

| Notes to Financial Statements | Defiance ETFs |

| October 31, 2024 (Unaudited) | |

The Defiance ETFs (defined below) (each a “Fund”, and collectively the “Funds”) are each a non-diversified series of Tidal Trust II (the “Trust”). The Trust was organized as a Delaware statutory trust on January 13, 2022. The Trust is registered with the Securities and Exchange Commission (the “SEC”) under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open -end management investment company and the offering of the Funds’ shares (“Shares”) is registered under the Securities Act of 1933 , as amended. The Trust is governed by the Board of Trustees (the “Board”). Tidal Investments LLC (“Tidal Investments” or the “Adviser”), a Tidal Financial Group company, serves as investment adviser to the Funds. Each Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946 “Financial Services – Investment Companies”.

| Fund: | Commencement Date: |

| Defiance Daily Target 2X Long AVGO ETF (the “AVGX ETF”) | August 21, 2024 |

| Defiance Daily Target 2X Long LLY ETF (the “LLYX ETF”) | August 7, 2024 |

| Defiance Daily Target 2X Long MSTR ETF (the “MSTX ETF”) | August 14, 2024 |

| Defiance Daily Target 2X Long SMCI ETF (the “SMCX ETF”) | August 21, 2024 |

| Defiance Daily Target 2X Long Uranium ETF (the “URAX ETF”) | May 23, 2024 |

| Defiance Daily Target 2X Short MSTR ETF (the “SMST ETF”) | August 20, 2024 |

The AVGX ETF’s primary investment objective is to seek daily investment results, before fees and expenses, of 2 times (200%) the daily percentage change in the share price of Broadcom, Inc.

The LLYX ETF’s primary investment objective is to seek daily investment results, before fees and expenses, of 2 times (200%) the daily percentage change in the share price of Eli Lilly & Co.

The MSTX ETF’s primary investment objective is to seek seeks daily investment results, before fees and expenses, of 2 times (200%) the daily percentage change in the share price of Microstrategy, Inc.

The SMCX ETF’s primary investment objective is to seek daily investment results, before fees and expenses, of 2 times (200%) the daily percentage change in the share price of Super Micro Computer, Inc.

The URAX ETF’s primary investment objective is to seek daily investment results, before fees and expenses, of 2 times (200%) the daily percentage change in the share price of the Global X Uranium ETF.

The SMST ETF’s primary investment objective is to seek daily inverse investment results, before fees and expenses, of -2 times (-200%) the daily percentage change in the share price of Microstrategy, Inc.

Broadcom, Inc. (“AVGO”), Eli Lilly & Co. (“LLY”), Microstrategy, Inc. (“MSTR”), Super Micro Computer, Inc. (“SMCI”) , and Global X Uranium ETF (“URA”) (each an “Underlying Security” and collectively the “Underlying Securities”).

| NOTE 2 – SIGNIFICANT ACCOUNTING POLICIES |

The following is a summary of significant accounting policies consistently followed by the Funds. These policies are in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”).

A. Security Valuation. Equity securities that are listed on a securities exchange, market or automated quotation system for which quotations are readily available (except for securities traded on the NASDAQ Stock Market, LLC (“NASDAQ”)), including securities traded over-the-counter, are valued at the last quoted sale price on the primary exchange or market (foreign or domestic) on which they are traded on the valuation date (or at approximately 4:00 p.m. EST if a security’s primary exchange is normally open at that time), or, if there is no such reported sale on the valuation date, at the most recent quoted bid price or mean between the most recent quoted bid and ask prices for long and short positions. For a security that trades on multiple exchanges, the primary exchange will generally be considered the exchange on which the security is generally most actively traded. For securities traded on NASDAQ, the NASDAQ Official Closing Price will be used. Prices of securities traded on the securities exchange will be obtained from recognized independent pricing agents each day that the Funds are open for business.

Debt securities are valued by using an evaluated mean of the bid and asked prices provided by independent pricing agents. The independent pricing agents may employ methodologies that utilize actual market transactions (if the security is actively traded), broker dealer supplied valuations, or other methodologies designed to identify the market value for such securities. In arriving at valuations,

| Notes to Financial Statements | Defiance ETFs |

| October 31, 2024 (Unaudited) | |

such methodologies generally consider factors such as security prices, yields, maturities, call features, ratings and developments relating to specific securities.

Options contracts are valued using the mean/mid of quoted bid and ask spread prices, as provided by independent pricing vendors.

Swap contracts, such as credit default swaps, total return swaps, interest rate swaps, currency swaps and swaptions, are priced by an approved independent pricing service. The independent pricing service includes observable market data inputs in an evaluated valuation methodology.

Under Rule 2a-5 of the 1940 Act, a fair value will be determined for securities for which quotations are not readily available by the Valuation Designee (as defined in Rule 2a-5) in accordance with the Pricing and Valuation Policy and Fair Value Procedures, as applicable, of the Adviser, subject to oversight by the Board. When a security is “fair valued,” consideration is given to the facts and circumstances relevant to the particular situation, including a review of various factors set forth in the Adviser’s Pricing and Valuation Policy and Fair Value Procedures, as applicable. Fair value pricing is an inherently subjective process, and no single standard exists for determining fair value. Different funds could reasonably arrive at different values for the same security. The use of fair value pricing by a fund may cause the net asset value (“NAV”) of its shares to differ significantly from the NAV that would be calculated without regard to such considerations.

As described above, the Funds utilize various methods to measure the fair value of its investments on a recurring basis. U.S. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of inputs are:

Level 1 – Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access.

Level 2 – Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Level 3 – Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available; representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability and would be based on the best information available.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

The following is a summary of the inputs used to value each Fund’s investments as of October 31, 2024:

AVGX ETF

| | | Level 1 | | Level 2 | | Level 3 | | Total |

| Assets: | | | | | | | | | | | | | | | | |

| Investments: | | | | | | | | | | | | | | | | |

| Common Stocks | | $ | 914,382 | | | $ | – | | | $ | – | | | $ | 914,382 | |

| Money Market Funds | | | 4,087,215 | | | | – | | | | – | | | | 4,087,215 | |

| Total Investments | | $ | 5,001,597 | | | $ | – | | | $ | – | | | $ | 5,001,597 | |

| | | | | | | | | | | | | | | | | |

| Other Financial Instruments*: | | | | | | | | | | | | | | | | |

| Total Return Swaps | | | 1,525,756 | | | | – | | | | – | | | | 1,525,756 | |

| Total Other Financial Instruments | | $ | 1,525,756 | | | $ | – | | | $ | – | | | $ | 1,525,756 | |

| Notes to Financial Statements | Defiance ETFs |

| October 31, 2024 (Unaudited) | |

| Liabilities: | | | | | | | | |

| Other Financial Instruments*: | | | | | | | | | | | | | | | | |

| Total Return Swaps | | $ | (73,861 | ) | | $ | – | | | $ | – | | | $ | (73,861 | ) |

| Total Other Financial Instruments | | $ | (73,861 | ) | | $ | – | | | $ | – | | | $ | (73,861 | ) |

LLYX ETF

| | | Level 1 | | Level 2 | | Level 3 | | Total |

| Assets: | | | | | | | | | | | | | | | | |

| Investments: | | | | | | | | | | | | | | | | |

| Common Stocks | | $ | 452,208 | | | $ | – | | | $ | – | | | $ | 452,208 | |

| Money Market Funds | | | 418,690 | | | | – | | | | – | | | | 418,690 | |

| Total Investments | | $ | 870,898 | | | $ | – | | | $ | – | | | $ | 870,898 | |

| | | | | | | | | | | | | | | | | |

| Liabilities: | | | | | | | | | | | | | | | | |

| Other Financial Instruments*: | | | | | | | | | | | | | | | | |

| Total Return Swaps | | $ | (645,972 | ) | | $ | – | | | $ | – | | | $ | (645,972 | ) |

| Total Other Financial Instruments | | $ | (645,972 | ) | | $ | – | | | $ | – | | | $ | (645,972 | ) |

MSTX ETF

| | | Level 1 | | Level 2 | | Level 3 | | Total |

| Assets: | | | | | | | | | | | | | | | | |

| Investments: | | | | | | | | | | | | | | | | |

| Common Stocks | | $ | 34,668,877 | | | $ | – | | | $ | – | | | $ | 34,668,877 | |

| Money Market Funds | | | 56,217,445 | | | | – | | | | – | | | | 56,217,445 | |

| Total Investments | | $ | 90,886,322 | | | $ | – | | | $ | – | | | $ | 90,886,322 | |

| | | | | | | | | | | | | | | | | |

| Other Financial Instruments*: | | | | | | | | | | | | | | | | |

| Total Return Swaps | | $ | 77,631,119 | | | $ | – | | | $ | – | | | $ | 77,631,119 | |

| Total Other Financial Instruments | | $ | 77,631,119 | | | $ | – | | | $ | – | | | $ | 77,631,119 | |

| | | | | | | | | | | | | | | | | |

| Liabilities: | | | | | | | | | | | | | | | | |

| Other Financial Instruments*: | | | | | | | | | | | | | | | | |

| Total Return Swaps | | $ | (867,386 | ) | | $ | – | | | $ | – | | | $ | (867,386 | ) |

| Total Other Financial Instruments | | $ | (867,386 | ) | | $ | – | | | $ | – | | | $ | (867,386 | ) |

SMCX ETF

| | | Level 1 | | Level 2 | | Level 3 | | Total |

| Assets: | | | | | | | | | | | | | | | | |

| Investments: | | | | | | | | | | | | | | | | |

| Common Stocks | | $ | 2,610,497 | | | $ | – | | | $ | – | | | $ | 2,610,497 | |

| Money Market Funds | | | 2,280,502 | | | | – | | | | – | | | | 2,280,502 | |

| Total Investments | | $ | 4,890,999 | | | $ | – | | | $ | – | | | $ | 4,890,999 | |

| | | | | | | | | | | | | | | | | |

| Liabilities: | | | | | | | | | | | | | | | | |

| Other Financial Instruments*: | | | | | | | | | | | | | | | | |

| Total Return Swaps | | $ | (21,001,912 | ) | | $ | – | | | $ | – | | | $ | (21,001,912 | ) |

| Total Other Financial Instruments | | $ | (21,001,912 | ) | | $ | – | | | $ | – | | | $ | (21,001,912 | ) |

| Notes to Financial Statements | Defiance ETFs |

| October 31, 2024 (Unaudited) | |

URAX ETF

| | | Level 1 | | Level 2 | | Level 3 | | Total |

| Assets: | | | | | | | | | | | | | | | | |

| Investments: | | | | | | | | | | | | | | | | |

| Exchange Traded Funds | | $ | 236,743 | | | $ | – | | | $ | – | | | $ | 236,743 | |

| Money Market Funds | | | 1,035,174 | | | | – | | | | – | | | | 1,035,174 | |

| Total Investments | | $ | 1,271,917 | | | $ | – | | | $ | – | | | $ | 1,271,917 | |

| | | | | | | | | | | | | | | | | |

| Liabilities: | | | | | | | | | | | | | | | | |

| Other Financial Instruments*: | | | | | | | | | | | | | | | | |

| Total Return Swaps | | $ | (26,162 | ) | | $ | – | | | $ | – | | | $ | (26,162 | ) |

| Total Other Financial Instruments | | $ | (26,162 | ) | | $ | – | | | $ | – | | | $ | (26,162 | ) |

SMST ETF

| | | Level 1 | | Level 2 | | Level 3 | | Total |

| Assets: | | | | | | | | | | | | | | | | |

| Investments: | | | | | | | | | | | | | | | | |

| Money Market Funds | | $ | 1,614,446 | | | $ | – | | | $ | – | | | $ | 1,614,446 | |

| Total Investments | | $ | 1,614,446 | | | $ | – | | | $ | – | | | $ | 1,614,446 | |

| | | | | | | | | | | | | | | | | |

| Other Financial Instruments*: | | | | | | | | | | | | | | | | |

| Total Return Swaps | | $ | 92,144 | | | $ | – | | | $ | – | | | $ | 92,144 | |

| Total Other Financial Instruments | | $ | 92,144 | | | $ | – | | | $ | – | | | $ | 92,144 | |

| | | | | | | | | | | | | | | | | |

| Liabilities: | | | | | | | | | | | | | | | | |

| Other Financial Instruments*: | | | | | | | | | | | | | | | | |

| Total Return Swaps | | $ | (144,246 | ) | | $ | – | | | $ | – | | | $ | (144,246 | ) |

| Total Other Financial Instruments | | $ | (144,246 | ) | | $ | – | | | $ | – | | | $ | (144,246 | ) |

* The fair value of each Fund’s investment represents the net unrealized appreciation (depreciation) as of October 31, 2024.

Refer to the Schedules of Investments for further disaggregation of investment categories.

B. Derivative Instruments. As the buyer of a call option, the Funds have a right to buy the underlying reference instrument (e.g., a currency or security) at the exercise price at any time during the option period (for American style options). The Funds may enter into closing sale transactions with respect to call options, exercise them, or permit them to expire. For example, the Funds may buy call options on underlying reference instruments that they intend to buy with the goal of limiting the risk of a substantial increase in its market price before the purchase is effected. Unless the price of the underlying reference instrument changes sufficiently, a call option purchased by the Funds may expire without any value to the Funds, in which case the Funds would experience a loss to the extent of the premium paid for the option plus related transaction costs.

| Notes to Financial Statements | Defiance ETFs |

| October 31, 2024 (Unaudited) | |

As the buyer of a put option, the Funds have the right to sell the underlying reference instrument at the exercise price at any time during the option period (for American style options). Like a call option, the Funds may enter into closing sale transactions with respect to put options, exercise them or permit them to expire. The Funds may buy a put option on an underlying reference instrument owned by the Funds (a protective put) as a hedging technique in an attempt to protect against an anticipated decline in the market value of the underlying reference instrument. Such hedge protection is provided only during the life of the put option when the Funds, as the buyer of the put option, are able to sell the underlying reference instrument at the put exercise price, regardless of any decline in the underlying instrument’s market price. The Funds may also seek to offset a decline in the value of the underlying reference instrument through appreciation in the value of the put option. A put option may also be purchased with the intent of protecting unrealized appreciation of an instrument when the Adviser deems it desirable to continue to hold the instrument because of tax or other considerations. The premium paid for the put option and any transaction costs would reduce any short-term capital gain that may be available for distribution when the instrument is eventually sold. Buying put options at a time when the buyer does not own the underlying reference instrument allows the buyer to benefit from a decline in the market price of the underlying reference instrument, which generally increases the value of the put option.

If a put option was not terminated in a closing sale transaction when it has remaining value, and if the market price of the underlying reference instrument remains equal to or greater than the exercise price during the life of the put option, the buyer would not make any gain upon exercise of the option and would experience a loss to the extent of the premium paid for the option plus related transaction costs. In order for the purchase of a put option to be profitable, the market price of the underlying reference instrument must decline sufficiently below the exercise price to cover the premium and transaction costs.

Writing options may permit the writer to generate additional income in the form of the premium received for writing the option. The writer of an option may have no control over when the underlying reference instruments must be sold (in the case of a call option) or purchased (in the case of a put option) because the writer may be notified of exercise at any time prior to the expiration of the option (for American style options). In general, though, options are infrequently exercised prior to expiration. Whether or not an option expires unexercised, the writer retains the amount of the premium. Writing “covered” call options means that the writer owns the underlying reference instrument that is subject to the call option. Call options may also be written on reference instruments that the writer does not own.