UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number (811-23793)

Tidal Trust II

(Exact name of registrant as specified in charter)

234 West Florida Street, Suite 203

Milwaukee, Wisconsin 53204

(Address of principal executive offices) (Zip code)

Eric W. Falkeis

Tidal Trust II

234 West Florida Street, Suite 203

Milwaukee, Wisconsin 53204

(Name and address of agent for service)

(844) 986-7700

Registrant’s telephone number, including area code

Date of fiscal year end: January 31

Date of reporting period: July 31, 2024

Item 1. Reports to Stockholders.

Return Stacked Bonds & Managed Futures ETF Tailored Shareholder Report

Return Stacked Bonds & Managed Futures ETF Tailored Shareholder Report

semi-annual Shareholder Report July 31, 2024 Return Stacked Bonds & Managed Futures ETF Return Stacked Bonds & Managed Futures ETF Ticker: RSBT (Listed on CBOE) |

This semi-annual shareholder report contains important information about the Return Stacked Bonds & Managed Futures ETF (the "Fund") for the period January 31, 2024 to July 31, 2024. You can find additional information about the Fund at https://www.returnstackedetfs.com. You can also request this information by contacting us at (844) 737-3001 or by sending an email request to info@returnstackedetfs.com.

What were the Fund costs for the past six months?

(based on a hypothetical $10,000 investment)

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Return Stacked Bonds & Managed Futures ETF | $47 | 0.94% |

Key Fund Statistics

(as of July 31, 2024)

| |

|---|

Fund Size (Thousands) | $90,987 |

Number of Holdings | 28 |

Portfolio Turnover | 41% |

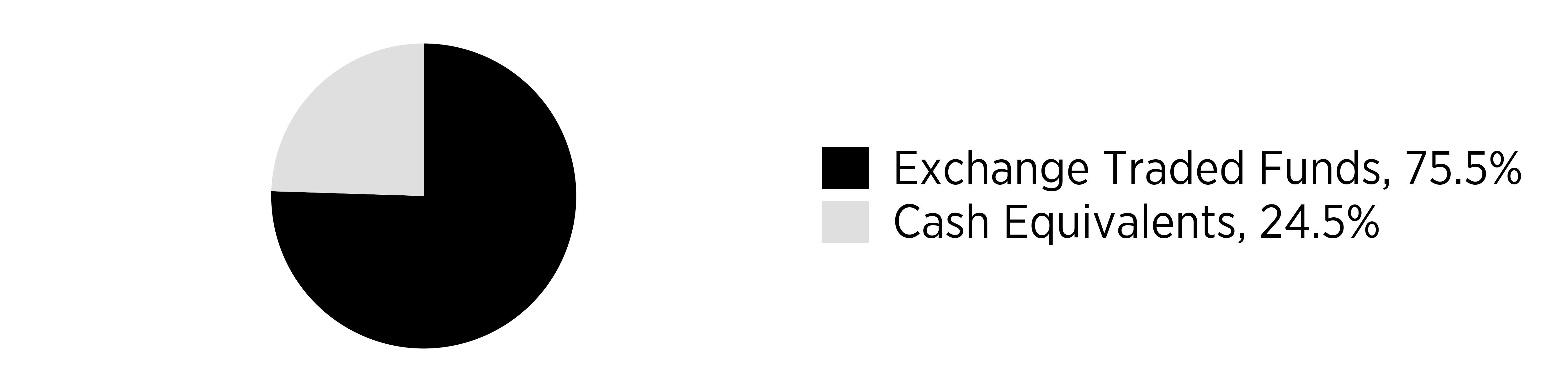

Security Type (% of net assets)

Security | % of Total Net Assets |

Exchange Traded Funds | 0.497 |

Cash & Cash Equivalents | 0.503 |

Other Financial Instruments Security Type

(% of net assets)

ALLOCATION OF OTHER FINANCIAL INSTRUMENTS Security Type | % of Total Net Assets |

Open Futures Contracts Purchased | 0.1% |

Open Futures Contracts Sold | -0.9% |

Percentages are based on total net assets. Percentages for futures contracts are based unrealized appreciation (depreciation). Cash & Cash Equivalents represents short-term investments, cash and other assets in excess of liabilities.

What did the Fund invest in?

(as of July 31, 2024)

Top Ten Holdings | (% of net assets) |

|---|

iShares Core U.S. Aggregate Bond ETF | 49.7 |

U.S. Treasury 5 Year Note Futures Contracts | 0.5 |

Natural Gas Futures Contracts | 0.2 |

U.S. Treasury Long Bonds Futures Contracts | 0.1 |

FTSE 100 Index Futures Contracts | 0.1 |

S&P/Toronto Stock Exchange 60 Index Futures Contracts | 0.1 |

Gold Futures Contracts | 0.1 |

Long Gilt Futures Contracts | 0.0 |

Crude Oil Futures Contracts | 0.0 |

Euro/US Dollar Cross Currency Rate Futures Contracts | 0.0 |

How has the Fund changed?

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants.

Householding

Householding is an option available to certain investors of the Fund. Householding is a method of delivery, based on the preference of the individual investor, in which a single copy of certain shareholder documents can be delivered to investors who share the same address, even if their accounts are registered under different names. Householding for the Fund is available through certain broker-dealers. If you are interested in enrolling in householding and receiving a single copy of prospectuses and other shareholder documents, please contact your broker-dealer. If you are currently enrolled in householding and wish to change your householding status, please contact your broker-dealer.

For additional information about the Fund, including its prospectus, financial information, holdings and proxy voting information, visit https://www.returnstackedetfs.com.

Return Stacked Global Stocks & Bonds ETF Tailored Shareholder Report

Return Stacked Global Stocks & Bonds ETF Tailored Shareholder Report

semi-annual Shareholder Report July 31, 2024 Return Stacked Global Stocks & Bonds ETF Return Stacked Global Stocks & Bonds ETF Ticker: RSSB (Listed on CBOE) |

This semi-annual shareholder report contains important information about the Return Stacked Global Stocks & Bonds ETF (the "Fund") for the period January 31, 2024 to July 31, 2024. You can find additional information about the Fund at https://www.returnstackedetfs.com. You can also request this information by contacting us at (844) 737-3001 or by sending an email request to info@returnstackedetfs.com.

What were the Fund costs for the past six months?

(based on a hypothetical $10,000 investment)

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Return Stacked Global Stocks & Bonds ETF | $17 | 0.35% |

Key Fund Statistics

(as of July 31, 2024)

| |

|---|

Fund Size (Thousands) | $178,102 |

Number of Holdings | 8 |

Portfolio Turnover | 3% |

Security Type (% of net assets)

Security | % of Total Net Assets |

Exchange Traded Funds | 0.888 |

Cash Equivalents | 0.112 |

Other Financial Instruments Security Type

(% of net assets)

ALLOCATION OF OTHER FINANCIAL INSTRUMENTS Security Type | % of Total Net Assets |

Open Futures Contracts Purchased | 1.6% |

Percentages are based on total net assets. Percentages for futures contracts are based unrealized appreciation (depreciation). Cash Equivalents represents short-term investments and other assets in excess of liabilities.

What did the Fund invest in?

(as of July 31, 2024)

Top Holdings | (% of net assets) |

|---|

Vanguard Total Stock Market ETF | 53.9 |

Vanguard Total International Stock ETF | 34.9 |

U.S. Treasury Long Bonds Futures Contracts | 0.5 |

U.S. Treasury 10 Year Notes Futures Contracts | 0.5 |

U.S. Treasury 5 Year Note Futures Contracts | 0.3 |

U.S. Treasury 2 Year Notes Futures Contracts | 0.2 |

S&P 500 Index Futures Contracts | 0.1 |

How has the Fund changed?

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants.

Householding

Householding is an option available to certain investors of the Fund. Householding is a method of delivery, based on the preference of the individual investor, in which a single copy of certain shareholder documents can be delivered to investors who share the same address, even if their accounts are registered under different names. Householding for the Fund is available through certain broker-dealers. If you are interested in enrolling in householding and receiving a single copy of prospectuses and other shareholder documents, please contact your broker-dealer. If you are currently enrolled in householding and wish to change your householding status, please contact your broker-dealer.

For additional information about the Fund, including its prospectus, financial information, holdings and proxy voting information, visit https://www.returnstackedetfs.com.

Return Stacked U.S. Stocks & Futures Yield ETF Tailored Shareholder Report

Return Stacked U.S. Stocks & Futures Yield ETF Tailored Shareholder Report

semi-annual Shareholder Report July 31, 2024 Return Stacked U.S. Stocks & Futures Yield ETF Return Stacked U.S. Stocks & Futures Yield ETF Ticker: RSSY (Listed on CBOE) |

This semi-annual shareholder report contains important information about the Return Stacked U.S. Stocks & Futures Yield ETF (the "Fund") for the period May 28, 2024 to July 31, 2024. You can find additional information about the Fund at https://www.returnstackedetfs.com. You can also request this information by contacting us at (844) 737-3001 or by sending an email request to info@returnstackedetfs.com.

What were the Fund costs for the past six months?

(based on a hypothetical $10,000 investment)

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Return Stacked U.S. Stocks & Futures Yield ETF | $17 | 0.95% |

The Fund commenced operations on May 28, 2024. Expenses for a full reporting period would be higher than the figures shown.

Key Fund Statistics

(as of July 31, 2024)

| |

|---|

Fund Size (Thousands) | $148,634 |

Number of Holdings | 28 |

Portfolio Turnover | 14% |

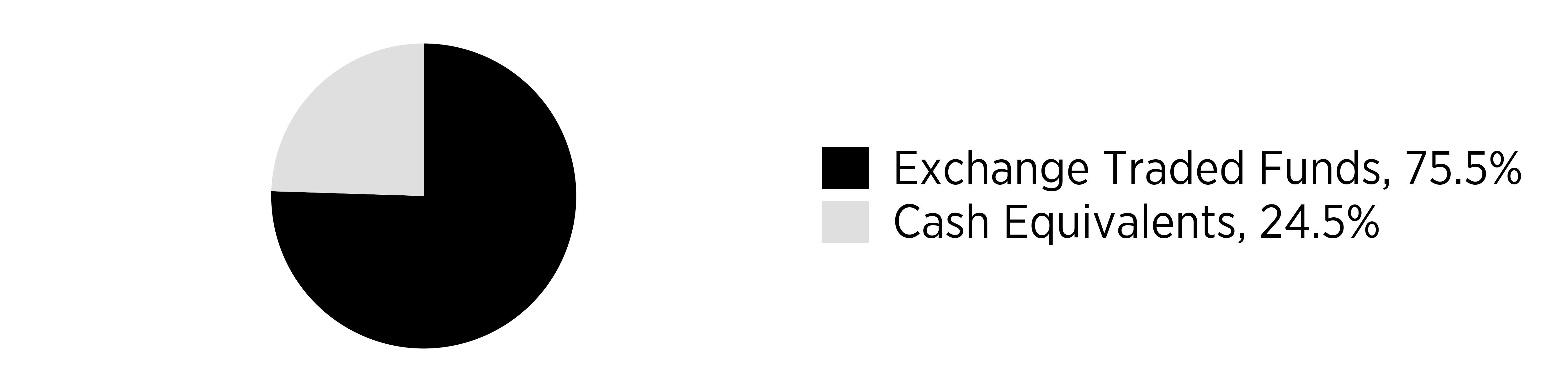

Security Type (% of net assets)

Security | % of Total Net Assets |

Exchange Traded Funds | 0.755 |

Cash Equivalents | 0.245 |

Other Financial Instruments Security Type

(% of net assets)

ALLOCATION OF OTHER FINANCIAL INSTRUMENTS Security Type | % of Total Net Assets |

Open Futures Contracts Purchased | 0.5% |

Open Futures Contracts Sold | -1.7% |

Percentages are based on total net assets. Percentages for futures contracts are based unrealized appreciation (depreciation). Cash Equivalents represents short-term investments and other assets in excess of liabilities.

What did the Fund invest in?

(as of July 31, 2024)

Top Ten Holdings | (% of net assets) |

|---|

iShares Core S&P 500 ETF | 75.5 |

Long Gilt Futures Contracts | 1.0 |

Canadian Dollar/US Dollar Cross Currency Rate Futures Contracts | 0.4 |

Natural Gas Futures Contracts | 0.2 |

Copper Futures Contracts | 0.1 |

Brent Crude Oil Futures Contracts | 0.1 |

S&P 500 Index Futures Contracts | 0.1 |

Low Sulphur Gas Oil Futures Contracts | 0.0 |

S&P/Toronto Stock Exchange 60 Index Futures Contracts | 0.0 |

Euro STOXX 50 Quanto Index Futures Contracts | 0.0 |

How has the Fund changed?

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants.

Householding

Householding is an option available to certain investors of the Fund. Householding is a method of delivery, based on the preference of the individual investor, in which a single copy of certain shareholder documents can be delivered to investors who share the same address, even if their accounts are registered under different names. Householding for the Fund is available through certain broker-dealers. If you are interested in enrolling in householding and receiving a single copy of prospectuses and other shareholder documents, please contact your broker-dealer. If you are currently enrolled in householding and wish to change your householding status, please contact your broker-dealer.

For additional information about the Fund, including its prospectus, financial information, holdings and proxy voting information, visit https://www.returnstackedetfs.com.

Return Stacked U.S. Stocks & Managed Futures ETF Tailored Shareholder Report

Return Stacked U.S. Stocks & Managed Futures ETF Tailored Shareholder Report

semi-annual Shareholder Report July 31, 2024 Return Stacked U.S. Stocks & Managed Futures ETF Return Stacked U.S. Stocks & Managed Futures ETF Ticker: RSST (Listed on CBOE) |

This semi-annual shareholder report contains important information about the Return Stacked U.S. Stocks & Managed Futures ETF (the "Fund") for the period January 31, 2024 to July 31, 2024. You can find additional information about the Fund at https://www.returnstackedetfs.com. You can also request this information by contacting us at (844) 737-3001 or by sending an email request to info@returnstackedetfs.com.

What were the Fund costs for the past six months?

(based on a hypothetical $10,000 investment)

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Return Stacked U.S. Stocks & Managed Futures ETF | $47 | 0.95% |

Key Fund Statistics

(as of July 31, 2024)

| |

|---|

Fund Size (Thousands) | $195,861 |

Number of Holdings | 28 |

Portfolio Turnover | 54% |

Security Type (% of net assets)

Security | % of Total Net Assets |

Exchange Traded Funds | 0.743 |

Cash Equivalents | 0.257 |

Other Financial Instruments Security Type

(% of net assets)

ALLOCATION OF OTHER FINANCIAL INSTRUMENTS Security Type | % of Total Net Assets |

Open Futures Contracts Purchased | -0.1% |

Open Futures Contracts Sold | -0.9% |

Percentages are based on total net assets. Percentages for futures contracts are based unrealized appreciation (depreciation). Cash Equivalents represents short-term investments and other assets in excess of liabilities.

What did the Fund invest in?

(as of July 31, 2024)

Top Ten Holdings | (% of net assets) |

|---|

iShares Core S&P 500 ETF | 74.3 |

U.S. Treasury 5 Year Note Futures Contracts | 0.3 |

Natural Gas Futures Contracts | 0.1 |

FTSE 100 Index Futures Contracts | 0.1 |

S&P/Toronto Stock Exchange 60 Index Futures Contracts | 0.1 |

Gold Futures Contracts | 0.1 |

Long Gilt Futures Contracts | 0.0 |

Crude Oil Futures Contracts | 0.0 |

Euro/US Dollar Cross Currency Rate Futures Contracts | 0.0 |

U.S. Treasury Long Bonds Futures Contracts | 0.0 |

How has the Fund changed?

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants.

Householding

Householding is an option available to certain investors of the Fund. Householding is a method of delivery, based on the preference of the individual investor, in which a single copy of certain shareholder documents can be delivered to investors who share the same address, even if their accounts are registered under different names. Householding for the Fund is available through certain broker-dealers. If you are interested in enrolling in householding and receiving a single copy of prospectuses and other shareholder documents, please contact your broker-dealer. If you are currently enrolled in householding and wish to change your householding status, please contact your broker-dealer.

For additional information about the Fund, including its prospectus, financial information, holdings and proxy voting information, visit https://www.returnstackedetfs.com.

Item 2. Code of Ethics.

Not applicable for semi-annual reports.

Item 3. Audit Committee Financial Expert.

Not applicable for semi-annual reports.

Item 4. Principal Accountant Fees and Services.

Not applicable for semi-annual reports.

Item 5. Audit Committee of Listed Registrants.

Not applicable for semi-annual reports.

Item 6. Investments.

| (a) | Schedule of Investments is included within the financial statements filed under Item 7 of this Form. |

Item 7. Financial Statements and Financial Highlights for Open-End Investment Companies.

Core Financial Statements

July 31, 2024 (Unaudited)

Tidal Trust II

| Return Stacked Bonds & Managed Futures ETF | | RSBT | | NYSE Arca, Inc |

| Return Stacked Global Stocks & Bonds ETF | | RSSB | | NYSE Arca, Inc |

| Return Stacked U.S. Stocks & Futures Yield ETF | | RSSY | | NYSE Arca, Inc |

| Return Stacked U.S. Stocks & Managed Futures ETF | | RSST | | NYSE Arca, Inc |

Return Stacked ETFs

Table of Contents

| Consolidated Schedule of Investments | Return Stacked Bonds & Managed Futures ETF |

July 31, 2024 (Unaudited)

| EXCHANGE TRADED FUNDS - 49.7% | | Shares | | | Value | |

| iShares Core U.S. Aggregate Bond ETF (a) | | | 456,399 | | | $ | 45,233,705 | |

| TOTAL EXCHANGE TRADED FUNDS (Cost $43,663,942) | | | | | | | 45,233,705 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENTS - 40.8% | | | | | | | | |

| Money Market Funds - 40.8% | | | | | | | | |

| First American Government Obligations Fund - Class X, 5.23% (b) | | | 37,109,387 | | | | 37,109,387 | |

| TOTAL SHORT-TERM INVESTMENTS (Cost $37,109,387) | | | | | | | 37,109,387 | |

| | | | | | | | | |

| TOTAL INVESTMENTS - 90.5% (Cost $80,773,329) | | | | | | $ | 82,343,092 | |

| Other Assets in Excess of Liabilities - 9.5% | | | | | | | 8,643,992 | |

| TOTAL NET ASSETS - 100.0% | | | | | | $ | 90,987,084 | |

Percentages are stated as a percent of net assets.

| (a) | Fair value of this security exceeds 25% of the Fund’s net assets. Additional information for this security, including the financial statements, is available from the SEC’s EDGAR database at www.sec.gov. |

| (b) | The rate shown represents the 7-day annualized effective yield as of July 31, 2024. |

The accompanying notes are an integral part of these financial statements.

| Consolidated Schedule of Futures Contracts | Return Stacked Bonds & Managed Futures ETF |

July 31, 2024 (Unaudited)

The Return Stacked Bonds & Managed Futures ETF & CFC had the following futures contracts outstanding with PhillipCapital Inc.

| Description | | Contracts Purchased | | Expiration Date | | Notional | | | Value / Unrealized Appreciation (Depreciation) | |

| Australian Dollar/US Dollar Cross Currency Rate | | 69 | | 09/16/2024 | | $ | 4,521,570 | | | $ | (98,074 | ) |

| British Pound/US Dollar Cross Currency Rate | | 138 | | 09/16/2024 | | | 11,092,613 | | | | (50,317 | ) |

| Crude Oil(a) | | 19 | | 08/20/2024 | | | 1,480,290 | | | | 12,223 | |

| Euro STOXX 50 Quanto Index (EUR) | | 60 | | 09/20/2024 | | | 3,180,072 | | | | (43,628 | ) |

| FTSE 100 Index (GBP) | | 99 | | 09/20/2024 | | | 10,627,489 | | | | 87,973 | |

| German Stock Index (EUR) | | 7 | | 09/20/2024 | | | 3,523,368 | | | | (7,869 | ) |

| Gold(a) | | 33 | | 12/27/2024 | | | 8,160,900 | | | | 60,503 | |

| Long Gilt (GBP) | | 24 | | 09/26/2024 | | | 3,058,648 | | | | 18,411 | |

| Nasdaq 100 Index | | 14 | | 09/20/2024 | | | 5,461,470 | | | | (280,458 | ) |

| Nikkei 225 Index | | 9 | | 09/12/2024 | | | 1,741,500 | | | | (84,938 | ) |

| S&P 500 Index | | 80 | | 09/20/2024 | | | 22,232,000 | | | | (115,572 | ) |

| S&P/Toronto Stock Exchange 60 Index (CAD) | | 23 | | 09/19/2024 | | | 4,612,820 | | | | 75,977 | |

| Silver(a) | | 5 | | 09/26/2024 | | | 723,450 | | | | (60,743 | ) |

| U.S. Treasury 5 Year Note | | 938 | | 09/30/2024 | | | 101,201,406 | | | | 465,406 | |

| U.S. Treasury Long Bonds | | 66 | | 09/19/2024 | | | 7,971,562 | | | | 93,588 | |

| | | | | | | | | | | $ | 72,482 | |

| Description | | Contracts Sold | | Expiration Date | | Notional | | | Value / Unrealized Appreciation (Depreciation) | |

| Canadian Dollar/US Dollar Cross Currency Rate | | (59) | | 09/17/2024 | | $ | 4,282,810 | | | $ | (12,045 | ) |

| Copper(a) | | (2) | | 09/26/2024 | | | 208,825 | | | | 618 | |

| Euro/US Dollar Cross Currency Rate | | (120) | | 09/16/2024 | | | 16,275,000 | | | | 8,666 | |

| Euro-Bund | | (3) | | 09/06/2024 | | | 434,127 | | | | (3,816 | ) |

| Japanese Yen/US Dollar Cross Currency Rate | | (142) | | 09/16/2024 | | | 11,878,300 | | | | (730,859 | ) |

| Low Sulphur Gas Oil(a) | | (37) | | 09/12/2024 | | | 2,749,100 | | | | 1,981 | |

| Natural Gas(a) | | (92) | | 08/28/2024 | | | 1,873,120 | | | | 148,037 | |

| NY Harbor ULSD(a) | | (6) | | 08/30/2024 | | | 614,452 | | | | (3,481 | ) |

| Reformulated Gasoline Blendstock | | (1) | | 08/30/2024 | | | 102,585 | | | | (1,616 | ) |

| U.S. Treasury 10 Year Notes | | (352) | | 09/19/2024 | | | 39,358,000 | | | | (244,823 | ) |

| U.S. Treasury 2 Year Notes | | (96) | | 09/30/2024 | | | 19,715,250 | | | | 573 | |

| | | | | | | | | | | $ | (836,765 | ) |

| Total Unrealized Appreciation (Depreciation) | | | $ | (764,283 | ) |

| (a) | All or a portion of the investment is a holding of Return Stacked Cayman Subsidiary. |

CAD – Canadian Dollar

EUR – EURO

GBP – Great British Pound

The accompanying notes are an integral part of these financial statements.

| Schedule of Investments | Return Stacked Global Stocks & Bonds ETF |

July 31, 2024 (Unaudited)

| EXCHANGE TRADED FUNDS - 88.8% | | Shares | | | Value | |

| Vanguard Total International Stock ETF (a) | | | 1,002,120 | | | $ | 62,011,186 | |

| Vanguard Total Stock Market ETF (a) | | | 352,181 | | | | 95,993,975 | |

| TOTAL EXCHANGE TRADED FUNDS (Cost $147,694,902) | | | | | | | 158,005,161 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENTS - 7.0% | | | | | | | | |

| Money Market Funds - 7.0% | | | | | | | | |

| First American Government Obligations Fund - Class X, 5.23% (b) | | | 12,544,521 | | | | 12,544,521 | |

| TOTAL SHORT-TERM INVESTMENTS (Cost $12,544,521) | | | | | | | 12,544,521 | |

| | | | | | | | | |

| TOTAL INVESTMENTS - 95.8% (Cost $160,239,423) | | | | | | $ | 170,549,682 | |

| Other Assets in Excess of Liabilities - 4.2% | | | | | | | 7,552,570 | |

| TOTAL NET ASSETS - 100.0% | | | | | | $ | 178,102,252 | |

Percentages are stated as a percent of net assets.

| (a) | Fair value of this security exceeds 25% of the Fund’s net assets. Additional information for this security, including the financial statements, is available from the SEC’s EDGAR database at www.sec.gov. |

| (b) | The rate shown represents the 7-day annualized effective yield as of July 31, 2024. |

The accompanying notes are an integral part of these financial statements.

| Schedule of Futures Contracts | Return Stacked Global Stocks & Bonds ETF |

July 31, 2024 (Unaudited)

The Return Stacked Global Stocks & Bonds ETF had the following futures contracts outstanding with PhillipCapital Inc.

| Description | | Contracts Purchased | | Expiration Date | | Notional | | | Value / Unrealized Appreciation (Depreciation) | |

| S&P 500 Index | | 60 | | 09/20/2024 | | $ | 16,674,000 | | | $ | 152,138 | |

| U.S. Treasury 10 Year Notes | | 392 | | 09/19/2024 | | | 43,830,500 | | | | 843,145 | |

| U.S. Treasury 2 Year Notes | | 212 | | 09/30/2024 | | | 43,537,844 | | | | 286,833 | |

| U.S. Treasury 5 Year Note | | 405 | | 09/30/2024 | | | 43,695,703 | | | | 641,286 | |

| U.S. Treasury Long Bonds | | 360 | | 09/19/2024 | | | 43,481,250 | | | | 981,178 | |

| Total Unrealized Appreciation (Depreciation) | | | $ | 2,904,580 | |

The accompanying notes are an integral part of these financial statements.

| Consolidated Schedule of Investments | Return Stacked U.S. Stocks & Futures Yield ETF |

July 31, 2024 (Unaudited)

| EXCHANGE TRADED FUNDS - 75.5% | | Shares | | | Value | |

| iShares Core S&P 500 ETF (a) | | | 202,785 | | | $ | 112,204,996 | |

| TOTAL EXCHANGE TRADED FUNDS (Cost $107,857,325) | | | | | | | 112,204,996 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENTS - 10.6% | | | | | | | | |

| Money Market Funds - 10.6% | | | | | | | | |

| First American Government Obligations Fund - Class X, 5.23% (b) | | | 15,710,416 | | | | 15,710,416 | |

| TOTAL SHORT-TERM INVESTMENTS (Cost $15,710,416) | | | | | | | 15,710,416 | |

| | | | | | | | | |

| TOTAL INVESTMENTS - 86.1% (Cost $123,567,741) | | | | | | $ | 127,915,412 | |

| Other Assets in Excess of Liabilities - 13.9% | | | | | | | 20,718,230 | |

| TOTAL NET ASSETS - 100.0% | | | | | | $ | 148,633,642 | |

Percentages are stated as a percent of net assets.

| (a) | Fair value of this security exceeds 25% of the Fund’s net assets. Additional information for this security, including the financial statements, is available from the SEC’s EDGAR database at www.sec.gov. |

| (b) | The rate shown represents the 7-day annualized effective yield as of July 31, 2024. |

The accompanying notes are an integral part of these financial statements.

| Consolidated Schedule of Futures Contracts | Return Stacked U.S. Stocks

& Futures Yield ETF |

July 31, 2024 (Unaudited)

The Return Stacked U.S. Stocks & Futures Yield ETF & CFC had the following futures contracts outstanding with PhillipCapital Inc.

| Description | | Contracts Purchased | | Expiration Date | | Notional | | | Value / Unrealized Appreciation (Depreciation) | |

| Australian Dollar/US Dollar Cross Currency Rate | | 553 | | 09/16/2024 | | $ | 36,238,090 | | | $ | (471,041 | ) |

| Brent Crude Oil(a) | | 133 | | 08/30/2024 | | | 10,751,720 | | | | 176,507 | |

| British Pound/US Dollar Cross Currency Rate | | 168 | | 09/16/2024 | | | 13,504,050 | | | | (124,935 | ) |

| Crude Oil(a) | | 154 | | 08/20/2024 | | | 11,998,140 | | | | (398,867 | ) |

| Long Gilt (GBP) | | 595 | | 09/26/2024 | | | 75,828,987 | | | | 1,500,799 | |

| Low Sulphur Gas Oil(a) | | 93 | | 09/12/2024 | | | 6,909,900 | | | | 19,282 | |

| NY Harbor ULSD(a) | | 46 | | 08/30/2024 | | | 4,710,796 | | | | (10,115 | ) |

| S&P 500 Index | | 78 | | 09/20/2024 | | | 21,676,200 | | | | 116,097 | |

| S&P/Toronto Stock Exchange 60 Index (CAD) | | 3 | | 09/19/2024 | | | 601,672 | | | | 4,666 | |

| | | | | | | | | | | $ | 812,393 | |

| Description | | Contracts Sold | | Expiration Date | | Notional | | | Value / Unrealized Appreciation (Depreciation) | |

| Canadian Dollar/US Dollar Cross Currency Rate | | (1,523) | | 09/17/2024 | | $ | 110,554,570 | | | $ | 571,003 | |

| Copper(a) | | (156) | | 09/26/2024 | | | 16,288,350 | | | | 205,368 | |

| Euro STOXX 50 Quanto Index (EUR) | | (22) | | 09/20/2024 | | | 1,166,026 | | | | (3,149 | ) |

| Euro/US Dollar Cross Currency Rate | | (429) | | 09/16/2024 | | | 58,183,125 | | | | (192,149 | ) |

| Euro-Bund (EUR) | | (286) | | 09/06/2024 | | | 41,386,796 | | | | (681,184 | ) |

| FTSE 100 Index (GBP) | | (257) | | 09/20/2024 | | | 27,588,531 | | | | (513,969 | ) |

| German Stock Index (EUR) | | (37) | | 09/20/2024 | | | 18,623,516 | | | | (102,735 | ) |

| Gold(a) | | (23) | | 12/27/2024 | | | 5,687,900 | | | | (40,273 | ) |

| Japanese Yen/US Dollar Cross Currency Rate | | (333) | | 09/16/2024 | | | 27,855,450 | | | | (1,491,588 | ) |

| Nasdaq 100 Index | | (33) | | 09/20/2024 | | | 12,873,465 | | | | (83,477 | ) |

| Natural Gas(a) | | (159) | | 08/28/2024 | | | 3,237,240 | | | | 289,674 | |

| Nikkei 225 Index | | (70) | | 09/12/2024 | | | 13,545,000 | | | | (15,342 | ) |

| Reformulated Gasoline Blendstock(a) | | (58) | | 08/30/2024 | | | 5,949,930 | | | | (128,251 | ) |

| Silver(a) | | (41) | | 09/26/2024 | | | 5,932,290 | | | | (99,674 | ) |

| U.S. Treasury 10 Year Notes | | (101) | | 09/19/2024 | | | 11,293,063 | | | | (108,828 | ) |

| U.S. Treasury 5 Year Note | | (184) | | 09/30/2024 | | | 19,851,875 | | | | (156,176 | ) |

| U.S. Treasury Long Bonds | | (24) | | 09/19/2024 | | | 2,898,750 | | | | (30,569 | ) |

| | | | | | | | | | | $ | (2,581,319 | ) |

| Total Unrealized Appreciation (Depreciation) | | | $ | (1,768,926 | ) |

| (a) | All or a portion of the investment is a holding of Return Stacked Cayman Subsidiary. |

CAD – Canadian Dollar

EUR – EURO

GBP – Great British Pound

| Consolidated Schedule of Investments | Return Stacked U.S. Stocks

& Managed Futures ETF |

July 31, 2024 (Unaudited)

The accompanying notes are an integral part of these financial statements.

| EXCHANGE TRADED FUNDS - 74.3% | | Shares | | | Value | |

| iShares Core S&P 500 ETF (a) | | | 263,239 | | | $ | 145,655,403 | |

| TOTAL EXCHANGE TRADED FUNDS (Cost $132,668,784) | | | | | | | 145,655,403 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENTS - 15.0% | | | | | | | | |

| Money Market Funds - 15.0% | | | | | | | | |

| First American Government Obligations Fund - Class X, 5.23% (b) | | | 29,324,307 | | | | 29,324,307 | |

| TOTAL SHORT-TERM INVESTMENTS (Cost $29,324,307) | | | | | | | 29,324,307 | |

| | | | | | | | | |

| TOTAL INVESTMENTS - 89.3% (Cost $161,993,091) | | | | | | $ | 174,979,710 | |

| Other Assets in Excess of Liabilities - 10.7% | | | | | | | 20,881,317 | |

| TOTAL NET ASSETS - 100.0% | | | | | | $ | 195,861,027 | |

Percentages are stated as a percent of net assets.

| (a) | Fair value of this security exceeds 25% of the Fund’s net assets. Additional information for this security, including the financial statements, is available from the SEC’s EDGAR database at www.sec.gov. |

| (b) | The rate shown represents the 7-day annualized effective yield as of July 31, 2024. |

| Consolidated Schedule of Futures Contracts | Return Stacked U.S. Stocks

& Managed Futures ETF |

July 31, 2024 (Unaudited)

The Return Stacked U.S. Stocks & Futures Yield ETF & CFC had the following futures contracts outstanding with PhillipCapital Inc.

| Description | | Contracts Purchased | | Expiration Date | | Notional | | | Value / Unrealized Appreciation (Depreciation) | |

| Australian Dollar/US Dollar Cross Currency Rate | | 147 | | 09/16/2024 | | $ | 9,632,910 | | | $ | (195,757 | ) |

| British Pound/US Dollar Cross Currency Rate | | 293 | | 09/16/2024 | | | 23,551,706 | | | | (107,303 | ) |

| Crude Oil(a) | | 41 | | 08/20/2024 | | | 3,194,310 | | | | 25,686 | |

| Euro STOXX 50 Quanto Index (EUR) | | 127 | | 09/20/2024 | | | 6,731,153 | | | | (86,587 | ) |

| FTSE 100 Index (GBP) | | 210 | | 09/20/2024 | | | 22,543,158 | | | | 175,113 | |

| German Stock Index (EUR) | | 14 | | 09/20/2024 | | | 7,046,736 | | | | (15,440 | ) |

| Gold(a) | | 71 | | 12/27/2024 | | | 17,558,300 | | | | 122,843 | |

| Long Gilt (GBP) | | 49 | | 09/26/2024 | | | 6,244,740 | | | | 38,273 | |

| Nasdaq 100 Index | | 30 | | 09/20/2024 | | | 11,703,150 | | | | (667,720 | ) |

| Nikkei 225 Index | | 19 | | 09/12/2024 | | | 3,676,500 | | | | (198,379 | ) |

| S&P 500 Index | | 342 | | 09/20/2024 | | | 95,041,800 | | | | (42,630 | ) |

| S&P/Toronto Stock Exchange 60 Index (CAD) | | 50 | | 09/19/2024 | | | 10,027,869 | | | | 150,602 | |

| Silver(a) | | 10 | | 09/26/2024 | | | 1,446,900 | | | | (114,186 | ) |

| U.S. Treasury 5 Year Note | | 1,774 | | 09/30/2024 | | | 191,397,969 | | | | 670,168 | |

| | | | | | | | | | | $ | (245,317 | ) |

| Description | | Contracts Sold | | Expiration Date | | Notional | | | Value / Unrealized Appreciation (Depreciation) | |

| Canadian Dollar/US Dollar Cross Currency Rate | | (126) | | 09/17/2024 | | $ | 9,146,340 | | | $ | (24,385 | ) |

| Copper(a) | | (5) | | 09/26/2024 | | | 522,063 | | | | (2,100 | ) |

| Euro/US Dollar Cross Currency Rate | | (254) | | 09/16/2024 | | | 34,448,750 | | | | 16,180 | |

| Euro-Bund (EUR) | | (6) | | 09/06/2024 | | | 868,254 | | | | (9,644 | ) |

| Japanese Yen/US Dollar Cross Currency Rate | | (303) | | 09/16/2024 | | | 25,345,950 | | | | (1,401,708 | ) |

| Low Sulphur Gas Oil(a) | | (79) | | 09/12/2024 | | | 5,869,700 | | | | (2,961 | ) |

| Natural Gas(a) | | (197) | | 08/28/2024 | | | 4,010,920 | | | | 291,551 | |

| NY Harbor ULSD(a) | | (12) | | 08/30/2024 | | | 1,228,903 | | | | 2 | |

| Reformulated Gasoline Blendstock(a) | | (2) | | 08/30/2024 | | | 205,170 | | | | (3,084 | ) |

| U.S. Treasury 10 Year Notes | | (963) | | 09/19/2024 | | | 107,675,438 | | | | (630,638 | ) |

| U.S. Treasury 2 Year Notes | | (321) | | 09/30/2024 | | | 65,922,867 | | | | 875 | |

| U.S. Treasury Long Bonds | | (56) | | 09/19/2024 | | | 6,763,750 | | | | 11,372 | |

| | | | | | | | | | | $ | (1,754,540 | ) |

| Total Unrealized Appreciation (Depreciation) | | | $ | (1,999,857 | ) |

| (a) | All or a portion of the investment is a holding of Return Stacked Cayman Subsidiary. |

CAD – Canadian Dollar

EUR – EURO

GBP – Great British Pound

The accompanying notes are an integral part of these financial statements.

| Statements of Assets and Liabilities | Return Stacked ETFs |

July 31, 2024 (Unaudited)

| | | Return Stacked Bonds & Managed Futures ETF (Consolidated) | | | Return Stacked Global Stocks & Bonds ETF | | | Return Stacked U.S. Stocks & Futures Yield ETF (Consolidated) | | | Return Stacked U.S. Stocks & Managed Futures ETF (Consolidated) | |

| ASSETS: | | | | | | | | | | | | | | | | |

| Investments, at value | | $ | 82,343,092 | | | $ | 170,549,682 | | | $ | 127,915,412 | | | $ | 174,979,710 | |

| Deposit at broker for Future Contracts | | | 9,078,222 | | | | 3,480,461 | | | | 20,549,912 | | | | 19,584,000 | |

| Receivable for fund shares sold | | | 1,330,445 | | | | 1,151,685 | | | | 1,012,430 | | | | 11,909,400 | |

| Receivable for investments sold | | | 1,107,333 | | | | — | | | | 414,052 | | | | 80,495 | |

| Unrealized appreciation on futures contracts | | | 973,956 | | | | 2,904,580 | | | | 2,883,396 | | | | 1,502,665 | |

| Interest receivable | | | 153,211 | | | | 67,187 | | | | 95,310 | | | | 142,939 | |

| Cash | | | 151,232 | | | | — | | | | — | | | | — | |

| Prepaid expenses and other assets | | | — | | | | — | | | | 531,815 | | | | 5,955 | |

| Total assets | | | 95,137,491 | | | | 178,153,595 | | | | 153,402,327 | | | | 208,205,164 | |

| | | | | | | | | | | | | | | | | |

| LIABILITIES: | | | | | | | | | | | | | | | | |

| Payable for investments purchased | | | 2,339,675 | | | | — | | | | — | | | | 8,695,581 | |

| Payable to adviser | | | 72,493 | | | | 49,954 | | | | 116,363 | | | | 146,034 | |

| Unrealized depreciation on futures contracts | | | 1,738,239 | | | | — | | | | 4,652,322 | | | | 3,502,522 | |

| Interest payable | | | — | | | | 1,389 | | | | — | | | | — | |

| Total liabilities | | | 4,150,407 | | | | 51,343 | | | | 4,768,685 | | | | 12,344,137 | |

| NET ASSETS | | $ | 90,987,084 | | | $ | 178,102,252 | | | $ | 148,633,642 | | | $ | 195,861,027 | |

| | | | | | | | | | | | | | | | | |

| NET ASSETS CONSISTS OF: | | | | | | | | | | | | | | | | |

| Paid-in capital | | $ | 88,159,093 | | | $ | 165,092,049 | | | $ | 146,935,492 | | | $ | 180,185,430 | |

| Total distributable earnings | | | 2,827,991 | | | | 13,010,203 | | | | 1,698,150 | | | | 15,675,597 | |

| Total net assets | | $ | 90,987,084 | | | $ | 178,102,252 | | | $ | 148,633,642 | | | $ | 195,861,027 | |

| | | | | | | | | | | | | | | | | |

| Net assets | | $ | 90,987,084 | | | $ | 178,102,252 | | | $ | 148,633,642 | | | $ | 195,861,027 | |

| Shares issued and outstanding(a) | | | 5,075,000 | | | | 7,600,000 | | | | 7,275,000 | | | | 8,225,000 | |

| Net asset value per share | | $ | 17.93 | | | $ | 23.43 | | | $ | 20.43 | | | $ | 23.81 | |

| | | | | | | | | | | | | | | | | |

| COST: | | | | | | | | | | | | | | | | |

| Investments, at cost | | $ | 80,773,329 | | | $ | 160,239,423 | | | $ | 123,567,741 | | | $ | 161,993,091 | |

| (a) | Unlimited shares authorized without par value. |

The accompanying notes are an integral part of these financial statements.

| Statements of Operations | Return Stacked ETFs |

For the Period Ended July 31, 2024 (Unaudited)

| | | Return Stacked Bonds & Managed Futures ETF (Consolidated) | | | Return Stacked Global Stocks & Bonds ETF | | | Return Stacked U.S. Stocks & Futures Yield ETF(a)(Consolidated) | | | Return Stacked U.S. Stocks & Managed Futures ETF (Consolidated) | |

| INVESTMENT INCOME: | | | | | | | | | | | | | | | | |

| Dividend income | | $ | 545,567 | | | $ | 844,274 | | | $ | 262,637 | | | $ | 522,234 | |

| Interest income | | | 666,915 | | | | 172,515 | | | | 184,471 | | | | 517,132 | |

| Other income | | | 46 | | | | 136 | | | | 975 | | | | 28,679 | |

| Total investment income | | | 1,212,528 | | | | 1,016,925 | | | | 448,083 | | | | 1,068,018 | |

| | | | | | | | | | | | | | | | | |

| EXPENSES: | | | | | | | | | | | | | | | | |

| Investment advisory fee | | | 303,295 | | | | 246,224 | | | | 211,071 | | | | 573,488 | |

| Interest expense | | | — | | | | 1,399 | | | | — | | | | 454 | |

| Other expenses and fees | | | 18 | | | | 17 | | | | — | | | | — | |

| Total expenses | | | 303,313 | | | | 247,640 | | | | 211,071 | | | | 573,942 | |

| Expense reimbursement by Adviser | | | — | | | | (73,868 | ) | | | — | | | | — | |

| Net expenses | | | 303,313 | | | | 173,772 | | | | 211,071 | | | | 573,942 | |

| NET INVESTMENT INCOME | | | 909,215 | | | | 843,153 | | | | 237,012 | | | | 494,103 | |

| | | | | | | | | | | | | | | | | |

| REALIZED AND UNREALIZED GAIN | | | | | | | | | | | | | | | | |

| Net realized gain/(loss) from: | | | | | | | | | | | | | | | | |

| Investments | | | (88,168 | ) | | | 3,140 | | | | (13,846 | ) | | | (581,753 | ) |

| Futures contracts | | | 2,800,764 | | | | (1,053,015 | ) | | | (1,140,314 | ) | | | 4,647,422 | |

| Foreign currency translation | | | (2,358 | ) | | | — | | | | 2,938 | | | | (12,109 | ) |

| Net realized gain/(loss) | | | 2,710,238 | | | | (1,049,875 | ) | | | (1,151,222 | ) | | | 4,053,560 | |

| Net change in unrealized | | | | | | | | | | | | | | | | |

| appreciation/(depreciation) on: | | | | | | | | | | | | | | | | |

| Investments | | | 526,124 | | | | 9,225,749 | | | | 4,347,671 | | | | 10,648,164 | |

| Future contracts | | | (1,621,024 | ) | | | 2,351,476 | | | | (1,768,926 | ) | | | (3,126,668 | ) |

| Foreign currency translation | | | 7,675 | | | | — | | | | 33,615 | | | | 55,062 | |

| Net change in unrealized | | | | | | | | | | | | | | | | |

| appreciation/(depreciation) | | | (1,087,225 | ) | | | 11,577,225 | | | | 2,612,360 | | | | 7,576,558 | |

| Net realized and unrealized gain | | | 1,623,013 | | | | 10,527,350 | | | | 1,461,138 | | | | 11,630,118 | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 2,532,228 | | | $ | 11,370,503 | | | $ | 1,698,150 | | | $ | 12,121,221 | |

| (a) | Inception date of the Fund was May 28, 2024. |

The accompanying notes are an integral part of these financial statements.

| Statements of Changes in Net Assets | Return Stacked ETFs |

| | | Return Stacked Bonds &

Managed Futures ETF (Consolidated) | | | Return Stacked Global

Stocks & Bonds ETF | |

| | | Period ended

July 31, 2024 (Unaudited) | | | Period ended January 31, 2024(a) | | | Period ended

July 31, 2024 (Unaudited) | | | Period ended January 31, 2024(b) | |

| OPERATIONS: | | | | | | | | | | | | | | | | |

| Net investment income | | $ | 909,215 | | | $ | 601,536 | | | $ | 843,153 | | | $ | 221,930 | |

| Net realized gain/(loss) | | | 2,710,238 | | | | (4,831,129 | ) | | | (1,049,875 | ) | | | 143 | |

| Net change in unrealized appreciation/(depreciation) | | | (1,087,225 | ) | | | 1,901,657 | | | | 11,577,225 | | | | 1,637,614 | |

| Net increase/(decrease) in net assets from operations | | | 2,532,228 | | | | (2,327,936 | ) | | | 11,370,503 | | | | 1,859,687 | |

| | | | | | | | | | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | | | | | | | | | |

| Distributions to shareholders | | | — | | | | (1,066,381 | ) | | | — | | | | (219,987 | ) |

| Total distributions to shareholders | | | — | | | | (1,066,381 | ) | | | — | | | | (219,987 | ) |

| | | | | | | | | | | | | | | | | |

| CAPITAL TRANSACTIONS: | | | | | | | | | | | | | | | | |

| Subscriptions | | | 39,849,965 | | | | 57,144,810 | | | | 101,884,100 | | | | 63,193,315 | |

| Redemptions | | | — | | | | (5,194,242 | ) | | | — | | | | — | |

| ETF transaction fees (See Note #) | | | 19,925 | | | | 28,715 | | | | 9,662 | | | | 4,972 | |

| Net increase in net assets from capital transactions | | | 38,869,890 | | | | 51,979,283 | | | | 101,893,762 | | | | 63,198,287 | |

| | | | | | | | | | | | | | | | | |

| NET INCREASE IN NET ASSETS | | | 42,402,118 | | | | 48,584,966 | | | | 113,264,265 | | | | 64,837,987 | |

| | | | | | | | | | | | | | | | | |

| NET ASSETS: | | | | | | | | | | | | | | | | |

| Beginning of the period | | | 48,584,966 | | | | — | | | | 64,837,987 | | | | — | |

| End of the period | | $ | 90,987,084 | | | $ | 48,584,966 | | | $ | 178,102,252 | | | $ | 64,837,987 | |

| | | | | | | | | | | | | | | | | |

| SHARES TRANSACTIONS: | | | | | | | | | | | | | | | | |

| Subscriptions | | | 2,200,000 | | | | 3,175,000 | | | | 4,525,000 | | | | 3,075,000 | |

| Redemptions | | | — | | | | (300,000 | ) | | | — | | | | — | |

| Total increase in shares outstanding | | | 2,200,000 | | | | 2,875,000 | | | | 4,525,000 | | | | 3,075,000 | |

| (a) | Inception date of the Fund was February 7, 2023. |

| (b) | Inception date of the Fund was December 4, 2023. |

The accompanying notes are an integral part of these financial statements.

| Statements of Changes in Net Assets | Return Stacked ETFs |

| | | Return Stacked U.S. Stocks & Futures Yield ETF (Consolidated) | | | Return Stacked U.S. Stocks & Managed Futures ETF (Consolidated) | |

| | | Period ended

July 31, 2024(a) (Unaudited) | | | Period ended

July 31, 2024 (Unaudited) | | | Period ended

January 31, 2024(b) | |

| OPERATIONS: | | | | | | | | | | | | |

| Net investment income | | $ | 237,012 | | | $ | 494,103 | | | $ | 125,627 | |

| Net realized gain/(loss) | | | (1,151,222 | ) | | | 4,053,560 | | | | (2,333,982 | ) |

| Net change in unrealized appreciation | | | 2,612,360 | | | | 7,576,558 | | | | 3,463,899 | |

| Net increase in net assets from operations | | | 1,698,150 | | | | 12,124,221 | | | | 1,255,544 | |

| | | | | | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | | | | | |

| Distributions to shareholders | | | — | | | | — | | | | (338,962 | ) |

| Total distributions to shareholders | | | — | | | | — | | | | (338,962 | ) |

| | | | | | | | | | | | | |

| CAPITAL TRANSACTIONS: | | | | | | | | | | | | |

| Subscriptions | | | 146,863,560 | | | | 126,867,963 | | | | 57,054,943 | |

| Redemptions | | | — | | | | (1,193,740 | ) | | | — | |

| ETF transaction fees (See Note #) | | | 71,932 | | | | 64,031 | | | | 27,027 | |

| Net increase in net assets from capital transactions | | | 146,935,492 | | | | 125,738,254 | | | | 57,081,970 | |

| | | | | | | | | | | | | |

| NET INCREASE IN NET ASSETS | | | 148,633,642 | | | | 137,862,475 | | | | 57,998,552 | |

| | | | | | | | | | | | | |

| NET ASSETS: | | | | | | | | | | | | |

| Beginning of the period | | | — | | | | 57,998,552 | | | | — | |

| End of the period | | $ | 148,633,642 | | | $ | 195,861,027 | | | $ | 57,998,552 | |

| | | | | | | | | | | | | |

| SHARES TRANSACTIONS | | | | | | | | | | | | |

| Subscriptions | | | 7,275,000 | | | | 5,375,000 | | | | 2,900,000 | |

| Redemptions | | | — | | | | (50,000 | ) | | | — | |

| Total increase in shares outstanding | | | 7,275,000 | | | | 5,325,000 | | | | 2,900,000 | |

| (a) | Inception date of the Fund was May 28, 2024. |

| (b) | Inception date of the Fund was September 5, 2023. |

The accompanying notes are an integral part of these financial statements.

| Consolidated Financial Highlights | Return Stacked Bonds &

Managed Futures ETF |

| | | Period ended

July 31, 2024

(Unaudited) | | | Period ended

January 31,

2024(a) | |

| PER SHARE DATA: | | | | | | | | |

| | | | | | | | | |

| Net asset value, beginning of period | | $ | 16.90 | | | $ | 20.00 | |

| | | | | | | | | |

| INVESTMENT OPERATIONS: | | | | | | | | |

| Net investment income(b)(c) | | | 0.25 | | | | 0.44 | |

| Net realized and unrealized gain (loss) on investments(d) | | | 0.77 | | | | (3.15 | ) |

| Total from investment operations | | | 1.02 | | | | (2.71 | ) |

| | | | | | | | | |

| LESS DISTRIBUTIONS FROM: | | | | | | | | |

| From net investment income | | | — | | | | (0.41 | ) |

| Total distributions | | | — | | | | (0.41 | ) |

| | | | | | | | | |

| ETF transaction fees per share | | | 0.01 | | | | 0.02 | |

| Net asset value, end of period | | $ | 17.93 | | | $ | 16.90 | |

| | | | | | | | | |

| TOTAL RETURN(e) | | | 6.10 | % | | | (13.53 | )% |

| | | | | | | | | |

| SUPPLEMENTAL DATA AND RATIOS: | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 90,987 | | | $ | 48,585 | |

| Ratio of expenses to average net assets(f)(g) | | | 0.95 | % | | | 0.99 | % |

| Ratio of dividends, interest and borrowing expense on securities sold short to average net assets(f)(g) | | | (0.01 | )% | | | — | % |

Ratio of operational expenses to average net assets excluding dividends, interest, and borrowing expense on securities sold

short(f)(g) | | | 0.95 | % | | | 0.99 | % |

| Ratio of net investment income to average net assets(f)(g) | | | 2.85 | % | | | 2.54 | % |

| Portfolio turnover rate(e)(h) | | | 41 | % | | | 259 | % |

| (a) | Inception date of the Fund was February 7, 2023. |

| (b) | Net investment income per share has been calculated based on average shares outstanding during the period. |

| (c) | Recognition of net investment income by the Fund is affected by the timing of the declaration of dividends by the underlying exchange traded funds in which the Fund invests. The ratio does not include net investment income of the exchange traded funds in which the Fund invests. |

| (d) | Realized and unrealized gains and losses per share in the caption are balancing amounts necessary to reconcile the change in net asset value per share for the years, and may not reconcile with the aggregate gains and losses in the Statements of Operations due to share transactions for the year. |

| (e) | Not annualized for periods less than one year. |

| (f) | Annualized for periods less than one year. |

| (g) | These ratios exclude the impact of expenses of the underlying exchange traded funds as represented in the Schedule of Investments. Recognition of net investment income by the Fund is affected by the timing of the underlying exchange traded funds in which the Fund invests. |

| (h) | Portfolio turnover rate excludes in-kind transactions. |

The accompanying notes are an integral part of these financial statements.

| Consolidated Financial Highlights | Return Stacked Global Stocks &

Bonds ETF |

| | | Period ended

July 31, 2024

(Unaudited) | | | Period ended

January 31,

2024(a) | |

| PER SHARE DATA: | | | | | | | | |

| | | | | | | | | |

| Net asset value, beginning of period | | $ | 21.09 | | | $ | 20.00 | |

| | | | | | | | | |

| INVESTMENT OPERATIONS: | | | | | | | | |

| Net investment income(b)(c) | | | 0.19 | | | | 0.11 | |

| Net realized and unrealized gain on investments(d) | | | 2.15 | | | | 1.11 | |

| Total from investment operations | | | 2.34 | | | | 1.22 | |

| | | | | | | | | |

| LESS DISTRIBUTIONS FROM: | | | | | | | | |

| From net investment income | | | — | | | | (0.13 | ) |

| Total distributions | | | — | | | | (0.13 | ) |

| | | | | | | | | |

| ETF transaction fees per share | | | 0.00 | (e) | | | 0.00 | (e) |

| Net asset value, end of period | | $ | 23.43 | | | $ | 21.09 | |

| | | | | | | | | |

| TOTAL RETURN(f) | | | 11.12 | % | | | 6.06 | % |

| | | | | | | | | |

| SUPPLEMENTAL DATA AND RATIOS: | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 178,102 | | | $ | 64,838 | |

| Ratio of expenses to average net assets: | | | | | | | | |

| Before expense reimbursement/recoupment(g)(h) | | | 0.50 | % | | | 0.50 | % |

| After expense reimbursement/recoupment(g)(h) | | | 0.35 | % | | | 0.35 | % |

| Ratio of dividends, interest and borrowing expense on securities sold short to average net assets(g)(h) | | | 0.00 | %(i) | | | — | % |

| Ratio of net investment income to average net assets(g)(h) | | | 1.71 | % | | | 3.41 | % |

| Portfolio turnover rate(f)(j) | | | 3 | % | | | 0 | % |

| (a) | Inception date of the Fund was December 4, 2023. |

| (b) | Net investment income per share has been calculated based on average shares outstanding during the period. |

| (c) | Recognition of net investment income by the Fund is affected by the timing of the declaration of dividends by the underlying exchange traded funds in which the Fund invests. The ratio does not include net investment income of the exchange traded funds in which the Fund invests. |

| (d) | Realized and unrealized gains and losses per share in the caption are balancing amounts necessary to reconcile the change in net asset value per share for the years, and may not reconcile with the aggregate gains and losses in the Statements of Operations due to share transactions for the year. |

| (e) | Amount represents less than $0.005 per share. |

| (f) | Not annualized for periods less than one year. |

| (g) | Annualized for periods less than one year. |

| (h) | These ratios exclude the impact of expenses of the underlying exchange traded funds as represented in the Schedule of Investments. Recognition of net investment income by the Fund is affected by the timing of the underlying exchange traded funds in which the Fund invests. |

| (i) | Amount represents less than 0.005%. |

| (j) | Portfolio turnover rate excludes in-kind transactions. |

The accompanying notes are an integral part of these financial statements.

| Consolidated Financial Highlights | Return Stacked U.S. Stocks &

Futures Yield ETF |

| | | Period ended

July 31, 2024(a)

(Unaudited) | |

| PER SHARE DATA: | | | | |

| | | | | |

| Net asset value, beginning of period | | $ | 20.00 | |

| | | | | |

| INVESTMENT OPERATIONS: | | | | |

| Net investment income(b)(c) | | | 0.04 | |

| Net realized and unrealized gain on investments(d) | | | 0.38 | |

| Total from investment operations | | | 0.42 | |

| | | | | |

| LESS DISTRIBUTIONS FROM: | | | | |

| Total distributions | | | — | |

| | | | | |

| ETF transaction fees per share | | | 0.01 | |

| Net asset value, end of period | | $ | 20.43 | |

| | | | | |

| TOTAL RETURN(e) | | | 2.19 | % |

| | | | | |

| SUPPLEMENTAL DATA AND RATIOS: | | | | |

| Net assets, end of period (in thousands) | | $ | 148,634 | |

| Ratio of expenses to average net assets(f)(g) | | | 0.95 | % |

| Ratio of net investment income to average net assets(f)(g) | | | 1.07 | % |

| Portfolio turnover rate(e)(h) | | | 14 | % |

| (a) | Inception date of the Fund was May 28, 2024. |

| (b) | Net investment income per share has been calculated based on average shares outstanding during the period. |

| (c) | Recognition of net investment income by the Fund is affected by the timing of the declaration of dividends by the underlying exchange traded funds in which the Fund invests. The ratio does not include net investment income of the exchange traded funds in which the Fund invests. |

| (d) | Realized and unrealized gains and losses per share in the caption are balancing amounts necessary to reconcile the change in net asset value per share for the years, and may not reconcile with the aggregate gains and losses in the Statements of Operations due to share transactions for the year. |

| (e) | Not annualized for periods less than one year. |

| (f) | Annualized for periods less than one year. |

| (g) | These ratios exclude the impact of expenses of the underlying exchange traded funds as represented in the Schedule of Investments. Recognition of net investment income by the Fund is affected by the timing of the underlying exchange traded funds in which the Fund invests. |

| (h) | Portfolio turnover rate excludes in-kind transactions. |

The accompanying notes are an integral part of these financial statements.

| Consolidated Financial Highlights | Return Stacked U.S. Stocks &

Managed Futures ETF |

| | | Period ended

July 31, 2024

(Unaudited) | | | Period ended

January 31,

2024(a) | |

| PER SHARE DATA: | | | | | | | | |

| | | | | | | | | |

| Net asset value, beginning of period | | $ | 20.00 | | | $ | 20.00 | |

| | | | | | | | | |

| INVESTMENT OPERATIONS: | | | | | | | | |

| Net investment income(b)(c) | | | 0.10 | | | | 0.11 | |

| Net realized and unrealized gain on investments(d) | | | 3.70 | | | | 0.06 | |

| Total from investment operations | | | 3.80 | | | | 0.17 | |

| | | | | | | | | |

| LESS DISTRIBUTIONS FROM: | | | | | | | | |

| From net investment income | | | — | | | | (0.12 | ) |

| From net realized gains | | | — | | | | (0.07 | ) |

| Total distributions | | | — | | | | (0.19 | ) |

| | | | | | | | | |

| ETF transaction fees per share | | | 0.01 | | | | 0.02 | |

| Net asset value, end of period | | $ | 23.81 | | | $ | 20.00 | |

| | | | | | | | | |

| TOTAL RETURN(e) | | | 19.00 | % | | | 0.92 | % |

| | | | | | | | | |

| SUPPLEMENTAL DATA AND RATIOS: | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 195,861 | | | $ | 57,999 | |

| Ratio of expenses to average net assets(f)(g) | | | 0.95 | % | | | 0.96 | % |

| Ratio of dividends, interest and borrowing expense on securities sold short to average net assets(f)(g) | | | 0.00 | %(h) | | | — | % |

| Ratio of net investment income to average net assets(f)(g) | | | 0.82 | % | | | 1.32 | % |

| Portfolio turnover rate(e)(i) | | | 54 | % | | | 19 | % |

| (a) | Inception date of the Fund was September 5, 2023. |

| (b) | Net investment income per share has been calculated based on average shares outstanding during the period. |

| (c) | Recognition of net investment income by the Fund is affected by the timing of the declaration of dividends by the underlying exchange traded funds in which the Fund invests. The ratio does not include net investment income of the exchange traded funds in which the Fund invests. |

| (d) | Realized and unrealized gains and losses per share in the caption are balancing amounts necessary to reconcile the change in net asset value per share for the years, and may not reconcile with the aggregate gains and losses in the Statements of Operations due to share transactions for the year. |

| (e) | Not annualized for periods less than one year. |

| (f) | Annualized for periods less than one year. |

| (g) | These ratios exclude the impact of expenses of the underlying exchange traded funds as represented in the Schedule of Investments. Recognition of net investment income by the Fund is affected by the timing of the underlying exchange traded funds in which the Fund invests. |

| (h) | Amount represents less than 0.005%. |

| (i) | Portfolio turnover rate excludes in-kind transactions. |

The accompanying notes are an integral part of these financial statements.

| Notes to the Consolidated Financial Statements | Return Stacked ETF |

The Return Stacked Bonds & Managed Futures ETF (the “RSBT ETF”), the Return Stacked Global Stocks and Bonds ETF (the “RSSB ETF”), the Return Stacked U.S. Stocks & Futures Yield ETF (the “RSSY Fund”), and the Return Stacked U.S. Stocks & Managed Futures ETF (the “RSST ETF”) (each a “Fund”, and collectively, the “Funds”) are each a non-diversified series of Tidal Trust II (the “Trust”). The Trust was organized as a Delaware statutory trust on January 13, 2022. The Trust is registered with the Securities and Exchange Commission (“SEC”) under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company and the offering of the Funds’ shares is registered under the Securities Act of 1933, as amended. The Trust is governed by the Board of Trustees (the “Board”). Tidal Investments LLC (f/k/a Toroso Investments, LLC) (“Tidal Investments” or the “Adviser”), a Tidal Financial Group company, serves as investment adviser to the Funds and Newfound Research LLC (the “Sub-Adviser”) serves as sub-adviser to the Funds. ReSolve Asset Management SEZC (Cayman) (“ReSolve or “Futures Trading Advisor”) serves as futures trading advisor to RSBT ETF, RSSY ETF and RSST ETF and their respective Subsidiaries. Each Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic 946 “Financial Services – Investment Companies.” The RSBT ETF commenced operations on February 7, 2023, the RSSB ETF commenced operations on December 4, 2023, the RSSY Fund commenced operations on May 28, 2024, and the RSST ETF commenced operations on September 5, 2023.

The investment objective of each Fund is to seek long-term capital appreciation.

| NOTE 2 – SIGNIFICANT ACCOUNTING POLICIES |

The following is a summary of significant accounting policies consistently followed by the Funds. These policies are in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”).

| A. | Security Valuation. Equity securities that are listed on a securities exchange, market or automated quotation system for which quotations are readily available (except for securities traded on the NASDAQ Stock Market (“NASDAQ”)), including securities traded over the counter, are valued at the last quoted sale price on the primary exchange or market (foreign or domestic) on which they are traded on the valuation date (or at approximately 4:00 p.m. EST if a security’s primary exchange is normally open at that time), or, if there is no such reported sale on the valuation date, at the most recent quoted bid price or mean between the most recent quoted bid and ask prices for long and short positions. For a security that trades on multiple exchanges, the primary exchange will generally be considered the exchange on which the security is generally most actively traded. For securities traded on NASDAQ, the NASDAQ Official Closing Price will be used. Prices of securities traded on the securities exchange will be obtained from recognized independent pricing agents (“Independent Pricing Agents”) each day that the Fund is open for business. |

Futures contracts are priced by an approved independent pricing service. Futures contracts are valued at the settlement price on the exchange on which they are principally traded.

Under Rule 2a-5 of the 1940 Act, a fair value will be determined for securities for which quotations are not readily available by the Valuation Designee (as defined in Rule 2a-5) in accordance with the Pricing and Valuation Policy and Fair Value Procedures, as applicable, of the Adviser, subject to oversight by the Board. When a security is “fair valued,” consideration is given to the facts and circumstances relevant to the particular situation, including a review of various factors set forth in the Adviser’s Pricing and Valuation Policy and Fair Value Procedures, as applicable. Fair value pricing is an inherently subjective process, and no single standard exists for determining fair value. Different funds could reasonably arrive at different values for the same security. The use of fair value pricing by a fund may cause the net asset value (“NAV”) of its shares to differ significantly from the NAV that would be calculated without regard to such considerations.

As described above, the Funds utilizes various methods to measure the fair value of its investments on a recurring basis. U.S. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of inputs are:

Level 1 – Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access.

Level 2 – Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

| Notes to the Consolidated Financial Statements | Return Stacked ETFs |

Level 3 – Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available; representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability and would be based on the best information available.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

The following is a summary of the inputs used to value each Fund’s investments as of July 31, 2024:

| RSBT ETF |

| | | | | | | | | |

| | | Level 1 | | Level 2 | | Level 3 | | Total |

| Assets: | | | | | | | | | | | | | | | | |

| Investments: | | | | | | | | | | | | | | | | |

| Exchange Traded Funds | | $ | 45,233,705 | | | $ | — | | | $ | — | | | $ | 45,233,705 | |

| Money Market Funds | | | 37,109,387 | | | | — | | | | — | | | | 37,109,387 | |

| Total Investments | | $ | 82,343,092 | | | $ | — | | | $ | — | | | $ | 82,343,092 | |

| | | | | | | | | | | | | | | | | |

| Other Financial Instruments:(a) | | | | | | | | | | | | | | | | |

| Futures Contracts | | $ | 973,956 | | | $ | — | | | $ | — | | | $ | 973,956 | |

| Total Other Financial Instruments | | $ | 973,956 | | | $ | — | | | $ | — | | | $ | 973,956 | |

| | | | | | | | | | | | | | | | | |

| Liabilities: | | | | | | | | | | | | | | | | |

| Other Financial Instruments:(a) | | | | | | | | | | | | | | | | |

| Futures Contracts | | $ | (1,738,239 | ) | | $ | — | | | $ | — | | | $ | (1,738,239 | ) |

| Total Other Financial Instruments | | $ | (1,738,239 | ) | | $ | — | | | $ | — | | | $ | (1,738,239 | ) |

| RSSB ETF |

| | | | | | | | | |

| | | Level 1 | | Level 2 | | Level 3 | | Total |

| Assets: | | | | | | | | | | | | | | | | |

| Investments: | | | | | | | | | | | | | | | | |

| Exchange Traded Funds | | $ | 158,005,161 | | | $ | — | | | $ | — | | | $ | 158,005,161 | |

| Money Market Funds | | | 12,544,521 | | | | — | | | | — | | | | 12,544,521 | |

| Total Investments | | $ | 170,549,682 | | | $ | — | | | $ | — | | | $ | 170,549,682 | |

| | | | | | | | | | | | | | | | | |

| Other Financial Instruments:(a) | | | | | | | | | | | | | | | | |

| Futures Contracts | | $ | 2,904,580 | | | $ | — | | | $ | — | | | $ | 2,904,580 | |

| Total Other Financial Instruments | | $ | 2,904,580 | | | $ | — | | | $ | — | | | $ | 2,904,580 | |

| Notes to the Consolidated Financial Statements | Return Stacked ETFs |

| RSSY ETF |

| | | | | | | | | |

| | | Level 1 | | Level 2 | | Level 3 | | Total |

| Assets: | | | | | | | | | | | | | | | | |

| Investments: | | | | | | | | | | | | | | | | |

| Exchange Traded Funds | | $ | 112,204,996 | | | $ | — | | | $ | — | | | $ | 112,204,996 | |

| Money Market Funds | | | 15,710,416 | | | | — | | | | — | | | | 15,710,416 | |

| Total Investments | | $ | 127,915,412 | | | $ | — | | | $ | — | | | $ | 127,915,412 | |

| | | | | | | | | | | | | | | | | |

| Other Financial Instruments:(a) | | | | | | | | | | | | | | | | |

| Futures Contracts | | $ | 2,883,396 | | | $ | — | | | $ | — | | | $ | 2,883,396 | |

| Total Other Financial Instruments | | $ | 2,883,396 | | | $ | — | | | $ | — | | | $ | 2,883,396 | |

| | | | | | | | | | | | | | | | | |

| Liabilities: | | | | | | | | | | | | | | | | |

| Other Financial Instruments:(a) | | | | | | | | | | | | | | | | |

| Futures Contracts | | $ | (4,652,322 | ) | | $ | — | | | $ | — | | | $ | (4,652,322 | ) |

| Total Other Financial Instruments | | $ | (4,652,322 | ) | | $ | — | | | $ | — | | | $ | (4,652,322 | ) |

| RSST ETF |

| | | | | | | | | | |

| | | Level 1 | | Level 2 | | Level 3 | | | Total |

| Assets: | | | | | | | | | | | | | | | | |

| Investments: | | | | | | | | | | | | | | | | |

| Exchange Traded Funds | | $ | 145,655,403 | | | $ | — | | | $ | — | | | $ | 145,655,403 | |

| Money Market Funds | | | 29,324,307 | | | | — | | | | — | | | | 29,324,307 | |

| Total Investments | | $ | 174,979,710 | | | $ | — | | | $ | — | | | $ | 174,979,710 | |

| | | | | | | | | | | | | | | | | |

| Other Financial Instruments:(a) | | | | | | | | | | | | | | | | |

| Futures Contracts | | $ | 1,502,665 | | | $ | — | | | $ | — | | | $ | 1,502,665 | |

| Total Other Financial Instruments | | $ | 1,502,665 | | | $ | — | | | $ | — | | | $ | 1,502,665 | |

| | | | | | | | | | | | | | | | | |

| Liabilities: | | | | | | | | | | | | | | | | |

| Other Financial Instruments:(a) | | | | | | | | | | | | | | | | |

| Futures Contracts | | $ | (3,502,522 | ) | | $ | — | | | $ | — | | | $ | (3,502,522 | ) |

| Total Other Financial Instruments | | $ | (3,502,522 | ) | | $ | — | | | $ | — | | | $ | (3,502,522 | ) |

| (a) | Other Financial Instruments are derivative instruments not reflected in the Consolidated Schedule of Investments, such as futures contracts, which are presented at the unrealized appreciation/depreciation on the investment. |

| B. | Derivative Investments. The Funds have provided additional disclosures below regarding derivatives and hedging activity intending to improve financial reporting by enabling investors to understand how and why the Funds uses futures contracts (a type of derivative), how they are accounted for and how they affect an entity’s results of operations and financial position. The Funds may use derivatives for risk management purposes or as part of their investment strategies. Derivatives are financial contracts whose values depend on, or are derived from, the value of an underlying asset, reference rate or index. The Funds may use derivatives to earn income and enhance returns, to hedge or adjust the risk profile of its portfolio, to replace more traditional direct investments and to obtain exposure to otherwise inaccessible markets. |

The average notional amount for futures contracts is based on the monthly notional amounts. The notional amount for futures contracts represents the U.S. dollar value of the contract as of the day of opening the transaction or latest contract reset date. Each Fund’s average notional value of futures contracts outstanding during the period ended July 31, 2024, was $(16,525,547) for the RSBT ETF, $112,999,583 for RSSB ETF, $(208,920,213) for RSSY ETF and $(70,674,907) for RSST ETF. The following tables show the effects of derivative instruments on the financial statements.

| Notes to the Consolidated Financial Statements | Return Stacked ETFs |

Statements of Assets and Liabilities

Fair value of derivative instruments as of July 31, 2024:

| | | Asset Derivatives | | Liability Derivatives |

| | | | | |

| Instrument | | Balance Sheet Location | | Fair Value | | Balance Sheet Location | | Fair Value |

| | | | | | | | | |

| RSBT ETF | | | | | | | | |

| Open Futures Contracts | | Unrealized appreciation | | | | Unrealized depreciation | | |

| Commodities Risk | | on futures contracts (see | | $223,361 | | on futures contracts (see | | $(65,841) |

| Equities Risk | | Consolidated Statements | | $163,951 | | Consolidated Statements | | $(532,464) |

| Foreign Exchange Currencies Risk | | of Assets and | | $8,666 | | of Assets and | | $(891,295) |

| Interest Rate Risk | | Liabilities) | | $577,978 | | Liabilities) | | $(248,639) |

| Total | | | | $973,956 | | | | $(1,738,239) |

| RSSB ETF | | Unrealized appreciation | | | | Unrealized depreciation | | |

| Open Futures Contracts | | on futures contracts (see | | | | on futures contracts (see | | |

| Equities Risk | | Consolidated Statements | | $152,138 | | Consolidated Statements | | — |

| Interest Rate Risk | | of Assets and Liabilities) | | $2,752,442 | | of Assets and Liabilities) | | — |

| Total | | | | $2,904,580 | | | | — |

| RSST ETF | | | | | | | | |

| Open Futures Contracts | | | | | | Unrealized depreciation | | |

| Commodities Risk | | Unrealized appreciation | | $440,082 | | on futures contracts (see | | $(122,331) |

| Equities Risk | | on futures contracts (see | | $325,715 | | Consolidated Statements | | $(1,010,757) |

| Foreign Exchange Currencies Risk | | Consolidated Statements | | $16,180 | | of Assets and | | $(1,729,152) |

| Interest Rate Risk | | of Assets and Liabilities) | | $720,688 | | Liabilities) | | $(640,282) |

| Total | | | | $1,502,665 | | | | $(3,502,522) |

| RSSY ETF | | | | | | | | |

| Open Futures Contracts | | | | | | | | |

| Commodities Risk | | Unrealized appreciation | | $690,831 | | Unrealized depreciation | | $(677,179) |

| Equities Risk | | on futures contracts (see | | $120,763 | | on futures contracts (see | | $(718,672) |

| Foreign Exchange Currencies Risk | | Consolidated Statements | | $571,003 | | Consolidated Statements | | $(2,279,714) |

| Interest Rate Risk | | of Assets and Liabilities) | | $1,500,799 | | of Assets and Liabilities) | | $(976,757) |

| Total | | | | $2,883,396 | | | | $(4,652,322) |

Statements of Operations

The effect of derivative instruments on the Statements of Operations for the period ended July 31, 2024:

| Instrument | | Location of Gain

(Loss) on Derivatives

Recognized in Income | | Realized Gain (Loss)

on Derivatives

Recognized in

Income | | Change in Unrealized

Appreciation/Depreciation

on Derivatives Recognized

in Income |

| RSBT ETF | | Net Realized and | | | | |

| Open Futures Contracts | | Unrealized Gain (Loss) | | | | |

| Commodities Risk | | | | $201,026 | | $102,898 |

| Equities Risk | | | | $3,467,645 | | $(1,034,147) |

| Foreign Exchange Currencies Risk | | | | $561,776 | | $(809,908) |

| Interest Rate Risk | | | | $(1,429,683) | | $120,133 |

| Total | | | | $2,800,764 | | (1,621,024) |

| RSSB ETF | | Net Realized and | | | | |

| Open Futures Contracts | | Unrealized Gain (Loss) | | | | |

| Equities Risk | | | | $917,516 | | $(24,871) |

| Interest Rate Risk | | | | $(1,970,530) | | $2,376,347 |

| Total | | | | $(1,053,014) | | $2,351,476 |

| | | | | | | |

| RSST ETF | | Net Realized and | | | | |

| Open Futures Contracts | | Unrealized Gain (Loss) | | | | |

| Commodities Risk | | | | $(416,195) | | $290,423 |

| Equities Risk | | | | $6,432,340 | | $(1,732,221) |

| Foreign Exchange Currencies Risk | | | | $1,151,407 | | $(1,744,136) |

| Interest Rate Risk | | | | $(2,509,891) | | $59,266 |

| Total | | | | $4,657,661 | | $(3,126,688) |

| RSSY ETF | | Net Realized and | | | | |

| Open Futures Contracts | | Unrealized Gain (Loss) | | | | |

| Commodities Risk | | | | $(1,393,318) | | $13,651 |

| Equities Risk | | | | $367,113 | | $(597,908) |

| Foreign Exchange Currencies Risk | | | | $367,454 | | $(1,708,711) |

| Interest Rate Risk | | | | $(481,563) | | $524,042 |

| Total | | | | $(1,140,314) | | $(1,768,926) |

| Notes to the Consolidated Financial Statements | Return Stacked ETFs |

| C. | Federal Income Taxes. The Funds have elected to be taxed as a “regulated investment company” and intends to distribute substantially all taxable income to its shareholders and otherwise comply with the provisions of the Internal Revenue Code applicable to regulated investment companies. Therefore, no provision for federal income taxes or excise taxes has been made. |

In order to avoid imposition of the excise tax applicable to regulated investment companies, the Fund intends to declare as dividends in each calendar year at least 98.0% of its net investment income (earned during the calendar year) and at least 98.2% of its net realized capital gains (earned during the twelve months ended October 31) plus undistributed amounts, if any, from prior years. As a registered investment company, each Fund is subject to a 4% excise tax that is imposed if a Fund does not distribute by the end of any calendar year at least the sum of (i) 98% of its ordinary income (not taking into account any capital gain or loss) for the calendar year and (ii) 98.2% of its capital gain in excess of its capital loss (adjusted for certain ordinary losses) for a one year period generally ending on October 31 of the calendar year (unless an election is made to use the fund’s fiscal year). The Funds generally intend to distribute income and capital gains in the manner necessary to minimize (but not necessarily eliminate) the imposition of such excise tax. The Funds may retain income or capital gains and pay excise tax when it is determined that doing so is in the best interest of shareholders. Management, in consultation with the Board of Trustees, evaluates the costs of the excise tax relative to the benefits of retaining income and capital gains, including that such undistributed amounts (net of the excise tax paid) remain available for investment by the Funds and are available to supplement future distributions. Tax expense is disclosed in the Statements of Operations, if applicable.

As of July 31, 2024, the Funds did not have any tax positions that did not meet the threshold of being sustained by the applicable tax authority. Generally, tax authorities can examine all the tax returns filed for the last three years. The Funds identify its major tax jurisdiction as U.S. Federal and the Commonwealth of Delaware; however, the Funds are not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially. The Funds recognizes interest and penalties, if any, related to unrecognized tax benefits on uncertain tax positions as income tax expense in the Statements of Operations.

| D. | Securities Transactions and Investment Income. Investment securities transactions are accounted for on the trade date. Gains and losses realized on sales of securities are determined on a specific identification basis. Discounts/premiums on debt securities purchased are accreted/amortized over the life of the respective securities using the effective interest method. Dividend income is recorded on the ex-dividend date. Debt income is recorded on an accrual basis. Other non-cash dividends are recognized as investment income at the fair value of the property received. Withholding taxes on foreign dividends have been provided for in accordance with the Funds’ understanding of the applicable country’s tax rules and rates. |