Exhibit 99.2

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

On May 27, 2022, Freightos HK completed a reorganization pursuant to which shareholders of Freightos HK exchanged shares in Freightos HK for shares in Freightos Limited, and Freightos HK became a subsidiary of Freightos Limited. Unless the context otherwise requires, all references in this section to the “Company,” “Freightos,” “we,” “us,” or “our” refer to the business which belonged to Freightos HK, including its subsidiaries, through May 27, 2022, and to Freightos Limited, including its subsidiaries, after May 27, 2022.

You should read the following discussion and analysis of our financial condition and results of operations together with our interim unaudited consolidated financial statements for the six months ended June 30, 2023, included as Exhibit 99.1 to this Report on Form 6-K (this “Report”) and our audited consolidated financial statements and the related notes for the year ended December 31, 2022 appearing in our Annual Report on Form 20-F for the year ended December 31, 2022 (our “Annual Report”) and “Item 5 – Operating and Financial Review and Prospects” of that Annual Report. This discussion contains forward-looking statements that reflect our plans, estimates and beliefs that involve risks and uncertainties. As a result of many factors, such as those set forth under the “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” sections of our Annual Report, our actual results may differ materially from those anticipated in these forward-looking statements.

Overview

Our mission is to expand trade among the people of the world by digitalizing the international shipping industry, reducing the friction that plagues global supply chains.

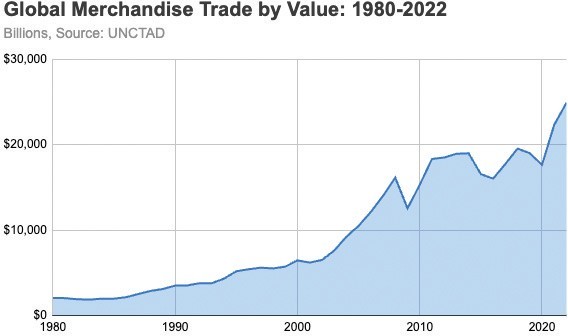

We operate a leading, vendor-neutral booking and payment platform for international freight. Our global freight booking and payments platforms, Freightos.com and WebCargo eBooking (collectively, the “Platform”) supports supply chain efficiency and agility by enabling real-time procurement of ocean and air shipping across more than ten thousand importers and exporters, thousands of freight forwarders, and dozens of airlines and ocean carriers. According to the United Nations Conference on Trade and Development, the value of goods traded internationally reached a record level of $24.9 trillion in 2022, representing nearly one quarter of the world’s gross domestic product. International trade is facilitated by the third-party logistics market, which, according to Astute Analytica, a research and data firm, was valued at $1.1 trillion in 2022 and is expected to reach $2.3 trillion by 2031, at a compounded annual growth rate of 8.7% between 2023 and 2031.

Despite its size and importance, global freight has not yet undergone a comprehensive digital transformation. Unlike passenger travel, hotels and retail, cross-border freight services remain largely offline, opaque and inefficient. Most international air and ocean shipments involve multiple intermediaries, often with as many as 30 actors and 100 people, communicating across time zones. These manual processes, replicated hundreds of thousands of times each day, typically result in delays, extra expenses, non-binding and inconsistent pricing, and uncertain transit times. Even on major trade lanes, such as Asia to the United States, our research shows that it is common for importers and exporters to wait several days for a spot price quote, and prices often vary by tens of percentage points. Actual prices and transit times are not guaranteed and are unpredictable, impairing supply chain planning and execution.

The consequences of this dysfunction reach international freight, supply chains and, ultimately, businesses and consumers everywhere. As a result, consumers pay more for goods, businesses experience reduced margins, and goods remain under or overstocked. The environment also suffers from this lack of efficiency; according to the International Air Transport Association (“IATA”), air cargo holds, for example, are typically about 50% unutilized, doubling greenhouse gas emissions per unit weight.

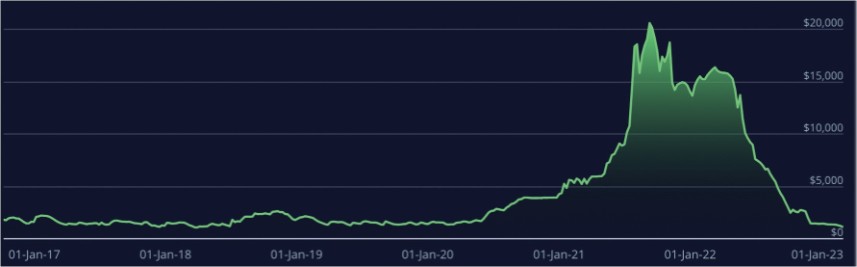

These challenges are exacerbated by ongoing and persistent supply chain problems, making global freight pricing more volatile than most stock and commodity markets. Without digitalization, supply chains are unable to respond to stressors in an agile and cost-effective manner. As a result, supply chains have struggled to adjust in an agile and cost-effective manner to stresses, such as wars, pandemics, weather problems, strikes, obstructions and other restrictions in key trade bottlenecks, such as the Suez Canal and Panama Canal, and trade wars.

We believe that the key metric for the size of our marketplace is the number of transactions on our Platform (“#Transactions”) and secondarily our gross bookings value (“GBV”), which represents the value of transactions consummated between the purchasers of logistics services, such as freight forwarders and importers/exporters (“Buyers”) and the sellers of logistics, services such as carriers and freight forwarders (“Sellers”) on our Platform, plus related fees charged to Buyers and Sellers, and pass-through payments such as duties. We also believe this metric to be a bellwether of marketplace liquidity and growth, correlated to the potential for Platform revenue. #Transactions on our Platform started growing rapidly in 2020 as carriers increasingly adopted digital cargo sales and bookings. GBV started growing rapidly too, however, GBV is directly influenced by industry price levels, which can fluctuate dramatically, which is why we believe #Transactions provides a more stable indicator of our Platform’s traction and liquidity.