Exhibit 99.2

OPERATING AND FINANCIAL REVIEW AND PROSPECTS

You should read the following discussion and analysis of results of operations, financial condition and prospects of Freightos Limited (referred to as “Freightos”, “the Company”, “our company”, “we”, “us” and similar terms) together with (i) our interim unaudited consolidated financial statements for the six months ended June 30, 2024, included as Exhibit 99.1 to the Report of Foreign Private Issuer on Form 6-K (the “Report”) to which this Operating and Financial Review and Prospects is attached, and (ii) our audited consolidated financial statements and the related notes for the year ended December 31, 2023 appearing in our Annual Report on Form 20-F for the year ended December 31, 2023, filed with the Securities and Exchange Commission (the “SEC”) on March 21, 2024 (our “Annual Report”) and “Item 5 – Operating and Financial Review and Prospects” of that Annual Report. This discussion contains forward-looking statements that reflect our plans, estimates and beliefs that involve risks and uncertainties. As a result of many factors, such as those set forth under the “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” sections of our Annual Report, our actual results may differ materially from those anticipated in these forward-looking statements.

Overview

Our mission is to expand trade among the people of the world by digitalizing the international shipping industry, reducing the friction that plagues global supply chains.

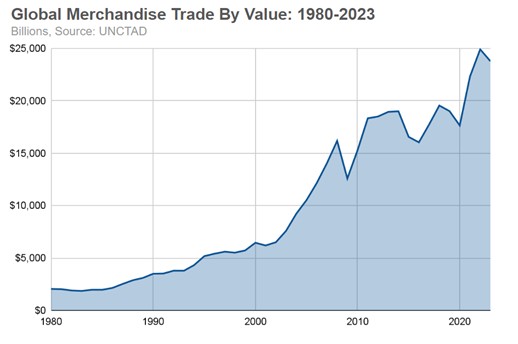

We operate a leading, vendor-neutral booking and payment platform for international freight. Our global freight booking and payments platforms, Freightos and WebCargo (collectively, the “Platform”), support supply chain efficiency and agility by enabling real-time procurement of ocean and air shipping across more than ten thousand importers/exporters, thousands of freight forwarders, and dozens of airlines and ocean carriers. According to the United Nations Conference on Trade and Development (“UNCTAD”), the value of goods traded internationally reached an estimated $23.8 trillion in 2023, representing approximately 23% of global gross domestic product (“GDP”). International trade is facilitated by the third-party logistics market, which, according to logistics research firm Armstrong & Associates, generated 1.2 trillion dollars in revenue in 2023, exceeding pre-pandemic numbers by some 25%.

Despite its size and importance, global freight has not yet undergone a comprehensive digital transformation. Unlike passenger travel, hotels and retail, cross-border freight services remain largely offline, opaque and inefficient. Most international air and ocean shipments involve multiple intermediaries, often with as many as 30 actors and 100 people, communicating across time zones. These manual processes, replicated hundreds of thousands of times each day, typically result in delays, non-binding and inconsistent pricing, and uncertain transit times. Even on major trade lanes, such as Asia to the United States, our research shows that it is common for importers/exporters to wait several days for a spot price quote, and prices often vary by tens of percentage points. Actual prices and transit times are usually not guaranteed and are unpredictable.

The consequences of this dysfunction flow through international freight, supply chains and, ultimately, businesses and consumers everywhere. As a result, consumers pay more for goods, businesses experience reduced margins, and goods remain under or overstocked. The environment also suffers from this lack of efficiency; according to the International Air Transport Association (“IATA”), air cargo holds, for example, were typically about 50% unutilized pre-pandemic, almost doubling greenhouse gas emissions per unit weight of cargo.

These challenges are exacerbated by ongoing and persistent supply chain problems, making global freight pricing more volatile than most stock and commodity markets. Without digitalization, supply chains are unable to respond to stressors in an agile and cost-effective manner. As a result, supply chains have struggled to adjust in an agile and cost-effective manner to stresses, such as wars, pandemics, weather problems, strikes, blockages of trade routes, such as the Suez Canal, and “trade wars.”

We operate our business in two segments. In our Platform segment, we connect Buyers and Sellers of freight services to provide digitalized price quoting, booking, payments and basic shipment management. In our Solutions segment, we provide software tools and data to help industry participants automate their pricing, sales and procurement processes. In addition to driving significant value for companies around the world, our SaaS products encourage adoption of our Platform. Other companies that have successfully deployed SaaS-enabled marketplace strategies include OpenTable, Zenefits and Carta.

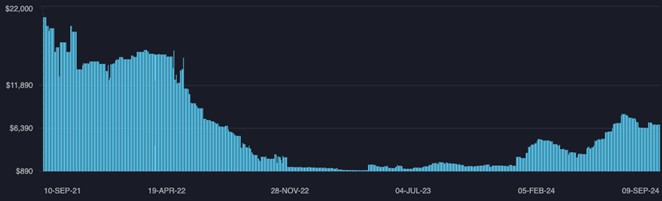

Given the size, complexity and conservatism of the international freight industry, it took us a decade to achieve direct digital connections with multiple layers of the industry: carriers, freight forwarders (who are analogous to sophisticated travel agents for goods) and importers/exporters. Around 2020, we achieved a critical mass of airlines offering digital connections, and our Platform reached an inflection point. Since then, we have achieved rapid growth of our gross booking value (“GBV”, also referred to by some as “GMV”), which is equal to the total value of freight services and related services purchased on our Platform. In most cases, freight services are purchased by importers/exporters or by freight forwarders (as purchasers of services, “Buyers”) from carriers or freight forwarders (as sellers of services, “Sellers”) who meet, transact and often pay each other on our Platform.