UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23801

Bitwise Funds Trust

(Exact name of registrant as specified in charter)

250 Montgomery Street, Suite 200

San Francisco, California 94104

(Address of principal executive offices) (Zip code)

Delaware Trust Company

251 Little Falls Drive

Wilmington, New Castle County, Delaware 19808

(Name and address of agent for service)

Copies of Communications to:

Richard J. Coyle, Esq.

Chapman and Cutler, LLP

320 South Canal Street

Chicago, Illinois 60606

Registrant’s telephone number, including area code: (415) 707-3663

Date of fiscal year end: December 31

Date of reporting period: December 31, 2023

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Explanatory Note: The Registrant is filing this second amendment to its Form N-CSR for the fiscal year ended December 31, 2023. The Registrant filed its original Form N-CSR with the Securities and Exchange Commission (“SEC”) on March 7, 2024 (Accession Number 0001193125-24-062128), and filed its first amendment to its Form N-CSR with the SEC on March 12, 2024 (Accession Number 0001193125-24-065156). The purpose of this second amendment is to refile the opinion of KPMG LLP included as part of the Report of Independent Registered Public Accounting Firm for the Bitwise Bitcoin Strategy Optimum Roll ETF, Bitwise Bitcoin and Ether Equal Weight Strategy ETF, and Bitwise Ethereum Strategy ETF. The refiled opinion includes a correction related to the name of one Fund.

Item 1. Reports to Stockholders.

December 31, 2023

Annual Report

Bitwise Funds Trust

Bitwise Web3 ETF (BWEB)

(This page intentionally left blank)

Bitwise Web3 ETF

Table of Contents

This report is provided for the general information of shareholders and is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

Bitwise Web3 ETF

Letter to Shareholders (Unaudited)

Dear Shareholder,

I am honored to write to you on behalf of the entire team at Bitwise Asset Management. We deeply appreciate the trust you have placed in us, and look to honor that trust every day.

For most investors, 2023’s stock market performance marked a much-needed comeback as compared to a dismal 2022. Bolstered by a strong economy, better-than-expected corporate earnings, and indications that the Federal Reserve had reached the end of its rate hiking cycle, the S&P 500 Index rallied 26.29% in 2023. Technology stocks (and risk assets more broadly) saw a sustained lift, as the market began to price in expectations of multiple Federal Reserve rate cuts in 2024, and as excitement grew around advancements in artificial intelligence technologies.

The crypto and blockchain industry benefited from these macro drivers, and added on positive industry-specific developments as well: a succession of encouraging court rulings, including landmark wins by Grayscale and Ripple Labs; top financial institutions putting their weight behind crypto in an unprecedented way, highlighted by BlackRock’s decision to file for spot bitcoin and Ethereum ETFs; and big gains in Layer 2 scaling solutions, which brought new speed and efficiency to blockchains. As a result, Web3 Equities had a stellar year, evidenced by the 99.45% rise in the Bitwise Web3 Equities Index.

As we look to 2024, the economic outlook appears stable but carries risks. Strong labor markets continue to support employment and wages, and household balance sheets and debt servicing levels remain healthy. However, consumer spending could slow down as a result of diminished excess savings, slowing wage gains, and an exhaustion of pent-up demand for goods and services. Even as inflation is expected to gradually move lower, allowing the Federal Reserve to cut interest rates, the pace of cuts remains unclear, and risks remain that inflation will be stickier than we hope.

Meanwhile, 2024 is shaping up to be a strong year for the crypto and blockchain industry. Already, we’ve had significant developments, as on January 11, the U.S. Securities and Exchange Commission approved the listing of spot bitcoin ETFs. The funds surged out of the gate, attracting billions in assets in the first weeks, while opening up significant swaths of the investment landscape to crypto for the first time. We believe we are in the early stages of a multi-year bull market in crypto, and are excited about additional catalysts on the horizon.

Our mission at Bitwise is to help investors gain exposure to the opportunities created by the development of crypto and public blockchains, which includes a broad set of opportunities that fall under the label “Web3.” We believe that the future opportunities surrounding companies building in the Web3 space are significant.

We look forward to continuing to help you and fellow investors gain exposure to these opportunities in an efficient manner.

Best regards,

Matt Hougan

Chief Investment Officer, Bitwise Asset Management

1

Bitwise Web3 ETF

Management’s Discussion of Fund Performance

December 31, 2023 (Unaudited)

Bitwise Web3 ETF [Ticker: BWEB]

From its inception on October 3, 2022 through December 31, 2023, BWEB returned +55.99%, compared to +25.45% for the S&P 500. The Fund’s outperformance was driven primarily by its exposure to crypto- and blockchain-related equities, which saw a substantial rally amid broader momentum in the technology sector alongside strong price action in crypto assets. The 19 pure-play crypto- and blockchain-related equities in the portfolio ranged in performance between -25.24% and +337.41%. The portfolio was also complemented by the strong returns in certain large-cap names, including Nvidia (+296.07%) and Meta (+155.36%).

Over the next 6-12 months, we expect the environment to remain modestly favorable for risk assets like many of the companies in BWEB, as the Federal Reserve begins to cut interest rates. We continue to see value in the exposure BWEB offers to some of the world’s most innovative and forward-looking public companies, and believe that the long-term trend of growth in the Web3 market is intact.

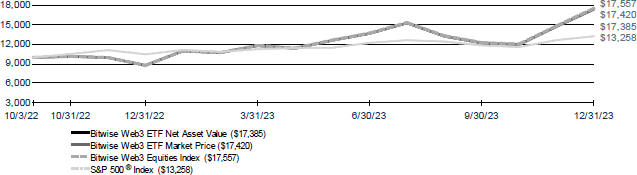

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period October 3, 2022* to December 31, 2023

HISTORICAL PERFORMANCE

Total Return as of December 31, 2023

| | | | |

| | | Average Annual Total Return |

| | | One Year | | Since

Inception* |

Bitwise Web3 ETF Net Asset Value | | 98.13% | | 55.99% |

Bitwise Web3 ETF Market Price | | 98.32% | | 56.24% |

Bitwise Web3 Equities Index | | 99.45% | | 57.23% |

S&P 500® Index | | 26.29% | | 25.45% |

* Commencement of operations was October 3, 2022.

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund Net Asset Value (“NAV”) returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (net) is 0.85%. Actual expenses can be referenced in the Financial Highlights section later in this report. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1 (866) 880-7228.

The Fund seeks investment results that, before fees and expenses, correspond generally to the performance of the Bitwise Web3 Equities Index. The Bitwise Web3 Equities Index provides focused exposure to companies that are well positioned to benefit from the emergence of Web3 and Web3 technologies.

The S&P 500® Index is a capitalization-weighted index of 500 stocks. This index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and it is not available for direct investment.

Investments involve risk. Principal loss is possible. Redemptions are limited and often commissions are charged on each trade. The ETF may be non-diversified, which may be more sensitive to economic, business, political or other changes affecting individual issuers

2

Bitwise Web3 ETF

Management’s Discussion of Fund Performance (Continued)

December 31, 2023 (Unaudited)

or investments than a diversified fund, which may result in greater fluctuation in the value of the Fund’s shares and greater risk of loss. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. The Fund is new and has limited operating history.

This document must be preceded or accompanied by a prospectus.

Investors in the Fund should be willing to accept a high degree of volatility in the price of the Fund’s shares and the possibility of significant losses. An investment in the Fund involves a substantial degree of risk.

There is no guarantee or assurance that the methodology used to create the Index will result in the Fund achieving positive investment returns or outperforming other investment products. Indices are unmanaged and do not include the effect of fees. One cannot invest directly in an index. In addition, the Fund’s returns may not match the Index due to expenses incurred by the Fund or lack of precise correlation with the Index.

Shares of ETFs are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Brokerage commissions will reduce returns.

The Fund will not invest either directly or indirectly in cryptocurrencies, such as through direct holdings of cryptocurrencies (e.g. bitcoin) or indirectly through derivatives that reference cryptocurrencies (e.g. bitcoin derivatives).

In addition to the normal risks associated with investing, international investments (including through American Depositary Receipts

(ADRs)) may involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles or from social, economic or political instability in other nations. ADRs may be less liquid than the underlying shares in their primary trading market. Emerging markets involve heightened risks related to the same factors as well as increased volatility and lower trading volume. Narrowly focused investments and investments in small companies typically exhibit higher volatility.

Certain of the Fund’s investments may be subject to the risks associated with investing in blockchain technology. The risks associated with blockchain technology may not fully emerge until the technology is widely used. Blockchain systems could be vulnerable to fraud, particularly if a significant minority of participants colluded to defraud the rest. Because blockchain technology systems may operate across many national boundaries and regulatory jurisdictions, it is possible that blockchain technology may be subject to widespread and inconsistent regulation. Blockchain technology also may never be implemented to a scale that provides identifiable economic benefit to the companies included in the underlying Index.

The technology relating to crypto assets and blockchain is new and developing. Currently, there are a limited number of publicly listed or quoted companies for which crypto assets and blockchain technology represent an attributable and significant revenue stream. This concentration in fewer companies may make the Fund more susceptible to adverse events that affect the Fund’s holdings more than the market as a whole.

Non-Diversification Risk. As a non-diversified fund, the Fund may hold a smaller number of portfolio securities than many other funds. To the extent the Fund invests in a relatively small number of issuers, a decline in the market value of a particular security held by the Fund may affect its value more than if it invested in a larger number of issuers.

Bitwise Investment Manager, LLC serves as the investment advisor of the Fund. The Fund is distributed by Foreside Fund Services LLC, which is not affiliated with Bitwise Investment Manager, LLC, Bitwise Asset Management Inc., or any of its affiliates.

3

Bitwise Web3 ETF

Schedule of Investments

December 31, 2023

| | | | | | | | |

| | | Shares | | | Value | |

Common Stocks – 100.0% | | | | | | | | |

Communication Services – 26.3% | | | | | | | | |

Alphabet, Inc., Class C* | | | 104 | | | $ | 14,657 | |

Electronic Arts, Inc. | | | 300 | | | | 41,043 | |

Meta Platforms, Inc., Class A* | | | 226 | | | | 79,995 | |

ROBLOX Corp., Class A* | | | 1,813 | | | | 82,890 | |

Take-Two Interactive Software, Inc.* | | | 262 | | | | 42,169 | |

Tencent Holdings Ltd. | | | 350 | | | | 13,160 | |

| | | | | | | | |

| | | | | | | 273,914 | |

| | | | | | | | |

Consumer Discretionary – 1.4% | | | | | | | | |

LVMH Moet Hennessy Louis Vuitton SE | | | 18 | | | | 14,587 | |

| | | | | | | | |

| | |

Energy – 1.3% | | | | | | | | |

Exxon Mobil Corp. | | | 134 | | | | 13,397 | |

| | | | | | | | |

| | |

Financials – 22.4% | | | | | | | | |

Bakkt Holdings, Inc.* | | | 2,446 | | | | 5,455 | |

BC Technology Group Ltd.* | | | 2,000 | | | | 3,114 | |

Block, Inc.* | | | 635 | | | | 49,117 | |

Coinbase Global, Inc., Class A* | | | 549 | | | | 95,482 | |

Galaxy Digital Holdings Ltd.* | | | 3,374 | | | | 26,432 | |

Mastercard, Inc., Class A | | | 33 | | | | 14,075 | |

Robinhood Markets, Inc., Class A* | | | 2,100 | | | | 26,754 | |

Visa, Inc., Class A | | | 53 | | | | 13,799 | |

| | | | | | | | |

| | | | | | | 234,228 | |

| | | | | | | | |

Information Technology – 41.7% | | | | | | | | |

Adobe, Inc.* | | | 23 | | | | 13,722 | |

Akamai Technologies, Inc.* | | | 356 | | | | 42,133 | |

Applied Digital Corp.* | | | 775 | | | | 5,224 | |

Bit Digital, Inc.* | | | 968 | | | | 4,095 | |

Bitdeer Technologies Group, Class A* | | | 487 | | | | 4,802 | |

Bitfarms Ltd.* | | | 3,292 | | | | 9,612 | |

Canaan, Inc., ADR* | | | 2,058 | | | | 4,754 | |

Cipher Mining, Inc.* | | | 632 | | | | 2,610 | |

Cleanspark, Inc.* | | | 1,677 | | | | 18,497 | |

Cloudflare, Inc., Class A* | | | 524 | | | | 43,628 | |

CompoSecure, Inc.* | | | 189 | | | | 1,021 | |

Hive Digital Technologies Ltd.* | | | 942 | | | | 4,258 | |

Hut 8 Corp.* | | | 473 | | | | 6,342 | |

Iris Energy Ltd.* | | | 560 | | | | 4,004 | |

Marathon Digital Holdings, Inc.* | | | 2,324 | | | | 54,591 | |

Microsoft Corp. | | | 36 | | | | 13,537 | |

Northern Data AG* | | | 256 | | | | 7,437 | |

NVIDIA Corp. | | | 29 | | | | 14,361 | |

Riot Platforms, Inc.* | | | 2,109 | | | | 32,626 | |

Shopify, Inc., Class A* | | | 992 | | | | 77,277 | |

Taiwan Semiconductor Manufacturing Co. Ltd., ADR | | | 140 | | | | 14,560 | |

Terawulf, Inc.* | | | 1,525 | | | | 3,660 | |

Unity Software, Inc.* | | | 1,269 | | | | 51,889 | |

| | | | | | | | |

| | | | | | | 434,640 | |

| | | | | | | | |

| | | | |

| See Notes to Financial Statements. | | 4 | | |

Bitwise Web3 ETF

Schedule of Investments (Continued)

December 31, 2023

| | | | | | | | |

| | | Shares | | | Value | |

Common Stocks (continued) | | | | | | | | |

Real Estate – 6.9% | | | | | | | | |

Equinix, Inc. | | | 89 | | | $ | 71,680 | |

| | | | | | | | |

| | |

Total Common Stocks (Cost $975,040) | | | | | | | 1,042,446 | |

| | | | | | | | |

| | |

Money Market Funds – 0.1% | | | | | | | | |

DWS Government Money Market Series Institutional, 5.30%(a)

(Cost $1,322) | | | 1,322 | | | | 1,322 | |

| | | | | | | | |

| | |

Total Investments – 100.1%

(Cost $976,362) | | | | | | $ | 1,043,768 | |

Liabilities in Excess of Other Assets – (0.1)% | | | | | | | (672) | |

| | | | | | | | |

Net Assets – 100.0% | | | | | | $ | 1,043,096 | |

| | | | | | | | |

| (a) | Rate shown reflects the 7-day yield as of December 31, 2023. |

ADR : American Depositary Receipt

Summary of Investment Type

| | | | |

| Industry | | % of Net

Assets | |

Information Technology | | | 41.7 | % |

Communication Services | | | 26.3 | % |

Financials | | | 22.4 | % |

Real Estate | | | 6.9 | % |

Consumer Discretionary | | | 1.4 | % |

Energy | | | 1.3 | % |

Money Market Funds | | | 0.1 | % |

Total Investments | | | 100.1 | % |

Liabilities in Excess of Other Assets | | | (0.1 | )% |

Net Assets | | | 100.0 | % |

Country Breakdown† | | | | |

| Country | | % of Net

Assets | |

United States | | | 83.9 | % |

Canada | | | 9.3 | % |

China | | | 2.5 | % |

France | | | 1.4 | % |

Taiwan | | | 1.4 | % |

Germany | | | 0.7 | % |

Cayman Islands | | | 0.5 | % |

Australia | | | 0.4 | % |

Liabilities in Excess of Other Assets | | | (0.1 | )% |

Total | | | 100.0 | % |

| † | The Fund’s country breakdown may change over time. |

| | | | |

| See Notes to Financial Statements. | | 5 | | |

Bitwise Web3 ETF

Statement of Assets and Liabilities

December 31, 2023

| | | | |

| | |

| | | Bitwise Web3

ETF | |

Assets | | | | |

Investments, at fair value | | $ | 1,043,768 | |

Receivables: | | | | |

Dividends | | | 52 | |

Foreign tax reclaim | | | 9 | |

| | | | |

Total assets | | | 1,043,829 | |

| | | | |

| |

Liabilities | | | | |

Payables: | | | | |

Investment advisory fees | | | 733 | |

| | | | |

Total liabilities | | | 733 | |

| | | | |

Net Assets | | $ | 1,043,096 | |

| | | | |

| |

Net Assets Consist of | | | | |

Paid-in capital | | $ | 996,740 | |

Distributable earnings (loss) | | | 46,356 | |

| | | | |

Net Assets | | $ | 1,043,096 | |

| | | | |

Number of Common Shares outstanding | | | 24,000 | |

| | | | |

Net Asset Value, offering and redemption price per share | | $ | 43.46 | |

| | | | |

Investments, at cost | | $ | 976,362 | |

| | | | |

| | | | |

| See Notes to Financial Statements. | | 6 | | |

Bitwise Web3 ETF

Statement of Operations

Year Ended December 31, 2023

| | | | |

| | |

| | | Bitwise Web3

ETF | |

Investment Income | | | | |

Dividend income* | | $ | 2,759 | |

| |

Expenses | | | | |

Investment advisory fees | | | 7,240 | |

| | | | |

Total expenses | | | 7,240 | |

| | | | |

Net investment income (loss) | | | (4,481) | |

| | | | |

| |

Realized and Unrealized Gain (Loss) | | | | |

Net realized gain (loss) from: | | | | |

Investments | | | (23,808) | |

In-kind redemptions | | | 635,995 | |

Foreign currency transactions | | | 133 | |

| | | | |

Net realized gain (loss) | | | 612,320 | |

| | | | |

Net change in unrealized appreciation (depreciation) on: | | | | |

Investments | | | 160,537 | |

| | | | |

Net realized and unrealized gain (loss) | | | 772,857 | |

| | | | |

Net Increase (Decrease) in Net Assets Resulting from Operations | | $ | 768,376 | |

| | | | |

* Foreign tax withheld | | $ | 57 | |

| | | | |

| See Notes to Financial Statements. | | 7 | | |

Bitwise Web3 ETF

Statement of Changes in Net Assets

| | | | | | | | |

| | | Bitwise Web3 ETF | |

| | | Year Ended

December 31,

2023 | | | For the period

October 3,

2022(1) to

December 31,

2022 | |

Increase (Decrease) in Net Assets from Operations | | | | | | | | |

Net investment income (loss) | | $ | (4,481) | | | $ | (1,636) | |

Net realized gain (loss) | | | 612,320 | | | | (110,972) | |

Net change in net unrealized appreciation (depreciation) | | | 160,537 | | | | (93,131) | |

| | | | | | | | |

Net increase (decrease) in net assets resulting from operations | | | 768,376 | | | | (205,739) | |

| | | | | | | | |

| | |

Fund Shares Transactions | | | | | | | | |

Proceeds from shares sold | | | 1,484,996(2) | | | | 2,554,673(3) | |

Value of shares redeemed | | | (2,614,222)(2) | | | | (944,988)(3) | |

| | | | | | | | |

Net increase (decrease) in net assets resulting from fund share transactions | | | (1,129,226) | | | | 1,609,685 | |

| | | | | | | | |

Total net increase (decrease) in net assets | | | (360,850) | | | | 1,403,946 | |

| | | | | | | | |

| | |

Net Assets | | | | | | | | |

Beginning of period | | | 1,403,946 | | | | — | |

| | | | | | | | |

End of period | | $ | 1,043,096 | | | $ | 1,403,946 | |

| | | | | | | | |

| | |

Changes in Shares Outstanding | | | | | | | | |

Shares outstanding, beginning of period | | | 64,000 | | | | — | |

Shares sold | | | 40,000(2) | | | | 104,000(3) | |

Shares redeemed | | | (80,000)(2) | | | | (40,000)(3) | |

| | | | | | | | |

Shares outstanding, end of period | | | 24,000 | | | | 64,000 | |

| | | | | | | | |

| (1) | Commencement of operations. |

| (2) | Certain proceeds from shares sold and value of shares redeemed were related to the normal fund rebalance process, amounting to $1,484,996 and $1,481,231, respectively. Shares sold and shares redeemed relating to rebalance activities totaled 40,000 and (40,000), respectively. |

| (3) | Certain proceeds from shares sold and value of shares redeemed were related to the normal fund rebalance process, amounting to $954,673 and $(944,988), respectively. Shares sold and shares redeemed relating to rebalance activities totaled 40,000 and (40,000), respectively. |

| | | | |

| See Notes to Financial Statements. | | 8 | | |

Bitwise Web3 ETF

Financial Highlights

| | | | | | | | |

Bitwise Web3 ETF Selected Per Share Data | | Year Ended

December 31,

2023 | | | Period Ended

December 31,

2022(a) | |

Net Asset Value, beginning of period | | $ | 21.94 | | | $ | 25.00 | |

| | | | | | | | |

Income (loss) from investment operations: | | | | | | | | |

Net investment income (loss)(b) | | | (0.16) | | | | (0.03) | |

Net realized and unrealized gain (loss) | | | 21.68 | | | | (3.03) | |

| | | | | | | | |

Total from investment operations | | | 21.52 | | | | (3.06) | |

| | | | | | | | |

Net Asset Value, end of period | | $ | 43.46 | | | $ | 21.94 | |

| | | | | | | | |

Total Return (%) | | | 98.13 | | | | (12.25)(c) | |

Ratios to Average Net Assets and Supplemental Data | | | | | | | | |

Net Assets, end of period ($ millions) | | $ | 1 | | | $ | 1 | |

Ratio of expenses (%) | | | 0.85 | | | | 0.85(d) | |

Ratio of net investment income (loss) (%) | | | (0.53) | | | | (0.44)(d) | |

Portfolio turnover rate (%)(e) | | | 32 | | | | 51(c) | |

| (a) | For the period October 3, 2022 (commencement of operations) through December 31, 2022. |

| (b) | Per share amounts have been calculated using the average shares outstanding. |

| (e) | Excludes the impact of in-kind transactions related to the processing of capital share transactions. |

| | | | |

| See Notes to Financial Statements. | | 9 | | |

Bitwise Web3 ETF

Notes to Financial Statements

December 31, 2023

1. Organization

Bitwise Funds Trust (the “Trust”) is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end registered management investment company organized on April 28, 2022 as a Delaware Statutory Trust.

As of December 31, 2023, the Trust consists of four investment series of exchange-traded funds (“ETFs”) (each a “Fund” and collectively, the “Funds”) in operation and trading. These financial statements report on the Fund listed below:

Bitwise Web3 ETF

The Fund is a non-diversified series of the Trust.

Bitwise Investment Manager, LLC (the “Adviser”) serves as investment adviser to the Trust and has overall responsibility for the general management and administration of the Fund, subject to the supervision of the Fund’s Board of Trustees (the “Board”). The Fund commenced operations on October 3, 2022.

The Fund offers shares that are listed and traded on the NYSE Arca, Inc. (“NYSE Arca”). Unlike conventional mutual funds, the Fund issues and redeems shares (“Shares” or “Fund Shares”) on a continuous basis, at net asset value (“NAV”), only in large specified lots of 20,000 shares, each called a “Creation Unit”, to authorized participants. An authorized participant is either (i) a broker-dealer or other participant in the clearing process through Continuous Net Settlement System of the National Securities Clearing Corporation or (ii) a Depository Trust Company participant and, in each case, must have executed a participant agreement with the Distributor. Shares are not individually redeemable securities of the Fund, and owners of shares may acquire those shares from the Fund or tender such shares for redemption to the Fund, in Creation Units only.

The Fund seeks investment results that, before fees and expenses, correspond generally to the performance of the Bitwise Web3 Equities Index (the “Index”). Under normal market conditions, the Fund generally invests substantially all, but at least 80%, of its net assets plus borrowings in the securities comprising the Index. The Index provides focused exposure to the equity securities of companies that are well-positioned to benefit from the emergence of Web3 and Web3 technologies.

2. Significant Accounting Policies

The financial statements have been prepared in conformity with U.S. generally accepted accounting principles (“U.S. GAAP”), which require management to make certain estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates. The Fund qualifies as an investment company under Topic 946 of the Accounting Standards Codification of U.S. GAAP. The following is a summary of significant accounting policies followed by the Fund.

Valuation of Investments

The Board has adopted procedures for valuing portfolio securities in circumstances where market quotes are not readily available. In accordance with Rule 2a-5 under the Investment Company Act of 1940, as amended, the Board has designated the Adviser as its valuation designee (the “Valuation Designee”). As Valuation Designee, the Adviser, subject to the oversight of the Board, is responsible for making fair value determinations. The Adviser’s day-to-day responsibilities as Valuation Designee are performed by a valuation committee established by the Adviser (“the Valuation Committee”).

The NAV of the Fund’s shares is calculated each business day as of the close of regular trading on the New York Stock Exchange, generally 4:00 p.m. Eastern Time. NAV per share is calculated by dividing a Fund’s net assets by the number of Fund shares outstanding.

The Fund’s investments are valued using procedures approved by the Board and are generally valued using market valuations (Market Approach). A market valuation generally means a valuation (i) obtained from an exchange, a pricing service, or a major market maker (or dealer) or (ii) based on a price quotation or other equivalent indication of value supplied by an exchange, a pricing service, or a major market maker (or dealer). A price obtained from a pricing service based on such pricing service’s valuation matrix may be considered a market valuation. Any assets or liabilities denominated in currencies other than the U.S. dollar are converted into U.S. dollars at the current market rates on the date of valuation as quoted by one or more sources.

Equity securities are valued at the most recent sale price or official closing price reported on the exchange (U.S. or foreign) or over-the-counter market on which they trade. Securities for which no sales are reported are valued at the calculated mean between the most recent bid and asked quotations on the relevant market or, if a mean cannot be determined, at the most recent bid quotation. Equity securities are generally categorized as Level 1 securities in the fair value hierarchy.

Investments in open-ended investment companies are valued at their reported NAV each business day and are categorized as Level 1.

If market quotations are not readily available, securities will be valued at their fair market value as determined using the “fair value” procedures approved by the Board. Fair value pricing involves subjective judgments and it is possible that the fair value determined for a security may be materially different than the value that could be realized upon the sale of that security. The fair value prices can differ from market prices when they become available or when a price becomes available. The Board designated the Adviser, as Valuation Designee, to perform fair valuation determinations pursuant to the fair valuation procedures approved by the Board. In undertaking these

Bitwise Web3 ETF

Notes to Financial Statements (Continued)

December 31, 2023

determinations, the Adviser’s Valuation Committee may also enlist third party consultants such as an audit firm or financial officer of a security issuer on an as-needed basis to assist in determining a security-specific fair value. These securities are either categorized as Level 2 or 3 of the fair value hierarchy depending on the relevant inputs used. The Board reviews and ratifies the execution of this process and the resultant fair value prices at least quarterly to assure the process produces reliable results.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

| | • | | Level 1 – Quoted prices in active markets for identical assets that the Funds have the ability to access. |

| | • | | Level 2 – Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.). |

| | • | | Level 3 – Significant unobservable inputs (including each Fund’s own assumptions in determining the fair value of investments). |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the valuations as of December 31, 2023 for the Fund based upon the three levels defined above:

| | | | | | | | | | | | | | | | |

Assets | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Common Stocks | | $ | 1,042,446 | | | $ | — | | | $ | — | | | $ | 1,042,446 | |

Money Market Funds | | | 1,322 | | | | — | | | | — | | | | 1,322 | |

| | | | | | | | | | | | | | | | |

TOTAL | | $ | 1,043,768 | | | $ | — | | | $ | — | | | $ | 1,043,768 | |

| | | | | | | | | | | | | | | | |

Cash

Cash consists of cash on deposit with a major financial institution which may exceed federally insured limits. As of December 31, 2023, the Fund did not hold any cash.

Investment Transactions and Related Income

For financial reporting purposes, investment transactions are reported on the trade date. However, for daily NAV determination, portfolio securities transactions are reflected no later than in the first calculation on the first business day following trade date. Dividend income is recorded on the ex-dividend date. Interest income is recognized on an accrual basis and includes, where applicable, the amortization of premium or accretion of discount based on effective yield. Gains or losses realized on sales of securities are determined using the specific identification method by comparing the identified cost of the security lot sold with the net sales proceeds. Dividend income on the Statements of Operations is shown net of any foreign taxes withheld on income from foreign securities, which are provided for in accordance with each Fund’s understanding of the applicable tax rules and regulations.

Income Tax Information and Distributions to Shareholders

The Fund’s policy is to comply with all requirements of the Internal Revenue Code of 1986, as amended (“the Code”). The Fund intends to qualify for and to elect treatment as a separate Regulated Investment Company (“RIC”) under Subchapter M of the Code. The Fund’s policy is to pay out dividends from net investment income at least annually. Taxable net realized gains from investment transactions, reduced by capital loss carryforwards, if any, will be declared and distributed to shareholders at least annually. The capital loss carryforward amount, if any, will be available to offset future net capital gains. The Fund may occasionally be required to make supplemental distributions at some other time during the year. The Fund reserves the right to declare special distributions if, in its reasonable discretion, such action is necessary or advisable to preserve the status of the Fund as a RIC or to avoid imposition of income or excise taxes on undistributed income. Dividends and distributions to shareholders, if any, will be recorded on the ex-dividend date. The amount of dividends and distributions from net investment income and net realized capital gains will be determined in accordance with federal income tax regulations which may differ from U.S. GAAP. These “book/tax” differences are either considered temporary or permanent in nature. To the extent these differences are permanent in nature, such amounts will be reclassified at the end of the year within the components of net assets based on their federal tax treatment; temporary differences do not require reclassification. The Funds may utilize equalization accounting for tax purposes and designate earnings and profits, including net realized gains distributed to shareholders on redemption of shares, as part of the dividends paid deduction for income tax purposes. Dividends and distributions, which exceed earnings and profits for the full year for tax purposes, will be reported as a tax return of capital.

In accordance with U.S. GAAP requirements regarding accounting for uncertainties in income taxes, management has analyzed the Fund’s tax positions expected to be taken on foreign, federal and state income tax returns for all open tax years and has concluded that no provision for income tax is required in the Fund’s financial statement.

The Fund will recognize interest and penalties, if any, related to uncertain tax positions as income tax expense on the Statement of Operations.

11

Bitwise Web3 ETF

Notes to Financial Statements (Continued)

December 31, 2023

Foreign Taxes

The Fund may be subject to foreign taxes (a portion of which may be reclaimable) on income, capital gains on investments, certain foreign currency transactions or other corporate events. All foreign taxes are recorded in accordance with the applicable foreign tax regulations and rates that exist in the foreign jurisdictions in which the Fund invests. These foreign taxes, if any, are paid by the Fund and are reflected in its Statement of Operations as follows: foreign taxes withheld at source are presented as a reduction of income, foreign taxes on capital gains from sales of investments and foreign currency transactions are included in its respective net realized gain (loss) categories. Receivables and payables related to foreign taxes, if any, are disclosed in the Fund’s Statement of Assets and Liabilities.

Foreign Currency Translations

The books and records of the Fund are maintained in U.S. dollars. Investment securities and other assets and liabilities denominated in a foreign currency are translated into U.S. dollars at the prevailing exchange rates at period end. Purchases and sales of investment securities, income and expenses are translated into U.S. dollars at the prevailing exchange rates on the respective dates of the transactions.

Net realized and unrealized gains and losses on foreign currency transactions represent net gains and losses between trade and settlement dates on securities transactions, the acquisition and disposition of foreign currencies, and the difference between the amount of net investment income accrued and the U.S. dollar amount actually received. The portion of both realized and unrealized gains and losses on investments that results from fluctuations in foreign currency exchange rates is not separately disclosed, but is included with net realized and unrealized gain/appreciation and loss/depreciation on investments.

3. Investment Advisory Agreement and Other Agreements

The Adviser has overall responsibility for the general management and administration of the Fund, subject to the oversight of the Board. Under an investment advisory agreement between the Trust, on behalf of the Fund, and the Adviser (the “Investment Advisory Agreement”), the Adviser is responsible for arranging sub-advisory, transfer agency, custody, fund administration, and all other non-distribution related services for the Fund to operate.

For its investment advisory services to the Fund, the Adviser is entitled to receive a management fee from the Fund based on the Fund’s average daily net assets, computed and accrued daily and payable monthly, at an annual rate equal to 0.85%.

This unitary management fee is designed to pay the Fund’s expenses and to compensate the Adviser for the services it provides to the Fund. Out of the unitary management fee, the Adviser pays substantially all expenses of the Fund, including the cost of transfer agency, custody, fund administration, legal, audit and other service and license fees. However, the Adviser is not responsible for distribution and service fees payable pursuant to a Rule 12b-1 plan, if any, brokerage commissions and other expenses connected with the execution of portfolio transactions, taxes, interest, and extraordinary expenses.

Vident Asset Management (the “Sub-Adviser”) serves as the Sub-Adviser to the Fund. In this capacity, the Sub-Adviser is responsible for trading portfolio securities for the Fund, including selecting broker-dealers to execute purchase and sale transactions or in connection with any rebalancing, subject to the supervision of the Adviser and the Board. For its services, the Sub-Adviser is entitled to a fee by the Adviser. The Fund does not directly compensate the Sub-Adviser.

The Bank of New York Mellon, a wholly-owned subsidiary of The Bank of New York Mellon Corporation, serves as Administrator, Custodian, Accounting Agent and Transfer Agent for the Fund.

Foreside Financial Services, LLC (the “Distributor”) serves as the distributor of Creation Units for the Fund on an agency basis. The Distributor does not maintain a secondary market in shares of the Fund.

A Trustee and certain Officers of the Fund are also employees of the Adviser and receive no compensation from the Fund.

4. Investment Transactions

The Fund’s purchases and sales of securities, other than short-term securities, U.S. Government Securities and in-kind transactions were as follows:

| | | | | | | | |

| Fund | | Purchases | | | Sales | |

Bitwise Web3 ETF | | $ | 941,999 | | | $ | 291,317 | |

| | |

Securities received and delivered in-kind through subscriptions and redemptions were as follows: | | | | | | | | |

| Fund | | Purchases | | | Sales | |

Bitwise Web3 ETF | | $ | 829,232 | | | $ | 2,595,563 | |

12

Bitwise Web3 ETF

Notes to Financial Statements (Continued)

December 31, 2023

5. Fund Share Transactions

The Fund issues and redeems Shares at NAV only in large blocks of 20,000 Shares (each block of Shares is called a “Creation Unit”). Creation Units are issued and redeemed primarily in-kind for securities but may include cash. Individual Shares may only be purchased and sold in secondary market transactions through brokers. Except when aggregated in Creation Units in transactions with Authorized Participants, the Shares are not redeemable securities of the Fund.

Fund Shares are listed and traded on the Exchange on each day that the Exchange is open for business (“Business Day”). The Fund’s Shares may only be purchased and sold on the Exchange through a broker-dealer. Because the Fund’s Shares trade at market prices rather than at their NAV, Shares may trade at a price equal to the NAV, greater than NAV (premium) or less than NAV (discount).

6. Concentration of Ownership

As of December 31, 2023, Bitwise Asset Management, Inc., the parent company of the Adviser, directly held 16.67% of the Fund’s shares outstanding.

7. Federal Income Taxes

As of December 31, 2023, the components of accumulated earnings (losses) on a tax basis were as follows:

| | | | | | | | | | | | |

| Fund | | Capital and

Other Gains

(Losses) | | | Unrealized

Appreciation

(Depreciation) | | | Accumulated

Earnings

(Losses) | |

Bitwise Web3 ETF | | $ | (15,889 | ) | | $ | 62,245 | | | $ | 46,356 | |

At December 31, 2023, for Federal income tax purposes, the Funds have capital loss carryforwards available as shown in the table below, to the extent provided by regulations, to offset future capital gains for an unlimited period. To the extent that these loss carryforwards are used to offset future capital gains, it is probable that the capital gains so offset will not be distributed to shareholders.

| | | | | | | | | | | | |

| Fund | | Short-Term | | | Long-Term | | | Total Amount | |

Bitwise Web3 ETF | | $ | 15,889 | | | $ | - | | | $ | 15,889 | |

For the fiscal year ended December 31, 2023, the effect of permanent “book/tax” reclassifications to the components of net assets are included below. These differences are primarily due to recognition of certain foreign currency gains (losses) as ordinary income (loss), Passive Foreign Investment Companies (“PFICs”), redemptions-in-kind, partnership investments, and accrued foreign capital gain taxes.

| | | | | | | | |

| Fund | | Distributable

earnings (loss) | | | Paid-in

Capital | |

Bitwise Web3 ETF | | $ | (449,334 | ) | | $ | 449,334 | |

As of December 31, 2023, the aggregate cost of investments for federal income tax purposes, the net unrealized appreciation or depreciation and the aggregated gross unrealized appreciation (depreciation) on investments were as follows:

| | | | | | | | | | | | | | | | |

| Fund | | Aggregate Tax

Cost | | | Net

Unrealized

Appreciation

(Depreciation) | | | Aggregate

Gross

Unrealized

Appreciation | | | Aggregate

Gross

Unrealized

(Depreciation) | |

Bitwise Web3 ETF | | $ | 981,523 | | | $ | 62,245 | | | $ | 76,090 | | | $ | (13,845 | ) |

8. Subsequent Events

For the period January 1, 2024 through February 28, 2024, the Fund created 20,000 shares for approximately $821,364.

In preparing these financial statements, management has evaluated events and transactions for potential recognition or disclosure through the date this financial statements were available to be issued. Management has determined that there were no other material events that would require disclosure in the Fund’s financial statements, which occurred during the period subsequent to December 31, 2023.

13

Bitwise Funds Trust

Report of Independent Registered Public Accounting Firm

To the Shareholders and Board of Trustees

Bitwise Funds Trust:

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of Bitwise Web3 ETF (the Fund), a series of Bitwise Funds Trust, including the schedule of investments as of December 31, 2023, the related statement of operations for the year then ended, the statements of changes in net assets for the year then ended and for the period October 3, 2022 (commencement of operations) to December 31, 2022, and the related notes (collectively, the financial statements) and the financial highlights for the year and period in the two-year period then ended. In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of December 31, 2023, and the results of its operations for the year then ended, and the changes in its net assets, and the financial highlights for the year and period in the two-year period then ended, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Trust in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risks of material misstatement of the financial statements and financial highlights, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements and financial highlights. Such procedures also included confirmation of securities owned as of December 31, 2023, by correspondence with the custodian. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements and financial highlights. We believe that our audits provide a reasonable basis for our opinion.

We have served as the auditor of one or more Bitwise Funds Trust investment companies since 2022.

/s/ KPMG LLP

New York, New York

February 28, 2024

14

Bitwise Web3 ETF

Fees and Expenses (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including brokerage commissions paid on purchases and sales of Fund shares, and (2) ongoing costs, including unitary management fees and other Fund expenses. The expense examples below are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds.

The examples in the tables are based on an investment of $1,000 invested at the beginning of the period and held for the entire period (July 1, 2023 to December 31, 2023).

Actual expenses

The first line in the following tables provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The second line in the following tables provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratios and an assumed rate of return of 5% per year before expenses (which is not the Fund’s actual return). The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only, and do not reflect any transactional costs. Therefore the second line in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | |

| | | Beginning

Account Value

July 1, 2023 | | | Ending

Account Value

December 31,

2023 | | | Annualized

Expense Ratio | | | Expenses Paid

During the

Period

Per $1,000 (1) | |

Bitwise Web3 ETF | | | | | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,270.54 | | | | 0.85% | | | | $4.86 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,020.92 | | | | 0.85% | | | | $4.33 | |

| (1) | Expenses are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 184 (the number of days in the in the most recent six-month period), then divided by 365. |

15

Bitwise Web3 ETF

Trustees and Officers (Unaudited)

The general supervision of the duties performed for the Fund under the Investment Management Agreement (as defined below) is the responsibility of the Board of Trustees. There are four Trustees of the Trust, one of whom is an “interested person” (as the term is defined in the 1940 Act) (the “Interested Trustee”) and three of whom are Trustees who are not officers or employees of BIM or any of its affiliates (each an “Independent Trustee” and collectively the “Independent Trustees”). The Trustees serve for indefinite terms until their resignation, death or removal. The Trust has not established a lead Independent Trustee position. The Trustees set broad policies for the Fund, choose the Trust’s officers and hired the Fund’s investment adviser. Each Trustee, except for Paul Fusaro, is an Independent Trustee. Mr. Fusaro is deemed an Interested Trustee of the Trust due to his position as Chief Operating Officer of BIM and President of the Trust. The officers of the Trust manage its day-to-day operations, are responsible to the Board of Trustees and serve indefinite terms. The following is a list of the Trustees and executive officers of the Trust and a statement of their present positions and principal occupations during the past five years, the number of portfolios each Trustee oversees and the other directorships they have held during the past five years, if applicable.

Independent Trustees

| | | | | | | | |

| Name, Address and Year of Birth | | Position/Term of Office* | | Principal Occupations

during the Past 5 Years | | Number of

Portfolios

during Fund

Complex**

Overseen by

Trustee | | Other Directorships Held during the Past 5 Years |

David Fogel c/o Bitwise Investment Manager, LLC 250 Montgomery Street Suite 200 San Francisco, CA 94104 Year of Birth: 1971 | | Independent Trustee Since inception | | Chief Executive Officer of North Country Colocation Services Corp. (2022 – present); Senior Adviser of U.S. Department of State (2020 – 2021); Chief of Staff of the Export- Import Bank of the United States (2019 – 2020); Senior Adviser of New York Life Investment Management (2018); President and Chief Executive Officer of IndexIQ LLC (2006 – 2017) | | 4 | | Ligilo Inc. (2022 –present) |

Jena Watson c/o Bitwise Investment Manager, LLC 250 Montgomery Street Suite 200 San Francisco, CA 94104 Year of Birth: 1972 | | Independent Trustee Since inception | | Partner of ArentFox Schiff LLP (2023 – present); Senior Vice President, Assistant General Counsel and Corporate Secretary of HomeStreet Bank (2021 – 2023); Senior Counsel of Silicon Valley Bank (2018 – 2021); Associate General Counsel of Fannie Mae (2013 – 2018) | | 4 | | City of Belvedere Parks and Open Spaces (2021 – present) |

Terrence Olson c/o Bitwise Investment Manager, LLC 250 Montgomery Street Suite 200 San Francisco, CA 94104 Year of Birth: 1967 | | Independent Trustee Since inception | | Andalusian Credit Partners, LLC (2023 – Present); Chief Finance Officer; Chief Operating Officer and Chief Financial Officer of First Eagle Alternative Credit, LLC (2020 – 2021); Chief Operating Officer and Chief Financial Officer of THL Credit Advisors, LLC (2008 – 2020) | | 4 | | None |

16

Bitwise Web3 ETF

Trustees and Officers (Unaudited) (Continued)

Interested Trustees

| | | | | | | | |

| Name and Year of Birth | | Position/Term of Office* | | Principal Occupations

during the Past 5 Years | | Number of

Portfolios

during Fund

Complex**

Overseen by

Trustee | | Other Directorships Held during the Past 5 Years |

Paul Fusaro(1) c/o Bitwise Investment Manager, LLC 250 Montgomery Street Suite 200 San Francisco, CA 94104 Year of Birth: 1985 | | Chairman of the Board of Trustees, President Since Inception | | President (2021 - present), Chief Operating Officer (2018 – 2021) of Bitwise Asset Management; Chief Operating Officer and Secretary of Bitwise Investment Manager, LLC (2022 – present); Senior Vice President of New York Life & Mainstay Investments (2015 – 2018); Senior Vice President, Head of Portfolio Management of IndexIQ (2013 – 2018) | | 4 | | None |

Officers of the Trust

| | | | | | | | |

| Name, Address and Year of Birth | | Position/Term of Office* | | Principal Occupations

during the Past 5 Years | | Number of

Portfolios

during Fund

Complex**

Overseen by

Trustee | | Other Directorships Held during the Past 5 Years |

James Bebrin c/o Bitwise Investment Manager, LLC 250 Montgomery Street Suite 200 San Francisco, CA 94104 Year of Birth: 1985 | | Assistant Treasurer Since October 5, 2022 | | Director of Controls and Fund Administration of Bitwise Asset Management (2021 – present); Fund Manager of WisdomTree Asset Management (2015 – 2021) | | N/A | | N/A |

Jim Gallo(2) c/o Foreside Fund Officer Services, LLC Three Canal Plaza Portland, ME 04101 Year of Birth: 1964 | | Treasurer and Principal Financial Officer Since inception | | Principal Consultant of ACA Foreside (2022 – present); Vice President and Director of Fund/ Client Accounting of Bank of New York Mellon (2002 – 2022) | | N/A | | N/A |

Katherine Dowling c/o Bitwise Investment Manager, LLC 250 Montgomery Street Suite 200 San Francisco, CA 94104 Year of Birth: 1972 | | General Counsel Since inception | | General Counsel and Vice President of Bitwise Investment Manager, LLC (2022 – present); General Counsel and Chief Compliance Officer of Bitwise Asset Management (2021 – present); Executive Management, General Counsel and Chief Compliance Officer of True Capital Management (2019 – 2021); Senior Advisor (2018), Managing Director, Chief Operating Officer and Chief Compliance Officer of Luminate Capital Partners (2015 – 2017) | | N/A | | N/A |

17

Bitwise Web3 ETF

Trustees and Officers (Unaudited) (Continued)

| | | | | | | | |

| Name, Address and Year of Birth | | Position/Term of Office* | | Principal Occupations during the Past 5 Years | | Number of

Portfolios during Fund Complex**

Overseen by

Trustee | | Other Directorships Held during the Past 5 Years |

Johanna Collins-Wood c/o Bitwise Investment Manager, LLC 250 Montgomery Street Suite 200 San Francisco, CA 94104 Year of Birth: 1987 | | Secretary and Vice President Since inception | | Senior Counsel of Bitwise Asset Management (2021 – present); Chief Compliance Officer of Bitwise Investment Manager, LLC (2022 – present); Associate of Wilson, Sonsini Goodrich & Rosati LLP (2019 – 2021); Associate of Troutman Pepper Hamilton Sanders LLP (2017 – 2019) | | N/A | | N/A |

Kevin Hourihan(2) c/o Foreside Fund Officer Services, LLC Three Canal Plaza Portland, ME 04101 Year of Birth: 1978 | | Chief Compliance Officer and Anti-Money Laundering Officer Since inception | | Fund Chief Compliance Officer of Foreside Fund Officer Services, LLC (2022 – present); Chief Compliance Officer of Ashmore Funds (2017 –2022); Chief Compliance Officer of Ashmore Equities Investment Management (2015 – 2019) | | N/A | | N/A |

| * | The term of office for each Trustee and officer listed above will continue indefinitely until the individual resigns or is removed. |

| ** | The term “Fund Complex” applies only to the Funds in the Trust. |

(1) Mr. Fusaro is deemed an “interested person” of the Trust due to his position as Chief Operating Officer and Secretary of Bitwise Investment Manager, LLC and President of the Trust.

(2) Mr. Gallo and Mr. Hourihan are employees of Foreside Fund Officer Services, LLC, a wholly-owned subsidiary of Foreside Financial Group, LLC, an affiliate of the Fund’s distributor.

Each Funds’ SAI includes additional information about the Trustees and is available free of charge, upon request, by calling toll-free at 1-866-880-7228.

18

Bitwise Web3 ETF

Liquidity Risk Management (Unaudited)

Pursuant to Rule 22e-4 (the “Liquidity Rule”) under the 1940 Act, the Fund has adopted and implemented a Liquidity Risk Management Program (the “Program”). The Program addresses the Liquidity Rule’s requirements for the periodic assessment and management of

Fund’s liquidity risk and compliance with the Liquidity Rule’s restrictions on investments in illiquid investments. Certain Trust officers and representatives from Bitwise Investment Manager, LLC, the Fund’s investment adviser, have been designated to administer the Program (the “Administrator”).

In connection with Rule 22e-4(b)(2) of the 1940 Act, prior to the board meeting held on September 6, 2023, the Administrator prepared its annual written report (the “Report”) evaluating the operation of the Program, assessing the adequacy and effectiveness of the implementation of the Program and considering any material changes to the Program. The Report was presented and discussed with the Board, including a including a majority of the Trustees who are not “interested persons” of the Trust, as defined in the 1940 Act, at the September 6, 2023 meeting of the Board. Among other things, the Report summarized the Administrator’s annual liquidity risk assessment, classification of the Fund’s portfolio holdings and monitoring for compliance with the Liquidity Rule’s restrictions on investments in illiquid investments. Further, the Report noted that the Program compiled with key factors for consideration under the Liquidity Rule for assessing, managing and periodically reviewing the Fund’s liquidity risk, including reviewing the Fund’s investment strategies and liquidity of portfolio investments during both normal and reasonably foreseeable stressed conditions; investments in derivatives; short-term and long-term cash flow projections during both normal and reasonably foreseeable stressed conditions; holdings of cash and cash equivalents as well as borrowing arrangements and other funding sources; the relationship between the Fund’s portfolio liquidity and the way in which, and the price and spreads at which, the Fund’s shares trade, including the efficiency of the arbitrage function and the level of active participation by market participants (including authorized participants); and the effect of the composition of baskets on the overall liquidity of the Fund’s portfolio.

The Report concluded that: (1) there were no material changes to the Program; (2) there were no significant liquidity events impacting the Fund; and (3) that it is the Administrator’s assessment that the Program is adequately designed and has been effective in managing the Fund’s liquidity risk and in implementing the requirements of the Liquidity Rule.

19

Bitwise Web3 ETF

Additional Information (Unaudited)

Proxy Voting Policies and Procedures

The Fund’s policies and procedures for voting proxies for portfolio securities and information about how the Fund voted proxies related to its portfolio securities during the most recent 12-month period ended December 31 are available on our website at www.bitwiseinvestments.com at or on the SEC’s Web site — www.sec.gov. To obtain a written copy of the Fund’s policies and procedures without charge, upon request, call us toll free at (866) 880-7228.

Portfolio Holdings Information

The Fund is required to file their complete schedule of portfolio holdings with the SEC for their first and third fiscal quarters on Form N-PORT. Copies of the filings are available without charge, upon request on the SEC’s website at www.sec.gov and are available by calling the Trust at 866-880-7228.

Discount & Premium Information

Information regarding how often shares of the Fund traded on NYSE Arca, as applicable, at a price above (i.e., at a premium) or below

(i.e., at a discount) the NAV of the Fund can be found at www.bitwiseinvestments.com.

Tax Information

Form 1099-DIV and other year-end tax information provide shareholders with actual calendar year amounts that should be included in their tax returns. Shareholders should consult their tax advisors.

20

| | | | |

| Investment Adviser | | Investment Sub-Adviser | | Custodian, Administrator, |

| Bitwise Investment | | Vident Asset Management | | Securities Lending Agent & |

| Manager, LLC | | 1125 Sanctuary Parkway, | | Transfer Agent |

| 250 Montgomery Street, | | Suite 515 | | The Bank of New York Mellon |

| Suite 200 | | Alpharetta, GA 30009 | | 240 Greenwich Street |

| San Francisco, CA 94104 | | | | New York, NY 10036 |

| | |

| Distributor | | Independent Registered | | Legal Counsel |

| Foreside Financial | | Public Accounting Firm | | Chapman and Cutler LLP |

| Services, LLC | | KPMG LLP | | 320 South Canal Street |

| Three Canal Plaza, Suite 100 | | 345 Park Avenue | | Chicago, IL 60606 |

| Portland, ME 04101 | | New York, NY 10154 | | |

| | |

| | | Bitwise Funds Trust | | |

| | 250 Montgomery Street, | | |

| | Suite 200, | | |

| | San Francisco, CA 94104 | | |

December 31, 2023

Annual Report

Bitwise Funds Trust

Bitwise Bitcoin and Ether Equal Weight Strategy ETF (BTOP)

Bitwise Bitcoin Strategy Optimum Roll ETF (BITC)

Bitwise Ethereum Strategy ETF (AETH)

Bitwise Funds Trust

Table of Contents

This report is provided for the general information of shareholders and is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

Bitwise Funds Trust

Letter to Shareholders (Unaudited)

Dear Shareholder,

I am honored to write to you on behalf of the entire team at Bitwise Asset Management. We deeply appreciate the trust you have placed in us, and look to honor that trust every day.

For most investors, 2023’s stock market performance marked a much-needed comeback as compared to a dismal 2022. Bolstered by a strong economy, better-than-expected corporate earnings, and indications that the Federal Reserve had reached the end of its rate hiking cycle, the S&P 500 Index rallied 26.29% in 2023. Technology stocks (and risk assets more broadly) saw a sustained lift, as the market began to price in expectations of multiple Federal Reserve rate cuts in 2024, and as excitement grew around advancements in artificial intelligence technologies.

The crypto and blockchain industry benefited from these macro drivers, and added on positive industry-specific developments as well: a succession of encouraging court rulings, including landmark wins by Grayscale and Ripple Labs; top financial institutions putting their weight behind crypto in an unprecedented way, highlighted by BlackRock’s decision to file for spot bitcoin and Ethereum ETFs; and big gains in Layer 2 scaling solutions, which brought new speed and efficiency to blockchains. As a result, bitcoin and Ethereum had a stellar year, up 156.89% and 89.89% respectively.

As we look to 2024, the economic outlook appears stable but carries risks. Strong labor markets continue to support employment and wages, and household balance sheets and debt servicing levels remain healthy. However, consumer spending could slow down as a result of diminished excess savings, slowing wage gains, and an exhaustion of pent-up demand for goods and services. Even as inflation is expected to gradually move lower, allowing the Federal Reserve to cut interest rates, the pace of cuts remains unclear, and risks remain that inflation will be stickier than we hope.

Meanwhile, 2024 is shaping up to be a strong year for the crypto and blockchain industry. Already, we’ve had significant developments, as on January 11, the U.S. Securities and Exchange Commission approved the listing of spot bitcoin ETFs. The funds surged out of the gate, attracting billions in assets in the first weeks, while opening up significant swaths of the investment landscape to crypto for the first time. We believe we are in the early stages of a multi-year bull market in crypto, and are excited about additional catalysts on the horizon.

Our mission at Bitwise is to help investors gain exposure to the opportunities created by the development of crypto and public blockchains. We believe that the future opportunities for bitcoin and Ethereum remain significant.

We look forward to continuing to help you and fellow investors gain exposure to these opportunities in an efficient manner.

Best regards,

Matt Hougan

Chief Investment Officer, Bitwise Asset Management

1

Bitwise Bitcoin and Ether Equal Weight Strategy ETF

Management’s Discussion of Fund Performance

December 31, 2023 (Unaudited)

Bitwise Bitcoin and Ether Equal Weight Strategy ETF [Ticker: BTOP]

From its inception on September 29, 2023, through December 31, 2023, BTOP returned +43.70%, compared to +57.98 for bitcoin and +36.99% for Ethereum.

Over the next 6-12 months, we expect the environment to remain modestly favorable for risk assets like bitcoin and Ethereum, as the Federal Reserve begins to cut interest rates. We also see unique positive drivers for bitcoin and Ethereum as well, including inflows to spot bitcoin ETFs, broader acceptance of bitcoin by traditional financial institutions, the upcoming bitcoin “halving” which will reduce new supply of bitcoin in the market, potential progress towards a spot Ethereum ETF, and upgrades to the Ethereum blockchain that could lead to new Ethereum-based applications. We continue to see value in the bitcoin and Ethereum-linked exposure BTOP offers via regulated Futures Contracts, and believe that bitcoin and Ethereum’s long-term trends of growth are intact.

At December 31, 2023, the Fund’s financial statements covered a period of less than 6 months, therefore a line graph is not presented.

| | | | |

HISTORICAL PERFORMANCE | | | | |

| |

Total Return as of December 31, 2023 | | | | |

| |

| | | Cumulative

Total Return* | |

Bitwise Bitcoin and Ether Equal Weight Strategy ETF Net Asset Value | | | 43.70% | |

Bitwise Bitcoin and Ether Equal Weight Strategy ETF Market Price | | | 44.41% | |

S&P 500 ® Index | | | 11.69% | |

* Commencement of operations was September 29, 2023.

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund Net Asset Value (“NAV”) returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (net) is 0.85%. Actual expenses can be referenced in the Financial Highlights section later in this report. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1 (866) 880-7228.

The Fund seeks to achieve its investment objective through equally-weighted exposure to bitcoin futures contracts (“Bitcoin Futures Contracts”) and ether futures contracts (“Ether Futures Contracts”). The Fund will equally weight its exposure to Bitcoin Futures Contracts and Ether Futures Contracts, meaning that it will seek 50% economic exposure to Bitcoin Futures Contracts and 50% economic exposure to Ether Futures Contracts on each portfolio rebalance. The Fund will rebalance these exposures quarterly. The Fund does not invest directly in bitcoin or ether.

The S&P 500® Index is a capitalization-weighted index of 500 stocks. This index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

Investments involve risk. Principal loss is possible. Redemptions are limited and often commissions are charged on each trade. The ETF may be non-diversified, which may be more sensitive to economic, business, political or other changes affecting individual issuers or investments than a diversified fund, which may result in greater fluctuation in the value of the Fund’s Shares and greater risk of loss. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. The Fund is new and has limited operating history.

This document must be preceded or accompanied by a prospectus.

There is no guarantee or assurance that the Fund’s methodology will result in the Fund achieving positive investment returns or outperforming other investment products.

The price of the Bitcoin Futures Contracts and Ether Futures Contracts in which the Fund invests should be expected to differ from the current cash price of bitcoin and ether, which is sometimes referred to as the “spot” price of bitcoin and ether. Consequently, the performance of the Fund should be expected to perform differently from the spot price of bitcoin and ether. These differences could be significant. Investors seeking direct exposure to the price of bitcoin and ether should consider an investment other than the Fund.

Shares of ETFs are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Brokerage commissions will reduce returns.

Risk of Loss. Bitcoin, ether, Bitcoin Futures Contracts, and Ether Futures Contracts are relatively new investments. They are subject to unique and substantial risks, and historically, have been subject to significant price volatility. The value of an investment in the Fund could decline significantly and without warning, including to zero. You may lose the full value of your investment within a single day. If you are not prepared to accept significant and unexpected changes in the value of the Fund and the possibility that you could lose your entire investment in the Fund you should not invest in the Fund. The market for Bitcoin Futures Contracts and Ether Futures Contracts are still developing and may be subject to periods of illiquidity. During such times it may be difficult or impossible to buy or sell a position at the

2

Bitwise Bitcoin and Ether Equal Weight Strategy ETF

Management’s Discussion of Fund Performance (Continued)

December 31, 2023 (Unaudited)

desired price. Investors in the fund should be willing to accept a high degree of volatility in the price of the Fund’s shares and the possibility of significant losses. An investment in the fund involves a substantial degree of risk.

Blockchain Technology Risk: Certain of the Fund’s investments may be subject to the risks associated with investing in blockchain technology. The risks associated with blockchain technology may not fully emerge until the technology is widely used. Blockchain systems could be vulnerable to fraud, particularly if a significant minority of participants colluded to defraud the rest. Because blockchain technology systems may operate across many national boundaries and regulatory jurisdictions, it is possible that blockchain technology may be subject to widespread and inconsistent regulation.

Borrowing Risk: The Fund may borrow for investment purposes using reverse repurchase agreements. The cost of borrowing may reduce the Fund’s return. Borrowing may cause a Fund to liquidate positions under adverse market conditions to satisfy its repayment obligations.

Frequent Trading Risk: The Fund regularly purchases and subsequently sells (i.e., “rolls”) individual futures contracts throughout the year so as to maintain a fully invested position. As the contracts near their expiration dates, the Fund rolls them over into new contracts. This frequent trading of contracts may increase the amount of commissions or mark-ups to broker-dealers that the Fund pays when it buys and sells contracts, which may detract from the Fund’s performance.

Cost of Futures Investment Risk: The market for Bitcoin Futures Contracts and Ether Futures Contracts have historically experienced extended periods of contango. When a Bitcoin Futures Contract or Ether Futures Contract is in contango, this will cause the return of the contract to underperform the spot price of bitcoin or ether, as applicable. When a Bitcoin Futures Contract or Ether Futures Contract is in backwardation, this will cause the return of the contract to overperform the spot price of bitcoin or ether. Contango in the Bitcoin Futures Contracts or Ether Futures Contracts market may have a significant adverse impact on the performance of the Fund and may cause Bitcoin Futures Contracts and Ether Futures Contracts, and therefore the Fund, to underperform the spot price of bitcoin and ether. Both contango and backwardation would reduce the Fund’s correlation to the spot price of bitcoin and ether and may limit or prevent the Fund from achieving its investment objective.

Leverage Risk: The Fund seeks to achieve and maintain the exposure to the spot price of bitcoin and ether by using leverage inherent in futures contracts. Therefore, the Fund is subject to leverage risk.

Non-Diversification Risk: As a non-diversified fund, the Fund may hold a smaller number of portfolio securities than many other funds. To the extent the Fund invests in a relatively small number of issuers, a decline in the market value of a particular security held by the Fund may affect its value more than if it invested in a larger number of issuers.

Bitwise Investment Manager, LLC serves as the investment advisor of the fund. The Fund is distributed by Foreside Fund Services, LLC which is not affiliated with Bitwise Investment Manager, LLC, Bitwise Asset Management, Inc., or any of its affiliates.

3

Bitwise Bitcoin Strategy Optimum Roll ETF

Management’s Discussion of Fund Performance

December 31, 2023 (Unaudited)

Bitwise Bitcoin Strategy Optimum Roll ETF [Ticker: BITC]

From its inception on March 20, 2023, through December 31, 2023, BITC returned +40.56%, compared to +52.56% for bitcoin. The Fund’s underperformance was driven primarily by the prevalence of contango in the bitcoin futures market during this time period.

Over the next 6-12 months, we expect the environment to remain modestly favorable for risk assets like bitcoin, as the Federal Reserve begins to cut interest rates. We also see unique positive drivers for bitcoin as well, including inflows to spot bitcoin ETFs, broader acceptance of bitcoin by traditional financial institutions, and the upcoming bitcoin “halving,” which will reduce new supply of bitcoin in the market. We continue to see value in the bitcoin-linked exposure BITC offers via regulated futures contracts, and believe that bitcoin’s long-term trend of growth is intact.

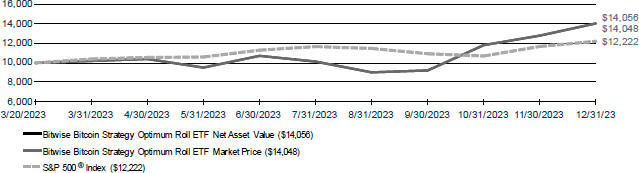

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period March 20, 2023* to December 31, 2023

| | | | | | | | |

HISTORICAL PERFORMANCE | | | | | | | | |

| | |

Total Return as of December 31, 2023 | | | | | | | | |

| | |

| | | 6 Month

Return | | | Cumulative

Total Return* | |

Bitwise Bitcoin Strategy Optimum Roll ETF Net Asset Value | | | 30.97 | % | | | 40.56% | |