UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☒ ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended October 31, 2024

OR

☐ TRANSITIONAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☐ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report ________

For the transition period from __________ to __________

Commission file number 001-41573

High-Trend International Group

(formerly Caravelle International Group)

(Exact Name of registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

Cayman Islands

(Jurisdiction of incorporation or organization)

60 Paya Lebar Road

#06-17 Paya Lebar Square

Singapore 409051

(65) 8304 8372

(Address of principal executive offices)

Shixuan He, Chief Executive Officer

60 Paya Lebar Road

#06-17 Paya Lebar Square

Singapore 409051

(65) 8304 8372

Email: brucehe@htcoint.com

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A Ordinary Shares, $0.0001 par value per share | | HTCO | | Nasdaq Capital Market |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: as of October 31, 2024, 117,885,481 Class A Ordinary Shares were issued and outstanding.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act Yes ☐ No ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. **Yes ☐ No ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. **Yes ☐ No ☒

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). **Yes ☐ No ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | Non-accelerated filer ☒ | Emerging growth company ☒ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards † provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. **Yes ☐ No ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☒ | International Financial Reporting Standards as issued

By the International Accounting Standards Board ☐ | Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

Table of Contents

INTRODUCTION

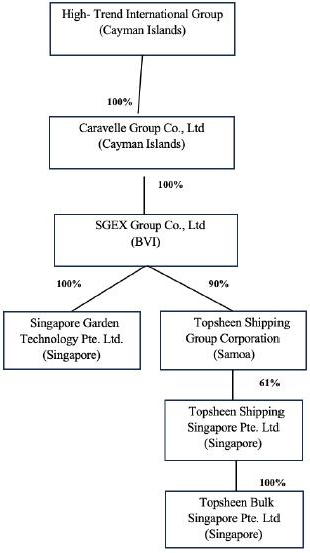

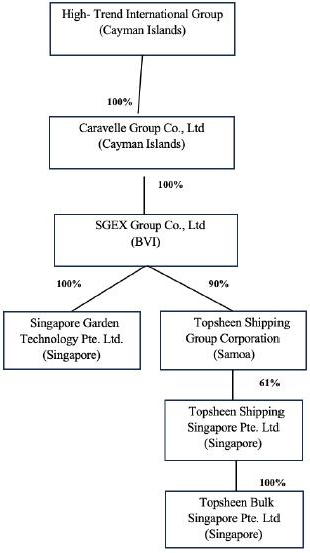

We are an exempted company that was incorporated under the laws of the Cayman Islands on February 28, 2022, as a holding company. On January 31, 2025, our name change from Caravelle International Group to High-Trend International Group became effective on the Nasdaq Capital Market and our Class A Ordinary Shares began to trade as our Class A Ordinary Shares. We are headquartered in Singapore and currently derives substantially all of our revenues from shipping services for customers in Asia, mostly in Singapore, Dubai, Korea, Japan, and India.

We previously planned to launch the CO-Tech business, which was expected to enable wood desiccation during the maritime shipping process, with full utilization of the shipping time, space, and the waste heat of exhaust gas from the shipping vessels. Despite its initial promise, the CO-Tech business faced significant delays due to a lack of funding and our inability to confirm that the business would be successful. In 2024, our new management team decided to withdraw from this business. Our new management team has engaged a consulting team to conduct research as to the feasibility of our entry into the business of providing carbon neutrality solutions for the shipping industry in light of the growing regulatory trends regarding carbon emissions. Based on the consulting team’s findings, we believe that there is significant potential in the provision of marine carbon neutrality technologies, particularly in onboard carbon capture (“OCC”). To capitalize on this opportunity, we are in the process of establishing a specialized team and developing strategic partnerships with leading technology suppliers. Our goal is to become a key provider of onboard carbon capture solutions, which will include designing and installing carbon capture equipment, transporting captured CO2, and participating in carbon credit trading. This initiative aligns with our commitment to support the shipping industry’s transition towards more environmentally friendly practices and sustainability.

Our website is www.htcointl.com. The information on our website is not incorporated by reference into this annual report. As used in this annual report, the terms “we,” “us,” “our,” “High-Trend,” and “the Company” refer to High-Trend International Group and its subsidiaries.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Report contains forward-looking statements as defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”) that involve significant risks and uncertainties. All statements other than statements of historical facts are forward-looking statements. These forward-looking statements include information about our possible or assumed future results of operations or our performance. Words such as “expects,” “intends,” “plans,” “believes,” “anticipates,” “estimates,” and variations of such words and similar expressions are intended to identify the forward-looking statements. The risk factors and cautionary language in this Report provide examples of risks, uncertainties and events that may cause actual results to differ materially from the expectations described in our forward-looking statements, including among other things, the items identified in “Item 3.D. — Risk Factors” section of this Report.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this Report. Although we believe that the expectations reflected in such forward-looking statements are reasonable, there can be no assurance that such expectations will prove to be correct. These statements involve known and unknown risks and are based upon a number of assumptions and estimates which are inherently subject to significant uncertainties and contingencies, many of which are beyond our control. Actual results may differ materially from those expressed or implied by such forward-looking statements. We undertake no obligation to publicly update or revise any forward-looking statements contained in this Report, or the documents to which we refer readers in this Report, to reflect any change in our expectations with respect to such statements or any change in events, conditions or circumstances upon which any statement is based.

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

A. Directors and Senior Management

Not applicable.

B. Advisors

Not applicable.

C. Auditors

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

A. Selected Financial Data

Not applicable .

B. Capitalization and indebtedness

Not applicable.

C. Reasons for the offer and use of proceeds

Not applicable.

D. Risk factors

Investing in our securities involves a high degree of risk. In addition to the other information contained in this Report, including the matters addressed under the headings “Cautionary Note Regarding Forward-Looking Statements,” “Item 5. Operating and Financial Review and Prospects”, and the consolidated financial statements and related notes contained herein, you should carefully consider the following risk factors presented in this Report. The risks associated with our company are discussed below, and many of these risks may have various ramifications. Therefore, the information below should be viewed as a starting point for understanding the significant risks relating to our company, and not as a limitation on the potential impact of the matters discussed. Our business, results of operations, financial condition and prospects could also be harmed by risks and uncertainties that are not presently known to us or that we currently believe are not material. If any of the risks actually occur, our business, results of operations, financial condition and prospects could be materially and adversely affected. Unless otherwise indicated, references to business being harmed in these risk factors include harm to our business, reputation, brand, financial condition, results of operations and future prospects.

Summary of Risk Factors

The following summary description sets forth an overview of the material risks we are exposed to in the normal course of our business activities. The summary does not purport to be complete and is qualified in its entirety by reference to the full risk factor discussion immediately following this summary description. We encourage you to read the full risk factor discussion carefully. The occurrence of one or more of the events or circumstances described in this section, alone or in combination with other events or circumstances, may have a material adverse effect on our business, cash flows, financial condition and results of operations.

Risks Related to Our International Shipping Business

| | ● | We primarily charter vessels from Topsheen Shipping Limited, a company controlled by Mr. Dong Zhang, our former principal shareholder, Chief Shipping Officer and director. |

| | | |

| | ● | The cyclical nature of the shipping industry could have an adverse effect on our business. |

| | | |

| | ● | If global economic conditions weaken, particularly in the Asia Pacific region, it could have a material adverse effect on our business, financial condition and results of operations |

| | | |

| | ● | Outbreaks of epidemic and pandemic diseases, such as the COVID-19 pandemic, and governmental responses thereto, could adversely affect our business. |

| | | |

| | ● | We operate in a highly competitive international shipping industry and if we do not compete successfully with new entrants or established companies with greater resources, our shipping business growth and results of operations may be adversely affected. |

| | | |

| | ● | Increases in marine fuel prices could increase our operating costs. |

| | | |

| | ● | Increases in port fees and stevedoring expenses could increase our operating costs. |

| | | |

| | ● | World events, including terrorist attacks and regional conflicts, could have a material adverse effect on our business, financial condition and results of operations. |

| | | |

| | ● | Acts of piracy on ocean-going vessels could adversely affect our business. |

| | | |

| | ● | Increased inspection procedures and tighter import and export controls could increase our costs and disrupt our business. |

| | | |

| | ● | Our vessels may call on ports located in countries that are subject to restrictions imposed by the United States, United Kingdom, United Nations or other governments. |

| | | |

| | ● | We operate vessels worldwide and, as a result, our business has inherent operational risks, which may reduce our revenue or increase our expenses, and we may not be adequately covered by insurance. |

| | | |

| | ● | Labor interruptions could disrupt our business. |

| | | |

| | ● | Failure to comply with the U.S. Foreign Corrupt Practices Act and other anti-bribery legislation in other jurisdictions could result in fines, criminal penalties, contract terminations and an adverse effect on our business. |

| | | |

| | ● | The smuggling of drugs or other contraband onto our carriers may lead to governmental claims against us. |

| | | |

| | ● | We need to maintain our relationships with local shipping agents, port and terminal operators. |

| | | |

| | ● | Our employees may engage in misconduct or other improper activities, including noncompliance with regulatory standards and requirements, which could expose us to potentially significant legal liabilities, reputational harm and have a material adverse effect on our business, results of operations and financial condition. |

| | | |

| | ● | Our shipping business depends on ongoing relationships with entities controlled by our former key executives, Dr. Guohua Zhang and Mr. Dong Zhang. |

| | | |

| | ● | We may not obtain and maintain sufficient insurance coverage, which could expose us to significant costs and business disruption. |

| | | |

| | ● | We may be subject to litigation that, if not resolved in our favor, could have a material adverse effect on its business, results of operations and financial condition. |

| | | |

| | ● | Because we generate most of our revenues in United States dollars but incur a portion of our expenses in other currencies, exchange rate fluctuations could hurt the results of our operations. |

| | | |

| | ● | Global inflationary pressures could negatively impact our results of operations and financial condition. |

| | | |

| | ● | Security breaches and disruptions to our information technology infrastructure (cyber-security) could interfere with its operations and expose it to liability, which could have a material adverse effect on its business, financial condition, cash flows and results of operations. |

| | | |

| | ● | The recent replacement of our management team may introduce uncertainties to our operations, strategies and future directions, and could materially affect our operating results and financial condition. |

Risks Relating to Our Company

| | ● | Our new management team faces challenges and uncertainty has been introduced by the new management team’s strategic reassessment of our company’s overall business. |

| | | |

| | ● | We have incurred losses in each of the last two years and we may not be able to achieve or maintain profitability in the future. |

| | | |

| | ● | Our plans to enter into the carbon neutral /carbon trading business may not be realized. If realized, assurance can be given that we will be successful. |

| | | |

| | ● | We will require additional capital to implement our business strategy, including developing our proposed carbon-neutral shipping business and expanding our traditional international shipping operations. |

| | | |

| | ● | The ability of our subsidiaries and consolidated affiliated entities in Singapore and Samoa to distribute dividends may be subject to restrictions under Singapore and Samoa laws. |

| | | |

| | ● | We may be classified as a Singapore tax resident., which could result in our being taxed. |

Risks Related to Our Class A Ordinary Shares

| | ● | Our share price may be volatile and could decline substantially. |

| | | |

| | ● | The Nasdaq Capital Market imposes listing standard on our Class A Ordinary Shares that we may not be able to fulfill in the future, thereby leading to a possible delisting of our Class A Ordinary Shares and there can be no assurance that we will be able to comply with the continued listing standards of Nasdaq. |

| | | |

| | ● | The future sales of our Class A Ordinary Shares by our principal shareholders may adversely affect the market price of our Class A Ordinary Shares. |

| | | |

| | ● | We may issue additional Class A Ordinary Shares or other equity or convertible debt securities without approval of our shareholders which would dilute existing ownership interests and may depress the market price of our Class A Ordinary Shares. |

| | | |

| | ● | We may be treated as a passive foreign investment company. |

| | | |

| | ● | Our dual class structure may adversely affect the trading market of our Class A Ordinary Shares. |

| | | |

| | ● | We do not expect to pay dividends in the foreseeable future. |

| | | |

| | ● | We are a foreign private issuer and as such we are exempt from certain provisions applicable to domestic public companies in the United States. |

| | | |

| | ● | As an exempted company incorporated in the Cayman Islands, we are permitted to adopt certain home country practices in relation to corporate governance matters that differ significantly from Nasdaq corporate governance listing standards; these practices may afford less protection to shareholders than they would enjoy if we complied fully with the Nasdaq corporate governance listing standards. |

| | ● | You may face difficulties in protecting your interests, and your ability to protect your rights through U.S. courts may be limited, because we are an exempted company incorporated under the laws of the Cayman Islands that conducts substantially all of our operations outside of the United States and a majority of our directors and executive officers reside outside of the United States. |

| | | |

| | ● | As a public reporting company, we are subject to rules and regulations established from time to time by the SEC regarding our internal control over financial reporting. If we fail to establish and maintain effective internal control over financial reporting and disclosure controls and procedures, we may not be able to accurately report our financial results or report them in a timely manner. |

| | ● | As a public reporting company, we are subject to rules and regulations established from time to time by the Securities and Exchange Commission (the “SEC”) regarding our internal control over financial reporting. If we fail to establish and maintain effective internal control over financial reporting and disclosure controls and procedures, we may not be able to accurately report our financial results or report them in a timely manner. |

| | | |

| | ● | Anti-takeover provisions contained in our memorandum and articles of association, as well as provisions of Cayman law, could impair a takeover attempt. |

| | | |

| | ● | We are an emerging growth company within the meaning of the Securities Act and may take advantage of certain reduced reporting requirement. |

Risks Related to Our Company

Our success depends on our new management team and uncertainty has been introduced by the new management team’s strategic reassessment of our overall business.

In 2024, we experienced significant changes in our executive management and board of directors, with the resignation of the prior management team. The newly appointed management team, led by Jinyu Chang, Chairman of the Board, Shixuan He, Chief Executive Officer, Zi Xia, Chief Financial Officer, along with our new independent directors Xuanhua Xi, Christopher Renn, and Jing Sang, has limited experience working together as a cohesive unit. In addition, in 2024, Mr. Dong Zhang, our former Chief Shipping Officer and director resigned his positions with our company.

We depend to a large extent on the abilities of our current management team, with our continued reliance on Mr. Dong Zhang, who continues as a member of the team management and as a shareholder of Topsheen Shipping Limited, from whom we charter most of our vessels. Mr. Zhang’s deep experience and extensive relationships in the shipping industry continues to add value to our management team. The loss of services of our new management team or of Mr. Zhang for any reason may have a material adverse effect on our business and prospects. Additionally, potential conflicts of interest may arise due to the prior affiliations of Mr. Zhang with our company, which could further complicate these commercial relationships and impact our strategic objectives.

Our new management may make further adjustments to the team and reassess our short and long-term business portfolio and development strategies. These potential changes could lead to shifts in our company’s strategic direction, which may impact our operations, financial condition, and overall business performance. While these adjustments may introduce uncertainty that could affect our ability to achieve our business objectives.

We have incurred losses in each of the last two years and we may not be able to achieve or maintain profitability in the future.

For the years ended October 31, 2024 and 2023, we incurred net losses of $21,214,850 and $15,777,704, respectively and as of October 31, 2024, we had an accumulated deficit $26,677,404. To the date, we have financed our operations primarily with proceeds from equity and debt offerings, borrowings, and loans from related parties. We cannot predict when we will return to profitable operations, if at all. If we are unable to generate sufficient revenue from our business and control our costs and expenses to achieve and maintain profitability, the value of your investment in us could be negatively affected.

Our plans to enter into the carbon neutrality solutions business may not be realized. If realized, no assurance can be given that we will be successful.

We are currently investigating entering carbon neutral /carbon trading business. No assurance can be given that we will enter this business or that if we enter into this business that we will be successful. In the future, we may seek to acquire or make strategic investments in complementary businesses, technologies, services or products, or enter into strategic partnerships or alliances with third parties in order to expand our business. Failure to manage and successfully integrate such acquisitions could materially harm our business and operating results. If we acquire other businesses, we may face difficulties, including:

| | ● | Difficulties in integrating the operations, systems, technologies, products, and personnel of the acquired businesses or enterprises; |

| | ● | Diversion of management’s attention from normal daily operations of the business and the challenges of managing larger and more widespread operations resulting from acquisitions; |

| | | |

| | ● | Integrating financial forecasting and controls, procedures and reporting cycles; |

| | | |

| | ● | Difficulties in entering markets in which we have no or limited direct prior experience and where competitors in such markets have stronger market positions; |

| | | |

| | ● | Insufficient revenue to offset increased expenses associated with acquisitions; and |

| | | |

| | ● | The potential loss of key employees, customers, distributors, vendors and other business partners of the companies we acquire following and continuing after announcement of acquisition plans. |

The ability of our subsidiaries and consolidated affiliated entities in Singapore and Samoa to distribute dividends may be subject to restrictions under Singapore and Samoa laws.

We are a holding company, and our principal subsidiaries are located in Singapore and Samoa. All or substantially all of our primary internal sources of funds to meet our cash needs is from dividends, if any, paid by our subsidiaries and consolidated affiliated entities. The distribution of dividends to us from the subsidiaries and consolidated affiliated entities in these markets as well as other markets where we operate is subject to restrictions imposed by the applicable laws and regulations in these markets, which may include foreign exchange controls.

For example, under Singapore law, dividends, whether in cash or in specie, can only be paid out of such Singapore subsidiary’s profits available for distribution. The availability of distributable profits is assessed on the basis of each Singapore subsidiary’s standalone unconsolidated accounts, which are based upon IFRS. There is no assurance that the Singapore subsidiaries will not incur losses, that they will become profitable, or that they will have sufficient distributable income that might be distributed to us as a dividend or other distribution in the foreseeable future. Therefore, the Singapore subsidiaries will be unable to pay dividends to us unless and until they have generated sufficient distributable reserves. Accordingly, it may not be legally permissible for the Singapore subsidiaries to pay dividends to us.

Notwithstanding that sufficient profits may be available for distribution, there are other conditions which may limit the Singapore subsidiaries’ ability to pay dividends. Any determination to pay dividends will be at the discretion of the Singapore subsidiary’s board of directors, which may exercise its discretion to retain such subsidiary’s future earnings for use in the development of such subsidiary’s business, in reducing its indebtedness or for general corporate purposes.

We may be classified as a Singapore tax resident, which could result in our being taxed.

We and our subsidiaries may be subject to tax in the jurisdictions in which we and they are organized or operate, reducing the amount of cash available for distribution. In computing our tax obligation in these jurisdictions, it is required to take various tax accounting and reporting positions on matters that are not entirely free from doubt and for which we have not received rulings from the governing authorities. We cannot be certain that upon review of these positions the applicable authorities will agree with our positions. A successful challenge by a tax authority could result in additional tax imposed on us or our subsidiaries, further reducing the cash available for distribution. In addition, changes in our operations or ownership could result in additional tax being imposed on us or our subsidiaries in jurisdictions in which we conduct operations

Risks Related to Our International Shipping Business

We primarily charter vessels from Topsheen Shipping Limited, a company controlled by Mr. Dong Zhang, our former principal shareholder, Chief Shipping Officer and director.

We charter vessels primarily from Topsheen Shipping Limited (‘Topsheen Ltd.”), a company controlled by Mr. Dong Zhang, our former principal shareholder, Chief Shipping Officer and director. If Topsheen Ltd. terminates its business relationship with us, we may be unable to secure adequate vessel replacements in a timely manner or may be required to pay a higher charter rate for comparable vessel replacements, which could have a material adverse effect on our business, financial condition and results of operations.

More generally, since Mr. Zhang was a related party of our company, the agreements previously negotiated between our company and the entities he controls may not have been negotiated at arm’s length. It is possible the agreements are more favorable to Mr. Zhang’s controlled entities than is industry standard, due to the possible conflicts of interest described above. On the other hand, it is also possible that the agreements are more favorable to us than is industry standard, in which event we may be unable to enter into agreements on similarly favorable terms with other vessel suppliers if Topsheen Ltd. terminates its relationship with our company or changes the agreement terms.

The cyclical nature of the shipping industry could have an adverse effect on our business.

Historically, the financial performance of the shipping industry has been cyclical, with volatility in profitability and asset values resulting from changes in the supply of, and demand for, international maritime shipping services. The level of shipping capacity is a function of the number and size of vessels in the world fleet, their deployment, the delivery of new vessels and the scrapping of older vessels. The demand for international maritime shipping services is influenced by, among other factors, global and regional economic conditions, currency exchange rates, the globalization of manufacturing, fluctuation in the levels of global and regional international trade, regulatory developments and changes in seaborne and other transportation patterns. Changes in the demand for international maritime shipping services are difficult to predict. Decreases in such demand and/or increases in international maritime shipping capacity could lead to significantly lower freight rates, reduced volume, or a combination of the two, which would have a material adverse effect on our business, financial condition and results of operations.

Our future profitability and growth depend on the demand for shipping vessels and global economic conditions, and the impact of consumer confidence and consumer spending on shipping volume and charter rates. Charter hire rates may experience volatility or increase, which would, in turn, adversely affect our profitability.

The ocean-going shipping industry is both cyclical and volatile in terms of charter hire rates and profitability. Charter rates are impacted by various factors, including supplies of vessels, the level of global trade, exports from one part of the world to the other parts, demand for the seaborne transportation cargoes, and shipping capacity. High demand for shipping capacity and lower supply of shipping capacity could result in higher charter rates, which may adversely affect our profitability. The factors affecting the supply and demand for shipping vessels are outside of our control, and the nature, timing and degree of changes in industry conditions are unpredictable. The Baltic Dry Index, or the BDI, an index of the daily average of charter rates for key routes published by the Baltic Exchange Limited, which has long been viewed as the main benchmark to monitor the movements of the vessel charter market and the performance of the entire shipping market, declined approximately 97.5% from its high of 11,793 in May 2008 to 290 on February 10, 2016, and has remained volatile since then. During the fiscal year ended October 31, 2024, the BDI continued to fluctuate, starting at approximately 1,401 in November 2023, after peaking at 3,346 on December 4, 2023, reaching a low of 1,308 in January 17, 2024, and finally closing at 1,388 on October 31, 2024.

| | ● | changes in global production of products transported by ships; |

| | ● | the distance that cargo products are to be moved by sea; |

| | ● | the globalization and deglobalization of manufacturing; |

| | ● | global and regional economic and political conditions; |

| | ● | developments and disruptions in international trade; |

| | ● | changes in seaborne and other transportation patterns, including changes in the distances over which cargoes are transported and the speed of vessels; |

| | ● | environmental and other regulatory developments; and |

| | ● | currency exchange rates. |

Factors that influence the supply of shipping capacity include:

| | ● | the number of new building deliveries; |

| | ● | the scrapping rate of older shipping vessels; |

| | ● | the price of steel and other raw materials; |

| | ● | changes in environmental and other regulations that may limit the useful life of shipping vessels; |

| | ● | the number of shipping vessels that are out of service; and |

An increase in trade protectionism globally, including the imposition of tariffs, could have a material adverse impact on our business and, in turn, could cause a material adverse impact on our business, financial condition and results of operation.

Our operations are exposed to the risk that increased trade protectionism globally, including the imposition of tariffs, could adversely affect our business. Governments may turn to tariffs and other trade barriers to protect or revive their domestic industries in the face of foreign imports, thereby depressing the demand for shipping. Restrictions on imports, including in the form of tariffs, could have a major impact on global trade and demand for shipping. Trade protectionism in the markets that we serve may cause an increase in the cost of exported goods, the length of time required to deliver goods and the risks associated with exporting goods and, as a result, a decline in the volume of exported goods and demand for shipping. The new President of the United States has repeatedly stated that he intends to impose tariffs on exports to the United States. The eventuality, timing and rates of potential tariffs are difficult to predict at this time. However, the economic impact of tariffs on goods that ship could negatively impact the volume of shipments which would have a material adverse effect on our business, operating results and financial condition.

We obtain revenues from the shipment of goods from Asia to various overseas export markets. Any reduction in or hindrance to the output of Asia-based exporters could have a material adverse effect on the growth rate of Asian-based exports and on our business.

If global economic conditions weaken, particularly in the Asia Pacific region, it could have a material adverse effect on our business, financial condition and results of operations.

Global economic conditions impact worldwide demand for various goods and, thus, the demand for shipping services. In particular, we anticipate a significant number of the port calls made by its vessels will continue to involve the loading or unloading of cargos in ports in the Asia Pacific region. As a result, negative changes in economic conditions in any Asia Pacific country can have a significant impact on the demand for international maritime shipping. However, if the pace of growth in the Asia Pacific declines in the future, this may have a negative impact on international maritime shipping demand and for our services.

Outbreaks of epidemic and pandemic diseases, such as the COVID-19 pandemic, and governmental responses thereto, could adversely affect our business.

Outbreaks of epidemic and pandemic diseases, along with governmental responses to such events, could adversely affect our business. While the COVID-19 pandemic has receded as an immediate threat due to widespread vaccination and easing of restrictions, it has had a lasting impact on the global economy, trade patterns, and the operational environment in which we operate. These changes could continue to materially affect our business, financial condition, cash flows, and results of operations.

Although most governments have lifted lockdowns and eased travel restrictions, the risk of new variants, localized outbreaks, or other public health crises remains. Such events could prompt renewed restrictions, disrupting global supply chains, trade routes, and our operations. Even as businesses return to normal, the global economy still faces challenges, including labor shortages, supply chain disruptions, and shifts in consumer behavior, all of which could impact the demand for our services.

We have adapted to operating in this new environment, but the potential for future public health emergencies could introduce new operational and financial risks. These include increased costs, logistical challenges, and potential interruptions in service due to health and safety measures. Moreover, the ongoing economic impact of the pandemic and potential future crises may continue to affect the financial stability of our customers and suppliers, further complicating operations.

The extent of any future public health crisis’s impact on our operations and financial performance will depend on various factors, including the severity of the outbreak, the effectiveness of governmental responses, the availability of medical interventions, and the resilience of the global economy. While we are taking steps to mitigate these risks, the potential for significant adverse effects on our company’s operations and financial condition remains.

We operate in a highly competitive international shipping industry and if we do not compete successfully with new entrants or established companies with greater resources, our shipping business and results of operations may be adversely affected.

The worldwide international maritime shipping business is highly competitive. Barriers to entry are relatively low for existing shipping companies wishing to enter, or expand their presence in, a new market or new trade lane. Carriers compete based on price, frequency of service, transit time, port coverage, service reliability, vessel availability, inland operations, quality of customer service, value added services and other customer requirements. There is strong competition in the international markets and trade lanes that we currently operate in and we expect that current competitive pressures within the international maritime shipping industry will continue.

Increases in marine fuel prices could increase our operating costs and adversely affect our business.

Since February 2022, crude oil prices have experienced significant volatility. The Russia-Ukraine conflict initially caused prices to surge, reaching a peak of over $120 per barrel by mid-2022 due to concerns over supply disruptions and sanctions imposed on Russia, one of the world’s largest oil exporters. These sanctions and trade restrictions have introduced significant uncertainty in global energy markets. However, oil prices have since fluctuated, experiencing periods of decline due to factors such as increased production from other sources, shifts in global demand, and concerns over a potential economic slowdown.

The cost of marine fuel is influenced by a variety of economic and political factors beyond our control, making it unpredictable and subject to fluctuation. These factors include geopolitical developments, the global supply of and demand for oil and gas, actions by the Organization of the Petroleum Exporting Countries (OPEC) and other oil-producing nations, as well as regional production patterns and environmental regulations. In the years 2024, 2023 and 2022, the cost of marine fuel accounted for approximately 28.4%, 28.5% and 21.9% of our total operating costs, respectively. In 2024, the average price of crude oil was approximately $80 per barrel, which was a slight increase compared to 2023.

A significant increase in fuel prices could materially affect our profitability, cash flows, and ability to pay dividends, as higher fuel costs would directly increase operational expenses. We must continue to monitor these market conditions closely and consider potential strategies to mitigate the impact of fuel price volatility on our operations and financial performance.

Increases in port fees and stevedoring expenses could increase our operating costs and adversely affect our business.

Pursuant to the terminal port agreements we entered into with stevedoring companies, we are charged for the use of their labor and the stevedoring facilities. Any increase in such fees and expenses could adversely affect our business, results of operations and financial condition in the event that we are unable to increase freight rates or otherwise recover such increased fees and expenses from our customers.

World events, including terrorist attacks and regional conflict, could have a material adverse effect on our business, financial condition and results of operations.

Past terrorist attacks, as well as the threat of future terrorist attacks around the world, continue to cause uncertainty in the world’s financial markets and may affect our business, operating results and financial condition. Continuing conflicts and recent developments in Ukraine, Russia, Azerbaijan, North Korea, Myanmar, the Middle East, North Africa and the Gulf of Guinea, may lead to additional acts of terrorism and armed conflict around the world, which may contribute to further economic instability in the global financial markets. Recently, government leaders have declared that their countries may turn to trade barriers to protect or revive their domestic industries in the face of foreign imports. Conflicts in a country in which a material supplier or customer of ours is located could impact that supply to us or our ability to earn revenue from that customer. In the past, l conflicts have also resulted in attacks on vessels, mining of waterways and other efforts to disrupt international shipping. Restrictions on imports, including in the form of tariffs, have had and could have a major impact on global trade and demand for shipping. Any of these occurrences could have a material adverse effect on our business, financial condition and results of operations.

Acts of piracy on ocean-going vessels could adversely affect our business.

Acts of piracy have historically affected ocean-going vessels trading in regions of the world such as the South China Sea, the Indian Ocean and in the Gulf of Aden off the coast of Somalia and, in particular, the Gulf of Guinea region off Nigeria, which experienced increased incidents of piracy in recent years. Sea piracy incidents continue to occur, increasingly in the Sulu Sea and the Gulf of Guinea. In the past, political conflicts have also resulted in attacks on vessels, mining of waterways and other efforts to disrupt international shipping particularly in the Arabian Gulf region and most recently in the Black Sea in connection with the ongoing Ukraine-Russia conflict and in the Red Sea in connection with Israeli-Hamas conflict. Commercial vessels have been attacked in international waters in the southern Red Sea, according to statements by the U.S. military, with Yemen’s Houthi claiming drone and missile attacks on two Israeli vessels in the area, in response to the ongoing conflict in the region. The perception that our vessels are a potential piracy or terrorist target could have a material adverse impact on our business, financial condition and results of operations.

Further, if these piracy attacks occur in regions in which our vessels are deployed that insurers characterize as “war risk” zones or by the Joint War Committee (consisting of underwriting representatives from both the Lloyd’s and International Underwriting Association company markets, representing the interests of those who write marine hull business in the London market) as “war and strikes” listed areas, premiums payable for such coverage could increase significantly and such insurance coverage may be more difficult to obtain, if available at all. In addition, crew costs, including costs that may be incurred to the extent on-board security guards are employed, could increase in such circumstances. We may not be adequately insured to cover losses from these incidents, which could have a material adverse effect on us. In addition, detention hijacking as a result of an act of piracy, or an increase in cost, or unavailability of insurance for our vessels, could have a material adverse impact on our business, results of operations, cash flows and financial condition, and this may result in loss of revenues, increased costs and decreased cash flows to our customers, which could impair their ability to make payments to us under our charters.

Increased inspection procedures and tighter import and export controls could increase our costs and disrupt our business.

International shipping is subject to various security and customs inspection and related procedures in countries of origin and destination and trans-shipment points. Inspection procedures may result in the seizure of contents being shipped in our vessels, delays in the loading, offloading, trans-shipment or delivery and the levying of customs duties, fines or other penalties against us. It is possible that changes to inspection procedures could impose additional financial and legal obligations on us. Changes to inspection procedures could also impose additional costs and obligations and may, in certain cases, render the shipment of certain types of cargo uneconomical or impractical. Any such changes or developments could have a material adverse effect on our business, financial condition and results of operations.

Our vessels may call on ports located in countries that are subject to restrictions imposed by the United States, United Kingdom, United Nations or other governments.

Although we do not expect that our vessels will call on ports located in countries subject to sanctions and embargoes imposed by the U.S. government and other authorities or countries identified by the U.S. government or other authorities as state sponsors of terrorism, from time to time on charterers’ instructions, our vessels may call on ports located in such countries in the future. The U.S. sanctions and embargo laws and regulations vary in their application, as they do not all apply to the same covered persons or proscribe the same activities, and such sanctions and embargo laws and regulations may be amended or strengthened over time. Although we believe that we are in compliance with all applicable sanctions and embargo laws and regulations, and intends to maintain such compliance, there can be no assurance that it will be in compliance in the future, particularly as the scope of certain laws may be unclear and may be subject to changing interpretations. Any such violation could result in a severe adverse impact on our ability to access U.S. capital markets.

Labor interruptions could disrupt our business.

We could be subject to labor stoppages at ports or other labor unrest that could prevent or hinder our operations from being carried out normally. If not resolved in a timely and cost-effective manner, such business interruptions could have a material adverse effect on its business, financial condition and results of operations. We have not encountered any labor issues to date.

Failure to comply with the U.S. Foreign Corrupt Practices Act and other anti-bribery legislation in other jurisdictions could result in fines, criminal penalties, contract terminations and an adverse effect on our business.

We operate in a number of countries throughout the world, including countries known to have a reputation for corruption. Although we are committed to doing business in accordance with applicable anti-corruption laws, we. are subject to the risk that persons and entities employed or engaged by us or their agents may take actions that are determined to be in violation of such anti-corruption laws, including the U.S. Foreign Corrupt Practices Act of 1977, or the “FCPA.” Any such violation could result in substantial fines, sanctions, civil and/or criminal penalties, or curtailment of operations in certain jurisdictions, and might adversely affect our business, results of operations or financial condition. In addition, actual or alleged violations could damage our reputation and ability to do business. Furthermore, detecting, investigating, and resolving actual or alleged violations is expensive and can consume significant time and attention of our senior management.

The smuggling of drugs or other contraband onto our vessels may lead to governmental claims against us.

Our vessels may call on ports where smugglers attempt to hide drugs and other contraband on vessels, with or without the knowledge of crew members. To the extent contraband is found in our vessels, whether with or without the knowledge of any of our crews, we may face reputational damage and governmental or other regulatory claims which could have a material adverse effect on our business, financial condition and results of operations.

We need to maintain our relationships with local shipping agents, and port and terminal operators.

Our shipping business is dependent upon our relationships with local shipping agents, and port and terminal operators operating in the ports where our customers ship and unload their products. We believe that these relationships will remain critical to our success in the future and the loss of one or more of which could materially and negatively impact our ability to retain and service our customers. We cannot be certain that we will be able to maintain and expand our existing relationships with local shipping agents and port and terminal operators, or enter into new relationships, or that new or renewed relationships will be available on commercially reasonable terms. If we are unable to maintain and expand our existing relationships, or enter into new relationships, we may lose customers or encounter delays in the ports in which we operate, which could have a material adverse effect on our business, financial condition and results of operations.

Our employees may engage in misconduct or other improper activities, either during or before their service for us, including noncompliance with regulatory standards and requirements, which could expose us to potentially significant legal liabilities, reputational harm and have a material adverse effect on our business, results of operations or financial condition.

We are exposed to the risk that our employees, business partners, suppliers or other parties we collaborate with may engage in misconduct or other illegal activity. Misconduct by these parties could include intentional, reckless or negligent conduct or other activities that violate laws and regulations, including production standards, fraud, abuse, data privacy and security laws, other similar laws or laws that require the true, complete and accurate reporting of financial information or data. It is not always possible to identify and deter misconduct by employees and other third parties, and the precautions we take to detect and prevent this activity may not be effective in controlling unknown or unmanaged risks or losses or in protecting it from governmental investigations or other actions or lawsuits stemming from a failure to be in compliance with such laws or regulations. If any such actions are instituted against us and it is not successful in defending itself or asserting its rights, those actions could have a material adverse effect on our business, results of operations or financial condition, including, without limitation, by way of imposition of significant civil, criminal and administrative penalties, damages, monetary fines, disgorgement, imprisonment and other sanctions, contractual damages, reputational harm, diminished profits and future earnings and curtailment of our operations.

We might not obtain and maintain sufficient insurance coverage, which could expose us to significant costs and business disruption.

Currently, we purchase Freight, Demurrage, and Defense Insurance for each shipment based on the estimated value of such shipment. This coverage is designed to provide compensation in the event that goods are lost or damaged during transit. However, there are also other risks which might not be covered by such insurance. Although we believe that we have the necessary insurance coverage, such insurance may not cover all potential legal expenses and compensation liabilities. For example, certain insurance policies may exclude losses caused by war, strikes, nuclear contamination, or intentional acts. As the shipping business faces increasing new risks (such as cybersecurity threats, stricter environmental regulations, and extreme weather events), insurance premiums may rise significantly. In addition, if a major accident or natural disaster occurs, leading to port closures or the inability of vessels to operate, business interruptions may occur for which we have no insurance, which in turn can affect our revenue and increase our expenses.

We may be subject to litigation that could have a material adverse effect on our business, financial condition and results of operations.

Although there is no pending litigation against us as of the date of this report, there can be no assurance that we will not be subject to any litigation, including, among other things, contract disputes, personal injury claims, employment matters, governmental claims for taxes or duties, and other litigation that arises in the ordinary course of its business. In the event that any litigation arises in the future, unfavorable outcomes of such litigation or the costs and time to resolve them could have a material adverse effect on our business, financial condition and results of operations.

The requirements of being a public company may strain our resources and divert management’s attention.

As a public company, we have incurred additional legal, accounting, insurance and other expenses. We are now subject to the reporting requirements of the Exchange Act, the Sarbanes-Oxley Act and applicable securities rules and regulations. These laws and regulations increase the scope, complexity and cost of corporate governance, reporting and disclosure practices over those of non-public or non-reporting companies. In order to maintain, appropriately document and, if required, improve our disclosure controls and procedures and internal control over financial reporting to meet the standards required by the Sarbanes-Oxley Act, additional resources and management oversight may be required. As a result, management’s attention may be diverted from other business concerns, which could harm our business and operating results. Additionally, any failure by us to file our periodic reports with the SEC in a timely manner could harm our reputation and cause our investors and potential investors to lose confidence in us, and restrict trading in, and reduce the market price of, our common stock, and potentially our ability to access the capital markets

Because we generate most of our revenues in United States dollars but incur a portion of our expenses in other currencies, exchange rate fluctuations could hurt the results of our operations.

We generate most of our revenues in United States dollars, but incur some of our expenses in currencies other than United States dollars, mainly Euros and Singapore Dollars. This difference could lead to fluctuations in net income due to changes in the value of the United States dollar relative to the other currencies, in particular the Euro and Singapore Dollar. Expenses incurred in foreign currencies against which the United States dollar falls in value could increase, thereby decreasing our net income. We have not hedged our currency exposure.

Global inflationary pressures could negatively impact our results of operations and financial condition.

Over the last few years, worldwide economies have experienced inflationary pressures. Global inflationary pressures have also increased due to trading pattern disruptions attributable to the armed conflict in Ukraine. Supply chain and transportation problems, as well as added volatility and rising energy, food and commodity prices, are accelerating global price growth. In the event that inflation becomes a significant factor in the global economy generally and in the shipping industry more specifically, inflationary pressures would result in increased operating, voyage and administrative costs which could in turn negatively impact our operating results, and in particular, our financial condition. Although historically the ocean shipping industry has been able to largely offset the inflationary pressure by passing the costs of inflation onto its customers, the industry as a whole and we in particular may not be able to offset such costs sufficiently, in which case our results and financial condition would be negatively impacted.

Specifically, we face two types of possible inflationary pressures: general pressure from inflation-related economic slowdown and a specific pressure from inflation of the prices of fuel, port and stevedoring services. First, inflation could slow down the global economy and thus disrupt global trade and ocean shipping, and thus negatively impact our ocean shipping business. In particular, since different countries face different rates of inflation, the country facing relatively higher inflation rates, such as the United States, would likely reduce its imports which may not be completely offset by the increase in its exports, thus resulting in a net reduction of global trade. Second, the 2022 inflation episode that was triggered by the conflict in Ukraine and the resulting increase in fossil fuel prices, has significantly impacted the ocean shipping industry which relies on fossil fuel to power its ships. Although historically the ocean shipping industry has been able to largely offset the inflationary pressure by passing the costs of inflation onto its customers, the industry as a whole and our company in particular may not be able to offset such costs sufficiently, in which case our results and financial condition would be negatively impacted.

Security breaches and disruptions to our information technology infrastructure could interfere with our operations and expose us to liability, which could have a material adverse effect on our business, financial condition and results of operations.

In the ordinary course of business, we rely heavily on information technology networks and systems to process, transmit, and store information electronically, and to manage and support a variety of business processes and activities. Additionally, we collect and store certain data, including proprietary business information and customer and employee data, and may have access to other confidential information in the ordinary course of our business. Despite our cybersecurity measures (including monitoring of networks and systems, and maintenance of backup and protective systems) which are continuously reviewed and upgraded, our information technology networks and infrastructure may still be vulnerable to damage, disruptions, or shutdowns due to attacks by hackers or breaches, employee error or malfeasance, data leakage, power outages, computer viruses and malware, telecommunication or utility failures, systems failures, natural disasters, or other catastrophic events. Further, the risk of potential cyberattacks by state actors or others have been heightened in connection with the ongoing conflict between Russia and Ukraine and it is uncertain how this new risk landscape will impact our operations. When geopolitical conflicts develop, government systems as well as critical infrastructures such as financial services and utilities may be targeted by state-sponsored cyberattacks even if they are not directly involved in the conflict.

We have not experienced and defended against threats to our systems and security (such as phishing attempts) to date. However, we could incur significant costs in order to investigate and respond to future attacks, to respond to evolving regulatory oversight requirements, to upgrade our cybersecurity systems and controls, and to remediate security compromise or damage. In response to past threats and attacks, we have implemented further controls and planned for other preventative actions to further strengthen our systems against future attacks. We cannot assure that such measures will provide absolute security, that we will be able to react in a timely manner, or that our remediation efforts following past or future attacks will be successful. Consequently, our financial performance and results of operations would be materially adversely affected.

In the event of a breach resulting in loss of data, such as personally identifiable information or other such data protected by data privacy or other laws, we may be liable for damages, fines and penalties for such losses under applicable regulatory frameworks despite not handling the data. Furthermore, if a high-profile security breach or cyber-attack occurs with respect to another provider of mission-critical data center facilities, our customers and potential customers may lose trust in the security of these business models generally, which could harm our reputation and brand image as well as our ability to retain existing customers or attract new ones. We could incur significant costs in order to investigate and respond to future attacks, to respond to evolving regulatory oversight requirements, to upgrade our cybersecurity systems and controls, and to remediate security compromise or damage. In addition, the regulatory framework around data custody, data privacy and breaches varies by jurisdiction and is an evolving area of law. We cannot assure that we will be able to react in a timely manner in the future, or that our remediation efforts will be successful. Consequently, our financial performance and results of operations would be materially adversely affected. We may not be able to limit our liability or damages in the event of such a loss.

Risks Related to our Class A Ordinary Shares

Our share price may be volatile, and purchasers of our Class A Ordinary Shares could incur substantial losses.

Our share price has been extremely volatile in the past and may continue to be so in the future. Since our IPO of SPAC, our Class A Ordinary Shares has traded at prices ranging from $0.28 and $10.27.The stock market in general has experienced extreme volatility that has often been unrelated to the operating performance of particular companies. As a result of this volatility, investors may not be able to sell their Class A Ordinary Shares at or above the price paid for such shares. The market price for our Class A Ordinary Shares may be influenced by many factors, including, but not limited to:

| | ● | actual or anticipated variations in our quarterly or annual financial results and prospects of our company or other companies in the same industry; |

| | ● | changes in economic and financial market conditions; |

| | ● | the inability to obtain or maintain the listing of our Class A Ordinary Shares on Nasdaq; |

| | ● | changes in the market valuations of other companies in the same industry; |

| | ● | announcements by us or our competitors of new services, expansions, investments, acquisitions, strategic partnerships or joint ventures; |

| | ● | mergers or other business combinations involving us; |

| | ● | additions and departures of key personnel and senior management; |

| | ● | risks related to the growth of our business; |

| | ● | the trading volume of our Class A Ordinary Shares in the public market; |

| | ● | the release of lockup, escrow or other transfer restrictions on our outstanding equity securities or sales of additional equity securities; |

| | ● | potential litigation or regulatory investigations; |

| | ● | natural disasters, terrorist acts, acts of war or periods of civil unrest; |

| | ● | the impact of epidemic and pandemic diseases, such as the COVID-19 pandemic, and governmental responses thereto, on the Company’s business, financial condition and results of operations; |

| | ● | changes in general market, economic and political conditions in the United States and global economies or financial markets, including those resulting from natural disasters, terrorist attacks, acts of war and responses to such events; and |

| | ● | the realization of some or all of the risks described in this section. |

In addition, the stock markets have experienced significant price and trading volume fluctuations from time to time, and the market prices of the equity securities of retailers have been extremely volatile and are sometimes subject to sharp price and trading volume changes. These broad market fluctuations may materially and adversely affect the market price of our Class A Ordinary Shares and could lead to class action law suits against our company.

The Nasdaq Capital Market imposes listing standards on our Class A Ordinary Shares that we may not be able to fulfill in the future, thereby leading to a possible delisting of our Class A Ordinary Shares.

As a listed Nasdaq Capital Market company, we are subject to various listing standards. There can be no assurance that we will be able to meet all of the criteria necessary for Nasdaq to allow our Class A Ordinary Shares to remain listed. On May 10, 2023, we received a notice from Nasdaq indicating that, due to not having timely filed our Annual Report on Form 20-F for the fiscal year ended October 31, 2022 (the “2022 Form 20-F”), we were not in compliance with Nasdaq Listing Rule 5250(c)(1), which requires the timely filing of all required periodic financial reports with the SEC. Pursuant to the Nasdaq Listing Rules, we had 60 calendar days from the date of the Nasdaq notice to submit a plan of compliance to Nasdaq. We timely submitted a plan of compliance and on July 17, 2023, we received a notice from Nasdaq granting us an exception to enable us to regain compliance with the Rule by filing the 2022 Form 20-F on or before August 28, 2023. We filed the 2022 Form 20-F on August 28, 2023 and regained compliance with Nasdaq Listing Rule 5250(c)(1)

On June 7, 2023, we received a notice from Nasdaq indicating the failure of our Class A Ordinary Shares to maintain a minimum bid price of $1.00 for over the previous 30 consecutive business days as required by Nasdaq Listing Rule 5550(a)(2) (the “Minimum Bid Requirement”) and granted us 180 calendar days to regain compliance with the Minimum Bid Requirement by October 22, 2023. On December 19, 2023, Nasdaq notified us that we had been granted an additional 180 calendar day period until June 3, 2024, to regain compliance with the Minimum Bid Requirement. On June 10, 2024, we received a determination letter from Nasdaq notifying us that for the 17 consecutive business days, from May 15, 2024, to June 7, 2024, the closing bid price of our Class A Ordinary Shares had been at $1.00 per share or greater and that we had regained compliance with the Minimum Bid Requirement.

On July 26, 2024, we received a deficiency letter from Nasdaq notifying us that, for the last 33 consecutive business days, the closing bid price for our Class A Ordinary Shares had been below the minimum $1.00 per share required for continued listing on The Nasdaq Capital Market pursuant to Minimum Bid Requirement. We were provided a compliance period of 180 calendar days, until January 22, 2025, to regain compliance. On November l4, 2024, Nasdaq provided confirmation that for the last 19 consecutive business days, from October 18, 2024 to November 13, 2024, the closing bid price of our Class A Ordinary Shares had been $1.00 per share or greater, and that we had regained compliance with Listing Rule 5550(a)(2).

On November 14, 2023, we received a notice from Nasdaq indicating that we failed to file our interim financial statements for the six-month period ended April 30, 2023, and that we no longer complied with Nasdaq’s Listing Rule 5250(c)(1) for continued listing. Pursuant to the Nasdaq Listing Rules, we had until January 16, 2024, to submit a plan to Nasdaq to regain compliance. We provided a plan to Nasdaq and on February 29, 2024, we issued a press release announcing our unaudited and unreviewed financial results for the six months ended April 30, 2023. On May 2, 2024, Nasdaq notified us that we had regained compliance.

On March 25, 2024, Nasdaq notified us of our failure to file our Annual Report on Form 20-F for the fiscal year ended October 31, 2023, and that we no longer complied with Nasdaq’s Listing Rule 5250(c)(1) for continued listing. Pursuant to the Nasdaq Listing Rules, We had 60 calendar days from the date of the Nasdaq notice to submit a plan of compliance to Nasdaq. We submitted a plan of compliance to Nasdaq on May 25, 2024 and Nasdaq subsequently determined to grant use an exception to file our Annual Report on Form 20-F for the fiscal year ended October 31, 2023, by September 10, 2024 (the “2023 Exception”), to enable us to regain compliance with Nasdaq Listing Rule 5250(c)(1). We filed Annual Report on Form 20-F for the fiscal year ended October 31, 2024 on September 9, 2024, On September 10, 2024, we received a formal notification from The Nasdaq Stock Market LLC confirming that, following the Company’s filing of its Form 20-F for the year ended October 31, 2023 on September 9, 2024, the Company had regained compliance with Nasdaq Listing Rule 5250(c)(1), which requires timely filing of all required periodic financial reports with the Securities and Exchange Commission.

If our Class A Ordinary Shares are ultimately delisted from the Nasdaq Capital Market the Class A Ordinary Shares would likely then trade only in the over-the-counter market and the market liquidity of the Class A Ordinary Shares would be adversely affected and their market price could decrease. If the Class A Ordinary Shares were to trade on the over-the-counter market, selling the Class A Ordinary Shares could be more difficult because smaller quantities of shares would likely be bought and sold, transactions could be delayed, and we could face significant material adverse consequences, including: a limited availability of market quotations for our securities; reduced liquidity with respect to our securities; a determination that our Class A Ordinary Shares are a “penny stock,” which will require brokers trading in our securities to adhere to more stringent rules, possibly resulting in a reduced level of trading activity in the secondary trading market for our securities; a reduced amount of news and analyst coverage for our company; and a decreased ability to issue additional securities or obtain additional financing in the future. These factors could result in lower prices and larger spreads in the bid and ask prices for the Class A Ordinary Shares and would substantially impair our ability to raise additional funds and could result in a loss of investor interest and fewer development opportunities for us.

The future sales of our Class A Ordinary Shares by our principal shareholders may adversely affect the market price of our Ordinary Shares.

Sales of a substantial number of our Class A Ordinary Shares in the public market by our principal shareholders, including shares issuable upon exercise of warrants to purchase 24,045,181 of our Ordinary Shares at an exercise price of $0.166 per share could occur at any time. If our principal shareholders sell, or the market perceives that they intend to sell, substantial amounts of our Class A Ordinary Shares in the public market, the market price of our Class A Ordinary Shares would likely decline.

We may issue additional Class A Ordinary Shares or other equity or convertible debt securities without approval of our shareholders which would dilute existing ownership interests and may depress the market price of our Class A Ordinary Shares.

We may issue additional Class A Ordinary Shares or other equity or convertible debt securities of equal or senior rank in the future without approval of our shareholders. Our issuance of additional Class A Ordinary Shares or other equity or convertible debt securities of equal or senior rank would have the following effects: (1) our existing shareholders’ proportionate ownership interest may decrease; (2) the amount of cash available per share, including for payment of dividends in the future, may decrease; (3) the relative voting power of each previously outstanding Class A Ordinary Share may be diminished; and (4) the market price of our Class A Ordinary Shares may decline.

We may be classified as a passive foreign investment company, or PFIC, which would subject our U.S. investors to adverse tax rules.

U.S. holders of our Class A Ordinary Shares may face income tax risks. Based on the composition of our income, assets (including the value of our goodwill, going-concern value or any other unbooked intangibles, which may be determined based on the price of the Class A Ordinary Shares, and operations, we believe we will not be classified as a “passive foreign investment company”, or PFIC, for the 2024 taxable year. However, because PFIC status is based on our income, assets and activities for the entire taxable year, it is not possible to determine whether we will be characterized as a PFIC for our current taxable year or future taxable years until after the close of the applicable taxable year. Moreover, we must determine our PFIC status annually based on tests that are factual in nature, and our status in the current year and future years will depend on our income, assets and activities in each of those years and, as a result, cannot be predicted with certainty as of the date hereof. Furthermore, fluctuations in the market price of our Common Shares may cause our classification as a PFIC for the current or future taxable years to change because the aggregate value of our assets for purposes of the asset test, including the value of our goodwill and unbooked intangibles, generally will be determined by reference to the market price of our shares from time to time (which may be volatile). The IRS or a court may disagree with our determinations, including the manner in which we determine the value of our assets and the percentage of our assets that are passive assets under the PFIC rules. Therefore, there can be no assurance that we will not be a PFIC for the current taxable year or for any future taxable year. Our treatment as a PFIC could result in a reduction in the after-tax return to U.S. Holders (as defined below under Item 10E. “Additional Information – Taxation”) of our Class A Ordinary Shares and would likely cause a reduction in the value of such shares. A foreign corporation will be treated as a PFIC for U.S. federal income tax purposes if either (1) at least 75% of its gross income for any taxable year consists of certain types of “passive income,” or (2) at least 50% of the average value of the corporation’s gross assets produce, or are held for the production of, such “passive income.” For purposes of these tests, “passive income” includes dividends, interest, gains from the sale or exchange of investment property, rents and royalties other than rents and royalties that are received from unrelated parties in connection with the active conduct of a trade or business. If we are treated as a PFIC, U.S. Holders of our Class A Ordinary Shares would be subject to a special adverse U.S. federal income tax regime with respect to the income derived by us, the distributions they receive from us, and the gain, if any, they derive from the sale or other disposition of their Class A Ordinary Shares. U.S. Holders should carefully read Item 10E. “Additional Information – Taxation” for a more complete discussion of the U.S. federal income tax risks related to owning and disposing of our Class A Ordinary Shares.

Our dual-class structure may adversely affect the trading market for our Class A Ordinary Shares.

Certain shareholder advisory firms have announced changes to their eligibility criteria for inclusion of the securities of public companies on certain indices, including the S&P 500, that would exclude companies with multiple classes of shares and companies whose public shareholders hold no more than 5% of the total voting power from being added to such indices. In addition, several shareholder advisory firms have announced their opposition to the use of multiple class structures. As a result, our dual-class structure may prevent the inclusion of our Class A Ordinary Shares in such indices and may cause shareholder advisory firms to publish negative commentary about our corporate governance practices or otherwise seek to cause us to change our capital structure. Any such exclusion from stock indices could result in a less active trading market for our Class A Ordinary Shares. Any actions or publications by shareholder advisory firms critical of our corporate governance practices or capital structure could also adversely affect the value of our Class A Ordinary Shares.

We do not expect to pay dividends in the foreseeable future.