First Quarter 2023 Results May 3, 2023

2 Non-GAAP financial measures and Forward-looking statements Non-GAAP financial measures We provide reconciliations of the non-GAAP financial measures contained in this release to the most directly comparable measure under GAAP, which are set forth in the financial tables attached to this release. The non-GAAP financial measures in this release include: adjusted earnings before interest, taxes, depreciation and amortization (“adjusted EBITDA”); adjusted EBITDA margin; adjusted gross margin (revenue less cost of transportation and services (exclusive of depreciation and amortization) and direct operating expense (exclusive of depreciation and amortization)) and adjusted gross margin as a percentage of revenue by service offering; free cash flow and free cash flow as a percentage of adjusted EBITDA (“free cash flow conversion”); adjusted free cash flow and adjusted free cash flow as a percentage of adjusted EBTIDA (“adjusted free cash flow conversion”); and adjusted net income and adjusted diluted earnings per share (“adjusted EPS”). We believe that these adjusted financial measures facilitate analysis of our ongoing business operations because they exclude items that may not reflect, or are unrelated to, RXO’s core operating performance, and may assist investors with comparisons to prior periods and assessing trends in our underlying businesses. Other companies may calculate these non-GAAP financial measures differently, and therefore our measures may not be comparable to similarly titled measures of other companies. These non-GAAP financial measures should only be used as supplemental measures of our operating performance. Adjusted EBITDA, adjusted EBITDA margin, adjusted net income and adjusted EPS include adjustments for transaction and integration costs, as well as restructuring costs and other adjustments as set forth in the attached tables. Management uses these non-GAAP financial measures in making financial, operating and planning decisions and evaluating RXO’s ongoing performance. We believe that adjusted EBITDA, adjusted EBITDA margin, adjusted gross margin and adjusted gross margin as a percentage of revenue improve comparability from period to period by removing the impact of our capital structure (interest and financing expenses), asset base (depreciation and amortization), tax impacts and other adjustments that management has determined do not reflect our core operating activities and thereby assist investors with assessing trends in our underlying business. We believe that adjusted net income and adjusted EPS improve the comparability of our operating results from period to period by removing the impact of certain costs that management has determined do not reflect our core operating activities, including amortization of acquisition-related intangible assets, transaction and integration costs, restructuring costs and other adjustments as set out in the attached tables. We believe that free cash flow, free cash flow conversion, adjusted free cash flow and adjusted free cash flow conversion are important measures of our ability to repay maturing debt or fund other uses of capital that we believe will enhance stockholder value. We calculate free cash flow as net cash provided by operating activities less payment for purchases of property and equipment plus proceeds from sale of property and equipment. We define adjusted free cash flow as free cash flow less cash paid for transaction, integration and restructuring costs. Forward-looking statements This release includes forward-looking statements, including statements relating to our continued year-over-year brokerage volume growth in the second quarter of 2023. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements. In some cases, forward-looking statements can be identified by the use of forward-looking terms such as "anticipate," "estimate," "believe," "continue," "could," "intend," "may," "plan,“ "predict," "should," "will," "expect," "project," "forecast," "goal," "outlook," "target,” or the negative of these terms or other comparable terms. However, the absence of these words does not mean that the statements are not forward-looking. These forward-looking statements are based on certain assumptions and analyses made by us in light of our experience and our perception of historical trends, current conditions and expected future developments, as well as other factors we believe are appropriate in the circumstances. These forward-looking statements are subject to known and unknown risks, uncertainties and assumptions that may cause actual results, levels of activity, performance, or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. Factors that might cause or contribute to a material difference include the risks discussed in our filings with the SEC and the following: competition and pricing pressures; economic conditions generally; the severity, magnitude, duration and aftereffects of the COVID-19 pandemic and government responses to the COVID-19 pandemic; fluctuations in fuel prices; increased carrier prices; severe weather, natural disasters, terrorist attacks or similar incidents that cause material disruptions to our operations or the operations of the third-party carriers and independent contractors with which we contract; our dependence on third-party carriers and independent contractors; labor disputes or organizing efforts affecting our workforce and those of our third-party carriers; legal and regulatory challenges to the status of the third-party carriers with which we contract, and their delivery workers, as independent contractors, rather than employees; litigation that may adversely affect our business or reputation; increasingly stringent laws protecting the environment, including transitional risks relating to climate change, that impact our third-party carriers; governmental regulation and political conditions; our ability to develop and implement suitable information technology systems and prevent failures in or breaches of such systems; the impact of potential cyber-attacks and information technology or data security breaches; issues related to our intellectual property rights; our ability to access the capital markets and generate sufficient cash flow to satisfy our debt obligations; our ability to attract and retain qualified personnel; our ability to successfully implement our cost and revenue initiatives and other strategies; our ability to successfully manage our growth; our reliance on certain large customers for a significant portion of our revenue; damage to our reputation through unfavorable publicity; our failure to meet performance levels required by our contracts with our customers; the inability to achieve the level of revenue growth, cash generation, cost savings, improvement in profitability and margins, fiscal discipline, or strengthening of competitiveness and operations anticipated or targeted; a determination by the IRS that the distribution or certain related separation transactions should be treated as taxable transactions; and the impact of the separation on our businesses, operations and results. All forward-looking statements set forth in this release are qualified by these cautionary statements and there can be no assurance that the actual results or developments anticipated by us will be realized or, even if substantially realized, that they will have the expected consequences to or effects on us or our business or operations. Forward-looking statements set forth in this release speak only as of the date hereof, and we do not undertake any obligation to update forward-looking statements to reflect subsequent events or circumstances, changes in expectations or the occurrence of unanticipated events, except to the extent required by law.

3 Q1 2023 highlights 1 Solid financial and operating results 2 Brokerage gaining profitable share with support from complementary services 3 Continued technology adoption and sales momentum 4 Strong cash flow and balance sheet 5 Share repurchase authorization

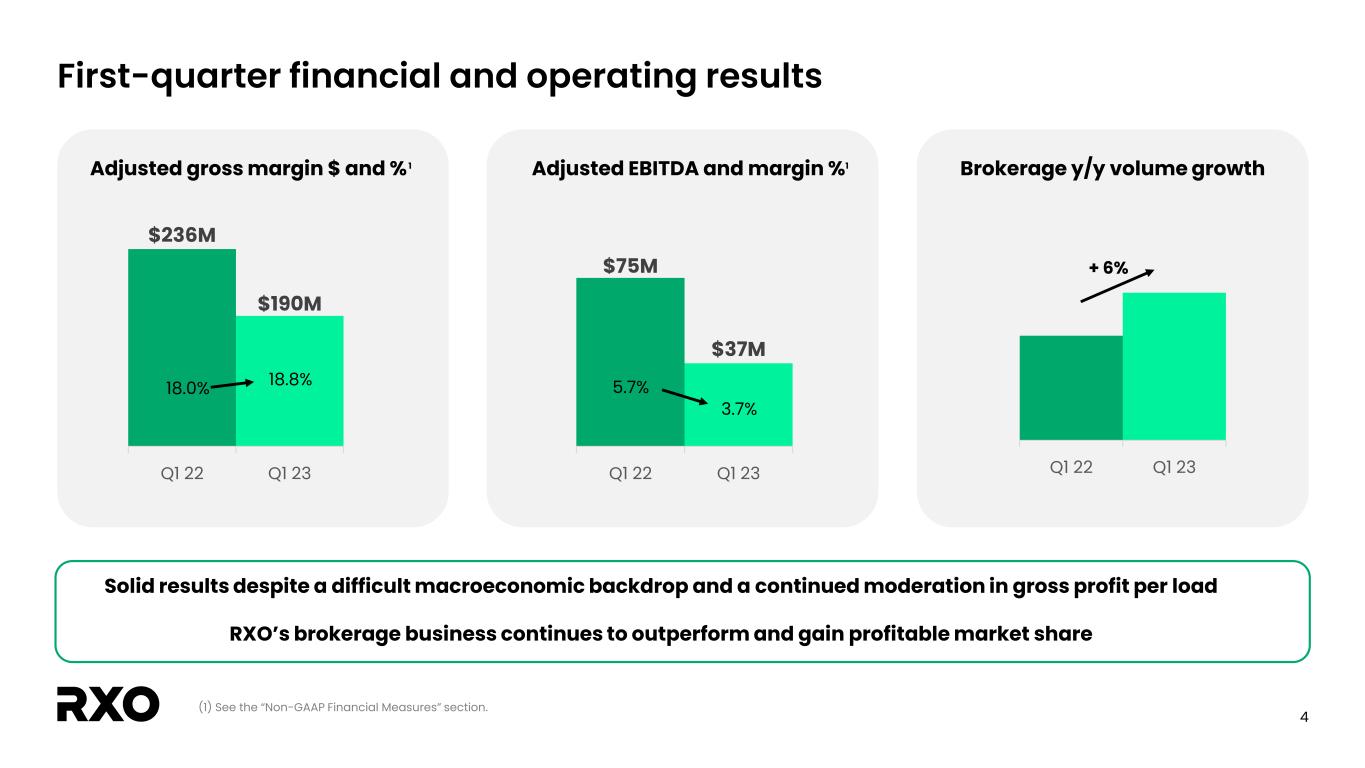

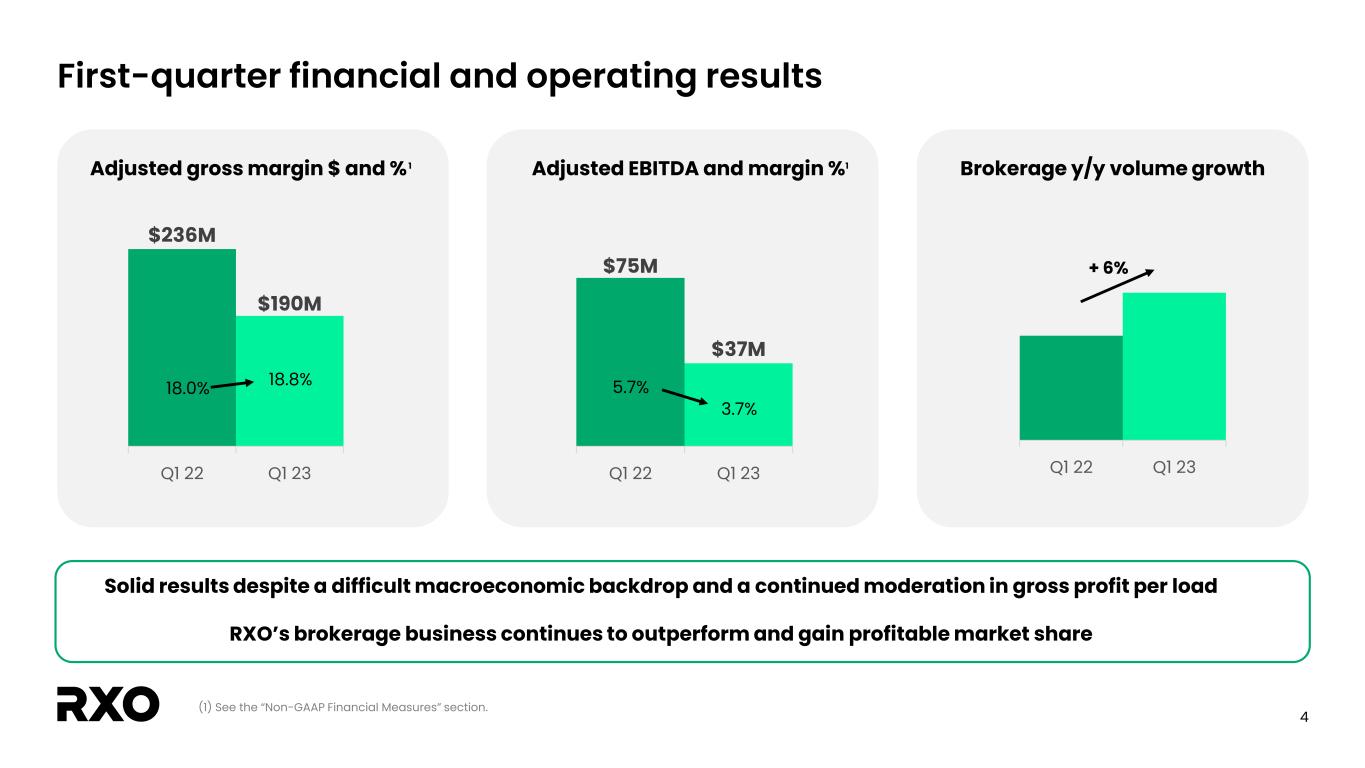

4 $75M $37M 540.00% 545.00% 550.00% 555.00% 560.00% 565.00% 570.00% 575.00% 580.00% 585.00% 590.00% $0 $10 $20 $30 $40 $50 $60 $70 $80 $90 $100 Q1 22 Q1 23 First-quarter financial and operating results Solid results despite a difficult macroeconomic backdrop and a continued moderation in gross profit per load RXO’s brokerage business continues to outperform and gain profitable market share Adjusted EBITDA and margin %1 Q1 22 Q1 23 Brokerage y/y volume growth $236M $190M $100 $120 $140 $160 $180 $200 $220 $240 $260 Q1 22 Q1 23 18.8%18.0% Adjusted gross margin $ and %1 (1) See the “Non-GAAP Financial Measures” section. 3.7% 5.7% + 6%

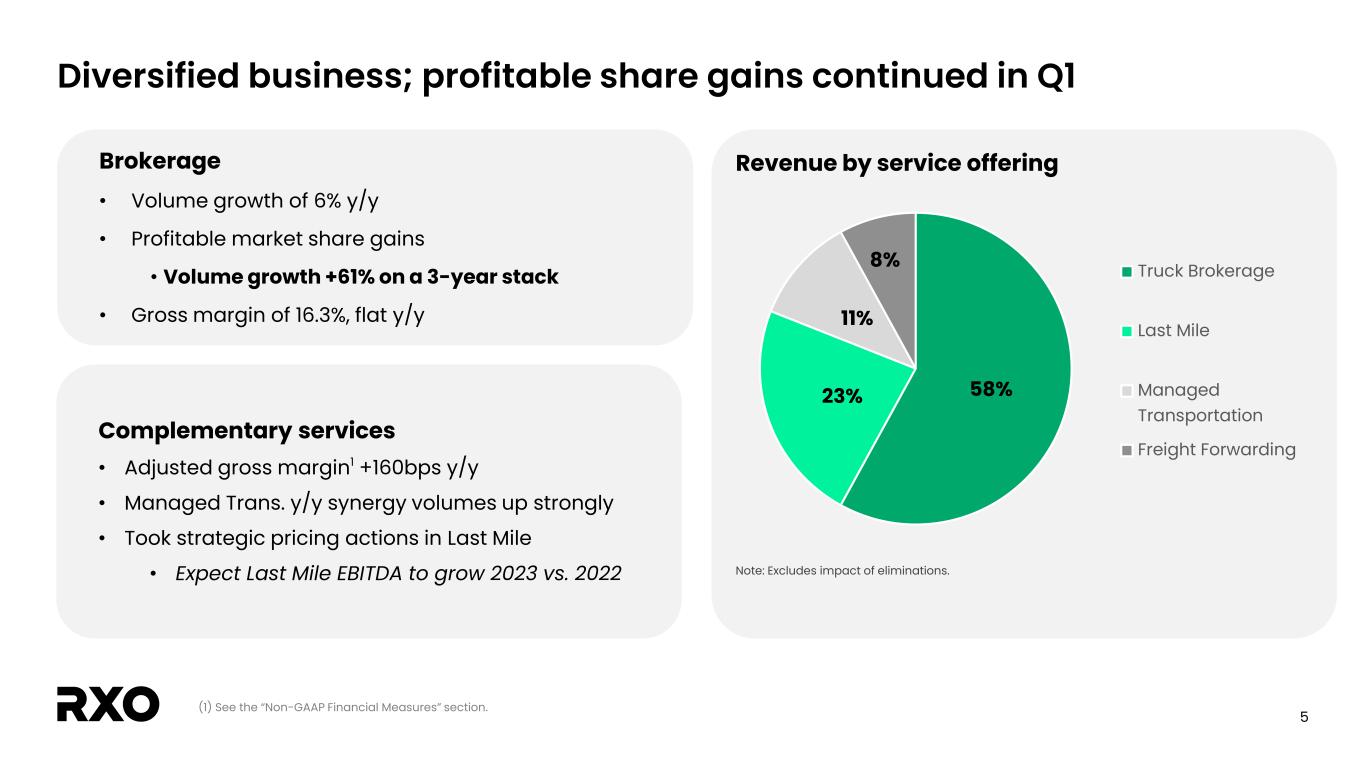

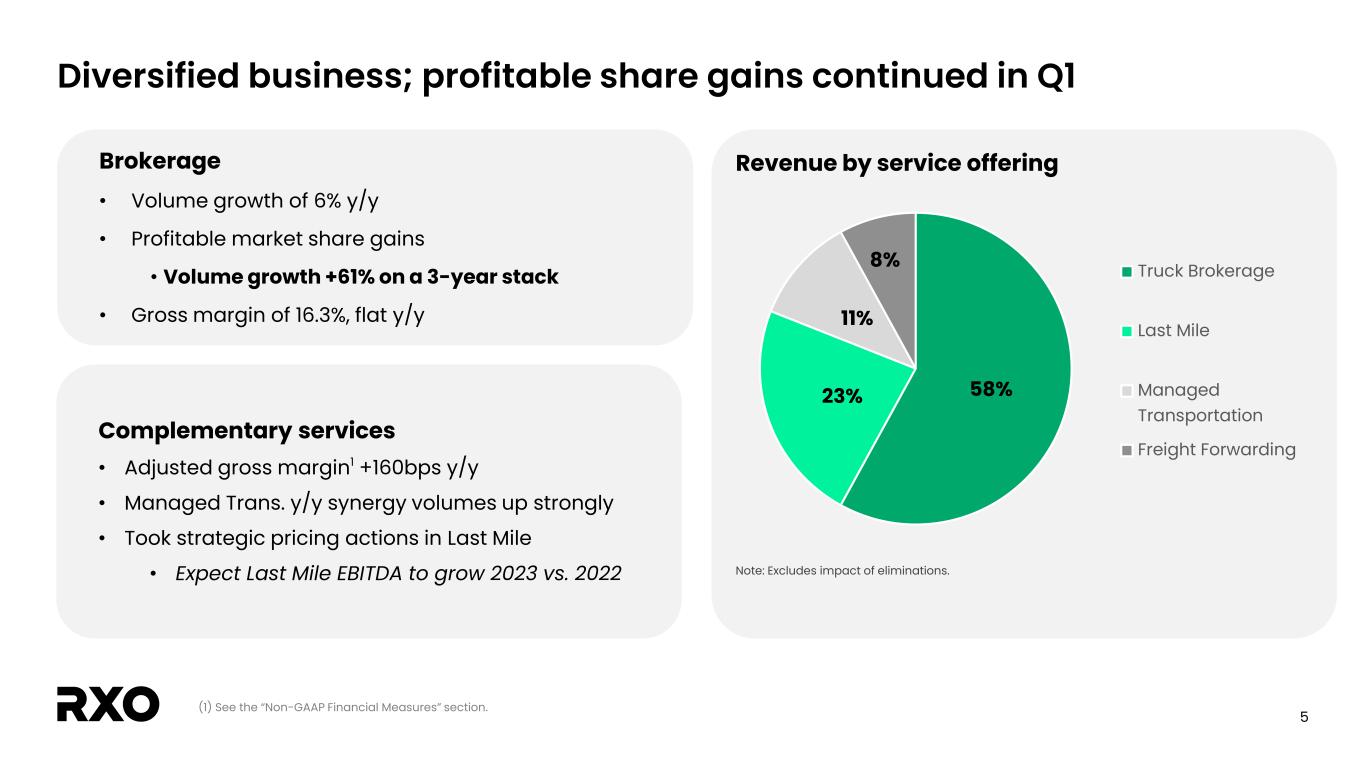

5 Diversified business; profitable share gains continued in Q1 Revenue by service offeringBrokerage • Volume growth of 6% y/y • Profitable market share gains • Volume growth +61% on a 3-year stack • Gross margin of 16.3%, flat y/y Complementary services • Adjusted gross margin1 +160bps y/y • Managed Trans. y/y synergy volumes up strongly • Took strategic pricing actions in Last Mile • Expect Last Mile EBITDA to grow 2023 vs. 2022 58%23% 11% 8% Truck Brokerage Last Mile Managed Transportation Freight Forwarding Note: Excludes impact of eliminations. (1) See the “Non-GAAP Financial Measures” section.

6 RXO technology adoption continues to increase 87% 96% Q4 22 Q1 23 920K 1M Q4 22 Q1 23 RXO Drive™ app total downloadsLoads created or covered digitally Engagement on the RXO platform continues to increase 7-day carrier retention up ~500bps sequentially 7-day carrier retention 79% Average weekly users +25% y/y Active network carriers -3% q/q

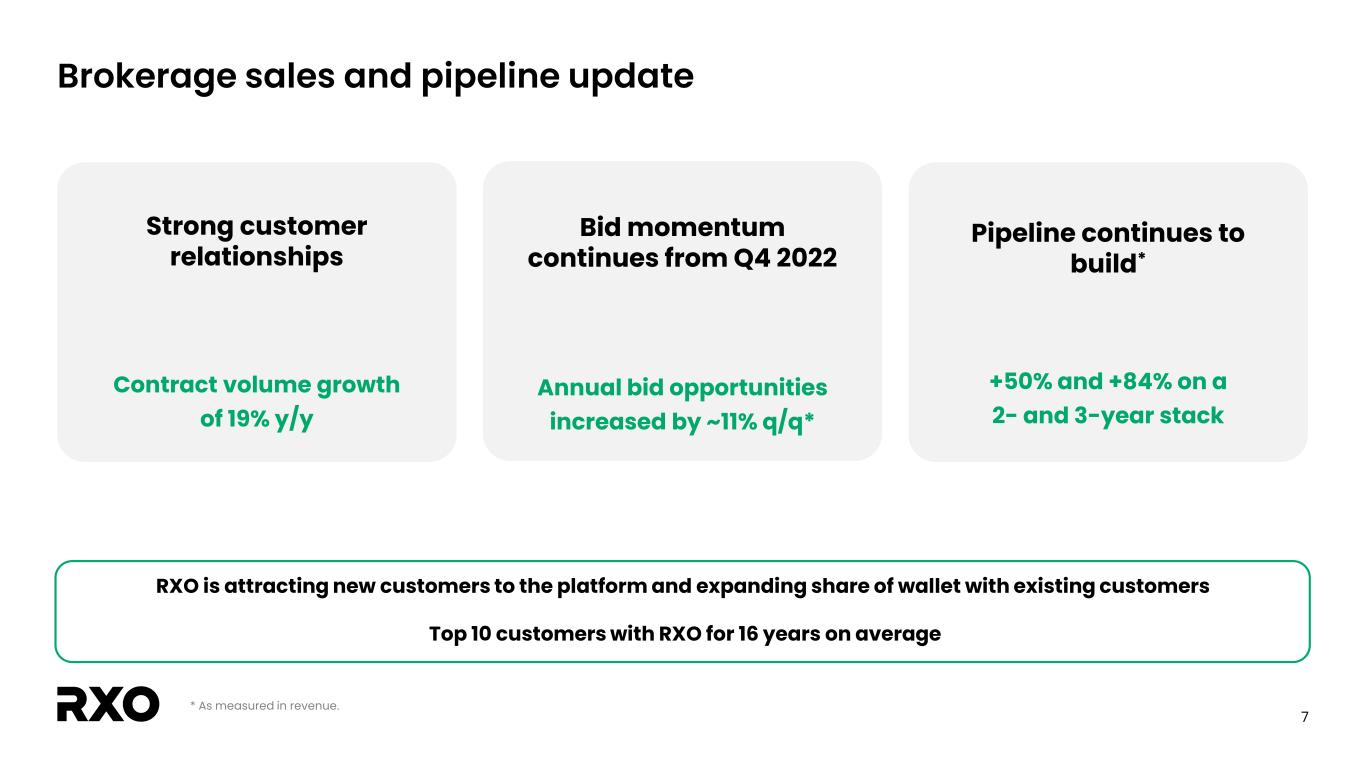

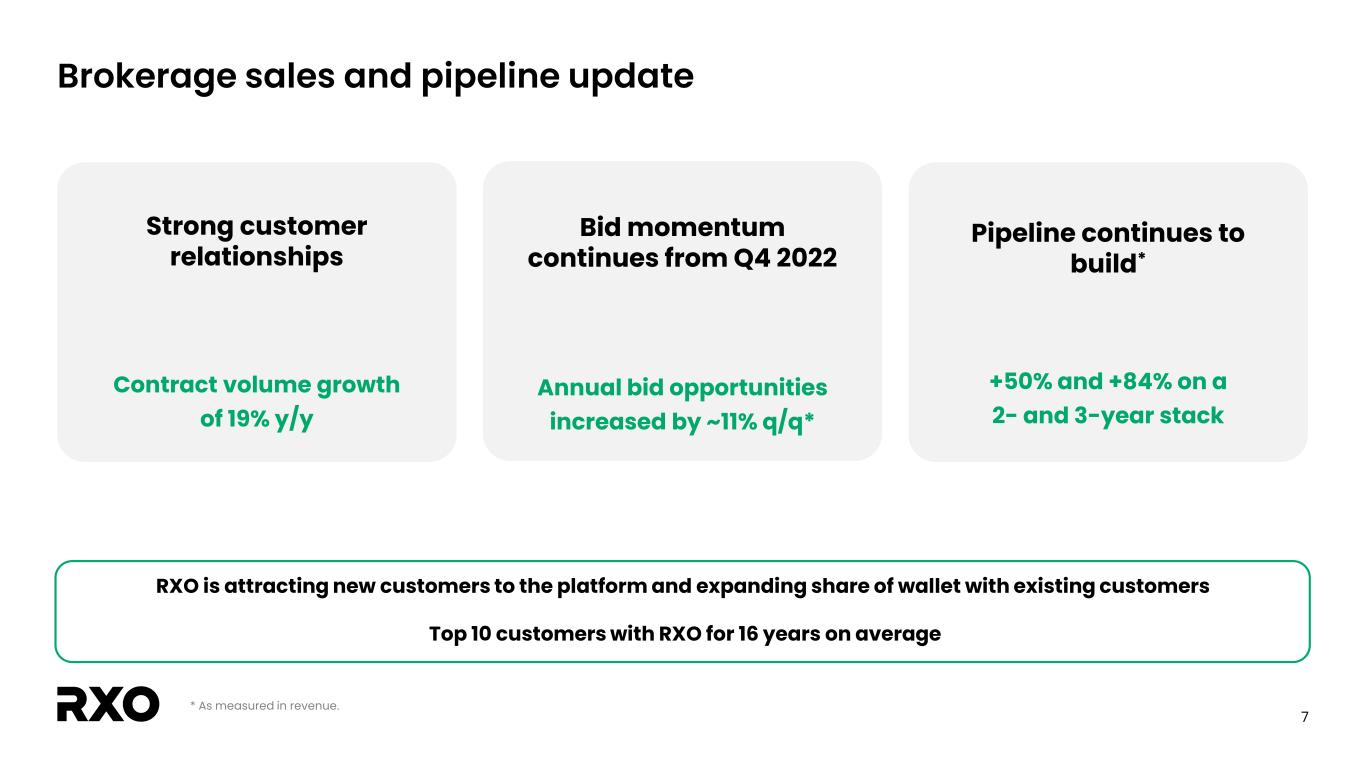

7 Brokerage sales and pipeline update Strong customer relationships Contract volume growth of 19% y/y Bid momentum continues from Q4 2022 Pipeline continues to build* +50% and +84% on a 2- and 3-year stack RXO is attracting new customers to the platform and expanding share of wallet with existing customers Top 10 customers with RXO for 16 years on average * As measured in revenue. Annual bid opportunities increased by ~11% q/q*

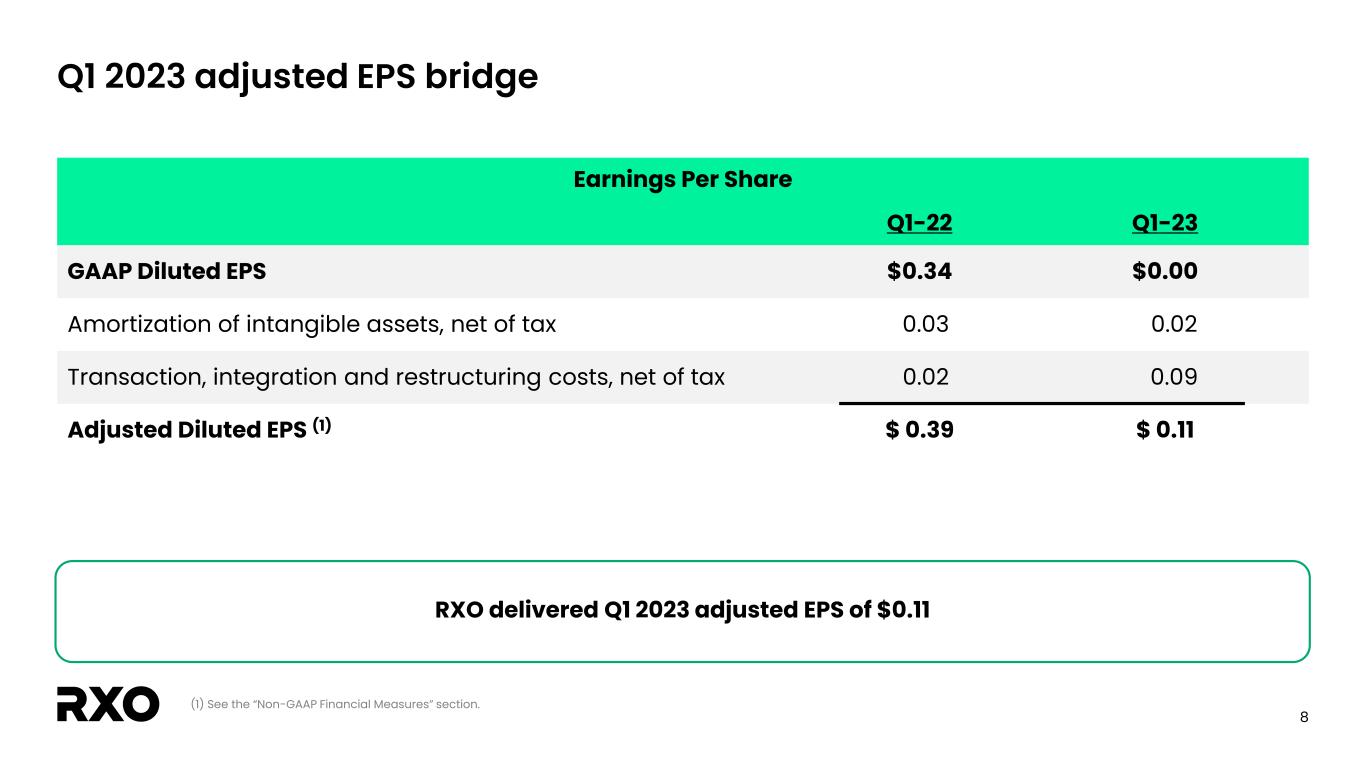

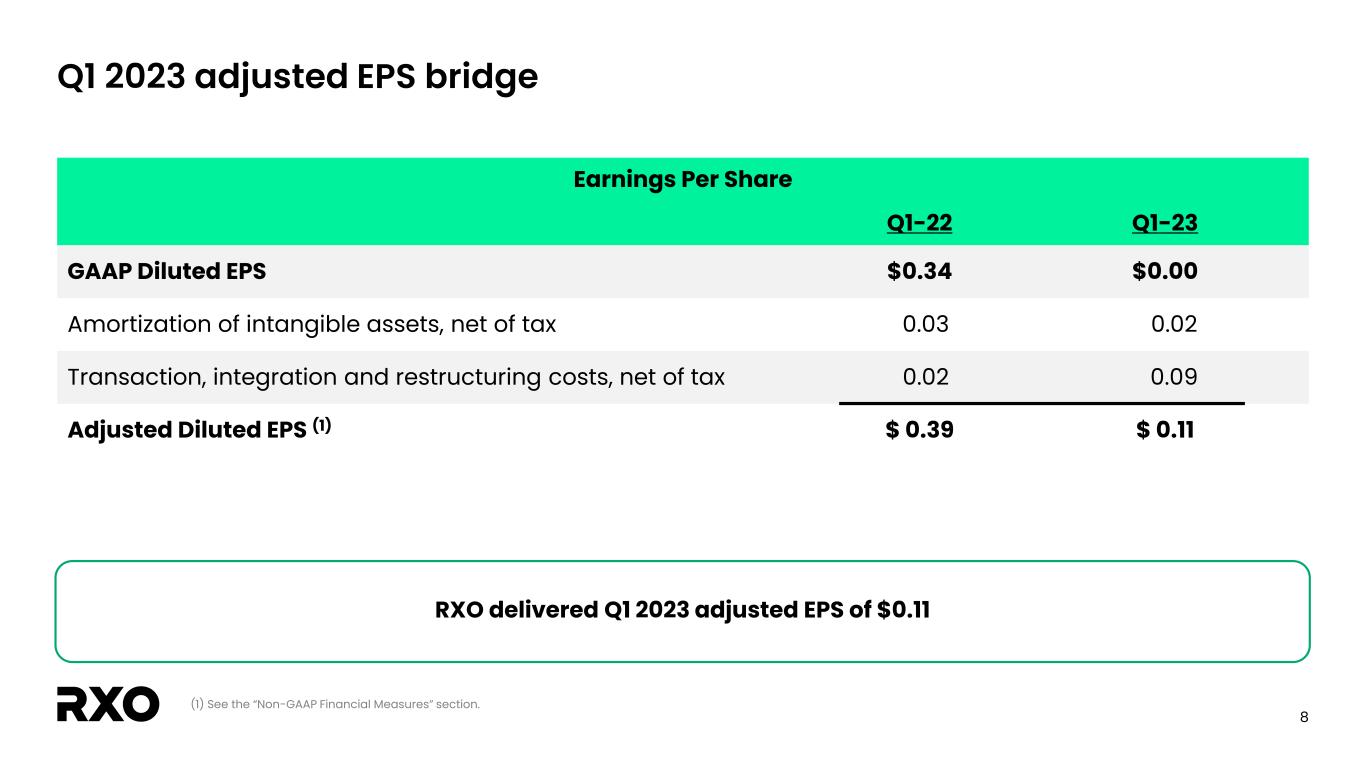

8 Q1 2023 adjusted EPS bridge Earnings Per Share Q1-22 Q1-23 GAAP Diluted EPS $0.34 $0.00 Amortization of intangible assets, net of tax 0.03 0.02 Transaction, integration and restructuring costs, net of tax 0.02 0.09 Adjusted Diluted EPS (1) $ 0.39 $ 0.11 RXO delivered Q1 2023 adjusted EPS of $0.11 (1) See the “Non-GAAP Financial Measures” section.

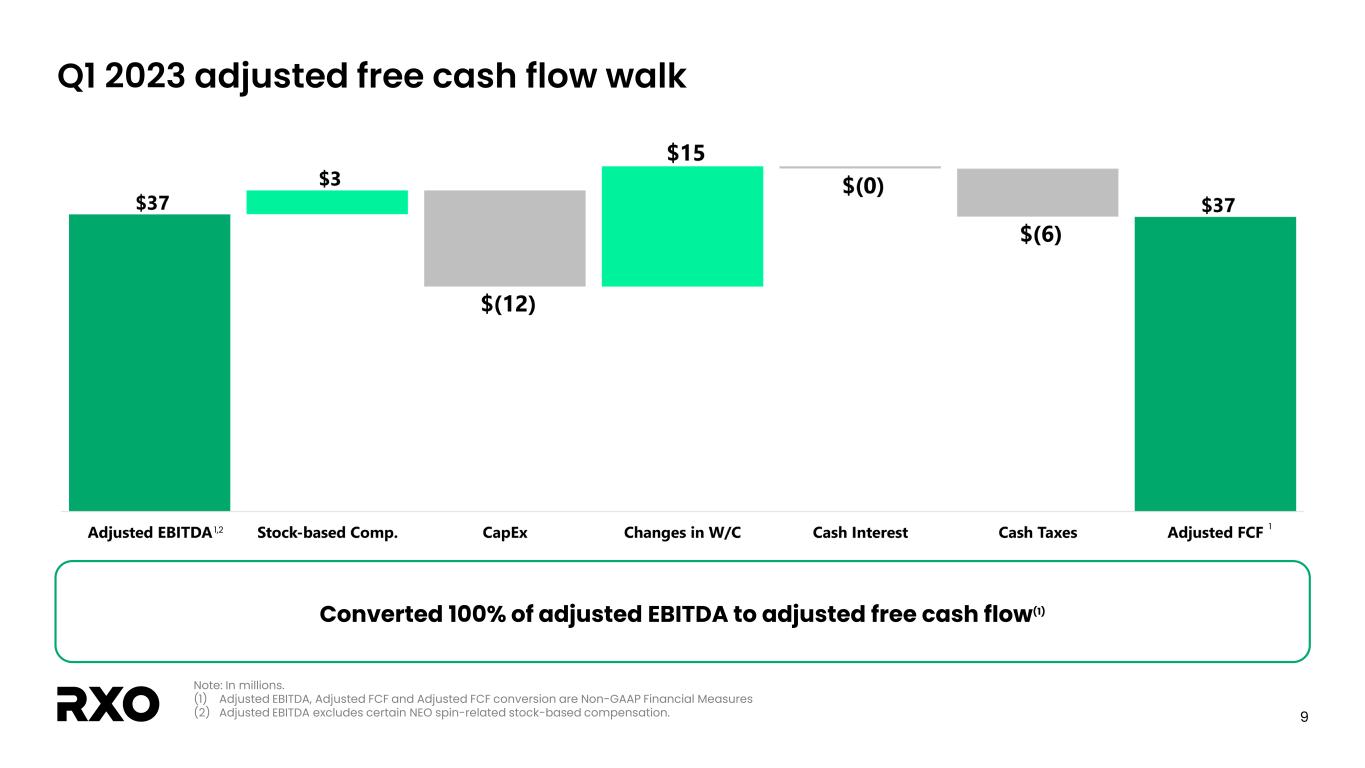

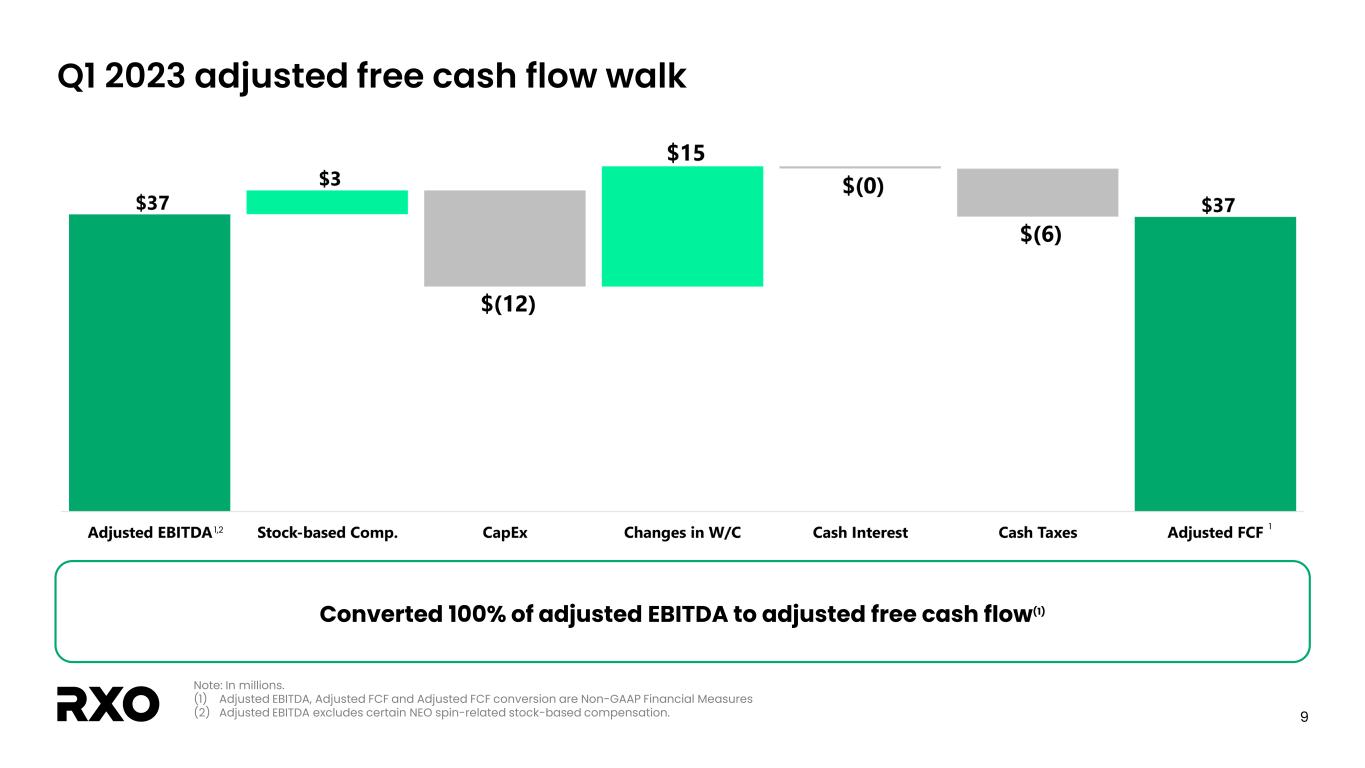

9 Q1 2023 adjusted free cash flow walk Note: In millions. (1) Adjusted EBITDA, Adjusted FCF and Adjusted FCF conversion are Non-GAAP Financial Measures (2) Adjusted EBITDA excludes certain NEO spin-related stock-based compensation. Converted 100% of adjusted EBITDA to adjusted free cash flow(1) 11,2

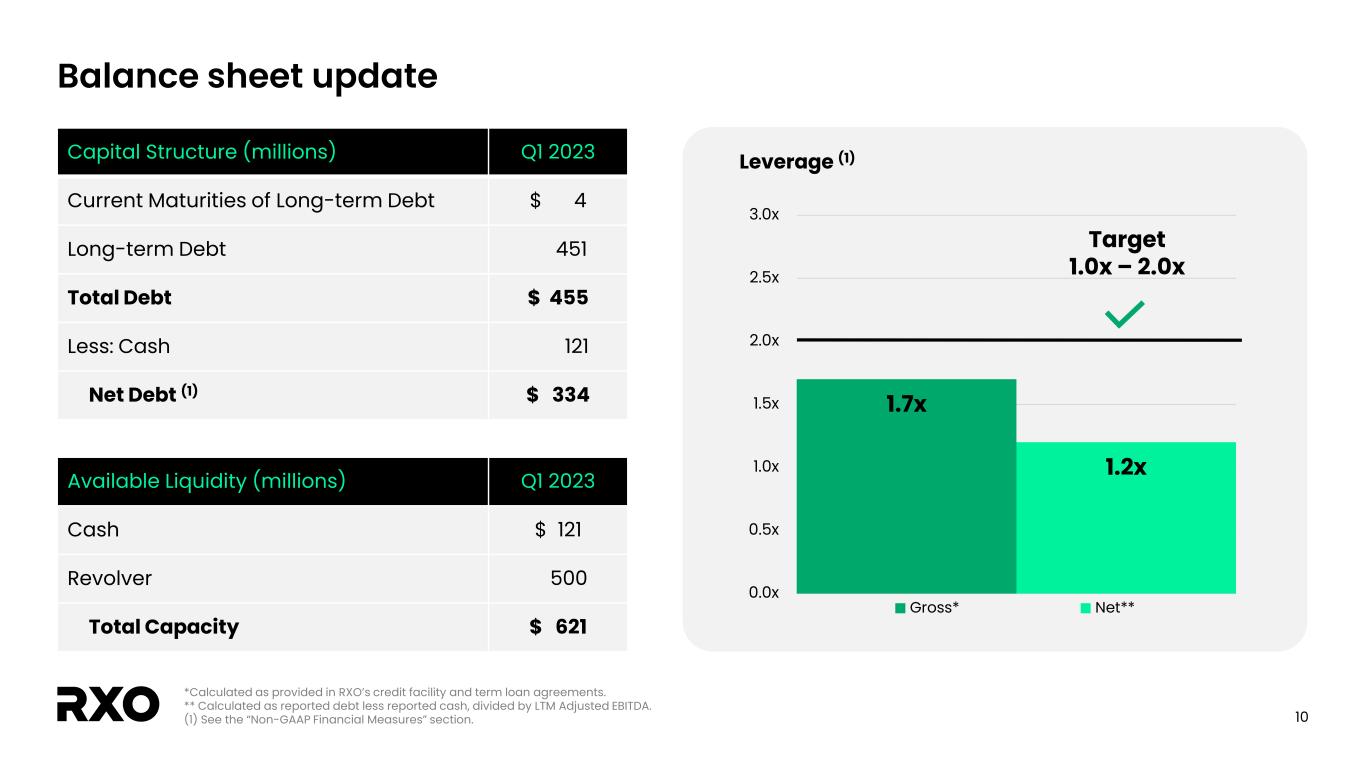

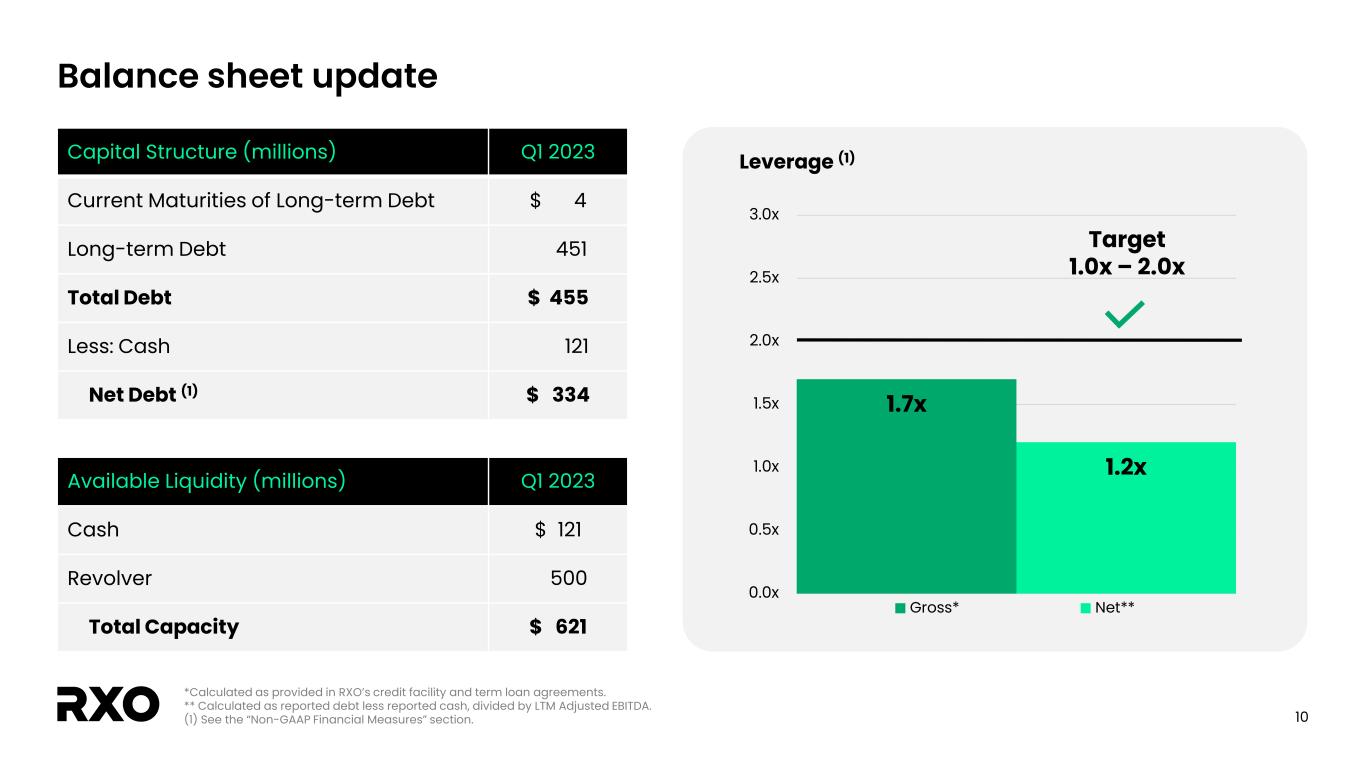

10 Balance sheet update 1.7x 1.2x 0.0x 0.5x 1.0x 1.5x 2.0x 2.5x 3.0x Gross* Net** Capital Structure (millions) Q1 2023 Current Maturities of Long-term Debt $ 4 Long-term Debt 451 Total Debt $ 455 Less: Cash 121 Net Debt (1) $ 334 Available Liquidity (millions) Q1 2023 Cash $ 121 Revolver 500 Total Capacity $ 621 Target 1.0x – 2.0x *Calculated as provided in RXO’s credit facility and term loan agreements. ** Calculated as reported debt less reported cash, divided by LTM Adjusted EBITDA. (1) See the “Non-GAAP Financial Measures” section. Leverage (1)

11 Balanced capital allocation Organic growth 42% return on invested capital(1) Share repurchases Opportunistic M&A Complementary to RXO’s strategy Balanced capital allocation philosophy with a ROIC-based approach $125 million share repurchase program (1) ROIC for 12 months ended December 31, 2022. Invested capital excludes goodwill and intangibles. See appendix for more details.

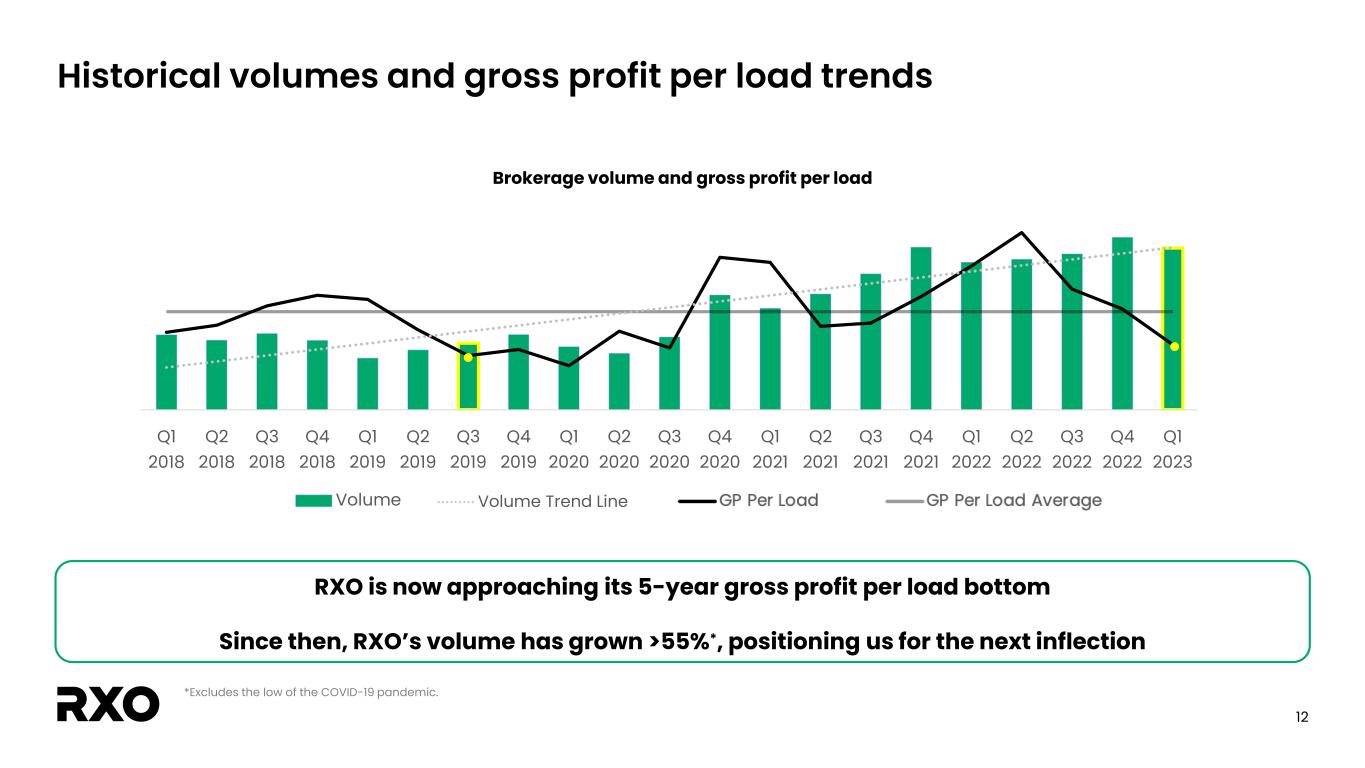

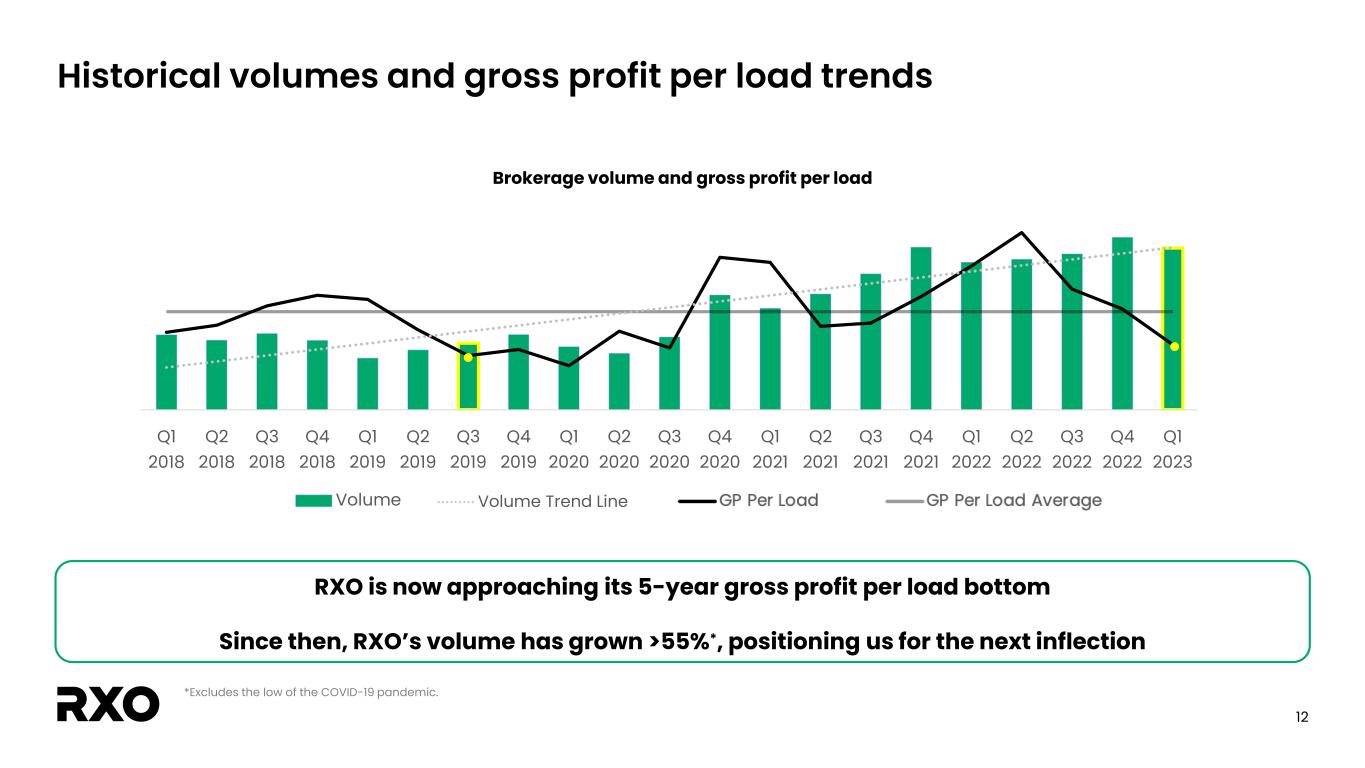

12 Historical volumes and gross profit per load trends RXO is now approaching its 5-year gross profit per load bottom Since then, RXO’s volume has grown >55%*, positioning us for the next inflection *Excludes the low of the COVID-19 pandemic. $150.00 $200.00 $250.00 $300.00 $350.00 $400.00 $450.00 $500.00 2,000 2,500 3,000 3,500 4,000 4,500 5,000 5,500 6,000 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Brokerage volume and gross profit per load Volume GP Per Load GP Per Load Average Linear (Volume)Volume Trend Line

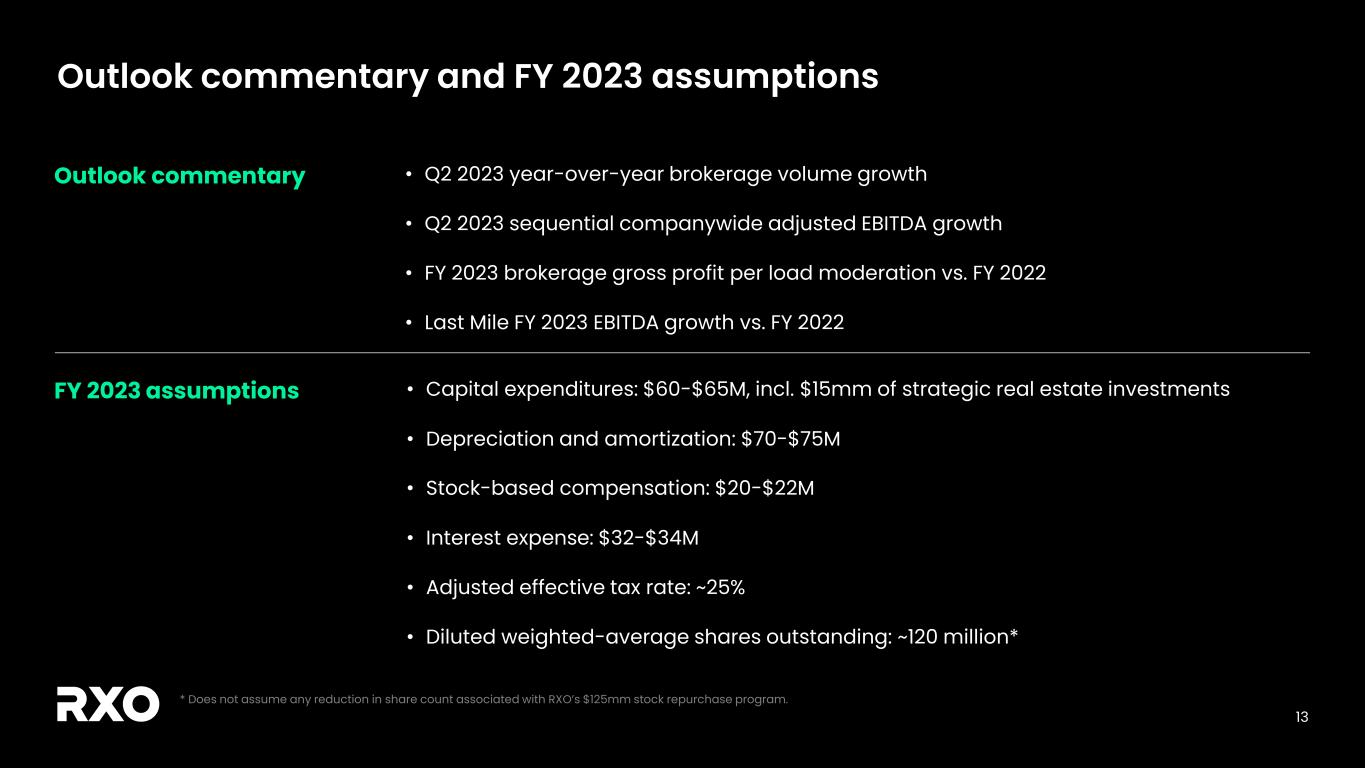

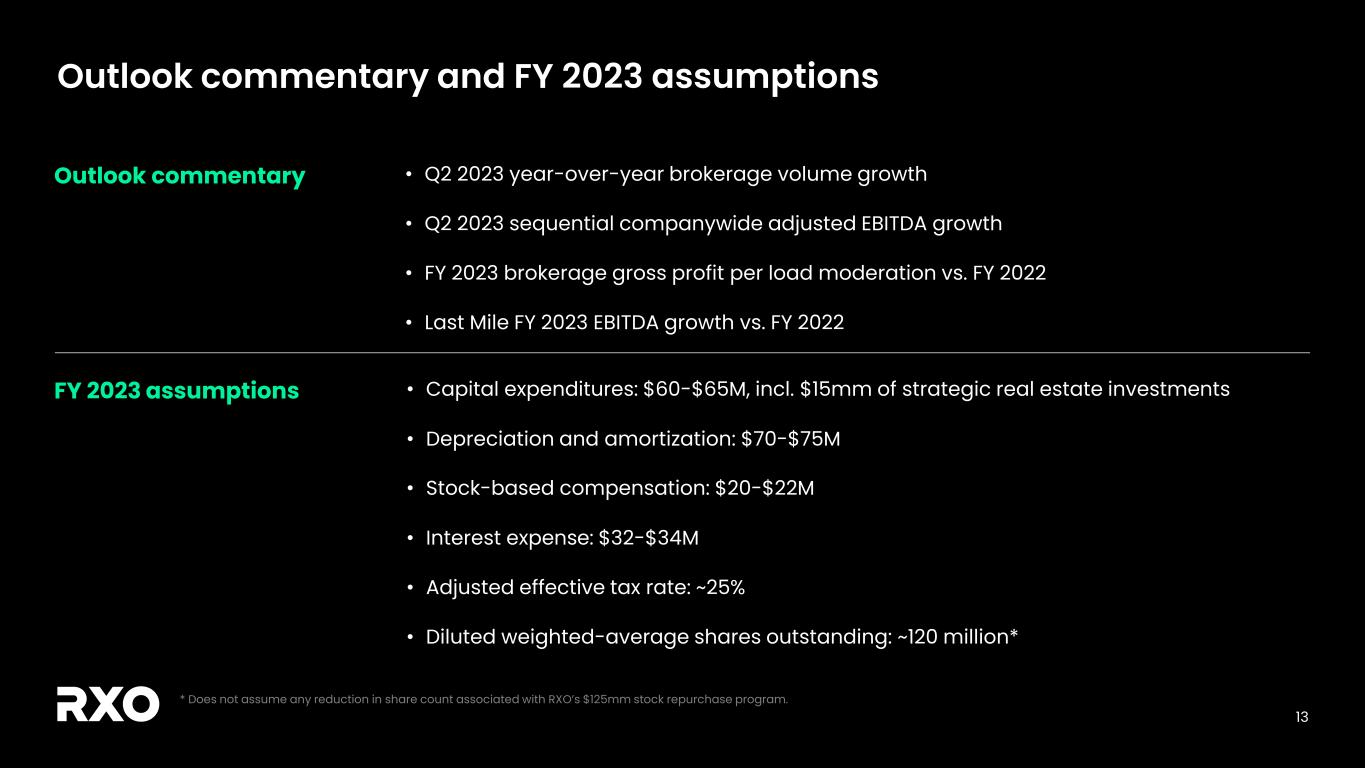

13 Outlook commentary and FY 2023 assumptions • Q2 2023 year-over-year brokerage volume growth • Q2 2023 sequential companywide adjusted EBITDA growth • FY 2023 brokerage gross profit per load moderation vs. FY 2022 • Last Mile FY 2023 EBITDA growth vs. FY 2022 Outlook commentary FY 2023 assumptions • Capital expenditures: $60-$65M, incl. $15mm of strategic real estate investments • Depreciation and amortization: $70-$75M • Stock-based compensation: $20-$22M • Interest expense: $32-$34M • Adjusted effective tax rate: ~25% • Diluted weighted-average shares outstanding: ~120 million* * Does not assume any reduction in share count associated with RXO’s $125mm stock repurchase program.

14 Key investment highlights 1 Large addressable market with secular tailwinds 2 Market-leading platform with complementary transportation solutions 3 Proprietary technology drives efficiency, volume and margin expansion 4 Long-term relationships with blue-chip customers 5 Diverse exposure across attractive end markets 6 Tiered approach to sales drives multi-faceted growth opportunities 7 Track record of above-market growth and high profitability 8 Experienced and proven leadership team

15 Appendix

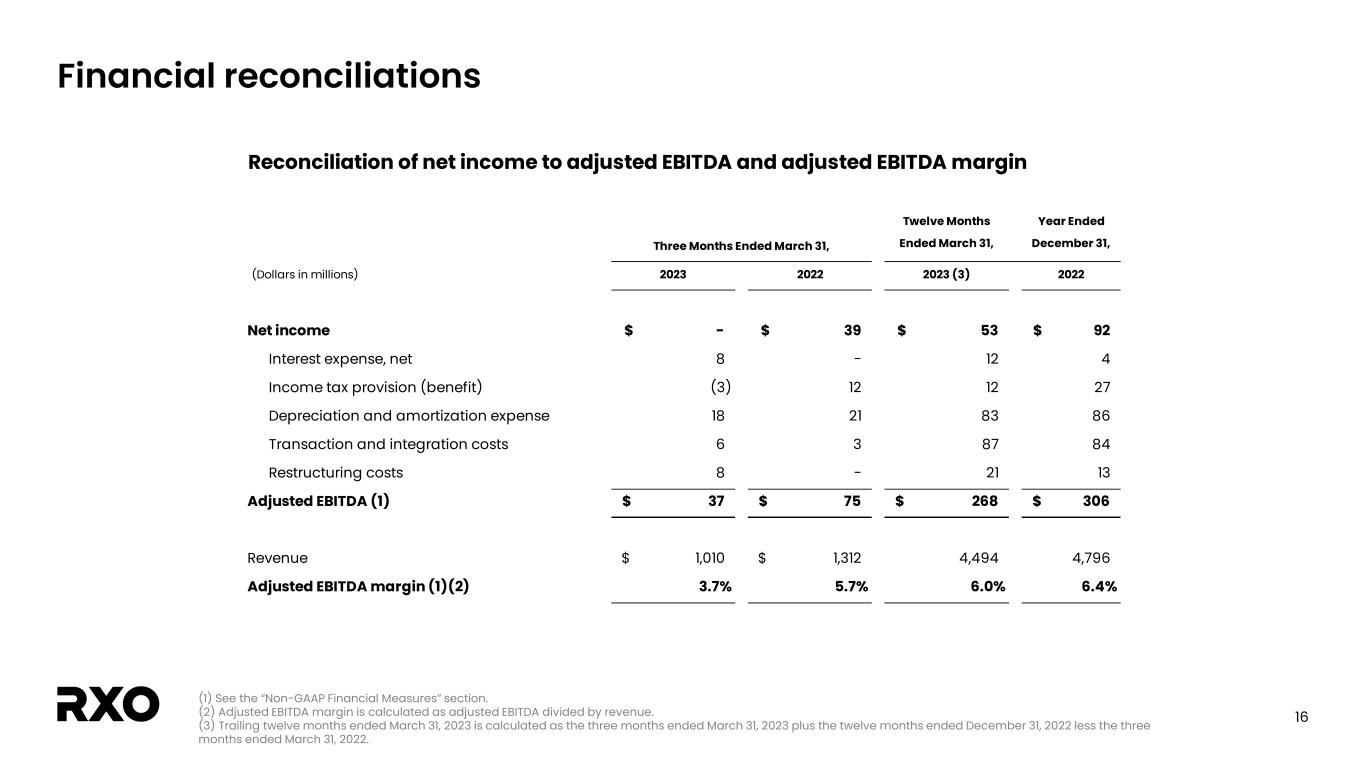

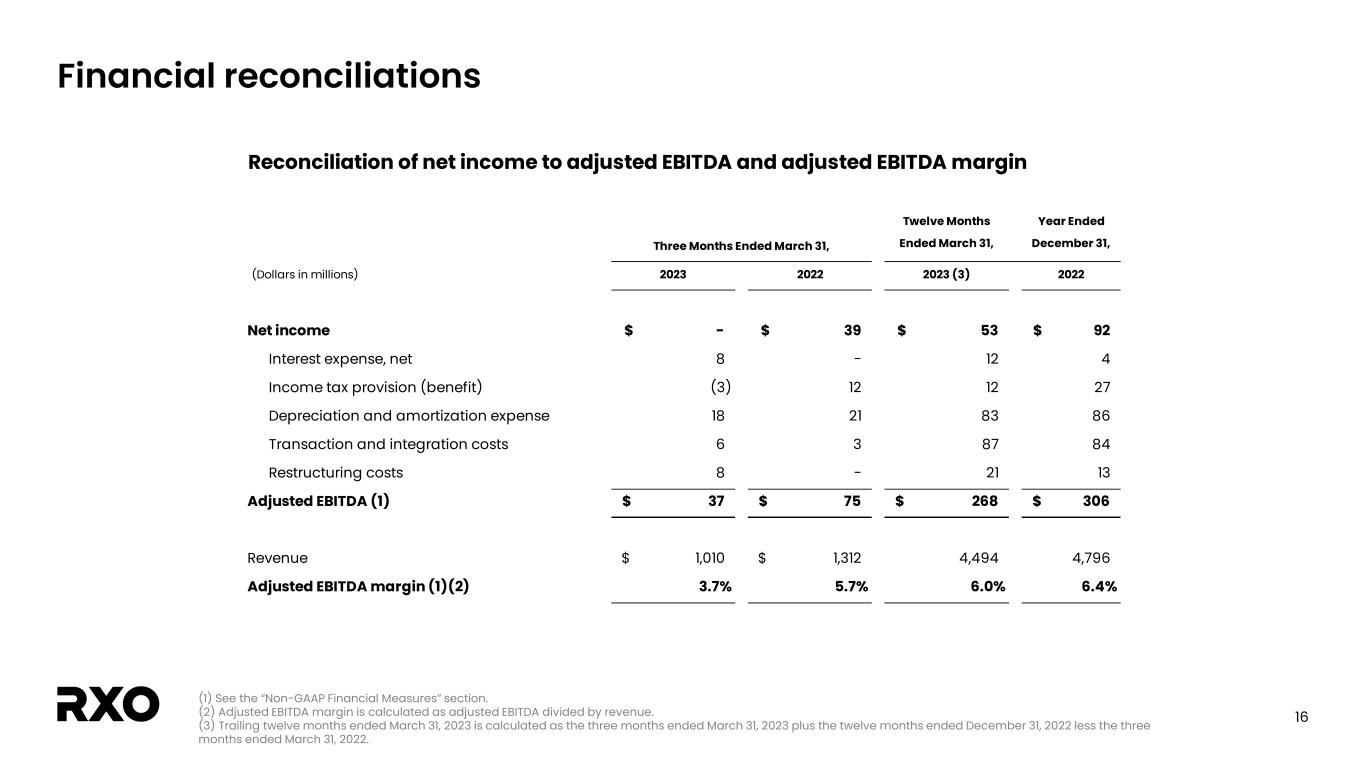

16 Financial reconciliations (1) See the “Non-GAAP Financial Measures” section. (2) Adjusted EBITDA margin is calculated as adjusted EBITDA divided by revenue. (3) Trailing twelve months ended March 31, 2023 is calculated as the three months ended March 31, 2023 plus the twelve months ended December 31, 2022 less the three months ended March 31, 2022. Reconciliation of net income to adjusted EBITDA and adjusted EBITDA margin Twelve Months Ended March 31, Year Ended December 31, (Dollars in millions) 2023 2022 2023 (3) 2022 Net income -$ 39$ 53$ 92$ Interest expense, net 8 - 12 4 Income tax provision (benefit) (3) 12 12 27 Depreciation and amortization expense 18 21 83 86 Transaction and integration costs 6 3 87 84 Restructuring costs 8 - 21 13 Adjusted EBITDA (1) 37$ 75$ 268$ 306$ Revenue 1,010$ 1,312$ 4,494 4,796 Adjusted EBITDA margin (1)(2) 3.7% 5.7% 6.0% 6.4% Three Months Ended March 31,

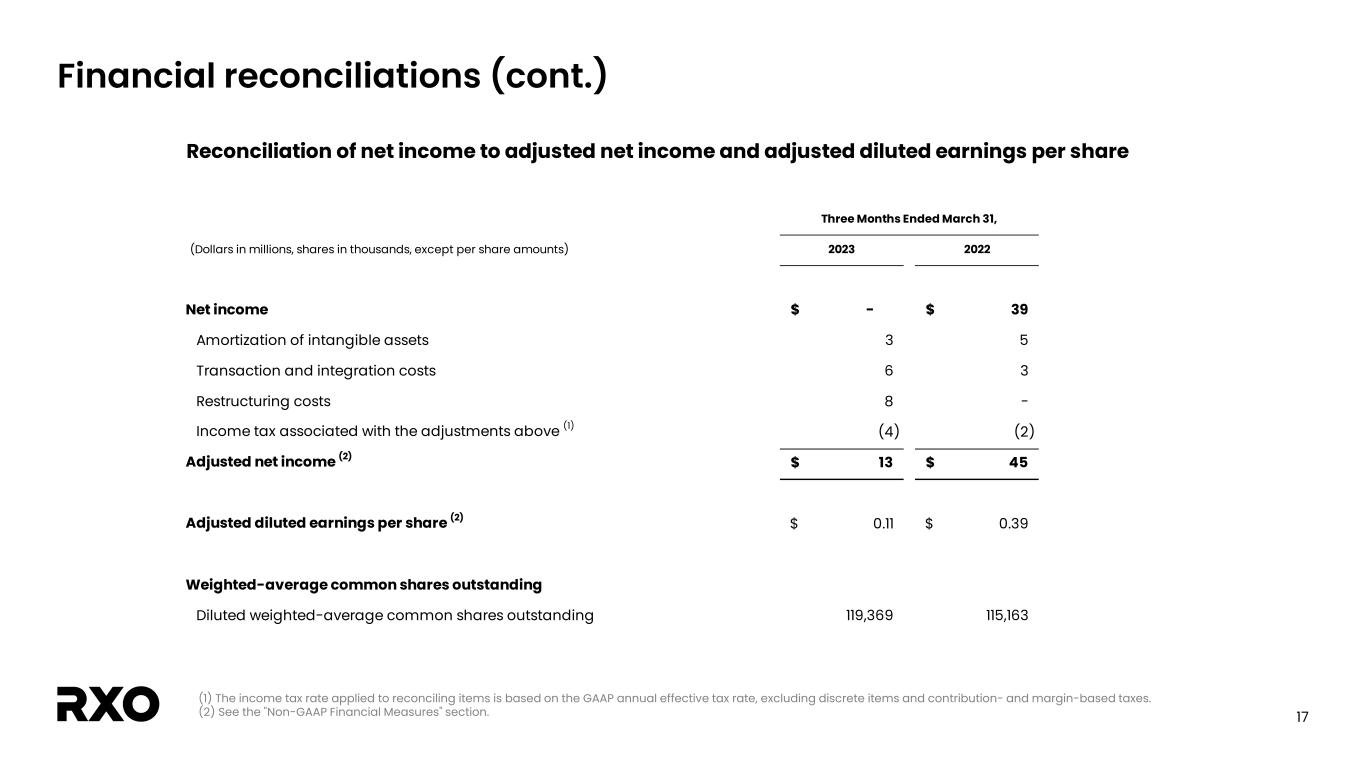

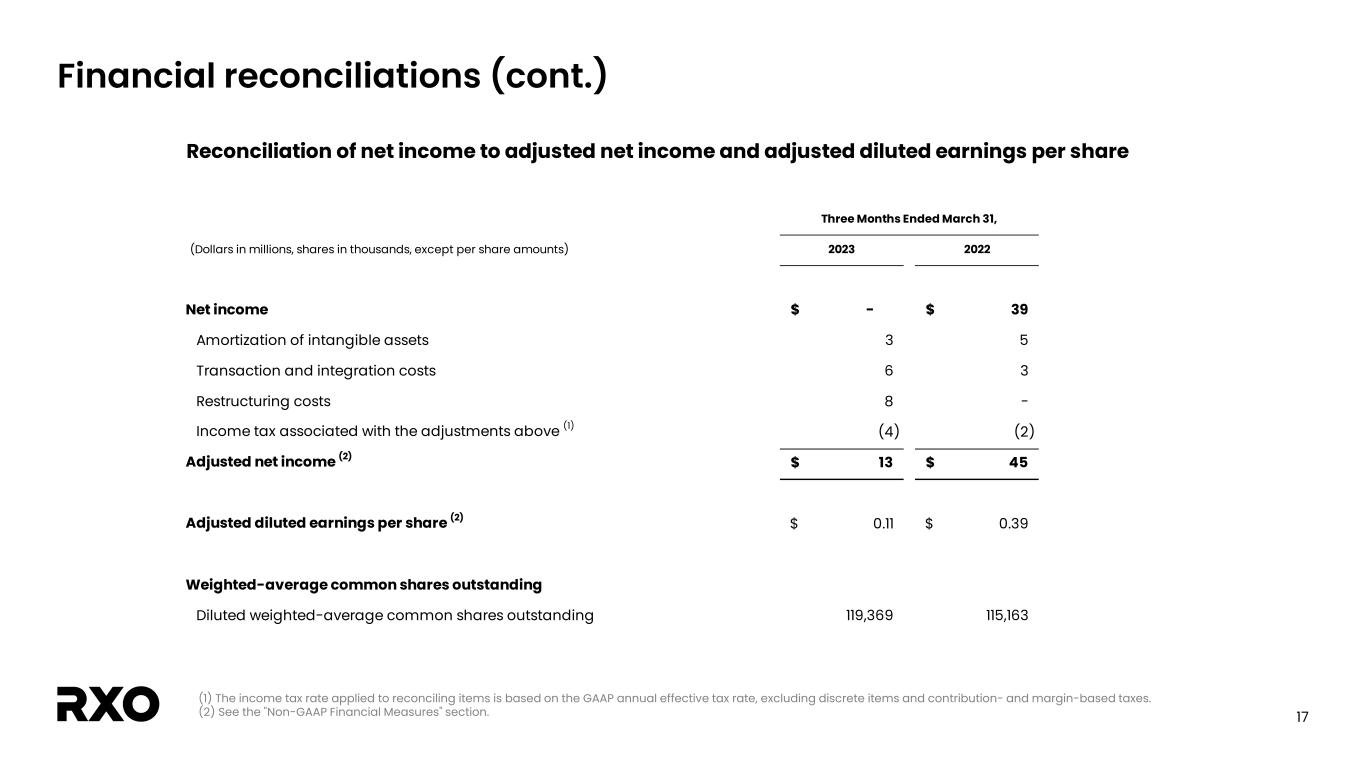

17 Financial reconciliations (cont.) (1) The income tax rate applied to reconciling items is based on the GAAP annual effective tax rate, excluding discrete items and contribution- and margin-based taxes. (2) See the "Non-GAAP Financial Measures" section. Reconciliation of net income to adjusted net income and adjusted diluted earnings per share (Dollars in millions, shares in thousands, except per share amounts) 2023 2022 Net income -$ 39$ Amortization of intangible assets 3 5 Transaction and integration costs 6 3 Restructuring costs 8 - Income tax associated with the adjustments above (1) (4) (2) Adjusted net income (2) 13$ 45$ Adjusted diluted earnings per share (2) 0.11$ 0.39$ Weighted-average common shares outstanding Diluted weighted-average common shares outstanding 119,369 115,163 Three Months Ended March 31,

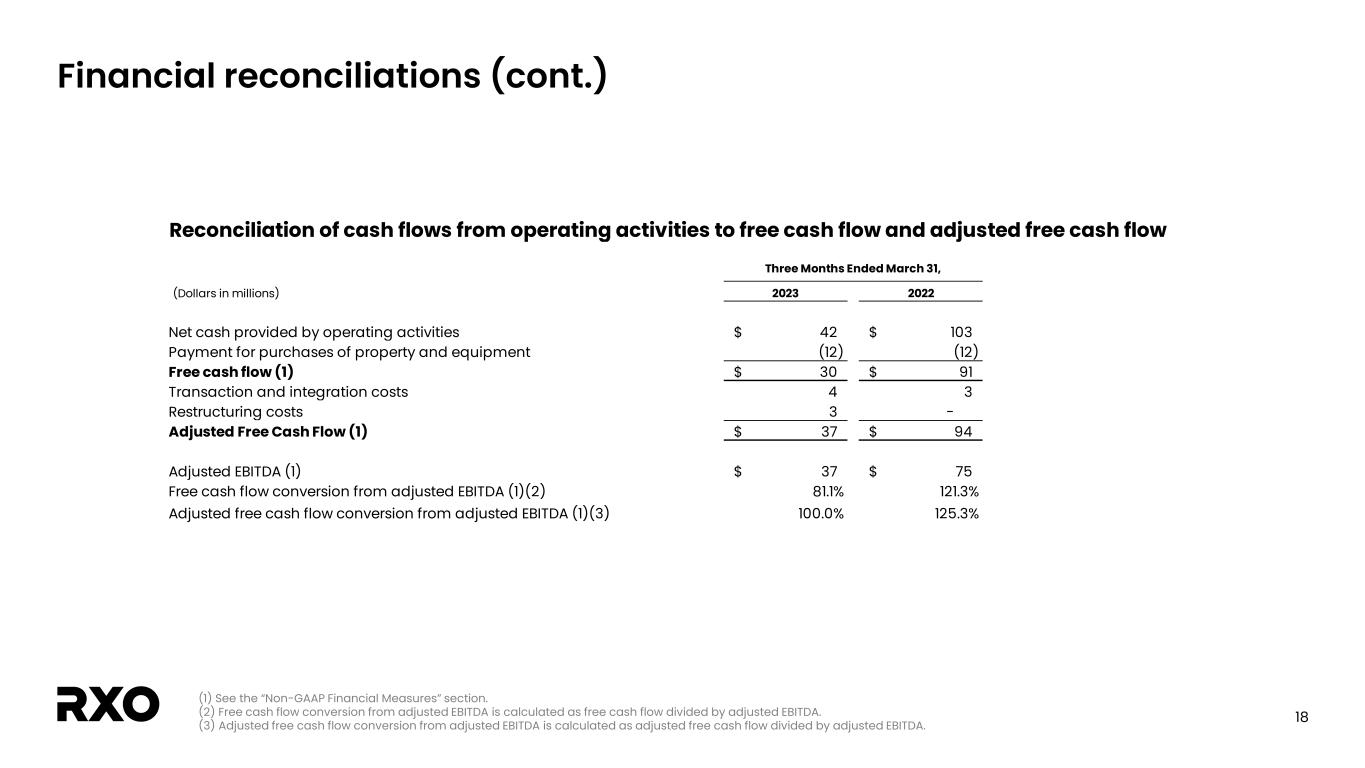

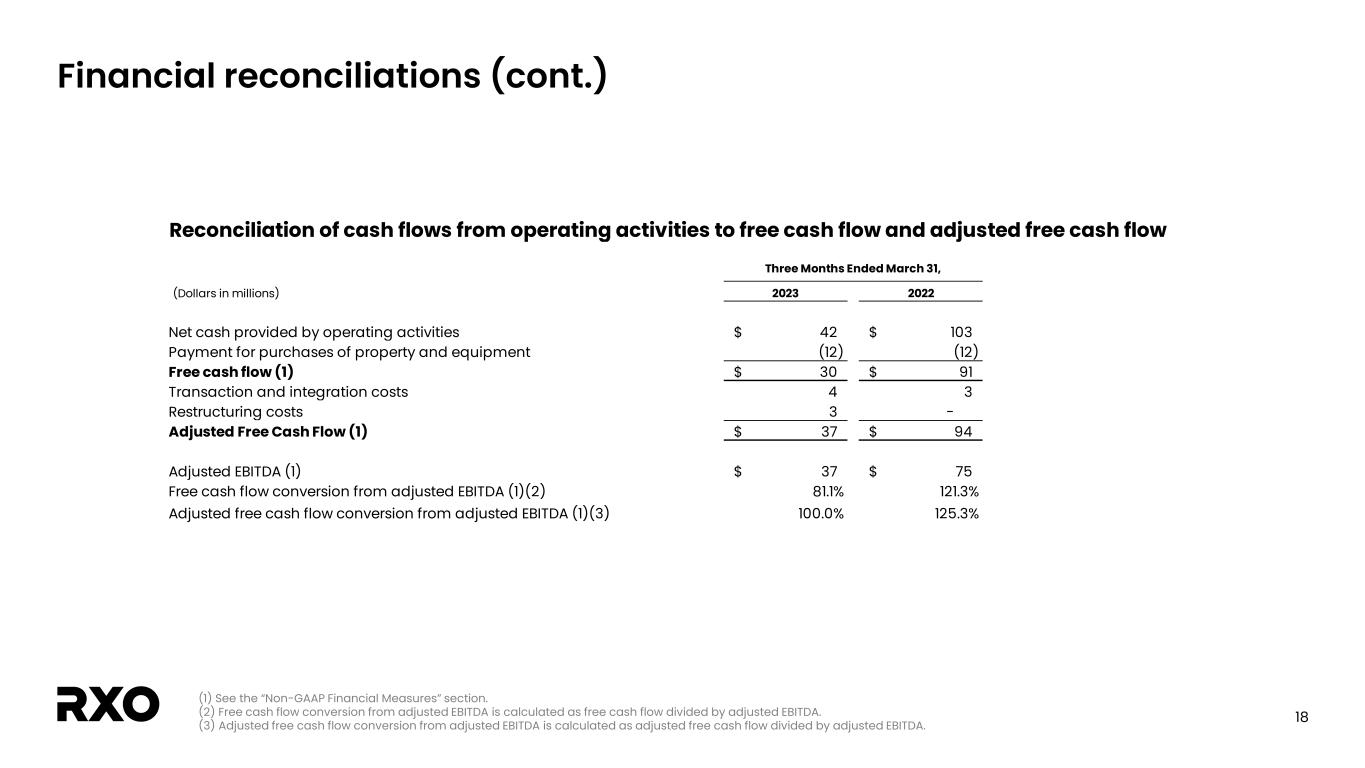

18 Financial reconciliations (cont.) (1) See the “Non-GAAP Financial Measures” section. (2) Free cash flow conversion from adjusted EBITDA is calculated as free cash flow divided by adjusted EBITDA. (3) Adjusted free cash flow conversion from adjusted EBITDA is calculated as adjusted free cash flow divided by adjusted EBITDA. Reconciliation of cash flows from operating activities to free cash flow and adjusted free cash flow (Dollars in millions) 2023 2022 Net cash provided by operating activities 42$ 103$ Payment for purchases of property and equipment (12) (12) Free cash flow (1) 30$ 91$ Transaction and integration costs 4 3 Restructuring costs 3 - Adjusted Free Cash Flow (1) 37$ 94$ Adjusted EBITDA (1) 37$ 75$ Free cash flow conversion from adjusted EBITDA (1)(2) 81.1% 121.3% Adjusted free cash flow conversion from adjusted EBITDA (1)(3) 100.0% 125.3% Three Months Ended March 31,

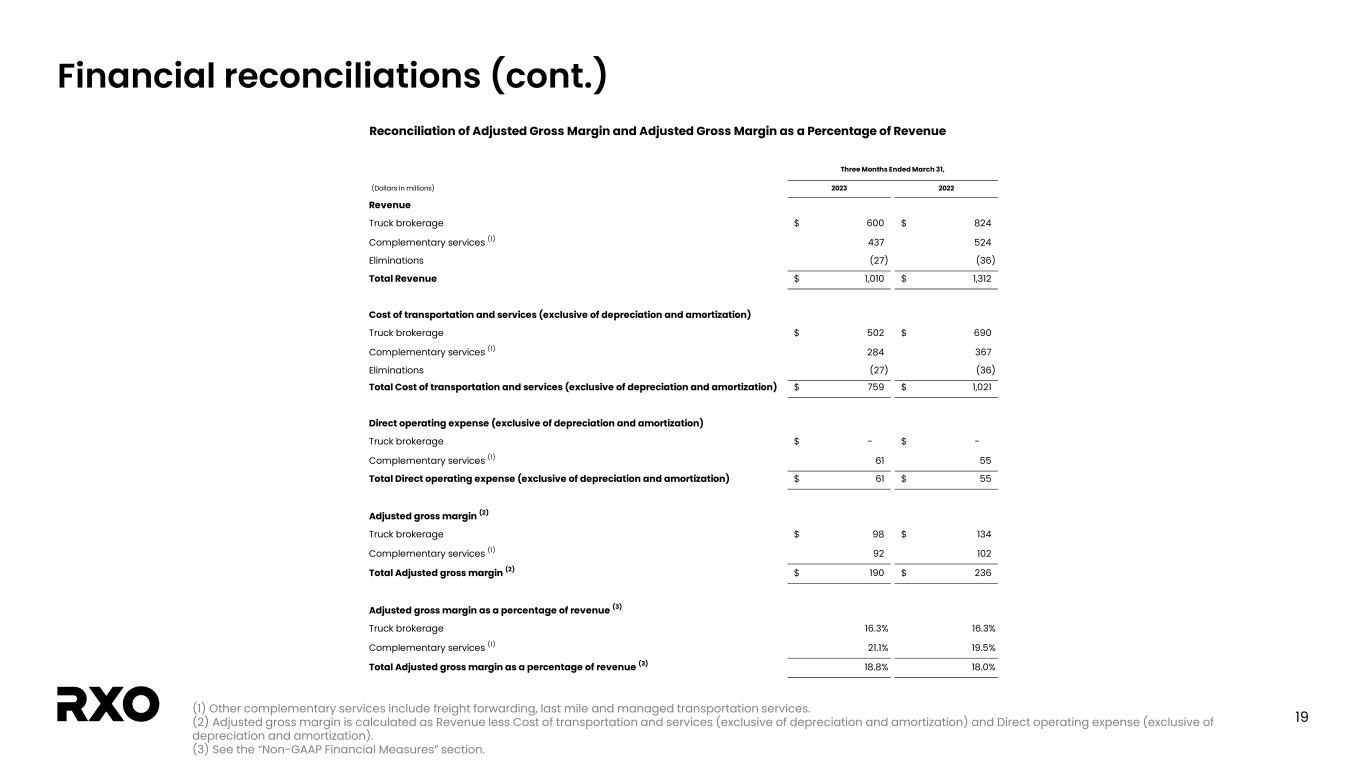

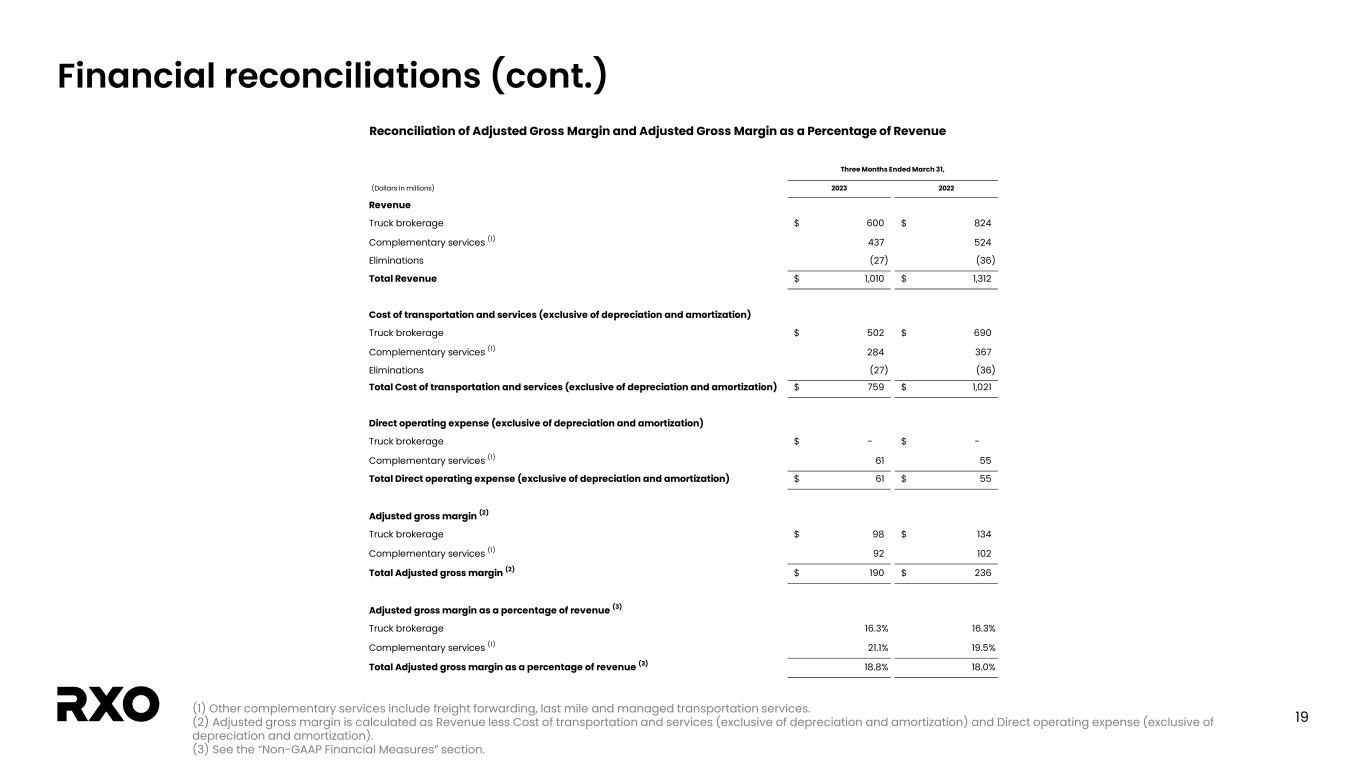

19 Financial reconciliations (cont.) (1) Other complementary services include freight forwarding, last mile and managed transportation services. (2) Adjusted gross margin is calculated as Revenue less Cost of transportation and services (exclusive of depreciation and amortization) and Direct operating expense (exclusive of depreciation and amortization). (3) See the “Non-GAAP Financial Measures” section. (Dollars in millions) 2023 2022 Revenue Truck brokerage 600$ 824$ Complementary services (1) 437 524 Eliminations (27) (36) Total Revenue 1,010$ 1,312$ Cost of transportation and services (exclusive of depreciation and amortization) Truck brokerage 502$ 690$ Complementary services (1) 284 367 Eliminations (27) (36) Total Cost of transportation and services (exclusive of depreciation and amortization) 759$ 1,021$ Direct operating expense (exclusive of depreciation and amortization) Truck brokerage -$ -$ Complementary services (1) 61 55 Total Direct operating expense (exclusive of depreciation and amortization) 61$ 55$ Adjusted gross margin (2) Truck brokerage 98$ 134$ Complementary services (1) 92 102 Total Adjusted gross margin (2) 190$ 236$ Adjusted gross margin as a percentage of revenue (3) Truck brokerage 16.3% 16.3% Complementary services (1) 21.1% 19.5% Total Adjusted gross margin as a percentage of revenue (3) 18.8% 18.0% Three Months Ended March 31, Reconciliation of Adjusted Gross Margin and Adjusted Gross Margin as a Percentage of Revenue

20 Financial reconciliations (cont.) (1) See the “Non-GAAP Financial Measures” section. Reconciliation of net debt, gross leverage and net leverage March 31, (Dollars in millions) 2023 Reconciliation of Net Debt Total debt 455$ Cash and cash equivalents 121 Net debt (1) 334$ Reconciliation of Gross Leverage Total debt 455$ Adjusted EBITDA for the trailing twelve months March 31, 2023 268$ Gross leverage (1) 1.7x Reconciliation of Net Leverage Net debt (1) 334$ Adjusted EBITDA for the trailing twelve months March 31, 2023 268$ Net leverage (1) 1.2x

21 Financial reconciliations (cont.) (1) Cash taxes is calculated as adjusted EBITDA less depreciation expense plus operating lease interest, multiplied by RXO's full year 2022 effective tax rate of 22.6%. (2) Operating lease interest is calculated as period end operating lease assets multiplied by the Company's incremental borrowing rate, net of tax. (3) See the “Non-GAAP Financial Measures” section. Reconciliation of Return on invested capital Year Ended December 31, December 31, September 30, June 30, March 31, (Dollars in millions) 2022 2022 2022 2022 2022 Adjusted EBITDA 306$ Total assets 2,031$ 2,237$ 2,372$ 2,296$ (-) Depreciation (65) (-) Cash (98) (187) (212) (46) (-) Cash taxes (1) (56) (-) Goodwill and intangibles (709) (715) (720) (725) (+) Operating lease interest (2) 8 Operating assets (excluding goodwill and intangibles) 1,224$ 1,335$ 1,440$ 1,525$ Net operating profit after tax (3) 193$ Total liabilities 1,444$ 1,093$ 1,173$ 1,253$ (-) Debt (455) (11) - - (-) Net deferred tax liability (16) (44) (51) (52) (-) Operating lease liability (162) (166) (174) (140) Non-debt liabilities 811$ 872$ 948$ 1,061$ Invested capital (3) 413$ 463$ 492$ 464$ Average invested capital 458$ Return on invested capital (ROIC) (3) 42%