Third Quarter 2024 Results November 7, 2024

2 Non-GAAP financial measures and forward-looking statements Non-GAAP financial measures We provide reconciliations of the non-GAAP financial measures contained in this presentation to the most directly comparable measure under GAAP, which are set forth in the financial tables attached to this presentation. The non-GAAP financial measures in this presentation include: adjusted earnings before interest, taxes, depreciation and amortization (“adjusted EBITDA”); free cash flow and free cash flow as a percentage of adjusted EBITDA (“free cash flow conversion”); adjusted free cash flow and adjusted free cash flow as a percentage of adjusted EBITDA (“adjusted free cash flow conversion”); net debt, gross leverage and net leverage; and adjusted net income and adjusted diluted earnings per share (“adjusted diluted EPS”). We believe that these adjusted financial measures facilitate analysis of our ongoing business operations because they exclude items that may not reflect, or are unrelated to, RXO’s core operating performance, and may assist investors with comparisons to prior periods and assessing trends in our underlying businesses. Other companies may calculate these non-GAAP financial measures differently, and therefore our measures may not be comparable to similarly titled measures of other companies. These non-GAAP financial measures should only be used as supplemental measures of our operating performance. Adjusted EBITDA, adjusted EBITDA margin, adjusted net income and adjusted diluted EPS include adjustments for transaction and integration costs, as well as restructuring costs and other adjustments as set forth in the attached tables. Management uses these non-GAAP financial measures in making financial, operating and planning decisions and evaluating RXO’s ongoing performance. We believe that adjusted EBITDA and adjusted EBITDA margin improve comparability from period to period by removing the impact of our capital structure (interest and financing expenses), asset base (depreciation and amortization), tax impacts and other adjustments that management has determined do not reflect our core operating activities and thereby assist investors with assessing trends in our underlying business. We believe that adjusted net income and adjusted diluted EPS improve the comparability of our operating results from period to period by removing the impact of certain costs that management has determined do not reflect our core operating activities, including amortization of acquisition-related intangible assets, transaction and integration costs, restructuring costs and other adjustments as set out in the attached tables, and thereby may assist investors with comparisons to prior periods and assessing trends in our underlying business. We believe that free cash flow, free cash flow conversion, adjusted free cash flow and adjusted free cash flow conversion are important measures of our ability to repay maturing debt or fund other uses of capital that we believe will enhance stockholder value, and may assist investors with assessing trends in our underlying business. We calculate free cash flow as net cash provided by operating activities less payment for purchases of property and equipment plus proceeds from sale of property and equipment. We define adjusted free cash flow as free cash flow less cash paid for transaction, integration, restructuring and other costs. We believe that net debt, gross leverage and net leverage are important measures of our overall liquidity position. Net debt is calculated by removing cash and cash equivalents from the principal balance of our total debt. Gross leverage is calculated as the principal balance of our total debt as a ratio of trailing twelve months adjusted EBITDA. Net leverage is calculated as net debt as a ratio of trailing twelve months adjusted EBITDA. With respect to our financial outlook for the fourth quarter of 2024 adjusted EBITDA, a reconciliation of this non-GAAP measure to the corresponding GAAP measure is not available without unreasonable effort due to the variability and complexity of the reconciling items described above that we exclude from this non-GAAP measure. The variability of these items may have a significant impact on our future GAAP financial results and, as a result, we are unable to prepare the forward-looking statement of income and statement of cash flows prepared in accordance with GAAP that would be required to produce such a reconciliation. Forward-looking statements This presentation includes forward-looking statements, including statements relating to our outlook and 2024 assumptions, integration with Coyote Logistics and cost synergies. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements. In some cases, forward-looking statements can be identified by the use of forward-looking terms such as "anticipate," "estimate," "believe," "continue," "could," "intend," "may," "plan,“ "predict," "should," "will," "expect," "project," "forecast," "goal," "outlook," "target,” or the negative of these terms or other comparable terms. However, the absence of these words does not mean that the statements are not forward-looking. These forward-looking statements are based on certain assumptions and analyses made by us in light of our experience and our perception of historical trends, current conditions and expected future developments, as well as other factors we believe are appropriate in the circumstances. These forward-looking statements are subject to known and unknown risks, uncertainties and assumptions that may cause actual results, levels of activity, performance, or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. Factors that might cause or contribute to a material difference include the risks discussed in our filings with the SEC and the following: the effect of the completion of the transaction to acquire Coyote Logistics on the parties’ business relationships and business generally; competition and pricing pressures; economic conditions generally; fluctuations in fuel prices; increased carrier prices; severe weather, natural disasters, terrorist attacks or similar incidents that cause material disruptions to our operations or the operations of the third-party carriers and independent contractors with which we contract; our dependence on third-party carriers and independent contractors; labor disputes or organizing efforts affecting our workforce and those of our third-party carriers; legal and regulatory challenges to the status of the third-party carriers with which we contract, and their delivery workers, as independent contractors, rather than employees; governmental regulation and political conditions; our ability to develop and implement suitable information technology systems and prevent failures in or breaches of such systems; the impact of potential cyber-attacks and information technology or data security breaches; issues related to our intellectual property rights; our ability to access the capital markets and generate sufficient cash flow to satisfy our debt obligations; litigation that may adversely affect our business or reputation; increasingly stringent laws protecting the environment, including transitional risks relating to climate change, that impact our third-party carriers; our ability to attract and retain qualified personnel; our ability to successfully implement our cost and revenue initiatives and other strategies; our ability to successfully manage our growth; our reliance on certain large customers for a significant portion of our revenue; damage to our reputation through unfavorable publicity; our failure to meet performance levels required by our contracts with our customers; the inability to achieve the level of revenue growth, cash generation, cost savings, improvement in profitability and margins, fiscal discipline, or strengthening of competitiveness and operations anticipated or targeted; a determination by the IRS that the distribution or certain related separation transactions should be treated as taxable transactions; and the impact of the separation on our businesses, operations and results. All forward-looking statements set forth in this presentation are qualified by these cautionary statements and there can be no assurance that the actual results or developments anticipated by us will be realized or, even if substantially realized, that they will have the expected consequences to or effects on us or our business or operations. Forward-looking statements set forth in this presentation speak only as of the date hereof, and we do not undertake any obligation to update forward-looking statements to reflect subsequent events or circumstances, changes in expectations or the occurrence of unanticipated events, except to the extent required by law.

3 Q3 2024 highlights 1 Coyote integration ahead of schedule; raising cost synergy estimate 2 Continued strong execution in a prolonged soft freight market 3 Improvement in legacy RXO gross profit per load during the quarter 4 Sustained growth momentum in Managed Transportation 5 Last Mile year-over-year stop growth accelerated

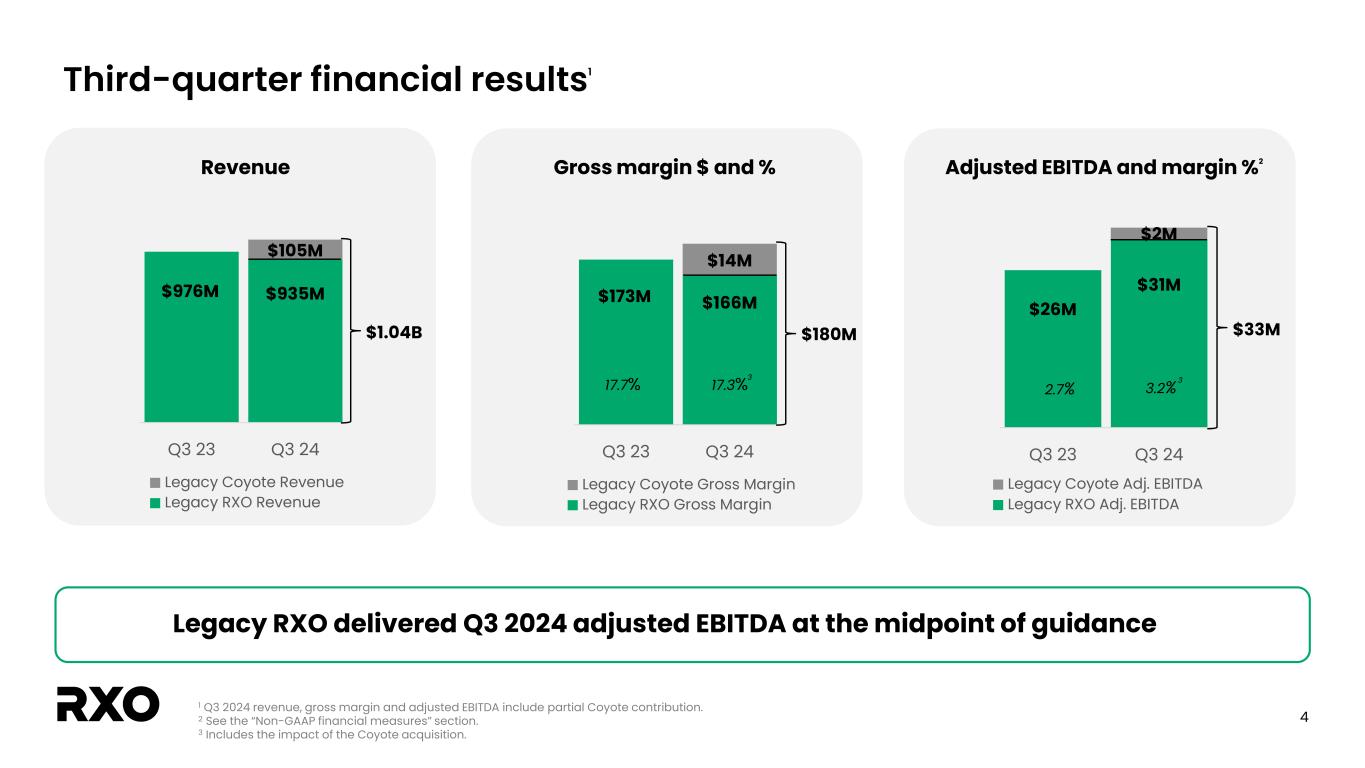

4 $173M $166M $14M Q3 23 Q3 24 Legacy Coyote Gross Margin Legacy RXO Gross Margin Third-quarter financial results1 Legacy RXO delivered Q3 2024 adjusted EBITDA at the midpoint of guidance Adjusted EBITDA and margin %2Gross margin $ and % 1 Q3 2024 revenue, gross margin and adjusted EBITDA include partial Coyote contribution. 2 See the “Non-GAAP financial measures” section. 3 Includes the impact of the Coyote acquisition. $26M $31M $2M Q3 23 Q3 24 Legacy Coyote Adj. EBITDA Legacy RXO Adj. EBITDA 2.7% 3.2%17.7% $180M $33M Revenue $976M $935M $105M Q3 23 Q3 24 Legacy Coyote Revenue Legacy RXO Revenue $1.04B 3 317.3%

5 Diversified portfolio with momentum in complementary services Combined Q3 revenue by service offering2 61% 25% 14% Truck Brokerage Last Mile Managed Transportation Excludes impact of eliminations. Numbers may not add up to 100% due to rounding. Legacy RXO Brokerage1 • Volume y/y: Down 5% – LTL volume y/y: Up 13% – Full truckload volume y/y: Down 9% • Solid profitability; gross margin of 13.8% Complementary services • Managed Trans. awarded >$300M of Freight Under Management (FUM) in Q3; expect to onboard >$400M in FUM in Q4 • Managed Trans. sales pipeline >$1.3B in new FUM • Last Mile stop growth accelerated to 11% y/y • Gross margin 21.5%; Up 150 bps y/y 1 Q3 2024 results and prior periods refer to legacy RXO and exclude the impact of the Coyote Logistics acquisition since September 16, 2024. 2 Includes the impact of the Coyote acquisition.

6 Coyote integration update People / Operations • Cultural alignment; focused on retaining key talent • Positive customer feedback; expanded service offerings and larger scale resonating well – 200+ cross-selling opportunities since closing • Leveraging combined capacity to better serve customers Coyote integration ahead of schedule; raising cost synergy estimate to at least $40M Technology • RXO Connect® will be primary operational system - Integrating unique capabilities from Coyote - “Best of both worlds” strategy will drive improved profitability and productivity • Anticipate technology integration to be substantially complete within first 12 months Synergies • Expect at least $40M of annualized cost synergies – >$15M completed by the end of Q4 2024 – An additional $10M completed within first 12 months of close – At least an incremental $15M completed late 2025 after technology integration – Does not include opportunities for cost of purchased transportation

7 Q3 2024 adjusted EPS bridge Earnings per share Q3-24 Q3-23 GAAP diluted EPS $(1.81) $ (0.01) Amortization of intangible assets 0.04 0.03 Transaction, integration and restructuring costs 1.81 0.04 Income tax associated with adjustments above1 (0.02) (0.01) Impact of dilutive shares 0.03 0.00 Adjusted diluted EPS2 $0.05 $ 0.05 RXO reported Q3 2024 adjusted diluted EPS of $0.05 1 The tax impact of non-GAAP adjustments represents the tax benefit (expense) calculated using the applicable statutory tax rate that would have been incurred had these adjustments been excluded from net income (loss). Our estimated tax rate on non-GAAP adjustments may differ from our GAAP tax rate due to differences in the methodologies applied. 2 See the “Non-GAAP financial measures” section.

8 Trailing three and six-month adjusted FCF walks Note: In millions. 1 Adjusted EBITDA and adjusted FCF are non-GAAP financial measures. 2 Adjusted EBITDA excludes certain NEO spin-related stock-based compensation. Trailing 3-month legacy RXO adj. free cash flow represented an 87% conversion Six month adjusted free cash flow 1 Three month adjusted free cash flow 1 1

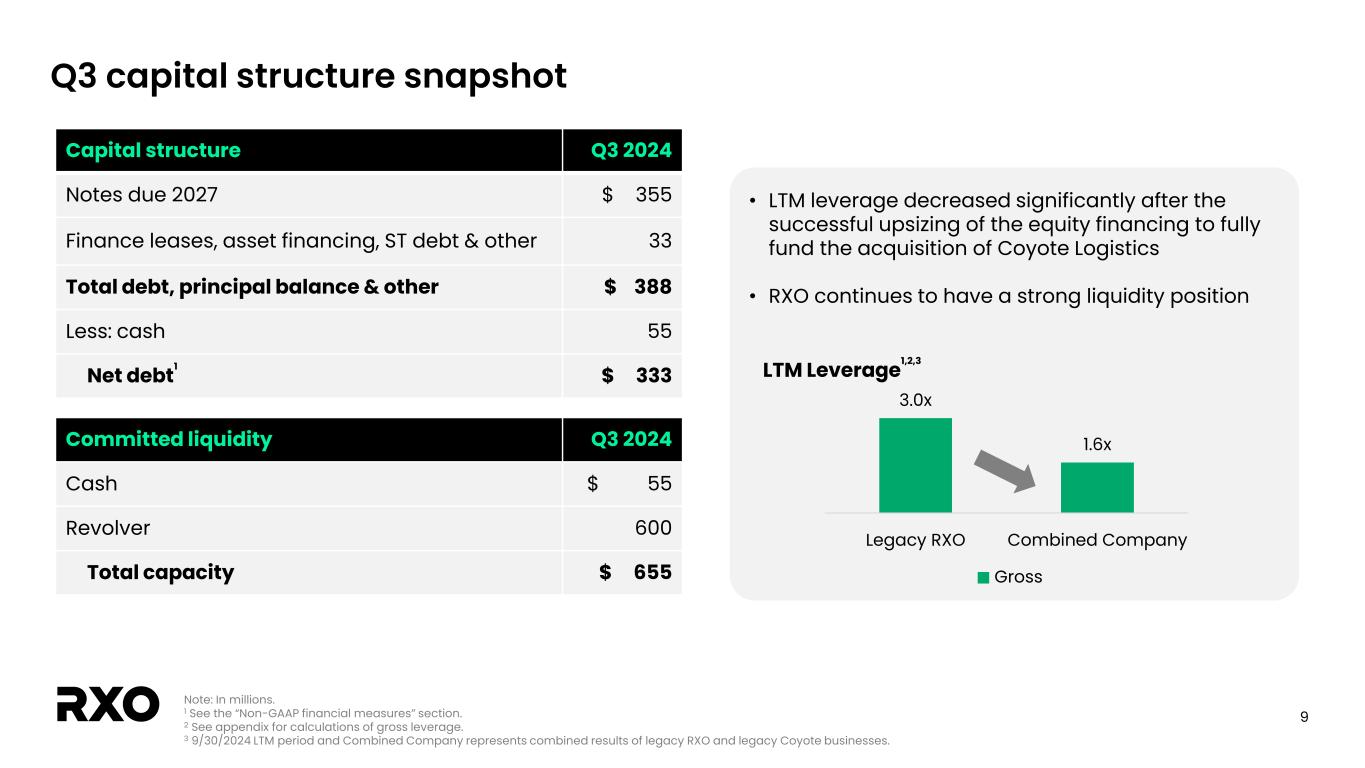

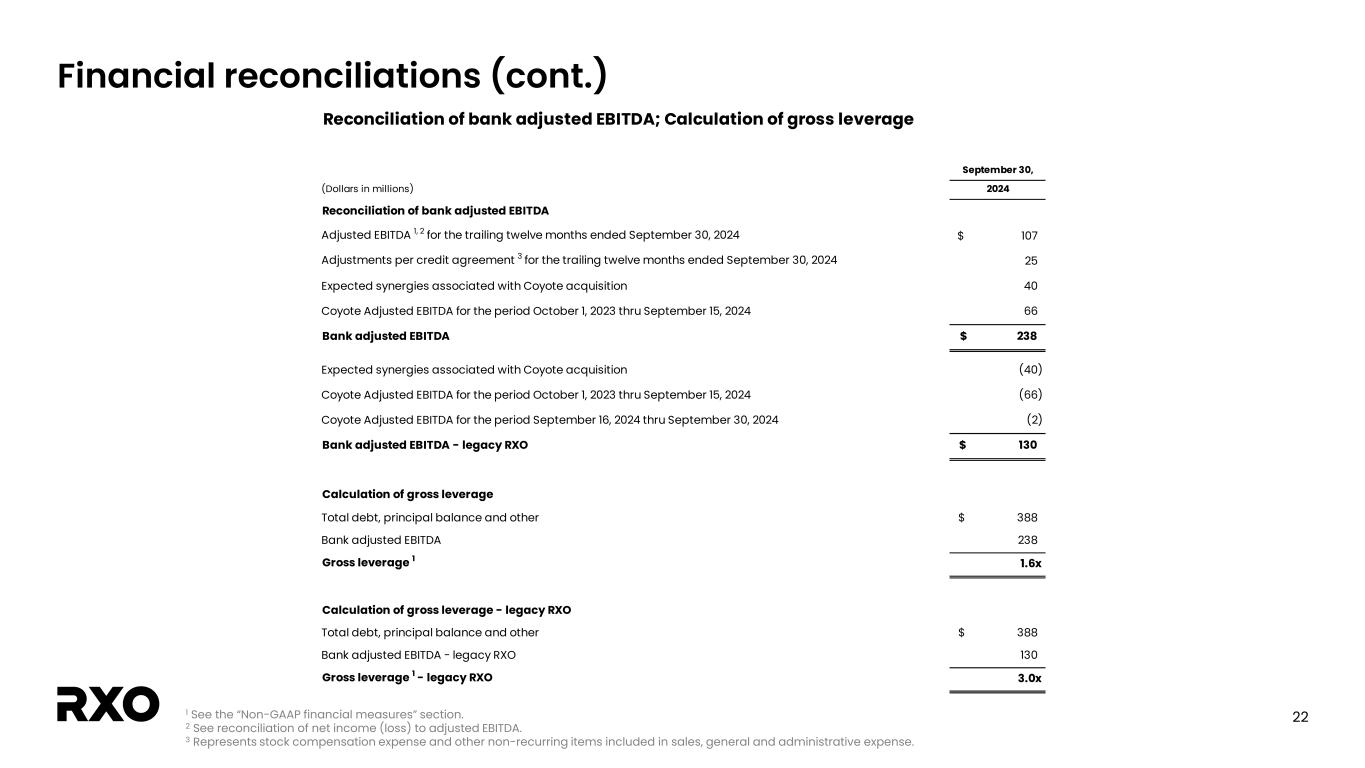

9 Q3 capital structure snapshot Capital structure Q3 2024 Notes due 2027 $ 355 Finance leases, asset financing, ST debt & other 33 Total debt, principal balance & other $ 388 Less: cash 55 Net debt1 $ 333 Committed liquidity Q3 2024 Cash $ 55 Revolver 600 Total capacity $ 655 Note: In millions. 1 See the “Non-GAAP financial measures” section. 2 See appendix for calculations of gross leverage. 3 9/30/2024 LTM period and Combined Company represents combined results of legacy RXO and legacy Coyote businesses. • LTM leverage decreased significantly after the successful upsizing of the equity financing to fully fund the acquisition of Coyote Logistics • RXO continues to have a strong liquidity position LTM Leverage1,2,3 3.0x 1.6x Legacy RXO Combined Company Gross

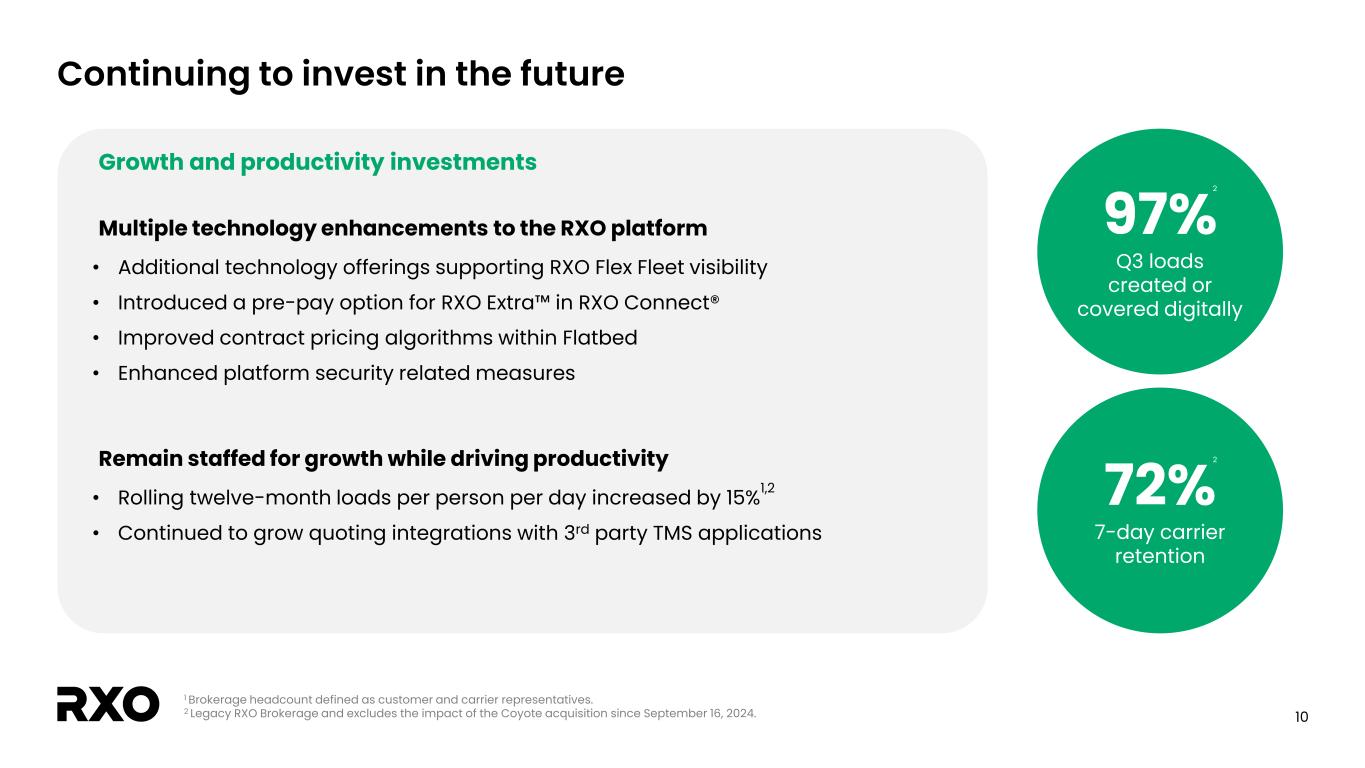

10 Continuing to invest in the future 1 Brokerage headcount defined as customer and carrier representatives. 2 Legacy RXO Brokerage and excludes the impact of the Coyote acquisition since September 16, 2024. Growth and productivity investments Multiple technology enhancements to the RXO platform • Additional technology offerings supporting RXO Flex Fleet visibility • Introduced a pre-pay option for RXO Extra™ in RXO Connect® • Improved contract pricing algorithms within Flatbed • Enhanced platform security related measures Remain staffed for growth while driving productivity • Rolling twelve-month loads per person per day increased by 15%1,2 • Continued to grow quoting integrations with 3rd party TMS applications 97% Q3 loads created or covered digitally 72% 7-day carrier retention 2 2

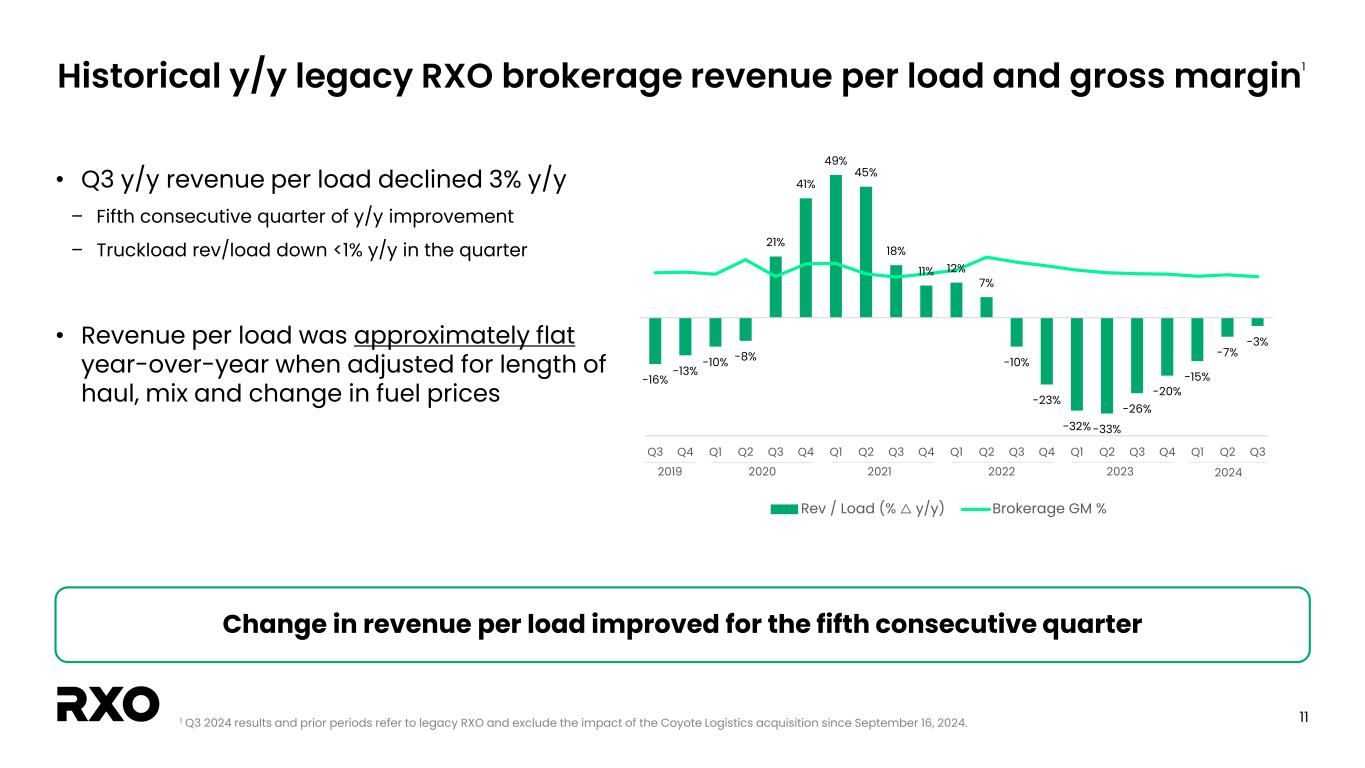

11 -16% -13% -10% -8% 21% 41% 49% 45% 18% 11% 12% 7% -10% -23% -32% -33% -26% -20% -15% -7% -3% Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Rev / Load (% △ y/y) Brokerage GM % Historical y/y legacy RXO brokerage revenue per load and gross margin1 Change in revenue per load improved for the fifth consecutive quarter • Q3 y/y revenue per load declined 3% y/y – Fifth consecutive quarter of y/y improvement – Truckload rev/load down <1% y/y in the quarter • Revenue per load was approximately flat year-over-year when adjusted for length of haul, mix and change in fuel prices 2019 2020 2021 2022 2023 2024 1 Q3 2024 results and prior periods refer to legacy RXO and exclude the impact of the Coyote Logistics acquisition since September 16, 2024.

12 Legacy RXO brokerage GM performance and current market conditions Market tightening has sustained in Q4; monitoring demand and capacity exits Market conditions relatively unchanged through Q3 • Load-to-truck ratio and industry-wide tender rejections reflect continued soft freight market • Limited spot opportunities, although spot mix slightly increased • Excess TL capacity; net carrier exits continued at a slow pace Market tightened in October due to capacity squeeze • Industry KPIs have moved higher during October – Impact predominantly in Southeast due to hurricanes • Buy rates have moved higher; spot opportunities helped offset Legacy RXO brokerage gross margin1 1 Excludes impact of non-recurring items.

13 Historical legacy RXO full truckload volume and gross profit per load1 Legacy RXO’s Brokerage full truckload gross profit per load was down modestly sequentially 1 Q3 2024 results and prior periods refer to legacy RXO and exclude the impact of the Coyote Logistics acquisition since September 16, 2024.

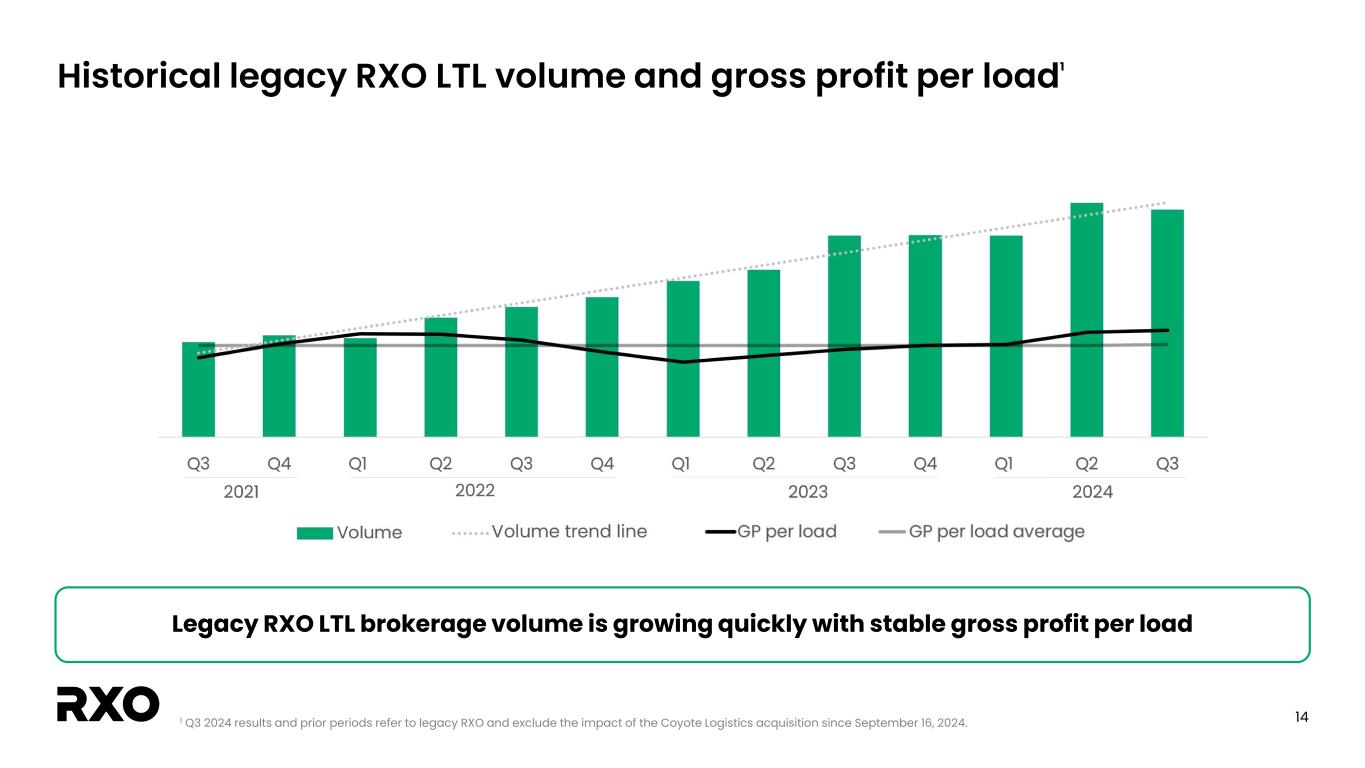

14 Historical legacy RXO LTL volume and gross profit per load1 Legacy RXO LTL brokerage volume is growing quickly with stable gross profit per load 1 Q3 2024 results and prior periods refer to legacy RXO and exclude the impact of the Coyote Logistics acquisition since September 16, 2024.

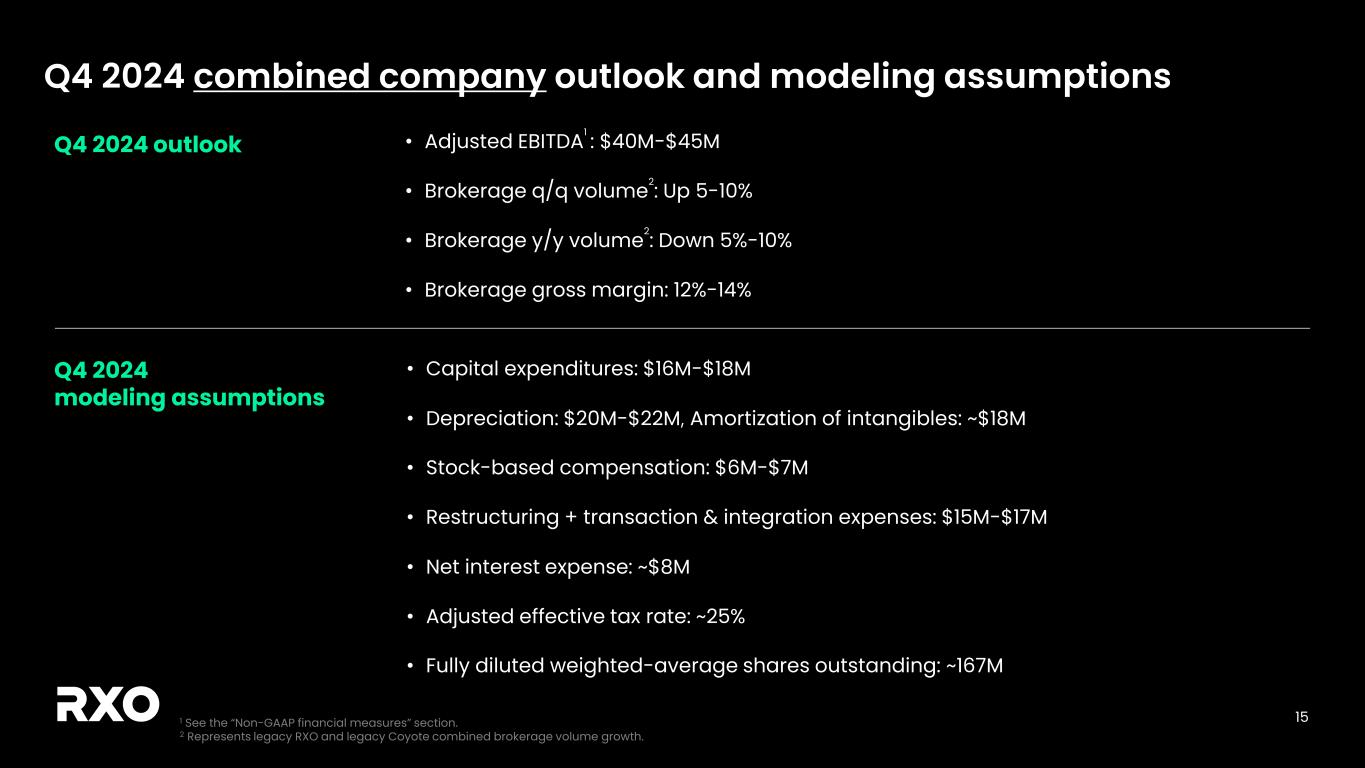

15 Q4 2024 combined company outlook and modeling assumptions • Adjusted EBITDA1 : $40M-$45M • Brokerage q/q volume2: Up 5-10% • Brokerage y/y volume2: Down 5%-10% • Brokerage gross margin: 12%-14% Q4 2024 outlook Q4 2024 modeling assumptions • Capital expenditures: $16M-$18M • Depreciation: $20M-$22M, Amortization of intangibles: ~$18M • Stock-based compensation: $6M-$7M • Restructuring + transaction & integration expenses: $15M-$17M • Net interest expense: ~$8M • Adjusted effective tax rate: ~25% • Fully diluted weighted-average shares outstanding: ~167M 1 See the “Non-GAAP financial measures” section. 2 Represents legacy RXO and legacy Coyote combined brokerage volume growth.

16 Key investment highlights 1 Large addressable market with secular tailwinds 2 Track record of above-market growth and high profitability 3 Proprietary technology drives productivity, volume and margin expansion 4 Long-term relationships with blue-chip customers 5 Market-leading platform with complementary transportation solutions 6 Tiered approach to sales drives multi-faceted growth opportunities 7 Diverse exposure across attractive end markets 8 Experienced and proven leadership team

17 Appendix

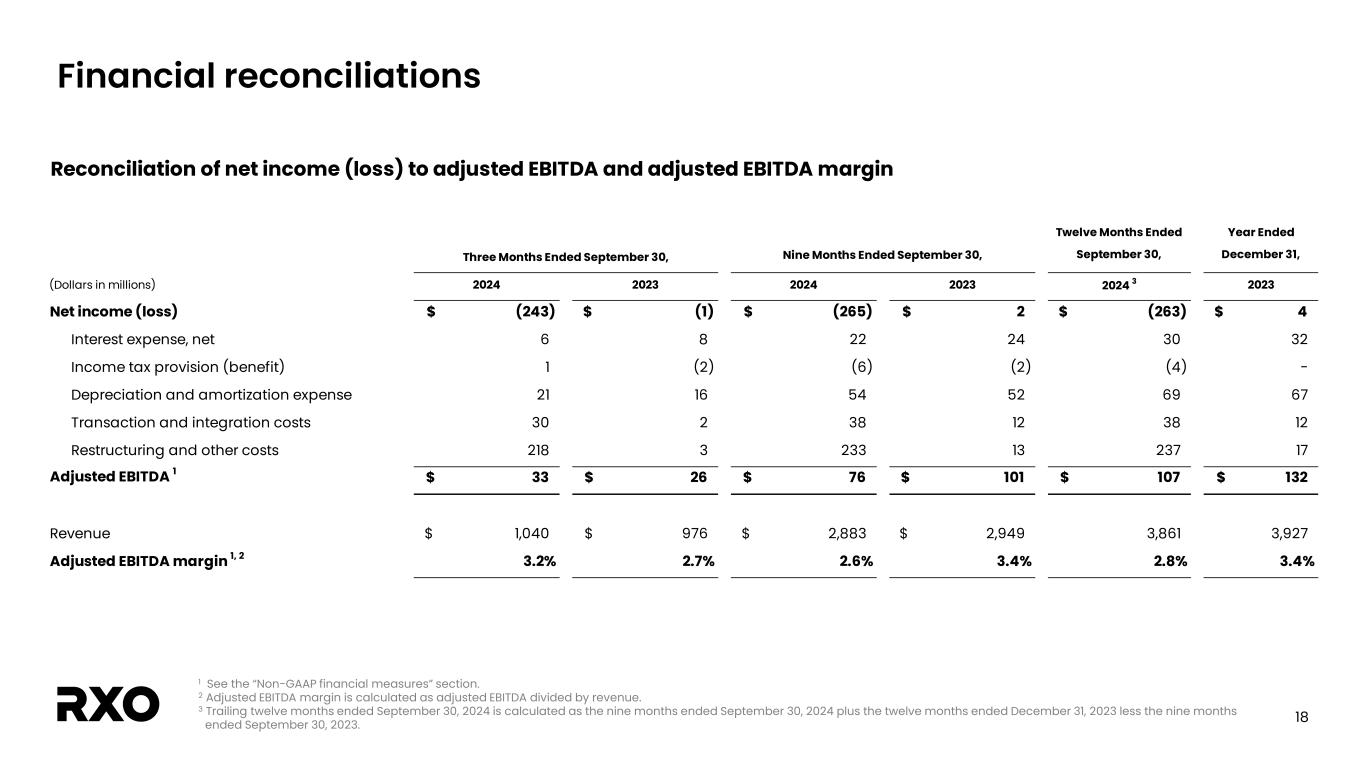

18 Financial reconciliations 1 See the “Non-GAAP financial measures” section. 2 Adjusted EBITDA margin is calculated as adjusted EBITDA divided by revenue. 3 Trailing twelve months ended September 30, 2024 is calculated as the nine months ended September 30, 2024 plus the twelve months ended December 31, 2023 less the nine months ended September 30, 2023. Reconciliation of net income (loss) to adjusted EBITDA and adjusted EBITDA margin Twelve Months Ended September 30, Year Ended December 31, (Dollars in millions) 2024 2023 2024 2023 2024 3 2023 Net income (loss) (243)$ (1)$ (265)$ 2$ (263)$ 4$ Interest expense, net 6 8 22 24 30 32 Income tax provision (benefit) 1 (2) (6) (2) (4) - Depreciation and amortization expense 21 16 54 52 69 67 Transaction and integration costs 30 2 38 12 38 12 Restructuring and other costs 218 3 233 13 237 17 Adjusted EBITDA 1 33$ 26$ 76$ 101$ 107$ 132$ Revenue 1,040$ 976$ 2,883$ 2,949$ 3,861 3,927 Adjusted EBITDA margin 1, 2 3.2% 2.7% 2.6% 3.4% 2.8% 3.4% Three Months Ended September 30, Nine Months Ended September 30,

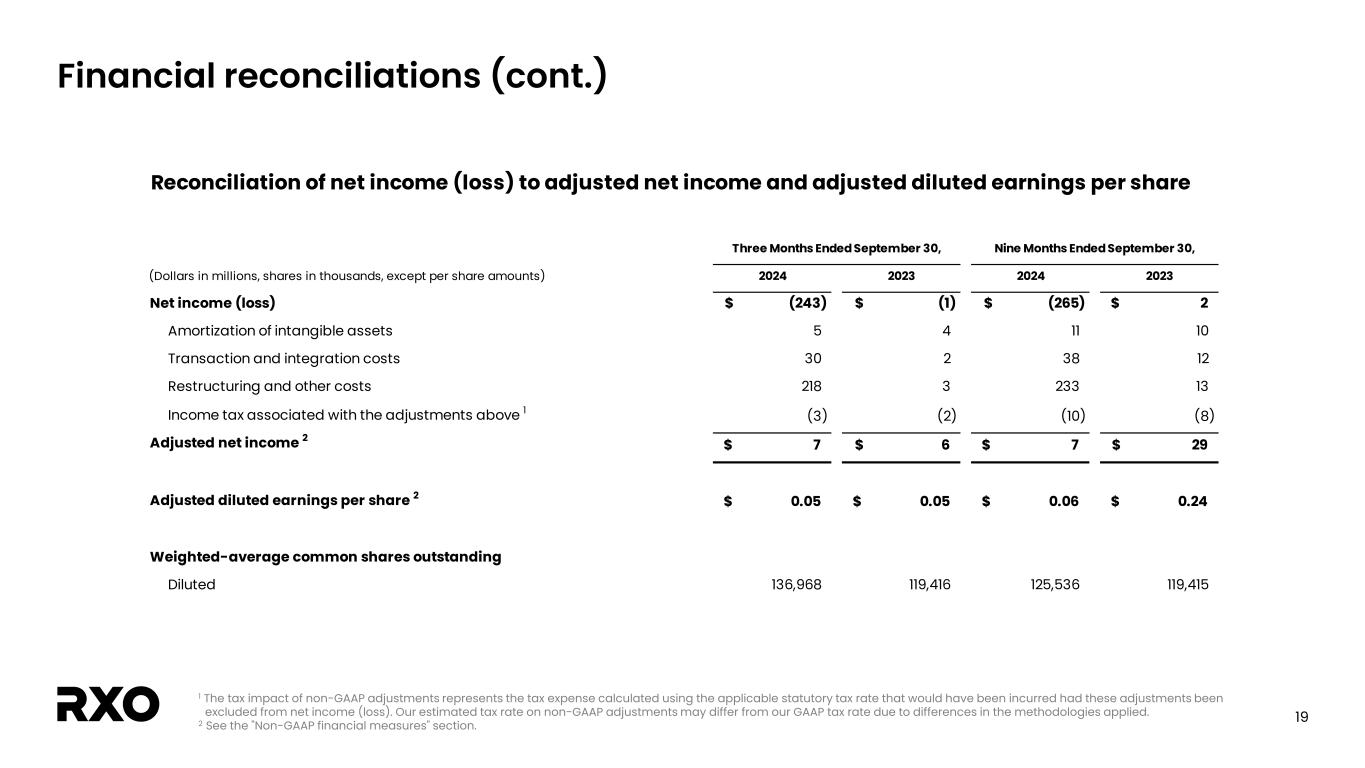

19 Financial reconciliations (cont.) 1 The tax impact of non-GAAP adjustments represents the tax expense calculated using the applicable statutory tax rate that would have been incurred had these adjustments been excluded from net income (loss). Our estimated tax rate on non-GAAP adjustments may differ from our GAAP tax rate due to differences in the methodologies applied. 2 See the "Non-GAAP financial measures" section. (Dollars in millions, shares in thousands, except per share amounts) 2024 2023 2024 2023 Net income (loss) (243)$ (1)$ (265)$ 2$ Amortization of intangible assets 5 4 11 10 Transaction and integration costs 30 2 38 12 Restructuring and other costs 218 3 233 13 Income tax associated with the adjustments above 1 (3) (2) (10) (8) Adjusted net income 2 7$ 6$ 7$ 29$ Adjusted diluted earnings per share 2 0.05$ 0.05$ 0.06$ 0.24$ Weighted-average common shares outstanding Diluted 136,968 119,416 125,536 119,415 Reconciliation of net income (loss) to adjusted net income and adjusted diluted earnings per share Nine Months Ended September 30,Three Months Ended September 30,

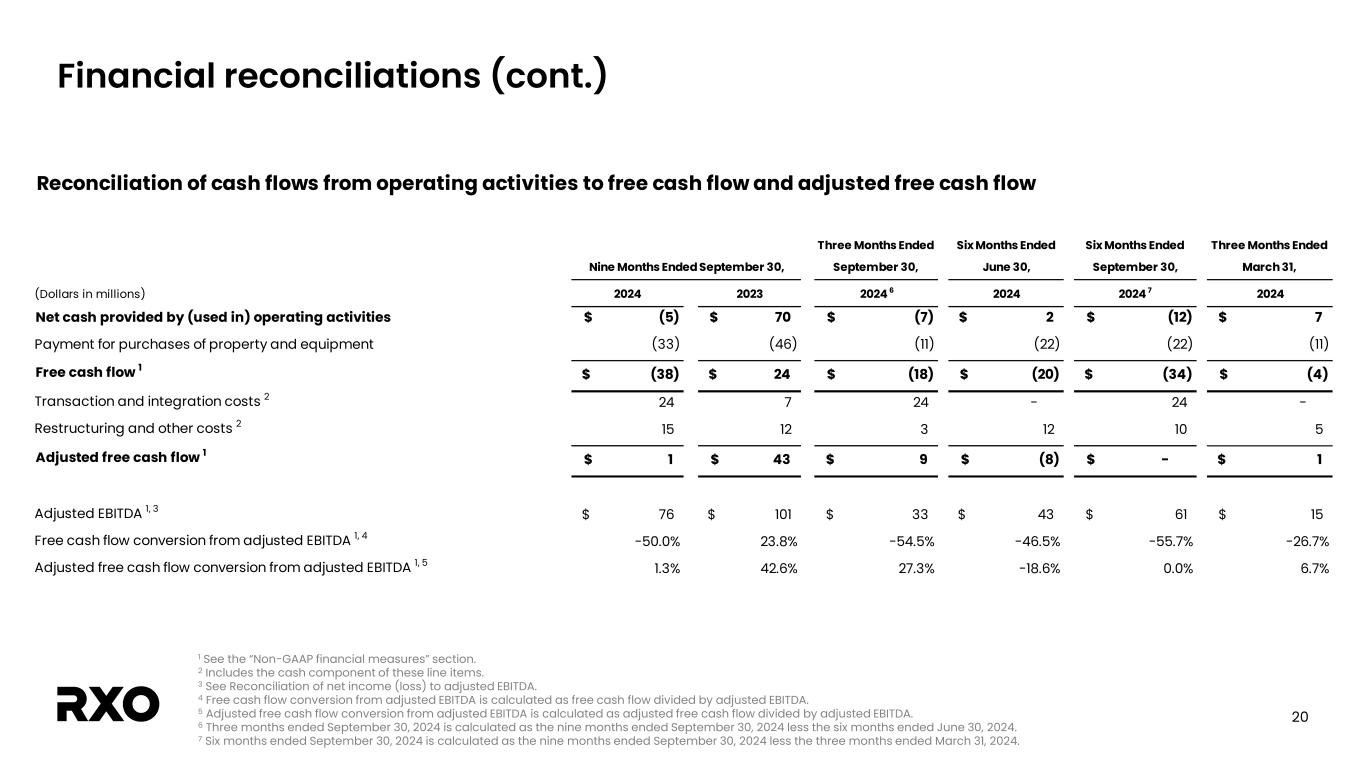

20 1 See the “Non-GAAP financial measures” section. 2 Includes the cash component of these line items. 3 See Reconciliation of net income (loss) to adjusted EBITDA. 4 Free cash flow conversion from adjusted EBITDA is calculated as free cash flow divided by adjusted EBITDA. 5 Adjusted free cash flow conversion from adjusted EBITDA is calculated as adjusted free cash flow divided by adjusted EBITDA. 6 Three months ended September 30, 2024 is calculated as the nine months ended September 30, 2024 less the six months ended June 30, 2024. 7 Six months ended September 30, 2024 is calculated as the nine months ended September 30, 2024 less the three months ended March 31, 2024. Financial reconciliations (cont.) Three Months Ended September 30, Six Months Ended June 30, Six Months Ended September 30, Three Months Ended March 31, (Dollars in millions) 2024 2023 2024 6 2024 2024 7 2024 Net cash provided by (used in) operating activities (5)$ 70$ (7)$ 2$ (12)$ 7$ Payment for purchases of property and equipment (33) (46) (11) (22) (22) (11) Free cash flow 1 (38)$ 24$ (18)$ (20)$ (34)$ (4)$ Transaction and integration costs 2 24 7 24 - 24 - Restructuring and other costs 2 15 12 3 12 10 5 Adjusted free cash flow 1 1$ 43$ 9$ (8)$ -$ 1$ Adjusted EBITDA 1, 3 76$ 101$ 33$ 43$ 61$ 15$ Free cash flow conversion from adjusted EBITDA 1, 4 -50.0% 23.8% -54.5% -46.5% -55.7% -26.7% Adjusted free cash flow conversion from adjusted EBITDA 1, 5 1.3% 42.6% 27.3% -18.6% 0.0% 6.7% Nine Months Ended September 30, Reconciliation of cash flows from operating activities to free cash flow and adjusted free cash flow

21 Financial reconciliations (cont.) 1 Complementary services include Last Mile and Managed Transportation services. Calculation of gross margin and gross margin as a percentage of revenue (Dollars in millions) 2024 2023 2024 2023 Revenue Truck brokerage 655$ 591$ 1,762$ 1,748$ Complementary services 1 419 419 1,224 1,293 Eliminations (34) (34) (103) (92) Revenue 1,040$ 976$ 2,883$ 2,949$ Cost of transportation and services (exclusive of depreciation and amortization) Truck brokerage 564$ 501$ 1,510$ 1,474$ Complementary services 1 279 275 801 842 Eliminations (34) (34) (103) (92) Cost of transportation and services (exclusive of depreciation and amortization) 809$ 742$ 2,208$ 2,224$ Direct operating expense (exclusive of depreciation and amortization) Truck brokerage 1$ 1$ 1$ 1$ Complementary services 1 48 58 151 178 Direct operating expense (exclusive of depreciation and amortization) 49$ 59$ 152$ 179$ Direct depreciation and amortization expense Truck brokerage -$ -$ 1$ -$ Complementary services 1 2 2 6 5 Direct depreciation and amortization expense 2$ 2$ 7$ 5$ Gross margin Truck brokerage 90$ 89$ 250$ 273$ Complementary services 1 90 84 266 268 Gross margin 180$ 173$ 516$ 541$ Gross margin as a percentage of revenue Truck brokerage 13.7% 15.1% 14.2% 15.6% Complementary services 1 21.5% 20.0% 21.7% 20.7% Gross margin as a percentage of revenue 17.3% 17.7% 17.9% 18.3% Three Months Ended September 30, Nine Months Ended September 30,

22 Financial reconciliations (cont.) 1 See the “Non-GAAP financial measures” section. 2 See reconciliation of net income (loss) to adjusted EBITDA. 3 Represents stock compensation expense and other non-recurring items included in sales, general and administrative expense. September 30, (Dollars in millions) 2024 Reconciliation of bank adjusted EBITDA Adjusted EBITDA 1, 2 for the trailing twelve months ended September 30, 2024 107$ Adjustments per credit agreement 3 for the trailing twelve months ended September 30, 2024 25 Expected synergies associated with Coyote acquisition 40 Coyote Adjusted EBITDA for the period October 1, 2023 thru September 15, 2024 66 Bank adjusted EBITDA 238$ Expected synergies associated with Coyote acquisition (40) Coyote Adjusted EBITDA for the period October 1, 2023 thru September 15, 2024 (66) Coyote Adjusted EBITDA for the period September 16, 2024 thru September 30, 2024 (2) Bank adjusted EBITDA - legacy RXO 130$ Calculation of gross leverage Total debt, principal balance and other 388$ Bank adjusted EBITDA 238 Gross leverage 1 1.6x Calculation of gross leverage - legacy RXO Total debt, principal balance and other 388$ Bank adjusted EBITDA - legacy RXO 130 Gross leverage 1 - legacy RXO 3.0x Reconciliation of bank adjusted EBITDA; Calculation of gross leverage