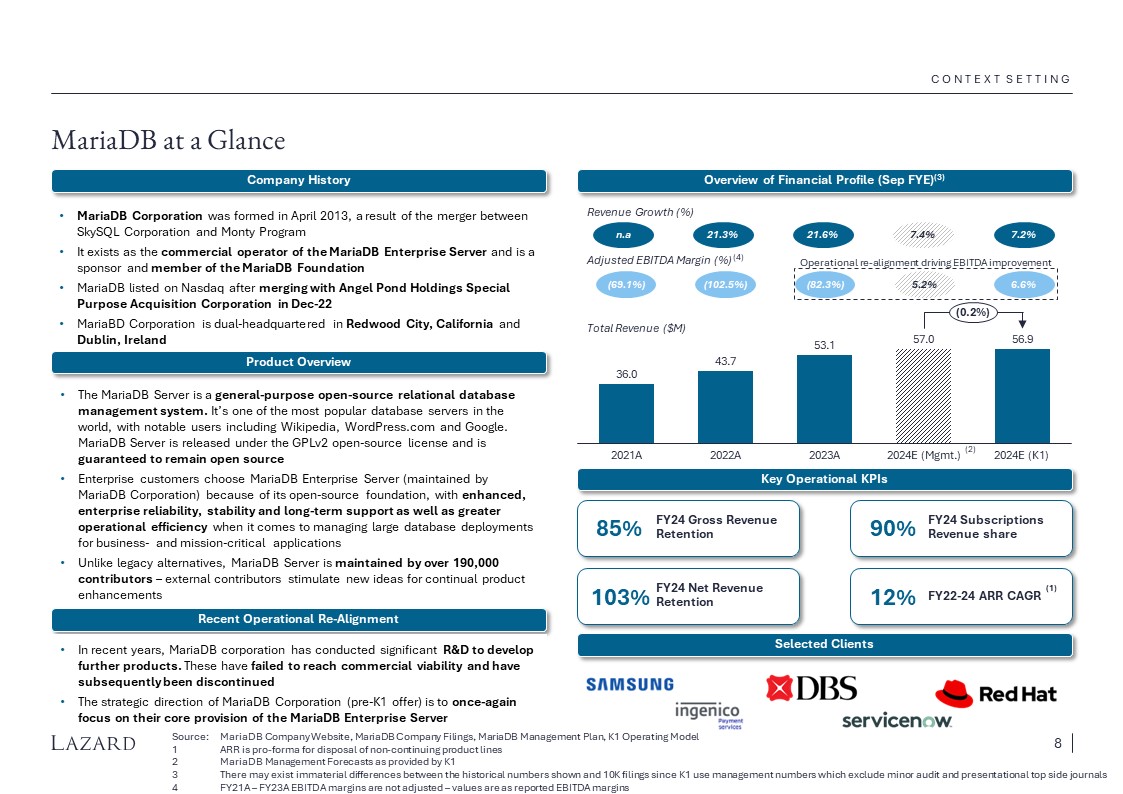

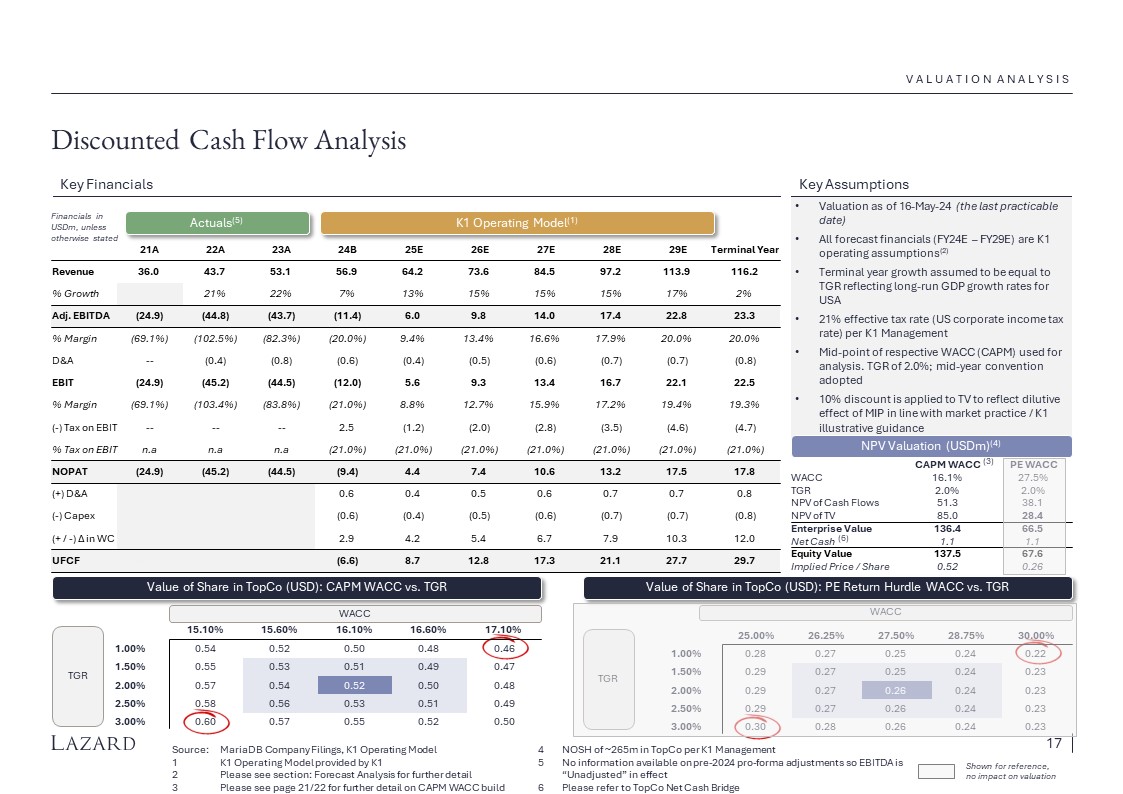

Situation Overview and Background Lazard’s client is K1 Investment Management, LLC (“K1”), a US-based investment firm primarily focused on the technology sector with AUM of ~$15 billion Lazard has been engaged by K1 on its take-private of MariaDB plc (“MariaDB” or “the Company”, NYSE: MRDB), a US-listed company domiciled in the US and Ireland (which therefore falls under the remit of the Irish Takeover Rules). The recommended cash offer has been made by Meridian BidCo LLC ("Bidco"), a newly formed affiliate of K1, as manager of K5 Private Investors, L.P. ("K5") MariaDB provides database software solutions and managed services for Enterprise and SMB customers The Company went public via SPAC (Angel Pond Holdings Corporation) in December 2022, but has struggled in the public market since then. As of February 15th, 2024, immediately prior to K1 announcing a R2.4 possible offer, MariaDB traded at ~$0.35 per share (vs. SPAC price of $10 / share) On April 24th, 2024, K1 released a R2.7 Announcement (the “R2.7 Announcement”) to acquire MariaDB. K1’s offer to acquire to MariaDB is as follows: $0.55 / share in cash for existing MariaDB shareholders (the “Cash Offer”), valuing the equity of MariaDB at ~$39.9 million; or As an alternative, shareholders may elect to reinvest into Meridian TopCo LLC (“TopCo”) (the “Unlisted Unit Alternative”) At the time of the R2.7 Announcement, K1 had received irrevocable undertakings to vote in favour of the offer / tender in to it in respect of 51.5% of the shareholder register As part of the Offer Document, an “appropriate financial advisor” is required under R24.11 of the Irish Takeover Rules to provide an estimate of the value of the Unlisted Unit Alternative. The purpose of this paper is to assess the value the Unlisted Unit Alternative The fully diluted share count of TopCo is ~265m shares per K1, representing an implied TopCo equity value of ~$145.7 million at a $0.55 issue price per share in TopCo The fully diluted share count of TopCo and Implied TopCo equity value is higher than those of MariaDB owing to a series of adjustments by K1 to reflect their entry price including, amongst other things, primary cash injection and the purchase of the company debt at a premium following a bilateral negotiation with the debt holder The Unlisted Unit Alternative allows current shareholders in MariaDB to reinvest in TopCo up to a total of 15% of the fully diluted equity value of TopCo In the event the Unlisted Unit Alternative is oversubscribed, reinvesting shareholders will be given a pro-rata entitlement and any surplus will be settled in cash at $0.55 / share In the event the Unlisted Unit Alternative is undersubscribed, those shareholders electing to reinvest will be able to acquire additional shares in TopCo at a price of $0.55 / share Source: K1 Management, Offer Document, R2.7 Announcement Executive Summary 4