UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-23806

Pender Real Estate Credit Fund

(Exact name of registrant as specified in charter)

c/o UMB Fund Services, Inc.

235 West Galena Street

Milwaukee, WI 53212

(Address of Principal Executive Offices)

Terrance P. Gallagher

235 West Galena Street

Milwaukee, WI 53212

(Name and Address of Agent for Service)

Copies to:

Joshua B. Deringer, Esq.

Faegre Drinker Biddle & Reath LLP

One Logan Square, Ste. 2000

Philadelphia, PA 19103-6996

215-988-2700

Registrant's telephone number, including area code: (414) 299-2270

Date of fiscal year end: December 31

Date of reporting period: December 31, 2023

Item 1. Reports to Stockholders.

(a) The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended.

Pender Real Estate Credit Fund

Annual Report December 31, 2023 |

i

Pender Real Estate Credit Fund |

Management’s Discussion of Fund Performance (Unaudited) |

Dear Shareholders,

We are pleased to present the annual report for the Pender Real Estate Credit Fund (“Fund”) for the fiscal period ended December 31, 2023. The Fund is successor to the Pender Asset Based Lending Fund 1, L.P. fund, which was a private fund organized under and subject to Regulation D under the Securitites Act of 1933. On April 24, 2023, the private fund partnership was reorganized into a publicly offered SEC Registered Closed-End Interval Fund. Much like its predecessor fund, the Fund seeks to generate risk-adjusted current income, while seeking to prioritize capital preservation primarily through credit investments secured by commercial real estate located in the United States. Our focus is on origination of short-term (12-36 month) bridge loans, secured by high quality senior position collateral in transitional commercial real estate assets, primarily in the lower middle market. The Fund may also make mezzanine and preferred equity investments in such real estate assets.

We seek real estate sub-sector and geographic diversity in the Fund’s portfolio over concentrated allocations. At the fiscal period end, the Fund held private market exposure to many sectors with a focus on multi-family housing, along with industrial, mixed use, retail, hospitality, mobile home, and office. This exposure was spread across 33 loans in 12 states.

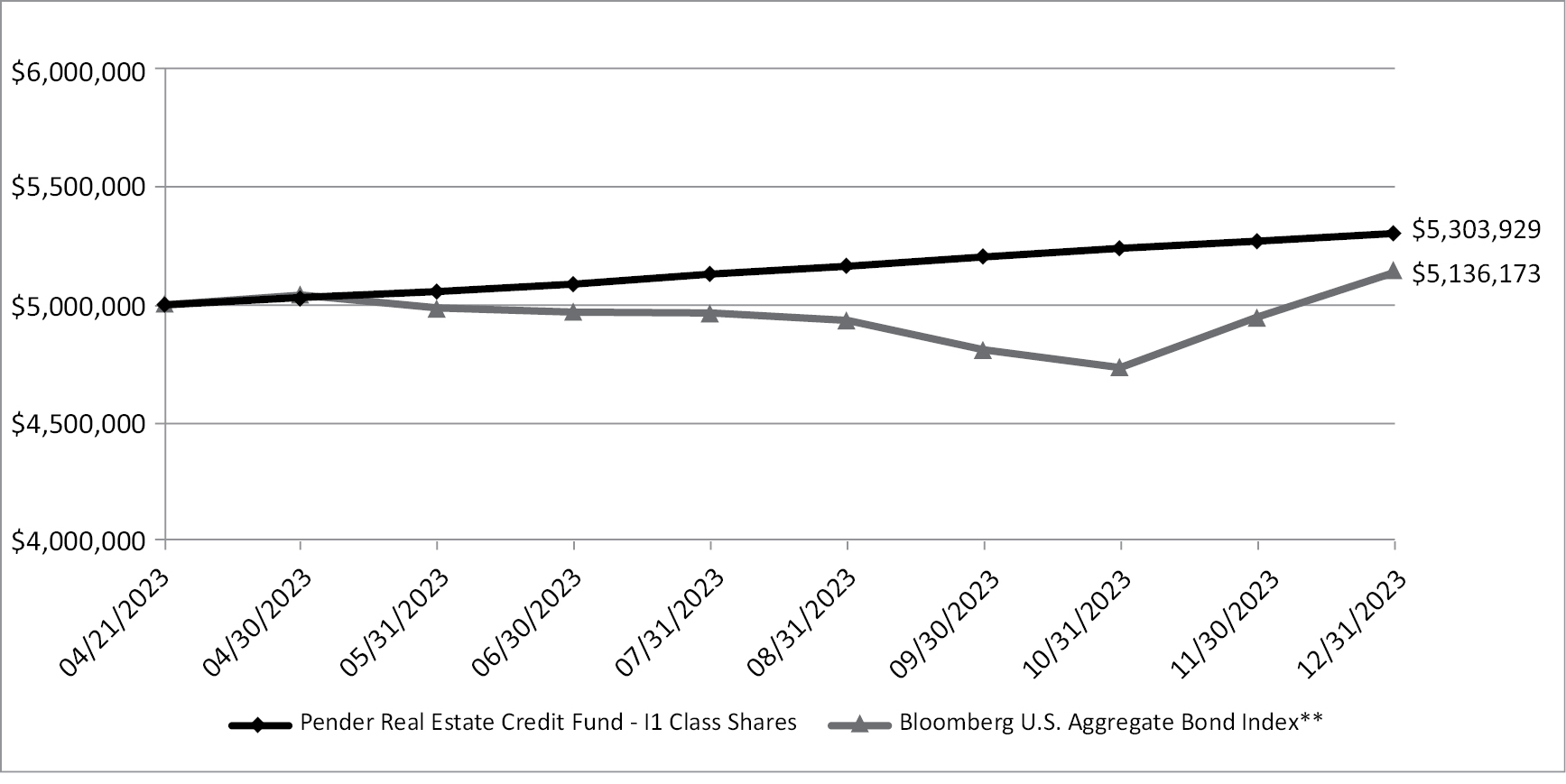

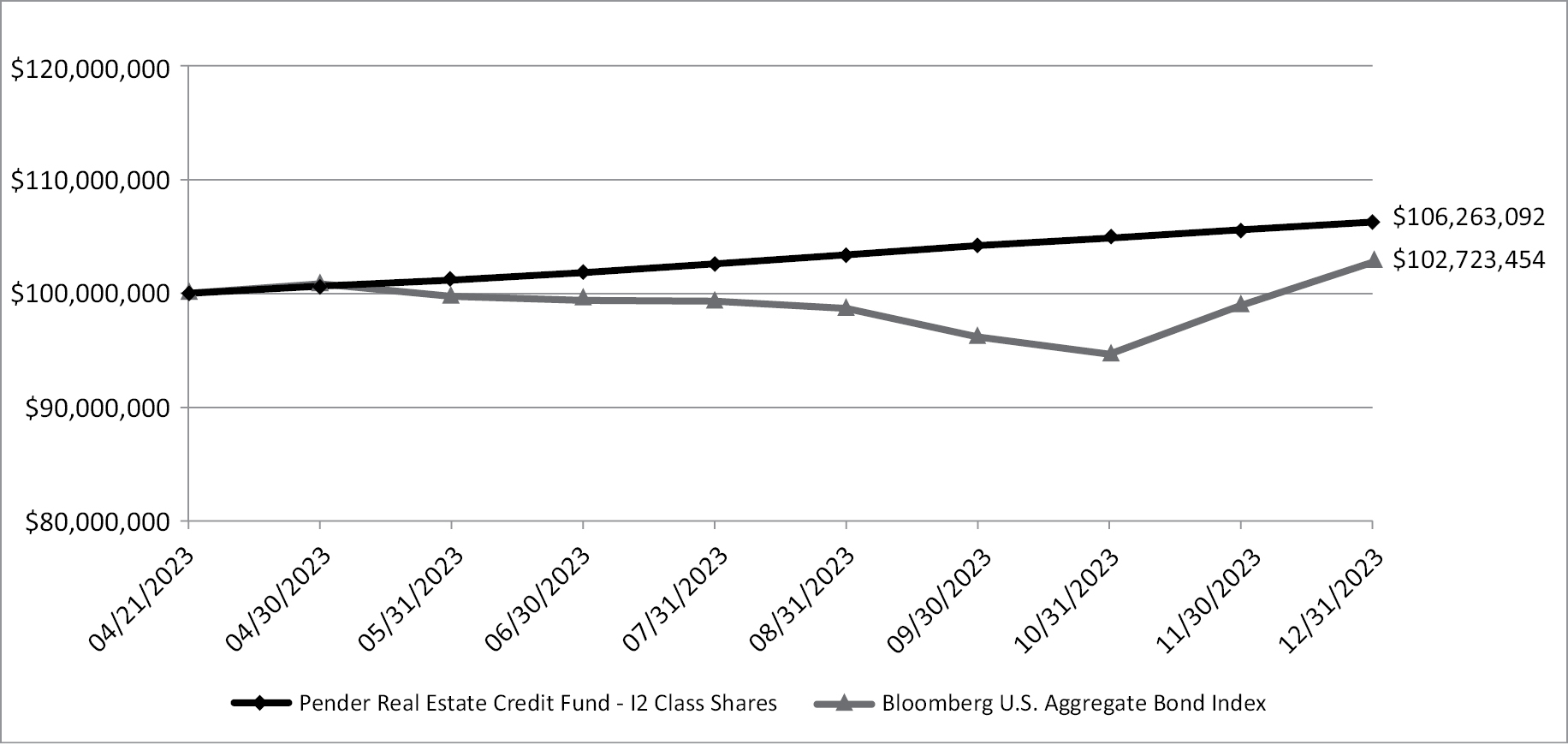

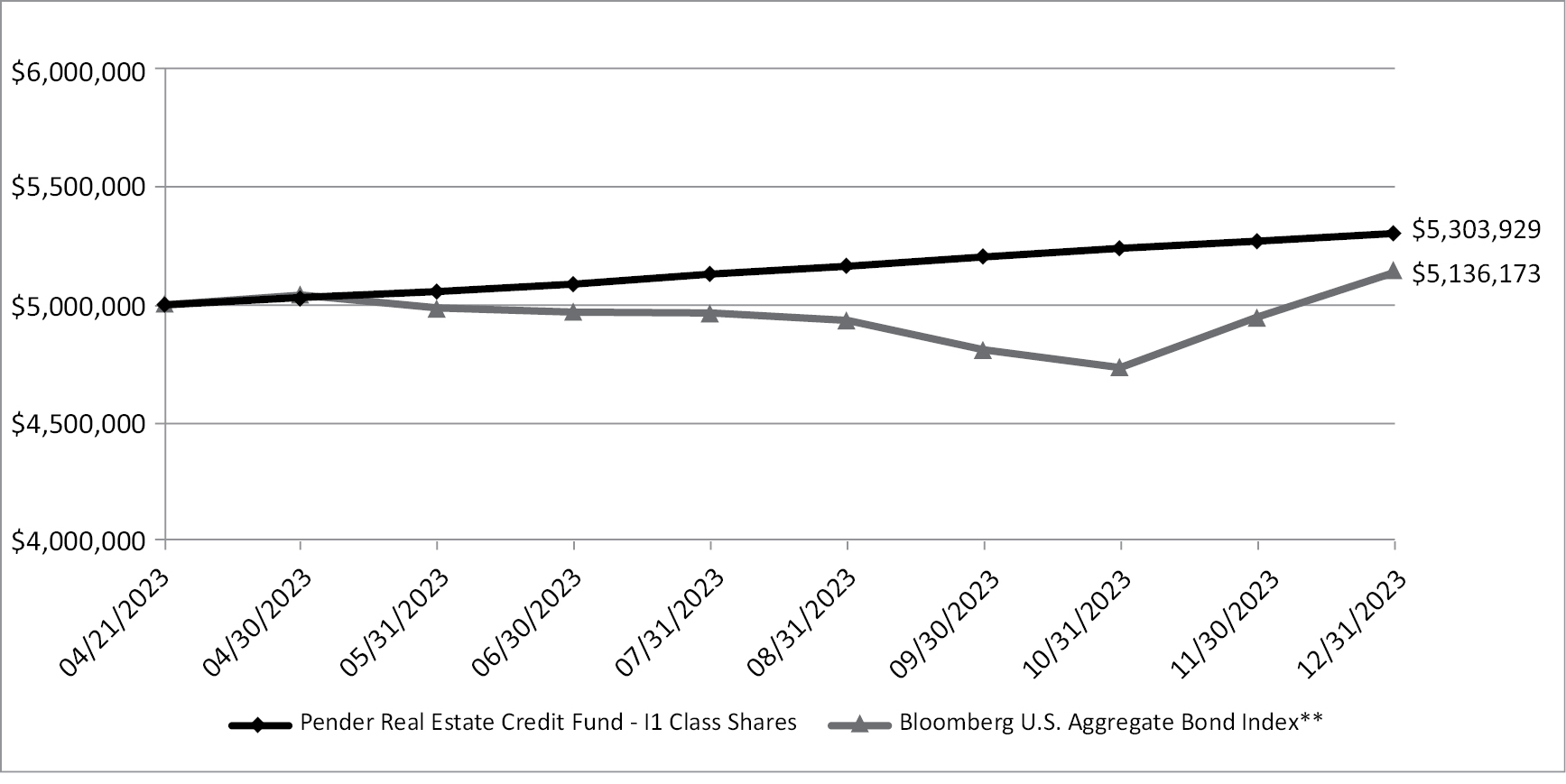

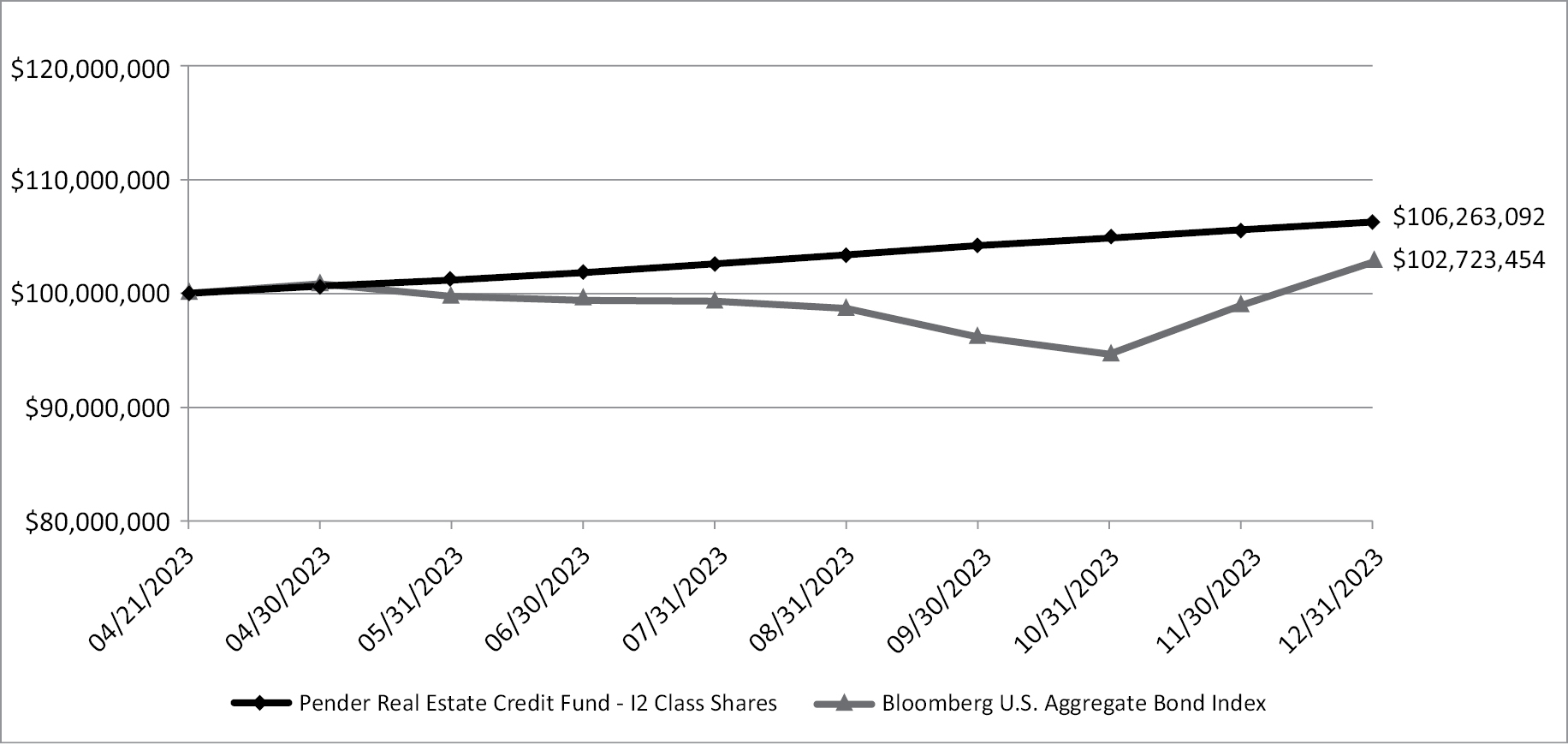

For the period from inception on April 24, 2023 through the fiscal period ended December 31, 2023, the I1 Share Class (PNDRX) produced a total return of 6.08%, and the I2 Share Class (PNDIX) produced a total return of 6.26%. This return compares favorably to other income solutions frequently utilized by investment advisors. For example, the Bloomberg U.S. Aggregate Bond Index* produced a return of 2.72% during the same period.

Initial expenses were higher than expected, which dragged on Fund performance. This is a common dynamic in newly formed funds and we do not believe that this will continue in 2024.

From the inception date to the fiscal year end, the Fund’s total active loan amounts increased by 20%, collateral value increased by 27%, loan to value strengthened by more than 6.5% and AUM increased by 62%. The conversion proved to be an easier way to invest, as our early growth suggests.

In 2023, the Fund originated 13 loans totaling $170,700,000. The Fund also received 591 total requests for financing totaling $8.4B. The quality of submissions has continued to trend upward, strengthening potential returns, and potentially reducing risk. The timing of the Fund conversion proved advantageous, providing a strong alternative for private credit with regional bank dislocation and large traditional lending becoming a less attractive option. There was very little change in net asset value during the period due to positive underlying performance, age of the investments and no material macro impacts or impairments.

With what we believe to be a strong pipeline of investments, we feel that we are well positioned to bring value to our shareholders and believe that our performance will compare favorably to other income solutions. Our emphasis during the next fiscal year will be to increase AUM to take advantage of the increasing opportunities for private credit. In addition to the traditional lending fallout and expected maturity of fixed term rate debt, we anticipate a significant opportunity to capture deal flows on new valuations.

Thank you for your investment and we truly appreciate your continued partnership with us.

Regards,

| |

|

Cory Johnson | | Zach Murphy |

President | | Investment Advisor |

US Bonds — Bloomberg U.S. Aggregate Bond Index is an unmanaged index representing more than 5,000 taxable government, investment-grade corporate and mortgage-backed securities, and is generally considered a barometer of the US bond market. (*Note, this is not an investable index).

1

Performance Disclosure: Quoted performance is net of all fees and expenses. Past performance does not guarantee future results. The performance data quoted represents past performance and future returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Performance data current to the most recent month end may be obtained by calling (877)-773-7703.

An investment in the Fund is subject to a substantial degree of risk. These risks include, but are not limited to, the following: Real estate entails special risks, including tenant lease renewals, defaults, environmental problems, and adverse changes in local economies. The Fund is “non-diversified” under the Investment Company Act of 1940. Changes in the market value of a single holding may cause greater fluctuation in the Fund’s net asset value than in a “diversified” fund. The Fund is not intended to be a significant portion of the investor’s portfolio but instead only a portion of an investor’s portfolio allocated to real estate. Diversification does not ensure a profit or guarantee against a loss. The Fund’s Borrowings are limited to 33 1/3% of the Fund’s total assets (less all liabilities and indebtedness not represented by 1940 Act leverage) immediately after such Borrowings. Borrowing presents opportunities to increase the Fund’s return, but potentially increases the losses as well. The Fund does not intend to list its Shares on any securities exchange, and a secondary market in the Shares is not expected to develop. There is no guarantee that shareholders will be able to sell all or a specified portion of their tendered shares during a quarterly repurchase offer. An investment in the Fund is not suitable for investors that require current liquidity. You should not expect to be able to sell your Shares other than through the Fund’s repurchase policy, regardless of how the Fund performs.

2

Pender Real Estate Credit Fund |

Fund Performance

December 31, 2023 (Unaudited) |

I1 Shares — Performance of a $5,000,000 Investment*

I2 Shares — Performance of a $100,000,000 Investment***

3

Cumulative Total Returns as of December 31, 2023 | | Since

Inception |

Pender Real Estate Credit Fund – Class I1 Shares (Inception Date 4/21/2023) | | 6.08 | % |

Pender Real Estate Credit Fund – Class I2 Shares (Inception Date 4/21/2023) | | 6.26 | % |

Bloomberg U.S. Aggregate Bond Index | | 2.72 | % |

The performance data quoted here represents past performance and past performance is not a guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. The most recent quarter end performance may be obtained by calling (877) 773-7703.

Performance results include the effect of expense reduction arrangements for some or all of the periods shown. If those arrangements had not been in place, the performance results for the period would have been lower.

Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and the performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

For the Fund’s current expense ratio, please refer to the Financial Highlights Section of this report.

4

Pender Real Estate Credit Fund |

Report of Independent Registered Public Accounting Firm |

Board of Trustees and Shareholders

Pender Real Estate Credit Fund

Opinion on the financial statements

We have audited the accompanying consolidated statement of assets and liabilities of Pender Real Estate Credit Fund (the “Company”), including the consolidated schedule of investments, as of December 31, 2023, the related consolidated statements of operations, cash flows, and changes in net assets and the consolidated financial highlights for the period from April 24, 2023 (commencement of operations) through December 31, 2023, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2023, the results of its operations, its cash flows, and the changes in net assets and its financial highlights for the period from April 24, 2023 (commencement of operations) through December 31, 2023, in conformity with accounting principles generally accepted in the United States of America.

Basis for opinion

These financial statements and financial highlights are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s financial statements and financial highlights based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audit we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audit included performing procedures to assess the risks of material misstatement of the financial statements and financial highlights, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements and financial highlights. Our procedures included confirmation of securities owned as of December 31, 2023, by correspondence with the borrowers; when replies were not received, we performed other auditing procedures. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements and financial highlights. We believe that our audit provides a reasonable basis for our opinion.

/s/ GRANT THORNTON LLP

We have served as the Company’s auditor since 2023.

Chicago, Illinois

February 29, 2024

5

Pender Real Estate Credit Fund

Consolidated Schedule of Investments

December 31, 2023 |

| | Spread | | Coupon

Rate

(%) | | Maturity

Date | | Original

Acquisition

Date | | Principal

Amount | | Cost | | Fair Value |

Private Debt — 95.7%(1),(2) |

Directly Originated Loans — 0.0% |

Retail — 0.0% |

David Streeter | | N/A | | 6.00 | | 7/1/2026 | | 5/21/2021 | | $ | 55,986 | | $ | 55,986 | | $ | 56,150 |

Total Directly Originated Loans | | | | | | | | | | | | | | 55,986 | | | 56,150 |

| | | | | | | | | | | | | | | | | | |

Senior Mortgage Loans — 95.7% |

Hospitality — 1.8% |

2422 Ridgeway ABL I Holdings, LLC(3) | | TBILL1M +

4.00% | | 9.37 | | 5/1/2024 | | 5/1/2022 | | | 3,312,000 | | | 3,328,401 | | | 3,333,528 |

Doswell VA, LLC(4),(5),(6) | | N/A | | 6.00 | | 6/1/2024 | | 5/17/2021 | | | 1,000,000 | | | 1,015,876 | | | 1,005,876 |

Wattsburg Hospitality, LLC(3),(6) | | TBILL1M +

4.20% | | 9.00 | | 4/1/2025 | | 3/29/2023 | | | 1,950,000 | | | 1,883,155 | | | 1,888,030 |

| | | | | | | | | | | | | | | 6,227,432 | | | 6,227,434 |

Industrial — 0.6% | | | | | | | | | | | | | | | | | |

100 Queensway St, LLC | | N/A | | 9.00 | | 4/1/2024 | | 12/22/2022 | | | 2,000,000 | | | 2,063,000 | | | 2,005,000 |

| | | | | | | | | | | | | | | | | | |

Mixed Use — 7.9% | | | | | | | | | | | | | | | | | |

1810 Chestnut Street Development, LLC(3),(6) | | TBILL1M +

8.17% | | 13.54 | | 8/1/2024 | | 8/2/2022 | | | 11,350,000 | | | 11,156,999 | | | 11,270,499 |

2601 Tandy ABL I Holdings, LLC(3),(6) | | SOFR1M +

4.13% | | 9.00 | | 4/1/2024 | | 4/1/2023 | | | 10,950,000 | | | 10,898,488 | | | 10,679,488 |

MBRV, LLC | | N/A | | 6.00 | | 7/1/2024 | | 9/30/2019 | | | 4,950,000 | | | 4,950,000 | | | 4,987,125 |

| | | | | | | | | | | | | | | 27,005,487 | | | 26,937,112 |

Mobile Home Park — 0.5% | | | | | | | | | | | | | | | |

WF Houston, LLC(6) | | N/A | | 7.00 | | 5/1/2024 | | 4/27/2021 | | | 2,680,000 | | | 1,682,820 | | | 1,793,340 |

| | | | | | | | | | | | | | | | | | |

Multifamily — 78.9% | | | | | | | | | | | | | | | | | |

2233 Woburn St, LLC(3) | | TBILL1M +

3.50% | | 7.00 | | 11/1/2024 | | 10/26/2022 | | | 3,375,000 | | | 3,400,312 | | | 3,380,063 |

3390 Fairburn, LLC(6) | | N/A | | 10.00 | | 4/1/2024 | | 12/20/2021 | | | 33,000,000 | | | 32,948,836 | | | 32,866,336 |

Brazos Thread Owner 1, LLC(6) | | N/A | | 8.00 | | 7/1/2025 | | 6/14/2023 | | | 11,075,000 | | | 9,921,356 | | | 9,937,969 |

Brazos Thread Owner 2, LLC(6) | | N/A | | 8.00 | | 7/1/2025 | | 6/14/2023 | | | 10,250,000 | | | 9,283,038 | | | 9,298,413 |

Brazos Thread Owner 3, LLC(6) | | N/A | | 8.00 | | 7/1/2025 | | 6/14/2023 | | | 20,200,000 | | | 18,877,563 | | | 18,928,063 |

C & S Storage, LLC(3) | | SOFR1M +

2.88% | | 7.75 | | 4/1/2024 | | 3/31/2023 | | | 25,000,000 | | | 25,000,000 | | | 25,062,500 |

Grandview Apartments 1002, LLC(3) | | TBILL1M +

3.50% | | 8.50 | | 3/1/2025 | | 2/27/2023 | | | 4,000,000 | | | 4,000,000 | | | 4,010,000 |

KSA GP, LLC(3),(6) | | TBILL1M +

4.00% | | 6.00 | | 6/1/2024 | | 5/4/2022 | | | 3,000,000 | | | 2,720,000 | | | 2,814,500 |

Lebanon 10, LLC(3) | | SOFR1M +

2.38% | | 7.25 | | 4/1/2024 | | 3/31/2023 | | | 4,708,816 | | | 4,708,816 | | | 4,715,879 |

MF Opp Fund I, LLC | | N/A | | 10.00 | | 7/1/2024 | | 6/14/2023 | | | 34,000,000 | | | 34,000,000 | | | 34,085,000 |

OKC1 Huntington Holdings, LLC(3),(6) | | TBILL1M +

6.35% | | 11.72 | | 4/1/2024 | | 10/29/2021 | | | 14,125,000 | | | 13,300,240 | | | 13,300,240 |

Prosper GP LP, LLC | | N/A | | 10.00 | | 10/1/2024 | | 9/15/2023 | | | 18,000,000 | | | 18,000,000 | | | 18,045,000 |

Riverbend PEGP, LLC | | N/A | | 11.00 | | 10/1/2024 | | 10/6/2023 | | | 17,500,000 | | | 17,500,000 | | | 17,543,750 |

6

Pender Real Estate Credit Fund

Consolidated Schedule of Investments — (Continued)

December 31, 2023 |

| | Spread | | Coupon

Rate

(%) | | Maturity

Date | | Original

Acquisition

Date | | Principal

Amount | | Cost | | Fair Value |

Sage Richmond, LLC(3),(6) | | TBILL1M +

7.00% | | 12.37 | | 7/1/2024 | | 6/28/2022 | | $ | 6,480,000 | | $ | 6,516,444 | | $ | 6,500,244 |

Sandman 4 Apartments, LLC(3) | | SOFR1M +

3.93% | | 9.25 | | 12/1/2024 | | 11/16/2023 | | | 4,400,000 | | | 4,400,000 | | | 4,411,000 |

Somerset Apartments,

LLC(3) | | TBILL1M +

2.00% | | 7.00 | | 1/1/2025 | | 12/8/2022 | | | 7,500,000 | | | 7,556,250 | | | 7,518,750 |

TMF Normandy Holdings, LLC(3) | | TBILL1M +

6.40% | | 11.77 | | 6/1/2024 | | 11/16/2021 | | | 3,480,000 | | | 3,488,700 | | | 3,488,700 |

Village Del Mar Apartments, LLC(3),(6) | | TBILL1M +

6.79% | | 12.16 | | 4/1/2024 | | 4/1/2022 | | | 14,500,000 | | | 8,952,363 | | | 9,119,113 |

Warrior Fund I, LLC(3),(6) | | TBILL1M +

3.50% | | 7.00 | | 11/1/2024 | | 11/3/2022 | | | 32,625,000 | | | 31,714,988 | | | 31,633,425 |

Wesley GP, LLC(3),(6) | | TBILL1M +

4.00% | | 6.00 | | 7/1/2024 | | 5/31/2022 | | | 8,350,000 | | | 8,072,897 | | | 8,239,897 |

Yakima 28, LLC(3) | | TBILL1M +

2.00% | | 7.00 | | 12/1/2024 | | 11/29/2022 | | | 4,060,000 | | | 4,090,450 | | | 4,049,850 |

| | | | | | | | | | | | | | | 268,452,253 | | | 268,948,692 |

Office — 2.4% | | | | | | | | | | | | | | | | | |

5751 Kroger ABL I Holidings, LLC(3),(6) | | SOFR1M +

3.13% | | 8.00 | | 4/1/2024 | | 4/1/2023 | | | 8,650,000 | | | 8,454,303 | | | 8,238,053 |

| | | | | | | | | | | | | | | | | | |

Retail — 3.6% | | | | | | | | | | | | | | | | | |

710 Route 38 ABL I Holdings, LLC(3) | | TBILL1M +

5.35% | | 9.00 | | 5/1/2024 | | 12/27/2022 | | | 12,200,000 | | | 12,230,500 | | | 12,230,500 |

Total Senior Mortgage Loans | | | | | | | | | | | | | | 326,115,795 | | | 326,380,131 |

Total Private Debt | | | | | | | | | | | | | | 326,171,781 | | | 326,436,281 |

| | | | | | | | | | | | | | | | | | |

Real Estate Owned — 1.0% |

Repossessed Property — 1.0% |

Mixed Use — 1.0% |

Theos Fedro Holdings,

LLC(6) | | N/A | | N/A | | N/A | | N/A | | | N/A | | | 3,478,162 | | | 3,478,162 |

Total Real Estate Owned | | | | | | | | | | | | | | 3,478,162 | | | 3,478,162 |

| | | | | | | | | | | | | | | | | | |

Total Investments

(Cost $329,649,943) — 96.7% | | | | | | | | | | | | | | | | $ | 329,914,443 |

Liabilities in excess of other assets — 3.3% | | | | | | | | | | | | | | | | | 11,343,609 |

Net Assets — 100% | | | | | | | | | | | | | | | | $ | 341,258,052 |

See accompanying Notes to Financial Statements.

7

Pender Real Estate Credit Fund

Consolidated Summary of Investments

December 31, 2023 |

Security Type | | Percent of

Total

Net Assets |

Private Debt | | | |

Directly Originated Loans | | 0.0 | % |

Senior Mortgage Loans | | 95.7 | % |

Total Private Debt | | 95.7 | % |

Real Estate Owned | | | |

Repossessed Property | | 1.0 | % |

Total Real Estate Owned | | 1.0 | % |

Total Investments | | 96.7 | % |

Liabilities in excess of other assets | | 3.3 | % |

Net Assets | | 100.0 | % |

Property Type | | Percent of

Total

Net Assets |

Private Debt | | | |

Hospitality | | 1.8 | % |

Industrial | | 0.6 | % |

Mixed Use | | 7.9 | % |

Mobile Home Park | | 0.5 | % |

Multifamily | | 78.9 | % |

Office | | 2.4 | % |

Retail | | 3.6 | % |

Total Private Debt | | 95.7 | % |

| | | | |

Real Estate Owned | | | |

Mixed Use | | 1.0 | % |

Total Real Estate Owned | | 1.0 | % |

| | | | |

Total Investments | | 96.7 | % |

Liabilities in excess of other assets | | 3.3 | % |

Net Assets | | 100.0 | % |

See accompanying Notes to Financial Statements.

8

Pender Real Estate Credit Fund

Consolidated Statement of Assets and Liabilities

December 31, 2023 |

Assets: | | | |

Investments, at fair value (cost $329,649,943) | | $ | 329,914,443 |

Cash | | | 18,453,246 |

Interest receivable | | | 3,408,679 |

Loan exit fees receivable | | | 1,047,273 |

Fund shares sold receivable | | | 2,166,647 |

Deferred offering costs (Note 2) | | | 85,746 |

Prepaid expenses | | | 1,439,423 |

Prepaid trustee fees | | | 5,596 |

Total Assets | | | 356,521,053 |

| | | | |

Liabilities: | | | |

Interest payable on lines of credit | | | 158,728 |

Origination fees | | | 1,963,670 |

Loan servicing fees payable | | | 13,423 |

Incentive fee payable, net of waiver | | | 125,322 |

Distribution and servicing fee payable – I1 Class | | | 99,936 |

Deferred interest | | | 9,705,019 |

Investment management fee payable, net of expense waiver and reimbursement | | | 418,213 |

Due to other accounts | | | 2,175,023 |

Other accrued liabilities | | | 603,667 |

Total Liabilities | | | 15,263,001 |

Net Assets | | $ | 341,258,052 |

Composition of Net Assets: | | | |

Paid-in capital | | $ | 341,073,639 |

Total distributable earnings | | | 184,413 |

Net Assets | | $ | 341,258,052 |

Net Assets Attributable to: | | | |

Class I1 Shares | | $ | 140,730,939 |

Class I2 Shares | | | 200,527,113 |

| | | $ | 341,258,052 |

Shares of Beneficial Interest Outstanding (Unlimited Number of Shares Authorized): | | | |

Class I1 Shares | | | 14,036,487 |

Class I2 Shares | | | 20,001,792 |

| | | | 34,038,279 |

Net Asset Value per Share: | | | |

Class I1 Shares | | $ | 10.03 |

Class I2 Shares | | | 10.03 |

See accompanying Notes to Financial Statements.

9

Pender Real Estate Credit Fund

Consolidated Statement of Operations

For the Period Ended December 31, 2023(1) |

Investment Income: | | | | |

Interest income | | $ | 20,130,547 | |

Loan origination fees | | | 2,282,067 | |

Exit loan income | | | 1,342,473 | |

Other income | | | 673,402 | |

Total Investment Income | | | 24,428,489 | |

Expenses: | | | | |

Interest expense on lines of credit | | | 4,367,989 | |

Investment management fee (Note 4) | | | 2,442,808 | |

Incentive fee (Note 4) | | | 1,555,533 | |

Other fees | | | 564,106 | |

Origination fees on lines of credit | | | 420,138 | |

Legal fees(2) | | | 407,848 | |

Distribution and servicing fees – I1 Class (Note 5) | | | 226,786 | |

Offering costs (Note 2) | | | 210,416 | |

Audit and tax fees | | | 210,002 | |

Custody fees | | | 173,797 | |

Fund acct. & admin fees | | | 169,897 | |

Organizational expenses (Note 2) | | | 98,080 | |

Loan servicing fees | | | 87,043 | |

Transfer agency fees | | | 60,058 | |

Insurance fees | | | 53,265 | |

Research fees | | | 46,257 | |

Trustee fees | | | 33,404 | |

Chief compliance officer fees | | | 16,220 | |

Total Expenses | | | 11,143,647 | |

Less: Net contractual waiver of fees and reimbursement of expenses (Note 4) | | | (163,064 | ) |

Less: Voluntary waiver of fees (Note 4) | | | (657,976 | ) |

Net Expenses | | | 10,322,607 | |

Net Investment Income | | | 14,105,882 | |

| | | | | |

Net Change in Unrealized Appreciation on Investments | | | 264,500 | |

Net Increase in Net Assets from Operations | | $ | 14,370,382 | |

See accompanying Notes to Financial Statements.

10

Pender Real Estate Credit Fund

Consolidated Statement of Changes in Net Assets |

| | For the Period

Ended

December 31,

2023(1) |

Net Increase in Net Assets from: | | | | |

Operations: | | | | |

Net investment income | | $ | 14,105,882 | |

Net change in unrealized appreciation | | | 264,500 | |

Net Increase in Net Assets Resulting from Operations | | | 14,370,382 | |

| | | | | |

Distributions to Shareholders: | | | | |

Distributions: | | | | |

I1 Class | | | (7,265,329 | ) |

I2 Class | | | (6,920,640 | ) |

Net Decrease in Net Assets from Distributions to Shareholders | | | (14,185,969 | ) |

| | | | | |

Capital Transactions: | | | | |

Proceeds from shares sold(2): | | | | |

I1 Class | | | 163,458,837 | |

I2 Class | | | 201,111,257 | |

Reinvestment of distributions: | | | | |

I1 Class | | | 413,788 | |

I2 Class | | | 134,130 | |

Cost of shares repurchased: | | | | |

Class I1 | | | (23,601,937 | ) |

Class I2 | | | (542,436 | ) |

Net Increase in Net Assets from Capital Transactions | | | 340,973,639 | |

| | | | | |

Total Net Increase in Net Assets | | | 341,158,052 | |

| | | | | |

Net Assets | | | | |

Beginning of period | | | 100,000 | (3) |

End of period | | $ | 341,258,052 | |

| | | | | |

Capital Share Transactions: | | | | |

Shares sold: | | | | |

I1 Class | | | 16,324,271 | |

I2 Class | | | 20,042,579 | |

Shares issued in reinvestment of distributions: | | | | |

I1 Class | | | 41,253 | |

I2 Class | | | 12,934 | |

Shares redeemed: | | | | |

Class I1 | | | (2,339,037 | ) |

Class I2 | | | (53,721 | ) |

Net Increase in Capital Shares Outstanding | | | 34,028,279 | |

11

Pender Real Estate Credit Fund

Consolidated Statement of Cash Flows

For the Period Ended December 31, 2023(1) |

Cash Flows from Operating Activities | | | | |

Net increase in net assets from operations | | $ | 14,370,382 | |

Adjustments to reconcile net increase in net assets from operations to net cash used in operating activities: | | | | |

Net change in unrealized appreciation from investments | | | (264,500 | ) |

Purchases of investments | | | (124,335,026 | ) |

Sales of investments | | | 66,779,473 | |

Loan holdbacks | | | (4,132,438 | ) |

Paydown gains | | | (22,775 | ) |

(Increase)/Decrease in Assets: | | | | |

Interest receivable | | | (1,996,145 | ) |

Loan exit fees receivable | | | (1,047,273 | ) |

Due from borrowers | | | 4,250,000 | |

Fund shares sold receivable | | | (2,166,647 | ) |

Deferred offering costs | | | (85,746 | ) |

Prepaid expenses | | | (1,089,255 | ) |

Prepaid trustee fees | | | (5,596 | ) |

Increase/(Decrease) in Liabilities: | | | | |

Interest payable on lines of credit | | | (79,214 | ) |

Loan servicing fees payable | | | 13,423 | |

Incentive fee payable, net of voluntary waiver | | | 125,322 | |

Distribution and servicing fee payable – I1 Class | | | 99,936 | |

Origination fees | | | 1,125,158 | |

Deferred interest | | | (233,347 | ) |

Investment management fee payable, net of expense waiver and reimbursement | | | (341,858 | ) |

Due to other accounts | | | (1,860,470 | ) |

Other accrued liabilities | | | 369,818 | |

Net Cash Used in Operating Activities | | | (50,526,778 | ) |

| | | | | |

Cash Flows from Financing Activities | | | | |

Proceeds from lines of credit | | | 117,356,953 | |

Payments made on lines of credit | | | (177,319,900 | ) |

Proceeds from shares sold | | | 155,881,647 | (2) |

Cash assumed from initial subscription | | | 10,743,748 | |

Distributions paid to shareholders, net of reinvestments | | | (13,638,051 | ) |

Payments for shares repurchased, net of repurchase fees | | | (24,144,373 | ) |

Net Cash Provided by Financing Activities | | | 68,880,024 | |

| | | | | |

Net Increase in Cash | | | 18,353,246 | |

Cash at beginning of period | | | 100,000 | |

Total Cash at End of Period | | $ | 18,453,246 | |

Supplemental Disclosure of Cash Activity | | | | |

Interest paid on lines of credit | | $ | 4,461,898 | |

Supplemental Disclosure of Non-Cash Activity | | | | |

Reinvestment of distributions | | $ | 547,918 | |

Investment security value of in-kind subscription | | $ | 267,939,177 | |

Other assets and liabilities of in-kind subscription | | $ | (69,994,478 | ) |

See accompanying Notes to Financial Statements.

12

Pender Real Estate Credit Fund

Consolidated Financial Highlights

I1 Class Shares |

Per share operating performance.

For a capital share outstanding throughout each period.

| | For the Period

Ended

December 31,

2023(1) |

Net Asset Value, Beginning of Period | | $ | 10.00 | |

Income from Investment Operations: | | | | |

Net investment income(2) | | | 0.57 | |

Net realized and unrealized appreciation on investments | | | 0.02 | |

Total from investment operations | | | 0.59 | |

| | | | | |

Distributions to Shareholders: | | | | |

From net investment income | | | (0.56 | ) |

Total distributions to shareholders | | | (0.56 | ) |

Net Asset Value, End of Period | | $ | 10.03 | |

Total Return(3),(4) | | | 6.08 | % |

| | | | | |

Ratios and Supplemental Data: | | | | |

Net Assets, end of period (in thousands) | | $ | 140,731 | |

Net investment income to average net assets(5),(6),(7),(8) | | | 8.38 | % |

Gross expenses to average net assets(5),(8) | | | 6.37 | % |

Net expenses to average net assets(5),(6),(7),(8) | | | 6.00 | % |

Portfolio turnover rate(3),(9) | | | 20 | % |

Credit Facility | | | | |

Senior securities, end of period (000’s) | | $ | — | |

Asset coverage, per $1,000 of senior security principal amount | | | — | |

Asset coverage ratio of senior securities | | | 0 | % |

See accompanying Notes to Financial Statements.

13

Pender Real Estate Credit Fund

Consolidated Financial Highlights

I2 Class Shares |

Per share operating performance.

For a capital share outstanding throughout each period.

| | For the Period

Ended

December 31,

2023(1) |

Net Asset Value, Beginning of Period | | $ | 10.00 | |

Income from Investment Operations: | | | | |

Net investment income(2) | | | 0.59 | |

Net realized and unrealized appreciation on investments | | | 0.02 | |

Total from investment operations | | | 0.61 | |

| | | | | |

Distributions to Shareholders: | | | | |

From net investment income | | | (0.58 | ) |

Total distributions to shareholders | | | (0.58 | ) |

Net Asset Value, End of Period | | $ | 10.03 | |

Total Return(3),(4) | | | 6.26 | % |

| | | | | |

Ratios and Supplemental Data: | | | | |

Net Assets, end of period (in thousands) | | $ | 200,527 | |

Net investment income to average net assets(5),(6),(7),(8) | | | 8.63 | % |

Gross expenses to average net assets(5),(8) | | | 6.12 | % |

Net expenses to average net assets(5),(6),(7),(8) | | | 5.75 | % |

Portfolio turnover rate(3),(9) | | | 20 | % |

Credit Facility | | | | |

Senior securities, end of period (000’s) | | $ | — | |

Asset coverage, per $1,000 of senior security principal amount | | | — | |

Asset coverage ratio of senior securities | | | 0 | % |

See accompanying Notes to Financial Statements.

14

Pender Real Estate Credit Fund

Notes to the Consolidated Financial Statements December 31, 2023 |

1. Organization

Pender Real Estate Credit Fund (the “Fund”) was organized as a Delaware statutory trust on May 4, 2022. The Fund is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a non-diversified, closed-end management investment company that operates as an interval fund pursuant to Rule 23c-3 under the 1940 Act. Pender Capital Management, LLC, an investment adviser registered with the Securities and Exchange Commission (“SEC”) under the Investment Advisers Act of 1940, as amended (the “Advisers Act”), serves as the Fund’s investment adviser (the “Investment Manager”). The Fund has an inception date of April 21, 2023 and commenced operations on the following business day.

Simultaneous with the commencement of the Fund’s operations, a private fund managed by the Investment Manager, Pender Capital Asset Based Lending I, LP (the “Predecessor Fund”), reorganized and transferred all of its portfolio securities into the Fund. The Predecessor Fund maintained an investment objective and pursued investment strategies that were substantially similar to those of the Fund. The Fund and the Predecessor Fund share the same Investment Manager and portfolio managers.

The Fund currently offers two classes of shares: I1 Class Shares and I2 Class Shares. The Fund has received an exemptive order from the SEC with respect to the Fund’s multi-class structure. As a result of the reorganization, $208,688,447 of net assets from the Predecessor Fund were transferred into the Fund in exchange for 12,544,961 I1 Class Shares and 8,323,884 I2 Class Shares.

The Fund’s investment objective is to generate risk-adjusted current income, while seeking to prioritize capital preservation through real estate-related investments that are predominantly credit investments secured by real estate located in the United States. The Fund will seek to achieve its investment objective by investing, under normal circumstances, at least 95% of its net assets, including the amount of any borrowings for investment purposes, in a portfolio of real estate credit related-investments. These investments may include, without limitation: (i) private real estate investments primarily in the form of debt (“Private Debt”), and (ii) publicly traded real estate debt securities (“Public Securities”).

The Fund’s Board of Trustees (the “Board” or “Board of Trustees”) has the overall responsibility for the management and supervision of the business operations of the Fund.

Basis for Consolidation

The Consolidated Schedule of Investments, Consolidated Statement of Assets and Liabilities, Consolidated Statement of Operations, Consolidated Statement of Changes in Net Assets, and the Consolidated Statement of Cash Flows include two active wholly owned subsidiaries as of December 31, 2023: Pender Credit Holdings I, LLC and Pender ABL I OW, LLC, both formed under the laws of Delaware as a limited liability company. All inter-company accounts and transactions have been eliminated in consolidation for the Fund.

2. Significant Accounting Policies

Basis of Presentation and Use of Estimates

The Fund is an investment company and as a result, maintains its accounting records and has presented these financial statements in accordance with the reporting requirements under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, Financial Services — Investment Companies (“ASC 946”). The policies are in conformity with generally accepted accounting principles (“GAAP”), which requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statement, as well as reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from these estimates.

Income Recognition and Expenses — Interest income is recognized on an accrual basis as earned. Dividend income is recorded on the ex-dividend date. Expenses are recognized on an accrual basis as incurred. The Fund bears all expenses incurred in the course of its operations, including, but not limited to, the following: all costs and expenses

15

Pender Real Estate Credit Fund

Notes to the Consolidated Financial Statements December 31, 2023 |

2. Significant Accounting Policies (cont.)

related to portfolio transactions and positions for the Fund’s account; professional fees; costs of insurance; registration expenses; and expenses of meetings of the Board. Expenses are subject to the Fund’s Expense Limitation Agreement (see Note 4).

Upfront investment income or other payments are sometimes charged to borrowers at the closing of a loan investment transaction. This income is received at the time of closing and then deferred to be recognized as investment income over the term of the loan. For the period ended December 31, 2023, the Fund accrued income of $2,282,067 for these transactions.

Investment Transactions — Investment transactions are accounted for on a trade date basis. Cost is determined and gains and losses are based upon the specific identification method for financial reporting.

Organizational and Offering Costs Policy

Organizational costs consist of the costs of forming the Fund, drafting of bylaws, administration, custody and transfer agency agreements, legal services in connection with the initial meeting of trustees and the Fund’s seed audit costs. Offering costs consist of the costs of preparation, review and filing with the SEC the Fund’s registration statement (including the Prospectus and the Statement of Additional Information (“SAI”)), the costs of preparation, review and filing of any associated marketing or similar materials, the costs associated with the printing, mailing or other distribution of the Prospectus, SAI and/or marketing materials, and the amounts of associated filing fees and legal fees associated with the offering.

Organizational costs incurred by the Fund may be reimbursed by the Investment Manager, some of which may be subject to recoupment by the Investment Manager in accordance with the Fund’s expense limitation agreement discussed in Note 4. Organizational costs are expensed as incurred. Offering costs, which are also subject to the Fund’s expense limitation agreement discussed in Note 4, are accounted for as a deferred charge and amortized to expense over the first twelve months of the Fund’s operations on a straight-line basis. For the period ended December 31, 2023, the Fund incurred $98,080 of organizational expenses. As of December 31, 2023, the Fund expensed $210,416 of offering costs and $85,746 remains an unamortized deferred asset.

Federal Income Taxes

The Fund intends to qualify to be treated as a real estate investment trust (“REIT”) for U.S. federal income tax purposes. The Fund expects to operate, in such a manner to qualify for taxation as a REIT. The Fund’s qualification for taxation as a REIT will depend upon its ability to meet the various REIT qualification tests imposed under the Code (as defined herein). No assurance can be given that the Fund will in fact satisfy such requirements for any taxable year. Those qualification tests involve the percentage of income that the Fund earns from specified sources, the percentage of the Fund’s assets that falls within specified categories, the diversity of the ownership of shares, and the percentage of the taxable income that the Fund distributes.

Distribution to Shareholders

Distributions from net investment income of the Fund, if any, are declared and paid on a monthly basis. Distributions of net realized gains, if any, are declared annually. Distributions to shareholders of the Fund are recorded on the ex-dividend date and are determined in accordance with income tax regulations, which may differ from GAAP. For tax purposes, a distribution that for purposes of GAAP is composed of return of capital and net investment income may be subsequently re-characterized to also include capital gains. Shareholders will be informed of the tax characteristics of the distributions after the close of the December 31, 2023 fiscal year end.

16

Pender Real Estate Credit Fund

Notes to the Consolidated Financial Statements December 31, 2023 |

2. Significant Accounting Policies (cont.)

Investment Valuation

UMB Fund Services, Inc. (the “Administrator”) calculates the Fund’s net asset value (“NAV”) as of the close of business on each business day and at such other times as the Board may determine, including in connection with repurchases of Shares, in accordance with the procedures described below or as may be determined from time to time in accordance with policies established by the Board (each, a “Determination Date”).

The Board has approved valuation procedures for the Fund (the “Valuation Procedures”). The Valuation Procedures provide that the Fund will value its investments in direct investments at fair value. The Board has delegated the day to day responsibility for fair value determinations in accordance with the Valuation Procedures and pricing to the Investment Manager (“Valuation Designee”), subject to oversight by the Board.

For purposes of calculating NAV, portfolio securities and other assets for which market quotations are readily available are valued at market value. A market quotation is readily available only when that quotation is a quoted price (unadjusted) in active markets for identical investments that the Fund can access at the measurement date, provided that a quotation will not be readily available if it is not reliable. Investments for which market quotations are not readily available are valued at fair value as determined in good faith pursuant to Rule 2a-5 under the 1940 Act. As a general principle, the fair value of a security or other asset is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The fair values of one or more assets may not be the prices at which those assets are ultimately sold and the differences may be significant.

Securities traded on one or more of the U.S. national securities exchanges, the Nasdaq Stock Market or any foreign stock exchange will be valued at the last sale price or the official closing price on the exchange or system where such securities are principally traded for the business day as of the relevant Determination Date. If no sale or official closing price of particular securities are reported on a particular day, the securities will be valued at the closing bid price for securities held long, or the closing ask price for securities held short, or if a closing bid or ask price, as applicable, is not available, at either the exchange or system-defined closing price on the exchange or system in which such securities are principally traded. Over-the-counter securities not quoted on the Nasdaq Stock Market will be valued at the last sale price on the relevant Determination Date or, if no sale occurs, at the last bid price, in the case of securities held long, or the last ask price, in the case of securities held short, at the time NAV is determined. Securities for which no prices are obtained under the foregoing procedures, including those for which a pricing service supplies no exchange quotation or a quotation that is believed by the Investment Manager not to reflect the market value, will be valued at the bid price, in the case of securities held long, or the ask price, in the case of securities held short, supplied by one or more dealers making a market in those securities or one or more brokers, in accordance with the Valuation Procedures. Futures index options will be valued at the mid-point between the last bid price and the last ask price on the relevant Determination Date at the time NAV is determined. The mid-point of the last bid and the last ask is also known as the ‘mark’.

Fixed-income securities, except for private debt investments discussed below, with a remaining maturity of sixty (60) days or more will normally be valued according to dealer-supplied bid quotations or bid quotations from a recognized pricing service. Fixed-income securities for which market quotations are unavailable or are believed by the Valuation Designee not to reflect market value will be valued based upon broker-supplied quotations provided that if such quotations are unavailable or are believed by the Valuation Designee not to reflect market value, such fixed-income securities will be valued using valuation models that take into account spread and daily yield changes on government securities in the appropriate market (e.g., matrix pricing). High quality investment grade debt securities (e.g., treasuries, commercial paper, etc.) with a remaining maturity of sixty (60) days or less are valued at amortized cost.

Assets and liabilities initially expressed in foreign currencies will be converted into U.S. dollars using foreign exchange rates provided by a pricing service. Trading in foreign securities generally is completed, and the values of such securities are determined, prior to the close of securities markets in the United States. Foreign exchange rates are also determined prior to such close. On occasion, the values of securities and exchange rates may be affected by events occurring between the time as of which determination of such values or exchange rates are made and the time as of

17

Pender Real Estate Credit Fund

Notes to the Consolidated Financial Statements December 31, 2023 |

2. Significant Accounting Policies (cont.)

which the NAV of the Fund is determined. When such events materially affect the values of securities held by the Fund or its liabilities, such securities and liabilities may be valued at fair value as determined in good faith in accordance with procedures approved by the Board.

Private Debt Investments. Loans held by the Fund are valued on an individual loan level and fair valuation of such loans are performed using inputs that incorporate borrower level data and a comparison of the stated interest rate on the loan as compared to prevailing market interest rates. The Fund expects that any loans held by the Fund will be secured by real property, and that the Fund will value such loans based on the ability of a borrower to repay a loan secured by the real estate property. The Fund expects to value such loans based on property level reporting by the borrower with respect to the following factors: net operating income, occupancy rates, rent rolls, property expenses, balance sheets and bank statements and a review of the property’s fair market value, if obtainable. As the Investment Manager receives this reporting, the Investment Manager reviews the information and inputs the appropriate data into the fair valuation. Although the minimum reporting requirement is generally monthly, many sponsors provide weekly occupancy reports and other qualitative updates more frequently. The Investment Manager intends to monitor and assess the key primary property-level data points on a daily basis, although these major property inputs rarely change daily. The Investment Manager will also closely evaluate that data if the loan is determined to be non-performing (the borrower has not made scheduled payments for 90 days) or the Investment Manager has determined that the collection of interest is less than probable or the collection of any portion of the loan’s principal is doubtful due to the occurrence of a Significant Event.

Real Estate Owned Investments. The Fund may acquire real estate through foreclosure of the collateral securing a nonperforming loan (“Real Estate Owned” or “REO”). The estimated fair value of the investments in REOs is determined, at the discretion of the Investment Manager, by using internally prepared models or third-party valuation appraisals. Upon the acquisition and sale of the REO, the Fund recognizes a realized gain or loss based on the proceeds related to the REO, less transaction costs, and cost of investment in loan, including unpaid accrued interest receivable. Differences between the cost basis of the investment in the REO and its fair value represents unrealized gain or loss. Change in unrealized gain and loss during a period is reflected in the consolidated statement of operations. As of December 31, 2023, the Fund had a fair market value of $3,600,000 in REOs.

3. Fair Value Disclosures

The Fund has established and documented processes and methodologies for determining the fair values of portfolio investments on a recurring basis in accordance with ASC Topic 820 — Fair Value Measurements and Disclosures (“ASC Topic 820”). Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability (i.e. the “exit price”) in an orderly transaction between market participants at the measurement date.

In determining fair value, the Fund uses various valuation techniques. A fair value hierarchy for inputs is used in measuring fair value that maximizes the use of observable inputs and minimizes the use of unobservable inputs by requiring that the most observable inputs are to be used when available. Valuation techniques that are consistent with the market or income approach are used to measure fair value. The fair value hierarchy is categorized into three levels based on the inputs as follows:

• Level 1 — Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund is able to access.

• Level 2 — Inputs, other than quoted prices included in Level 1 that are observable either directly or indirectly. These inputs may include: (a) quoted prices for similar assets in active markets; (b) quoted prices for identical or similar assets in markets that are not active; (c) inputs other than quoted prices that are observable for the asset; or (d) inputs derived principally from or corroborated by observable market data by correlation or other means.

• Level 3 — Valuations based on inputs that are unobservable and significant to the overall fair value measurement.

18

Pender Real Estate Credit Fund

Notes to the Consolidated Financial Statements December 31, 2023 |

3. Fair Value Disclosures (cont.)

Fair value is a market-based measure, based on assumptions of prices and inputs considered from the perspective of a market participant that are current as of the measurement date, rather than an entity-specific measure. Therefore, even when market assumptions are not readily available, the Fund’s own assumptions are set to reflect those that market participants would use in pricing the asset or liability at the measurement date.

The availability of valuation techniques and observable inputs can vary from investment to investment and are affected by a wide variety of factors, including the type of investment, whether the investment is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the transaction. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgement. Because of the inherent uncertainty of valuation, those estimated values may be materially higher or lower than the values that would have been used had a readily available market price for the investments existed. Accordingly, the degree of judgment exercised by the Fund in determining fair value is greatest for investments categorized in Level 3. In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, the level in the fair value hierarchy which the fair value measurement falls in its entirely is determined based on the lowest level input that is significant to the fair value measurement.

In the case of the Fund’s investments in loans, the Fund typically holds these positions as level 3 fair value instruments. In doing so, the Fund takes into consideration timely payment of interest and maintenance of loan covenants over the course of the holding period. In the event facts and circumstances change, the Fund will determine whether an adjustment to the fair value of the loan should be made. Such adjustment may potentially take into consideration a range of factors, including, but not limited to, the size of the original loan, the rate of interest, value of collateral package, maturity, the nature of the loan, and the nature of the borrower.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following is a summary of the inputs used to determine fair value of the Fund’s investments as of December 31, 2023:

Investments | | Fair Value Measurements at the End of the

Reporting Period Using | | Total |

Level 1 | | Level 2 | | Level 3 | |

Security Type | | | | | | | | | | | | |

Private Debt | | $ | — | | $ | — | | $ | 339,034,716 | | $ | 339,034,716 |

Real Estate Owned | | | — | | | — | | | 3,600,000 | | | 3,600,000 |

Total | | $ | — | | $ | — | | $ | 342,634,716 | | $ | 342,634,716 |

The following is a roll-forward of the activity in investments in which significant unobservable inputs (Level 3) were used in determining fair value on a recurring basis:

| | Beginning

Balance

as of

April 24,

2023 | | Transfers

into

Level 3

during the

period | | Transfers

out of

Level 3

during the

period | | Purchases or

Conversions | | Sales or

Distributions | | Net

Realized

Gain | | Change in net

unrealized

appreciation | | Ending

Balance

as of

December 31,

2023 |

Private Debt | | $ | 281,191,888 | | $ | — | | $ | — | | $ | 124,335,026 | | $ | (66,756,698 | ) | | $ | — | | $ | 264,500 | | $ | 339,034,716 |

Real Estate Owned | | | 3,600,000 | | | — | | | — | | | — | | | — | | | | — | | | — | | | 3,600,000 |

| | | $ | 284,791,888 | | $ | — | | $ | — | | $ | 124,335,026 | | $ | (66,756,698 | ) | | $ | — | | $ | 264,500 | | $ | 342,634,716 |

The change in net unrealized appreciation (depreciation) included in the Statement of Operations attributable to Level 3 investments that were held as of December 31, 2023 is $264,500.

19

Pender Real Estate Credit Fund

Notes to the Consolidated Financial Statements December 31, 2023 |

3. Fair Value Disclosures (cont.)

The following is a summary of quantitative information about significant unobservable valuation inputs for Level 3 Fair Value Measurements for investments held as of December 31, 2023:

Type of Level 3 Investment | | Fair Value

as of

December 31,

2023 | | Valuation

Technique | | Unobservable

Inputs | | Range of

Inputs/

(weighted

average) | | Impact on

Valuation from an

Increase in Input |

Private Debt | | $ | 339,034,716 | | Factor Analysis | | Credit Score Adjustment | | (50) – 50 | | Increase |

| | | | | | | | Recovery Analysis | | Not applicable | | Not applicable |

Real Estate Owned | | $ | 3,600,000 | | Qualitative Factors | | Market Comparison and Broker Appraisal | | Not applicable | | Not applicable |

4. Fees and Transactions with Related Parties and Other Agreements

The Fund has entered into an Investment Management Agreement with the Investment Manager, pursuant to which the Investment Manager will provide investment advisory services to the Fund. For providing these services, the Investment Manager is entitled to a fee consisting of three components: the Management Fee, the Incentive Fee, and the Loan Servicing Fee. The Management Fee is an annual rate equal to 1.45% of the Fund’s average daily calculated NAV, payable monthly in arrears. The Incentive Fee is calculated and payable monthly in arrears in an amount equal to 10% of the Fund’s realized “pre- incentive fee net investment income” for the immediately preceding month. “Pre-incentive fee net investment income” is defined as interest income, dividend income and any other income accrued during the calendar month, minus the Fund’s operating expenses for the month (including the Investment Management Fee, expenses payable to the Administrator, any interest expense and dividends paid on any issued and outstanding preferred shares but excluding the Incentive Fee, any realized gains, realized capital losses or unrealized capital appreciation or depreciation).

The Loan Servicing Fee is a fee calculated at an annual rate of 0.05%, payable monthly in arrears, based upon the Fund’s net assets as of month-end for providing loan servicing to the Fund. Such services include collecting and applying broker loan payments, reviewing all financial information to ensure it is in accordance with the loan documents, reviewing and approving capital expenditure draws, coordinating pay-off demands, payment of property taxes and insurance, and coordinating collections and litigation in the event of default; and all such other duties or services necessary for the appropriate servicing of loans held by the Fund. For the period ended December 31, 2023, the Fund incurred $2,442,808, $1,555,533, and $87,043 for the Management Fee, Incentive Fee, and Loan Servicing Fee, respectively.

Certain Fund officers are also officers of the Investment Manager.

The Investment Manager has entered into an expense limitation and reimbursement agreement (the “Expense Limitation and Reimbursement Agreement”) with the Fund, whereby the Investment Manager has agreed to waive fees that it would otherwise have been paid, and or to assume expenses of the Fund (a “Waiver”), if required to ensure the Total Annual Expenses (excluding any taxes, leverage interest, brokerage commissions, loan servicing fees, Incentive Fees, dividend and interest expenses on short sales, acquired fund fees and expenses (as determined in accordance with SEC Form N-2), expenses incurred in connection with any merger or reorganization, and extraordinary expenses, such as litigation expenses) do not exceed 2.75% and 2.50% of the average daily net assets of I1 and I2 Class Shares respectively. The Expense Limitation and Reimbursement Agreement will remain in effect until April 24, 2024 and will automatically renew for consecutive one-year terms thereafter. Either the Fund or the Investment Manager may terminate the Expense Limitation and Reimbursement Agreement upon 30 days’ written notice. For the period ended December 31, 2023, the Investment Manager waived $163,064 pursuant to the Expense Limitation and Reimbursement Agreement.

For a period not to exceed three years from the date on which a Waiver is made, the Investment Manager may recoup amounts waived or assumed, provided it is able to effect such recoupment without causing the Fund’s expense ratio (after recoupment) to exceed the lesser of (i) the expense limit in effect at the time of the waiver and (ii) the expense

20

Pender Real Estate Credit Fund

Notes to the Consolidated Financial Statements December 31, 2023 |

4. Fees and Transactions with Related Parties and Other Agreements (cont.)

limit in effect at the time of the recoupment. As of December 31, 2023, the Investment Manager may seek recoupment for previously waived or reimbursed expenses, subject to the limitations noted above, no later than the dates and amounts outlined below.

| | January 31,

2026 | | December 31,

2026 | | |

$335,448 | | $163,064 | |

On June 1, 2023, the Investment Manager agreed to voluntarily waive a portion of the Incentive Fee. The Investment Manager reserves the right to cease the voluntary waiver at any time. For the period ended December 31, 2023, $657,976 of Incentive Fees were voluntarily waived and are not subject to recoupment by the Investment Manager.

During the period ended December 31, 2023, there were $88,336 of litigation expenses incurred by the Fund that were distinguishable in their characterization as being unusual in nature as well as not expected to be recurring in future periods. The amount caused the ratio of net expenses to average net assets of the Class I1 and Class I2 shares to exceed the contractual expense limitation.

Vigilant Compliance, LLC provides Chief Compliance Officer (“CCO”) services to the Fund. The Fund’s allocated fees incurred for CCO services for the period ended December 31, 2023 are reported on the Statement of Operations.

UMB Distribution Services, LLC serves as the Fund’s distributor (also known as the principal underwriter); UMB Fund Services, Inc. (“UMBFS”) serves as the Fund’s fund accountant, transfer agent and administrator. For the period ended December 31, 2023, the Fund’s allocated UMBFS fees are reported on the Statement of Operations.

5. Other Agreements

The Fund has adopted a Distribution and Service Plan with respect to I1 Class Shares in compliance with Rule 12b-1 under the 1940 Act. The Distribution and Service Plan allows the Fund to pay distribution and servicing fees for the sale and servicing of its I1 Class Shares. Under the Distribution and Service Plan, the Fund is permitted to pay as compensation up to 0.25% on an annualized basis of the aggregate net assets of the Fund attributable to I1 Class Shares (the “Distribution and Servicing Fee”) to the Fund’s distributor and/or other qualified recipients. The Distribution and Servicing Fee is paid out of the Fund’s assets and decreases the net profits or increases the net losses of the Fund. For the period ended December 31, 2023, $226,786 had been incurred for Class I1 distribution fees.

6. Capital Share Transactions

Fund shares are continually offered under Rule 415 of the Securities Act of 1933, as amended. As an interval fund, the Fund has adopted a fundamental policy requiring it to make quarterly repurchase offers pursuant to Rule 23c-3 of the 1940 Act. Each quarterly repurchase offer will be for no less than 5% and no more than 25% of the Fund’s Shares outstanding at NAV. The Fund currently expects the quarterly repurchase offers to be set at 5% of the Fund’s Shares. If Shareholders tender for repurchase more than the Repurchase Offer Amount for a given repurchase offer, the Fund may, but is not required to, repurchase an additional amount of Shares not to exceed 2% of the outstanding Shares of the Fund on the Repurchase Request Deadline. If the Fund determines not to repurchase more than the Repurchase Offer Amount, or if shareholders tender Shares in an amount exceeding the Repurchase Offer Amount plus 2% of the outstanding Shares on the Repurchase Request Deadline, the Fund will repurchase the Shares on a pro rata basis. As a result, tendering shareholders may not have all of their tendered Shares repurchased by the Fund. During the period ended December 31, 2023, the Fund completed two quarterly repurchase offers. The results of the repurchase offers were as follows:

Repurchase

Offer Notice | | Repurchase

Request Deadline | | Repurchase

Pricing Date | | Repurchase

Offer Amount | | % of Shares

Repurchased | | Number of

Shares

Repurchased |

June 16, 2023 | | July 21, 2023 | | July 21, 2023 | | 5% | | 5.00% | | 1,177,889 |

September 18, 2023 | | October 23, 2023 | | October 23, 2023 | | 5% | | 5.00% | | 1,214,863 |

21

Pender Real Estate Credit Fund

Notes to the Consolidated Financial Statements December 31, 2023 |

7. Investment Transactions

Purchases and sales of investments for the period ended December 31, 2023, were $124,335,026 and $66,779,473, respectively.

8. Commitments and Contingencies

The Fund indemnifies the Fund’s officers and Board of Trustees for certain liabilities that might arise from their performance of their duties to the Fund. Additionally, in the normal course of business the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown. However, the Fund expects the risk of loss to be remote. The Fund may enter into unfunded commitments. As of December 31, 2023 the total unfunded amount was $12,720,273 or 3.73% of the Fund’s net assets.

9. Federal Tax Information

This section discusses certain U.S. federal income tax considerations relating to the ownership of Shares in the Fund. The Fund intends to elect to be taxed as a REIT for U.S. federal income tax purposes under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”). The Fund expects to operate in a manner to qualify as a REIT. The Fund’s qualification for taxation as a REIT will depend upon its ability to meet the various and complex REIT qualification tests imposed under the Code on a continuous basis. No assurance can be given that the Fund will in fact satisfy such requirements for any taxable year. If the Fund qualifies for taxation as a REIT, it generally will be allowed to deduct dividends paid to its Shareholders and, as a result, it generally will not be subject to U.S. federal income tax on that portion of its ordinary income and any net capital gain that it annually distributes to its Shareholders, as long as the Fund meets the minimum distribution requirements under the Code. The Fund intends to make distributions (at least 90% of the Fund’s annual REIT taxable income) to its Shareholders on a regular basis as necessary to avoid material U.S. federal income tax and to comply with the REIT distributions requirements. Even if the Fund qualifies for taxation as a REIT, it may be subject to certain state and local taxes on its income and property, and federal income and excise taxes on its undistributed income.

For the period ended December 31, 2023, components of net assets are as follows:

| | Paid-in Capital | | Total Distributable

Earnings | | |

$ | 341,980,782 | | $ | 184,413 | |

For the period ended December 31, 2023, the tax character of distributions paid are as follows:

Distribution paid from: | | | |

Return of Capital | | $ | — |

Distributable Earnings | | | 14,185,969 |

Total Distributions | | $ | 14,185,969 |

For the period ended December 31, 2023, gross unrealized appreciation and depreciation of investments owned by the Fund, based on cost for federal income tax purposes are as follows:

Cost of Investments | | $ | 329,649,943 | |

Gross Unrealized Appreciation | | | 797,672 | |

Gross Unrealized Depreciation | | | (533,172 | ) |

Net Unrealized Appreciation (Depreciation) on Investments | | $ | 264,500 | |

22

Pender Real Estate Credit Fund

Notes to the Consolidated Financial Statements December 31, 2023 |

10. Risk Factors

There can be no assurance that the investment objective of the Fund will be achieved or that the Fund’s portfolio design and risk monitoring strategies will be successful. The following list is not intended to be a comprehensive listing of all the potential risks associated with the Fund. The Fund’s prospectus provides further details regarding the Fund’s risks and considerations.

General Economic and Market Conditions. The success of the Fund’s investment program may be affected by general economic and market conditions, such as interest rates, availability of credit, inflation rates, economic uncertainty, changes in laws, and national and international political circumstances. These factors may affect the level and volatility of securities prices and the liquidity of investments held by the Fund. Unexpected volatility or illiquidity could impair the Fund’s profitability or result in losses.

Limited Liquidity. Shares in the Fund provide limited liquidity since Shareholders will not be able to redeem Shares on a daily basis. A Shareholder may not be able to tender its Shares in the Fund promptly after it has made a decision to do so. In addition, with very limited exceptions, Shares are not transferable, and liquidity will be provided only through repurchase offers made quarterly by the Fund. Shares in the Fund are therefore suitable only for investors who can bear the risks associated with the limited liquidity of Shares and should be viewed as a long-term investment.

Real Estate Risk. Since the business of the Fund consists of real estate lending, the Fund’s performance depends on the ability of its borrowers to repay their loans. In turn, the Fund’s borrowers are subject to local, regional, and national real estate market and economic conditions beyond their control and beyond the control of the Fund. Such risks include, but are not limited to the risks associated with the general economic climate, local real estate conditions (including the availability of excess supply of properties relative to demand), demographic changes, changes in the availability of financing, credit risk arising from the financial condition of tenants, buyers, and sellers of properties, geographic market concentration, competition from other space, vacancy, tenant defaults, construction related risks, condemnation, taxes, government regulations (such as changes in regulations governing land usage, improvements, zoning, and environmental issues), natural and man-made disasters, liability arising out of the presence of certain construction materials, uninsurable losses, and fluctuations in interest rates. The Fund intends to lend to borrowers who own a variety of types of property, including office property, industrial property, retail property, multifamily property and mixed-use property. The foregoing real estate risks may be more prevalent or pronounced in one or more of these property types from time to time.

Real Estate Lending Risk. Real estate lending is a highly competitive business. The Fund will be competing for business against other lenders, including traditional institutional lenders, other real estate lending funds, individual lenders, and other so-called private lenders. If the Fund fails to source an adequate number of secured real estate loans in the face of such competition, it will be unable to accumulate a substantial enough loan portfolio to support its financial objectives.

Real Estate Related Risk. The Fund will invest over 25% of its total assets in the real estate industry, The main risk of real estate related investments is that the value of the underlying real estate may go down. Many factors may affect real estate values. These factors include both the general and local economies, the amount of new construction in a particular area, the laws and regulations (including zoning and tax laws) affecting real estate and the costs of owning, maintaining and improving real estate. The availability of mortgages and changes in interest rates may also affect real estate values. If the Fund’s real estate-related investments are concentrated in one geographic area or in one property type, the Fund will be particularly subject to the risks associated with that area or property type. The Fund may invest in a wide array of real estate exposures that involve equity or equity-like risk in the underlying properties. Real estate historically has experienced significant fluctuation and cycles in value, and specific market conditions may result in a permanent reduction in value. The value of the real estate will depend on many factors beyond the control of the general partner, including, without limitation: changes in general economic or local conditions; changes in supply of or demand for competing properties in an area (as a result, for instance, of over-building); changes in interest rates; the promulgation and enforcement of governmental regulations relating to land use and zoning restrictions, environmental protection and occupational safety; unavailability of mortgage funds which may render the construction, leasing, sale or refinancing of a property difficult; the financial condition of borrowers and of tenants, buyers and sellers of property; changes in real estate tax rates and other operating expenses; the imposition of rent controls; energy and supply shortages; various uninsured or uninsurable risks; and natural disasters. As a result, the Fund’s portfolio may be subject to greater risk and volatility than if investments had been made in a broader diversification of investments in terms of asset type, geographic location, sector, industry or securities instrument.

23

Pender Real Estate Credit Fund

Notes to the Consolidated Financial Statements December 31, 2023 |

10. Risk Factors (cont.)

Debt Securities. Debt securities of all types of issuers may have speculative characteristics, regardless of whether they are rated. The issuers of such instruments (including sovereign issuers) may face significant ongoing uncertainties and exposure to adverse conditions that may undermine the issuer’s ability to make timely payment of interest and principal in accordance with the terms of the obligations.

Cash Concentration Risk. The Fund may hold varying concentrations of cash and cash equivalents periodically which may consist primarily of cash, deposits in money market accounts and other short-term investments which are readily convertible into cash and have an original maturity of three months or less. Cash and cash equivalents are subject to credit risk to the extent those balances exceed applicable Securities Investor Protection Corporations (“SIPC”) or Federal Deposit Insurance Corporation (“FDIC”) limitations.

11. Line of Credit Agreements

As of April 24, 2023, Pender Credit Holdings I, LLC, a wholly-owned subsidiary of the Fund, as borrower, entered into an amendment to its Credit and Security Agreement (“Veritex Facility”) with Veritex Community Bank, a Texas state bank, as administrative agent (the “Agent”) and certain lenders from time to time party thereto and the Fund, as guarantor of the Veritex Facility, entered into an Amended, Restated and Reaffirmed Guaranty. Separately, as of the same date, Pender ABL I OW, LLC, a wholly-owned subsidiary of the Fund, as borrower, the Fund, as corporate guarantor and other parties thereto entered into an amendment to the Loan and Security Agreement (“Oakwood Facility” and together with the Veritex Facility, the “Facilities”) with Oakwood Bank, as lender (“Lender”) and the Fund, as guarantor of the Oakwood Facility, entered into an Amended, Restated and Reaffirmed Guaranty. Both Facilities are secured by the assets of the applicable borrower, but not by the assets of the Fund as guarantor. The Veritex Facility provides for borrowings on a committed basis in an aggregate principal amount up to $100,000,000, subject to a borrowing base, which may be increased by agreement of the parties thereto under the terms of the Veritex Facility. The Oakwood Facility provides for borrowings on a committed basis in an initial aggregate principal amount of up to $15,000,000, subject to a borrowing base.

The Fund pays interest on the Oakwood Facility line of credit at a per annum rate equal to the lesser of (a) the maximum rate permitted by law, or (b) the greater of (i) the prime rate plus 0.50%, or (ii) 3.75%. During the period ended December 31, 2023, the average principal balance, maximum outstanding balance, and average interest rate were approximately $11,218,333, $15,000,000, and 8.23% per annum, respectively. As of December 31, 2023, there was no principal outstanding balance.

The Fund pays interest on the Veritex Facility line of credit at a per annum rate equal to the lesser of (a)(i) Term SOFR plus an applicable margin of 3.25% per annum or (ii) if applicable, the base rate (as defined below) or (b) the maximum rate permitted by law; provided that in no event shall the interest rate be less than 4.00% per annum. The rate is subject to a 0.25% increase if the Borrower and its affiliates fail to maintain certain deposits with Veritex. The base rate, for any day, is equal to the sum of (A) 3.25% per annum plus (B) the highest of (i) the prime rate in effect on such day (ii) the Federal Funds Effective Rate in effect on such day plus 0.50% and (iii) Term SOFR for a one-month term in effect on such day. During the period December 31, 2023, the average principal balance, maximum outstanding balance, and average interest rate were approximately $61,167,975, $91,900,900, and 8.27% per annum, respectively. As of December 31, 2023, there was no principal outstanding balance.

Expenses for the loans are paid by the Fund. During the period ended December 31, 2023, the Fund incurred $4,367,989 in interest expenses.

12. Subsequent Events

The Fund completed a quarterly repurchase offer on January 22, 2024. 1,963,687 shares of Class I1 and 121,587 shares of Class I2 were repurchased. The shares repurchased were made on a pro-rata basis and represented 6% of the Fund’s outstanding shares on the Repurchase Pricing Date. The Fund has evaluated the impact of all subsequent events on the Fund through the date the financial statements were issued and has determined that there were no other subsequent events requiring recognition or disclosure in the financial statements.

24

Pender Real Estate Credit Fund

Additional Information

December 31, 2023 (Unaudited) |

Proxy Voting

The Fund is required to file Form N-PX, with its complete proxy voting record for the twelve months ended June 30, no later than August 31. The Fund’s Form N-PX filing is available: (i) without charge, upon request, by calling the Fund c/o UMB Fund Services, by telephone at 1-877-773-7703 or (ii) by visiting the SEC’s website at www.sec.gov.

A description of the Fund’s proxy voting policies and procedures related to portfolio securities is available without charge, upon request, by calling the Fund at 1-877-773-7703 or on the SEC website at www.sec.gov.

Availability of Quarterly Portfolio Schedules

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. The Fund’s Form N-PORT is available, without charge and upon request, on the SEC’s website at www.sec.gov.

25

Pender Real Estate Credit Fund

Fund Management

December 31, 2023 (Unaudited) |

The identity of the members of the Board and the Fund’s officers and brief biographical information is set forth below. The Fund’s Statement of Additional Information includes additional information about the membership of the Board and is available without charge, upon request, by calling the Fund at (877) 773-7703.

INDEPENDENT TRUSTEES

NAME,

ADDRESS AND

YEAR OF BIRTH | POSITION(S)

HELD WITH

THE FUND | LENGTH

OF TIME

SERVED | PRINCIPAL

OCCUPATION(S)

DURING PAST

5 YEARS | NUMBER OF

PORTFOLIOS

IN FUND

COMPLEX*

OVERSEEN

BY DIRECTOR | OTHER