UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended September 30, 2024

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☐ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report

For the transition period from to

Commission file number: 001-42256

WORK Medical Technology Group LTD

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name into English)

Cayman Islands

(Jurisdiction of incorporation or organization)

Floor 23, No. 2 Tonghuinan Road

Xiaoshan District, Hangzhou City, Zhejiang Province

The People’s Republic of China

+86-571-82613568

(Address of principal executive offices)

Shuang Wu, Chief Executive Officer

Telephone: +86-571-82613568

Email: wushuang@workmedtech.com

Floor 23, No.2 Tonghuinan Road

Xiaoshan District, Hangzhou City, Zhejiang Province

The People’s Republic of China

+86-571-82613568

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Ordinary Shares | | WOK | | The Nasdaq Stock Market |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

An aggregate of 14,591,942 ordinary shares, par value $0.0005 per share, as of September 30, 2024.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ☐ No ☒

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | | Emerging growth company | ☒ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive- based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☒ | International Financial Reporting Standards as issued by the

International Accounting Standards Board ☐ | Other ☐ |

| * | If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ☐ Item 18 ☐ |

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ☐ No ☐

TABLE OF CONTENTS

INTRODUCTION

In this annual report on Form 20-F, unless the context otherwise requires, references to:

| ● | “China” or the “PRC” are to the People’s Republic of China, including the special administrative regions of Hong Kong, Macau and Taiwan. The term “Chinese” has a correlative meaning for the purpose of this annual report. When used in the case of laws, regulations and rules, of “China” or the “PRC”, it refers to only such laws, regulations and rules of mainland China. When used in the case of government, governmental authorities, regulatory agencies, courts, jurisdictions, tax, entities, enterprises, individuals and residents of “China” or the “PRC” or “Chinese”, it refers to only such government, governmental authorities, regulatory agencies, courts, jurisdictions, tax, entities, enterprises, individuals and residents of mainland China; |

| ● | “Class I medical device” are to a medical device with a low level of risks and whose safety and effectiveness can be ensured through routine administration, pursuant to the Regulations on the Supervision and Administration of Medical Devices (as amended in 2021) (the “2021 Medical Device Regulation”); |

| ● | “Class II medical device” are to a medical device with moderate risks that must be strictly controlled and regulated to ensure its safety and effectiveness, pursuant to the 2021 Medical Device Regulation; |

| ● | “Class III medical device” are to a medical device with relatively high risks that must be strictly controlled and regulated through special measures to ensure its safety and effectiveness, pursuant to the 2021 Medical Device Regulation; |

| ● | “Code” are to the United States Internal Revenue Code of 1986, as amended; |

| ● | “Exchange Act” are to the Securities Exchange Act of 1934, as amended; |

| ● | “FDA” are to the U.S. Food and Drug Administration; |

| ● | “Group” are to the WORK Medical Technology Group LTD, Work Medical Technology Group Limited, and the PRC subsidiaries, collectively; |

| ● | “Hangzhou Hanshi” are to Hangzhou Hanshi Medical Equipment Co., Ltd.; |

| ● | “Hangzhou Shanyou” are to Hangzhou Shanyou Medical Equipment Co., Ltd.; |

| ● | “Hangzhou Woli” are to Hangzhou Woli Medical Treatment Technology Co., Ltd.; |

| ● | “Hangzhou Youshunhe” are to Hangzhou Youshunhe Technology Co., Ltd.; |

| ● | “Huangshan Saitumofei” are to Huangshan Saitumofei Medical Technology Co., Ltd.; |

| ● | “Hunan Saitumofei” are to Hunan Saitumofei Medical Treatment Technology Co., Ltd.; |

| ● | “mainland China” or “Chinese mainland” are to the People’s Republic of China, excluding, solely for the purpose of this annual report, the special administrative regions of Hong Kong, Macau and Taiwan. The term “mainland Chinese” has a correlative meaning for the purpose of this annual report; |

| ● | “Nasdaq” are to the Nasdaq Capital Market; |

| ● | “Ordinary Shares” are to ordinary shares of the Company, par value $0.0005 per share; |

| ● | “PFIC” are to a passive foreign investment company; |

| ● | “PRC subsidiaries” are to Work Hangzhou, Hangzhou Shanyou, Shanghai Chuqiang, Hangzhou Hanshi, Hangzhou Woli, Shanghai Saitumofei, and Hunan Saitumofei, collectively; |

| ● | “RMB” or the “Renminbi” are to the legal currency of China; |

| ● | “SEC” are to the United States Securities and Exchange Commission; |

| ● | “Securities Act” are to the Securities Act of 1933, as amended; |

| ● | “Shanghai Chuqiang” are to Shanghai Chuqiang Medical Equipment Co., Ltd.; |

| ● | “Shanghai Saitumofei” are to Shanghai Saitumofei Medical Treatment Technology Co., Ltd.; |

| ● | “US$,” “USD,” “U.S. dollars,” “$,” and “dollars” are to the legal currency of the United States; |

| ● | “Work BVI” are to Work Medical Technology Group Limited; |

| ● | “WFOE” or “Work Age” are to Work Age (Hangzhou) Medical Treatment Technology Co., Ltd, which is a limited liability company formed in China; and |

| ● | “Work Hangzhou” are to Work (Hangzhou) Medical Treatment Technology Co., Ltd. |

This annual report on Form 20-F includes our audited consolidated financial statements for the fiscal years ended September 30, 2024 and 2023. In this annual report, we refer to assets, obligations, commitments, and liabilities in our consolidated financial statements in United States dollars. These dollar references are based on the exchange rate of RMB to United States dollars, determined as of a specific date or for a specific period. Changes in the exchange rate will affect the amount of our obligations and the value of our assets in terms of United States dollars which may result in an increase or decrease in the amount of our obligations and the value of our assets.

This annual report contains translations of certain RMB amounts into U.S. dollars at specified rates. Unless otherwise stated, the following exchange rates are used in this annual report:

| | | September 30, |

| US$ Exchange Rate | | 2024 | | 2023 | | 2022 |

| At the end of the year - RMB | | RMB7.0176 to $1.00 | | RMB7.2960 to $1.00 | | RMB7.1135 to $1.00 |

| Average rate for the year - RMB | | RMB7.2043 to $1.00 | | RMB7.0824 to $1.00 | | RMB6.5532 to $1.00 |

Part I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not Applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not Applicable.

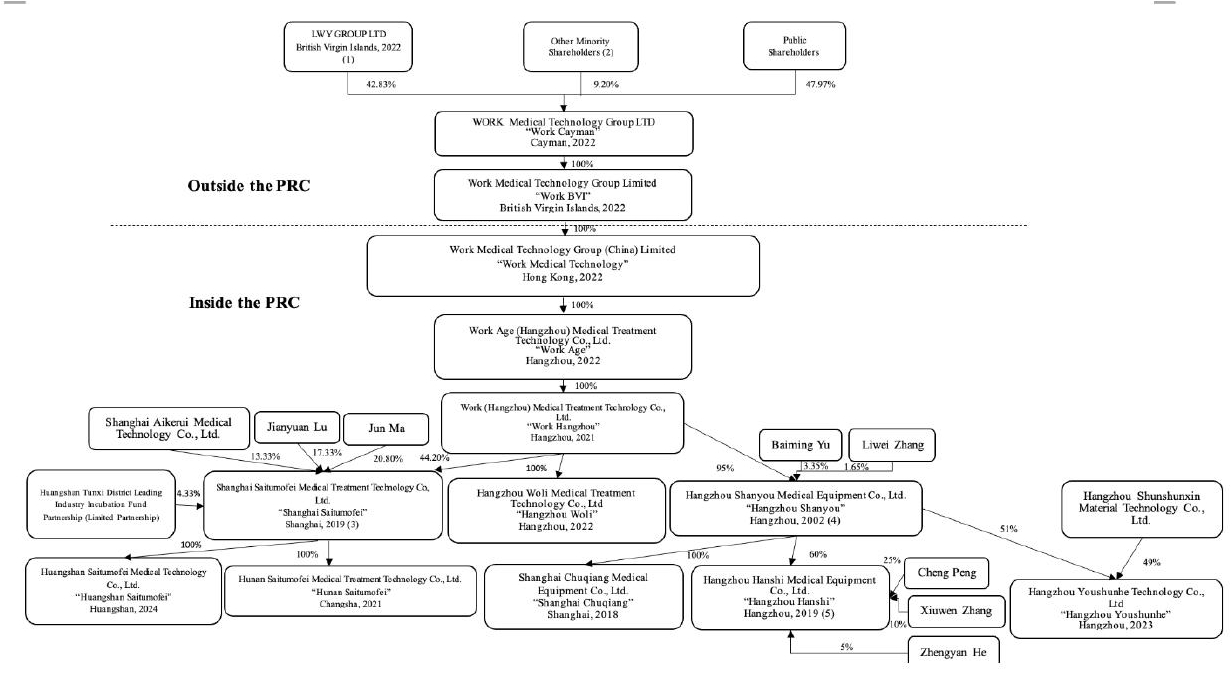

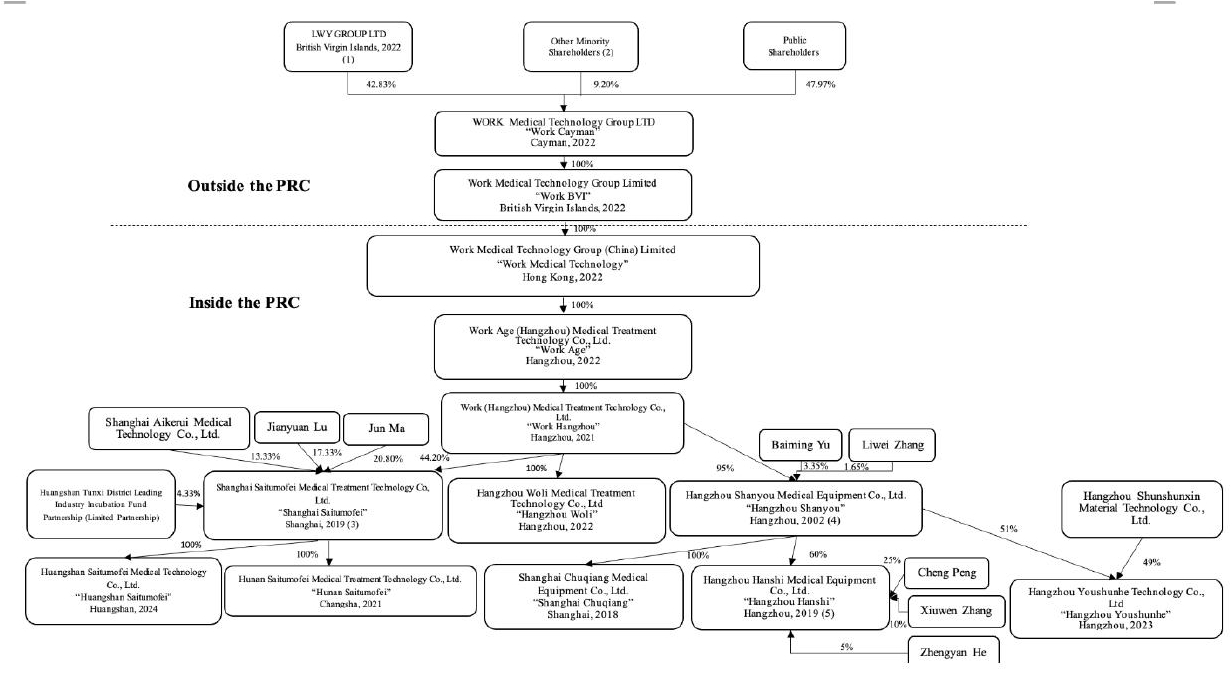

ITEM 3. KEY INFORMATION

In this annual report, unless otherwise stated, the terms “we,” “us,” “our,” “Work Cayman,” “our Company,” and the “Company” refer to WORK Medical Technology Group LTD, an exempted company limited by shares incorporated under the laws of the Cayman Islands and not a Chinese operating company. Work Cayman has no operations of its own and conducts all of its operations through the PRC subsidiaries, namely, Work (Hangzhou) Medical Treatment Technology Co., Ltd. (“Work Hangzhou”), our wholly owned PRC subsidiary, and its subsidiaries, Hangzhou Shanyou Medical Equipment Co., Ltd. (“Hangzhou Shanyou”), Shanghai Chuqiang Medical Equipment Co., Ltd. (“Shanghai Chuqiang”), Hangzhou Hanshi Medical Equipment Co., Ltd. (“Hangzhou Hanshi”), Hangzhou Woli Medical Treatment Technology Co., Ltd. (“Hangzhou Woli”), Shanghai Saitumofei Medical Treatment Technology Co., Ltd. (“Shanghai Saitumofei”), Huangshan Saitumofei Medical Technology Co., Ltd. (“Huangshan Saitumofei”), and Hunan Saitumofei Medical Treatment Technology Co., Ltd. (“Hunan Saitumofei”) (collectively referred to herein as “the PRC subsidiaries”). The operations of the PRC subsidiaries could affect other parts of our business.

Investors in our Ordinary Shares should be aware that they will not directly hold equity interests in the PRC subsidiaries but rather are purchasing equity solely in WORK Medical Technology Group LTD, a Cayman Islands holding company, which indirectly owns a majority of the equity interests in such PRC subsidiaries. The Chinese regulatory authorities could disallow this structure, which would likely result in a material change in our operations and/or a material change in the value of the securities we are registering for sale, including that it could cause the value of such securities to significantly decline or become worthless. For risks facing our Company as a result of our organizational structure and doing business in China, see “Item 3. Key Information—D. Risk Factors—Risks Related to Doing Business in China.” We do not currently use a variable interest entity (“VIE”) structure.

In addition, as we conduct all of our operations through the PRC subsidiaries in China, we and the PRC subsidiaries are subject to legal and operational risks associated with being based in China, including risks related to the legal, political and economic policies of the Chinese government, the relations between China and the United States, or Chinese or United States regulations, which risks could result in a material change in the PRC subsidiaries’ operations and/or cause the value of our Ordinary Shares to significantly decline or become worthless and affect our ability to offer or continue to offer securities to investors. Recently, the PRC government initiated a series of regulatory actions and made a number of public statements on the regulation of business operations in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas, adopting new measures to extend the scope of cybersecurity reviews, and expanding efforts in anti-monopoly enforcement. We do not believe, as advised by our PRC counsel, AllBright Law Offices (Fuzhou), that we or the PRC subsidiaries are directly subject to these regulatory actions or statements, as neither we nor the PRC subsidiaries have implemented any monopolistic behavior, and the PRC subsidiaries’ business does not implicate cybersecurity, because the PRC subsidiaries currently engage in the manufacture and sale of medical devices and neither we nor the PRC subsidiaries possess the personal information of over one million users, nor are we or the PRC subsidiaries involved in any type of restricted industries. On September 8, 2006, the Regulations on Mergers and Acquisitions of Domestic Enterprises by Foreign Investors (the “M&A Rules”) which were jointly adopted by six PRC regulatory agencies came into effect. The M&A Rules include, among other things, provisions that purport to require that offshore special purpose vehicles (each, an “SPV”) that are controlled by PRC entities or individuals and that have been formed for overseas listing purposes through acquisitions of PRC domestic interests held by such PRC entities or individuals, obtain the approval of the China Securities Regulatory Commission (the “CSRC”) prior to the listing and trading of any such SPV’s securities on an overseas stock exchange. On September 21, 2006, the CSRC published on its official website procedures regarding its approval of overseas listings by SPVs. Since the Company is neither controlled by PRC entities or individuals, nor formed for overseas listing purposes through acquisitions of PRC domestic interests held by such PRC entities or individuals, we believe, as advised by our PRC counsel, AllBright Law Offices (Fuzhou), that the Company is not an SPV, and, therefore, the M&A Rules do not apply to us, and we do not need to obtain the approval from the CSRC under the M&A Rules. However, substantial uncertainty remains regarding the scope and applicability of the M&A Rules to offshore SPVs.

Furthermore, on March 31, 2023, the Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies (the “Trial Administrative Measures”) and relevant supporting guidelines (collectively, the “New Administrative Rules Regarding Overseas Listings”) issued by the CSRC came into force. These rules propose to establish a new filing-based regime to regulate overseas offerings and listings by Chinese domestic companies. According to the New Administrative Rules Regarding Overseas Listings, among other things, Chinese domestic companies conducting overseas securities offering and listing activities, either in direct or indirect form, shall complete filing procedures with the CSRC pursuant to the requirements of Trial Administrative Measures within three working days following their submission of initial public offering (“IPO”), listing applications, or completion of subsequent securities offerings. The New Administrative Rules Regarding Overseas Listings apply to both IPO and subsequent securities offerings of a company in the same overseas market where it has previously offered and listed securities. Under these rules, companies like ours must file with the CSRC within three working days after completing a post-IPO securities offering. On the same day, the Provisions on Strengthening Confidentiality and Archives Administration of Overseas Securities Offering and Listing by Domestic Companies (the “Confidentiality and Archives Administration Provisions”) promulgated by the CSRC became effective. According to the Confidentiality and Archives Administration Provisions, domestic companies that seek overseas offering and listing (either in direct or indirect means) and the securities companies and securities service (either incorporated domestically or overseas) providers that undertake relevant businesses shall not leak any state secret or working secret of government agencies, or harm national security and public interests. Furthermore, a domestic company that provides accounting archives or copies of accounting archives to any entities, including securities companies, securities service providers and overseas regulators, and individuals, shall fulfill due procedures in compliance with applicable regulations. Our Ordinary Shares began trading on the Nasdaq Capital Market under the symbol “WOK” on August 23, 2024, and on August 26, 2024, the Company completed its IPO. We believe, as advised by our PRC counsel, Allbright Law Offices (Fuzhou), that our IPO did not involve the leaking of any state secret or working secret of government agencies, or the harming of national security and public interests. However, we may be required to perform additional procedures in connection with the provision of accounting archives. The specific requirements of the relevant procedures are currently unclear, and we cannot be certain whether we will be able to perform the relevant procedures. We also believe, based on the advice of our PRC counsel, AllBright Law Offices (Fuzhou), that (i) because we are not an SPV which acquires PRC domestic companies’ equity with our shares prior to the listing of our Ordinary Shares on Nasdaq, we were not required to submit an application to the CSRC for its approval of the IPO and the listing and trading of our Ordinary Shares with Nasdaq under the M&A Rules; (ii) as we are regarded as a domestic company to be indirectly listed on overseas markets under the Trial Administrative Measures, we were required to complete the filing procedures with the CSRC in accordance with the Trial Administrative Measures with respect to our IPO and on December 21, 2023, we completed all the required filing procedures with the CSRC with respect to our IPO; (iii) neither we nor the PRC subsidiaries are subject to cybersecurity review with the Cyberspace Administration of China (the “CAC”), pursuant to the Measures for Cybersecurity Review (2021 version), which became effective on February 15, 2022, since the PRC subsidiaries currently engage in the manufacture and sale of medical devices and neither we nor the PRC subsidiaries possess personal information of over one million users; (iv) the Company is currently not required to obtain permission or approval from any of the PRC central or local governmental authorities, except for completing the filing procedures with the CSRC, and it has not received any denial to list on a U.S. exchange. However, in the event that we conduct subsequent offerings, we could be subject to new filing requirements with the CSRC. In the event that filings with the CSRC are required, we cannot assure you that we can complete the filing procedures, obtain the approvals, or complete other compliance procedures in a timely manner, or at all, or that any completion of filing or approval or other compliance procedures would not be rescinded. Any such failure would subject us to sanctions by the CSRC or other PRC regulatory authorities. These regulatory authorities may impose restrictions and penalties on the operations of the PRC subsidiaries in China, significantly limit or completely hinder our ability to launch any new offering of our securities, limit our ability to pay dividends outside of China, delay or restrict the repatriation of the proceeds from future capital raising activities into China, or take other actions that could materially and adversely affect our business, results of operations, financial condition and prospects, as well as the trading price of our Ordinary Shares. Furthermore, the PRC government authorities may further strengthen oversight and control over listings and offerings that are conducted overseas. Any such action may adversely affect our operations and significantly limit or completely hinder our ability to offer or continue to offer securities to you and cause the value of such securities to significantly decline or be worthless; and (v) there are substantial uncertainties regarding the interpretation and application of PRC laws and regulations and future PRC laws and regulations, and there can be no assurance that the relevant government agencies will not take a view that is contrary to, or otherwise different from, the conclusions stated above. If the relevant government agencies take a view that is contrary to, or otherwise different from, the foregoing conclusions, it could have a material adverse effect on the PRC subsidiaries’ business, operating results and reputation, as well as the trading price of our Ordinary Shares. See “Item 3. Key Information—D. Risk Factors—Risks Related to Doing Business in China—Any requirement to obtain prior approval under the M&A Rules and/or any other regulations promulgated by relevant PRC regulatory agencies in the future could delay our subsequent securities offerings and failure to obtain any such approvals, if required, could have a material adverse effect on the PRC subsidiaries’ and our business, operating results and reputation, as well as the trading price of our Ordinary Shares, and could also create uncertainties for our subsequent securities offerings and affect our ability to offer or continue to offer securities to investors outside China” on page 32; “Item 3. Key Information—D. Risk Factors—Risks Related to Doing Business in China—There are uncertainties regarding the interpretation and enforcement of PRC laws, rules and regulations” on page 27; and “Item 3. Key Information—D. Risk Factors—Risks Related to Doing Business in China—Additional compliance procedures may be required in connection with our subsequent securities offerings, due to the promulgation of the new filing-based administrative rules for overseas offering and listing by domestic companies in China, which could significantly limit or completely hinder our ability to offer or continue to offer our Ordinary Shares to investors and could cause the value of our Ordinary Shares to significantly decline or become worthless” on page 30.

However, since these statements and regulatory actions by the PRC government are newly published and official guidance and related implementation rules have yet to be fully issued, it is highly uncertain what the potential impact such modified or new laws and regulations will have on the PRC subsidiaries’ daily business operations, the ability to accept foreign investments and list on a U.S. exchange. Moreover, the Standing Committee of the National People’s Congress (the “SCNPC”) or other PRC regulatory authorities may in the future promulgate laws or regulations or implementing rules that require our Company, or any of our subsidiaries to obtain regulatory approval from Chinese authorities before listing in the U.S. Although the Company is currently not required to obtain permission or approval from any of the PRC central or local governmental authorities, except for completing the filing procedures with the CSRC, and it has not received any denial to list on a U.S. exchange, the PRC subsidiaries’ operations could be adversely affected, directly or indirectly; our ability to offer, or continue to offer, securities to investors would be potentially hindered; and the value of our securities might significantly decline or be worthless, by existing or future laws and regulations relating to the business of the PRC subsidiaries or our industry or by intervention or interruption by PRC governmental authorities, if we or the PRC subsidiaries (i) do not receive or maintain such permissions or approvals, (ii) inadvertently conclude that such permissions or approvals are not required, (iii) applicable laws, regulations, or interpretations change and we or the PRC subsidiaries are required to obtain such permissions or approvals in the future, or (iv) due to any intervention or interruption by PRC governmental with little advance notice. See “Item 3. Key Information—D. Risk Factors—Risks Related to Doing Business in China” beginning on page 27 for a discussion of these legal and operational risks and other information that should be considered before making a decision to purchase our securities.

Moreover, the Chinese government may exert substantial influence over the manner in which the PRC subsidiaries conduct their business activities. The PRC government may also intervene or influence the PRC subsidiaries’ operations and our subsequent securities offerings at any time, which could result in a material change in the PRC subsidiaries’ operations and our Ordinary Shares could decline in value significantly or become worthless. See “Item 3. Key Information—D. Risk Factors—Risks Related to Doing Business in China—The PRC government exerts substantial influence over the manner in which the PRC subsidiaries conduct their business activities. The PRC government may also intervene or influence the PRC subsidiaries’ operations and our subsequent securities offerings at any time, which could result in a material change in the PRC subsidiaries’ operations and our Ordinary Shares could significantly decline in value or become worthless” on page 29.

In addition, although Work Medical Technology Group (China) Limited (“Work Medical Technology”), our Hong Kong subsidiary, is an investment holding company, the legal and operational risks associated with operating in mainland China may also apply to the future activities (if any) in Hong Kong of Work Medical Technology, to the extent that they are made applicable to such entity and its anticipated operations. Work Medical Technology, as of the date of this annual report, has yet to commence operations and is expected to be limited to operating as an investment holding company in the future without any substantive or data-related operations in Hong Kong. However, such operations may be affected if Hong Kong adopts rules, regulations or policy guidance with respect to currency exchange control. Furthermore, as of the date of this annual report, we do not expect that any regulatory actions related to data security or anti-monopoly concerns in Hong Kong will impact the Company’s ability to conduct its business, accept foreign investments, or list on a U.S. or foreign exchange because we have never had and do not plan to have any material operations in Hong Kong. See “Item 3. Key Information—D. Risk Factors—Risks Related to Doing Business in China—The enactment of Law of the PRC on Safeguarding National Security in the Hong Kong Special Administrative Region and Hong Kong Autonomy Act of U.S. could impact our Hong Kong holding subsidiary” on page 42.

Hong Kong was established as a special administrative region of the PRC in accordance with Article 31 of the Constitution of the PRC. The Basic Law of the Hong Kong Special Administrative Region of the PRC (the “Basic Law”) was adopted and promulgated on April 4, 1990, and became effective on July 1, 1997, when the PRC resumed the exercise of sovereignty over Hong Kong. Pursuant to the Basic Law, Hong Kong is authorized by the National People’s Congress of the PRC to exercise a high degree of autonomy and enjoy executive, legislative, and independent judicial power, under the principle of “one country, two systems,” and the PRC laws and regulations shall not be applied in Hong Kong except for those listed in Annex III of the Basic Law (which is confined to laws relating to national defense, foreign affairs, and other matters that are not within the scope of autonomy of Hong Kong). While the National People’s Congress of the PRC has the power to amend the Basic Law, the Basic Law also expressly provides that no amendment to the Basic Law shall contravene the established basic policies of the PRC regarding Hong Kong. As a result, the national laws of the PRC not listed in Annex III of the Basic Law do not apply to our Hong Kong subsidiary, Work Medical Technology. However, there is no assurance that certain PRC laws and regulations, including existing laws and regulations and those enacted or promulgated in the future, will not be applicable to Work Medical Technology due to changes in the current political arrangements between mainland China and Hong Kong or other unforeseeable reasons. The application of such laws and regulations may have a material adverse impact on Work Medical Technology, as relevant authorities may impose fines and penalties upon Work Medical Technology, delay or restrict the repatriation of the proceeds from our securities offerings into mainland China and Hong Kong, and any failure by us to fully comply with any such new regulatory requirements may significantly limit or completely hinder our ability to offer or continue to offer our Ordinary Shares, cause significant disruption to our business operations, and severely damage our reputation, which would materially and adversely affect our financial condition and results of operations and cause our Ordinary Shares to significantly decline in value or in extreme cases, become worthless.

Furthermore, as more stringent criteria have been imposed by the U.S. Securities and Exchange Commission (the “SEC”) and the Public Company Accounting Oversight Board (the “PCAOB”) recently, our securities may be prohibited from trading on a national exchange or over-the-counter under the Holding Foreign Companies Accountable Act (“the HFCA Act”), if the PCAOB is unable to inspect our auditors for two consecutive years. As a result, an exchange may determine to delist our securities. Pursuant to the HFCA Act, if the PCAOB is unable to inspect an issuer’s auditors for two consecutive years, the issuer’s securities are prohibited to trade on a U.S. stock exchange. The PCAOB issued a Determination Report on December 16, 2021 which found that the PCAOB is unable to inspect or investigate completely registered public accounting firms headquartered in: (1) mainland China of the People’s Republic of China because of a position taken by one or more authorities in mainland China; and (2) Hong Kong, a Special Administrative Region and dependency of the PRC, because of a position taken by one or more authorities in Hong Kong. Furthermore, the PCAOB’s report identified the specific registered public accounting firms which are subject to these determinations. On June 22, 2021, United States Senate passed the Accelerating Holding Foreign Companies Accountable Act. On December 29, 2022, legislation entitled “Consolidated Appropriations Act, 2023” (the “Consolidated Appropriations Act”), was signed into law by President Biden. The Consolidated Appropriations Act contained, among other things, an identical provision to the Accelerating Holding Foreign Companies Accountable Act, which reduces the number of consecutive non-inspection years required for triggering the prohibitions under the HFCA Act from three years, as was formerly required under the HFCA Act before such amendment, to two consecutive years. According to the Consolidated Appropriations Act, any foreign jurisdiction could be the reason why the PCAOB does not have complete access to inspect or investigate a company’s auditor. As it was originally enacted, the HFCA Act applied only if the PCAOB’s inability to inspect or investigate was due to a position taken by an authority in the foreign jurisdiction where the relevant public accounting firm is located. As a result of the Consolidated Appropriations Act, the HFCA Act now also applies if the PCAOB’s inability to inspect or investigate the relevant accounting firm is due to a position taken by an authority in any foreign jurisdiction. The denying jurisdiction does not need to be where the accounting firm is located. As of the date of this annual report, our auditor WWC, P.C., is not on the list published by the PCAOB subject to the determinations as to inability to inspect or investigate completely, as announced by the PCAOB on December 16, 2021, and it is based in the U.S. and is registered with the PCAOB and subject to PCAOB inspection, having its latest inspection completed in 2023. However, recently developments with respect to audits of China-based companies, create uncertainty about the ability of our auditor, to fully cooperate with the PCAOB’s request for audit workpapers without the approval of the Chinese authorities. In the event it is later determined that the PCAOB is unable to inspect or investigate completely the Company’s auditor because of a position taken by an authority in a foreign jurisdiction, then such lack of inspection could cause trading in the Company’s securities to be prohibited under the HFCA Act, and ultimately result in a determination by a securities exchange to delist the Company’s securities. The delisting of our Ordinary Shares, or the threat of their being delisted, may materially and adversely affect the value of your investment, even making it worthless. On August 26, 2022, the CSRC, the Ministry of Finance of the PRC (the “MOF”), and the PCAOB signed a Statement of Protocol (the “Protocol”), which sets out specific arrangements on conducting inspections and investigations over relevant audit firms within the jurisdiction of the PRC and the U.S, including the audit firms based in mainland China and Hong Kong, taking the first step toward opening access for the PCAOB to inspect and investigate registered public accounting firms headquartered in mainland China and Hong Kong. On December 15, 2022, the PCAOB Board determined that the PCAOB was able to secure complete access to inspect and investigate registered public accounting firms headquartered in mainland China and Hong Kong and voted to vacate its previous determinations to the contrary. However, should PRC authorities obstruct or otherwise fail to facilitate the PCAOB’s access in the future, the PCAOB Board will consider the need to issue a new determination. Notwithstanding the foregoing, in the event it is later determined that the PCAOB is unable to inspect or investigate completely our auditor, then such lack of inspection could cause our securities to be delisted from the stock exchange. See “Item 3. Key Information—D. Risk Factors—Risks Related to Doing Business in China—Our Ordinary Shares may be delisted under the Holding Foreign Companies Accountable Act if the PCAOB is unable to inspect our auditors. The delisting of our Ordinary Shares, or the threat of their being delisted, may materially and adversely affect the value of your investment. Furthermore, on June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act, and on December 29, 2022, the Consolidated Appropriations Act was signed into law by President Biden. The Consolidated Appropriations Act contained, among other things, an identical provision to the Accelerating Holding Foreign Companies Accountable Act, which reduces the number of consecutive non-inspection years required for triggering the prohibitions under the HFCA Act from three years to two.” on page 40.

As a holding company, we may rely on dividends and other distributions on equity paid by the PRC subsidiaries for our cash and financing requirements. If any of the PRC subsidiaries incur debt on its own behalf in the future, the instruments governing such debt may restrict their ability to pay dividends to us. Subject to certain contractual, legal, and regulatory restrictions, and our internal cash management policy, cash and capital contributions may be transferred among our Cayman Islands holding company and our subsidiaries. If needed, our Cayman Islands holding company can transfer cash to the PRC subsidiaries through loans and/or capital contributions, and the PRC subsidiaries can transfer cash to our Cayman Islands holding company through issuing dividends or other distributions. Our finance department supervises cash management, following the instructions of our management. Our finance department is responsible for establishing our cash operation plan and coordinating cash management matters among our subsidiaries and departments. Each subsidiary or department initiates a cash request by putting forward a cash demand plan, which explains the specific amount and timing of cash requested and submitting it to our finance department. The finance department reviews the cash demand plan and prepares a summary for the management of our Company. Management examines and approves the allocation of cash based on the sources of cash and the priorities of the needs. Other than the above, we currently do not have other cash management policies or procedures that dictate how funds are transferred. As of the date of this annual report, none of the PRC subsidiaries have made any dividends or other distributions of earnings to the Company or any U.S. investors. As of the date of this annual report, the Company has transferred the net proceeds in the amount of $7,373,839 from our IPO through Work BVI to Work Medical Technology, from such amount, $5,404,654 of the net proceeds remained available after reimbursing PRC subsidiaries for expenses advanced from them in connection with the IPO. In the fiscal year ended September 30, 2023, and 2022, there was no cash transferred from the Cayman Islands holding company to its PRC subsidiaries. Funds also transferred among five PRC subsidiaries, Hangzhou Shanyou, Hangzhou Hanshi, Hangzhou Woli, Shanghai Saitumofei, and Work Hangzhou for operational purposes. The aggregate principal amounts of funds transferred among the PRC subsidiaries were $2,459,263, $8,262,606, and $84,234 for the fiscal years ended September 30, 2024, 2023, and 2022, respectively. As of the date of this annual report, there have been no other transfers or distributions made or dividends paid among the Company and its subsidiaries, except as described above. In the future, cash proceeds raised from overseas financing activities, including subsequent securities offerings, may be transferred by us to the PRC subsidiaries via capital contribution or shareholder loans, as the case may be. See also “Item 8. Financial Information—A. Consolidated Statements and Other Financial Information—Dividend Policy” and our audited consolidated financial statements for the fiscal years ended September 30, 2024 and 2023.

Cash transfers from our Cayman Islands holding company are subject to applicable PRC laws and regulations on loans and direct investment. We may rely on dividends from our subsidiaries in China for our cash requirements, including any payment of dividends to our shareholders. PRC regulations may restrict the ability of our PRC subsidiaries to pay dividends to us, and as a holding company, we will be dependent on receipt of funds from our Hong Kong subsidiary, Work Medical Technology. Current PRC regulations permit our indirect PRC subsidiaries to pay dividends to Work Medical Technology only out of their respective accumulated profits, if any, determined in accordance with Chinese accounting standards and regulations. In addition, each of our subsidiaries in China is required to set aside at least 10% of its after-tax profits each year, if any, to fund a statutory reserve until such reserve reaches 50% of its registered capital. Each of such entity in China is also required to further set aside a portion of its after-tax profits to fund the employee welfare fund, although the amount to be set aside, if any, is determined at the discretion of its board of directors. Although the statutory reserves can be used, among other ways, to increase the registered capital and eliminate future losses in excess of retained earnings of the respective companies, the reserve funds are not distributable as cash dividends except in the event of liquidation.

The PRC government also imposes controls on the conversion of RMB into foreign currencies and the remittance of currencies out of the PRC. Therefore, we may experience difficulties in complying with the administrative requirements necessary to obtain and remit foreign currency for the payment of dividends from our profits, if any. Furthermore, if our subsidiaries and affiliates in the PRC incur debt on their own in the future, the instruments governing the debt may restrict their ability to pay dividends or make other payments. If we or our subsidiaries are unable to receive all of the revenue from our or their operations, we may be unable to pay dividends on our Ordinary Shares.

Cash dividends, if any, on our Ordinary Shares will be paid in U.S. dollars. Work Medical Technology may be considered a non-resident enterprise for tax purposes, so that any dividends our PRC subsidiaries pay to Work Medical Technology may be regarded as China-sourced income and as a result may be subject to PRC withholding tax at a rate of up to 10%. See “Item 10. Additional Information—E. Taxation—People’s Republic of China Taxation.”

In order for us to pay dividends to our shareholders, we will rely on payments made from Work Hangzhou and its subsidiaries to WFOE and from WFOE to Work Medical Technology, and then to our Company. According to the EIT Law, such payments from subsidiaries to parent companies in China are subject to the PRC enterprise income tax at a rate of 25%. In addition, if Work Age or its subsidiaries or branches incur debt on their own behalf in the future, the instruments governing the debt may restrict its ability to pay dividends or make other distributions to us.

Pursuant to the Double Tax Avoidance Arrangement, the 10% withholding tax rate may be lowered to 5% if a Hong Kong resident enterprise owns no less than 25% of a PRC project. The 5% withholding tax rate, however, does not automatically apply and certain requirements must be satisfied, including without limitation that (a) the Hong Kong project must be the beneficial owner of the relevant dividends; and (b) the Hong Kong project must directly hold no less than 25% share ownership in the PRC project during the 12 consecutive months preceding its receipt of the dividends. In current practice, a Hong Kong project must obtain a tax resident certificate from the Hong Kong tax authority to apply for the 5% lower PRC withholding tax rate. As the Hong Kong tax authority will issue such a tax resident certificate on a case-by-case basis, we cannot assure you that we will be able to obtain the tax resident certificate from the relevant Hong Kong tax authority and enjoy the preferential withholding tax rate of 5% under the Double Taxation Arrangement with respect to any dividends paid by our PRC subsidiaries to its immediate holding company, Work Medical Technology. As of the date of this annual report, we have not applied for the tax resident certificate from the relevant Hong Kong tax authority. Work Medical Technology intends to apply for the tax resident certificate if and when Work Age plans to declare and pay dividends to Work Medical Technology.

To the extent cash is located in the PRC or within a PRC domiciled entity and may need to be used to fund operations outside of the PRC, the funds may not be available due to limitations placed on us and our subsidiaries by the PRC government. To the extent cash in and assets of the business is in the PRC or a PRC entity, the funds and assets may not be available to fund operations or for other use outside of the PRC due to interventions in or the imposition of restrictions and limitations on the ability of us or our subsidiaries by the PRC government to transfer cash and assets.

A. [Reserved]

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

Summary of Risk Factors

Investing in our securities involves significant risks. You should carefully consider all of the information in this annual report before investing in our securities. Below is a summary of the principal risks we face. These risks are discussed more fully under “Item 3. Key Information—D. Risk Factors.”

Risks Related to the PRC Subsidiaries’ Business and Industry (for a more detailed discussion, see “Item 3. Key Information — D. Risk Factors — Risks Related to the PRC Subsidiaries’ Business and Industry”)

Risks and uncertainties related to the PRC Subsidiaries’ business and industry include, but are not limited to, the following:

| | ● | The PRC subsidiaries’ operating history may not be indicative of our future growth or financial results and the PRC subsidiaries may not be able to sustain their historical growth rates. |

| | ● | Failure to maintain the quality and safety of the PRC subsidiaries’ products could have a material and adverse effect on the PRC subsidiaries’ and our reputation, financial condition and results of operations. |

| | ● | The PRC subsidiaries may experience significant liability claims or complaints from customers, doctors and patients, litigation and regulatory investigations and proceedings, such as claiming in relation to medical device safety, or adverse publicity involving their products, which could adversely affect the PRC subsidiaries’ and our financial condition and results of operations. |

| | ● | The decreased demand for masks and in the unit price of masks could reduce our revenue, which could adversely affect the PRC subsidiaries’ and our results of operations. |

| | ● | The PRC subsidiaries face the risk of fluctuations in the cost, availability and quality of their raw materials, which could adversely affect their results of operations, and thus, adversely affect the Group as a whole. |

| | ● | A significant interruption in the operations of the PRC subsidiaries’ third-party suppliers and other business partners could potentially disrupt their operations. |

| | ● | The PRC subsidiaries do not have long term contracts with their suppliers and the suppliers can reduce order quantities or terminate sales to the PRC subsidiaries at any time. |

| | ● | Overall tightening of the labor market, increases in labor costs or any possible labor unrest may adversely affect the PRC subsidiaries’ business and results of operations, which may also adversely affect the Group as a whole. |

| | | |

| | ● | The PRC subsidiaries’ industry is intensely competitive. The PRC subsidiaries may face competition from, and they may be unable to compete successfully against, new entrants and established companies with greater resources. |

| | ● | The continuing development of the PRC subsidiaries’ products depends upon the PRC subsidiaries’ maintaining strong working relationships with their customers, distributors and sales agents. |

| | ● | Technological changes may adversely affect sales of the PRC subsidiaries’ products and may cause their products to become obsolete. |

| | ● | Consolidation in the medical device industry could have an adverse effect on the PRC subsidiaries’ revenue and results of operations. |

| | ● | If the PRC subsidiaries fail to identify, acquire and develop other products, they may be unable to grow their business. |

| | ● | If the PRC subsidiaries are not able to implement their strategies to achieve their business objectives, their business operations and financial performance will be adversely affected. |

| | ● | If the PRC subsidiaries fail to adopt new technologies to meet evolving customer needs or emerging industry standards, their business may be materially and adversely affected. |

| | ● | If the PRC subsidiaries sell medical devices to non-profit medical institutions through public bid invitation, their sales prices will be limited based on the results of the bidding. |

| | ● | Changes to the PRC subsidiaries’ payment terms with both customers and suppliers may materially and adversely affect their operating cash flows. |

| | ● | Our success depends on our management team and other key personnel, the loss of any of whom could disrupt our operations. |

| | ● | The PRC subsidiaries may not be able to adequately protect and maintain their intellectual property. |

| | ● | The PRC subsidiaries’ introduction of new technologies and products may increase the likelihood that third parties will assert claims that the PRC subsidiaries’ products infringe upon their proprietary rights. |

| | ● | The PRC subsidiaries may not be able to prevent others from unauthorized use of their intellectual property, which could harm their business and competitive position and adversely affect the Group as a whole. |

| | ● | Economic recessions could have a significant, adverse impact on the PRC subsidiaries’ business. |

| | ● | Changes in U.S. and international trade policies, particularly with regard to China, may adversely impact the PRC subsidiaries’ business and operating results, which may adversely affect the Group as a whole. |

| | ● | The PRC subsidiaries do not have any product liability, business interruption, or property insurance and they may incur liabilities that are not covered by insurance, which could expose them to significant costs and business disruption. |

| | ● | If we do not obtain substantial additional financing, our ability to execute on our business plan as outlined in this annual report will be impaired. |

| | ● | Pandemics and epidemics, natural disasters, terrorist activities, political unrest, and other outbreaks could disrupt the PRC subsidiaries’ delivery and operations, which could materially and adversely affect the PRC subsidiaries’ and our business, financial condition, and results of operations. |

| | ● | The PRC subsidiaries’ international sales are subject to a variety of risks that could adversely affect their profitability and operating results, which may adversely affect the profitability and operating results of the Group. |

| | ● | The PRC subsidiaries are subject to a variety of environmental laws that could be costly for them to comply with, and they could incur liability if they fail to comply with such laws or if they are responsible for releases of contaminants to the environment, which could adversely affect the Group as a whole. |

| | ● | The PRC subsidiaries are subject to a variety of fire protection laws that could be costly for them to comply with, and they could incur liability if they fail to comply with such laws, which could adversely affect the Group as a whole. |

| | ● | The PRC subsidiaries are subject to a variety of construction laws, and they could incur liability if they fail to comply with such laws, which could adversely affect their operations. |

| | ● | The PRC subsidiaries’ rights to use their leased driveways, warehouses, and a parking area could be challenged by governmental authorities, due to the lessor’s failure to obtain the property ownership certificate as required by law, and their rights to use the leased collectively managed construction land could be challenged by governmental authorities, due to the lessor’s failure to comply with legal procedures related to land lease. Failure to comply with administrative or regulatory requirements with respect to property leased by the PRC subsidiaries may disrupt their usage and occupancy rights and could result in penalties and dispossession from such properties, which may disrupt their operations. |

| | ● | If the PRC subsidiaries fail to timely renew their medical device licenses or registration certificates, it could adversely affect the PRC subsidiaries’ and our reputation, financial condition and results of operations. |

| | ● | The PRC subsidiaries have entered into a number of related party transactions in the ordinary course of their business, and may continue to enter into related party transactions in the future. |

| | ● | If our PRC subsidiaries cannot collect timely payments from their customers, their business and operations, and the Group’s financial condition and results of operations may be materially and adversely affected. |

| | ● | Our PRC subsidiaries rely in part on third-party distributors to place their products into the market and they may not be able to control their distributors. |

| | ● | Our success will be dependent upon our PRC subsidiaries’ ability to maintain relationships with existing suppliers who are critical and necessary to the production of our PRC subsidiaries’ products and our PRC subsidiaries’ ability to create relationships with new suppliers. |

Risks Related to Doing Business in China (for a more detailed discussion, see “Item 3. Key Information—D. Risk Factors — Risks Related to Doing Business in China”)

We face risks and uncertainties relating to doing business in the PRC in general, including, but not limited to, the following:

| | ● | Changes in the political and economic policies of the PRC government or in relations between China and the United States may materially and adversely affect the PRC subsidiaries’ and our business, financial condition and results of operations and may result in the PRC subsidiaries’ inability to sustain their growth and expansion strategies. |

| | ● | There are uncertainties regarding the interpretation and enforcement of PRC laws, rules and regulations. |

| | ● | The PRC government exerts substantial influence over the manner in which the PRC subsidiaries conduct their business activities. The PRC government may also intervene or influence the PRC subsidiaries’ operations and subsequent securities offerings at any time, which could result in a material change in the PRC subsidiaries’ operations and our Ordinary Shares could significantly decline in value or become worthless. |

| | ● | Additional compliance procedures may be required in connection with our subsequent securities offerings, due to the promulgation of the new filing-based administrative rules for overseas offering and listing by domestic companies in China, which could significantly limit or completely hinder our ability to offer or continue to offer our Ordinary Shares to investors and could cause the value of our Ordinary Shares to significantly decline or become worthless. |

| | ● | You may experience difficulties in effecting service of legal process, enforcing foreign judgments or bringing actions in China against us or our directors and officers named in the annual report based on foreign laws. |

| | ● | You may incur additional costs and face procedural obstacles in effecting service of legal process, enforcing foreign judgments or bringing actions in Hong Kong against us or our management named in this annual report based on Hong Kong laws. |

| | ● | Any requirement to obtain prior approval under the M&A Rules and/or any other regulations promulgated by relevant PRC regulatory agencies in the future could delay our securities offerings and failure to obtain any such approvals, if required, could have a material adverse effect on the PRC subsidiaries’ and our business, operating results and reputation, as well as the trading price of our Ordinary Shares, and could also create uncertainties for our securities offerings and affect our ability to offer or continue to offer securities to investors outside China. |

| | ● | PRC regulations regarding acquisitions impose significant regulatory approval and review requirements, which could make it more difficult for the PRC subsidiaries to pursue growth through acquisitions. |

| | ● | PRC regulations relating to investments in offshore companies by PRC residents may subject our PRC-resident beneficial owners or the PRC subsidiaries to liability or penalties, limit our ability to inject capital into the PRC subsidiaries or limit the PRC subsidiaries’ ability to increase their registered capital or distribute profits. |

| | ● | PRC regulations relating to investments in offshore companies by PRC residents may subject our PRC-resident beneficial owners or the PRC subsidiaries to liability or penalties, limit our ability to inject capital into the PRC subsidiaries or limit the PRC subsidiaries’ ability to increase their registered capital or distribute profits. |

| | ● | PRC regulation of loans to and direct investment in PRC entities by offshore holding companies and governmental control of currency conversion may delay us from using the proceeds of our IPO and subsequent securities offerings to make loans or additional capital contributions to the PRC subsidiaries, which could materially and adversely affect our liquidity and our ability to fund and expand the PRC subsidiaries’ business. |

| | ● | We rely to a significant extent on dividends and other distributions on equity paid by our subsidiaries to fund offshore cash and financing requirements and any limitation on the ability of the PRC subsidiaries to make remittance to pay dividends to us could limit our ability to access cash generated by the operations of those entities. |

| | ● | We may be treated as a resident enterprise for PRC tax purposes under the PRC Enterprise Income Tax Law, and we may therefore be subject to PRC income tax on our global income. |

| | ● | Dividends payable to our foreign investors and gains on the sale of our Ordinary Shares by our foreign investors may be subject to PRC tax. |

| | ● | We and our shareholders face uncertainties with respect to indirect transfers of equity interests in PRC resident enterprises by their non-PRC holding companies. |

| | ● | Restrictions on currency exchange may limit our ability to utilize our revenue effectively. |

| | ● | Fluctuations in exchange rates could result in foreign currency exchange losses to us and may reduce the value of, and amount in U.S. Dollars of dividends payable on, our shares in foreign currency terms. |

| | ● | Failure to make adequate contributions to various employee benefit plans and withhold individual income tax on employees’ salaries as required by PRC regulations may subject the PRC subsidiaries to penalties. |

| | ● | Our Ordinary Shares may be delisted under the Holding Foreign Companies Accountable Act if the PCAOB is unable to inspect our auditors. The delisting of our Ordinary Shares, or the threat of their being delisted, may materially and adversely affect the value of your investment. Furthermore, on June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act, and on December 29, 2022, the Consolidated Appropriations Act was signed into law by President Biden. The Consolidated Appropriations Act contained, among other things, an identical provision to the Accelerating Holding Foreign Companies Accountable Act, which reduces the number of consecutive non-inspection years required for triggering the prohibitions under the HFCA Act from three years to two. |

| | ● | The enactment of Law of the PRC on Safeguarding National Security in the Hong Kong Special Administrative Region and Hong Kong Autonomy Act of U.S. could impact our Hong Kong holding subsidiary. |

Risks Relating to Our Ordinary Shares and the Trading Market (for a more detailed discussion, see “Item 3. Key Information—D. Risk Factors—Risks Relating to Our Ordinary Shares and the Trading Market”)

In addition to the risks described above, we are subject to general risks and uncertainties relating to our Ordinary Shares and the trading market, including, but not limited to, the following:

| | ● | Our share price may be volatile and could decline substantially, which could result in substantial losses to our investors. |

| | | |

| | ● | We may issue additional Ordinary Shares or other equity securities without your approval, which would dilute your ownership interests and may depress the market price of our Ordinary Shares. |

| | ● | We currently do not expect to pay dividends on our Ordinary Shares in the foreseeable future. |

| | ● | If securities or industry analysts do not publish research or publish inaccurate or unfavorable research about us or our business, our Ordinary Share price and trading volume could decline. |

| | ● | Our Chief Operating Officer and Liwei Zhang have substantial influence over our Company. Their interests may not be aligned with the interests of our other shareholders, and they could prevent or cause a change of control or other transactions. |

| | ● | A sale or perceived sale of a substantial number of our Ordinary Shares may cause the price of our Ordinary Shares to decline. |

| | ● | We incur substantial increased costs being a public company. |

| | ● | There can be no assurance that we will not be a passive foreign investment company (“PFIC”) for United States federal income tax purposes for any taxable year, which could subject United States holders of our Ordinary Shares could be subject to adverse United States federal income tax consequences. |

| | ● | For as long as we are an emerging growth company, we will not be required to comply with certain reporting requirements, including those relating to accounting standards and disclosure about our executive compensation, that apply to other public companies. |

| | ● | Our ability to produce accurate financial statements have been materially adversely affected by our failure to establish proper internal financial reporting controls. If we fail to establish and maintain proper internal financial reporting controls in a reasonably timely manner, our ability to produce accurate financial statements or comply with applicable regulations may continue to be impaired. |

| | ● | As a foreign private issuer, we are not subject to certain U.S. securities law disclosure requirements that apply to a domestic U.S. issuer, which may limit the information publicly available to our shareholders. |

| | ● | As a foreign private issuer, we are permitted to adopt certain home country practices in relation to corporate governance matters that differ significantly from the Nasdaq listing standards. These practices may afford less protection to shareholders than they would enjoy if we complied fully with corporate governance listing standards. |

| | ● | We may lose our foreign private issuer status in the future, which could result in significant additional costs and expenses. |

| | ● | The laws of the Cayman Islands may not provide our shareholders with benefits comparable to those provided to shareholders of corporations incorporated in the United States. |

| | ● | You may be unable to present certain proposals before annual general meetings or extraordinary general meetings not called by shareholders. |

| | ● | The obligation to disclose information publicly may put us at a disadvantage to competitors that are private companies. |

| | ● | Our shareholders may be held liable for claims by third parties against us to the extent of distributions received by them upon redemption of their shares. |

| | ● | Our board of directors may decline to register transfers of Ordinary Shares in certain circumstances. Certain provisions in our amended and restated articles of association may discourage, delay, or prevent a change in control. |

Risks Related to the PRC Subsidiaries’ Business and Industry

The PRC subsidiaries’ operating history may not be indicative of our future growth or financial results and the PRC subsidiaries may not be able to sustain their historical growth rates.

The PRC subsidiaries’ operating history may not be indicative of their future growth or financial results. There is no assurance that the PRC subsidiaries will be able to grow their revenue in future periods. Their growth rates may decline for any number of possible reasons, and some of them are beyond their control, including decreasing customer demand, increasing competition, declining growth of the medical device industry in general, emergence of alternative business models, or changes in government policies or general economic conditions. The PRC subsidiaries expect to continue to expand their sales network and product offerings to bring greater convenience to their customers and to increase their customer base and number of transactions. However, the execution of their expansion plan is subject to uncertainty and the total number of items sold and number of transacting customers may not grow at the rate they expect for the reasons stated above. If their growth rates decline, investors’ perceptions of their business and prospects may be adversely affected and the market price of our Ordinary Shares could decline.

Failure to maintain the quality and safety of the PRC subsidiaries’ products could have a material and adverse effect on the PRC subsidiaries’ and our reputation, financial condition and results of operations.

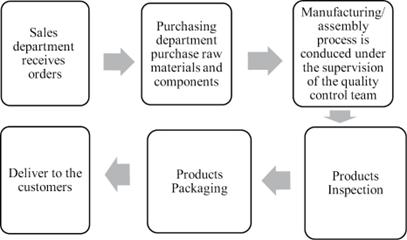

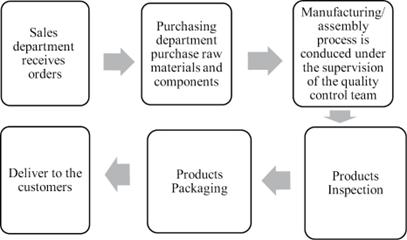

The quality and safety of the PRC subsidiaries’ products, whether self-manufactured or out-sourced, are critical to our success. As a medical device manufacturer with a history of over 20 years, quality and safety are always the core values, as medical devices are directly used for the human body and thus essential to the human health. The PRC subsidiaries pay close attention to quality control, monitoring each step in the process from procurement to production and from warehouse to delivery. Yet, maintaining consistent product quality depends significantly on the effectiveness of their quality control system, which in turn depends on a number of factors, including, but not limited to the design of a quality control system, employee training to ensure that employees adhere to and implement the quality control policies and procedures and the effectiveness of monitoring any potential violation of their quality control policies and procedures. Despite such quality control management system, the PRC subsidiaries cannot eliminate the risks of errors, defects or failures. They may fail to detect or cure defects as a result of a number of factors, many of which are outside their control. Please refer to “Item 4. Information on the Company—B. Business Overview—Quality Control” for more information.

In addition, the quality of the products or services provided by the PRC subsidiaries’ suppliers or business partners is subject to factors beyond the PRC subsidiaries’ control, including the effectiveness and the efficiency of their quality control system, among others. There can be no assurance that the PRC subsidiaries’ suppliers or business partners may always be able to adopt appropriate quality control systems and meet the PRC subsidiaries’ stringent quality control requirements in respect of the products or services they provide. Any failure of suppliers or business partners to provide satisfactory products or services could harm the PRC subsidiaries’ reputation and adversely impact the PRC subsidiaries’ operations. In addition, the PRC subsidiaries may be unable to receive sufficient compensation from suppliers and business partners for the losses caused by them.

As of the date of this annual report, the PRC subsidiaries are unaware of material quality accidents.

The PRC subsidiaries may experience significant liability claims or complaints from customers, doctors and patients, litigation and regulatory investigations and proceedings, such as claiming in relation to medical device safety, or adverse publicity involving their products, which could adversely affect the PRC subsidiaries’ and our financial condition and results of operations.

The PRC subsidiaries face an inherent risk of liability claims or complaints from customers, doctors and patients. The PRC subsidiaries take those complaints and claims seriously and endeavor to reduce such complaints by implementing various remedial measures. Nevertheless, we cannot assure you that they can successfully prevent or address all complaints.

Any complaints or claims against the PRC subsidiaries, even if meritless and unsuccessful, may divert management attention and other resources from the PRC subsidiaries’ business and adversely affect their business and operations. Customers may lose confidence in the PRC subsidiaries and their brands, which may adversely affect their business and results of operations. Furthermore, negative publicity including but not limited to negative online reviews on social media and crowd-sourced review platforms, industry findings or media reports related to medical device quality and safety, public health concerns, illness, injuries, whether or not accurate, and whether or not concerning the PRC subsidiaries’ products, can adversely affect the PRC subsidiaries’ business, results of operations and reputation.

The PRC subsidiaries face potential liability, expenses for legal claims, and harm due to the nature of their business. For example, customers could assert legal claims against them in connection with personal injuries or illness related to the use of medical devices they sell. The PRC government, media outlets and public advocacy groups have been increasingly focused on customer protection in recent years. Selling defective products may expose the PRC subsidiaries to liabilities associated with customer protection laws. The PRC subsidiaries may be responsible for compensation for a customer’s loss even if personal injuries or illness are not caused by them. Thus, they may also be held liable if their suppliers or other business partners fail to comply with applicable product quality and safety related rules and regulations. Though they can ask the responsible parties for indemnity after that, their reputation could still be adversely affected.

The PRC subsidiaries may face additional exposure to claims and lawsuits. These claims could divert management time and attention away from their business and result in significant costs to investigate and defend, regardless of the merits of the claims. In some instances, they may elect or be forced to pay substantial damages if they are unsuccessful in their efforts to defend against these claims, which could harm their business, financial condition, and results of operations. In addition, the PRC subsidiaries’ directors, management and employees may from time to time be subject to litigation and regulatory investigations and proceedings or otherwise face potential liability and expense in relation to medical device quality and safety, commercial, labor, employment, securities or other matters, which could adversely affect their and respective reputations and the Group’s financial condition and results of operations.

Moreover, the PRC subsidiaries’ products may be subject to recall by competent authorities if they fail to comply with certain quality requirements. Recalls may be accompanied by claims or lawsuits for breaches of contract, for the inability to provide products of a certain quality on time, for which the PRC subsidiaries may elect or be forced to pay substantial damages if they are unsuccessful in their efforts to defend against these claims or lawsuits, and thus, could harm their business, and the Group’s financial condition and results of operations.

On November 16, 2020, Hangzhou Shanyou was required to recall 20,000 disposable medical masks by Heilongjiang Provincial Drug Administration, because the mask strings failed to comply with an elastic requirement.

The PRC subsidiaries have not, as of the date of this annual report, been notified that they will be subject to any punishment, nor are they aware of any risk, currently or in the foreseeable future, regarding these recalls by the relevant government authorities, however, there is no assurance that the relevant government authorities will not later determine that a basis does exist for punishment with respect to recalled products.

As of the date of this annual report, the PRC subsidiaries are not aware of any warning, investigations, prosecutions, disputes, claims or other proceedings in respect of customer protection rights or breaches of contract, nor have they been punished or can foresee any punishment to be made by any government authorities of the PRC or any in any overseas jurisdiction. However, there is no assurance that such entities will not find a basis in the future for investigations, prosecutions, disputes, claims or other proceedings with respect to customer protection rights or breaches of contract with respect to the PRC subsidiaries’ products, which could adversely harm their business, and the Group’s financial condition and results of operations.

The decreased demand for masks and in the unit price of masks could reduce our revenue, which could adversely affect the PRC subsidiaries’ and our results of operations.

Since China lifted travel restrictions and quarantine requirements in December 2022, the demand for masks and the sales volume and unit price of masks substantially decreased. With the reduced demand for masks and unit price of masks, our net revenue from sales of masks decreased from $10,619,035, which accounted for approximately 53.87% of our total net revenue, for the fiscal year ended September 30, 2022, to $5,091,331, or approximately 37.53% of our total net revenue, for the fiscal year ended September 30, 2023. Furthermore, our net revenue from sales of masks decreased to $1,559,750, or approximately 13.56% of our total net revenue, for the fiscal year ended September 30, 2024.

While we do not expect this trend to continue in future financial periods, we estimate that the demand and unit price of masks have since stabilized. To mitigate these adverse effects, we have been strengthening our marketing efforts, focusing on medical devices other than masks. Nevertheless, if such trend continues, it could further reduce our revenue from sales of masks, thereby decreasing our total revenue, which could adversely affect the PRC subsidiaries’, the Group’s financial condition and our results of operations.

The PRC subsidiaries face the risk of fluctuations in the cost, availability and quality of their raw materials, which could adversely affect their results of operations, and thus, adversely affect the Group as a whole.

The cost, availability and quality of the PRC subsidiaries’ principal raw materials, such as meltblown, non-woven fabrics, steel spring, OPP membrane, and methyl silicone oil, are important to their operations. If the cost of raw materials increases due to policy changes, large market price fluctuation or any other reason, the business and results of operations of the PRC subsidiaries could be adversely affected, as well as the Group’s financial condition and results of operations.

Lack of availability of raw materials, whether due to shortages in supply, delays or interruptions in processing, failure of timely delivery or otherwise, could interrupt the PRC subsidiaries’ operations and adversely affect their financial results, which could adversely affect the Group as a whole.

Defective raw materials could subject the PRC subsidiaries to product liability claims or legal actions, which could adversely affect their and the Group’s financial condition and results of operations.

A significant interruption in the operations of the PRC subsidiaries’ third-party suppliers and other business partners could potentially disrupt their operations.

The PRC subsidiaries have limited control over the operations of their third-party suppliers and other business partners and any significant interruption in their operations may have an adverse impact on the PRC subsidiaries’ operations. For example, a significant interruption in the operations of their supplier’s manufacturing facilities could cause delay or termination of shipment of the raw materials to them, which may cause delay or termination of shipment of ordered products to their customers, resulting in damage to their customer relationships. If the PRC subsidiaries are unable to adequately address the impact of the interruptions of operations of their third-party suppliers, their business operations and financial results may be materially and adversely affected, and the Group’s financial condition and results of operations may be materially and adversely affected accordingly.

Although the PRC subsidiaries believe that they could establish alternate sources from other suppliers for most of their raw materials, any delay in locating and establishing relationships with other sources could result in shortages or back orders for such raw materials. There can be no assurance that such replacement suppliers will provide the raw materials that are needed by the PRC subsidiaries in the quantities that they request or at the prices that they are willing to pay. Any shortage in quantities or increase in prices could adversely affect the PRC subsidiaries’ and the Group’s financial condition and results of operations.