partially offset by proceeds from principal payments of $22.8 million. During the same period, cash provided by financing activities was $1,205.7 million, primarily driven by borrowings on debt of $1,117.4 million and proceeds from the issuance of common shares of $650.3 million, that were partially offset by repayments of debt of $544.3 million and distributions paid of $7.9 million.

As of September 30, 2023, we had cash and cash equivalents of $35.0 million. In addition, as of September 30, 2023, we had foreign currencies of $0.9 million and restricted cash and cash equivalents of $14.8 million. Cash and cash equivalents and foreign currencies are available to fund new investments, pay operating expenses and pay distributions. Restricted cash and cash equivalents can be used to pay principal and interest on borrowings and to fund new investments that meet the guidelines under our debt securitizations or credit facilities, as applicable.

As of June 30, 2023, the CLO Vehicle had restricted cash and cash equivalents of $4.9 million. Cash and cash equivalents and foreign currencies are available to fund new investments, pay operating expenses and pay distributions. Restricted cash and cash equivalents can be used to pay principal and interest on borrowings and to fund new investments that meet the guidelines under our debt securitizations or credit facilities, as applicable.

Net Worth of Sponsors

The NASAA, in its Omnibus Guidelines Statement of Policy adopted on March 29, 1992 and as amended on May 7, 2007 and from time to time (the “Omnibus Guidelines”), requires that our affiliates and Investment Adviser, or our Sponsor as defined under the Omnibus Guidelines, have an aggregate financial net worth, exclusive of home, automobiles and home furnishings, of the greater of either $100,000, or 5.0% of the first $20 million of both the gross amount of securities currently being offered in this offering and the gross amount of any originally issued direct participation program securities sold by our affiliates and sponsors within the past 12 months, plus 1.0% of all amounts in excess of the first $20 million. In accordance with these requirements, our Investment Adviser and its affiliates, while not liable directly or indirectly for any indebtedness we may incur, have an aggregate financial net worth in excess of those amounts required by the Omnibus Guidelines. The Investment Adviser or one of its affiliates manages other business development companies, including GBDC, whose financial statements and other information can be found at www.sec.gov.

Revolving Debt Facilities

SMBC Credit Facility: On September 6, 2023, we entered into the SMBC Credit Facility, which, as of September 30, 2023, allowed us to borrow up to $490.0 million at any one time outstanding, subject to leverage and borrowing base restrictions. As of September 30, 2023, we had outstanding debt under the SMBC Credit Facility of $176.8 million. As of September 30, 2023, subject to leverage and borrowing base restrictions, we had $313.2 million of remaining commitments and $242.7 million of availability on the SMBC Credit Facility. On December 15, 2023, we entered into an agreement with Manufacturers & Traders Trust Company pursuant to which, through the accordion feature in the SMBC Credit Facility, the aggregate commitments under the SMBC Credit Facility increased from $490.0 million to $565.0 million.

Adviser Revolver: On July 3, 2023, we entered into the Adviser Revolver with GC Advisors. As of September 30, 2023, we were permitted to borrow up to $50.0 million at any one time outstanding under the Adviser Revolver. We entered into the Adviser Revolver in order to have the ability to borrow funds on a short-term basis and generally intend to repay borrowings under the Adviser Revolver within 30 to 45 days from which they are drawn. As of September 30, 2023, we had no amounts outstanding under the Adviser Revolver. On December 19, 2023, the Fund and the Investment Adviser amended the Adviser Revolver to increase the borrowing capacity under the Adviser Revolver from $50.0 million to $100.0 million.

Debt Securitizations

2023 Debt Securitization: On September 21, 2023, we completed the 2023 Debt Securitization. The Class A-1 Notes are included in the September 30, 2023 Consolidated Statement of Financial Condition as our debt and the Class A-2 Notes and Subordinated 2023 Notes were eliminated in consolidation. As of September 30, 2023, we had outstanding debt under the 2023 Debt Securitization of $395.5 million.

Asset Coverage, Contractual Obligations, Off-Balance Sheet Arrangements and Other Liquidity Considerations

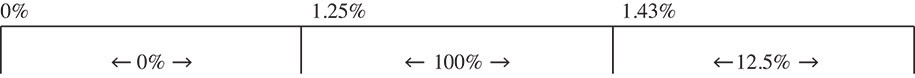

In accordance with the 1940 Act, with certain limited exceptions, we are currently allowed to borrow amounts such that our asset coverage, as defined in the 1940 Act, is at least 150% after such borrowing. On May 17, 2023, our sole shareholder approved the application of the reduced asset coverage requirements of Section 61(a)(2) of the 1940 Act and declined an offer by us to repurchase