GCP SG Warehouse 2022-1 Financial Statements June 30, 2023 Exhibit 99.1

Table of Contents Report of Independent Auditors 1 Financial Statements Statement of Financial Condition as of June 30, 2023 3 Statement of Operations for the period from June 8, 2023 (commencement of operations) to June 30, 2023 4 Statement of Changes in Net Assets for the period from June 8, 2023 (commencement of operations) to June 30, 2023 5 Statement of Cash Flows for the period from June 8, 2023 (commencement of operations) to June 30, 2023 6 Schedule of Investments as of June 30, 2023 7 Notes to Financial Statements 12

1 Report of Independent Auditors The Investment Manager GCP SG Warehouse 2022-1 Opinion We have audited the financial statements of GCP SG Warehouse 2022-1 (the “Fund”), which comprise the statement of financial condition, including the schedule of investments, as of June 30, 2023, and the related statements of operations, changes in net assets and cash flows for the period from June 8, 2023 (commencement of operations) to June 30, 2023, and the related notes (collectively referred to as the “financial statements”). In our opinion, the accompanying financial statements present fairly, in all material respects, the financial position of the Fund at June 30, 2023, and the results of its operations, changes in its net assets and its cash flows for the period from June 8, 2023 (commencement of operations) to June 30, 2023 in accordance with accounting principles generally accepted in the United States of America. Basis for Opinion We conducted our audit in accordance with auditing standards generally accepted in the United States of America (GAAS). Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Financial Statements section of our report. We are required to be independent of the Fund and to meet our other ethical responsibilities in accordance with the relevant ethical requirements relating to our audit. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. Responsibilities of Management for the Financial Statements Management is responsible for the preparation and fair presentation of the financial statements in accordance with accounting principles generally accepted in the United States of America, and for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free of material misstatement, whether due to fraud or error. In preparing the financial statements, management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about the Fund’s ability to continue as a going concern for one year after the date that the financial statements are available to be issued.

2 Auditor’s Responsibilities for the Audit of the Financial Statements Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free of material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not a guarantee that an audit conducted in accordance with GAAS will always detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements are considered material if there is a substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a reasonable user based on the financial statements. In performing an audit in accordance with GAAS, we: Exercise professional judgment and maintain professional skepticism throughout the audit. Identify and assess the risks of material misstatement of the financial statements, whether due to fraud or error, and design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control. Accordingly, no such opinion is expressed. Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluate the overall presentation of the financial statements. Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about the Fund’s ability to continue as a going concern for a reasonable period of time. We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings, and certain internal control-related matters that we identified during the audit. September 6, 2023

Assets Investments at fair value (amortized cost of $935,568,081) $ 935,310,172 Restricted cash and cash equivalents 4,926,970 Interest receivable 2,656,001 Other assets 505,685 Total Assets $ 943,398,828 Liabilities and Net Assets Liabilities Debt $ 498,641,492 Less deferred debt issuance costs (1,580,000) Debt less deferred debt issuance costs 497,061,492 Interest payable 2,489,584 Other payables 1,580,000 Total Liabilities 501,131,076 Net Assets Net Assets 442,267,752 Total Liabilities and Net Assets $ 943,398,828 See Notes to Financial Statements GCP SG Warehouse 2022-1 Statement of Financial Condition June 30, 2023 3

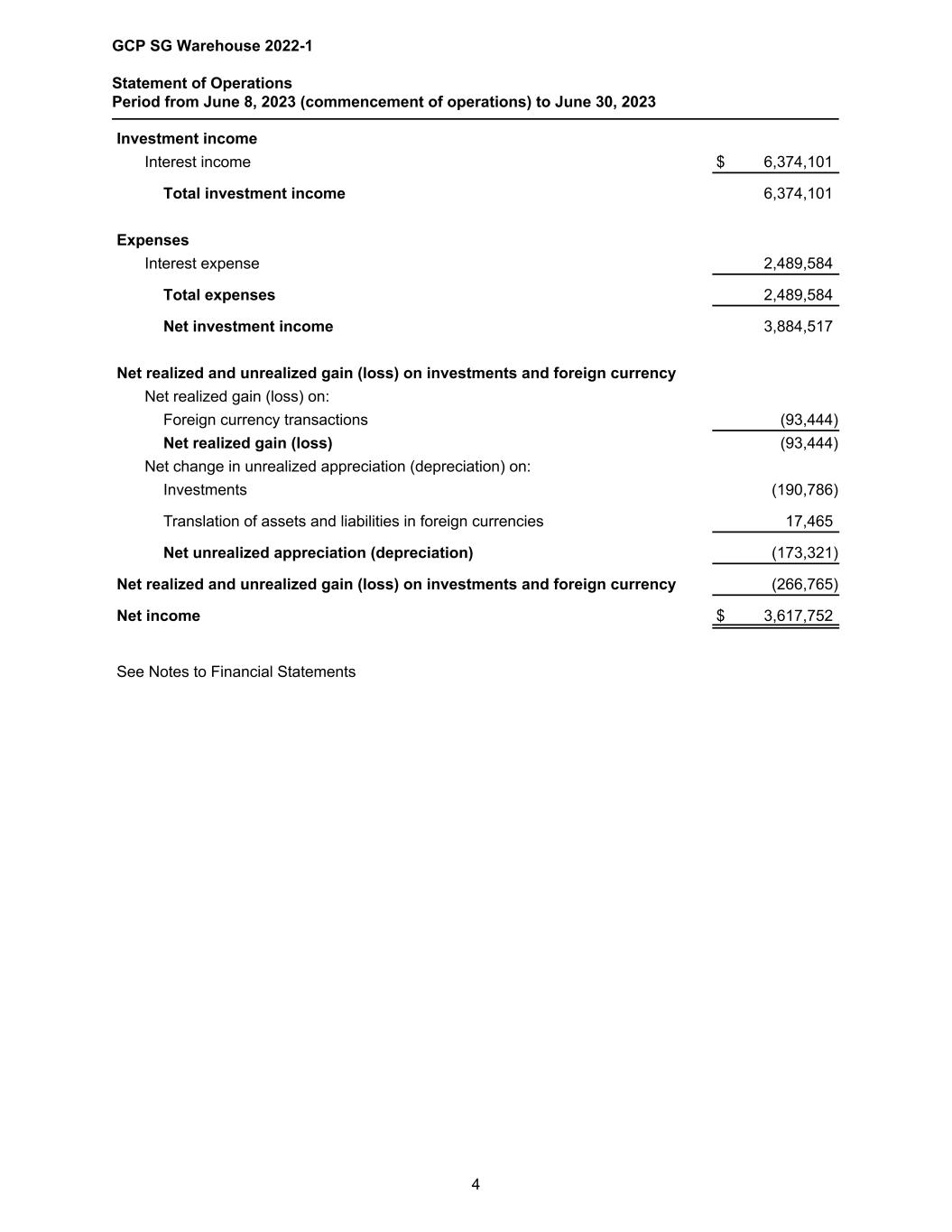

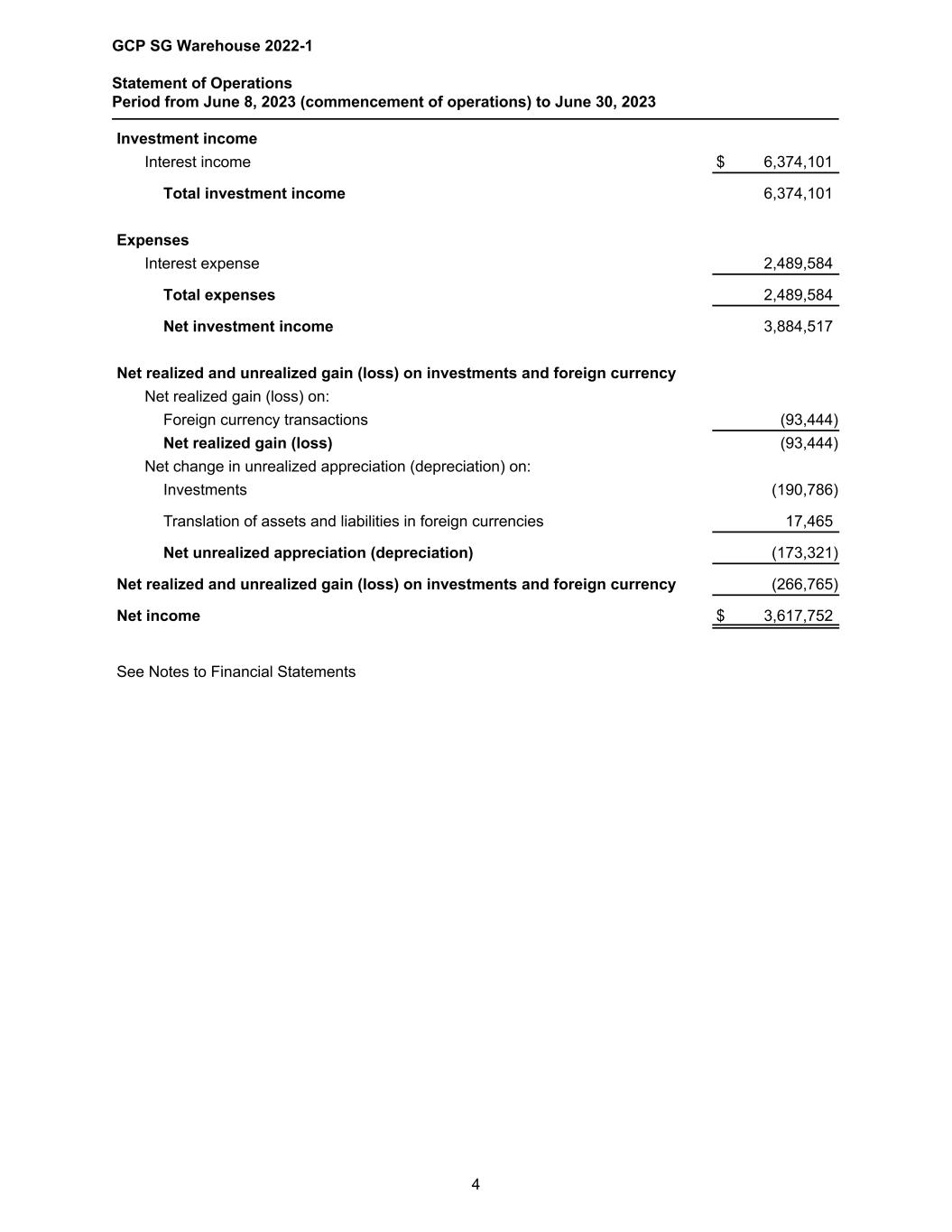

Investment income Interest income $ 6,374,101 Total investment income 6,374,101 Expenses Interest expense 2,489,584 Total expenses 2,489,584 Net investment income 3,884,517 Net realized and unrealized gain (loss) on investments and foreign currency Net realized gain (loss) on: Foreign currency transactions (93,444) Net realized gain (loss) (93,444) Net change in unrealized appreciation (depreciation) on: Investments (190,786) Translation of assets and liabilities in foreign currencies 17,465 Net unrealized appreciation (depreciation) (173,321) Net realized and unrealized gain (loss) on investments and foreign currency (266,765) Net income $ 3,617,752 See Notes to Financial Statements GCP SG Warehouse 2022-1 Statement of Operations Period from June 8, 2023 (commencement of operations) to June 30, 2023 4

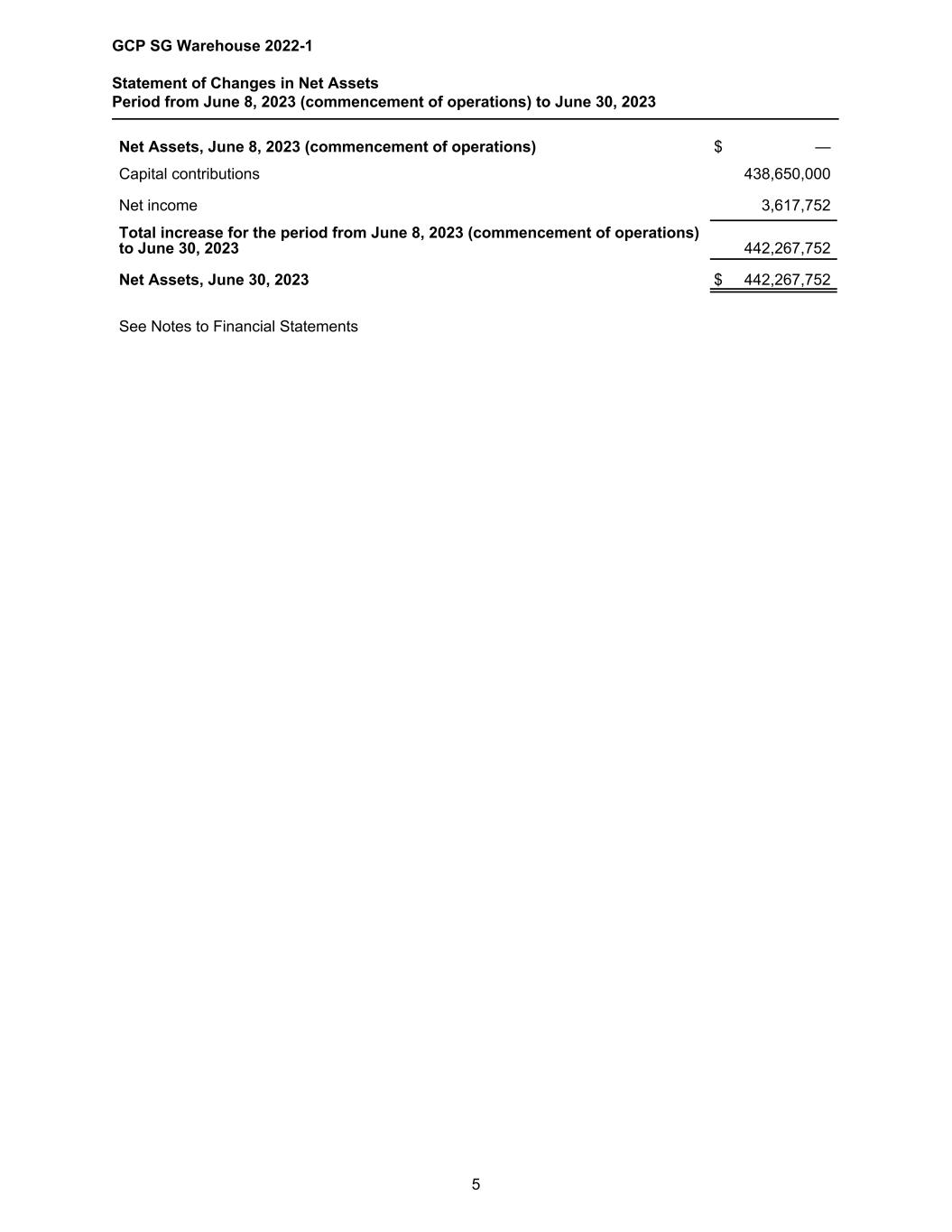

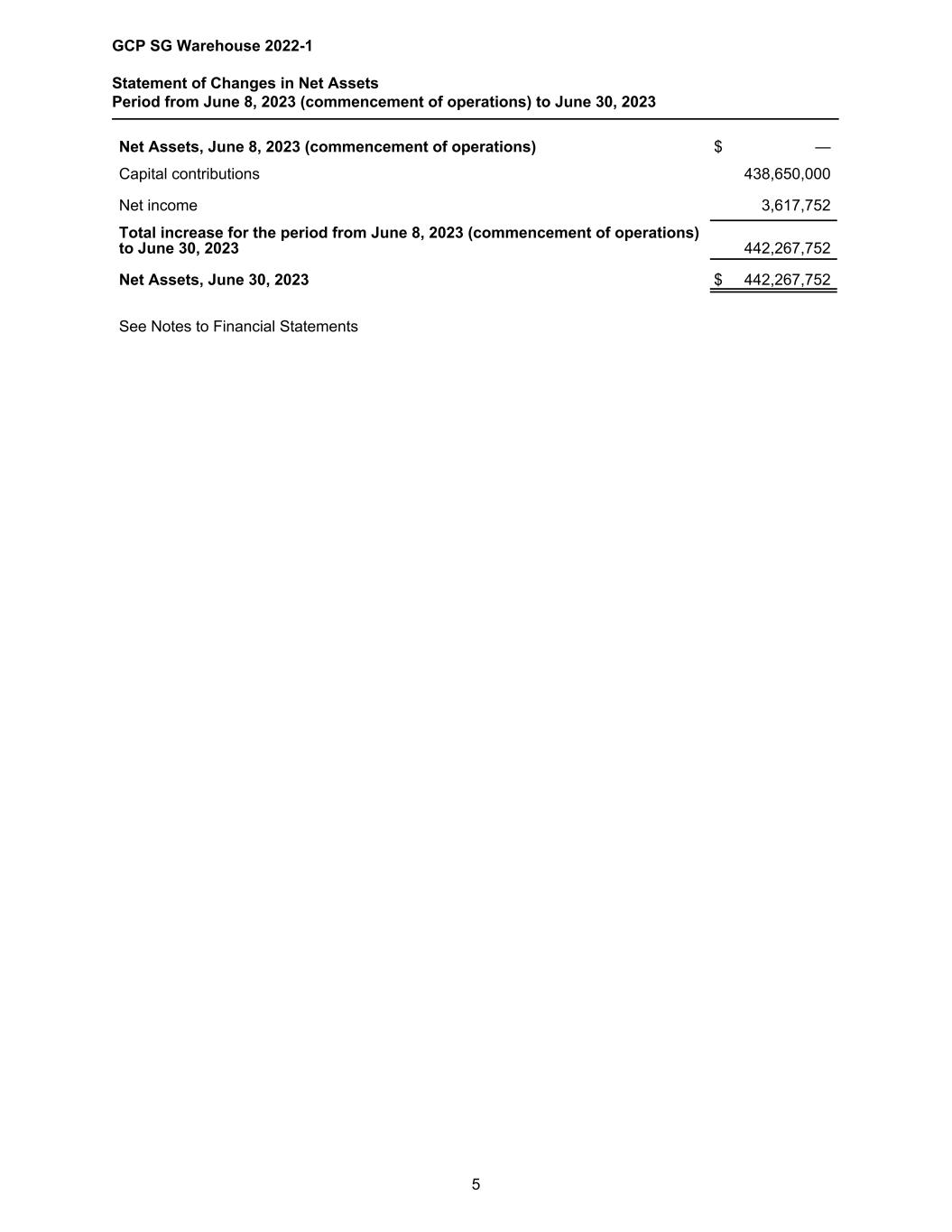

Net Assets, June 8, 2023 (commencement of operations) $ — Capital contributions 438,650,000 Net income 3,617,752 Total increase for the period from June 8, 2023 (commencement of operations) to June 30, 2023 442,267,752 Net Assets, June 30, 2023 $ 442,267,752 See Notes to Financial Statements GCP SG Warehouse 2022-1 Statement of Changes in Net Assets Period from June 8, 2023 (commencement of operations) to June 30, 2023 5

Cash flows from operating activities Net income $ 3,617,752 Adjustments to reconcile net income to net cash used in operating activities: Accretion of discounts and amortization of premiums on investments (274,650) Net realized (gain) loss on foreign currency transactions 93,444 Net change in unrealized (appreciation) depreciation on investments 190,786 Net change in unrealized (appreciation) depreciation on translation of assets and liabilities in foreign currencies (17,465) Purchases of investments (936,995,797) Proceeds from principal payments 1,907,839 Capitalized PIK interest (205,621) Changes in operating assets and liabilities: Interest receivable (2,656,001) Other assets (505,685) Interest payable 2,489,584 Net cash used in operating activities (932,355,814) Cash flows from financing activities Borrowings on debt 498,726,080 Proceeds from capital contributions 438,650,000 Net cash provided by financing activities 937,376,080 Net increase in restricted cash and cash equivalents 5,020,266 Effect of foreign currency exchange rates (93,296) Restricted cash and cash equivalents, beginning of period — Restricted cash and cash equivalents, end of period $ 4,926,970 See Notes to Financial Statements GCP SG Warehouse 2022-1 Statement of Cash Flows Period from June 8, 2023 (commencement of operations) to June 30, 2023 6

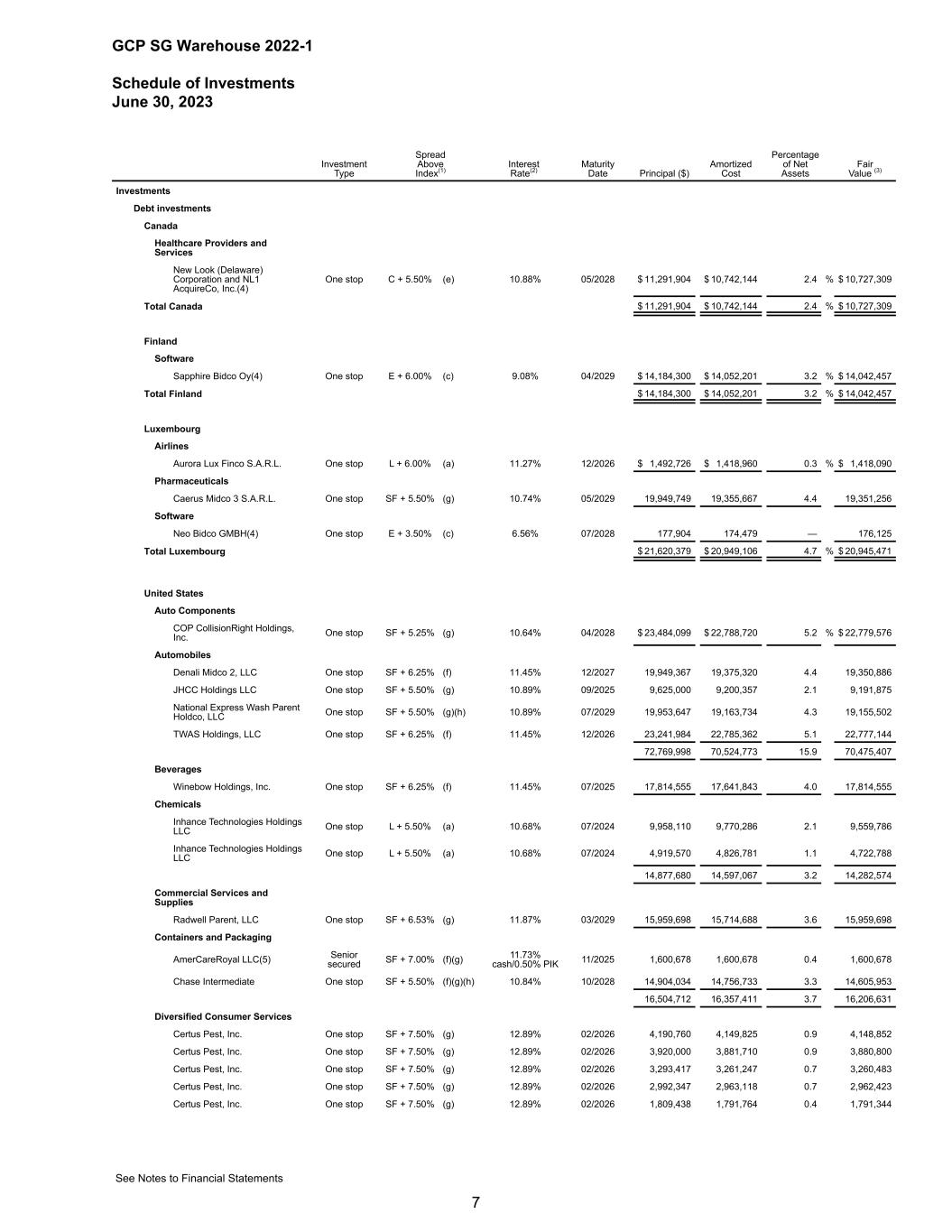

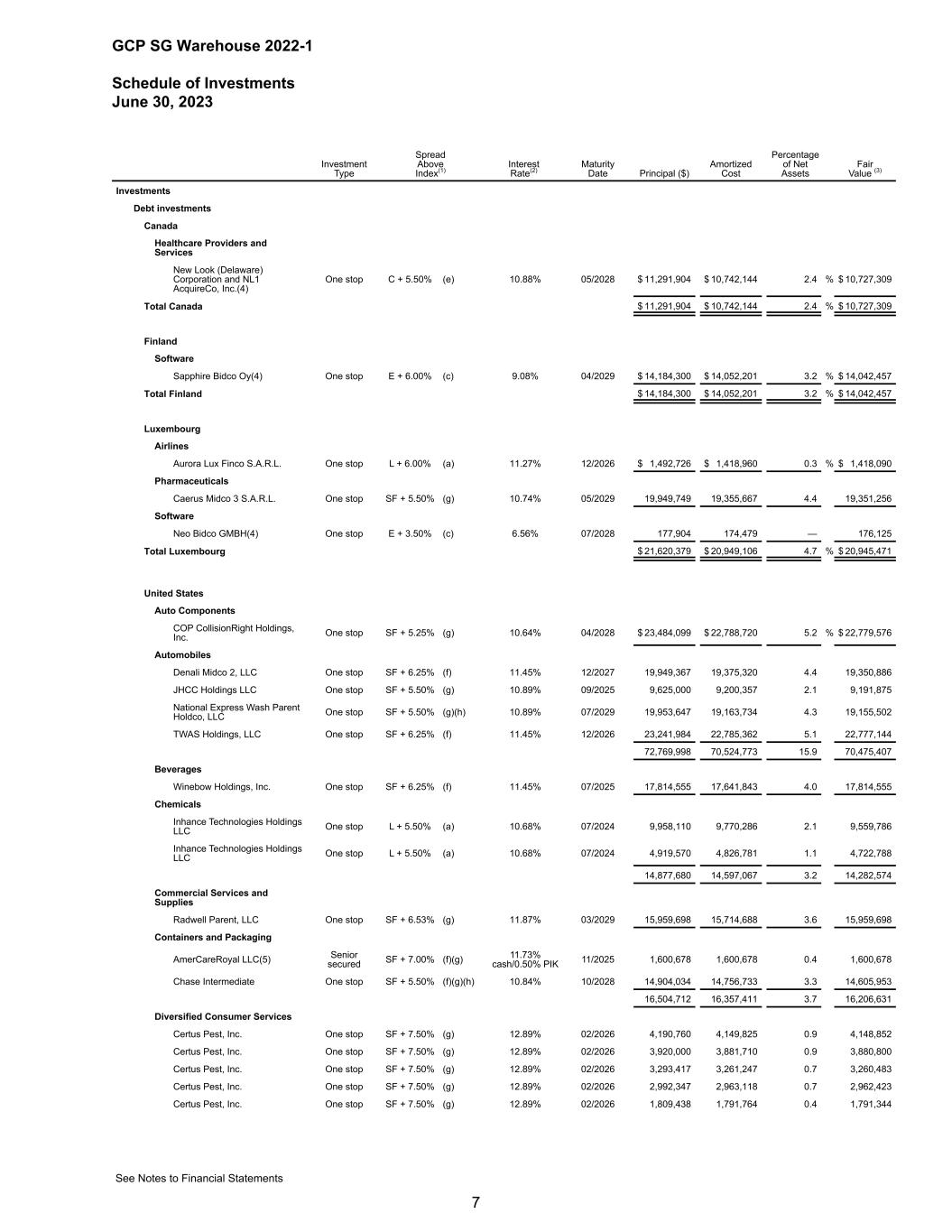

Investments Debt investments Canada Healthcare Providers and Services New Look (Delaware) Corporation and NL1 AcquireCo, Inc.(4) One stop C + 5.50% (e) 10.88% 05/2028 $ 11,291,904 $ 10,742,144 2.4 % $ 10,727,309 Total Canada $ 11,291,904 $ 10,742,144 2.4 % $ 10,727,309 Finland Software Sapphire Bidco Oy(4) One stop E + 6.00% (c) 9.08% 04/2029 $ 14,184,300 $ 14,052,201 3.2 % $ 14,042,457 Total Finland $ 14,184,300 $ 14,052,201 3.2 % $ 14,042,457 Luxembourg Airlines Aurora Lux Finco S.A.R.L. One stop L + 6.00% (a) 11.27% 12/2026 $ 1,492,726 $ 1,418,960 0.3 % $ 1,418,090 Pharmaceuticals Caerus Midco 3 S.A.R.L. One stop SF + 5.50% (g) 10.74% 05/2029 19,949,749 19,355,667 4.4 19,351,256 Software Neo Bidco GMBH(4) One stop E + 3.50% (c) 6.56% 07/2028 177,904 174,479 — 176,125 Total Luxembourg $ 21,620,379 $ 20,949,106 4.7 % $ 20,945,471 United States Auto Components COP CollisionRight Holdings, Inc. One stop SF + 5.25% (g) 10.64% 04/2028 $ 23,484,099 $ 22,788,720 5.2 % $ 22,779,576 Automobiles Denali Midco 2, LLC One stop SF + 6.25% (f) 11.45% 12/2027 19,949,367 19,375,320 4.4 19,350,886 JHCC Holdings LLC One stop SF + 5.50% (g) 10.89% 09/2025 9,625,000 9,200,357 2.1 9,191,875 National Express Wash Parent Holdco, LLC One stop SF + 5.50% (g)(h) 10.89% 07/2029 19,953,647 19,163,734 4.3 19,155,502 TWAS Holdings, LLC One stop SF + 6.25% (f) 11.45% 12/2026 23,241,984 22,785,362 5.1 22,777,144 72,769,998 70,524,773 15.9 70,475,407 Beverages Winebow Holdings, Inc. One stop SF + 6.25% (f) 11.45% 07/2025 17,814,555 17,641,843 4.0 17,814,555 Chemicals Inhance Technologies Holdings LLC One stop L + 5.50% (a) 10.68% 07/2024 9,958,110 9,770,286 2.1 9,559,786 Inhance Technologies Holdings LLC One stop L + 5.50% (a) 10.68% 07/2024 4,919,570 4,826,781 1.1 4,722,788 14,877,680 14,597,067 3.2 14,282,574 Commercial Services and Supplies Radwell Parent, LLC One stop SF + 6.53% (g) 11.87% 03/2029 15,959,698 15,714,688 3.6 15,959,698 Containers and Packaging AmerCareRoyal LLC(5) Senior secured SF + 7.00% (f)(g) 11.73% cash/0.50% PIK 11/2025 1,600,678 1,600,678 0.4 1,600,678 Chase Intermediate One stop SF + 5.50% (f)(g)(h) 10.84% 10/2028 14,904,034 14,756,733 3.3 14,605,953 16,504,712 16,357,411 3.7 16,206,631 Diversified Consumer Services Certus Pest, Inc. One stop SF + 7.50% (g) 12.89% 02/2026 4,190,760 4,149,825 0.9 4,148,852 Certus Pest, Inc. One stop SF + 7.50% (g) 12.89% 02/2026 3,920,000 3,881,710 0.9 3,880,800 Certus Pest, Inc. One stop SF + 7.50% (g) 12.89% 02/2026 3,293,417 3,261,247 0.7 3,260,483 Certus Pest, Inc. One stop SF + 7.50% (g) 12.89% 02/2026 2,992,347 2,963,118 0.7 2,962,423 Certus Pest, Inc. One stop SF + 7.50% (g) 12.89% 02/2026 1,809,438 1,791,764 0.4 1,791,344 Investment Type Spread Above Index(1) Interest Rate(2) Maturity Date Principal ($) Amortized Cost Percentage of Net Assets Fair Value (3) GCP SG Warehouse 2022-1 Schedule of Investments June 30, 2023 See Notes to Financial Statements 7

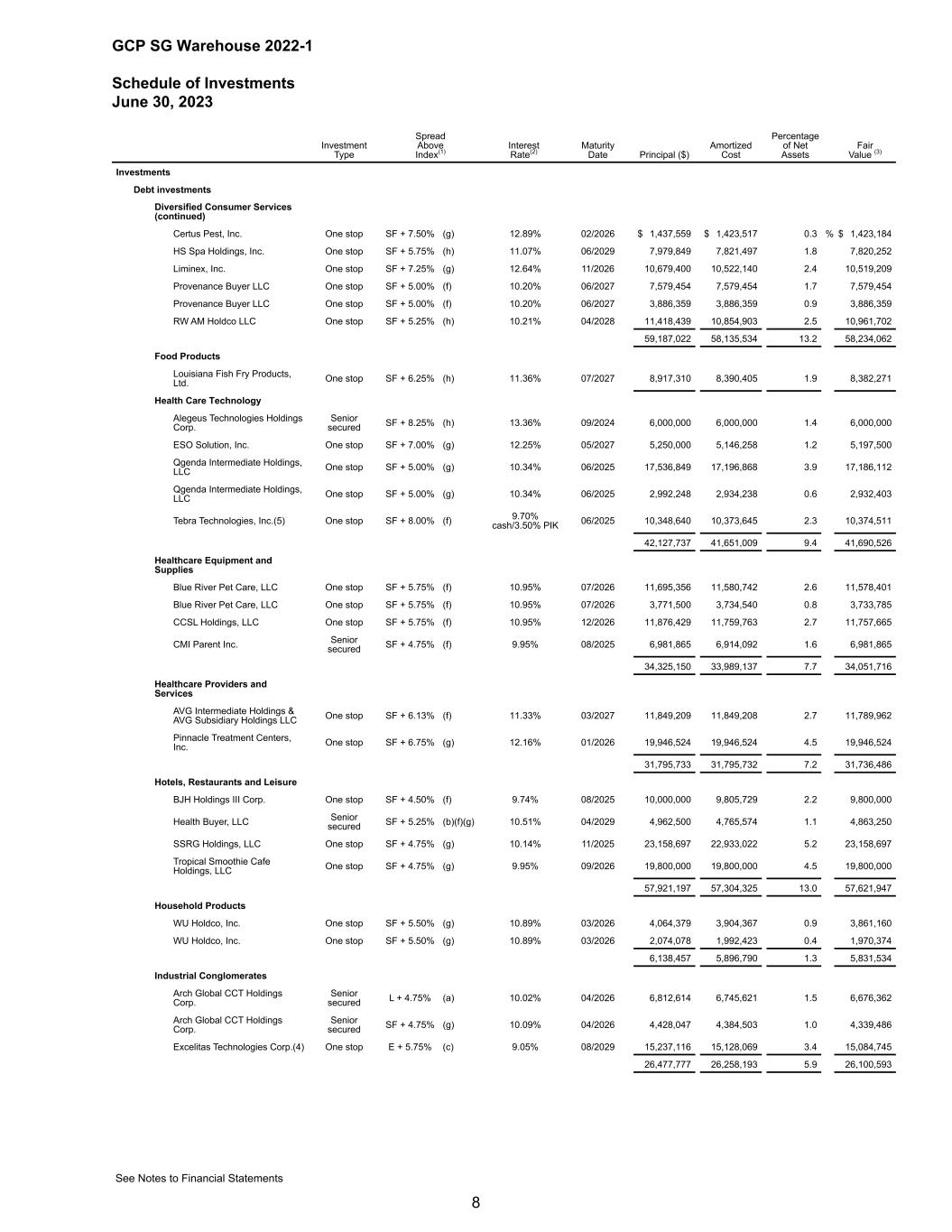

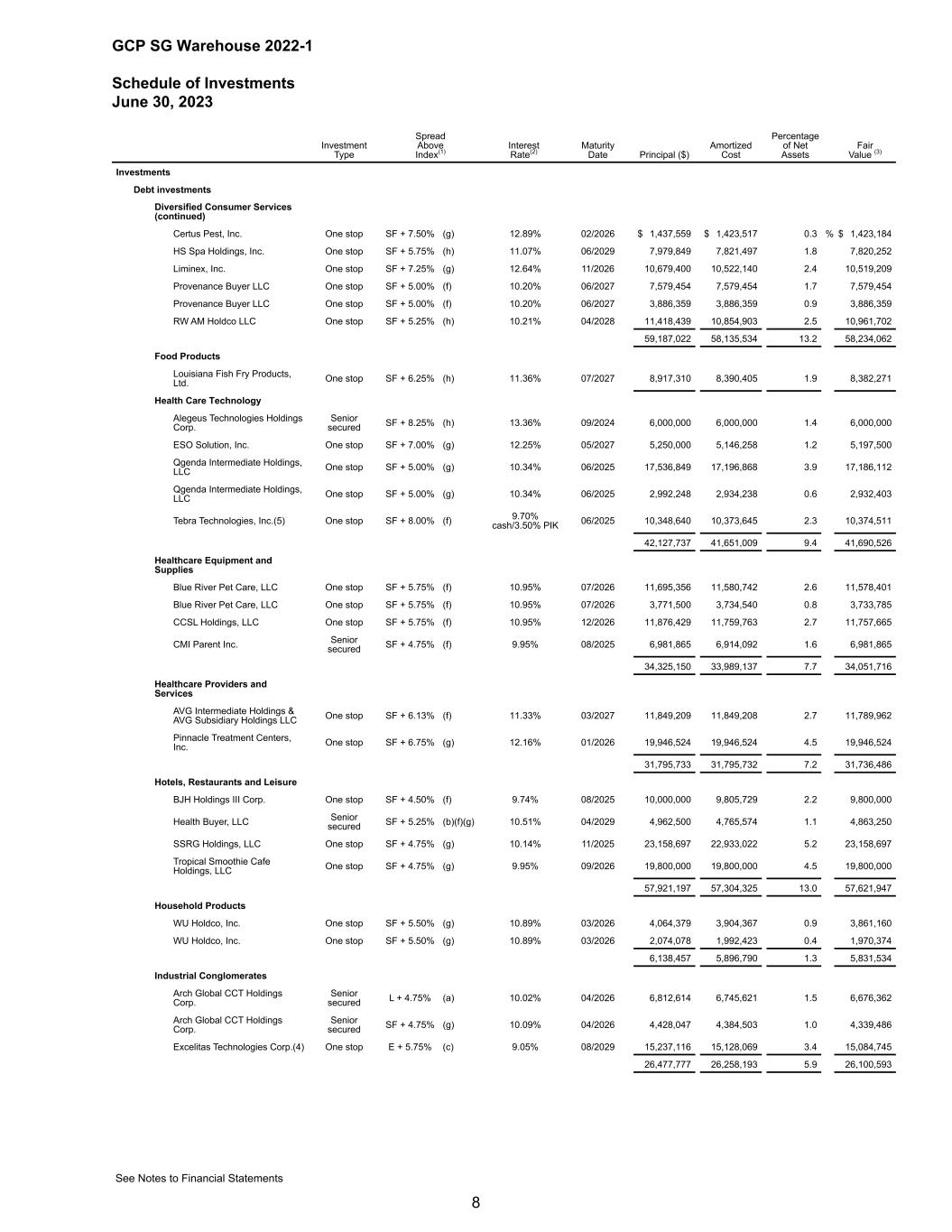

Investments Debt investments Diversified Consumer Services (continued) Certus Pest, Inc. One stop SF + 7.50% (g) 12.89% 02/2026 $ 1,437,559 $ 1,423,517 0.3 % $ 1,423,184 HS Spa Holdings, Inc. One stop SF + 5.75% (h) 11.07% 06/2029 7,979,849 7,821,497 1.8 7,820,252 Liminex, Inc. One stop SF + 7.25% (g) 12.64% 11/2026 10,679,400 10,522,140 2.4 10,519,209 Provenance Buyer LLC One stop SF + 5.00% (f) 10.20% 06/2027 7,579,454 7,579,454 1.7 7,579,454 Provenance Buyer LLC One stop SF + 5.00% (f) 10.20% 06/2027 3,886,359 3,886,359 0.9 3,886,359 RW AM Holdco LLC One stop SF + 5.25% (h) 10.21% 04/2028 11,418,439 10,854,903 2.5 10,961,702 59,187,022 58,135,534 13.2 58,234,062 Food Products Louisiana Fish Fry Products, Ltd. One stop SF + 6.25% (h) 11.36% 07/2027 8,917,310 8,390,405 1.9 8,382,271 Health Care Technology Alegeus Technologies Holdings Corp. Senior secured SF + 8.25% (h) 13.36% 09/2024 6,000,000 6,000,000 1.4 6,000,000 ESO Solution, Inc. One stop SF + 7.00% (g) 12.25% 05/2027 5,250,000 5,146,258 1.2 5,197,500 Qgenda Intermediate Holdings, LLC One stop SF + 5.00% (g) 10.34% 06/2025 17,536,849 17,196,868 3.9 17,186,112 Qgenda Intermediate Holdings, LLC One stop SF + 5.00% (g) 10.34% 06/2025 2,992,248 2,934,238 0.6 2,932,403 Tebra Technologies, Inc.(5) One stop SF + 8.00% (f) 9.70% cash/3.50% PIK 06/2025 10,348,640 10,373,645 2.3 10,374,511 42,127,737 41,651,009 9.4 41,690,526 Healthcare Equipment and Supplies Blue River Pet Care, LLC One stop SF + 5.75% (f) 10.95% 07/2026 11,695,356 11,580,742 2.6 11,578,401 Blue River Pet Care, LLC One stop SF + 5.75% (f) 10.95% 07/2026 3,771,500 3,734,540 0.8 3,733,785 CCSL Holdings, LLC One stop SF + 5.75% (f) 10.95% 12/2026 11,876,429 11,759,763 2.7 11,757,665 CMI Parent Inc. Senior secured SF + 4.75% (f) 9.95% 08/2025 6,981,865 6,914,092 1.6 6,981,865 34,325,150 33,989,137 7.7 34,051,716 Healthcare Providers and Services AVG Intermediate Holdings & AVG Subsidiary Holdings LLC One stop SF + 6.13% (f) 11.33% 03/2027 11,849,209 11,849,208 2.7 11,789,962 Pinnacle Treatment Centers, Inc. One stop SF + 6.75% (g) 12.16% 01/2026 19,946,524 19,946,524 4.5 19,946,524 31,795,733 31,795,732 7.2 31,736,486 Hotels, Restaurants and Leisure BJH Holdings III Corp. One stop SF + 4.50% (f) 9.74% 08/2025 10,000,000 9,805,729 2.2 9,800,000 Health Buyer, LLC Senior secured SF + 5.25% (b)(f)(g) 10.51% 04/2029 4,962,500 4,765,574 1.1 4,863,250 SSRG Holdings, LLC One stop SF + 4.75% (g) 10.14% 11/2025 23,158,697 22,933,022 5.2 23,158,697 Tropical Smoothie Cafe Holdings, LLC One stop SF + 4.75% (g) 9.95% 09/2026 19,800,000 19,800,000 4.5 19,800,000 57,921,197 57,304,325 13.0 57,621,947 Household Products WU Holdco, Inc. One stop SF + 5.50% (g) 10.89% 03/2026 4,064,379 3,904,367 0.9 3,861,160 WU Holdco, Inc. One stop SF + 5.50% (g) 10.89% 03/2026 2,074,078 1,992,423 0.4 1,970,374 6,138,457 5,896,790 1.3 5,831,534 Industrial Conglomerates Arch Global CCT Holdings Corp. Senior secured L + 4.75% (a) 10.02% 04/2026 6,812,614 6,745,621 1.5 6,676,362 Arch Global CCT Holdings Corp. Senior secured SF + 4.75% (g) 10.09% 04/2026 4,428,047 4,384,503 1.0 4,339,486 Excelitas Technologies Corp.(4) One stop E + 5.75% (c) 9.05% 08/2029 15,237,116 15,128,069 3.4 15,084,745 26,477,777 26,258,193 5.9 26,100,593 Investment Type Spread Above Index(1) Interest Rate(2) Maturity Date Principal ($) Amortized Cost Percentage of Net Assets Fair Value (3) GCP SG Warehouse 2022-1 Schedule of Investments June 30, 2023 See Notes to Financial Statements 8

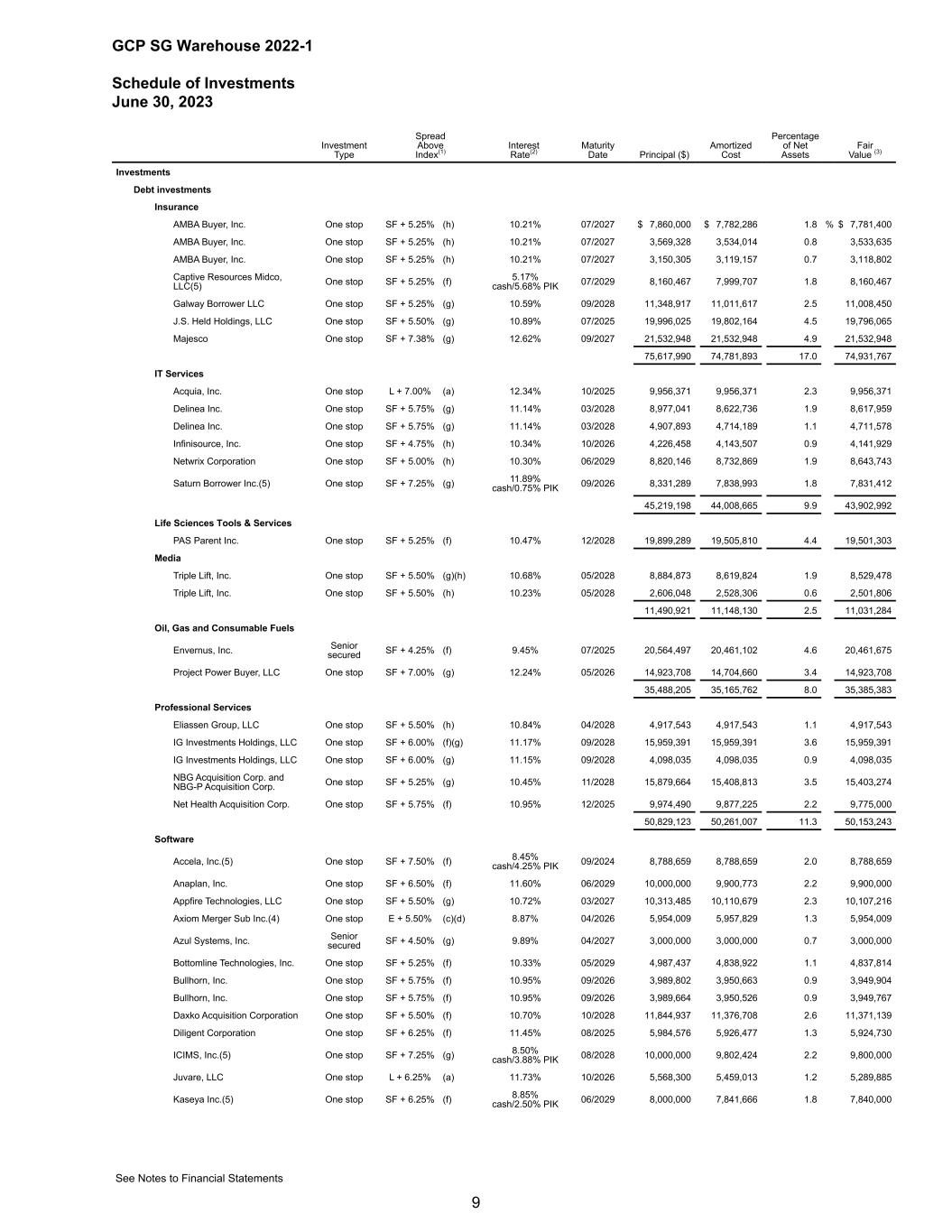

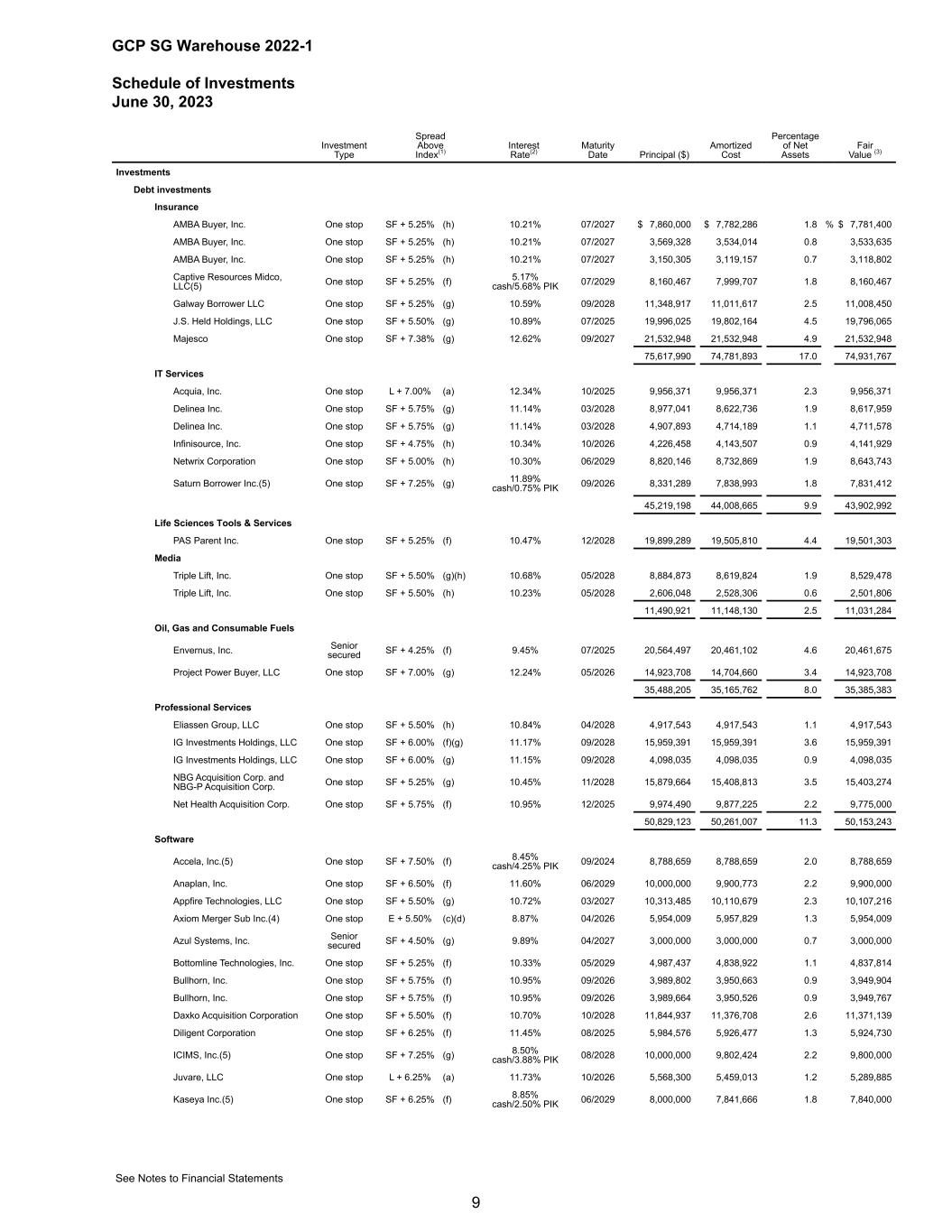

Investments Debt investments Insurance AMBA Buyer, Inc. One stop SF + 5.25% (h) 10.21% 07/2027 $ 7,860,000 $ 7,782,286 1.8 % $ 7,781,400 AMBA Buyer, Inc. One stop SF + 5.25% (h) 10.21% 07/2027 3,569,328 3,534,014 0.8 3,533,635 AMBA Buyer, Inc. One stop SF + 5.25% (h) 10.21% 07/2027 3,150,305 3,119,157 0.7 3,118,802 Captive Resources Midco, LLC(5) One stop SF + 5.25% (f) 5.17% cash/5.68% PIK 07/2029 8,160,467 7,999,707 1.8 8,160,467 Galway Borrower LLC One stop SF + 5.25% (g) 10.59% 09/2028 11,348,917 11,011,617 2.5 11,008,450 J.S. Held Holdings, LLC One stop SF + 5.50% (g) 10.89% 07/2025 19,996,025 19,802,164 4.5 19,796,065 Majesco One stop SF + 7.38% (g) 12.62% 09/2027 21,532,948 21,532,948 4.9 21,532,948 75,617,990 74,781,893 17.0 74,931,767 IT Services Acquia, Inc. One stop L + 7.00% (a) 12.34% 10/2025 9,956,371 9,956,371 2.3 9,956,371 Delinea Inc. One stop SF + 5.75% (g) 11.14% 03/2028 8,977,041 8,622,736 1.9 8,617,959 Delinea Inc. One stop SF + 5.75% (g) 11.14% 03/2028 4,907,893 4,714,189 1.1 4,711,578 Infinisource, Inc. One stop SF + 4.75% (h) 10.34% 10/2026 4,226,458 4,143,507 0.9 4,141,929 Netwrix Corporation One stop SF + 5.00% (h) 10.30% 06/2029 8,820,146 8,732,869 1.9 8,643,743 Saturn Borrower Inc.(5) One stop SF + 7.25% (g) 11.89% cash/0.75% PIK 09/2026 8,331,289 7,838,993 1.8 7,831,412 45,219,198 44,008,665 9.9 43,902,992 Life Sciences Tools & Services PAS Parent Inc. One stop SF + 5.25% (f) 10.47% 12/2028 19,899,289 19,505,810 4.4 19,501,303 Media Triple Lift, Inc. One stop SF + 5.50% (g)(h) 10.68% 05/2028 8,884,873 8,619,824 1.9 8,529,478 Triple Lift, Inc. One stop SF + 5.50% (h) 10.23% 05/2028 2,606,048 2,528,306 0.6 2,501,806 11,490,921 11,148,130 2.5 11,031,284 Oil, Gas and Consumable Fuels Envernus, Inc. Senior secured SF + 4.25% (f) 9.45% 07/2025 20,564,497 20,461,102 4.6 20,461,675 Project Power Buyer, LLC One stop SF + 7.00% (g) 12.24% 05/2026 14,923,708 14,704,660 3.4 14,923,708 35,488,205 35,165,762 8.0 35,385,383 Professional Services Eliassen Group, LLC One stop SF + 5.50% (h) 10.84% 04/2028 4,917,543 4,917,543 1.1 4,917,543 IG Investments Holdings, LLC One stop SF + 6.00% (f)(g) 11.17% 09/2028 15,959,391 15,959,391 3.6 15,959,391 IG Investments Holdings, LLC One stop SF + 6.00% (g) 11.15% 09/2028 4,098,035 4,098,035 0.9 4,098,035 NBG Acquisition Corp. and NBG-P Acquisition Corp. One stop SF + 5.25% (g) 10.45% 11/2028 15,879,664 15,408,813 3.5 15,403,274 Net Health Acquisition Corp. One stop SF + 5.75% (f) 10.95% 12/2025 9,974,490 9,877,225 2.2 9,775,000 50,829,123 50,261,007 11.3 50,153,243 Software Accela, Inc.(5) One stop SF + 7.50% (f) 8.45% cash/4.25% PIK 09/2024 8,788,659 8,788,659 2.0 8,788,659 Anaplan, Inc. One stop SF + 6.50% (f) 11.60% 06/2029 10,000,000 9,900,773 2.2 9,900,000 Appfire Technologies, LLC One stop SF + 5.50% (g) 10.72% 03/2027 10,313,485 10,110,679 2.3 10,107,216 Axiom Merger Sub Inc.(4) One stop E + 5.50% (c)(d) 8.87% 04/2026 5,954,009 5,957,829 1.3 5,954,009 Azul Systems, Inc. Senior secured SF + 4.50% (g) 9.89% 04/2027 3,000,000 3,000,000 0.7 3,000,000 Bottomline Technologies, Inc. One stop SF + 5.25% (f) 10.33% 05/2029 4,987,437 4,838,922 1.1 4,837,814 Bullhorn, Inc. One stop SF + 5.75% (f) 10.95% 09/2026 3,989,802 3,950,663 0.9 3,949,904 Bullhorn, Inc. One stop SF + 5.75% (f) 10.95% 09/2026 3,989,664 3,950,526 0.9 3,949,767 Daxko Acquisition Corporation One stop SF + 5.50% (f) 10.70% 10/2028 11,844,937 11,376,708 2.6 11,371,139 Diligent Corporation One stop SF + 6.25% (f) 11.45% 08/2025 5,984,576 5,926,477 1.3 5,924,730 ICIMS, Inc.(5) One stop SF + 7.25% (g) 8.50% cash/3.88% PIK 08/2028 10,000,000 9,802,424 2.2 9,800,000 Juvare, LLC One stop L + 6.25% (a) 11.73% 10/2026 5,568,300 5,459,013 1.2 5,289,885 Kaseya Inc.(5) One stop SF + 6.25% (f) 8.85% cash/2.50% PIK 06/2029 8,000,000 7,841,666 1.8 7,840,000 Investment Type Spread Above Index(1) Interest Rate(2) Maturity Date Principal ($) Amortized Cost Percentage of Net Assets Fair Value (3) GCP SG Warehouse 2022-1 Schedule of Investments June 30, 2023 See Notes to Financial Statements 9

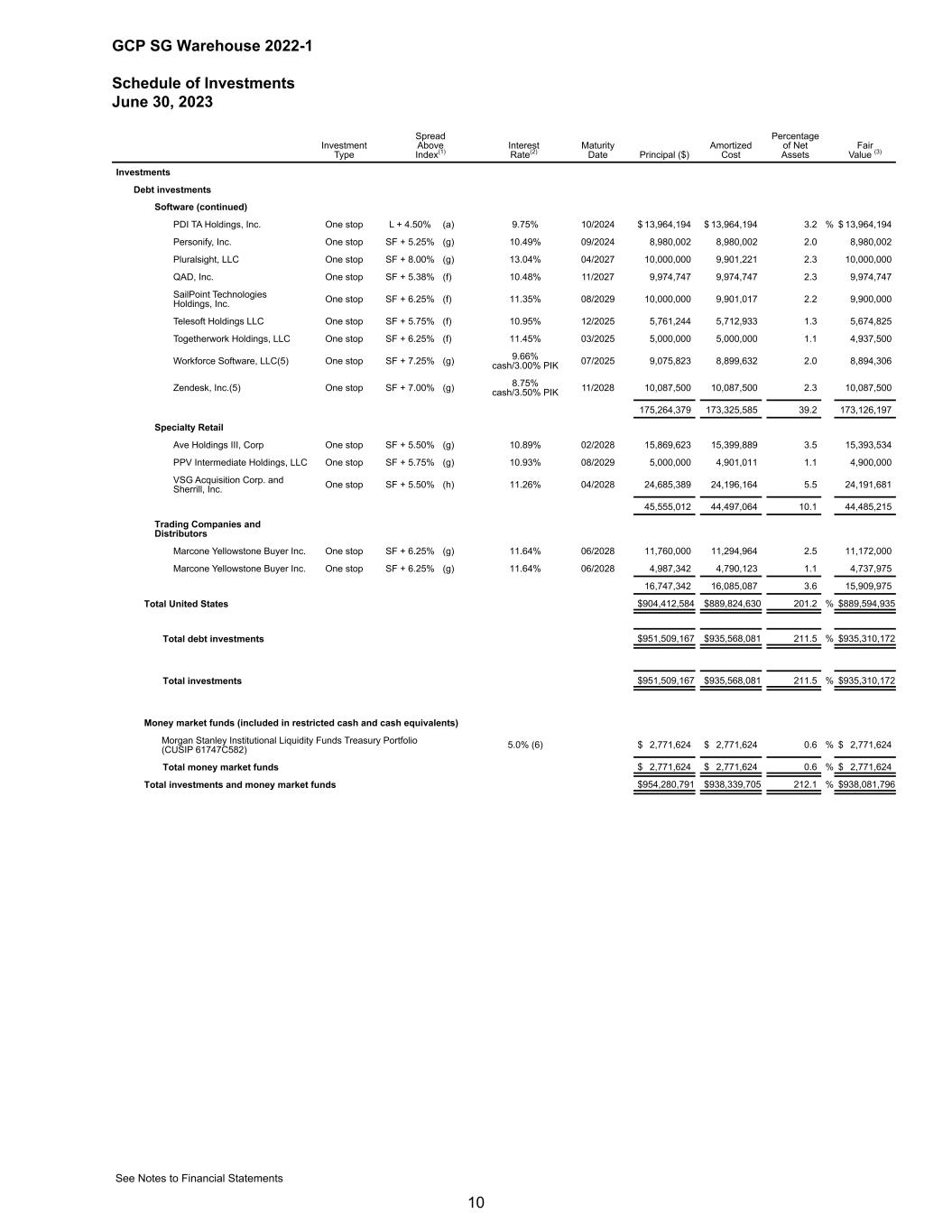

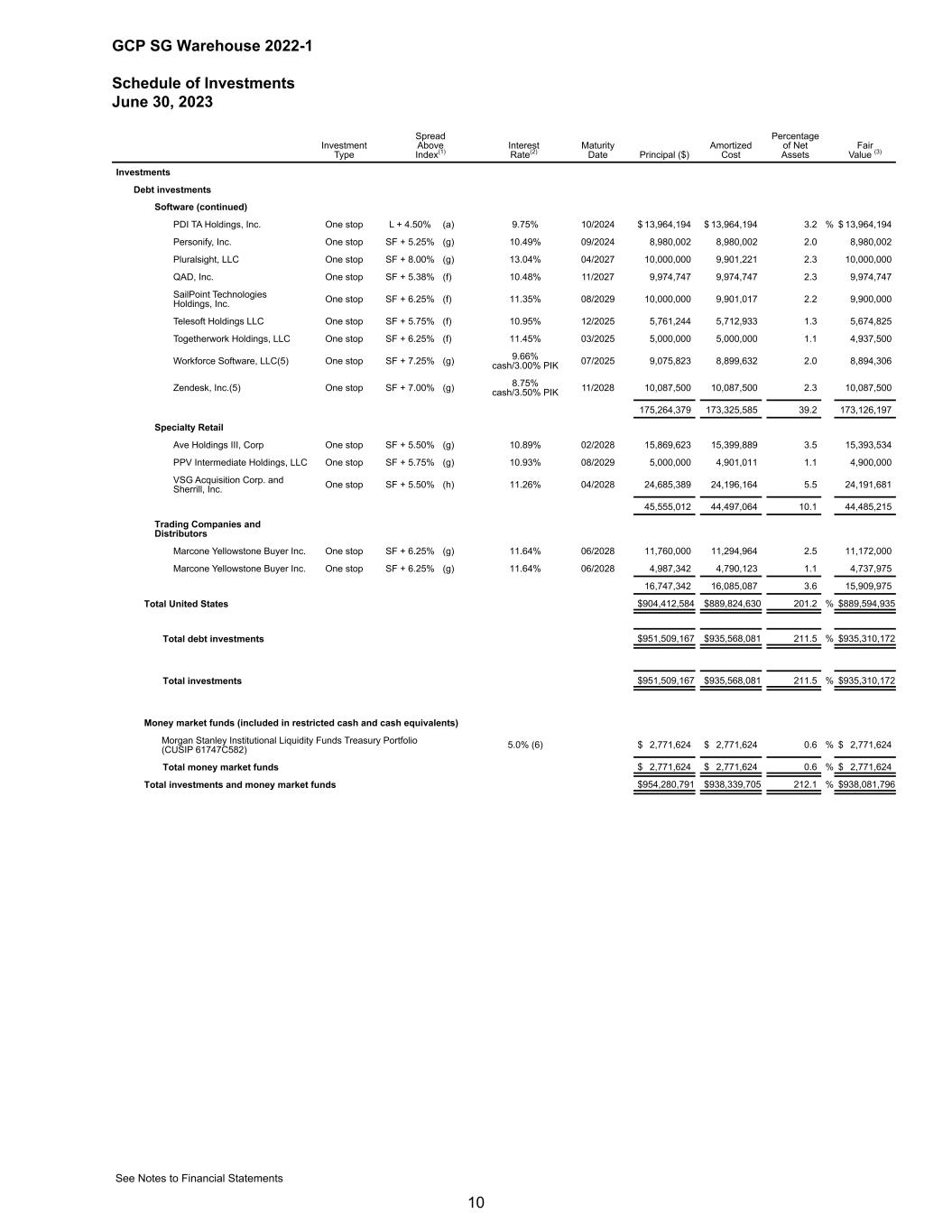

Investments Debt investments Software (continued) PDI TA Holdings, Inc. One stop L + 4.50% (a) 9.75% 10/2024 $ 13,964,194 $ 13,964,194 3.2 % $ 13,964,194 Personify, Inc. One stop SF + 5.25% (g) 10.49% 09/2024 8,980,002 8,980,002 2.0 8,980,002 Pluralsight, LLC One stop SF + 8.00% (g) 13.04% 04/2027 10,000,000 9,901,221 2.3 10,000,000 QAD, Inc. One stop SF + 5.38% (f) 10.48% 11/2027 9,974,747 9,974,747 2.3 9,974,747 SailPoint Technologies Holdings, Inc. One stop SF + 6.25% (f) 11.35% 08/2029 10,000,000 9,901,017 2.2 9,900,000 Telesoft Holdings LLC One stop SF + 5.75% (f) 10.95% 12/2025 5,761,244 5,712,933 1.3 5,674,825 Togetherwork Holdings, LLC One stop SF + 6.25% (f) 11.45% 03/2025 5,000,000 5,000,000 1.1 4,937,500 Workforce Software, LLC(5) One stop SF + 7.25% (g) 9.66% cash/3.00% PIK 07/2025 9,075,823 8,899,632 2.0 8,894,306 Zendesk, Inc.(5) One stop SF + 7.00% (g) 8.75% cash/3.50% PIK 11/2028 10,087,500 10,087,500 2.3 10,087,500 175,264,379 173,325,585 39.2 173,126,197 Specialty Retail Ave Holdings III, Corp One stop SF + 5.50% (g) 10.89% 02/2028 15,869,623 15,399,889 3.5 15,393,534 PPV Intermediate Holdings, LLC One stop SF + 5.75% (g) 10.93% 08/2029 5,000,000 4,901,011 1.1 4,900,000 VSG Acquisition Corp. and Sherrill, Inc. One stop SF + 5.50% (h) 11.26% 04/2028 24,685,389 24,196,164 5.5 24,191,681 45,555,012 44,497,064 10.1 44,485,215 Trading Companies and Distributors Marcone Yellowstone Buyer Inc. One stop SF + 6.25% (g) 11.64% 06/2028 11,760,000 11,294,964 2.5 11,172,000 Marcone Yellowstone Buyer Inc. One stop SF + 6.25% (g) 11.64% 06/2028 4,987,342 4,790,123 1.1 4,737,975 16,747,342 16,085,087 3.6 15,909,975 Total United States $ 904,412,584 $ 889,824,630 201.2 % $ 889,594,935 Total debt investments $ 951,509,167 $ 935,568,081 211.5 % $ 935,310,172 Total investments $ 951,509,167 $ 935,568,081 211.5 % $ 935,310,172 Money market funds (included in restricted cash and cash equivalents) Morgan Stanley Institutional Liquidity Funds Treasury Portfolio (CUSIP 61747C582) 5.0% (6) $ 2,771,624 $ 2,771,624 0.6 % $ 2,771,624 Total money market funds $ 2,771,624 $ 2,771,624 0.6 % $ 2,771,624 Total investments and money market funds $ 954,280,791 $ 938,339,705 212.1 % $ 938,081,796 Investment Type Spread Above Index(1) Interest Rate(2) Maturity Date Principal ($) Amortized Cost Percentage of Net Assets Fair Value (3) GCP SG Warehouse 2022-1 Schedule of Investments June 30, 2023 See Notes to Financial Statements 10

(1) The majority of the investments bear interest at a rate that is permitted to be determined by reference to the Secured Overnight Financing Rate (‘‘SOFR’’ or ‘‘SF”), Euro Interbank Offered Rate (“EURIBOR” or “E”), Canadian Bankers Acceptance Rate (”CDOR” or "C”) or the London Interbank Offered Rate (“LIBOR” or “L”) denominated in U.S. dollars which reset daily, monthly, quarterly, semiannually or annually. For each, the Fund has provided the spread over the applicable index and the weighted average current interest rate in effect as of June 30, 2023. Certain investments are subject to an interest rate floor. For fixed rate loans, a spread above a reference rate is not applicable. For positions with multiple outstanding contracts, the spread for the largest outstanding contract is shown. (a) Denotes that all or a portion of the contract was indexed to the 90-day LIBOR, which was 5.55% as of June 30, 2023. (b) Denotes that all or a portion of the contract was indexed to the Prime rate, which was 8.25% as of June 30, 2023. (c) Denotes that all or a portion of the contract was indexed to the 90-day EURIBOR, which was 3.58% as of June 30, 2023. (d) Denotes that all or a portion of the contract was indexed to the 180-day EURIBOR, which was 3.90% as of June 30, 2023. (e) Denotes that all or a portion of the contract was indexed to the 90-day CDOR, which was 5.40% as of June 30, 2023. (f) Denotes that all or a portion of the contract was indexed to the 30-day Term SOFR, which was 5.14% as of June 30, 2023. (g) Denotes that all or a portion of the contract was indexed to the 90-day Term SOFR, which was 5.27% as of June 30, 2023. (h) Denotes that all or a portion of the contract was indexed to the 180-day Term SOFR, which was 5.39% as of June 30, 2023. (2) For positions with multiple interest rate contracts, the interest rate shown is a weighted average current interest rate in effect as of June 30, 2023. (3) The fair values of investments were valued using significant unobservable inputs. See Note 5. Fair Value Measurements. (4) Investment is denominated in foreign currency and is translated into U.S. dollars as of the valuation date or the date of the transaction. See Note 2. Accounting Policies and Recent Accounting Updates - Foreign Currency Translation. (5) All or a portion of the loan interest was capitalized into the outstanding principal balance of the loan in accordance with the terms of the credit agreement during the period from June 8, 2023 (commencement of operations) to June 30, 2023. (6) The rate shown is the annualized seven-day yield as of June 30, 2023. GCP SG Warehouse 2022-1 Schedule of Investments June 30, 2023 See Notes to Financial Statements 11

Note 1. Organization GCP SG Warehouse 2022-1 (“GCP SG Warehouse” or the “Fund”) was organized in the state of Delaware on December 9, 2022 as a Delaware statutory trust for the purpose of making investments primarily through direct lending to U.S. private companies in the middle market in the form of one stop and other senior secured loans. On June 8, 2023, the Fund entered into a credit agreement (the “GCP Warehouse Credit Facility”) by and among the Fund, as borrower, Société Générale, as administrative agent, the lenders and the subordinated noteholders party thereto, and Wilmington Trust, National Association as collateral agent, collateral administrator, custodian and collateral custodian. In connection with entering into the GCP Warehouse Credit Facility, the Fund’s trust agreement was amended and restated (the “Amended Trust Agreement”) and the Fund commenced operations. The Fund is beneficially owned by GCP HS Fund, a Delaware statutory trust, and GCP CLO Holdings Sub LP (“GCP CLO Sub”), an exempted limited partnership registered in the Cayman Islands (together the “Beneficial Owners”). GC Investment Management LLC (the “Investment Manager”) serves as the investment manager of GCP HS Fund. GC Investment Management LLC is a relying adviser of GC OPAL Advisors LLC, which is a registered investment adviser with the Securities and Exchange Commission. Note 2. Accounting Policies and Recent Accounting Updates Basis of presentation: The accompanying financial statements of the Fund have been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”) as established by the Financial Accounting Standards Board (“FASB”). The Investment Manager has evaluated the structure, objectives and activities of the Fund and determined that it meets the characteristics of an investment company. As such, these financial statements reflect the guidance set forth in Accounting Standards Codification (“ASC”) Topic 946 - Financial Services - Investment Companies. Fair value of financial instruments: The Fund records all of its financial instruments at fair value in accordance with ASC Topic 820 - Fair Value Measurement (“ASC Topic 820”). See Note 5 for further discussion on the fair value of financial instruments. Use of estimates: The preparation of the financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts on the financial statements and accompanying notes. Actual results could differ from those estimates. Restricted cash and cash equivalents: Restricted cash and cash equivalents include amounts that are collected and are held by trustees who have been appointed as custodians of the assets securing certain of the Fund’s financing transactions. Restricted cash and cash equivalents are held by the trustees for payment of interest expense and principal on the outstanding borrowings or reinvestment into new assets. Foreign currency translation: The Fund’s books and records are maintained in U.S. dollars. Any foreign currency amounts are translated into U.S. dollars on the following basis: GCP SG Warehouse 2022-1 Notes to Financial Statements 12

Note 2. Accounting Policies and Recent Accounting Updates (Continued) (1) restricted cash and cash equivalents, investments at fair value, interest receivable, debt, interest payable and other assets and payables - at the spot exchange rate on the last business day of the period; and (2) purchases and sales of investments, borrowings and payments of debt, income and expenses - at the exchange rates prevailing on the respective dates of such transactions. Net assets and fair values are presented based on the applicable foreign exchange rates described above and fluctuations arising from the translation of assets and liabilities are included with the net change in unrealized appreciation (depreciation) on translation of assets and liabilities in foreign currencies on the Statement of Operations. Realized gains or losses arising from foreign currency transactions are reported as components of the net realized gain (loss) on foreign currency transactions on the Statement of Operations. Foreign security and currency transactions involve certain considerations and risks not typically associated with investing in U.S. companies. These risks include, but are not limited to, currency fluctuations and revaluations and future adverse political, social and economic developments, which could cause investments in foreign markets to be less liquid and prices more volatile than those of comparable U.S. companies or U.S. government securities. Revenue recognition: Investments and related investment income: Investment transactions are accounted for on a trade-date basis. Interest income is accrued based upon the outstanding principal amount and contractual interest terms of debt investments. Market discount or premium is capitalized, and the Fund accretes or amortizes such amounts over the life of the loan as interest income. When the Fund receives principal payments on a loan in an amount that exceeds the loan’s amortized cost, it records the excess principal payment as interest income. For the period from June 8, 2023 (commencement of operations) to June 30, 2023, interest income included $274,650 of accretion of discounts and amortization of premiums. For investments with contractual payment-in-kind (“PIK”) interest, contractual interest is accrued, added to the principal balance and generally becomes due at maturity. For the period from June 8, 2023 (commencement of operations) to June 30, 2023, the Fund capitalized PIK interest of $205,621 into the principal balance of certain debt investments. Realized gains or losses on investments are measured by the difference between the net proceeds from the disposition and the amortized cost basis of investment, without regard to unrealized gains or losses previously recognized. The Fund reports the changes in fair value of investments that are measured at fair value as a component of the net change in unrealized appreciation (depreciation) on investments on the Statement of Operations. Non-accrual loans: A loan can be left on accrual status during the period the Fund is pursuing repayment of the loan. Management reviews all loans that become 90 days or more past due on principal and interest, or when there is reasonable doubt that principal or interest will be collected, for possible placement on non-accrual status. When a loan is placed on non-accrual status, unpaid interest credited to income is reversed. Additionally, any unamortized market discount is no longer accreted to interest income as of the date the loan is placed on non-accrual status. For loans with contractual PIK interest, the Fund will not accrue the PIK interest if the related loan has been placed on non-accrual status. GCP SG Warehouse 2022-1 Notes to Financial Statements 13

Note 2. Accounting Policies and Recent Accounting Updates (Continued) Interest payments received on non-accrual loans are recognized as income or applied to principal depending upon management’s judgment. When the Fund receives principal payments on a non-accrual loan in an amount that exceeds the loan’s amortized cost, it may recognize the excess principal payment as interest income based on upon management’s judgement. Non-accrual loans are restored to accrual status when past due principal and interest is paid, and, in management’s judgment, payments are likely to remain current. As of June 30, 2023, the Fund had no portfolio company investments on non-accrual status. Income taxes: ASC Topic 740 - Income Taxes (“ASC Topic 740”) provides guidelines for how uncertain tax positions should be recognized, measured, presented and disclosed in financial statements. ASC Topic 740 requires the evaluation of tax positions taken in the course of preparing the Fund’s tax returns to determine whether the tax positions are “more-likely-than-not” to be sustained by the applicable tax authority. Tax benefits of positions not deemed to meet the more-likely-than-not threshold would be recorded as a tax expense or tax benefit in the current year. There were no material unrecognized tax benefits or unrecognized tax liabilities related to uncertain income tax positions through June 30, 2023. Deferred debt issuance costs: Deferred debt issuance costs represent fees and other direct incremental costs incurred in connection with the Fund’s borrowings. These amounts are amortized and included in interest expense in the Statement of Operations over the estimated average life of the borrowings. As of June 30, 2023, the Fund had deferred debt issuance costs of $1,580,000. Note 3. Net Assets As of June 30, 2023, the Fund was beneficially owned 98% by GCP HS Fund and 2% by GCP CLO Sub. Profits and losses are allocated to the Beneficial Owners in proportion to their respective beneficial ownership percentage. Note 4. Related Party and Affiliate Activity Entities are considered to be an affiliate if they share direct or indirect common ownership or are managed by the Investment Manager, or an affiliate of the Investment Manager. The Investment Manager entered into an agreement to serve as the collateral manager to the GCP Warehouse Credit Facility. Under the terms of the collateral management agreement between the Investment Manager and the Fund (“GCP Warehouse Collateral Management Agreement”), the Investment Manager is entitled to receive an annual fee in an amount equal to 0.25% of the principal balance of the portfolio of loans held by the Fund at the beginning of the collection period relating to each payment date, which is payable quarterly in arrears unless waived or deferred by the Investment Manager. For the period from June 8, 2023 (commencement of operations) to June 30, 2023, the Investment Manager irrevocably waived $130,519 of collateral management fees payable under the GCP Warehouse Collateral Management Agreement. During the period from June 8, 2023 (commencement of operations) to June 30, 2023, the Fund purchased investments from entities managed by the Investment Manager, or an affiliate of the Investment Manager, at fair value for $936,995,797. GCP SG Warehouse 2022-1 Notes to Financial Statements 14

Note 5. Fair Value Measurements The Fund follows ASC Topic 820 for measuring fair value. Fair value is the price that would be received in the sale of an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Where available, fair value is based on observable market prices or parameters, or derived from such prices or parameters. Where observable prices or inputs are not available, valuation models are applied. These valuation models involve some level of management estimation and judgment, the degree of which is dependent on the price observability for the financial instruments or market and the financial instrument complexity. Management’s fair value analysis includes the value of any unfunded loan commitments. Financial instruments recorded at fair value on the financial statements are categorized for disclosure purposes based upon the level of judgment associated with the inputs used to measure their value. The valuation hierarchical levels are based upon the observability of the inputs to the valuation of the financial instrument as of the measurement date. The three levels are defined as follows: Level 1: Inputs are unadjusted, quoted prices in active markets for identical financial instruments at the measurement date. Level 2: Inputs include quoted prices for similar financial instruments in active markets and inputs that are observable for the financial instruments, either directly or indirectly, for substantially the full term of the financial instrument. Level 3: Inputs include significant unobservable inputs for the financial instruments and include situations where there is little, if any, market activity for the financial instrument. The inputs into the determination of fair value are based upon the best information available and require significant management judgment or estimation. In certain cases, the inputs used to measure fair value fall into different levels of the fair value hierarchy. In such cases, a financial instrument’s level within the fair value hierarchy is based on the lowest level of input that is significant to the fair value measurement. Management’s assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment and considers factors specific to the financial instrument. Management assesses the levels of financial instruments at each measurement date, and transfers between levels are recognized at the end of the period in which the event or change in circumstances that caused the transfers occurred. There were no transfers among Level 1, 2 and 3 of the fair value hierarchy for assets and liabilities for the period from June 8, 2023 (commencement of operations) to June 30, 2023. The following section describes the valuation techniques used by the Fund to measure different assets and liabilities at fair value and includes the level within the fair value hierarchy in which the assets and liabilities are categorized. Level 1 investments are valued using quoted market prices. Level 2 investments are valued using market consensus prices that are corroborated by observable market data and quoted market prices for similar assets and liabilities. Level 3 investments are valued at fair value as determined in good faith by management under a consistently applied valuation process. All investments as of June 30, 2023 were valued using Level 3 inputs of the fair value hierarchy. As of June 30, 2023, money market funds included in restricted cash and cash equivalents were valued using Level 1 inputs. GCP SG Warehouse 2022-1 Notes to Financial Statements 15

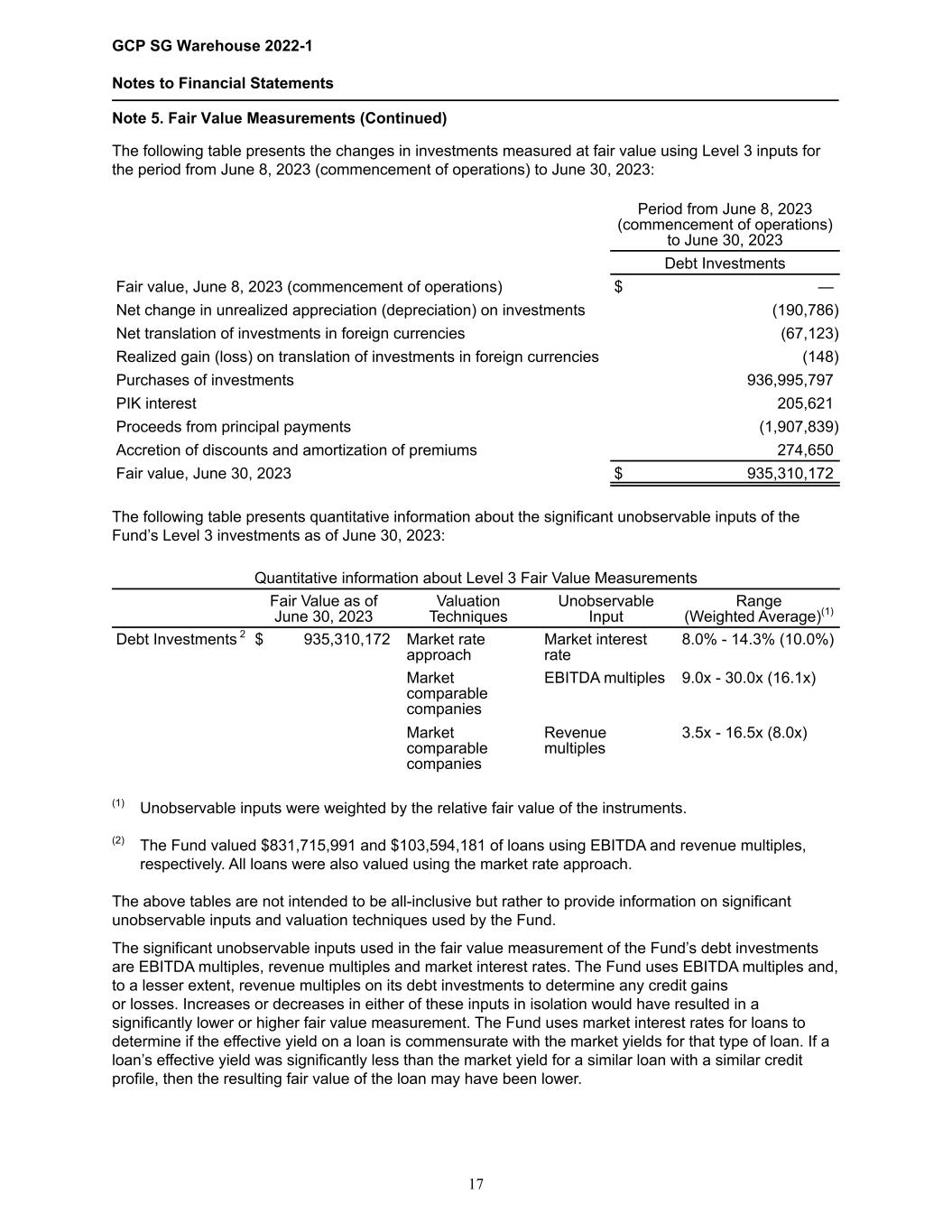

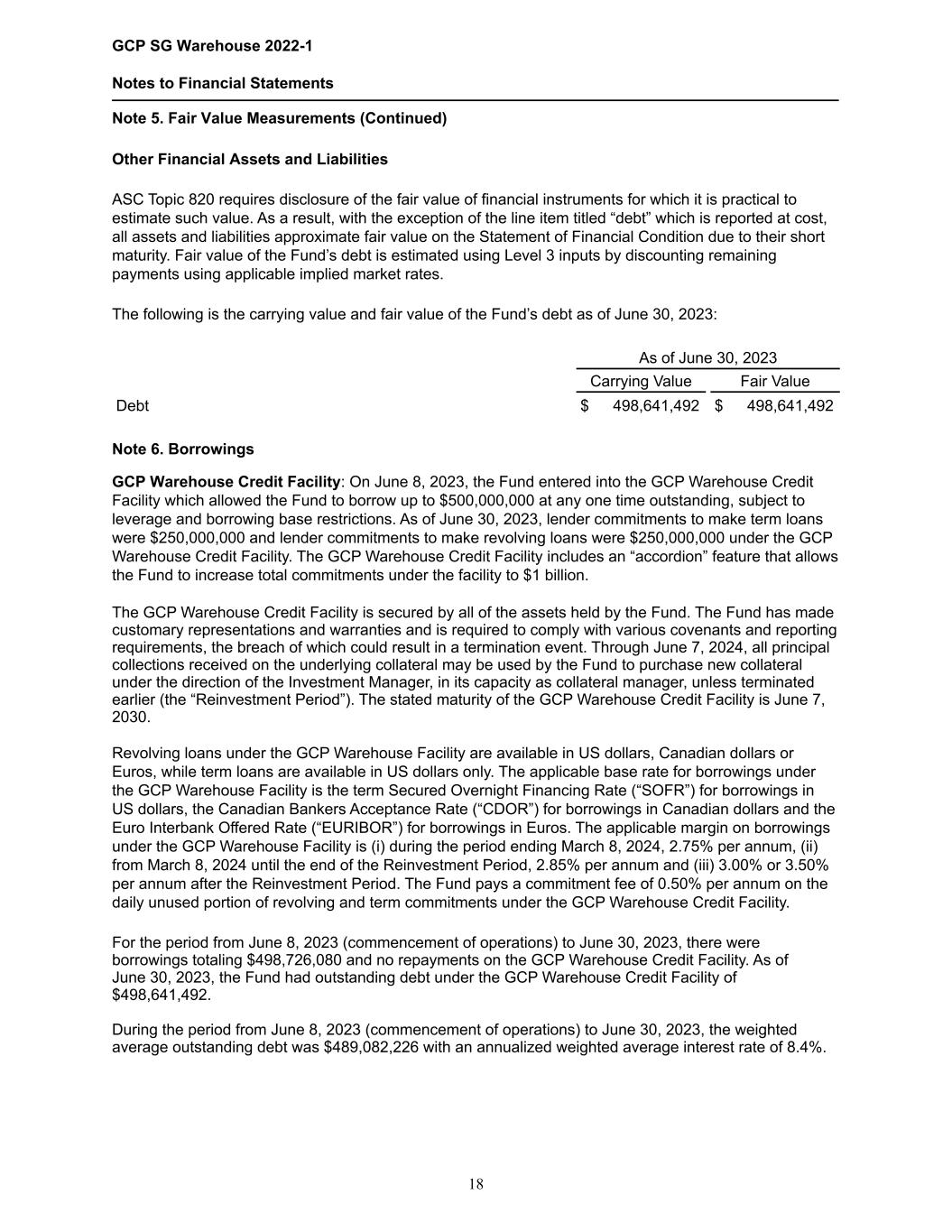

Note 5. Fair Value Measurements (Continued) When determining fair value of Level 3 debt investments, management may take into account the following factors, where relevant, in determining the fair value of the investments: the enterprise value of a portfolio company, the nature and realizable value of any collateral, the portfolio company’s ability to make payments and its earnings, discounted cash flows, the markets in which the portfolio company does business, comparisons to publicly traded securities and changes in the interest rate environment and the credit markets generally that affect the price at which similar investments are made and other relevant factors. The primary method for determining enterprise value uses a multiple analysis whereby appropriate multiples are applied to the portfolio company’s net income before net interest expense, income tax expense, depreciation and amortization (“EBITDA”). The enterprise value analysis is performed to determine if debt investments are credit impaired. If debt investments are credit impaired, the Fund will use the enterprise value analysis or a liquidation basis analysis to determine fair value. For debt investments that are not determined to be credit impaired, the Fund uses a market interest rate yield analysis to determine fair value. Due to the inherent uncertainty of determining the fair value of Level 3 instruments that do not have a readily available market value, the fair value of the financial instruments may differ significantly from the values that would have been used had a ready market existed for such financial instruments and may differ materially from the values that are ultimately received or settled. Further, such financial instruments are generally subject to legal and other restrictions or otherwise are less liquid than publicly traded financial instruments. If required to liquidate a portfolio investment in a forced or liquidation sale, the Fund could realize significantly less than the value at which such investment had previously been recorded. The Fund’s investments are subject to market risk. Market risk is the potential for changes in the value due to market changes. Market risk is directly impacted by the volatility and liquidity in the markets in which the investments are traded. The following tables present fair value measurements of the Fund’s investments and indicate the fair value hierarchy of the valuation techniques utilized by the Fund to determine such fair value as of June 30, 2023: As of June 30, 2023 Fair Value Measurements Using Description Level 1 Level 2 Level 3 Total Assets: Debt Investments(1) $ — $ — $ 935,310,172 $ 935,310,172 Money Market Funds(1)(2) 2,771,624 — — 2,771,624 Total Assets $ 2,771,624 $ — $ 935,310,172 $ 938,081,796 (1) Refer to the Schedule of Investments for further details. (2) Included in restricted cash and cash equivalents on the Statement of Financial Condition. GCP SG Warehouse 2022-1 Notes to Financial Statements 16

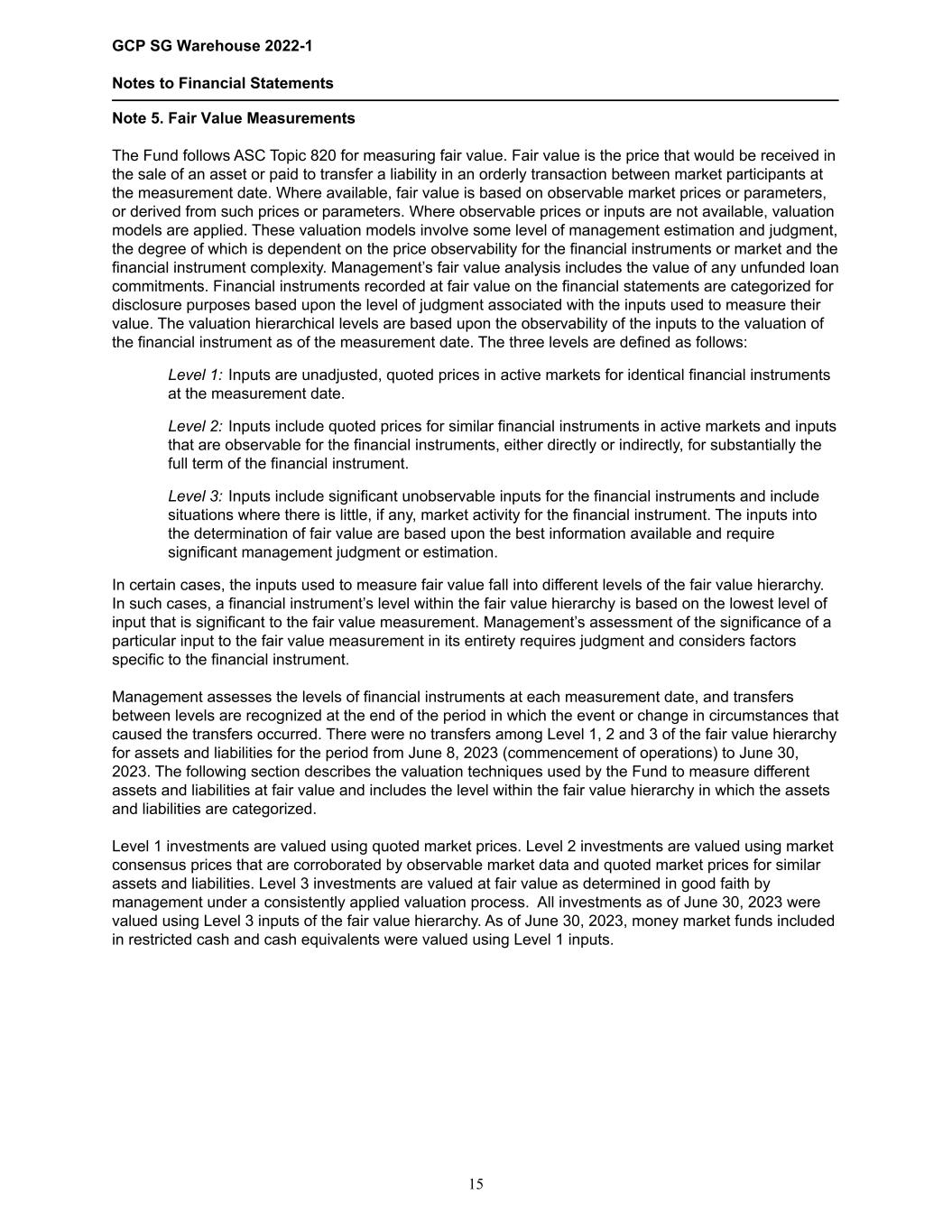

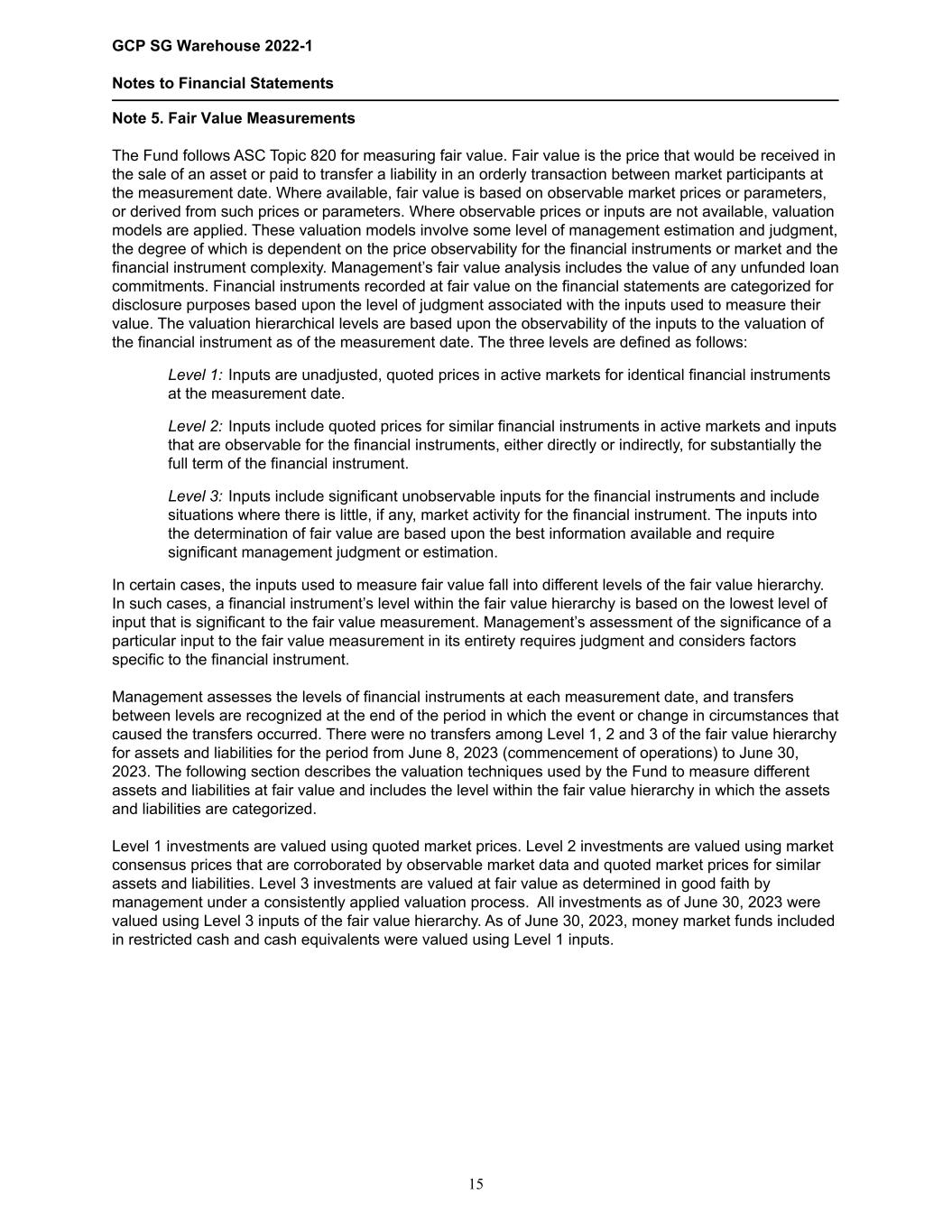

Note 5. Fair Value Measurements (Continued) The following table presents the changes in investments measured at fair value using Level 3 inputs for the period from June 8, 2023 (commencement of operations) to June 30, 2023: Period from June 8, 2023 (commencement of operations) to June 30, 2023 Debt Investments Fair value, June 8, 2023 (commencement of operations) $ — Net change in unrealized appreciation (depreciation) on investments (190,786) Net translation of investments in foreign currencies (67,123) Realized gain (loss) on translation of investments in foreign currencies (148) Purchases of investments 936,995,797 PIK interest 205,621 Proceeds from principal payments (1,907,839) Accretion of discounts and amortization of premiums 274,650 Fair value, June 30, 2023 $ 935,310,172 The following table presents quantitative information about the significant unobservable inputs of the Fund’s Level 3 investments as of June 30, 2023: Quantitative information about Level 3 Fair Value Measurements Fair Value as of June 30, 2023 Valuation Techniques Unobservable Input Range (Weighted Average)(1) Debt Investments 2 $ 935,310,172 Market rate approach Market interest rate 8.0% - 14.3% (10.0%) Market comparable companies EBITDA multiples 9.0x - 30.0x (16.1x) Market comparable companies Revenue multiples 3.5x - 16.5x (8.0x) (1) Unobservable inputs were weighted by the relative fair value of the instruments. (2) The Fund valued $831,715,991 and $103,594,181 of loans using EBITDA and revenue multiples, respectively. All loans were also valued using the market rate approach. The above tables are not intended to be all-inclusive but rather to provide information on significant unobservable inputs and valuation techniques used by the Fund. The significant unobservable inputs used in the fair value measurement of the Fund’s debt investments are EBITDA multiples, revenue multiples and market interest rates. The Fund uses EBITDA multiples and, to a lesser extent, revenue multiples on its debt investments to determine any credit gains or losses. Increases or decreases in either of these inputs in isolation would have resulted in a significantly lower or higher fair value measurement. The Fund uses market interest rates for loans to determine if the effective yield on a loan is commensurate with the market yields for that type of loan. If a loan’s effective yield was significantly less than the market yield for a similar loan with a similar credit profile, then the resulting fair value of the loan may have been lower. GCP SG Warehouse 2022-1 Notes to Financial Statements 17

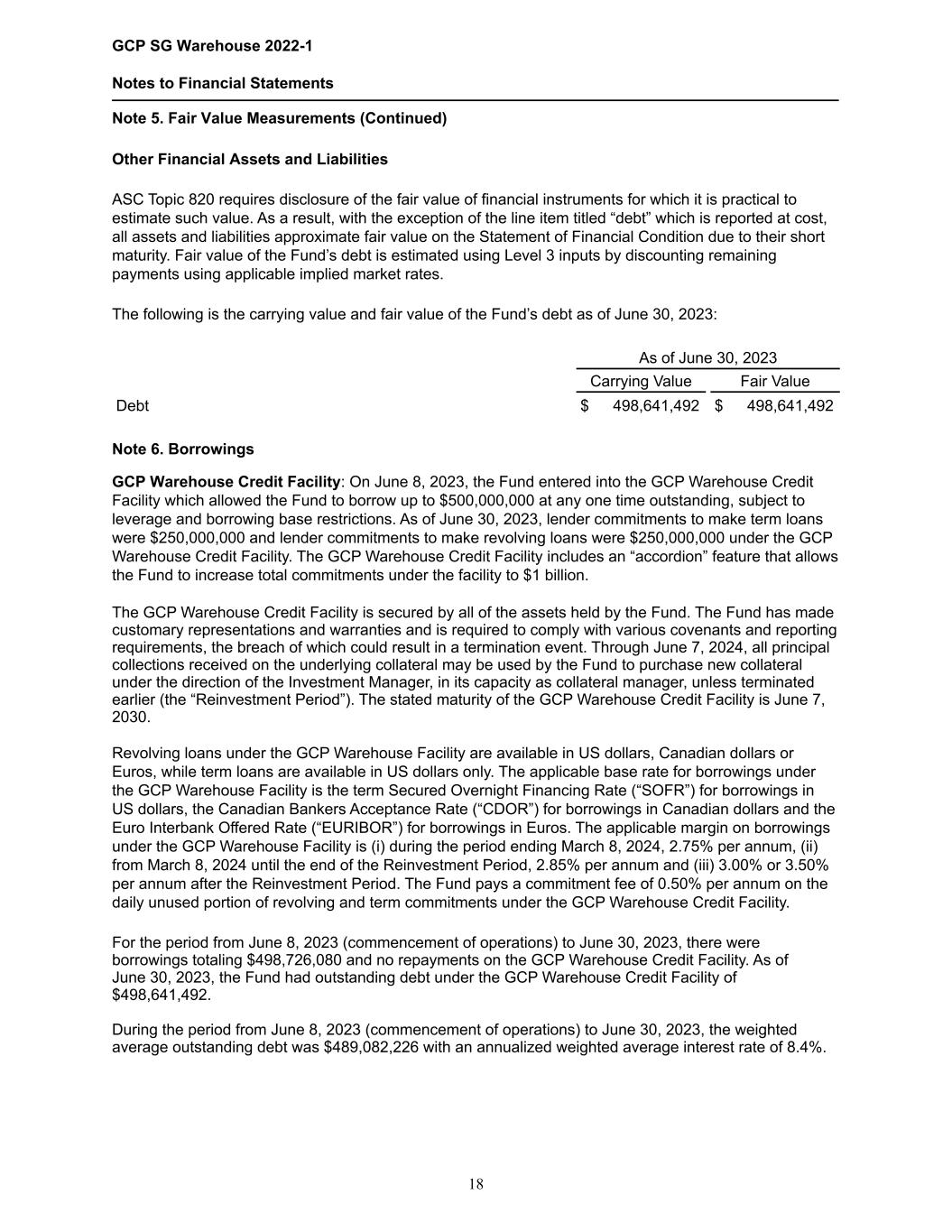

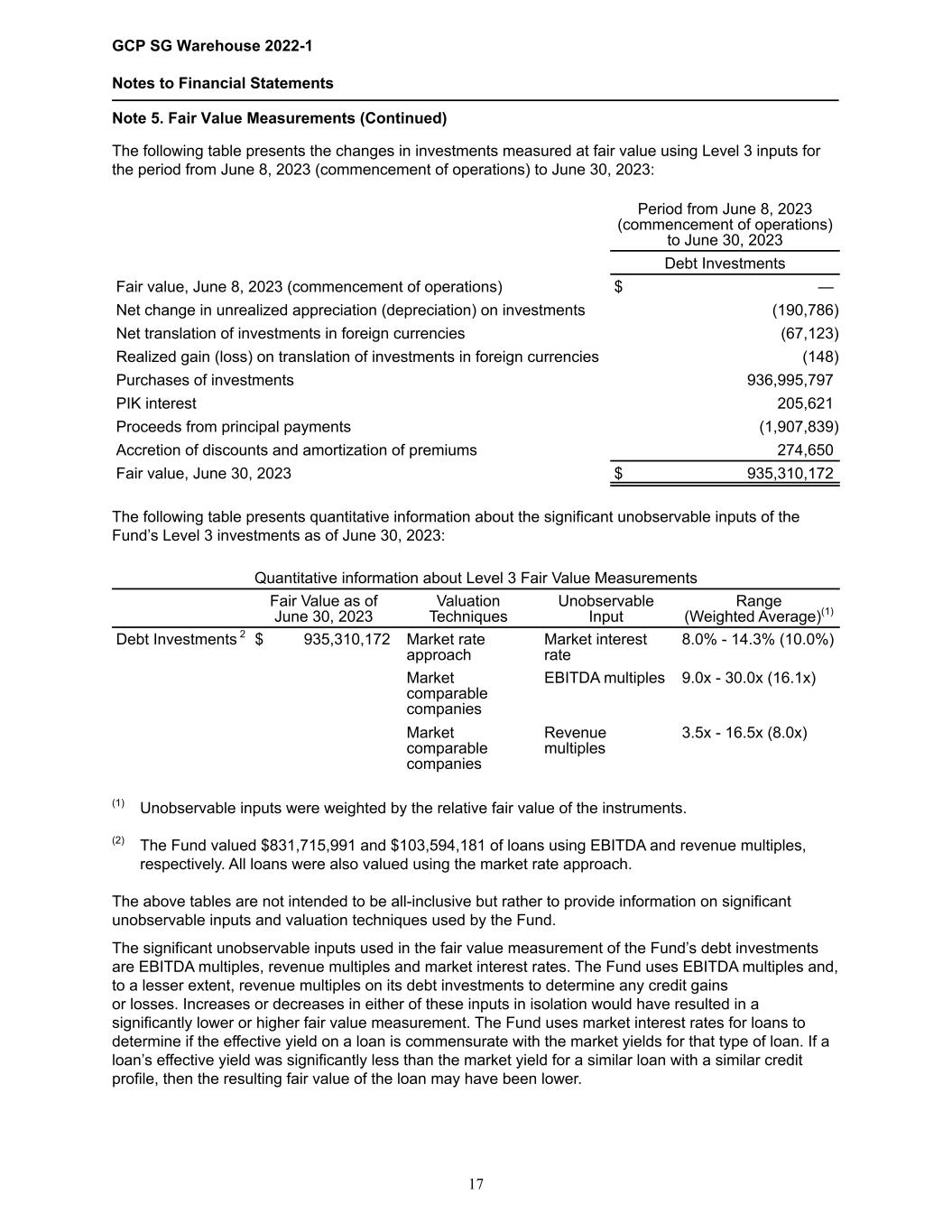

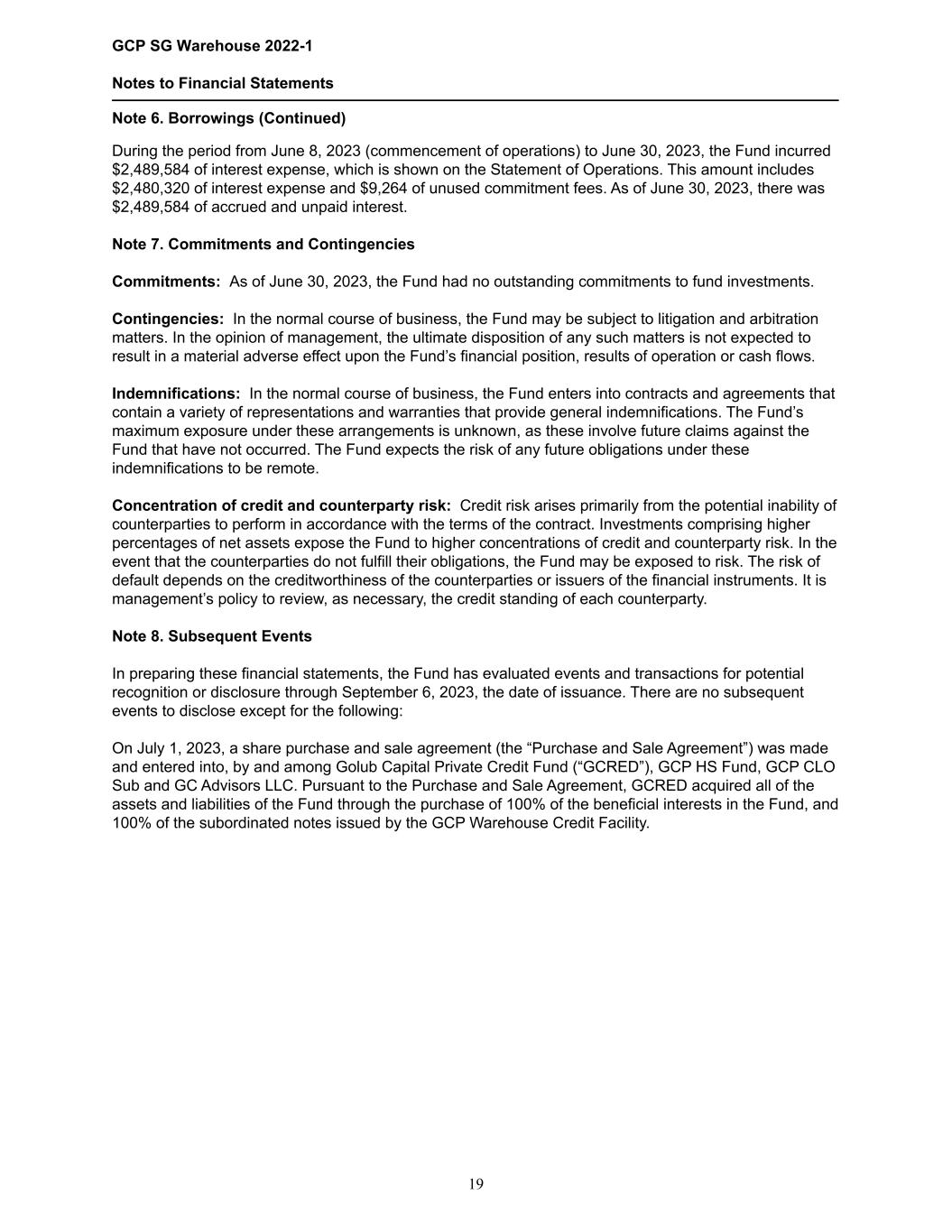

Note 5. Fair Value Measurements (Continued) Other Financial Assets and Liabilities ASC Topic 820 requires disclosure of the fair value of financial instruments for which it is practical to estimate such value. As a result, with the exception of the line item titled “debt” which is reported at cost, all assets and liabilities approximate fair value on the Statement of Financial Condition due to their short maturity. Fair value of the Fund’s debt is estimated using Level 3 inputs by discounting remaining payments using applicable implied market rates. The following is the carrying value and fair value of the Fund’s debt as of June 30, 2023: As of June 30, 2023 Carrying Value Fair Value Debt $ 498,641,492 $ 498,641,492 Note 6. Borrowings GCP Warehouse Credit Facility: On June 8, 2023, the Fund entered into the GCP Warehouse Credit Facility which allowed the Fund to borrow up to $500,000,000 at any one time outstanding, subject to leverage and borrowing base restrictions. As of June 30, 2023, lender commitments to make term loans were $250,000,000 and lender commitments to make revolving loans were $250,000,000 under the GCP Warehouse Credit Facility. The GCP Warehouse Credit Facility includes an “accordion” feature that allows the Fund to increase total commitments under the facility to $1 billion. The GCP Warehouse Credit Facility is secured by all of the assets held by the Fund. The Fund has made customary representations and warranties and is required to comply with various covenants and reporting requirements, the breach of which could result in a termination event. Through June 7, 2024, all principal collections received on the underlying collateral may be used by the Fund to purchase new collateral under the direction of the Investment Manager, in its capacity as collateral manager, unless terminated earlier (the “Reinvestment Period”). The stated maturity of the GCP Warehouse Credit Facility is June 7, 2030. Revolving loans under the GCP Warehouse Facility are available in US dollars, Canadian dollars or Euros, while term loans are available in US dollars only. The applicable base rate for borrowings under the GCP Warehouse Facility is the term Secured Overnight Financing Rate (“SOFR”) for borrowings in US dollars, the Canadian Bankers Acceptance Rate (“CDOR”) for borrowings in Canadian dollars and the Euro Interbank Offered Rate (“EURIBOR”) for borrowings in Euros. The applicable margin on borrowings under the GCP Warehouse Facility is (i) during the period ending March 8, 2024, 2.75% per annum, (ii) from March 8, 2024 until the end of the Reinvestment Period, 2.85% per annum and (iii) 3.00% or 3.50% per annum after the Reinvestment Period. The Fund pays a commitment fee of 0.50% per annum on the daily unused portion of revolving and term commitments under the GCP Warehouse Credit Facility. For the period from June 8, 2023 (commencement of operations) to June 30, 2023, there were borrowings totaling $498,726,080 and no repayments on the GCP Warehouse Credit Facility. As of June 30, 2023, the Fund had outstanding debt under the GCP Warehouse Credit Facility of $498,641,492. During the period from June 8, 2023 (commencement of operations) to June 30, 2023, the weighted average outstanding debt was $489,082,226 with an annualized weighted average interest rate of 8.4%. GCP SG Warehouse 2022-1 Notes to Financial Statements 18

Note 6. Borrowings (Continued) During the period from June 8, 2023 (commencement of operations) to June 30, 2023, the Fund incurred $2,489,584 of interest expense, which is shown on the Statement of Operations. This amount includes $2,480,320 of interest expense and $9,264 of unused commitment fees. As of June 30, 2023, there was $2,489,584 of accrued and unpaid interest. Note 7. Commitments and Contingencies Commitments: As of June 30, 2023, the Fund had no outstanding commitments to fund investments. Contingencies: In the normal course of business, the Fund may be subject to litigation and arbitration matters. In the opinion of management, the ultimate disposition of any such matters is not expected to result in a material adverse effect upon the Fund’s financial position, results of operation or cash flows. Indemnifications: In the normal course of business, the Fund enters into contracts and agreements that contain a variety of representations and warranties that provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as these involve future claims against the Fund that have not occurred. The Fund expects the risk of any future obligations under these indemnifications to be remote. Concentration of credit and counterparty risk: Credit risk arises primarily from the potential inability of counterparties to perform in accordance with the terms of the contract. Investments comprising higher percentages of net assets expose the Fund to higher concentrations of credit and counterparty risk. In the event that the counterparties do not fulfill their obligations, the Fund may be exposed to risk. The risk of default depends on the creditworthiness of the counterparties or issuers of the financial instruments. It is management’s policy to review, as necessary, the credit standing of each counterparty. Note 8. Subsequent Events In preparing these financial statements, the Fund has evaluated events and transactions for potential recognition or disclosure through September 6, 2023, the date of issuance. There are no subsequent events to disclose except for the following: On July 1, 2023, a share purchase and sale agreement (the “Purchase and Sale Agreement”) was made and entered into, by and among Golub Capital Private Credit Fund (“GCRED”), GCP HS Fund, GCP CLO Sub and GC Advisors LLC. Pursuant to the Purchase and Sale Agreement, GCRED acquired all of the assets and liabilities of the Fund through the purchase of 100% of the beneficial interests in the Fund, and 100% of the subordinated notes issued by the GCP Warehouse Credit Facility. GCP SG Warehouse 2022-1 Notes to Financial Statements 19