Performance Update GCRED delivered a strong quarter, with Class I shares generating a 2.7% quarterly return, bringing the annualized inception-to-date net return to 11.4%.1 The annualized net distribution rate for Class I was 9.6% in the quarter.2 Our investment portfolio remained healthy as our net asset value (NAV) increased 0.2% in the quarter to $25.14 as of December 31, 2024.3 Portfolio Summary Record quarter of origination. GCRED had a strong quarter of investment origination, deploying approximately $1.1 billion in gross capital and net funds growth of approximately $0.8 billion. Golub Capital’s long-standing sponsor and borrower relationships generated attractive deal flow for GCRED as the M&A environment improved compared to 2023 and the first half of 2024. While our origination activity increased in the quarter, we remain highly selective—focusing on quality over quantity. We continue to see spread compression across all credit markets but believe our focus on core middle market lending provided insulation compared to large market lenders. $4.1 billion Total Investments6 99% First Lien, Senior Secured7 99% Floating Rate8 100% Sponsor-Backed Loans $76 million Median EBITDA9 43% Average Loan-to-Value10 0.99x Leverage Ratio11 Golub Capital Private Credit Fund (“GCRED” or the “Fund”) Q4 2024 Quarterly Update Source: Golub Capital. As of December 31, 2024, unless otherwise stated. Note: You will bear substantial fees and expenses in connection with your investment. This page is accompanied by the Additional Footnotes at the end of this document, which are an integral part of this report (the “Material”). This is neither an offer to sell nor a solicitation of an offer to buy the securities described herein, and must be read in conjunction with the prospectus (the "Prospectus") in order to understand fully all of the implications and risks of the offering to which this sales and advertising literature relates. Past performance is not necessarily indicative of future results, and there can be no assurance that any Golub Capital fund or investment will achieve its objectives or avoid substantial losses. A copy of the Prospectus must be made available to you in connection with this offering, and is available at www.gcredbdc.com. Consider carefully GCRED’s investment objectives, risks, charges, expenses and other matters of interest set forth in the Prospectus and any accompanying prospectus supplements. The Prospectus and any accompanying prospectus supplements contain this and other information about GCRED. Please read the Prospectus and any accompanying prospectus supplements carefully before investing. 1 Total Net Returns1 Class IClass D4Class S4 1.04% --0.94% 1-Month 2.66% --2.36% 3-Month 10.91% --6.87% YTD5 11.45% --6.87% Annualized ITD5

Golub Capital Private Credit Fund (“GCRED”) | Q4 2024 Quarterly Update 2 Strong portfolio resilience continued. The overall credit performance of GCRED’s investment portfolio was strong in the quarter. As part of our investment monitoring process, we assign internal performance ratings to all loans in the portfolio on a scale from 1 (highest risk) to 5 (lowest risk). Approximately 98% of GCRED’s investment portfolio falls within rating categories 4 and 5, indicating borrowers performing at or above expectations and presenting lower risk to the portfolio. Notably, GCRED has zero debt investments rated in category 1 (highest risk) and category 2 (increased risk). Non-accrual investments are another common metric for assessing the credit health of a portfolio, as they may indicate potential defaults. GCRED’s portfolio has zero debt investments on non-accrual. This metric is significantly below the industry average.12 GCRED’s investment portfolio continues to demonstrate strong resilience, even amidst increased credit stress and manager dispersion across private and liquid credit markets. Source: Golub Capital. As of December 31, 2024, unless otherwise stated. Note: This page is accompanied by the Additional Footnotes at the end of this document, which are an integral part of this Material. $25.05 $25.00 $25.00 $25.07 $25.07 $25.02 $25.06 $25.17 $25.15 $25.19 $25.12 $25.08 $25.12 $25.10 $25.14 $23.00 $24.00 $25.00 Historical Price Per Share3,5 Loan Market Insights M&A volume recovered but remained below market expectations. Private equity deal activity increased in Q4 year- over-year, and 2024 compared favorably to 2023, but M&A volumes remain well below consensus expectations and lower than what we consider a “normal” level.13 While we remain cautious about making predictions, it appears that M&A activity could continue its upward recovery in 2025. There remain several secular tailwinds supporting increased M&A activity, including: a generally healthy U.S. economy, a stock of nearly $2 trillion of private equity dry powder available to invest, and growing pressure on private equity firms to return capital to their investors.14

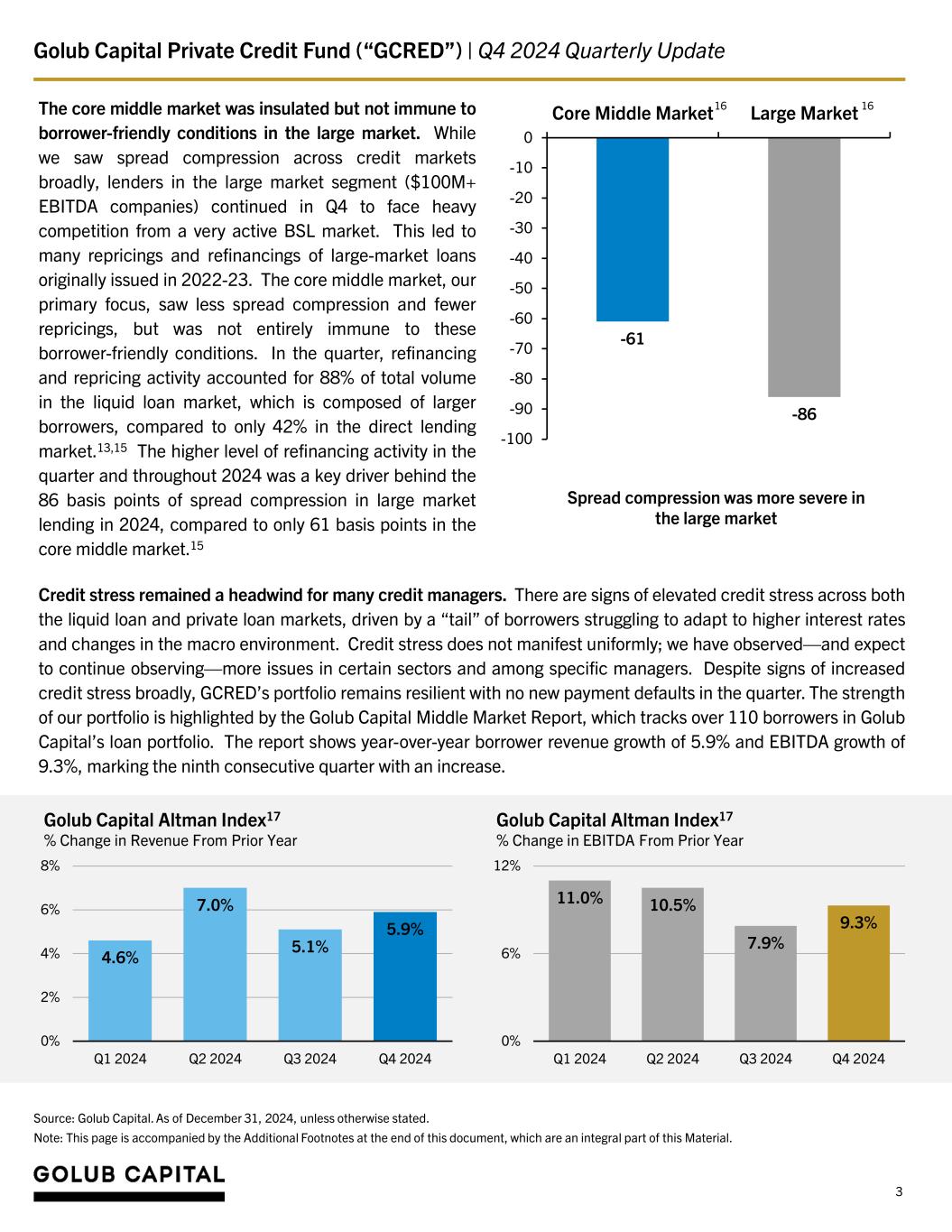

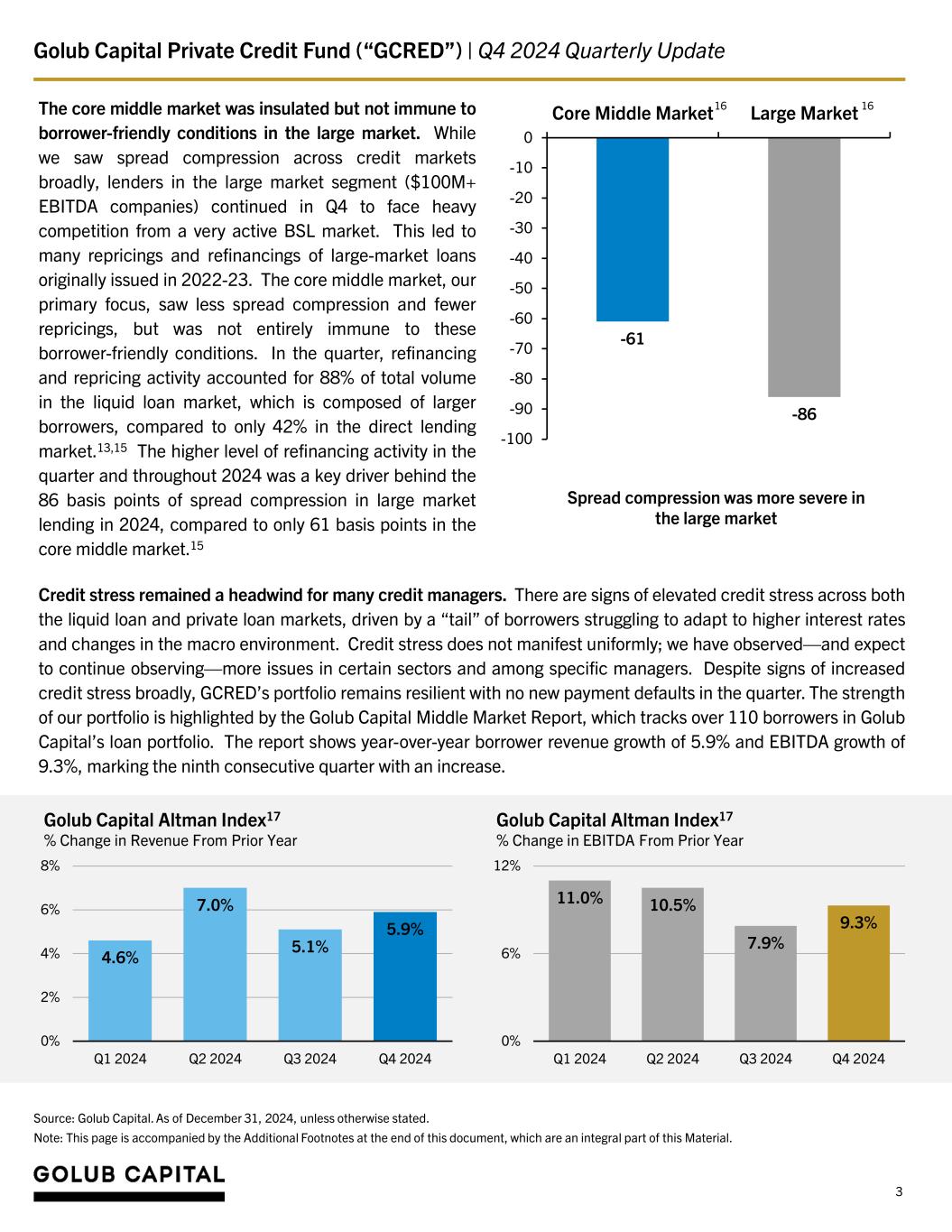

Golub Capital Private Credit Fund (“GCRED”) | Q4 2024 Quarterly Update 3 The core middle market was insulated but not immune to borrower-friendly conditions in the large market. While we saw spread compression across credit markets broadly, lenders in the large market segment ($100M+ EBITDA companies) continued in Q4 to face heavy competition from a very active BSL market. This led to many repricings and refinancings of large-market loans originally issued in 2022-23. The core middle market, our primary focus, saw less spread compression and fewer repricings, but was not entirely immune to these borrower-friendly conditions. In the quarter, refinancing and repricing activity accounted for 88% of total volume in the liquid loan market, which is composed of larger borrowers, compared to only 42% in the direct lending market.13,15 The higher level of refinancing activity in the quarter and throughout 2024 was a key driver behind the 86 basis points of spread compression in large market lending in 2024, compared to only 61 basis points in the core middle market.15 4.6% 7.0% 5.1% 5.9% 0% 2% 4% 6% 8% Q1 2024 Q2 2024 Q3 2024 Q4 2024 Golub Capital Altman Index17 % Change in Revenue From Prior Year 11.0% 10.5% 7.9% 9.3% 0% 6% 12% Q1 2024 Q2 2024 Q3 2024 Q4 2024 Golub Capital Altman Index17 % Change in EBITDA From Prior Year Credit stress remained a headwind for many credit managers. There are signs of elevated credit stress across both the liquid loan and private loan markets, driven by a “tail” of borrowers struggling to adapt to higher interest rates and changes in the macro environment. Credit stress does not manifest uniformly; we have observed—and expect to continue observing—more issues in certain sectors and among specific managers. Despite signs of increased credit stress broadly, GCRED’s portfolio remains resilient with no new payment defaults in the quarter. The strength of our portfolio is highlighted by the Golub Capital Middle Market Report, which tracks over 110 borrowers in Golub Capital’s loan portfolio. The report shows year-over-year borrower revenue growth of 5.9% and EBITDA growth of 9.3%, marking the ninth consecutive quarter with an increase. -61 -86 -100 -90 -80 -70 -60 -50 -40 -30 -20 -10 0 Core Middle Market Large Market Spread compression was more severe in the large market 16 16 Source: Golub Capital. As of December 31, 2024, unless otherwise stated. Note: This page is accompanied by the Additional Footnotes at the end of this document, which are an integral part of this Material.

Golub Capital Private Credit Fund (“GCRED”) | Q4 2024 Quarterly Update 4 Outlook We are confident in GCRED’s ability to navigate a variety of potential environments. We believe our core middle market strategy distinguishes us from many of our competitors focused on larger companies. This is particularly important given that increased competition from the syndicated loan market has pressured terms in the large market in 2024. We believe our focus on the core middle market places us in a favorable position compared to our large market-focused peers. We are seeing signs of elevated credit stress across markets broadly. An environment with elevated levels of credit stress is one that has historically separated lenders with strong businesses and real competitive advantages from those who do not. GCRED is well-positioned to be on the favorable end of this dispersion, thanks to the competitive advantages we have developed over decades of lending to sponsor-backed businesses. Thus far, our portfolio has remained resilient with stable internal performance ratings and zero loans on non-accrual status. Looking ahead, there are cross-currents in the market that warrant both optimism and concern. Our approach is to stay humble and focus on preparing for a variety of potential scenarios. We believe GCRED is uniquely positioned to continue delivering strong earnings regardless of the environment. This confidence stems from our resilient portfolio, core middle market focus and our manager’s expertise in navigating diverse and often challenging environments over the past 30 years. Source: Golub Capital. As of December 31, 2024, unless otherwise stated. _________________________________ Important Investor Information Golub Capital (including its various affiliates) creates and manages multiple investment funds. Two of its control affiliates, GC Advisors LLC (“GC Advisors” or the “Investment Adviser”) and GC OPAL Advisors LLC (“GC OPAL Advisors”, and together with GC Advisors, the “Registered Advisers”) are registered investment advisers with the U.S. Securities and Exchange Commission (the “SEC”). A number of other investment advisers, such as GC Investment Management LLC and OPAL BSL LLC (Management Series) (collectively, the “Relying Advisers”) are registered in reliance upon GC OPAL Advisors’ registration. The Registered Advisers and the Relying Advisers (collectively, the “Advisers”) manage certain of Golub Capital’s affiliated funds and accounts. For a detailed description of the Advisers and each of their investment advisory fees, please see the Registered Advisers’ Form ADV Part 1 and 2A on file with the SEC. Registration is not an endorsement by the SEC, nor does it mean that a government agency approves an advisor or reviews its qualifications. Registration does not imply a certain level of skill or training, nor does it guarantee success or future performance. Past performance is not indicative nor a guarantee of future returns and there can be no assurance that GCRED will achieve results comparable to those of any of Golub Capital’s investment funds or be able to implement its strategy or achieve its investment objectives, including due to an inability to access sufficient investment opportunities.

Golub Capital Private Credit Fund (“GCRED”) | Q4 2024 Quarterly Update 5 Additional Footnotes 1. Total Net Return is calculated as the change in price per share during the period, plus distributions per share (assuming dividends and distributions are reinvested) divided by the beginning price per share. Returns greater than one year are annualized. All returns shown are derived from unaudited financial information and are net of all expenses, including general and administrative expenses, transaction related expenses, management fees, incentive fees, and share class specific fees, but exclude the impact of early repurchase deductions on the repurchase of shares that have been outstanding for less than one year. Past performance is historical and not a guarantee of future results. The returns have been prepared using unaudited data and valuations of the underlying investments in GCRED's portfolio, which are estimates of fair value and form the basis for GCRED’s price per share. Valuations based upon unaudited reports from the underlying investments may be subject to later adjustments, may not correspond to realized value and may not accurately reflect the price at which assets could be liquidated. 2. As of December 31, 2024. Annualized Net Distribution Rate is calculated by multiplying the sum of (i) the last three monthly distributions per share and (ii) special distributions, if any, payable or paid by four, and dividing the result by the price per share of the month preceding the relevant three month period. Distributions are not guaranteed. While GCRED may seek a level distribution rate, GCRED’s distribution rates may be affected by numerous factors, including but not limited to changes in realized and projected market returns, fluctuations in market interest rates, fund performance, and other factors. There can be no assurance that a change in market conditions or other factors will not result in a change in GCRED’s distribution rate or that the rate will be sustainable in the future. Past performance is not necessarily indicative of future results. Distributions have been and may in the future be funded through sources other than cash flow. See GCRED’s prospectus for additional information. Please visit GCRED’s website for notices regarding distributions subject to Section 19(a) of the Investment Company Act of 1940. We cannot guarantee that we will make distributions, and if we do we may fund such distributions from sources other than cash flow from operations, including the sale of assets, borrowings, return of capital, or offering proceeds, and although we generally expect to fund distributions from cash flow from operations, we have not established limits on the amounts we may pay from such sources. As of December 31, 2024, 100% of inception to date distributions were funded from cash flows from operations and current estimates do not expect a return of capital. A return of capital (1) is a return of the original amount invested, (2) does not constitute earnings or profits and (3) will have the effect of reducing the basis such that when a shareholder sells its shares the sale may be subject to taxes even if the shares are sold for less than the original purchase price. Distributions may also be funded in significant part, directly or indirectly, from temporary waivers or expense reimbursements borne by the Investment Adviser or its affiliates, that may be subject to reimbursement to the Investment Adviser or its affiliates. The repayment of any amounts owed to our affiliates will reduce future distributions to which you would otherwise be entitled. 3. The price per share is determined in accordance with the Fund's share pricing policy. The NAV per share is determined quarterly by dividing the value of total assets minus liabilities by the total number of shares outstanding. For each fiscal quarter end, the price per share is the NAV per share as determined by the Fund’s valuation process. For months in which the Fund’s NAV per share is not determined, the price per share is an offering price per share that reflects a price per share that is no less then the then-current NAV per share. Please refer to the Prospectus for disclosures relating to the share pricing policy. 4. The Fund has received an exemptive order from the U.S. Securities and Exchange Commission that permits the Fund to issue multiple classes of Common Shares with, among others, different ongoing shareholder servicing and/or distribution fees. 5. The Class I inception date was July 1, 2023 and the Class S inception date was April 1, 2024. 6. Represents total investments at fair value. As of December 31, 2024. 7. Measured as the fair value of investments for each category against the total fair value of all investments. Junior debt is comprised of second lien and subordinated debt. Totals may not sum due to rounding. 8. As a percentage of debt investments in GCRED's portfolio. As of December 31, 2024, GCRED held five debt investments in an amount that represented approximately 1% of debt investments based on fair value that had a fixed interest rate. Numbers may not be exact due to rounding. 9. As of September 30, 2024. The portfolio median EBITDA (defined as earnings before interest, taxes, depreciation and amortization) is based on our portfolio of debt investments and excludes (i) portfolio companies with negative or de minimis EBITDA, (ii) investments designated as recurring revenue and broadly syndicated loans and (iii) portfolio companies with any loans on non-accrual status. 10. As of September 30, 2024. Includes all private debt investments for which fair value is determined in good faith in accordance with the Fund’s valuation process, which includes the review of the valuation of each portfolio company, subject to a de minimis threshold, by an independent third-party valuation firm. Excludes quoted assets and recurring revenue loans. Average loan-to-value represents the ratio of loan-to-value for each portfolio company, weighted based on the fair value of total applicable GCRED private debt investments. Loan-to-value is calculated as the current total debt through each respective loan tranche divided by the estimated enterprise value of the portfolio company using the most recently received portfolio company information. Therefore, current enterprise value may not be up to date for certain portfolio companies. See GCRED’s Prospectus for additional information. 11. Represents the Fund’s debt-to-equity leverage ratio. As of December 31, 2024. 12. KBW “BDC Credit Monitor” and Golub Capital internal analysis. As of September 30, 2024. 13. Pitchbook LCD’s “US Credit Markets Quarterly Wrap” and Golub Capital internal analysis. As of December 31, 2024. 14. Preqin; dry powder is defined as the sum of uncalled capital commitments which GPs will have to invest. As of December 31, 2024. 15. KBRA’s “KBRA DLD Monthly Insights & Outlook; U.S. Sponsored Deals; December 2024/4Q Report,” and Golub Capital analysis. As of December 31, 2024. 16. Core Middle Market = $20M EBITDA to < $100M EBITDA (average of $20M EBITDA to $50M EBITDA and $50M EBITDA to <$100M EBITDA segments). Large Market Deals = $100M+ EBITDA. 17. The Golub Capital Altman Index (“GCAI”) measures the median revenue and earnings growth of approximately 110–150 privately owned companies in the Golub Capital loan portfolio for the first two months of each calendar quarter. The GCAI is produced by Golub Capital in collaboration with credit expert Dr. Edward I. Altman. For more information, including a description of the methodology used to create the GCAI, please visit golubcapital.com/middle-market- report.

Golub Capital Private Credit Fund (“GCRED”) | Q4 2024 Quarterly Update Key Risk Factors (Not Inclusive of All Risks to the Fund) − In considering any investment performance information contained in this Material, prospective investors should bear in mind that past or estimated performance is not necessarily indicative of future results and there can be no assurance that the Fund will achieve comparable results, implement its investment strategy, achieve its objectives or avoid substantial losses or that any expected returns will be met. − Embedded Growth. Embedded growth represents Golub Capital LLC’s (together with its affiliates, “Golub Capital”) expectations for growth based on its view of the current market environment. These expectations are based on certain assumptions that may not be correct and on certain variables that may change, are presented for illustrative purposes only and do not constitute forecasts. There can be no assurance that any such results will actually be achieved. Summary of Risks − We are a relatively new company with a limited operating history and there is no assurance that we will achieve our investment objective. − The majority of our portfolio investments are valued using the investment’s fair value, as determined in good faith by our valuation designee, subject to oversight by our board of trustees, and, as a result, there could be uncertainty as to the value of our portfolio investments. − Because subscriptions must be submitted at least five business days prior to the first calendar day of each month (unless waived), you will not know the net offering price per share at which you will be subscribing at the time you subscribe. − You should not expect to be able to sell your common shares of beneficial interest (“Common Shares”) regardless of how we perform. − You should not expect to have access to the money you invest for an extended period of time. − We do not intend to list our Common Shares on any securities exchange, and we do not expect a secondary market in our Common Shares to develop prior to any listing. − Because you should not expect to be able to sell your shares, you should not expect to be able to reduce your exposure in any market downturn. − At the discretion of our board of trustees, we have commenced a quarterly share repurchase program, but only a limited number of shares will be eligible for repurchase and repurchases will be subject to available liquidity, among other significant restrictions. Our board of trustees may amend, suspend or terminate the share repurchase program upon 30 days’ notice, if it deems such action to be in our best interest and the best interest of our shareholders. As a result, we cannot guarantee that share repurchases will be made available each quarter. − An investment in our Common Shares is not suitable for you if you need access to the money you invest. − You will bear substantial fees and expenses in connection with your investment. − Because the incentive fee is based on the performance of our portfolio, the Investment Adviser may be incentivized to make investments on our behalf that are riskier or more speculative than would be the case in the absence of such compensation arrangement. − We cannot guarantee that we will make distributions, and if we do, we may fund such distributions from sources other than cash flow from operations, including the sale of assets, borrowings, return of capital or offering proceeds, and although we generally expect to fund distributions from cash flow from operations, we have not established limits on the amounts we may pay from such sources. Any capital returned through distributions will be returned after the payment of fees and expenses. − Distributions may also be funded in significant part, directly or indirectly, from temporary waivers or expense reimbursements borne by the Investment Adviser or its affiliates, that may be subject to reimbursement to the Investment Adviser or its affiliates. The repayment of any amounts owed to our affiliates will reduce future distributions to which you would otherwise be entitled. − We use and expect to continue to use leverage, which will magnify the potential for loss on amounts invested in us. − We invest in securities that are rated below investment grade by independent rating agencies or that would be rated below investment grade if they were rated. Below investment grade securities, which are often referred to as “junk,” have predominantly speculative characteristics with respect to the issuer’s capacity to pay interest and repay principal. They may also be illiquid and difficult to value. − Neither the U.S. Securities and Exchange Commission nor any state securities regulator has approved or disapproved of these securities or determined if the Prospectus is truthful or complete. Any representation to the contrary is a criminal offense. Securities regulators have also not passed upon whether this offering can be sold in compliance with existing or future suitability or conduct standards including the ‘Regulation Best Interest’ standard to any or all purchasers. − This Material must be accompanied or proceeded by the Prospectus and must be read in conjunction with the Prospectus in order to fully understand all the implications and risks of an investment in GCRED. This Material is neither an offer to sell nor a solicitation of an offer to buy securities. An offering is made only by the Prospectus. Prior to making an investment, investors should read the Prospectus, including the “Risk Factors” section therein, which contain the risks and uncertainties that we believe are material to our business’ operating results. 6

Golub Capital Private Credit Fund (“GCRED”) | Q4 2024 Quarterly Update Important Disclosure Information In considering any investment performance information contained in this Material, prospective and current investors should bear in mind that past or projected performance is not necessarily indicative of future results and there can be no assurance that the Fund will achieve comparable results, implement its investment strategy, achieve its objectives or avoid substantial losses or that any expected returns will be met. Estimates /Targets. Any estimates, targets, forecasts, or similar predictions or returns set forth herein are based on assumptions and assessments made by Golub Capital that it considers reasonable under the circumstances as of the date hereof. They are necessarily speculative, hypothetical, and inherently uncertain in nature, and it can be expected that some or all of the assumptions underlying such estimates, targets, forecasts , or similar predictions or returns contained herein will not materialize and/or that actual events and consequences thereof will vary materially from the assumptions upon which such estimates, targets, forecasts, or similar predictions or returns have been based. Among the assumptions to be made by Golub Capital in performing its analysis are (i) the amount and frequency of current income from an investment, (ii) the holding period length, (iii) EBITDA growth and cost savings over time, (iv) the manner and timing of sale, (v) exit multiples reflecting long-term averages for the relevant asset type, (vi) customer growth and other business initiatives, (vii) availability of financing, (viii) potential investment opportunities Golub Capital is currently or has recently reviewed and (ix) overall macroeconomic conditions such as GDP growth, unemployment and interest rate levels. Inclusion of estimates, targets, forecasts, or similar predictions or returns herein should not be regarded as a representation or guarantee regarding the reliability, accuracy or completeness of such information, and neither Golub Capital nor the Fund is under any obligation to revise such returns after the date provided to reflect the occurrence of future events, even in the event that any or all of the assumptions underlying such returns are later shown to be incorrect. None of Golub Capital, the Fund, their affiliates or any of the respective directors, officers, employees, partners, shareholders, advisers and agents of any of the foregoing makes any assurance, representation or warranty as to the accuracy of such assumptions. Investors and clients are cautioned not to place undue reliance on these forward-looking statements. Recipients of this Material are encouraged to contact Fund representatives to discuss the procedures and methodologies used to make the estimates, targets, forecasts, and/or similar predictions or returns and other information contained herein. Forward-Looking Statements. Certain information contained in this Material constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “continue” or other similar words, or the negatives thereof. These may include financial predictions estimates and their underlying assumptions, statements about plans, objectives and expectations with respect to future operations, and statements regarding future performance. Such forward‐looking statements are inherently uncertain and there are or may be important factors that could cause actual outcomes or results to differ materially from those indicated in such statements. Golub Capital believes these factors include but are not limited to those described under the section entitled “Risk Factors”, which are further described in the Prospectus, and any such updated factors included in GCRED's periodic filings with the U.S. Securities and Exchange Commission, which will be accessible on the SEC’s website at www.sec.gov. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this Material and in the filings. Golub Capital undertakes no obligation to publicly update or review any forward‐looking statement, whether as a result of new information, future developments or otherwise. Investments mentioned may not be suitable for all investors. Any product discussed herein may be purchased only after an investor has carefully reviewed the prospectus and executed the subscription document, which will contain additional information about the fund. Accordingly, the terms and provisions included herein are presented as of the dates indicated and information about the fund in its final form may differ materially from the information set forth herein. Alternative investments often are speculative, typically have higher fees than traditional investments, often include a high degree of risk and are suitable only for eligible, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time. They may be highly illiquid and can engage in leverage and other speculative practices that may increase volatility and risk of loss. 7

Golub Capital Private Credit Fund (“GCRED”) | Q4 2024 Quarterly Update Important Disclosure Information (Cont’d) − Highly Competitive Market for Investment Opportunities. The activity of identifying, completing and realizing attractive investments is highly competitive, and involves a high degree of uncertainty. There can be no assurance that the Fund will be able to locate, consummate and exit investments that satisfy its objectives or realize upon their values or that the Fund will be able to fully invest its committed capital. There is no guarantee that investment opportunities will be allocated to the Fund and/or that the activities of Golub Capital’s other funds will not adversely affect the interests of the Fund. − Material, Non-Public Information. In connection with other activities of Golub Capital, certain Golub Capital personnel may acquire confidential or material non-public information or be restricted from initiating transactions in certain securities, including on the Fund’s behalf. As such, the Fund may not be able to initiate a transaction or sell an investment. In addition, policies and procedures maintained by Golub Capital to deter the inappropriate sharing of material non-public information may limit the ability of Golub Capital personnel to share information with personnel in Golub Capital’s other business groups, which may ultimately reduce the positive synergies expected to be realized by the Fund as part of the broader Golub Capital investment platform. − No Assurance of Investment Return. Prospective investors should be aware that an investment in the Fund is speculative and involves a high degree of risk. There can be no assurance that the Fund will achieve comparable results, implement its investment strategy, achieve its objectives or avoid substantial losses or that any expected returns will be met. The Fund’s performance may be volatile. An investment should only be considered by sophisticated investors who can afford to lose all or a substantial amount of their investment. The Fund’s fees and expenses may offset or exceed its profits. − Opinions. Opinions expressed reflect the current opinions of Golub Capital as of the date appearing in this Material only and are based on Golub Capital’s opinions of the current market environment, which is subject to change. Certain information contained in this Material discusses general market activity, industry or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice. This Material is not complete and the information contained herein may change at any time without notice. Opinions expressed herein may differ from the opinions expressed by a Dealer and/or other businesses / affiliates of a Dealer. This is not a “research report” as defined by FINRA Rule 2241 and was not prepared by the research departments of a Dealer or its affiliates. − Reliance on Key Management Personnel. The success of the Fund will depend, in large part, upon the skill and expertise of certain Golub Capital professionals. In the event of the death, disability or departure of any key Golub Capital professionals, the business and the performance of the Fund may be adversely affected. − Target Allocations. There can be no assurance that the Fund will achieve its objectives or avoid substantial losses. Allocation targets depend on a variety of factors, including prevailing market conditions and investment availability. There is no guarantee that such targets will be achieved and any particular investment may not meet the target criteria. − Third Party Information. Certain information contained in this Material has been obtained from sources outside Golub Capital, which in certain cases have not been updated through the date hereof. While such information is believed to be reliable for purposes used herein, no representations are made as to the accuracy or completeness thereof and none of Golub Capital, its funds, nor any of their affiliates takes any responsibility for, and has not independently verified, any such information. In particular, you should note that, since many investments of the Fund may be unquoted, net asset value figures in relation to the Fund may be based wholly or partly on estimates of the values of the Fund’s investments provided by the originating banks of those underlying investments or other market counterparties, which estimates may themselves have been subject to no verification or auditing process or may relate to a valuation at a date before the relevant net asset valuation for the Fund, or which have otherwise been estimated by Golub Capital. − This Material may contain information obtained from third parties. Reproduction and distribution of third party content in any form is prohibited except with the prior written permission of the related third party. Third party content providers do not guarantee the accuracy, completeness, timeliness or availability of any information, including ratings, and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such content. THIRD PARTY CONTENT PROVIDERS GIVE NO EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE. THIRD PARTY CONTENT PROVIDERS SHALL NOT BE LIABLE FOR ANY DIRECT, INDIRECT, INCIDENTAL, EXEMPLARY, COMPENSATORY, PUNITIVE, SPECIAL OR CONSEQUENTIAL DAMAGES, COSTS, EXPENSES, LEGAL FEES, OR LOSSES (INCLUDING LOST INCOME OR PROFITS AND OPPORTUNITY COSTS OR LOSSES COSTS DUE TO NEGLIGENCE) IN CONNECTION WITH ANY USE OF THEIR CONTENT, INCLUDING RATINGS. − Trends. There can be no assurances that any of the trends described herein will continue or will not reverse. Past events and trends do not imply, predict or guarantee, and are not necessarily indicative of, future events or results. − This communication does not constitute a solicitation to buy any security or instrument, or a solicitation of interest in any Golub Capital fund, account or strategy. The content of this communication should not be construed as legal, tax or investment advice. − Securities offered through Arete Wealth Management, LLC Member: FINRA/SIPC. Only available in states where Arete Wealth Management, LLC is registered. Arete Wealth Management, LLC is not affiliated with any other entities identified in this communication. 8