Exhibit 99.2

VCI Global Limited and Subsidiaries

BVI Registration Number: 2035574

Interim Condensed Consolidated Financial Statements

VCI Global Limited and Subsidiaries

Interim condensed consolidated financial statements (unaudited)

Interim condensed consolidated statements of financial position

| | | Note | | | As of

June 30, 2023

(Unaudited) | | | As of

December 31,

2022

(Audited) | |

| | | | | | RM | | | USD | | | RM | |

| ASSETS | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Non-current assets | | | | | | | | | | | | |

| Financial assets measured at fair value through other comprehensive income | | | 4 | | | | 7,002,234 | | | | 1,500,082 | | | | 12,819,747 | |

| Financial assets measured at fair value through profit and loss | | | 5 | | | | 76,044 | | | | 16,291 | | | | 72,295 | |

| Property and equipment | | | 6 | | | | 2,081,771 | | | | 445,976 | | | | 1,551,579 | |

| Right-of-use of assets | | | 7 | | | | 555,445 | | | | 118,992 | | | | 714,143 | |

| Deferred initial public offering expense | | | 8 | | | | - | | | | - | | | | 6,564,162 | |

| Deferred tax assets | | | 9 | | | | 339,650 | | | | 72,763 | | | | 339,650 | |

| Total non-current assets | | | | | | | 10,055,144 | | | | 2,154,104 | | | | 22,061,576 | |

| | | | | | | | | | | | | | | | | |

| Current assets | | | | | | | | | | | | | | | | |

| Trade and other receivables | | | 10 | | | | 55,983,342 | | | | 11,993,261 | | | | 15,759,533 | |

| Amount due from related parties | | | | | | | - | | | | - | | | | 7,000 | |

| Cash and bank balances | | | 11 | | | | 15,328,861 | | | | 3,283,888 | | | | 3,995,995 | |

| Total current assets | | | | | | | 71,312,203 | | | | 15,277,149 | | | | 19,762,528 | |

| | | | | | | | | | | | | | | | | |

| Total assets | | | | | | | 81,367,347 | | | | 17,431,253 | | | | 41,824,104 | |

| | | | | | | | | | | | | | | | | |

| LIABILITIES AND EQUITY | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Current liabilities | | | | | | | | | | | | | | | | |

| Trade and other payables | | | 12 | | | | 6,395,343 | | | | 1,370,068 | | | | 10,408,318 | |

| Bank and other borrowings | | | 15 | | | | 682,410 | | | | 146,192 | | | | 783,542 | |

| Lease liabilities | | | 14 | | | | 162,837 | | | | 34,884 | | | | 322,208 | |

| Income tax payable | | | | | | | 1,833,795 | | | | 392,852 | | | | 1,716,794 | |

| Total current liabilities | | | | | | | 9,074,385 | | | | 1,943,996 | | | | 13,230,862 | |

| | | | | | | | | | | | | | | | | |

| Non-current liabilities | | | | | | | | | | | | | | | | |

| Bank and other borrowings | | | 15 | | | | 309,331 | | | | 66,268 | | | | 309,331 | |

| Lease liabilities | | | 14 | | | | 422,751 | | | | 90,566 | | | | 422,751 | |

| Amount due to related parties | | | | | | | 2,017,705 | | | | 432,251 | | | | 3,586,646 | |

| Total non-current liabilities | | | | | | | 2,749,787 | | | | 589,085 | | | | 4,318,728 | |

| | | | | | | | | | | | | | | | | |

| Total liabilities | | | | | | | 11,824,172 | | | | 2,533,081 | | | | 17,549,590 | |

| | | | | | | | | | | | | | | | | |

| Capital and reserves | | | | | | | | | | | | | | | | |

| Share capital | | | 16 | | | | 37,069,050 | | | | 7,941,269 | | | | 13,127,427 | |

| Capital reserve | | | 17 | | | | 6,532,560 | | | | 1,399,465 | | | | 6,532,560 | |

| Currency translation reserve | | | 18 | | | | 1,272,834 | | | | 272,678 | | | | - | |

| Retained earnings | | | | | | | 27,459,238 | | | | 5,882,566 | | | | 6,255,851 | |

| Attributable to equity owners of the Company | | | | | | | 72,333,682 | | | | 15,495,978 | | | | 25,915,838 | |

| Non-controlling interests | | | | | | | (2,790,507 | ) | | | (597,806 | ) | | | (1,641,324 | ) |

| Total equity | | | | | | | 69,543,175 | | | | 14,898,172 | | | | 24,274,514 | |

| | | | | | | | | | | | | | | | | |

| Total equity and liabilities | | | | | | | 81,367,347 | | | | 17,431,253 | | | | 41,824,104 | |

The accompanying notes form an integral part of the unaudited interim condensed consolidated financial statements.

VCI Global Limited and Subsidiaries

Interim condensed consolidated financial statements (unaudited)

Interim condensed consolidated statements of comprehensive income (unaudited)

| | | Note | | Six months ended

June 30,

2023 | | | Six months

ended

June 30,

2022 | |

| | | | | RM | | | USD | | | RM | |

| Revenue | | 19 | | | 44,463,195 | | | | 9,525,310 | | | | 15,931,394 | |

| Revenue – related party | | | | | - | | | | - | | | | 5,443,238 | |

| Total revenue | | | | | 44,463,195 | | | | 9,525,310 | | | | 21,374,632 | |

| Other income | | 20 | | | 1,054,906 | | | | 225,992 | | | | 109,802 | |

| Fair value adjustment on financial assets measured at fair value through profit and loss | | | | | - | | | | - | | | | 1,679,842 | |

| Cost of services | | 21 | | | (6,049,234 | ) | | | (1,295,922 | ) | | | (2,216,929 | ) |

| Depreciation | | | | | (274,425 | ) | | | (58,790 | ) | | | (11,203 | ) |

| Directors’ fees | | | | | (5,435,664 | ) | | | (1,164,477 | ) | | | (141,000 | ) |

| Employee benefits expenses | | 22 | | | (7,770,225 | ) | | | (1,664,608 | ) | | | (4,807,371 | ) |

| Impairment allowance on trade receivables | | | | | - | | | | - | | | | (183,546 | ) |

| Rental expenses | | | | | (149,951 | ) | | | (32,124 | ) | | | (156,673 | ) |

| Legal and professional fees | | | | | (1,473,823 | ) | | | (315,736 | ) | | | (117,377 | ) |

| Finance cost | | 23 | | | (15,875 | ) | | | (3,401 | ) | | | (8,685 | ) |

| Other operating expenses | | 24 | | | (3,668,557 | ) | | | (785,912 | ) | | | (1,474,666 | ) |

| Profit before income tax | | 25 | | | 20,680,347 | | | | 4,430,332 | | | | 14,046,826 | |

| Income tax expense | | 26 | | | (626,143 | ) | | | (134,138 | ) | | | (283,648 | ) |

| Profit for the period | | | | | 20,054,204 | | | | 4,296,194 | | | | 13,763,178 | |

| Other comprehensive income (loss): | | | | | | | | | | | | | | |

| Exchange differences on translating foreign operations | | | | | 1,272,834 | | | | 272,678 | | | | - | |

| Fair value adjustment on financial assets measured at fair value through other comprehensive income | | | | | - | | | | - | | | | (4,199,770 | ) |

| Total comprehensive income for the period | | | | | 21,327,038 | | | | 4,568,872 | | | | 9,563,408 | |

| | | | | | | | | | | | | | | |

| Profit attributable to: | | | | | | | | | | | | | | |

| Equity owners of the Company | | | | | 21,203,387 | | | | 4,542,382 | | | | 13,568,156 | |

| Non-controlling interests | | | | | (1,149,183 | ) | | | (246,188 | ) | | | 195,022 | |

| Total | | | | | 20,054,204 | | | | 4,296,194 | | | | 13,763,178 | |

| | | | | | | | | | | | | | | |

| Total comprehensive income attributable to: | | | | | | | | | | | | | | |

| Equity owners of the Company | | | | | 22,476,221 | | | | 4,815,060 | | | | 9,368,386 | |

| Non-controlling interests | | | | | (1,149,183 | ) | | | (246,188 | ) | | | 195,022 | |

| | | | | | 21,327,038 | | | | 4,568,872 | | | | 9,563,408 | |

| | | | | | | | | | | | | | | |

| Earnings per share - Basic and diluted | | | | | 0.55 | | | | 0.12 | | | | 0.40 | |

EARNINGS PER SHARE

| | | June 30, | |

| | | 2023 | | | 2022 | |

| Weighted average number of ordinary shares used in computing basic earnings | | | 36,292,259 | | | | 33,636,100 | |

| Weighted average number of ordinary shares used in computing diluted earnings | | | 36,292,259 | | | | 33,636,100 | |

The accompanying notes form an integral part of the unaudited interim condensed consolidated financial statements.

VCI Global Limited and Subsidiaries

Interim condensed consolidated financial statements (unaudited)

Interim condensed consolidated statements of changes in equity (Unaudited)

| | | Attributable to equity owners of the Company | | | | | | | |

| | | Share | | | Capital | | | Foreign

exchange | | | Retained | | | | | | Non-

controlling | | | Total | |

| | | capital | | | reserves | | | reserves | | | earnings | | | Total | | | interests | | | equity | |

| | | RM | | | RM | | | RM | | | RM | | | RM | | | RM | | | RM | |

| Balance at January , 2022 | | | 220,000 | | | | 6,532,566 | | | | - | | | | 12,981,936 | | | | 19,734,502 | | | | (371,259 | ) | | | 19,363,243 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Profit for the period | | | - | | | | - | | | | - | | | | 13,568,156 | | | | 13,568,156 | | | | 195,022 | | | | 13,763,178 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Other comprehensive loss | | | - | | | | - | | | | - | | | | (4,199,770 | ) | | | (4,199,770 | ) | | | - | | | | (4,199,770 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total comprehensive income for the period | | | - | | | | - | | | | - | | | | 9,368,386 | | | | 9,368,386 | | | | 195,022 | | | | 9,563,408 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Issuance of share capital | | | 2,615,477 | | | | - | | | | - | | | | - | | | | 2,615,477 | | | | - | | | | 2,615,477 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance at June 30, 2022 | | | 2,835,477 | | | | 6,532,566 | | | | - | | | | 22,350,322 | | | | 31,718,365 | | | | (176,237 | ) | | | 31,542,128 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance at January 1, 2023 | | | 13,127,427 | | | | 6,532,560 | | | | - | | | | 6,255,851 | | | | 25,915,838 | | | | (1,641,324 | ) | | | 24,274,514 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Profit for the period | | | - | | | | - | | | | - | | | | 21,203,387 | | | | 21,203,387 | | | | (1,149,183 | ) | | | 20,054,204 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Exchange differences on translating foreign operations | | | - | | | | - | | | | 1,272,834 | | | | - | | | | 1,272,834 | | | | - | | | | 1,272,834 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total comprehensive income for the period | | | - | | | | - | | | | 1,272,834 | | | | 21,203,387 | | | | 22,476,221 | | | | (1,149,183 | ) | | | 21,327,038 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Issuance of ordinary shares in initial public offering, net of issuance costs | | | 16,939,389 | | | | - | | | | - | | | | - | | | | 16,939,389 | | | | - | | | | 16,939,389 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Issuance of ordinary shares via share-swap arrangement | | | 7,002,234 | | | | - | | | | - | | | | - | | | | 7,002,234 | | | | - | | | | 7,002,234 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance at June 30, 2023 | | | 37,069,050 | | | | 6,532,560 | | | | 1,272,834 | | | | 27,459,238 | | | | 72,333,682 | | | | (2,790,507 | ) | | | 69,543,175 | |

The accompanying notes form an integral part of the interim condensed consolidated financial statements.

VCI Global Limited and Subsidiaries

Interim condensed consolidated financial statements (unaudited)

Interim condensed consolidated statements of cash flows (unaudited)

| | | Note | | Six months ended

June 30,

2023 | | | Six months

ended

June 30,

2022 | |

| | | | | RM | | | USD | | | RM | |

| Operating activities | | | | | | | | | | | | | | |

| Profit before income tax | | | | | 20,680,347 | | | | 4,430,332 | | | | 14,046,826 | |

| Adjustments for: | | | | | | | | | | | | | | |

| Impairment allowance on trade receivable | | | | | - | | | | - | | | | 183,546 | |

| Unrealised foreign exchange loss | | | | | 805,197 | | | | 172,498 | | | | - | |

| Depreciation of property and equipment | | | | | 115,727 | | | | 24,792 | | | | 11,203 | |

| Depreciation of right-of-use of assets | | | | | 158,698 | | | | 33,998 | | | | - | |

| Fair value adjustment on financial assets measured at fair value through profit and loss | | | | | - | | | | - | | | | (1,679,842 | ) |

| Gain on disposal of investment | | | | | (780,319 | ) | | | (167,167 | ) | | | - | |

| Gain on disposal of property and equipment | | | | | - | | | | - | | | | (1,891 | ) |

| Interest expense | | | | | 15,875 | | | | 3,401 | | | | 8,685 | |

| Interest income | | | | | (942 | ) | | | (202 | ) | | | (22 | ) |

| Operating cash flow before movement in working capital | | | | | 20,994,583 | | | | 4,497,652 | | | | 12,568,505 | |

| Trade and other receivables | | | | | (40,216,809 | ) | | | (8,615,611 | ) | | | (8,629,924 | ) |

| Trade and other payables | | | | | 2,551,187 | | | | 546,538 | | | | (4,804,822 | ) |

| Cash used in operations | | | | | (16,671,039 | ) | | | (3,571,421 | ) | | | (866,241 | ) |

| Interest received | | | | | - | | | | - | | | | 22 | |

| Income tax paid | | | | | (509,142 | ) | | | (109,073 | ) | | | 224,626 | |

| Net cash used in operating activities | | | | | (17,180,181 | ) | | | (3,680,494 | ) | | | (641,593 | ) |

| | | | | | | | | | | | | | | |

| Investing activities | | | | | | | | | | | | | | |

| Purchase of property and equipment | | | | | (645,919 | ) | | | (138,375 | ) | | | (33,896 | ) |

| Proceeds from disposal of property and equipment | | | | | - | | | | - | | | | 11,706 | |

| Interest paid | | | | | - | | | | - | | | | - | |

| Interest received | | | | | 942 | | | | 202 | | | | - | |

| Acquisition of financial assets measured at fair value through profit and loss | | | | | - | | | | - | | | | (156,120 | ) |

| Proceeds from disposal of financial assets measured at fair value through other comprehensive income | | | | | 13,600,066 | | | | 2,913,530 | | | | - | |

| Net cash generated from / (used in) investing activities | | | | | 12,955,089 | | | | 2,775,357 | | | | (178,310 | ) |

| | | | | | | | | | | | | | | |

| Financing activities | | | | | | | | | | | | | | |

| Proceeds from issuance of shares | | | | | - | | | | - | | | | 2,615,477 | |

| Proceeds from initial public offering, net of issuance costs | | | | | 17,457,899 | | | | 3,739,990 | | | | - | |

| Interest paid | | | | | (15,875 | ) | | | (3,401 | ) | | | - | |

| Repayments of other borrowings | | | | | (101,132 | ) | | | (21,665 | ) | | | (54,781 | ) |

| Repayment of advances to related parties | | | | | (1,568,941 | ) | | | (336,113 | ) | | | (3,149,847 | ) |

| Repayment of operating leases | | | | | (159,371 | ) | | | (34,142 | ) | | | - | |

| Net cash generated from / (used in) financing activities | | | | | 15,612,580 | | | | 3,344,669 | | | | (589,151 | ) |

| | | | | | | | | | | | | | | |

| Net increase / (decrease) in cash and cash equivalents | | | | | 11,387,488 | | | | 2,439,532 | | | | (1,409,054 | ) |

| Effect of currency translation on cash and cash equivalents | | | | | (54,622 | ) | | | (11,702 | ) | | | - | |

| Cash and bank balances at beginning of the period | | | | | 3,995,995 | | | | 856,058 | | | | 3,122,947 | |

| Cash and bank balances at end of the period | | | | | 15,328,861 | | | | 3,283,888 | | | | 1,713,893 | |

The accompanying notes form an integral part of the unaudited interim condensed consolidated financial statements.

VCI Global Limited and Subsidiaries

Interim condensed consolidated financial statements (unaudited)

Notes to the unaudited interim condensed consolidated financial statements

These notes form an integral part of the unaudited interim condensed consolidated financial statements.

The unaudited interim condensed consolidated financial statements were authorised for issue by the Board of Directors on November 30, 2022.

| 1 | ORGANIZATION AND PRINCIPAL ACTIVITIES |

Organization and reorganization

VCI Global Limited was incorporated in the British Virgin Islands on April 29, 2020. The registered office of the Company is situated at Vistra Corporate Services Centre, Wickhams Cay II, Road Town, Tortola, British Virgin Islands. The principal place of business of the Company is situation at B03-C-8, Menara 3A, KL Eco City, No.3 Jalan Bangsar, 59200 Kuala Lumpur, Malaysia.

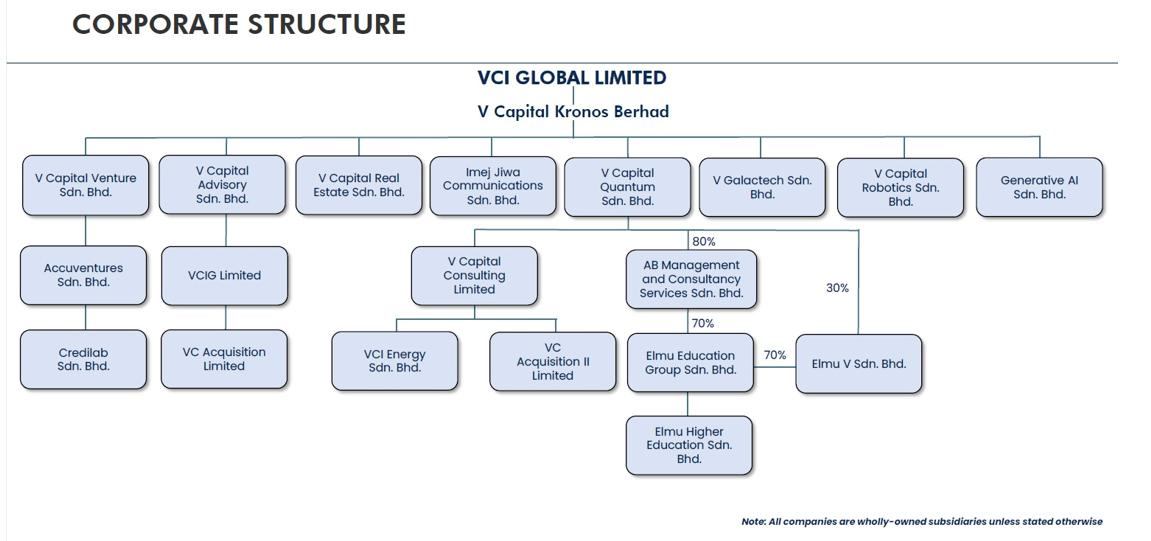

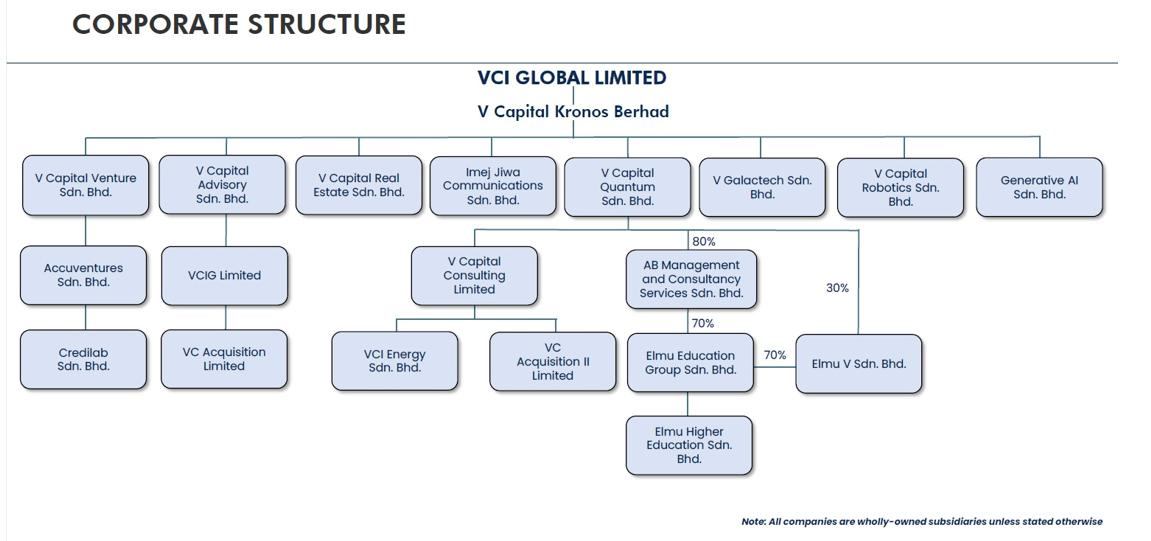

The Group structure which represents the operating subsidiaries and dormant companies as the reporting date is as follow:

VCI Global Limited and Subsidiaries

Interim condensed consolidated financial statements (unaudited)

The Company and its subsidiaries are in the table as follows:

| | | | | Percentage of effective ownership | | | | |

| Name | | Date of

incorporation | | June 30,

2023 | | 31 December

2022 | | Place of

incorporation | | Principal activities |

| | | | | % | | % | | | | |

| VCI Global Limited | | 29.04.2020 | | 100 | | 100 | | British Virgin Island | | Holding company |

| V Capital Kronos Berhad | | 01.09.2020 | | 100 | | 100 | | Malaysia | | Holding company |

| V Capital Venture Sdn Bhd | | 19.08.2014 | | 100 | | 100 | | Malaysia | | Provision of corporate and business advisory services in corporate finance, corporate structuring and restructuring, listings on recognised stock exchanges, and fintech advisory |

| Accuventures Sdn Bhd | | 22.06.2015 | | 100 | | 80 | | Malaysia | | Provision of technology development, computer software programming and holding company. |

| Credilab Sdn Bhd | | 26.10.2020 | | 100 | | 80 | | Malaysia | | Carry on licensed money lending activities, consulting, information technology development, and computer software programming |

| V Capital Advisory Sdn Bhd | | 12.02.2018 | | 100 | | 100 | | Malaysia | | Provision of corporate and business advisory in relation to corporate listing exercise, equity investment, corporate restructuring, merger and acquisition and corporate finance. |

| V Capital Quantum Sdn Bhd | | 18.01.2018 | | 100 | | 100 | | Malaysia | | Provision of information technology development, business consultancy services and holding company. |

| V Capital Consulting Limited | | 01.03.2016 | | 100 | | 100 | | British Virgin Island | | Provision of corporate and business advisory services in corporate finance, corporate structuring and restructuring, listings on recognised stock exchanges, and fintech advisory |

| Generative AI Sdn Bhd | | 21.07.2023 | | 100 | | - | | Malaysia | | Provision of Artificial Intelligence, image processing, communication, networking, & process control software services. |

| Imej Jiwa Communications Sdn Bhd | | 29.10.2012 | | 100 | | 100 | | Malaysia | | Provision of investor relation consultation services. |

| AB Management and Consultancy Services Sdn Bhd | | 05.04.2020 | | 80 | | 80 | | Malaysia | | Holding company |

| Elmu Education Group Sdn Bhd | | 03.12.2020 | | 56 | | 56 | | Malaysia | | Education and training services |

| Elmu V Sdn Bhd | | 18.05.2021 | | 69.2 | | 69.2 | | Malaysia | | Education and training services |

| Elmu Higher Education Sdn Bhd | | 24.05.2021 | | 56 | | 56 | | Malaysia | | Education and training services |

| V Capital Real Estate Sdn Bhd | | 05.07.2021 | | 100 | | 100 | | Malaysia | | Provision of consultancy services in relation to real estate |

| V Capital Robotics Sdn Bhd | | 12.10.2021 | | 100 | | 100 | | Malaysia | | Dormant |

| VCI Energy Sdn Bhd (F.K.A TGI V Sdn Bhd) | | 12.11.2021 | | 100 | | 100 | | Malaysia | | Dormant |

| VCIG Limited | | 29.04.2020 | | 100 | | 100 | | British Virgin Island | | Dormant |

| V Galactech Sdn Bhd | | 12.01.2022 | | 100 | | 100 | | Malaysia | | Provision of information technology development |

| VC Acquisition Ltd | | 04.01.2022 | | 100 | | 100 | | Malaysia | | Dormant |

| VC Acquisition II Ltd | | 04.01.2022 | | 100 | | 100 | | British Virgin Island | | Dormant |

VCI Global Limited and Subsidiaries

Interim condensed consolidated financial statements (unaudited)

Principal activities

The Company is a holding company. The principal activities of the Company and its subsidiaries (collectively referred to as the “Company” or “the Group”) are the provision of business strategy consultancy and technology development solution consultancy. The Company is headquartered in Malaysia and conducts its primary operations through its significant direct and indirectly held subsidiaries that are incorporated and domiciled in Malaysia, namely V Capital Kronos Berhad, V Capital Quantum Sdn. Bhd., and V Capital Consulting Limited where was incorporated in the British Virgin Islands.

| 2 | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

BASIS OF ACCOUNTING

The unaudited interim condensed consolidated financial statements have been prepared in accordance with the historical cost basis, except as disclosed in the accounting policies below, and are drawn up in accordance with the provisions of the International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”).

Historical cost is generally based on the fair value of the consideration given in exchange for goods and services.

Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date, regardless of whether that price is directly observable or estimated using another valuation technique. In estimating the fair value of an asset or a liability, the Company takes into account the characteristics of the asset or liability which market participants would take into account when pricing the asset or liability at the measurement date. Fair value for measurement and/or disclosure purposes in these unaudited interim condensed consolidated financial statements is determined on such a basis.

In addition, for financial reporting purposes, fair value measurements are categorised into Level 1, 2 or 3 based on the degree to which the inputs to the fair value measurements are observable and the significance of the inputs to the fair value measurement in its entirety, which are described as follows:

| | ● | Level 1 inputs are quoted prices (unadjusted) in active markets for identical assets or liabilities that the entity can access at the measurement date; |

| | ● | Level 2 inputs are inputs, other than quoted prices included within Level 1, that are observable for the asset or liability, either directly or indirectly; and |

| | ● | Level 3 inputs are unobservable inputs for the asset or liability. |

ADOPTION OF NEW AND REVISED STANDARDS

At the date of authorisation of these unaudited interim condensed consolidated financial statements, management anticipates that the adoption of the new and revised IFRSs and amendments to IFRS in future periods will not have a material impact on the unaudited interim condensed consolidated financial statements of the Group in the period of their initial adoption.

NEW AND REVISED IFRS IN ISSUE BUT NOT YET EFFECTIVE

At the date of authorisation of these unaudited interim condensed consolidated financial statements, the Group has not adopted the new and revised IFRS, IFRS INT and amendments to IFRS that have been issued but are not yet effective to them. The Group do not anticipate that the adoption of these new and revised IFRS pronouncements in future periods will have a material impact on the Group’s unaudited interim condensed consolidated financial statements in the period of their initial adoption.

The preparation of these unaudited interim condensed consolidated financial statements in conformity with IFRS requires management to exercise its judgement in the process of applying the Group’s accounting policies. It also requires the use of certain critical accounting estimates and assumptions. The areas involving a higher degree of judgement or complexity, or areas where estimates and assumptions are significant to the unaudited interim condensed consolidated financial statements are disclosed in Note 3.

VCI Global Limited and Subsidiaries

Interim condensed consolidated financial statements (unaudited)

BASIS OF CONSOLIDATION

As the Group were under same control of the controlling shareholders and their entire equity interests were also ultimately held by the controlling shareholders immediately prior to the group reorganization, the unaudited interim condensed consolidated statements of profit or loss and other comprehensive income, unaudited interim condensed consolidated statements of changes in equity and unaudited interim condensed consolidated statements of cash flows statements are prepared as if the current group structure had been in existence throughout the period ended June 30, 2023 and 2022, or since the respective dates of incorporation/establishment of the relevant entity, where this is a shorter period. The consolidated statements of financial position as at June 30, 2022 and 2023 present the assets and liabilities of the aforementioned companies now comprising the Group which had been incorporated/established as at the relevant balance sheet date as if the current group structure had been in existence at those dates based on the same control aforementioned. The Group eliminates all significant intercompany balances and transactions in its consolidated unaudited interim condensed consolidated financial statements.

Subsidiary corporations are all entities (including structured entities) over which the Group has control. The Group controls an entity when the Group is exposed to, or has rights to, variable returns from its involvement with the entity and has the ability to affect those returns through its power over the entity. Subsidiary corporations are fully consolidated from the date on which control is transferred to the Group. They are deconsolidated from the date on that control ceases.

In preparing the unaudited interim condensed consolidated financial statements, transactions, balances and unrealized gains on transactions between group entities are eliminated. Unrealized losses are also eliminated unless the transaction provides evidence of an impairment indicator of the transferred asset. Accounting policies of subsidiary corporations have been changed where necessary to ensure consistency with the policies adopted by the Group.

Non-controlling interests comprise the portion of a subsidiary corporation’s net results of operations and its net assets, which is attributable to the interests that are not owned directly or indirectly by the equity holders of the Company. They are shown separately in the consolidated statements of comprehensive income, statements of changes in equity, and statements of financial position. Total comprehensive income is attributed to the non-controlling interests based on their respective interests in a subsidiary, even if this results in the non-controlling interests having a deficit balance.

Acquisition of entities under an internal reorganization scheme does not result in any change in economic substance. Accordingly, the unaudited interim condensed consolidated financial statements of the Group are a continuation of the acquired entities and is accounted for as follows:

| | (i) | The results of entities are presented as if the internal reorganization occurred from the beginning of the earliest period presented in the unaudited interim condensed consolidated financial statements; |

| | (ii) | The Group will consolidate the assets and liabilities of the acquired entities at the pre-combination carrying amounts. No adjustments are made to reflect fair values, or recognize any new assets or liabilities, at the date of the internal reorganization that would otherwise be done under the acquisition method; and |

| | (iii) | No new goodwill is recognized as a result of the internal reorganization. The only goodwill that is recognized is the existing goodwill relating to the combining entities. Any difference between the consideration paid/transferred and the equity acquired is reflected within equity as merger reserve or deficit. |

VCI Global Limited and Subsidiaries

Interim condensed consolidated financial statements (unaudited)

The acquisition method of accounting is used to account for business combinations entered into by the Group.

The consideration transferred for the acquisition of a subsidiary corporation or business comprises the fair value of the assets transferred, the liabilities incurred, and the equity interests issued by the Group. The consideration transferred also includes any contingent consideration arrangement and any pre-existing equity interest in the subsidiary measured at their fair values at the acquisition date.

Acquisition-related costs are expensed as incurred.

Identifiable assets acquired and liabilities and contingent liabilities assumed in a business combination are, with limited exceptions, measured initially at their fair values at the acquisition date.

On an acquisition-by-acquisition basis, the Group recognizes any non-controlling interest in the acquiree at the date of acquisition either at fair value or at the non-controlling interest’s proportionate share of the acquiree’s identifiable net assets.

The excess of (a) the consideration transferred, the amount of any non-controlling interest in the acquiree and the acquisition-date fair value of any previous equity interest in the acquiree over the (b) fair value of the identifiable net assets acquired is recorded as goodwill.

When a change in the Group’s ownership interest in a subsidiary corporation result in a loss of control over the subsidiary corporation, the assets and liabilities of the subsidiary corporation including any goodwill are derecognized. Amounts previously recognized in other comprehensive income in respect of that entity are also reclassified to profit or loss or transferred directly to retained earnings if required by a specific Standard.

Any retained equity interest in the entity is remeasured at fair value. The difference between the carrying amount of the retained interest at the date when control is lost, and its fair value is recognized in profit or loss.

| | (d) | Transactions with non-controlling interests |

Changes in the Group’s ownership interest in a subsidiary corporation that do not result in a loss of control over the subsidiary corporation are accounted for as transactions with equity owners of the Company. Any difference between the change in the carrying amounts of the non-controlling interest and the fair value of the consideration paid or received is recognized within equity attributable to the equity holders of the Company.

VCI Global Limited and Subsidiaries

Interim condensed consolidated financial statements (unaudited)

CONVENIENCE TRANSLATION

Translations of amounts in the unaudited interim condensed consolidated financial statements from RM into USD as of and for the year ended June 30, 2023 are solely for the convenience of the reader and were calculated at the noon buying rate of USD1 = RM 4.6679, as published in H.10 statistical release of the United States Federal Reserve Board. No representation is made that the RM amounts could have been, or could be, converted, realized or settled into USD at such rate or at any other rate.

FINANCIAL ASSETS

| | (a) | Classification and measurement |

The Group classifies its financial assets at fair value through other comprehensive income, fair value through profit and loss and amortized cost.

The classification depends on the Group’s business model for managing the financial assets as well as the contractual terms of the cash flows of the financial assets.

Financial assets at fair value through other comprehensive income (“FVTOCI”) are equity securities which are not held for trading but more for strategic investments or debt securities where contractual cash flows are solely principal and interest and the objective of the Group’s business model is achieved both by collecting contractual cash flow and selling financial assets.

On initial recognition, the Group may make an irrevocable election (on an instrument-by-instrument basis) to designate investments in equity instruments as at FVTOCI. Designation at FVTOCI is not permitted if the equity investment is held for trading or if it is contingent consideration recognised by an acquirer in a business combination.

Investments in equity instruments as at FVTOCI are initially measured at fair value plus transaction costs. Subsequently, they are measured at fair value with gains and losses arising from changes in fair value recognised in other comprehensive income (“OCI”) and accumulated in the retained earnings. The cumulative gain or loss will not be reclassified to profit or loss on disposal of the equity investments, and will be transferred to retained earnings.

The Group reclassifies debt instruments when and only when its business model for managing those assets changes.

At subsequent measurement - Debt instrument

Debt instruments mainly comprise of cash and cash equivalents and other receivables (excluding prepayments).

Debt instruments that are held for collection of contractual cash flows where those cash flows represent solely payments of principal and interest are measured at amortized cost. A gain or loss on a debt instrument that is subsequently measured at amortized cost and is not part of a hedging relationship is recognized in profit or loss when the asset is derecognized or impaired. Interest income from these financial assets is included in interest income using the effective interest rate method.

The Group recognises a loss allowance for ECL on financial assets which are subject to impairment assessment under IFRS 9. The amount of ECL is updated at each reporting date to reflect changes in credit risk since initial recognition of the respective financial instrument. The Group always recognises lifetime ECL for accounts receivables. The ECL on these financial assets are estimated using a provision matrix based on the Group’s historical credit loss experience, adjusted for factors that are specific to the debtors, general economic conditions and an assessment of both the current as well as the forecast direction of conditions at the reporting date, including time value of money where appropriate. For all other financial instruments, the Group measures the loss allowance equal to 12-month ECL, unless when there has a significant increase in credit risk since initial recognition, the Group recognises lifetime ECL. The assessment of whether lifetime ECL should be recognised is based on significant increase in the likelihood or risk of a default occurring since initial recognition.

VCI Global Limited and Subsidiaries

Interim condensed consolidated financial statements (unaudited)

Significant increase in credit risk

In assessing whether the credit risk has increased significantly since initial recognition, the Group compares the risk of a default occurring on the financial instrument as at the reporting date with the risk of a default occurring on the financial instrument as at the date of initial recognition. In making this assessment, the Group considers both quantitative and qualitative information that is reasonable and supportable, including historical experience and forward-looking information that is available without undue cost or effort. Forward-looking information considered includes the future prospects of the industries in which the Group’s debtors operate, obtained from economic expert reports, financial analysts, governmental bodies, relevant think-tanks and other similar organisations, as well as consideration of various external sources of actual and forecast economic information that relate to the Group’s operations.

In particular, the following information is taken into account when assessing whether credit risk has increased significantly:

| | ● | an actual or expected significant deterioration in the financial instrument’s external (if available) or internal credit rating; |

| | ● | significant deterioration in external market indicators of credit risk, e.g. a significant increase in the credit spread, the credit default swap prices for the debtor; |

| | ● | existing or forecast adverse changes in business, financial or economic conditions that are expected to cause a significant decrease in the debtor’s ability to meet its debt obligations; |

| | ● | an actual or expected significant deterioration in the operating results of the debtor; |

| | ● | significant increases in credit risk on other financial instruments of the same debtor; |

| | ● | an actual or expected significant adverse change in the regulatory, economic, or technological environment of the debtor that results in a significant decrease in the debtor’s ability to meet its debt obligations. |

Irrespective of the outcome of the above assessment, the Group presumes that the credit risk has increased significantly since initial recognition when contractual payments are more than 60 days past due, unless the Group has reasonable and supportable information that demonstrates otherwise.

| | (b) | Recognition and derecognition |

Regular way purchases and sales of financial assets are recognized on trade date – the date on which the Group commits to purchase or sell the asset.

Financial assets are derecognized when the rights to receive cash flows from the financial assets have expired or have been transferred and the Group has transferred substantially all risks and rewards of ownership.

On disposal of a debt instrument, the difference between the carrying amount and the sale proceeds is recognized in profit or loss.

VCI Global Limited and Subsidiaries

Interim condensed consolidated financial statements (unaudited)

FINANCIAL LIABILITIES AND EQUITY INSTRUMENTS

Classification as debt or equity

Debt and equity instruments issued by the Group are classified as either financial liabilities or as equity in accordance with substance of the contractual arrangements and the definitions of a financial liability and an equity instrument.

Equity instruments

An equity instrument is any contract that evidences a residual interest in the assets of an entity after deducting all of its liabilities. Equity instruments issued by the Group are recognised at the proceeds received, net of direct issue costs.

Financial liabilities

Except for derivative financial instruments which are stated at fair value through profit or loss, all other financial liabilities are subsequently measured at amortised cost using the effective interest method.

The effective interest method is a method of calculating the amortised cost of a financial liability and of allocating interest expense over the relevant period. The effective interest rate is the rate that exactly discounts estimated future cash payments (including all fees and points paid or received that form an integral part of the effective interest rate, transaction costs and other premiums or discounts) through the expected life of the financial liability, or (where appropriate) a shorter period, to the amortised cost of a financial liability.

Derecognition of financial liabilities

The Group derecognises financial liabilities when, and only when, the Group’s obligations are discharged, cancelled or expired. The difference between the carrying amount of the financial liability derecognised and the consideration paid and payable, including any non-cash assets transferred or liabilities assumed, is recognised in profit or loss.

Offsetting financial instruments

Financial assets and liabilities are offset, and the net amount reported in the balance sheet when there is a legally enforceable right to offset and there is an intention to settle on a net basis or realize the asset and settle the liability simultaneously.

PROPERTY AND EQUIPMENT

| | (i) | Property and equipment |

Property and equipment are initially recognized at cost and subsequently carried at cost less accumulated depreciation and accumulated impairment losses.

The cost of an item of property and equipment initially recognized includes its purchase price and any cost that is directly attributable to bringing the asset to the location and condition necessary for it to be capable of operating in the manner intended by management.

VCI Global Limited and Subsidiaries

Interim condensed consolidated financial statements (unaudited)

Depreciation on other items of property and equipment is calculated using the straight-line method to allocate their depreciable amounts over their estimated useful lives as followed;

| Office renovation | - | 10 years |

| Office equipment | - | 5 years |

| Furniture and fittings | - | 5 years |

| Electrical and fittings | - | 10 years |

| Right of use asset | - | 3 years |

No depreciation is charged on construction in progress.

The residual values estimated useful lives and depreciation method of property and equipment are reviewed, and adjusted as appropriate, at each balance sheet date. The effects of any revision are recognized in profit or loss when the changes arise.

| | (c) | Subsequent expenditure |

Subsequent expenditure relating to property and equipment that has already been recognized is added to the carrying amount of the asset only when it is probable that future economic benefits associated with the item will flow to the entity and the cost of the item can be measured reliably. All other repair and maintenance expenses are recognized in profit or loss when incurred.

On disposal of an item of property and equipment, the difference between the disposal proceeds and its carrying amount is recognized in profit or loss.

TRADE AND OTHER RECEIVABLES

A receivable is recognised when the Group has an unconditional right to receive consideration. A right to receive consideration is unconditional if only the passage of time is required before payment of that consideration is due. If revenue has been recognised before the Group has an unconditional right to receive consideration, the amount is presented as a contract asset. Trade receivables that do not contain a significant financing component are initially measured at their transaction price. Trade receivables that contain a significant financing component and other receivables are initially measured at fair value plus transaction costs. All receivables are subsequently stated at amortised cost, using the effective interest method and including an allowance for credit losses.

IMPAIRMENT OF NON-FINANCIAL ASSETS

Property and equipment are tested for impairment whenever there is any objective evidence or indication that these assets may be impaired.

For the purpose of impairment testing, the recoverable amount (i.e., the higher of the fair value less cost to sell and the value-in-use) is determined on an individual asset basis unless the asset does not generate cash inflows that are largely independent of those from other assets. If this is the case, the recoverable amount is determined for the Cash Generating units (“CGU”) to which the asset belongs.

If the recoverable amount of the asset (or CGU) is estimated to be less than its carrying amount, the carrying amount of the asset (or CGU) is reduced to its recoverable amount. The difference between the carrying amount and recoverable amount is recognized as an impairment loss in profit or loss.

An impairment loss for an asset is reversed if, and only if, there has been a change in the estimates used to determine the asset’s recoverable amount since the last impairment loss was recognized. The carrying amount of this asset is increased to its revised recoverable amount, provided that this amount does not exceed the carrying amount that would have been determined (net of any accumulated amortization or depreciation) had no impairment loss been recognized for the asset in prior years.

A reversal of impairment loss for an asset other than goodwill is recognized in profit or loss.

VCI Global Limited and Subsidiaries

Interim condensed consolidated financial statements (unaudited)

TRADE AND OTHER PAYABLES

Trade and other payables represent liabilities for goods and services provided to the Group prior to the end of financial year which are unpaid. They are classified as current liabilities if payment is due within one year or less (or in the normal operating cycle of the business if longer). Otherwise, they are presented as non-current liabilities.

Trade and other payables are initially recognized at fair value, and subsequently carried at amortized cost using the effective interest method.

CONTRACT LIABILITIES

A contract liability is recognised when the customer pays non-refundable consideration before the Group recognises the related revenue. A contract liability would also be recognised if the Group has an unconditional right to receive non-refundable consideration before the Group recognises the related revenue. In such cases, a corresponding receivable would also be recognised. Contract liabilities are recognized as revenue when the Group satisfied its performance obligation.

BANK AND OTHER BORROWINGS

Borrowings are presented as current liabilities unless the Group has an unconditional right to defer settlement for at least 12 months after the balance sheet date, in which case they are presented as non-current liabilities.

| | (a) | Borrowings - Borrowings are initially recognized at fair value (net of transaction costs) and subsequently carried at amortized cost. Any difference between the proceeds (net of transaction costs) and the redemption value is recognized in profit or loss over the period of the borrowings using the effective interest method. |

| | (b) | Borrowing costs - Borrowing costs directly attributable to the acquisition, construction or production of qualifying assets, which are assets that necessarily take a substantial period of time to get ready for their intended use or sale, are added to the cost of those assets, until such time as the assets are substantially ready for their intended use or sale. Investment income earned on the temporary investment of specific borrowings pending their expenditure on qualifying assets is deducted from the borrowing costs eligible for capitalisation. |

All other borrowing costs are recognised in profit or loss in the period in which they are incurred.

DEFERRED REVENUE

Deferred revenue refers to advance payment from clients for services that have not yet been rendered. Under the accrual basis of accounting, the Group records this payment as a liability. Once the services have been rendered, the liability is reversed and revenue is recorded instead.

LEASES

When the Group is the lessee

At the inception of the contract, the Group assesses if the contract contains a lease. A contract contains a lease if the contract conveys the right to control the use of an identified asset for a period of time in exchange for consideration. Reassessment is only required when the terms and conditions of the contract are changed.

VCI Global Limited and Subsidiaries

Interim condensed consolidated financial statements (unaudited)

The Group recognizes a right-of-use asset and lease liability at the date which the underlying asset is available for use. Right-of-use assets are measured at cost which comprises the initial measurement of lease liabilities adjusted for any lease payments made at or before the commencement date and lease incentive received. Any initial direct costs that would not have been incurred if the lease had not been obtained are added to the carrying amount of the right- of-use assets.

The right-of-use asset is subsequently depreciated using the straight-line method from the commencement date to the earlier of the end of the useful life of the right-of-use asset or the end of the lease term.

Right-of-use assets are presented within “Property and equipment”.

The initial measurement of a lease liability is measured at the present value of the lease payments discounted using the implicit rate in the lease, if the rate can be readily determined. If that rate cannot be readily determined, the Group shall use its incremental borrowing rate.

Lease payments include the following:

| | - | Fixed payment (including in-substance fixed payments), less any lease incentives receivables; |

| | - | Variable lease payment that are based on an index or rate, initially measured using the index or rate as at the commencement date; |

| | - | Amount expected to be payable under residual value guarantees; |

| | - | The exercise price of a purchase option if is reasonably certain to exercise the option; and |

| | - | Payment of penalties for terminating the lease, if the lease term reflects the Group exercising that option. |

For contracts that contain both lease and non-lease components, the Group allocates the consideration to each lease component on the basis of the relative stand-alone price of the lease and non-lease component. The Group has elected to not separate lease and non-lease component for property leases and account these as one single lease component.

Lease liability is measured at amortized cost using the effective interest method. Lease liability shall be remeasured when:

| | - | There is a change in future lease payments arising from changes in an index or rate; |

| | - | There is a change in the Group’s assessment of whether it will exercise an extension option; or |

| | - | There is modification in the scope or the consideration of the lease that was not part of the original term. |

Lease liability is remeasured with a corresponding adjustment to the right-of-use assets, or is recorded in profit or loss if the carrying amount of the right-of-use asset has been reduced to zero.

| | ● | Short-term and low-value leases |

The Group has elected to not recognized right-of-use assets and lease liabilities for short-term leases that have lease terms of 12 months or less and leases of low-value leases. Lease payments relating to these leases are expensed to profit or loss on a straight-line basis over the lease term.

Variable lease payments that are not based on an index or a rate are not included as part of the measurement and initial recognition of the lease liability. The Group shall recognize those lease payments in profit or loss in the periods that triggered those lease payments.

VCI Global Limited and Subsidiaries

Interim condensed consolidated financial statements (unaudited)

EMPLOYEE BENEFITS

Employee benefits are recognized as an expense, unless the cost qualifies to be capitalized as an asset.

| | (a) | Defined contribution plans |

Defined contribution plans are post-employment benefit plans under which the Group pays fixed contributions into separate entities such as the Employees Provident Fund on a mandatory, contractual or voluntary basis. The Group has no further payment obligations once the contributions have been paid.

| | (b) | Employee leave entitlement |

Employee entitlements to annual leave are recognized when they accrue to employees. A provision is made for the estimated liability for annual leave as a result of services rendered by employees up to the balance sheet date.

PROVISIONS

Provisions are recognised when the Group has a present obligation (legal or constructive) as a result of a past event, it is probable that the Group will be required to settle the obligation, and a reliable estimate can be made of the amount of the obligation.

The amount recognised as a provision is the best estimate of the consideration required to settle the present obligation at the end of the reporting period, taking into account the risks and uncertainties surrounding the obligation. Where a provision is measured using the cash flows estimated to settle the present obligation, its carrying amount is the present value of those cash flows.

When some or all of the economic benefits required to settle a provision are expected to be recovered from a third party, the receivable is recognised as an asset if it is virtually certain that reimbursement will be received and the amount of the receivable can be measured reliably.

REVENUE RECOGNITION

Revenue is recognised to depict the transfer of promised services to clients at an amount that reflects the consideration to which an entity expects to be entitled in exchange for those services. Specifically, the Group uses a five-step approach to recognise revenue:

| ● | Step 1: Identify the contract(s) with a client |

| ● | Step 2: Identify the performance obligations in the contract |

| ● | Step 3: Determine the transaction price |

| ● | Step 4: Allocate the transaction price to the performance obligations in the contract |

| ● | Step 5: Recognise revenue when (or as) the Group satisfies a performance obligation |

The Group recognises revenue when (or as) a performance obligation is satisfied, i.e., when “control” of the services underlying the particular performance obligations is transferred to clients.

A performance obligation represents a service (or a bundle of services) that is distinct or a series of distinct services that are substantially the same.

VCI Global Limited and Subsidiaries

Interim condensed consolidated financial statements (unaudited)

Control is transferred overtime and revenue is recognised overtime by reference to the progress towards complete satisfaction of the relevant performance obligation if one of the following criteria is met:

| | ● | the client simultaneously receives and consumes the benefits provided by the Group’s performance as the Group performs; |

| | ● | the Group’s performance creates or enhances an asset that the client controls as the asset is created or enhanced; or |

| | ● | the Group’s performance does not create an asset with an alternative use to the Group and the Group has an enforceable right to payment for performance completed to date. |

Otherwise, revenue is recognised at a point in time when the customer obtains control of the distinct service.

Advance payments received from clients are recognized as contract liabilities as the Group has not yet satisfied its performance obligation. Contract liabilities are recognized as revenue when the Group satisfied its performance obligation. The Group may receive payment for service prior to, or after it satisfies the performance obligation under a service agreement.

| | a) | Business Strategy Consultancy |

Business strategy consultancy services primarily included listing advisory and solutions, investors relations and boardroom strategies consultancy. The revenues generated from business strategy consultancy services are generally based on the fixed fee billing arrangements that require the clients to pay a pre-established fee in exchange for a predetermined set of professional services. The clients agree to pay a fixed fee periodically over the contract terms as specified in the service agreements.

Our contracts from business strategy consultancy are typically less than a year in duration. Revenues are generally recognised over time. When contractual billings represent an amount that corresponds directly with the value provided to the client, revenues are recognised as amount become billable in accordance with the contract terms. Revenues from fixed-priced contracts are generally recognised using costs incurred to date relative to total estimated costs at completion to measure progress toward satisfying the Company performance obligations. Incurred cost represents work performed, which corresponds with, and thereby best depicts, the transfer of control to client.

| | b) | Technology Development, Solutions and Consultancy |

Technology development, solutions and consultancy primarily included digital development, fintech solution and software solutions.

Technology Development

The contract is typically fixed priced and does not provide any post contract client support or upgrades. The Group designs system based on clients’ specific needs which require the Group to perform services including design/redesign, development, and integration. These services also require significant customization. Upon delivery of the services, client acceptance is generally required. The Group assesses that software development services is considered as a performance obligation. The duration of the development period is usually six months to two years.

The Group’s system development service revenues are generated primarily from contracts with clients across sectors. The contracts contain negotiated billing terms which generally include multiple payment phases throughout the contract term and a portion of contract amount usually is billed upon the completion of the related projects. Pursuant to the contract terms, the Group has enforceable right on payments for the work performed.

The Group’s revenue from technology development contracts is generally recognized over time. The Group uses an input method based on cost incurred as the Group believes that this method most accurately reflects the Group’s progress toward satisfaction of the performance obligation, which usually takes six months to two years. Under this method, the Group could appropriately measure the fulfilment of a performance obligation. Assumptions, risks, and uncertainties inherent in the estimates used to measure progress could affect the amount of revenues, receivables, and deferred revenues at each reporting period.

VCI Global Limited and Subsidiaries

Interim condensed consolidated financial statements (unaudited)

Solutions and Consultancy

Revenue from solutions and consulting services is primarily comprised of fixed-fee contracts, which require the Group to provide professional solutions and consulting services over contract terms beginning on the commencement date of each contract, which is the date its service is made available to clients. Billings to the clients are generally on a monthly or quarterly basis over the contract term, which is typically 6 to 12 months. The solutions and consulting services contracts typically include a single performance obligation. The revenue from solutions and consulting services is recognized over the contract term.

| | c) | Interest income received |

Interest income is received from the money lending other entities and individuals. Interest income is recognised on a time-proportion basis using the effective interest method. When a receivable is impaired, the Group reduces the carrying amount to its recoverable amount, being the estimated future cashflow discounted at original effective interest rate of the instrument, and thereafter amortising the discount as interest income.

GOVERNMENT GRANTS AND SUBSIDIES

Grants from the government are recognized as a receivable at their fair value when there is reasonable assurance that the grant will be received and the Group will comply with all the attached conditions.

Government grants receivable are recognized as income over the periods necessary to match them with the related costs which they are intended to compensate, on a systematic basis. Government grants relating to expenses are shown separately as other income.

Grants related to assets are presented as deferred income under trade and other payables.

CASH AND CASH EQUIVALENTS

For the purpose of presentation in the consolidated statements of cash flows, cash and cash equivalents include cash on hand, deposits with financial institutions which are subject to an insignificant risk of change in value.

SHARE CAPITAL

Ordinary shares are classified as equity. Incremental costs directly attributable to the issuance of new ordinary shares are deducted against the share capital account.

INCOME TAX

Current income tax for current and prior periods is recognized at the amount expected to be paid to or recovered from the tax authorities, using the tax rates and tax laws that have been enacted or substantively enacted by the end of the reporting period. Management periodically evaluates positions taken in tax returns with respect to situations in which applicable tax regulation is subject to interpretation and considers whether it is probable that a tax authority will accept an uncertain tax treatment. The Group measures its tax balances either based on the most likely amount or the expected value, depending on which method provides a better prediction of the resolution of the uncertainty.

Deferred income tax is recognized for all temporary differences arising between the tax bases of assets and liabilities and their carrying amounts in the financial statements except when the deferred income tax arises from the initial recognition of goodwill or an asset or liability in a transaction that is not a business combination and affects neither accounting nor taxable profit or loss at the time of the transaction.

A deferred income tax liability is recognized on temporary differences arising on investments in subsidiaries, associates and joint ventures, except where the Group is able to control the timing of the reversal of the temporary difference and it is probable that the temporary difference will not reverse in the foreseeable future.

A deferred income tax asset is recognized to the extent that it is probable that future taxable profit will be available against which the deductible temporary differences and tax losses can be utilized.

VCI Global Limited and Subsidiaries

Interim condensed consolidated financial statements (unaudited)

Deferred income tax is measured:

| | (i) | at the tax rates that are expected to apply when the related deferred income tax asset is realized or the deferred income tax liability is settled, based on tax rates and tax laws that have been enacted or substantively enacted by the balance sheet date; and |

| | (ii) | based on the tax consequence that will follow from the manner in which the Group expects, at the balance sheet date, to recover or settle the carrying amounts of its assets and liabilities except for investment properties. Investment property measured at fair value is presumed to be recovered entirely through sale. |

Current and deferred income taxes are recognized as income or expense in profit or loss, except to the extent that the tax arises from a business combination or a transaction which is recognized directly in equity. Deferred tax arising from a business combination is adjusted against goodwill on acquisition.

The Group accounts for investment tax credits (for example, productivity and innovation credit) similar to accounting for other tax credits where a deferred tax asset is recognized for unused tax credits to the extent that it is probable that future taxable profit will be available against which the unused tax credits can be utilized.

FOREIGN CURRENCY TRANSACTIONS

| | (a) | Functional and presentation currency |

Items included in the unaudited interim condensed consolidated financial statements of each entity in the Group are measured using the currency of the primary economic environment in which the entity operates (“functional currency”). The unaudited interim condensed consolidated financial statements are presented in Ringgit Malaysia (“RM”), which is the functional currency of the Company and the presentation currency of the Group.

The value of foreign currencies including, the US Dollar (“USD”), may fluctuate against the RM. Any significant variations of the aforementioned currencies relative to the RM may materially affect the Group’s financial condition in terms of reporting in RM. The following table outlines the currency exchange rates that were used in preparing the accompanying consolidated unaudited interim condensed consolidated financial statements:

| | | December 31, | | | June 30, | |

| | | 2022 | | | 2022 | | | 2023 | |

| RM to USD at the end of the period | | | 4.4025 | | | | 4.4075 | | | | 4.6679 | |

| RM to USD Average rate | | | 4.3983 | | | | 4.2867 | | | | 4.4863 | |

| | (b) | Transactions and balances |

Transactions in a currency other than the functional currency (“foreign currency”) are translated into the functional currency using the exchange rates at the dates of the transactions. Currency exchange differences resulting from the settlement of such transactions and from the translation of monetary assets and liabilities denominated in foreign currencies at the closing rates at the balance sheet date are recognized in profit or loss. Monetary items include primarily financial assets (other than equity investments), contract assets and financial liabilities. However, in the unaudited interim condensed consolidated financial statements, currency translation differences arising from borrowings in foreign currencies and net investment in foreign operations, are recognized in other comprehensive income and accumulated in the currency translation reserve.

When a foreign operation is disposed of or any loan forming part of the net investment of the foreign operation is repaid, a proportionate share of the accumulated currency translation differences is reclassified to profit or loss, as part of the gain or loss on disposal.

Non-monetary items measured at fair values in foreign currencies are translated using the exchange rates at the date when the fair values are determined.

VCI Global Limited and Subsidiaries

Interim condensed consolidated financial statements (unaudited)

| | (c) | Translation of Group entities’ financial statements |

The results and financial position of all the Group entities (none of which has the currency of a hyperinflationary economy) that have a functional currency different from the presentation currency are translated into the presentation currency as follows:

| | (i) | assets and liabilities are translated at the closing exchange rates at the reporting date; |

| | (ii) | income and expenses are translated at average exchange rates (unless the average is not a reasonable approximation of the cumulative effect of the rates prevailing on the transaction dates, in which case income and expenses are translated using the exchange rates at the dates of the transactions); and |

| | (iii) | all resulting currency translation differences are recognized in other comprehensive income and accumulated in the currency translation reserve. These currency translation differences are reclassified to profit or loss on disposal or partial disposal with loss of control of the foreign operation. |

Goodwill and fair value adjustments arising on the acquisition of foreign operations are treated as assets and liabilities of the foreign operations and translated at the closing rates at the reporting date.

RELATED PARTIES

| (a) | A person, or a close member of that person’s family, is related to the Group if that person: |

| (i) | has control or joint control over the Group; |

| | (ii) | has significant influence over the Group; or |

| | (iii) | is a member of the key management personnel of the Group or the Group’s parent. |

| | (b) | An entity is related to the Group if any of the following conditions applies: |

| (i) | The entity and the group are members of the same Group (which means that each parent, subsidiary and fellow subsidiary is related to the others). |

| | (ii) | One entity is an associate or joint venture of the other entity (or an associate or joint venture of a member of a Group of which the other entity is a member). |

| | (iii) | Both entities are joint ventures of the same third party. |

| | (iv) | One entity is a joint venture of a third entity and the other entity is an associate of the third entity. |

| | (v) | The entity is a post-employment benefit plan for the benefit of employees of either the Group or an entity related to the group. |

| | (vi) | The entity is controlled or jointly controlled by a person identified in (a). |

| | (vii) | A person identified in (a)(i) has significant influence over the entity or is a member of the key management personnel of the entity (or of a parent of the entity). |

| | (viii) | The entity, or any member of a Group of which it is a part, provides key management personnel services to the Group or to the Group’s parent. Close members of the family of a person are those family members who may be expected to influence, or be influenced by, that person in their dealings with the entity. |

EARNINGS PER SHARE

The Group presents basic and diluted earnings per share data for its ordinary shares. Basic earnings per share is calculated by dividing the profit or loss attributable to ordinary shareholders of the Company by the weighted-average number of ordinary shares outstanding during the year, adjusted for own shares held, if any. Diluted earnings per share is determined by adjusting the profit or loss attributable to ordinary shareholders and the weighted-average number of ordinary shares outstanding, adjusted for own shares held, if any, for the effects of all dilutive potential ordinary shares.

VCI Global Limited and Subsidiaries

Interim condensed consolidated financial statements (unaudited)

SEGMENT REPORTING

Operating segments, and the amounts of each segment item reported in the unaudited interim condensed consolidated financial statements, are identified from the financial information provided regularly to the Group’s most senior executive management for the purposes of allocating resources to, and assessing the performance of, the Group’s various lines of business and geographical locations.

Individually material operating segments are not aggregated for financial reporting purposes unless the segments have similar economic characteristics and are similar in respect of the nature of products and services, the nature of production processes, the type or class of customers, the methods used to distribute the products or provide the services, and the nature of the regulatory environment. Operating segments which are not individually material may be aggregated if they share a majority of these criteria.

| 3 | CRITICAL ACCOUNTING JUDGEMENTS AND KEY SOURCES OF ESTIMATION UNCERTAINTY |

In the application of the Group’s accounting policies, which are described in Note 2 to the unaudited interim condensed consolidated financial statements, management is required to make judgements, estimates and assumptions about the carrying amounts of assets and liabilities that are not readily apparent from other sources. The estimates and associated assumptions are based on historical experience and other factors that are considered to be relevant. Actual results may differ from these estimates.

The estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are recognised in the period in which the estimate is revised if the revision affects only that period, or in the period of the revision and future periods.

Critical judgements in applying the Group’s accounting policies

There are no critical judgements, apart from those involving estimation (see below) that the management has made in the process of applying the Group’s accounting policy and that has the most significant effect on the amounts recognised in the unaudited interim condensed consolidated financial statements.

Key sources of estimation uncertainty

The key assumptions concerning the future and other key sources of estimation uncertainty at the end of the reporting period, that have a significant risk of causing a material adjustment to the carrying amounts of assets and liabilities within the next financial year, are disclosed below:

Fair value measurement of unquoted shares (Note 5)

In determining the fair value of the unquoted shares, the Group relies on the net asset values of the investee companies or independent valuation report.

The availability of observable inputs can vary from investment to investment. For certain investments classified under Level 3 of the fair value hierarchy, the valuation could be based on models or inputs that are less observable or unobservable in the market and the determination of the fair values require significant judgement. Those estimated values do not necessarily represent the amounts that may be ultimately realized due to occurrence of future events which could not be reasonably determined as at the balance sheet date.

VCI Global Limited and Subsidiaries

Interim condensed consolidated financial statements (unaudited)

| 4 | FINANCIAL ASSETS MEASURED AT FAIR VALUE THROUGH OTHER COMPREHENSIVE INCOME |

| | | December 31, 2022 | | | June 30, 2023 | |

| | | RM | | | RM | | | USD | |

| Quoted shares measured at fair value through other comprehensive income (“FVTOCI”): | | | | | | | | | | | | |

| At beginning of year | | | 34,221,879 | | | | 12,819,747 | | | | 2,746,363 | |

| Addition | | | - | | | | 7,002,234 | | | | 1,500,082 | |

| Fair value adjustment | | | (21,402,132 | ) | | | - | | | | - | |

| Disposal | | | - | | | | (12,819,747 | ) | | | (2,746,363 | ) |

| At end of the period | | | 12,819,747 | | | | 7,002,234 | | | | 1,500,082 | |

Quoted shares measured at FVTOCI

In prior financial year, quoted investment in shares measured at FVTOCI related to an equity interest of 14.55% in Treasure Global Inc (“TGL”), an entity that is listed on the Nasdaq Stock Market. Hoo Voon Him is also a director in TGI. In January 2023, the Company disposed all of its shareholdings in TGL shares.

In May 2023, the Company acquired 500 shares from Globexus Holding Corp via a share-swap arrangement (Note 16).

| 5 | FINANCIAL ASSETS MEASURED AT FAIR VALUE THROUGH PROFIT AND LOSS |

| | | December 31,

2022 | | | June 30, 2023 | |

| | | RM | | | RM | | | USD | |

| Unquoted shares: | | | | | | | | | |

| At beginning of year | | | 1,309,134 | | | | 72,295 | | | | 15,488 | |

| Addition | | | 10,211 | | | | - | | | | - | |

| Disposal | | | (1,247,050 | ) | | | - | | | | - | |

| Adjustment – forex exchange | | | - | | | | 3,749 | | | | 803 | |

| At end of year | | | 72,295 | | | | 76,044 | | | | 16,291 | |

Other unquoted shares

Included in the unquoted shares are investment in the following:

| ● | 5% (December 31, 2022: 5%) equity interest in Zero Carbon Farms Ltd, an entity incorporated in United Kingdom. |

| ● | 0.1% (December 31, 2022: 0.1%) equity interest in Unique Fire Holdings Berhad, an entity incorporated in Malaysia. |

In September 2022, the Company disposed all of its shareholdings in DFA Robotic Co. Ltd to a third party.

The above valuations are categorised under Level 3 of the fair value hierarchy and are generally sensitive to the unobservable inputs. Any increase or decrease in transacted price would result in an increase or decrease in the fair value of the unquoted investments. Any significant movement in inputs would result in a significant change to the fair value of the unquoted investment. There are no transfers between Levels 1 and 2 and into or out of Level 3 during the year.

VCI Global Limited and Subsidiaries

Interim condensed consolidated financial statements (unaudited)

| 6 | PROPERTY, PLANT AND EQUIPMENT |

| | | Office equipment | | | Fixtures and fittings | | | Office renovations | | | Computer & software | | | Total | |

| | | RM | | | RM | | | RM | | | RM | | | RM | |

| Cost | | | | | | | | | | | | | | | |

| As of January 1, 2022 | | | 29,869 | | | | 146,711 | | | | 102,550 | | | | 142,198 | | | | 421,328 | |

| Additions | | | 157,518 | | | | 218,109 | | | | 1,221,412 | | | | 71,912 | | | | 1,668,951 | |

| Disposals | | | (2,302 | ) | | | (104,017 | ) | | | - | | | | (86,460 | ) | | | (192,779 | ) |

| As of December 31, 2022 | | | 185,085 | | | | 260,803 | | | | 1,323,962 | | | | 127,650 | | | | 1,897,500 | |

| Additions | | | 33,822 | | | | 20,457 | | | | 419,947 | | | | 171,693 | | | | 645,919 | |

| Disposals | | | - | | | | - | | | | - | | | | - | | | | - | |

| As of June 30, 2023 | | | 218,907 | | | | 281,260 | | | | 1,743,909 | | | | 299,343 | | | | 2,543,419 | |

| | | | | | | | | | | | | | | | | | | | | |

| Accumulated depreciation | | | | | | | | | | | | | | | | | | | | |

| As of January 1, 2022 | | | 20,145 | | | | 143,851 | | | | 48,909 | | | | 55,891 | | | | 268,796 | |

| Depreciation for the period | | | 17,944 | | | | 31,613 | | | | 135,552 | | | | 44,459 | | | | 229,568 | |

| Disposals | | | (2,300 | ) | | | (104,006 | ) | | | - | | | | (46,137 | ) | | | (152,443 | ) |

| As of December 31, 2022 | | | 35,789 | | | | 71,458 | | | | 184,461 | | | | 54,213 | | | | 345,921 | |

| Depreciation for the period | | | 10,931 | | | | 35,393 | | | | 68,070 | | | | 1,333 | | | | 115,727 | |

| As of June 30, 2023 | | | 46,720 | | | | 106,851 | | | | 252,531 | | | | 55,546 | | | | 461,648 | |

| | | | | | | | | | | | | | | | | | | | | |

| Carrying amounts | | | | | | | | | | | | | | | | | | | | |

| As of December 31, 2022 | | | 149,296 | | | | 189,345 | | | | 1,139,501 | | | | 73,437 | | | | 1,551,579 | |

| As of June 30, 2023 | | | 172,187 | | | | 174,409 | | | | 1,491,378 | | | | 243,797 | | | | 2,081,771 | |

| As of June 30, 2023 (USD) | | | 36,887 | | | | 37,364 | | | | 319,497 | | | | 52,228 | | | | 445,976 | |

VCI Global Limited and Subsidiaries

Interim condensed consolidated financial statements (unaudited)

| | | RM | |

| Cost | | | |

| At January 1, 2022 | | | - | |

| Additions | | | 952,191 | |

| At December 31,2022 | | | 952,191 | |

| Additions | | | - | |

| At June 30, 2023 | | | 952,191 | |

| | | | | |

| Accumulated depreciation | | | | |

| At January 1, 2022 | | | - | |

| Depreciation for the period | | | 238,048 | |

| At December 31, 2022 | | | 238,048 | |

| Depreciation for the period | | | 158,698 | |