AS SUBMITTED TO THE SECURITIES AND EXCHANGE COMMISSION ON NOVEMBER 14, 2022

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

VALUEONE, INC.

(Exact name of Registrant as specified in its charter)

Nevada | | 8731 | | 83-2466129 |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification No.) |

30 Corporate Park, Suite 315

Irvine, CA 92606

(nnn)xxx-yyyy

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

Tea Hyen Shin, President

30 Corporate Park, Suite 315

Irvine, CA 92606

(nnn) xxx-yyyy

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

John E. Dolkart, Esq. Dolkart Law PC

100 Pine Street, Suite 1250

San Francisco, CA 94111

(415) 707-2717

Approximate Date of Proposed Sale to the Public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

| | | |

Non-accelerated filer | x | Smaller reporting company | x |

| | | |

| | Emerging growth company | x |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. x

CALCULATION OF REGISTRATION FEE

Title of each Class of Securities to be Registered | | Shares to be Registered(1) | | | Proposed Maximum Aggregate Offering Price Per Share(2) | | | Maximum Aggregate Offering Price(1)(2) | | | Amount of Registration Fee(2) | |

Shares of Common Stock, par value $.001, issuable to each stockholder of the Company holding restricted shares equal to 100% of their beneficial ownership | | | 19,100,000 | | | $ | 0.50 | | | $ | 9,550,000 | | | $ | | |

Shares of Common Stock, par value $.001. | | | 5,000,000 | | | $ | 0.50 | | | $ | 2,500,000 | | | $ | | |

| | | | | | | | | | | | | | | | |

TOTAL | | | 24,100,000 | | | | | | | $ | 12,050,000 | | | $ | $1,327.91 | |

| (1) | Pursuant to Rule 416 under the Securities Act, this registration statement shall be deemed to cover additional securities (i) to be offered or issued in connection with any provision of any securities purported to be registered hereby pursuant to terms which provide for a change in the amount of securities being offered or issued to prevent dilution resulting from stock splits, stock dividends, or similar transactions and (ii) of the same class as the securities covered by this registration statement issued or issuable prior to completion of the distribution of the securities covered by this registration statement as a result of a split of, or a stock dividend on, the registered securities. |

| (2) | Estimated solely for the purpose of calculating the amount of the registration fee in accordance with Rule 457(o) promulgated under the Securities Act of 1933, as amended. |

This Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

DATED November 14, 2022

Prospectus

24,100,000 Shares of Common Stock

VALUEONE, INC.

This prospectus (the "Prospectus") covers 24,100,00 shares of our common stock (the "Shares") of which 19,100,00 may be offered for resale or otherwise disposed of by each our record and beneficial stockholders in an amount equal to 100% of the shares of our common stock that each stockholder owns (the "Selling Stockholders") and 5,000,000 shares that may be offered for resale or otherwise disposed of by qualified investors who may purchase shares of our common stock in connection with a financing in which we are seeking to raise and additional $2,500,000 USD. This is the initial public offering of our common stock.

We will not receive any proceeds from the sale or other disposition of the securities by the Selling Stockholders. However, we may receive up to approximately $2,500,000 in gross proceeds upon the purchase of the to-be-offered 5,000,000 shares. We will use such proceeds, if and when received, for acquisitions, research and development and working capital. We do not have any planned acquisitions at this time. The prices at which the Selling Stockholders may sell the shares will be determined by the prevailing market price for the shares or in negotiated transactions. See "Selling Stockholders" for additional information regarding the sales process available to the Selling Stockholders.

We are an "emerging growth company" under the federal securities laws and will be subject to reduced public company reporting requirements as set forth on page 19 of this prospectus. There is a limited established market for our stock. The offering price of our shares has been determined arbitrarily by us. The price does not bear any relationship to our assets, book value, earnings, or other established criteria for valuing a privately held company. In determining the number of shares to be offered and the offering price, we took into consideration our capital structure and the amount of money we would need to implement our business plans. Accordingly, the offering price should not be considered an indication of the actual value of our securities.

Our common stock is not currently quoted on any national securities exchange. We plan to list our common stock on the OTC Markets Group, Inc. "Pink Current Information Tier" and apply with FINRA for the symbol "VLUS" upon the approval of this The closing of this offering is contingent upon the successful listing of the Company on the OTC Markets Group, Inc. ("OTC").

Investing in our securities involves a high degree of risk. See "Risk Factors" beginning on page 15 in this prospectus for a discussion of information that should be considered in connection with an investment in our securities.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is November 14, 2022

ADDITIONAL INFORMATION

You should rely only on the information contained or incorporated by reference in this prospectus and in any accompanying prospectus supplement. No one has been authorized to provide you with different information. The shares are not being offered in any jurisdiction where the offer is not permitted. You should not assume that the information in this prospectus or any prospectus supplement is accurate as of any date other than the date on the front of such documents.

We have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the Shares offered hereby, but only under the circumstances and in the jurisdictions where it is lawful to do so. The information contained in this prospectus or in any applicable free writing prospectus is current only as of its date, regardless of its time of delivery or any sale of Shares. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside the United States: We have not done anything that would permit this offering or possession or distribution of this prospectus or any applicable free writing prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus and any applicable free writing prospectus must inform themselves, and observe any restrictions relating to, the offering of the Units and the distribution of this prospectus outside the United States.

TABLE OF CONTENTS

| Page No. |

PROSPECTUS SUMMARY | 8 |

| |

THE OFFERING | 13 |

| |

RISK FACTORS | 15 |

| |

USE OF PROCEEDS | 22 |

| |

MARKET FOR REGISTRANT's COMMON EQUITY AND RELATED STOCKHOLDER MATTERS | 22 |

| |

DILUTION | 22 |

| |

MANAGEMENT's DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 24 |

| |

BUSINESS | 25 |

| |

MANAGEMENT | 35 |

| |

EXECUTIVE COMPENSATION | 40 |

| |

PRINCIPAL AND SELLING SECURITYHOLDERS | 40 |

| |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND DIRECTOR INDEPENDENCE | 41 |

| |

DESCRIPTION OF SECURITIES | 41 |

| |

SHARES ELIGIBLE FOR FUTURE SALE | 43 |

| |

PLAN OF DISTRIBUTION | 45 |

| |

LEGAL MATTERS | 46 |

| |

EXPERTS | 46 |

| |

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS | F-1 |

CAUTIONARY NOTE TO INVESTORS

This Prospectus qualifies the distribution of securities of an entity that presently derives all of its revenue, if any, from to be implemented business plans for the distribution of medical testing devices in the United States and in North American and European Markets.

The United States and the Republic of Korea (aka "South Korea") are parties to the Intellectual Property Rights (IPR) Chapter of the U.S.-South Korea trade agreement which contains state-of-the-art protections spanning all types of intellectual property, and requirements to join key multilateral IPR agreements. It also contains strong enforcement provisions to ensure that American intellectual property rights are efficiently and effectively protected in South Korea.

Any intellectual property protected by ValueOne, South Korea, will seek to have reciprocal rights acknowledged by both the United States Patent and Trademark Office ("USPTO") and the Korean Intellectual Property Office ("KIPO").

ValueOne is the strategic joint-venture partner of ValueOne, Inc., a Republic of Korea corporation. The South Korean corporation holds all intellectual property in this prospectus and provides the exclusive right to use the same to ValueOne. The two companies are working together cooperatively to develop new intellectual property pursuant to a Joint Venture Agreement for the Development Ownership; and Control of Intellectual Property and Work Product, Exhibit 1.5 hereto.

Depending on which joint venture partner the primary developer of any new intellectual property is the partners will register the intellectual property in the appropriate jurisdiction and then seek reciprocal registration in any remaining jurisdictions required.

ValueOne does not have any approval or authority to operate in such markets but has applied to do so in South Korea. Upon approval of the South Korean government to manufacture, sell and distribute its devices, the United States corporation will seek reciprocal approval from relevant United States government agencies.

Trademarks

This prospectus contains references to trademarks and service marks and to those belonging to other entities. Solely for convenience, trademarks and trade names referred to in this prospectus may appear without the © or TM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent possible under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names. We do not intend our use or display of other companies' trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by any other companies.

PROSPECTUS SUMMARY

The following summary highlights information contained elsewhere in this prospectus. This summary may not contain all of the information that may be important to you. You should read this entire prospectus carefully, including the sections entitled "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our historical financial statements and related notes included elsewhere in this prospectus. In this prospectus, unless otherwise noted, the terms "the Company," "we," "us," and "our" refer to ValueOne, Inc., a Nevada corporation.

The Company

Background

ValueOne, Inc. was incorporated in the State of Nevada as a for-profit Company on May 30, 2018 and adopted the calendar year-end. The Company operates as the exclusive joint-venture partner of ValueOne, Inc. of South Korea.

ValueOne,Inc.is aSouthKoreanbiotechnologycompany founded in Seoul by Tea Hyen Shin 2015. Withonly $50,000 USD in seed capital the company has been able to develop a suite of at home in vitromedical testing devices, with plans for its own clinical testing laboratory and globaldistributionnetwork.

The South Korean parent company has granted an exclusive license to Value One, Inc. ofNevada as part of a strategic joint venture agreement whereby Value One Nevada will act as the primary advertising, marking, distribution and assist in the co-development of researchanddevelopmentfor newmarkets ofproductsdesignedin SouthKorea.

The two joint venture partner companies will work cooperatively to develop these medical testing devicesand establish a supply chain for distribution, sales and marketing in the United Statesand South Korea. An important part of the Company's success relies on the existence ofa clinical laboratory formedicalanddiagnostic testing.

No determination has been made on whether this facility will be acquired or developed from scratch. This will require the retainer of qualified medical doctors and laboratorytechnical personnel to staff the lab to preform testing in support of the company'srangeof athometestingproducts.

Capital Structure

The Company amended its articles of incorporation on May 10, 2021 increasing its total authorized common shares from two million (2,000,000) at $0.001 par value to two hundred million (200,000,000) at $0.001 par value with twenty million (20,000,000) preferred shares at par value of $0.001. On May 19, 2021, one million (1,000,000) shares of Series A Preferred Shares are designated with a par value of $0.001, which carry voting rights senior to the Common Stock and will not be subject to any reverse splits or deductions.

The Preferred Series A shall rank senior to the Common Stock as to dividends and upon liquidation, dissolutions or winding up. On or about May 26, 2021 the 1,000,000 Series A Preferred Shares were issued to our president, chief executive, chairman and controlling shareholder Tea Hyen Shin in return for $1,000 USD cash payment by him.

Overview

We are a Nevada corporation and the joint-venture partner of ValueOne, Inc. of South Korea who holds valuable intellectual property in the medical and biometric testing industry. ValueOne, Inc. intends to develop, market, and distribute medical testing devices and new technologies with exclusive rights to do so in North America.

In or about January 2021 the Company entered into an Exclusive Joint Venture Agreement for the Ownership, Development and Control of Intellectual Property and Work Product. ValueOne is a development stage company that does not currently have any substantial business operations and has not generated any revenues. The Company will not be profitable until it derives sufficient revenues and cash flows from the marketing of its products.

We believe that, if we obtain the proceeds from this offering, the Company will be able to implement its business plan and conduct business pursuant to the business plan for at least the next twelve months. Our operations to date have been devoted primarily to business plan design, start-up and development activities, which include the following:

Development of the ValueOne, Inc., North American business plan.

Defining initial short-term and long-term marketing efforts including scouting locations, and designing and developing a network of affiliates who will assist in the implementation of our business plan.

Research and Development to develop intellectual property and biological testing systems for the at-home use market.

Implementaion of business strategies and techniques. This includes hourly rates and the number of hours required to develop our business plan. These numbers have been incorporated into our Use of Proceeds budget.

Beginning of due diligence on our planned distribution of medical testing kits in North American and later in Europe.

ValueOne never been party to any bankruptcy, receivership or similar proceeding, nor has it undergone any material reclassification, merger, consolidation, purchase or sale of a significant amount of assets not in the ordinary course of business.

We currently do not have trademarks, patents, or any other types of protection on our business plans. Please refer to "Description of Our Business." We have no revenues since inception, have sustained losses since inception, do not have any employees, other than Tea Hyen Shin, our CEO and Chairman of the Board of Directors.

We may not generate sufficient revenues even if we are able to gain market acceptance of our business plan. Accordingly, we will be dependent on future financings in order to maintain our operations and continue our research and development. Please refer to "Risk Factors."

Voting Control

The voting control of our common stock is possessed by Tea Hyen Shin, our Chief Executive Officer and Chairman of the Board of Directors, who was issued 1,000,000 shares, or 100%, of our Preferred Series A Stock for $1,000 in or about May 2021. Mr. Shin also holds 6.5 million shares of our Common Stock, or 34% of the outstanding common shares.

After this Offering, assuming all of the shares in this Offering are sold, which there can be no guarantee, Mr. Shin will still retain 26.9% ownership and control in the Company. When factoring the preferred and common shares together, Mr. Shin will hold 94.2% pre-sale and 92.1% post-sale voting rights effectively controlling the corporation with a super-majority quorum.

Recent Reverse Split

On January 3, 2022 our board of directors approved a reverse split of 2:1 for all common shares.

Our Corporate Strategy

We intend to enter the at-home in-vitro medical testing market in the United States, with potential expansion to other markets such as Canada, Mexico, the United Kingdom and European Union.

We operate through a Joint Venture Agreement with ValueOne, Inc. of South Korea. We plan to work cooperatively to develop new intellectual property and work product to further develop our current line of at-home in-vitro testing kits. The primary location where this will occur at least initially is in Seoul, South Korea at ValueOne, Inc. of South Korea. Our company will benefit from access to this intellectual property and the exclusive license to sell, market and distribute the same. Our kits focus on the in-home diagnosis of sexually transmitted diseases.

The key elements of our growth strategy are:

Research and Development of New Products - We can leverage our relationship with our joint venture partner to tap the biotechnology pipeline from South Korea to introduce new in-vitro testing and other medical products designed for home-use to larger markets.

Entry into Strategic Partnerships - We plan to use our increased market presence in the United States to develop new strategic connections for advertising, marketing, distribution, sales and for the growth of us a brand name for home-use medical and testing products.

| | Develop Additional Revenue Streams - Our kits focus on the in-home diagnosis of sexually transmitted diseases, but with additional investment capital we can develop other testing kits for a broader range of infectious diseases. Further Develop Our Technology and Intellectual Property -We plan to use capital raised from the offering described in this prospectus to fund additional research and development of our IP portfolio and to if beneficial acquire other technology and IP from third parties consistent with our business plans and models. Promotion of Our Brand and Name Recognition -We plan to use capital raised from the offering described in this prospectus to fund development of our brand name and recognition on the internet and in the North American market place for in-vitro and home-use medical testing kits and devices. Securing Additional Capital to Finance Manufacturing and Testing Facilities-We plan to use capital raised from the offering described in this prospectus to fund future offerings of our common stock to raise additional funds for manufacturing and testing facilities although no firm plans exist at this time. |

Industry Analysis

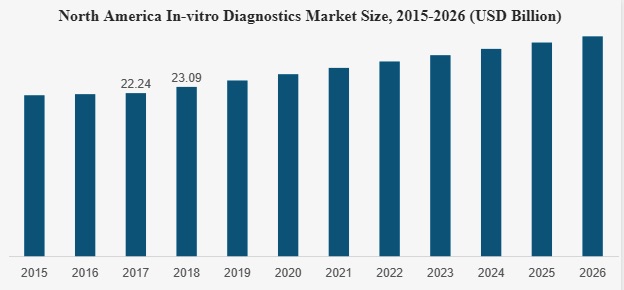

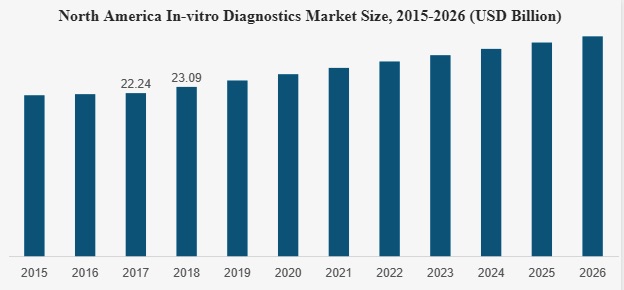

In Vitro Diagnostics is used for the purposes of diagnosis and prognosis of diseases, determination of health conditions, determination of effectiveness of disease treatment, and prevention. It is a medical device that tests using tissue cells, blood, urine, feces, saliva, etc. collected from the human body.

In vitro diagnostic device technology is divided into a total of eight (8) sub-fields as follows, and there are differences in diagnosable diseases. Considering the global market share and average annual growth rate, among the eight sub-fields, the current main ones are immunochemical diagnostics, molecular diagnostics, point-of-care diagnostics, and self-diagnostic blood glucose measurements.

Fields | Description |

Molecular Diagnostics | DNA and RNA containing genetic information of the human body or virus are tested and used to test for immunodeficiency virus (HIV), human papilloma virus (HPV), cancer genes, and genetic diseases |

Immunochemical Diagnosis | Detects the presence of specific small molecules in a sample and uses antigen-antibody reaction to diagnose and track various diseases such as cancer markers, infectious diseases, thyroid function, anemia, allergies, pregnancy, and substance abuse. |

Point-of-Care (POCT) | It enhances the therapeutic effect by allowing the patient to immediately test what was previously tested in the fields of immunology and clinical chemistry. It is used for blood gas test, myocardial infarction test, blood coagulation test, etc. |

Self-Diagnosis of Blood Glucose Measurement | Used by diabetic patients for self-diagnosis of blood sugar levels. |

Blood Diagnosis | A test that studies blood and bone marrow. It is a field that tests blood cells such as red blood cells, white blood cells, platelets, and hemoglobin. It is used for diagnosing or treating leukemia, anemia, autoimmune disease, etc., and tracking and monitoring anticoagulation treatment. |

Clinical Microbiological Diagnosis | It is used for diagnosing and tracking diseases caused by infection by diagnosing microbial infection by testing serum, plasma, and urine, and determining the appropriate antibiotic and dosage. |

Histopathology Diagnosis | Used for diagnosing and tracking diseases caused by infection by finding the source of infection using human tissue. |

Hemostasis Diagnosis | Diagnosis by analyzing body fluids or living tissues to observe cancer tissues or cells |

Our Market Opportunity

As of 2019 the US home medical testing market was valued at $250 million and expected to double by 2024. This assessment was conducted by Cardinal Health and occurred pre-Covid. With the onset of the Covid-19 pandemic consumers were increasingly asked to perform at-home medical tests not only to determine if they were infected with the Covid-19 virus but to perform other medical tests that were unable to be performed in medical offices. Major corporations such as Amazon have sought to exploit this market. We seek to leverage access to South Korean bio-medical and technologies to exploit North American market opportunities in home medical testing.

Our Competitive Advantage

We can leverage access to the South Korean biotechnology market with strategic connections for distribution across larger markets, i.e. the United States. With access to United States capital markets we finance continued research and development of intellectual property in South Korea and the United States all with the security of shared management and mutual benefit vis a vis the Joint Venture Agreement.

Summary of Risk Factors

Our business is subject to a number of risks, including risks that may prevent us from achieving our business objectives or may adversely affect our business, financial condition, results of operations, cash flows and prospects that you should consider before making a decision to invest in our Common Stock. These risks are discussed more fully in "Risk Factors" beginning on page 15 of this prospectus. These risks include, but are not limited to, the following:

º We have a history of net losses, and we expect to continue to incur losses for the foreseeable future. If we achieve profitability, we may not be able to sustain it;

º The commercial success of our in-development and future diagnostic tests and services and our revenue growth depends upon attaining significant market acceptance among payers providers, clinics, patients, and biopharmaceutical companies;

º If we fail to retain our distribution partners and, as we grow, fail to increase our sales and marketing capabilities or develop broad awareness of our in-development and future diagnostic tests in a cost-effective manner, we may not be able to generate revenue growth;

º If we cannot maintain our current relationships, or enter into new relationships, including with biopharmaceutical companies, our revenue prospects could be reduced;

º We currently depend upon third-party suppliers and expect to depend on third party suppliers in the future, including contract manufacturers and single source suppliers, making us vulnerable to supply problems and price fluctuations;

º Natural or man-made disasters and other similar events, including the COVID-19 pandemic, may significantly disrupt our business, and negatively impact our business, financial condition and results of operations;

º Any failure to offer high-quality support for our in-development and future diagnostic tests and services may adversely affect our relationships with providers and negatively impact our reputation among patients and providers, which may adversely affect our business, financial condition and results of operations;

º We may face additional costs, loss of revenue, significant liabilities, harm to our brand, decreased use of our products or services and business disruption if there are any disruptions in our information technology systems as a result of security or data privacy breaches or other unauthorized or improper access through us or third-parties under domestic and foreign privacy and data laws;

º Our results of operations will be materially harmed if we are unable to accurately forecast customer demand for, and utilization of, our diagnostic tests and manage our inventory;

º Cost-containment efforts of our customers, purchasing groups and governmental purchasing organizations could have a material adverse effect on our future sales and profitability;

º Litigation and other legal proceedings, including costs of insurance and others, may adversely affect our business;

º Our Officers and Directors are currently employed by our joint venture partner ValueOne, Inc., of South Korea and are physically located there in Seoul.. As our business plan is implemented and our company grows we may need to hire new officers or directors who are located in the United States. This may require additional capital to fund such executive employment agreements.

º We will need to raise additional capital to fund our existing operations, develop our platform, commercialize new diagnostic tests and/or expand our operation;

º Failure to obtain or maintain adequate coverage and reimbursement for in-development or future diagnostic tests could limit our ability, and that of our collaborators, to fully commercialize our in-development or future diagnostic tests, which would decrease our ability to generate revenue;

º Healthcare reform measures could hinder or prevent the commercial success of our in-development or future diagnostic tests;

º Compliance with United States Food and Drug Administration ("FDA") regulations can be costly and time-consuming, and violations can lead to severe fines, administrative or judicial sanctions, and other penalties that could be disruptive to our business;

º

º If we are ultimately unable to obtain any necessary or desirable FDA and comparable foreign regulatory authorities' approvals or clearances, or if such approvals or clearances are significantly delayed, our business will be substantially harmed;

º Delays or failures in our clinical trials will prevent us from commercializing any in-development, modified or new diagnostic tests and will adversely affect our business, operating results and prospects;

º Clinical development is a lengthy and expensive process with an uncertain outcome, and results of earlier studies and trials may not be predictive of future trial results;

º

º We and our third-party suppliers must comply with environmental, health and safety laws and regulations, which can be expensive, disruptive, and restrict how we do business;

º Our success may be impaired if we are unable to obtain, maintain and protect our intellectual property rights and confidentiality of trade secrets;

º Changes in patent law could diminish the value of patents in general, thereby impairing our ability to protect our in-development and future diagnostic tests, products and services;

º We may become involved in lawsuits to protect or enforce our patents, the patents of our licensors or other intellectual property rights, which could be expensive, time consuming and unsuccessful;

º Patent terms may be inadequate to protect our competitive position on our in-development and future diagnostic tests, products and services for an adequate amount of time;

º There has been no prior public market for our Shares and an active trading market may not develop;

º If we are unable to execute our current operating plans, our results of operations may be materially adversely affected, and we may not be able to continue as a going concern, resulting in our securities having little or no value at all.

º We expect that the price of our Shares will fluctuate substantially, and you may not be able to sell the shares you purchase in this offering at or above the offering price;

º If you purchase our Shares in this offering, you will incur immediate and substantial dilution in the book value of your shares;

º A significant portion of our total outstanding shares are restricted from immediate resale but may be sold into the market in the near future. This could cause the market price of our Shares to drop significantly, even if our business is doing well;

º Our directors, officers and principal stockholders beneficially own in the aggregate 35.4% of the Company's current outstanding Common Stock entitled to vote and may take actions that may not be in the best interests of our other stockholders;

º When factoring our Preferred Series A Stock in our cumulative voting rights, our directors, officers, and principal stockholders beneficially own in the aggregate 94.2% of the Company's total voting rights, a super-majority quorum, under Nevada law.

º The significant voting power held by the Company's directors, officers and principal stockholders may affect the market value of shares with different voting rights.

Corporate Information

We were incorporated in the State of Nevada on May 30, 2018. Our executive office is located at 30 Corporate Park, Suite 315 Irvine, CA 92606 and our telephone number is +1 (954) 253-5840. Our internet website is www.valueone.us. The information on, or that can be accessed through, our website is not part of this prospectus, and you should not rely on any such information in making the decision whether to purchase our common stock.

The Offering

Common Stock to be Sold | Up to 19,100,000 shares of our common stock representing 100% of the shares of our common stock that each of our stockholders owns and 5,000,000 shares of our common stock to be sold to qualified investors at $0.50 per share to qualified persons in connection with a financing in which we are seeking to raise $2,500,000. |

| |

Common Stock Outstanding before the Offering Common Stock Outstanding after the Offering | 19,100,000 as of November 14, 2022(1) 24,100,000 |

| |

Use of Proceeds | This is a resale prospectus to register shares of the Selling Stockholders but we may receive up to approximately $2,500,000 in gross proceeds upon the cash purchase of the additional securities to be sold. We intend to use the net proceeds from the additional securities for (i) potential mergers and acquisitions, (ii) research and development; (iii) repayment of debt and (iv) general working capital. The expected uses of the net proceeds from the exercise of the warrants represent our intentions based upon our current plans and business conditions. The precise uses, amounts and timing of the application of proceeds have yet to be determined by our management and may differ, in some or all respects, from those enumerated above. The amounts used for each purpose and timing of our actual expenditures may also vary significantly depending on numerous factors. See "Use of Proceeds." We will not receive any of the proceeds from the sale or other disposition of the securities by the Selling Stockholders. We have agreed to bear the expenses relating to the registration of the shares of our common stock held by the Selling Stockholders. See "Use of Proceeds". |

| |

Dividend Policy | We have never declared any cash dividends on our common stock. We currently intend to retain all available funds and any future earnings for use in financing the growth of our business and do not anticipate paying any cash dividends for the foreseeable future. See "Dividend Policy". |

| |

| |

Risk Factors _________________________________ | You should carefully consider the information set forth in this prospectus and, in particular, the specific factors set forth in the "Risk Factors" section beginning on page 15 of this prospectus before deciding whether or not to invest in our common stock. ___________ |

WHERE YOU CAN FIND MORE INFORMATION

We have filed a registration statement on Form S-1 with the SEC registering under the Securities Act the common stock being offered under this prospectus. This prospectus, which is a part of such registration statement, does not include all of the information contained in the registration statement and its exhibits. For further information regarding us, the Selling Securityholders and our common stock, you should consult the registration statement and its exhibits.

Statements contained in this prospectus concerning the provisions of any documents are summaries of those documents and are not necessarily complete, and we refer you to the documents filed with the SEC for more information. The registration statement and any of its amendments, including exhibits filed as a part of the registration statement or an amendment to the registration statement, are available for inspection and copying as described below.

We will distribute annual reports to our stockholders, including financial statements audited and reported on by an independent registered public accounting firm. Any or all reports and other documents we will file with the SEC, as well as any or all of the documents incorporated by reference in this prospectus or the registration statement we filed with the SEC registering for sale the shares of our common stock being offered pursuant to this prospectus, are available at the SEC's website www.sec.gov, as well as our website www.valueone.us. If you do not have internet access, requests for copies of such documents should be directed to Tea Hyen Shin, the Company's CEO, at ValueOne, Inc., 30 Corporate Park, Suite 315 Irvine, CA 92606.

RISK FACTORS

Investing in our common stock involves a high degree of risk. Prospective investors should carefully consider the risks described below, together with all of the other information included or referred to in this prospectus, before purchasing shares of our common stock. There are numerous and varied risks that may prevent us from achieving our goals. If any of these risks actually occurs, our business, financial condition or results of operations may be materially adversely affected. In such case, the trading price of our common stock could decline and investors in our common stock could lose all or part of their investment.

Risks Related to Our Company

Since we have a limited operating history in our industry, it is difficult for potential investors to evaluate our business.

Our short operating history makes it difficult for potential investors to evaluate our business or prospective operations. As an early stage company, we are subject to all the risks inherent in the financing, expenditures, operations, complications and delays inherent in a new business. Accordingly, our business and success face risks from uncertainties faced by developing companies in a competitive environment. There can be no assurance that our efforts will be successful or that we will ultimately be able to attain profitability.

We have a history of operating losses and we may need additional financing to meet our future long-term capital requirements.

We have a history of losses and may continue to incur operating and net losses for the foreseeable future. We have not achieved sustainable profitability on an annual basis. We may not be able to reach a level of revenue to achieve profitability. If our revenues grow slower than anticipated, or if operating expenses exceed expectations, then we may not be able to achieve profitability in the near future or at all, which may depress our stock price.

We may not be able to raise capital when needed, if at all, which would force us to delay, reduce or eliminate our acquisition of suitable target companies and could cause our business plan to fail.

We will need substantial additional funding to pursue our acquisition of companies and business units that meet our desired standards. There are no assurances that future funding will be available on favorable terms or at all. The failure to fund our operating and capital requirements could have a material adverse effect on our business, financial condition and results of operations. If we are unable to raise capital when needed or on attractive terms, we could be forced to delay, reduce or eliminate our acquisition strategy. Any of these events could significantly harm our business, financial condition and prospects.

We may acquire other assets or businesses, or form collaborations or make investments in other companies or technologies that could harm our operating results, dilute our stockholders' ownership, increase our debt or cause us to incur significant expense.

As part of our business strategy, we may pursue acquisitions of businesses and assets or enter into strategic alliances and collaborations, to initiate and then expand our operations. We may not identify or complete these transactions in a timely manner, on a cost-effective basis, or at all, and we may not realize the anticipated benefits of any such transaction, any of which could have a detrimental effect on our financial condition, results of operations and cash flows. We have limited experience with acquiring other companies and assets and limited experience with forming strategic alliances and collaborations. We may not be able to find suitable acquisition candidates, and if we make any acquisitions, we may not be able to integrate these acquisitions successfully into our existing business and we may incur additional debt or assume unknown or contingent liabilities in connection therewith. Integration of an acquired company or assets may also disrupt ongoing operations, require the hiring of additional personnel and the implementation of additional internal systems and infrastructure, especially the acquisition of commercial assets, and require management resources that would otherwise focus on developing our existing business. We may not be able to find suitable strategic alliance or collaboration partners or identify other investment opportunities, and we may experience losses related to any such investments.

To finance any acquisitions or collaborations, we may choose to issue debt or equity securities as consideration. Any such issuance of securities would dilute the ownership of our stockholders. If the price of our Common Stock is low or volatile, we may not be able to acquire other assets or companies or fund a transaction using our stock as consideration. Alternatively, it may be necessary for us to raise additional funds for acquisitions through public or private financings. Additional funds may not be available on terms that are favorable to us, or at all.

Our future success depends on our ability to retain our CEO and to attract, retain and motivate qualified personnel.

Our future business and results of operations depend in significant part upon the continued contributions of our CEO and his business acumen and strategic connections. If we lose his service or if he fails to perform in his current position, or if we are not able to attract and retain skilled personnel as needed, our business could suffer.

Because we do not have an audit or compensation committee, shareholders will have to rely on the entire Board of Directors to perform these functions.

We do not have an audit or compensation committee comprised of independent directors. Indeed, we do not have any audit or compensation committee. These functions are performed by the Board of Directors as a whole. Thus, there is a potential conflict in that board members who are also part of management will participate in discussions concerning management compensation and audit issues that may affect management decisions.

We expect to face intense competition, often from companies with greater resources and experience than we have.

To acquire qualified companies, we are likely to face competition from companies that have substantially greater financial, technological, managerial and research and development resources and experience than we have. In addition, if we are successful in closing our acquisition of one or more target companies, these acquired companies are likely to face competition for their service and product offerings from large and well-established companies that have greater marketing and sales experience and capabilities than we have. If we are unable to compete successfully, we may be unable to grow, sustain our revenue or be successful in achieving our business plan.

Current global financial conditions have been characterized by increased volatility which could negatively impact our business, prospects, liquidity and financial condition.

Current global financial conditions and recent market events have been characterized by increased volatility and the resulting tightening of the credit and capital markets has reduced the amount of available liquidity and overall economic activity. We cannot guaranty that debt or equity financing, the ability to borrow funds or cash generated by operations will be available or sufficient to meet or satisfy our initiatives, objectives or requirements. Our inability to access sufficient amounts of capital on terms acceptable to us for our operations will negatively impact our business, prospects, liquidity and financial condition.

We are growing the size of our organization, and we may experience difficulties in managing any growth we may achieve.

As of the date of this prospectus, we have one full-time employee, our CEO, Tea Hyen Shin. As our acquisition plans proceed and development and commercialization plans and strategies develop, we expect to need additional development, managerial, operational, sales, marketing, financial, accounting, legal, and other resources. Future growth would impose significant added responsibilities on members of management. Our management may not be able to accommodate those added responsibilities, and our failure to do so could prevent us from effectively managing future growth, if any, and successfully growing our Company.

Our industry is subject to rapid change, which could make our solutions and the diagnostic tests we develop and services we offer, obsolete. If we are unable to continue to innovate and improve our diagnostic tests and services, we could lose customers or market share.

Our industry is characterized by rapid changes, including technological and scientific breakthroughs, frequent new product introductions and enhancements and evolving industry standards, all of which could make our current diagnostic tests and others we are developing obsolete. Our future success will depend on our ability to keep pace with the evolving needs of our customers on a timely and cost-effective basis and to pursue new market opportunities that develop as a result of scientific and technological advances. In recent years, there have been numerous advances in technologies relating to the diagnosis and treatment of cancer. There have also been advances in methods used to analyze very large amounts of molecular information. We must continuously enhance our offerings and develop new and improved diagnostic tests to keep pace with evolving standards of care. If we do not leverage or scale our sample and data biobank, discover new diagnostic biomarkers or applications or update our diagnostic tests to reflect new scientific knowledge, including about prostate cancer biology and other cancers in our product development pipeline, information about new cancer therapies or relevant clinical trials, our diagnostic tests could become obsolete and sales of our current diagnostic tests and any new tests we develop could decline or fail to grow as expected. This failure to make continuous improvements to our diagnostic tests to keep ahead of those of our competitors could result in the loss of customers or market share that would adversely affect our business, financial condition and results of operations. The development of new liquid biopsy technologies could negatively impact demand for our products.

Our potential for rapid growth and our entry into new markets make it difficult for us to evaluate our current and future business prospects, and we may be unable to effectively manage any growth associated with these new markets, which may increase the risk of your investment and could harm our business, financial condition, results of operations and cash flow.

Our entry into new markets as we acquire new businesses may place a significant strain on our resources and increase demands on our executive management, personnel and systems, and our operational, administrative and financial resources may be inadequate. We may also not be able to effectively manage any expanded operations or achieve planned growth on a timely or profitable basis, particularly if the number of customers using our technology significantly increases or their demands and needs change as our business expands. If we are unable to manage expanded operations effectively, we may experience operating inefficiencies, the quality of our products and services could deteriorate, and our business and results of operations could be materially adversely affected.

If we are unable to develop and maintain our brand and reputation for our service and product offerings, our business and prospects could be materially harmed.

Our business and prospects depend, in part, on developing and then maintaining and strengthening our brand and reputation in the markets we will serve for the companies we acquire. If problems arise with our future products or services, our brand and reputation could be diminished. If we fail to develop, promote and maintain our brand and reputation successfully, our business and prospects could be materially harmed.

We may not maintain sufficient insurance coverage for the risks associated with our future business operations.

Risks associated with our prospective businesses and operations include, but are not limited to, claims for wrongful acts committed by our officers, directors, and other representatives, the loss of intellectual property rights, the loss of key personnel, risks posed by natural disasters and risks of lawsuits from customers who are injured from or dissatisfied with our services. Any of these risks may result in significant losses. We cannot provide any assurance that our insurance coverage will be sufficient to cover any losses that we may sustain, or that we will be able to successfully claim our losses under our insurance policies on a timely basis or at all. If we incur any loss not covered by our insurance policies, or the compensated amount is significantly less than our actual loss or is not timely paid, our business, financial condition and results of operations could be materially and adversely affected.

Any failure to protect our future intellectual property rights could impair our ability to protect our technology and our brand.

Our success depends in part on our ability to enforce our intellectual property and other proprietary rights of the companies we expect to acquire. We expect to rely upon a combination of trademark and trade secret laws, as well as license and other contractual provisions, to protect our intellectual property and other proprietary rights. These laws, procedures and restrictions provide only limited protection and any of our intellectual property rights may be challenged, invalidated, circumvented, infringed or misappropriated. To the extent that our intellectual property and other proprietary rights are not adequately protected, third parties may gain access to our proprietary information, develop and market solutions similar to ours or use trademarks similar to ours, each of which could materially harm our business. The failure to adequately protect our intellectual property and other proprietary rights could have a material adverse effect on our business, financial condition and results of operations.

The impact of epidemics or pandemics may limit our future business both from the demand and supply sides. Our sale people may not be able to effectively engage with customers due to restrictions on travel, conferences and in-person meetings. Our supply chain may be impacted by production and distribution delays. Due to these factors we may limit future operations to reduce expenses until events support and allow normal business procedures.

Our future acquired businesses and/or operations and the businesses of our potential customers could be materially and adversely affected by the risks, or the public perception of the risks, related to a pandemic or other health crisis, such as the global outbreak of the novel coronavirus (COVID-19).

The growth of the businesses we acquire may, in part, be reliant on the willingness of customers to invest in their products and solutions. The risk, or public perception of the risk, of a pandemic or media coverage of infectious diseases could cause customers to avoid purchases which would delay sales of those products and solutions.

In addition, since we source raw materials used in our products from various U.S. suppliers, the impact of COVID-19 on these suppliers, or any of our other suppliers, distributors and resellers, or transportation or logistics providers, may negatively affect the price and availability of our ingredients and/or packaging materials and impact our supply chain. If the disruptions caused by COVID-19 continue for an extended period of time, our ability to meet the demands of our consumers may be materially impacted.

To date, we have not experienced any reduction in the available supply of our products. Additionally, many of our employees, including members of our management team, have been working remotely as a result of the closure of our offices and warehouses in compliance with local and state regulations in response to the COVID-19 pandemic. If our operations or productivity become, or continue to be, impacted throughout the duration of the COVID-19 outbreak and government-mandated closures, those occurrences may negatively impact our business, financial condition, and cash flow.

The extent to which the COVID-19 pandemic will further impact our business will depend on future developments and, given the uncertainty around the extent and timing of the potential future spread or mitigation and around the imposition or relaxation of protective measures, we cannot reasonably estimate the impact to our business at this time.

Risks Related to the Securities Markets and Ownership of our Equity Securities

The market price of our Common Stock may fluctuate, and you could lose all or part of your investment.

The price of our common stock may decline below the Offering price of the shares following this offering. The stock market in general, and the market price of our common stock will likely be subject to fluctuation, whether due to, or irrespective of, our operating results, financial condition and prospects.

Our financial performance, our industry's overall performance, changing consumer preferences, technologies, government regulatory action, tax laws and market conditions in general could have a significant impact on the future market price of our Common Stock. Some of the other factors that could negatively affect our share price or result in fluctuations in our share price include:

| * | actual or anticipated variations in our periodic operating results; |

| | |

| * | increases in market interest rates that lead purchasers of our common stock to demand a higher investment return; |

| | |

| * | changes in earnings estimates; |

| | |

| * | changes in market valuations of similar companies; |

| | |

| * | actions or announcements by our competitors; |

| | |

| * | adverse market reaction to any increased indebtedness we may incur in the future; |

| | |

| * | additions or departures of key personnel; |

| | |

| * | actions by stockholders; |

| | |

| * | speculation in the media, online forums, or investment community; and |

| | |

| * | our intentions and ability to list our Common Stock on the NYSE MKT and our subsequent ability to maintain such listing. |

| | |

You will experience immediate and substantial dilution as a result of this offering.

You will incur immediate and substantial dilution as a result of this offering. After giving effect to the sale by us of our shares of Common Stock in this offering at an assumed public offering price of $0.50 per share for aggregate gross proceeds of up to $2,500,000 and after deducting the estimated offering expenses payable by us, investors in this offering can expect an immediate dilution of $0.001 per share.

We do not know whether an active, liquid and orderly trading market will develop for our securities or what the market price of our securities will be and as a result it may be difficult for you to sell your shares of our Common Stock.

There is currently an illiquid market for our securities. The lack of an active market may impair your ability to sell those securities at the time you wish to sell them or at a price that you consider reasonable. The lack of an active market may also reduce the fair market value of your securities. Further, an inactive market may also impair our ability to raise capital by selling securities and may impair our ability to enter into collaborations or acquire companies or products by using our securities as consideration.

If we do not meet the listing standards of a national securities exchange our investors' ability to make transactions in our securities will be limited, and we will be subject to additional trading restrictions.

Our securities are not currently but will be in the near future traded over-the-counter on the OTC Markets Group, Inc. Pink Current Information or QB Market Tiers, and are not qualified to be listed on a national securities exchange, such as NASDAQ or NYSE. Accordingly, we face significant material adverse consequences, including:

A limited availability of market quotations for our securities;

A reduced liquidity with respect to our securities;

Our shares of common stock are currently classified as "penny stock" which requires brokers trading in our shares of common stock to adhere to more stringent rules, resulting in a reduced level of trading activity in the secondary trading market for our shares of common stock;

A limited amount of news and analyst coverage for our company; and

A decreased ability to issue additional securities or obtain additional financing in the future.

The National Securities Markets Improvement Act of 1996, which is a federal statute, prevents or preempts the states from regulating the sale of certain securities, which are referred to as "covered securities." Since our Common Stock is traded on the OTC.PINK or OTC.QB, our common stock is a covered security. Although the states are preempted from regulating the sale of our securities, the federal statute allows the states to investigate companies if there is a suspicion of fraud, and, if there is a finding of fraudulent activity, then the states can regulate or bar the sale of covered securities in a particular case. Further, if we were no longer traded over-the-counter, our common stock would not be a covered security and we would be subject to regulation in each state in which we offer our securities.

Because we do not anticipate paying any cash dividends on our capital stock in the foreseeable future, capital appreciation, if any, will be your sole source of gain.

We have never declared or paid cash dividends on our capital stock. We currently intend to retain all of our future earnings, if any, to finance the growth and development of our business. In addition, the terms of any future debt agreements may preclude us from paying dividends. As a result, capital appreciation, if any, of our securities will be your sole source of gain for the foreseeable future.

Some provisions of our charter documents and Nevada law may have anti-takeover effects that could discourage an acquisition of us by others, even if an acquisition would be beneficial to our stockholders and may prevent attempts by our stockholders to replace or remove our current management.

Provisions in our articles of incorporation and bylaws that will become effective in connection with consummation of this offering, as well as provisions of Nevada law, could make it more difficult for a third party to acquire us or increase the cost of acquiring us, even if doing so would benefit our stockholders, or remove our current management. These include provisions that:

Permit our Board of Directors to issue up to 1,000,000 shares of preferred stock, with any rights, preferences and privileges as it may designate, of which we have designated 1,000,000 Series A preferred stock with 10,000 votes per share, which are held by Tea Hyen Shin. These shares vote a preference to common of 200:1.

Provide that all vacancies on our Board of Directors, including as a result of newly created directorships, may, except as otherwise required by law, be filled by the affirmative vote of a majority of directors then in office, even if less than a quorum;

Not provide for cumulative voting rights, thereby allowing the holders of a majority of the shares of common stock entitled to vote in any election of directors to elect all of the directors standing for election;

Provide that special meetings of our stockholders may be called by a majority of the Board of Directors; and

Provide that our Board of Directors is expressly authorized to make, alter or repeal the bylaws.

These provisions may frustrate or prevent any attempts by our stockholders to replace or remove our current management by making it more difficult for stockholders to replace members of our Board of Directors, who are responsible for appointing the members of our management. Any provision of our articles of incorporation or bylaws or Nevada law that has the effect of delaying or deterring a change in control could limit the opportunity for our stockholders to receive a premium for their shares of our Common Stock and could also affect the price that some investors are willing to pay for our Common Stock.

The subscription agreement for the purchase of common stock from the Company contains an exclusive forum provision, which will limit investors ability to litigate any issue that arises in connection with the offering anywhere other than the Federal courts in Nevada.

The subscription agreement states that it shall be governed by the local law of the State of Nevada and the United States, and the parties consent to the exclusive forum of the Federal courts in Nevada for any action brought under the Securities Act, the Exchange Act, or any matters derived from the subscription agreement. They will not have the benefit of bringing a lawsuit in a more favorable jurisdiction or under more favorable law than the local law of the State of Nevada. Moreover, we cannot provide any certainty as to whether a court would enforce such a provision. In addition, you cannot waive compliance with the federal securities laws and the rules and regulations thereunder as Section 22 of the Securities Act creates concurrent jurisdiction for federal and state courts over all suits brought to enforce any duty or liability created by the Securities Act or the rules and regulations thereunder. The combination of both potentially unfavorable forum and the lack of certainty regarding enforceability poses a risk regarding litigation related to the subscription to this offering and should be considered by each investor before signing the subscription agreement. In addition, our exclusive forum provision may result in additional costs related to litigation of the matter for an investor.

Forward Looking Statements

This prospectus contains forward-looking statements within the meaning of the Federal securities laws. These statements relate to future events or future predictions, including events or predictions relating to our future financial performance, and are based on current expectations, estimates, forecasts and projections about us, our future performance, our beliefs and management's assumptions. They are generally identifiable by use of the words "may," "will," "should," "expect," "plan," "anticipate," "believe," "feel," "confident," "estimate," "intend," "predict," "forecast," "potential" or "continue" or the negative of such terms or other variations on these words or comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks described under "Risk Factors" that may cause the Company's or its industry's actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. In addition to the risks described in Risk Factors, important factors to consider and evaluate in such forward-looking statements include: (i) general economic conditions and changes in the external competitive market factors which might impact the Company's results of operations; (ii) unanticipated working capital or other cash requirements including those created by the failure of the Company to adequately anticipate the costs associated with acquisitions and other critical activities; (iii) changes in the Company's corporate strategy or an inability to execute its strategy due to unanticipated changes; and (iv) the failure of the Company to complete any or all of the transactions described herein on the terms currently contemplated. In light of these risks and uncertainties, many of which are described in greater detail elsewhere in this Risk Factors discussion, there can be no assurance that the forward-looking statements contained in this prospectus will in fact transpire.

Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, the Company cannot guarantee future results, levels of activity, performance or achievements. Moreover, neither the Company nor any other person assumes responsibility for the accuracy and completeness of such statements. We do not undertake any duty to update any of the forward-looking statements after the date of this prospectus to conform such statements to actual results or changes in our expectations.

Emerging Growth Company Status

The Jumpstart Our Business Startups Act of 2012, or the JOBS Act, permits an "emerging growth company" such as us to take advantage of an extended transition period to comply with new or revised accounting standards applicable to public companies. We are choosing to elect the extended transition period for complying with new or revised accounting standards applicable to public companies. As a result, our financial statements may not be comparable to companies that comply with new or revised accounting pronouncements as of public company effective dates.

USE OF PROCEEDS

This prospectus relates to shares of our common stock that may be offered and sold from time to time by the Selling Stockholders. We will receive no proceeds from the sale of shares of Common Stock by the Selling Stockholders in this offering. We may receive proceeds from additional shares included in the offering. The following table illustrates the amount of net proceeds of up to $2,500,000 we may receive from warrants exercised by the Selling Stockholders. It is possible that we may only receive some or none of the $2,500,000 should there be some or no exercise by the Selling Stockholders of their rights to purchase shares of our common stock under their warrants. In such case, we will reallocate our use of proceeds as the Board of Directors deems to be in the best interests of the Company to effectuate our business plan. The intended use of proceeds is as follows:

| | 100% | | | 75% | | | 50% | 25% | |

Gross Offering Proceeds | | $ | 2,500,000 | | | | $1,875,00 | | | | $1,250,000 | | $625,000 | |

Offering Costs(1) | | | $100,000 | | | | $100,000 | | | | $100,000 | | $100,000 | |

Use of Net Proceeds: | | | | | | | | | | | | | | |

Research and Development | | | $1,000,000 | | | | $750,000 | | | | $500,000 | | $250,000 | |

Acquisitions | | | $500,000 | | | | $375,000 | | | | $250,000 | | $125,000 | |

Working Capital(2) | | | $1,500,000 | | | | $1,125,000 | | | | $750,000 | | $375,000 | |

Debt Reduction | | | $0 | | | | $0 | | | | $0 | | $0 | |

(1) | We expect to spend approximately $100,000 in expenses relating to this offering, including legal, accounting, consulting, travel, printing, administrative filing fees and other miscellaneous costs. |

(2) We use working capital to pay for miscellaneous and general operating expenses, as well as legal and accounting fees, for executive compensation and core consulting services fees. |

The allocation of the use of proceeds among the categories of anticipated expenditures represents management's best estimates based on the current status of our proposed operations, plans, investment objectives, capital requirements, and financial conditions. Future events, including changes in economic or competitive conditions of our business plan or the completion of less than the total offering, may cause us to modify the above-described allocation of proceeds. Our use of proceeds may vary significantly in the event any of our assumptions prove inaccurate. We reserve the right to change the allocation of net proceeds from the Offering as unanticipated events or opportunities arise.

MARKET FOR REGISTRANT's COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

Dividend Policy

We have not declared nor paid any cash dividend on our common stock, and we currently intend to retain future earnings, if any, to finance the expansion of our business, and we do not expect to pay any cash dividends in the foreseeable future. The decision whether to pay cash dividends on our common stock will be made by our board of directors, in their discretion, and will depend on our financial condition, results of operations, capital requirements and other factors that our board of directors considers significant.

DILUTION

The sale of shares of our common stock by the Selling Stockholders may have a dilutive impact on our stockholders.

Our net tangible book value as of December 31, 2021 was approximately $(30,450.00) or $(.001) per share. Net tangible book value per share is determined by dividing our total tangible assets, less total liabilities, by the number of shares of common stock outstanding as of December 31, 2021. Dilution with respect to net tangible book value per share represents the difference between the amount per share paid by the Selling Stockholders and the net tangible book value per share of common stock immediately after sale of such shares.

After giving effect to the issuance of 2,500,000 shares of our common stock to the other Selling Stockholders at the assumed average sale price of $0.50 per share, and after deducting estimated offering expenses payable by us, our as adjusted net tangible book value as of December 31, 2021 would have been approximately $(30,450.00), or $(.001) per share.

In addition, we may choose to raise additional capital due to market conditions or strategic considerations even if we believe we have sufficient funds for our current or future operating plans. To the extent that additional capital

is raised through the sale of equity or convertible debt securities, the issuance of these securities could result in further dilution to our stockholders.

SELLING STOCKHOLDERS

This prospectus relates to the possible resale by the Selling Stockholders of shares of our common stock that represent 100% of the shares of our common stock held by each of our stockholders and shares of common stock. Under the terms of the Stock Purchase Agreement we may sell an additional 5,000,000 common shares netting proceeds of approximately $2,500,000. We are filing the registration statement of which this prospectus is a part pursuant to the provisions of the Purchase Agreement.

The table below sets forth, to our knowledge, information concerning the beneficial ownership of shares of our common stock by the Selling Stockholders as of November 1, 2022. The percentages of shares owned before and after the offering are based on 19,100,00 of common stock outstanding. The information in the table below with respect to the Selling Stockholders has been obtained from the Selling Stockholders. solely on information supplied to us by the Selling Stockholders and assumes the sale of all the shares offered hereby. Other than as described in the footnotes below, the Selling Stockholders have not, within the past three years, had any position, office or other material relationship with us or any of our predecessors or affiliates other than as a holder of our securities, or are broker-dealers or affiliates of a broker-dealer. Information concerning the Selling Stockholders may change from time to time and, if necessary and required, we will amend or supplement this prospectus accordingly.

Beneficial ownership is determined in accordance with the rules of the SEC and includes voting or investment power with respect to shares. Unless otherwise indicated below, to our knowledge, all persons named in the table have sole voting and investment power with respect to their shares of common stock. The inclusion of any shares in this table does not constitute an admission of beneficial ownership for the person named below.

MANAGEMENT's DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION

The following discussion should be read in conjunction with the consolidated financial statements and the related notes contained elsewhere in this prospectus. In addition to historical information, the following discussion contains forward looking statements based upon current expectations that are subject to risks and uncertainties. Actual results may differ substantially from those referred to herein due to a number of factors, including, but not limited to, risks described in the section entitled "Risk Factors" and elsewhere in this prospectus.

General

Our executive offices are located at 30 Corporate Park, Suite 315 Irvine, CA 92606; telephone

(954) 253-5840. Our corporate website address is www.valueone.us

Overview

We are a Nevada corporation based in California operating under an Exclusive Joint Venture Agreement for the Development Ownership and Control of Intellectual Property and Work Product with a South Korean corporation, ValueOne, Inc. Our executive officers and directors are compensated by our South Korean joint venture partner and and do not have compensation plans with the Company but for Tea Hyen Shin who performs services based on an Executive Employment Agreement with a term of three years from August 2021 to August 2024. We are seeking to manufacture and distribute a proprietary line of in-vitro testing equipment designed for in home use.

Results of Operations

We are a start-up company in the early phase of development with limited operations and cash flows. Our operating history constitutes three and a half (3.5) years of losses and payment of basic expenses to maintain our corporation and prepare our business plans.

Liquidity and Capital Requirements

There is no public market for our capital stock and although we are seeking to list our common stock on the OTC Markets Group, Inc. even when listed will constitute a penny-stock and be subjected to heightened scrutiny by broker-dealers and therefore be more illiquid more difficult to deposit, clear and trade by our individual shareholders.

We are seeking to raise an additional $2.5 million dollars through this prospectus and intend on using these funds to finance our operations. If we are unsuccessful in raising additional funds we may have to obtain loans or issue debt to finance our operations.

Based on our historic operations we have low operating costs, however we expect this to increase if we become a public company subject to the periodic reporting requirements of the Securities and Exchange Act of 1934, as amended, and therefore will require additional funds to maintain basic operations.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements that are reasonably likely to have a current or future effect on our financial condition, revenues, result of operations, liquidity or capital expenditures.

CONDENSED COMBINED FINANCIAL STATEMENTS

The accompanying notes (Index, at F-5) are an integral part of these financial statements.

BUSINESS

Overview

We were incorporated on May 30, 2018 in the State of Nevada. We have undergone several name changes and changes of control since our incorporation. Our founder has been involved in a similar business located in Seoul, South Korea. This is our joint venture partner ValueOne, Inc. of South Korea. Together, pursuant to our Joint Venture Agreement, we intend to enter the at-home in-vitro medical testing market in the United States, with potential expansion to other markets such as Canada, Mexico, the United Kingdom and European Union.