As filed with the U.S. Securities and Exchange Commission on January 24, 2025

Registration No. 333-[●]

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-3

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

CCSC Technology International Holdings Limited

(Exact name of registrant as specified in its charter)

| Cayman Islands | | Not Applicable |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

301-03, 13/f Shatin Galleria, 18-24 Shan Mei St

Fotan, Shatin, Hong Kong

00852-26870272

(Address and telephone number of Registrant’s principal executive offices)

Cogency Global Inc.

122 East 42nd Street, 18th Floor

New York, NY 10168

800-221-0102

(Name, address, and telephone number of agent for service)

With a Copy to:

Ying Li, Esq.

Lisa Forcht, Esq.

Hunter Taubman Fischer & Li LLC

950 Third Avenue, 19th Floor

New York, NY 10022

212-530-2206

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of the registration statement.

If only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.C. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.C. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

| † | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act, or until this registration statement shall become effective on such date as the U.S. Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell the securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting any offer to buy these securities in any jurisdiction where such offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED JANUARY 24, 2025 |

CCSC Technology International Holdings Limited

$100,000,000 of

Class A Ordinary Shares

Debt Securities

Warrants

Rights

and

Units

We may, from time to time, in one or more offerings, offer and sell up to $100,000,000 of our Class A ordinary shares, par value $0.0005 per share (“Class A Ordinary Shares”), debt securities, warrants, rights, and units, or any combination thereof, together or separately, as described in this prospectus. In this prospectus, references to the term “securities” refers, collectively, to our Class A Ordinary Shares, debt securities, warrants, rights, and units. The prospectus supplement for each offering of securities will describe in detail the plan of distribution for that offering. For general information about the distribution of the securities offered, please see “Plan of Distribution” in this prospectus.

This prospectus provides a general description of the securities we may offer. We will provide the specific terms of the securities offered in one or more supplements to this prospectus.

We may also authorize one or more free writing prospectuses to be provided to you in connection with these offerings. You should read this prospectus, any prospectus supplement, and any free writing prospectus before you invest in any of our securities. The prospectus supplement and any related free writing prospectus may add, update, or change information contained in this prospectus. You should read carefully this prospectus, the applicable prospectus supplement, and any related free writing prospectus, as well as the documents incorporated or deemed to be incorporated by reference, before you invest in any of our securities. This prospectus may not be used to offer or sell any securities unless accompanied by the applicable prospectus supplement.

Our Class A Ordinary Shares are listed on the Nasdaq Capital Market, or “Nasdaq,” under the symbol “CCTG.” On January 22, 2025, the last reported sale price of our Class A Ordinary Shares on Nasdaq was $1.615 per share.

We are a “foreign private issuer” and we are currently an “emerging growth company” under applicable U.S. federal securities laws and are eligible for reduced public company reporting requirements. Subject to any other conditions as prescribed in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”), we will no longer be an “emerging growth company,” as defined in the JOBS Act, from the last day of the fiscal year ending March 31, 2029.

Investing in our securities involves a high degree of risk. Before making an investment decision, please read the information under the heading “Risk Factors” beginning on page 10 of this prospectus and risk factors set forth in our most recent annual report on Form 20-F (the “2024 Annual Report”), in other reports incorporated herein by reference, and in an applicable prospectus supplement under the heading “Risk Factors.”

We may offer and sell the securities from time to time at fixed prices, at market prices, or at negotiated prices, to or through underwriters, to other purchasers, through agents, or through a combination of these methods. If any underwriters are involved in the sale of any securities with respect to which this prospectus is being delivered, the names of such underwriters and any applicable commissions or discounts will be set forth in a prospectus supplement. The offering price of such securities and the net proceeds we expect to receive from such sale will also be set forth in a prospectus supplement. See “Plan of Distribution” elsewhere in this prospectus for a more complete description of the ways in which the securities may be sold.

As of the date of this prospectus, our director and chairman of the Board, Dr. Chi Sing Chiu, beneficially owns approximately 98.76% of the aggregate voting power of our outstanding Ordinary Shares. As a result, we will be deemed to be a “controlled company” for the purpose of the Nasdaq listing rules. However, even if we qualify as a “controlled company,” we do not intend to rely on the controlled company exemptions provided under the Nasdaq listing rules. For more information about risks relating to “controlled company”, see “Item 3. Key Information — D. Risk Factors — Risks Relating to Our Ordinary Shares and This Offering — Since Dr. Chi Sing Chiu, the chairman of the board of directors of the Company, will own at least 50% of our Ordinary Shares following the initial public offering, he will have the ability to elect directors and approve matters requiring shareholder approval by way of resolution of members” on page 23 of the 2024 Annual Report and “Risk Factors — Our director and chairman of the Board, Dr. Chi Sing Chiu, has substantial influence over our Company. His interests may not be aligned with the interests of our other shareholders” on page 10 of this prospectus.

We are not a Chinese operating company, but rather a holding company incorporated in the Cayman Islands. As a holding company with no material operations of our own, we conduct our operations through operating wholly-owned subsidiaries established in Hong Kong, mainland China, the Netherlands, and Serbia. As such, our corporate structure involves unique risks to investors. Investors of our Class A Ordinary Shares do not directly own any equity interests in our operating subsidiaries, but will instead own shares of a Cayman Islands holding company. The Chinese regulatory authorities could intervene in or influence the operations of our operating subsidiaries, including disallowing our corporate structure, which would likely result in a material change in our operations and/or a material change in the value of our Class A Ordinary Shares. For details, see “Item 3. Key Information — D. Risk Factors — Risks Relating to Doing Business in China — The Chinese government exerts substantial influence over the manner in which we must conduct our business and may intervene or influence our operations at any time, which actions may result in a material change in our operations and impact our operations materially and adversely, and significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of our Ordinary Shares to significantly decline or be worthless” on page 4 of the 2024 Annual Report.

We are subject to legal and operational risks associated with being based in and having the majority of our operations in China. These risks may result in a material change in our operations, or a complete hindrance of our ability to offer or continue to offer our securities to investors, and could cause the value of such securities to significantly decline or become worthless. Recently, the PRC government initiated a series of regulatory actions and statements to regulate business operations in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas using variable interest entity structure, and adopting new measures to extend the scope of cybersecurity reviews. On July 6, 2021, the General Office of the Communist Party of China Central Committee and the General Office of the State Council jointly issued an announcement to crack down on illegal activities in the securities market and promote the high-quality development of the capital market, which, among other things, requires the relevant governmental authorities to strengthen cross-border oversight of law-enforcement and judicial cooperation, to enhance supervision over China-based companies listed overseas, and to establish and improve the system of extraterritorial application of the PRC securities laws. On December 28, 2021, the Cyberspace Administration of China (the “CAC”), together with 12 other governmental departments of the PRC, jointly promulgated the Cybersecurity Review Measures, which became effective on February 15, 2022. The Cybersecurity Review Measures require that, among other, an online platform operator which possesses the personal information of at least one million users must apply for a cybersecurity review by the CAC if it intends to be listed in foreign countries. On September 30, 2024, the State Council of China published the Regulations on Network Data Security Administration, which provides that data processing operators engaging in data processing activities that affect or may affect national security must be subject to network data security review by the relevant cyberspace administration of the PRC. The Regulations on Network Data Security Administration became effective on January 1, 2025. As confirmed by Jincheng Tongda & Neal Law Firm, or JT&N, our counsel as to PRC law, since we are not an online platform operator that possesses over one million users’ personal information or engages in data processing activities that affect or may affect national security, we are not subject to the cybersecurity review with the CAC under the Cybersecurity Review Measures and the Regulations on Network Data Security Administration. There remains uncertainty, however, as to how the Cybersecurity Review Measures will be interpreted or implemented in the future and whether the PRC regulatory agencies, including the CAC, may adopt new laws, regulations, rules, or detailed implementation and interpretation related to the Cybersecurity Review Measures and the Regulations on Network Data Security Administration. For further details, see “Item 3. Key Information — D. Risk Factors — Risks Relating to Doing Business in China — Recent greater oversight by the CAC over cybersecurity and data security, particularly for companies seeking to list on a foreign exchange, could adversely impact our business” on page 2 of the 2024 Annual Report.

In addition, since 2021, the Chinese government has strengthened its anti-monopoly supervision, mainly in three aspects: (1) establishing the National Anti-Monopoly Bureau; (2) revising and promulgating anti-monopoly laws and regulations, including: the Anti-Monopoly Law (draft Amendment published on October 23, 2021 for public opinion; the newly revised Anti-Monopoly Law was promulgated on June 24, 2022, and became effective on August 1, 2022), the anti-monopoly guidelines for various industries, and the detailed Rules for the Implementation of the Fair Competition Review System; and (3) expanding the anti-monopoly law enforcement targeting Internet companies and large enterprises. As of the date of this prospectus, the Chinese government’s recent statements and regulatory actions related to anti-monopoly concerns have not impacted our ability to conduct business, accept foreign investments, or list on a U.S. or other foreign exchange, because neither the Company nor its PRC subsidiary engage in monopolistic behaviors that are subject to these statements or regulatory actions.

On February 17, 2023, the China Securities Regulatory Commission (the “CSRC”) released the Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies, or the Trial Measures, and five supporting guidelines, which came into effect on March 31, 2023. The Trial Measures regulate both direct and indirect overseas offering and listing by PRC domestic companies by adopting a filing-based regulatory regime. Pursuant to the Trial Measures, domestic companies that seek to offer or list securities overseas, whether directly or indirectly, should fulfill the filing procedures and report relevant information to the CSRC within three working days after submitting listing applications and subsequent amendments. Existing Issuers are not required to complete the filing procedures immediately, and they shall be required to file with the CSRC for any subsequent offerings. JT&N, our counsel as to PRC law, has advised us that, as the CSRC notified us in writing that we do not fall within the scope of the filing requirements under the Trial Measures, we believe that we are not required to obtain permission or approvals from the competent Chinese authorities for the listing and trading of our Class A Ordinary Shares on U.S. exchanges. Given the current PRC regulatory environment, it is uncertain whether we or our PRC subsidiary will be required to obtain approvals from the PRC government to offer securities to foreign investors in the future, and whether we would be able to obtain such approvals. If we are unable to obtain such approvals if required in the future, or inadvertently conclude that such approvals are not required then the value of our Class A Ordinary Shares may depreciate significantly or become worthless. For details, see “Item 3. Key Information — D. Risk Factors —Risks Relating to Doing Business in China — The approval of the China Securities Regulatory Commission and other compliance procedures may be required in the future in connection with any of our future offerings, and, if required, we cannot predict whether we will be able to obtain such approval” and “Item 3. Key Information — D. Risk Factors —Risks Relating to Doing Business in China — The New Overseas Listing Rules and other relevant rules promulgated by the CSRC may subject us to additional compliance requirements in the future” on pages 3 to 4 of the 2024 Annual Report.

JT&N, our counsel as to PRC law, has advised us that, as of the date of this prospectus, we and our PRC subsidiary have received from the PRC authorities all requisite licenses, permissions, or approvals that are required and material for conducting our operations in China, such as business licenses and import and export filings. However, it is uncertain whether we or our PRC subsidiary will be required to obtain additional approvals, licenses, or permits in connection with our business operations pursuant to evolving PRC laws and regulations, and whether we would be able to obtain and renew such approvals on a timely basis or at all. Failing to do so could result in non-compliance and material change in our operations, and the value of our Class A Ordinary Shares could depreciate significantly or become worthless.

Under Cayman Islands law, a Cayman Islands company may pay a dividend on its shares out of either profit or share premium account, provided that in no circumstances may a dividend be paid if this would result in the company being unable to pay its debts due in the ordinary course of business. As of the date of this prospectus, (1) the Company transferred approximately $5.15 million and $nil to a subsidiary, CCSC Interconnect Technology Limited, in fiscal years 2024 and 2023, respectively, and no other cash transfers or transfers of other assets have occurred between the Company and its subsidiaries, and (2) the Company and its subsidiaries have not made any dividends or distributions to investors. We intend to keep any future earnings to finance the expansion of our business, and we do not anticipate that any cash dividends will be paid in the foreseeable future. As of the date of this prospectus, we have not installed any cash management policies that dictate how funds are transferred among the Company, its subsidiaries, or investors.

A significant amount of our business is conducted in mainland China by our PRC subsidiary, CCSC Interconnect DG, the books and records of which are maintained in RMB. Under our current corporate structure, to fund any cash and financing requirements we may have, we may rely on dividend payments from the PRC subsidiary. Under existing PRC foreign exchange regulations, payment of current account items, such as profit distributions and trade and service-related foreign exchange transactions, can be made in foreign currencies without prior approval from State Administration of Foreign Exchange (“SAFE”) by complying with certain procedural requirements. Therefore, our PRC subsidiary is able to pay dividends in foreign currencies to us without prior approval from SAFE, subject to the condition that the remittance of such dividends outside of the PRC complies with certain procedures under PRC foreign exchange regulations, such as the overseas investment registrations by our shareholders or the ultimate shareholders of our corporate shareholders who are PRC residents. Approval from or registration with appropriate government authorities is, however, required where the RMB is to be converted into foreign currency and remitted out of China to pay capital expenses, such as the repayment of loans denominated in foreign currencies. The PRC government may also at its discretion restrict access in the future to foreign currencies for current account transactions.

Current PRC regulations permit our PRC subsidiary to pay dividends to the Company only out of its accumulated profits, if any, determined in accordance with Chinese accounting standards and regulations. In addition, our PRC subsidiary is required to set aside at least 10% of its after-tax profits each year, if any, to fund a statutory reserve until such reserve reaches 50% of its registered capital. Such entity in China is also required to further set aside a portion of its after-tax profits to fund the employee welfare fund, although the amount to be set aside, if any, is determined at the discretion of its board of directors. Although the statutory reserves can be used, among other ways, to increase the registered capital and eliminate future losses in excess of retained earnings of the respective companies, the reserve funds are not distributable as cash dividends except in the event of liquidation. Cash dividends, if any, on our Class A Ordinary Shares, will be paid in U.S. dollars. If we are considered a PRC tax resident enterprise for tax purposes, any dividends we pay to our overseas shareholders may be regarded as China-sourced income and, as a result, may be subject to PRC withholding tax at a rate of up to 10.0%. Pursuant to the Arrangement between Mainland China and the Hong Kong Special Administrative Region for the Avoidance of Double Taxation and Tax Evasion on Income, or the Double Tax Avoidance Arrangement, the 10% withholding tax rate may be lowered to 5% if a Hong Kong resident enterprise owns no less than 25% of a PRC project. The 5% withholding tax rate, however, does not automatically apply and certain requirements must be satisfied, including, without limitation that (a) the Hong Kong project must be the beneficial owner of the relevant dividends; and (b) the Hong Kong project must directly hold no less than 25% share ownership in the PRC project during the 12 consecutive months preceding its receipt of the dividends. In current practice, a Hong Kong project must obtain a tax resident certificate from the Hong Kong tax authority to apply for the 5% lower PRC withholding tax rate. As the Hong Kong tax authority will issue such a tax resident certificate on a case-by-case basis, we cannot assure you that we will be able to obtain the tax resident certificate from the relevant Hong Kong tax authority and enjoy the preferential withholding tax rate of 5% under the Double Taxation Arrangement with respect to any dividends paid by WFOE, CCSC Interconnect DG, to CCSC Technology Group, in which case, we would be subject to the higher withholding tax rate of 10% on dividends received. As of the date of this prospectus, we have not applied for the tax resident certificate from the relevant Hong Kong tax authority. Our Hong Kong subsidiaries intend to apply for the tax resident certificate if and when our PRC subsidiary plans to declare and pay dividends to our Hong Kong subsidiary, CCSC Technology Group.

As of the date of this prospectus, there are no restrictions or limitations imposed by the Hong Kong government on the transfer of capital within, into and out of Hong Kong (including funds from Hong Kong to the PRC), except for the transfer of funds involving money laundering and criminal activities. For details, see “Item 3. Key Information — D. Risk Factors — Risks Relating to Doing Business in China — To the extent cash or assets of our business, or of our PRC or Hong Kong subsidiaries, is in mainland China or Hong Kong, such cash or assets may not be available to fund operations or for other use outside of the PRC or Hong Kong, due to interventions in or the imposition of restrictions and limitations by the PRC government to the transfer of cash or assets” on page 12 of the 2024 Annual Report.

Our Class A Ordinary Shares may be delisted under the Holding Foreign Companies Accountable Act (“HFCAA”) if the Public Company Accounting Oversight Board of the United States (the “PCAOB”) is unable to inspect our auditors for three consecutive years beginning in 2021. On December 29, 2022, the Accelerating Holding Foreign Companies Accountable Act was signed into law as part of the Consolidated Appropriations Act, which amended the HFCAA by reducing the number of consecutive non-inspection years required for triggering the prohibitions under the HFCAA from three years to two.

On December 16, 2021, the PCAOB issued a report on its determinations that it was unable to inspect or investigate completely PCAOB-registered public accounting firms headquartered in mainland China and in Hong Kong, a Special Administrative Region of the PRC, because of positions taken by PRC authorities in those jurisdictions (the “Determination”). On August 26, 2022, the China Securities Regulatory Commission (the “CSRC”), the Ministry of Finance of the PRC (the “MOF”), and the PCAOB signed the Statement of Protocol (the “Protocol”), governing inspections and investigations of audit firms based in China and Hong Kong, taking the first step toward opening access for the PCAOB to inspect and investigate registered public accounting firms headquartered in mainland China and Hong Kong. Pursuant to the fact sheet with respect to the Protocol disclosed by the U.S. Securities and Exchange Commission (the “SEC”), the PCAOB shall have independent discretion to select any issuer audits for inspection or investigation and has the unfettered ability to transfer information to the SEC. On December 15, 2022, the PCAOB determined that it was able to secure complete access to inspect and investigate registered public accounting firms headquartered in mainland China and Hong Kong and vacated its previous determinations to the contrary. Our former auditor, Friedman LLP, the independent registered public accounting firm that issued the audit report included in the annual report for our initial public offering, was headquartered in the City of New York and registered with the PCAOB during the time it served as our independent auditor. Effective on September 1, 2022, Friedman LLP combined with Marcum LLP. The services previously provided by Friedman LLP were then provided by Marcum Asia CPAs LLP (“MarcumAsia”), which is a PCAOB registered public accounting firm headquartered in New York. On November 1, 2024, we appointed Enrome LLP (“Enrome”) as our independent registered public accounting firm. Enrome replaces MarcumAsia, which we dismissed on the same day. Our current and former auditors are all subject to laws in the United States pursuant to which the PCAOB conducts regular inspections to assess an auditor’s compliance with the applicable professional standards, and have been inspected by the PCAOB on a regular basis. As such, as of the date of this prospectus, our offering is not affected by the HFCAA and related regulations. However, should PRC authorities obstruct or otherwise fail to facilitate the PCAOB’s access in the future, the PCAOB may consider the need to issue a new determination. There is a risk that our auditor cannot be inspected by the PCAOB in the future, and if the PCAOB determines that it cannot inspect or fully investigate our auditor for two consecutive years beginning in 2022, our securities will be prohibited from trading on a national exchange or over-the-counter under the HFCAA, and, as a result, Nasdaq may determine to delist our securities, which may cause the value of our securities to decline or become worthless. For details, see “Item 3. Key Information — D. Risk Factors —Risk Factors — Risks Relating to Doing Business in China — The HFCAA and the Accelerating Holding Foreign Companies Accountable Act call for additional and more stringent criteria to be applied to emerging market companies upon assessing the qualification of their auditors, especially the non-U.S. auditors who are not inspected by the PCAOB. These developments could add uncertainties to our offering and listing on the Nasdaq Capital Market, and Nasdaq may determine to delist our securities if the PCAOB determines that it cannot inspect or fully investigate our auditor” on page 6 of the 2024 Annual Report.

We are a “foreign private issuer” and we are an “emerging growth company” under the federal securities laws and will be subject to reduced public company reporting requirements. See “Prospectus Summary — Implications of Being an Emerging Growth Company” on page 8 of this prospectus for additional information.

The information contained or incorporated in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of our securities.

Neither the U.S. Securities and Exchange Commission nor any state securities commission nor any other regulatory body has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2025.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the SEC utilizing a “shelf” registration process. Under this shelf registration process, we may, from time to time, sell the securities described in this prospectus in one or more offerings, up to a total offering amount of $100,000,000.

This prospectus provides you with a general description of the securities we may offer. This prospectus and any accompanying prospectus supplement do not contain all of the information included in the registration statement. We have omitted parts of the registration statement in accordance with the rules and regulations of the SEC. Statements contained in this prospectus and any accompanying prospectus supplement about the provisions or contents of any agreement or other documents are not necessarily complete. If the SEC rules and regulations require that an agreement or other document be filed as an exhibit to the registration statement, please see that agreement or document for a complete description of these matters. This prospectus may be supplemented by a prospectus supplement that may add, update, or change information contained or incorporated by reference in this prospectus. You should read both this prospectus and any prospectus supplement or other offering materials together with additional information described under the headings “Where You Can Find Additional Information” and “Incorporation of Documents by Reference.”

Each time we sell securities under this shelf registration, we will provide a prospectus supplement that will contain certain specific information about the terms of that offering, including a description of any risks related to the offering. A prospectus supplement may also add, update, or change information contained in this prospectus (including documents incorporated herein by reference). If there is any inconsistency between the information in this prospectus and the applicable prospectus supplement, you should rely on the information in the prospectus supplement. The registration statement we filed with the SEC includes exhibits that provide more details on the matters discussed in this prospectus. You should read this prospectus and the related exhibits filed with the SEC and the accompanying prospectus supplement together with additional information described under the headings “Incorporation of Documents by Reference” before investing in any of the securities offered.

The information in this prospectus is accurate as of the date on the front cover. Information incorporated by reference into this prospectus is accurate as of the date of the document from which the information is incorporated. You should not assume that the information contained in this prospectus is accurate as of any other date.

You should rely only on the information provided or incorporated by reference in this prospectus or in the prospectus supplement. We have not authorized anyone to provide you with additional or different information. This document may only be used where it is legal to sell these securities.

As permitted by SEC rules and regulations, the registration statement of which this prospectus forms a part includes additional information not contained in this prospectus. You may read the registration statement and the other reports we file with the SEC at its website or at its offices described below under “Where You Can Find Additional Information.”

COMMONLY USED DEFINED TERMS

Unless otherwise indicated or the context requires otherwise, references in this prospectus or in a prospectus supplement to:

| ● | “BVI” are to the “British Virgin Islands”; |

| ● | “CCSC Group” are to our direct wholly-owned subsidiary, CCSC Group Limited, an exempted company with limited liability incorporated under the laws of the BVI; |

| ● | “CCSC Interconnect DG” are to CCSC Technology Group’s wholly-owned subsidiary, Dongguan CCSC Interconnect Electronic Technology Limited, a company organized under the laws of the PRC; |

| ● | “CCSC Interconnect NL” are to CCSC Technology Group’s wholly-owned subsidiary, CCSC Interconnect Technology Europe B.V., a private limited liability company organized under the laws of the Netherlands; |

| ● | “CCSC Technology Group” are to CCSC Group’s direct wholly-owned subsidiary, CCSC Technology Group Limited, a limited liability company incorporated under the laws of Hong Kong; |

| ● | “Class B Ordinary Shares” are to Class B ordinary shares of the Company, par value $0.0005 per share; |

| ● | “China” or the “PRC” are to the People’s Republic of China, including the special administrative regions of Hong Kong and Macau for the purposes of this prospectus; |

| ● | “Exchange Act” are to the Securities Exchange Act of 1934; |

| ● | “mainland China” are to the mainland China of the PRC, excluding Taiwan, the special administrative regions of Hong Kong and Macau for the purposes of this prospectus only; |

| ● | “Ordinary Shares” are to Class A Ordinary Shares and Class B Ordinary Shares, collectively; |

| ● | “PRC subsidiary” and “WFOE” are to CCSC Interconnect DG; |

| ● | “RMB” are to Renminbi, the official currency of mainland China; |

| ● | “SEC” are to the U.S. Securities and Exchange Commission; |

| ● | “Serbia” are to the Republic of Serbia; |

| ● | “U.S. dollars,” “$,” and “US$” are to the legal currency of the United States; and |

| ● | “we,” “us,” “the Company”, “our”, “our company”, or “CCSC Cayman” are to CCSC Technology International Holdings Limited, an exempted company with limited liability incorporated under the laws of the Cayman Islands. |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, an applicable prospectus supplement, and our SEC filings that are incorporated by reference into this prospectus contain or incorporate by reference forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. All statements other than statements of historical fact are “forward-looking statements,” including any projections of earnings, revenue or other financial items, any statements of the plans, strategies, and objectives of management for future operations, any statements concerning proposed new projects or other developments, any statements regarding future economic conditions or performance, any statements of management’s beliefs, goals, strategies, intentions, and objectives, and any statements of assumptions underlying any of the foregoing. The words “believe,” “anticipate,” “estimate,” “plan,” “expect,” “intend,” “may,” “could,” “should,” “potential,” “likely,” “projects,” “continue,” “will,” and “would” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Forward-looking statements reflect our current views with respect to future events, are based on assumptions, and are subject to risks and uncertainties. We cannot guarantee that we actually will achieve the plans, intentions, or expectations expressed in our forward-looking statements and you should not place undue reliance on these statements. There are a number of important factors that could cause our actual results to differ materially from those indicated or implied by forward-looking statements. These important factors include those discussed under the heading “Risk Factors” contained or incorporated by reference in this prospectus and in the applicable prospectus supplement and any free writing prospectus we may authorize for use in connection with a specific offering. These factors and the other cautionary statements made in this prospectus should be read as being applicable to all related forward-looking statements whenever they appear in this prospectus. Except as required by law, we undertake no obligation to update publicly any forward-looking statements, whether as a result of new information, future events, or otherwise.

Prospectus Summary

Overview

We are a holding company incorporated in the Cayman Islands. As a holding company with no material operations of its own, we conduct our operations through operating direct wholly-owned subsidiaries established in Hong Kong, mainland China, the Netherlands, and Serbia primarily in the sale, design and manufacturing of interconnect products, including connectors, cables and wire harnesses. As of the date of this report, we have a diversified global customer base located in more than 25 countries throughout Asia, Europe, the Americas, and Australia.

Interconnect products are essential components that form physical or logical connections between two electronic devices or networks. We specialize in customized interconnect products, including connectors, cables and harnesses that are used for a range of applications in a diversified set of industries, including industrial, automotive, robotics, medical equipment, computer, network and telecommunication, and consumer products.

We produce both OEM and ODM interconnect products for manufacturing companies that produce end products, as well as electronic manufacturing services (“EMS”) companies, that procure and assemble products on behalf of such companies. OEM products refer to products we manufacture based on design and specifications provided by customers, while ODM products refer to those products that we design, develop and manufacture based on the specifications provided by customers. For the fiscal years ended March 31, 2024, 2023 and 2022 and the six months ended September 30, 2024 and 2023, almost all, or more than 99%, of our sales were attributed to manufacturing companies and EMSs, while the remaining sales were attributed to dealers who resell interconnect products. Many of our customers are global name-brand manufacturers, such as Linak, Danfoss, Bitzer, Maersk, Universal Robots, Philips, Osram, Flextronics, Harman and Vtech, with whom we have established long-term working relationships.

We work closely with our customers in developing products and providing solutions that meet their specific requirements for the end applications, and believe that our focus on customers’ needs has contributed to our steady growth in the last two decades. We strive to achieve high customer satisfaction by (1) providing value-added services such as our “design for manufacturing” (“DFM”) analysis, through which we routinely analyze product design and specifications based on end application requirements to ensure final products achieve optimal results for customers, and (2) providing prompt and effective responses to customer inquiries and requests by utilizing our in-house management information system, which is designed to store, track and analyze data collected from various operational units, including sales, procurement, production, quality control, and engineering. Additionally, in order to better service our growing customer base in Europe, in 2016, we established our Netherlands subsidiary, CCSC Interconnect NL, which has since served as our European logistics and service hub.

We seek to deliver quality products at competitive prices through a vertically integrated production process. CCSC Interconnect DG, our PRC subsidiary, is our manufacturing and product development hub. CCSC Interconnect DG leases a facility in Dongguan, Guangdong Province, where more than 260 employees carry out design and development, engineering, manufacturing and assembly, and quality control of our products. While we strive to achieve efficiency and low costs by standardizing and optimizing certain processes across the production cycle, we understand the importance of maintaining the quality of our products. Our team of more than 25 quality assurance specialists strictly enforce our quality control protocols at every step of the production process.

Our product research and development capabilities have been a cornerstone of our success. Our engineering team that is responsible for product research and development currently has 29 employees, many of whom are experienced mechanical and electrical engineers. We hold the rights to 72 patents registered with the PRC intellectual property agency.

CCSC Interconnect DG has been certified as a HNTE since 2016 and, therefore, enjoys a preferred income tax rate of 15%. The HNTE accreditation may be renewed every three year, and, as of the date of this prospectus, we are in the process of renewing the HNTE accreditation for 2025 to 2027. In July 2023, CCSC Interconnect DG was selected by the Ministry of Industry and Information Technology (MIIT) of China as a “Specialized Refinement Differential Innovation Little Giant Enterprise”, a recognition given to small and medium-sized enterprises that specialize in niche sectors and boast strong innovative capability. We intend to continually invest in our engineering team and further enhance our research and development capabilities.

We are led by a management team with extensive experience in research and development, manufacturing and commercialization of interconnect products. We believe our management team is well positioned to lead us through the development and commercialization of new products, while maintaining and improving the market position of our existing products.

Our revenue was approximately $14.75 million, $24.06 million and $27.17million, for the fiscal years ended March 31, 2024, 2023 and 2022, respectively. Our net loss was approximately $1.30 million, and net income was approximately $2.21 million and $2.29 million, for the fiscal years ended March 31, 2024, 2023 and 2022, respectively. For the six months ended September 30, 2024 and 2023, we had total revenue of approximately US$9.22 million and US$7.50 million, respectively, and net loss of approximately US$0.74 million and net income of approximately US$0.41 million, respectively.

For the fiscal years ended March 31, 2024, 2023 and 2022, approximately 61.6%, 63.3% and 58.8% of our revenue was generated from our top ten customers, respectively. For the six months ended September 30, 2024 and 2023, approximately 61.2% and 61.5% of our revenue was generated from our top ten customers, respectively.

Regulatory Developments on Overseas-listing

Recently, the Chinese government promulgated a series of statements and actions to regulate business operations in China with limited advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas, adopting new measures to extend the scope of cybersecurity reviews, and expanding efforts with respect to anti-monopoly enforcement. For example, the General Office of the Central Committee of the Communist Party of China and the General Office of the State Council jointly issued the “Opinions on Severely Cracking Down on Illegal Securities Activities According to Law,” or the “Opinions”, which were made available to the public on July 6, 2021. The Opinions emphasized the need to strengthen the administration over illegal securities activities, and the need to strengthen the supervision over overseas listings by Chinese companies. Moreover, the CAC promulgated the Cybersecurity Review Measure that became effective on February 15, 2022, which extends the scope of cybersecurity review to online platform operators engaging in data processing activities that affect or may affect national security, including listing in a foreign country, and require a mandatory clearance of cybersecurity review to be completed by online platform operators that possess personal information of more than 1 million users. See “Item 3. Key Information — D. Risk Factors —Risks Relating to Doing Business in China — Recent greater oversight by the CAC over cybersecurity and data security, particularly for companies seeking to list on a foreign exchange, could adversely impact our business and our proposed offering” on page 2 of the 2024 Annual Report.

On August 8, 2006, six PRC governmental and regulatory agencies, including the China Securities Regulatory Commission, or the CSRC, promulgated the Rules on Acquisition of Domestic Enterprises by Foreign Investors, or the M&A Rules, that became effective on September 8, 2006, and was amended on June 22, 2009. The M&A Rules, among other things, require that offshore special purpose vehicles, or “SPVs”, that are controlled by mainland China companies or individuals and that have been formed for overseas listing purposes through acquisitions of mainland China domestic interests held by such companies or individuals, shall obtain the approval of the CSRC prior to publicly listing their securities on an overseas stock exchange. See “Item 3. Key Information — D. Risk Factors — Risks Relating to Doing Business in China — The approval of the China Securities Regulatory Commission and other compliance procedures may be required in connection with this offering, and, if required, we cannot predict whether we will be able to obtain such approval” on page 2 of the 2024 Annual Report.

In addition, on February 17, 2023, the CSRC promulgated the “Trial Measures” and five (5) supporting guidelines, which became effective on March 31, 2023. Pursuant to the Trial Measures, a PRC domestic company that seeks to offer or list securities overseas, by both direct and indirect means, shall submit the filing materials with the CSRC as required by the Trial Measures within three (3) business days following its submission of an application for its initial public offering or listing to overseas securities authorities. If the PRC domestic company fails to complete the required filing procedures, conceals any material fact, or falsifies any major content in its filing documents, such PRC domestic company may be subject to administrative penalties, such as an order to rectify, warnings, fines, and its controlling shareholders, actual controllers, the person directly in charge and other directly liable persons may also be subject to administrative penalties, such as warnings and fines. In compliance with the Trial Measures, we submitted our filing materials to the CSRC on August 31, 2023. Upon examination of our filing materials, the CSRC informed us in writing on November 6, 2023 that we do not fall within the scope of the filing requirements and are thus not required to complete the filing procedures under the Trial Measures at this time. However, we cannot assure you that we will not become subject to the filing requirements in the future, if the CSRC issues any further guidelines that otherwise subjects us to them. See “Item 3. Key Information — D. Risk Factors — Risks Relating to Doing Business in China — The New Overseas Listing Rules and other relevant rules promulgated by the CSRC may subject us to additional compliance requirements in the future” on page 4 of the 2024 Annual Report.

Based on the opinion of our PRC counsel, JT&N, we are not required by any currently effective PRC laws or regulations to obtain approval, permission, or clearance from any other PRC authorities to issue our securities to foreign investors, and we have not received any inquiry, notice, warning, sanction, or any regulatory objection to this offering from the CSRC, the CAC, or any other PRC authorities that have jurisdiction over our operations. Further, JT&N has advised us that, based on their understanding of the current PRC laws and regulations, as of the date of this prospectus, we and/or our PRC subsidiary (i) are not subject to the cybersecurity review by the CAC, as stipulated in the Cybersecurity Review Measure, since we are not deemed to be a critical information infrastructure operator or online platform operator possessing personal information of more than 1 million users; (ii) are not subject to the CSRC approval in the context of this offering as required under M&A Rules, as we formed our PRC subsidiary, CCSC Interconnect DG, by way of equity investment rather than by a merger with or acquisition of a PRC company.

Since these statements and regulatory actions are new, it is highly uncertain how soon legislative or administrative regulation making bodies will respond and what existing or new laws or regulations or implementations and interpretations will be modified or promulgated, if any, and the potential impact such modified or new laws and regulations will have on our business operation, our ability to accept foreign investments or list on a U.S. exchange. There is a possibility that we could have inadvertently concluded that we are not subject to such review or approval. Given the current PRC regulatory environment, we cannot assure you that we or our PRC subsidiary would be able to obtain clearance from the CAC if we are deemed to be subject to cybersecurity review in the future. Further, while the CSRC has determined that we do not fall within the scope of the filing requirements under the Trial Measures at this time, we cannot assure you that we will not become subject to the filing requirements in the future, if the CSRC issues any further guidelines that otherwise subjects us to them. If we are unable to complete the filings with the CSRC or obtain its approval in the future, should it be required at a later date, or if we inadvertently conclude that such approval or clearance is not required, our ability to offer or continue to offer our Ordinary Shares to investors could be significantly limited or completely hindered, and the value of our Ordinary Shares may depreciate significantly or become worthless. See “Item 3. Key Information — D. Risk Factors —Risks Relating to Doing Business in China” of the 2024 Annual Report.

Permissions from the PRC Authorities

As of the date of this prospectus, we and our PRC subsidiary have received from the PRC authorities all requisite licenses, permissions, or approvals that are required for conducting our operations in China, such as business licenses, and import and export filings. However, it is uncertain whether we or our PRC subsidiary will be required to obtain additional approvals, licenses, or permits in connection with our business operations pursuant to evolving PRC laws and regulations, and whether we would be able to obtain and renew such approvals on a timely basis or at all. If (i) we do not receive or maintain such permissions or approvals, (ii) we inadvertently conclude that such permissions or approvals are not required, or (iii) applicable PRC laws, regulations, or interpretations change and we are required to obtain such permissions or approvals in the future, we may be subject to fines or other penalties, including suspension of business and revocation of prerequisite licenses, which could result in a material change in our operations, and may have a material adverse effect on our business, financial condition or results of operations, and the value of our Ordinary Shares could depreciate significantly or become worthless. For more details, see “Item 3. Key Information — D. Risk Factors —Risks Relating to Doing Business in China — The Chinese government exerts substantial influence over the manner in which we must conduct our business and may intervene or influence our operations at any time, which actions may result in a material change in our operations and impact our operations materially and adversely, and significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of our Ordinary Shares to significantly decline or be worthless” on page 4 of the 2024 Annual Report.

Dividends and Distributions

Under the Cayman Islands law, a Cayman Islands company may pay a dividend on its shares out of either profits, if any, or share premium amounts, provided that under no circumstances may a dividend be paid if this would result in the company being unable to pay its debts due in the ordinary course of business. As of the date of this prospectus, (1) no cash transfer or transfer of other assets have occurred among the Company and its subsidiaries, (2) no dividends or distributions have been made by a subsidiary to the Company, and (3) the Company has not made any dividends or distributions to U.S. investors. We intend to keep any future earnings to finance the expansion of our business, and we do not anticipate that any cash dividends will be paid in the foreseeable future, or any funds will be transferred from one entity to another. As such, we have not installed any cash management policies that dictate how funds are transferred among the Company, its subsidiaries, or investors. Under our current corporate structure, we rely on dividend payments from our operating subsidiaries to fund any cash and financing requirements we may have, including providing the funds necessary to pay dividends and other cash distributions to our shareholders or to service any debt we may incur. There are no laws or regulations that restrict us from providing funding to or receiving dividends from our Hong Kong or Netherlands subsidiaries; however, the transfer of funds to or from our PRC subsidiary is subject to PRC laws and regulations.

We are permitted under PRC laws and regulations to provide funding to our PRC subsidiary only through loans or capital contributions, and only if we satisfy the applicable government registration and approval requirements. For more details, see “Item 3. Key Information — D. Risk Factors —Risks Relating to Doing Business in China — PRC laws and regulations of parent/subsidiary loans and direct investment by offshore holding companies to PRC entities may delay or prevent us from using the proceeds of this offering to make loans or additional capital contributions to our PRC subsidiary, which could materially and adversely affect our liquidity and our ability to fund and expand our business” on page 10 of the 2024 annual report. Our PRC subsidiary is permitted to pay dividends only out of its retained earnings and is required to set aside at least 10% of its after-tax profits each year, after making up for previous year’s accumulated losses, if any, to fund certain statutory reserves, until the aggregate amount of such funds reaches 50% of its registered capital. Our PRC subsidiary is also required to further set aside a portion of its after-tax profits to fund an employee welfare fund, although the amount to be set aside, if any, is determined at its discretion. These reserves are not distributable as cash dividends. If our PRC subsidiary incurs debt on its own behalf in the future, the instruments governing the debt may restrict its ability to pay dividends or make other payments to us. Furthermore, dividends paid by our PRC subsidiary to its parent company will be subject to a 10% withholding tax, which can be reduced to 5% if certain requirements are met. For more details, see “Item 3. Key Information — D. Risk Factors —Risks Relating to Doing Business in China — We may rely on dividends and other distributions on equity paid by our PRC subsidiary to fund any cash and financing requirements we may have, and any limitation on the ability of our PRC subsidiary to make payments to us could have a material and adverse effect on our ability to conduct our business” on page 9 of the 2024 Annual Report.

In addition, the PRC government imposes regulations on the convertibility of Renminbi into foreign currencies and, in certain cases, the remittance of currency out of mainland China. If the foreign exchange system of mainland China prevents us from obtaining sufficient foreign currencies to satisfy our foreign currency demands, we may not be able to transfer cash out of mainland China and pay dividends in foreign currencies to our shareholders. There can be no assurance that the PRC government will not intervene or impose restrictions on our ability to transfer or distribute cash within our organization or to foreign investors, which could result in an inability or prohibition on making transfers or distributions outside of mainland China and may adversely affect our business, financial condition and results of operations. For more details, see “Item 3. Key Information — D. Risk Factors —Risks Relating to Doing Business in China — Governmental Controls and Restrictions on currency exchange may limit our ability to utilize our revenues effectively” on page 11 of the 2024 Annual Report, and “Item 3. Key Information — D. Risk Factors —Risks Relating to Doing Business in China — To the extent cash or assets of our business, or of our PRC or Hong Kong subsidiaries, is in mainland China or Hong Kong, such cash or assets may not be available to fund operations or for other use outside of mainland China or Hong Kong, due to interventions in or the imposition of restrictions and limitations by the PRC government to the transfer of cash or assets” on page 11 of the 2024 Annual Report.

PCAOB’s Determinations on Public Accounting Firms Headquartered in Mainland China and in Hong Kong

Our Ordinary Shares may be delisted under the HFCAA and related regulations, if the PCAOB is unable to inspect our auditors for two consecutive years. On December 16, 2021, the PCAOB issued a report on its determinations that it was unable to inspect or investigate completely PCAOB-registered public accounting firms headquartered in mainland China and in Hong Kong, a Special Administrative Region of the PRC, because of positions taken by PRC authorities in those jurisdictions (the “Determinations”). On August 26, 2022, the PCAOB signed a Statement of Protocol Agreement (the “SOP”) with the CSRC and the MOF, together with two protocol governing inspections and investigations (together, the “SOP Agreements”), to establish a specific, accountable framework to make possible complete inspections and investigations by the PCAOB of audit firms based in mainland China and Hong Kong, as required under U.S. law. On December 15, 2022, the PCAOB determined that it was able to secure complete access to inspect and investigate registered public accounting firms headquartered in mainland China and Hong Kong and vacated its previous determinations to the contrary. Our former auditor, Friedman LLP, the independent registered public accounting firm that issued the audit report included elsewhere in this prospectus, was a PCAOB-registered public accounting firm headquartered in New York during the time it served as our independent auditor. Effective on September 1, 2022, Friedman LLP combined with Marcum LLP. The services previously provided by Friedman LLP were then provided by MarcumAsia, which is a PCAOB registered public accounting firm headquartered in New York. On November 1, 2024, we appointed Enrome as our independent registered public accounting firm. Enrome replaced MarcumAsia, which we dismissed on the same day. Our current and former auditors are all subject to laws in the United States pursuant to which the PCAOB conducts regular inspections to assess an auditor’s compliance with the applicable professional standards, and have been inspected by the PCAOB on a regular basis. As such, as of the date of this prospectus, our offering is not affected by the HFCAA and related regulations. However, should PRC authorities obstruct or otherwise fail to facilitate the PCAOB’s access in the future, the PCAOB may consider the need to issue a new determination. However, there is a risk that our auditor cannot be inspected by the PCAOB in the future, and if the PCAOB determines that it cannot inspect or fully investigate our auditors for two consecutive years, our securities will be prohibited from trading on a national exchange or over-the-counter trading market, and, as a result, Nasdaq may determine to delist our securities, which may cause the value of our securities to decline or become worthless. See “Item 3. Key Information — D. Risk Factors —Risks Relating to Doing Business in China — The HFCAA and the Accelerating Holding Foreign Companies Accountable Act call for additional and more stringent criteria to be applied to emerging market companies upon assessing the qualification of their auditors, especially the non-U.S. auditors who are not inspected by the PCAOB. These developments could add uncertainties to our offering and listing on the Nasdaq Capital Market, and Nasdaq may determine to delist our securities if the PCAOB determines that it cannot inspect or fully investigate our auditor” on page 6 of the 2024 Annual Report.

Summary of Risk Factors

An investment in our Class A Ordinary Shares is subject to a number of risks, including risks relating to our business and industry, risks relating to doing business in China, and risk relating to our Ordinary Shares in this offering. You should carefully consider all the information in this prospectus before making an investment in the Class A Ordinary Shares. The following list summarizes some, but not all, of these risks. These risks are discussed more fully under “Item 3. Key Information—D. Risk Factors” beginning on page 1 of the 2024 Annual Report and in the section titled “Risk Factors” beginning on page 10 of this prospectus.

Risks Relating to Doing Business in China

| ● | Changes in China’s economic, political, or social conditions or government policies could have a material adverse effect on our business and operations. For details, see the risk factor on page 1 of the 2024 Annual Report; |

| ● | There are uncertainties regarding the enforcement of laws and rules and regulations in China, which can change quickly with little advance notice, and there is a risk that the Chinese government may exert more oversight and control over offerings that are conducted overseas, which could materially and adversely affect our business and hinder our ability to offer our securities or continue our operations, and cause the value of our securities to significantly decline or become worthless. For details, see the risk factor on page 2 of the 2024 Annual Report; |

| ● | Recent greater oversight by the CAC over cybersecurity and data security, particularly for companies seeking to list on a foreign exchange, could adversely impact our business and our proposed offering. For details, see the risk factor on page 2 of the 2024 Annual Report; |

| ● | The approval of the CSRC and other compliance procedures may be required in connection with this offering, and, if required, we cannot predict whether we will be able to obtain such approval. For details, see the risk factor on page 3 of the 2024 Annual Report; |

| ● | The New Overseas Listing Rules and other relevant rules promulgated by the CSRC may subject us to additional compliance requirements in the future. For details, see the risk factor on page 4 of the 2024 Annual Report; |

| ● | The Chinese government exerts substantial influence over the manner in which we must conduct our business and may intervene or influence our operations at any time, which actions may result in a material change in our operations and impact our operations materially and adversely, and significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of our Ordinary Shares to significantly decline or be worthless. For details, see the risk factor on page 4 of the 2024 Annual Report; |

| ● | You may experience difficulties in effecting service of legal process, enforcing foreign judgments, or bringing actions in mainland China against us or our management named in the prospectus based on foreign laws. It may also be difficult for you or overseas regulators to conduct investigations or collect evidence within mainland China. For details, see the risk factor on page 5 of the 2024 Annual Report; |

| ● | The HFCAA and the Accelerating Holding Foreign Companies Accountable Act call for additional and more stringent criteria to be applied to emerging market companies upon assessing the qualification of their auditors, especially the non-U.S. auditors who are not inspected by the PCAOB. These developments could add uncertainties to our offering and listing on the Nasdaq Capital Market, and Nasdaq may determine to delist our securities if the PCAOB determines that it cannot inspect or fully investigate our auditor. For details, see the risk factor on page 6 of the 2024 Annual Report; |

| ● | We may face disruption to our technology systems, if our technology systems or the proprietary information and/or data collected and stored by our PRC subsidiary via such systems, particularly billing and client information, were to be accessed or tampered with by unauthorized persons, and, in any such case, our reputation and relationships with our customers could be harmed and our business could be materially and adversely affected. For details, see the risk factor on page 7 of the 2024 Annual Report; |

| ● | Increases in labor costs in the PRC may adversely affect our business and our profitability. For details, see the risk factor on page 8 of the 2024 Annual Report; |

| ● | Our PRC subsidiary has not made adequate social insurance and housing fund contributions for all employees as required by PRC regulations, which may subject us to penalties in the PRC. For details, see the risk factor on page 8 of the 2024 Annual Report; |

| ● | PRC laws and regulations relating to offshore investment activities by mainland China residents may subject our mainland China resident beneficial owners or our PRC subsidiary to liability or penalties, limit our ability to inject capital into our PRC subsidiary, limit our PRC subsidiary’s ability to increase its registered capital or distribute profits to us. For details, see the risk factor on page 9 of the 2024 Annual Report; |

| ● | We may rely on dividends and other distributions on equity paid by our PRC subsidiary to fund any cash and financing requirements we may have, and any limitation on the ability of our PRC subsidiary to make payments to us could have a material and adverse effect on our ability to conduct our business. For details, see the risk factor on page 9 of the 2024 Annual Report; |

| ● | PRC laws and regulations of parent/subsidiary loans and direct investment by offshore holding companies to PRC entities may delay or prevent us from using the proceeds of this offering to make loans or additional capital contributions to our PRC subsidiary, which could materially and adversely affect our liquidity and our ability to fund and expand our business. For details, see the risk factor on page 10 of the 2024 Annual Report; |

| ● | Fluctuations in exchange rates between the RMB and other currencies could have a material and adverse effect on our results of operations and the value of your investment. For details, see the risk factor on page 11 of the 2024 Annual Report; |

| ● | Governmental control and restriction on currency exchange may limit our ability to utilize our revenues effectively. For details, see the risk factor on page 11 of the 2024 Annual Report; |

| ● | To the extent cash or assets of our business, or of our PRC or Hong Kong subsidiaries, is in mainland China or Hong Kong, such cash or assets may not be available to fund operations or for other use outside of mainland China or Hong Kong, due to interventions in or the imposition of restrictions and limitations by the PRC government to the transfer of cash or assets. For details, see the risk factor on page 12 of the 2024 Annual Report; |

| ● | There are uncertainties under the PRC Securities Law relating to the procedures and requisite timing for the U.S. securities regulatory agencies to conduct investigations and collect evidence within the territory of mainland China. For details, see the risk factor on page 12 of the 2024 Annual Report; |

| ● | Under the PRC Enterprise Income Tax Law (“EIT Law”), we may be classified as a mainland China “resident enterprise” for PRC enterprise income tax purposes. Such classification would likely result in unfavorable tax consequences to us and our shareholders who are not mainland China residents and have a material adverse effect on our results of operations and the value of your investment. For details, see the risk factor on page 13 of the 2024 Annual Report; |

| ● | We face uncertainty with respect to indirect transfers of equity interests in mainland China resident enterprises by their holding companies that are not mainland China resident companies. For details, see the risk factor on page 13 of the 2024 Annual Report; |

| ● | There are significant uncertainties under the EIT Law relating to the withholding tax liabilities of CCSC Interconnect DG, and dividends payable by CCSC Interconnect DG to our offshore subsidiaries may not qualify to enjoy certain treaty benefits. For details, see the risk factor on page 14 of the 2024 Annual Report; |

| ● | The M&A Rules and certain other PRC laws and regulations establish complex procedures for some acquisitions of Chinese companies by foreign investors, which could make it more difficult for us to pursue growth through acquisitions in mainland China. For details, see the risk factor on page 14 of the 2024 Annual Report; |

| ● | If we become directly subject to the scrutiny, criticism, and negative publicity involving U.S.-listed Chinese companies, we may have to expend significant resources to investigate and resolve the matter which could harm our business operations, stock price, and reputation. For details, see the risk factor on page 15 of the 2024 Annual Report; and |

| ● | The disclosures in our reports and other filings with the SEC and our other public pronouncements may be subject to the scrutiny of any regulatory bodies in the PRC. For details, see the risk factor on page 15 of the 2024 Annual Report; |

Risks Relating to Our Business

| ● | We operate in a highly competitive industry, and the scale and resources of some of our competitors may allow them to compete more effectively than we can, which could result in a loss of our market share and a decrease in our net revenues and profitability. For details, see the risk factor on page 15 of the 2024 Annual Report; |

| ● | A disruption, termination or alteration of the supply of materials or components due to natural disasters, political and economic turmoil, or widespread disease or pandemics (such as the COVID-19 pandemic) could materially and adversely affect the sales of our products. For details, see the risk factor on page 16 of the 2024 Annual Report; |

| ● | If we fail to acquire new customers or retain existing customers, especially our large customers, our business, financial condition and results of operations could be materially and adversely affected. For details, see the risk factor on page 16 of the 2024 Annual Report; |

| ● | Increases in the price of raw materials could impact our ability to sustain and grow earnings. For details, see the risk factor on page 16 of the 2024 Annual Report; |

| ● | We have limited sources of working capital and may need substantial additional financing. For details, see the risk factor on page 18 of the 2024 Annual Report; |

| ● | The Company is dependent on the end markets, including industrial, automotive, robotics, medical equipment, computer, network and telecommunication, and consumer products, for the demand of its interconnect products, and is susceptible to negative trends relating to those industries that could adversely affect the Company’s operating results. For details, see the risk factor on page 18 of the 2024 Annual Report; |

| ● | The Company’s international operations subject the Company to additional business risks that may have a material adverse effect on the Company’s business, operating results and financial condition. For details, see the risk factor on page 19 of the 2024 Annual Report; and |

| ● | The Company’s business will suffer if the Company fails to develop and successfully introduce new and enhanced products that meet the changing needs of the Company’s customers. For details, see the risk factor on page 20 of the 2024 Annual Report; |

Risks Relating to Our Ordinary Shares and This Offering

| ● | If we fail to implement and maintain an effective system of internal controls or fail to remediate the material weaknesses in our internal control over financial reporting that have been identified, we may fail to meet our reporting obligations or be unable to accurately report our results of operations or prevent fraud, and investor confidence and the market price of our Ordinary Shares may be materially and adversely affected. For details, see the risk factor on page 24 of the 2024 Annual Report; |

| ● | As a foreign private issuer, we are not subject to certain U.S. securities law disclosure requirements that apply to a domestic U.S. issuer, which may limit the information publicly available to our shareholders. For details, see the risk factor on page 25 of the 2024 Annual Report; |

| ● | As a foreign private issuer, we are not subject to certain U.S. securities law disclosure requirements that apply to a domestic U.S. issuer and are exempt from certain Nasdaq corporate governance standards applicable to U.S. issuers, which may limit the information publicly available to our investors and afford them less protection than if we were an U.S. issuer. For details, see the risk factor on page 25 of the 2024 Annual Report; and |

| ● | We do not intend to pay dividends for the foreseeable future. For details, see the risk factor on page 26 of the 2024 Annual Report; |

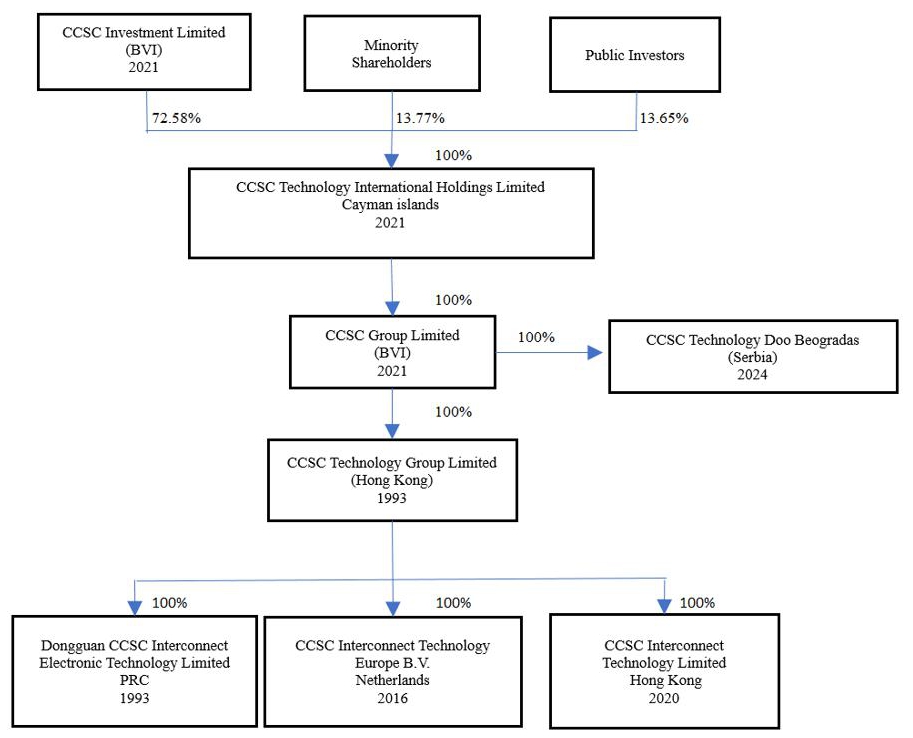

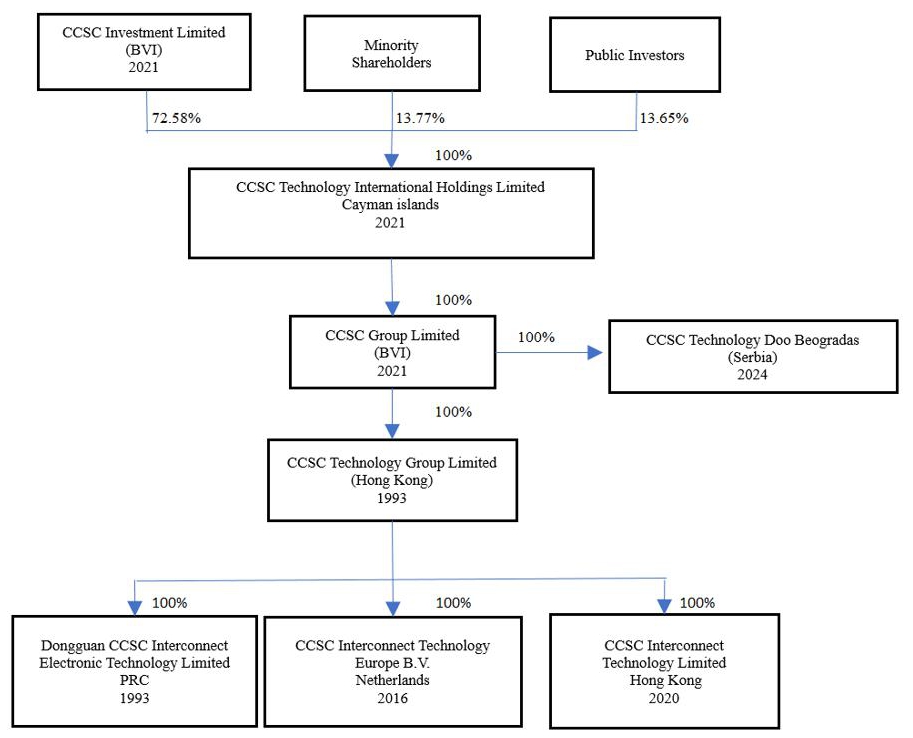

Corporate Structure

We are a Cayman Islands exempted company incorporated on October 19, 2021. Exempted companies are Cayman Island companies conducting business mainly outside the Cayman Islands and, as such, are exempted from complying with certain provisions of the Companies Act (As Revised).

The following diagram illustrates our corporate structure as of the date of this prospectus.

Corporate Information

Our principal executive offices are located at 1301-03, 13/f Shatin Galleria, 18-24 Shan Mei St, Fotan, Shatin, Hong Kong, and our phone number is 00852-26870272. Our registered office in the Cayman Islands is located at PO Box 309, Ugland House, Grand Cayman, KY1-1104, Cayman Islands, and the phone number of our registered office is +1 345 949 8066. Investors should submit any inquiries to the address and telephone number of our principal executive offices. We maintain a corporate website at http://www.ccsc-interconnect.com. The information contained in, or accessible from, our website or any other website does not constitute a part of this prospectus. Our agent for service of process in the United States is Cogency Global Inc., 122 East 42nd Street, 18th Floor, New York, NY 10168.

Implications of Being an Emerging Growth Company

As a company with less than US$1.235 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, as amended, or the “JOBS Act”. As long as we remain an emerging growth company, we may rely on exemptions from some of the reporting requirements applicable to public companies that are not emerging growth companies. In particular, as an emerging growth company, we:

| ● | may present only two (2) years of audited financial statements and only two (2) years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations, or “MD&A;” |

| ● | are not required to provide a detailed narrative disclosure discussing our compensation principles, objectives and elements and analyzing how those elements fit with our principles and objectives, which is commonly referred to as “compensation discussion and analysis”; |

| ● | are not required to obtain an attestation and report from our auditors on our management’s assessment of our internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002; |

| ● | are not required to obtain a non-binding advisory vote from our shareholders on executive compensation or golden parachute arrangements (commonly referred to as the “say-on-pay,” “say-on frequency” and “say-on-golden-parachute” votes); |

| ● | are exempt from certain executive compensation disclosure provisions requiring a pay-for-performance graph and chief executive officer pay ratio disclosure; |

| ● | are eligible to claim longer phase-in periods for the adoption of new or revised financial accounting standards under §107 of the JOBS Act; and |

| ● | will not be required to conduct an evaluation of our internal control over financial reporting until our second annual report on Form 20-F following the effectiveness of our initial public offering. |

We intend to take advantage of all of these reduced reporting requirements and exemptions, including the longer phase-in periods for the adoption of new or revised financial accounting standards under §107 of the JOBS Act. Our election to use the phase-in periods may make it difficult to compare our financial statements to those of non-emerging growth companies and other emerging growth companies that have opted out of the phase-in periods under §107 of the JOBS Act.