The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS

Subject to Completion, dated

American Depositary Shares

QuantaSing Group Limited

Representing Class A Ordinary Shares

This is an initial public offering of American Depositary Shares (“ADSs”) by QuantaSing Group Limited. Each ADS represents of our Class A ordinary shares, par value US$0.0001 per share. We anticipate that the initial public offering price per ADS will be between US$ and US$ .

Prior to this offering, there has been no public market for the ADSs. We have applied to list the ADSs on the Nasdaq Stock Market, under the symbol “QSG.”

Immediately prior to the completion of this offering, our issued and outstanding share capital will consist of Class A ordinary shares and Class B ordinary shares. Mr. Peng Li, our founder, chairman and chief executive officer, will beneficially own all of such issued Class B ordinary shares and will be able to exercise % of the total voting power of such issued and outstanding share capital immediately following the completion of this offering, assuming that the underwriters do not exercise their option to purchase additional ADSs. Holders of Class A ordinary shares and Class B ordinary shares have the same rights except for voting and conversion rights. Holder of each Class A ordinary share is entitled to one vote, and holder of each Class B ordinary share is entitled to ten votes. At the option of the holder of Class B ordinary shares, each Class B ordinary share is convertible into one Class A ordinary share at any time. Class A ordinary shares are not convertible into Class B ordinary shares under any circumstances. For further information, see “Description of Share Capital.”

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012, as amended, and, as such, may elect to comply with certain reduced public company reporting requirements in future reports after the completion of this offering.

Upon the completion of this offering, we will be a “controlled company” as defined under corporate governance rules of the Nasdaq Stock Market, because Mr. Peng Li, our founder, chairman and chief executive officer, will beneficially own % of our then issued and outstanding ordinary shares and will be able to exercise % of the total voting power of our issued and outstanding ordinary shares immediately after the consummation of this offering, assuming the underwriters do not exercise their option to purchase additional ADSs. As a result, Mr. Peng Li will have the ability to control or significantly influence the outcome of matters requiring approval by shareholders. For further information, see “Principal Shareholders” and “Risk Factor — Risks Related to the ADSs and this Offering — We will be a “controlled company” within the meaning of the Nasdaq Stock Market listing rules and, as a result, may rely on exemptions from certain corporate governance requirements that provide protection to shareholders of other companies.”

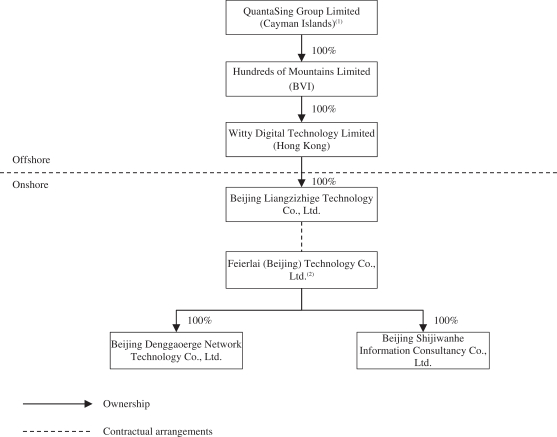

QuantaSing Group Limited is a Cayman Islands holding company and not a Chinese operating company. We carry out our business in China through our wholly-owned PRC subsidiary (“WFOE”) and its contractual arrangements, commonly known as the VIE structure, with a variable interest entity (the “VIE”) and its subsidiaries (collectively, the “affiliated entities”) based in China. The VIE structure is used to provide investors with exposure to foreign investment in China-based companies where the PRC law restricts direct foreign investment in certain operating companies, such as certain value-added telecommunication services and other internet related business. Neither QuantaSing Group Limited nor our WFOE owns any equity interests in the affiliated entities. Our contractual arrangements with the VIE and its nominee shareholder are not equivalent of an investment in the equity interest of the VIE, and investors may never hold equity interests in the Chinese operating companies, including the affiliated entities. Instead, we are regarded as the primary beneficiary of the VIE and consolidate the financial results of the affiliated entities under U.S. GAAP in light of the VIE structure. Investors in the ADSs are purchasing the equity securities of QuantaSing Group Limited, the Cayman Islands holding company, rather than the equity securities of the affiliated entities. As used in this prospectus, “we,” “us,” “our company,” “our,” “QuantaSing,” or “QuantaSing Group” refers to QuantaSing Group Limited, together as a group with its subsidiaries, and, in the context of describing the substantive operations and financial information relating to such operations of QuantaSing Group Limited and its subsidiaries and the affiliated entities as a whole, refers to QuantaSing Group Limited and its subsidiaries and the affiliated entities. The VIE structure involves unique risks to investors in the ADSs. It may not provide effective operational control over the affiliated entities and also faces risks and uncertainties associated with, among others, the interpretation and the application of the current and future PRC laws, regulations and rules to such contractual arrangements. As of the date of this prospectus, the agreements under the contractual arrangements among our WFOE, the VIE and its nominee shareholder have not been tested in a court of law. If the PRC regulatory authorities find these contractual arrangements non-compliant with the restrictions on direct foreign investment in the relevant industries, or if the relevant PRC laws, regulations and rules or their interpretation change in the future, we could be subject to severe penalties or be forced to relinquish our interests in the VIE or forfeit our rights under the contractual arrangements. The PRC regulatory authorities could disallow the VIE structure at any time in the future, which would cause a material adverse change in our operations and cause the value of our securities you invested in this offering to significantly decline or become worthless. For further information, see “Risk Factors — Risks Related to Our Corporate Structure.”

We face various legal and operational risks and uncertainties related to doing business in China as we, through our WFOE and the affiliated entities, conduct our operations in China. We are subject to complex and evolving laws and regulations in China. The PRC government has indicated an intent to exert more oversight and control over offerings that are conducted overseas and/or foreign investment in China-based issuers, and initiated various regulatory actions and made various public statements, some of which are published with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas, adopting new measures to extend the scope of cybersecurity reviews, and expanding efforts in anti-monopoly enforcement. For instance, we face risks associated with regulatory approvals on overseas offerings and oversight on cybersecurity and data privacy, which may impact our ability to conduct certain business, accept foreign investments, or list and conduct offerings on a U.S. or other foreign stock exchange. These risks could result in a material adverse change in our operations and the value of the ADSs, significantly limit or completely hinder our ability to offer or continue to offer securities to investors, or cause the value of such securities to significantly decline or become worthless. For details, see “Risk Factors — Risks Related to Doing Business in China.”

We are subject to a number of prohibitions, restrictions and potential delisting risk under the Holding Foreign Companies Accountable Act (the “HFCAA”). Pursuant to the HFCAA and related regulations, if we have filed an audit report issued by a registered public accounting firm that the Public Company Accounting Oversight Board (the “PCAOB”) has determined that it is unable to inspect and investigate completely, the Securities and Exchange Commission (the “SEC”) will identify us as a “Commission-identified Issuer,” and the trading of our securities on any U.S. national securities exchange, as well as any over-the-counter trading in the United States, will be prohibited if we are identified as a Commission-identified Issuer for three consecutive years. There have been various initiatives to reduce the number of consecutive non-inspection years required for triggering the prohibitions under the HFCAA from three to two years. On June 22, 2021, the U.S. Senate passed a bill known as the Accelerating Holding Foreign Companies Accountable Act to that effect, and on February 4, 2022, the United States House of Representatives passed a bill which contained, among others, an identical provision. If this provision is enacted into law, our shares and ADSs could be prohibited from trading in the United States if we are identified as a Commission-identified Issuer for two consecutive years. In August 2022, the PCAOB, the China Securities Regulatory Commission (the “CSRC”) and the Ministry of Finance of the PRC signed a Statement of Protocol (the “Statement of Protocol”), which establishes a specific and accountable framework for the PCAOB to conduct inspections and investigations of PCAOB-governed accounting firms in mainland China and Hong Kong. On December 15, 2022, the PCAOB announced that it was able to secure complete access to inspect and investigate PCAOB-registered public accounting firms headquartered in mainland China and Hong Kong completely in 2022. The PCAOB Board vacated its previous 2021