Dated January 25, 2024

Filed Pursuant to Rule 433 of the Securities Act of 1933, as amended

Relating to Preliminary Prospectus as Amended Dated November 7, 2023

Registration Statement No. 333-275379

North America’s Maritime Tour Activity and Attraction Operator

Disclaimer and Other Important Information This presentation relates to the proposed initial public offering ("the offering”) of Amphitrite Digital Incorporated (collectively with its consolidated subsidiaries, the “company”, “we”, “us", or “our"), which highlights the basic information about the offering and the Company, and therefore should be read together with the Registration Statement on Form S - 1, as amended (the "Registration Statement"), we filed with the Securities and Exchange Commission (the "SEC”) for the offering to which this presentation relates and may be accessed through the following web link: https:// www.sec.gov/edgar/browse/?CIK=1933762. The Registration Statement has not yet become effective. Before you invest, you should read the prospectus in the Registration Statement (including the risk factors described therein) and other documents we have with the SEC in their entirety for more complete information about us and the offering. You may get these documents for free by visiting EDGAR on the SEC website at https:// www.sec.gov. Alternatively, copies of the preliminary prospectus related to the offering can be obtained from: Kingswood Investments, a division of Kingswood Capital Partners, LLC, by email at syndicate@kingswoodus.com, or by telephone at 212 - 487 - 1080. This presentation includes statistical and other industry and market data that we obtained from industry publications and research, surveys and studies conducted by third parties, industry publications and third - party research, surveys and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. Statistical data in these publications also include projections based on a number of assumptions. While we believe these industry publications and third - party research, surveys arid studies are reliable, you are cautioned not to give undue weight to this information. In addition, the new and rapidly changing nature of the healthy food industry results in significant uncertainties for any projections or estimates relating to the growth prospects or future condition of our industry. Furthermore, if any one or more of the assumptions underlying the market data are later found to be incorrect, actual results may differ from the projections based on these assumptions. You should not place undue reliance on these forward - looking statements. This presentation shall not constitute an offer to sell, or the solicitation of an offer to buy, or will there be any sale of the Company's securities in any state or other jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of such state or jurisdiction. The offering may only be made by means of a prospectus pursuant to a registration statement that is filed with the SEC after such registration becomes effective. Neither the SEC nor any other regulatory body has passed upon the adequacy or accuracy of this free writing prospectus. Any representation to the contrary is a criminal offense.

Forward - Looking Statements Certain statements in this Presentation, including but not limited to those regarding the possible or assumed future or performance of AMDI or its industry or other trend projections, are not historical facts but are forward - looking statements for purposes of the safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995. Forward - looking statements generally are accompanied by words such as “believe,” “may,” “will,” estimate,” “anticipate,” “intend,” “expect,” “predict,” “potential,” “growth,” “seek,” “future,” ” and similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward - looking statements include, but are not limited to, statements regarding the timing; anticipated size and terms of the proposed offering; liquidity and capital resources; statements regarding estimates and forecasts of financial and performance metrics; expected results; the anticipated growth and expansion of AMDI's business and the viability of AMDI's growth strategy; trends and developments in AMDI's industry; AMDI's addressable market; competitive position; potential market opportunities; expected synergies; the Company's long - term model; other non - historical statements; the expected management and governance of AMDI and other matters. These statements are based on various assumptions, whether or not identified in this Presentation, and on the current expectations of AMDI’s management and are not predictions of actual performance. These forward - looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by, any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of AMDI. By their nature, forward - looking statements involve known and unknown risks, uncertainties, assumptions, and other factors because they relate to events and depend on circumstances that will occur in the future whether or not outside the control of the Company, including those described in "Risk Factors," "Cautionary Note Regarding Forward - Looking Statements" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" in our Registration Statement on Form S - 1, as amended, filed with the SEC, as well as those contained in the Risk Factors provided at the end of this Presentation. If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward - looking statements. There may be additional risks that AMDI presently does not know or that AMDI currently believes are immaterial that could also cause actual results to differ from those contained in the forward - looking statements. In addition, forward - looking statements reflect AMDI’s expectations, plans or forecasts of future events as of the date of this Presentation. AMDI anticipates that subsequent events and developments will cause AMDI’s assessments to change. However, while AMDI may elect to update these forward - looking statements at some point in the future, AMDI specifically disclaims any obligation to do so. These forward - looking statements should not be relied upon as representing AMDI's assessments as of any date subsequent to the date of this Presentation. Accordingly, undue reliance should not be placed upon the forward - looking statements. Financial Information ; Non - GAAP Financial Terms This Presentation includes certain financial measures not presented in accordance with generally accepted accounting principles (“GAAP”), also known as ''non - GAAP financial measures” . These non - GAAP financial measures may not be comparable to similarly - titled measures presented by other companies or to third - party expectations, nor should they be construed as an alternative to other financial measures determined in accordance with GAAP . Refer to the Appendix for a reconciliation of those non - GAAP financial measures to the most directly comparable GAAP measures . Trademarks This Presentation contains trademarks, service marks, trade names, and copyrights of AMDI and third parties, which are the property of their respective owners. The use or display of third parties' trademarks, service marks, trade names or copyrights in this Presentation is not intended to, and does not imply, a relationship with AMDI, or an endorsement or sponsorship by or of AMDI. Solely for convenience, the trademarks, service marks, trade names and copyrights referred to in this Presentation may appear without the TM, SM, or O symbols, but such references are not intended to indicate, in any way, that AMDI will not assert, to the fullest extent under applicable law, their rights or the rights of the applicable licensor to these trademarks, service marks, trade names and copyrights.

TERMS OF THE OFFERING Amphitrite Digital Inc. Issuer Initial Public Offering Offering Type NYSE American / AMDI Exchange / Symbol Common Stock 1,750,000 shares offered 11,685,279 share pre - offer outstanding Securities Offered $3.50 - $4.50 per share Expected Price Range $7.0 million at midpoint Expected Gross Offering Size (i) Payoff acquisition debt for of $1,576,000 of Paradise Adventures LLC¹ (ii) Acquire Paradise Group of Companies with $3,078,000 2 (iii) Technology development of “The Helm” integrated digital operating platform (iv) Reserves for future acquisitions³ (v) Design and implement new digitally enabled customer acquisition programs (vi) Recruitment and general working capital Use of Proceeds Kingswood Investments, a division of Kingswood Capital Partners LLC Book Running Managers 1. Upon the acquisition of Paradise Adventures LLC on January 18, 2023, the Company signed a promissory note for $2,075,999 due and payable upon the effective date of this offering. On September 30, 2023 the balance on this promissory note was $1,576,000. 2. Balance of $62,000 is currently in escrow with Paradise Group of Companies. 3. We intend to enter new geographic markets through acquisitions of existing and well - established maritime tour activity and attraction operators. Once we begin operating in a geographic market we expect to grow our business organically, however small synergistic acquisitions in such markets may be considered. We intend to utilize approximately $440,874 of the net proceeds from this offering for future acquisitions in 2024 which do not pertain to the completion of the acquisition of the Paradise Group of Companies. We anticipate our acquisition of the Paradise Group of Companies (“PGC”) including Paradise Yacht Management will be completed upon the consummation of this offering.

OUR VISION AND MISSION Become the maritime tour activity and attractions market share leader through organic growth and buy then build. Provide unparalleled guest satisfaction for our guests and hospitality partners. Our guests have the 'Best Day of Their Vacation' . We strive to foster a deep appreciation for the beauty and significance of the seas while ensuring sustainable practices that preserve the marine environment for future generations. Amphitrite Digital | 5

PROVEN LEADERSHIP UNIQUE TO OUR INDUSTRY SCOTT STAWSKI Founder & Exec Chairman ROB CHAPPLE CEO & Director Global Tech & Ops Executive, Start Up Growth CRO Tech & Sales Executive & Bestselling Author PAT MULLETT Dir. of Operations & Director HOPE STAWSKI Founder, President & Director Hospitality and Marketing Executive International Hospitality & Operations Executive Amphitrite Digital | 6

We are mariners at heart , with deep technology and hospitality experience Seas the Day Charters USVI Tall Ship Windy Paradise Adventures Paradise Yacht Mangement 1 Started building in the Virgin Islands , we bought then built in Florida and the Great Lakes Operations platform – clipboard to the cloud – best of class digital technology tailored to maritime We see a large addressable market - raising capital to take this vision further faster SALT WATER, SAILS AND SILICON Amphitrite Digital | 7 1. We anticipate our acquisition of the Paradise Group of Companies (“PGC”) including Paradise Yacht Management will be completed upon the consummation of this offering.

Immersive educational experiences for urban and suburban groups of all ages Per - person boat tours – unbeatable views with a drink in your hand and a pod of dolphins Exclusive, all - inclusive week - long luxury vacations at sea Private day charter - swim, snorkel & beaches on luxury yachts for your family and friends LUXURY, LEISURE & LEARNING Sun, sand & smiles Sunsets & memories Private vacations First times as sea Amphitrite Digital | 8

A UNIQUE OPPORTUNITY TO DISRUPT ➔ Customer acquisition fueling growth ➔ Digital operating model creating cash ➔ Buy, then build empirical success ➔ Award - winning guest experiences ➔ Maritime Tours is a large market ➔ Clipboard to cloud operations ➔ Buy, then build for fast growth ➔ Proven team with a clear vision ATTRACTIVE BUSINESS MODEL KEY INDICATORS of PROGRESS Amphitrite Digital | 9

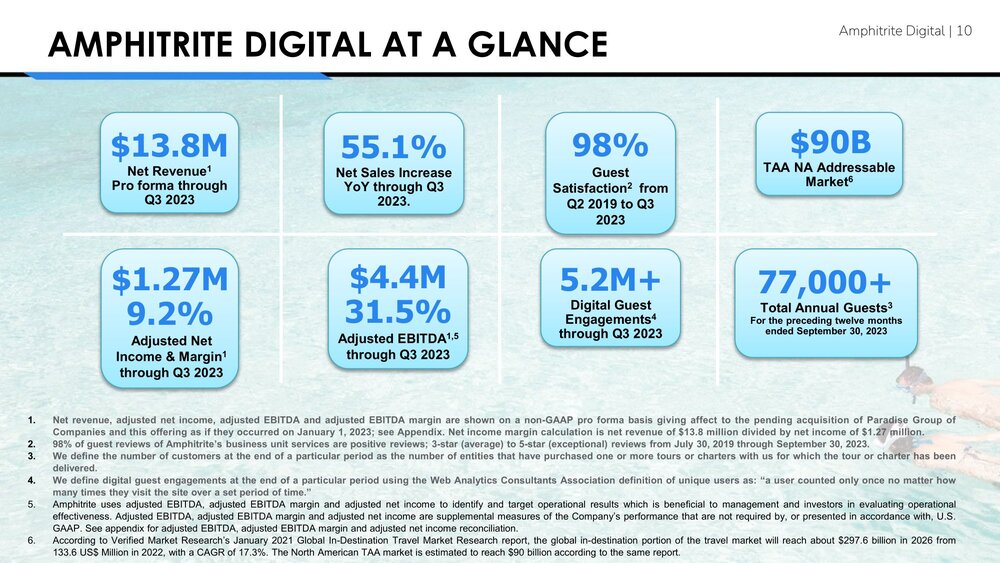

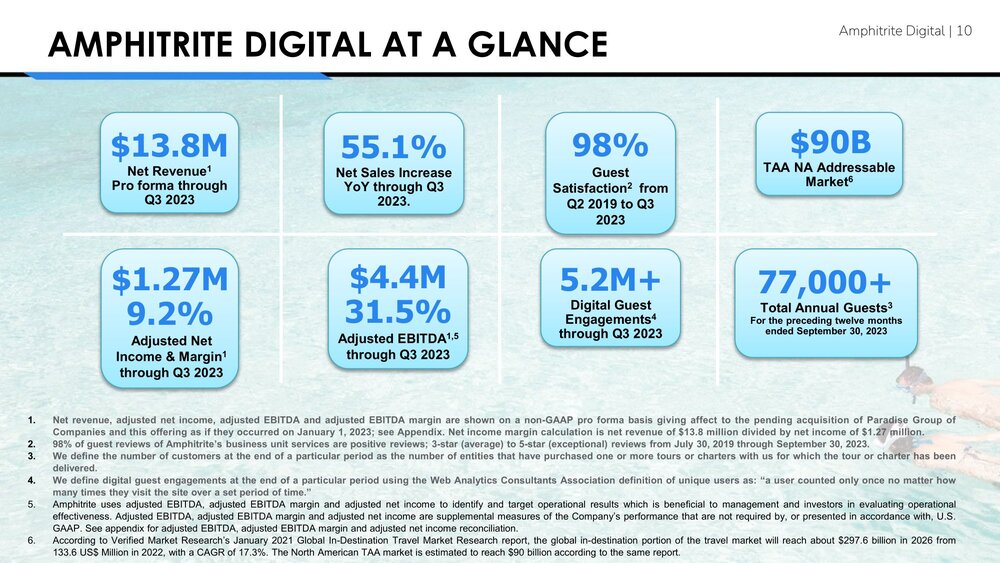

AMPHITRITE DIGITAL AT A GLANCE 1. Net revenue, adjusted net income, adjusted EBITDA and adjusted EBITDA margin are shown on a non - GAAP pro forma basis giving affect to the pending acquisition of Paradise Group of Companies and this offering as if they occurred on January 1 , 2023 ; see Appendix . Net income margin calculation is net revenue of $ 13 . 8 million divided by net income of $ 1 . 27 million . 2. 98 % of guest reviews of Amphitrite’s business unit services are positive reviews ; 3 - star (average) to 5 - star (exceptional) reviews from July 30 , 2019 through September 30 , 2023 . 3. We define the number of customers at the end of a particular period as the number of entities that have purchased one or more tours or charters with us for which the tour or charter has been delivered . 4. We define digital guest engagements at the end of a particular period using the Web Analytics Consultants Association definition of unique users as : “a user counted only once no matter how many times they visit the site over a set period of time . ” 5. Amphitrite uses adjusted EBITDA, adjusted EBITDA margin and adjusted net income to identify and target operational results which is beneficial to management and investors in evaluating operational effectiveness . Adjusted EBITDA, adjusted EBITDA margin and adjusted net income are supplemental measures of the Company’s performance that are not required by, or presented in accordance with, U . S . GAAP . See appendix for adjusted EBITDA, adjusted EBITDA margin and adjusted net income reconciliation . 6. According to Verified Market Research’s January 2021 Global In - Destination Travel Market Research report, the global in - destination portion of the travel market will reach about $ 297 . 6 billion in 2026 from 133 . 6 US $ Million in 2022 , with a CAGR of 17 . 3 % . The North American TAA market is estimated to reach $ 90 billion according to the same report . Amphitrite Digital | 10 77,000+ Total Annual Guests 3 For the preceding twelve months ended September 30, 2023 $13.8M Net Revenue 1 Pro forma through Q3 2023 $1.27M 9.2% Adjusted Net Income & Margin 1 through Q3 2023 $90B TAA NA Addressable Market 6 5.2M+ Digital Guest Engagements 4 through Q3 2023 55.1% Net Sales Increase YoY through Q3 2023. 98% Guest Satisfaction 2 from Q2 2019 to Q3 2023 $4.4M 31.5% Adjusted EBITDA 1,5 through Q3 2023

“TAA is possibly the most diverse and fragmented sector in the global tourism industry.” 2 – Phocuswright OUR COMPETITION IS.... Amphitrite Digital | 11 SMALL 80%+ of operators generate less than $200,000 in annual revenue 1 SLOW Tech Laggards “Nearly every other travel sector have leveraged the internet to modernize...Tours and activities are a notable exception largely because of global fragmentation.” 3 – Skift Research 1. 2. 3. Phocuswright Research, “ Move to digital gains momentum in tours and activities sector ”, by Kathryn Watson, October 14, 2022. (See https: //www . phocus w ire.com/move - to - digital - tours - and - activities - sector) Phocuswright Research. K Watson Oct. 14, 2022. Skift Research, “ Tours and Experiences: The Next Great Untapped Market in Online Travel ”, by Dan Peltier and Andrew Sheivachman , September 18th, 2018. (See https://skift.com/2018/09/18/tours - and - experiences - the - next - great - untapped - market - in - online - travel/)

CLIPBOARD TO THE CLOUD DISRUPTION Amphitrite Digital | 12 Program Driven Experience Digital Systems & Processes Data - driven Marketing Independent Owner Operators Low/No Technology Vertical Integration Antiquated Processes Inconsistent Guest Experience Experienced Operating Team

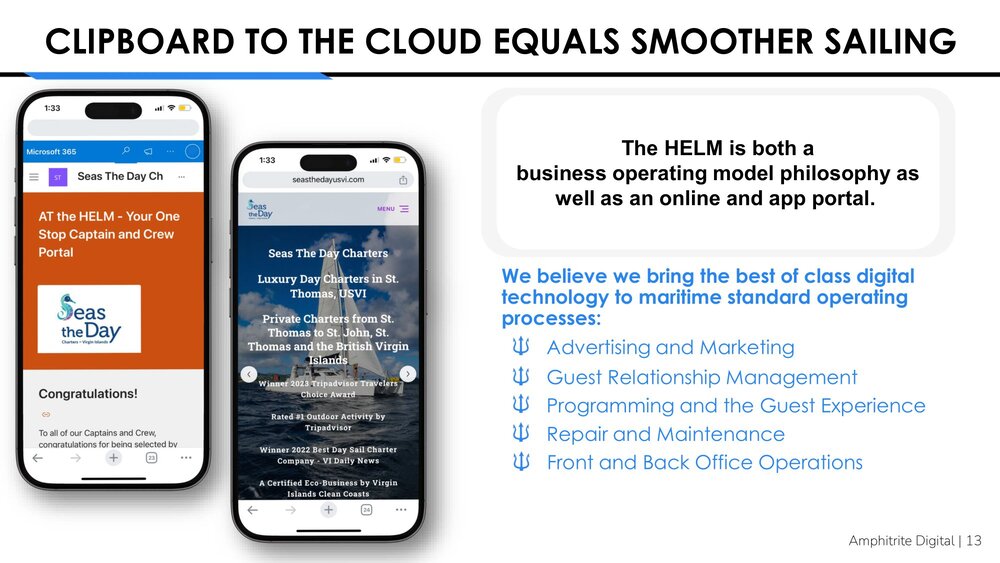

Amphitrite Digital | 13 CLIPBOARD TO THE CLOUD EQUALS SMOOTHER SAILING The HELM is both a business operating model philosophy as well as an online and app portal. We believe we bring the best of class digital technology to maritime standard operating processes: Advertising and Marketing Guest Relationship Management Programming and the Guest Experience Repair and Maintenance Front and Back Office Operations

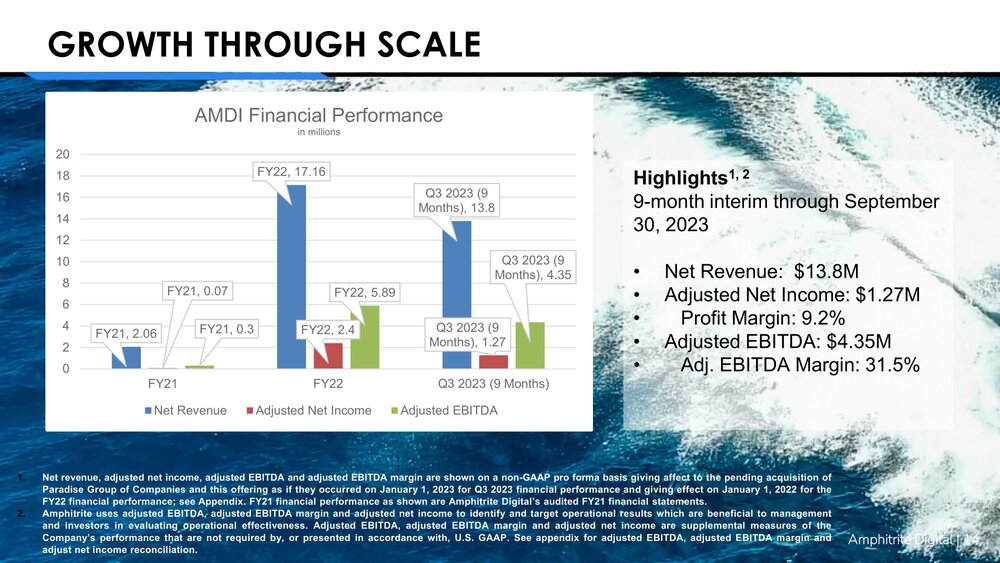

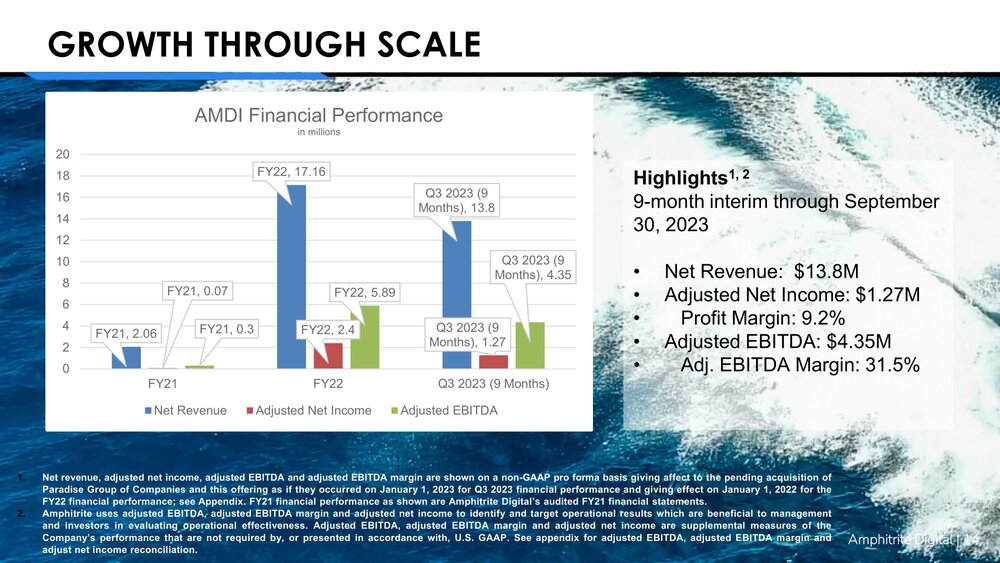

GROWTH THROUGH SCALE Amphitrite Digital | 14 1. Net revenue, adjusted net income, adjusted EBITDA and adjusted EBITDA margin are shown on a non - GAAP pro forma basis giving affect to the pending acquisition of Paradise Group of Companies and this offering as if they occurred on January 1 , 2023 for Q 3 2023 financial performance and giving effect on January 1 , 2022 for the FY 22 financial performance ; see Appendix . FY 21 financial performance as shown are Amphitrite Digital’s audited FY 21 financial statements . 2. Amphitrite uses adjusted EBITDA, adjusted EBITDA margin and adjusted net income to identify and target operational results which are beneficial to management and investors in evaluating operational effectiveness . Adjusted EBITDA, adjusted EBITDA margin and adjusted net income are supplemental measures of the Company’s performance that are not required by, or presented in accordance with, U . S . GAAP . See appendix for adjusted EBITDA, adjusted EBITDA margin and adjust net income reconciliation . Highlights 1, 2 9 - month interim through September 30, 2023 • Net Revenue: $13.8M • Adjusted Net Income: $1.27M • Profit Margin: 9.2% • Adjusted EBITDA: $4.35M • Adj. EBITDA Margin: 31.5% FY21, 2.06 FY22, 17.16 Q3 2023 (9 Months), 13.8 FY21, 0.07 FY22, 2.4 Q3 2023 (9 Months), 1.27 FY21, 0.3 FY22, 5.89 Q3 2023 (9 Months), 4.35 4 2 0 8 6 20 18 16 14 12 10 AMDI Financial Performance in millions FY21 FY22 Q3 2023 (9 Months) Net Revenue Adjusted Net Income Adjusted EBITDA

GROWTH & EXPANSION STRATEGY OVERVIEW BUY THEN BUILD ACQUISITION GROWTH The sector is fragmented. The sector has self - imposed low margins. POST ACQUISITION GROWTH We believe a 15% market share for maritime tours and activities in each geography entered achieves the economies of scale and operational efficiency to maximize profitability. In each geography entered, we will continue to use our competitive strength in digitally enabled guest acquisition to achieve this target. EXPANSION PLANS The company has an active acquisition pipeline and it is the company’s intent to complete further acquisitions in the next twelve months. ORGANIC GROWTH As new markets are opened either organically or through acquisition, We believe that our digital operating model drives organic growth. As AMDI establishes presence in a geographic, service and product line extensions are further used to drive organic growth including merchandise and affiliate sales. Amphitrite Digital | 15

CORPORATE TIMELINE The Company has a successful history of acquisitions. We believe we have proven our founding hypothesis that we can acquire market share leaders which provides a geographic foundation for future organic growth. The company has an active acquisition pipeline and it is the company’s intent to complete further acquisitions in the next twelve months. Seas the Day Charters USVI Organic Growth SY Pisces Windy of Chicago LTD Paradise Adventures LLC 2023 Paradise Group of Companies 1 2024 Acquisition Pipeline 2022 2019 - 2021 2018 1. We anticipate our acquisition of the Paradise Group of Companies (“PGC”) including Paradise Yacht Management will be completed upon the consummation of this offering. Amphitrite Digital | 16

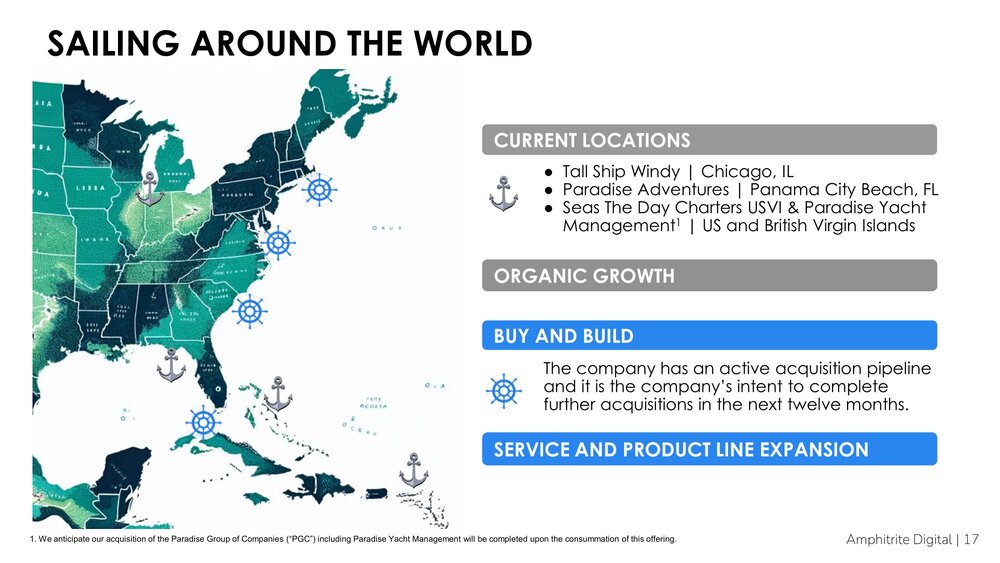

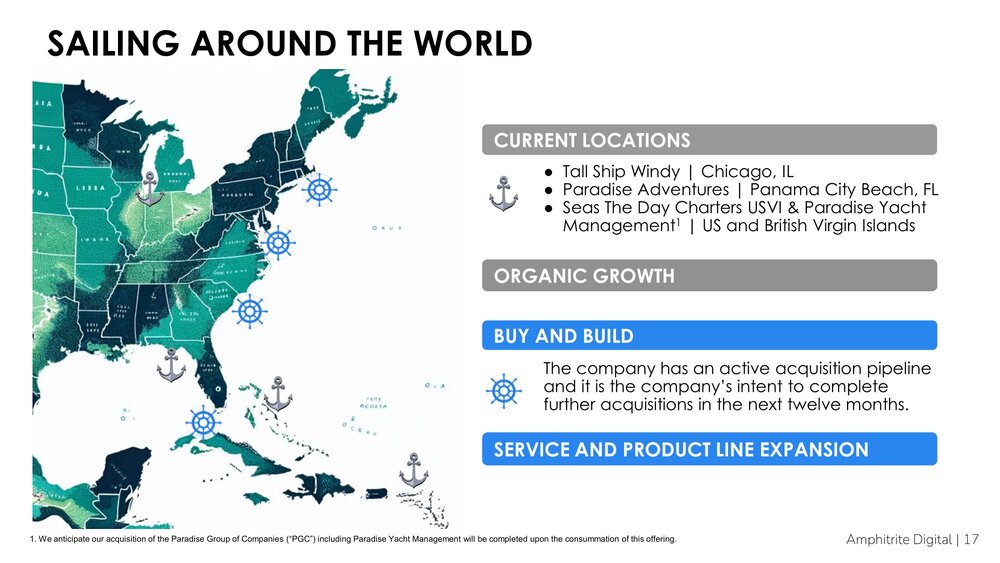

SAILING AROUND THE WORLD CURRENT LOCATIONS ● Tall Ship Windy | Chicago, IL ● Paradise Adventures | Panama City Beach, FL ● Seas The Day Charters USVI & Paradise Yacht Management 1 | US and British Virgin Islands ORGANIC GROWTH BUY AND BUILD The company has an active acquisition pipeline and it is the company’s intent to complete further acquisitions in the next twelve months. SERVICE AND PRODUCT LINE EXPANSION Amphitrite Digital | 17 1. We anticipate our acquisition of the Paradise Group of Companies (“PGC”) including Paradise Yacht Management will be completed upon the consummation of this offering.

EXPERIENCED BOARD OF DIRECTORS MARC BROOKS Governance Member Boat Captain & Former Lawyer MIKE KLAUS Chair, Audit RICHARD PHILLIPS Chair, Gov, Audit Member ANU SINGH Audit & Comp Member MARTI GORUM, ESQ Chair, Comp Comm BRYAN MASON, ESQ Employee Rep KEVIN DRITSCHLER Safety Advisory Travel & Hospitality CEO & Entrepreneur Former US Air Force & Retired Fire Fighter, USCG Captain Former Tec CXO CEO Coach M&A Practice Leader, Valuation Advisory Former M&A Banker PE Operating Exec Former Hospitality Exec, Advising HR & Talent Tech CEO, Architect & Entrepreneur AARON HUGHES Comp & Tech Advisory Amphitrite Digital | 18

THANK YOU Info@AmphitriteDigital.com

Appendix Amphitrite Digital | 20

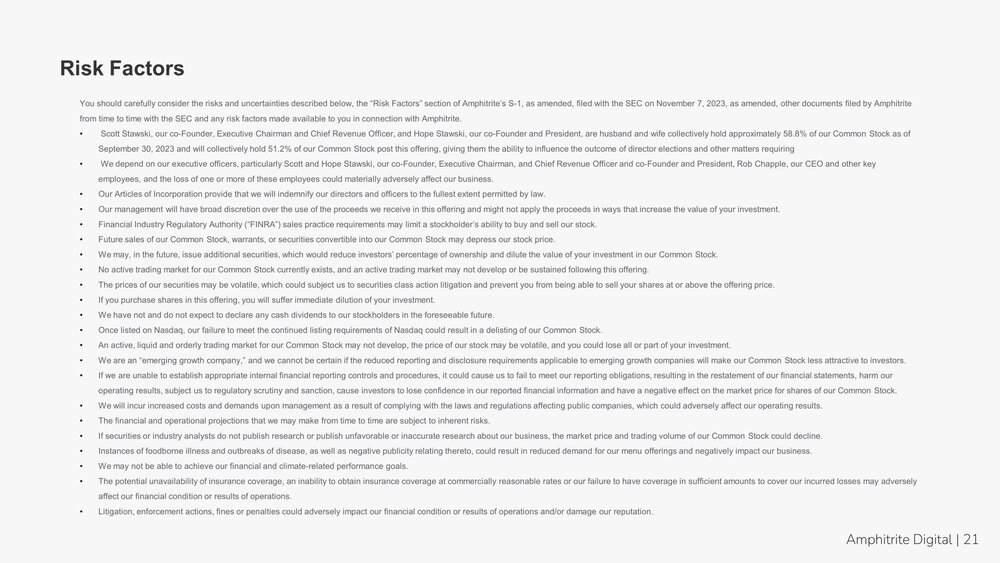

Risk Factors You should carefully consider the risks and uncertainties described below, the “Risk Factors” section of Amphitrite’s S - 1, as amended, filed with the SEC on November 7, 2023, as amended, other documents filed by Amphitrite from time to time with the SEC and any risk factors made available to you in connection with Amphitrite. • • Scott Stawski, our co - Founder, Executive Chairman and Chief Revenue Officer, and Hope Stawski, our co - Founder and President, are husband and wife collectively hold approximately 58.8% of our Common Stock as of September 30, 2023 and will collectively hold 51.2% of our Common Stock post this offering, giving them the ability to influence the outcome of director elections and other matters requiring We depend on our executive officers, particularly Scott and Hope Stawski, our co - Founder, Executive Chairman, and Chief Revenue Officer and co - Founder and President, Rob Chapple, our CEO and other key employees, and the loss of one or more of these employees could materially adversely affect our business. • Our Articles of Incorporation provide that we will indemnify our directors and officers to the fullest extent permitted by law. • Our management will have broad discretion over the use of the proceeds we receive in this offering and might not apply the proceeds in ways that increase the value of your investment. • Financial Industry Regulatory Authority (“FINRA”) sales practice requirements may limit a stockholder’s ability to buy and sell our stock. • Future sales of our Common Stock, warrants, or securities convertible into our Common Stock may depress our stock price. • We may, in the future, issue additional securities, which would reduce investors’ percentage of ownership and dilute the value of your investment in our Common Stock. • No active trading market for our Common Stock currently exists, and an active trading market may not develop or be sustained following this offering. • The prices of our securities may be volatile, which could subject us to securities class action litigation and prevent you from being able to sell your shares at or above the offering price. • If you purchase shares in this offering, you will suffer immediate dilution of your investment. • We have not and do not expect to declare any cash dividends to our stockholders in the foreseeable future. • Once listed on Nasdaq, our failure to meet the continued listing requirements of Nasdaq could result in a delisting of our Common Stock. • An active, liquid and orderly trading market for our Common Stock may not develop, the price of our stock may be volatile, and you could lose all or part of your investment. • We are an “emerging growth company,” and we cannot be certain if the reduced reporting and disclosure requirements applicable to emerging growth companies will make our Common Stock less attractive to investors. • If we are unable to establish appropriate internal financial reporting controls and procedures, it could cause us to fail to meet our reporting obligations, resulting in the restatement of our financial statements, harm our operating results, subject us to regulatory scrutiny and sanction, cause investors to lose confidence in our reported financial information and have a negative effect on the market price for shares of our Common Stock. • We will incur increased costs and demands upon management as a result of complying with the laws and regulations affecting public companies, which could adversely affect our operating results. • The financial and operational projections that we may make from time to time are subject to inherent risks. • If securities or industry analysts do not publish research or publish unfavorable or inaccurate research about our business, the market price and trading volume of our Common Stock could decline. • Instances of foodborne illness and outbreaks of disease, as well as negative publicity relating thereto, could result in reduced demand for our menu offerings and negatively impact our business. • We may not be able to achieve our financial and climate - related performance goals. • The potential unavailability of insurance coverage, an inability to obtain insurance coverage at commercially reasonable rates or our failure to have coverage in sufficient amounts to cover our incurred losses may adversely affect our financial condition or results of operations. • Litigation, enforcement actions, fines or penalties could adversely impact our financial condition or results of operations and/or damage our reputation. Amphitrite Digital | 21

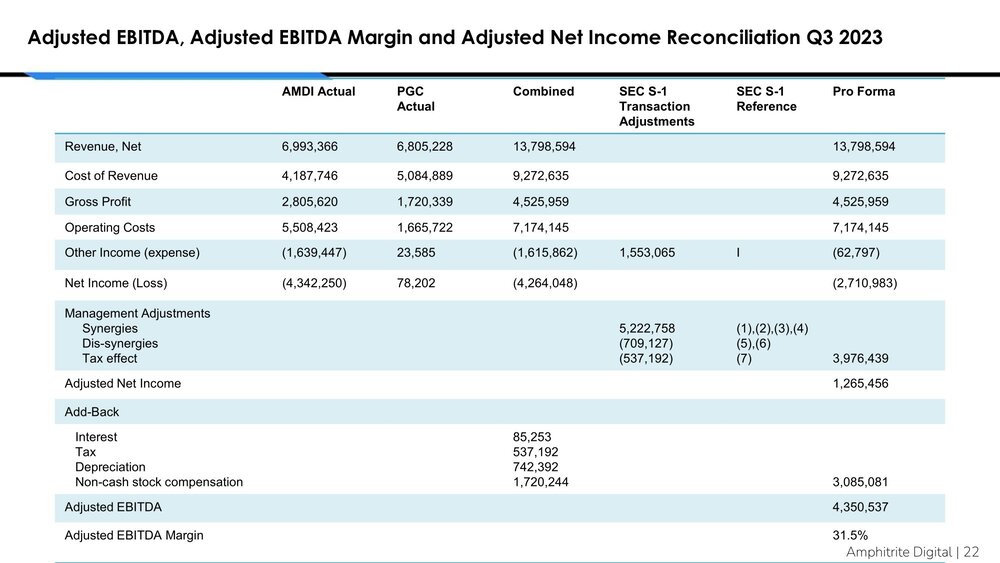

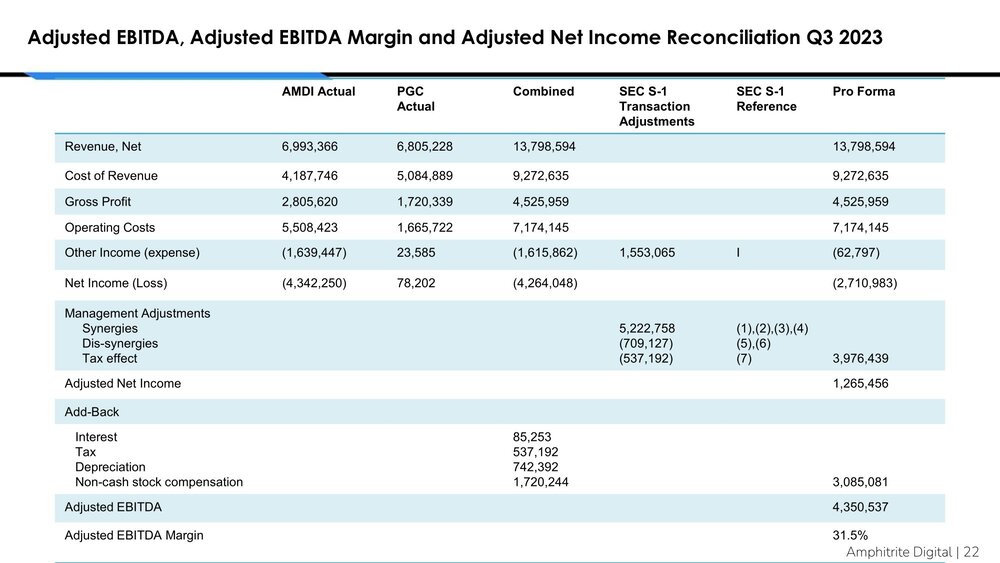

Adjusted EBITDA, Adjusted EBITDA Margin and Adjusted Net Income Reconciliation Q3 2023 Pro Forma SEC S - 1 Reference SEC S - 1 Transaction Adjustments Combined PGC Actual AMDI Actual 13,798,594 13,798,594 6,805,228 6,993,366 Revenue, Net 9,272,635 9,272,635 5,084,889 4,187,746 Cost of Revenue 4,525,959 4,525,959 1,720,339 2,805,620 Gross Profit 7,174,145 7,174,145 1,665,722 5,508,423 Operating Costs (62,797) I 1,553,065 (1,615,862) 23,585 (1,639,447) Other Income (expense) (2,710,983) (4,264,048) 78,202 (4,342,250) Net Income (Loss) Management Adjustments (1),(2),(3),(4) 5,222,758 Synergies (5),(6) (709,127) Dis - synergies 3,976,439 (7) (537,192) Tax effect 1,265,456 Adjusted Net Income Add - Back 85,253 Interest 537,192 Tax 742,392 Depreciation 3,085,081 1,720,244 Non - cash stock compensation 4,350,537 Adjusted EBITDA 31.5% Amphitrite Digita Adjusted EBITDA Margin l | 22

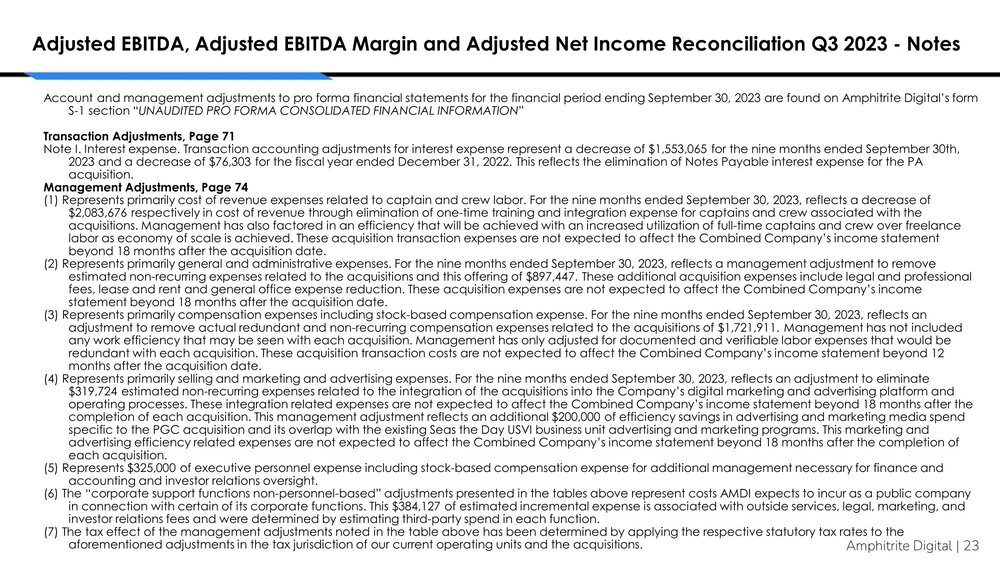

Adjusted EBITDA, Adjusted EBITDA Margin and Adjusted Net Income Reconciliation Q3 2023 - Notes Account and management adjustments to pro forma financial statements for the financial period ending September 30, 2023 are found on Amphitrite Digital’s form S - 1 section “ UNAUDITED PRO FORMA CONSOLIDATED FINANCIAL INFORMATION ” Transaction Adjustments, Page 71 Note I. Interest expense. Transaction accounting adjustments for interest expense represent a decrease of $1,553,065 for the nine months ended September 30th, 2023 and a decrease of $76,303 for the fiscal year ended December 31, 2022. This reflects the elimination of Notes Payable interest expense for the PA acquisition. Management Adjustments, Page 74 (1) Represents primarily cost of revenue expenses related to captain and crew labor. For the nine months ended September 30, 2023, reflects a decrease of $2,083,676 respectively in cost of revenue through elimination of one - time training and integration expense for captains and crew associated with the acquisitions. Management has also factored in an efficiency that will be achieved with an increased utilization of full - time captains and crew over freelance labor as economy of scale is achieved. These acquisition transaction expenses are not expected to affect the Combined Company’s income statement beyond 18 months after the acquisition date. (2) Represents primarily general and administrative expenses. For the nine months ended September 30, 2023, reflects a management adjustment to remove estimated non - recurring expenses related to the acquisitions and this offering of $897,447. These additional acquisition expenses include legal and professional fees, lease and rent and general office expense reduction. These acquisition expenses are not expected to affect the Combined Company’s income statement beyond 18 months after the acquisition date. (3) Represents primarily compensation expenses including stock - based compensation expense. For the nine months ended September 30, 2023, reflects an adjustment to remove actual redundant and non - recurring compensation expenses related to the acquisitions of $1,721,911. Management has not included any work efficiency that may be seen with each acquisition. Management has only adjusted for documented and verifiable labor expenses that would be redundant with each acquisition. These acquisition transaction costs are not expected to affect the Combined Company’s income statement beyond 12 months after the acquisition date. (4) Represents primarily selling and marketing and advertising expenses. For the nine months ended September 30, 2023, reflects an adjustment to eliminate $319,724 estimated non - recurring expenses related to the integration of the acquisitions into the Company’s digital marketing and advertising platform and operating processes. These integration related expenses are not expected to affect the Combined Company’s income statement beyond 18 months after the completion of each acquisition. This management adjustment reflects an additional $200,000 of efficiency savings in advertising and marketing media spend specific to the PGC acquisition and its overlap with the existing Seas the Day USVI business unit advertising and marketing programs. This marketing and advertising efficiency related expenses are not expected to affect the Combined Company’s income statement beyond 18 months after the completion of each acquisition. (5) Represents $325,000 of executive personnel expense including stock - based compensation expense for additional management necessary for finance and accounting and investor relations oversight. (6) The “corporate support functions non - personnel - based” adjustments presented in the tables above represent costs AMDI expects to incur as a public company in connection with certain of its corporate functions. This $384,127 of estimated incremental expense is associated with outside services, legal, marketing, and investor relations fees and were determined by estimating third - party spend in each function. (7) The tax effect of the management adjustments noted in the table above has been determined by applying the respective statutory tax rates to the aforementioned adjustments in the tax jurisdiction of our current operating units and the acquisitions. Amphitrite Digital | 23

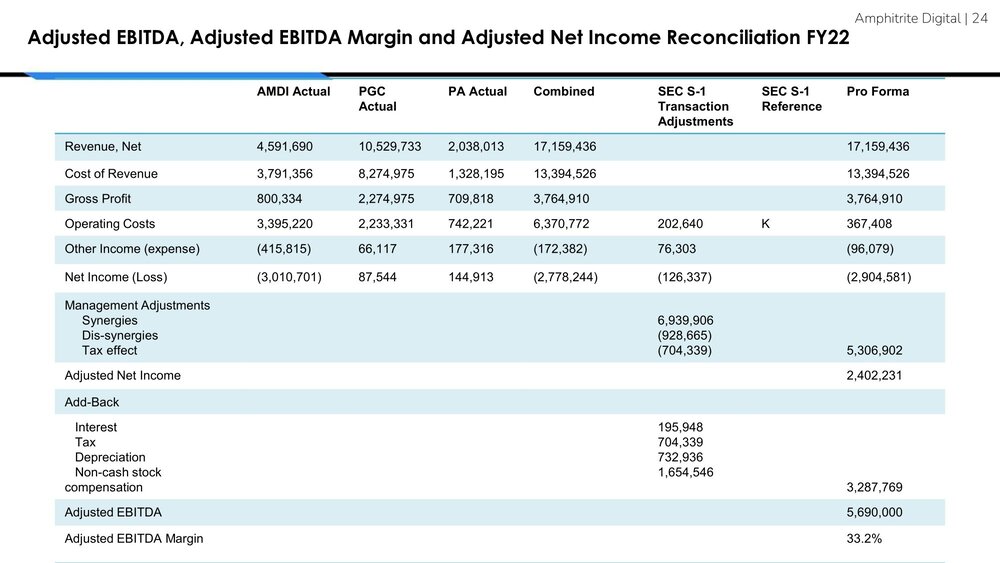

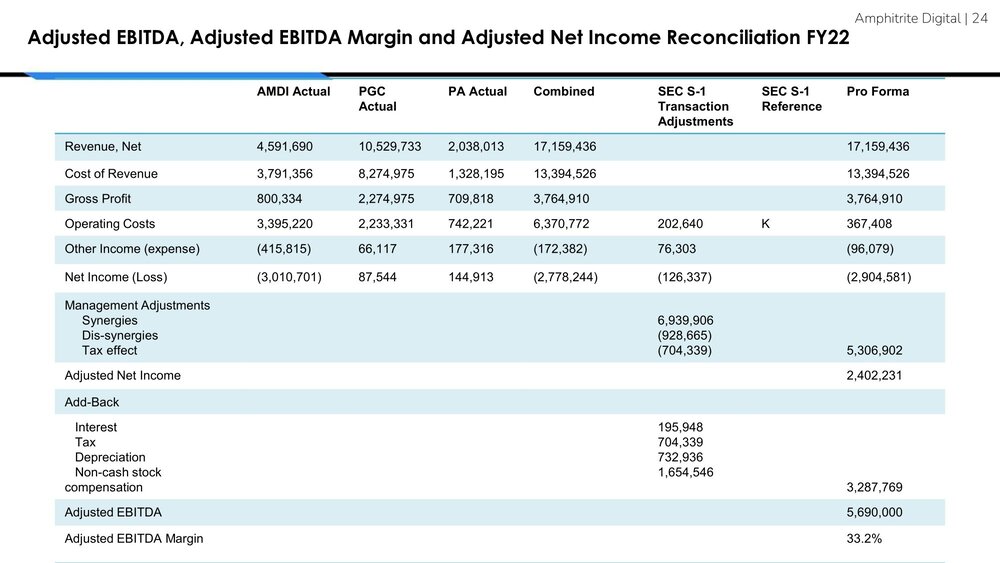

Adjusted EBITDA, Adjusted EBITDA Margin and Adjusted Net Income Reconciliation FY22 Pro Forma SEC S - 1 Reference SEC S - 1 Transaction Adjustments Combined PA Actual PGC Actual AMDI Actual 17,159,436 17,159,436 2,038,013 10,529,733 4,591,690 Revenue, Net 13,394,526 13,394,526 1,328,195 8,274,975 3,791,356 Cost of Revenue 3,764,910 3,764,910 709,818 2,274,975 800,334 Gross Profit 367,408 K 202,640 6,370,772 742,221 2,233,331 3,395,220 Operating Costs (96,079) 76,303 (172,382) 177,316 66,117 (415,815) Other Income (expense) (2,904,581) (126,337) (2,778,244) 144,913 87,544 (3,010,701) Net Income (Loss) Management Adjustments 6,939,906 Synergies (928,665) Dis - synergies 5,306,902 (704,339) Tax effect 2,402,231 Adjusted Net Income Add - Back 195,948 Interest 704,339 Tax 732,936 Depreciation 1,654,546 Non - cash stock 3,287,769 compensation 5,690,000 Adjusted EBITDA 33.2% Adjusted EBITDA Margin Amphitrite Digital | 24

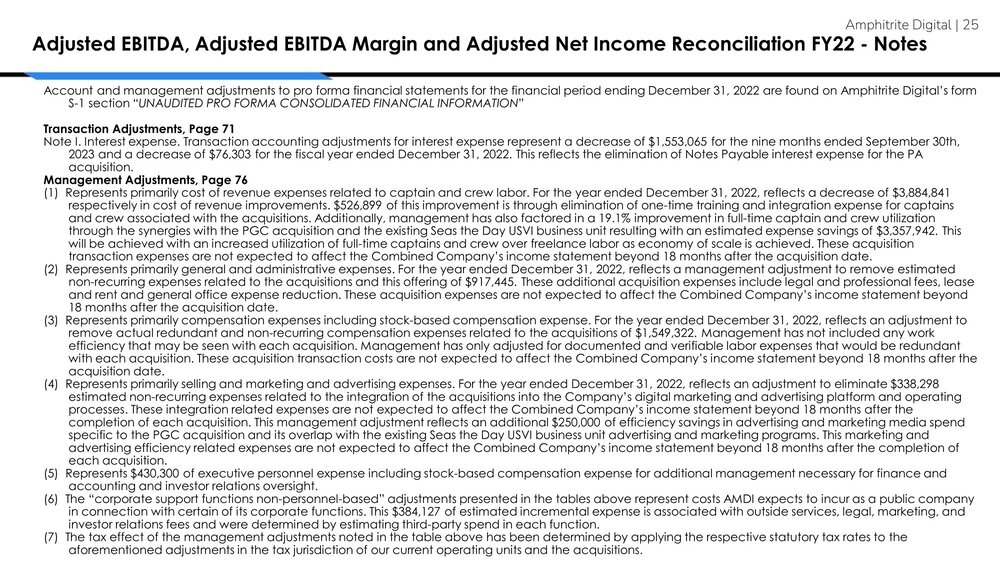

Adjusted EBITDA, Adjusted EBITDA Margin and Adjusted Net Income Reconciliation FY22 - Notes Account and management adjustments to pro forma financial statements for the financial period ending December 31, 2022 are found on Amphitrite Digital’s form S - 1 section “ UNAUDITED PRO FORMA CONSOLIDATED FINANCIAL INFORMATION ” Transaction Adjustments, Page 71 Note I. Interest expense. Transaction accounting adjustments for interest expense represent a decrease of $1,553,065 for the nine months ended September 30th, 2023 and a decrease of $76,303 for the fiscal year ended December 31, 2022. This reflects the elimination of Notes Payable interest expense for the PA acquisition. Management Adjustments, Page 76 (1) Represents primarily cost of revenue expenses related to captain and crew labor. For the year ended December 31, 2022, reflects a decrease of $3,884,841 respectively in cost of revenue improvements. $526,899 of this improvement is through elimination of one - time training and integration expense for captains and crew associated with the acquisitions. Additionally, management has also factored in a 19.1% improvement in full - time captain and crew utilization through the synergies with the PGC acquisition and the existing Seas the Day USVI business unit resulting with an estimated expense savings of $3,357,942. This will be achieved with an increased utilization of full - time captains and crew over freelance labor as economy of scale is achieved. These acquisition transaction expenses are not expected to affect the Combined Company’s income statement beyond 18 months after the acquisition date. (2) Represents primarily general and administrative expenses. For the year ended December 31, 2022, reflects a management adjustment to remove estimated non - recurring expenses related to the acquisitions and this offering of $917,445. These additional acquisition expenses include legal and professional fees, lease and rent and general office expense reduction. These acquisition expenses are not expected to affect the Combined Company’s income statement beyond 18 months after the acquisition date. (3) Represents primarily compensation expenses including stock - based compensation expense. For the year ended December 31, 2022, reflects an adjustment to remove actual redundant and non - recurring compensation expenses related to the acquisitions of $1,549,322. Management has not included any work efficiency that may be seen with each acquisition. Management has only adjusted for documented and verifiable labor expenses that would be redundant with each acquisition. These acquisition transaction costs are not expected to affect the Combined Company’s income statement beyond 18 months after the acquisition date. (4) Represents primarily selling and marketing and advertising expenses. For the year ended December 31, 2022, reflects an adjustment to eliminate $338,298 estimated non - recurring expenses related to the integration of the acquisitions into the Company’s digital marketing and advertising platform and operating processes. These integration related expenses are not expected to affect the Combined Company’s income statement beyond 18 months after the completion of each acquisition. This management adjustment reflects an additional $250,000 of efficiency savings in advertising and marketing media spend specific to the PGC acquisition and its overlap with the existing Seas the Day USVI business unit advertising and marketing programs. This marketing and advertising efficiency related expenses are not expected to affect the Combined Company’s income statement beyond 18 months after the completion of each acquisition. (5) Represents $430,300 of executive personnel expense including stock - based compensation expense for additional management necessary for finance and accounting and investor relations oversight. (6) The “corporate support functions non - personnel - based” adjustments presented in the tables above represent costs AMDI expects to incur as a public company in connection with certain of its corporate functions. This $384,127 of estimated incremental expense is associated with outside services, legal, marketing, and investor relations fees and were determined by estimating third - party spend in each function. (7) The tax effect of the management adjustments noted in the table above has been determined by applying the respective statutory tax rates to the aforementioned adjustments in the tax jurisdiction of our current operating units and the acquisitions. Amphitrite Digital | 25

Adjusted EBITDA, Adjusted EBITDA Margin and Adjusted Net Income Reconciliation FY21 Pro Forma SEC S - 1 Reference SEC S - 1 Transaction Adjustments AMDI Actual 2,059,001 2,059,001 Revenue, Net 1,633,373 1,633,373 Cost of Revenue 425,628 425,628 Gross Profit 324,727 324,727 Operating Costs (28,277) (28,277) Other Income (expense) 72,624 72,624 Net Income (Loss) - Management Adjustments Synergies Dis - synergies Tax effect 72,624 Adjusted Net Income Add - Back 44,555 1 230,448 2 Interest Tax Depreciation Non - cash stock compensation 275,003 347,627 Adjusted EBITDA 16.9% Adjusted EBITDA Margin Amphitrite Digital | 26

Adjusted EBITDA, Adjusted EBITDA Margin and Adjusted Net Income Reconciliation FY21 - Notes Account and management adjustments to pro forma financial statements for the financial period ending December 31, 2021 are found on Amphitrite Digital’s form S - 1 section “ MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS - Non - GAAP Financial Measures”, page 95. Notes: (1) $44,555 in interest expense, (2) $230,448 in non - cash depreciation expense, Amphitrite Digital | 27