Investor Presentation December 2011

Anthony M. Romano President and Chief Executive Officer Eric M. Specter Executive Vice President and Chief Financial Officer 1

Forward Looking Statements The Company’s presentation may contain certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 concerning the Company's operations, performance, and financial condition. Such forward-looking statements are subject to various risks and uncertainties that could cause actual results to differ materially from those indicated. Such risks and uncertainties may include, but are not limited to: the Company’s strategic review (including its plan to divest its Fashion Bug brand) may not result in any specific course of action or transaction; the failure to successfully execute our business plans could result in lower than planned sales and profitability, the failure to successfully execute or realize the projected benefits discussed above from our real estate strategy relating to store openings and relocations to strip shopping centers could result in lower than planned sales and profitability, the failure to divest Fashion Bug on a favorable or timely basis could distract the Company’s management, cause the Company to continue to sustain losses and affect the execution of other components of its business plan, the failure to realize the benefits from the operation of our credit card program by our third-party provider, the impact of changes in laws and regulations governing credit cards could limit the availability of, or increase the cost of, credit to our customers, the failure to enhance the Company's merchandise and marketing and accurately predict fashion trends, customer preferences and other fashion-related factors, the failure of growth in the women's plus apparel market, the failure to continue receiving financing at an affordable cost through the availability of credit we receive from our bankers, suppliers and their agents, the failure to effectively implement our store closing plans, the failure to continue receiving accurate and compliant e-commerce and third-party processing services, the failure to achieve improvement in the Company's competitive position, the failure to maintain efficient and uninterrupted order- taking and fulfillment in our e-commerce and direct-to-consumer businesses, extreme or unseasonable weather conditions, economic downturns, escalation of energy and transportation costs, adverse changes in the costs or availability of fabrics and raw materials, a weakness in overall consumer demand, the failure to find suitable store locations, increases in wage rates, the ability to hire and train associates, trade and security restrictions and political or financial instability in countries where goods are manufactured, the failure of our vendors to deliver quality and timely shipments in compliance with applicable laws and regulations, the interruption of merchandise flow from the Company's centralized distribution facilities and third-party distribution providers, inadequate systems capacity, inability to protect trademarks or other intellectual property, competitive pressures, and the adverse effects of natural disasters, war, acts of terrorism or threats of either, or other armed conflict, on the United States and international economies. These, and other risks and uncertainties, are detailed in the Company's filings with the Securities and Exchange Commission, including the Company's Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other Company filings with the Securities and Exchange Commission. Charming Shoppes assumes no duty to update or revise its forward-looking statements even if experience or future changes make it clear that any projected results expressed or implied therein will not be realized. 2

Through our brands, Charming Shoppes offers fashion, fit and value in women’s plus-size apparel 3

Our Market And Leadership Positions • Largest women’s specialty plus-size apparel retailer in the U.S.* • More than half of American women wear size 14 or larger • Charming Shoppes ranks #2* in the $17.4B* women’s plus-size apparel market • Lane Bryant’s Cacique brand ranks #3* in the $3.2B* women’s plus size intimate apparel market •According to The NPD Group, Inc., a leading provider of global market information, during the twelve month period ended July 2011. 4

Our Continuing Progress • Favorable customer reception of our product offerings • Inventories are more productive • Leveraging expenses • Generating strong cash flow • First nine months Adjusted EBITDA* of $69 million has already exceeded all of last year’s $50 million result 5 *Refer to GAAP to non-GAAP reconciliation at http://phx.corporate-ir.net/phoenix.zhtml?c=106124&p=irol-audioarchives 5

Our Vision Of 10% Adjusted EBITDA 6 • Migrate And Grow Lane Bryant In Power-strip And Lifestyle Centers • Low-to-mid Single Digit Comp Store Increases • Growth Of Cacique Intimate Apparel • Digital Commerce Growth • Improved Inventory Productivity

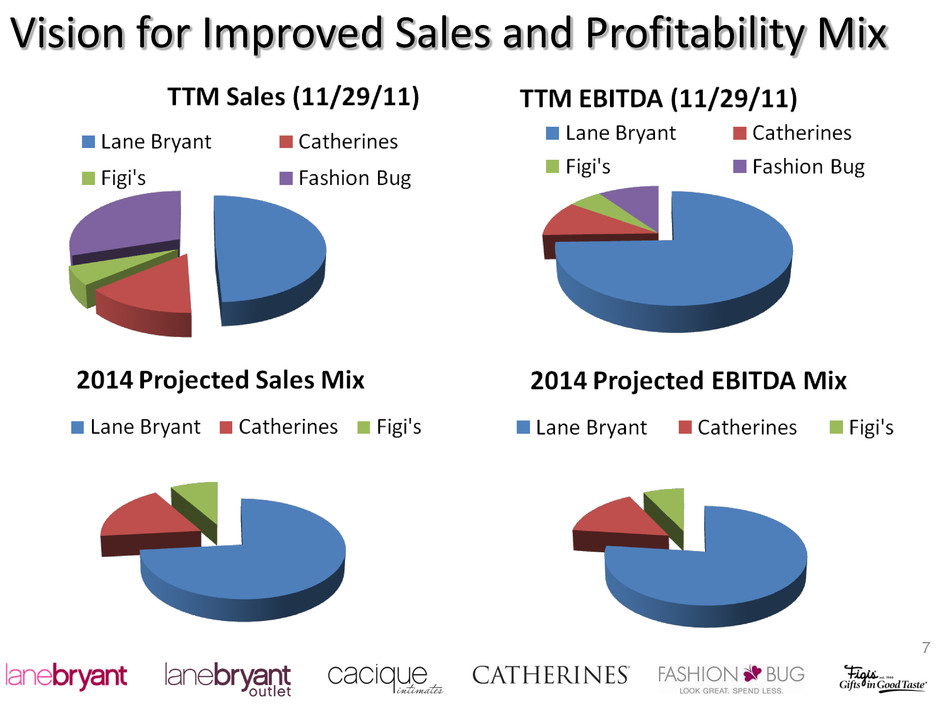

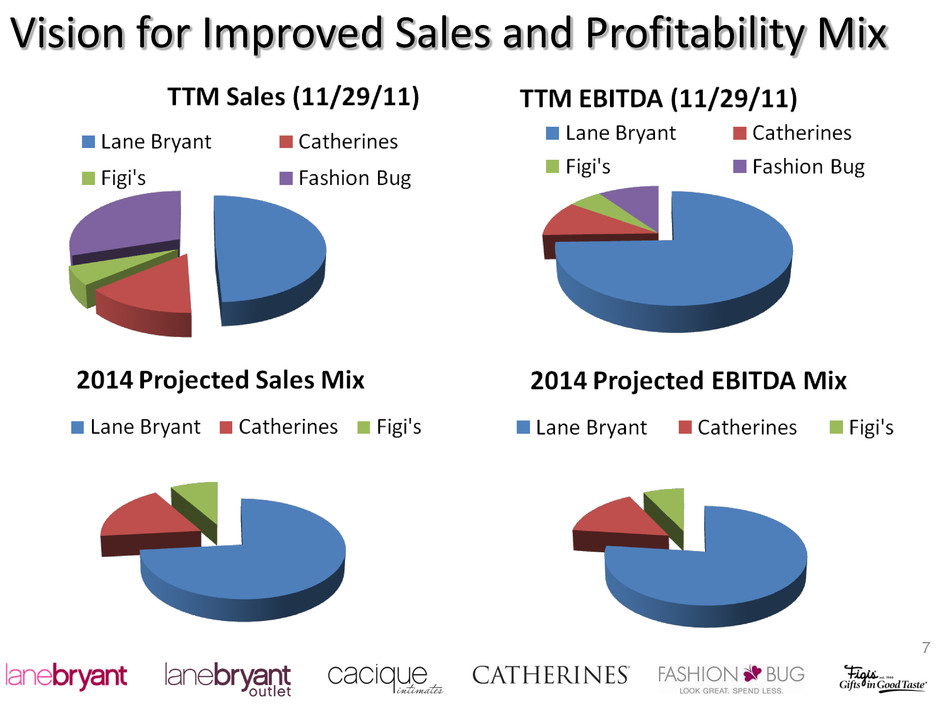

Vision for Improved Sales and Profitability Mix 7

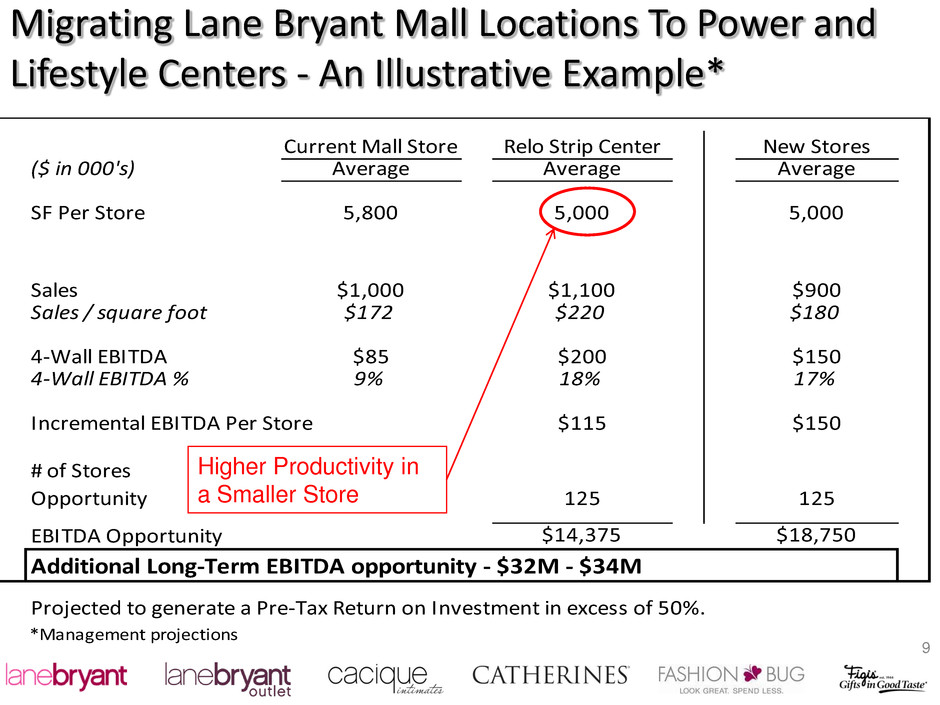

A Growing and More Productive Lane Bryant Migrating Mall Locations To Power and Lifestyle Centers • Our plans include: – Relocating approximately 125 stores – Opening approximately 125 new stores – Grow Lane Bryant retail stores to approximately 750 stores – Grow Lane Bryant Outlet to approximately 150 locations • Investment ranging from $250- $300k net of landlord allowances 8

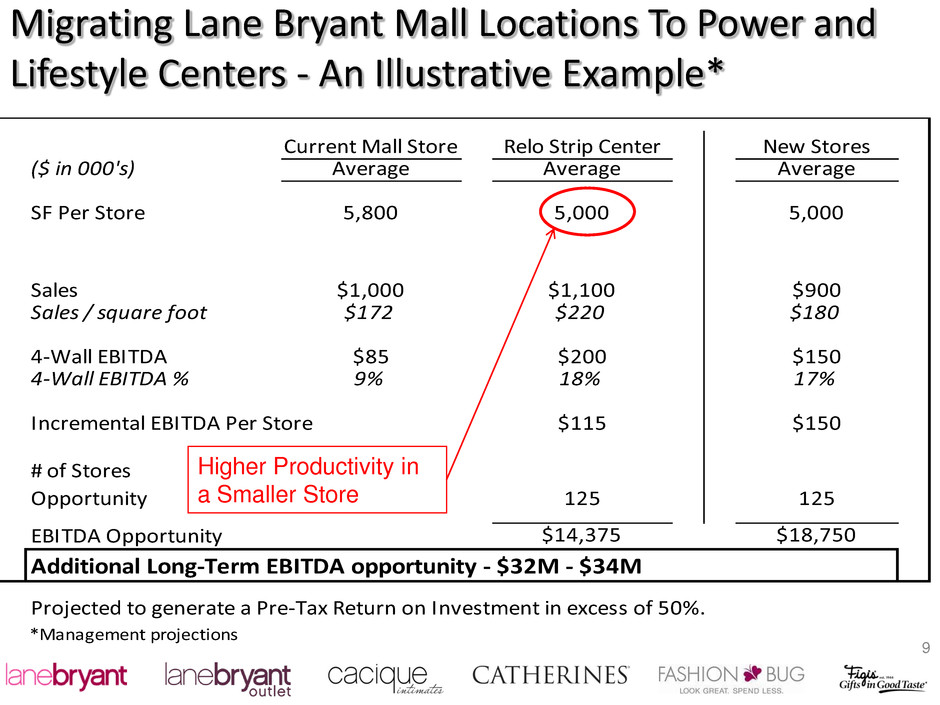

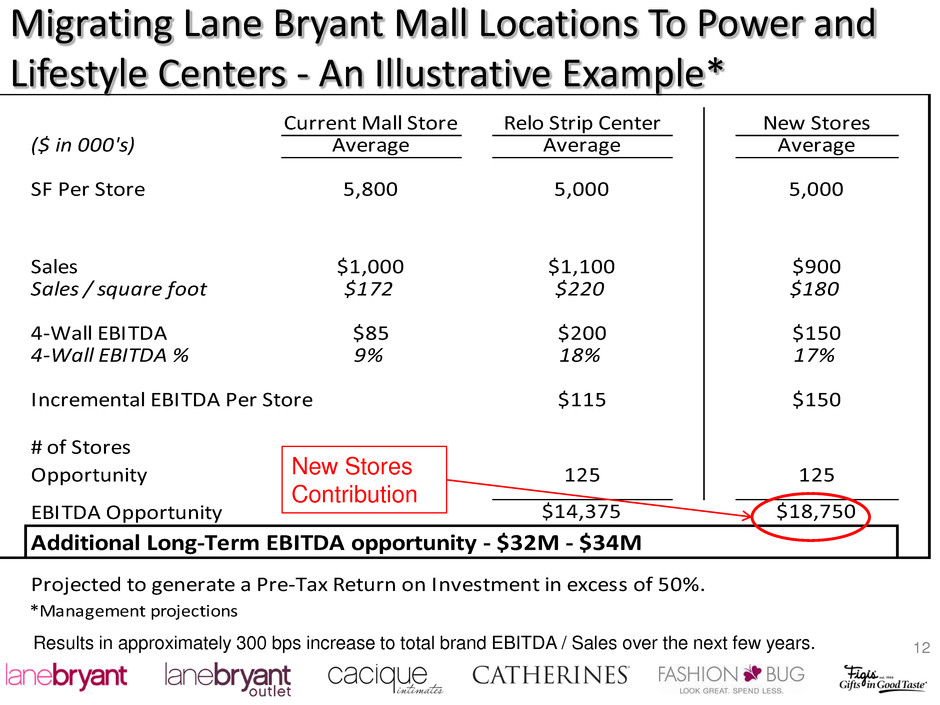

Migrating Lane Bryant Mall Locations To Power and Lifestyle Centers - An Illustrative Example* Relo Strip Center New Stores ($ in 000's) Average Average Average SF Per Store 5,800 5,000 5,000 Sales $1,000 $1,100 $900 Sales / square foot $172 $220 $180 4-Wall EBITDA $85 $200 $150 4-Wall EBITDA % 9% 18% 17% $115 $150 # of Stores Opportunity 125 125 $14,375 $18,750 *Management projections Additional Long-Term EBITDA opportunity - $32M - $34M Projected to generate a Pre-Tax Return on Investment in excess of 50%. EBITDA Opportunity Current Mall Store Incremental EBITDA Per Store Higher Productivity in a Smaller Store 9

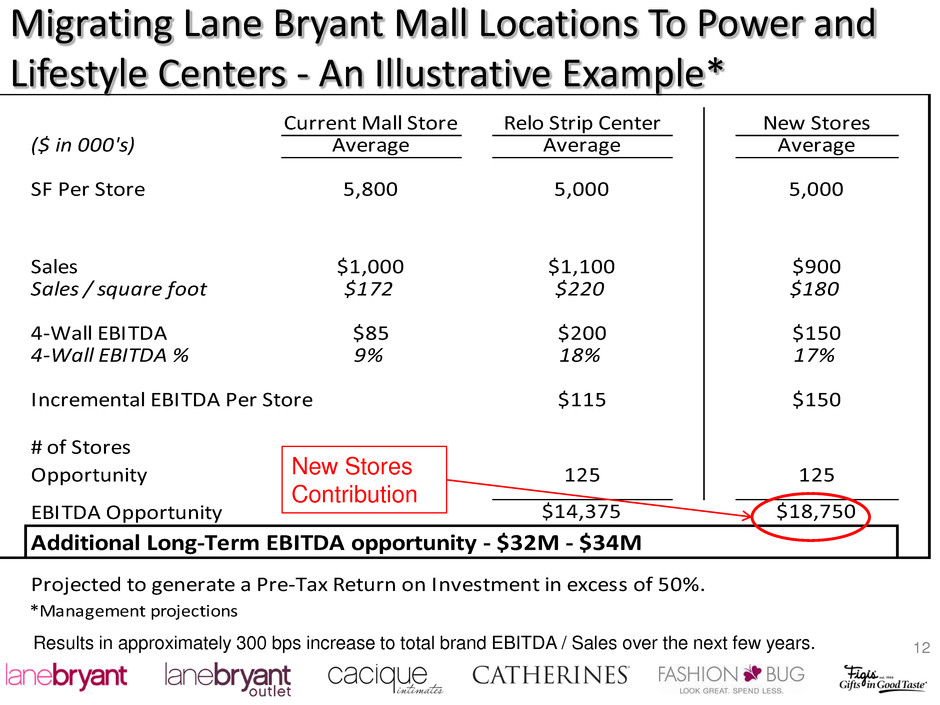

Migrating Lane Bryant Mall Locations To Power and Lifestyle Centers - An Illustrative Example* Relo Strip Center New Stores ($ in 000's) Average Average Average SF Per Store 5,800 5,000 5,000 Sales $1,000 $1,100 $900 Sales / square foot $172 $220 $180 4-Wall EBITDA $85 $200 $150 4-Wall EBITDA % 9% 18% 17% $115 $150 # of Stores Opportunity 125 125 $14,375 $18,750 *Management projections Additional Long-Term EBITDA opportunity - $32M - $34M Projected to generate a Pre-Tax Return on Investment in excess of 50%. EBITDA Opportunity Current Mall Store Incremental EBITDA Per Store Sales Increase of 10% - 20%... 10

Migrating Lane Bryant Mall Locations To Power and Lifestyle Centers - An Illustrative Example* Relo Strip Center New Stores ($ in 000's) Average Average Average SF Per Store 5,800 5,000 5,000 Sales $1,000 $1,100 $900 Sales / square foot $172 $220 $180 4-Wall EBITDA $85 $200 $150 4-Wall EBITDA % 9% 18% 17% $115 $150 # of Stores Opportunity 125 125 $14,375 $18,750 *Management projections Additional Long-Term EBITDA opportunity - $32M - $34M Projected to generate a Pre-Tax Return on Investment in excess of 50%. EBITDA Opportunity Current Mall Store Incremental EBITDA Per Store …And Lower Occupancy Results in Improved EBITDA 11

Migrating Lane Bryant Mall Locations To Power and Lifestyle Centers - An Illustrative Example* Relo Strip Center New Stores ($ in 000's) Average Average Average SF Per Store 5,800 5,000 5,000 Sales $1,000 $1,100 $900 Sales / square foot $172 $220 $180 4-Wall EBITDA $85 $200 $150 4-Wall EBITDA % 9% 18% 17% $115 $150 # of Stores Opportunity 125 125 $14,375 $18,750 *Management projections Additional Long-Term EBITDA opportunity - $32M - $34M Projected to generate a Pre-Tax Return on Investment in excess of 50%. EBITDA Opportunity Current Mall Store Incremental EBITDA Per Store New Stores Contribution 12 Results in approximately 300 bps increase to total brand EBITDA / Sales over the next few years.

• Enhance Cacique intimate apparel brand awareness and merchandise offerings • Represents 31% of sales from the full-line Lane Bryant chain • Offers key intimates categories and complementary products • Expect to explore additional sales distribution channels 13

• Sales increased 15% in first nine months 2011, after increasing 38% in the last fiscal year • Innovation is constant, including our universal cart and most recently Fashion Genius • We commenced international shipping to 90 countries • 864,000 Facebook fans • 478,000 mobile phone opt-ins Driving Growth Through Our Digital Initiatives 14

Improving Inventory Productivity • Strengthening Merchandise Offerings –Increased percentage of novelty and fashion –Elevated colors, prints and patterns –Focus on outfitting solutions –New product launches with innovative solutions 15

Financial Review – First Nine Months 2011 ($ in millions, except EPS) Nine Months 2011 Nine Months 2010 Net Sales $1,433.3 $1,486.0 Same Store Sales 0% +1% Gross Profit $764.0 $767.4 Gross Margin 53.3% 51.6% Total Operating Expenses* $737.8 $778.1 Expense to Sales 51.5% 52.4% Adjusted EBITDA* $68.7 $39.5 EBITDA to Sales 4.8% 2.7% GAAP income (loss) per diluted share $0.09 $(0.20) Non-GAAP income (loss) per diluted share* $0.09 $(0.18) Cash $157.8 $104.2 (Net Debt) $(4.8) $(61.9) *Refer to GAAP to non-GAAP reconciliation at http://phx.corporate-ir.net/phoenix.zhtml?c=106124&p=irol-audioarchives 16

• Strong Balance Sheet • $158 million in Cash • $140.5 million in 1.125% senior convertible notes due in 2014 • Inventories well managed and positioned Down 8% • Positive Operating Cash Flow* • Undrawn $200 million credit facility Balance Sheet and Liquidity at October 29, 2011 17 *Refer to GAAP to non-GAAP reconciliation at http://phx.corporate-ir.net/phoenix.zhtml?c=106124&p=irol-audioarchives

Summary • 3rd Quarter and year-to-date 2011 improved performance as compared to the prior year • Continue to build Lane Bryant into a high performance lifestyle brand • Grow Cacique intimate apparel business • Divest underperforming Fashion Bug brand • Improve our cost structure and enhance our operating systems • Consistent, improving performance will be the measure of our success 18

Appendix

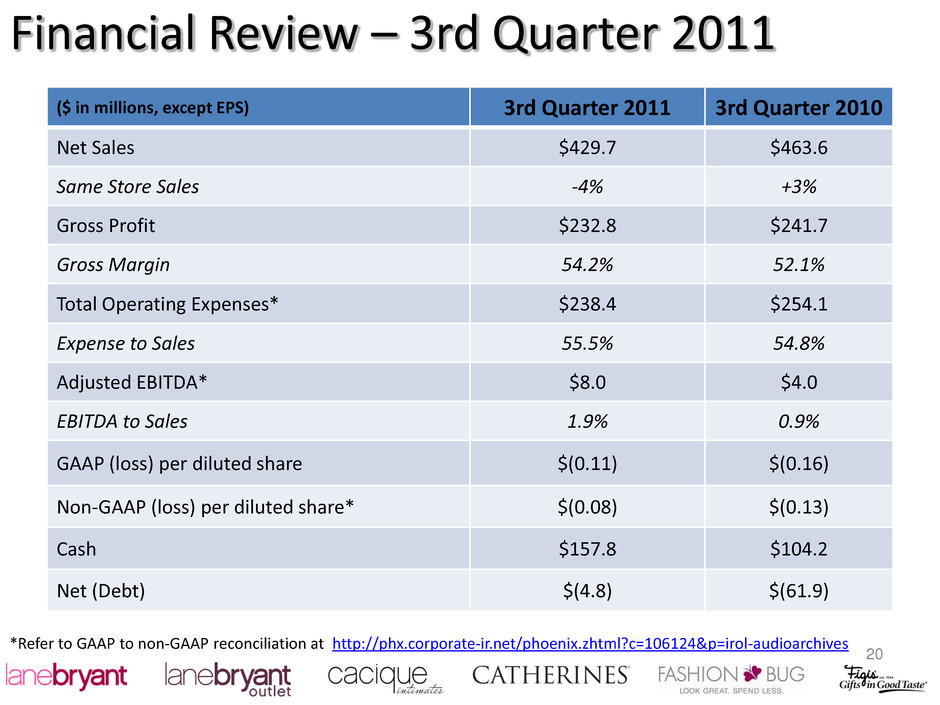

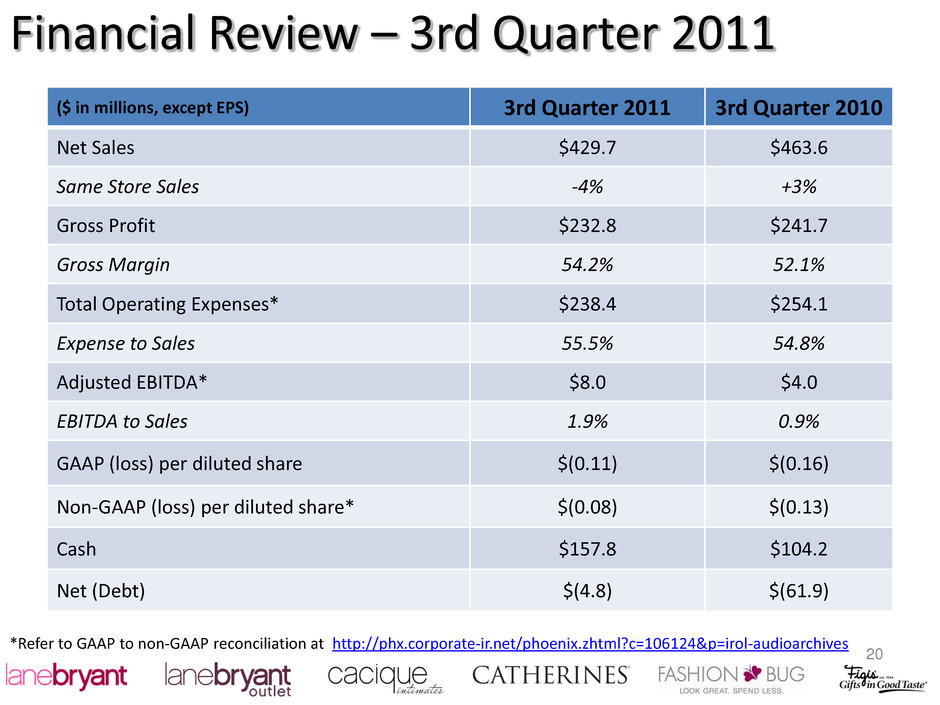

Financial Review – 3rd Quarter 2011 ($ in millions, except EPS) 3rd Quarter 2011 3rd Quarter 2010 Net Sales $429.7 $463.6 Same Store Sales -4% +3% Gross Profit $232.8 $241.7 Gross Margin 54.2% 52.1% Total Operating Expenses* $238.4 $254.1 Expense to Sales 55.5% 54.8% Adjusted EBITDA* $8.0 $4.0 EBITDA to Sales 1.9% 0.9% GAAP (loss) per diluted share $(0.11) $(0.16) Non-GAAP (loss) per diluted share* $(0.08) $(0.13) Cash $157.8 $104.2 Net (Debt) $(4.8) $(61.9) *Refer to GAAP to non-GAAP reconciliation at http://phx.corporate-ir.net/phoenix.zhtml?c=106124&p=irol-audioarchives 20

Financial Review – Fiscal Year 2010 ($ in millions, except EPS) 2010 2009 Net Sales $2,061.8 $2,064.6 Same Store Sales +3% -13% Gross Profit $1,015.0 $1,023.6 Gross Margin 49.2% 49.6% Total Operating Expenses* $1,033.2 $1,049.5 Expense to Sales 50.1% 50.8% Adjusted EBITDA* $50.2 $50.5 EBITDA to Sales 2.4% 2.4% GAAP (loss) per diluted share $(0.47) $(0.67) Non-GAAP (loss) per diluted share* $(0.26) $(0.52) Cash $117.5 $186.6 Net (Debt) $(47.0) $(33.3) *Refer to GAAP to non-GAAP reconciliation at http://phx.corporate-ir.net/phoenix.zhtml?c=106124&p=irol-audioarchives 21

• 1,929 stores at October 29, 2011 • Capital for store growth being distorted to Lane Bryant – 5-7 new, and 10-13 relocations for Lane Bryant and Lane Bryant Outlet locations – Continue to migrate from unprofitable malls to lifestyle strip centers • Eliminating negative EBITDA stores – Generated $6 million in negative EBITDA in 2010 – 240 stores closing in 2011 (144 closed as of 10/29/11) Stores 22

www.lanebryant.com She is 35-55 years old She is a woman of many lifestyles – work, casual, active Likes to experiment with fashion She shops frequently and likes to buy clothes with good quality at a reasonable price She is brand-conscious and prefers retailers that offer fashionable choices 23

www.cacique.com Known for solutions, fit, quality, fashion and style Represents 31% of sales from the full-line Lane Bryant chain Offers key intimates categories and complementary products Introducing caciquebody 24

www.catherines.com She’s our baby-boomer, 45+ years old Classic styling with an emphasis on fit and comfort Offering styling for the woman wearing extended sizes She prefers clothing that is more appropriate for her age – she does not want to dress “younger” than she is Likes to look “put together” 25

She is 30-50 years old She is value-minded Loves the challenge of finding a great deal with coupons and store promotions that are easy to understand Likes to shop for complete outfits www.fashionbug.com 26

Investor Presentation December 2011