Exhibit 99.6

MANAGEMENT INFORMATION CIRCULAR

As at November 12, 2024

TABLE OF CONTENTS

NOTICE OF ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS | 2 |

| | |

INTRODUCTION | 1 |

| | |

Glossary of Terms | 1 |

Attendance | 1 |

Date | 1 |

Notice and Access | 1 |

Documents Incorporated by Reference | 1 |

| | |

FORWARD-LOOKING INFORMATION | 3 |

| | |

TECHNICAL INFORMATION | 4 |

| | |

REPORTING CURRENCIES AND ACCOUNTING PRINCIPLES | 5 |

| | |

NOTE TO UNITED STATES SECURITYHOLDERS | 5 |

| | |

GLOSSARY OF TERMS | 6 |

| | |

SUMMARY | 7 |

| | |

The Meeting | 7 |

The Arrangement | 8 |

Details of the Arrangement | 8 |

Reasons for the Arrangement | 10 |

Recommendation of the Foremost Board | 10 |

Conditions to Closing | 11 |

Court Approval | 12 |

Effective Date and Distribution Record Date | 13 |

Stock Exchange Listings | 13 |

Foremost Following the Arrangement | 13 |

Spinco Following the Arrangement | 14 |

Procedure for Receipt of New Foremost Shares and Spinco Shares | 14 |

Dissent Rights with Respect to the Arrangement | 14 |

Spinco Financing | 15 |

Canadian Securities Laws Matters | 15 |

U.S. Securities Laws Matters | 16 |

Certain Canadian Federal Income Tax Considerations | 16 |

Certain U.S. Federal Income Tax Considerations | 16 |

Risk Factors | 16 |

| | |

GENERAL PROXY INFORMATION | 18 |

| | |

Notice and Access | 18 |

Management Solicitation of Proxies | 18 |

Appointment of Proxy | 19 |

Voting by Proxy and Exercise of Discretion by Management Proxyholders | 20 |

Advice to Non-Registered Shareholders | 20 |

Revocation of Proxies | 21 |

Notice to Shareholders in the United States | 21 |

| | |

VOTING SECURITIES AND PRINCIPAL HOLDERS OF VOTING SECURITIES | 22 |

| | |

Record Date | 22 |

Voting Rights | 22 |

Principal Holders of Foremost Shares | 22 |

Quorum | 22 |

Required Votes | 23 |

| | |

PARTICULARS OF MATTERS TO BE ACTED UPON | 23 |

| | |

PRESENTATION OF FOREMOST FINANCIAL STATEMENTS | 23 |

| | |

APPROVAL OF FIXING THE NUMBER OF DIRECTORS | 24 |

| | |

APPROVAL OF THE ELECTION OF DIRECTORS | 24 |

| | |

APPROVAL OF THE APPOINTMENT OF AUDITOR | 28 |

| | |

APPROVAL OF THE AMENDMENT TO THE FOREMOST INCENTIVE PLAN | 28 |

| | |

Amendments Requiring Shareholder Approval at the Meeting | 28 |

| | |

APPROVAL OF THE PLAN OF ARRANGEMENT AND RELATED MATTERS | 29 |

| | |

Approval of the Arrangement Resolution | 29 |

Recommendation of the Foremost Board | 30 |

Principal Steps of the Arrangement | 30 |

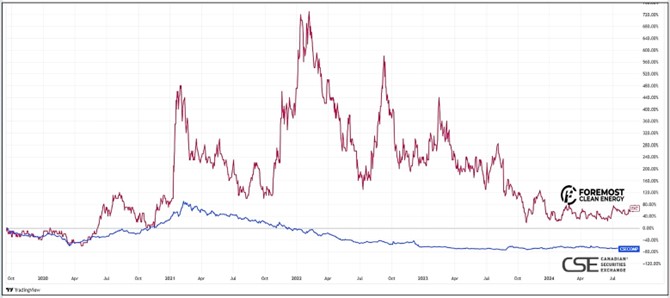

Reasons for the Arrangement | 35 |

Fairness of the Arrangement | 36 |

Authority of the Foremost Board | 36 |

Distribution of Shares | 37 |

The Arrangement Agreement | 38 |

Regulatory Approvals | 40 |

Proposed Timetable for the Arrangement | 41 |

Expenses of the Arrangement – Foremost Loan | 41 |

Risk Factors Relating to the Arrangement | 41 |

| | |

DISSENT RIGHTS | 43 |

| | |

CERTAIN SECURITIES LAW MATTERS | 46 |

| | |

Canadian Securities Laws | 47 |

U.S. Securities Laws | 48 |

| | |

CERTAIN CANADIAN FEDERAL INCOME TAX CONSIDERATIONS | 51 |

| | |

Holders Resident in Canada | 52 |

Holders Not Resident in Canada | 57 |

| | |

CERTAIN UNITED STATES FEDERAL INCOME TAX CONSIDERATIONS | 59 |

| | |

Taxation Regimes | 60 |

| | |

APPROVAL OF THE SPINCO INCENTIVE PLAN | 69 |

Summary of the Material Terms of the Spinco Incentive Plan | 69 |

| | |

OTHER MATTERS TO BE ACTED ON | 73 |

| | |

STATEMENT OF EXECUTIVE COMPENSATION | 73 |

| | |

Definitions | 73 |

Compensation Discussion and Analysis | 74 |

Director Compensation | 84 |

Additional Compensation Disclosure | 85 |

Employment, Consulting and Management Agreements | 85 |

Foremost Incentive Plan | 87 |

| | |

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS | 95 |

| | |

AUDIT COMMITTEE | 95 |

| | |

Foremost Audit Committee Charter | 95 |

Composition of Audit Committee | 95 |

Relevant Education and Experience | 96 |

Audit Committee Oversight | 97 |

Reliance on Certain Exemptions | 97 |

Pre-approval Policies and Procedures | 97 |

External Auditor Service Fees (By Category) | 98 |

| | |

CORPORATE GOVERNANCE | 98 |

| | |

General | 98 |

Board of Directors | 98 |

Directorships | 99 |

Director Attendance | 99 |

Orientation and Continuing Education | 100 |

Position Descriptions | 100 |

Ethical Business Conduct | 100 |

Nomination of Directors | 101 |

Director Compensation | 101 |

Other Board Committees | 102 |

Assessments | 102 |

| | |

INFORMATION CONCERNING FOREMOST POST-ARRANGEMENT | 102 |

| | |

INFORMATION CONCERNING SPINCO POST-ARRANGEMENT | 102 |

| | |

OTHER INFORMATION | 103 |

| | |

Indebtedness of Directors and Executive Officers | 103 |

Interest of Certain Persons or Companies in Matters to be Acted Upon | 103 |

Interest of Informed Persons in Material Transactions | 103 |

Additional Information | 103 |

| | |

APPROVAL OF THE BOARD OF DIRECTORS | 105 |

| | |

Pursuant to the terms of the Arrangement Agreement, assuming the completion of the Arrangement, as well as the successful completion of the Offering (including the full exercise of the Agent's Option) in the full amount, and the issuance of the Foremost Loan to Spinco, the Company will have approximately $10,500,250 in available cash upon completion of the Arrangement | 9 |

Prices, Markets and Marketing of Gold and Metal Prices | 62 |

Inflation | 62 |

Property Commitments | 63 |

Social and Environmental Activism | 63 |

| | |

NOTICE TO READER | 1 |

| | |

Defined Terms | 1 |

General | 1 |

Financial Information | 1 |

Currency | 1 |

| | |

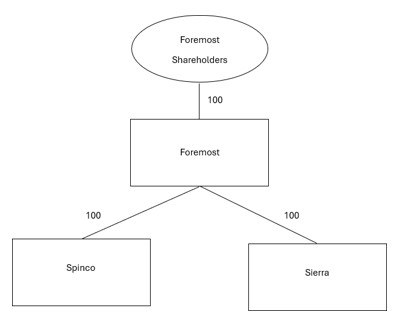

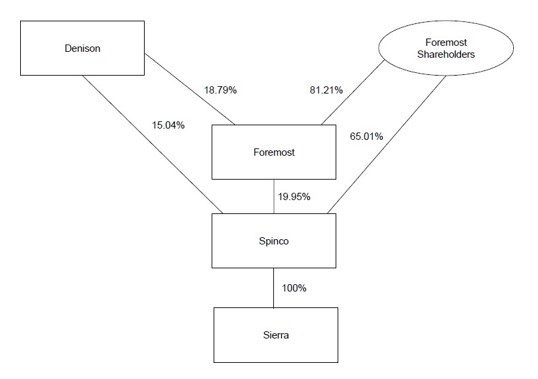

CORPORATE STRUCTURE | 1 |

| | |

Name, Address and Incorporation | 1 |

Intercorporate Relationships | 2 |

Spinco Loan | 2 |

Foremost Loan | 2 |

| | |

DESCRIPTION OF THE BUSINESS | 3 |

| | |

Overview | 3 |

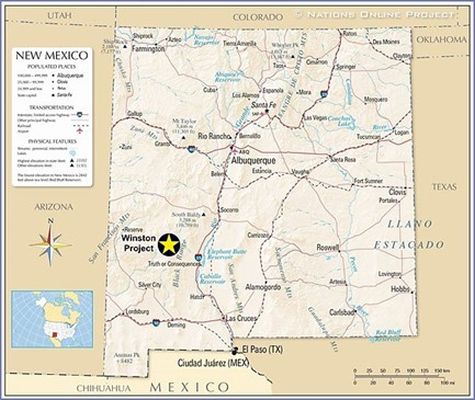

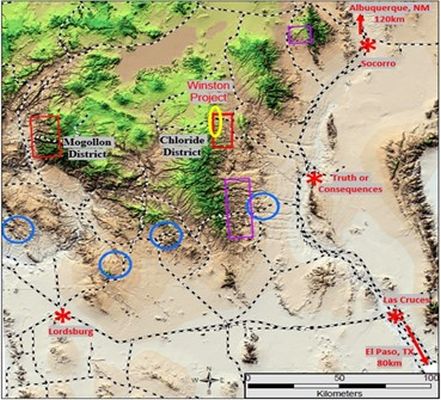

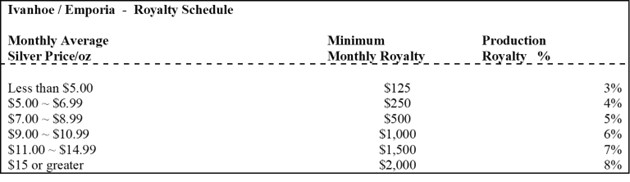

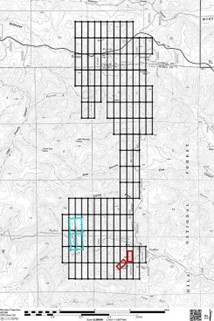

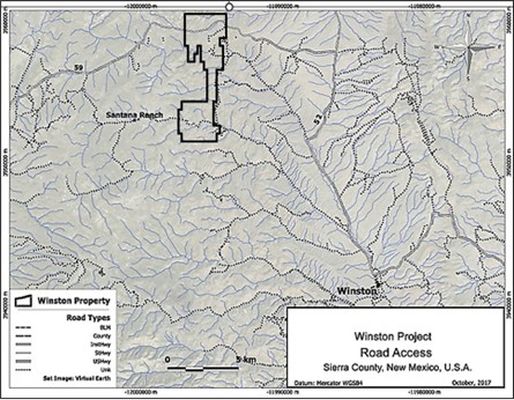

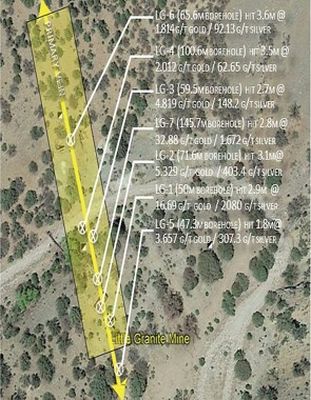

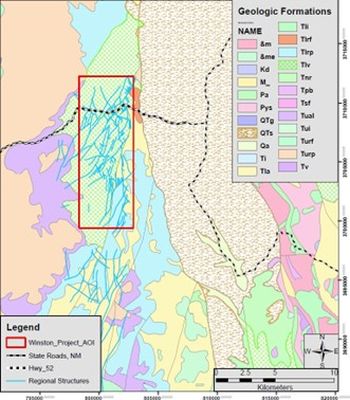

Winston Property | 3 |

Production and Operations | 3 |

Specialized Skills and Knowledge | 4 |

Competitive Conditions | 4 |

Components | 4 |

Cycles and Seasonality | 4 |

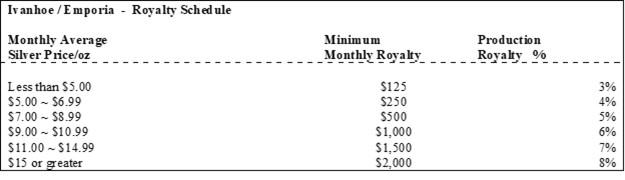

Economic Dependence and Changes to Contracts | 5 |

Employees | 5 |

Foreign Operations | 5 |

Environmental Protection | 5 |

Reorganizations | 6 |

Three Year History | 6 |

Total Available Funds | 6 |

Principal Purposes of Funds Available | 6 |

| | |

MINERAL PROPERTIES | 7 |

| | |

Winston Property | 7 |

| | |

DIVIDENDS OR DISTRIBUTIONS | 29 |

| | |

MANAGEMENT'S DISCUSSION AND ANALYSIS | 29 |

| | |

DESCRIPTION OF CAPITAL STRUCTURE | 31 |

| | |

Spinco Shares | 32 |

Spinco Financing | 32 |

Foremost Loan | 33 |

Spinco Options | 34 |

Spinco RSUs | 34 |

Share Purchase Warrants | 35 |

Spinco Incentive Plan | 35 |

CONSOLIDATED CAPITALIZATION | 35 |

| | |

Pro Forma Capitalization | 36 |

| | |

OPTIONS TO PURCHASE SECURITIES | 36 |

| | |

PRIOR SALES | 37 |

| | |

ESCROWED SECURITIES AND SECURITIES SUBJECT TO CONTRACTUAL RESTRICTION ON TRANSFER | 37 |

| | |

PRINCIPAL HOLDERS OF SPINCO SHARES | 37 |

| | |

DIRECTORS AND EXECUTIVE OFFICERS | 37 |

| | |

Cease Trade Orders, Bankruptcies, Penalties and Sanctions | 39 |

Conflicts of Interest | 40 |

| | |

INDEBTEDNESS OF DIRECTORS AND EXECUTIVE OFFICERS | 40 |

| | |

EXECUTIVE COMPENSATION | 40 |

| | |

AUDIT COMMITTEE | 41 |

| | |

Relevant Education and Experience | 41 |

| | |

CORPORATE GOVERNANCE | 42 |

| | |

RISK FACTORS | 42 |

| | |

Exploration Development and Operating Risk | 43 |

Liquidity and Additional Capital | 43 |

Profitability Cannot be Assured | 43 |

Negative Cash Flow from Operating Activities | 44 |

No Mineral Resources | 44 |

Issuance of additional Spinco Shares | 44 |

Markets for Securities | 44 |

Commodity Prices | 44 |

Government Regulation | 45 |

Environmental, Aboriginal and Permitting | 45 |

Political Regulatory Risks | 46 |

Title to Property | 46 |

Competition | 46 |

Dependence on Management and Key Personnel | 46 |

Conflicts of Interest | 47 |

Acquisition Risk | 47 |

Global Economy Risk | 47 |

Uninsured and Underinsured Risks | 47 |

Climate Change | 47 |

Risks Related to Operating in Remote Locations | 48 |

Social and Environmental Activism | 48 |

| | |

INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | 48 |

| | |

LEGAL PROCEEDINGS AND REGULATORY ACTIONS | 49 |

| | |

AUDITOR, TRANSFER AGENT AND REGISTRAR | 49 |

| | |

MATERIAL CONTRACTS | 49 |

INTERESTS OF EXPERTS | 49 |

| | |

Names of Experts | 49 |

Interests of Experts | 50 |

| | |

OTHER MATERIAL FACTS | 50 |

| | |

FINANCIAL STATEMENTS AND MANAGEMENT'S DISCUSSION AND ANALYSIS | 50 |

SCHEDULES

| Schedule "A" | - | Glossary of Terms |

| Schedule "B" | - | Arrangement Resolution |

| Schedule "C" | - | Foremost Incentive Plan, as amended |

| Schedule "D" | - | Spinco Incentive Plan |

| Schedule "E" | - | Foremost Audit Committee Charter |

| Schedule "F" | - | Plan of Arrangement |

| Schedule "G" | - | Interim Order |

| Schedule "H" | - | Notice of Hearing for Final Order |

| Schedule "I" | - | Dissent Provisions of the Business Corporations Act (British Columbia) |

| Schedule "J" | - | Information Concerning Foremost Post-Arrangement |

| Schedule "K" | - | Information Concerning Spinco Post-Arrangement |

| Schedule "L" | - | Spinco Audit Committee Charter |

| Schedule "M" | - | Spinco Financial Statements |

| Schedule "N" | - | Sierra Financial Statements and related MD&As |

| Schedule "O" | - | Spinco Pro Forma Financial Statements |

INTRODUCTION

This management information circular and the accompanying form of proxy are furnished in connection with the solicitation of proxies by the management of Foremost Clean Energy Ltd. for use at the annual general and special meeting of shareholders to be held on December 20, 2024, at 10:00 a.m. (Pacific Time) at the offices of Stikeman Elliott LLP, at 666 Burrard St Suite 1700, Vancouver, BC V6C 2X8, and any adjournment thereof, for the purposes set forth in the Notice of the Meeting.

Glossary of Terms

Unless the context requires otherwise, capitalized terms used herein and not otherwise defined shall have the meaning set form in Schedule "A" Glossary of Terms to this Circular.

Attendance

To ensure Shareholders and proxyholders are able to access the Meeting location, the Company requests Shareholders and proxyholders planning to attend the Meeting in person to pre-register. Pre-registration will enable the Company to make the necessary arrangements and provide specific access instructions.

To pre-register for attendance, please contact the meeting coordinator via email to info@foremostcleanenergy.com.

Date

The information contained in this Circular is accurate as at November 12, 2024, except as otherwise stated and except that information in documents incorporated by reference is given as of the dates noted therein.

Notice and Access

The Company is not sending the Circular or proxy-related materials in connection with the Meeting to registered Shareholders or Non-Registered Shareholders through its reliance on the "Notice and Access" provisions set out in NI 54-101. For more information on Notice and Access, see the heading "General Proxy Information - Notice and Access".

Documents Incorporated by Reference

All summaries of, and references to, the below listed documents in this Circular are qualified in their entirety by reference to the complete texts of those documents, each of which is either included as a schedule to this Circular or filed under the Company's issuer profile on SEDAR+ at www.sedarplus.ca. Shareholders are urged to carefully read the full text of these documents:

1. | the audited financial statements of Foremost as at, and for the financial years ended, March 31, 2024 and 2023, together with the auditors' report thereon and the notes thereto, being the Foremost Annual Financial Statements; |

2. | MD&A of Foremost for the financial years ended March 31, 2024 and 2023; |

3. | the unaudited condensed interim consolidated financial statements of Foremost for the three (3) months ended June 30, 2024 and 2023, together with the notes thereto, being the Foremost Interim Financial Statements; |

4. | MD&A of Foremost for the three (3) months ended June 30, 2024 and 2023; and |

5. | the Arrangement Agreement. |

Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for the purposes of this Circular to the extent that a statement contained in this Circular or in any subsequently filed document that also is or is deemed to be incorporated by reference herein modifies, replaces or supersedes such statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Circular. The modifying or superseding statement need not state that it has modified or superseded a prior statement or include any other information set forth in the document that it modifies or supersedes. The making of such a modifying or superseding statement shall not be deemed an admission for any purpose that the modified or superseded statement, when made, constituted a misrepresentation, an untrue statement of a material fact or an omission to state a material fact that is required to be stated or that is necessary to make a statement not misleading in light of the circumstances in which it was made.

The Circular contains details of matters to be considered at the Meeting. Please review the Circular before voting.

FORWARD-LOOKING INFORMATION

This Circular includes and incorporates statements that are prospective in nature that constitute forward- looking information and/or forward-looking statements within the meaning of applicable securities laws (collectively, "forward-looking statements"). Forward-looking statements include, but are not limited to, statements concerning the completion and proposed terms of, and matters relating to, the Arrangement and the expected timing related thereto; the tax treatment of the Arrangement; the expected operations, financial results and condition of Foremost and Spinco following the Arrangement; each company's future objectives and strategies to achieve those objectives; the future prospects of each company as an independent company; the listing or continued listing of Foremost and Spinco on the CSE; the listing or continued listing of Foremost on the NASDAQ; any market created for either company's shares; the estimated cash flow, capitalization and adequacy thereof for each company following the Arrangement; the expected benefits of the Arrangement to, and resulting treatment of, Shareholders and holders of convertible securities of each company; the anticipated effects of the Arrangement; the estimated costs of the Arrangement; the satisfaction of the conditions to consummate the Arrangement including Court approval and CSE approval; the completion of the Spinco Financing and the Foremost Loan; as well as other statements with respect to management's beliefs, plans, estimates and intentions, and similar statements concerning anticipated future events, results, circumstances, performance or expectations that are not historical facts. Forward-looking statements generally can be identified by the use of forward- looking terminology such as "outlook", "objective", "may", "will", "expect", "intend", "estimate", "anticipate", "believe", "should", "plans" or "continue", or similar expressions suggesting future outcomes or events.

Forward-looking statements reflect management's current beliefs, expectations and assumptions and are based on information currently available to management, management's historical experience, perception of trends and current business conditions, expected future developments and other factors which management considers appropriate. With respect to the forward-looking statements included in or incorporated into this Circular, we have made certain assumptions with respect to, among other things, the anticipated approval of the Arrangement by Shareholders and the Court; the anticipated receipt of any required regulatory approvals and consents; the expectation that each of Foremost and Spinco will comply with the terms and conditions of the Arrangement Agreement; the expectation that no event, change or other circumstance will occur that could give rise to the termination of the Arrangement Agreement; that no unforeseen changes in the legislative and operating framework for the respective businesses of Foremost and Spinco will occur; the completion of the Spinco Financing and the Foremost Loan; that each company will meet its future objectives and priorities; that each company will have access to adequate capital to fund its future projects and plans; that each company's future projects and plans will proceed as anticipated; as well as assumptions concerning general economic and industry growth rates, commodity prices, currency exchange and interest rates and competitive intensity.

Readers are cautioned not to place undue reliance on forward-looking statements, as there can be no assurance that the future circumstances, outcomes or results anticipated or implied by such forward- looking statements will occur or that plans, intentions or expectations upon which the forward-looking statements are based will occur. By their nature, forward-looking statements involve known and unknown risks and uncertainties and other factors that could cause actual results to differ materially from those contemplated by such statements. Factors that could cause such differences include, but are not limited to: conditions precedent or approvals required for the Arrangement not being obtained; the potential benefits of the Arrangement not being realized; the risk of tax liabilities as a result of the Arrangement, and general business and economic uncertainties and adverse market conditions; the potential for the trading price of New Foremost Shares (if any) after the Arrangement being less than the trading price of Foremost Shares immediately prior to the Arrangement; there being no established market for the Spinco Shares; Spinco Shares may not be "Qualified Investments" as defined in Canadian federal income tax law; Foremost's ability to delay or amend the implementation of all or part of the Arrangement or to proceed with the Arrangement even if certain consents and approvals are not obtained on a timely basis; the reduced diversity of Foremost and Spinco as separate companies; the costs related to the Arrangement that must be paid even if the Arrangement is not completed; obtaining approvals and consents, or satisfying other requirements, necessary or desirable to permit or facilitate completion of the Arrangement; global financial markets, general economic conditions, competitive business environments, and other factors that may negatively impact Foremost's financial condition; future factors that may arise making it inadvisable to proceed with, or advisable to delay, all or part of the Arrangement; and, the potential inability or unwillingness of current Shareholders to hold New Foremost Shares and/or Spinco Shares following the Arrangement.

For a further description of these and other factors that could cause actual results to differ materially from the forward-looking statements included in or incorporated into this Circular, see the risk factors discussed under "Approval of the Plan of Arrangement and Related Matters – Risk Factors Relating to the Arrangement" in this Circular and under the heading "Risk Factors" in Schedules "J" and "K", as well as the risk factors included in Foremost's management's discussion and analysis for the year ended March 31, 2024, and for the three (3) months ended June 30, 2024, as described from time to time in the reports and disclosure documents filed by Foremost with Canadian securities regulatory authorities, which are available under Foremost's profile on SEDAR+ at www.sedarplus.ca. This list is not exhaustive of the factors that may impact Foremost's forward-looking statements. These and other factors should be considered carefully and readers should not place undue reliance on Foremost's forward-looking statements. As a result of the foregoing and other factors, there can be no assurance that actual results will be consistent with these forward-looking statements.

All forward-looking statements included in or incorporated by reference into this Circular are qualified by these cautionary statements. The forward-looking statements contained herein are made as of the date of this Circular and, except as required by applicable law, neither Foremost nor Spinco undertakes any obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

Readers are cautioned that the actual results achieved will vary from the information provided herein and that such variations may be material. Consequently, there are no representations by Foremost or Spinco that actual results achieved will be the same in whole or in part as those set out in the forward-looking statements.

TECHNICAL INFORMATION

The scientific data for the Winston Property is derived from the Company's Winston Property Report, prepared by Jocelyn Pelletier, Msc, SEG-F, P.Geo and Michael N. Feinstein, CPG, PhD, both a "qualified person" under NI 43-101 and Regulation S-K 1300. Jocelyn Pelletier, Msc, SEG-F, P.Geo and Michael N. Feinstein, CPG, PhD have reviewed and approved the technical and scientific information in the Circular regarding the Winston Property. For the Zoro Property, the data is derived from the Company's Zoro Property Report, authored by Qualified Persons Mark Fedikow PHD, P.Geo and Scott Zelligan, P.Geo. Additional technical information and mineral disclosures for the Athabasca Uranium Properties and Lithium Lane Properties have been reviewed and approved by Qualified Persons Jody Dahrouge, P.Geo, Matthew Carter, P.Geo (both from Dahrouge Geological Consulting Ltd.) and Mark Fedikow, PhD, P.Geo.

REPORTING CURRENCIES AND ACCOUNTING PRINCIPLES

All dollar amounts referenced, unless otherwise indicated, are expressed in Canadian dollars.

The financial statements and historical financial information included or incorporated by reference in this Circular have been prepared based upon IFRS and are subject to Canadian auditing standards and auditor independence standards and thus are not comparable in all respects to financial statements prepared in accordance with U.S. Generally Accepted Accounting Principles (GAAP) and subject to standards of the Association of International Certified Professional Accountants. Likewise, information concerning the operations of Foremost and Spinco contained herein has been prepared based on IFRS disclosure standards, which are not comparable in all respects to U.S. disclosure standards.

NOTE TO UNITED STATES SECURITYHOLDERS

THE ARRANGEMENT AND THE SECURITIES TO BE ISSUED IN CONNECTION WITH THE ARRANGEMENT HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION ("SEC") OR THE SECURITIES REGULATORY AUTHORITIES OF ANY STATE OF THE UNITED STATES, NOR HAS THE SEC OR THE SECURITIES REGULATORY AUTHORITIES OF ANY STATE OF THE UNITED STATES PASSED UPON THE FAIRNESS OR MERITS OF THE ARRANGEMENT OR UPON THE ADEQUACY OR ACCURACY OF THIS CIRCULAR. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENCE.

The Foremost Shares and Spinco Shares, as well as the Foremost Class A Common Shares, to be issued to Shareholders in connection with the Arrangement have not been and will not be registered under the U.S. Securities Act or the securities laws of any state of the United States, and such securities are being issued in reliance upon the exemption from the registration requirements of the U.S. Securities Act provided under the Section 3(a)(10) thereto (the "Section 3(a)(10) Exemption") on the basis of the approval of the Court, which will consider, among other things, the fairness of the Arrangement to Shareholders as further described in "Certain Securities Law Matters – U.S. Securities Laws" of this Circular, and in reliance on exemptions from or qualifications under the registration requirements under any applicable securities laws of any state of the United States. The Section 3(a)(10) Exemption provides for securities issued in exchange for one or more bona fide outstanding securities, or partly in such exchange and partly for cash, where the terms and conditions of the issuance and exchange of such securities have been approved by a court authorized to grant such approval after a hearing upon the fairness of the terms and conditions of the issuance and exchange at which all persons to whom the securities will be issued have the right to appear and have received adequate notice thereof. All Shareholders who will receive shares in connection with the Arrangement are entitled to appear and be heard at the fairness hearing to be held by the Court prior to granting the Final Order. For further information about how to appear and be heard at the fairness hearing, see "Approval of the Plan of Arrangement and Related Matters – The Arrangement Agreement – Court Approval of the Arrangement" in this Circular. Prior to the hearing on the Final Order, the Court will be informed of the Parties' intended reliance on the Final Order as the basis for the Section 3(a)(10) Exemption.

The U.S. Securities Act imposes restrictions on the resale of Foremost Shares received pursuant to the Arrangement by persons who will be "affiliates" of Foremost after the Effective Time or who have been "affiliates" of Foremost within ninety (90) days of the Effective Time. The U.S. Securities Act also imposes restrictions on the resale of Spinco Shares received pursuant to the Arrangement by persons who will be "affiliates" of Spinco after the Effective Time or who have been "affiliates" of Spinco or Foremost within ninety (90) days of the Effective Time.

As used in this Circular, as it relates to Foremost and Spinco, the information concerning mineral properties has been prepared in accordance with NI 43-101 and the Canadian Institute of Mining ("CIM") Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended. These requirements differ in material respects from the requirements of the SEC set forth in Regulation S-K 1300. Accordingly, the disclosure in this Circular regarding mineral properties may differ materially from the information that would be disclosed by a U.S. company subject to Regulation S-K 1300.

Shareholders in the United States should be aware that the Arrangement described in this Circular may have tax consequences in both the United States and Canada. Such consequences for such securityholders are not described herein. For a general discussion of the Canadian federal income tax consequences to Shareholders who are not resident in Canada, see "Certain Canadian Federal Income Tax Considerations – Holders Not Resident in Canada". Shareholders in the United States are urged to consult their own tax advisors to determine the particular Canadian and United States tax consequences to them of the Arrangement in light of their particular situation, as well as any tax consequences that may arise under the laws of any other relevant foreign, state, local, or other taxing jurisdiction.

The enforcement by Shareholders of civil liabilities under applicable U.S. securities laws may be affected adversely by the fact that the Parties are incorporated or organized outside the United States, that some of their respective directors and officers and the experts named in this Circular are not residents of the United States and that all or a substantial portion of the assets of the Parties and of said persons are located outside the United States. As a result, securityholders in the United States may be unable to effect service of process within the United States upon certain officers and directors or the experts named herein, or to realize against them upon judgments of courts of the United States predicated upon civil liabilities under the federal securities laws of the United States or any applicable securities laws of any state of the United States. In addition, Securityholders in the United States should not assume that the courts of Canada: (a) would enforce judgments of United States courts obtained in actions against such persons predicated upon civil liabilities under the federal securities laws of the United States or any applicable securities laws of any state of the United States; or (b) would enforce, in original actions, liabilities against such persons predicated upon civil liabilities under the federal securities laws of the United States or any applicable securities laws of any state of the United States.

GLOSSARY OF TERMS

The Glossary of Terms is set forth in Schedule "A" to this Circular.

SUMMARY

The following is a summary of the principal features of the Arrangement and certain other matters and should be read together with the more detailed information and financial statements contained elsewhere or incorporated by reference in this Circular, including the schedules hereto. Capitalized terms not otherwise defined in this summary are defined in the Glossary of Terms attached as Schedule "A" to this Circular. This summary is qualified in its entirety by the more detailed information appearing or referred to elsewhere in this Circular.

The Meeting

Foremost has fixed October 24, 2024, as the Record Date for determining the Shareholders entitled to receive notice of and vote at the Meeting. The Meeting will be held on December 20, 2024, at 10:00 a.m. (Pacific Time) at the offices of Stikeman Elliott LLP, at 666 Burrard St Suite 1700, Vancouver, BC V6C 2X8, and any adjournment thereof, for the purposes set forth in the Notice of the Meeting.

At the Meeting, Shareholders will be asked to consider the following matters:

| | (a) | to receive the audited financial statements of the Company for the year ended March 31, 2024, and the report of the auditor thereon; |

| | (b) | to fix the number of directors to be elected at the Meeting at six (6); |

| | (c) | to elect six (6) directors of the Company to hold office until the next annual meeting of the Shareholders; |

| | (d) | to appoint MNP LLP, as auditor of the Company for the ensuing year and to authorize the directors of the Company to fix the remuneration to be paid to the auditor; |

| | (e) | to consider and, if deemed advisable, to pass, with or without variation, an ordinary resolution to approve the amendment to the Foremost Incentive Plan; |

| | (f) | to consider and, if deemed advisable, to pass, with or without variation, the Arrangement Resolution; and |

| | (g) | subject to the approval of the Arrangement Resolution, to consider and, if deemed advisable, to pass, with or without variation, an ordinary resolution to approve the Spinco Incentive Plan. |

By passing the Arrangement Resolution, Shareholders will also be giving authority to the Foremost Board to use its best judgment to proceed with and cause Foremost to complete the Arrangement in the event of any variation of, or amendments to, the Arrangement Agreement or Plan of Arrangement without any requirement to seek or obtain any further approval of the shareholders.

For further information on voting Foremost Shares at the Meeting, see the sections entitled "General Proxy Information" and "Voting Securities and Principal Holders of Voting Securities – Voting Rights" "in this Circular.

The Arrangement

The Arrangement will be completed by way of plan of arrangement pursuant to Section 288 of the BCBCA involving Foremost and the securityholders of Foremost and Spinco. The disclosure of the principal features of the Arrangement, as summarized below, is qualified in its entirety by reference to the full text of the Arrangement Agreement, which is incorporated by reference and available on the Company's SEDAR+ profile at www.sedarplus.ca.

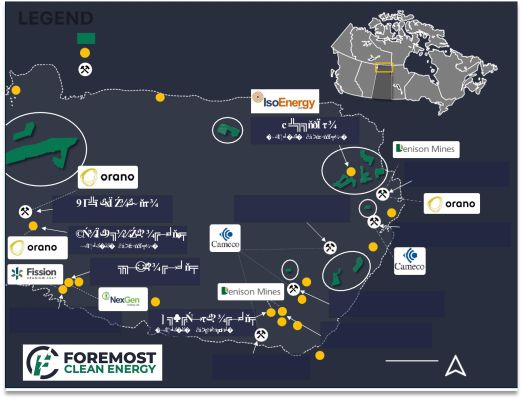

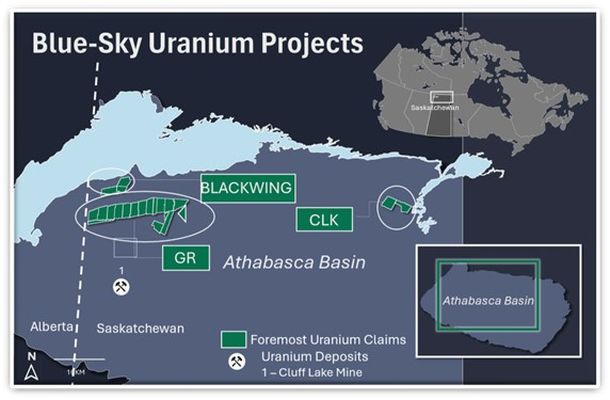

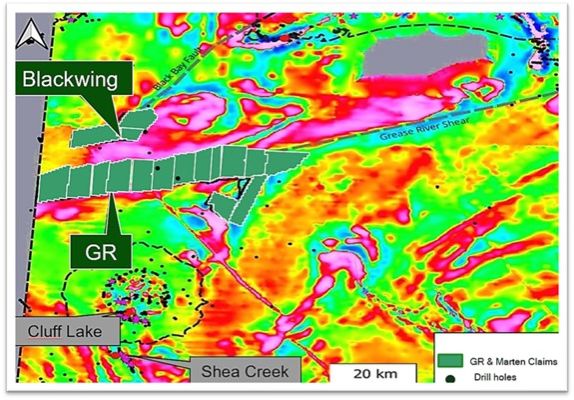

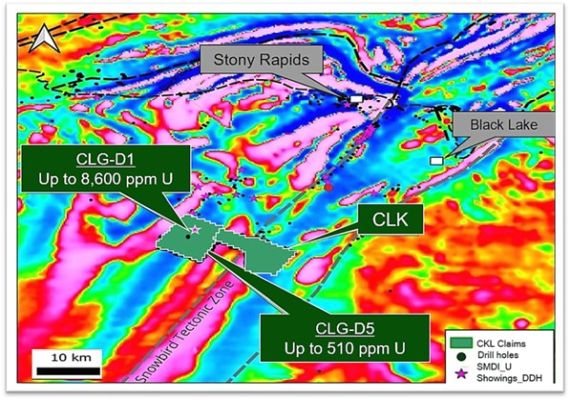

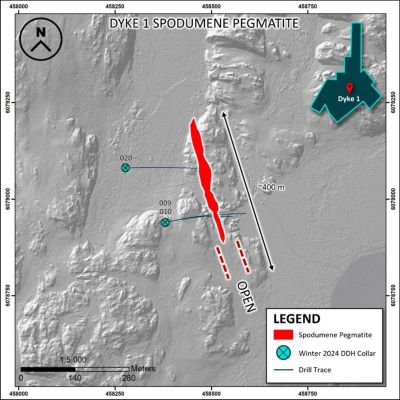

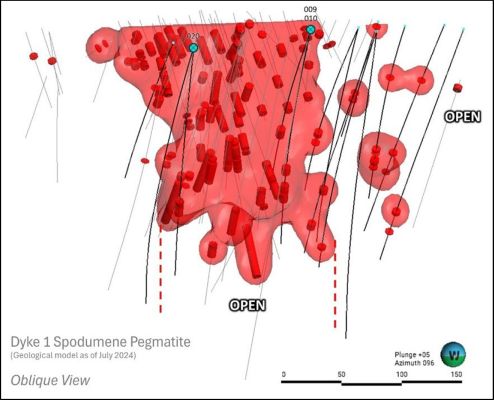

The purpose of the Arrangement and the related transactions is to reorganize Foremost into two (2) separate companies: (i) Foremost, a publicly traded emerging exploration company focused on the advancement of the Athabasca Uranium Properties in Saskatchewan and its secondary portfolio of significant lithium projects, being the Lithium Lane Properties and the Lac Simard South Property, in Manitoba and Quebec, respectively, and (ii) Spinco, a publicly traded gold and silver exploration company focused exclusively on the advancement of the Winston Property. Upon completion of the Arrangement, Shareholders (other than Dissenting Shareholders) will hold the outstanding New Foremost Shares and Spinco Shares in proportion to their holdings of Foremost Shares at the Effective Time.

Details of the Arrangement

The following is a summary of the principal steps of the Arrangement:

| | (a) | Each Dissenting Share will be directly transferred and assigned by such Dissenting Shareholder to Foremost, without any further act or formality and free and clear of any encumbrances and such Dissenting Share will be cancelled and cease to be outstanding. |

| | (b) | Foremost will (i) transfer to Spinco the right to collect receivables in respect of all amounts outstanding and owing from Sierra to Foremost as at the Effective Date, and (ii) assign and transfer to Spinco the Sierra Shares in consideration for Spinco issuing to Foremost such number of Spinco Shares as is equal to the quotient obtained by dividing by 0.8005 the product obtained by multiplying the number of Foremost Shares issued and outstanding immediately prior to the Effective Time by two (2). |

| | (c) | The authorized share capital of Foremost and the Foremost Articles will be amended by: |

| | (a) | Renaming and redesignating all of the issued and unissued Foremost Shares as Foremost Class A Common Shares, and amending the special rights and restrictions attached thereto to provide the holders thereof with two (2) votes for each Foremost Class A Common Share and, concurrently therewith, the Foremost Class A Common Shares will be represented for listing purposes on the CSE by the continued listing of the Foremost Shares; and |

| | (b) | Creating a new class of shares consisting of an unlimited number of New Foremost Shares, which shares shall be unlimited in number and have special rights and restrictions identical to those of the Foremost Shares immediately prior to the Effective Date. |

| | (d) | Foremost's Notice of Articles will be amended to reflect the First Amendment. |

| | (e) | The Spinco Incentive Plan will come into force and effect. |

| | (f) | Each Foremost Option then outstanding to acquire one (1) Foremost Share shall be deemed to be simultaneously surrendered and transferred by the holder thereof in the following portions: |

| | (a) | 0.9136 of each Foremost Option held immediately prior to the Effective Time will be transferred and exchanged for one (1) Foremost Replacement Option entitling the holder thereof to acquire one (1) Foremost Share having an exercise price (rounded up to the nearest cent) as determined in accordance with the Plan of Arrangement; and |

| | (b) | 0.0864 of each Foremost Option held immediately prior to the Effective Time will be transferred and exchanged for two (2) Spinco Options, with each whole Spinco Option entitling the holder thereof to acquire one (1) Spinco Share having an exercise price (rounded up to the nearest cent) as determined in accordance with the Plan of Arrangement. |

| | (g) | Each Foremost RSU held immediately prior to the Effective Time will be deemed to be simultaneously surrendered and transferred by the holder thereof in the following portions: |

| | (a) | 0.9136 of each Foremost RSU held immediately prior to the Effective Time shall be transferred and exchanged for one (1) Foremost Replacement RSU to acquire such number of New Foremost Shares and on such vesting and other conditions as set forth in the applicable award agreement in respect of such Foremost RSU; and |

| | (b) | 0.0864 of each Foremost RSU held by a Foremost RSU holder immediately prior to the Effective Time shall be transferred and exchanged for two (2) Spinco RSUs to acquire such number of Spinco Shares and on such vesting and other conditions as set forth in the applicable award agreement in respect of such Foremost RSU. |

| | (h) | Each issued and outstanding Foremost Class A Common Share outstanding immediately following the First Amendment will be surrendered and transferred by the holder thereof to Foremost in exchange for one (1) New Foremost Share and two (2) Spinco Shares held by Foremost (subject to any withholding of Spinco Shares required to be made pursuant to the Plan of Arrangement). |

| | (i) | Following the exchange of Foremost Class A Common Shares, the Foremost Class A Common Shares will be cancelled and the authorized share structure and Foremost Articles will be amended by eliminating the Foremost Class A Common Shares. |

| | (j) | Concurrently with the exchange of Foremost Options and Foremost RSUs, all outstanding Foremost Warrants will be deemed to be simultaneously amended to entitle each holder thereof to receive, upon due exercise of the Foremost Warrant for the original exercise price, one (1) New Foremost Share and two (2) Spinco Shares. |

See further details under the section entitled "Approval of the Plan of Arrangement and Related Matters – Principal Steps of the Arrangement".

Reasons for the Arrangement

The Foremost Board believes that the creation of two (2) separate companies: (i) Foremost, a publicly traded emerging exploration company focused on the advancement of the Athabasca Uranium Properties and its secondary portfolio of significant lithium projects being the Lithium Lane Properties and the Lac Simard South Property, in Manitoba and Quebec, respectively, and (ii) Spinco, a publicly traded gold and silver company focused on the advancement of the Winston Property, will provide a number of benefits to Foremost, Spinco and the securityholders of Foremost, including:

| | ● | providing Shareholders with enhanced value by creating independent investment opportunities in separate project focused companies; |

| | ● | expanding Spinco's shareholder base by allowing investors that want specific ownership in a particular resource portfolio to invest directly rather than through Foremost; |

| | ● | unlocking the value of Foremost's Winston Property, which is not fairly valued in the Foremost portfolio; |

| | ● | enabling investors, analysts and other stakeholders or potential stakeholders to more accurately evaluate each company and compare the assets to appropriate peers; |

| | ● | retaining Shareholders' existing pro rata ownership of Foremost and providing Shareholders' with pro rata ownership of Spinco (subject to the Foremost Retained Interest) to ensure that existing Shareholders retain upside potential as the Winston Property is advanced; |

| | ● | providing each company with a sharper business focus, enabling them to pursue independent business and financing strategies best suited to their respective business plans; |

| | ● | enabling each company to pursue independent growth and capital allocation strategies; and |

| | ● | allowing each company to be led by experienced executives and directors who have experience exploring resource properties. |

See further details under the section entitled "Approval of the Plan of Arrangement and Related Matters – Reasons for the Arrangement".

Recommendation of the Foremost Board

The Foremost Board, having reviewed the Plan of Arrangement and related transactions and considered, among other things, the reasons for the Arrangement, has unanimously determined that the Arrangement is in the best interests of Foremost and is fair to the Shareholders. The Foremost Board has unanimously approved the Arrangement, and the transactions contemplated thereby, and unanimously recommends that Shareholders vote FOR the Arrangement Resolution.

The Arrangement was determined by the Foremost Board to be in the best interests of Foremost and fair to the Shareholders based upon the following factors, among others:

| | (a) | the procedures by which the Arrangement will be approved, including the requirement for (i) approval at the Meeting by at least 66⅔% of the votes cast by Shareholders in person or by proxy and (ii) approval by the Court after a hearing at which the fairness of the Arrangement will be considered; |

| | (b) | each Shareholder at the Effective Time (other than Dissenting Shareholders) will participate in the Arrangement such that each Shareholder will hold, upon completion of the Arrangement, the same pro rata interest in Foremost that such Shareholder held in Foremost immediately prior to the Arrangement, and will receive pro rata ownership of Spinco (subject to the Foremost Retained Interest); |

| | (c) | each holder of Foremost Options at the Effective Time will receive the same proportionate value in Foremost and Spinco collectively upon exercise that such securityholder would have received in Foremost immediately prior to the Arrangement; |

| | (d) | each holder of Foremost RSUs at the Effective Time will receive the same value in Foremost and Spinco collectively upon redemption that such securityholder would have received in Foremost immediately prior to the Arrangement; and |

| | (e) | each holder of Foremost Warrants at the Effective Time will receive the same proportionate value in Foremost and Spinco collectively upon exercise that such warrant securityholder would have received in Foremost immediately prior to the Arrangement; |

| | (f) | the opportunity for registered Shareholders who are opposed to the Arrangement, upon compliance with certain conditions, to exercise Dissent Rights under the BCBCA, as modified by the Interim Order, Plan or Arrangement or any other order of the Court. |

See further details under the section entitled "Approval of the Plan of Arrangement and Related Matters – Fairness of the Arrangement".

Conditions to Closing

The Arrangement will be subject to the satisfaction or waiver, as applicable, of certain conditions, including the following:

| | (a) | the Interim Order shall have been granted in a form and substance satisfactory to each of Foremost and Spinco; |

| | (b) | the Arrangement Resolution, with or without amendment, shall have been approved and adopted at the Meeting in accordance with the provisions of the BCBCA, the Interim Order, and the requirements of any applicable regulatory authorities; |

| | (c) | the Final Order shall have been obtained in a form and substance satisfactory to each of Foremost and Spinco; |

| | (d) | the CSE, and if required, the NASDAQ, shall have conditionally approved (i) the Arrangement, including the listing of the New Foremost Shares issuable to Shareholders under the Plan of Arrangement in exchange for the Foremost Class A Common Shares, and (ii) the delisting of the Foremost Class A Common Shares, as of the Effective Date, subject to compliance with the requirements of the CSE and/or the NASDAQ, as applicable; |

| | (e) | the CSE shall have conditionally approved the listing of the Spinco Shares, subject to compliance with the requirements of the CSE; |

| | (f) | the Spinco Financing shall have been completed; |

| | (g) | the issuance of the Spinco Promissory Note; |

| | (h) | the issuance of the Foremost Loan; |

| | (i) | the issuance of the Foremost Promissory Note; |

| | (j) | if requested by Foremost, Foremost and Spinco shall have jointly made and filed the election in the prescribed form and manner pursuant to Section 85(1) of the Tax Act prior to the Effective Time; |

| | (k) | all other consents, orders, regulations and approvals, including regulatory and judicial approvals and orders required or necessary or desirable for the completion of the transactions provided for in the Arrangement Agreement and the Plan of Arrangement shall have been obtained or received from the persons, authorities or bodies having jurisdiction in the circumstances, each in a form acceptable to Foremost and Spinco; |

| | (l) | there shall not be in force any order or decree restraining or enjoining the consummation of the transactions contemplated by the Arrangement Agreement and the Plan of Arrangement; |

| | (m) | no law, regulation or policy shall have been proposed, enacted, promulgated or applied which interferes or is inconsistent with the completion of the Arrangement and Plan of Arrangement, including any material change to the income tax laws of Canada, which would reasonably be expected to have a Material Adverse Effect on any of Foremost, the Shareholders, or if the Arrangement is completed, Spinco or the Spinco Shareholders; |

| | (n) | the aggregate number of Foremost Shares held, directly or indirectly, by those holders of such shares who have validly exercised Dissent Rights and not withdrawn such exercise in connection with the Arrangement shall not exceed 5% of the aggregate number of Foremost Shares outstanding immediately prior to the Effective Time; |

| | (o) | the issuance of the securities under the Plan of Arrangement shall be exempt from registration under Section 3(a)(1) of the U.S. Securities Act; and |

| | (p) | the Arrangement Agreement shall not have been terminated under Article 6 thereof. |

Court Approval

An arrangement under the BCBCA requires approval of the Court. Prior to mailing this Circular, Foremost obtained the Interim Order, which provides for the calling and holding of the Meeting, Dissent Rights and certain other procedural matters. A copy of the Interim Order is attached as Schedule "G" to this Circular.

Subject to the approval of the Arrangement Resolution by Shareholders at the Meeting, Foremost intends to make an application to the Court for the Final Order on January 10, 2025 at 9:45 a.m. (Pacific Time) or as soon thereafter as counsel may be heard at the Court house at 800 Smithe Street, Vancouver, BC or at any other date and time as the Court may direct. At the hearing, any Shareholder or other interested party who wishes to participate or be represented or present arguments or evidence must file and serve a response to petition no later than 4:00 p.m. (Pacific Time) on January 8, 2025 along with any other documents required, all as set out in the Interim Order and Notice of Hearing for Final Order, copies of which are attached as Schedule "G" and "H", respectively, and satisfy any other requirement of the Court.

The Court may approve the Arrangement either as proposed or as amended in any manner the Court may direct, and subject to compliance with such terms and conditions, if any, as the Court sees fit.

See further details under the section entitled "Approval of the Plan of Arrangement and Related Matters – The Arrangement Agreement – Court Approval of the Arrangement".

Effective Date and Distribution Record Date

Upon receipt of the Final Order, Foremost will announce by news release the proposed Effective Date of the Arrangement, which is expected to be on or about January 10, 2025. The Distribution Record Date of the Arrangement is expected to be the Business Day prior to the Effective Date.

Stock Exchange Listings

The Foremost Shares are currently listed and traded on the CSE under the symbol "FAT" and on the NASDAQ in the United States under the symbol "FMST" and will continue to be listed on both stock exchanges following the Arrangement, subject to required listing approvals.

Approval from the CSE and NASDAQ is required for the completion of the Arrangement. Upon completion of the Arrangement, it is expected that Spinco will be a reporting issuer in British Columbia, Alberta, and Ontario. Spinco has also made an application to list the Spinco Shares on the CSE following completion of the Arrangement. Any listing will be subject to the approval of the CSE. There can be no assurances that Spinco will be able to attain a listing on the CSE or any other stock exchange.

Shareholders should be aware that certain of the foregoing approvals, including a listing on the CSE or a determination that Spinco will be a reporting issuer in the specified jurisdictions, have not yet been received from the applicable regulatory authorities. There is no assurance that such approvals will be obtained.

Foremost Following the Arrangement

Upon completion of the Arrangement, Foremost will be an exploration company focused on the advancement of the Athabasca Uranium Properties in Saskatchewan, and its secondary portfolio of significant lithium projects, being the Lithium Lane Properties and the Lac Simard South Property, in Manitoba and Quebec, respectively.

For a more detailed description of Foremost following the completion of the Arrangement, see Schedule "J" to this Circular.

Spinco Following the Arrangement

Upon completion of the Arrangement, Spinco will own 100% of the Sierra Shares. As Sierra owns the Winston Property, Spinco will thereby indirectly control the Winston Property and will concentrate its activities on the exploration and development of the Winston Property.

For a more detailed description of Spinco following the completion of the Arrangement, see Schedule "K" to this Circular, and for the Spinco Financial Statements, the Sierra Financial Statements and related MD&As, and the Spinco Pro Forma Financial Statements, see Schedules "M", "N" and "O", respectively, to this Circular.

Procedure for Receipt of New Foremost Shares and Spinco Shares

Shareholders on the Effective Date will be entitled to receive New Foremost Shares and Spinco Shares pursuant to the Arrangement.

Upon request, the Depositary will provide to registered Shareholders a Letter of Transmittal containing instructions with respect to the deposit of certificates for Foremost Shares for use in exchanging their Foremost Shares for DRS Statements representing New Foremost Shares and Spinco Shares, to which they are entitled under the Arrangement.

Until exchanged, each certificate representing Foremost Shares will, after the Effective Time, represent only the right to receive, upon surrender, New Foremost Shares and Spinco Shares. Any fractional shares issuable pursuant to the Arrangement will be rounded down to the nearest whole number without any compensation in lieu thereof.

Shareholders who fail to submit their certificates representing Foremost Shares together with a duly completed Letter of Transmittal and any other documents required by the Depositary on or before the sixth (6th) anniversary of the Effective Date will cease to have any right or claim against or interest of any kind or nature in Foremost or Spinco. Accordingly, persons who tender certificates for Foremost Shares after the sixth (6th) anniversary of the Effective Date will not receive any New Foremost Shares or Spinco Shares, will not own any interest in Foremost or Spinco and will not be paid any cash or other compensation in lieu thereof.

Dissent Rights with Respect to the Arrangement

The Interim Order provides that each registered Shareholder may exercise Dissent Rights in accordance with Sections 237 to 247 of the BCBCA as modified by the Interim Order, Plan or Arrangement or any other order of the Court. Each Dissenting Shareholder is entitled to be paid the fair value of all, but not less than all, of the holder's Foremost Shares, provided that the holder duly dissents to the Arrangement Resolution and the Arrangement becomes effective.

To exercise Dissent Rights, registered Shareholders must provide written notice to Foremost, c/o Stikeman Elliott LLP, 666 Burrard St Suite 1700, , Vancouver, BC V6C 2X8, Attention: Ben Schach at or before 10:00 a.m. (Pacific Time) on December 18, 2024 (or on the Business Day that is two (2) Business Days immediately preceding any adjourned or postponed Meeting) in the manner described under the heading "Dissent Rights" in the Circular. If a registered Shareholder exercises Dissent Rights in strict compliance with the BCBCA and Interim Order and the Arrangement is completed, such Dissenting Shareholder is entitled to be paid the "fair value" of the Foremost Shares with respect to which Dissent Rights were exercised, as calculated immediately before the passing of the Arrangement Resolution. Only registered Shareholders are entitled to exercise Dissent Rights. Non-Registered Shareholders who wish to exercise Dissent Rights must cause each registered Shareholder holding their Foremost Shares to deliver the required notice of dissent or, alternatively, make arrangements to become registered Shareholders. Shareholders should carefully read the section of this Circular entitled "Dissent Rights" and consult with their advisors if they wish to exercise Dissent Rights. Any failure to fully comply with the provisions of the BCBCA, as modified by the Interim Order, Plan or Arrangement or any other order of the Court, may result in a loss of that Shareholder's Dissent Rights.

For the avoidance of doubt, no registered Shareholder will be paid fair value for such registered Shareholder's Foremost Shares more than once pursuant to the exercise of Dissent Rights.

Spinco Financing

As a condition to completion of the Arrangement, Christina Barnard and Jason Barnard, current Shareholders, shall issue to Spinco the Spinco Loan, being a secured loan in the amount of $677,450 (being the "Spinco Financing"). The Spinco Financing is evidenced by the Spinco Promissory Note dated November 5, 2024 issued by Spinco to Christina Barnard and Jason Barnard, which is due and payable in full on November 5, 2027, and which bears interest at a rate of eight-point-nine-five percent (8.95)% per year.

See further details on the Spinco Financing sections entitled "Description of Capital Structure – Spinco Financing" in Schedule "K" of this Circular.

Canadian Securities Laws Matters

Foremost is a reporting issuer in British Columbia, Alberta, and Ontario. The Foremost Shares currently trade on the CSE under the symbol "FAT" in Canada and on the NASDAQ in the United States under the symbol "FMST".

Following completion of the Arrangement, it is anticipated that Foremost and Spinco will be reporting issuer in British Columbia, Alberta and Ontario.

Foremost is currently subject to applicable securities laws in Canada, including MI 61-101 and NI 45-102.

The distribution of the Spinco Shares pursuant to the Arrangement will constitute a distribution of securities which is exempt from prospectus requirements of Canadian securities legislation. With certain exceptions, the Spinco Shares may generally be resold in each of the provinces of Canada provided the trade is not a "control distribution" as defined in NI 45-102, no unusual effort is made to prepare the market or create a demand for those securities, no extraordinary commission or consideration is paid to a person or company in respect of the trade and, if the selling security holder is an insider or officer of Spinco, the insider or officer has no reasonable grounds to believe that Spinco is in default of securities legislation.

Additionally, the Company is subject to MI 61-101, which is intended to regulate certain transactions between a corporation and related parties, generally by requiring enhanced disclosure, approval by a majority of shareholders excluding interested or related parties and, in certain instances, independent valuations and approval and oversight of the transaction by a special committee of independent directors.

As the Arrangement is considered a "downstream transaction" for the purposes of MI 61-101, it is exempt from such minority approval and formal valuation requirements.

See further details under the section entitled "Certain Securities Law Matters – Canadian Securities Laws".

U.S. Securities Laws Matters

The New Foremost Shares and Spinco Shares to be issued to Shareholders and the Foremost Replacement Options and Spinco Options to be issued to holders of Foremost Options, in each case pursuant to the Arrangement, will not be registered under the U.S. Securities Act or the securities laws of any state of the United States and will be issued and distributed in reliance upon the Section 3(a)(10) Exemption and available exemptions from applicable state registration requirements. Such securities issued to Shareholders pursuant to the Arrangement will generally not be subject to resale restrictions under U.S. federal securities laws for persons who are not affiliates of Foremost or Spinco following the Arrangement or within ninety (90) days prior to the Arrangement. The Section 3(a)(10) Exemption for the issuance of the Foremost Replacement Options and Spinco Options does not exempt the issuance of securities upon the exercises of such options, and New Foremost Shares and Spinco Shares issuable upon the exercise of Foremost Replacement Options and Spinco Options, respectively, may be issued only pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the U.S. Securities Act and applicable securities laws of any state of the United States or following registration under such laws, if any.

See further details under the section entitled "Certain Securities Law Matters – U.S. Securities Laws".

Certain Canadian Federal Income Tax Considerations

A summary of certain Canadian federal income tax considerations for Shareholders who participate in the Arrangement is set out in this Circular under the heading "Certain Canadian Federal Income Tax Considerations".

Shareholders should carefully review the tax considerations applicable to them under the Arrangement and are urged to consult their own legal, tax and financial advisors in regard to their particular circumstances.

Certain U.S. Federal Income Tax Considerations

A summary of certain United States federal income tax considerations for Shareholders who participate in the Arrangement is set out under the heading "Certain United States Federal Income Tax Considerations".

Shareholders should carefully review the tax considerations applicable to them under the Arrangement and are urged to consult their own legal, tax and financial advisors in regard to their particular circumstances.

Risk Factors

The securities of Foremost and Spinco should be considered highly speculative investments and the transactions contemplated herein should be considered of a high-risk nature. Shareholders should carefully consider all of the information disclosed in this Circular prior to voting on the matters being put before them at the Meeting.

Shareholders should be aware that there are various known and unknown risk factors in connection with the Arrangement and the ownership of New Foremost Shares and Spinco Shares following the completion of the Arrangement. Shareholders should carefully consider the risks identified in this Circular under the heading "Approval of the Plan of Arrangement and Related Matters – Risk Factors Relating to the Arrangement" and under the heading "Risk Factors" in Schedules "J" and "K", as well as within the documents incorporated by reference, before deciding whether or not to approve the Arrangement Resolution.

GENERAL PROXY INFORMATION

Notice and Access

Notice-and-Access means provisions concerning the delivery of proxy-related materials to shareholders found in Section 9.1.1. of NI 51-102 in the case of registered Shareholders, and Section 2.7.1 of NI 54-101 in the case of Non-Registered Shareholders, which allow an issuer to deliver an information circular forming part of proxy-related materials to shareholders via certain specified electronic means provided that the conditions of NI 51-102 and NI 54-101 are met (collectively, the "Notice-and-Access Provisions").

In order to rely on Notice-and-Access Provisions to deliver the Circular and proxy-related materials through the Company's website, the Company must send a notice to Shareholders, including Non- Registered Shareholders, indicating that the Circular and proxy-related materials have been posted on the website and explaining how a Shareholder can access them or obtain from the Company a paper copy of the Circular. This Circular has been posted in full on the Company's website at https://www.foremostcleanenergy.com/investors/shareholder-meeting.html and is also available for viewing under the Company's SEDAR+ profile at www.sedarplus.ca.

In order to use Notice-and-Access Provisions, a reporting issuer must set the record date for notice (the "Notice-and-Access Notification") of the meeting to be on a date that is at least thirty (30) days prior to the meeting in order to ensure there is sufficient time for the circular to be posted on the applicable website and other materials to be delivered to shareholders. The Notice-and-Access Notification has been delivered to Shareholders by the Company along with the applicable voting document (a form of proxy in the case of registered Shareholders or a VIF in the case of Non-Registered Shareholders). The Company will not rely upon the use of 'stratification'. Stratification occurs when a reporting issuer using the Notice- and-Access Provisions provides a paper copy of its information circular with the notice to be provided to shareholders as described above. In relation to the Meeting, all Shareholders will receive the required documentation under the Notice-and-Access Provisions and all documents required to vote in respect of all matters to be voted on at the Meeting. No Shareholder will receive a paper copy of the Circular from the Company or any Intermediary (as defined herein) unless such Shareholder specifically requests the same.

This Circular is available for review at https://www.foremostcleanenergy.com/investors/shareholder- meeting.html, being the website address to the Company's annual general meeting page. Any Shareholder who wishes to obtain a paper copy of the Circular should contact the Company, at 750 West Pender St Suite 250, Vancouver, BC V6C 2T7, by phone at 604-330-8067 or through email at info@foremostcleanenergy.com. A Shareholder may also use the number noted above to obtain additional information about Notice-and-Access Provisions. To ensure that a paper copy of the Circular can be delivered to a requesting Shareholder in time for them to review the Circular and return a Proxy or VIF prior to the proxy deadline, it is strongly suggested such Shareholder's' request is received by the Company by no later than December 10, 2024.

Management Solicitation of Proxies

It is expected that the solicitation of proxies by the management of the Company will be conducted primarily by mail and may be supplemented by telephone or other personal contact to be made without special compensation by the directors, officers and employees of the Company. The Company does not reimburse Shareholders, nominees or agents for costs incurred in obtaining from their principals' authorization to execute forms of proxy, except that the Company has requested brokers and nominees who hold stock in their respective names to furnish this proxy material to their customers, and the Company will reimburse such brokers and nominees for their related out-of-pocket expenses. No solicitation will be made by specifically engaged employees or soliciting agents. The cost of solicitation will be borne by the Company.

No person has been authorized to give any information or to make any representation other than as contained in this Circular in connection with the solicitation of proxies. If given or made, such information or representations must not be relied upon as having been authorized by the Company. The delivery of this Circular shall not create, under any circumstances, any implication that there has been no change in the information set forth herein since the date of this Circular. This Circular does not constitute the solicitation of a proxy by anyone in any jurisdiction in which such solicitation is not authorized, or in which the person making such solicitation is not qualified to do so, or to anyone to whom it is unlawful to make such an offer of solicitation.

Appointment of Proxy

Only registered Shareholders or duly appointed proxyholders are permitted to vote at the Meeting. A registered Shareholder is entitled to one (1) vote for each Foremost Share that such registered Shareholder holds on the Record Date. Please read and follow the instructions on the form of proxy carefully and return by 10:00 a.m. (Pacific Time), on December 18, 2024, or the day that is two (2) Business days immediately preceding the date of any adjourned or postponed Meeting. The Company may refuse to recognize any instrument of proxy deposited in writing or by the internet received later than fourty eight (48) hours (excluding Saturdays, Sundays and statutory holidays in British Columbia) prior to the Meeting or any adjournment thereof.

The purpose of a proxy is to designate persons who will vote the proxy on a registered Shareholder's behalf in accordance with the instructions given by the registered Shareholder in the proxy. The persons whose names are printed on the enclosed proxy form are officers and/or directors of the Company (the "Management Proxyholders").

A registered Shareholder has the right to appoint a person or company to attend and act for or on behalf of that registered Shareholder at the Meeting, other than the Management Proxyholders named in the enclosed proxy form. A proxyholder need not be a Shareholder.

Such right may be exercised by striking out the printed names and inserting the name of such other person and, if desired, an alternate to such person, in the blank space provided in the proxy form. Such registered Shareholder should notify the nominee of the appointment, obtain the nominee's consent to act as proxy, and should provide instruction to the nominee on how the registered Shareholder's Foremost Shares should be voted. The nominee should bring personal identification to the Meeting.

Those registered Shareholders desiring to be represented at the Meeting by proxy must deposit their respective forms of proxy with the Depositary, Odyssey Trust Company, at 350 – 409 Granville Street, Vancouver, BC V6C 1T2, Attention: Proxy Department, by mail, facsimile transmission, telephone voting system or via the internet by December 18, 2024, at 10:00 a.m. (Pacific Time) or the day that is two (2) Business days immediately preceding the date of any adjourned or postponed Meeting. The deadline for deposit of proxies may be waived or extended by the Chairman of the Meeting at their discretion, without notice.

Voting by Proxy and Exercise of Discretion by Management Proxyholders

Foremost Shares represented by a properly executed proxy will be voted or be withheld from voting on each matter referred to in the Notice of Meeting in accordance with the instructions of the registered Shareholder on any ballot that may be called for and if the registered Shareholder specifies a choice with respect to any matter to be acted upon, the Foremost Shares will be voted accordingly.

If a registered Shareholder does not specify a choice and the registered Shareholder has appointed the Management Proxyholders as proxyholder, the Management Proxyholders will vote FOR the matters specified in the Notice of Meeting and FOR all other matters proposed by management at the Meeting.

The form of proxy also gives discretionary authority to the person named therein as proxyholder with respect to amendments or variations to matters identified in the Notice of Meeting and with respect to other matters which may properly come before the Meeting. As of the date of this Circular, management of the Company knows of no such amendments, variations or other matters to come before the Meeting.

Advice to Non-Registered Shareholders

The information in this section is significant to many Shareholders, as a substantial number of Shareholders do not hold their Foremost Shares in their own name.

Only registered Shareholders or duly appointed proxyholders are permitted to vote at the Meeting. Most Shareholders are "Non-Registered Shareholders" because the Foremost Shares they own are not registered in their names but are instead registered in the name of the brokerage firm, bank or trust company through which Foremost Shares were purchased. More particularly, a person is not a registered Shareholder in respect of Foremost Shares which are held on behalf of that person (the "Non-Registered Shareholders") but which are registered either: (a) in the name of an intermediary (an "Intermediary") that the Non-Registered Shareholders deals with in respect of the Foremost Shares (Intermediaries include, among others, banks, trust companies, securities dealers or brokers and trustees or administrators or self-administered RRSPs, RRIFs, RESPs and similar plans); or (b) in the name of a clearing agency (such as CDS Clearing and Depositary Services Inc. or CDS & Co. ("CDS")) of which the Intermediary is a participant. In Canada, the vast majority of such shares are registered under the name of CDS, which acts as nominee for many Canadian brokerage firms. Foremost Shares held by brokers or their nominees can only be voted upon the instructions of the Non-Registered Shareholders. Without specific voting instructions, brokers and their nominees are prohibited from voting Foremost Shares held for Non- Registered Shareholders. Therefore, Non-Registered Shareholders should ensure that instructions respecting the voting of their Foremost Shares are communicated to the appropriate person or that the Foremost Shares are duly registered in their name.

Applicable Canadian securities regulatory policy requires intermediaries/brokers to seek voting instructions from Non-Registered Shareholders in advance of shareholders' meetings. Every intermediary has its own mailing procedures and provides its own return instructions to clients. In either case, the purpose of this procedure is to permit a Non-Registered Shareholder to direct the voting of Foremost Shares which they beneficially own. Non-Registered Shareholders should carefully follow the instructions of their Intermediary, including those regarding when and where the form of proxy is to be delivered.

In Canada, the majority of brokers and intermediaries now delegate the responsibility for obtaining voting instructions from Non-Registered Shareholders to Broadridge. Broadridge typically supplies a VIF and asks Non-Registered Shareholders to return the completed forms to Broadridge. Broadridge then tabulates the results of all instructions received and provides appropriate instructions respecting the voting of Foremost Shares to be represented at the Meeting. A Non-Registered Shareholder receiving such a form from Broadridge cannot use that form to vote Foremost Shares directly at the Meeting. The form must be returned to Broadridge well in advance of the Meeting in order to have the Foremost Shares voted.

A Non-Registered Shareholder who wishes to attend the Meeting and vote in person may write the name of the Non-Registered Shareholder in the place provided for that purpose on the VIF. A Non-Registered Shareholder also has the right to appoint a person or company other than the persons designated in the form of proxy, who need not be a Shareholder, to attend the Meeting and act on behalf of the Non- Registered Shareholder. Unless prohibited by law, the person whose name is written in the space provided in the VIF will be appointed as proxyholder for the Non-Registered Shareholder and will have full authority to present matters to the Meeting and vote on all matters that are presented at the Meeting, even if those matters are not set out in the VIF or this Circular. A Non-Registered Shareholder should consult a legal advisor if the Non-Registered Shareholder wishes to modify the authority of the person to be appointed as proxyholder in any way.

Revocation of Proxies

A registered Shareholder who has submitted a proxy may revoke it at any time prior to the exercise thereof by: (i) completing and signing a proxy bearing a later date and delivering such proxy to the Transfer Agent by 10:00 a.m. (Pacific Time) on December 19, 2024, or the last Business Day prior to the day the Meeting is reconvened if it is adjourned; (ii) sending a signed written statement (or having your attorney sign a statement with your written authorization) to: Corporate Secretary, Foremost Clean Energy Ltd., Email: info@foremostcleanenergy.com prior to 10:00am (Pacific Time) on December 19, 2024, or the last Business Day prior to the day the Meeting is reconvened if it is adjourned; (iii) providing a signed written statement, at the Meeting, to the chair of the Meeting prior to the vote being taken; or (iv) any other manner permitted by law.

If you have followed the instructions for attending and voting at the Meeting, voting at the Meeting will revoke any previous proxy.

A beneficial Shareholder who has changed their mind should contact their broker or nominee for further information regarding changing their voting instructions.

Notice to Shareholders in the United States

The solicitation of proxies involves securities of an issuer located in Canada and is being effected in accordance with the corporate laws of the Province of British Columbia, Canada, and securities laws of the provinces of Canada. The proxy solicitation rules under the Exchange Act, are not applicable to the Company or this solicitation. This solicitation has been prepared in accordance with the disclosure requirements of the securities laws of the provinces of Canada. Shareholders should be aware that disclosure requirements under the securities laws of the provinces of Canada differ from the disclosure requirements under United States securities laws.

The enforcement by Shareholders of civil liabilities under United States federal securities laws may be affected adversely by the fact that the Company is incorporated under the BCBCA, some of its directors and its executive officers are residents of Canada and a substantial portion of its assets and the assets of such persons are located outside the United States. Shareholders may not be able to sue a foreign company or its officers or directors in a foreign court for violations of United States federal securities laws. It may be difficult to compel a foreign company and its officers and directors to subject themselves to a judgement by a United States court.

VOTING SECURITIES AND PRINCIPAL HOLDERS OF VOTING SECURITIES

Record Date

The Foremost Board has fixed October 24, 2024, as the Record Date for determining the persons entitled to receive notice of Meeting. Only Shareholders of record as at the Record Date are entitled to receive notice of and to attend and vote at the Meeting or any adjournment thereof, unless after that date a Shareholder of record transfers their Foremost Shares and the transferee, upon producing properly endorsed certificates evidencing such Foremost Shares or otherwise establishing that they own such Foremost Shares, requests at least ten (10) days prior to the Meeting that the transferee's name be included in the list of Shareholders entitled to vote, in which case such transferee is entitled to vote such Foremost Shares at the Meeting.

In addition, persons who are Non-Registered Shareholders as at the Record Date will be entitled to exercise their voting rights in accordance with the procedures established under NI 54-101. See "General Proxy Information– Advice to Non-Registered Shareholders".

Voting Rights

The authorized share capital of the Company consists of an unlimited number of common shares, being the Foremost Shares. As at the Record Date, there were 7,291,896 Foremost Shares issued and outstanding. Each Shareholder, as of the Record Date, is entitled to one (1) vote for each Foremost Share registered in their name. No group of Shareholders has the right to elect a specified number of directors, nor are there cumulative or similar voting rights attached to the Foremost Shares.

Principal Holders of Foremost Shares

To the knowledge of the directors and executive officers of the Company, no person or company beneficially owns or controls or directs, directly or indirectly, voting securities carrying ten percent (10%) or more of the voting rights attached to any class of outstanding voting securities of the Company as at the Record Date, other than the below:

Name of Shareholder | Number of Foremost Shares Owned | Percentage of Outstanding Foremost Shares |

Denison | 1,369,810 | 18.79% |

Quorum

Pursuant to the Foremost Articles, at all meetings of the Shareholders, it is necessary in order to constitute a quorum that two (2) persons entitled to vote at the meeting are present and not less than five precent (5%) of the outstanding Foremost Shares which may be voted at the Meeting must be represented in person or by proxy or by a duly authorized representative of a Shareholder.

Required Votes

The following chart describes the proposals to be considered at the Meeting, the voting options and the vote required for each matter:

Matter | Voting Options | Required Vote |

Number of Directors | For; Against | At least a majority (50% + 1) of votes cast at the |

| | | Meeting by Shareholders to elect each nominee to |