Exhibit 99.1 March 2023

Disclaimer This presentation (together with oral statements made in connection herewith, this “Presentation”) is for informational purposes only. This Presentation shall not constitute an offer to sell, or the solicitation of an offer to buy, any securities, nor shall there be any sale of securities in any states or jurisdictions in which such offer, solicitation or sale would be unlawful. Forward Looking Statements Certain statements included in this Presentation that are not historical facts are forward-looking statements for purposes of the safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements generally are accompanied by words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “plan,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook” and similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements by NewAmsterdam Pharma Company N.V. (“NewAmsterdam” or the “Company”) regarding estimates and forecasts of other financial and performance metrics and projections of market opportunity; expectations and timing related to the success, cost and timing of product development activities, including timing of initiation, completion and data readouts for clinical trials and the potential approval of the Company’s product candidate; the size and growth potential of the markets for the Company’s product candidate; the therapeutic and curative potential of the Company’s product candidate; financing and other business milestones; and the Company’s expected cash runway. These statements are based on various assumptions, whether or not identified in this Presentation, and on the current expectations of the Company’s management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as and must not be relied on as a guarantee, an assurance, a prediction, or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and may differ from assumptions. Many actual events and circumstances are beyond the control of the Company. These forward-looking statements are subject to a number of risks and uncertainties, including changes in domestic and foreign business, market, financial, political, and legal conditions; risks related to the approval of NewAmsterdam’s product candidate and the timing of expected regulatory and business milestones; ability to negotiate definitive contractual arrangements with potential customers; the impact of competitive product candidates; ability to obtain sufficient supply of materials; the impact of COVID-19; global economic and political conditions, including the Russia-Ukraine conflict; the effects of competition on NewAmsterdam’s future business; and those factors discussed in documents filed by the Company with the SEC. Additional risks related to NewAmsterdam’s business include, but are not limited to: uncertainty regarding outcomes of the company’s ongoing clinical trials, particularly as they relate to regulatory review and potential approval for its product candidate; risks associated with the Company’s efforts to commercialize a product candidate; the Company’s ability to negotiate and enter into definitive agreements on favorable terms, if at all; the impact of competing product candidates on the Company’s business; intellectual property-related claims; the Company’s ability to attract and retain qualified personnel; and the Company’s ability to continue to source the raw materials for its product candidate, together with the risks described in the Company’s filings made with the U.S. Securities and Exchange Commission from time to time. If any of these risks materialize or NewAmsterdam’s assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that are presently unknown by the Company or that NewAmsterdam currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect NewAmsterdam’s expectations, plans, or forecasts of future events and views as of the date of this Presentation and are qualified in their entirety by reference to the cautionary statements herein. NewAmsterdam anticipates that subsequent events and developments will cause the Company’s assessments to change. These forward-looking statements should not be relied upon as representing NewAmsterdam’s assessments as of any date subsequent to the date of this Presentation. Accordingly, undue reliance should not be placed upon the forward-looking statements. Neither NewAmsterdam nor any of its affiliates undertakes any obligation to update these forward-looking statements, except as required by law. Market Data Certain information contained in this Presentation relates to or is based on third-party studies, publications, surveys and NewAmsterdam’s own internal estimates and research. In addition, all of the market data included in this Presentation involves a number of assumptions and limitations, and there can be no guarantee as to the accuracy or reliability of such assumptions. Finally, while NewAmsterdam believes its internal research is reliable, such research has not been verified by any independent source and NewAmsterdam cannot guarantee and makes no representation or warranty, express or implied, as to its accuracy and completeness. Trademarks This Presentation contains trademarks, service marks, trade names, and copyrights of NewAmsterdam and other companies, which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade name or products in this Presentation is not intended to, and does not imply, a relationship with NewAmsterdam or an endorsement or sponsorship by or of NewAmsterdam. Solely for convenience, the trademarks, service marks and trade names referred to in this Presentation may appear with the TM or SM symbols, but such references are not intended to indicate, in any way, that NewAmsterdam will not assert, to the fullest extent permitted under applicable law, their rights or the right of the applicable licensor to these trademarks, service marks and trade names. 2 PROPRIETARY

NewAmsterdam is developing oral obicetrapib as CETPi to address major unmet need in hypercholesterolemia and other cardiometabolic diseases O B I C E T RA P I B Company history: Achievements and milestones: • Significant unmet need for oral LDL-lowering therapy as adjunct to statins: 35mm+ patients in US/EU5 are not achieving LDL-lowering goals despite • Mid-’20: Founded after standard-of-care • Fully-funded through 2026 spin-out from Amgen including CVOT readout and • Simple, oral, once-daily, low dose CETP inhibitor with strong LDL-lowering potential global launch • Jan ’21: $196M Series A efficacy and safety observed through Phase 2b: • Significant number of • June ’22: >$1B European • ~50% LDL-lowering as monotherapy, ~59% in combination with ezetimibe, patients randomized in Phase 3 license with Menarini Group observed on top of high-intensity statins to-date, first DSMB meeting (including €142.5M committed completed • Strong safety and tolerability in >700 pts capital + significant back-end economics) • Robust effects on ApoB, non-HDL-C, HDL-C and Lp(a) • Late-stage inflection points expected from 2023-2025 • Nov ’22: NASDAQ listing • Convenient oral format + low cost of goods sold (COGS) enables broad (including Phase 2 & 3 clinical (NAMS) with $328M total readouts and registrational market access strategy to address existing unmet need proceeds ($93M from FLAC trust filings) in deSPAC, plus $235M PIPE co- lead by Frazier and Bain) • Pipeline expansion potential >35M ~59% in Alzheimer’s disease and $4B+ • Jan ’23: ~$1B market cap addressable LDL-lowering diabetes global market and $450M cash patient observed in opportunity population Phase 2b 3 PROPRIETARY

Expert cardiometabolic leadership supported by top investors Michael Davidson, M.D. John Kastelein, M.D. Douglas Kling Lina Gugucheva Louise Kooij Marc Ditmarsch, M.D. CEO CSO COO CBO CFO CDO SANDER SLOOTWEG JULIET JAMIE NICHOLAS LOU MICHAEL DAVIDSON JOHN JOHN W. SEASONED BOARD AUDET TOPPER DOWNING LANGE KASTELEIN SMITHER OF Managing Partner, Partner, Managing Partner, Partner, Partner, CEO, NewAmsterdam CSO, NewAmsterdam Independent DIRECTORS: Forbion Forbion Frazier Life Sciences Bain Capital Asset Management Pharma Pharma Ventures BACKED BY TOP TIER INVESTORS: 4 PROPRIETARY

Net proceeds expected to fund obicetrapib development through several value-creating milestones 2023 2022 2023 2024 2025 2026 1H 2H 1H 2H 1H 2H 1H 2H 1H 2H Phase 3 BROADWAY Trial Lipid Mono Study BROADWAY Ph3 LDL (ASCVD; LDL-C ≥ 55 mg/dL; n=2,400) regulatory filing Phase 3 BROOKLYN Trial BROOKLYN Ph3 Lipid Mono Study (HeFH; LDL-C ≥ 70 mg/dL; HeFH; n=300) Obicetrapib MACE Monotherapy Phase 3 CVOT PREVAIL Trial PREVAIL CVOT regulatory Product (ASCVD or HeFH; LDL-C ≥ 70 mg/dL; n=9,000) filing (obicetrapib 10mg) Phase 2b Japan Trial Japan Ph2b (LDL-C ≥ 70 mg/dL; n=100) Phase 2b ROSE2 Trial ROSE2 Ph2b LEGEND Ezetimibe FDC (LDL-C ≥ 70 mg/dL; n=114) Product Initiation (obicetrapib 10mg + Phase 3 FDC Trial ezetimibe 10mg) FDC Ph3 Enrollment complete (LDL-C ≥ 70 mg/dL; n=XXX) Ph3 readout CVOT readout Alzheimer’s Phase 2a Alzheimer’s Product Disease Trial Alzheimer’s Ph2a Ph2 readout (proprietary (n=10–15) dose/formulation incorporating obicetrapib) PROJECTED CASH RUNWAY THROUGH 2026 Numerous catalysts throughout 2023 5 Note: Other than as noted, the pipeline represents trials that are currently ongoing. Projections are subject to inherent limitations. Actual results may differ from expectations. The timing of regulatory submissions is subject to additional discussions PROPRIETARY with regulators. Neuro- Cardiovascular metabolic

Obicetrapib for Cardiovascular Disease 6

Despite availability of statins, CVD remains the leading cause of death worldwide (1) 231 million Adults in US/EU5 with hypercholesterolemia LDL-C goals (2) 84 million removed in Treated with prescription medication 2013 <1 million post-statin (4) (3) (3) 8 million 22 million patients treated with Statin- Still above current branded options intolerant LDL-C target Male deaths Female deaths 30 million* ~5 million** Patients with US ASCVD patients w/ 55-70mgl/dl residual need Year Key factors limiting penetration include product limitations and market access hurdles Despite statins, CVD deaths on the rise **Factoring in new U.S. guidance lowering LDL-C goals to 55 mg/dL for very high-risk patients, which will grow addressable patient population Sources: Trinity NewAmsterdam Market Research Summary; Trinity quantitative market research with N = 100 PCPs and Cardiologists; Bloomberg Prescription Data; IQVIA Rx Tracker. (1) Literature review suggesting hypercholesterolemia prevalence of ~94mm in the US (average of He et al. 2020, Mercado et al. 2015, Muntner et al. 2013) and ~137mm in EU5 (average of Gomez-Huelgas et al. 2010, Guallar-Castillon et al. 2012, Tragni et al. 2012, Grau et al. 2011). (2) 2020 US prescription data for statins, PCSK9s, and bempedoic acid were pulled from the Bloomberg Prescription Data Portal that Trinity subscribes to; assuming 12 scripts/year per patient and 70% compliance for PCSK9s (based on PCSK9 literature) and 59% compliance for statins & Nex/Nex (based on statin literature) treated patient volume estimates were derived from the prescription data and extrapolated to the EU5. (3) 8mm statin-intolerant & 22mm above LDL-C target: Percentage of patients in each category estimated from Trinity quantitative market research and the – percentages were then applied to the estimated 84mm treated number above. 7 (4) <1mm branded patients: 2020 US prescription data for Repatha, Praluent, and Nexletol/Nexlizet were pulled from the Bloomberg Prescription Data Portal that Trinity subscribes to; assuming 12 scripts/year and 70% compliance for PCSK9s (based on PROPRIETARY PCSK9 literature) and 59% compliance for Nex/Nex (based on statin literature) patient volume estimates were derived from the prescription data and extrapolated to the EU5. Deaths in Thousands

Cardiovascular field is returning to the mantra of “Lower is Better”, as supported by recently published FOURIER-OLE analysis In patients with atherosclerotic cardiovascular disease, long-term achievement of lower LDL-C levels, down to <20 mg/dL (<0.5 mmol/L), was associated with lowest of cardiovascular outcomes compared to patients who achieved less robust LDL- C reduction Risk of CV death, MI, stroke ≥70 LDL-C 55-≤70 LDL-C Achieved LDL-C 40-≤55 LDL-C ≤20 LDL-C Composite of cardiovascular death, myocardial infarction, or stroke from FOURIER-OLE (Further Cardiovascular Outcomes Research With PCSK9 Inhibition in Subjects With Elevated Risk Open-Label Extension) p-value = 0.0001 Time post-enrollment (years) Note: Gaba P, et. al., Association Between Achieved Low-Density Lipoprotein Cholesterol Levels and Long-Term Cardiovascular and Safety Outcomes: An Analysis of FOURIER-OLE. Circulation. 2023 Feb 13. doi: 10.1161/CIRCULATIONAHA.122.063399 PROPRIETARY 8 Cumulative incidence rate (%)

Currently approved post-statin LDL-lowering products all fall short of the profile patients need Patients need a drug that fits Ezetimibe Nexletol PCSK9 the following profile: (1) (1) Modest Modest Strong Strong Efficacy Oral, Oral, Injectable, Oral, Low Dose High Dose High Dose Administration/ 10mg 180mg ~140-150mg Low Dose Dose Disruptive Price, Very High Price, Generic, Branded Price, Market Access/Price Highly Restricted Access Broad Access Broad Access Limited Access (High COGS) (Low COGS) Safe, Safe, FDA Label: Safe Safety & Tolerability Tendon rupture & gout warning Painful injection site reactions Well Tolerated Well-Tolerated Strong Lp(a) Lowering, HDL Raising has Potential Ancillary None None Modest Lp(a) Lowering Benefits in Alzheimer’s and Benefit(s) Diabetes Note: Novartis’ stated price of Inclisiran to be approximate to net prices of PCSK9 mAbs. (1) Lighter shaded region of bar chart represents the additional potential efficacy for fixed dose combinations with ezetimibe. 9 PROPRIETARY

~50% LDL-C reduction efficacy would be virtually identical to PCSK9 injectables and is substantially better than other oral therapies Cross trial comparison of LDL-C reduction across different approaches (in %) Obicetrapib Anacetrapib Evacetrapib Dalcetrapib Ezetimibe Nexletol Repatha Praluent Leqvio * 1 2 3 4 5 6 7 8 10mg 100mg 130mg 600mg 10mg 180mg 420mg 150mg 284mg 0 -7 -10 -15 -17 -20 -21 -25 -30 There is Obicetrapib currently -40 mono dose no approved observed to oral drug with reduce LDL-C LDL-lowering by 51% in -46 -47 potency in the Phase 2b -50 50% range -51 Obicetrapib + ezetimibe combo shown to reduce -60 Prior CETP inhibitors Existing oral therapies PCSK9 injectables LDL by ~59% in Ezetimibe is generic, Nexletol bears FDA label Phase 2b for tendon rupture, gout The trials represented were selected due to their shared features that reflect the Phase 3 obicetrapib studies. Selecting trials with shared features allows for a potentially more accurate comparison of the LDL-C lowering results, with factors being considered such as: a) presence of intensive LDL-lowering therapy including (high intensity) statins and PCSK9 inhibitors, b) patient population – ASCVD or ASCVD risk equivalent patients (including primary hypercholesterolemia and HefH) and c) where possible, selected studies where LDL-C measured by preparative ultracentrifugation (PUC ) as opposed to Friedewald; noted below are those instances where PUC was not used – this is important because at low LDL-C levels (< 50 mg/dL), calculated LDL-C by Friedewald is overestimated; certain significant deviations from these parameters are provided in the footnotes. Note: The above trials and data do not represent head-to-head comparisons. Actual results may differ from expectations. Sources: * Circulation. 2021;144:e564–e593 17065. 1. Bowman, L et al. N Engl J Med 2017. 2. Amirhossein, S et al. Curr Pharmaceutical Design 2016. Meta-analysis - Also included hyperlipidaemia patients. LDL-C measured using direct assays and Friedewald. 3. de Grooth et al. Circulation 2002. LDL-C measured only using Friedewald and did not require subjects to be on prior statin therapy or present with ASCVD. 4. PI Zetia table 7. refers to; Gagne, C et al. Am J Cardiol 2002. LDL-C measured only using Friedewald. 5. PI Nexletol; study 2. refers to; Goldberg, A et al. JAMA 2019;322(18):1780-1788. LDL-C measured using Friedewald and direct assay for LDL-C <50 mg/dL. 6. PI Repatha; study 3. refers to; Blom, D et al. N Engl J Med 2014. Also 10 PROPRIETARY included hyperlipidaemia patients. 7. PI Praluent; study 3. refers to; Kereiakes, D et al. Am Heart J 2015. 8. PI Leqvio; study 1. Refers to; Ray, K. N Engl J Med 2020. % LDL-C change versus baseline

Obicetrapib has potential to be ideal complement to statin therapy STATINS STATINS LDL-C + Lp(a) Diabetes STATINS ApoB risk effects Lowering + OBI OBI OBI = finally achieve 55 mg/dl LDL goal CETPi has been shown clinically to Obicetrapib’s robust Lp(a)-lowering Obicetrapib’s LDL and ApoB lowering reverse diabetes risk, potentially effect (~57% lowering seen in P2) potency may finally take statin patients ameliorating key patient concerns counter-acts Lp(a)-raising effect to goal about high dose statins observed with statins 11 PROPRIETARY

Obicetrapib has potential to solve a substantial unmet medical need in dyslipidemia (1) 231mm Patients with >35mm patients not sufficiently addressed by available treatment options hyperlipidemia OBICETRAPIB Fewer than 1mm patients treated with 10mg current branded options: ü ~50% LDL-lowering observed for monotherapy, ~59% in combination with ezetimibe in Phase 2b 180mg ü Potential for attractive pricing to unlock broad Bempedoic Acid PCSK9s access THE SOLUTION ü Strong safety and tolerability profile observed o Payors highly restrict access THE ü Convenient once-daily oral tablet o Low prescriber enthusiasm PROBLEM ü High prescriber and payor enthusiasm o Relatively low patient compliance (2) >$4B global market opportunity (1) Literature review suggesting hypercholesterolemia prevalence of ~94mm in the US (average of He et al. 2020, Mercado et al. 2015, Muntner et al. 2013) and ~137mm in EU5 (average of Gomez-Huelgas et al. 2010, Guallar-Castillon et al. 2012, Tragni et al. 2012, Grau et al. 2011). 12 PROPRIETARY (2) Value derived from top-down epidemiology-based market model for obicetrapib; assumptions derived from secondary research / literature and primary market research with US and EU5 physicians and payers.

US market research indicates strong prescriber and payor enthusiasm, wide window of pricing opportunity to enable broad market access strategy Strong enthusiasm from prescribers Broad market access opportunity: and payors: Market access hurdles plague existing brands: PRESCRIBER ENTHUSIAM: “There is a lot of documentation involved as Nexletol PCSK9i Obicetrapib $$$$ we’re really trying to restrict to the highest PRICE IS TOO HIGH risk patients that actually need these costly for meaningful access (~$6K) products” Efficacy Moderate/Low* High High -Payor $$$ MODEST EFFICACY, comparable to generics, Safety/ Moderate High High Tolerability make any branded price hard to justify (~$4K) Route of High Low High Administration Obicetrapib positioned to unlock significantly better access: ü Low COGS enables favorable pricing PAYOR ENTHUSIAM: ü Strong LDL-C lowering, virtually same as injectables $$ “Biggest need (is) a product that works like the PCSK9s but with a more ü Simple, convenient oral pill gives payors confidence around patient convenient ROA and no diabetes risk” compliance ü Ancillary benefits for diabetes prevention, Lp(a) lowering “Fulfills an important unmet need” Key: Blue cells denote high ratings (6.5 – 9) / Yellow cells denote moderate ratings (5 – 6.4) / Red cells denote lowest ratings (1 – 4.9); ratings were given on a 9-point scale, thus lower / red ratings actually reflect the ~midpoint of the scale. *In our survey, obicetrapib mono therapy received a moderate score and obicetrapib FDC therapy received a high score. Source for other scores: Trinity quantitative market research; N = 100 (50 PCPs + 50 cardiologists). 13 PROPRIETARY Obicetrapib has not been approved by the U.S. Food and Drug Administration

Developing monotherapy and FDC in parallel builds in optionality for patients and prescribers, optimizes chances of broad market access o Expected to be preferred: • Initially, by less aggressive prescribers and those seeking more experience with CETPi class Obicetrapib Monotherapy • By prescribers with lingering misperceptions Product about ezetimibe (obicetrapib 10mg) • Over time, expect that this will be the product that moves into earlier lines of therapy and primary care utilization o Expected to be preferred: • By more aggressive prescribers & KOLs • For highest risk patients MORE EXPERIENCE WITH CETPi Note: Nexletol/Nexlizet scripts are currently Ezetimibe FDC • By more physicians over time as treatment plus generating 1:1 sales, Product paradigms shift, CETPi experience is gained Expected to (obicetrapib 10mg however ESPR has + ezetimibe 10mg) BROADER ADOPTION OF NEW TREATMENT signaled expectations drive heavier Parity pricing with monotherapy should ensure parity access PARADIGMS: for Nexlizet to become CVOT data from both obicetrapib and ezetimibe monotherapies + FDC utilization preferred with time Phase 3 FDC data would be included in FDC label “Lower is better” ü over time Decreased LDL target goals ü Earlier-line use of combination ü therapy 14 PROPRIETARY

Obicetrapib will launch at least 2-3 years ahead of any oral PSCK9 with a better optimized product profile Obicetrapib Oral PCSK9 • True small molecule• Peptide (not small molecule) • Needs high-dose complex gut- • Simple 10mg low-dose penetrating formulation formulation • Formulation poses significant • Strong tolerability potential tolerability & safety profile concerns • Significant food effect introduces • MOA has shown reduction of patient inconvenience/compliance diabetes risk/progression issues • Low COGS enables • Very high COGS likely precludes LAUNCH TIMING: disruptive pricing disruptive pricing Obi: PCSK9: 2026-2027 2028-2029 15 PROPRIETARY

Disease background and summary of clinical data 16

In ROSE Phase 2b clinical trial, obicetrapib demonstrated robust LDL-C lowering as adjunct 1 to high intensity statins Preparative ultra-centrifugation (PUC) is “gold-standard” for LDL-C quantification Median (min, max) LDL-C levels (mg/dL) at baseline and EoT Placebo Obicetrapib 5mg Obicetrapib 10mg 10 Time Placebo Obicetrapib Obicetrapib 5mg 10mg 0 90.0 95.0 88.0 Baseline (63, 204) (54, 236) (39, 207) -10 Median -7 N=40 N=39 N=40 86.0 -20 53.0 49.5 EoT (43, 137) (13, 126) (23, 83) Median -30 N=39 N=39 N=40 -6.5 -41.45 -50.75 % Change -40 from Baseline (-53.9, 31.6) (-71.2, 62.3) (-76.9, 15.6) -41 (median) N=39 N=38* N=40 -50 -51 % Change from -37.98 -44.15 -4.76 Baseline -60 (--44.80, -31.17) (-50.95, -37.35) (-11.74, 2.22) LS mean (95% CI) P-value 0.1814 <0.0001 <0.0001 * In obicetrapib 5mg arm, 40 patients were randomized. N-value at end-of-treatment decreased to 38 because one patient was missing an LDL value at baseline and a second patient was missing an LDL value at end-of-treatment reading. 17 PROPRIETARY Source: 1. Nicholls SJ, et al. Nat Med 2022;28:1672-1678. LDL-C % reduction from baseline (median)

Robust consistency of efficacy profile across multiple studies and within ROSE LDL-C lowering activity of obicetrapib 10mg across all efficacy ROSE waterfall: 10mg vs. placebo studies to-date • Almost all patients experienced meaningful LDL-C reductions • LDL-C reduction of >60% was observed in 40% of obicetrapib 10mg Monotherapy across Ph1 & Ph2 On top of high intensity statins patients 1 2 3 4 Phase 1 TULIP TA-8995-06 ROSE N=10 N=35 N=13 N=40 0 Patients were treated with obicetrapib on top -10 of statin therapy (rosuvastatin 20 or 40mg, or atorvastatin 40 or -20 80mg) -30 -40 -44 -44 -45 -50 -51 Note: Each bar represents one subject in the trial. 18 PROPRIETARY Source: 1. Ford J, et al. Br J Clin Pharmacol 2014;78:498-508; 2. Hovingh GK, et al. Lancet 2015;386:452-460; 3. Data on file; 4. Nicholls SJ, et al. Nat Med 2022;28:1672-1678 LDL-C % reduction from baseline (mean)

1 ApoB & Lp(a) percent reduction from baseline in ROSE • ApoB is currently considered the most important biomarker for CVD risk reduction (in addition to non-HDL and LDL-C) • Elevated Lp(a) is emerging as a strong and independent marker of cardiovascular risk and an exciting new CVD drug target ApoB Lp(a) Placebo Obicetrapib 5mg Obicetrapib 10mg Placebo Obicetrapib 5mg Obicetrapib 10mg 10 10 4 5 0 0 -10 -5 -3 -20 -10 -15 -30 -20 -34 -40 -25 -24 -50 -30 -30 -57 -35 -60 19 PROPRIETARY Source: 1. Nicholls SJ, et al. Nat Med 2022;28:1672-1678. ApoB % change from baseline (median) Lp(a) % change from baseline (median)

Obicetrapib safety profile in ROSE and across multiple studies: overview of AEs, SAEs and withdrawals Clean safety profile; Similar rates of drug discontinuation were observed for obicetrapib and placebo Obicetrapib Pooled ROSE Safety Pooled Safety (1) (2) Comparator 5mg + 10mg Placebo Obicetrapib, 5mg Obicetrapib, 10mg (N=231) (N=309) (N=40) (N=40) (N=40) AEs (%) TEAEs (%) AEs, total TEAEs, total 136 (58.9) 173 (55.9) 19 (47.5) 15 (37.5) 8 (20.0) AEs, related TEAEs, related 45 (19.5) 49 (15.8) 4 (10.0) 2 (5.0) 1 (2.5) AEs, severe TEAEs, severe 5 (2.2) 7 (2.3) 1 (2.5) 0 0 SAEs TESAEs SAEs, total *TESAEs, total 6 (2.6) 4 (1.3) 2 (5.0) 0 0 SAEs, related TESAEs, related 0 0 0 0 0 Deaths Deaths 0 0 0 0 0 Withdrawals study / medication Withdrawals study / medication TEAEs leading to TEAEs leading to 1 (2.5) 0 0 13 (5.6) 13 (4.2) discontinuation of discontinuation of study drug study drug TESAEs leading to TESAEs leading to 0 0 0 0 0 discontinuation of discontinuation of study study * There were three additional TESAEs in other obicetrapib dose arms: two in the TULIP 2.5mg arm, and one in the Lp(a) 2.5mg arm; none were considered to be related to study drug. (1) The Comparator group included patients receiving placebo and non-obicetrapib monotherapy. 20 PROPRIETARY (2) The pooled obicetrapib group includes patients treated with obicetrapib as a monotherapy and in combination with atorvastatin, rosuvastatin and ezetimibe.

Target biology and class overview: Key lessons learned 21

CETP inhibition works to lower LDL via a two-step mechanism of action STEP 1: CETPi stops transfer of cholesterol from LDL to HDL, increasing HDL- STEP 2: Increase in HDL particles leads to increased LDL-R expression in the C and lowering LDL-C liver, promoting further clearance of LDL Increased HDL levels CETPi Increased HDL HDL levels LDL-R levels LDL-R Reduced LDL levels LDL-R taking up LDL LDL Further reduced LDL LDL levels PCSK9i STATINS EZETIMIBE OBICETRAPIB Electron micrograph CETP C-terminal opening Decrease in hepatic cholesterol Most current LDL-lowering therapies, including CETPi, work by promoting LDL Increase in hepatic LDL receptors receptor upregulation N-terminal opening is where CETPi bind Decrease in plasma LDL levels Note: Figures adapted from Meng Zhang, at al., Assessing the mechanisms of cholesteryl ester transfer protein inhibitors, Biochimica et Biophysica Acta (BBA) - Molecular and Cell Biology of Lipids, 1862(12), 2017, 1606-1617, and from Lei D, et al., Insights into the Tunnel Mechanism of Cholesteryl Ester Transfer Protein through All-atom Molecular Dynamics Simulations, J Biol Chem., 2291(27), 2016, 14034-14044. 22 PROPRIETARY

Absolute reduction of LDL-C and ApoB, and duration of that reduction are key to reducing cardiovascular risk Key factor 1: Absolute reduction Key factor 2: Study duration CTT meta-regression line shows a linear and predictable Meta-analysis of CVOT duration shows that ~3.5 year median follow relationship between absolute LDL-C lowering and MACE up optimizes the probability of seeing maximal MACE reduction reduction benefit M M ACE ACE be be ne nfe it fs its im im pa pc atc etd e d b y by 2 2 ke ky ey fac fac to tr o sr :s: Low absolute LDL reduction Optimal MACE leads to small MACE benefit benefit observed with 3-4 year duration trials ABSOLUTE th ESPR CVOT is 7 MOA that falls right on the REDUCTION CTT meta-regression line Less than 3 years is too * short to see true MACE High absolute benefit... LDL reduction STUDY leads to large DURATION Diminishing incremental MACE MACE benefit benefit observed for trials longer than 4 years... Sources: American Heart Association, CDC, Mayo clinic, Global Health estimates 2016: Deaths by Cause, Age, Sex, by Country and by Regio, 2000-2016, Geneva, WHO; 2018. Lancet 2005;366:1267-78; Silverman MG, et al. JAMA 2016;27:1289-1297. * ESPR CVOT depiction based on ACC 2023 presentation, drawn as approximation to existing meta-regression figure. 23 PROPRIETARY

Obicetrapib program designed to overcome limitations of all prior CETP inhibitors SAFETY We believe that all prior CETPi were developed with a misguided focus on HDL increase (rather than LDL decrease) as the primary MoA for CVD risk reduction, leading to 1 OFF-TARGET TOXICITY, INCREASED BLOOD T O R C E T R A P I B inappropriate compound selection or inappropriate CVOT design PRESSURE, ALDOSTERONE (seen early in Suffered from drug-specific toxicity Phase 2) issue (Pfizer) LDL-LOWERING POTENCY 2 NO LDL-LOWERING D A L C E T R A P I B Safe & Drug showed no well-tolerated CVOT DESIGN LDL-lowering efficacy (Roche) (DURATION & BASELINE LDL) 3 E V A C E T R A P I B Strong safety Modest LDL-lowering INSUFFICIENT TRIAL DURATION (only 2 Overall mortality benefit (P =.04) – profile Safe & years) but CVOT was too short to across ~59k well-tolerated demonstrate MACE benefit patients (Lilly) COMMERCIAL VIABILITY COMMERCIALLY UNVIABLE - HIGH Sufficient duration Modest LDL-lowering 4 A N A C E T R A P I B (4.1 years, with 6.4 year follow up) LIPOPHILICITY AND FAT TISSUE Safe & Meaningful MACE benefit observed - well-tolerated ACCUMULATION LED TO 4+ YEAR HALF- Baseline LDL too low but drug accumulated in fat tissue (60 mg/dL) LIFE (Merck) ü Strong safety and tolerability ü Longer trial duration (4 yrs) ü Favorable PK/PD profile ü ~50% LDL-LOWERING profile observed in >600 patients + 5 OBICETRAPIB OBSERVED IN PHASE 2B ü No accumulation in fat tissue (1) through Phase 2b ü High baseline LDL (100 mg/dL) observed ü No concerns seen in biomarker = PREVAIL CVOT design expected to safety data, including blood translate into >20% MACE benefit pressure-associated biomarkers ü ~59% LDL-LOWERING OBSERVED IN FDC PHASE 2 Note: The above trials and data do not represent head-to-head comparisons. (1) Represents estimated average baseline LDL to be enrolled, not entry criteria. 24 PROPRIETARY Sources: 1. Barter PJ, et al. N Engl J Med 2007;357:2109-2122; 2. Schwartz GG, et al. N Engl J Med 2012;367:2089-2099; 3. Lincoff AM, et al. N Engl J Med 2017;376:1933-1942; 4. The HPS3/TIMI55–REVEAL Collaborative Group. N Engl J Med 2017; 377:1217-1227; 5. Data on file

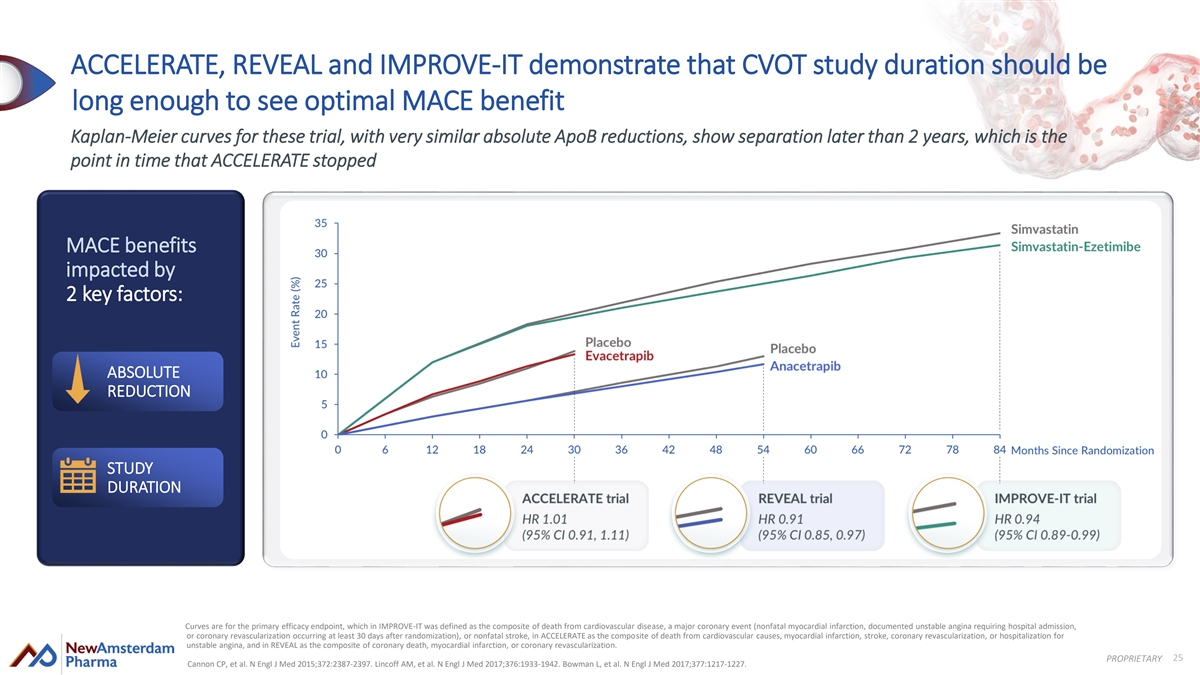

ACCELERATE, REVEAL and IMPROVE-IT demonstrate that CVOT study duration should be long enough to see optimal MACE benefit Kaplan-Meier curves for these trial, with very similar absolute ApoB reductions, show separation later than 2 years, which is the point in time that ACCELERATE stopped MACE benefits impacted by 2 key factors: ABSOLUTE REDUCTION STUDY DURATION Curves are for the primary efficacy endpoint, which in IMPROVE-IT was defined as the composite of death from cardiovascular disease, a major coronary event (nonfatal myocardial infarction, documented unstable angina requiring hospital admission, or coronary revascularization occurring at least 30 days after randomization), or nonfatal stroke, in ACCELERATE as the composite of death from cardiovascular causes, myocardial infarction, stroke, coronary revascularization, or hospitalization for unstable angina, and in REVEAL as the composite of coronary death, myocardial infarction, or coronary revascularization. 25 PROPRIETARY Cannon CP, et al. N Engl J Med 2015;372:2387-2397. Lincoff AM, et al. N Engl J Med 2017;376:1933-1942. Bowman L, et al. N Engl J Med 2017;377:1217-1227.

MACE benefits in CVOT of anacetrapib (REVEAL) observed to be exactly as expected, informing NewAmsterdam’s CVOT design for obicetrapib At 4.1 years, two important learnings: Learning 1: Predictable MACE benefit Learning 2: Baseline levels were too low M M ACE ACE be be ne nfe it fs its • 9% drop in MACE is exactly predicted by the CTT metaregression • Baseline 60 mg/dL already below U.S. guideline goals im im pa pc atc etd e d b y by line • Modest drug LDL-lowering potency (17%) resulted in very small 2 2 ke ky ey fac fac to tr o sr :s: • Indicates CETPi behaves like statins in reducing MACE absolute reduction (only 11 mg/dL) z 11 9% 60mg 17% ABSOLUTE mg/dL benefit REDUCTION 9% drop LDL LDL Modest ABSOLUTE in MACE baseline lowering LDL REDUCTION MACE% 11 mg/dL drop in benefit absolute LDL-C STUDY DURATION At 6.4 years: 20% additional MACE risk reduction z Anacetrapib’s long half-life causes it to continue to have effects in patients (patients remained randomized) At both time readouts, REVEAL showed statistically significant drop across all composites of MACE* Source: The HPS3/TIMI55-REVEAL Collaborative Group. European Heart Journal (2021) 00, 1–9; The HPS3/TIMI55–REVEAL Collaborative Group. N Engl J Med 2017; 377:1217-1227 26 *Composites of MACE included in this analysis were coronary death, myocardial infarction or coronary revascularization. PROPRIETARY

REVEAL supports translation from absolute LDL reduction to MACE benefit EXPERIENCE: REVEAL (anacetrapib) PREDICTION: PREVAIL (obicetrapib) ~ 51% ~ (1) 61 mg/dL 17% 11 mg/dL 100 mg/dL 50 mg/dL anticipated Low Drug showed modest Results in SMALL absolute LDL Enrich for higher baseline Stronger expected LDL- Expected to result in more baseline LDL-lowering % reduction lowering % absolute LDL reduction >20% drop in MACE anticipated >20% 9% drop drop 9% anticipated drop in MACE Smaller MACE* Bigger expected benefit anticipated MACE** benefit 11 mg/dL drop in ~50 mg/dL drop in absolute absolute LDL-C LDL-C anticipated Note: Actual results may differ from expectations. * Composites of MACE included in this analysis were coronary death, myocardial infarction or coronary Source: Cholesterol Treatment Trialists Collaboration. Lancet. 2010 376:1670-81 Circulation. 2021;144:e564–e593 17065: revascularization. Obicetrapib Lowers LDL-C in Patients Taking High Intensity Statins. Source: The HPS3/TIMI55–REVEAL Collaborative Group. N Engl J Med 2017; 377:1217-1227 27 (1) Represents estimated average baseline LDL to be enrolled, not entry criteria. PROPRIETARY Cholesterol Treatment Trialists Collaboration. Lancet. 2010 376:1670-81. ** MACE includes cardiovascular death, myocardial infarction, stroke and non-elective coronary revascularization in adults.

PREVAIL trial design & power calculations leverage lessons learned Differentiation over prior CVOTs • Study design: Superior LDL-lowering activity o n = 9000 Higher absolute LDL-c 51% observed in Phase 2b o Inclusion: ASCVD patients on maximally tolerated plus reduction leads to greater statins with risk enhancers and LDL-C > 70mg/dl Targeting higher baseline LDL patients MACE benefit o Minimum follow up 2.5 years ~100mg/dc anticipated • Primary endpoint: 4-point MACE • First secondary: 3-point MACE Longer duration of follow up • Prespecified endpoints: Median of 48 months vs. only 2.1 years in ACCELERATE o Conversion of pre-diabetes to diabetes plus More time + higher patient o A1c levels in diabetes patients Targeting higher-risk patient population risk maximizes opportunity ASCVD patients further enriched with with risk enhancers • Power assumptions: for MACE reduction shown in REVEAL long-term follow up to have stronger relative o 4.4% annual event rate risk reduction (high LDL/ApoB, diabetes, high triglycerides, o 45mg/dl reduction in LDL-C recent MI) o 90% power to achieve a 20% relative risk reduction (p < 0.01) Enhanced commercial profile vs. other LDL-lowering Differentiated secondary endpoints agents + potential Lp(a)-lowering, HDL-raising, diabetes, and Alzheimer’s benefits therapeutic area expansion Note: Actual results may differ from expectations. 28 PROPRIETARY

Therapeutic area expansion opportunities 29

HDL and apoA1 effects potentially offer pipeline expansion opportunities in Alzheimer’s , AMD and diabetes • HDL is the “vacuum cleaner” of the body, POSITIVE TISSUE EFFECTS IN THE BRAIN HDL effluxing free cholesterol out of peripheral • Increasing HDL and apoA1 is expected to 2 tissues to promote healthy cell function & promote healthy tissue survival in the brain 1 survival ABCA1 • Administration of CETPi to APP/CETP knock-in mice observed to promote cholesterol removal • NewAmsterdam is exploring potential HDL- and 3 from the brain and improve cognition apoA1- raising benefits in other indications such • We are testing obicetrapib in Alzheimer’s as Alzheimer’s disease (AD) and diabetes Removal of ASTROCYTE patients in a Phase 2a biomarker study toxic form of cholesterol POSITIVE BETA ISLET CELL EFFECTS IN THE PANCREAS CETPi • Increasing HDL is expected to promote beta islet Obicetrapib cell survival in the pancreas, potentially improving 4,5 insulin production observed to • All four prior CETPi CVOTs demonstrated increase HDL HDL statistically significant reduction of diabetes risk or precursors by >160% 6-9 reversal of diabetes progression Toxic form of Increased small cholesterol BETA ISLET • We are measuring diabetes progression as an functional HDL levels Removal of CELL endpoint in PREVAIL and are exploring regulatory toxic form of paths for a diabetes prevention indication cholesterol Sources: 1. Tall AR, et al. Nat Rev Immunol 2015;15:104-116; 2. Hottman DA, et al. Neurobiol Dis 2014 2014;72:22-36; 3. Phenix J, et al. Alzheimer’s Dement. 2021;17(Suppl. 3):e051134; 4. Fryirs MA, et al. Arteriosclerosis, Thrombosis, and Vascular Biology. 2010;30:1642–1648; 5. Petremand J, et al. Diabetes 2012;61:1100-1111; 6. Barter PJ, et al. N Engl J Med 2007;357:2109-2122; 7. Schwartz GG, et al. N Engl J Med 2012;367:2089-2099; 8. Lincoff AM, et al. N Engl J Med 2017;376:1933- 30 PROPRIETARY 1942; 9. The HPS3/TIMI55–REVEAL Collaborative Group. N Engl J Med 2017; 377:1217-1227

Clinical development and exclusivity timelines 31

Net proceeds expected to fund obicetrapib development through several value-creating milestones 2023 2022 2023 2024 2025 2026 1H 2H 1H 2H 1H 2H 1H 2H 1H 2H Phase 3 BROADWAY Trial Lipid Mono Study BROADWAY Ph3 LDL (ASCVD; LDL-C ≥ 55 mg/dL; n=2,400) regulatory filing Phase 3 BROOKLYN Trial BROOKLYN Ph3 Lipid Mono Study (HeFH; LDL-C ≥ 70 mg/dL; HeFH; n=300) Obicetrapib MACE Monotherapy Phase 3 CVOT PREVAIL Trial PREVAIL CVOT regulatory Product (ASCVD or HeFH; LDL-C ≥ 70 mg/dL; n=9,000) filing (obicetrapib 10mg) Phase 2b Japan Trial Japan Ph2b (LDL-C ≥ 70 mg/dL; n=100) Phase 2b ROSE2 Trial ROSE2 Ph2b LEGEND Ezetimibe FDC (LDL-C ≥ 70 mg/dL; n=114) Product Initiation (obicetrapib 10mg + Phase 3 FDC Trial ezetimibe 10mg) FDC Ph3 Enrollment complete (LDL-C ≥ 70 mg/dL; n=XXX) Ph3 readout CVOT readout Alzheimer’s Phase 2a Alzheimer’s Product Disease Trial Alzheimer’s Ph2a Ph2 readout (proprietary (n=10–15) dose/formulation incorporating obicetrapib) PROJECTED CASH RUNWAY THROUGH 2026 Numerous catalysts throughout 2023 32 Note: Other than as noted, the pipeline represents trials that are currently ongoing. Projections are subject to inherent limitations. Actual results may differ from expectations. The timing of regulatory submissions is subject to additional discussions PROPRIETARY with regulators. Neuro- Cardiovascular metabolic

Projected exclusivity timelines in the EU and US Assumes EU approval on June 1, 2025 and US approval on July 1, 2027 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 2036 2037 2038 2039 2041 2042 2043 SPC max EU approval EU 6/35 6/36 Data exclusivity (8 + 2 years) 2/41 6/1/25 Regulatory exclusivity 6 mo. PTE max NDA approval US 7/32 1/35 pedi. NCE exclusivity 30 mo. stay 7/41 7/1/27 (7/35) st Original genus patent family 8/27 1 gen 2/34 2/34 8/39* SPC Species selection patent family EU SPC Statin combo patent family 2/41* nd 2 gen 7/38* 2/34 PTE Species selection patent family US 1/39* 2/34 Statin combo patent family PTE Proprietary form (COM) patent family** 7/43 EU rd 3 gen US Proprietary form (COM) patent family 7/43 Note: Filled colors = granted patents & dotted lines = pending patents; one patent only to be selected for SPC/PTE; an earlier US approval leads to earlier regulatory expiry & shorter PTE; *including pediatric extension 6m; ** will be pending once a PCT application is filed; actual results may differ from expectations. 33 PROPRIETARY

Appendix 35

Obicetrapib development history Preclinical—Phase 1b (2008-2012) o Mitsubishi Tanabe (MTPC) is a Japanese pharmaceutical company, invented obicetrapib in late 2000’s o MTPC completed development through Phase 1b and thereafter deprioritized any lipid-lowering therapeutics o Dr. Kastelein was a consultant of MTPC, Phase 1b data compelled him to spin-out program to NewCo (Dezima Pharma) in 2012 Mitsubishi Tanabe Pharma Further development through Phase 2a (2012-2015) o Completed further early Phase 1/2 studies o Completed Phase 2a TULIP study on top of low-dose statins, demonstrating ~45% LDL-lowering efficacy o Company was acquired by Amgen in 2015 for $300M upfront + $1.5B in CVRs Manufacturing scale-up (2015-2016 ) o “Paused” clinical development to scale-up manufacturing to support Phase 3/commercial supply o Discovered manufacturing process that led to current $3/month projected peak COGS o In 2015/2016, a “perfect storm” of external factors (incl. Merck and Lilly CETPi CVOT read-outs) led to a re-prioritization th within Amgen’s CVD portfolio, and obicetrapib was de-prioritized to 4 -in-line for a CVOT • Dr. Kastelein & Forbion spun obicetrapib from Amgen to Phase 2b through CVOT NAMS in 2020, resulting in full transfer of IP ownership & and commercialization full global rights (2020 through present) • Amgen and MTPC are shareholders of NAMS, hold no other commercial/economic rights (i.e., no milestones/royalties) 36 PROPRIETARY

Menarini partnership overview Partnership with Menarini brings in significant non-dilutive capital and could enable NewAmsterdam to simultaneously launch obicetrapib in different markets with the ideal partner to optimize the commercial opportunity in the EU R I GHT PARTNER R I GHT T I ME R I GHT D EAL MENARINI TO RECEIVE EXCLUSIVE RIGHTS TO OBICETRAPIB MENARINI IS A LEADING EUROPEAN PHARMACEUTICAL ~3 YEARS FROM LAUNCH OPTIMIZES EUROPEAN MONOTHERAPY AND EZETIMIBE FDC FOR CVD IN EUROPE COMPANY DEVELOPMENT WITH AN EXCELLENT EUROPEAN PARTNER Leading presence in cardiovascular disease: NewAmsterdam retains all other global rights and is • Pricing and access in Europe is critical for • 18 marketed products in cardiometabolic diseases eligible for significant non-dilutive financial terms: obicetrapib’s success • #1 share of voice among cardiologists, internists • €142.5mm committed capital and GPs in EU5• Local expertise is needed to jumpstart P&MA (Consisting of €115mm upfront + €27.5mm strategy, including evidence generation and Deep commercial expertise: committed R&D funding) proactive HTA engagement • 540 launches in 50 countries • Up to €863mm payable upon achievement of • Strong relationships with EU KOLs will support • >2,500 sales reps and >280 specialist field force certain clinical, regulatory and commercial obicetrapib market entry while more effectively members in Europe milestones disseminating the obicetrapib value story • Successfully secured access for >500 products • Tiered royalties from teens to mid-twenties Strong partnering track record, with 60+ partnerships spanning small biotech to large pharma UP TO €1,005.5mm OF TOTAL CASH CONSIDERATION 37 PROPRIETARY

LDL-C, ApoB and Lp(a) are causal in the development of atherosclerosis and heart disease ApoB is a molecule that envelopes LDL in a 1:1 ratio LDL-C ApoB: Each LDL-C particle contains one ApoB molecule • ApoB-containing particles can become trapped in the arterial wall • High ApoB levels lead to atherosclerotic plaque formation and buildup over time Each Lp(a) particle has a LDL particle that contains an Lp(a) ApoB wrapped with an Apo(a) molecule Atherosclerotic plaque • Genetic mutations can lead to higher Lp(a) levels in certain individuals • These individuals are at a higher risk of developing arterial plaques and experiencing adverse Reducing the number of ApoB and Lp(a) particles cardiovascular events in circulation is critical to halting plaque build-up and reducing CV risk Source: Adapted from Ference BA, Kastelein JPP, Catapano AL. JAMA, 2020. 38 PROPRIETARY

Genetic support that CETPi drives CVD benefit through LDL reduction Analysis of >1mm patient-years’ shows loss-of-function equivalent to targets of other LDL-lowering drugs Odds ratio for CVD Decreased Increased per decrease in LDL-C CVD risk CVD risk of 10 mg/dL (95% CI) • A 16% reduction in CVD risk is - loss-of-function genotype CETP target 0.843 (0.788-0.901) 16% CETP observed for every 10 mg/dL reduction in - loss-of-function genotype Statin target HMGCR 0.834 (0.775-0.896) decrease in LDL levels CVD risk - loss-of-function genotype PCSK9 target 0.824 (0.774-0.876) PCSK9 • This is ~equivalent to the effect seen in loss-of-function genotypes for - loss-of-function genotype Ezetimibe target NPC1L1 0.839 (0.773-0.911) statins, PCSK9 inhibitors and 0.7 1.0 ezetimibe Analysis from >1mm patient-years combined Avg Decreased Increased Odds ratio for CAD risk risk risk (95% CI) Coronary artery disease risk 1.08 (0.94, 1.23) 0.5 1.0 1.5 Difference in More CETP = serum lipids (95% CI) more CAD risk, HDL-cholesterol (mmol/L) -0.23 (-0.26, -0.20) less HDL, more LDL Triglycerides (mmol/L) 0.02 (-0.06, 0.09) and more ApoB LDL-cholesterol (mmol/L) 0.08 (0.00, 0.16) -0.3 0.0 0.3 Avg Sources: Ference BA et al. JAMA 2017; Blauw et al; Genome-Wide Association Study on Circulating CETP. Note: CAD means coronary artery disease. 39 PROPRIETARY

REVEAL long-term follow-up identified risk enhancers important for PREVAIL HIGHER RISK subgroups have higher event rates & larger treatment effects REVEAL total study population 15.6% 11.9% RR decrease RR decrease Best 15.5% 18.1% risk RR decrease RR decrease enhancer 11.3% shows RR decrease highest 14.6% decrease RR decrease (linked to DM, obesity, etc) ARR 1.8% ARR 2.5% ARR 3% ARR 2.1 % ARR 2.2 % ARR 3.2 % NNT 55.6 NNT 40 NNT 33 NNT 47 NNT 45 NNT 31.3 LDL-C HDL-C RR = relative risk PREVAIL study inclusion criteria requires high PREVAIL study risk enhancers will increase high-risk ARR = absolute risk reduction baseline LDL-C (also translates to high ApoB) patient populations NNT = number needed to treat Inclusion criteria: Lp(a) >75 mg/dL, HDL-C <40 mg/dL, Inclusion criteria: LDL-C ≥70 mg/dL triglycerides >150 mg/dL 40 PROPRIETARY Source: The HPS3/TIMI55-REVEAL Collaborative Group. European Heart Journal (2021) 00, 1–9

Obicetrapib does not show an effect on systolic and diastolic blood pressure • In the TULIP study, obicetrapib did not show any effect on blood pressure, aldosterone and electrolytes • A dedicated meta-analysis of the obicetrapib ROSE, TULIP and OCEAN study did not reveal any signal in systolic and diastolic blood pressure • By contrast, in the cardiovascular outcome trial ILLUMINATE, torcetrapib showed a significant 5.4 and 2.0mm Hg increase in systolic blood and diastolic pressure and was associated with a significant decrease in serum potassium, and increases in serum sodium, bicarbonate and aldosterone Diastolic* Systolic* Placebo Obicetrapib 5mg Obicetrapib 10mg Placebo Obicetrapib 5mg Obicetrapib 10mg 4 4 2 2 0 0 -2 -2 -4 -4 BL Week 4 Week 8 Week 12 BL Week 4 Week 8 Week 12 Sources: Circulation 2021;144:e564–e593 17065: Obicetrapib Lowers LDL-C in Patients Taking High Intensity Statins: Results From Rose Clinical Trial. *Represents pooled data from the ROSE, TULIP and OCEAN clinical trials. 41 PROPRIETARY LS mean mmHg change versus baseline LS mean mmHg change versus baseline

Consistent LDL-C lowering and HDL-C increase observed across three Phase 2 studies of obicetrapib HDL-C levels increase LDL-C levels decrease 200 184 -5 180 165 157 160 -15 135 140 127 121 120 -25 100 -30 80 -35 60 -41 40 -45 -46 -46 20 -51 -51 0 -55 5mg 10mg 5mg 10mg 5mg 5mg Obi + 5mg 10mg 5mg 10mg 5mg 5mg Obi + Obi Obi Obi Obi Obi 10mg Exe Obi Obi Obi Obi Obi 10mg Exe 1 2 3 1 2 3 ROSE TULIP OCEAN ROSE TULIP OCEAN Source: 1. Nicholls SJ, et al. Nat Med 2022;28:1672-1678; 2. Hovingh GK, et al. Lancet 2015;386:452-460; 3. Data on File 42 PROPRIETARY % change from baseline (median) % change from baseline (median)

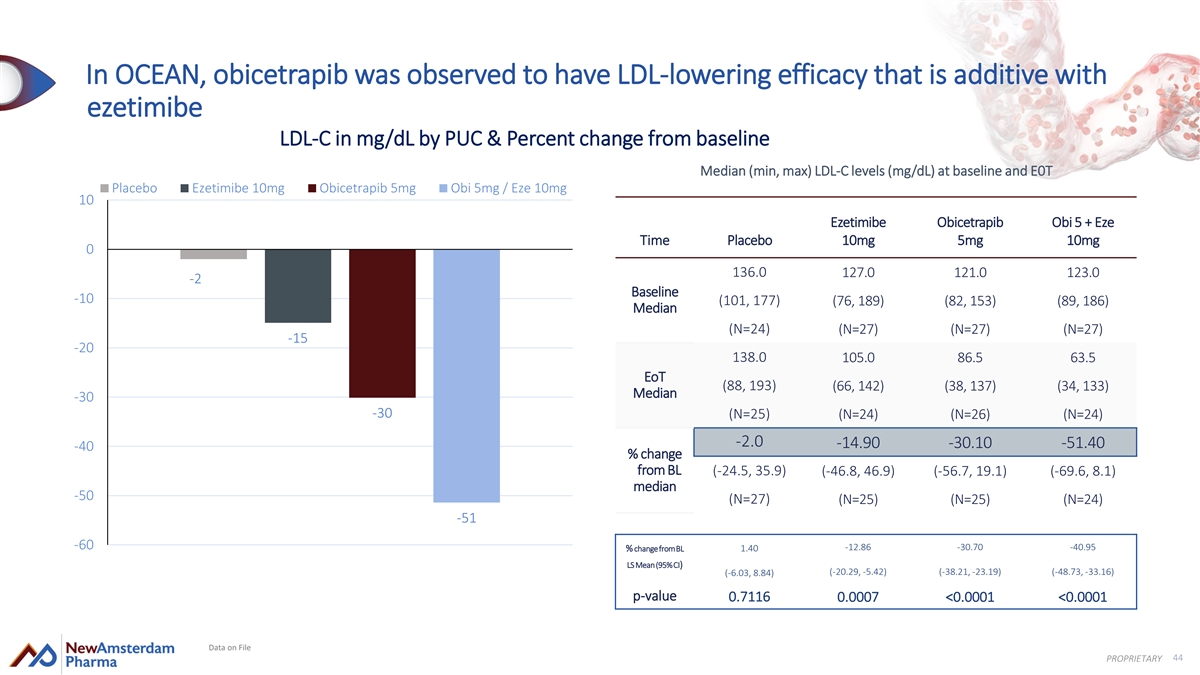

OCEAN: Phase 2b evaluating 5mg obicetrapib in combination with 10mg ezetimibe Objective To evaluate the effect of obicetrapib in combination with ezetimibe compared to placebo on LDL-C Inclusion criteria Study design Obi 5mg + eze 10mg (n=25) • Mild dyslipidaemia • Fasting LDL-C levels >2.5 mmol/L and Obi placebo + eze 10mg (n=25) Patients (n=100) <4.5 mmol/L Mild dyslipidaemia (18 – 75 years) Obi 5mg + eze placebo (n=25) Exclusion criteria Obi placebo + eze placebo (n=25) • Currently taking any lipid-lowering therapy • Any clinical manifestation of atherosclerotic CVD 3 2 4 Visit: 1 5 6 7 • Diagnosis of type 1 or type 2 diabetes mellitus 4 0 Week: Up to 2 8 • Uncontrolled hypertension 12 16 20 Eligibility Labs, PK Labs Labs Labs, PK Labs, PK Labs, PK Primary efficacy endpoint CETPm, Safety Safety Safety CETPm CETPm CETPm • Percent change from baseline in LDL-C for the Safety Safety Safety combination therapy group compared to the Safety FU placebo group 43 PROPRIETARY

In OCEAN, obicetrapib was observed to have LDL-lowering efficacy that is additive with ezetimibe LDL-C in mg/dL by PUC & Percent change from baseline Median (min, max) LDL-C levels (mg/dL) at baseline and E0T Placebo Ezetimibe 10mg Obicetrapib 5mg Obi 5mg / Eze 10mg 10 Ezetimibe Obicetrapib Obi 5 + Eze Time Placebo 10mg 5mg 10mg 0 136.0 127.0 121.0 123.0 -2 Baseline -10 (101, 177) (76, 189) (82, 153) (89, 186) Median (N=24) (N=27) (N=27) (N=27) -15 -20 138.0 105.0 86.5 63.5 EoT (88, 193) (66, 142) (38, 137) (34, 133) Median -30 -30 (N=25) (N=24) (N=26) (N=24) -2.0 -14.90 -30.10 -51.40 -40 % change from BL (-24.5, 35.9) (-46.8, 46.9) (-56.7, 19.1) (-69.6, 8.1) median -50 (N=27) (N=25) (N=25) (N=24) -51 -60 -12.86 -30.70 -40.95 % change from BL 1.40 LS Mean (95% CI) (-20.29, -5.42) (-38.21, -23.19) (-48.73, -33.16) (-6.03, 8.84) p-value 0.7116 0.0007 <0.0001 <0.0001 Data on File 44 PROPRIETARY

OCEAN: ApoB in mg/dL & percent change from baseline Median (min, max) ApoB levels (mg/dL) at baseline and E0T Placebo Ezetimibe 10mg Obicetrapib 5mg Obi 5mg / Eze 10mg 10 Ezetimibe Obicetrapib Obi 5mg + 5 Time Placebo 10mg 5mg Eze 10mg 0 105.5 103.0 102.0 105.0 Baseline -1 (74, 141) (79, 133) (74, 124) (77, 158) -5 Median (N=28) (N=28) (N=28) (N=27) -10 -9 107.0 94.0 75.0 73.0 -15 EoT (69, 153) (59, 137) (45, 103) (49, 105) Median -20 (N=27) (N=25) (N=26) (N=24) -25 -0.9 -8.9 -23.5 -34.8 -24 % change from BL (-19.8, 25.4) (-45.4, 32.3) (-39.3, 21.2) (-53.0, 8.9) -30 Median (N=27) (N=25) (N=26) (N=24) -35 -35 -40 Data on File 45 PROPRIETARY % change from baseline (median)

OCEAN safety: TEAEs, TESAEs and withdrawals overview Obicetrapib 5mg well tolerated compared to placebo Placebo Ezetimibe 10mg Obicetrapib 5mg Obi 5mg / Eze 10mg TEAEs (%) TEAEs, total 6 (21.4) 8 (28.6) 4 (14.3) 9 (33.3) TEAEs, related 4 (14.3) 3 (10.7) 1 (3.6) 3 (11.1) TEAEs, severe 0 1 (3.6) 0 0 TESAEs TESAEs, total 0 2 (7.1) 0 0 TESAEs, related 0 0 0 0 Deaths 0 0 0 0 Withdrawal's study / medication TEAEs leading to discon of 1 (3.6) 1 (3.6) 0 2 (7.4) study drug TESAEs leading to discon of 0 1 (3.6) 0 0 study Data on File 46 PROPRIETARY

TULIP Phase 2a trial results TULIP clinical trial design Percent change of LDL-C levels from baseline • Randomized double-blind placebo-controlled Placebo 1mg 2.5mg 5mg 10mg trial, once daily dosing P<0.0001 0.8mg • Endpoints: • Percent change in LDL-C at week 12 compared to baseline -27.4 -32.7 -45.3 -45.3 • Safety • Tolerability 10mg Atorva Atorva 20mg Rosuva Rosuva 10mg 20mg + 10mg 10mg + 10mg • Duration: 12 weeks treatment • Patients: • 364 patients (aged 18–75 years) • Fasting LDL-C levels: 2.5 - 4.5 mmol/L -45.3 -45.4 -45.3 -63.3 -68.2 No serious obicetrapib related 50.3% incremental 39.7% incremental adverse events or signs of liver or muscle side effects LDL-C reduction LDL-C reduction with 10mg with 10mg Source: Hovingh GK, et al. Lancet 2015;386:452-460 47 PROPRIETARY OUTCOMES OF TULIP TRIAL

TULIP: HDL-C, ApoA-1, ApoE and nascent HDL levels increases observed 200% 100% 180%* 180% 161%* 160% 77% 80% 140% 65% 122%* 58% 120% 60% 57% 56% 100% 48% 76%* 80% 40% 38% 37% 35% 33% 32% 28% 60% 25% 40% 20% 19% 20% 3% 2% 1% 0% 0% placebo 1 2.5 5 10 placebo placebo 1 2.5 5 10 1 2.5 5 10 5 10 5 10 5 10 Obicetrapib levels (mg) Obicetrapib levels (mg) Pre-b 1 Pre-b 2 Nascent ABCA-1 HDL-C ApoA-1 ApoE HDL levels efflux Source: Hovingh GK, et al. Lancet 2015;386:452-460; Van Capelleveen JC, et al. J Clin Lipidol 2016;10:1137-1144 48 PROPRIETARY % change at week 12

Obicetrapib bears significant potential to also beneficially impact diabetes risk CETP validated both genetically and clinically to reduce/reverse diabetes risk 1 • While statins increase diabetes risk by 11-15% , CETP inhibition is clinically demonstrated to reverse existing diabetes, decrease new-onset diabetes, and improve glucose control 2 • Genetic CETP deficiency lowers glucose levels Dalcetrapib reduces the risk of diabetes by 26% and Decreased increases the conversion to non-diabetes in high risk CV Odds ratio Relative diabetes risk STUDY NAME 95% CI weight patients Illuminate Torcetrapib (Pfizer) 0.77 (0.57-1.05) 8.59 CETP inhibitor therapy Dal-Outcomes Dalcetrapib (Roche) 0.97 (0.80-1.17) 23.06 0.20 associated with Accelerate Evacetrapib (Lilly) 0.81 (0.65-1.02) 15.60 a significant 12% HR=0.77 (95% CI: 0.68, 0.8 p<0 8),.001 0.15 Reveal Anacetrapib (Merck) 0.88 (0.77-0.99) 52.76 reduction in Placebo TOTAL 0.88 (0.81-0.96) incidence of Dalcetrapib 0.10 diabetes (CETP modulator) Meta-analysis of four eligable trials of CETP inhibitors 0.5 1.0 73,479 patients tested Avg 0.05 Natural Logarithm Diabetes & Metabolism December 2018 of Odds Ratio 0 0 1 2 3 Years Post Randomization 1 2 3 4 Sources: Sattar. Lancet. 2010 Feb 27; Brian ference, data on file; REVEAL trial. N Engl J Med. 2017 Sep 28; Barter. Circulation. 2011 Aug 2 49 PROPRIETARY Cumulative Risk of Incident Diabetes (in patients without diabetes)