Exhibit 99.1

Our Business

Overview

NewAmsterdam Pharma Company N.V. (“we,” “us,” “our” or the “Company”) is a clinical-stage biopharmaceutical company developing oral, non-statin medicines for patients at high risk of cardiovascular disease (“CVD”) with residual elevation of low-density lipoprotein cholesterol (“LDL-C” or “LDL”), for whom existing therapies are not sufficiently effective or well-tolerated. There exists a significant unmet need for a potent, cost-effective and convenient LDL-lowering therapy as an adjunct to statins, a class of lipid-lowering medications that are the current standard of care for high-risk CVD patients with high cholesterol. Our lead product candidate, obicetrapib, is a next-generation, oral, low-dose cholesteryl ester transfer protein (“CETP”) inhibitor that is currently in four ongoing Phase 3 and Phase 2b clinical trials as both a monotherapy and a combination therapy with ezetimibe for lowering LDL-C and preventing major adverse cardiovascular events (“MACE”). We believe that CETP inhibition may also play a role in other indications by potentially mitigating the risk of developing diseases such as Alzheimer’s disease or diabetes.

CVD is a leading cause of death worldwide and the top cause of death in the United States. Atherosclerotic cardiovascular disease (“ASCVD”) is primarily caused by atherosclerosis, which involves the build-up of fatty material within the inner walls of the arteries. Atherosclerosis is the primary cause of heart attacks, strokes and peripheral vascular disease. One of the most important risk factors for ASCVD is hypercholesterolemia, which refers to elevated LDL-C levels within the body, commonly known as high cholesterol.

A significant proportion of patients with high cholesterol do not achieve acceptable LDL-C levels using statins alone. We estimate that there are more than 35 million patients in the United Kingdom, Germany, France, Spain and Italy and in the United States who are not achieving LDL-lowering goals on the current standard of care. Existing non-statin treatment options have been largely unable to address the needs of patients with high cholesterol due to modest efficacy, prohibitive pricing, or an inconvenient and painful injectable administration route. It is estimated that over 75% of ASCVD outpatients prefer oral drugs to injectable therapies.

Our product candidate, obicetrapib, is a next-generation, oral, low-dose CETP inhibitor that we are developing to potentially overcome the limitations of current LDL-lowering treatments. We believe that obicetrapib has the potential to be a once-daily oral CETP inhibitor for lowering LDL-C, if approved. In our Phase 2b ROSE trial, obicetrapib demonstrated a 51% lowering of LDL-C from baseline at a 10 mg dose level on top of high-intensity statins. In three of our Phase 2 trials, TULIP, ROSE and OCEAN, evaluating obicetrapib as a monotherapy or a combination therapy, we observed statistically significant LDL-lowering activity combined with generally moderate side effects and no drug-related, treatment-emergent serious adverse events (“TESAEs”). Obicetrapib has demonstrated strong tolerability in more than 800 patients with low or elevated lipid levels in our clinical trials to date. Obicetrapib is also expected to be relatively low in cost to manufacture compared to most other branded LDL-lowering therapies on the market. We believe that the estimated low cost of goods for obicetrapib will enable favorable pricing and position it to significantly improve patient access compared to existing non-statin treatments. Furthermore, we believe that obicetrapib’s oral delivery, demonstrated activity in low doses, chemical properties and tolerability make it well-suited for combination approaches. We are developing a fixed dose combination of obicetrapib 10 mg and ezetimibe 10 mg, which has been observed to demonstrate even greater potency in one of our clinical trials to date.

Lowering of LDL-C, and particularly ApoB-containing lipoproteins, has been associated with MACE benefit in trials of LDL-lowering drugs, including the REVEAL trial with the CETP inhibitor, anacetrapib. We are performing a cardiovascular outcomes trial (“CVOT”) to reconfirm this relationship.

We have partnered with A. Menarini International Licensing S.A., part of Menarini Group (“Menarini”) to provide them with the exclusive rights to commercialize obicetrapib 10 mg either as a sole active ingredient product or in a fixed dose combination with ezetimibe in the majority of European countries, if approved. Subject to receipt of marketing approval, our current plan is to pursue development and commercialization of obicetrapib in the United

States ourselves, and to consider additional partners for jurisdictions outside of the United States and the EU, including in Japan, China and the United Kingdom. In addition to our partnership with Menarini, we may in the future utilize a variety of types of collaboration, license, monetization, distribution and other arrangements with other third parties relating to the development or commercialization, once approved, of obicetrapib or future product candidates or indications. We are also continually evaluating the potential acquisition or license of new product candidates.

We are conducting two Phase 3 pivotal trials, BROADWAY and BROOKLYN, to evaluate obicetrapib as a monotherapy used as an adjunct to maximally tolerated lipid-lowering therapies to potentially enhance LDL-lowering for high-risk CVD patients. As of June 6, 2023, over 1,700 patients have been randomized in the BROADWAY trial and over 350 patients have been enrolled in the BROOKLYN trial. We expect to complete enrollment in BROADWAY in the middle of 2023, and we completed enrollment in BROOKLYN in April 2023. We currently expect to report data from both BROADWAY and BROOKLYN in the second half of 2024.

In March 2022, we commenced our Phase 3 PREVAIL CVOT, which is designed to assess the potential of obicetrapib to reduce occurrences of MACE, including cardiovascular death, non-fatal myocardial infarction, non-fatal stroke and non-elective coronary revascularization. As of June 6, 2023, over 3,400 patients have been randomized in the PREVAIL trial. We expect to complete enrollment in PREVAIL in the first quarter of 2024. We currently expect to report data from PREVAIL in 2026.

We also expect to report data from our Phase 2a clinical trial evaluating obicetrapib in patients with early Alzheimer’s disease in the second half of 2023.

We strive to protect and enhance our proprietary inventions and improvements that we consider commercially important to the development of our business, including by seeking, maintaining, and defending U.S. and foreign patent rights. All of the issued patents and pending patent applications in our patent portfolio are owned by our subsidiary, NewAmsterdam Pharma B.V., Dutch Chamber of Commerce registry number 55971946. As of December 31, 2022, we owned seven issued U.S. patents and nine pending U.S. patent applications. We also owned 98 granted European patents and three pending European patent applications, two granted Chinese patents and seven pending Chinese patent applications. In addition, we owned 74 granted patents and 31 pending patent applications in other foreign jurisdictions, including international applications under the Patent Cooperation Treaty, or PCT. Certain of our key second generation patents include U.S. Patent Nos. 10,653,692, 11,013,742, 11,642,344 and 10,300,059.

Recent Developments

Phase 2 ROSE2 Trial

On June 3, 2023, we announced full results of ROSE2, our Phase 2 clinical trial evaluating obicetrapib in combination with ezetimibe as an adjunct to high-intensity statin therapy. ROSE2 met its primary and secondary endpoints, with statistically significant and clinically meaningful reductions in LDL-C and ApoB observed. Statistically significant improvements in non-HDL cholesterol (“non-HDL-C”) and total and small LDL particles (“LDL-P”) were also observed. We also observed significant improvements in lipoprotein(a) (“Lp(a)”). In addition, the combination of obicetrapib and ezetimibe was observed to be well-tolerated, with a safety profile observed to be comparable to placebo.

ROSE2 was designed as a placebo-controlled, double-blind, randomized Phase 2 clinical trial to evaluate the efficacy, safety and tolerability of obicetrapib 10 mg in combination with ezetimibe 10 mg as an adjunct to high-intensity statin therapy. Patients were randomized to receive combination therapy, obicetrapib 10 mg or placebo for a 12 week treatment period. A total of 119 patients enrolled in ROSE2, of whom 97 were included in the on-treatment analysis. Certain patients were excluded from the on-treatment population as a result of suspected non-adherence to the trial protocol. Patients presented at baseline with a fasting LDL-C greater than 70 mg/dL and triglycerides less than 400 mg/dL and all were receiving a stable dose of high-intensity statin therapy.

The primary endpoint was the percent change from baseline to week 12 in Friedewald-calculated LDL-C for the obicetrapib plus ezetimibe combination treatment group compared with placebo. Secondary efficacy endpoints included the percent changes from baseline to week 12 in LDL-C for obicetrapib monotherapy compared with placebo and in ApoB for the obicetrapib plus ezetimibe combination compared with placebo and the obicetrapib monotherapy compared with placebo. Exploratory endpoints included the percent changes from baseline to week 12 in lipoprotein(a), non-HDL-C, HDL-C, total and small LDL-P assessed by NMR, and the proportion of patients at the end of treatment who achieved LDL-C levels below 100 mg/dL, 70 mg/dL and 55 mg/dL for the obicetrapib plus ezetimibe combination and obicetrapib monotherapy groups compared with placebo.

A summary of key observations from the ROSE2 trial is set forth below.

Topline Results

The p-value for the LS mean for each endpoint presented in the table below compared to placebo was <0.0001. The table below shows the median percent change from baseline in patients receiving the combination of obicetrapib and ezetimibe, obicetrapib monotherapy and placebo.

| Median percent change from baseline | Placebo (n=40) | Obicetrapib 10 mg (n=26) | Obicetrapib 10 mg + Ezetimibe 10 mg (n=31) | |||||||||

Friedewald-calculated LDL-C | -6.4 | -43.5 | -63.4 | |||||||||

ApoB | -2.1 | -24.2 | -34.4 | |||||||||

Non-HDL-C | -5.6 | -37.5 | -55.6 | |||||||||

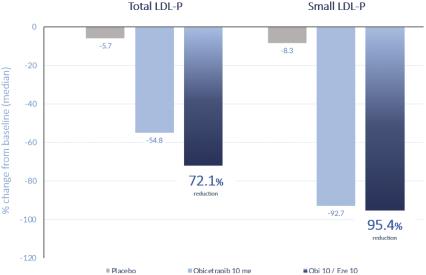

Total LDL particles | -5.7 | -54.8 | -72.1 | |||||||||

Small LDL particles | -8.3 | -92.7 | -95.4 | |||||||||

LDL particle size | -0.5 | 1.5 | 1.8 | |||||||||

In addition, we observed median reduction in Lp(a) of 47.2% and 40.2% in the monotherapy and combination arms, respectively.

Percent Change from Baseline to 12 Weeks in Lipid Biomarkers

Friedewald- calculated | Placebo | Obicetrapib 10 mg | Obicetrapib 10 mg / Ezetimibe 10 mg | |||||

LDL-C | Baseline: | |||||||

| n | 40 | 26 | 31 | |||||

| Median (min, max) | 95.5 (60, 211) | 100.0 (35, 189) | 87.0 (62, 152) | |||||

| Percent Change: | ||||||||

| Median (min, max) | -6.4 (-36.4, 96.7) | -43.5 (-78.4, 22.6) | -63.4 (-83.7, -29.7) | |||||

| LS Mean (SE)1 | -0.85 (3.47) | -39.20 (4.13) | -59.2 (3.79) | |||||

| p-value vs. placebo | — | <0.0001 | <0.0001 | |||||

ApoB | Baseline: | |||||||

| n | 40 | 26 | 31 | |||||

| Median (min, max) | 89.0 (52, 146) | 85.0 (33, 130) | 85.0 (56, 130) | |||||

| Percent Change: | ||||||||

| Median (min, max) | -2.1 (-30.9, 76.9) | -24.2 (-44.8, 27.1) | -34.4 (-54.3, -14.7) | |||||

| LS Mean (SE)1 | 0.72 (2.57) | -21.6 (3.10) | -35.0 (2.80) | |||||

| p-value vs. placebo | — | <0.0001 | <0.0001 | |||||

HDL-C | Baseline: | |||||||

| n | 40 | 26 | 31 | |||||

| Median (min, max) | 42.5 (31,68) | 47.0 (28, 111) | 46.0 (28, 76) | |||||

| Percent Change: | ||||||||

| Median (min, max) | 0.75 (-33.3, 45.0) | 142 (34.9, 311) | 136 (46.5, 261) | |||||

| LS Mean (SE)1 | -0.32 (6.71) | 151 (8.15) | 144 (7.27) | |||||

| p-value vs. placebo | — | <0.0001 | <0.0001 | |||||

non-HDL-C | Baseline: | |||||||

| n | 40 | 26 | 31 | |||||

| Median (min, max) | 126 (73, 227) | 122 (57, 209) | 116 (77, 189) | |||||

| Percent Change: | ||||||||

| Median (min, max) | -5.6 (-34.9, 83.6) | -37.5 (-59.2, 20.0) | -55.6 (-76.2, -30.8) | |||||

| LS Mean (SE)1 | -0.84 (2.99) | -33.8 (3.55) | -54.0 (3.25) | |||||

| p-value vs. placebo | — | 0.0005 | <0.0001 | |||||

Lp(a)2 | Baseline: | |||||||

| n | — | 24 | 31 | |||||

| Median (min, max) | — | 44.0 (0.8, 372.4) | 27.6 (0.2, 479.9) | |||||

| Percent Change: | — | |||||||

| Median (min, max) | — | -47.2 (-97.5, 214.5) | -40.2 (-92.4, 702.0) | |||||

| 1 | Least squares mean SE and p-values are from a mixed model for repeated measured model which included fixed effects for treatment, visit, and treatment-by-visit interaction, along with a covariate of the baseline value as a continuous covariate. Missing at random was assumed for all missing data at scheduled visits. |

| 2 | Lp(a) data for the placebo group was not available as of the date of this report on Form 6-K. |

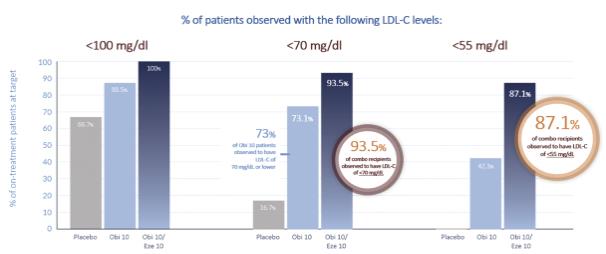

In addition, the combination of obicetrapib plus ezetimibe resulted in significantly more patients achieving LDL-C levels of less than 100 mg/dL, 70 mg/dL and 55 mg/dL than the placebo group (100%, 93.5% and 87.1% compared to 66.7%, 16.7% and 0.0%, respectively) (p<0.05 compared to placebo for combination therapy). These results are presented in further detail below:

Overall, obicetrapib alone and in combination with ezetimibe was observed to be well-tolerated compared to placebo. Treatment-emergent adverse events (“TEAEs”) were reported by 11 subjects in the combination group, eight subjects in the monotherapy group and 16 subjects in the placebo group. Adverse events were generally mild to moderate, with the most prevalent TEAEs being nausea (two subjects in the placebo group and two subjects in the combination group), urinary tract infection (two subjects in the placebo group and one subject in the combination group) and headache (two subjects in the placebo group and one subject in the monotherapy group). One TESAE was observed in each of the placebo (nervous system disorder) and monotherapy groups (cardiac disorder), neither of which was considered by the investigator to be related to trial treatment. Overall, no drug-related, TESAEs were observed, and there were no TEAEs leading to death. One subject in the combination group had a TEAE leading to discontinuation of the trial drug, compared to two in the monotherapy group and two in the placebo group. There were two severe TEAEs in the placebo group (both nervous system disorders) and one in the monotherapy group (a cardiac disorder).

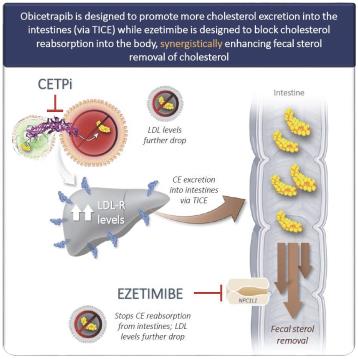

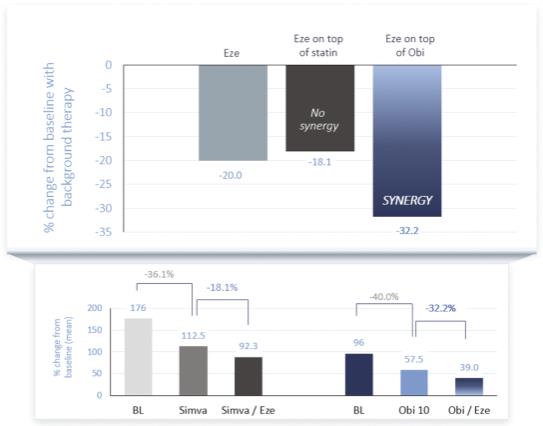

We believe that the stronger observed LDL-C lowering among patients receiving the combination therapy as compared with those receiving ezetimibe in combination with statins is potentially due to the synergistic mechanisms of action for each of obicetrapib and ezetimibe. While obicetrapib is designed to promote the expression of LDL receptors in the liver, there is evidence that CETP inhibition also promotes cholesterol excretion into the intestines, where ezetimibe is designed to block cholesterol reabsorption into the body. Therefore, the combined mechanism is expected to synergistically enhance fecal sterol removal of cholesterol, as shown in the figure below.

As suggested by the calculations below, we believe that LDL-C lowering effects of ezetimibe can be enhanced by introducing obicetrapib to help facilitate this synergistic mechanism of action.

Source for all figures on the left: Davidson MH, et al. J Am Coll Cardiol. 2002 December 18; 40(12): 2125-34.

The calculations above are not based on a head-to-head comparison or clinical study and are hypothetical calculations. These calculations are based on the findings in our ROSE2 trial with respect to the figures on the bottom right and the findings of source noted above with respect to the figures on the bottom left, and assume one patient was treated with each drug independently.

With the data and learnings from our ROSE2 trial, we have selected a formulation for a fixed-dose combination tablet of obicetrapib and ezetimibe and plan to advance the compound into a Phase 3 trial in the first quarter of 2024, with the goal of submitting an NDA for the combination shortly after submission of an NDA for the obicetrapib monotherapy. We are designing the trial as a randomized, double-blind, placebo-controlled clinical trial with the primary efficacy endpoint of percent change from baseline in LDL-C compared to placebo. We plan to enroll 400 adults with a fasting LDL-C greater than 70 mg/dL with ASCVD or heterozygous familial hypercholesterolemia. An End-of-Phase 2 meeting has been granted by FDA and scheduled for June 2023 to review the design of our Phase 3 trial. If this Phase 3 trial is commenced on schedule, we currently expect to report data in the first half of 2025.

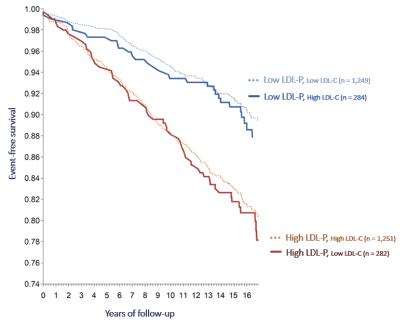

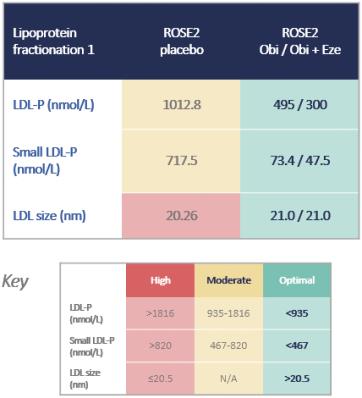

LDL-P

LDL-P is believed to one of the most robust predictors of CVD risk. High LDL-P levels typically signify that a patient has a higher proportion of small dense LDL-P compared to larger-sized LDL-P, and small dense LDL-Ps are more likely to become trapped in the arterial wall than larger-sized LDL-P, putting the patient at higher risk of CVD. Therefore, where LDL-P and LDL-C levels are discordant, low LDL-P has been observed to confer a lower risk, even in patients with high LDL-C, and high LDL-P confers a higher risk, even in patients with low LDL-C as shown in the graph below.

Source: Cromwell WC, et al. Clin Lipidol. 2007 December 1; 1(6): 583–592

In the ROSE2 trial, we observed significant reductions in total and small LDL-P, bringing patients who had baseline elevated LDL-P to optimal parameters, as shown in the figures below. The LS mean reductions in both total and small LDL-P were statistically significant.

Even though all LDL particles contain only one ApoB protein, small dense LDL particles have a less massive ApoB protein. As such, in patients who have a higher proportion of small dense LDL particles relative to total LDL particles, we have observed a discordance between total particle number and ApoB level. We believe this is particularly relevant in assessing future CVD risk, and we believe it is important to observe both total LDL particle numbers as well as small dense LDL particles in both treatment arms of the ROSE2 trial.

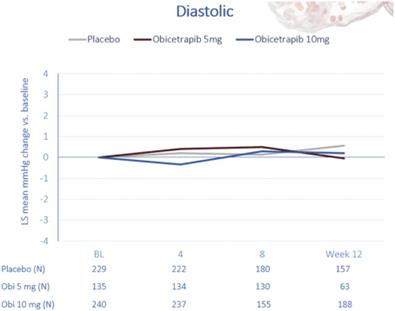

Blood Pressure Observations

A summary of the blood pressure data from our Phase 2 trials of obicetrapib is contained in the figures below.

To date, in all three of our ongoing Phase 3 trials, PREVAIL, BROADWAY and BROOKLYN, aggregate blood pressure has been observed to be stable over time.

Phase 2b Japan Trial

On June 5, 2023, we announced topline results from our Phase 2b Japan trial, which was a placebo-controlled, double-blind, randomized, dose-finding trial to evaluate the efficacy, safety and tolerability of obicetrapib as an adjunct to stable statin therapy in Japanese patients. The trial enrolled 102 adult participants, who were randomized 1:1:1:1 to receive obicetrapib 2.5 mg, 5 mg, 10 mg or placebo for a 56-day treatment period.

Patients treated with obicetrapib 2.5 mg, 5 mg or 10 mg achieved a median reduction in LDL-C of 24.8%, 31.9%, and 45.8%, respectively, as compared to patients treated with placebo, who achieved a median reduction in LDL-C of 0.9%. In addition, patients treated with obicetrapib 10 mg achieved a median reduction in ApoB of 29.7%, compared to a 0.4% reduction in patients treated with placebo, and a median reduction in non-HDL-C of 37.0%, as compared to a 0.4% reduction in patients treated with placebo. The p-value for each endpoint in the obicetrapib arms of the trial compared to placebo was <0.0001.

Overall, the different dosages of obicetrapib were observed to be generally well-tolerated, with a safety profile comparable to placebo. TEAEs were reported by 15 subjects in the 10 mg group, eight subjects in the 5 mg group, nine subjects in the 2.5 mg group and 15 subjects in the placebo group. Adverse events observed to date were primarily mild. One TESAE was observed in the 5 mg group, but it was not considered by the investigator to be related to trial treatment. Overall, no drug-related TESAEs were observed, and there were no TEAEs leading to death.

RISK FACTORS

An investment in our securities involves a high degree of risk. Before you make a decision to buy our securities, in addition to the risks and uncertainties discussed in the sections titled “Forward-Looking Statements” in this exhibit and “Special Note Regarding Forward-Looking Statements” in our registration statement on Form F-1 (File No. 333-268888) filed with the Securities and Exchange Commission (the “SEC”) and as supplemented to date (as so supplemented, the “Registration Statement”) you should carefully consider the risks and uncertainties described below and in the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the Registration Statement , including our financial statements and related notes appearing in such registration statement before deciding to invest in our securities. The Company may face additional risks and uncertainties that are not presently known to such entity, or that are currently deemed immaterial, which may also impair their business or financial condition.

We currently expect to lose foreign private issuer status as a result of the offering described in the Form 6-K of which this exhibit forms a part, which would result in significant additional costs and expenses and subject the Company to increased regulatory requirements.

As a foreign private issuer we are not required to comply with certain provisions of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) that are applicable to U.S. domestic public companies, including (1) the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act, (2) the sections of the Exchange Act requiring insiders to file public reports of their share ownership and trading activities and liability for insiders who profit from trades made in a short period of time and (3) all of the periodic disclosure and current reporting requirements of the Exchange Act applicable to domestic issuers. We have also elected to follow home country corporate governance practices rather than those of Nasdaq, including (A) not providing for quorum requirements generally applicable to general meetings in our articles of association as is permitted under Dutch law, (B) not soliciting proxies as required by Nasdaq Listing Rule 5620(b), (C) opting out of the requirement for independent directors to have regularly scheduled meetings at which only independent directors are present, and (D) opting out of shareholder approval requirements, as included in the Nasdaq Listing Rules, for the issuance of securities in connection with certain events such as the acquisition of shares or assets of another company (if, due to the potential issuance of ordinary shares, the ordinary shares would have upon issuance voting power equal to or in excess of 20% of the voting power outstanding before the issuance of stock), the establishment of or amendments to equity-based compensation plans for employees, a change of control of our company and certain private placements.

The determination of foreign private issuer status is made annually on the last business day of an issuer’s most recently completed second fiscal quarter, and, accordingly, the next determination will be made with respect to the Company on June 30, 2023 at which point, assuming completion of the offering of securities described in the Form 6-K of which this exhibit forms a part, we do not expect to satisfy the requirements for retaining our foreign private issuer status and as a result would cease to be a foreign private issuer and cease to be eligible for the foregoing exemptions and privileges effective January 1, 2024.

If we lose our foreign private issuer status, we will be required to file with the SEC periodic reports and registration statements on U.S. domestic issuer forms, which are more detailed and extensive than the forms available to a foreign private issuer. We would have to begin preparing our financial statements in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”) which will result in financial statements that are different than our historical financial statements and may make it difficult for investors to compare our financial performance over time. We would also have to mandatorily comply with U.S. federal proxy requirements, and our officers, directors and principal shareholders will become subject to the reporting and short-swing profit disclosure and recovery provisions of Section 16 of the Exchange Act. In addition, we would lose our ability to rely upon exemptions from certain corporate governance requirements under the listing rules of Nasdaq. As a U.S. listed public company that is not a foreign private issuer, we would incur significant additional legal, accounting and other expenses that we will not incur as a foreign private issuer. We also expect that if we were required to comply with the rules and regulations applicable to United States domestic issuers, it would make it more difficult and expensive for us to obtain director and officer liability insurance, and we may be required to accept reduced coverage or incur substantially higher costs to obtain coverage. These rules and regulations could also make it more difficult for us to attract and retain qualified members of our management team.

The price of our Ordinary Shares may be volatile, and you may be unable to sell your Ordinary Shares at or above the price at which you purchased them.

The market price of our Ordinary Shares may be volatile and could be subject to wide fluctuations in response to many risk factors listed in this section and in the Registration Statement, and others beyond our control.

Furthermore, the stock markets have experienced price and volume fluctuations that have affected and continue to affect the market prices of equity securities of many companies. These fluctuations often have been unrelated or disproportionate to the operating performance of those companies. These broad market and industry fluctuations, as well as general economic, political and market conditions such as recessions, interest rate changes or international currency fluctuations, may negatively impact the market price of our Ordinary Shares. If the market price of our Ordinary Shares does not exceed the price at which you purchased them, you may not realize any return on your investment and may lose some or all of your investment.

Sales of a substantial number of our securities in the public market by the selling securityholders and/or by our existing securityholders could cause the price of our Ordinary Share to fall.

Our executive officers and directors, the selling securityholders and certain other securityholders have entered into lock-up agreements, on substantially similar terms, which expire 90 days from June 6, 2023. Jefferies LLC and SVB Securities LLC, as the representatives of the underwriters in the transaction described in the Form 6-K of which this exhibit forms a part, at any time and without notice, may release all or any portion of the Ordinary Shares subject to the foregoing lock-up agreements. If the restrictions under the lock-up agreements are waived, then the Ordinary Shares held by such holders subject to lock-up agreements, subject to compliance with the Securities Act of 1933, as amended (the “Securities Act”), or exceptions therefrom, will be available for sale into the public markets. The market price of our Ordinary Shares could decline as a result of sales of a large number of shares in the market after the expiration or early release of the lock-up period or even the perception that these sales could occur.

Pursuant to the Registration Statement, certain shareholders can resell up to 76,892,642 Ordinary Shares (including the Ordinary Shares contemplated for sale by transaction described in the Form 6-K of which this exhibit forms a part) constituting approximately 88.9% of our issued and outstanding Ordinary Shares as of March 31, 2023 (assuming the exercise of all outstanding Warrants). After giving effect to the sale of 13,857,415 Ordinary Shares being offered by the selling securityholders in the transaction described in the Form 6-K of which this exhibit forms a part (assuming no exercise of the underwriters’ option), 63,035,227 Ordinary Shares will remain available for resale under the Form F-1, which represent a substantial percentage of our outstanding Ordinary Shares, and the sales of such securities, or the perception that those sales might occur, could depress the market price of our Ordinary Shares and could impair our ability to raise capital through the sale of additional equity securities. We are unable to predict the effect that such sales may have on the prevailing market price of our Ordinary Shares but the sale of a large number of securities could result in a significant decline in the public trading price of our securities.

Certain of the selling securityholders acquired their securities at a price that is less than the market price of our Ordinary Shares as of June 5, 2023. As a result, such selling securityholders may earn a positive rate of return even if the price of our Ordinary Shares declines and may be willing to sell their shares at a price less than shareholders that acquired our shares in the public market.

Certain of our securityholders purchased their respective Ordinary Shares at prices lower than current market prices and may therefore experience a positive rate of return on their investment, even if our public securityholders experience a negative rate of return on their investment. The closing price of our Ordinary Shares on Nasdaq on June 5, 2023 was $13.85 per share. Based on the prices paid by certain of our securityholders they would be able to recognize a greater return on their investment than shareholders that purchased Ordinary Shares in the public market. Furthermore, such shareholders may earn a positive rate of return even if the price of our Ordinary Shares declines significantly. As a result, such securityholders may be willing to sell their shares at a price less than shareholders that acquired our shares in the public market or at higher prices than the price paid by such securityholders. The sale or possibility of sale of these Ordinary Shares, could have the effect of increasing the volatility in the price of the Ordinary Shares or putting significant downward pressure on the price of the Ordinary Shares.

Each of the Sponsor and NewAmsterdam Pharma’s former shareholders own a significant portion of Ordinary Shares and have representation on the Board of Directors. The Sponsor and NewAmsterdam Pharma’s former shareholders may have interests that differ from those of other shareholders.

As of December 31, 2022, approximately 16.2% of our Ordinary Shares were owned by the Sponsor and the former holders of all other issued and outstanding FLAC Class B ordinary shares (together, the “FLAC Shareholders”), approximately 44.5% were owned by NewAmsterdam Pharma’s former shareholders (excluding Ordinary Shares purchased in the PIPE Financing) and approximately 23.2% of our Ordinary Shares were owned by the PIPE Investors (as defined in the Registration Statement) (excluding the FLAC Shareholders and affiliates of the Sponsor). These levels of ownership interests assume that (i) none of the Warrants have been exercised, (ii) none of the 1,886,137 Earnout Shares have been issued, and (iii) no options to purchase Ordinary Shares (the “Options”) or awards that may be issued under the Company’s long-term incentive plan have been exercised. In addition, two of our non-executive director nominees were designated by FLAC and two other directors are affiliated with Forbion, our largest shareholder. As a result, the Sponsor and NewAmsterdam Pharma’s former shareholders may be able to significantly influence the outcome of matters submitted for director action, subject to obligation of our board of directors (the “Board of Directors”) to act in the interest of all of our stakeholders, and for shareholder action, including the designation and appointment of the Board of Directors and approval of significant corporate transactions, including business combinations, consolidations and mergers. The influence of the Sponsor or its affiliates and certain of our current shareholders over our management could have the effect of delaying or preventing a change in control or otherwise discouraging a potential acquirer from attempting to obtain control of the Company, which could cause the market price of our Ordinary Shares to decline or prevent our shareholders from realizing a premium over the market price for their Ordinary Shares. Additionally, the Sponsor, which is in the business of making investments in companies and which may from time to time acquire and hold interests in businesses that compete directly or indirectly with us or that supply us with goods and services. The Sponsor may also pursue acquisition opportunities that may be complementary to (or competitive with) our business, and as a result those acquisition opportunities may not be available to us. Investors in our Ordinary Shares should consider that the interests of the Sponsor or its affiliates and certain of our current shareholders may differ from their interests in material respects.

Our PFIC status could result in adverse U.S. federal income tax consequences to U.S. Holders.

Based on current estimates of the composition of the income and assets of the Company and its subsidiaries for the taxable year ended December 31, 2022, we believe that the Company may be treated as a passive foreign investment company (a “PFIC”) for U.S. federal income tax purposes for the 2022 taxable year, which was the year in which the Business Combination was completed. However, we have not yet determined whether we expect to be a PFIC for the current taxable year or any future taxable years. Under the U.S. Internal Revenue Code of 1986, as amended (the “Code”), a non-U.S. corporation is classified as a PFIC for any tax year if, after the application of certain “look-through” rules with respect to subsidiaries, at least 75% of its gross income is “passive income” or at least 50% of the value of its assets, determined on the basis of quarterly averages, is attributable to assets that produce or are held for the production of “passive income.” The determination of whether the Company or any of its non-U.S. subsidiaries is a PFIC is made annually and thus subject to change, and it generally cannot be made until the end of the taxable year.

Passive income generally includes dividends, interest, royalties, rents (other than certain rents and royalties derived in the active conduct of a trade or business), annuities and gains from assets that produce passive income. Cash is a passive asset for PFIC purposes, even if held as working capital. For this purpose, a non-U.S. corporation is generally treated as owning a proportionate share of the assets and earning a proportionate share of the income of any other corporation in which it owns, directly or indirectly, at least 25% (by value) of the stock. Accordingly, the Company will be treated as owning the cash and other cash-equivalent items of Frazier Lifesciences Acquisition Corporation.

A U.S. Holder (as defined in the section entitled “United States Federal Income Tax Considerations” in this exhibit) generally will be subject to additional U.S. federal income taxes and interest charges on the gain from a sale of the Company’s ordinary shares, with a nominal value of € 0.12 per share (“Ordinary Shares”) or the public warrants initially issued in connection with FLAC’s initial public offering (the “Public Warrants”), and the private placement warrants acquired by Frazier Lifesciences Sponsor LLC (such warrants, together with the Public Warrants, the “Warrants”) and on receipt of an “excess distribution” with respect to Ordinary Shares or any of its non-U.S. subsidiaries. A U.S. Holder of stock of a PFIC generally may mitigate these adverse U.S. federal income tax consequences, however, by making a “qualified electing fund” election or a “mark-to-market” election. If we determine that we and/or any of our subsidiaries is a PFIC for any taxable year, we intend to provide a U.S. Holder such information as the United States Internal Revenue Service (the “IRS”) may require, including a PFIC Annual Information Statement, in order to enable the U.S. Holder to make and maintain a “qualified electing fund” election with respect to the Company and/or such non-U.S. subsidiaries, but there can be no assurance that we will be able to timely provide such required information. U.S. Holders generally will not be able to make a qualified electing fund election solely with respect to the Warrants.

Provisions of our Articles of Association or Dutch corporate law might deter acquisition bids for the Company that might be considered favorable and prevent, delay or frustrate any attempt to replace or dismiss directors.

Under Dutch law, various protective measures are possible and permissible within the boundaries set by Dutch law and Dutch case law.

In this respect, certain provisions of the Articles of Association may make it more difficult for a third-party to acquire control of us or effect a change in the composition of the Board of Directors. These include:

| • | a provision that the Company’s directors can only be appointed on the basis of a binding nomination prepared by the Board of Directors which can only be overruled by a two-thirds majority of votes cast representing more than half of our issued share capital; |

| • | a provision that the Company’s directors can only be dismissed by the general meeting of our shareholders (the “General Meeting”) by a two-thirds majority of votes cast representing more than half of our issued share capital, unless the dismissal is proposed by the Board of Directors in which latter case a simple majority of the votes cast would be sufficient; |

| • | a provision allowing, among other matters, the former chairperson of the Board of Directors or the Company’s former Chief Executive Officer to manage the Company’s affairs if all of its directors are dismissed and to appoint others to be charged with our affairs, including the preparation of a binding nomination for our directors as discussed above, until new directors are appointed by the General Meeting on the basis of such binding nomination; and |

| • | a requirement that certain matters, including an amendment of the Articles of Association, may only be resolved upon by the General Meeting if proposed by the Board of Directors. |

Dutch law also allows for staggered multi-year terms of our directors, as a result of which only part of our Board of Directors will be subject to appointment or re-appointment in any given year.

Furthermore, in accordance with the Dutch Corporate Governance Code (the “DCGC”), shareholders who have the right to put an item on the agenda for the General Meeting or to request the convening of a General Meeting shall not exercise such rights until after they have consulted the Board of Directors. If exercising such rights may result in a change in our strategy (for example, through the dismissal of one or more directors), the Board of Directors must be given the opportunity to invoke a reasonable period of up to 180 days to respond to the shareholders’ intentions. If invoked, the Board of Directors must use such response period for further deliberation and constructive consultation, in any event with the shareholder(s) concerned and exploring alternatives. At the end of the response

time, the Board of Directors shall report on this consultation and the exploration of alternatives to the General Meeting. The response period may be invoked only once for any given General Meeting and shall not apply (i) in respect of a matter for which a response period or a statutory cooling-off period (as discussed below) has been previously invoked or (ii) in situations where a shareholder holds at least 75% of our issued share capital as a consequence of a successful public bid.

Moreover, under Dutch law, the Board of Directors can invoke a cooling-off period of up to 250 days when shareholders, using their right to have items added to the agenda for a General Meeting or their right to request a General Meeting, propose an agenda item for the General Meeting to dismiss, suspend or appoint one or more directors (or to amend any provision in the Articles of Association dealing with those matters) or when a public offer for the Company is made or announced without our support, provided, in each case, that the Board of Directors believes that such proposal or offer materially conflicts with the interests of the Company and its business. During a cooling-off period, the General Meeting cannot dismiss, suspend or appoint directors (or amend the provisions in the Articles of Association dealing with those matters) except at the proposal of the Board of Directors. During a cooling-off period, the Board of Directors must gather all relevant information necessary for a careful decision-making process and at least consult with shareholders representing 3% or more of our issued share capital at the time the cooling-off period was invoked, as well as with our Dutch works council (if we or, under certain circumstances, any of our subsidiaries would have one). Formal statements expressed by these consulted parties during such consultations must be published on our website to the extent these consulted parties have approved that publication. Ultimately, one week following the last day of the cooling-off period, the Board of Directors must publish a report in respect of its policy and conduct of affairs during the cooling-off period on our website. This report must remain available for inspection by shareholders and others with meeting rights under Dutch law at our office and must be tabled for discussion at the next General Meeting. Shareholders representing at least 3% of our issued share capital may request the Enterprise Chamber (Ondernemingskamer) of the Amsterdam Court of Appeal (the “Enterprise Chamber”), for early termination of the cooling-off period. The Enterprise Chamber must rule in favor of the request if the shareholders can demonstrate that:

| • | the Board of Directors, in light of the circumstances at hand when the cooling-off period was invoked, could not reasonably have concluded that the relevant proposal or hostile offer constituted a material conflict with the interests of us and our business; |

| • | the Board of Directors cannot reasonably believe that a continuation of the cooling-off period would contribute to careful policy-making; or |

| • | other defensive measures, having the same purpose, nature and scope as the cooling-off period, have been activated during the cooling-off period and have not since been terminated or suspended within a reasonable period at the relevant shareholders’ request (i.e., no “stacking” of defensive measures). |

UNITED STATES FEDERAL INCOME TAX CONSIDERATIONS

The following is a description of the material U.S. federal income tax consequences to the U.S. Holders (as defined below) of owning and disposing of our Ordinary Shares and Warrants, which we refer to collectively as our securities. It is not a comprehensive description of all tax considerations that may be relevant to a particular person’s decision to acquire securities. This discussion applies only to a U.S. Holder that is an initial purchaser of securities pursuant to the Registration Statement and that holds our securities as a capital asset for tax purposes (generally, property held for investment). In addition, this discussion does not describe all of the tax consequences that may be relevant in light of a U.S. Holder’s particular circumstances, including state and local tax consequences, estate tax consequences, alternative minimum tax consequences, the potential application of the Medicare contribution tax on net investment income, and tax consequences applicable to U.S. Holders subject to special rules, such as:

| • | banks or insurance companies; |

| • | mutual funds and pension plans; |

| • | U.S. expatriates and certain former citizens or long-term residents of the United States; |

| • | dealers or traders in securities who use a mark-to-market method of tax accounting; |

| • | persons holding Ordinary Shares or Warrants as part of a hedging transaction, “straddle,” “hedge,” “conversion,” “synthetic security,” “constructive ownership transaction,” “constructive sale” or other integrated transaction for U.S. federal income tax purposes; |

| • | U.S. Holders whose “functional currency” for U.S. federal income tax purposes is not the U.S. dollar; |

| • | brokers, dealers or traders in securities, commodities or currencies; |

| • | tax-exempt organizations, qualified retirement plans, individual retirement accounts or other tax deferred accounts; |

| • | S corporations, partnerships, or other entities or arrangements classified as partnerships for U.S. federal income tax purposes; |

| • | regulated investment companies or real estate investment trusts; |

| • | persons who acquired our Ordinary Shares or Warrants pursuant to the exercise of any employee stock option or otherwise as compensation; |

| • | Corporations that accumulate earnings to avoid U.S. federal income tax; |

| • | persons holding our Ordinary Shares or Warrants in connection with a trade or business or permanent establishment outside the United States; and |

| • | persons who own (directly or through attribution) 10% or more (by vote or value) of our outstanding Ordinary Shares. |

If an entity that is classified as a partnership for U.S. federal income tax purposes holds our securities, the U.S. federal income tax treatment of a partner will generally depend on the status of the partner and the activities of the partnership. Partnerships holding our securities and partners in such partnerships are encouraged to consult their tax advisors as to the particular U.S. federal income tax consequences of holding and disposing of our securities.

The discussion is based on the Code, administrative pronouncements, judicial decisions, final, temporary and proposed Treasury Regulations, all as of the date hereof, changes to any of which may affect the tax consequences described herein—possibly with retroactive effect.

A “U.S. Holder” is a holder who, for U.S. federal income tax purposes, is a beneficial owner of securities and is:

| (A) | An individual who is a citizen or individual resident of the United States; |

| (B) | a corporation, or other entity taxable as a corporation, created or organized in or under the laws of the United States, any state therein or the District of Columbia; |

| (C) | an estate the income of which is subject to U.S. federal income taxation regardless of its source; or |

| (D) | a trust if (1) a U.S. court is able to exercise primary supervision over the administration of the trust and one or more U.S. persons have authority to control all substantial decisions of the trust or (2) the trust has a valid election to be treated as a U.S. person under applicable U.S. Treasury Regulations. |

PERSONS CONSIDERING AN INVESTMENT IN OUR SECURITIES SHOULD CONSULT THEIR OWN TAX ADVISORS AS TO THE PARTICULAR TAX CONSEQUENCES APPLICABLE TO THEM RELATING TO THE ACQUISITION, OWNERSHIP AND DISPOSITION OF OUR SECURITIES, INCLUDING THE APPLICABILITY OF U.S. FEDERAL, STATE AND LOCAL TAX LAWS.

Consequences of Ownership and Disposition of Ordinary Shares or Warrants to U.S. Holders—Application of Passive Foreign Investment Company Rules to U.S. Holders of Ordinary Shares or Warrants

Based on current estimates of the composition of the income and assets of the Company and its subsidiaries for the taxable year ended December 31, 2022, we believe that the Company may be treated as a PFIC for U.S. federal income tax purposes for the 2022 taxable year, the year during which the Business Combination (as defined in the Registration Statement) was completed. However, we have not yet determined whether we expect to be a PFIC for the current taxable year or any future taxable years. A non-U.S. corporation will be classified as a PFIC for U.S. federal income tax purposes if either (i) at least 75% of its gross income in a taxable year, including its pro rata share of the gross income of any corporation in which it is considered to own at least 25% of the shares by value, is passive income or (ii) at least 50% of its assets in a taxable year (ordinarily determined based on fair market value and averaged quarterly over the year), including its pro rata share of the assets of any corporation in which it is considered to own at least 25% of the shares by value, are held for the production of, or produce, passive income. Passive income generally includes dividends, interest, rents and royalties (other than rents or royalties derived in the active conduct of a trade or business) and gains from the disposition of passive assets. A separate determination must be made after the close of each taxable year as to whether a foreign corporation was a PFIC for that year. Once a foreign corporation is treated as a PFIC it is, with respect to a shareholder during the time it qualifies as a PFIC, and subject to certain exceptions, always treated as a PFIC with respect to such shareholder, regardless of whether it satisfied either of the qualification tests in subsequent years.

There are three separate taxation regimes that could apply to a U.S. Holder of Ordinary Shares or Warrants under the PFIC rules, which are (i) the excess distribution regime (which is the default regime), (ii) the QEF regime, and (iii) the mark-to-market regime (each discussed below). A U.S. Holder who holds (actually or constructively) stock in a foreign corporation during any year in which such corporation qualifies as a PFIC is subject to U.S. federal income taxation under one of these three regimes. The effect of the PFIC rules on a U.S. Holder will depend upon which of these regimes applies to such U.S. Holder. Moreover, dividends paid by a PFIC are not eligible for the lower rates of taxation applicable to qualified dividend income (“QDI”) under any of the foregoing regimes.

Excess Distribution Regime

A U.S. Holder that does not make a QEF election or a mark-to-market election, both as described below, will be subject to the default “excess distribution regime” under the PFIC rules with respect to (i) any gain realized on a sale or other disposition (including a pledge) of Ordinary Shares, and (ii) any “excess distribution” received on the U.S. Holder’s Ordinary Shares (generally, any distributions in excess of 125% of the average of the annual distributions on Ordinary Shares during the preceding three years or the U.S. Holder’s holding period, whichever is shorter).

Generally, under this excess distribution regime: the gain or excess distribution will be allocated ratably over the period during which the U.S. Holder held the Ordinary Shares; the amount allocated to the current taxable year, will be treated as ordinary income; and the amount allocated to prior taxable years will be subject to the highest tax rate in effect for that taxable year and the interest charge generally applicable to underpayments of tax will be imposed on the resulting tax attributable to each such year.

The tax liability for amounts allocated to years prior to the year of disposition or excess distribution will be payable generally without regard to offsets from deductions, losses and expenses. In addition, gains (but not losses) a U.S. Holder realizes on the sale of Ordinary Shares cannot be treated as capital gains, even if the U.S. Holder holds the shares as capital assets. Further, no portion of any distribution will be treated as QDI.

QEF Regime

A QEF election is effective for the taxable year for which the election is made and all subsequent taxable years and may not be revoked without the consent of the IRS. If a U.S. Holder makes a timely QEF election with respect to its direct or indirect interest in a PFIC, the U.S. Holder will be required to include in income each year a portion of the ordinary earnings and net capital gains of the PFIC as QEF income inclusions, even if amount is not distributed to the U.S. Holder. Thus, the U.S. Holder may be required to report taxable income as a result of QEF income inclusions without corresponding receipts of cash. U.S. Holders of Ordinary Shares should not expect that they will receive cash distributions from the Company sufficient to cover their respective U.S. tax liability with respect to such QEF income inclusions. In addition, as discussed below, U.S. Holders of Warrants will not be able to make a QEF election with respect to their Warrants.

The timely QEF election also allows the electing U.S. Holder to: (i) generally treat any gain recognized on the disposition of its shares of the PFIC as capital gain; (ii) treat its share of the PFIC’s net capital gain, if any, as long-term capital gain instead of ordinary income; and (iii) either avoid interest charges resulting from PFIC status altogether, or make an annual election, subject to certain limitations, to defer payment of current taxes on its share of PFIC’s annual realized net capital gain and ordinary earnings subject, however, to an interest charge on the deferred tax computed by using the statutory rate of interest applicable to an extension of time for payment of tax. In addition, net losses (if any) of a PFIC will not pass through to an electing U.S. Holder and may not be carried back or forward in computing such PFIC’s ordinary earnings and net capital gain in other taxable years. Consequently, a U.S. Holder may over time be taxed on amounts that as an economic matter exceed our net profits.

A U.S. Holder’s tax basis in Ordinary Shares will be increased to reflect QEF income inclusions and will be decreased to reflect distributions of amounts previously included in income as QEF income inclusions. No portion of the QEF income inclusions attributable to ordinary income will be treated as QDI. Amounts included as QEF income inclusions with respect to direct and indirect investments generally will not be taxed again when distributed. U.S. Holders should consult their tax advisors as to the manner in which QEF income inclusions affect their allocable share of the Company’s income and their basis in their Ordinary Shares.

The Company intends to determine its PFIC status at the end of each taxable year and intends to satisfy any applicable record keeping and reporting requirements that apply to a QEF, including providing to U.S. Holders, for each taxable year that it determines it is or, in its reasonable determination, may be a PFIC, a PFIC Annual Information Statement containing information necessary for U.S. Holders to make a QEF Election with respect to the Company. The Company will provide such information electronically.

U.S. Holders of Warrants will not be able to make a QEF election with respect to their Warrants. As a result, if a U.S. Holder sells or otherwise disposes of such Warrants (other than upon exercise of such Warrants for cash) and the Company was a PFIC at any time during the U.S. Holder’s holding period of such Warrants, any gain recognized generally will be treated as an excess distribution, taxed as described above under “—Excess Distribution Regime.” If a U.S. Holder that exercises such a Warrants properly makes and maintains a QEF election with respect to the newly acquired Ordinary Shares (or has previously made a QEF election with respect to the Ordinary Shares), the QEF election will apply to the newly acquired Ordinary Shares.

Notwithstanding such QEF election, the adverse tax consequences relating to PFIC shares, adjusted to take into account the current income inclusions resulting from the QEF election, will continue to apply with respect to such newly acquired Ordinary Shares (which generally will be deemed to have a holding period for purposes of the PFIC rules that includes the period the U.S. Holder held the Warrants), unless the U.S. Holder makes a purging election under the PFIC rules. Under one type of purging election, the U.S. Holder will be deemed to have sold such shares at their fair market value and any gain recognized on such deemed sale will be treated as an excess distribution, as described above.

Mark-to-Market Regime

Alternatively, a U.S. Holder may make an election to mark marketable shares in a PFIC to market on an annual basis. PFIC shares generally are marketable if: (i) they are “regularly traded” on a national securities exchange that is registered with the SEC or on the national market system established under Section 11A of the Exchange Act; or (ii) they are “regularly traded” on any exchange or market that the Treasury Department determines to have rules sufficient to ensure that the market price accurately represents the fair market value of the stock.

For these purposes, the securities will be considered regularly traded during any calendar year during which they are traded, other than in de minimis quantities, on at least 15 days during each calendar quarter, on a qualified exchange. Any trades that have as their principal purpose meeting this requirement will be disregarded. Our securities are listed on Nasdaq, which is a qualified exchange for these purposes. Consequently, if our Ordinary Shares remain listed on Nasdaq and are regularly traded, and you are a U.S. Holder of securities, we expect the mark-to-market election would be available to you if we are a classified as a PFIC. Each U.S. Holder should consult its tax advisor as to the whether a mark-to-market election is available or advisable with respect to the securities. U.S. Holders of Warrants will not be able to make a mark-to-market election with respect to their Warrants.

A U.S. Holder that makes a mark-to-market election must include in ordinary income for each year an amount equal to the excess, if any, of the fair market value of the securities at the close of the taxable year over the U.S. Holder’s adjusted tax basis in the Ordinary Shares. An electing holder may also claim an ordinary loss deduction for the excess, if any, of the U.S. Holder’s adjusted basis in the Ordinary Shares over the fair market value of the shares at the close of the taxable year, but this deduction is allowable only to the extent of any net mark-to-market gains for prior years. Gains from an actual sale or other disposition of the Ordinary Shares will be treated as ordinary income, and any losses incurred on a sale or other disposition of the Ordinary Shares will be treated as an ordinary loss to the extent of any net mark-to-market gains for prior years. Once made, the election cannot be revoked without the consent of the IRS, unless the securities cease to be marketable.

However, a mark-to-market election generally cannot be made for equity interests in any lower-tier PFICs that we own, unless shares of such lower-tier PFIC are themselves “marketable.” As a result, even if a U.S. Holder validly makes a mark-to-market election with respect to our securities, the U.S. Holder may continue to be subject to the PFIC rules (described above) with respect to its indirect interest in any of our investments that are treated as an equity interest in a PFIC for U.S. federal income tax purposes. U.S. Holders should consult their tax advisors to determine whether any of these elections would be available and if so, what the consequences of the alternative treatments would be in their particular circumstances.

Unless otherwise provided by the IRS, each U.S. shareholder of a PFIC is required to file an annual report on IRS Form 8621. A U.S. Holder’s failure to file the annual report will cause the statute of limitations for such U.S. Holder’s U.S. federal income tax return to remain open with regard to the items required to be included in such report until three years after the U.S. Holder files the annual report, and, unless such failure is due to reasonable cause and not willful neglect, the statute of limitations for the U.S. Holder’s entire U.S. federal income tax return will remain open during such period. U.S. Holders should consult their tax advisors regarding the requirements of filing such information returns under these rules.

WE STRONGLY URGE YOU TO CONSULT YOUR TAX ADVISOR REGARDING THE IMPACT OF OUR PFIC STATUS ON YOUR INVESTMENT IN THE SECURITIES AS WELL AS THE APPLICATION OF THE PFIC RULES TO YOUR INVESTMENT IN THE SECURITIES.

U.S. Federal Income Tax Consequences of Ownership and Disposition of Ordinary Shares or Warrants to U.S. Holders if the Company is not a PFIC

Distributions on Ordinary Shares

The treatment of U.S. Holders of Ordinary Shares or Warrants will be materially different from that described above if the Company is not treated as a PFIC for the taxable year during which the Business Combination was completed. If the Company is not treated as a PFIC for the taxable year during which the Business Combination was completed, the gross amount of any distribution on Ordinary Shares generally will be taxable to a U.S. Holder as ordinary

dividend income on the date such distribution is actually or constructively received, to the extent that the distribution is paid out of the Company’s current or accumulated earnings and profits (as determined under U.S. federal income tax principles). Because the Company does not maintain, nor is it required to maintain, calculations of its earnings and profits under U.S. federal income tax principles, it is currently expected that any distributions generally will be reported to U.S. Holders as dividends. Any such dividends generally will not be eligible for the dividends received deduction allowed to corporations in respect of dividends received from other U.S. corporations.

With respect to non-corporate U.S. Holders, dividends will be taxed at the preferential long-term capital gains rate (see “—Sale, Exchange, Redemption or Other Taxable Disposition of Ordinary Shares or Warrants” below), provided the applicable holding period is met, if Ordinary Shares are readily tradable on an established securities market in the United States (which they will be if the Ordinary Shares continue to be traded on the Nasdaq) and certain other requirements are met. There can be no assurance that Ordinary Shares will be considered readily tradable on an established securities market in all future years. U.S. Holders should consult their tax advisors regarding the potential availability of the lower rate for any dividends paid with respect to Ordinary Shares.

A U.S. Holder must include any Dutch tax withheld from the dividend payment in the gross amount of the dividend even if the holder does not in fact receive it. The dividend is taxable to the holder when the holder receives the dividend, actually or constructively. The amount of the dividend distribution includible in a U.S. Holder’s income will be the U.S. dollar value of the Euro payments made, determined at the spot Euro/U.S. dollar rate on the date the dividend distribution is includible in income, regardless of whether the payment is in fact converted into U.S. dollars. Generally, any gain or loss resulting from currency exchange fluctuations during the period from the date the dividend payment is included in income to the date the payment is converted into U.S. dollars will be treated as ordinary income or loss and will not be eligible for the special tax rate applicable to qualified dividend income. The gain or loss generally will be income or loss from sources within the United States for foreign tax credit limitation purposes.

Dividends that the Company distributes generally should constitute “passive category income,” or, in the case of certain U.S. Holders, “general category income” for foreign tax credit limitation purposes. The rules relating to the determination of the foreign tax credit limitation are complex, and U.S. Holders should consult their tax advisor to determine whether and to what extent they will be entitled to a credit for Dutch withholding taxes imposed in respect of any dividend the Company distributes.

Sale or Other Taxable Disposition of Ordinary Shares or Warrants

If the Company is not treated as a PFIC for the taxable year during which the Business Combination was completed, a U.S. Holder generally will recognize gain or loss on any sale, exchange, redemption (subject to the discussion below) or other taxable disposition of Ordinary Shares or Warrants in an amount equal to the difference between (i) the amount realized on the disposition and (ii) such U.S. Holder’s adjusted tax basis in such securities. Any gain or loss recognized by a U.S. Holder on a taxable disposition of Ordinary Shares or Warrants generally will be capital gain or loss and will be long-term capital gain or loss if the holder’s holding period in such shares and/or warrants exceeds one year at the time of the disposition. Preferential tax rates may apply to long-term capital gains of non-corporate U.S. Holders (including individuals). The deductibility of capital losses is subject to limitations.

If the consideration received by a U.S. Holder is in the form of currency other than U.S. dollars, the amount realized will be the U.S. dollar value of the payment received determined by reference to the spot rate of exchange on the date of the sale or other disposition. However, if the securities disposed of in the transaction are treated as traded on an “established securities market” and you are either a cash basis taxpayer or an accrual basis taxpayer that has made a special election (which must be applied consistently from year to year and cannot be changed without the consent of the IRS), you will determine the U.S. dollar value of the amount realized in a non-U.S. dollar currency by translating the amount received at the spot rate of exchange on the settlement date of the sale. If you are an accrual basis taxpayer that is not eligible to or does not elect to determine the amount realized using the spot rate on the settlement date, you will recognize foreign currency gain or loss to the extent of any difference between the U.S. dollar amount realized on the date of sale or disposition and the U.S. dollar value of the currency received at the spot rate on the settlement date.

Exercise or Lapse of a Warrant

Except as discussed below with respect to the cashless exercise of a Warrant, a U.S. Holder generally will not recognize taxable gain or loss upon the exercise of a Warrant for cash. The U.S. Holder’s initial tax basis in our Ordinary Shares received upon exercise of the Warrant will generally be an amount equal to the sum of the U.S. Holder’s acquisition cost of the Warrant and the exercise price of such Warrant. It is unclear whether a U.S. Holder’s holding period for the Ordinary Shares received upon exercise of the Warrant would commence on the date of exercise of the Warrant or the day following the date of exercise of the Warrant; however, in either case the holding period will not include the period during which the U.S. Holder held the Warrants. If a Warrant is allowed to lapse unexercised, a U.S. Holder generally will recognize a capital loss equal to such holder’s tax basis in the Warrant.

The tax consequences of a cashless exercise of a Warrant are not clear under current tax law. A cashless exercise may be nontaxable, either because the exercise is not a realization event or because the exercise is treated as a recapitalization for U.S. federal income tax purposes. In either situation, a U.S. Holder’s initial tax basis in the Ordinary Shares received generally should equal the holder’s adjusted tax basis in the Warrant. If the cashless exercise were treated as not being a realization event, it is unclear whether a U.S. Holder’s holding period for the Ordinary Shares would commence on the date of exercise of the Warrant or the day following the date of exercise of the Warrant; in either case, the holding period would not include the period during which the U.S. Holder held the Warrant. If, instead, the cashless exercise were treated as a recapitalization, the holding period of the Ordinary Shares generally would include the holding period of the Warrant.

It is also possible that a cashless exercise of a Warrant will be treated in part as a taxable exchange in which gain or loss is recognized. In such event, a U.S. Holder could be deemed to have surrendered a portion of the Warrants being exercised having a value equal to the exercise price of such Warrants in satisfaction of such exercise price. Although not free from doubt, such U.S. Holder generally should recognize capital gain or loss in an amount equal to the difference between the fair market value of the Warrants deemed surrendered to satisfy the exercise price and the U.S. Holder’s adjusted tax basis in such Warrants. In this case, a U.S. Holder’s initial tax basis in the Ordinary Shares received would equal the sum of the exercise price and the U.S. holder’s adjusted tax basis in the Warrants exercised. It is unclear whether a U.S. Holder’s holding period for the Ordinary Shares would commence on the date of exercise of the Warrant or the day following the date of exercise of the Warrant; in either case, the holding period would not include the period during which the U.S. Holder held the Warrant. Due to the uncertainty and absence of authority on the U.S. federal income tax treatment of a cashless exercise, including when a U.S. Holder’s holding period would commence with respect to the Ordinary Shares received, U.S. Holders are urged to consult their tax advisors regarding the tax consequences of a cashless exercise.

Information Reporting and Backup Withholding

Payments of dividends and sales proceeds that are made within the United States or through certain U.S.-related financial intermediaries generally are subject to information reporting, and may be subject to backup withholding, unless (i) the U.S. Holder is a corporation or other exempt recipient or (ii) in the case of backup withholding, the U.S. Holder provides a correct taxpayer identification number and certifies that it is not subject to backup withholding on a duly executed IRS Form W-9 or otherwise establishes an exemption.

Backup withholding is not an additional tax. The amount of any backup withholding from a payment to a U.S. Holder may be allowed as a credit against the U.S. Holder’s U.S. federal income tax liability and may entitle the U.S. Holder to a refund, provided that the required information is timely furnished to the IRS.

Information with Respect to Foreign Financial Assets

Certain U.S. Holders who are individuals (and, under regulations, certain entities) may be required to report information relating to the securities, subject to certain exceptions (including an exception for securities held in accounts maintained by certain U.S. financial institutions), by filing IRS Form 8938 (Statement of Specified Foreign Financial Assets) with their federal income tax return. A U.S. Holder will not be required to file IRS Form 8938 if the holder timely files IRS Form 8621. Such U.S. Holders who fail to timely furnish the required information may be subject to a penalty. Additionally, if a U.S. Holder does not file the required information, the statute of limitations with respect to tax returns of the U.S. Holder to which the information relates may not close until three years after such information is filed. U.S. Holders should consult their tax advisors regarding their reporting obligations with respect to their ownership and disposition of the securities.

U.S. Treasury Regulations meant to require the reporting of certain tax shelter transactions could be interpreted to cover transactions generally not regarded as tax shelters, including certain foreign currency transactions. Under the applicable U.S. Treasury Regulations, certain transactions are required to be reported to the IRS including, in certain circumstances, a sale, exchange, retirement or other taxable disposition of foreign currency, to the extent that such sale, exchange, retirement or other taxable disposition results in a tax loss in excess of a threshold amount. U.S. Holders should consult their tax advisors to determine the tax return obligations, if any, with respect to our securities, and the receipt of Euro in respect thereof, including any requirement to file IRS Form 8886 (Reportable Transaction Disclosure Statement).

Forward-Looking Statements

Certain statements included in this document that are not historical facts are forward-looking statements for purposes of the safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements generally are accompanied by words such as “believe,” “will,” “continue,” “anticipate,” “intend,” “expect,” “predict,” “potential,” “seek,” “target” and similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding the Company’s business and strategic plans, the Company’s status as a “foreign private issuer,” the Company’s status as a PFIC, the Company’s clinical trials and the timing for enrolling patients (including commencement of its Phase 3 trial), the timing and forums for announcing data and the achievement and timing of regulatory approvals. These statements are based on various assumptions, whether or not identified in this document, and on the current expectations of the Company’s management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as and must not be relied on as a guarantee, an assurance, a prediction, or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and may differ from assumptions. Many actual events and circumstances are beyond the control of the Company. These forward-looking statements are subject to a number of risks and uncertainties, including changes in domestic and foreign business, market, financial, political, and legal conditions; risks related to the approval of the Company’s product candidate and the timing of expected regulatory and business milestones; ability to negotiate definitive contractual arrangements with potential customers; the impact of competitive product candidates; ability to obtain sufficient supply of materials; the impact of COVID-19; global economic and political conditions, including the Russia-Ukraine conflict; the effects of competition on the Company’s future business; and those factors described in the Company’s public filings with the U.S. Securities and Exchange Commission. Additional risks related to the Company’s business include, but are not limited to: uncertainty regarding outcomes of the Company’s ongoing clinical trials, particularly as they relate to regulatory review and potential approval for its product candidate; risks associated with the Company’s efforts to commercialize a product candidate; the Company’s ability to negotiate and enter into definitive agreements on favorable terms, if at all; the impact of competing product candidates on the Company’s business; intellectual property related claims; the Company’s ability to attract and retain qualified personnel; ability to continue to source the raw materials for its product candidate. If any of these risks materialize or the Company’s assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that the Company does not presently know or that the Company currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect the Company’s expectations, plans, or forecasts of future events and views as of the date of this document and are qualified in their entirety by reference to the cautionary statements herein. The Company anticipates that subsequent events and developments may cause the Company’s assessments to change. These forward-looking statements should not be relied upon as representing the Company’s assessment as of any date subsequent to the date of this communication. Accordingly, undue reliance should not be placed upon the forward-looking statements. Neither the Company nor any of its affiliates undertakes any obligation to update these forward-looking statements, except as may be required by law.