Filed Pursuant to Rule 424(b)(5)

Registration No. 333-279916

The information in this preliminary prospectus supplement is not complete and may be changed. A registration statement relating to these securities has been declared effective by the Securities and Exchange Commission. This preliminary prospectus supplement and the accompanying prospectus are not an offer to sell these securities, and we are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated February 4, 2025

PRELIMINARY PROSPECTUS SUPPLEMENT

(To prospectus dated June 3, 2024)

$50,000,000

SunCar Technology Group Inc.

Class A Ordinary Shares

We are offering Class A Ordinary Shares, par value $0.0001 per share, pursuant to this prospectus supplement and the accompanying prospectus. The public offering price for each Class A Ordinary Share is $ .

Our Class A Ordinary Shares are listed on The Nasdaq Capital Market under the symbol “SDA.” On February 3, 2025, the last reported sale price of our Class A Ordinary Shares was $10.15 per share.

We are an “emerging growth company” as defined under U.S. federal securities laws and, as such, have elected to comply with reduced public company reporting requirements. This prospectus supplement complies with the requirements that apply to an issuer that is an emerging growth company.

SunCar is not an operating company but a Cayman Islands holding company with operations primarily conducted by its subsidiaries in China.

SunCar’s PRC Operating Entities (as defined below) face various legal and operational risks and uncertainties related to doing business in China. For instance, SunCar’s PRC Operating Entities face risks associated with regulatory approvals on offshore offerings, anti-monopoly regulatory actions, and oversight on cybersecurity and data privacy, as well as the ability of the Public Company Accounting Oversight Board (United States) (“PCAOB”) to inspect SunCar’s auditors, which may impact the ability of SunCar’s subsidiaries to conduct certain businesses, accept foreign investors, or its continuing listing on the Nasdaq. These risks could result in a material adverse change in SunCar’s business operations and the value of our Class A Ordinary Shares, significantly limit or hinder our ability to offer or continue to offer securities to investors, or cause such securities to significantly decline in value or become worthless.

SunCar’s corporate structure as a Cayman Islands holding company with operations primarily conducted by its subsidiaries in China involves unique risks to investors. Chinese regulatory authorities could disallow this structure, which would result in SunCar not being able to continue its operations without changing the corporate structure or switching the business focus. This may in turn cause the value of the securities to significantly decline or even become worthless. According to the Foreign Investment Law in China, the State Council shall promulgate or approve a list of special administrative measures for market access of foreign investments, or the Negative List. The Foreign Investment Law grants national treatment to foreign-invested entities, except for those foreign-invested entities that operate in industries specified as either “restricted” or “prohibited” from foreign investment in the Negative List. The Foreign Investment Law provides that foreign-invested entities operating in “restricted” or “prohibited” industries will require market entry clearance and other permissions or approvals from relevant PRC government authorities. On September 6, 2024, the National Development and Reform Commission of China (“NDRC”) and the Ministry of Commerce (“MOFCOM”) jointly issued the Special Administrative Measures for Foreign Investment Access (Negative List) (2024 Edition), effective November 1, 2024. As a company operating its business in auto service, auto eInsurance service and technology service, which are not included in the 2024 Negative List, SunCar believes its business is not subject to any ownership restrictions. However, since the Negative List has been adjusted and updated almost on an annual basis in the recent years, we cannot assure you that the aforementioned business segments will continuously be beyond the “prohibited” category, which would likely result in a material change in our operations or in the value of our securities. The PRC government will also establish a foreign investment information reporting system, according to which foreign investors or foreign-invested enterprises shall submit investment information to the competent department for commerce concerned through the enterprise registration system and the enterprise credit information publicity system, and a security review system under which the security review shall be conducted for foreign investment affecting or likely affecting the state security. For a detailed description of risks related to doing business in China, see “Risk Factors — Risk Factors Relating to Doing Business in China” in our most recent Annual Report on Form 20-F, incorporated herein by reference.

SunCar may encounter several limitations related to cash transfer among its PRC Operating Entities, the holding company and its investors. Any funds we transfer to the PRC Operating Entities, either as a shareholder loan or as an increase in registered capital, are subject to permission and approval by or registration with relevant governmental authorities in China. According to the relevant PRC regulations on foreign invested enterprises in China, capital contributions to our PRC Operating Entities are subject to the registration with the State Administration for Market Regulation or its local counterpart and registration with a local bank authorized by SAFE. In addition, (i) any foreign loan procured by our PRC Operating Entities is required to be registered with the SAFE or its local branches and (ii) any of our PRC Operating Entities may not procure loans which exceed the difference between its total investment amount and registered capital or, as an alternative, only procure loans subject to the calculation approach and limitation as provided by the People’s Bank of China. As a holding company with no operations, our ability to distribute dividends largely depends on the distribution from our PRC Operating Entities. In addition, if SunCar is determined to be a PRC resident enterprise for enterprise income tax purposes, we could be subject to PRC tax at a rate of 25% on our worldwide income, which could materially reduce our net income, and we may be required to withhold a 10% withholding tax from dividends we pay to our shareholders that are non-resident enterprises, including the holders of our Ordinary Shares, and non-resident enterprise shareholders (including our Ordinary Shareholders) may be subject to PRC tax at a rate of 10% on gains realized on the sale or other disposition of Ordinary Shares, if such income is treated as sourced from within China. An “indirect transfer” of PRC assets, including a transfer of equity interests in an unlisted non-PRC holding company of a PRC resident enterprise, by non-PRC resident enterprises may be re-characterized and treated as a direct transfer of the underlying PRC assets, if such arrangement does not have a reasonable commercial purpose and was established for the purpose of avoiding payment of PRC enterprise income tax. As a result, gains derived from such indirect transfer may be subject to PRC enterprise income tax, and the transferee or other person who is obligated to pay for the transfer is obligated to withhold the applicable taxes, currently at a rate of 10% for the transfer of equity interests in a PRC resident enterprise.

On February 17, 2023, the China Securities Regulatory Commission (the “CSRC”) released the Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies (the “Trial Measures”) with five interpretive guidelines (together with the New Overseas Listing Rules, collectively, the “New Overseas Listing Rules”), which came into effect on March 31, 2023. The New Overseas Listing Rules apply to overseas securities offerings and/or listings conducted by (i) companies incorporated in the PRC, or PRC domestic companies, directly and (ii) companies incorporated overseas with operations primarily in the PRC and valued on the basis of interests in PRC domestic companies, or indirect offerings. Under the New Overseas Listing Rules, a filing-based regulatory system applies to “indirect overseas offerings and listings” of companies in mainland China, which refers to securities offerings and listings in an overseas market made under the name of an offshore entity but based on the underlying equity, assets, earnings or other similar rights of a company in mainland China that operates its main business in mainland China. The New Overseas Listing Rules state that, any post-listing follow-on offering by an issuer in an overseas market, including issuance of shares, convertible notes, exchangeable notes and preferred shares, shall be subject to filing requirement within three business days after the completion of the offering. Additionally, if we do not obtain the permissions and approvals of the filing procedure for any subsequent offering in a timely manner under PRC laws and regulations, we may be subject to investigations by competent PRC regulators, fines or penalties, ordered to suspend our relevant operations and rectify any non-compliance, prohibited from engaging in relevant business or conducting any offering, and these risks could result in a material adverse change in our operations, limit our ability to continue to offer securities to investors, or cause such securities to significantly decline in value or become worthless. Based on our understanding of the rules, we are required to submit the filing report to the CSRC within three business days upon the completion of this offering pursuant to this prospectus supplement. It is uncertain whether such filing can be completed or how long it will take to complete such filing. Any delay in completing such filing procedures might affect the other filing procedures with respect to other applicable circumstances, under the New Overseas Listing Rules in the future, such as the secondary listing, primary listing, spin-off listing and making overseas offering and listing anew after being delisted from an overseas exchange, which might affect our future public market financings and capital market transactions. To date, there are uncertainties in the interpretation and enforcement of these new laws and guidelines, which could materially and adversely impact our business and financial outlook and may impact our ability to accept foreign investments, or continue to list on a U.S. or other foreign exchange.

SunCar also may face risks relating to the lack of PCAOB inspection on its auditor, which may cause our securities to be delisted from a U.S. stock exchange or prohibited from being traded over-the-counter in the future under the Holding Foreign Companies Accountable Act as amended by the Accelerating Holding Foreign Companies Accountable Act (the “AHFCAA”) that was signed into law on December 29, 2022, if the PCAOB has determined it is unable to investigate SunCar’s auditor completely for two consecutive years beginning in 2021. The delisting or the cessation of trading of our securities, or the threat of their being delisted or prohibited from being traded, may materially and adversely affect the value of your investment. On December 16, 2021, the PCAOB issued a report to notify the SEC its determinations that it is unable to inspect or investigate completely registered public accounting firms headquartered in China and Hong Kong, respectively, and identifies the registered public accounting firms in China and Hong Kong that are subject to such determinations. SunCar’s auditor is headquartered in Singapore and has been inspected by the PCAOB on a regular basis and is therefore not subject to the determinations announced by the PCAOB on December 16, 2021. However, since the audit work was carried out by SunCar’s auditor with the collaboration of its China-based office, the audit working papers of SunCar’s financial statements may not be inspected by the PCAOB without the approval of the PRC authorities. On August 26, 2022, the PCAOB announced and signed a Statement of Protocol (the “Protocol”) with the China Securities Regulatory Commission and the Ministry of Finance of the People’s Republic of China. The Protocol provides the PCAOB with: (1) sole discretion to select the firms, audit engagements and potential violations it inspects and investigates, without any involvement of Chinese authorities; (2) procedures for PCAOB inspectors and investigators to view complete audit work papers with all information included and for the PCAOB to retain information as needed; and (3) direct access to interview and take testimony from all personnel associated with the audits the PCAOB inspects or investigates. On December 15, 2022, the PCAOB announced in the 2022 Determination its determination that the PCAOB was able to secure complete access to inspect and investigate accounting firms headquartered in mainland China and Hong Kong, and the PCAOB Board voted to vacate previous determinations to the contrary. Should the PCAOB again encounter impediments to inspections and investigations in mainland China or Hong Kong as a result of positions taken by any authority in either jurisdiction, including by the CSRC or the MOF, the PCAOB will make determinations under the HFCAA as and when appropriate. We cannot assure you whether Nasdaq or regulatory authorities would apply additional and more stringent criteria to us after considering the effectiveness of our auditor’s audit procedures and quality control procedures, adequacy of personnel and training, or sufficiency of resources, geographic reach, or experience as it relates to the audit of our financial statements. There is a risk that the PCAOB is unable to inspect or investigate completely the Company’s auditor because of a position taken by an authority in a foreign jurisdiction or any other reasons, and that the PCAOB may re-evaluate its determinations as a result of any obstruction with the implementation of the Protocol. Such lack of inspection or re-evaluation could cause trading in the Company’s securities to be prohibited under the HFCAA and ultimately result in a determination by a securities exchange to delist the Company’s securities. In addition, under the HFCAA, as amended by the AHFCAA, our securities may be prohibited from trading on the Nasdaq or other U.S. stock exchanges if our auditor is not inspected by the PCAOB for two consecutive years, and this ultimately could result in our Ordinary Shares being delisted by the Nasdaq.

The structure of cash flows within our organization and a summary of the applicable regulations are as follows: Our equity structure is a direct holding structure. ASGL (as defined below), direct and wholly owned subsidiary of SunCar, controls Haiyan Trading (Shanghai) Co., Ltd (“Haiyan Trading”, or the “WFOE”) and other domestic operating entities through the Hong Kong company, Auto Market Group Ltd. (“Auto Market HK”). Within our direct holding structure, the cross-border transfer of funds within our corporate group is legal and compliant with the current laws and regulations of the PRC. After any non-PRC based investors’ funds enter SunCar at SunCar’s securities offerings outside of China, the funds can be directly transferred to Auto Market HK, and then transferred to subordinate operating entities through the WFOE in accordance with relevant laws and regulations of the PRC. To the extent cash in the business is in the PRC/Hong Kong or a PRC/Hong Kong entity, the funds may not be available to fund operations or for other use outside of the PRC/Hong Kong due to interventions in or the imposition of restrictions and limitations on the ability of SunCar or SunCar’s subsidiaries, by the PRC government to transfer cash.

If we intend to distribute dividends, we will transfer the funds to Auto Market HK from WFOE in accordance with the laws and regulations of the PRC, and then Auto Market HK will transfer the dividends to SunCar, and the dividends will be distributed from SunCar to all shareholders respectively in proportion to the shares they hold, regardless of whether the shareholders are U.S. investors or investors in other countries or regions. In terms of the cash transfer among SunCar and its subsidiaries, subject to the amounts of cash transfer and the nature of the use of funds, requisite internal approval shall be obtained prior to each cash transfer. Specifically, all transactions require the approvals of the financial controllers of the entities involved. As for an internal cash transfer that exceeds RMB10,000,000 (approximately $1.5 million), the general manager is also required to conduct review and approval. There are no other cash management policies.

In the reporting periods presented in this prospectus supplement, (1) no cash transfers have occurred between our holding company and its subsidiaries, (2) no dividends nor distributions have been made by the subsidiaries to our holding company, and (3) our holding company has not paid any dividends nor made any distributions to U.S. investors. For further details, please refer to “Management’s Discussion and Analysis of Financial Condition and Results of Operations” as well as the consolidated financial statements for fiscal years ending December 31, 2023, 2022 and 2021, and the periods ended June 30, 2024 and September 30, 2024, incorporated by reference in this prospectus supplement. As of the date of this prospectus supplement, SunCar does not have any cash management policy other than that stated in the paragraph above. For the foreseeable future, we intend to use the earnings for research and development, to develop new products and to expand our production capacity. As a result, SunCar currently does not have a plan to declare dividends to its shareholders in the foreseeable future.

The ability of SunCar’s PRC subsidiaries to distribute dividends is based upon their distributable earnings. Current PRC regulations permit our PRC subsidiaries to pay dividends to their respective shareholders only out of their accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. In addition, each of our PRC subsidiaries is required to set aside at least 10% of its after-tax profits each year, if any, to fund a statutory reserve until such reserve reaches 50% of each of their registered capitals. These reserves are not distributable In addition, PRC Operating Entities cannot distribute dividends until previous years’ loss has been offset.

To address persistent capital outflows and the RMB’s depreciation against the U.S. dollar in the fourth quarter of 2016, the People’s Bank of China and the State Administration of Foreign Exchange, or SAFE, have implemented a series of capital control measures, including stricter vetting procedures for China-based companies to remit foreign currency for overseas acquisitions, dividend payments and shareholder loan repayments. The PRC government may continue to strengthen its capital controls and our PRC subsidiaries’ dividends and other distributions may be subject to tightened scrutiny in the future. The PRC government also imposes controls on the conversion of RMB into foreign currencies and the remittance of currencies out of the PRC. Therefore, we may experience difficulties in completing the administrative procedures necessary to obtain and remit foreign currency for the payment of dividends from our profits, if any. Furthermore, if our subsidiaries in the PRC incur debt on their own in the future, the instruments governing the debt may restrict their ability to pay dividends or make other payments.

Investing in our securities involves a high degree of risk. See the “Risk Factors” section on page S-7 of this prospectus supplement, in any accompanying prospectus supplement or in the documents incorporated by reference into this prospectus supplement before making a decision to invest in our securities.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities or determined if this prospectus supplement is accurate or adequate. Any representation to the contrary is a criminal offense.

| | | Per share | | | Total | |

| Public offering price | | $ | | | | $ | | |

| Underwriting discounts and commissions(1) | | $ | | | | $ | | |

| Proceeds to the Company, before expenses | | $ | | | | $ | | |

| (1) | See the section of this prospectus supplement entitled “Underwriting” for a description of the compensation payable to the underwriters. |

We have granted the underwriters an option to purchase up to additional Class A Ordinary Shares, at the public offering price, less the underwriting discount, for 30 days after the date of this prospectus supplement.

The underwriters expect to deliver the Class A Ordinary Shares being offered hereby to purchasers on or about , 2025.

| BTIG | Macquarie Capital | Oppenheimer & Co. |

The date of this prospectus supplement is February , 2025.

TABLE OF CONTENTS

Prospectus Supplement

Base Prospectus

We are responsible for the information contained and incorporated by reference in this prospectus supplement and the accompanying prospectus that we have authorized for use in connection with this offering. We and the underwriters have not authorized anyone to give you any other information, and we and the underwriters take no responsibility for any other information that others may give you. We and the underwriters are not making offers to sell the securities in any jurisdiction in which an offer or solicitation is not authorized or permitted or in which the person making such offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to make an offer or solicitation. The information contained and incorporated by reference in this prospectus supplement and the accompanying prospectus speaks only as of the date of this document, unless the information specifically indicates that another date applies. Neither the delivery of this prospectus supplement nor the accompanying prospectus, nor any sale of securities made under these documents, will, under any circumstances, create any implication that there has been no change in our affairs since the date of this prospectus supplement or the accompanying prospectus, nor that the information contained or incorporated by reference is correct as of any time subsequent to the date of such information. You should assume that the information contained and incorporated by reference in this prospectus supplement and the accompanying prospectus is accurate only as of the date of the documents containing the information, unless the information specifically indicates that another date applies. Our business, financial condition, results of operations and prospects may have changed since those dates.

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is part of a registration statement that we filed with the Securities and Exchange Commission, or the SEC, using a “shelf” registration process and consists of two parts. The first part is this prospectus supplement, which describes the specific terms of this offering and also adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference herein. The second part, the accompanying prospectus, provides more general information.

This prospectus supplement has been filed pursuant to our registration statement on Form F-3 (File No. 333-279916). To the extent there is a conflict between the information contained in this prospectus supplement, on the one hand, and the information contained in the accompanying prospectus or any document incorporated by reference herein, on the other hand, you should rely on the information in this prospectus supplement.

This prospectus supplement contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus supplement is a part, and you may obtain copies of those documents as described below under “Where You Can Find More Information.”

CERTAIN DEFINED TERMS

In this prospectus supplement, unless otherwise stated, references to:

“ASGL” are to Auto Services Group Limited, a Cayman Islands exempted company;

“Business Combination” are to the mergers contemplated under the Merger Agreement;

“China” or “PRC” are to the People’s Republic of China;

“Class A Ordinary Shares” are to the Class A Ordinary Shares of the Company, each having a par value in U.S. dollars of $0.0001 per share;

“Class B Ordinary Shares” are to the Class B Ordinary Shares of the Company, each having a par value in U.S. dollars of $0.0001 per share;

“Company”, “SunCar”, “we,” “our” or “us” are to SunCar Technology Group Inc., a Cayman Islands exempted company;

“Exchange Act” are to the Securities Exchange Act of 1934, as amended;

“GBRG” are to Goldenbridge Acquisition Limited, the Company’s predecessor;

“Merger Agreement” are to the agreement and plan of merger among SunCar, GBRG, Merger Sub, and certain other parties;

“Merger Sub” are to SunCar Technology Global Inc., a Cayman Islands exempted company and a direct wholly owned subsidiary of SunCar;

“Nasdaq” are to the Nasdaq Capital Market;

“Ordinary Shares” are to the Class A Ordinary Shares together with the Class B Ordinary Shares;

“PRC Operating Entities” are to Anqi Technology (Zhejiang) Co., Ltd and its subsidiaries, Shanghai Cuhong Automotive Service Co., Ltd. and Zhejiang Qixuan Automotive Service Co., Shanghai Xuanbei Automobile Service Co., Limited, Shanghai Chengle Network Technology Co., Limited, Shanghai Qianjing Automobile Service Co., Limited, Shanghai Louduo Technology Co., Limited, Jingning Jiashun Automobile Technology Co., Limited, Beijing Beisheng United Insurance Agency Co., Ltd, Chengdu Shengda Insurance Agency Co., Ltd, Nanjing Xinda New Insurance Agency Co., Ltd, Shanghai Anite insurance Agency Co., Ltd, Shanghai Shengshi Dalian Automobile Service Co., Ltd, Shengshi Dalian Insurance Agency Co., Ltd., Shanghai Feiyou Trading Co., Limited; Li Mo (Shanghai) Technology Co., Ltd., Guangdong Tianzhuo Automobile Service Co., Ltd., Jiangsu Shengda Automobile Service Co., Ltd, Haiyan Trading (shanghai) Co., Ltd., and Zhejiang Qixuan Automobile Service Co., Ltd.

“RMB” or “Renminbi” are to the legal currency of the PRC;

“SEC” are to the U.S. Securities and Exchange Commission;

“U.S. Dollars,” “$,” or “US$” are to the legal currency of the United States; and

“U.S. GAAP” or “GAAP” are to accounting principles generally accepted in the United States.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement and the documents incorporated by reference into this prospectus supplement contain forward-looking statements that involve substantial risks and uncertainties. The Private Securities Litigation Reform Act of 1995 (the “PSLRA”) provides safe harbor protections for forward-looking statements in order to encourage companies to provide prospective information about their business. Forward-looking statements include, without limitation, our expectations concerning the outlook for our business, productivity, plans and goals for future operational improvements and capital investments, operational performance, future market conditions or economic performance and developments in the capital and credit markets and expected future financial performance, as well as any information concerning possible or assumed future results of operations.

SunCar desires to take advantage of the safe harbor provisions of the PSLRA and is including this cautionary statement in connection with this safe harbor legislation. All statements other than statements of historical facts contained in this prospectus supplement, including statements regarding our future financial position, business strategy and plans and objectives of management for future operations, are forward-looking statements. In some cases, you can identify forward-looking statements by words such as “estimate,” “plan,” “project,” “forecast,” “intend,” “expect,” “anticipate,” “believe,” “seek,” “strategy,” “future,” “opportunity,” “may,” “target,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” or similar expressions that predict or indicate future events or trends or that are not statements of historical matters.

Forward-looking statements involve a number of risks, uncertainties and assumptions, and actual results or events may differ materially from those implied in those statements. Important factors that could cause such differences include, but are not limited to:

| | ● | the ability of the Company to grow and manage growth profitably, maintain relationships with customers, compete within its industry and retain its key employees; |

| | ● | future exchange and interest rates; |

| | ● | the Company is highly dependent on the services of its executive officers; |

| | ● | the Company may experience difficulties in managing its growth and expanding its operations; |

| | ● | the outcome of any legal proceedings that may be instituted against the Company or others in connection with the Business Combination and the related transactions; |

| | ● | the Company may face risks and uncertainties associated with laws and regulations within the People’s Republic of China, which may have a material adverse effect on its business; |

| | ● | the Company’s auto services (automobile after-sales services) business and auto eInsurance (digitalized insurance intermediation) business largely depend on relationships with customers; |

| | ● | the Company relies on our auto service providers and external referral sources to operate its business, therefore relationships with its service providers are crucial to its business; |

| | ● | misconduct of the external referral sources the Company engaged to promote our auto eInsurance services is difficult to detect and deter and could harm our reputation or lead to regulatory sanctions or litigation costs; |

| | ● | the Company is subject to customer concentration risk; |

| | ● | the Company is subject to credit risks from its customers; |

| | ● | the Company’s negative net operating cash flows in the past may expose it to certain liquidity risks and could constrain operational flexibility; |

| | | |

| | ● | the Company’s ability to use certain of its leased properties due to defects related to these properties; |

| ● | the Company’s ability to protect its intellectual property rights and proprietary information; |

| | | |

| | ● | the Company is subject to regulation and administration by the China Banking and Insurance Regulatory Commission and other government authorities, and failure to comply with any applicable regulations and rules by us could result in financial losses or harm to our business; |

| | ● | changes in government policies and regulations; |

| | ● | the insurance business is historically cyclical in nature, and there may be periods with excess underwriting capacity and unfavorable premium rates; |

| | ● | any significant disruption in services on the Company’s apps, websites or computer systems; and any significant disruption in services on the Company’s apps, websites or computer systems; and |

| | ● | other matters described under “Item 3.D.-Risk Factors” in our most recent Annual Report on Form 20-F, incorporated herein by reference. |

You should refer to the section titled “Risk Factors” of this prospectus supplement and in our other filings with the SEC for a discussion of important factors that may cause our actual results to differ materially from those expressed or implied by our forward-looking statements. As a result of these factors, we cannot assure that the forward-looking statements in this prospectus supplement, the accompanying prospectus or the documents we have filed with the SEC that are incorporated by reference will prove to be accurate. Furthermore, if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, these statements should not be regarded as representations or warranties by us or any other person that we will achieve our objectives and plans in any specified time frame, or at all. We caution you not to rely on forward-looking statements, which reflect current beliefs and are based on information currently available as of the date a forward-looking statement is made. Forward-looking statements set forth herein speak only as of the date of this prospectus supplement. We undertake no obligation to revise forward-looking statements to reflect future events, changes in circumstances or changes in beliefs except to the extent required by law. In the event that any forward-looking statement is updated, no inference should be made that we will make additional updates with respect to that statement, related matters, or any other forward-looking statements except to the extent required by law.

Market, ranking and industry data used throughout this prospectus supplement, including statements regarding market size and technology adoption rates, is based on the good faith estimates of our management, which in turn are based upon our management’s review of internal surveys, independent industry surveys and publications and other third-party research and publicly available information. These data involve a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. While we are not aware of any misstatements regarding the industry data presented herein, its estimates involve risks and uncertainties and are subject to change based on various factors.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this prospectus supplement, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements as predictions of future events.

You should read this prospectus supplement, the documents incorporated by reference in this prospectus supplement and the documents that we have filed as exhibits to the registration statement of which this prospectus supplement is a part completely and with the understanding that our actual future results may be materially different from what we expect. Any corrections or revisions and other important assumptions and factors that could cause actual results to differ materially from forward-looking statements, including discussions of significant risk factors, may appear in our public filings with the SEC, which are or will be (as appropriate) accessible at www.sec.gov, and which you are advised to consult. For additional information, please see the section entitled “Where You Can Find More Information.”

PROSPECTUS SUPPLEMENT SUMMARY

The following summary is qualified in its entirety by, and should be read in conjunction with, the more detailed information and financial statements and notes thereto appearing elsewhere in this prospectus supplement, the accompanying prospectus, and the documents incorporated by reference herein and therein. In addition to this summary, we urge you to read the entire prospectus supplement, the accompanying prospectus, and the documents incorporated by reference carefully, especially the risks of investing in the Ordinary Shares discussed under “Risk Factors” of this prospectus supplement and under “Item 3. Key Information — 3.D. Risk Factors” in our 2023 Form 20-F that is incorporated by reference in this prospectus supplement and the accompanying prospectus. This prospectus supplement contains information from an industry report commissioned by us and prepared by Frost & Sullivan Report to provide information regarding our industry. We refer to this report as the “Frost & Sullivan Report.” The definition of some of the terms used in this prospectus supplement are set forth under the section “Selected Definitions.” For additional information, see the section of this prospectus supplement entitled “Where You Can Find More Information.”

Overview

We are a leading cloud-based provider of digitalized enterprise auto services and auto eInsurance service in China. For the years ended December 31, 2022 and 2023, we generated revenue of $282.4 million and $363.7 million, respectively. Building on our leading position in both of these segments and the synergies between them, we offer one-stop, fully digitalized, on-demand automotive service systems to help our enterprise clients build up their customer base and serve their end customers.

Since our inception in 2007, we have amassed ample experience in perceiving and serving the expanding needs of China’s automobile owners. Rising with the increasing prevalence of the mobile internet in China, we introduced online apps for our insurance and auto business in 2014 and 2015, respectively. We have built comprehensive digital systems for both of our auto service and our auto eInsurance business segments, centered on our multi-tenant, cloud-based platform which empowers our clients and service providers to optimally access and manage the types of services and insurance they desire.

We operate our auto services business through offering customized service solutions to our enterprise clients (“auto service partners”), who are major banks, insurance companies, telecommunication companies, new energy vehicle (or NEV) original equipment manufacturers (OEMs) or any client who has end customers demanding automotive services. These enterprise clients purchase our service solutions for the members of their reward programs or customer loyalty programs to enjoy. The auto service solutions cover over 300 types of services such as car wash, oil change, tire repair, car beautification, road assistance, flight pickup, designated driving, VIP lounge, etc. They are provided in collaboration with our auto service providers, which are typically third-party auto service providers. As of September 30, 2024, we have established a service network of over 47,600 third-party brick-and-mortar auto service providers, leasing and roadside assistance companies (compared to 47,000 and 45,000 as of December 31, 2023 and 2022), covering over 350 cities (out of a total of approximately 690), and 33 (out of a total of 33) provinces of China. With this extensive service network, we serve over 1,460 enterprise clients.

For our auto eInsurance business, we primarily facilitate the sales of auto eInsurance products underwritten by major insurance companies in China. We receive commissions from these insurance companies, typically a percentage of the premium paid by insurance purchasers. We implement, automate and streamline the insurance purchasing process on our proprietary, fully online digital apps, integrating full spectrum products from leading insurers in China. We sell insurance policies through a network of over 64,000 external sales partners. These sales partners include an offline auto network with frequent exposure to car owners, an online marketplace with large user traffic, and emerging NEV OEMs and service providers. As of June 30, 2024, we have branch headquarters in 31 cities in 20 provinces of China. We have also established collaborative relationships with 85 insurance companies (including the top 10 insurance companies with combined over 90% market share).

We have built up our business as a digitalized, technology-driven provider of online platforms that enable and facilitate B2B services. We have secured 150 registered copyrights of computer software. Our proprietary technology solution is centered on our multi-tenant platform and our cloud infrastructure. On the auto services side, our digital platform provides API docking, front-end plug-in and module integration for our enterprise clients, as well as efficient, user friendly management and operations tools for our service providers. On the auto eInsurance side, our platform empowers our insurance company clients to manage all aspects of their business including customer orders, products, commissions, and reports. For insurance purchasers, our online insurance interface provides data-driven, AI-empowered real time quotation, pricing, underwriting and payment, by connecting to our market-wide insurer clients and the full spectrum of their policy selections. Our AI-empowered hybrid cloud infrastructure provides the secure storage and computation to support the demands by both insurance companies as well as end customers.

We have started making our technologies into a new business line. With growing demands to efficiently manage their businesses, our automotive service providers are now paying for our online tools to streamline their business workflows, manage their customer relationships and automate orders processing. With the iterative upgrades of our technology, we are working on developing a SaaS model product offering and plan to gradually turn our automotive service providers into our technology customers.

We believe the cross-utilizations and interconnections between our auto service and auto eInsurance business lines enable positive feedback loops between them and symbiotic growth of both. While we are developing our nation-wide automotive service provider network, these service providers become our sales partners of our auto eInsurance business. Conversely, when we engage with insurance companies to sell their insurance products, we also engage them as clients of our auto service solutions. We believe our synergistic business development will boost our sales channels as well as client network in both of our business segments.

As our business is closely connected to the automotive industry, we have also embraced the recent trends of electric and smart vehicles. We are now working with 20 mainstream NEV and smart car panel players, embedding our auto service solutions into their online applications and panels, and providing various insurance products to NEV owners.

Summary of Risk Factors

Investing in our Class A Ordinary Shares involves significant risks. You should carefully consider all of the information in this prospectus supplement before making an investment in our Class A Ordinary Shares. Below please find a summary of the principal risks we face, organized under relevant headings. You should carefully consider the matters discussed under “Item 3. Key Information — 3.D. Risk factors” in our 2023 Form 20-F, “Risk Factors”, as well as other documents incorporated by reference in to the accompanying prospectus.

General Risks Related to SunCar’s Business

| ● | Our auto services business and auto eInsurance business largely depend on our relationships with our customers. |

| ● | We rely on our auto service providers and external referral sources to operate our business, therefore our relationships with our service providers are crucial to our business. |

| ● | We are subject to customer concentration risk. |

| ● | We are subject to credit risks from our customers. |

| ● | Our negative net operating cash flows in the past may expose us to certain liquidity risks and could constrain our operational flexibility. See Risk Factor under such title. |

| ● | Any significant disruption in services on our apps, websites or computer systems, including events beyond our control, could materially and adversely affect our business, financial condition and results of operation. See Risk Factor under such title. |

| ● | If we are unable to manage our growth or execute our strategies effectively, our business and prospects may be materially and adversely affected. See Risk Factor under such title. |

| ● | We are an “emerging growth company” and we cannot be certain if the reduced disclosure requirements applicable to “emerging growth companies” will make our ordinary shares less attractive to investors. See Risk Factor under such title. |

| ● | We may not be able to use certain of our leased properties due to defects related to these properties. |

| ● | If we fail to protect our intellectual property rights and proprietary information, we may lose our competitive edge and our brand, reputation and operations may be materially and adversely affected. See Risk Factor under such title. |

Risks Related to SunCar’s Insurance Services

| ● | We participate in the business as an insurance intermediary, therefore, we only obtained necessary licenses for the sale of insurance, but these insurances do not allow us to create/modify insurance products either. |

| ● | Our business is subject to regulation and administration by the China Banking and Insurance Regulatory Commission and other government authorities, and failure to comply with any applicable regulations and rules by us could result in financial losses or harm to our business. |

| ● | Misconduct of the external referral sources we engaged to promote our auto eInsurance services is difficult to detect and deter and could harm our reputation or lead to regulatory sanctions or litigation costs. |

| ● | Examinations and investigations by the PRC regulatory authorities may result in fines and/or other penalties that may have a material adverse effect on our reputation, business, results of operations and financial condition. See Risk Factor under such title. |

| ● | Because the commission revenue we earn on the sale of insurance products is based on premium and commission rates set by insurance companies, any decrease in these premiums or commission rates, or increase in the referral fees we pay to our external referral sources, may have an adverse effect on our results of operation. |

| ● | The insurance business is historically cyclical in nature, and there may be periods with excess underwriting capacity and unfavorable premium rates, which may negatively affect SunCar’s overall revenues. |

Risks Related to Doing Business in China

| ● | PRC regulations relating to investments in offshore companies by PRC residents may subject our PRC-resident beneficial owners or our PRC Operating Entities to liability or penalties. |

| ● | Substantial uncertainties exist with respect to the interpretation and implementation of the PRC Foreign Investment Law and how it may impact the viability of our current corporate structure, corporate governance and business operations. |

| ● | The Chinese government exerts substantial influence over the manner in which SunCar must conduct our business activities. |

| ● | Our business is conducted in RMB and the price of our ordinary shares is quoted in United States dollars, changes in currency conversion rates may affect the value of your investments. |

| ● | We may become subject to a variety of laws and regulations in the PRC regarding privacy, data security, cybersecurity, and data protection. SunCar may be liable for improper use or appropriation of personal information. |

| ● | If SunCar is classified as a PRC resident enterprise for PRC income tax purposes, such classification could result in unfavorable tax consequences to us and our non-PRC shareholders and ordinary shareholders. |

| ● | Failure to obtain any preferential tax treatments or the discontinuation, reduction or delay of any of the preferential tax treatments that may be available to us in the future could materially and adversely affect our business, financial condition and results of operations. |

| ● | The permission or approval of the China Securities Regulatory Commission may be required in future offerings or financings, and, if required, we cannot predict whether we will be able to obtain such permission or approval. |

| ● | PRC regulation of loans to and direct investment in PRC entities by offshore holding companies may delay us from using the proceeds of future offerings. In addition, the PRC government imposes controls on the convertibility of RMB into foreign currencies and, in certain cases, the remittance of currency out of China, to the extent cash in the business is in the PRC/Hong Kong or a PRC/Hong Kong entity, the funds may not be available to fund operations or for other use outside of the PRC/Hong Kong due to interventions in or the imposition of restrictions and limitations on the ability of SunCar or SunCar’s subsidiaries, by the PRC government to transfer cash. In terms of the cash transfer among SunCar and its subsidiaries, subject to the amounts of cash transfer and the nature of the use of funds, requisite internal approval shall be obtained prior to each cash transfer. Specifically, all transactions require the approvals of the financial controllers of the entities involved. As for an internal cash transfer exceeds RMB10,000,000 (approximately $1.5 million), the general manager is also required to conduct review and approval. |

| ● | Recently, the PRC government initiated a series of regulatory actions and released guidelines to regulate business operations in China with little advance notice, including those related to data security or anti-monopoly concerns, which may have an impact on our ability to conduct certain business in China, accept foreign investments, or list on a U.S. or other foreign exchange. |

| ● | The Chinese government exerts substantial influence over the manner in which we must conduct our business activities. Therefore, investors in the securities and our business face potential uncertainty from the PRC government’s policy. The Chinese government may intervene or influence our operations at any time, or may exert more control over offerings conducted overseas and/or foreign investment in China-based issuers, which could result in a material change in our operations and/or the value of our securities. Any actions by the Chinese government to exert more oversight and control over offerings that are conducted overseas and/or foreign investment in China-based issuers could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or to be worthless. |

| ● | Our auditor is headquartered in Singapore, Singapore, and is subject to inspection by the PCAOB on a regular basis. |

| ● | Failure to comply with the U.S. Foreign Corrupt Practices Act of 1977, or the FCPA, could result in fines, criminal penalties, and an adverse effect on our business. |

Risks Related to Ownership of SunCar Securities

| ● | Because there are no current plans to pay cash dividends on the Class A Ordinary Share for the foreseeable future, you may not receive any return on investment unless you sell your Class A Ordinary Share for a price greater than that which you paid for it. |

| ● | If SunCar fails to implement and maintain an effective system of internal controls to remediate its material weaknesses over financial reporting, SunCar may be unable to accurately report its results of operations, meets its reporting obligations or prevent fraud, and investor confidence and the market price of SunCar’s ordinary shares may be materially and adversely affected. |

| ● | Future sales or perceived sales of substantial amounts of our securities in the public market could have a material adverse effect on the prevailing market price of our Ordinary Shares and our ability to raise capital in the future, and may result in dilution of your shareholdings. |

| ● | We may have conflicts of interest with our largest shareholder and may not be able to resolve such conflicts on favorable terms for us. |

Emerging Growth Company Status

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012 (“JOBS Act”). As an emerging growth company, it is exempt from certain requirements related to executive compensation, including the requirements to hold a nonbinding advisory vote on executive compensation and to provide information relating to the ratio of total compensation of its Chief Executive Officer to the median of the annual total compensation of all of its employees, each as required by the Investor Protection and Securities Reform Act of 2010, which is part of the Dodd-Frank Act.

Section 102(b)(1) of the Jumpstart Our Business Startups Act of 2012 (“JOBS Act”) exempts emerging growth companies from being required to comply with new or revised financial accounting standards until private companies are required to comply with the new or revised financial accounting standards. The JOBS Act provides that a company can choose not to take advantage of the extended transition period and comply with the requirements that apply to non-emerging growth companies, and any such election to not take advantage of the extended transition period is irrevocable. We previously elected to avail ourself of the extended transition period, and following the consummation of the Business Combination, we are an emerging growth company at least until December 31, 2023 and are taking advantage of the benefits of the extended transition period emerging growth company status permits. During the extended transition period, it may be difficult or impossible to compare our financial results with the financial results of another public company that complies with public company effective dates for accounting standard updates because of the potential differences in accounting standards used.

We will remain an emerging growth company under the JOBS Act until the earliest of (a) December 31, 2025, (b) the last date of our fiscal year in which we have a total annual gross revenue of at least $1.235 billion, (c) the date on which we are deemed to be a “large accelerated filer” under the rules of the SEC with at least $700.0 million of outstanding securities held by non-affiliates or (d) the date on which we have issued more than $1.0 billion in non-convertible debt securities during the previous three years.

Implications of Being a Foreign Private Issuer

We are a foreign private issuer within the meaning of the rules under the Exchange Act, and as such we are exempt from certain provisions of the securities rules and regulations in the United States that are applicable to U.S. domestic issuers. Moreover, the information we are required to file with or furnish to the SEC will be less extensive and less timely compared to that required to be filed with the SEC by U.S. domestic issuers. In addition, as a company incorporated in the Cayman Islands, we are permitted to adopt certain home country practices in relation to corporate governance matters that differ significantly from the Nasdaq corporate governance listing standards. These practices may afford less protection to shareholders than they would enjoy if we complied fully with the Nasdaq corporate governance listing standards.

Corporate Information

SunCar is a Cayman Islands exempted company with operations primarily conducted by its subsidiaries in China.

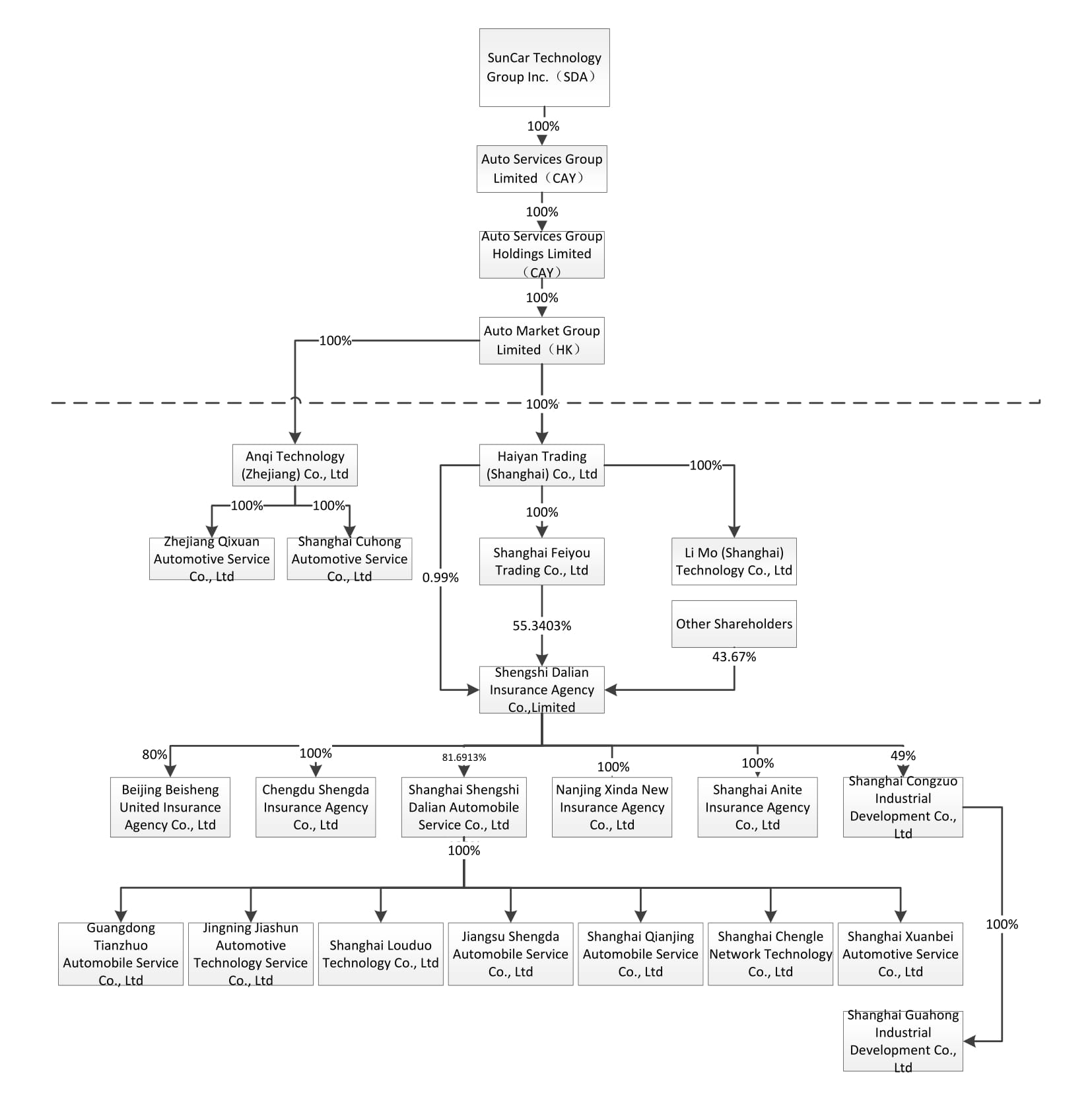

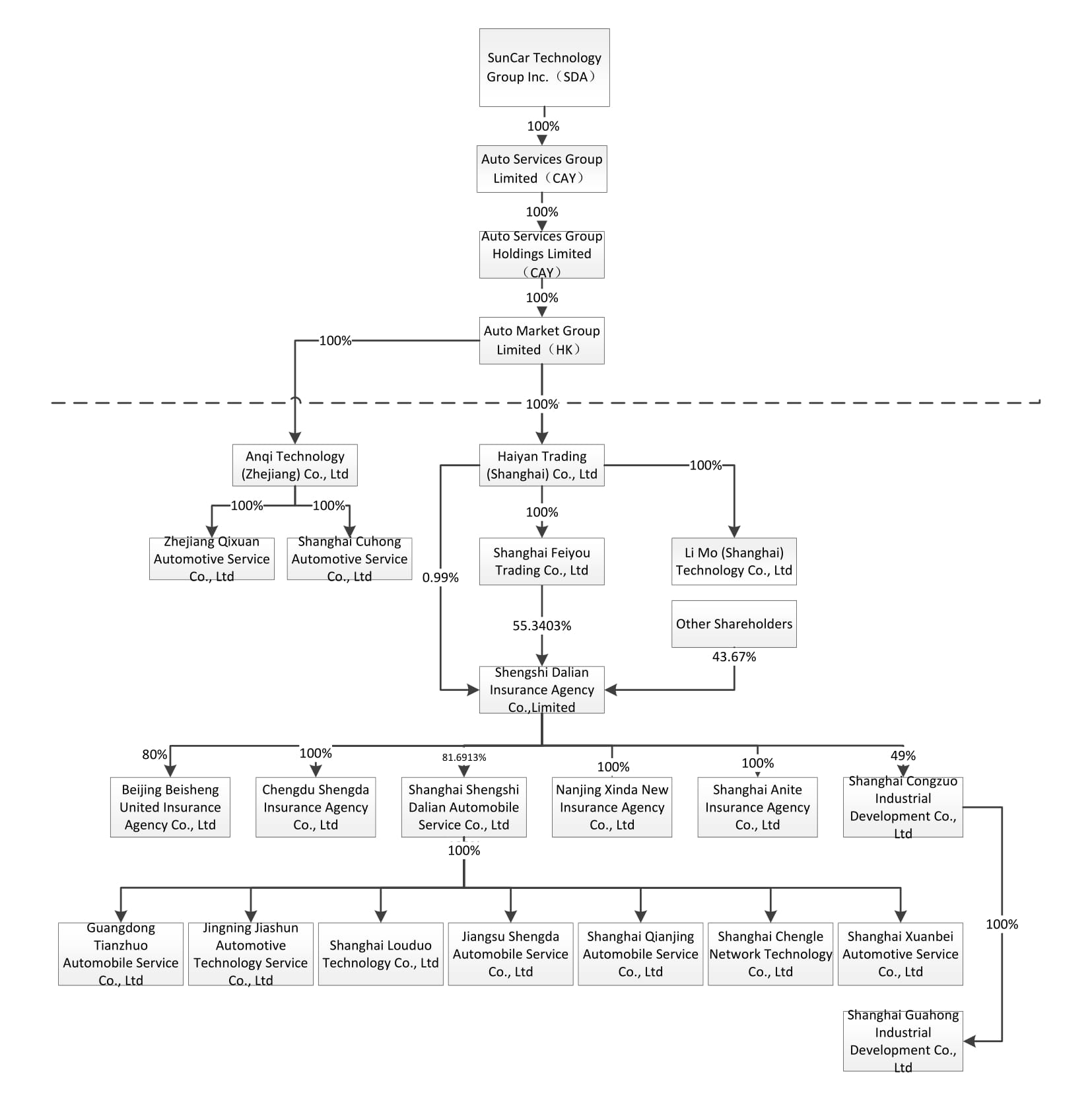

The chart below summarizes the Company’ corporate structure and identifies its principal subsidiaries, where the entities below the dashed line are organized in PRC under PRC laws.

The Company’s principal executive offices are located at Suite 209, No. 656 Lingshi Road, Jing’an District, Shanghai, 200072, People’s Republic of China, and its telephone number is (86) 138-1779-6110. The Company’s website is https://suncartech.com/. The information contained on, or accessible through, the Company’s website is not incorporated by reference into this prospectus supplement, and you should not consider it a part of this prospectus supplement.

The SEC maintains an internet site that contains reports, proxy and information statements, and other information regarding issuers, such as us, that file electronically, with the SEC at www.sec.gov.

THE OFFERING

| Issuer | | SunCar Technology Group Inc. |

| | | |

| Securities Offered | | Class A Ordinary Shares. |

| | | |

| Option to purchase additional Class A Ordinary Shares | | The underwriters have a 30-day option to purchase up to additional Class A Ordinary Shares from us. |

| | | |

| Class A Ordinary Shares outstanding before this offering | | 51,845,493 shares |

| | | |

| Class A Ordinary Shares to be outstanding after this offering | | shares (or shares if the underwriters exercise in full their option to purchase additional Class A Ordinary Shares). |

| | | |

| Use of proceeds | | We currently expect to use the net proceeds from this offering for general corporate purposes, which may include operating expenses, research and development, working capital, and general capital expenditures. See “Use of Proceeds” section of this prospectus supplement. |

| | | |

| Market for Class A Ordinary Shares and warrants | | Our Class A Ordinary Shares are currently traded on Nasdaq under the symbol “SDA”. |

| | | |

| Risk factors | | Investing in our Class A Ordinary Shares involves a high degree of risk. See the information contained in or incorporated by reference under the heading “Risk Factors” in this prospectus supplement, in the accompanying prospectus and in the documents incorporated by reference into this prospectus supplement. |

The number of Class A Ordinary Shares to be outstanding after this offering is based on 51,845,493 Class A Ordinary Shares outstanding before this offering as of February 4, 2025 and excludes:

| ● | 2,682,597 Class A Ordinary Shares issuable upon the exercise of 5,365,194 public warrants outstanding, the holder of each such warrant entitled to purchase one-half (1/2) of one Class A Ordinary Share at an exercise price of $11.50 per full share; |

| ● | 175,000 Class A Ordinary Shares issuable upon the exercise of 350,000 private placement warrants outstanding, and the holder of each such warrant entitled to purchase one-half (1/2) of one Class A Ordinary Share at an exercise price of $11.50 per full share; |

| ● | 2,839,951 Class A Ordinary Shares issuable upon the exercise of a warrant to purchase our Class A Ordinary Shares by GEM Yield Bahamas Ltd. at an exercise price of $11.50 per full share; |

| ● | 3,850,857 Class A Ordinary Shares issuable upon the exercise of certain common warrants issued on October 30, 2023, at an exercise price of $9.00 per full share; |

| ● | 25,672 Class A Ordinary Shares issuable upon the exercise of certain PA warrants issued on October 30, 2023, at an exercise price of $10.225 per full share. |

Except as otherwise indicated, all information in this prospectus supplement assumes no exercise of the underwriters’ option to purchase additional Class A Ordinary Shares.

RISK FACTORS

Investing in our securities involves risk. Before making a decision to invest in our securities, you should carefully consider the risks disclosed in our then-most recent Annual Report on Form 20-F, and any updates to those risk factors in our reports on Form 6-K incorporated by reference in this prospectus supplement, together with all of the other information appearing or incorporated by reference in this prospectus supplement, in light of your particular investment objectives and financial circumstances. Although we discuss key risks in our discussion of risk factors, new risks may emerge in the future, which may prove to be significant. We cannot predict future risks or estimate the extent to which they may affect our business, results of operations, financial condition and prospects.

Risks Related to an Investment in Our Securities and this Offering

Our management team will have immediate and broad discretion over the use of the net proceeds from this offering and may not use them effectively.

We currently intend to use the net proceeds of this offering for working capital and general corporate purposes. See “Use of Proceeds.” However, our management will have broad discretion in the application of the net proceeds. Our shareholders may not agree with the manner in which our management chooses to allocate the net proceeds from this offering. The failure by our management to apply these funds effectively could have a material adverse effect on our business, financial condition and results of operation. Pending their use, we may invest the net proceeds from this offering in a manner that does not produce income. The decisions made by our management may not result in positive returns on your investment and you will not have an opportunity to evaluate the economic, financial or other information upon which our management bases its decisions.

Failure to comply with the U.S. Foreign Corrupt Practices Act of 1977, or the FCPA, could result in fines, criminal penalties, and an adverse effect on our business.

We operate in a number of countries throughout the world, including countries known to have a reputation for corruption. Furthermore, we generate approximately 90% of our revenue from business relationships with PRC government entities. We are committed to doing business in accordance with applicable anti-corruption laws and have adopted a code of business conduct and ethics that is consistent with the FCPA. We are subject, however, to the risk that we, our affiliated entities or our or their respective officers, directors, employees, and agents may take actions determined to be in violation of such anti-corruption laws, including the FCPA. In addition, actual or alleged violations could damage our reputation and ability to do business. Furthermore, detecting, investigating, and resolving actual or alleged violations is expensive and can consume significant time and attention of our senior management. Any such violation could result in substantial fines, sanctions, civil and/or criminal penalties, curtailment of operations in certain jurisdictions, and might adversely affect our business, earnings or financial condition.

If you purchase our securities in this offering, you may incur immediate and substantial dilution in the book value of your shares. You will also experience further dilution if we issue additional equity or equity-linked securities in the future.

The public offering price of the Class A Ordinary Shares offered pursuant to this prospectus supplement may be substantially higher than the net tangible book value per Class A Ordinary Share immediately prior to the offering. After giving effect to the sale of Class A Ordinary Shares in this offering at the public offering price of $ per share, and after deducting the underwriting discounts and commissions, and estimated offering expenses payable by us, purchasers of our Class A Ordinary shares in this offering will incur immediate dilution of $ per share in the net tangible book value of the Class A Ordinary Shares they acquire.

If we issue additional Class A Ordinary shares (including pursuant to the exercise of outstanding stock options or warrants), or securities convertible into or exchangeable or exercisable for Class A Ordinary Shares, our shareholders, including investors who purchase Class A Ordinary shares in this offering, will experience additional dilution, and any such issuances may result in downward pressure on the price of our Class A Ordinary Shares. We also cannot assure you that we will be able to sell shares or other securities in any other offering at a price per share that is equal to or greater than the price per share paid by investors in this offering, and investors purchasing shares or other securities in the future could have rights superior to existing shareholders.

Sales of a significant number of Class A Ordinary Shares in the public markets, or the perception that such sales could occur, could depress the market price of our Class A Ordinary Shares and our ability to raise funds in future offerings.

Sales of a substantial number of Class A Ordinary Shares in the public markets, or the perception that such sales could occur, could depress the market price of our Class A Ordinary Shares and impair our ability to raise capital through the sale of additional equity securities. We, our directors, our executive officers and certain of our significant shareholders have agreed not to sell, dispose of or hedge any Class A Ordinary Shares or securities convertible into or exchangeable for Class A Ordinary Shares during the period from the date of this prospectus supplement continuing through and including the date 60 days after the date of this prospectus supplement, subject to certain exceptions. The underwriters may, in their discretion, release the restrictions on any such shares at any time without notice. See “Underwriting.” We cannot predict the effect that future sales of our Class A Ordinary Shares would have on the market price of our Class A Ordinary Shares.

Future issuances of our Class A Ordinary Shares or our other equity or debt securities could further depress the market for our Class A Ordinary Shares. We expect to continue to incur significant expenses in the continuing expansion of our business, and to satisfy our funding requirements, we may need to sell additional securities. The proceeds of this offering will not be sufficient to fund the Company beyond a limited time and we may need to sell additional securities to continue operating. The sale or the proposed sale of substantial amounts of our Class A Ordinary Shares, or our other securities may adversely affect the market price of our Class A Ordinary Shares and our stock price may decline substantially. Our shareholders may experience substantial dilution and a reduction in the price that they are able to obtain upon sale of their shares. New securities issued may have greater rights, preferences or privileges than our existing Class A Ordinary Shares.

Certain judgments obtained against us by our shareholders may not be enforceable.

We are an exempted company incorporated under the laws of the Cayman Islands with limited liability. We conduct substantially all of our operations in China and substantially all of our assets are located in China. In addition, a majority of our directors and executive officers reside within China, and most of the assets of these persons are located within China. As a result, it may be difficult or impossible for you to effect service of process within the United States upon these individuals, or to bring an action against us or against these individuals in the United States in the event that you believe your rights have been infringed under the U.S. federal securities laws or otherwise. Even if you are successful in bringing an action of this kind, the laws of the Cayman Islands and of the PRC may render you unable to enforce a judgment against our assets or the assets of our directors and officers.

You may face difficulties in protecting your interests, and your ability to protect your rights through U.S. courts may be limited, because we are incorporated under Cayman Islands law.

We are an exempted company incorporated under the laws of the Cayman Islands with limited liability. Our corporate affairs are governed by our memorandum and articles of association, the Companies Act of the Cayman Islands and the common law of the Cayman Islands. The rights of shareholders to take action against the directors, actions by minority shareholders and the fiduciary duties of our directors to us under Cayman Islands law are to a large extent governed by the common law of the Cayman Islands. The common law of the Cayman Islands is derived in part from comparatively limited judicial precedent in the Cayman Islands as well as from the common law of England, the decisions of whose courts are of persuasive authority, but are not binding, on a court in the Cayman Islands. The rights of our shareholders and the fiduciary duties of our directors under Cayman Islands law are not as clearly established as they would be under statutes or judicial precedent in some jurisdictions in the United States. In particular, the Cayman Islands has a less developed body of securities laws than the United States. Some U.S. states, such as Delaware, have more fully developed and judicially interpreted bodies of corporate law than the Cayman Islands. In addition, Cayman Islands companies may not have standing to initiate a shareholder derivative action in a federal court of the United States courts.

Shareholders of Cayman Islands exempted companies like us have no general rights under Cayman Islands law to inspect corporate records (apart from our memorandum and articles of association, our register of mortgages and charges and special resolutions of our shareholders) or to obtain copies of lists of shareholders of these companies. Our directors have discretion under our Articles of Association, to determine whether or not, and under what conditions, our corporate records may be inspected by our shareholders, but are not obliged to make them available to our shareholders. This may make it more difficult for you to obtain the information needed to establish any facts necessary for a shareholder resolution or to solicit proxies from other shareholders in connection with a proxy contest.

As a result of all of the above, our public shareholders may have more difficulty in protecting their interests in the face of actions taken by management, members of the board of directors or controlling shareholders than they would as public shareholders of a company incorporated in the United States.

We are a foreign private issuer within the meaning of the rules under the Exchange Act, and as such we are exempt from certain provisions applicable to U.S. domestic public companies.

Because we qualify as a foreign private issuer under the Exchange Act, we are exempt from certain provisions of the securities rules and regulations in the United States that are applicable to U.S. domestic issuers, including:

| ● | the rules under the Exchange Act requiring the filing with the SEC of quarterly reports on Form 10-Q or current reports on Form 8-K; |

| ● | the sections of the Exchange Act regulating the solicitation of proxies, consents, or authorizations in respect of a security registered under the Exchange Act; |

| ● | the sections of the Exchange Act requiring insiders to file public reports of their stock ownership and trading activities and liability for insiders who profit from trades made in a short period of time; and |

| ● | the selective disclosure rules by issuers of material nonpublic information under Regulation FD. |

We are required to file an annual report on Form 20-F within four months of the end of each fiscal year. In addition, we publish our results on a quarterly basis as press releases, distributed pursuant to the rules and regulations of Nasdaq. Press releases relating to financial results and material events will also be furnished to the SEC on Form 6-K. However, the information we are required to file with or furnish to the SEC will be less extensive and less timely compared to that required to be filed with the SEC by U.S. domestic issuers. As a result, you may not be afforded the same protections or information that would be made available to you were you investing in a U.S. domestic issuer.

As an exempted company incorporated in the Cayman Islands, we are permitted to adopt certain home country practices in relation to corporate governance matters that differ significantly from the Nasdaq listing standards; these practices may afford less protection to shareholders than they would enjoy if we complied fully with such corporate governance listing standards.

As a Cayman Islands exempted company listed on Nasdaq, we are subject to the Nasdaq listing standards. However, the Nasdaq rules permit a foreign private issuer like us to follow the corporate governance practices of its home country. Certain corporate governance practices in the Cayman Islands, which is our home country, may differ significantly from Nasdaq corporate governance listing standards. For example, neither the Companies Act (As Revised) of the Cayman Islands nor our Articles of Association requires a majority of our directors to be independent and we could include non-independent directors as members of our compensation committee and nominating committee, and our independent directors would not necessarily hold regularly scheduled meetings at which only independent directors are present. Currently, we rely on home country practice with respect to certain aspects of our corporate governance, including each requirement of the Nasdaq Listing Rule 5600 Series. But given the other home country practice we follow, our shareholders may be afforded less protection than they otherwise would under the Nasdaq corporate governance listing standards applicable to U.S. domestic issuers.

USE OF PROCEEDS

We estimate that the net proceeds of this offering will be approximately $ million (or approximately $ million if the underwriters exercise the option to purchase an additional Class A Ordinary Shares in full), after deducting underwriting discounts and commissions and estimated offering expenses.

We will retain broad discretion over the use of the net proceeds from the sale of the securities offered hereby. Unless otherwise specified in a prospectus supplement accompanying this prospectus, the net proceeds from the sale by us of the securities to which this prospectus supplement relates will be used as working capital, including continuing to advance our technologies, and for general corporate purposes. Our expected use of proceeds from the sale of the securities offered hereby represents our current intentions based on our present plans and business condition. As of the date of this prospectus supplement, we cannot predict with certainty all of the particular uses for the proceeds to be received from the sale of the securities offered hereby or the amounts that we will actually spend on the uses set forth above.

Pending the use of the net proceeds, we may invest the proceeds in interest-bearing, investment-grade securities, certificates of deposit or government securities.

DILUTION

If you purchase Class A Ordinary Shares in this offering, your ownership interest will be diluted to the extent of the difference between the purchase price per share and the as adjusted net tangible book value per share after giving effect to this offering. We calculate net tangible book value per share by dividing the net tangible book value, which is total tangible assets less total liabilities, by the number of Class A Ordinary Shares (assuming the conversion by shareholders of all Class B Ordinary Shares for Class A Ordinary Shares). Dilution represents the difference between the portion of the amount per share paid by purchasers of Class A Ordinary Shares in this offering and the as adjusted net tangible book value per share of Class A Ordinary Share immediately after giving effect to this offering. Our net tangible book value as of September 30, 2024, was approximately $59.40 million, or $0.603 per share.

After giving effect to the issuance and sale of Class A Ordinary Shares in this offering at a sale price of $ per share, and after deducting commissions and estimated aggregate offering expenses payable by us, our as adjusted net tangible book value as of September 30, 2024, would have been $ million, or $ per Class A Ordinary Share. This represents an immediate increase in the as adjusted net tangible book value of $ per share to our existing shareholders and an immediate dilution of $ per share to new investors purchasing shares in this offering. The following table illustrates this per share dilution:

| Public offering price per share | | $ | | |

| Net tangible book value per share as of September 30, 2024 | | $ | 0.603 | |

| Increase in net tangible book value per share attributable to new investors in offering | | $ | | |

| As adjusted net tangible book value per share as of September 30, 2024, after giving effect to this offering | | $ | | |

| Dilution per share to new investors in this offering | | $ | | |

If the underwriters exercise their option in full to purchase an additional Class A Ordinary Shares, our as adjusted net tangible book value per share after this offering would be approximately $ per share, representing an increase of as adjusted net tangible book value of $ per share to our existing shareholders and an immediate dilution of approximately $ per share to investors participating in this offering.

The number of Class A Ordinary Shares that will be outstanding after this offering is based on 98,505,058 Class A Ordinary Shares outstanding (assuming the conversion by shareholders of all 46,659,565 Class B Ordinary Shares for Class A Ordinary Shares on a one-to-one basis) as of September 30, 2024 and excludes:

| ● | 2,682,597 Class A Ordinary Shares issuable upon the exercise of 5,365,194 public warrants outstanding, the holder of each such warrant entitled to purchase one-half (1/2) of one Class A Ordinary Share at an exercise price of $11.50 per full share; |

| ● | 175,000 Class A Ordinary Shares issuable upon the exercise of 350,000 private placement warrants outstanding, and the holder of each such warrant entitled to purchase one-half (1/2) of one Class A Ordinary Share at an exercise price of $11.50 per full share; |

| ● | 2,839,951 Class A Ordinary Shares issuable upon the exercise of a warrant to purchase our Class A Ordinary Shares by GEM Yield Bahamas Ltd. at an exercise price of $11.50 per full share; |

| ● | 3,850,857 Class A Ordinary Shares issuable upon the exercise of certain common warrants issued on October 30, 2023, at an exercise price of $9.00 per full share; |

| ● | 25,672 Class A Ordinary Shares issuable upon the exercise of certain PA warrants issued on October 30, 2023, at an exercise price of $10.225 per full share. |