MANAGEMENT’S DISCUSSION AND ANALYSIS

Introduction

This management’s discussion and analysis (“MD&A”) included in this Form 6-K presents the financial position of Brookfield Asset Management Ltd. (the “Manager”) as at March 31, 2023, and December 31, 2022, and the results of operations for the period from January 1, 2023 to March 31, 2023. This MD&A also presents the financial position of Brookfield Asset Management ULC (the “Asset Management Company” or the “Asset Management Business” or the “Company”) as at March 31, 2023, and December 31, 2022, and the results of operations for the three months ended March 31, 2023, and 2022 then ended.

The information in this MD&A should be read in conjunction with the following Condensed Consolidated Financial Statements included elsewhere in this Form 6-K: (i) the unaudited Condensed Consolidated Financial Statements of the Manager as at March 31, 2023 and December 31, 2022, and the results of operations for the period from January 1, 2023 to March 31, 2023 (ii) the unaudited Condensed Consolidated and Combined Financial Statements of the Asset Management Company as at March 31, 2023 and December 31, 2022 and the results of operations for the three months ended March 31, 2023, and 2022.

Business History

The Manager and the Asset Management Company were formed by Brookfield Asset Management Inc. (now known as Brookfield Corporation or the “Corporation”) on July 4, 2022 for the purpose of effecting the court approved plan of arrangement (the “Arrangement”) of the Corporation as a result of which (i) the shareholders of the Corporation, while retaining their shares of the Corporation, became shareholders of the Manager, which acquired a 25% interest in our asset management business through common shares of the Asset Management Company, and (ii) the Corporation changed its name from “Brookfield Asset Management Inc.” to “Brookfield Corporation”.

The Manager was established to become a company through which investors can directly access a leading, pure-play global alternative asset management business previously carried on by Brookfield Asset Management Inc. and its subsidiaries and currently owned and operated through the Asset Management Company, owned 75% by the Corporation and 25% by the Manager. The Arrangement, which closed on December 9, 2022, involved the division of Brookfield Asset Management Inc. into two publicly traded companies – the Manager, a pure-play asset manager with a leading global alternative asset management business, and the Corporation, focused on deploying capital across its operating businesses and compounding that capital over the long term. As a result of the Arrangement, holders of the Corporation Class A Shares received 0.25 of a Class A Share of the Manager for each Corporation Class A Share held. The Class A Shares are listed on the NYSE and the TSX under the symbol “BAM”.

Business Overview

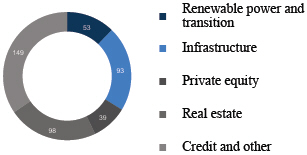

We are one of the world’s leading alternative asset managers, with $834 billion of assets under management (“AUM”) as of March 31, 2023, across renewable power and transition, infrastructure, real estate, private equity and credit. We invest client capital for the long-term with a focus on real assets and essential service businesses that form the backbone of the global economy. We draw on our heritage as an owner and operator to invest for value and generate strong returns for our clients, across economic cycles.

To do this, we leverage our exceptional team of over 2,500 investment and asset management professionals, our global reach, deep operating expertise and access to large-scale capital to identify attractive investment opportunities and invest on a proprietary basis. Our investment approach and strong track record have been the foundation and driver of our growth.

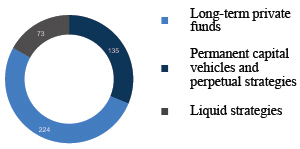

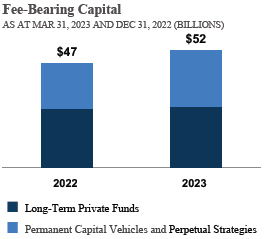

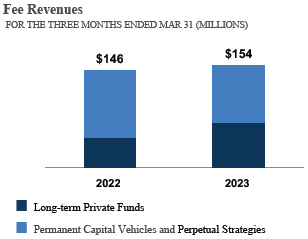

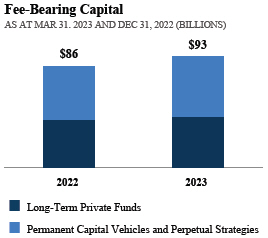

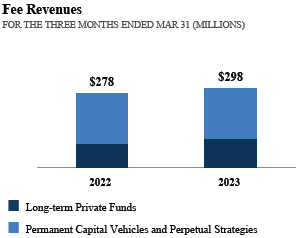

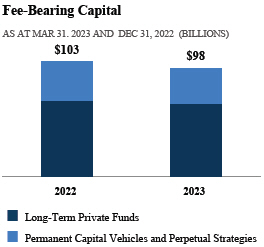

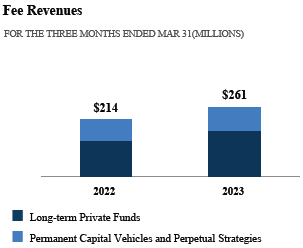

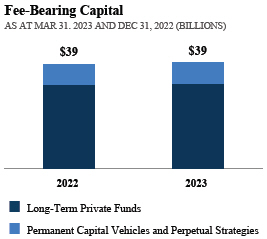

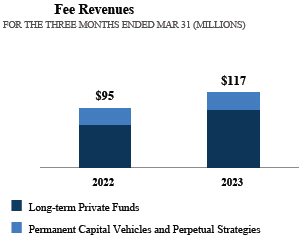

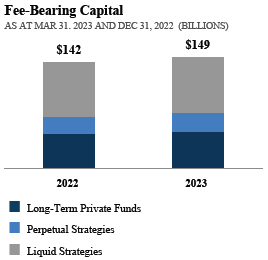

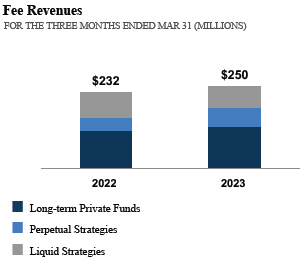

We provide a highly diversified suite of alternative investment strategies to our clients and are constantly innovating new strategies to meet their needs. We have approximately 50 unique product offerings that span a wide range of risk-adjusted returns, including opportunistic, value-add, core, super-core and credit. We evaluate the performance of these product offerings and our investment strategies using a number of non-GAAP measures as outlined in “Key Financial and Operating Measures” within this MD&A. The Manager will utilize Distributable Earnings to measure performance, while, in addition to this metric, Fee Revenues and Fee-Related Earnings are closely utilized in order to assess the performance of our asset management business.

We have over 2,000 clients, made up of some of the world’s largest institutional investors, including sovereign wealth funds, pension plans, endowments, foundations, financial institutions, insurance companies and individual investors.

We are in a fortunate position to be trusted with our clients’ capital and our objective is to meet their financial goals and provide for a better financial future while providing a market leading experience. Our team of 270 client service professionals across 18 global offices are dedicated to our clients and ensuring the business is exceeding their service expectations.

10