TABLE OF CONTENTS

| | | | | | | | | | | |

| LETTER TO SHAREHOLDERS | 2 |

| | | |

| PART I | MANAGEMENT'S DISCUSSION & ANALYSIS | |

| | | |

| ITEM 1 | FORWARD-LOOKING STATEMENTS | 7 |

| ITEM 2 | CAUTIONARY STATEMENT REGARDING THE USE OF NON-GAAP MEASURES | 9 |

| ITEM 3 | BUSINESS OVERVIEW | 10 |

| ITEM 4 | KEY FINANCIAL AND OPERATING MEASURES | 16 |

| ITEM 5 | REVIEW OF CONSOLIDATED FINANCIAL RESULTS | 18 |

| ITEM 6 | ANALYSIS OF KEY NON-GAAP FINANCIAL AND OPERATING MEASURES | 24 |

| ITEM 7 | INVESTMENT STRATEGY RESULTS | 26 |

| ITEM 8 | LIQUIDITY AND CAPITAL RESOURCES | 38 |

| ITEM 9 | ACCOUNTING POLICIES | 40 |

| ITEM 10 | QUANTITATIVE AND QUALITATIVE RISK DISCLOSURES | 41 |

| | | |

| PART II | FINANCIAL STATEMENTS | |

| | | |

| ITEM 11 | BROOKFIELD ASSET MANAGEMENT LTD. FINANCIAL STATEMENTS | 42 |

| ITEM 12 | BROOKFIELD ASSET MANAGEMENT ULC FINANCIAL STATEMENTS | 54 |

LETTER TO SHAREHOLDERS

Overview

We are pleased to report that we are off to an excellent start in 2023. Our financial performance was strong, posting distributable earnings (DE) of $563 million, 15% higher than the comparative period in 2022.

The first quarter of 2023 marked our first full quarter as a pure play, publicly traded alternative asset manager following our spin-off from Brookfield Corporation, and we are encouraged by the positive feedback we have received. Our business is centered around extremely resilient and growing cashflows and industry leading businesses, both of which are well-positioned to benefit from secular global trends over the coming decades. This is bolstered by our access to large scale capital, global reach, and deep operating expertise.

The backdrop for investing capital into alternative assets continues to be very favorable, and we believe the long-term trend is even stronger. Total assets under management now exceed $825 billion, and our total capital available for new investments is nearly $80 billion. We are actively adding capital in virtually all areas across the business and with financial conditions tightening, we are finding increasingly attractive opportunities to put capital to work.

Market environment

Inflation is beginning to ease to more moderate levels and the market’s expectations for interest rates is beginning to stabilize. While the Fed’s continued rate hikes have had their desired effect of curtailing inflationary pressures, the secondary effects of this sharp rise in interest rates are only beginning to work through the financial system.

Capital has become increasingly scarce and relatively more expensive versus the lows of the past couple of years, leaving asset owners with fewer options to refinance debt maturities or fund growth. This creates an opportunity for large alternative asset managers with significant dry powder to put to work—and as a result, we are seeing an increased number of long-term value opportunities with less competition.

Large, multi-product global managers are set to win

Every industry eventually goes through consolidation. The normal evolution of business is that an industry starts with early entrepreneurs, and their success leads others to enter the business. This often brings a glut of investment, with additional market participants looking to capture a portion of the broader industry growth. In a growing market, distinguishing between the market participants can be difficult. However, when market conditions soften, the differentiation becomes clearer. All industries go through this cycle, and the alternatives industry is in the midst of this today.

Great assets and businesses perform well throughout market cycles, while more commodity-like assets struggle in weaker market conditions. As markets become tougher, average players often see their growth plateau, small players lack the resources to push through the down cycle, and niche players are relegated to being niche players forever. The bottom line is that during tougher markets, consolidation occurs and the best-in-class players continue to perform, separating themselves from the rest.

In virtually all sectors, from banking and insurance to consumer products and technology, there are up to 10 industry leading players in the world. These firms are able to drive profitable growth over extended periods and across market cycles. And while the membership of this group does change from time to time, those that execute well are much more likely to maintain their position.

The attributes of leading asset managers are strong investment performance over a long period of time; access to scale capital; fund and geographic diversification; and a large-scale organization to service clients and capture future growth trends. Similar to the other major industries, there are only a handful of alternative asset managers who have these attributes today.

Our $825 billion of total assets under management, our ability to raise $75 to $100 billion annually for investing, and our ability to offer compelling co-underwrite and co-invest opportunities at scale, makes us one of these major players. We feel exceptionally privileged to be in this category and work hard every day for our clients and partners to ensure we stay there.

Fundraising at scale

Year to date we raised a total of $19 billion, of which $13 billion occurred during the first quarter. Fee-bearing capital grew $14 billion during the first quarter to $432 billion. Despite macroeconomic headwinds making fundraising more challenging, we expect 2023 to be another strong year from a capital raising perspective, with all our flagship funds and a number of other complementary

fund strategies in some stage of fundraising. Given the recent launch of several of our largest products, which are well-suited to the current market backdrop, we see the potential for our fundraising to accelerate throughout the year.

Our confidence regarding our ability to raise and deploy capital on a large scale is due primarily to our global approach to building our business. Today we operate in 30 countries, and much of our expansion has occurred over the last ten years—designed to facilitate our growth and ensure we have “boots on the ground” in every country in which we invest. Equally important is the fact that each of our offices includes asset management professionals focused on building long-term relationships with a broad range of local investors. This ensures that we are well diversified across our client base and can efficiently and consistently raise capital in different economic environments.

We are currently seeing an increased proportion of our fundraising coming from non-US clients. This is due to our long-standing dedication to be a local presence in the areas we invest and fundraise. As an example, we established offices and significant business operations in the Middle East and Asia over the past 10 years and these regions accounted for approximately 40% of the capital we raised in the last twelve months.

Institutional investors are increasingly concentrating their commitments among the largest asset managers who can offer a range of asset types and investment strategies to help them achieve their financial objectives. Our scale, demonstrated track record, and expanding suite of products are increasingly benefitting us as institutional investors continue to grow their allocation to private assets, and we expect that this trend will continue.

Operating results were excellent

Financial results

Our business delivered strong earnings growth, generating fee-related earnings of $547 million in the quarter and $2.2 billion over the last 12 months. Fundraising year-to-date has been strong at $19 billion, and almost $100 billion over the past 12 months. We expect this momentum to continue as we raise capital for flagship and complementary fund strategies focused on investing in the backbone of the global economy.

Operations update

It was an active quarter on the fundraising front, with many of our funds resonating with investors, as this environment plays to our strengths. We are in the market with all five of our flagship funds at various stages and making good progress. We are also raising capital for a number of complementary strategies. A few key highlights below:

◦We are nearing a final close of our fifth flagship infrastructure fund, which currently stands at $24 billion, our largest fund ever, and our sixth flagship private equity fund, which sits at $9 billion today. Both funds already exceed the size of their prior vintage, and we still have meaningful capital to raise for these strategies.

◦In January, we launched fundraising for our fifth flagship real estate fund with the objective of investing capital into a market that we believe should provide significant opportunities to invest at highly attractive risk-adjusted returns. We expect a first close on this fund later in the year.

◦Earlier this month, we launched fundraising for our second flagship transition fund, which is focused on investing in and facilitating the global transition to a net-zero economy. We launched our first $15 billion fund in 2021 and after signing an agreement to acquire Origin Energy in a public-to-private transaction, more than 85% of the fund has been invested or committed. Given the strong demand from institutional capital for this strategy, we expect that the second fund in this series will be even larger than the first.

◦In February, we launched Brookfield Infrastructure Income Fund (“BII”), an innovative open-ended, semi-liquid infrastructure product offering private wealth investors access to Brookfield’s infrastructure platform. While private infrastructure has become a meaningful asset class for institutions, individual investors have historically had few options to gain exposure to this important asset class. We launched BII with two distribution partners and have raised more than $750 million to date.

Our expansion to private credit is accelerating

Over the past fifteen years, we have built a powerful global private credit franchise, growing both organically and via acquisition. The current economic environment and the resulting reduced bank lending for corporate, real estate, and buy-out transactions is proving to be a great catalyst for this business to achieve yet another step change in growth.

Our credit business is among the largest globally, with approximately $140 billion of fee-bearing capital across a diverse set of strategies. We offer private credit funds across all our verticals of real estate, infrastructure, renewable power, private equity, and corporate lending. With the significant market tailwinds for credit, we believe we are still in the early innings for many of these product offerings, with significant room for growth.

One area of particular focus recently has been direct lending, an asset class that has expanded significantly and now represents a global market of approximately $1.5 trillion. Our roots in the asset class date back to 2001, and we have become a partner of choice for counterparties, using a solutions-oriented approach tailored to meeting the unique needs of each borrower. In doing so, we prioritize risk control and have focused on asset value and prudent structuring. We have historically avoided the more commoditized parts of the market by structuring customized solutions for our borrowers, enabling us to deliver a more efficient financing solution to meet their needs and create a better covenant package to protect our principal. The combination of these factors has helped us generate a long track record of market-leading returns and minimal losses.

The direct lending market has become increasingly attractive recently due to the limited availability of debt capital to finance private equity-sponsored transactions combined with the record-high levels of committed private equity capital raised for deals. While the need for this type of lending is significant, we anticipate less competition given both banks’ reduction of appetite for this form of financing and the scarcity of non-bank lenders that possess the necessary scale, flexibility, and credit expertise.

Given this backdrop, we recently announced the launch of a direct lending strategy. This strategy is originating senior secured loans of $500 million or more to private equity-owned U.S. companies, and we are encouraged by the positive investor feedback we have received so far. Given the large-scale nature of this fund and the significant opportunity we see for this strategy going forward, our direct lending fund will represent our sixth flagship fund family at Brookfield.

In addition to this fund, we are making significant progress raising capital for various other debt and debt-like strategies.

1.Infrastructure Debt Fund: We are currently raising our third fund in this series at a size that represents a 60% increase from the previous vintage. This fund strategy enables us to provide private credit solutions across the full suite of infrastructure asset types to partners seeking alternatives to equity capital.

2.Real Estate Debt Fund: Our sixth real estate debt fund is currently 33% invested. As one of the largest real estate investors globally, we have access to data, insights and deal flow that we have utilized to provide real estate finance capital for more than 20 years. Given the increasing demand for private real estate debt capital, we expect to continue to deploy the remaining commitments and come back to market soon with the seventh fund.

3.Special Investments Credit Strategy: This fund strategy provides capital to counterparties in the form of preferred equity or subordinated debt. We recently launched fundraising on our second vintage in this strategy, which we expect will be meaningfully larger than the first.

4.Consumer and SME Credit Funds: Through our partnership with the owners of LCM Partners, we participate in lending to small business, commercial, and retail markets, leveraging our proprietary technology and in-house servicing operations. LCM’s Strategic Origination and Lending Opportunities (SOLO) strategy invests in asset finance, real-estate financing, and renewables. SOLO is launching its second vintage in May 2023.

The increased opportunity set we are seeing in private credit broadly, and particularly in direct lending, in addition to our broad and diversified capabilities, gives us confidence that we should be able to grow our overall business to $1.5 to $2 trillion and fee-bearing capital to $1 trillion in the next five years, further strengthening and diversifying our franchise in the years ahead.

Closing

We remain committed to being a world-class asset manager, and to investing capital for you and our other investment partners in high-quality assets that earn solid returns, while emphasizing downside protection. The primary objective of the company continues to be growing our fee-bearing capital in order to generate increasing cash flows on a per-share basis, and to distribute that cash to you by way of dividends or share repurchases.

Sincerely,

Bruce Flatt Connor Teskey

Chief Executive Officer President

May 10, 2023

BROOKFIELD ASSET MANAGEMENT LTD.

MANAGEMENT’S DISCUSSION AND ANALYSIS

FORWARD-LOOKING STATEMENTS

In addition to historical information, this MD&A contains “forward-looking statements” within the meaning of applicable U.S. securities laws, including the United States Private Securities Litigation Reform Act of 1995, and “forward-looking information” within the meaning of Canadian securities laws (collectively, “forward-looking information”). Forward-looking information may relate to our outlook and anticipated events or results and may include information regarding the financial position, business strategy, growth strategy, budgets, operations, financial results, taxes, dividends, distributions, plans and objectives of our business. Particularly, information regarding future results, performance, achievements, prospects or opportunities of the Manager, our asset management business or the Canadian, U.S. or international markets is forward-looking information. In some cases, forward-looking information can be identified by the use of forward-looking terminology such as “plans”, “targets”, “expects” or “does not expect”, “is expected”, “an opportunity exists”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate” or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might”, “will” or “will be taken”, “occur” or “be achieved”.

Our forward-looking statements are based on our beliefs, assumptions and expectations of future performance, taking into account all information currently available to us. These beliefs, assumptions and expectations can change as a result of many possible events or factors, not all of which are known to us or within our control. If a change occurs, our business, financial condition, liquidity and results of operations may vary materially from those expressed in our forward-looking statements. Several factors, including those described in this MD&A, among others, could cause our actual results to vary from our forward-looking statements. These factors include:

•the Manager’s lack of independent means of generating revenue;

•the Manager’s material assets consisting solely of its interest in the Asset Management Company;

•challenges relating to maintaining our relationship with the Corporation and potential conflicts of interest;

•the Manager being a newly formed company;

•our liability for our asset management business;

•our ability to maintain the Manager’s excepted status as a “foreign private issuer” and an “emerging growth company” under U.S. federal securities laws;

•the difficulty for investors to effect service of process and enforce judgments in the United States, Canada and/or other applicable jurisdictions;

•the impact on growth in Fee-Bearing Capital of poor product development or marketing efforts;

•our ability to maintain our global reputation;

•volatility in the trading price of the Class A Shares;

•being subjected to numerous laws, rules and regulatory requirements;

•the potential ineffectiveness of our policies to prevent violations of applicable law;

•meeting our financial obligations due to our cash flow from our asset management business;

•foreign currency risk and exchange rate fluctuations;

•requirement of temporary investments and backstop commitments to support our asset management business;

•rising interest rates;

•revenues impacted by a decline in the size or pace of investments made by our managed assets;

•our earnings growth can vary, which may affect our dividend and the trading price of the Class A Shares;

•exposed risk due to increased amount and type of investment products in our managed assets;

•difficulty in maintaining our culture;

•political instability or changes in government;

•unfavorable economic conditions or changes in the industries in which we operate;

•catastrophic events and COVID-19;

•deficiencies in public company financial reporting and disclosures;

•ineffective management of ESG considerations;

•failure of our information technology systems;

•the threat of litigation;

•losses not covered by insurance;

•inability to collect on amounts owing to us;

•information barriers that may give rise to conflicts and risks;

•risks related to our real estate, renewable power and transition, infrastructure and private equity strategies;

•risks relating to Canadian and United States taxation laws; and

•other factors described in this MD&A.

We caution that the factors that may affect future results described in this MD&A are not exhaustive. The forward-looking statements represent our views as of the date of this MD&A and should not be relied upon as representing our views as of any date subsequent to the date of this MD&A. While we anticipate that subsequent events and developments may cause our views to change, we disclaim any obligation to update the forward-looking statements, other than as required by applicable law. For further information on these known and unknown risks.

These statements and other forward-looking information are based on opinions, assumptions and estimates made by us in light of our experience and perception of historical trends, current conditions and expected future developments, as well as other factors that we believe are appropriate and reasonable in the circumstances, but there can be no assurance that such estimates and assumptions will prove to be correct. Accordingly, readers should not place undue reliance on forward-looking information. We do not undertake to update any forward-looking information contained herein, except as required by applicable securities laws.

In addition to carefully considering the disclosure made in this MD&A, you should carefully consider the disclosure made by the Corporation in its continuous disclosure filings. Copies of the Corporation’s continuous disclosure filings are available electronically on EDGAR on the SEC’s website at www.sec.gov or on SEDAR at www.sedar.com.

CAUTIONARY STATEMENT REGARDING THE USE OF NON-GAAP MEASURES

Brookfield Asset Management Ltd. and Brookfield Asset Management ULC prepare their financial statements in conformity with U.S. GAAP. This Form 6-K discloses a number of non-GAAP financial and supplemental financial measures which are utilized in monitoring the Manager and our asset management business, including for performance measurement, capital allocation and valuation purposes. The Manager believes that providing these performance measures is helpful to investors in assessing the overall performance of our asset management business. These non-GAAP financial measures should not be considered as the sole measure of the Manager’s or our asset management business’ performance and should not be considered in isolation from, or as a substitute for, similar financial measures calculated in conformity with U.S. GAAP financial measures. Non-GAAP measures include Distributable Earnings, Fee Revenues and Fee-Related Earnings. These non-GAAP measures are not standardized financial measures and may not be comparable to similar financial measures used by other issuers. Supplemental financial measures include AUM, Fee-Bearing Capital and Uncalled Fund Commitments. The Manager includes the asset management activities of Oaktree, an equity accounted affiliate, in its key financial and operating measures for the asset management business.

For further details regarding the use of non-GAAP measures, please see the “Key Financial and Operating Measures” in the Management Discussion and Analysis.

MANAGEMENT’S DISCUSSION AND ANALYSIS

Introduction

This management’s discussion and analysis (“MD&A”) included in this Form 6-K presents the financial position of Brookfield Asset Management Ltd. (the "Manager") as at March 31, 2023, and December 31, 2022, and the results of operations for the period from January 1, 2023 to March 31, 2023. This MD&A also presents the financial position of Brookfield Asset Management ULC (the "Asset Management Company" or the "Asset Management Business" or the "Company") as at March 31, 2023, and December 31, 2022, and the results of operations for the three months ended March 31, 2023, and 2022 then ended.

The information in this MD&A should be read in conjunction with the following Condensed Consolidated Financial Statements included elsewhere in this Form 6-K: (i) the unaudited Condensed Consolidated Financial Statements of the Manager as at March 31, 2023 and December 31, 2022, and the results of operations for the period from January 1, 2023 to March 31, 2023 (ii) the unaudited Condensed Consolidated and Combined Financial Statements of the Asset Management Company as at March 31, 2023 and December 31, 2022 and the results of operations for the three months ended March 31, 2023, and 2022.

Business History

The Manager and the Asset Management Company were formed by Brookfield Asset Management Inc. (now known as Brookfield Corporation or the "Corporation") on July 4, 2022 for the purpose of effecting the court approved plan of arrangement (the "Arrangement") of the Corporation as a result of which (i) the shareholders of the Corporation, while retaining their shares of the Corporation, became shareholders of the Manager, which acquired a 25% interest in our asset management business through common shares of the Asset Management Company, and (ii) the Corporation changed its name from “Brookfield Asset Management Inc.” to “Brookfield Corporation”.

The Manager was established to become a company through which investors can directly access a leading, pure-play global alternative asset management business previously carried on by Brookfield Asset Management Inc. and its subsidiaries and currently owned and operated through the Asset Management Company, owned 75% by the Corporation and 25% by the Manager. The Arrangement, which closed on December 9, 2022, involved the division of Brookfield Asset Management Inc. into two publicly traded companies – the Manager, a pure-play asset manager with a leading global alternative asset management business, and the Corporation, focused on deploying capital across its operating businesses and compounding that capital over the long term. As a result of the Arrangement, holders of the Corporation Class A Shares received 0.25 of a Class A Share of the Manager for each Corporation Class A Share held. The Class A Shares are listed on the NYSE and the TSX under the symbol “BAM”.

Business Overview

We are one of the world’s leading alternative asset managers, with $834 billion of assets under management ("AUM") as of March 31, 2023, across renewable power and transition, infrastructure, real estate, private equity and credit. We invest client capital for the long-term with a focus on real assets and essential service businesses that form the backbone of the global economy. We draw on our heritage as an owner and operator to invest for value and generate strong returns for our clients, across economic cycles.

To do this, we leverage our exceptional team of over 2,500 investment and asset management professionals, our global reach, deep operating expertise and access to large-scale capital to identify attractive investment opportunities and invest on a proprietary basis. Our investment approach and strong track record have been the foundation and driver of our growth.

We provide a highly diversified suite of alternative investment strategies to our clients and are constantly innovating new strategies to meet their needs. We have approximately 50 unique product offerings that span a wide range of risk-adjusted returns, including opportunistic, value-add, core, super-core and credit. We evaluate the performance of these product offerings and our investment strategies using a number of non-GAAP measures as outlined in "Key Financial and Operating Measures" within this MD&A. The Manager will utilize Distributable Earnings to measure performance, while, in addition to this metric, Fee Revenues and Fee-Related Earnings are closely utilized in order to assess the performance of our asset management business.

We have over 2,000 clients, made up of some of the world’s largest institutional investors, including sovereign wealth funds, pension plans, endowments, foundations, financial institutions, insurance companies and individual investors.

We are in a fortunate position to be trusted with our clients’ capital and our objective is to meet their financial goals and provide for a better financial future while providing a market leading experience. Our team of 270 client service professionals across 18 global offices are dedicated to our clients and ensuring the business is exceeding their service expectations.

Our guiding principle is to operate our business and conduct our relationships with the highest level of integrity. Our emphasis on diversity and inclusion reinforces our culture of collaboration, allowing us to attract and retain top talent. Strong ESG practices are embedded throughout our business, underpinning our goal of having a positive impact on the communities and environment within which we operate.

Value Creation

We create shareholder value by increasing the earnings profile of our asset management business. Alternative asset management businesses such as ours are typically valued based on multiples of their fee-related earnings and performance income. Accordingly, we create value by increasing the amount and quality of fee-related earnings and carried interest, net of associated costs. This growth is achieved primarily by expanding the amount of Fee-Bearing Capital we manage, earning performance income such as carried interest through superior investment results and maintaining competitive operating margins.

As at March 31, 2023, we had Fee-Bearing Capital of $432 billion, of which 83% is long-dated or perpetual in nature, providing significant stability to our earnings profile. We consider Fee-Bearing Capital that is long-dated or perpetual in nature to be Fee-Bearing Capital relating to our long-term private funds, which are typically committed for 10 years with two one-year extension options, and Fee-Bearing Capital relating to our perpetual strategies, which include the permanent capital vehicles as well as capital we manage in our perpetual core and core plus private fund strategies. We seek to increase our Fee-Bearing Capital by growing the size of our existing product offering and developing new strategies that cater to our clients’ investment needs. We also aim to deepen our existing institutional relationships, develop new institutional relationships and access new distribution channels such as high net worth individuals and retail.

As of March 31, 2023, we had over 2,000 clients with a strong base in North America, Asia, the Middle East and Australia and a growing proportion of third-party commitments from Europe. Our high-net-worth channel also continues to grow and is 4% of current commitments. We have a dedicated team of over 100 people that are focused on distributing and developing catered products to the private wealth channel.

We are also actively progressing new growth strategies, including transition, insurance, secondaries and technology. These new initiatives, in addition to our existing strategies are expected to have a very meaningful impact on our growth trajectory in the long term.

As we grow our Fee-Bearing Capital, we earn incremental base management fees. In order to support this growth, we have been growing our exceptional team of investment and asset management professionals. Our costs are predominantly in the form of compensation for the over 2,500 professionals we employ globally.

When deploying our clients’ capital, we seek to leverage our competitive advantages to acquire high-quality real assets or businesses that provide essential services that form the backbone of the global economy. We use our global reach and access to scale capital to source attractive investment opportunities and leverage our deep operating expertise to underwrite investments and create value throughout our ownership. Our goal is to deliver superior investment returns to our clients and successfully doing so results in the continued growth of realized carried interest.

We generate robust free cash flows or Distributable Earnings, which is our primary financial performance metric. Distributable Earnings of the Manager represent our share of Distributable Earnings from the Asset Management Company less general and administrative expenses, but excluding equity-based compensation costs of the Manager. The Manager intends to pay out approximately 90% of our Distributable Earnings to shareholders quarterly and reinvest the balance back into the business.

We also monitor the broader markets and occasionally identify attractive, strategic investment opportunities that have the potential to supplement our existing business and add to our organic growth. We expect acquisitions can allow us to achieve immediate scale in a new asset class or grant us access to additional distribution channels. An example of such growth is the partnership we formed with Oaktree in 2019. Such acquisitions may happen from time to time should they be additive to our franchise, attractive to our clients and accretive to our shareholders.

Products

Our products broadly fall into one of three categories: (i) long-term private funds, (ii) permanent capital vehicles and perpetual strategies and (iii) liquid strategies. These are invested across five principal strategies: (i) Renewable Power and Transition, (ii) Infrastructure, (iii) Private Equity, (iv) Real Estate, (v) Credit and other.

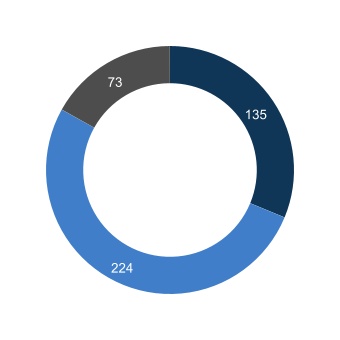

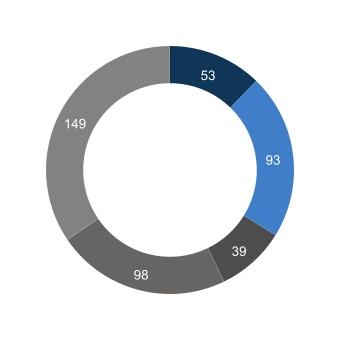

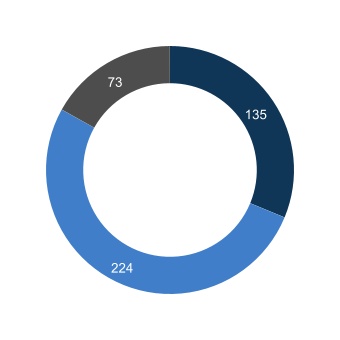

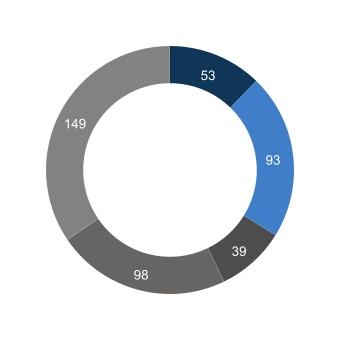

Fee-Bearing Capital Diversification

AS AT MAR. 31, 2023 (BILLIONS)

| | | | | | | | | | | | | | |

| By Fund Type | | | By Business Line | |

| | | | | |

| ■ | Long-term private funds |

| ■ | Permanent capital vehicles and perpetual strategies |

| ■ | Liquid strategies |

| |

| | | | | |

| ■ | Renewable power and transition |

| ■ | Infrastructure |

| ■ | Private equity |

| ■ | Real estate |

| ■ | Credit and other |

For discussion on Fee-Bearing Capital, see “Key Financial and Operating Measures”.

Long-term Private Funds

As of March 31, 2023, we managed approximately $224 billion of Fee-Bearing Capital across a diverse range of long-term private funds that target opportunistic (20%+, gross), value-add (15%-16%, gross), core and core plus (9%-13%, gross) returns. These funds are generally closed-end and have a long duration, typically committed for 10 years with two one-year extension options.

On these products, we earn:

•Diversified and long-term base management fees, typically on committed capital or invested capital, depending on the nature of the fund and the period that the fund is in its life,

•Transaction and advisory fees on co-investment capital that we raise and deploy alongside our long-term private funds, which vary based on transaction agreements, and

•Carried interest or performance fees, which entitles us to a portion of overall fund profits, provided that investors receive a minimum prescribed preferred return. Carried interest is typically paid towards the end of the life of a fund after capital has been returned to investors and may be subject to “clawback” until all investments have been monetized and minimum investment returns are sufficiently assured. The Corporation is entitled to receive 33.3% of the carried interest on new sponsored funds of our asset management business and will retain all of the carried interest earned on mature funds.

Permanent Capital Vehicles and Perpetual Strategies

As of March 31, 2023, we managed approximately $135 billion of Fee-Bearing Capital across our permanent capital vehicles, perpetual core and core plus private funds.

On these products, we earn:

•Long-term perpetual base management fees, which are based on the market capitalization or net asset value of our permanent capital vehicles and on the net asset value of our perpetual private funds.

•Stable incentive distribution fees from Brookfield Renewable Partners L.P. ("BEP") and Brookfield Infrastructure Partners L.P. ("BIP"), which are linked to the growth in cash distributions paid to investors above a predetermined hurdle. Both BEP and BIP have a long-standing track record of growing distributions annually within a target range of 5-9%.

•Performance fees from Brookfield Business Partners L.P. ("BBU") are based on unit price performance above a prescribed high-water mark price, which are not subject to clawback, as well as carried interest on our perpetual private funds.

Liquid Strategies

As of March 31, 2023, we managed approximately $73 billion of Fee-Bearing Capital across our liquid strategies, which included capital that we manage on behalf of our publicly listed funds and separately managed accounts, with a focus on fixed income and equity securities across real estate, infrastructure and natural resources.

On these products, we earn:

•Base management fees, which are based on committed capital or fund net asset value, and

•Performance income based on investment returns above a minimum prescribed return.

Renewable Power and Transition

Overview

•We are a leading global investment manager in renewable power and transition, with $77 billion of AUM as of March 31, 2023.

•Clean energy occupies a uniquely complementary position to the global goals of net-zero emissions, low-cost energy and energy security. We believe that the growing global demand for low-carbon energy, especially amongst corporate off takers, will lead to continued growth opportunities for us in the future. The investment environment for renewable power and transition remains favorable and we expect to continue to advance our substantial pipeline of renewable power and transition opportunities on behalf of our clients and managed assets.

•We have approximately 100 investment and asset management professionals globally that are focused on our renewable power and transition strategy, supported by approximately 3,700 employees in the renewable power and transition operating businesses that we manage. Our extensive experience and knowledge in this industry allows us to be a leader in all major technologies with deep operating and development capabilities.

Our Products

Long-term Private Funds

•We manage the largest of its kind global transition fund, Brookfield Global Transition Fund ("BGTF"), which is our $15 billion flagship strategy focused on investments aimed at accelerating the global transition to a net-zero carbon economy. The mandate of this product is to assist utility, energy and industrial businesses reduce carbon dioxide emissions, expand low-carbon and renewable energy production levels and advance sustainable solutions.

Permanent Capital Vehicles and Perpetual Strategies

•We also manage BEP, one of the world’s largest publicly traded renewable power platforms, which is listed on the NYSE and TSX and has a market capitalization of over $21.0 billion as of March 31, 2023.

Infrastructure

Overview

•We are one of the world’s largest investment managers in infrastructure, with $161 billion of AUM as of March 31, 2023.

•We focus on acquiring high-quality businesses on behalf of our clients that deliver essential goods and services, diversified across the utilities, transport, midstream and data infrastructure sectors. We partner closely with management teams to enable long-term success through operational and other improvements.

•We have approximately 230 investment and asset management professionals globally that are focused on our infrastructure strategy, supported by approximately 51,400 employees in the infrastructure operating businesses that we manage.

Our Products

Long-term Private Funds

•Brookfield Infrastructure Funds ("BIF") is our flagship infrastructure fund series. In this product offering, we invest on behalf of our clients in high-quality infrastructure assets on a value basis and seek to add value through the investment life cycle by utilizing our operations-oriented approach.

•Brookfield Infrastructure Debt (“BID”) is our infrastructure debt fund series, which invests on behalf of our clients in mezzanine debt investments in high-quality, core infrastructure assets.

Permanent Capital Vehicles and Perpetual Strategies

•We manage BIP, one of the largest, pure play, publicly traded global infrastructure platforms, which is listed on the NYSE and TSX and has a market capitalization of $27 billion as of March 31, 2023. In this product offering, we invest on behalf of our clients in high-quality, long-life assets that provide essential products and services for the global economy.

•We manage Brookfield Super-Core Infrastructure Partners (“BSIP”), which is our perpetual infrastructure private fund strategy. In this product offering, we invest on behalf of our clients in core infrastructure assets in developed markets, with a focus on yield, diversification and inflation-protection.

•We also recently launched Brookfield Infrastructure Income Fund (“BII”), a semi-liquid infrastructure product strategy, offering private wealth investors with access to our best-in-class infrastructure platform.

Real Estate

Overview

•We are one of the world’s largest investment managers in real estate, with over $270 billion of AUM as of March 31, 2023.

•We have invested, on behalf of clients, in iconic properties in the world’s most dynamic markets with the goal of generating stable and growing distributions for our investors while protecting them against downside risk.

•We have approximately 660 investment and asset management professionals that are focused on generating superior returns across our real estate strategies, supported by approximately 29,600 operating employees in the real estate operating businesses that we manage.

Our Products

Long-term Private Funds

•Our opportunistic real estate flagship fund series is Brookfield Strategic Real Estate Partners (“BSREP”). Through this product, we invest globally across various sectors and geographies on behalf of our clients in high-quality real estate with a focus on large, complex, distressed assets, turnarounds and recapitalizations.

•Our commercial real estate debt fund series, Brookfield Real Estate Finance Fund (“BREF”), targets investments in transactions, predominantly in the U.S., that are senior to traditional equity and subordinate to first mortgages or investment-grade corporate debt.

•We also recently launched our real estate secondaries strategy, Brookfield Real Estate Secondaries (“BRES”), with a focus on providing liquidity solutions for other real estate general partners.

Permanent Capital Vehicles and Perpetual Strategies

•We manage $19 billion of Fee-Bearing Capital in Brookfield Property Group ("BPG") as of March 31, 2023, which we invest, on behalf of the Corporation, directly in real estate assets or through our real estate private fund offerings. BPG owns, operates and develops iconic properties in the world’s most dynamic markets with a global portfolio of office, retail, multifamily, logistics, hospitality, land and housing, triple net lease, manufactured housing and student housing assets on five continents.

•We also manage capital in our perpetual private fund real estate strategy, Brookfield Premier Real Estate Partner (“BPREP”). This is a core plus strategy that invests in high-quality, stabilized real assets located primarily in the U.S. with a focus on office, retail, multifamily and logistics real estate assets. We also have two regional BPREP strategies that are dedicated specifically to investments in Australia (“BPREP-A”) and Europe (“BPREP-E”).

•We manage capital across our perpetual real estate debt strategy, Brookfield Senior Mezzanine Real Estate Finance Fund (“BSREF”). We seek to originate, acquire and actively manage investments in U.S. senior commercial real estate debt for this strategy.

•We also manage a non-traded REIT, Brookfield Real Estate Income Trust (“Brookfield REIT”), which is a semi-liquid strategy catering specifically to the private wealth channel. This product invests in high quality income-producing opportunities globally through equity or real-estate related debt.

Private Equity

Overview

•We are a leading private equity investment manager with $139 billion of AUM as of March 31, 2023.

•We focus on high-quality businesses that provide essential products and services, diversified across the industrial operations and business services sectors. We partner closely with management teams to enable long-term success through operational and other improvements.

•We have approximately 280 investment and asset management professionals globally that are focused on our private equity strategy, supported by approximately 105,400 employees in the operating businesses that we manage.

Our Products

Long-term Private Funds

•Our global opportunistic flagship fund series, Brookfield Capital Partners (“BCP”), is our leading private equity product offering. This series of funds focuses on cash-flowing essential service businesses. We seek investments that benefit from high barriers to entry and enhance their cash flow capabilities by improving strategy and execution.

•Our special investments strategy, Brookfield Special Investments (“BSI”), is focused on large-scale, non-control investments. This product capitalizes on potential transactions that do not fit our traditional control-oriented flagship private equity fund series. These include recapitalizations to strategic growth capital, where we expect to generate equity-like returns while ensuring downside protection through structured investments.

•Our growth equity strategy, Brookfield Growth (“BTG”), was launched in 2016 and has developed into a meaningful business that we expect to continue to scale over time. This strategy focuses on investing in technology-related growth stage companies that surround our broader ecosystem of managed assets.

Permanent Capital Vehicles and Perpetual Strategies

•We manage BBU, which is a publicly traded global business services and industrials partnership focused on owning and operating high-quality providers of essential products and services. BBU is listed on the NYSE and TSX and had a market capitalization of $4.1 billion as of March 31, 2023.

Credit and Other

Overview

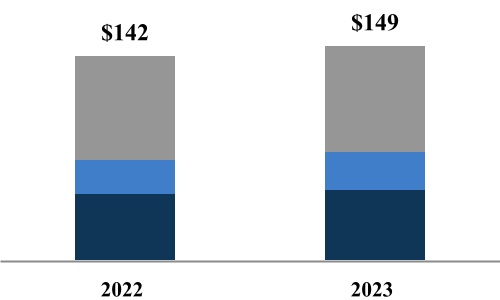

•As a result of our 61% investment in Oaktree in 2019, we established ourselves as a leader among global investment managers specializing in alternative credit investments. As of March 31, 2023, our interest in Oaktree is 64%. Oaktree is one of the premier credit franchises globally, with $149 billion of Fee-Bearing Capital as of March 31, 2023 and an expertise in investing across the capital structure with an emphasis on an opportunistic, value-oriented and risk-controlled investments.

•We offer one of the most comprehensive alternative credit offerings available today and have a global presence through our experienced team of investment professionals.

Our Products

•Our credit strategies invest in both liquid and illiquid instruments, sourced directly from borrowers and via public markets. We focus primarily on rated and non-rated debt of sub-investment grade issuers in developed and emerging markets, and offer investments in an array of private credit, high yield bonds, convertible securities, leveraged loans, structured credit instruments and opportunistic credit.

•Our flagship credit strategy, the Opportunistic Credit series, focuses on protecting against loss by buying claims on assets at attractive or distressed prices. We aim to achieve substantial gains by actively participating in restructurings to restore companies to financial viability, while creating value. The latest vintage of this series of funds was raised in 2020 and 2021 with a total fund size of $16 billion and is the largest fund in the series to date.

•Our Insurance business manages policyholder capital and deploys it across liquid credit strategies, direct loans and private funds.

•Also included amongst our strategies is our Public Securities Group (“PSG”), which manages the Fee-Bearing Capital associated with our liquid strategies. PSG serves institutions and individuals seeking the investment advantages of real assets through actively managed listed equity and debt strategies.

Key Financial and Operating Measures

The Manager and the Asset Management Company prepare their financial statements in conformity with U.S. GAAP. This MD&A discloses a number of non-GAAP financial and supplemental financial measures which are utilized in monitoring our asset management business, including for performance measurement, capital allocation and valuation purposes. The Manager believes that providing these performance measures is helpful to investors in assessing overall performance, as well as the performance of our asset management business. These non-GAAP financial measures should not be considered as the sole measure of the Manager’s or our asset management business’ performance and should not be considered in isolation from, or as a substitute for, similar financial measures calculated in conformity with U.S. GAAP financial measures. These non-GAAP measures are not standardized financial measures and may not be comparable to similar financial measures used by other issuers. The asset management business includes the asset management activities of Oaktree, an equity accounted affiliate, in its key financial and operating measures for our asset management business. See “Reconciliation of U.S. GAAP to Non-GAAP Measures”.

Non-GAAP Measures

Fee Revenues

Fee Revenues is a key metric analyzed by management to determine the growth in recurring cash flows from our asset management business. Fee Revenues include base management fees, incentive distributions, performance fees and transaction fees. Fee Revenues exclude carried interest, but include Fee Revenues earned by Oaktree. The most directly comparable measure of Fee Revenues disclosed in the primary financial statements is total management fee revenues.

Fee-Related Earnings

Fee-Related Earnings is used to provide additional insight into the operating profitability of our asset management activities. Fee-Related Earnings are recurring in nature and not based on future realization events. Fee-Related Earnings is comprised of Fee Revenues less direct costs associated with earning those fees, which include employee expenses and professional fees as well as business related technology costs, other shared services and taxes. The most directly comparable measure of Fee-Related Earnings disclosed in the primary financial statements is net income.

Distributable Earnings

Distributable Earnings used by the Manager provides insight into earnings that are available for distribution or to be reinvested by the Manager. Distributable Earnings of the Manager represent its share of Distributable Earnings from our asset management business less general and administrative expenses, but excluding equity-based compensation costs, of the Manager. The most directly comparable measure disclosed in our primary financial statements for Distributable Earnings of the Manager is net income.

Distributable Earnings used by our asset management business provides insight into earnings that are available for distribution or to be reinvested by our asset management business. It is calculated as the sum of its Fee-Related Earnings, realized carried interest, interest expense, and general and administrative expenses; excluding equity-based compensation costs and depreciation and amortization. The most directly comparable measure disclosed in the primary financial statements of our asset management business for Distributable Earnings is net income.

The Manager intends to pay out approximately 90% of its Distributable Earnings to shareholders quarterly and reinvest the balance back into the business. The asset management business intends to pay dividends to the Manager on a quarterly basis sufficient to ensure that the Manager can pay its intended dividend.

Supplemental Financial Measures Utilized by Our Asset Management Business

Assets under management

Assets under management (“AUM”) refers to the total fair value of assets managed, calculated as follows:

•investments that Brookfield, which includes the Corporation, the asset management business or their affiliates, either:

◦consolidates for accounting purposes (generally, investments in respect of which Brookfield has a significant economic interest and unilaterally directs day-to-day operating, investing and financing activities), or

◦does not consolidate for accounting purposes but over which Brookfield has significant influence by virtue of one or more attributes (e.g., being the largest investor in the investment, having the largest representation on the investment’s governance body, being the primary manager and/or operator of the investment, and/or having other significant influence attributes),

◦are calculated at 100% of the total fair value of the investment taking into account its full capital structure — equity and debt — on a gross asset value basis, even if Brookfield does not own 100% of the investment, with the exception of investments held through our perpetual funds, which are calculated at its proportionate economic share of the investment’s net asset value.

•all other investments are calculated at Brookfield’s proportionate economic share of the total fair value of the investment taking into account its full capital structure — equity and debt — on a gross asset value basis, with the exception of investments held through our perpetual funds, which are calculated at Brookfield’s proportionate economic share of the investment’s net asset value.

Our methodology for determining AUM differs from the methodology that is employed by other alternative asset managers as well as the methodology for calculating regulatory AUM that is prescribed for certain regulatory filings (e.g., Form ADV and Form PF).

Fee-Bearing Capital

Fee-Bearing Capital represents the capital committed, pledged or invested in our permanent capital vehicles, private funds and liquid strategies that we manage which entitles us to earn Fee Revenues. Fee-Bearing Capital includes both called (“invested”) and uncalled (“pledged” or “committed”) amounts.

When reconciling period amounts, we utilize the following definitions:

•Inflows include capital commitments and contributions to our private and liquid strategies funds, and equity issuances from the permanent capital vehicles.

•Outflows represent distributions and redemptions of capital from within the liquid strategies capital.

•Distributions represent quarterly distributions from the permanent capital vehicles as well as returns of committed capital (excluding market valuation adjustments), redemptions and expiry of uncalled commitments within our private funds.

•Market valuation includes gains (losses) on portfolio investments, the permanent capital vehicles and liquid strategies based on market prices.

•Other includes changes in net non-recourse leverage included in the determination of the permanent capital vehicle capitalizations and the impact of foreign exchange fluctuations on non-U.S. dollar commitments.

Uncalled Fund Commitments

Total Uncalled Fund Commitments includes capital callable from fund investors, including funds outside of their investment period, for which capital is callable for follow-on investments.

Review of Consolidated Financial Results of the Manager

Consolidated Statement of Comprehensive Income

The following table summarizes the financial results of the Manager for the period of January 1, 2023 to March 31, 2023:

| | | | | | | | | | | | | | |

| | | | | | |

FOR THE THREE MONTHS ENDED MARCH 31,

(MILLIONS) | | | | | | | 2023 | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Compensation and benefits recovery | | | | | | | $ | 138 | | | | |

| | | | | | | | | | |

| Expenses | | | | | | | | | | |

| Compensation and benefits | | | | | | | (84) | | | | |

| Unrealized carried interest compensation expense | | | | | | | (56) | | | | |

| Other operating expense | | | | | | | (2) | | | | |

| Total expenses | | | | | | | (142) | | | | |

| Share of income from equity method investments | | | | | | | 129 | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Income tax (expense) benefit | | | | | | | — | | | | |

| Net income and comprehensive income | | | | | | | $ | 125 | | | | |

During the three months ended March 31, 2023, the Manager recorded net income attributable to shareholders of $125 million. Net income consists of the Manager’s equity interest in the earnings of the Asset Management Company less compensation and benefit costs, primarily attributable to executive compensation costs of the Manager and unrealized carried interest compensation expense. A material portion of these costs are reimbursed by the Corporation and the Asset Management Business in accordance with the Asset Management Services Agreement and the Relationship Agreement. Refer to the following discussion for details on the earnings of the Asset Management Company.

The following table summarizes the statement of operations for the Asset Management Company for the three months ended March 31, 2023, and 2022:

| | | | | | | | | | | | | | | | | | |

FOR THE THREE MONTHS ENDED MARCH 31

(MILLIONS) | | | | | 2023 | | 2022 |

| Revenues | | | | | | | |

| Management fee revenues | | | | | | | |

| Base management and advisory fees | | | | | $ | 791 | | | $ | 671 | |

| Total management fee revenues | | | | | 791 | | | 671 | |

| Investment income | | | | | | | |

| Carried interest allocations | | | | | | | |

| Realized | | | | | 31 | | | 47 | |

| Unrealized | | | | | 28 | | | (48) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Total investment income | | | | | 59 | | | (1) | |

| Interest and dividend revenue | | | | | 43 | | | 67 | |

| Other revenues | | | | | 161 | | | 18 | |

| Total revenues | | | | | 1,054 | | | 755 | |

| Expenses | | | | | | | |

| Compensation, operating, and general and administrative expenses | | | | | | | |

| Compensation and benefits | | | | | (299) | | | (169) | |

| Other operating expenses | | | | | (70) | | | (51) | |

| General, administrative and other | | | | | (7) | | | (40) | |

| Total compensation, operating, and general and administrative expenses | | | | | (376) | | | (260) | |

| Carried interest allocation compensation | | | | | | | |

| Realized | | | | | — | | | (10) | |

| Unrealized | | | | | (88) | | | (103) | |

| Total carried interest allocation compensation | | | | | (88) | | | (113) | |

| Interest expense | | | | | (2) | | | (42) | |

| Total expenses | | | | | (466) | | | (415) | |

| Other income (expenses), net | | | | | (22) | | | 457 | |

| Share of income from equity accounted investments | | | | | 43 | | | 68 | |

| Income before taxes | | | | | 609 | | | 865 | |

| Income tax expense | | | | | (93) | | | (142) | |

| Net income | | | | | 516 | | | 723 | |

| Net loss (income) attributable to redeemable non-controlling interests in consolidated funds | | | | | — | | | (375) | |

| Net loss (income) attributable to preferred share redeemable non-controlling interest | | | | | 19 | | | — | |

| Net loss (income) attributable to non-controlling interest | | | | | (19) | | | — | |

| Net income attributable to the common stockholders | | | | | $ | 516 | | | $ | 348 | |

For the three months ended March 31, 2023 and 2022

Net income for the three months was $516 million, of which $516 million was attributable to common stockholders. This compares to net income of $723 million for the three months ended March 31, 2022, of which $348 million was attributable to common stockholders.

Revenues

Revenues for the three months were $1.1 billion, which represents an increase of $299 million or 40% compared to $755 million in the three months ended March 31, 2022.

Base management and advisory fees for the three months were $697 million, which represents an increase of $110 million or 19% compared to the three months ended March 31, 2022. The increase was predominantly driven by incremental contributions from

capital raised for our latest flagship funds and capital deployed across our complementary strategies. Incentive distributions for the three months ended March 31, 2023 were $94 million, an increase of $10 million from the three months ended March 31, 2022, driven by growth in BIP and BEP's dividends, which increased by 6% and 5%, respectively.

Carried interest allocations

Realized carried interest allocations were $31 million for the three months ended March 31, 2023, which represents a decrease of $16 million compared to the three months ended March 31, 2022. Realized carried interest allocations in the period were primarily driven by dispositions within our real estate long-term and perpetual funds.

Unrealized carried interest allocations were $28 million for the three months ended March 31, 2023, which represents an increase of $76 million compared to the three months ended March 31, 2022. The unrealized carried interest allocations were primarily related to growth in valuations in our infrastructure and private equity flagship funds, partially offset by realizations in the period.

Interest and dividend revenue

Interest and dividend revenue for the three months ended were $43 million, which represents a decrease of $24 million compared to the three months ended March 31, 2022. The decrease was a result of the transfer of certain investments and loans of the Asset Management Business to the Corporation as part of the Arrangement.

Expenses

Total expenses for the three months ended were $466 million, an increase of $51 million or 12% compared to the three months ended March 31, 2022.

Compensation and benefits for the three months ended March 31, 2023 were $299 million, which represents an increase of $130 million compared to the three months months ended March 31, 2022. This is primarily attributable to increased compensation costs resulting from increases in the employee population as a result of the Arrangement, as well as increases in headcount as a result of the growth of our business.

Other operating expenses are comprised of professional fees, facilities and technology, as well as travel costs directly associated with our fundraising and investment functions. Other operating expenses were $70 million for the three months ended, compared to $51 million for the three months ended March 31, 2022. The increase was primarily attributable to an increase in headcount and travel activity during the current period.

Compensation expenses related to carried interest allocation compensation were $88 million for the three months end March 31, 2023, which represents a decrease of $25 million compared to the three months ended March 31, 2022. The decrease is predominantly driven by a decrease in relative valuation gains compared to the three months ended March 31, 2022 across our legacy funds. As outlined in the Relationship Agreement, the carried interest compensation expense associated with mature funds is fully recoverable from the Corporation. For more information on accounting policies, please refer to the "Summary of Significant Accounting Policies of the Manager" in this MD&A.

Other income

Other income for the three months ended primarily consists of mark-to-market adjustments on call and put options associated with our investments in Primary Wave and Oaktree. Other income in the prior period relates to dividend income received from BSREP III which was previously consolidated.

Share of income from equity accounted investments

Our share of income from equity accounted investments was $43 million compared to income of $68 million in the prior period. This line item primarily consists of earnings associated with our 64% interest in Oaktree.

Income tax expense

Income tax expense was $93 million for the three months ended March 31, 2023, which represents a decrease of $49 million compared to the three months ended March 31, 2022. This was driven by lower net income before taxes in the period.

Consolidated Statement of Financial Condition

The following table summarizes the Condensed and Consolidated Statement of Financial Condition of the Manager as at March 31, 2023 and December 31, 2022:

| | | | | | | | | | | | | |

AS AT MARCH 31, AND DECEMBER 31

(MILLIONS) | | | 2023 | | 2022 |

| Assets | | | | | |

| Cash and cash equivalents | | | $ | 12 | | | $ | 1 | |

| | | | | |

| Due from affiliates | | | 875 | | | 782 | |

| Other assets | | | 41 | | | — | |

| Investments | | | 2,374 | | | 2,378 | |

| Total assets | | | $ | 3,302 | | | $ | 3,161 | |

| | | | | |

| Liabilities | | | | | |

| Accounts payable and accrued liabilities | | | $ | 873 | | | $ | 781 | |

| Due to affiliates | | | 100 | | | 3 | |

| Total liabilities | | | 973 | | | 784 | |

| Equity | | | | | |

| | | | | |

| Common Stock: | | | | | |

| Class A (unlimited authorized and 412,428,007 issued and 392,409,501 outstanding) | | | 2,411 | | | 2,410 | |

| Class B (unlimited authorized and 21,280 issued and outstanding) | | | — | | | — | |

| Class A held in treasury (20,018,506 shares) | | | (482) | | | (330) | |

| Additional paid-in-capital | | | 374 | | | 278 | |

| Retained earnings | | | 17 | | | 19 | |

| Non-controlling interest | | | 9 | | | — | |

| Total equity | | | 2,329 | | | 2,377 | |

| Total liabilities and equity | | | $ | 3,302 | | | $ | 3,161 | |

As at March 31, 2023, the Manager’s total assets were $3.3 billion, consisting primarily of the 25% interest in the Asset Management Company and reimbursements due from affiliates related to long-term executive compensation programs assumed by the Manager.

As at March 31, 2023, the Manager’s total liabilities were $973 million, an increase of $189 million compared to the prior period. Accounts payable and accrued liabilities increased by $92 million driven by carried interest compensation due to employees as well as an increase in the liability associated with cash settled compensation plans. Due to affiliates increased by $97 million due to borrowings on the credit facility with the Brookfield Asset Management ULC.

As at March 31, 2023, the Manager's total equity has decreased by $48 million to $2.3 billion due to the purchase of treasury shares during the period, partially offset by additional paid-in-capital related to stock based compensation plans.

Refer to the section below for details of the Asset Management Company’s Condensed Consolidated and Combined Statement of Financial Condition as at March 31, 2023 and December 31, 2022:

| | | | | | | | | | | | | | | | |

AS AT MARCH 31, AND DECEMBER 31

(MILLIONS) | | 2023 | | 2022 | | | | |

| Assets | | | | | | | | |

| Cash and cash equivalents | | $ | 3,152 | | | $ | 3,545 | | | | | |

| Accounts receivable and other | | 564 | | | 429 | | | | | |

| Due from affiliates | | 2,157 | | | 2,121 | | | | | |

| Investments | | 6,976 | | | 6,877 | | | | | |

| Property, plant and equipment | | 67 | | | 68 | | | | | |

| Intangible assets | | 55 | | | 59 | | | | | |

| Goodwill | | 265 | | | 249 | | | | | |

| Deferred income tax assets | | 737 | | | 739 | | | | | |

| Total assets | | $ | 13,973 | | | $ | 14,087 | | | | | |

| | | | | | | | |

| Liabilities and shareholder’s equity | | | | | | | | |

| Accounts payable and other | | $ | 1,815 | | | $ | 1,842 | | | | | |

| Due to affiliates | | 615 | | | 811 | | | | | |

| Deferred income tax liabilities | | 18 | | | 17 | | | | |

| Total liabilities | | 2,448 | | | 2,670 | | | | | |

| | | | | | | | |

| Preferred shares redeemable non-controlling interest | | 1,864 | | | 1,811 | | | | | |

| | | | | | | | |

| Equity | | | | | | | | |

| Common equity (common shares - unlimited authorized, 1,635,327,858 issued and outstanding) | | 9,242 | | | 9,271 | | | | | |

| Retained earnings | | 72 | | | 84 | | | | | |

| Accumulated other comprehensive income | | 159 | | | 153 | | | | | |

| Additional paid-in capital | | 32 | | | — | | | | | |

| Total common equity | | 9,505 | | | 9,508 | | | | | |

| Non-controlling interest | | 156 | | | 98 | | | | | |

| | | | | | | | |

| | | | | | | | |

| Total equity | | 9,661 | | | 9,606 | | | | | |

| Total liabilities, redeemable non-controlling interest and common equity | | $ | 13,973 | | | $ | 14,087 | | | | | |

As at March 31, 2023 and December 31, 2022

Total assets were $14.0 billion as at March 31, 2023, a decrease of $114 million due to decreases in Cash and cash equivalents compared to December 31, 2022.

Cash and cash equivalents were $3.2 billion, a decrease of $393 million from the prior period, largely due to the payment of working capital needs of managed funds that will be subsequently reimbursed. Of this balance, $2.9 billion is on deposit with the Corporation.

Accounts receivable and other of $564 million primarily consists of receivables from third parties, mark-to-market derivative assets and prepaid expenses. The increase over the prior period is largely driven by the prepayments of stock based compensation costs as prescribed by the Asset Management Services Agreement.

Due from affiliates of $2.2 billion primarily relates to management fees earned but not collected from our managed funds as well as reimbursements due from the Corporation for long-term cash based and equity compensation awards. The increase of $36 million from the prior period was primarily the result of the timing of settlements.

Investments are predominantly comprised of an 18% limited partnership interest in BSREP III and a 64% interest in Oaktree. The increase from the prior period of $99 million was primarily a result of income earned from our investment in Oaktree during the period.

Total liabilities were $2.4 billion as at March 31, 2023, a decrease of $222 million compared to the prior period.

Accounts payable and other primarily consists of accrued compensation, and mark-to-market derivatives associated with put options in investments. Movement in the period of $27 million reflects the timing of payments.

Due to affiliates of $615 million reflects amounts owed to Brookfield affiliates; the decrease reflects the settlement of balances in the normal course of operations.

Preferred shares redeemable non-controlling interest was $1.9 billion as at March 31, 2023, an increase of $53 million compared to $1.8 billion as at December 31, 2022. This increase was due to carried interest generated by our legacy real estate and infrastructure funds during the period.

Review of Consolidated Statement of Cash Flows

The following table summarizes the changes in the Manager’s cash for the three months ended March 31, 2023:

| | | | | | | | | | | | | | | | |

| | | | | |

FOR THE THREE MONTHS ENDED MARCH 31

(MILLIONS) | | | | | | | | 2023 | | | |

| | | | | | | | | | | | |

| Operating activities before net changes in working capital and other non-cash operating items | | | | | | | | | $ | (16) | | | | |

| Net changes in working capital | | | | | | | | | 15 | | | | |

| Other non-cash operating items | | | | | | | | | 2 | | | | |

| Operating activities | | | | | | | | | 1 | | | | |

| Investing activities | | | | | | | | | 91 | | | | |

| Financing activities | | | | | | | | | (81) | | | | |

| Change in cash and cash equivalents | | | | | | | | | $ | 11 | | | | |

As at March 31, 2023, the Manager’s activities generated $11 million of net cashflow. Refer to the following table that summarizes our Asset Management Business’ Condensed Consolidated and Combined Statement of Cash Flows for the three months ended March 31, 2023.

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | |

FOR THE THREE MONTHS ENDED MARCH 31

(MILLIONS) | | | | | | | | 2023 | | 2022 | | | |

| | | | | | | | | | | | | | |

| Operating activities before net changes in working capital and other non-cash operating items | | | | | | | | | $ | 515 | | | $ | 621 | | | | |

| Net changes in working capital | | | | | | | | | (553) | | | (409) | | | | |

| Other non-cash operating items | | | | | | | | | (3) | | | (611) | | | | |

| Operating activities | | | | | | | | | (41) | | | (399) | | | | |

| Investing activities | | | | | | | | | (5) | | | 262 | | | | |

| Financing activities | | | | | | | | | (347) | | | 222 | | | | |

| Change in cash and cash equivalents | | | | | | | | | $ | (393) | | | $ | 85 | | | | |

For the three months ended March 31, 2023

Net cash outflows from operating activities totaled $41 million. Excluding net changes in working capital and other non-cash operating items, operating cash inflows were $515 million, representing an decrease of $106 million, due to the deconsolidation of previously consolidated funds.

Investing Activities

Net cash outflows from investing activities totaled $5 million. The change from prior period cashflows is due to the recognition of proceeds from disposition of investments held in the prior period.

Financing Activities

Net cash outflows from financing activities totaled $347 million. The current period primarily consists of distributions to stockholders of $528 million and advances provided to related parties of $95 million, partially offset by borrowings from related parties of $235 million. The prior period inflows were primarily as a result of contributions from parents and borrowings from related parties.

Analysis of Key Non-GAAP Financial and Operating Measures of Our Asset Management Business

The following section contains a discussion and analysis of key financial and operating measures utilized in managing our asset management business, including for performance measurement, capital allocation and valuation purposes. For further detail on our non-GAAP and performance measures, please refer to “Key Financial and Operating Measures”.

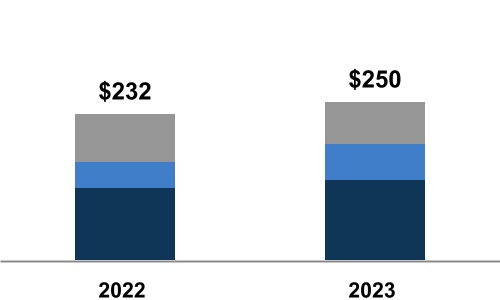

Distributable Earnings

| | | | | | | | | | | | | | | | | | | |

FOR THE THREE MONTHS ENDED MARCH 31

(MILLIONS) | | | | | | | | 2023 | | 2022 |

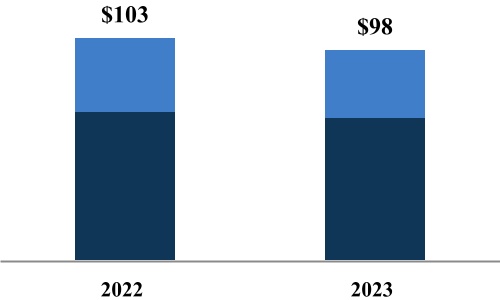

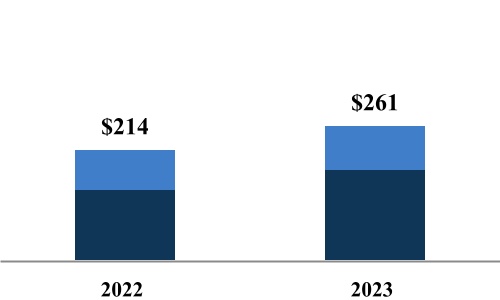

| Fee Revenues | | | | | | | | | $ | 1,080 | | | $ | 965 | |

| | | | | | | | | | | |

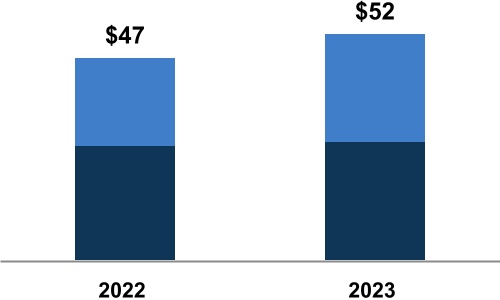

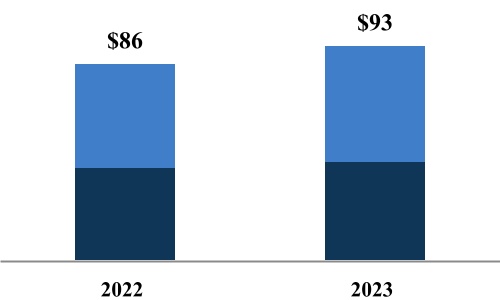

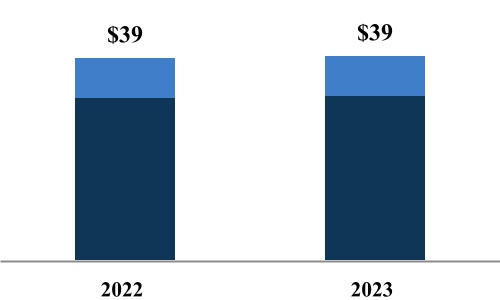

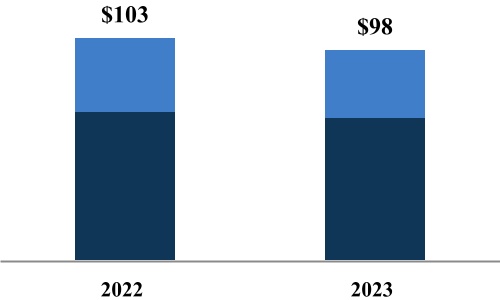

Fee-Related Earnings1 | | | | | | | | | 547 | | | 492 | |

| Add back: equity-based compensation costs | | | | | | | | | 19 | | | 25 | |

| Taxes and other | | | | | | | | | (3) | | | (26) | |

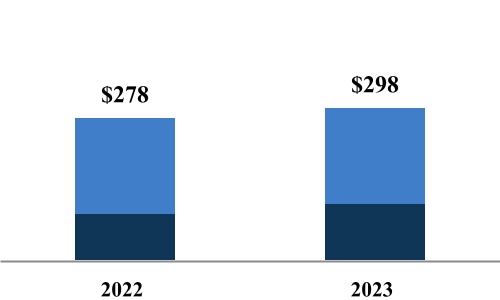

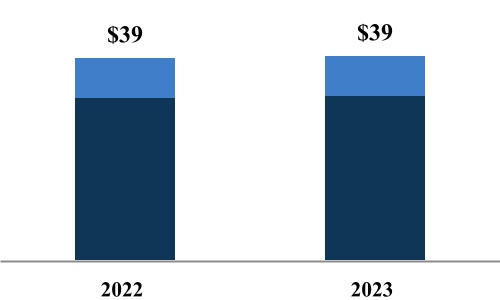

| Distributable Earnings | | | | | | | | | $ | 563 | | | $ | 491 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

1. Fee-Related Earnings include Oaktree’s Fee-Related Earnings at our 64% share (2022 - 64%).

For the three months ended March 31, 2023 and 2022

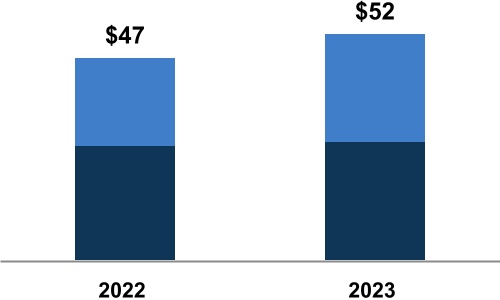

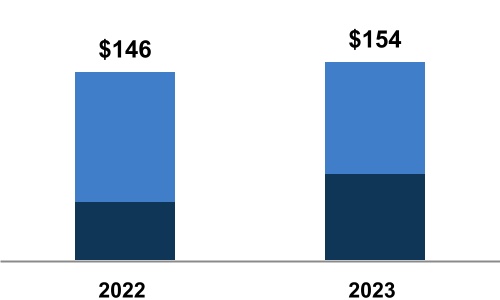

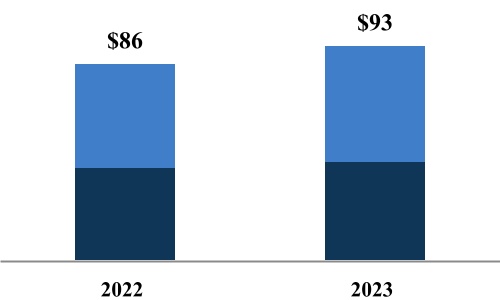

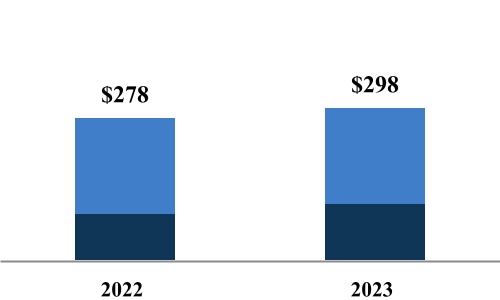

Distributable Earnings were $563 million for the three months ended March 31, 2023, an increase of $72 million or 15% compared to the prior period. The increase was driven by higher Fee-Related Earnings, primarily attributable to fundraising and capital deployment efforts across our flagship funds. These increases were partially offset by lower fees from our permanent capital vehicles due to a decline in their share prices compared to prior period.

Fee-Bearing Capital

The following table summarizes Fee-Bearing Capital as at March 31, 2023 and December 31, 2022:

| | | | | | | | | | | | | | | | | | | | | | | |

AS AT (MILLIONS) | Long-term private funds | | Perpetual strategies | | Liquid strategies | | Total |

| Renewable power and transition | $ | 27,727 | | | $ | 24,757 | | | $ | — | | | $ | 52,484 | |

| Infrastructure | 47,246 | | | 45,506 | | | — | | | 92,752 | |

| Private equity | 32,046 | | | 7,426 | | | — | | | 39,472 | |

| Real estate | 66,716 | | | 31,376 | | | — | | | 98,092 | |

| Credit and other | 50,234 | | | 25,507 | | | 73,120 | | | 148,861 | |

| March 31, 2023 | $ | 223,969 | | | $ | 134,572 | | | $ | 73,120 | | | $ | 431,661 | |

| December 31, 2022 | $ | 218,857 | | | $ | 127,155 | | | $ | 71,851 | | | $ | 417,863 | |

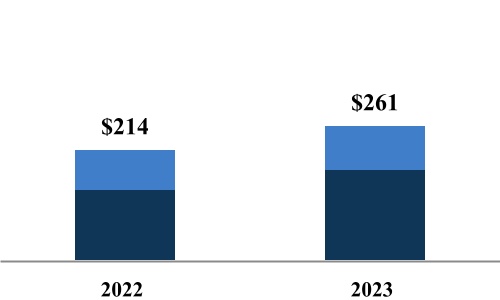

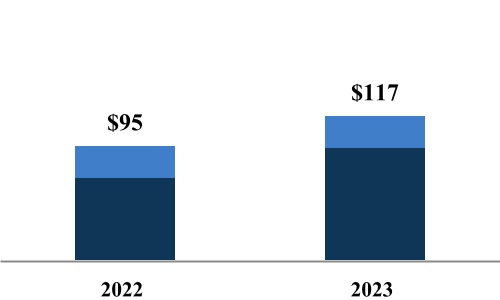

Fee-Bearing Capital was $432 billion as at March 31, 2023 compared to $418 billion as at December 31, 2022. The increase of $14 billion was primarily attributable to inflows of $18 billion resulting from capital raised across flagship funds, capital inflows within credit and other funds in our insurance solutions business, and capital raised and deployed across various strategies. These increases were partially offset by distributions across strategies and the end of the commitment period of BSREP III, resulting in a change of fee base from committed to invested capital.

The changes are set out in the following tables:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

AS AT (MILLIONS) | Renewable power and transition | | Infrastructure | | Private equity | | Real estate | | Credit and other | | Total |

| Balance, December 31, 2022 | $ | 47,218 | | | $ | 85,887 | | | $ | 39,317 | | | $ | 103,025 | | | $ | 142,416 | | | $ | 417,863 | |

| Inflows | 1,876 | | | 3,944 | | | 1,477 | | | 1,433 | | | 9,350 | | | 18,080 | |

| Outflows | — | | | (6) | | | — | | | (132) | | | (4,614) | | | (4,752) | |

| Distributions | (558) | | | (914) | | | (105) | | | (2,046) | | | (1,231) | | | (4,854) | |

| Market valuation | 3,965 | | | 2,460 | | | (291) | | | (1,833) | | | 2,285 | | | 6,586 | |

| Other | (17) | | | 1,381 | | | (926) | | | (2,355) | | | 655 | | | (1,262) | |

| Change | 5,266 | | | 6,865 | | | 155 | | | (4,933) | | | 6,445 | | | 13,798 | |

| Balance, March 31, 2023 | $ | 52,484 | | | $ | 92,752 | | | $ | 39,472 | | | $ | 98,092 | | | $ | 148,861 | | | $ | 431,661 | |

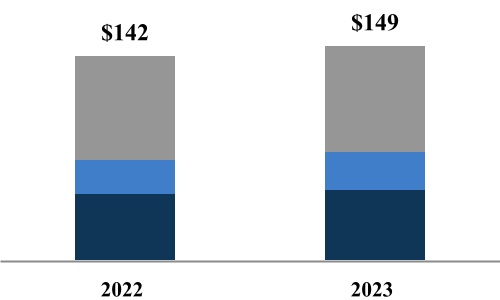

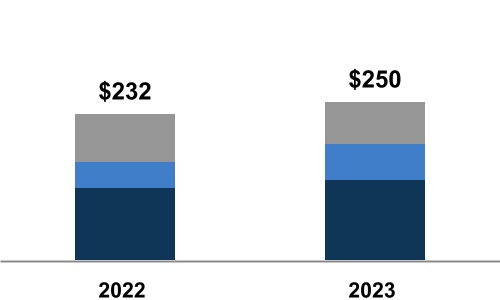

Fee Revenues and Fee-Related Earnings

| | | | | | | | | | | | | | | | | | | |

FOR THE THREE MONTHS ENDED MARCH 31

(MILLIONS) | | | | | | | | 2023 | | 2022 |

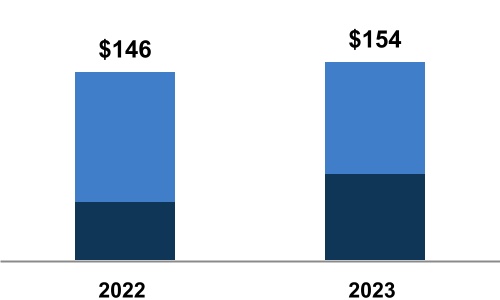

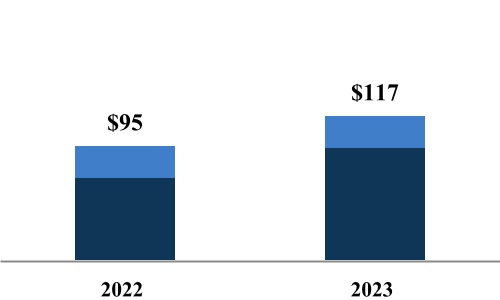

Base management fees1 | | | | | | | | | $ | 981 | | | $ | 850 | |

| Incentive distributions | | | | | | | | | 94 | | | 84 | |

| Transaction and advisory fees | | | | | | | | | 5 | | | 31 | |

| Fee Revenues | | | | | | | | | 1,080 | | | 965 | |