UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23832

JPMorgan Private Markets Fund

(Exact name of registrant as specified in charter)

277 Park Avenue

New York, New York 10172

(Address of principal executive offices) (zip code)

Ashmi Mehrotra

277 Park Avenue

New York, New York 10172

(212) 648-2293

(Name, Address and Telephone Number of Person Authorized to Receive Notices and

Communications on Behalf of the Filing Person(s))

(Name and address of agent for service)

Copy to:

Rajib Chanda

Ryan P. Brizek

Simpson Thacher & Bartlett LLP

900 G Street, N.W.

Washington, DC 20001

Registrant’s telephone number, including area code: (212) 648-2293

Date of fiscal year end: March 31

Date of reporting period: March 31, 2024

Item 1. Report to Shareholders.

| (a) | The annual report (the “Report”) of JPMorgan Private Markets Fund (the “Fund”) for the period July 12, 2023 (commencement of operations) through March 31, 2024 is attached herewith: |

JPMorgan Private Markets Fund

For the period July 12, 2023 (commencement of operations) through

March 31, 2024

JPMorgan Private Markets Fund

TABLE OF CONTENTS

Private Equity Market Overview and Outlook

Over the course of 2023 and the first quarter of 2024, the public markets exhibited solid growth. The private equity industry’s performance was more measured as market participants continued to adjust to a higher interest rate environment, geopolitical tensions and mixed macroeconomic signals, making it difficult for buyers and sellers to bridge the bid-ask spread. This created a challenging exit environment for private equity sponsors, also known as General Partners (“GP”s), and a corresponding slowdown in distributions to their Limited Partner (“LP”) investors, many of whom are now above their target private equity allocations and constrained in their ability to make new commitments.

These dynamics have created what we believe is an attractive environment for investors who can offer liquidity directly to LP’s by acquiring their interests or indirectly via GP-led continuation vehicles. The J.P. Morgan Private Equity Group (“PEG”) seeks to capitalize on what it views as a compelling opportunity for secondary investments by utilizing its platform and network of over 250 GP relationships, cultivated by a seasoned team of senior portfolio managers who have worked together for an average of 24 years1. Further, the slower pace of exits and fundraising has created opportunities for co-investments and partially funded primary commitments, which are also important elements of PEG’s strategy.

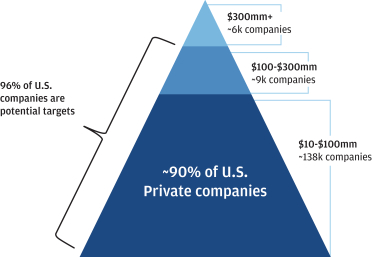

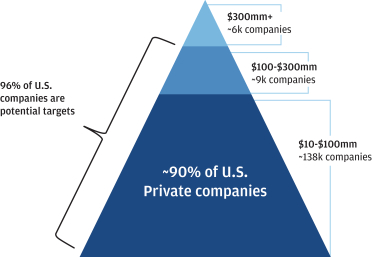

Irrespective of the market environment, PEG focuses on small and mid-market buyout investments, which comprise what we believe is a vast opportunity set. In the U.S. alone, over 147,000 companies generate annual revenues between $10 million and $300 million, representing approximately 96% of the nation’s privately held companies.

Distribution of U.S. Private Companies by Size2

The smaller end of the private equity market also offers the potential for lower average entry and leverage multiples, along with value creation opportunities for private equity sponsors, such as operational improvements and add-on acquisitions. Companies currently owned by small and mid-market private equity firms are prime targets for large buyout firms, sitting on capital they have been slow to deploy in a lower transaction volume environment. In the coming years, we believe this backdrop is constructive for investors that are equipped to capitalize on the potential outperformance that small and mid-market buyouts may offer.

Fund Overview

The JPMorgan Private Markets Fund (“JPMF” or the “Fund”) was established with the objective of providing long-term capital appreciation by investing primarily in an actively managed portfolio of private equity and other private assets, including secondary, co-investment and primary investments (collectively “Private Market Investments”). The Fund also has exposure to private debt securities and other yield-oriented investments to manage liquidity needs. JPMF commenced investment operations on July 12, 2023, which is less than nine months prior to the March 31, 2024 reference date for this report, and PEG intends to invest 80% of the Fund’s net (under normal circumstances) in Private Market Investments.

As of March 31, 2024, the Fund has $284 million of net assets and has made 21 private equity investments, consisting of 10 secondary investments, 10 co-investments, and 1 seasoned primary investment, collectively providing exposure to 25 individual holdings and over 215 underlying portfolio companies. The Fund’s private equity asset value is almost exclusively comprised of buyout investments (99%), and is spread across secondaries (63%), co-investments (32%), and primaries (5%). Geographically, North America represents 72% of private equity portfolio value with the remaining 28% allocated to European investments.

| 1 | Includes investing experience at both PEG and AT&T Investment Management Corporation (ATTIMCO). |

| 2 | Source: FactSet as of 2/28/2024. $mm in USD Annual Revenue. |

| | | | | | | | | | |

| | | | | |

| MARCH 31, 2024 | | JPMORGAN PRIVATE MARKETS FUND | | | | | | | | 1 |

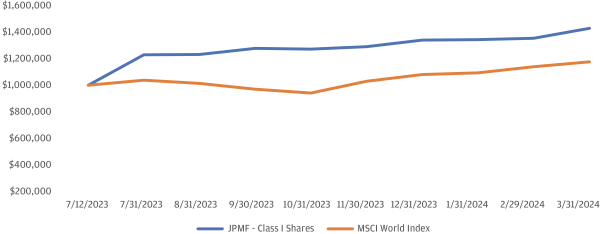

JPMF’s Class I shares generated a 45.2% net return for the Fund’s initial fiscal year ended March 31, 2024. JPMF’s strong early performance has been driven by co-investments and secondary investments alongside what we believe to be high quality small and mid-market private equity managers. Among the positive contributors is a co-investment in a fast-growing premium haircare products company that was part of a transaction in which PEG made two co-investments alongside a primary commitment to a promising emerging manager raising their first institutional fund. The Fund also benefitted from several secondary investments based in North America and Europe that were acquired at attractive valuations and have appreciated in value post-closing.

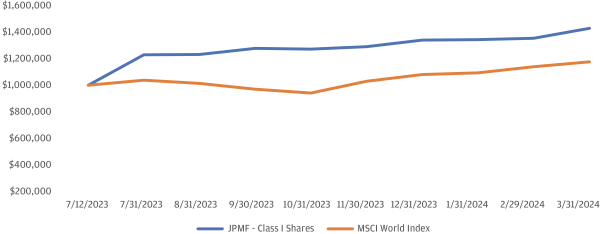

This graph shows the change in value of a hypothetical $1,000,000 investment in the Fund since commencement of operations this past July 12. The result is compared with the MSCI World Index, a broadly diversified global public equity benchmark.

Performance of Initial Investment of $1,000,0003

| 3 | The graph shown above represents historical performance of a hypothetical investment of $1,000,000 in Class I Shares of the Fund since inception. The result is compared with a broad-based market index, the MSCI World Index. Class I Shares have a $1,000,000 minimum initial investment. The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The MSCI World Index consists of 23 developed market country indices. An investor cannot invest directly in an index. The market index has not been reduced to reflect any of the fees and costs of investing. Past performance does not guarantee future results. All returns reflect reinvested dividends, but do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the repurchase of Fund shares. Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. |

The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

The performance quoted is past performance and not a guarantee of future results. Registered investment companies are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when repurchased, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown.

| | | | | | | | | | |

| | | | | |

| 2 | | | | | | | | JPMORGAN PRIVATE MARKETS FUND | | MARCH 31, 2024 |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Trustees and Shareholders of JPMorgan Private Markets Fund

Opinion on the Financial Statements

We have audited the accompanying consolidated statement of assets and liabilities, including the consolidated schedule of investments, of JPMorgan Private Markets Fund and its subsidiary (the “Fund”) as of March 31, 2024, and the related consolidated statements of operations, of changes in net assets, and of cash flows for the period from July 12, 2023 (commencement of operations) through March 31, 2024, including the related notes, and the financial highlights for each of the periods indicated therein (collectively referred to as the “consolidated financial statements”). In our opinion, the consolidated financial statements present fairly, in all material respects, the financial position of the Fund as of March 31, 2024, and the results of its operations, changes in net assets and its cash flows for the period from July 12, 2023 through March 31, 2024 and the financial highlights for each of the periods indicated therein in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audit included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of March 31, 2024 by correspondence with the custodian, transfer agent and underlying investment fund managers. We believe that our audit provides a reasonable basis for our opinion.

/s/ PricewaterhouseCoopers LLP

New York, New York

May 31, 2024

We have served as the auditor of one or more investment companies in the JPMorgan Funds complex since 1993.

| | | | | | | | | | |

| | | | | |

| MARCH 31, 2024 | | JPMORGAN PRIVATE MARKETS FUND | | | | | | | | 3 |

JPMorgan Private Markets Fund

CONSOLIDATED SCHEDULE OF INVESTMENTS

MARCH 31, 2024

| | | | | | | | | | | | | | | | | | | | |

| | | GEOGRAPHIC

REGION | | | ACQUISITION

DATE | | | COST

BASIS | | | FAIR

VALUE | | | PERCENTAGE

OF

NET ASSETS | |

Private Equity Investments (65.67%)1 | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Co-Investments (21.49%) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

GTCR (C) Investors LP*,2 | | | Europe | | | | 9/13/2023 | | | $ | 6,889,934 | | | $ | 8,473,613 | | | | 2.97 | % |

| | | | | |

Hg Vega Co-Invest L.P.*,2 | | | Europe | | | | 3/28/2024 | | | | 15,199 | | | | 0 | 5 | | | 0.00 | % |

| | | | | |

Alkeme Co-Invest B, LLC* | | | North America | | | | 3/1/2024 | | | | 4,428,314 | | | | 4,412,000 | | | | 1.54 | % |

| | | | | |

ASTP Holdings Co-Investment LP*,2 | | | North America | | | | 9/8/2023 | | | | 2,658,677 | | | | 3,312,706 | | | | 1.16 | % |

| | | | | |

Ishtar Co-Invest-B LP2,6 | | | North America | | | | 7/14/2023 | | | | 4,864,100 | | | | 24,300,689 | | | | 8.51 | % |

| | | | | |

Oshun Co-Invest-B LP*,2 | | | North America | | | | 7/14/2023 | | | | 2,407,401 | | | | 3,833,099 | | | | 1.34 | % |

| | | | | |

Project Phoenix Co-Invest Fund, L.P.* | | | North America | | | | 11/6/2023 | | | | 3,678,553 | | | | 4,534,291 | | | | 1.59 | % |

| | | | | |

Southfield PMH Co-Invest LP* | | | North America | | | | 3/5/2024 | | | | 2,495,716 | | | | 2,501,800 | | | | 0.87 | % |

| | | | | |

WCI-BXC Investment Holdings, LP*,2 | | | North America | | | | 3/29/2024 | | | | 6,099,865 | | | | 6,047,077 | | | | 2.12 | % |

| | | | | |

GHK WSB Co-Investment Vehicle LP*,2 | | | North America | | | | 8/28/2023 | | | | 3,996,037 | | | | 3,959,190 | | | | 1.39 | % |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total Co-Investments (21.49%) | | | | | | | | | | $ | 37,533,796 | | | $ | 61,374,465 | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Primary Investments (3.55%) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Bansk Fund I-A and I-B, LP2,6 | | | North America | | | | 7/31/2023 | | | | 7,385,550 | | | | 10,134,345 | | | | 3.55 | % |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total Primary Investments (3.55%) | | | | | | | | | | $ | 7,385,550 | | | $ | 10,134,345 | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Secondary Investments (40.63%) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Hayfin Private Equity Funds LP*,2 | | | Europe | | | | 11/29/2023 | | | | 4,772,164 | | | | 6,002,557 | | | | 2.10 | % |

| | | | | |

Hayfin Private Equity Solutions II LP*,2 | | | Europe | | | | 11/29/2023 | | | | 3,237,969 | | | | 3,853,956 | | | | 1.35 | % |

| | | | | |

Hayfin Sapphire III LP*,2 | | | Europe | | | | 11/29/2023 | | | | 2,505,407 | | | | 3,965,433 | | | | 1.39 | % |

| | | | | |

PSC III G, LP*,2 | | | Europe | | | | 3/28/2024 | | | | 16,366,429 | | | | 23,282,194 | | | | 8.15 | % |

| | | | | |

Ufenau Continuation 4, SLP*,2 | | | Europe | | | | 9/7/2023 | | | | 6,566,540 | | | | 8,008,438 | | | | 2.81 | % |

| | | | | |

Access Car Wash Co-Investment, LP* | | | North America | | | | 3/28/2024 | | | | 2,636,078 | | | | 3,176,183 | | | | 1.11 | % |

| | | | | |

Access Holdings Fund I, L.P.*,2 | | | North America | | | | 12/28/2023 | | | | 19,046,387 | | | | 22,260,992 | | | | 7.79 | % |

| | | | | |

Aterian Opportunities II, L.P.*,2 | | | North America | | | | 9/26/2023 | | | | 8,142,737 | | | | 8,006,802 | | | | 2.80 | % |

| | | | | |

Brynwood Partners VIII L.P.* | | | North America | | | | 12/31/2023 | | | | 9,447,273 | | | | 10,782,985 | | | | 3.78 | % |

| | | | | |

GTCR Fund XIII/C LP*,2 | | | North America | | | | 12/28/2023 | | | | 4,130,355 | | | | 4,799,851 | | | | 1.68 | % |

| | | | | |

Kohlberg TE Investors IX, LP*,2 | | | North America | | | | 9/29/2023 | | | | 10,771,697 | | | | 13,202,506 | | | | 4.62 | % |

| | | | | |

MLC Private Equity Partners Feeder, LP*,2 | | | North America | | | | 3/25/2024 | | | | 8,732,387 | | | | 8,696,104 | | | | 3.05 | % |

| | | | | |

Vestar Capital Partners Rainforest, L.P.*,2 | | | North America | | | | 3/28/2024 | | | | 22,381 | | | | 0 | 5 | | | 0.00 | % |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total Secondary Investments (40.63%) | | | | | | | | | | $ | 96,377,804 | | | $ | 116,038,001 | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total Private Equity Investments (Cost $141,297,150) (65.67%) | | | | | | | | | | $ | 141,297,150 | | | $ | 187,546,811 | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | SHARES | | | FAIR

VALUE | | | PERCENTAGE

OF

NET ASSETS | |

| | | | | |

| | | | | | | | | | | | | | | | |

Investment Companies (17.51%) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

JPMorgan Floating Rate Income Fund, Class I Shares3 | | | | | | | | | | | 5,849,455 | | | | 50,012,836 | | | | 17.51 | % |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total Investment Companies (Cost $50,149,918) (17.51%) | | | | | | | | | | | | | | $ | 50,012,836 | | | | | |

| | | | | | | | | | | | | | | | | | | | |

THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE CONSOLIDATED FINANCIAL STATEMENTS.

| | | | | | | | | | |

| | | | | |

| 4 | | | | | | | | JPMORGAN PRIVATE MARKETS FUND | | MARCH 31, 2024 |

JPMorgan Private Markets Fund

CONSOLIDATED SCHEDULE OF INVESTMENTS (continued)

MARCH 31, 2024

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | SHARES | | | FAIR

VALUE | | | PERCENTAGE

OF

NET ASSETS | |

Short-Term Investments (7.70%) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

JPMorgan U.S. Treasury Plus Money Market Fund, Class Morgan Shares, 4.90%3,4 | | | | | | | | | | | 21,979,539 | | | $ | 21,979,539 | | | | 7.70 | % |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total Short-Term Investments (Cost $21,979,539) (7.70%) | | | | | | | | | | | | | | $ | 21,979,539 | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Total Investments (Cost $213,426,607) (90.88%) | | | | | | | | | | | | | | $ | 259,539,186 | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Other Assets (Liabilities) (9.13%) | | | | | | | | | | | | | | | 26,082,793 | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Net Assets (100.00%) | | | | | | | | | | | | | | $ | 285,621,979 | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| * | Non Income Producing Security. |

| 1 | Investments have no redemption provisions, are issued in private placement transactions and are restricted as to resale. For investments that were acquired through multiple transactions, the acquisition date represents initial acquisition date of the Fund’s investment in the position. Total fair value of restricted securities amounts to $185,981,598, which represents 65.44% of net assets as of March 31, 2024. |

| 2 | The Fund has unfunded commitments to the indicated investment as of March 31, 2024. Total unfunded commitments amount to $58,905,583 as of March 31, 2024. |

| 4 | The rate shown is the annualized seven-day yield as of March 31, 2024. |

| 5 | No capital has been called. |

| 6 | The Fund invests in the Ishtar Co-Invest B-LP and Bansk Fund I-A and I-B LP, both of which invest directly in Ishtar LLC. Through these investments the Fund owns approximately 7.27% of Ishtar LLC which holds Amika Holdco LLC. In the aggregate the Ishtar holding accounts for approximately 9.49% of the JPMF Net Asset Value. |

THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE CONSOLIDATED FINANCIAL STATEMENTS.

| | | | | | | | | | |

| | | | | |

| MARCH 31, 2024 | | JPMORGAN PRIVATE MARKETS FUND | | | | | | | | 5 |

CONSOLIDATED STATEMENT OF ASSETS AND LIABILITIES

MARCH 31, 2024

| | | | |

ASSETS | | | | |

Unaffiliated investments, at fair value (cost $141,297,150) | | $ | 187,546,811 | |

Affiliated investments, at fair value (cost $50,149,918) | | | 50,012,836 | |

Short-term investments in affiliates, at fair value (cost $21,979,539) | | | 21,979,539 | |

Cash | | | 28,637,578 | |

Cash denominated in foreign currencies, at value (cost $13,659) | | | 13,631 | |

Due from adviser | | | 631,803 | |

Dividend receivable from affiliates | | | 320,717 | |

Deferred offering costs | | | 250,115 | |

Other receivable | | | 13 | |

| | | | |

Total assets | | | 289,393,043 | |

| | | | |

| |

LIABILITIES | | | | |

Incentive fee payable | | | 2,356,725 | |

Professional fees payable | | | 752,503 | |

Tax expense payable | | | 327,558 | |

Distribution and servicing fees payable | | | 115,399 | |

Management fee payable | | | 112,557 | |

Directors’ fees payable | | | 42,501 | |

Organizational costs payable | | | 42,500 | |

Other liabilities payable | | | 21,321 | |

| | | | |

Total liabilities | | | 3,771,064 | |

| | | | |

NET ASSETS | | $ | 285,621,979 | |

| | | | |

Commitments and Contingencies (Note 4) | | | | |

| |

COMPOSITION OF NET ASSETS | | | | |

Paid-in capital | | $ | 240,925,697 | |

Distributable earnings (accumulated loss) | | | 44,696,282 | |

| | | | |

NET ASSETS | | $ | 285,621,979 | |

| | | | |

Class D | | | | |

Net assets | | $ | 382,985 | |

Shares outstanding | | | 35,409 | |

Net asset value per share | | $ | 10.82 | |

Class I | | | | |

Net assets | | $ | 190,031,748 | |

Shares outstanding | | | 13,090,812 | |

Net asset value per share | | $ | 14.52 | |

Class S | | | | |

Net assets | | $ | 95,207,246 | |

Shares outstanding | | | 8,106,733 | |

Net asset value per share | | $ | 11.74 | |

THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE CONSOLIDATED FINANCIAL STATEMENTS.

| | | | | | | | | | |

| | | | | |

| 6 | | | | | | | | JPMORGAN PRIVATE MARKETS FUND | | MARCH 31, 2024 |

CONSOLIDATED STATEMENT OF OPERATIONS

| | | | |

| | | For the period

July 12, 2023

(Commencement of

Operations) to

March 31, 2024 | |

INVESTMENT INCOME | | | | |

Dividend income from affiliates | | $ | 2,611,403 | |

Dividend income from non-affiliates | | | 87,687 | |

| | | | |

Total investment income | | | 2,699,090 | |

| | | | |

| |

EXPENSES | | | | |

Incentive fees | | | 4,769,165 | |

Professional fees | | | 2,090,214 | |

Advisory fees | | | 1,068,383 | |

Offering costs | | | 671,366 | |

Tax expenses | | | 327,558 | |

Accounting and administration fees | | | 187,499 | |

Directors’ fees | | | 170,000 | |

Distribution and servicing fees | | | | |

Class D | | | 164 | |

Class S | | | 141,533 | |

Other expenses | | | 65,530 | |

| | | | |

Total expenses | | | 9,491,412 | |

| | | | |

WAIVERS/REIMBURSEMENTS | | | | |

Waiver of advisory fees | | | (801,287 | ) |

Reimbursement of affiliate fees | | | (60,253 | ) |

Reimbursement from adviser | | | (2,736,909 | ) |

| | | | |

Total waivers/reimbursements | | | (3,598,449 | ) |

| | | | |

Total net expenses | | | 5,892,963 | |

| | | | |

Net investment loss | | | (3,193,873 | ) |

| | | | |

| |

NET REALIZED GAIN (LOSS) ON: | | | | |

Unaffiliated investments | | | 95,560 | |

Foreign currencies | | | (91,749 | ) |

| | | | |

Net realized gain | | | 3,811 | |

| | | | |

| |

NET CHANGE IN ACCUMULATED UNREALIZED APPRECIATION (DEPRECIATION) ON: | | | | |

Unaffiliated investments | | | 46,249,661 | |

Affiliated investments | | | (137,082 | ) |

Foreign currencies | | | (38 | ) |

| | | | |

Net change in accumulated unrealized appreciation (depreciation) | | | 46,112,541 | |

| | | | |

Net realized and unrealized gain (loss) | | | 46,116,352 | |

| | | | |

Net increase (decrease) in net assets from operations | | $ | 42,922,479 | |

| | | | |

THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE CONSOLIDATED FINANCIAL STATEMENTS.

| | | | | | | | | | |

| | | | | |

| MARCH 31, 2024 | | JPMORGAN PRIVATE MARKETS FUND | | | | | | | | 7 |

CONSOLIDATED STATEMENT OF CHANGES IN NET ASSETS

| | | | |

| | | For the period July 12, 2023 (Commencement of Operations) to March 31, 2024 | |

INCREASE (DECREASE) IN NET ASSETS FROM OPERATIONS: | | | | |

Net investment loss | | $ | (3,193,873 | ) |

Net realized gain | | | 3,811 | |

Net change in accumulated unrealized appreciation (depreciation) | | | 46,112,541 | |

| | | | |

Net increase (decrease) in net assets from operations | | | 42,922,479 | |

| | | | |

| |

CAPITAL TRANSACTIONS (SEE NOTE 6): | | | | |

Proceeds from shares issued | | | | |

Class D1 | | | 355,000 | |

Class I2 | | | 155,016,000 | |

Class S3 | | | 87,228,500 | |

| | | | |

Total increase in net assets from capital transactions | | | 242,599,500 | |

| | | | |

Total increase in net assets | | | 285,521,979 | |

| | | | |

Net assets at beginning of period | | | 100,000 | |

| | | | |

Net assets end of period | | $ | 285,621,979 | |

| | | | |

| 1 | Class D commenced operations on January 1, 2024. |

| 2 | Class I commenced operations on July 12, 2023. |

| 3 | Class S commenced operations on September 1, 2023. |

THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE CONSOLIDATED FINANCIAL STATEMENTS.

| | | | | | | | | | |

| | | | | |

| 8 | | | | | | | | JPMORGAN PRIVATE MARKETS FUND | | MARCH 31, 2024 |

CONSOLIDATED STATEMENT OF CASH FLOWS

| | | | |

| | | For the period July 12, 2023 (Commencement

of Operations) to March 31, 2024 | |

CASH FLOWS FROM OPERATING ACTIVITIES | | | | |

Net increase/(decrease) in net assets from operations | | $ | 42,922,479 | |

Adjustments to reconcile net increase (decrease) in net assets from operations: | | | | |

Net realized gain from investments | | | (95,560 | ) |

Net change in accumulated unrealized (appreciation) depreciation on investments | | | (46,112,579 | ) |

Purchases of investments | | | (198,292,091 | ) |

Proceeds from sales of investments | | | 6,940,583 | |

Net (purchases) sales and amortization of short-term investments | | | (21,979,539 | ) |

Amortization of offering costs1 | | | 671,366 | |

(Increase)/Decrease in Assets: | | | | |

Increase in dividend receivable from affiliates | | | (320,717 | ) |

Decrease in due from adviser | | | 829,818 | |

Increase in other receivable | | | (13 | ) |

Increase/(Decrease) in Liabilities: | | | | |

Increase in professional fees payable | | | 752,503 | |

Increase in tax expense payable | | | 327,558 | |

Increase in directors’ fees payable | | | 42,501 | |

Increase in incentive fee payable | | | 2,356,725 | |

Decrease in organizational costs payable | | | (1,419,121 | ) |

Increase in management fee payable | | | 112,557 | |

Increase in distribution and service fees payable | | | 115,399 | |

Increase in other liabilities payable | | | 21,321 | |

| | | | |

Net cash used in operating activities | | $ | (213,126,810 | ) |

| | | | |

CASH FLOWS FROM FINANCING ACTIVITIES | | | | |

Proceeds from shares issued | | | 242,599,500 | |

Offering costs paid1 | | | (921,481 | ) |

| | | | |

Net cash provided by financing activities | | $ | 241,678,019 | |

| | | | |

Net change in cash | | $ | 28,551,209 | |

Cash at beginning of period | | $ | 100,000 | |

| | | | |

Cash at end of period2 | | $ | 28,651,209 | |

| | | | |

| 1 | The Fund commenced operations on July 12, 2023. |

| 2 | Balance includes cash and cash denominated in foreign currencies of $28,637,578 and $13,631, respectively. |

THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE CONSOLIDATED FINANCIAL STATEMENTS.

| | | | | | | | | | |

| | | | | |

| MARCH 31, 2024 | | JPMORGAN PRIVATE MARKETS FUND | | | | | | | | 9 |

CONSOLIDATED FINANCIAL HIGHLIGHTS

| | | | |

| Class D | | For the period

January 1, 2024

(Commencement

of Operations) to

March 31, 2024 | |

Per share operating performance: | | | | |

Net asset value, beginning of period | | $ | 10.00 | |

Income (loss) from investment operations: | | | | |

Net investment income (loss)1 | | | (0.11 | ) |

Net realized & unrealized gain (loss)1 | | | 0.93 | |

| | | | |

Total income (loss) from investment operations | | | 0.82 | |

| | | | |

Net asset value, end of period | | $ | 10.82 | |

| | | | |

Total return2 | | | 8.16 | %3,4 |

| | | | |

Ratios and supplemental data: | | | | |

Net Assets, End of Period (000’s) | | $ | 383 | |

Ratios to average net assets:5 | | | | |

Total expenses, before waiver | | | 4.01 | %6 |

Total expenses, excluding incentive fees, net of waiver | | | 1.72 | %6 |

Incentive fees | | | 1.19 | %3 |

Total expenses, including incentive fees, net of waiver | | | 2.91 | %6 |

Net investment income (loss), before waiver | | | (1.25 | )%6 |

Net investment income (loss), after waiver | | | (0.14 | )%6 |

Portfolio turnover rate7 | | | 7 | %3 |

| 1 | Calculated using average shares outstanding. |

| 2 | Total return based on net asset value calculated as the change in Net Asset Value per Share during the period, assuming distributions, if any, are reinvested based on the Fund’s dividend reinvestment plan. |

| 4 | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset values for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

| 5 | The ratios do not include investment income or expenses of the Portfolio Funds. |

| 6 | Annualized with the exception of certain expenses. |

| 7 | Portfolio turnover is calculated at the Fund level. Percentage indicated was calculated for the period from July 12, 2023 (Commencement of Operations) to March 31, 2024. |

THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE CONSOLIDATED FINANCIAL STATEMENTS.

| | | | | | | | | | |

| | | | | |

| 10 | | | | | | | | JPMORGAN PRIVATE MARKETS FUND | | MARCH 31, 2024 |

CONSOLIDATED FINANCIAL HIGHLIGHTS (continued)

| | | | |

| Class I | | For the period

July 12, 2023

(Commencement

of Operations) to

March 31, 2024 | |

Per share operating performance: | | | | |

Net asset value, beginning of period | | $ | 10.00 | |

Income (loss) from investment operations: | | | | |

Net investment income (loss)1 | | | (0.28 | ) |

Net realized & unrealized gain (loss)1 | | | 4.80 | |

| | | | |

Total income (loss) from investment operations | | | 4.52 | |

| | | | |

Net asset value, end of period | | $ | 14.52 | |

| | | | |

Total return2 | | | 45.16 | %3,4 |

| | | | |

Ratios and supplemental data: | | | | |

Net Assets, End of Period (000’s) | | $ | 190,032 | |

Ratios to average net assets:5 | | | | |

Total expenses, before waiver | | | 7.65 | %6 |

Total expenses, excluding incentive fees, net of waiver | | | 0.62 | %6 |

Incentive fees | | | 3.32 | %3 |

Total expenses, including incentive fees, net of waiver | | | 3.94 | %6 |

Net investment income (loss), before waiver | | | (5.09 | )%6 |

Net investment income (loss), after waiver | | | (1.38 | )%6 |

Portfolio turnover rate7 | | | 7 | %3 |

| 1 | Calculated using average shares outstanding. |

| 2 | Total return based on net asset value calculated as the change in Net Asset Value per Share during the period, assuming distributions, if any, are reinvested based on the Fund’s dividend reinvestment plan. |

| 4 | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset values for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

| 5 | The ratios do not include investment income or expenses of the Portfolio Funds. |

| 6 | Annualized with the exception of certain expenses. |

| 7 | Portfolio turnover is calculated at the Fund level. Percentage indicated was calculated for the period from July 12, 2023 (Commencement of Operations) to March 31, 2024. |

THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE CONSOLIDATED FINANCIAL STATEMENTS.

| | | | | | | | | | |

| | | | | |

| MARCH 31, 2024 | | JPMORGAN PRIVATE MARKETS FUND | | | | | | | | 11 |

CONSOLIDATED FINANCIAL HIGHLIGHTS (continued)

| | | | |

| Class S | | For the period

September 1, 2023

(Commencement

of Operations) to

March 31, 2024 | |

Per share operating performance: | | | | |

Net asset value, beginning of period | | $ | 10.00 | |

Income (loss) from investment operations: | | | | |

Net investment income1 | | | (0.23 | ) |

Net realized & unrealized gain (loss)1 | | | 1.97 | |

| | | | |

Total income (loss) from investment operations | | | 1.74 | |

| | | | |

Net asset value, end of period | | $ | 11.74 | |

| | | | |

Total return2 | | | 17.44 | %3,4 |

| | | | |

Ratios and supplemental data: | | | | |

Net Assets, End of Period (000’s) | | $ | 95,207 | |

Ratios to average net assets:5 | | | | |

Total expenses, before waiver | | | 6.29 | %6 |

Total expenses, excluding incentive fees, net of waiver | | | 1.66 | %6 |

Incentive fees | | | 2.57 | %3 |

Total expenses, including incentive fees, net of waiver | | | 4.23 | %6 |

Net investment income (loss), before waiver | | | (3.62 | )%6 |

Net Investment Income (loss), after waiver | | | (1.57 | )%6 |

Portfolio turnover rate7 | | | 7 | %3 |

| 1 | Calculated using average shares outstanding. |

| 2 | Total return based on net asset value calculated as the change in Net Asset Value per Share during the period, assuming distributions, if any, are reinvested based on the Fund’s dividend reinvestment plan. |

| 4 | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset values for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

| 5 | The ratios do not include investment income or expenses of the Portfolio Funds. |

| 6 | Annualized with the exception of certain expenses. |

| 7 | Portfolio turnover is calculated at the Fund level. Percentage indicated was calculated for the period from July 12, 2023 (Commencement of Operations) to March 31, 2024. |

THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE CONSOLIDATED FINANCIAL STATEMENTS.

| | | | | | | | | | |

| | | | | |

| 12 | | | | | | | | JPMORGAN PRIVATE MARKETS FUND | | MARCH 31, 2024 |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2024

1. Organization

JPMorgan Private Markets Fund (the “Fund”) is a Delaware statutory trust registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a non-diversified, closed-end management investment company which commenced operations on July 12, 2023 (“Commencement of Operations”). J.P. Morgan Investment Management Inc. serves as the Fund’s investment adviser (the “Adviser”) and is responsible for making investment decisions for the Fund’s portfolio.

The Board of Trustees of the Fund (the “Board”) is responsible for the overall management of the Fund, including supervision of the duties performed by the Adviser. As is the case with virtually all investment companies (as distinguished from operating companies), service providers to the Fund, primarily the Adviser, have responsibility for the day-to-day management and operation of the Fund.

The Fund’s investment objective is to seek to provide long-term capital appreciation. In pursuing its investment objective, the Fund intends to invest primarily in an actively managed portfolio of private equity and other private assets (collectively, “Private Market Investments”). The Fund’s Private Market Investments focus on private equity strategies including private equity and venture capital. The Fund’s investment exposure to these strategies is implemented via a variety of investment types that include: (i) investments in private equity funds managed by various unaffiliated asset managers (“Portfolio Funds”) acquired in privately negotiated transactions (a) from investors in these Portfolio Funds, and/or (b) in connection with a restructuring transaction of a Portfolio Fund(s) (“Secondary Investments”); (ii) indirect investments in the equity of private companies, alongside private equity funds and/or other private equity firms via special purpose vehicles (“Co-Investments”); and (iii) primary investments in newly formed Portfolio Funds (“Primary Investments”). To manage portfolio liquidity, the Fund may also have exposure to privately placed debt securities and other yield-oriented investments (“Private Credit Investments”). The Fund may invest in Private Credit Investments indirectly through affiliated and unaffiliated mutual funds and ETFs. The Fund may modify its investment strategy in the future.

Under normal circumstances, the Fund invests at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in Private Market Investments. For purposes of this policy, Private Market Investments include Secondary Investments; Co-Investments; Primary Investments; and Private Credit Investments.

To manage the liquidity of its investment portfolio, the Fund also invests a portion of its assets in affiliated and unaffiliated money market funds, cash and/or cash equivalents (“Liquid Assets”).

The Fund offers Class S, Class D and Class I shares (“Shares”). The Shares will generally be offered on the first business day of each month at the net asset value (“NAV”) per Share on that day. No person who is admitted as a shareholder of the Fund (a “Shareholder”) will have the right to require the Fund to redeem its Shares.

2. Significant Accounting Policies

a. Basis of Accounting

The consolidated financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The Fund is considered an investment company and therefore applies the guidance of Accounting Standards Codification (“ASC”) Topic 946, Financial Services — Investment Companies. The consolidated financial statements reflect all adjustments and reclassifications, which, in the opinion of management, are necessary for the fair presentation of the results of operations and financial condition as of and for the periods presented. All intercompany balances and transactions have been eliminated. The following is a summary of significant accounting policies used in preparing the consolidated financial statements.

b. Valuation of Investments

The Fund values its investments monthly at fair value consistent with the principles of ASC Topic 820, Fair Value Measurements. The Fund has written valuation policies and procedures (the “Valuation Procedures”), which have been approved by the Fund’s Board of Trustees (the “Board”). Effective May 15, 2023, the Adviser was designated as the Valuation Designee (the “Valuation Designee”) for the Fund pursuant to Rule 2a-5 under the 1940 Act. The Adviser’s fair valuation team is responsible for monitoring developments that may impact the fair value of securities. The Fund generally uses the latest net asset value (“NAV”) provided by the manager or general partner of a Portfolio Fund (the “Portfolio Fund Manager”) as a practical expedient to determine the fair value of its investments in Portfolio Funds and certain Co-Investments held through investment vehicles. Ordinarily, the fair value of a Portfolio Fund or Co-Investment held by the Fund is based on the NAV of that Portfolio Fund or Co-Investment reported by the Portfolio Fund Manager. If the Adviser determines that the most recent NAV reported by the Portfolio Fund Manager does not represent the fair value or if the Portfolio Fund Manager fails to report a NAV to the Fund, a fair value determination is made by the Adviser with oversight from the Board in accordance with the Fund’s valuation procedures. This may include adjusting the previous NAV provided by a Portfolio Fund Manager with other relevant information available at the time the Fund values its portfolio, including capital activity and events occurring between the reference dates of the Portfolio Fund Manager’s valuation and the relevant valuation date, to the extent that the Adviser is aware of such information.

On a monthly basis, valuation of Private Market Investments (other than interests in Portfolio Funds and certain Co-Investments, as described above) will originally be valued at cost which will subsequently be adjusted based on a determination of such investment’s fair value. In instances where there is reason to believe that the valuation of a security or other investment does not represent the current value of such security or investment, or

| | | | | | | | | | |

| | | | | |

| MARCH 31, 2024 | | JPMORGAN PRIVATE MARKETS FUND | | | | | | | | 13 |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2024 (Unaudited) (continued)

when a security or investment cannot be valued pursuant to the procedures described above, the fair value of the investment will be determined by the Adviser taking into account various factors, as relevant, as provided for in the Fund’s valuation procedures, which may include:

| • | | Pending sales and potential exit transactions, including (a) any sales price in a letter of intent, offer letter or term sheet, (b) the company’s total enterprise value or (c) information from an investment bank during an initial public offering. |

| • | | Liquidation analysis (cost approach). |

| • | | Any other information, factor or set of factors that may affect the valuation of the Fund’s investment as determined by the Adviser. |

The amounts shown in the accompanying financial statements include adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset values for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions.

Investment companies are valued at the reported NAV and no valuation adjustments are applied.

c. Estimates

The Fund’s financial statements are prepared in accordance with U.S. GAAP which requires the use of management estimates that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates and such differences could be material.

d. Cash

In order to maintain liquidity pending investment in Private Market Investments, the Fund uses non-interest bearing accounts at State Street Bank and Trust Company and only earns interest on amounts moved to money market funds.

e. Other Investment Companies

Short-term investments represent investments in money market instruments and money market mutual funds, which are recorded at NAV per share and approximate fair value. Money market instruments are high quality, short-term fixed-income obligations, which generally have remaining maturities of one year or less and may include U.S. Government securities, commercial paper, certificates of deposit and bankers’ acceptances issued by domestic branches of U.S. banks that are members of the Federal Deposit Insurance Corporation, and repurchase agreements. There are no restrictions on the short-term investments held by the Fund.

f. Consolidation of Subsidiary

The consolidated financial statements of the Fund include JPMorgan Private Markets Fund and JPMorgan Private Markets Fund Blocker, LLC (the “Blocker”), a wholly-owned subsidiary of the Fund. Inter-company balances and transactions have been eliminated in consolidation.

g. Foreign Currency Translation

The books and records of the Fund are maintained in U.S. Dollars. Generally, valuations of assets and liabilities denominated in currencies other than the U.S. Dollar are translated into U.S. Dollar equivalents using valuation date exchange rates, while purchases, realized gains and losses, income and expenses are translated at transaction date exchange rates.

The Fund does not isolate the portion of the results of operations due to fluctuations in foreign exchange rates from other changes in fair values of the investments during the period.

h. Income Recognition and Expenses

Income is recognized on an accrual basis as earned. Expenses are recognized on an accrual basis as incurred. Distributions from Portfolio Funds occur at irregular intervals and the exact timing of the distributions cannot be determined. The classification of distributions received, including return of capital, realized gains and dividend income, is based on information received from the investment manager of the Portfolio Fund. The change in unrealized appreciation on investments and foreign currency translation within the Consolidated Statement of Operations includes the Fund’s share of unrealized gains and losses, realized undistributed gains and losses and the undistributed net investment income or loss on investments for the relevant period.

i. Dividends and Distributions

Dividends and distributions to shareholders, if any, are recorded on the ex-dividend date. Income dividends and capital gains distributions are determined in accordance with federal tax regulations and may differ from those determined in accordance with U.S. GAAP. To the extent these differences are permanent, such amounts are reclassified within the capital accounts based on their federal tax basis treatment; temporary differences do not require such reclassification.

j. Federal Income Taxes

The Fund intends to meet the requirements under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”), applicable to regulated investment companies (“RIC”), and to distribute substantially all of its net investment income and any net realized capital gains to its shareholders annually.

| | | | | | | | | | |

| | | | | |

| 14 | | | | | | | | JPMORGAN PRIVATE MARKETS FUND | | MARCH 31, 2024 |

The Fund intends to make distributions in one or more payments on an annual basis in aggregate amounts representing substantially all of the Fund’s investment company taxable income (including realized short-term capital gains), if any, earned during the year. Distributions may also include net capital gains, if any.

Because the Fund intends to qualify annually as a RIC under the Code, the Fund intends to distribute at least 90% of its annual net taxable income to its Shareholders. Nevertheless, there can be no assurance that the Fund will pay distributions to Shareholders at any particular rate.

The Fund files tax returns as prescribed by the tax laws of the jurisdictions in which it operates. In the normal course of business, the Fund is subject to examination by U.S. federal, state, local and foreign jurisdictions, where applicable. The Blocker is taxed as a C-corporation for federal income tax purposes and as such is obligated to pay federal and state income tax. Under current law, the Blocker is not eligible to elect treatment as a RIC.

k. Organizational and Offering Costs

The Fund has incurred certain organizational and initial offering costs. The Adviser has agreed to advance those costs to the Fund in accordance with the Expense Limitation Agreement (as defined in Note 5). Such costs incurred by the Adviser are subject to recoupment by the Adviser. The Fund’s initial offering costs, whether borne by the Adviser or the Fund, were capitalized and are being amortized over the 12-month period beginning at the Commencement of Operations. The Fund’s organizational costs were expensed as incurred.

l. Investment Transactions with Affiliates

The Fund invested in two underlying funds, which are advised by the Adviser and are considered affiliates. The table below shows transactions with the affiliates. For the purposes of the consolidated financial statements, the Fund considers the issuer listed in the table below to be an affiliated issuer. The underlying fund’s distributions may be reinvested into such underlying fund. Reinvestment amounts are included in the purchases at cost amounts in the tables below.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Affiliates | | Shares at March 31,

2024 | | | Value at July 12,

2023 | | | Purchases at

Cost | | | Proceeds

from Sales | | | Net Realized

Gains/Losses | | | Change in

Unrealized

Appreciation

(Depreciation) | | | Value at March 31,

2024 | | | Dividend

Income | |

JPMorgan Floating Rate Income Fund, Class I Shares | | | 5,849,454 | | | $ | — | | | $ | 50,149,918 | | | | $— | | | $ | — | | | $ | (137,082 | ) | | $ | 50,012,836 | | | $ | 749,918 | |

JPMorgan U.S. Treasury Plus Money Market Fund, Class Morgan Shares | | | 21,979,539 | | | | — | | | | 216,482,539 | | | | (194,503,000 | ) | | | — | | | | — | | | | 21,979,539 | | | | 1,861,486 | |

Total Affiliates | | | | | | $ | — | | | $ | 266,632,457 | | | $ | (194,503,000 | ) | | $ | — | | | $ | (137,082 | ) | | $ | 71,992,375 | | | $ | 2,611,404 | |

3. Fair Value Measurements

The Fund follows the provisions of ASC 820-10, Fair Value Measurements and Disclosures (“ASC 820-10”), which among other matters, requires enhanced disclosures about investments that are measured and reported at fair value. ASC 820-10 defines fair value, establishes a framework for measuring fair value in accordance with GAAP and expands disclosure of fair value measurements. ASC 820-10 determines fair value to be the price that would be received for an investment in a current sale, which assumes an orderly transaction between market participants on the measurement date. ASC 820-10 requires the Fund to assume that the portfolio investment is sold in its principal market to market participants or, in the absence of a principal market, the most advantageous market, which may be a hypothetical market. Market participants are defined as buyers and sellers in the principal or most advantageous market that are independent, knowledgeable, and willing and able to transact. In accordance with ASC 820-10, the Fund has considered its principal market as the market in which the Fund exits its portfolio investments with the greatest volume and level of activity. ASC 820-10 specifies a hierarchy of valuation techniques based on whether the inputs to those valuation techniques are observable or unobservable. In accordance with ASC 820-10, these inputs are summarized in the three broad levels listed below:

The three-tier hierarchy of inputs is summarized below:

| • | | Level 1 — Inputs that reflect unadjusted quoted prices in active markets for identical financial instruments that the reporting entity has the ability to access at the measurement date. |

| • | | Level 2 — Inputs other than quoted prices included within Level 1 that are observable for the financial instrument, either directly or indirectly. Level 2 inputs also include quoted prices for similar assets and liabilities in active markets, and quoted prices for identical or similar assets and liabilities in markets that are not active. |

| • | | Level 3 — Significant unobservable inputs for the financial instrument (including management’s own assumptions in determining the fair value of investments). |

Investments in Portfolio Funds are recorded at fair value, using the Portfolio Funds’ net asset value as a “practical expedient,” in accordance with ASC 820-10 and are excluded from leveling classification noted above.

Investments in Portfolio Funds generally are restricted securities that are subject to substantial holding periods and are not traded in public markets. Accordingly, the Fund may not be able to resell or realize some of its investments for extended periods, which may be several years. The types of Portfolio Funds that the Fund may make investments in include Primary and Secondary Investments.

| | | | | | | | | | |

| | | | | |

| MARCH 31, 2024 | | JPMORGAN PRIVATE MARKETS FUND | | | | | | | | 15 |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2024 (Unaudited) (continued)

The fair value relating to certain underlying investments of these Portfolio Funds, for which there is no public market, has been estimated by the respective Portfolio Fund Manager and is based upon available information in the absence of readily ascertainable fair values and does not necessarily represent amounts that might ultimately be realized. Due to the inherent uncertainty of valuation, those estimated fair values may differ significantly from the values that would have been used had a public market for the investments existed. These differences could be material.

Portfolio Funds measure their investment assets at fair value, and typically report a NAV per share on a calendar quarterly basis. In accordance with ASC 820-10, the Fund has elected to apply the practical expedient methodology and to value its investments in Portfolio Funds at their respective NAVs typically at each quarter.

The amounts shown in the accompanying financial statements include adjustments in accordance with accounting principles generally accepted in the United States of America and known through the date of issuance of these financial statements as such, the net asset values for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions.

Due to the inherent uncertainty of estimates, fair value determinations based on estimates may materially differ from the values that would have been used had a ready market for the securities existed. The following is a summary of the Fund’s investments in affiliated funds which are classified in the fair value hierarchy as of March 31, 2024:

| | | | | | | | | | | | | | | | |

| Investments in Securities at Value | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Investment Companies | | $ | 50,012,836 | | | $ | — | | | $ | — | | | $ | 50,012,836 | |

Short-Term Investments | | $ | 21,979,539 | | | $ | — | | | $ | — | | | $ | 21,979,539 | |

| | | | | | | | | | | | | | | | |

Total Investments | | $ | 71,992,375 | | | $ | — | | | $ | — | | | $ | 71,992,375 | |

| | | | | | | | | | | | | | | | |

The Fund held Portfolio Funds with a fair value of $187,546,811, that in accordance with ASC 820, are excluded from the fair value hierarchy as of March 31, 2024, as investments in Portfolio Funds valued at net asset value, as a “practical expedient”, are not required to be included in the fair value hierarchy. Changes in inputs or methods used for valuing investments may result in transfers in or out of levels within the fair value hierarchy. The inputs or methods used for valuing investments may not necessarily be an indication of the risk associated with investing in those investments. Transfers between levels of the fair value hierarchy are reported at values at the beginning of the reporting period in which they occur.

4. Unfunded Commitments

The Fund had the following unfunded commitments and unrealized appreciation/depreciation by investments as of March 31, 2024. The Fund maintains sufficient cash on hand, available borrowings and liquid securities to fund any unfunded commitments should the need arise.

| | | | | | | | | | | | | | | | | | | | |

Investment

Category | | Investment

Strategy | | Fair Value | | | Unfunded

Commitments | | | Redemption

Frequency* | | | Notice Period

(In Days) | | | Redemption

Restrictions Terms** |

| Co-Investments | | Investments in an operating company alongside other investors | | $ | 61,374,465 | | | $ | 20,735,989 | | | | None | | | | N/A | | | Liquidity in the form of

distributions from Private

Market investments |

| Primary Investments | | Investments in newly established Portfolio Funds | | | 10,134,345 | | | | 3,320,072 | | | | None | | | | N/A | | | Liquidity in the form of

distributions from Private

Market investments |

| Secondary Investments | | Investments in existing Portfolio Funds that are typically acquired in privately negotiated transactions | | | 116,038,001 | | | | 34,849,522 | | | | None | | | | N/A | | | Liquidity in the form of

distributions from Private

Market investments |

| | | | | | | | | | | | | | | | | | | | |

Totals | | | | $ | 187,546,811 | | | $ | 58,905,583 | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| * | The information summarized in the table above represents the general terms for the specified investment type. Individual Private Market Investments may have terms that are more or less restrictive than those terms indicated for the investment type as a whole. In addition, most Private Market Investments have the flexibility, as provided for in their constituent documents, to modify and waive such terms. |

| ** | Distributions from Private Market investments occur at irregular intervals, and the exact timing of distributions from Private Market Investments cannot be determined. It is estimated that distributions will occur over the life of the Private Market Investments. |

| | | | | | | | | | |

| | | | | |

| 16 | | | | | | | | JPMORGAN PRIVATE MARKETS FUND | | MARCH 31, 2024 |

5. Advisory Fee and Other Transactions with Affiliates

a. Advisory Fee

In consideration of the advisory services provided by the Adviser, the Fund pays the Adviser a quarterly advisory fee at an annual rate of 1.00% based on the value of the Fund’s net assets calculated and accrued monthly as of the last business day of each month (the “Advisory Fee”). For purposes of determining the Advisory Fee payable to the Adviser, the value of the Fund’s net assets will be calculated prior to the inclusion of the Advisory Fee and Incentive Fee (as defined below), if any, payable to the Adviser or to any purchases or repurchases of Shares of the Fund or any distributions by the Fund. The Advisory Fee is paid to the Adviser out of the Fund’s assets, and therefore decreases the net profits or increases the net losses of the Fund. The Adviser has contractually agreed to reduce its Advisory Fee to an annual rate of 0.25% through June 30, 2024. For the period from July 12, 2023 (Commencement of Operations) through March 31, 2024, the Fund incurred $1,068,383 in Advisory Fee, of which $801,287 was waived and $60,253 of affiliate fees were reimbursed by the Adviser. Waived affiliate fees relate to the fees incurred on the JPMorgan U.S. Treasury Plus Money Market.

b. Expense Limitation Agreement (“ELA”)

Pursuant to an expense limitation agreement with the Fund (the “Expense Limitation Agreement”), the Adviser has agreed to waive fees that it would otherwise be paid, and/or to assume expenses of the Fund, if required to ensure certain annual operating expenses (excluding the Advisory Fee, Incentive Fee, any Distribution and Servicing Fee, interest, taxes, brokerage commissions, acquired fund fees and expenses, dividend and interest expenses relating to short sales, borrowing costs, merger or reorganization expenses, shareholder meetings expenses, litigation expenses, expenses associated with the acquisition and disposition of investments (including interest and structuring costs for borrowings and line(s) of credit) and extraordinary expenses, if any; collectively, the “Excluded Expenses”) do not exceed 0.30% per annum (excluding Excluded Expenses) of the Fund’s average monthly net assets of each class of Shares. With respect to each class of Shares, the Fund agrees to repay the Adviser any fees waived or expenses assumed under the Expense Limitation Agreement for such class of Shares, provided that repayments do not cause the Fund’s annual operating expenses (excluding Excluded Expenses) for that class of Shares to exceed the expense limitation in place at the time the fees were waived and/or the expenses were reimbursed, or the expense limitation in place at the time the Fund repays the Adviser, whichever is lower. Any such repayments must be made within thirty-six months after the months in which the Adviser incurred the expense, as shown in the table below. The Expense Limitation Agreement will have a term ending one-year from the date the Fund commences operations, and the Adviser may extend the term for a period of one year on an annual basis. The Adviser may not terminate the Expense Limitation Agreement during its initial one-year term. The initial term ends on July 12, 2024. For the period from July 12, 2023 (Commencement of Operations) through March 31, 2024, the Adviser has reimbursed $2,736,909 to the Fund which is subject to repayment to the Advisor.

| | | | |

| Expiration Period | | | |

May 15, 2026 | | $ | 1,461,621 | |

May 16, 2026 - March 31, 2027 | | | 2,736,928 | |

| | | | |

Total | | $ | 4,198,549 | |

| | | | |

c. Incentive Fee

At the end of each calendar quarter of the Fund (and at certain other times), the Adviser (or, to the extent permitted by applicable law, an affiliate of the Adviser) will be entitled to receive an Incentive Fee equal to 10% of the excess, if any, of (i) the net profits of the Fund for the relevant period over (ii) the then balance, if any, of the Loss Recovery Account (defined below). For the purposes of the Incentive Fee and Loss Recovery Account, the term “net profits” shall mean the amount by which (i) the sum of (A) the net asset value of the Fund as of the end of such quarter, (B) the aggregate repurchase price of all shares repurchased by the Fund during such quarter and (C) the amount of dividends and other distributions paid in respect of the Fund during such quarter and not reinvested in additional shares through the Dividend Reinvestment Plan (“DRIP”) exceeds (ii) the sum of (X) the net asset value of the Fund as of the beginning of such quarter and (Y) the aggregate issue price of shares of the Fund issued during such quarter (excluding any shares of such class issued in connection with the reinvestment through the DRIP of dividends paid, or other distributions made, by the Fund through the DRIP). For the period ended March 31, 2024, the Fund incurred $4,769,165 in Incentive fees due to the Adviser.

The Fund will maintain a memorandum account (the “Loss Recovery Account”), which will have an initial balance of zero and will be (i) increased upon the close of each calendar quarter of the Fund by the amount of the net losses of the Fund for the quarter, before giving effect to any repurchases or distributions for such quarter, and (ii) decreased (but not below zero) upon the close of each calendar quarter by the amount of the net profits of the Fund for the quarter. For purposes of the Loss Recovery Account, the term “net losses” shall mean the amount by which (i) the sum of (A) the net asset value of the Fund as of the beginning of such quarter and (B) the aggregate issue price of shares of the Fund issued during such quarter (excluding any Shares of such Class issued in connection with the reinvestment of dividends paid, or other distributions made, by the Fund through the DRIP) exceeds (ii) the sum of (X) the net asset value of the Fund as of the end of such quarter, (Y) the aggregate repurchase price of all shares repurchased by the Fund during such quarter and (Z) the amount of dividends and other distributions paid in respect of the Fund during such quarter and not reinvested in additional shares through the DRIP. Shareholders will benefit from the Loss Recovery Account in proportion to their holdings of Shares. For purposes of the “net losses” calculation, the net asset value shall include unrealized appreciation or depreciation of investments and realized income and gains or losses and expenses (including offering and organizational expenses). Incentive Fees are accrued monthly

| | | | | | | | | | |

| | | | | |

| MARCH 31, 2024 | | JPMORGAN PRIVATE MARKETS FUND | | | | | | | | 17 |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2024 (Unaudited) (continued)

and paid quarterly. For purposes of calculating Incentive Fees, such accruals are not deducted from net asset value. For the avoidance of doubt, any change in the net asset value of the Fund directly as a result of subscriptions or repurchases during each measurement period are not included for purposes of the “net profits” or “net losses” calculations.

d. Distribution and Servicing Fee

Class S and Class D Shares are subject to an ongoing distribution and shareholder servicing fee (the “Distribution and Servicing Fee”) to compensate financial industry professionals for distribution-related expenses, if applicable, and providing ongoing services in respect of Shareholders who own Class S or Class D Shares of the Fund. Although the Fund is not an open-end investment company, it will comply with the terms of Rule 12b-1 as a condition of the SEC exemptive relief, which permits the Fund to have, among other things, a multi-class structure and distribution and shareholder servicing fees. Accordingly, the Fund has adopted a distribution and servicing plan for its Class S Shares and Class D Shares (the “Distribution and Servicing Plan”) and pays the Distribution and Servicing Fee with respect to its Class S and Class D Shares. The Distribution and Servicing Plan operates in a manner consistent with Rule 12b-1 under the 1940 Act.

Class S Shares and Class D Shares pay a distribution and Servicing Fee to the Distributor at an annual rate of 0.70% and 0.25%, respectively, based on the aggregate net assets of the Fund attributable to such class.

Class I Shares are not subject to a Distribution and Servicing Fee.

The Adviser, or its affiliates, may pay additional compensation out of its own resources (i.e., not Fund assets) to certain selling agents or financial intermediaries in connection with the sale of the Shares. The additional compensation may differ among brokers or dealers in amount or in the method of calculation. Payments of additional compensation may be fixed dollar amounts or, based on the aggregate value of outstanding Shares held by Shareholders introduced by the broker or dealer, or determined in some other manner. The receipt of the additional compensation by a selling broker or dealer may create potential conflicts of interest between an investor and its broker or dealer who is recommending the Fund over other potential investments.

e. Administrative Fees

The Fund has retained State Street Bank and Trust Company (the ”Administrator”) to provide it with certain administrative services, including fund administration and fund accounting services. The Fund compensates the Administrator for these services and reimburses the Administrator for certain out-of-pocket expenses (the “Administration Fee”). The Administration Fee is paid to the Administrator out of the assets of the Fund and therefore decreases the net profits or increases the net losses of the Fund.

SS&C GIDS, Inc. (“SS&C”) serves as the transfer agent to the Fund. Under the Services Agreement with the Fund, SS&C is responsible for maintaining all shareholder records of the Fund.

SS&C is a wholly-owned subsidiary of SS&C Technologies Holdings, Inc., a publicly traded company listed on the NASDAQ Global Select Market.

State Street Bank and Trust Company (the “Custodian”) serves as custodian to the Fund. Under a Custody Agreement with the Fund, the Custodian is responsible for the holding and safekeeping of the Fund’s assets.

6. Capital Shares

Shares will generally be offered for purchase as of the first business day of each calendar month at the NAV per Share on that date. Fractions of Shares will be issued to one one-hundredth of a Share.

No Shareholder will have the right to require the Fund to redeem Shares. With very limited exceptions, Shares are not transferable, and liquidity for investments in Shares may be provided only through periodic offers by the Fund to repurchase Shares from Shareholders.

To provide a limited degree of liquidity to Shareholders, at the sole discretion of the Board, the Fund may from time to time offer to repurchase Shares pursuant to written tenders by Shareholders.

A shareholder who tenders some but not all of its Shares for repurchase will be required to maintain a minimum account balance of $10,000. Such minimum ownership requirement may be waived by the Board, in its sole discretion. If such requirement is not waived by the Board, the Fund may redeem all of the shareholder’s Shares. To the extent a shareholder seeks to tender all of the Shares they own and the Fund repurchases less than the full amount of Shares that the shareholder requests to have repurchased, the shareholder may maintain a balance of Shares of less than $10,000 following such Share repurchase.

A 2.00% early repurchase fee may be charged by the Fund with respect to any repurchase of Shares from a shareholder at any time prior to the day immediately preceding the one-year anniversary of the shareholder’s purchase of the Shares. An early repurchase fee payable by a shareholder may be waived by the Fund in circumstances where the Board determines that doing so is in the best interests of the Fund. There can be no assurance that the Fund will conduct repurchase offers in any particular period and shareholders may be unable to tender Shares for repurchase for an indefinite period of time. During the period ended March 31, 2024, no Shares were tendered.

The Fund operates under an “opt-out” dividend reinvestment plan, pursuant to which the Fund’s distributions, net of any applicable U.S. withholding tax, are reinvested in the same class of Shares of the Fund held by the shareholder unless the investor elects to receive its distribution in cash.

| | | | | | | | | | |

| | | | | |

| 18 | | | | | | | | JPMORGAN PRIVATE MARKETS FUND | | MARCH 31, 2024 |

Transactions in Shares were as follows:

| | | | | | | | |

| | | Period Ended March 31, 2024 | |

| | | Shares | | | Dollar Amounts | |

Class D | | | | | | | | |

Sales | | | 35,409 | | | $ | 355,000 | |

| | | | | | | | |

Net increase (decrease) | | | 35,409 | | | $ | 355,000 | |

Class I | | | | | | | | |

Sales | | | 13,090,812 | | | $ | 155,016,000 | |

| | | | | | | | |

Net increase (decrease) | | | 13,090,812 | | | $ | 155,016,000 | |

Class S | | | | | | | | |

Sales | | | 8,106,733 | | | $ | 87,228,500 | |

| | | | | | | | |

Net increase (decrease) | | | 8,106,733 | | | $ | 87,228,500 | |

7. Investment Transactions

Total purchases of investments for the period ended March 31, 2024 amounted to $198,292,091. Total distribution proceeds from sale, redemption, or other disposition of investments for the period ended March 31, 2024 amounted to $6,940,583. The cost of investments for U.S. federal income tax purposes is adjusted for items of taxable income allocated to the Fund from such investments. The Fund relies upon actual and estimated tax information provided by the Portfolio Fund Managers as to the amounts of taxable income allocated to the Fund as of March 31, 2024.

8. Indemnification

In the normal course of business, the Fund may enter into contracts that provide general indemnification. The Fund’s maximum exposure under these agreements is dependent on future claims that may be made against the Fund under such agreements, and therefore cannot be established; however, based on management’s experience, the risk of loss from such claims is considered remote.

9. Risk Factors

The following are certain principal risk factors that relate to the operations and terms of the Fund. These considerations, which do not purport to be a complete description of any of the particular risks referred to or a complete list of all risks involved in an investment in the Fund, should be carefully evaluated before determining whether to invest in the Fund. The Fund’s investment program is speculative and entails substantial risks. The following risks may be directly applicable to the Fund or may be indirectly applicable through the Fund’s Private Market Investments. In considering participation in the Fund, prospective investors should be aware of certain principal risk factors, including the following:

Risks of Private Equity Strategies. The Fund’s investment portfolio will include Secondary Investments, Co-Investments and Primary Investments. The Portfolio Funds and special purpose vehicles that the Fund invests in will hold securities issued primarily by private companies. Operating results for private companies in a specified period may be difficult to determine. Such investments involve a high degree of business and financial risk that can result in substantial losses.

Less information may be available with respect to private company investments and such investments offer limited liquidity. Private companies are generally not subject to SEC reporting requirements, are not required to maintain their accounting records in accordance with generally accepted accounting principles, and are not required to maintain effective internal controls over financial reporting. As a result, there is risk that the Fund may invest on the basis of incomplete or inaccurate information, which may adversely affect the Fund’s investment performance. Private companies in which the Fund may invest also may have limited financial resources, shorter operating histories, more asset concentration risk, narrower product lines and smaller market shares than larger businesses, which tend to render such private companies more vulnerable to competitors’ actions and market conditions, as well as general economic downturns. These companies generally have less predictable operating results, may from time to time be parties to litigation, may be engaged in rapidly changing businesses with products subject to a substantial risk of obsolescence, and may require substantial additional capital to support their operations, finance expansion or maintain their competitive position. In addition, investments in private companies generally are in restricted securities that are not traded in public markets and subject to substantial holding periods. There can be no assurance that the Fund will be able to realize the value of such investments in a timely manner.

Private equity investments are subject to general market risks. Investments made in connection with acquisition transactions are subject to a variety of special risks, including the risk that the acquiring company has paid too much for the acquired business, the risk of unforeseen liabilities, the risks associated with new or unproven management or new business strategies and the risk that the acquired business will not be successfully integrated with existing businesses or produce the expected synergies.

The Fund is subject to the risks of its Private Market Investments. The Fund’s investments in Portfolio Funds are subject to a number of risks. Portfolio Fund interests are expected to be illiquid, their marketability may be restricted and the realization of investments from them may take considerable time and/or be costly. Although the Adviser will seek to receive detailed information from each Portfolio Fund regarding its business strategy and any performance history, in most cases the Adviser will have little or no means of independently verifying this information. In addition, Portfolio Funds may have little or no near-term cash flow available to distribute to investors, including the Fund.

| | | | | | | | | | |

| | | | | |

| MARCH 31, 2024 | | JPMORGAN PRIVATE MARKETS FUND | | | | | | | | 19 |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2024 (Unaudited) (continued)

Portfolio Fund interests are ordinarily valued based upon valuations provided by the Portfolio Fund Manager, which may be received on a delayed basis. Certain securities in which the Portfolio Funds invest may not have a readily ascertainable market price and are fair valued by the Portfolio Fund Managers. The Adviser reviews and performs due diligence on the valuation procedures used by each Portfolio Fund Manager and monitor the returns provided by the Portfolio Funds. However, neither the Adviser nor the Board is able to confirm the accuracy of valuations provided by Portfolio Fund Managers.

The Fund will pay asset-based fees, and, in most cases, will be subject to performance-based fees in respect of its interests in Portfolio Funds. Such fees and performance-based compensation are in addition to the Advisory Fee and Incentive Fee. In addition, performance-based fees charged by Portfolio Fund Managers may create incentives for the Portfolio Fund Managers to make risky investments, and may be payable by the Fund to a Portfolio Fund Manager based on a Portfolio Fund’s positive returns even if the Fund’s overall returns are negative. Moreover, a Shareholder in the Fund will indirectly bear a proportionate share of the fees and expenses of the Portfolio Funds, in addition to its proportionate share of the expenses of the Fund.