- MGLN Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Magellan Health (MGLN) 8-KRegulation FD Disclosure

Filed: 13 Sep 04, 12:00am

Exhibit 99.1

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Searchable text section of graphics shown above

Magellan Health Services, Inc. (MGLN)

René Lerer

President and Chief Operating Officer

Magellan Health Services, Inc.

[LOGO]

Cautionary Statement

The following schedules and statements made in this presentation constitute forward-looking statements contemplated under the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on management’s current expectations and are subject to known and unknown uncertainties and risks which could cause actual results to differ materially from those reflected, contemplated or implied by such forward-looking statements including, but not limited to, the following:

• termination or non-renewal of contracts by customers

• renegotiation of rates paid to and/or by the Company by customers and/or providers

• higher utilization of behavioral health treatment services by members

• delays, higher costs or inability to implement the Company’s initiatives

• the impact of new or amended laws or regulations

• acts of war, terrorism or other catastrophic events

• the impact of increased competition on ability to maintain or obtain contracts

• the impact of increased competition on rates paid to or by the Company

• governmental inquiries and/or litigation

• interest rate increases

• economic uncertainties

Many of these factors are beyond the control of the Company. Any and all forward-looking statements made in this presentation are qualified in their entirety by the complete discussion of risks set forth under the caption “Cautionary Statements” in Magellan’s Annual Report on Form 10-K for the year ended December 31, 2003 filed with the Securities and Exchange Commission on March 30, 2004. Magellan undertakes no obligation to update any forward-looking or cautionary statements.

2

Business Overview

Accomplishments

The Future

[LOGO]

Mental Health in the United States

• 44 million individuals (22% of American adults) have diagnosable mental disorders

• Depression is leading cause of disability in U.S.

• Direct and indirect U.S. costs estimated at $250 billion

Source: Mental Health: A Report of the Surgeon General 1999 & White House Office of National Drug Control Policy

4

Business Profile

• Magellan coordinates and manages the delivery of behavioral health care treatment:

• Mental health

• Substance abuse and chemical dependency

• Life management services

• EAP – Employee Assistance Programs

• Work Life

5

• Market leader (60M members)

• Strong financials

• Quality customer base

• Major Health Plans

• Average tenure of top 10 Health Plan accounts is 9 years

• State and local government agencies

• Fortune 1000 employers

• Leader in behavioral health management

6

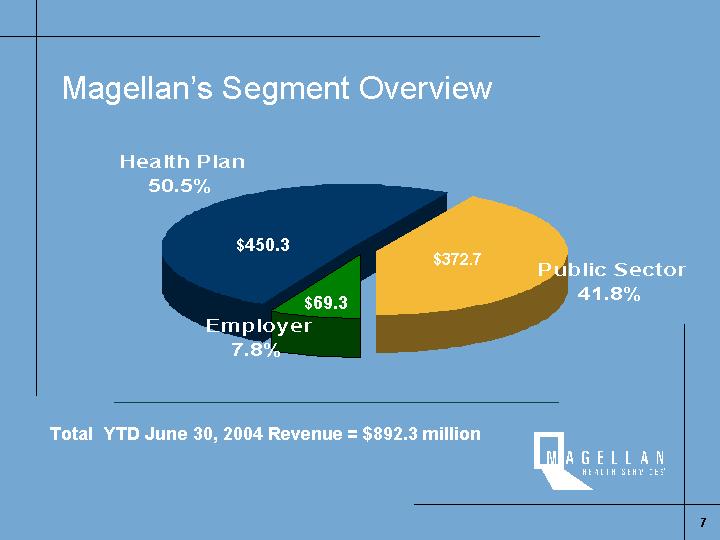

Magellan’s Segment Overview

[CHART]

Total YTD June 30, 2004 Revenue = $892.3 million

7

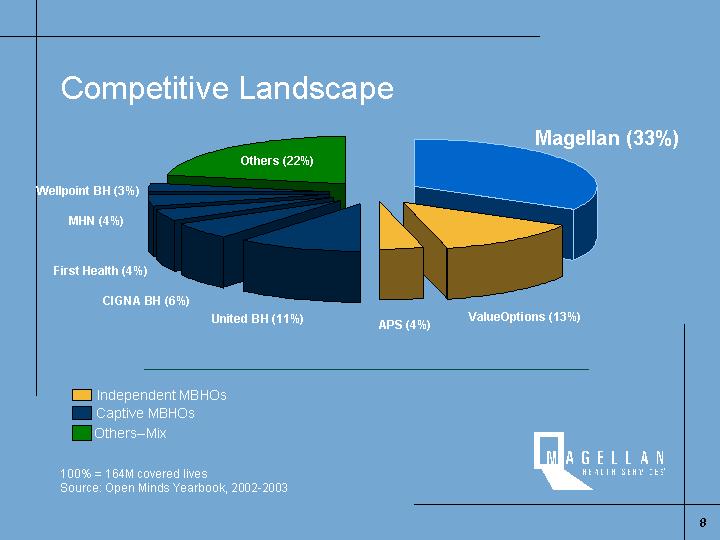

Competitive Landscape

[CHART]

100% = 164M covered lives

Source: Open Minds Yearbook, 2002-2003

8

Business Overview

Accomplishments

The Future

[LOGO]

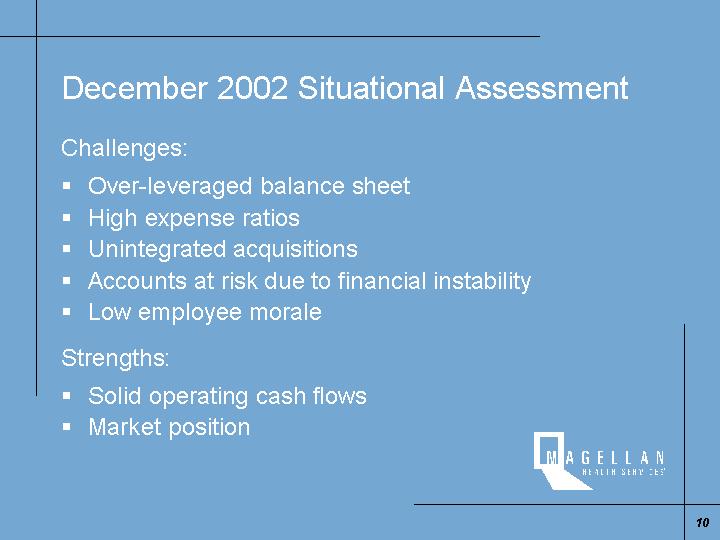

December 2002 Situational Assessment

Challenges:

• Over-leveraged balance sheet

• High expense ratios

• Unintegrated acquisitions

• Accounts at risk due to financial instability

• Low employee morale

Strengths:

• Solid operating cash flows

• Market position

10

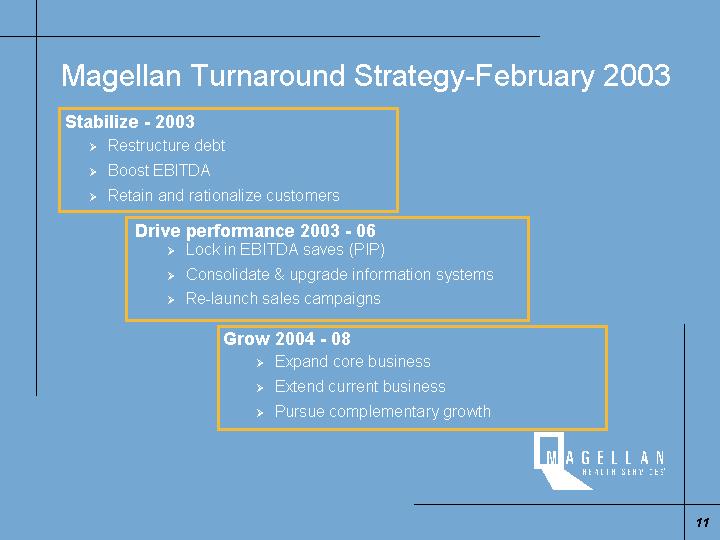

Magellan Turnaround Strategy-February 2003

Stabilize - 2003

• Restructure debt

• Boost EBITDA

• Retain and rationalize customers

Drive performance 2003 - 06

• Lock in EBITDA saves (PIP)

• Consolidate & upgrade information systems

• Re-launch sales campaigns

Grow 2004 - 08

• Expand core business

• Extend current business

• Pursue complementary growth

11

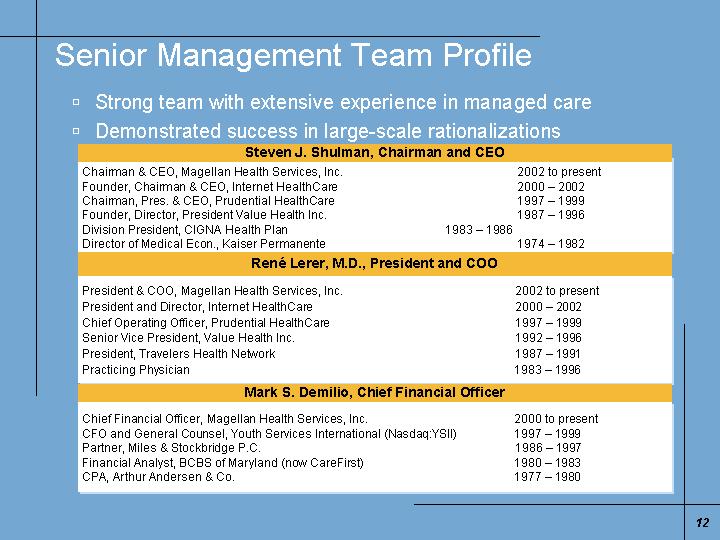

Senior Management Team Profile

• Strong team with extensive experience in managed care

• Demonstrated success in large-scale rationalizations

Steven J. Shulman, Chairman and CEO

Chairman & CEO, Magellan Health Services, Inc. |

| 2002 to present |

Founder, Chairman & CEO, Internet HealthCare |

| 2000 – 2002 |

Chairman, Pres. & CEO, Prudential HealthCare |

| 1997 – 1999 |

Founder, Director, President Value Health Inc. |

| 1987 – 1996 |

Division President, CIGNA Health Plan |

| 1983 – 1986 |

Director of Medical Econ., Kaiser Permanente |

| 1974 – 1982 |

René Lerer, M.D., President and COO

President & COO, Magellan Health Services, Inc. |

| 2002 to present |

President and Director, Internet HealthCare |

| 2000 – 2002 |

Chief Operating Officer, Prudential HealthCare |

| 1997 – 1999 |

Senior Vice President, Value Health Inc. |

| 1992 – 1996 |

President, Travelers Health Network |

| 1987 – 1991 |

Practicing Physician |

| 1983 – 1996 |

Mark S. Demilio, Chief Financial Officer

Chief Financial Officer, Magellan Health Services, Inc. |

| 2000 to present |

CFO and General Counsel, Youth Services International (Nasdaq:YSII) |

| 1997 – 1999 |

Partner, Miles & Stockbridge P.C. |

| 1986 – 1997 |

Financial Analyst, BCBS of Maryland (now CareFirst) |

| 1980 – 1983 |

CPA, Arthur Andersen & Co. |

| 1977 – 1980 |

12

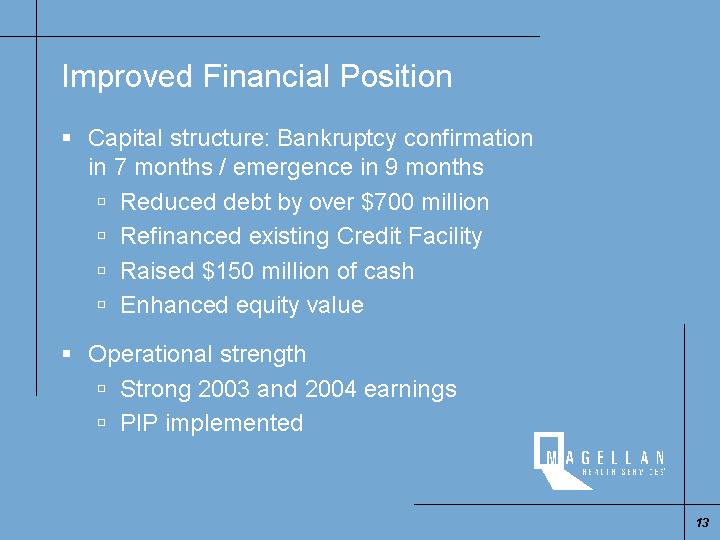

Improved Financial Position

• Capital structure: Bankruptcy confirmation in 7 months / emergence in 9 months

• Reduced debt by over $700 million

• Refinanced existing Credit Facility

• Raised $150 million of cash

• Enhanced equity value

• Operational strength

• Strong 2003 and 2004 earnings

• PIP implemented

13

Business Overview

Accomplishments

The Future

2004 Objectives

• Drive for Efficiency & Effectiveness

• Manage administrative and cost of care expenses

• Deliver excellent clinical and customer services

• Retain Customers

• Continue to foster long-term relationships

• Improve executive ownership for large accounts

• Strategically position for new growth

• Develop innovative products

15

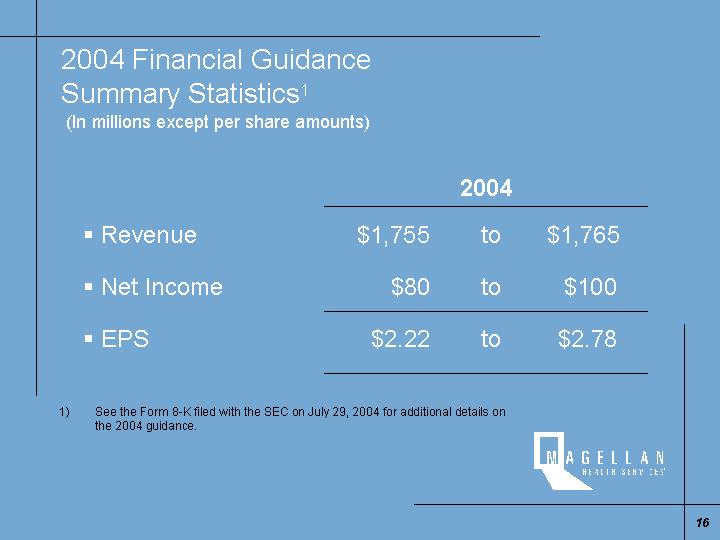

2004 Financial Guidance

Summary Statistics(1)

(In millions except per share amounts)

|

| 2004 |

| ||||||

• Revenue |

| $ | 1,755 |

| to |

| $ | 1,765 |

|

|

|

|

|

|

|

|

| ||

• Net Income |

| $ | 80 |

| to |

| $ | 100 |

|

|

|

|

|

|

|

|

| ||

• EPS |

| $ | 2.22 |

| to |

| $ | 2.78 |

|

(1) See the Form 8-K filed with the SEC on July 29, 2004 for additional details on the 2004 guidance.

16

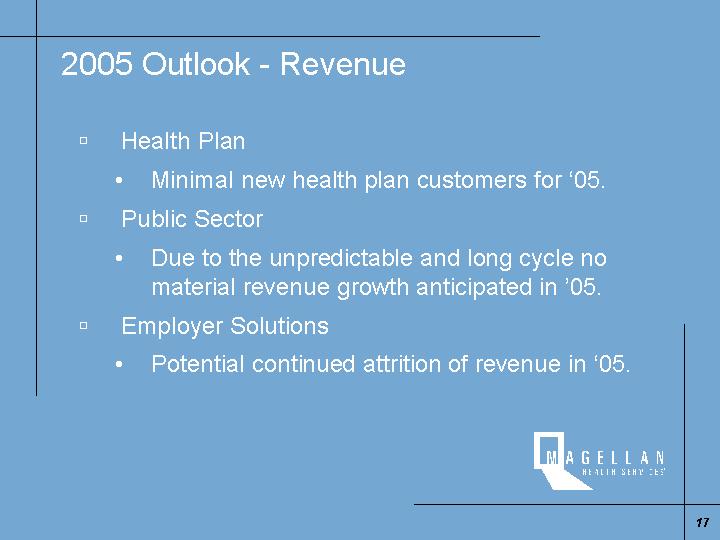

2005 Outlook - Revenue

• Health Plan

• Minimal new health plan customers for ‘05.

• Public Sector

• Due to the unpredictable and long cycle no material revenue growth anticipated in ‘05.

• Employer Solutions

• Potential continued attrition of revenue in ‘05.

17

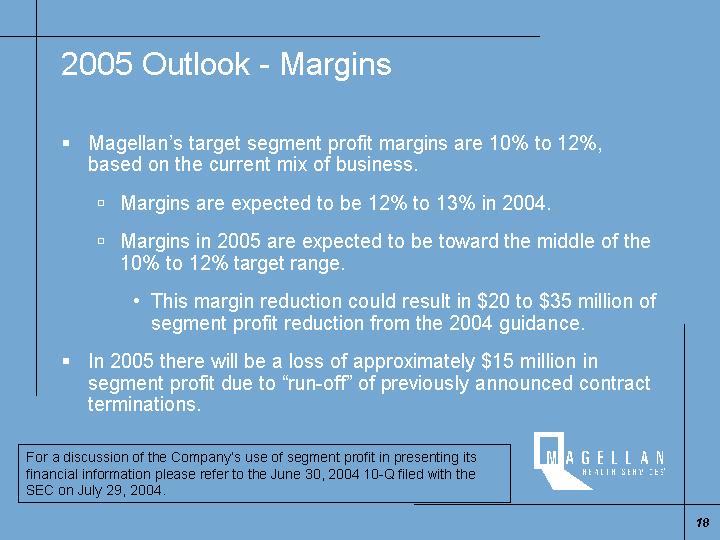

2005 Outlook - Margins

• Magellan’s target segment profit margins are 10% to 12%, based on the current mix of business.

• Margins are expected to be 12% to 13% in 2004.

• Margins in 2005 are expected to be toward the middle of the 10% to 12% target range.

• This margin reduction could result in $20 to $35 million of segment profit reduction from the 2004 guidance.

• In 2005 there will be a loss of approximately $15 million in segment profit due to “run-off” of previously announced contract terminations.

For a discussion of the Company’s use of segment profit in presenting its financial information please refer to the June 30, 2004 10-Q filed with the SEC on July 29, 2004.

18

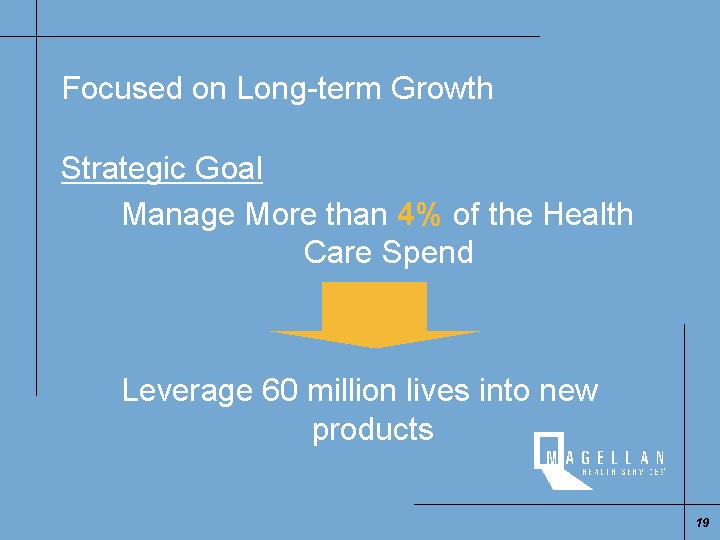

Focused on Long-term Growth

Strategic Goal

Manage More than 4% of the Health Care Spend

[GRAPHIC]

Leverage 60 million lives into new products

19

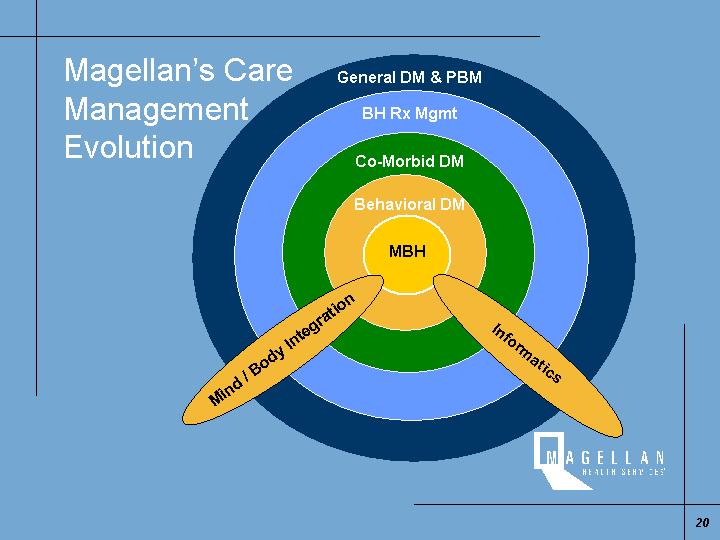

Magellan’s Care Management Evolution

[GRAPHIC]

20

Pharmacy

• If we manage Rx, we can significantly increase our opportunity…

• Up to 20% - 40% of total behavioral health cost is related to psychotropic drugs

21

U.S. Sales of Mental Health Drugs

|

| Sales in $ Billions |

|

|

| ||||

|

| 1997 |

| 2001 |

| AGR |

| ||

|

|

|

|

|

|

|

| ||

Anti-psychotics |

| $ | 1.7 |

| $ | 5.4 |

| 33.2 | % |

|

|

|

|

|

|

|

|

|

|

Anti-depressants |

| $ | 5.1 |

| $ | 12.1 |

| 23.9 | % |

Overall drug spending growth rate - 18%

Source: Frank & Conti, The President’s Mental Health Commission

22

Disease Management

• Fully integrated disease management program

• Focus on depressive diseases directly

• Focus on the depressive component of other chronic illnesses (cardiac, metabolic – including obesity, pulmonary, etc)

• Manages patients through a holistic approach to the clinical and social scenario

• Integrated data analysis and reporting

23

Disease Management

Employees at High Risk for Depression & Stress Cost More

[CHART]

Source: Goetzel et al. (1998)

24

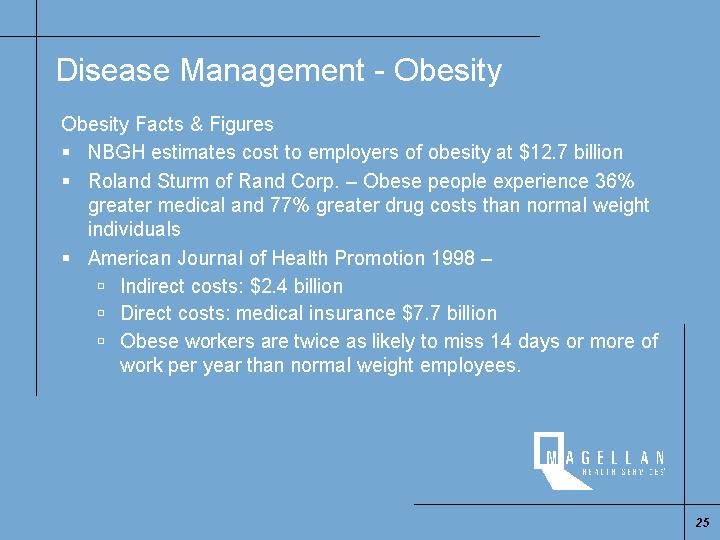

Disease Management - Obesity

Obesity Facts & Figures

• NBGH estimates cost to employers of obesity at $12.7 billion

• Roland Sturm of Rand Corp. – Obese people experience 36% greater medical and 77% greater drug costs than normal weight individuals

• American Journal of Health Promotion 1998 –

• Indirect costs: $2.4 billion

• Direct costs: medical insurance $7.7 billion

• Obese workers are twice as likely to miss 14 days or more of work per year than normal weight employees.

25

Obesity Disease Management – Product Concept

• Tiered Intervention:

• Web-based coaching, educational and support capabilities

• CM coaches provide live support for treatment plan adherence

• Specialized behavioral health network with demonstrated expertise in behavior modification specific to change management strategies for treating obesity

• Intensive care program for surgical candidates

26

Steps in Product Development

• Identify market opportunities (including market trends)

• Evaluate ability to bring value to those markets

• Explore pilots of products/relationships to address target markets

• Develop products

• Sell products

• 2004 and 2005 investing in the development of new products

27

Investment Considerations

• Market Leadership:

• 33% market share

• Superior brand; strong customer base; highly complex operating structure causes significant barriers to entry

• New Management:

• Highly experienced management team

• Financials:

• Solid financial position

• Strong cash flows

• Emerging Market:

• Well positioned to lead emerging markets

28

Magellan Health Services, Inc. (MGLN)

[LOGO]