As filed with the Securities and Exchange Commission on September 18, 2023.

No. 333-270504

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________

AMENDMENT NO. 8

FORM F-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

_____________________________________

Next.e.GO B.V.

(Exact Name of Registrant as Specified in Its Charter)

_____________________________________

The Netherlands | | 3711 | | Not Applicable |

(State or Other Jurisdiction of

Incorporation or Organization) | | (Primary Standard Industrial

Classification Code Number) | | (I.R.S. Employer

Identification Number) |

c/o Next.e.GO Mobile SE

Lilienthalstraße 1

52068 Aachen, Germany

Tel: +49 (241) 510 30 100

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

_____________________________________

Puglisi & Associates

850 Library Avenue, Suite 204

Newark, Delaware 19711

+1 (302) 738 6680

(Name, address, including zip code, and telephone number, including area code, of agent for service)

_____________________________________

Copies to:

Clemens Rechberger

Sullivan & Cromwell LLP

Neue Mainzer Straße 52 60311 Frankfurt, Germany +49 (69) 4272 5200 | | Joel L. Rubinstein Morgan Hollins White & Case LLP 1221 Avenue of the Americas New York NY 10020 (212) 819 8200 | | Daniel Nussen White & Case LLP 555 South Flower Street, Suite 2700 Los Angeles, CA 90071 (213) 620-7700 |

____________________________________

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement and all other conditions to the proposed Business Combination described herein have been satisfied or waived.

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) ☐

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

____________________________________

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary proxy statement/prospectus is not complete and may be changed. We may not issue these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary proxy statement/prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PRELIMINARY PROXY STATEMENT/PROSPECTUS

SUBJECT TO COMPLETION, DATED , 2023

PROXY STATEMENT FOR

SPECIAL MEETING OF STOCKHOLDERS

AND

SPECIAL MEETING OF WARRANT HOLDERS

OF

ATHENA CONSUMER ACQUISITION CORP.

and

PROSPECTUS FOR UP TO ORDINARY SHARES

Next.e.GO B.V.

_____________________________________

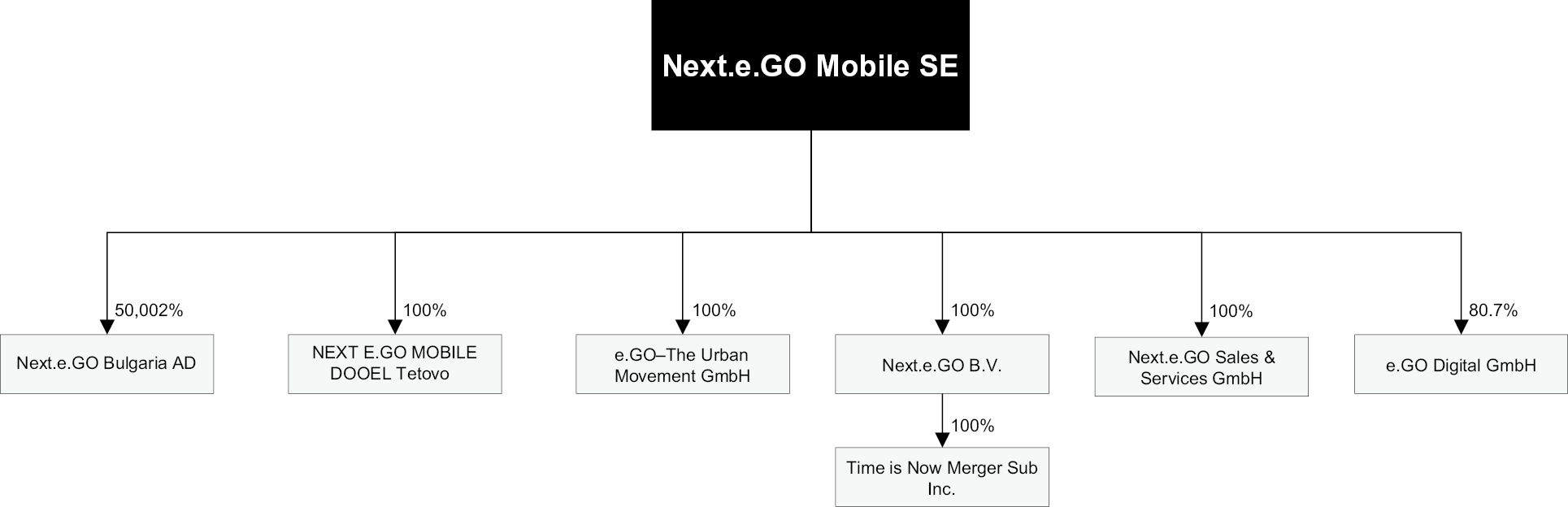

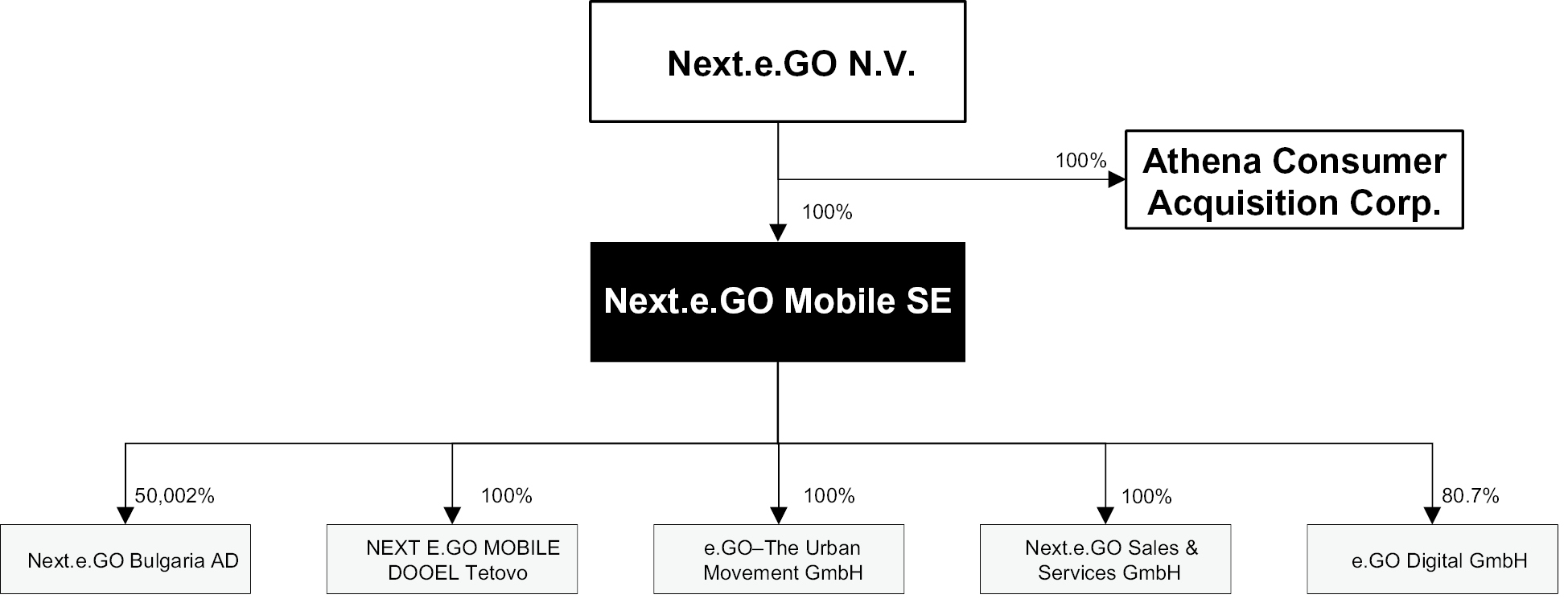

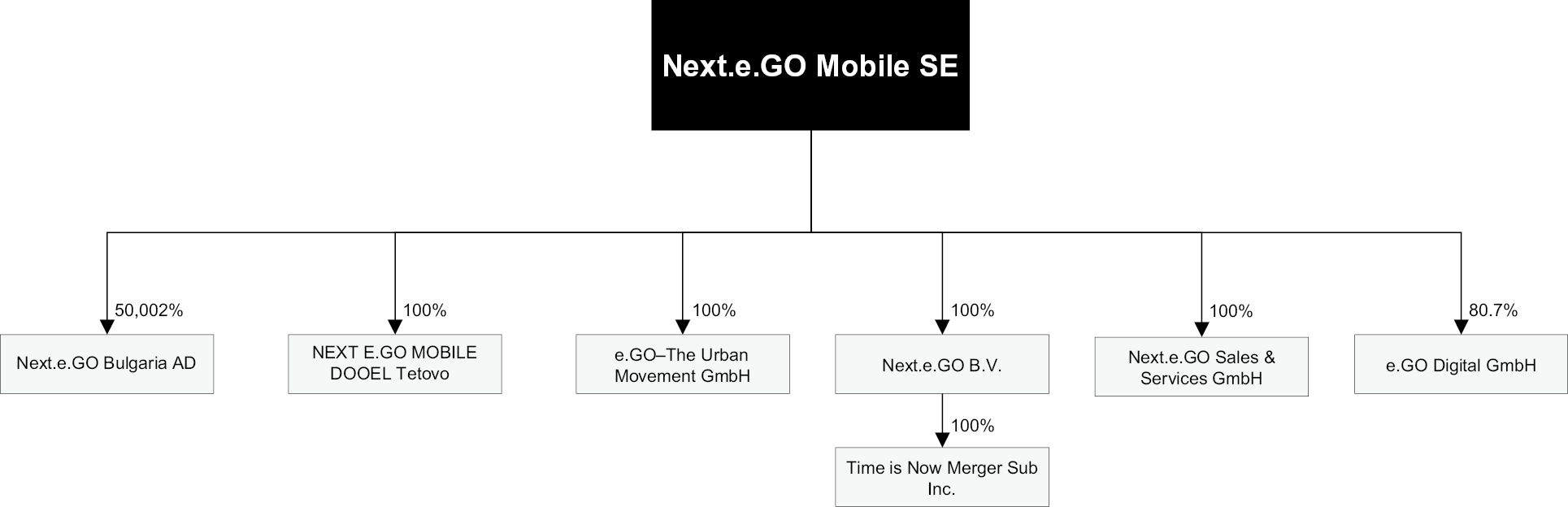

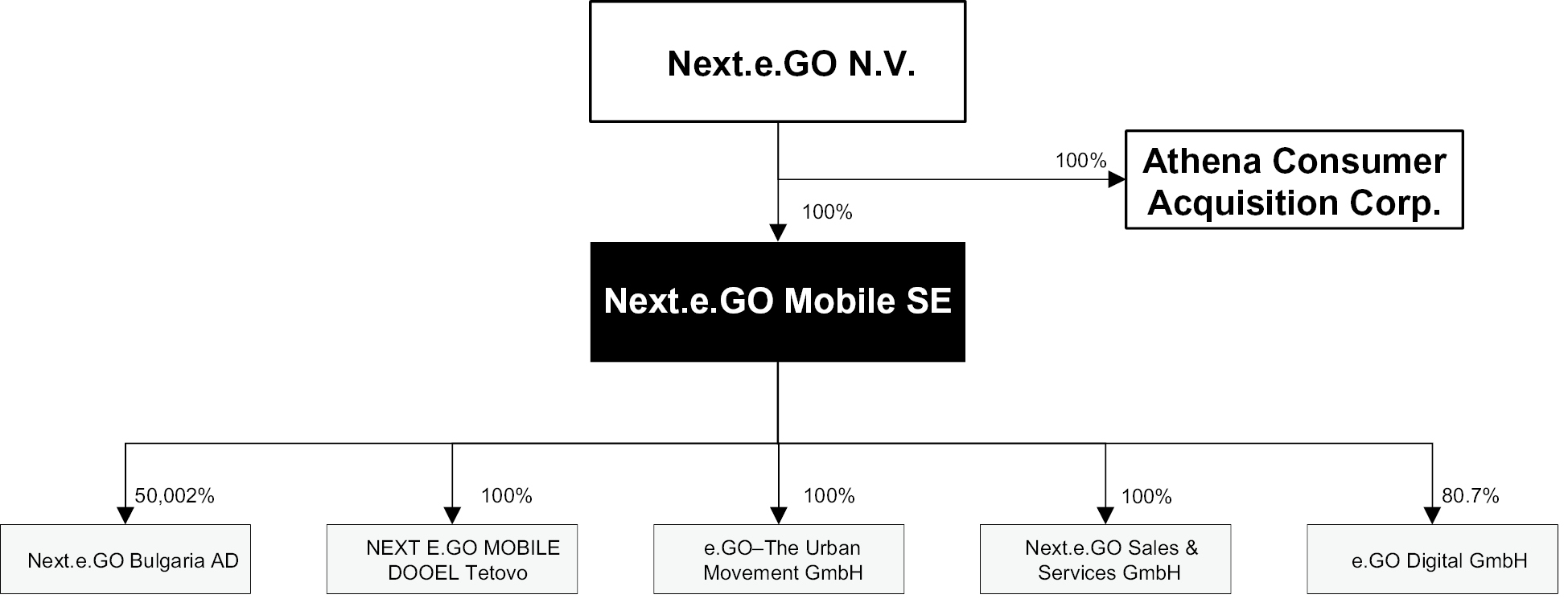

On July 26, 2022, the board of directors of Athena Consumer Acquisition Corp., a Delaware corporation (“Athena” or the “Company”), unanimously approved the business combination agreement, dated as of July 28, 2022 (as amended by the amendments to the business combination agreement, dated as of September 29, 2022, June 29, 2023, July 18, 2023, August 25, 2023, September 8, 2023, and September 11, 2023, and as may be further, supplemented or otherwise modified from time to time, the “Business Combination Agreement”), by and among Athena, Next.e.GO Mobile SE, a European company incorporated in Germany (“e.GO”), Next.e.GO B.V., a Dutch private limited liability company and a wholly-owned subsidiary of e.GO (“TopCo”), and Time is Now Merger Sub, Inc., a Delaware corporation and wholly-owned subsidiary of TopCo (“Merger Sub”), pursuant to which, among other things and upon the terms and subject to the conditions thereof: (i) TopCo will issue to the holders of e.GO’s equity securities, including certain former convertible loan lenders of e.GO (the “e.GO Shareholders”), an aggregate of up to 79,019,608 newly issued ordinary shares, nominal value €0.12 per share, of TopCo (the “TopCo Shares”), inclusive of 30,000,000 shares, 20,000,000 of which will be unvested and subject to an earn-out over a certain period, while 10,000,000 shares will vest immediately as of Closing (as defined below) and will be subject to a 12-month lock-up, in each case as described below (such 30,000,000 shares, the “Earn-Out Shares”), in exchange for the contribution by the e.GO Shareholders of all of the paid up no-par value shares (Stückaktien) shares of e.GO to TopCo and the convertible loans held by the Lenders, assuming that all e.GO Shareholders and Lenders participate in the exchange; (ii) TopCo will change its legal form from a Dutch private limited liability company (besloten vennootschap met beperkte aansprakelijkheid) to a Dutch public limited liability company (naamloze vennootschap); (iii) Merger Sub will merge with and into Athena, with Athena as the surviving company in the merger (the “Surviving Company”) (the “Merger”) and, after giving effect to the Merger, becoming a direct, wholly-owned subsidiary of TopCo; (iv) each share of Class A common stock par value $0.0001 of Athena (the “Athena Class A Common Stock”) and each issued and outstanding share of Class B common stock, par value $0.0001 per share, of Athena (the “Athena Class B Common Stock”, together with the Athena Class A Common Stock, the “Athena Common Stock”) will be converted into one share of common stock, par value $0.0001 per share, of the Surviving Company (the “Surviving Company Common Stock”); (v) immediately thereafter, each of the resulting shares of Surviving Company Common Stock will be automatically exchanged for one TopCo Share; and (vi) in connection therewith and subject to the approval of the public warrant holders of Athena (the “Athena Warrant Holders”) at the Warrant Holders Meeting (as defined below), each outstanding warrant to purchase a share of Athena Class A Common Stock (the “Athena Warrants”) will be automatically cancelled and exchanged for 0.175 TopCo Shares (the “Warrant Shares”) per Athena Warrant, with any fractional entitlement being rounded down (the “Warrant Exchange”) ((i) through (vi) together, the “Business Combination”).

Table of Contents

Prior to the closing of the Business Combination (the “Closing”), TopCo, Athena and the e.GO Shareholders will enter into an earnout agreement pursuant to which, among other things, TopCo will issue or cause to be issued to the e.GO Shareholders the Earn-Out Shares at the Closing. 20,000,000 of the Earn-Out Shares will be divided into four equal 5,000,000 share tranches, with each tranche subject to immediate vesting and release of trading and voting restrictions if the trading price per TopCo Share at any point during the trading hours of a trading day is greater than or equal to $12.50, $15.00, $20.00 and $25.00, respectively, for any 20 trading days within any period of 30 consecutive trading days during the five-year period following the Closing. The remaining 10,000,000 of such Earn-Out shares will vest immediately as of the Closing and will be subject to a 12-month lock-up.

Proposals to approve the Business Combination Agreement and the other related matters discussed in this proxy statement/prospectus will be presented at a special meeting of stockholders of Athena (the “Athena Stockholders,” and such meeting, the “Special Meeting”) initially scheduled to be held at 10:00 a.m., Eastern time, on September 21, 2023, which Athena intends to convene and then adjourn, without conducting any business, until September 28, 2023, at 1:00 p.m., Eastern Time, or at such other time on such other date to which the meeting may be postponed or further adjourned virtually via live webcast, at https://www.cstproxy.com/athenaconsumerspac/2023.

Proposals to approve the Warrant Exchange and the other related matters discussed in this proxy statement/prospectus will be presented at a special meeting of the Athena Warrant Holders (the “Warrant Holders Meeting),” and together with the Special Meeting, the “Special Meetings”) initially scheduled to be held at 10:30 a.m., Eastern time, on September 21, 2023, which Athena intends to convene and then adjourn, without conducting any business, until September 28, 2023, at 1:30 p.m., Eastern Time, or at such other time on such other date to which the meeting may be postponed or further adjourned virtually via live webcast, at https://www.cstproxy.com/athenaconsumerspac/2023.

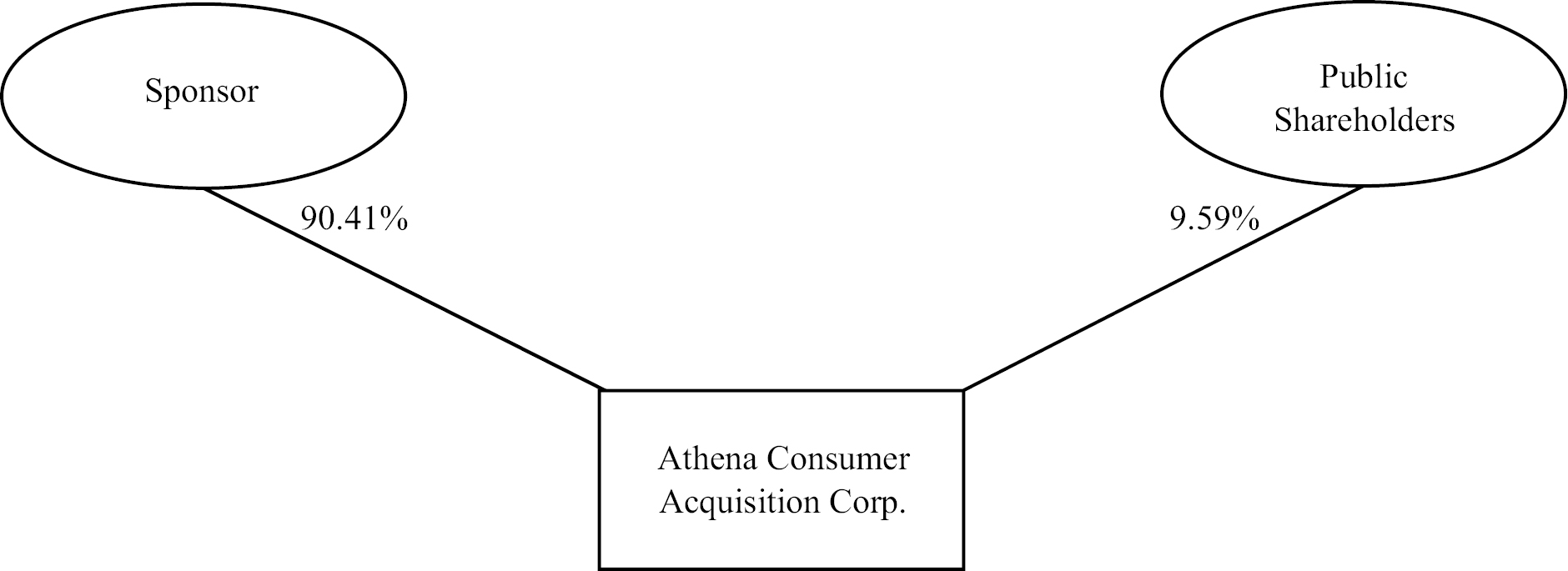

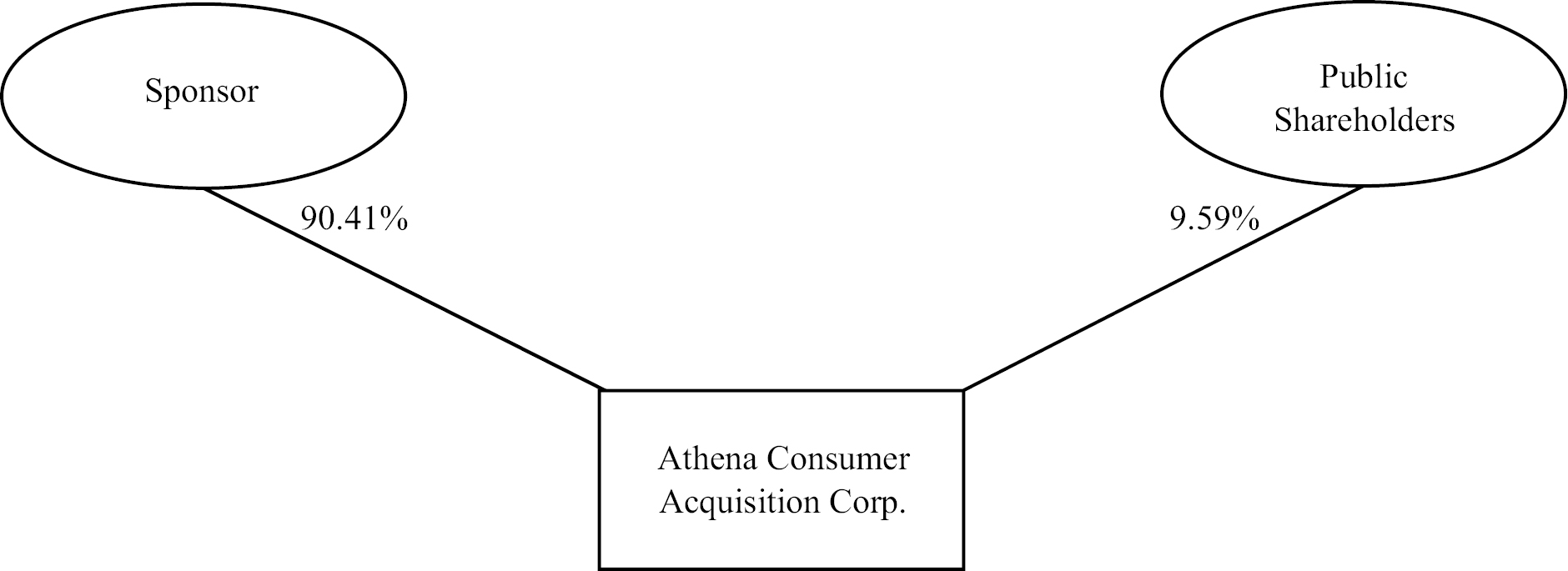

In connection with Athena’s initial public offering (the “IPO”), Athena Consumer Acquisition Sponsor LLC, a Delaware limited liability company (the “Athena Sponsor”), entered into a letter agreement pursuant to which it agreed to vote its shares of Athena Class B Common Stock purchased prior to the IPO (the “Sponsor Shares”) as well as any Athena Class A Common Stock purchased by the Athena Sponsor during or after the IPO, in favor of Athena’s initial business combination. Further, pursuant to a letter agreement dated July 28, 2022, by and among Athena, the Athena Sponsor, e.GO, TopCo and certain of Athena’s executives and officers (as amended on September 22, 2022, the “Sponsor Letter Agreement”), the Athena Sponsor agreed to vote all voting equity securities owned by it in favor of the Business Combination Agreement, the Business Combination, and all other proposals being presented at the Special Meeting. As of the date hereof and as a result of redemptions in connection with Athena’s stockholder meetings held on December 21, 2022 and July 19, 2023, respectively, to approve the extensions of the deadline date that Athena has to complete a business combination by (the “Extension Meetings”), the Athena Sponsor owns approximately 90.41% of the total outstanding shares of Athena Common Stock. The approval of the proposals being presented at the Special Meeting requires the affirmative vote of the holders of a majority of the outstanding shares of Athena Common Stock as of the record date, voting together as a single class. Accordingly, the Athena Sponsor will be able to approve all of the proposals to be presented at the Special Meeting, including approval of the Business Combination Agreement and the Business Combination, even if no Athena Public Stockholders vote in favor of approving the Business Combination or any of the proposals to be presented at the Special Meeting.

Although TopCo is not currently a public reporting company in any jurisdiction, following the effectiveness of the registration statement of which this proxy statement/prospectus is a part and the Closing, TopCo will become subject to the reporting requirements of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”). TopCo intends to apply to list the TopCo Shares on the Nasdaq Global Market LLC (“Nasdaq”), under the proposed symbol “EGOX” in connection with the Business Combination.

TopCo will be an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, and is therefore eligible to take advantage of certain reduced reporting requirements otherwise applicable to other public companies.

TopCo will be a “foreign private issuer” as defined in the Exchange Act and will be exempt from certain rules under the Exchange Act that impose certain disclosure obligations and procedural requirements for proxy solicitations under Section 14 of the Exchange Act. In addition, TopCo’s officers, directors and principal

Table of Contents

shareholders will be exempt from the reporting and “short-swing” profit recovery provisions under Section 16 of the Exchange Act. Moreover, TopCo will not be required to file periodic reports and financial statements with the U.S. Securities and Exchange Commission as frequently or as promptly as U.S. companies whose securities are registered under the Exchange Act. Additionally, Nasdaq rules allow foreign private issuers to follow home country practices in lieu of certain of Nasdaq’s corporate governance rules. As a result, its shareholders may not have the same protections afforded to shareholders of companies that are subject to all Nasdaq corporate governance requirements.

This proxy statement/prospectus provides Athena Stockholders and Athena Warrant Holders with detailed information about the Business Combination and other matters to be considered at the Special Meeting. We encourage you to read this proxy statement/prospectus, including the Annexes and other documents referred to herein, carefully and in their entirety. You should, in particular, carefully consider the risk factors described in “Risk Factors” beginning on page 53 of this proxy statement/prospectus.

The board of directors of Athena has unanimously approved and adopted the Business Combination Agreement and unanimously recommends that the Athena Stockholders and Athena Warrant Holders vote “FOR” all of the proposals presented to its stockholders. Further, the board of directors of Athena has unanimously approved the forms of amendments to the amended and restated public warrant agreement and amended and restated private warrant agreement, copies of which are attached as Annex H and Annex I to the accompanying proxy statement/prospectus, to effectuate the Warrant Exchange, and unanimously recommends that the Athena Warrant Holders vote “FOR” all of the proposals presented to its warrant holders. When you consider the board of directors’ recommendation of these proposals, you should keep in mind that certain of Athena’s directors and officers have interests in the Business Combination that may conflict with or be different from your interests as a stockholder or a warrant holder, as applicable. See the section entitled “Proposal No. 1 — The Business Combination Proposal — Interests of Athena’s Directors, Officers and Sponsor in the Business Combination” in this proxy statement/prospectus for a further discussion of these considerations.

None of the U.S. Securities and Exchange Commission, any state securities commission or the securities commission of any state or other jurisdiction has approved or disapproved of the securities to be issued in connection with the Business Combination, or determined if this proxy statement/prospectus is accurate or adequate. Any representation to the contrary is a criminal offense.

This proxy statement/prospectus dated , 2023 is first being mailed to Athena Stockholders and Athena Warrant Holders on or about , 2023.

Table of Contents

Athena Consumer Acquisition Corp.

442 5th Avenue

New York, NY 10018

NOTICE OF ADJOURNED SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON SEPTEMBER 28, 2023

TO THE STOCKHOLDERS OF ATHENA CONSUMER ACQUISITION CORP.:

NOTICE IS HEREBY GIVEN that a special meeting (the “Special Meeting”) of the stockholders of Athena Consumer Acquisition Corp., a Delaware corporation (“Athena,” “we,” “us” or “our”), initially scheduled to be held at 10:00 a.m., Eastern time, on September 21, 2023, which Athena intends to convene and then adjourn, without conducting any business, will reconvene at 1:00 p.m., Eastern Time, on September 28, 2023, in virtual format. You are cordially invited to attend the Special Meeting, which will be held for the following purposes:

1. Proposal No. 1 — The Business Combination Proposal — to consider and vote upon a proposal to approve the business combination agreement dated as of July 28, 2022 (as amended by the amendments to the business combination agreement, dated as of September 29, 2022, June 29, 2023, July 18, 2023, August 25, 2023, September 8, 2023, and September 11, 2023, and as may be further amended or restated from time to time, the “Business Combination Agreement”), by and among Athena, Next.e.GO Mobile SE, a European company incorporated in Germany (“e.GO”), Next.e.GO B.V., a Dutch private limited liability company and a wholly-owned subsidiary of e.GO (“TopCo”), and Time is Now Merger Sub, Inc., a Delaware corporation and wholly-owned subsidiary of TopCo (“Merger Sub”) and the transactions contemplated thereby (the “Business Combination”), pursuant to which, among other things, (i) Merger Sub will merge with and into Athena, with Athena surviving and continuing as a direct, wholly-owned subsidiary of TopCo (the “Merger”), (ii) after giving effect to the Merger, each issued and outstanding share of Athena Common Stock (as defined herein) will be converted into a number of shares of common stock, par value $0.0001 per share, of the company surviving the Merger (the “Surviving Company Common Stock”), (iii) immediately thereafter, each of the resulting shares of Surviving Company Common Stock will be automatically exchanged for one ordinary share, nominal value of €0.12 per share, of TopCo (the “TopCo Share”), and (iv) in connection therewith and subject to the approval of the public warrant holders of Athena (the “Athena Warrant Holders”) at the Warrant Holders Meeting (as defined below), each outstanding warrant to purchase a share of Athena Class A Common Stock (the “Athena Warrants”) will be automatically cancelled and exchanged for 0.175 TopCo Shares (the “Warrant Shares”) per Athena Warrant, with any fractional entitlement being rounded down (the “Warrant Exchange”). We refer to this proposal as the “Business Combination Proposal.” A copy of the Business Combination Agreement is attached to the accompanying proxy statement/prospectus as Annex A;

2. Proposal No. 2 — The Advisory Charter Proposals — to consider and vote upon three sub-proposals to approve and adopt, on a non-binding advisory basis, certain governance provisions in the proposed TopCo Articles of Association, which are being presented separately in accordance with the SEC guidance to give stockholders the opportunity to present their separate views on important corporate governance provisions (the “Advisory Charter Proposals”):

A. Proposal No.2A: A proposal to increase the total number of authorized shares to approximately five times the number of outstanding ordinary shares immediately after the Business Combination;

B. Proposal No.2B: A proposal to provide flexibility with respect to future share issuances and provide that the TopCo General Meeting may authorize a designated corporate body of TopCo to issue ordinary shares for up to five years;

C. Proposal No.2C: A proposal to require supermajority voting for director removal and board nomination;

3. Proposal No. 3 — The Adjournment Proposal — to consider and vote upon a proposal to approve the adjournment of the Special Meeting to a later date or dates, if necessary or appropriate, to permit further solicitation and vote of proxies in the event that there are insufficient votes for, or otherwise in connection with, the approval of any of the condition precedents set forth in the Business Combination Agreement or we determine that one or more of the conditions to Closing under the Business Combination Agreement is not satisfied or waived (the “Adjournment Proposal”).

Table of Contents

These items of business are more fully described in the accompanying proxy statement/prospectus, which we encourage you to read carefully and in its entirety before voting. Only holders of record of Athena Class A Common Stock and Athena Class B Common Stock at the close of business on August 28, 2023, the record date, are entitled to notice of the Special Meeting and to vote and have their votes counted at the Special Meeting and any adjournments or postponements of the Special Meeting. Pursuant to the Existing Athena Charter, the holders of Athena Class A Common Stock and the holders of Athena Class B Common Stock will vote together as a single class with respect to these items of business.

In connection with the Business Combination, certain related agreements have been or will be entered into prior to the Closing, including (i) the shareholder undertaking, dated July 28, 2022, by and among substantially all of the shareholders of e.GO who will receive TopCo Shares, Athena, and e.GO, (ii) the lender undertaking dated July 28, 2022, by and among substantially all of the convertible loan lenders of e.GO, Athena, and e.GO, (iii) the shareholder lock-up agreements, dated July 28, 2022, by and among substantially all of the shareholders of e.GO and TopCo, (iv) a letter agreement dated July 28, 2022, by and among Athena, the Athena Sponsor, e.GO, TopCo and certain of Athena’s executives and officers (as amended on September 22, 2022, the “Sponsor Letter Agreement”), and (v) the amended and restated registration rights agreement to be entered into by and among TopCo, Athena, the Ahena Sponsor, certain shareholders of e.GO, certain of Athena’s officers and directors, certain members of the Sponsor and/or their respective affiliates at the closing of the Business Combination. See “Related Agreements” in the accompanying proxy statement/prospectus for more information.

After careful consideration, the Athena Board has unanimously determined that the Business Combination Proposal, the Advisory Charter Proposals and the Adjournment Proposal are advisable and fair to and in the best interest of Athena and its stockholders and recommends that you vote or give instruction to vote “FOR” the Business Combination Proposal, “FOR” each of the Advisory Charter Proposals and, if presented, “FOR” the Adjournment Proposal.

When you consider the board of directors’ recommendation of these proposals, you should keep in mind that certain of Athena’s directors and officers have interests in the Business Combination that may conflict with or be different from your interests as a stockholder. See the section entitled “Proposal No. 1 — The Business Combination Proposal — Interests of Athena’s Directors, Officers and Sponsor in the Business Combination” in the accompanying proxy statement/prospectus for a further discussion of these considerations.

The Business Combination is conditioned on the approval of the Business Combination Proposal at the Special Meeting. If the Business Combination Proposal is not approved by Athena Stockholders in accordance with Athena’s governing documents, the Business Combination will not be consummated. The Business Combination is not conditioned upon the approval of the Advisory Charter Proposals or the Adjournment Proposal and none of the Advisory Charter Proposals or the Adjournment Proposal is conditioned on the approval of the other proposals.

In connection with Athena’s initial public offering (the “IPO”), Athena Consumer Acquisition Sponsor LLC, a Delaware limited liability company (the “Athena Sponsor”), entered into a letter agreement pursuant to which it agreed to vote its shares of Class B common stock, par value $0.0001 per share, of Athena (the “Athena Class B Common Stock”) purchased prior to the IPO (the “Sponsor Shares”) as well as any shares of Class A common stock, par value $0.0001 per share, of Athena (the “Athena Class A Common Stock”, together with the Athena Class B Common Stock, the “Athena Common Stock”) purchased by the Athena Sponsor during or after the IPO, in favor of Athena’s initial business combination. Further, pursuant to the Sponsor Letter Agreement, the Athena Sponsor agreed to vote all voting equity securities owned by it in favor of the Business Combination Agreement, the Business Combination, and all other proposals being presented at the Special Meeting. As of the date hereof and as a result of redemptions in connection with Athena’s stockholder meetings held on December 21, 2022 and July 19, 2023, respectively, to approve the extensions of the deadline date that Athena has to complete a business combination by (the “Extension Meetings”), the Athena Sponsor owns approximately 90.4% of the total outstanding shares of Athena Common Stock. The approval of the proposals being presented at the Special Meeting requires the affirmative vote of the holders of a majority of the outstanding shares of Athena Common Stock as of the record date, voting together as a single class. Accordingly, the Athena Sponsor will be able to approve all of the proposals to be presented at the Special Meeting, including approval of the Business Combination Agreement and the Business Combination, even if no Athena Public Stockholders vote in favor of approving the Business Combination or any of the proposals to be presented at the Special Meeting.

Table of Contents

Pursuant to the Existing Athena Charter, a holder of Public Shares (an “Athena Public Stockholder”) may request that Athena redeem all or a portion of its Public Shares for cash if the Business Combination is consummated. There will be no redemption rights upon the completion of the Business Combination, with respect to Athena Warrants or the Sponsor Shares. Assuming the Business Combination is consummated, Athena Public Stockholders will be entitled to receive cash for any Public Shares to be redeemed only if you:

(i) (a) hold Public Shares or (b) hold Public Shares through Athena Units and you elect to separate your Athena Units into the underlying Public Shares and Athena Warrants (the “Public Warrants”), prior to exercising your redemption rights with respect to the Public Shares; and

(ii) prior to 5:00 p.m., Eastern time, on September 26, 2023 (two business days prior to the scheduled date of the adjourned Special Meeting), (a) submit a written request, including the legal name, phone number and address of the beneficial owner of the shares for which redemption is requested, to Continental Stock Transfer & Trust Company, Athena’s transfer agent (the “Transfer Agent”), that Athena redeem your Public Shares for cash and (b) deliver your Public Shares to the Transfer Agent, physically or electronically through Depository Trust Company (“DTC”).

Holders of Athena Units must elect to separate the underlying Public Shares and Athena Public Warrants prior to exercising redemption rights with respect to the Public Shares. If holders hold their Athena Units in an account at a brokerage firm or bank, holders must notify their broker or bank that they elect to separate the Athena Units into the underlying Public Shares and Athena Public Warrants, or if a holder holds Athena Units registered in its own name, the holder must contact the Transfer Agent, directly and instruct it to do so. Athena Public Stockholders may elect to redeem all or a portion of their Public Shares even if they vote for the Business Combination Proposal, do not vote at all, or are not holders on the record date. If the Business Combination is not consummated, the Public Shares will not be redeemed for cash. If the Business Combination is consummated and an Athena Public Stockholder properly exercises its right to redeem its Public Shares and timely delivers its shares to the Transfer Agent, we will redeem each Public Share for a per share price, payable in cash, equal to the aggregate amount then on deposit in the trust account established in connection with our IPO (the “Trust Account”), calculated as of two business days prior to the consummation of the Business Combination, including interest earned on the funds held in the Trust Account and not previously released to us to pay our taxes, divided by the number of then issued and outstanding Public Shares. For illustrative purposes, as of August 28, 2023, the record date, this would have amounted to approximately $10.98 per Public Share, subject to deduction of allowable taxes payable. Prior to exercising redemption rights, Athena Public Stockholders should verify the market price of the Athena Class A Common Stock as they may receive higher proceeds from the sale of their Athena Class A Common Stock in the public market than from exercising their redemption rights if the market price per share is higher than the redemption price. Athena cannot assure our stockholders that they will be able to sell their Athena Class A Common Stock in the open market, even if the market price per share is higher than the redemption price stated above, as there may not be sufficient liquidity in our securities when our stockholders wish to sell their shares. If an Athena Public Stockholder exercises its redemption rights, then it will be exchanging its redeemed Public Shares for cash and will no longer own such shares. Any request to redeem Public Shares, once made, may be withdrawn at any time until the deadline for submitting redemption requests, which is 5:00 p.m., Eastern time, on September 26, 2023 (two business days prior to the scheduled date of the adjourned Special Meeting), and, thereafter, with our consent, until the Closing. If a holder of Public Shares delivers its Public Shares in connection with an election to redeem and subsequently decides prior to the deadline for submitting redemption requests not to elect to exercise such rights, it may simply request that Athena instruct the Transfer Agent to return the shares (physically or electronically). The holder can make such request by contacting the Transfer Agent, at the address or email address listed in this proxy statement/prospectus. See “Special Meeting of Athena Stockholders — Redemption Rights” in the proxy statement/prospectus for a detailed description of the procedures to be followed if you wish to redeem your Public Shares for cash.

Notwithstanding the foregoing, a holder of Public Shares, together with any affiliate of such Athena Public Stockholder or any other person with whom such Athena Public Stockholder is acting in concert or as a “group” (as defined in Section 13(d)(3) of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”)), will be restricted from redeeming its shares with respect to more than an aggregate of 15% of the shares sold in our IPO without Athena’s prior consent. Accordingly, if an Athena Public Stockholder, alone or acting in concert or as a group, seeks to redeem more than 15% of the Public Shares sold in Athena’s IPO, then any such shares in excess of that 15% limit would not be redeemed for cash without Athena’s prior consent.

Table of Contents

All Athena Stockholders are cordially invited to attend the Special Meeting virtually. To ensure your representation at the Special Meeting, however, you are urged to complete, sign, date and return the enclosed proxy card as soon as possible. If you are a stockholder of record of Athena Class A Common Stock or Athena Class B Common Stock, you may also cast your vote virtually at the Special Meeting. If your shares are held in an account at a brokerage firm or bank, you must instruct your broker or bank on how to vote your shares or, if you wish to attend the Special Meeting and vote in person, you must obtain a proxy from your broker or bank. If you do not vote or do not instruct your broker or bank how to vote, it will have no effect on the Business Combination Proposal, the Advisory Charter Proposals or the Adjournment Proposal. Abstentions will be counted as present for purposes of establishing a quorum for the Special Meeting; Broker Non-Votes will not. Broker Non-Votes means the failure of an Athena Stockholder, who holds his or her shares in “street name” through a broker or other nominee, to give voting instructions to such broker or other nominee, as to how to vote on matters deemed “non-routine”.

A complete list of the Athena Stockholders of record entitled to vote at the Special Meeting will be available for ten days before the Special Meeting at the principal executive offices of Athena for inspection by Athena Stockholders during ordinary business hours for any purpose germane to the Special Meeting.

Your vote is important regardless of the number of shares you own. Whether you plan to attend the Special Meeting or not, please sign, date and return the enclosed proxy card as soon as possible in the envelope provided. If your shares are held in “street name” or are in a margin or similar account, you should contact your broker or bank to ensure that votes related to the shares you beneficially own are properly counted. The Business Combination is conditioned on the approval of the Business Combination Proposal at the Special Meeting. Each of the proposals is more fully described in the accompanying proxy statement/prospectus, which each stockholder is encouraged to read carefully and in its entirety.

If you have any questions or need assistance voting your common stock, please contact Morrow Sodali, Athena’s proxy solicitor, by calling toll free 800-662-5200 (or banks and brokers can call 203-658-9400), or by emailing ACAQ.info@investor.morrowsodali.com. The proxy statement/prospectus relating to the Business Combination will be available at https://www.cstproxy.com/athenaconsumerspac/2023.

Thank you for your participation. We look forward to your continued support.

The accompanying proxy statement/prospectus is dated , 2023, and is first being mailed to Athena stockholders on or about , 2023.

By Order of the Board of Directors | | |

| | |

Isabelle Freidheim, Chairperson

, 2023 | | |

IF YOU RETURN YOUR PROXY CARD WITHOUT AN INDICATION OF HOW YOU WISH TO VOTE, YOUR SHARES OF ATHENA COMMON STOCK WILL BE VOTED IN FAVOR OF EACH OF THE PROPOSALS. ATHENA PUBLIC STOCKHOLDERS ARE NOT REQUIRED TO AFFIRMATIVELY VOTE FOR OR AGAINST THE BUSINESS COMBINATION PROPOSAL OR AT ALL OR TO BE A HOLDER OF RECORD ON THE RECORD DATE IN ORDER TO HAVE THEIR SHARES REDEEMED FOR CASH. TO EXERCISE REDEMPTION RIGHTS, HOLDERS MUST (1) IF THEY HOLD ATHENA CLASS A COMMON STOCK THROUGH ATHENA UNITS, ELECT TO SEPARATE THEIR ATHENA UNITS INTO THE UNDERLYING SHARES OF CLASS A COMMON STOCK AND PUBLIC WARRANTS PRIOR TO EXERCISING REDEMPTION RIGHTS, (2) SUBMIT A WRITTEN REQUEST, INCLUDING THE LEGAL NAME, PHONE NUMBER, AND ADDRESS OF THE BENEFICIAL OWNER OF THE SHARES FOR WHICH REDEMPTION IS REQUESTED, TO CONTINENTAL STOCK TRANSFER & TRUST COMPANY, ATHENA’S TRANSFER AGENT, THAT THEIR PUBLIC SHARES BE REDEEMED FOR CASH, AND (3) TENDER THEIR SHARES TO CONTINENTAL STOCK TRANSFER & TRUST COMPANY, ATHENA’S TRANSFER AGENT, NO LATER THAN 5:00 P.M., EASTERN TIME, ON SEPTEMBER 26, 2023 (TWO (2) BUSINESS DAYS PRIOR TO THE SCHEDULED DATE OF THE ADJOURNED SPECIAL MEETING). YOU MAY TENDER YOUR SHARES BY EITHER DELIVERING YOUR SHARE CERTIFICATE TO THE TRANSFER AGENT OR

Table of Contents

BY DELIVERING YOUR SHARES ELECTRONICALLY USING THE DEPOSITORY TRUST COMPANY’S DWAC (DEPOSIT/WITHDRAWAL AT CUSTODIAN) SYSTEM. IF THE BUSINESS COMBINATION IS NOT COMPLETED, THEN THESE SHARES WILL NOT BE REDEEMED FOR CASH. IF YOU HOLD THE SHARES IN STREET NAME, YOU WILL NEED TO INSTRUCT THE ACCOUNT EXECUTIVE AT YOUR BANK OR BROKER TO WITHDRAW THE SHARES FROM YOUR ACCOUNT IN ORDER TO EXERCISE YOUR REDEMPTION RIGHTS. SEE “SPECIAL MEETING OF ATHENA STOCKHOLDERS — REDEMPTION RIGHTS” FOR MORE SPECIFIC INSTRUCTIONS.

Important Notice Regarding the Availability of Proxy Materials for the adjourned Special Meeting to be held on September 28, 2023: Athena’s proxy statement/prospectus is available at https://www.cstproxy.com/athenaconsumerspac/2023.

Table of Contents

Athena Consumer Acquisition Corp.

442 5th Avenue

New York, NY 10018

NOTICE OF ADJOURNED SPECIAL MEETING OF WARRANT HOLDERS

TO BE HELD ON SEPTEMBER 28, 2023

TO THE WARRANT HOLDERS OF ATHENA CONSUMER ACQUISITION CORP.:

NOTICE IS HEREBY GIVEN that a special meeting (the “Warrant Holders Meeting”) of the holders of the Public Warrants (as defined below) of Athena Consumer Acquisition Corp., a Delaware corporation (“Athena,” “we,” “us” or “our” and, the holders of Public Warrants, “Athena Warrant Holders”), initially scheduled to be held at 10:30 a.m., Eastern time, on September 21, 2023, which Athena intends to convene and then adjourn, without conducting any business, will reconvene at 1:30 p.m., Eastern Time, on September 28, 2023, in virtual format. You are cordially invited to attend the Warrant Holders Meeting, which will be held for the following purposes:

1. Proposal No. 1 — The Warrant Amendment Proposal — to consider and vote upon an amendment to the public warrant agreement that governs all of Athena’s outstanding Public Warrants (the “Public Warrant Agreement” and, the proposed amendment, the “Warrant Amendment”). The Warrant Amendment proposes to amend the Public Warrant Agreement to provide that, upon the closing of the transactions contemplated by the Business Combination Agreement (as defined below, such closing, the “Closing”), each of the then outstanding public warrants of Athena (such warrants being the warrants of Athena issued in Athena’s initial public offering that was consummated on October 22, 2021 (the “IPO”), which entitle the holder thereof to purchase one share of Class A common stock, par value $0.0001 per share, of Athena (an “Athena Class A Common Stock”), at an exercise price of $11.50 per share (the “Public Warrants”)) will, in connection with the Merger (as defined below), be cancelled and exchanged for 0.175 ordinary shares, nominal value €0.12 per share, of Next.e.GO N.V. (“TopCo” and its ordinary shares, “TopCo Shares”) (such TopCo Shares to be issued in exchange for the Public Warrants, the “Warrant Shares”) per Athena Warrant, with any fractional entitlement being rounded down (the “Warrant Exchange” and such proposal, the “Warrant Amendment Proposal”), the substantive text of which is attached to the accompanying proxy statement/prospectus as Annex H; and

2. Proposal No. 2 — The Warrant Holders Adjournment Proposal — to consider and vote upon a proposal to approve the adjournment of the Warrant Holders Meeting to a later date or dates, if necessary or appropriate, to permit further solicitation and vote of proxies if, based upon the tabulated vote at the time of the Warrant Holders Meeting, the Warrant Amendment Proposal would not be duly approved and adopted by the holders of the requisite amount of the then outstanding Public Warrants or we determine that one or more of the Closing conditions under the Business Combination Agreement is not satisfied or waived (the “Warrant Holders Adjournment Proposal” and, together with the Warrant Amendment Proposal, the “Warrant Holder Proposals”).

On July 28, 2022, Athena, Next.e.GO Mobile SE, a European company incorporated in Germany (“e.GO”), TopCo, a Dutch private limited liability company and a wholly-owned subsidiary of e.GO, and Time is Now Merger Sub, Inc., a Delaware corporation and wholly-owned subsidiary of TopCo (“Merger Sub”) entered into a business combination agreement (as amended by the amendments dated as of September 29, 2022, June 29, 2023 July 18, 2023, August 25, 2023, September 8, 2023, and September 11, 2023, and as may be further amended or restated from time to time, the “Business Combination Agreement”), pursuant to which, among other things, (i) Merger Sub will merge with and into Athena, with Athena surviving and continuing as a direct, wholly-owned subsidiary of TopCo (the “Merger”), (ii) after giving effect to the Merger, each issued and outstanding share of common stock of Athena will be converted into a number of shares of common stock, par value $0.0001 per share, of the company surviving the Merger (the “Surviving Company Common Stock”), (iii) immediately thereafter, each of the resulting shares of Surviving Company Common Stock will be automatically exchanged for one TopCo Share, and (iv) in connection therewith and subject to the approval of the Athena Warrant Holders at the Warrant Holders Meeting, each outstanding warrant to purchase a share of Athena Class A Common Stock (the “Athena Warrants”) will be automatically cancelled and exchanged for the Warrant Shares.

Table of Contents

These items of business are more fully described in the accompanying proxy statement/prospectus, which we encourage you to read carefully and in its entirety before voting. Only holders of record of Public Warrants at the close of business on August 28, 2023, the record date, are entitled to notice of the Warrants Holders Meeting and to vote and have their votes counted at the Warrants Holders Meeting and any adjournments or postponements of the Warrants Holders Meeting.

The Athena Sponsor will enter into a support agreement with Athena (the “Sponsor Warrant Support Agreement”) prior to the Warrant Holders Meeting, pursuant to which the Athena Sponsor will provide its written consent to the Warrant Exchange with respect to the private placement warrants issued as part of the private placement units the Athena Sponsor purchased in connection with Athena’s IPO (such private placement warrants, the “Private Placement Warrant”) in the form of amendment attached as Annex I to this proxy statement/prospectus, which Private Placement Warrants are governed by a separate warrant agreement than the Public Warrants, subject only to the Athena Warrant Holders’ approval of the Warrant Amendment Proposal at the Warrant Holders Meeting.

After careful consideration, the Athena Board has unanimously determined that the Warrant Holder Proposals are advisable and fair to and in the best interest of Athena and Athena Warrant Holders and recommends that you vote or give instruction to vote “FOR” the Warrant Amendment Proposal and, if presented, “FOR” the Warrant Holders Adjournment Proposal.

All Athena Warrant Holders are cordially invited to attend the Warrant Holders Meeting virtually. To ensure your representation at the Warrant Holders Meeting, however, you are urged to complete, sign, date and return the enclosed proxy card as soon as possible. You may also cast your vote virtually at the Warrant Holders Meeting. If your Athena Warrants are held in an account at a brokerage firm or bank, you must instruct your broker or bank on how to vote your warrants or, if you wish to attend the Warrant Holders Meeting and vote in person, you must obtain a proxy from your broker or bank. If you do not vote or do not instruct your broker or bank how to vote, it will have no effect on the Warrant Amendment Proposal or the Warrant Holders Adjournment Proposal. Abstentions will be counted as present for purposes of establishing a quorum for the Special Meeting; Broker Non-Votes will not. Broker Non-Votes means the failure of an Athena Warrant Holder, who holds his or her warrants in “street name” through a broker or other nominee, to give voting instructions to such broker or other nominee, as to how to vote on matters deemed “non-routine”.

A complete list of the Athena Warrant Holders of record entitled to vote at the Warrant Holders Meeting will be available for ten days before the Warrant Holders Meeting at the principal executive offices of Athena for inspection by Athena Warrant Holders during ordinary business hours for any purpose germane to the Warrant Holders Meeting.

Your vote is important regardless of the number of warrants you own. Whether you plan to attend the Warrant Holders Meeting or not, please sign, date and return the enclosed proxy card as soon as possible in the envelope provided. If your warrants are held in “street name” or are in a margin or similar account, you should contact your broker or bank to ensure that votes related to the warrants you beneficially own are properly counted. Each of the Warrant Holder Proposals is more fully described in the accompanying proxy statement/prospectus, which each Athena Warrant Holder is encouraged to read carefully and in its entirety.

If you have any questions or need assistance voting your Athena Warrants, please contact Morrow Sodali, Athena’s proxy solicitor, by calling toll free 800-662-5200 (or banks and brokers can call 203-658-9400), or by emailing ACAQ.info@investor.morrowsodali.com. The proxy statement/prospectus relating to the Business Combination will be available at https://www.cstproxy.com/athenaconsumerspac/2023.

Thank you for your participation. We look forward to your continued support.

Table of Contents

The accompanying proxy statement/prospectus is dated , 2023, and is first being mailed to Athena Warrant Holders on or about , 2023.

By Order of the Board of Directors | | |

| | |

Isabelle Freidheim, Chairperson , 2023 | | |

Important Notice Regarding the Availability of Proxy Materials for the adjourned Warrant Holders Meeting to Be Held on September 28, 2023: Athena’s proxy statement/prospectus is available at https://www.cstproxy.com/athenaconsumerspac/2023.

Table of Contents

i

Table of Contents

ii

Table of Contents

REFERENCES TO ADDITIONAL INFORMATION

This proxy statement/prospectus incorporates important business and financial information that is not included in or delivered with this proxy statement/prospectus. This information is available for you to review through the SEC’s website at www.sec.gov.

You may request copies of this proxy statement/prospectus and any of the documents incorporated by reference into this proxy statement/prospectus or other publicly available information concerning Athena, without charge, by written request to 442 5th Avenue, New York, NY 10018.

In order for Athena Stockholders to receive timely delivery of the documents in advance of the adjourned Special Meeting to be held on September 28, 2023, you must request the information no later than September 21, 2023, five business days prior to the date of the Special Meeting.

In order for Athena Warrant Holders to receive timely delivery of the documents in advance of the adjourned Warrant Holders Meeting to be held on September 28, 2023, you must request the information no later than September 21, 2023, five business days prior to the date of the Warrant Holders Meeting.

1

Table of Contents

ABOUT THIS PROXY STATEMENT

This document, which forms part of a registration statement on Form F-4 filed with the U.S. Securities and Exchange Commission, or SEC, by TopCo (File No. 333-270504), constitutes a prospectus of TopCo under Section 5 of the U.S. Securities Act of 1933, as amended, or the Securities Act, with respect to the TopCo securities to be issued to Athena Stockholders, e.GO Stockholders, if the Business Combination described herein is consummated. This document also constitutes a notice of meeting and a proxy statement under Section 14(a) of the U.S. Securities Exchange Act of 1934, as amended, or the Exchange Act, with respect to (i) the Special Meeting at which Athena Stockholders will be asked to consider and vote upon a proposal to adopt the Business Combination Agreement and approve the Business Combination by the approval and adoption of the Business Combination Proposal, among other matters, and (ii) the Warrant Holders Meeting at which Athena Warrant Holders will be asked to consider and vote upon Warrant Exchange by the approval and adoption of the Warrant Amendment.

2

Table of Contents

CONVENTIONS WHICH APPLY TO THIS PROXY STATEMENT/PROSPECTUS

In this proxy statement/prospectus, unless otherwise specified or the context otherwise requires:

• “$” and “U.S. dollar” each refer to the United States dollar;

• “€” and “Euro” each refer to the Euro.

The exchange rate used for conversion between U.S. dollars and Euros is based on the Euro foreign exchange reference rate published by the European Central Bank.

3

Table of Contents

IMPORTANT INFORMATION ABOUT IFRS AND NON-IFRS FINANCIAL MEASURES

e.GO’s audited financial statements are prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IASB”) and referred to in this proxy statement/prospectus as “IFRS.” IFRS differs in certain material respects from U.S. generally accepted accounting principles (“U.S. GAAP”) and, as such, e.GO’s financial statements are not comparable to the financial statements of U.S. companies prepared in accordance with U.S. GAAP.

This proxy statement/prospectus contains non-IFRS measures that are not required by, or presented in accordance with, IFRS. e.GO presents non-IFRS measures because they are used by e.GO’s management in monitoring e.GO’s business and because e.GO believes that they and similar measures are frequently used by securities analysts, investors and other interested parties in evaluating companies in its industry.

4

Table of Contents

TRADEMARKS, SERVICE MARKS AND TRADE NAMES

The e.GO logo and other trademarks or service marks of e.GO appearing in this prospectus are the property of e.GO. Solely for convenience, some of the trademarks, service marks, logos and trade names referred to in this prospectus are presented without the ® and ™ symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensors to these trademarks, service marks and trade names. This prospectus contains additional trademarks, service marks and trade names of others. All trademarks, service marks and trade names appearing in this prospectus are, to our knowledge, the property of their respective owners. We do not intend to use or display of other companies’ trademarks, service marks, copyrights or trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

The Athena logo and other trademarks or service marks of Athena appearing in this prospectus are the property of Athena. Solely for convenience, some of the trademarks, service marks, logos and trade names referred to in this prospectus are presented without the ® and ™ symbols, but such references are not intended to indicate, in any way, that Athena will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensors to these trademarks, service marks and trade names. This prospectus contains additional trademarks, service marks and trade names of others. All trademarks, service marks and trade names appearing in this prospectus are, to Athena’s knowledge, the property of their respective owners. Athena does not intend to use or display of other companies’ trademarks, service marks, copyrights or trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

5

Table of Contents

GENERAL INFORMATION

Presentation of Financial Information

This proxy statement/prospectus contains:

• the audited consolidated financial statements of e.GO as of and for the fiscal years ended December 31, 2022 and December 31, 2021, each prepared in accordance with IFRS as issued by the IASB;

• the audited financial statements of Athena for the fiscal years ended December 31, 2022 and December 31, 2021, each prepared in accordance with U.S. GAAP;

• the unaudited interim condensed consolidated financial statements of Athena as of and for the six months ended June 30, 2023;

• the unaudited pro forma condensed combined statement of operations of TopCo for the fiscal year ended December 31, 2022, and the unaudited pro forma condensed combined balance sheet as of December 31, 2022 prepared in accordance with Article 11 of Regulation S-X.

Unless indicated otherwise, financial data presented in this document has been taken from the audited consolidated financial statements of Athena included in this document, and the audited consolidated financial statements of e.GO included in this document. Where information is identified as “unaudited,” it has not been subject to an audit.

Cautionary Note Regarding Forward-looking Statements

This proxy statement/prospectus contains forward-looking statements. Forward-looking statements provide Athena’s, e.GO’s and TopCo’s current expectations or forecasts of future events. Forward-looking statements include statements about Athena’s, e.GO’s and TopCo’s expectations, beliefs, plans, objectives, intentions, assumptions and other statements that are not historical facts. Words or phrases such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “objective,” “ongoing,” “plan,” “potential,” “predict,” “project,” “should,” “will” and “would,” or similar words or phrases, or the negatives of those words or phrases, may identify forward-looking statements, but the absence of these words does not necessarily mean that a statement is not forward-looking. Examples of forward-looking statements in this proxy statement/prospectus include, but are not limited to, statements regarding TopCo’s disclosure concerning e.GO’s operations, cash flows, financial position and dividend policy.

Forward-looking statements appear in a number of places in this proxy statement/prospectus including, without limitation, in the sections entitled “e.GO’s Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Athena’s Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Business of Athena and Certain Information About Athena” and “Business of e.GO and Certain Information About e.GO.” The risks and uncertainties include, but are not limited to:

• changes in domestic and foreign business, market, financial, political and legal conditions;

• the inability of the parties to successfully or timely consummate the proposed Business Combination, including the risk that any required regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the proposed Business Combination or that the approval of the stockholders of Athena or e.GO or Athena Warrant Holders is not obtained;

• failure to realize the anticipated benefits of the proposed Business Combination;

• risks relating to the uncertainty of the projected financial information with respect to e.GO;

• the outcome of any legal proceedings that may be instituted against Athena and/or e.GO following the announcement of the Business Combination;

6

Table of Contents

• future global, regional or local economic and market conditions;

• the development, effects and enforcement of laws and regulations;

• e.GO’s ability to grow and achieve its business objectives;

• the effects of competition on e.GO’s future business;

• the amount of redemption requests made by Athena Public Stockholders;

• the ability of Athena or the combined company to issue equity or equity-linked securities in the future;

• the ability of e.GO and Athena to raise interim financing in connection with the Business Combination, including to secure a senior secured note;

• the outcome of any potential litigation, government and regulatory proceedings, investigations and inquiries;

• the risk that the proposed Business Combination disrupts current plans and operations as a result of the announcement and consummation;

• costs related to the Business Combination;

• the impact of the global COVID-19 pandemic; and

• those factors discussed below under the heading “Risk Factors” and in the documents filed, or to be filed, by Athena and TopCo with the SEC.

Forward-looking statements are subject to known and unknown risks and uncertainties and are based on potentially inaccurate assumptions that could cause actual results to differ materially from those expected or implied by the forward-looking statements. Actual results could differ materially from those anticipated in forward-looking statements for many reasons, including the factors described in “Risk Factors” in this proxy statement/prospectus. Accordingly, you should not rely on these forward-looking statements, which speak only as of the date of this proxy statement/prospectus. None of Athena, e.GO nor TopCo undertake any obligation to publicly revise any forward-looking statement to reflect circumstances or events after the date of this proxy statement/prospectus or to reflect the occurrence of unanticipated events. You should, however, review the factors and risks TopCo describes in the reports it will file from time to time with the SEC after the date of this proxy statement/prospectus.

In addition, statements that “Athena believes,” “e.GO believes” or “TopCo believes” (as applicable) and similar statements reflect Athena’s, e.GO’s or TopCo’s (as applicable) beliefs and opinions on the relevant subject. These statements are based on information available to Athena, e.GO and TopCo (as applicable) as of the date of this proxy statement/prospectus. While Athena, e.GO and TopCo (as applicable) each believe that information provides a reasonable basis for these statements, that information may be limited or incomplete. None of Athena’s, e.GO’s nor TopCo’s (as applicable) statements should be read to indicate that it has conducted an exhaustive inquiry into, or review of, all relevant information. These statements are inherently uncertain, and you are cautioned not to unduly rely on these statements.

Although Athena, e.GO and TopCo (as applicable) each believe the expectations reflected in the forward-looking statements were reasonable at the time made, none of Athena, e.GO nor TopCo (as applicable) can guarantee future results, level of activity, performance or achievements. Moreover, none of Athena, e.GO, TopCo nor any other person or entity assumes responsibility for the accuracy or completeness of any of these forward-looking statements, nor does any of Athena, e.GO or TopCo assume any obligation to update forward-looking statements set forth in this proxy statement/prospectus. You should carefully consider the cautionary statements contained or referred to in this section in connection with the forward-looking statements contained in this proxy statement/prospectus and any subsequent written or oral forward-looking statements that may be issued by Athena, e.GO or TopCo (in each case, as applicable) or persons acting on its behalf.

7

Table of Contents

FREQUENTLY USED TERMS AND BASIS OF PRESENTATION

Unless otherwise stated or unless the context otherwise requires, the term “Company” refers to Next e.GO Mobile SE, a company organized under the laws of Germany; the term “Athena” refers to Athena Consumer Acquisition Corp., a Delaware corporation; the term “TopCo” refers to Next.e.GO B.V., a Dutch private limited liability company (besloten vennootschap met beperkte aansprakelijkheid) and a wholly-owned subsidiary of e.GO.

In addition, in this proxy statement/prospectus:

“80% Test” means a requirement under the Existing Athena Charter that Athena’s initial business combination must be comprised of one or more business combinations having an aggregate fair market value of at least 80% of the value of the assets held in the Trust Account (excluding the deferred underwriting commissions and taxes payable on interest earned on the Trust Account) at the time Athena signs a definitive agreement in connection with its initial business combination.

“Adjournment Proposal” means the proposal to approve the adjournment of the Special Meeting to a later date or dates, if necessary or appropriate, to permit further solicitation and vote of proxies in the event that there are insufficient votes for, or otherwise in connection with, the approval of any of the condition precedent set forth in the Business Combination Agreement or if one or more of the closing conditions under the Business Combination Agreement is not satisfied or waived.

“Advisory Charter Proposals” mean the proposals to approve and adopt, on a non-binding advisory basis, certain governance provisions in the proposed TopCo Articles of Association.

“Amended and Restated Registration Rights Agreement” means that certain amended and restated registration rights agreement to be entered into by and among TopCo, Athena, the Athena Sponsor and certain former shareholders of e.GO, which shall be effective as of the Closing of the Business Combination and which shall be substantially in the form attached hereto as Annex G.

“Ancillary Documents” means, collectively, the Sponsor Letter Agreement, the Amended and Restated Registration Rights Agreement, the Shareholders’ Undertakings, the Lenders’ Undertakings, the Earnout Agreement, and the Shareholder Lock-Up Agreements.

“Athena” means Athena Consumer Acquisition Corp., a Delaware corporation.

“Athena Board” means the board of directors of Athena.

“Athena Breach Termination Event” means if Athena fails to comply in all material respects with any covenant or agreement set forth in the Business Combination Agreement such that certain conditions to Closing cannot be satisfied and the breach or breaches of such representations or warranties or the failure to perform such covenant or agreement, as applicable, are not cured or cannot be cured within certain specified time periods.

“Athena Class A Common Stock” means the Class A common stock par value $0.0001 per share, of Athena.

“Athena Class B Common Stock” means the Class B common stock, par value $0.0001 per share, of Athena.

“Athena Common Stock” means collectively the shares of Athena Class A Common Stock and Athena Class B Common Stock.

“Athena Public Stockholders” means the holders of Public Shares, including the Athena Sponsor and the directors and officers of Athena to the extent they hold Public Shares, provided, that the Athena Sponsor or any of the directors and officers of Athena will be considered a “Public Stockholder” only with respect to any Public Shares held by them.

“Athena Sponsor” or “Sponsor” means Athena Consumer Acquisition Sponsor, LLC, a Delaware limited liability company.

“Athena Stockholder” means a holder of Athena Common Stock.

“Athena’s Transaction Expenses” means the fees and expenses incurred by or on behalf of Athena in connection with the preparation, negotiation and execution of the Business Combination Agreement and the other Transaction Agreements and the consummation of the Business Combination (i) the fees and disbursements of

8

Table of Contents

outside counsel to Athena (including its direct and indirect equity holders), (ii) the fees and expenses of accountants to Athena, (iii) the fees and expenses of the consultants and other advisors to Athena, (iv) the fees and disbursements of bona fide third-party investment bankers and financial and capital markets advisors to Athena, (v) the Deferred Discount (as defined in the Trust Agreement), (vi) loans from the Athena Sponsor or affiliates of the Athena Sponsor or certain of Company’s officers and directors and (vii) any premiums, fees, disbursements, costs or expenses incurred in connection with any tail insurance policy for the directors’ and officers’ liability insurance of Athena.

“Athena Units” means the equity securities of Athena issued in the IPO, each consisting of one (1) share of Athena Class A Common Stock and one-half of one (0.5) Public Warrant.

“Athena Warrant” means a warrant to purchase one share of Athena Class A Common Stock at the price of $11.50 per share, in accordance with the terms of the Warrant Agreements, and includes Public Warrants and Private Placement Warrants.

“Athena Warrant Holders” means the holders of Athena Public Warrants.

“Bridge Financing” means the credit agreement dated September 29, 2022 and as amended on October 17, 2022, and settled in accordance with a settlement and release agreement dated June 29, 2023, between e.GO, Brucke Funding LLC and certain lenders thereto, and Brucke Agent LLC as administrative and collateral agent and the financing provided thereunder.

“Broker Non-Vote” means the failure of an Athena Stockholder, who holds his or her shares in “street name” through a broker or other nominee, to give voting instructions to such broker or other nominee, as to how to vote on matters deemed “non-routine”.

“Business Combination” means all of the transactions contemplated by the Business Combination Agreement and the other transaction documents, including (i) the Merger; (ii) the Exchange and (iii) the Conversion. For accounting and financial reporting purposes, the Exchange will be accounted for as a recapitalization under IFRS, while the other transactions will be accounted for based on IFRS 2 (Share-based Payment).

“Business Combination Agreement” means that certain business combination agreement, dated as of July 28, 2022, by and among Athena, e.GO, TopCo, and Merger Sub, which is attached hereto as Annex A-1, as such agreement may be amended or otherwise modified from time to time in accordance with its terms, including as amended by the first amendment to Business Combination Agreement dated September 29, 2022 which is attached hereto as Annex A-2, the second amendment to Business Combination Agreement dated June 29, 2023 which is attached hereto as Annex A-3, the third amendment to Business Combination Agreement dated July 18, 2023 which is attached hereto as Annex A-4, the fourth amendment to Business Combination Agreement dated August 25, 2023 which is attached hereto as Annex A-5, the fifth amendment to Business Combination Agreement dated September 8, 2023 which is attached hereto as Annex A-6 and the sixth amendment to Business Combination Agreement dated September 11, 2023 which is attached hereto as Annex A-7.

“Business Combination Proposal” means the proposal to adopt the Business Combination Agreement and approve the transactions contemplated thereby, including the Business Combination.

“Change in Legal Form of TopCo” means the transactions whereby TopCo will change its legal form from a Dutch private limited liability company (besloten vennootschap met beperkte aansprakelijkheid) to a Dutch public company (naamloze vennootschap).

“Closing” means the closing of the transactions contemplated by the Business Combination Agreement.

“Closing Date” means the date on which the Closing shall occur.

“Company” means e.GO, unless the context requires otherwise.

“Conversion” means the conversion of the entire loan amount granted to e.GO under the Convertible Loan Agreements plus accrued interest thereunder into (a) e.GO Common Stock or (b) TopCo Shares by way of an issuance of TopCo Shares, including the relevant Earn-Out Shares, through the execution of a Dutch notarial deed of issuance against contribution in kind of all the claims arising from the Convertible Loan Agreements as contemplated by the Lender Undertaking. Fractional interests may be settled in cash. Five of the Convertible

9

Table of Contents

Loan Agreements with a nominal amount of €65,000 have been repaid, including accrued interest, in August 2023 and all other Convertible Loan Agreements were converted into common shares of e.GO by a contribution and assignment agreement with e.GO and the relevant lenders dated June 26, 2023 and by the registration of the capital increase against contribution in kind in the commercial register of Aachen on July 4, 2023. The claims under these Convertible Loan Agreements were converted into 17,026 common shares of e.GO.

“Convertible Loan Agreements” means the convertible loan agreements in the total nominal amount of €40,935,000 between the Company and certain lenders (all of which ceased to be in effect upon the consummation of the Conversion or their repayment, as the case may be, as described in the definition of “Conversion”).

“COVID-19” means a strain of the coronavirus and the infectious disease caused by it.

“DCGC” means the Dutch Corporate Governance Code, as amended from time to time.

“DGCL” means the Delaware General Corporation Law, as amended.

“DTC” means The Depository Trust Company.

“Earnout Agreement” means that certain Earnout Agreement, to be agreed amongst the parties to the Business Combination Agreement prior to the Closing, form of which is attached hereto as Annex J.

“e.GO” means Next.e.GO Mobile SE, a European company organized under German and European law.

“e.GO Common Stock” means 144,879 paid up registered shares with restricted transferability (vinkulierte Namensaktien) of e.GO in the nominal amount of €1.00 per share as of July 28, 2022; provided that, if the Conversion is effected through conversion into shares of e.GO, the term e.GO Common Stock shall also include such shares of e.GO that will be issued as a result of the Conversion. Following the Conversion of certain Convertible Loan Agreements into 17,026 shares of e.GO by a contribution and assignment agreement with e.GO and the relevant lenders dated June 26, 2023 and by the registration of the capital increase against contribution in kind in the commercial register of Aachen on July 4, 2023, the e.GO Common Stock as of July 4, 2023 amounts to 161,905 paid up registered shares with restricted transferability (vinkulierte Namensaktien) of e.GO in the nominal amount of €1.00 per share.

“e.GO Group” means e.GO together with its consolidated subsidiaries.

“e.GO Shareholder” means any holder of e.GO Shares, including, since the consummation of the Conversion, certain former Lenders who received e.GO Shares as part of the Conversion.

“e.GO Shares” means ordinary shares of e.GO.

“Effective Time” means the effective time of the Business Combination pursuant to the Business Combination Agreement and the DGCL.

“Exchange” means the exchange for the contribution by the Participating Shareholders, pursuant to the Shareholders’ Undertakings and the Lenders’ Undertakings, as the case may be, of all of the paid up shares in e.GO to TopCo, deemed to have an aggregate value of $500 million under the Business Combination Agreement, in exchange for TopCo Shares.

“Exchange Act” means the Securities Exchange Act of 1934, as amended, together with the rules and regulations promulgated thereunder.

“Exchange Agent” means Continental Stock Transfer & Trust Company (or another entity selected by Athena and reasonably satisfactory to Merger Sub to act as exchange agent in connection with the Business Combination).

“Existing Athena Charter” means Athena’s amended and restated certificate of incorporation, as amended on December 21, 2022, and July 19, 2023.

“Gross Closing Proceeds” means the funds contained in the Trust Account maintained by Athena, together with the cash on Athena’s balance sheet and the aggregate amount of gross proceeds from any subscription or investment agreement entered into by Merger Sub, TopCo or Athena between the date of the Business Combination Agreement and Closing, after giving effect to the Redemptions, but before giving effect to the payment of Athena’s Transaction Expenses.

10

Table of Contents

“Interim Financing” means up to $50 million in proceeds that may be obtained by e.GO in a private financing prior to the Closing.

“Investment Company Act” means the Investment Company Act of 1940, as amended.

“IPO” means Athena’s initial public offering, consummated on October 22, 2021 of 23,000,000 Athena Units (including 3,000,000 Athena Units sold pursuant to the underwriters’ exercise in full of their over-allotment option) at $10.00 per Athena Unit, with each Athena Unit consisting of one share of Athena Class A Common Stock and one-half of one Athena Public Warrant.

“IRS” means the U.S. Internal Revenue Service.

“JOBS Act” means the Jumpstart Our Business Startups Act of 2012.

“Lenders” means the lenders under the Convertible Loan Agreements.

“Lenders’ Undertakings” means, collectively, the irrevocable lenders’ undertakings certain lenders of e.GO entered into concurrently with, or following, the execution of the Business Combination Agreement.

“Liquidation Date” means the date by which Athena will have to complete its initial business combination. The Existing Athena Charter provides that Athena has 22 months from the closing of IPO, or August 22, 2023, to complete its initial business combination and that Athena has the right, without a stockholder vote, to extend the Liquidation Date up to two times by an additional one month each time from August 22, 2023 to up to October 22, 2023 (the date which is 24 months from the closing date of the IPO). As of the date of this prospectus/proxy statement, Athena currently has until October 22, 2023, which is 24 months from the closing of IPO to complete its initial business combination.

“Merger” means the merger of Merger Sub with and into Athena, with Athena being the surviving company.

“Merger Sub” means Time is Now Merger Sub, Inc., a Delaware corporation.

“Minimum Cash Condition” is a closing condition set forth in the Business Combination Agreement that provides that Merger Sub will not be required to consummate the Business Combination if the Gross Closing Proceeds do not equal or exceed the sum of Athena’s and e.GO’s transaction expenses with respect to the Transactions (as further described and defined in the Business Combination Agreement). The Minimum Cash Condition may be waived by e.GO in its sole discretion.

“Morrow Sodali” means Morrow Sodali LLC, proxy solicitor to Athena in connection with the Special Meetings.

“Nasdaq” means the Nasdaq Global Market LLC.

“No Redemptions Scenario” means the hypothetical scenario in which no Athena Public Stockholder elects to have its Public Shares redeemed in connection with the Business Combination. The “no redemption scenario” already incorporates the exercised redemptions as a result of the extension meeting held on December 21, 2022 and the extension meeting held on July 19, 2023.

“Note Purchase Agreement” means the note purchase and guaranty agreement in relation to the Senior Secured Notes dated June 30, 2023 between e.GO as issuer, TopCo, E.GO – The Urban Movement GmbH, Next.e.GO Sales & Services GmbH and Merger Sub as guarantors, Echo IP Series 1 LLC as collateral agent, UMB Bank, N.A. as note administrative and certain funds as note purchasers thereto managed by Western Asset as investment manager.

“NYSE” means the New York Stock Exchange.

“NYSE American” means the NYSE American LLC.

“Participating Shareholders” means (i) each of the shareholders of e.GO that duly executed and delivered a Shareholders’ Undertaking agreeing to participate in the transaction prior to the Closing, and (ii), given that the Conversion was effected through conversion into shares of e.GO, any lender who duly executed and delivered a Lenders’ Undertaking.

11

Table of Contents

“Pre-Closing e.GO Shareholders” means all of the shareholders of e.GO prior to the Closing and the persons who will become shareholders of e.GO following the roll-up and the Conversion, provided that the Conversion is effected through conversion into shares of e.GO (each of which will receive TopCo Shares in the Exchange at Closing).

“Private Placement Shares” means the shares of Athena Class A Common Stock in the Private Placement Units.

“Private Placement Units” means the equity securities of Athena issued in a private sale to the Athena Sponsor simultaneously with the consummation of the IPO, each consisting of one (1) share of Athena Class A Common Stock and one-half of one (0.5) Private Placement Warrant.

“Private Placement Warrants” means the Sponsor Warrants.

“Private Warrant Agreement” means the amended and restated private warrant agreement, dated as of March 24, 2022, between Athena and Continental Stock Transfer & Trust Company, as warrant agent (the “Warrant Agent”).

“Public Shares” means the shares of Athena Class A Common Stock in the Athena Units issued in the IPO.

“Public Warrants” means warrants to acquire Athena Class A Common Stock, issued as part of the Athena Units, at an initial exercise price of $11.50 per share.

“Public Warrant Agreement” means the amended and restated public warrant agreement, dated as of March 24, 2022, between Athena and the Warrant Agent.

“Required Company Shareholders’ Consent” means the approval of the termination of the Series C Shareholders’ Agreement dated August 12, 2021 by and between, among others, the Company and certain investors.

“Sarbanes-Oxley Act” means the Sarbanes-Oxley Act of 2002.

“SEC” means the U.S. Securities and Exchange Commission.

“Securities Act” means the U.S. Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder.

“Senior Secured Notes” means the promissory notes that e.GO issued on June 30, 2023, to third-party note purchasers to be secured by certain guaranties, pledges in shares of certain subsidiaries and e.GO and liens on company assets of e.GO and insured by certain insurers in the initial gross amount of $75 million and a potential additional issue in the gross amount of $25 million.

“Shareholders’ Undertakings” means, collectively, the irrevocable shareholders’ undertakings the Pre-Closing e.GO Shareholders entered into concurrently with, or following, the execution of the Business Combination Agreement.