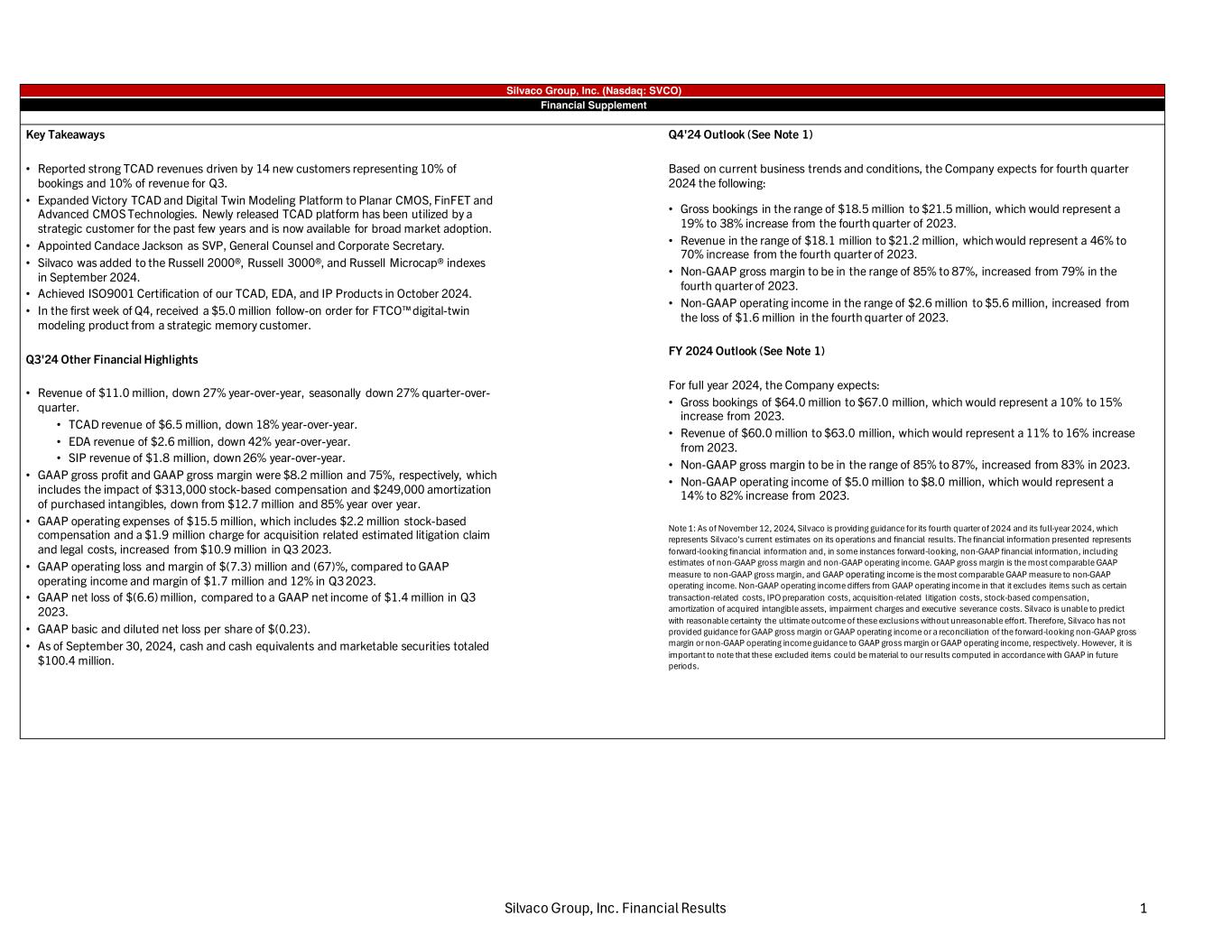

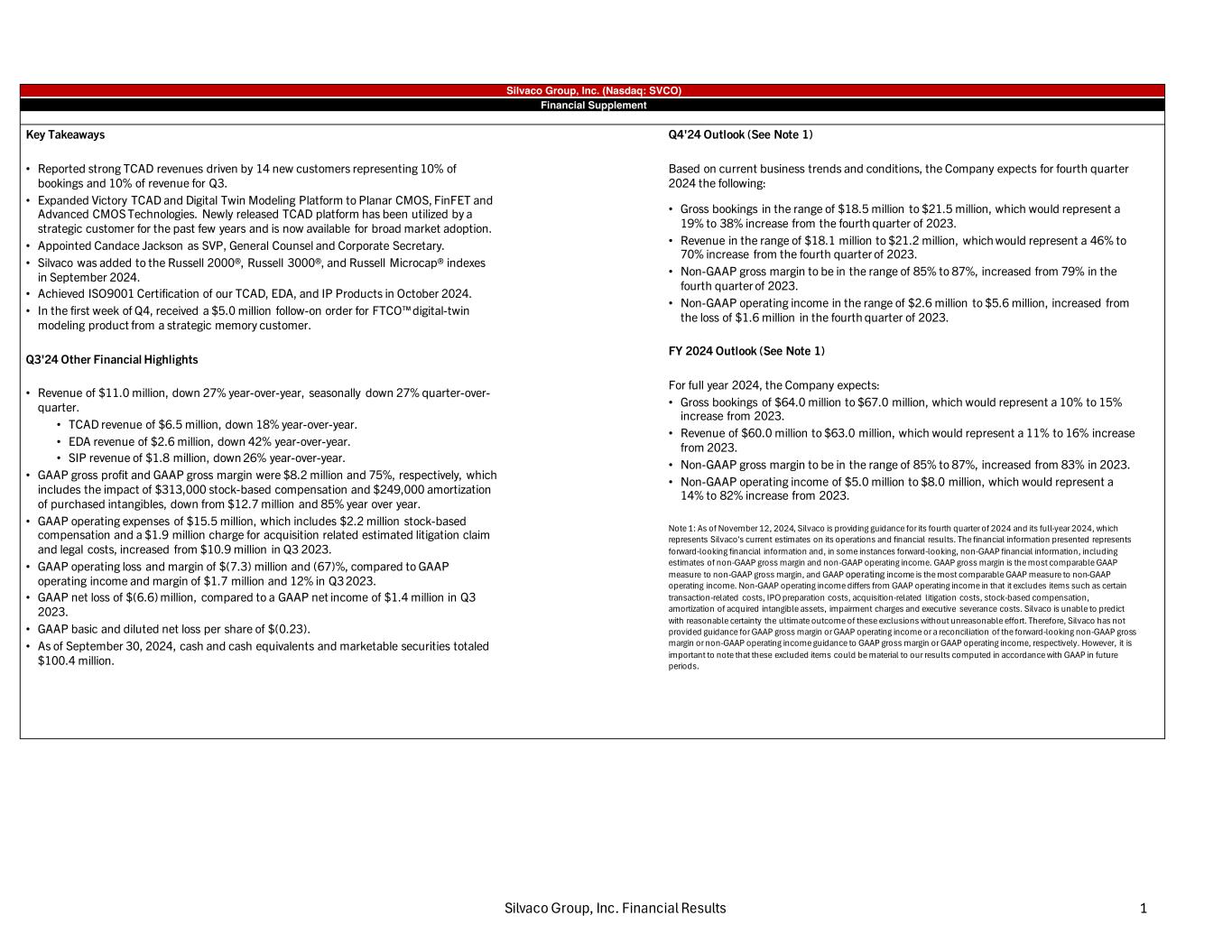

Silvaco Group, Inc. Financial Results 1 Silvaco Group, Inc. (Nasdaq: SVCO) Financial Supplement Key Takeaways • Reported strong TCAD revenues driven by 14 new customers representing 10% of bookings and 10% of revenue for Q3. • Expanded Victory TCAD and Digital Twin Modeling Platform to Planar CMOS, FinFET and Advanced CMOS Technologies. Newly released TCAD platform has been utilized by a strategic customer for the past few years and is now available for broad market adoption. • Appointed Candace Jackson as SVP, General Counsel and Corporate Secretary. • Silvaco was added to the Russell 2000®, Russell 3000®, and Russell Microcap® indexes in September 2024. • Achieved ISO9001 Certification of our TCAD, EDA, and IP Products in October 2024. • In the first week of Q4, received a $5.0 million follow-on order for FTCO™ digital-twin modeling product from a strategic memory customer. Q3'24 Other Financial Highlights • Revenue of $11.0 million, down 27% year-over-year, seasonally down 27% quarter-over- quarter. • TCAD revenue of $6.5 million, down 18% year-over-year. • EDA revenue of $2.6 million, down 42% year-over-year. • SIP revenue of $1.8 million, down 26% year-over-year. • GAAP gross profit and GAAP gross margin were $8.2 million and 75%, respectively, which includes the impact of $313,000 stock-based compensation and $249,000 amortization of purchased intangibles, down from $12.7 million and 85% year over year. • GAAP operating expenses of $15.5 million, which includes $2.2 million stock-based compensation and a $1.9 million charge for acquisition related estimated litigation claim and legal costs, increased from $10.9 million in Q3 2023. • GAAP operating loss and margin of $(7.3) million and (67)%, compared to GAAP operating income and margin of $1.7 million and 12% in Q3 2023. • GAAP net loss of $(6.6) million, compared to a GAAP net income of $1.4 million in Q3 2023. • GAAP basic and diluted net loss per share of $(0.23). • As of September 30, 2024, cash and cash equivalents and marketable securities totaled $100.4 million. x Q4'24 Outlook (See Note 1) Based on current business trends and conditions, the Company expects for fourth quarter 2024 the following: • Gross bookings in the range of $18.5 million to $21.5 million, which would represent a 19% to 38% increase from the fourth quarter of 2023. • Revenue in the range of $18.1 million to $21.2 million, which would represent a 46% to 70% increase from the fourth quarter of 2023. • Non-GAAP gross margin to be in the range of 85% to 87%, increased from 79% in the fourth quarter of 2023. • Non-GAAP operating income in the range of $2.6 million to $5.6 million, increased from the loss of $1.6 million in the fourth quarter of 2023. FY 2024 Outlook (See Note 1) For full year 2024, the Company expects: • Gross bookings of $64.0 million to $67.0 million, which would represent a 10% to 15% increase from 2023. • Revenue of $60.0 million to $63.0 million, which would represent a 11% to 16% increase from 2023. • Non-GAAP gross margin to be in the range of 85% to 87%, increased from 83% in 2023. • Non-GAAP operating income of $5.0 million to $8.0 million, which would represent a 14% to 82% increase from 2023. Note 1: As of November 12, 2024, Silvaco is providing guidance for its fourth quarter of 2024 and its full-year 2024, which represents Silvaco's current estimates on its operations and financial results. The financial information presented represents forward-looking financial information and, in some instances forward-looking, non-GAAP financial information, including estimates of non-GAAP gross margin and non-GAAP operating income. GAAP gross margin is the most comparable GAAP measure to non-GAAP gross margin, and GAAP operating income is the most comparable GAAP measure to non-GAAP operating income. Non-GAAP operating income differs from GAAP operating income in that it excludes items such as certain transaction-related costs, IPO preparation costs, acquisition-related litigation costs, stock-based compensation, amortization of acquired intangible assets, impairment charges and executive severance costs. Silvaco is unable to predict with reasonable certainty the ultimate outcome of these exclusions without unreasonable effort. Therefore, Silvaco has not provided guidance for GAAP gross margin or GAAP operating income or a reconciliation of the forward-looking non-GAAP gross margin or non-GAAP operating income guidance to GAAP gross margin or GAAP operating income, respectively. However, it is important to note that these excluded items could be material to our results computed in accordance with GAAP in future periods.

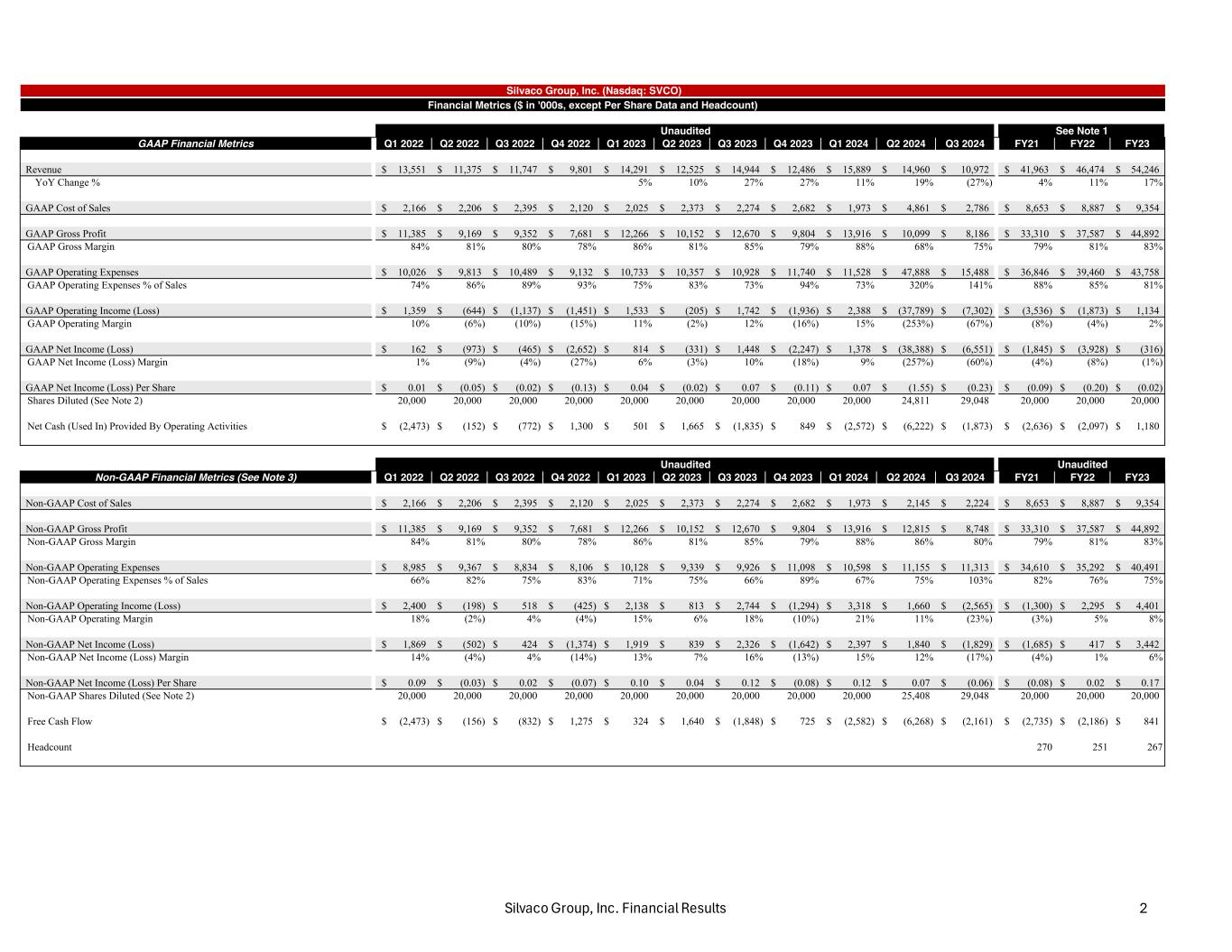

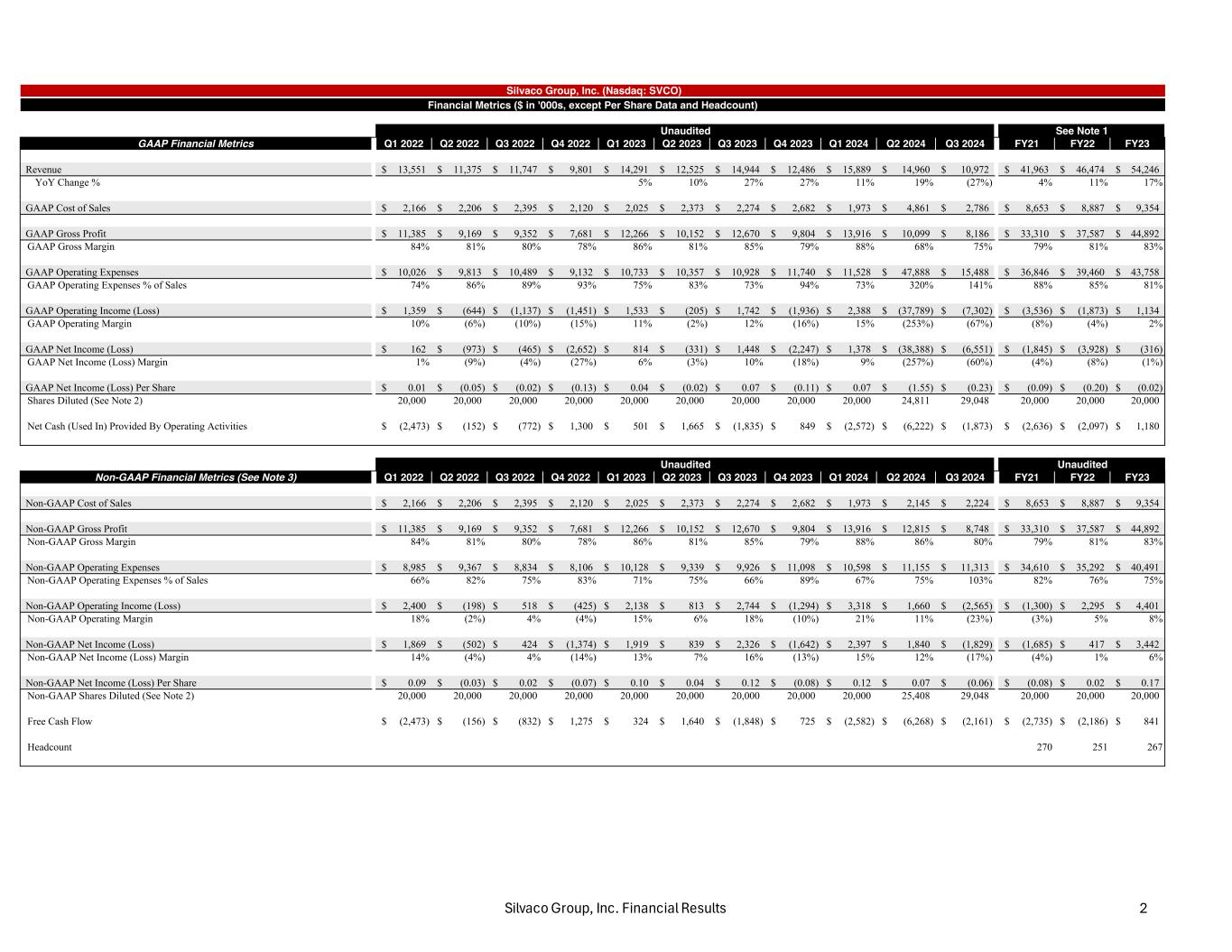

Silvaco Group, Inc. Financial Results 2 Silvaco Group, Inc. (Nasdaq: SVCO) Financial Metrics ($ in '000s, except Per Share Data and Headcount) Unaudited See Note 1 GAAP Financial Metrics Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 FY21 FY22 FY23 Revenue 13,551$ 11,375$ 11,747$ 9,801$ 14,291$ 12,525$ 14,944$ 12,486$ 15,889$ 14,960$ 10,972$ 41,963$ 46,474$ 54,246$ YoY Change % 5% 10% 27% 27% 11% 19% (27%) 4% 11% 17% GAAP Cost of Sales 2,166$ 2,206$ 2,395$ 2,120$ 2,025$ 2,373$ 2,274$ 2,682$ 1,973$ 4,861$ 2,786$ 8,653$ 8,887$ 9,354$ GAAP Gross Profit 11,385$ 9,169$ 9,352$ 7,681$ 12,266$ 10,152$ 12,670$ 9,804$ 13,916$ 10,099$ 8,186$ 33,310$ 37,587$ 44,892$ GAAP Gross Margin 84% 81% 80% 78% 86% 81% 85% 79% 88% 68% 75% 79% 81% 83% GAAP Operating Expenses 10,026$ 9,813$ 10,489$ 9,132$ 10,733$ 10,357$ 10,928$ 11,740$ 11,528$ 47,888$ 15,488$ 36,846$ 39,460$ 43,758$ GAAP Operating Expenses % of Sales 74% 86% 89% 93% 75% 83% 73% 94% 73% 320% 141% 88% 85% 81% GAAP Operating Income (Loss) 1,359$ (644)$ (1,137)$ (1,451)$ 1,533$ (205)$ 1,742$ (1,936)$ 2,388$ (37,789)$ (7,302)$ (3,536)$ (1,873)$ 1,134$ GAAP Operating Margin 10% (6%) (10%) (15%) 11% (2%) 12% (16%) 15% (253%) (67%) (8%) (4%) 2% GAAP Net Income (Loss) 162$ (973)$ (465)$ (2,652)$ 814$ (331)$ 1,448$ (2,247)$ 1,378$ (38,388)$ (6,551)$ (1,845)$ (3,928)$ (316)$ GAAP Net Income (Loss) Margin 1% (9%) (4%) (27%) 6% (3%) 10% (18%) 9% (257%) (60%) (4%) (8%) (1%) GAAP Net Income (Loss) Per Share 0.01$ (0.05)$ (0.02)$ (0.13)$ 0.04$ (0.02)$ 0.07$ (0.11)$ 0.07$ (1.55)$ (0.23)$ (0.09)$ (0.20)$ (0.02)$ Shares Diluted (See Note 2) 20,000 20,000 20,000 20,000 20,000 20,000 20,000 20,000 20,000 24,811 29,048 20,000 20,000 20,000 Net Cash (Used In) Provided By Operating Activities (2,473)$ (152)$ (772)$ 1,300$ 501$ 1,665$ (1,835)$ 849$ (2,572)$ (6,222)$ (1,873)$ (2,636)$ (2,097)$ 1,180$ Unaudited Unaudited Non-GAAP Financial Metrics (See Note 3) Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 FY21 FY22 FY23 Non-GAAP Cost of Sales 2,166$ 2,206$ 2,395$ 2,120$ 2,025$ 2,373$ 2,274$ 2,682$ 1,973$ 2,145$ 2,224$ 8,653$ 8,887$ 9,354$ Non-GAAP Gross Profit 11,385$ 9,169$ 9,352$ 7,681$ 12,266$ 10,152$ 12,670$ 9,804$ 13,916$ 12,815$ 8,748$ 33,310$ 37,587$ 44,892$ Non-GAAP Gross Margin 84% 81% 80% 78% 86% 81% 85% 79% 88% 86% 80% 79% 81% 83% Non-GAAP Operating Expenses 8,985$ 9,367$ 8,834$ 8,106$ 10,128$ 9,339$ 9,926$ 11,098$ 10,598$ 11,155$ 11,313$ 34,610$ 35,292$ 40,491$ Non-GAAP Operating Expenses % of Sales 66% 82% 75% 83% 71% 75% 66% 89% 67% 75% 103% 82% 76% 75% Non-GAAP Operating Income (Loss) 2,400$ (198)$ 518$ (425)$ 2,138$ 813$ 2,744$ (1,294)$ 3,318$ 1,660$ (2,565)$ (1,300)$ 2,295$ 4,401$ Non-GAAP Operating Margin 18% (2%) 4% (4%) 15% 6% 18% (10%) 21% 11% (23%) (3%) 5% 8% Non-GAAP Net Income (Loss) 1,869$ (502)$ 424$ (1,374)$ 1,919$ 839$ 2,326$ (1,642)$ 2,397$ 1,840$ (1,829)$ (1,685)$ 417$ 3,442$ Non-GAAP Net Income (Loss) Margin 14% (4%) 4% (14%) 13% 7% 16% (13%) 15% 12% (17%) (4%) 1% 6% Non-GAAP Net Income (Loss) Per Share 0.09$ (0.03)$ 0.02$ (0.07)$ 0.10$ 0.04$ 0.12$ (0.08)$ 0.12$ 0.07$ (0.06)$ (0.08)$ 0.02$ 0.17$ Non-GAAP Shares Diluted (See Note 2) 20,000 20,000 20,000 20,000 20,000 20,000 20,000 20,000 20,000 25,408 29,048 20,000 20,000 20,000 Free Cash Flow (2,473)$ (156)$ (832)$ 1,275$ 324$ 1,640$ (1,848)$ 725$ (2,582)$ (6,268)$ (2,161)$ (2,735)$ (2,186)$ 841$ Headcount 270 251 267

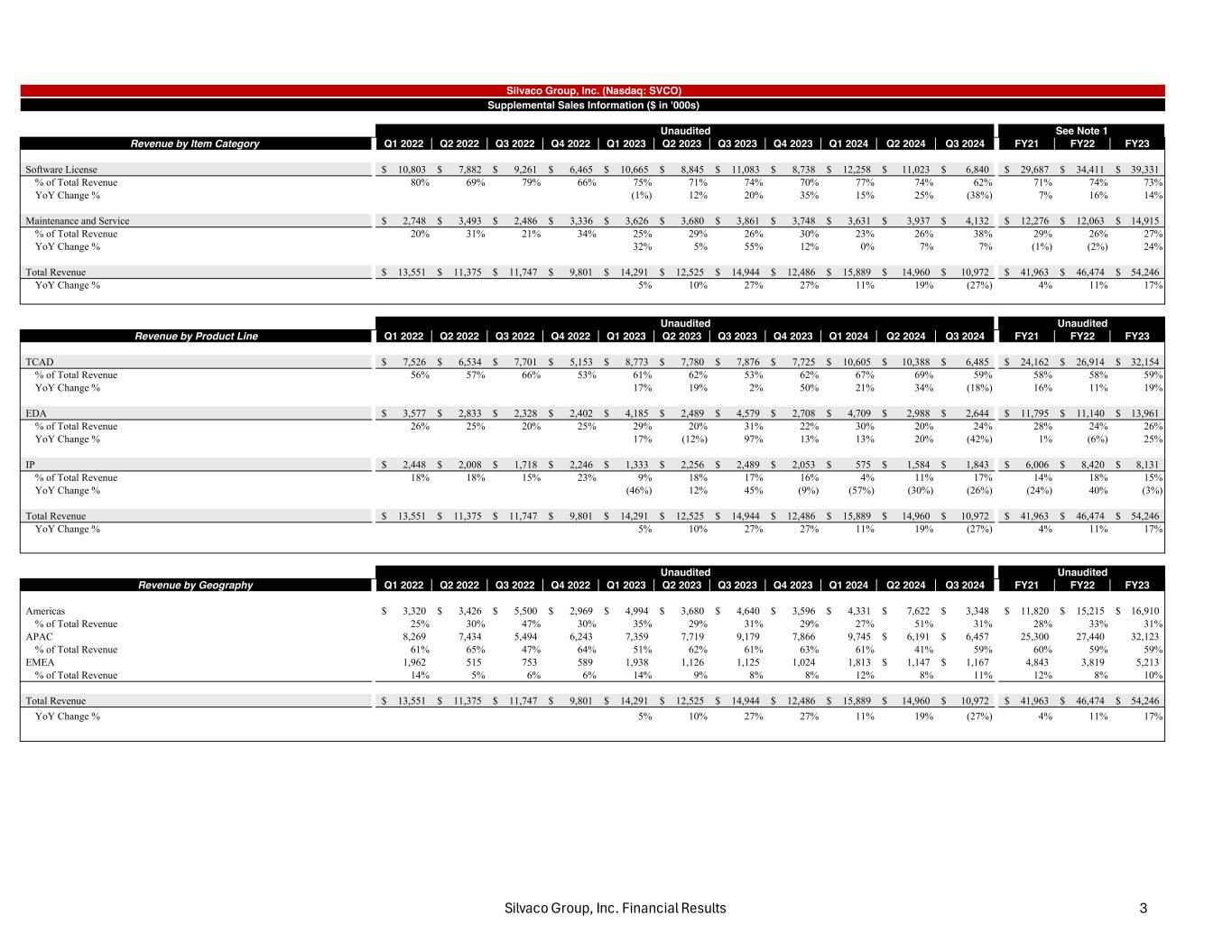

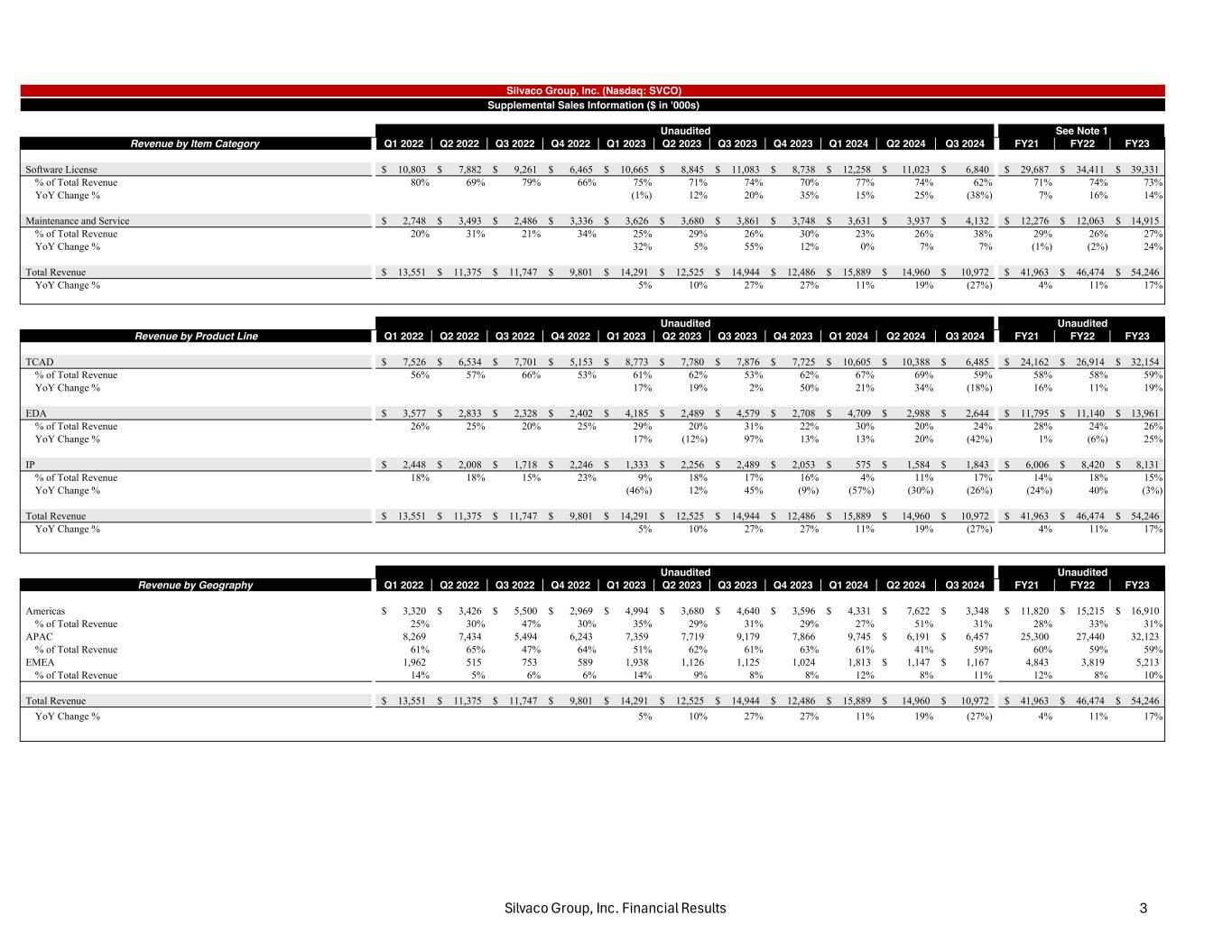

Silvaco Group, Inc. Financial Results 3 Silvaco Group, Inc. (Nasdaq: SVCO) Supplemental Sales Information ($ in '000s) Unaudited See Note 1 Revenue by Item Category Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 FY21 FY22 FY23 Software License 10,803$ 7,882$ 9,261$ 6,465$ 10,665$ 8,845$ 11,083$ 8,738$ 12,258$ 11,023$ 6,840$ 29,687$ 34,411$ 39,331$ % of Total Revenue 80% 69% 79% 66% 75% 71% 74% 70% 77% 74% 62% 71% 74% 73% YoY Change % (1%) 12% 20% 35% 15% 25% (38%) 7% 16% 14% Maintenance and Service 2,748$ 3,493$ 2,486$ 3,336$ 3,626$ 3,680$ 3,861$ 3,748$ 3,631$ 3,937$ 4,132$ 12,276$ 12,063$ 14,915$ % of Total Revenue 20% 31% 21% 34% 25% 29% 26% 30% 23% 26% 38% 29% 26% 27% YoY Change % 32% 5% 55% 12% 0% 7% 7% (1%) (2%) 24% Total Revenue 13,551$ 11,375$ 11,747$ 9,801$ 14,291$ 12,525$ 14,944$ 12,486$ 15,889$ 14,960$ 10,972$ 41,963$ 46,474$ 54,246$ YoY Change % 5% 10% 27% 27% 11% 19% (27%) 4% 11% 17% Unaudited Unaudited Revenue by Product Line Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 FY21 FY22 FY23 TCAD 7,526$ 6,534$ 7,701$ 5,153$ 8,773$ 7,780$ 7,876$ 7,725$ 10,605$ 10,388$ 6,485$ 24,162$ 26,914$ 32,154$ % of Total Revenue 56% 57% 66% 53% 61% 62% 53% 62% 67% 69% 59% 58% 58% 59% YoY Change % 17% 19% 2% 50% 21% 34% (18%) 16% 11% 19% EDA 3,577$ 2,833$ 2,328$ 2,402$ 4,185$ 2,489$ 4,579$ 2,708$ 4,709$ 2,988$ 2,644$ 11,795$ 11,140$ 13,961$ % of Total Revenue 26% 25% 20% 25% 29% 20% 31% 22% 30% 20% 24% 28% 24% 26% YoY Change % 17% (12%) 97% 13% 13% 20% (42%) 1% (6%) 25% IP 2,448$ 2,008$ 1,718$ 2,246$ 1,333$ 2,256$ 2,489$ 2,053$ 575$ 1,584$ 1,843$ 6,006$ 8,420$ 8,131$ % of Total Revenue 18% 18% 15% 23% 9% 18% 17% 16% 4% 11% 17% 14% 18% 15% YoY Change % (46%) 12% 45% (9%) (57%) (30%) (26%) (24%) 40% (3%) Total Revenue 13,551$ 11,375$ 11,747$ 9,801$ 14,291$ 12,525$ 14,944$ 12,486$ 15,889$ 14,960$ 10,972$ 41,963$ 46,474$ 54,246$ YoY Change % 5% 10% 27% 27% 11% 19% (27%) 4% 11% 17% Unaudited Unaudited Revenue by Geography Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 FY21 FY22 FY23 Americas 3,320$ 3,426$ 5,500$ 2,969$ 4,994$ 3,680$ 4,640$ 3,596$ 4,331$ 7,622$ 3,348$ 11,820$ 15,215$ 16,910$ % of Total Revenue 25% 30% 47% 30% 35% 29% 31% 29% 27% 51% 31% 28% 33% 31% APAC 8,269 7,434 5,494 6,243 7,359 7,719 9,179 7,866 9,745 6,191$ 6,457$ 25,300 27,440 32,123 % of Total Revenue 61% 65% 47% 64% 51% 62% 61% 63% 61% 41% 59% 60% 59% 59% EMEA 1,962 515 753 589 1,938 1,126 1,125 1,024 1,813 1,147$ 1,167$ 4,843 3,819 5,213 % of Total Revenue 14% 5% 6% 6% 14% 9% 8% 8% 12% 8% 11% 12% 8% 10% Total Revenue 13,551$ 11,375$ 11,747$ 9,801$ 14,291$ 12,525$ 14,944$ 12,486$ 15,889$ 14,960$ 10,972$ 41,963$ 46,474$ 54,246$ YoY Change % 5% 10% 27% 27% 11% 19% (27%) 4% 11% 17%

Silvaco Group, Inc. Financial Results 4 Silvaco Group, Inc. (Nasdaq: SVCO) Supplemental Sales Information ($ in '000s) Unaudited Unaudited New Bookings by Product Line Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 FY21 FY22 FY23 TCAD 8,385$ 6,455$ 7,472$ 7,227$ 10,999$ 8,022$ 7,894$ 8,494$ 12,191$ 14,246$ 6,225$ 26,502$ 29,539$ 35,409$ % of Total Bookings 59% 58% 62% 58% 70% 56% 63% 55% 76% 73% 63% 56% 59% 61% YoY Change % 31% 24% 6% 18% 11% 78% (21%) 25% 11% 20% EDA 4,193$ 3,374$ 2,774$ 3,650$ 3,205$ 4,255$ 3,335$ 4,179$ 3,800$ 3,521$ 2,652$ 14,336$ 13,991$ 14,974$ % of Total Bookings 30% 30% 23% 29% 20% 30% 27% 27% 24% 18% 27% 30% 28% 26% YoY Change % (24%) 26% 20% 14% 19% (17%) (20%) (13%) (2%) 7% IP 1,533$ 1,372$ 1,720$ 1,539$ 1,464$ 2,084$ 1,257$ 2,891$ 121$ 1,711$ 998$ 6,458$ 6,164$ 7,696$ % of Total Bookings 11% 12% 14% 12% 9% 15% 10% 19% 1% 9% 10% 14% 12% 13% YoY Change % (5%) 52% (27%) 88% (92%) (18%) (21%) 2% (5%) 25% Total Bookings 14,111$ 11,201$ 11,967$ 12,416$ 15,667$ 14,362$ 12,486$ 15,565$ 16,112$ 19,478$ 9,875$ 47,296$ 49,695$ 58,080$ YoY Change % 11% 28% 4% 25% 3% 36% (21%) 8% 5% 17% Remaining Performance Obligation 29,098$ 33,181$ 32,592$ 21,223$ 26,990$ 29,818$ Silvaco Group, Inc. (Nasdaq: SVCO) Safe Harbor Statement Safe Harbor Statement This financial supplement contains forward-looking statements based on Silvaco Group, Inc.'s current expectations. The words “believe”, “estimate”, “expect”, “intend”, “anticipate”, “plan”, “project”, “will”, and similar phrases as they relate to Silvaco Group, Inc. are intended to identify such forward-looking statements. These forward-looking statements reflect the current views and assumptions of Silvaco Group, Inc. and are subject to various risks and uncertainties that could cause actual results to differ materially from expectations. These forward-looking statements include but are not limited to, statements regarding our future operating results, financial position, and guidance, our business strategy and plans, our objectives for future operations, our development or delivery of new or enhanced products, and anticipated results of those products for our customers, our competitive positioning, projected costs, technological capabilities, and plans, and macroeconomic trends. A variety of risks and factors that are beyond our control could cause actual results to differ materially from those in the forward-looking statements including, without limitation, the following: (a) market conditions; (b)anticipated trends, challenges and growth in our business and the markets in which we operate; (c) our ability to appropriately respond to changing technologies on a timely and cost-effective basis; (d) the size and growth potential of the markets for our software solutions, and our ability to serve those markets; (e) our expectations regarding competition in our existing and new markets; (f) the level of demand in our customers’ end markets; (g) regulatory developments in the United States and foreign countries; (h) changes in trade policies, including the imposition of tariffs; (i) proposed new software solutions, services or developments; (j) our ability to attract and retain key management personnel; (k) our customer relationships and our ability to retain and expand our customer relationships; (l) our ability to diversify our customer base and develop relationships in new markets; (m) the strategies, prospects, plans, expectations, and objectives of management for future operations; (n) public health crises, pandemics, and epidemics, and their effects on our business and our customers’ businesses; (o) the impact of the current conflicts between Ukraine and Russia and Israel and Hamas and the ongoing trade disputes among the United States and China on our business, financial condition or prospects, including extreme volatility in the global capital markets making debt or equity financing more difficult to obtain, more costly or more dilutive, delays and disruptions of the global supply chains and the business activities of our suppliers, distributors, customers and other business partners; (p) changes in general economic or business conditions or economic or demographic trends in the United States and foreign countries including changes in interest rates and inflation; (q) our ability to raise additional capital; (r) our ability to accurately forecast demand for our software solutions; (s) our expectations regarding the outcome of any ongoing litigation; (t) our expectations regarding the period during which we qualify as an emerging growth company under the JOBS Act and as a smaller reporting company under the Exchange Act; (u) our expectations regarding our ability to obtain, maintain, protect and enforce intellectual property protection for our technology; (v) our status as a controlled company; and (w) our use of the net proceeds from our initial public offering. It is not possible for us to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results or outcomes to differ materially from those contained in any forward-looking statements we may make. Accordingly, you should not rely on any of the forward-looking statements. Additional information relating to the uncertainty affecting the Silvaco’s business is contained in Silvaco's filings with the Securities and Exchange Commission. These documents are available on the SEC Filings section of the Investor Relations section of Silvaco's website at http://investors.silvaco.com/. These forward-looking statements represent Silvaco's expectations as of the date of this press release. Subsequent events may cause these expectations to change, and Silvaco disclaims any obligations to update or alter these forward-looking statements in the future, whether as a result of new information, future events or otherwise.

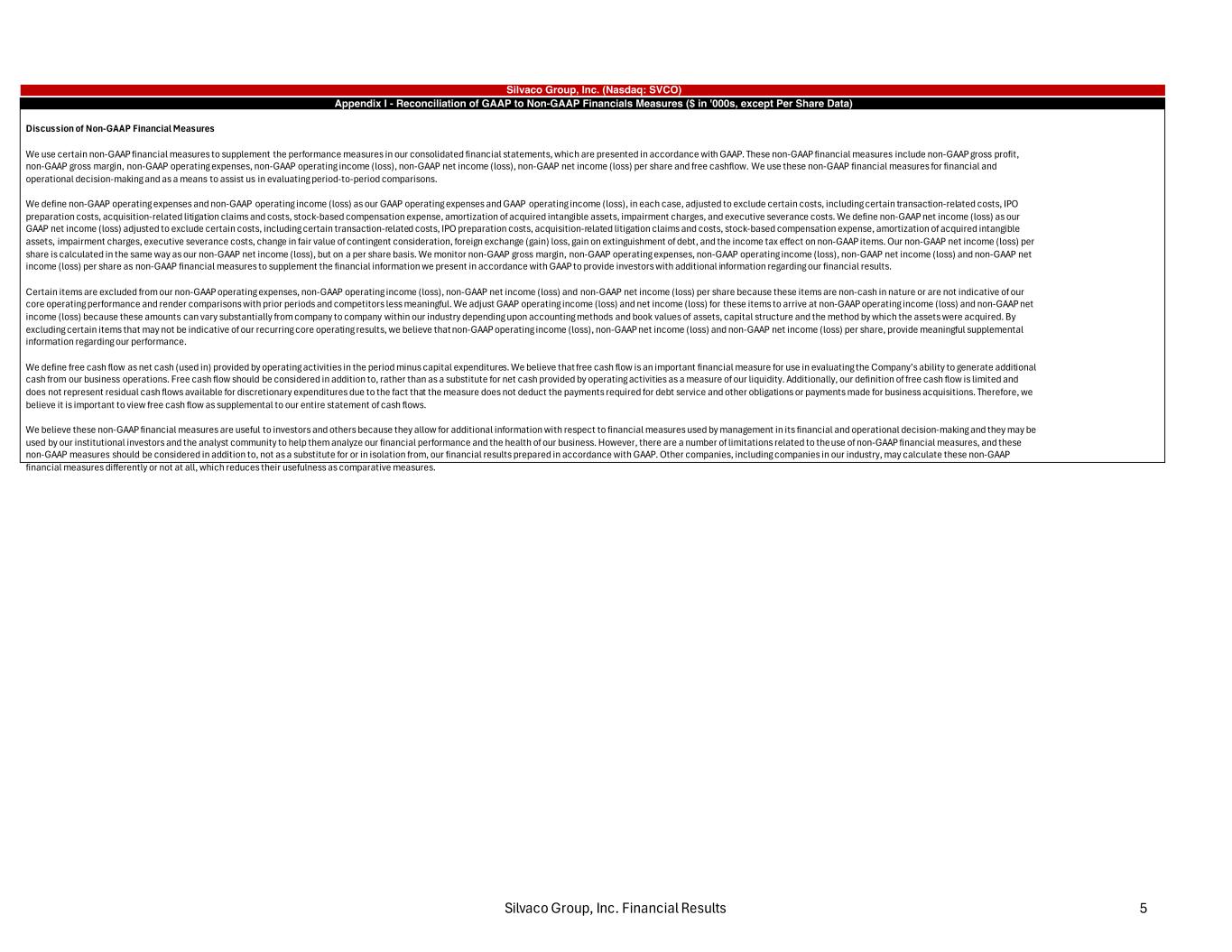

Silvaco Group, Inc. Financial Results 5 Silvaco Group, Inc. (Nasdaq: SVCO) Appendix I - Reconciliation of GAAP to Non-GAAP Financials Measures ($ in '000s, except Per Share Data) Discussion of Non-GAAP Financial Measures We use certain non-GAAP financial measures to supplement the performance measures in our consolidated financial statements, which are presented in accordance with GAAP. These non-GAAP financial measures include non-GAAP gross profit, non-GAAP gross margin, non-GAAP operating expenses, non-GAAP operating income (loss), non-GAAP net income (loss), non-GAAP net income (loss) per share and free cashflow. We use these non-GAAP financial measures for financial and operational decision-making and as a means to assist us in evaluating period-to-period comparisons. We define non-GAAP operating expenses and non-GAAP operating income (loss) as our GAAP operating expenses and GAAP operating income (loss), in each case, adjusted to exclude certain costs, including certain transaction-related costs, IPO preparation costs, acquisition-related litigation claims and costs, stock-based compensation expense, amortization of acquired intangible assets, impairment charges, and executive severance costs. We define non-GAAP net income (loss) as our GAAP net income (loss) adjusted to exclude certain costs, including certain transaction-related costs, IPO preparation costs, acquisition-related litigation claims and costs, stock-based compensation expense, amortization of acquired intangible assets, impairment charges, executive severance costs, change in fair value of contingent consideration, foreign exchange (gain) loss, gain on extinguishment of debt, and the income tax effect on non-GAAP items. Our non-GAAP net income (loss) per share is calculated in the same way as our non-GAAP net income (loss), but on a per share basis. We monitor non-GAAP gross margin, non-GAAP operating expenses, non-GAAP operating income (loss), non-GAAP net income (loss) and non-GAAP net income (loss) per share as non-GAAP financial measures to supplement the financial information we present in accordance with GAAP to provide investors with additional information regarding our financial results. Certain items are excluded from our non-GAAP operating expenses, non-GAAP operating income (loss), non-GAAP net income (loss) and non-GAAP net income (loss) per share because these items are non-cash in nature or are not indicative of our core operating performance and render comparisons with prior periods and competitors less meaningful. We adjust GAAP operating income (loss) and net income (loss) for these items to arrive at non-GAAP operating income (loss) and non-GAAP net income (loss) because these amounts can vary substantially from company to company within our industry depending upon accounting methods and book values of assets, capital structure and the method by which the assets were acquired. By excluding certain items that may not be indicative of our recurring core operating results, we believe that non-GAAP operating income (loss), non-GAAP net income (loss) and non-GAAP net income (loss) per share, provide meaningful supplemental information regarding our performance. We define free cash flow as net cash (used in) provided by operating activities in the period minus capital expenditures. We believe that free cash flow is an important financial measure for use in evaluating the Company’s ability to generate additional cash from our business operations. Free cash flow should be considered in addition to, rather than as a substitute for net cash provided by operating activities as a measure of our liquidity. Additionally, our definition of free cash flow is limited and does not represent residual cash flows available for discretionary expenditures due to the fact that the measure does not deduct the payments required for debt service and other obligations or payments made for business acquisitions. Therefore, we believe it is important to view free cash flow as supplemental to our entire statement of cash flows. We believe these non-GAAP financial measures are useful to investors and others because they allow for additional information with respect to financial measures used by management in its financial and operational decision-making and they may be used by our institutional investors and the analyst community to help them analyze our financial performance and the health of our business. However, there are a number of limitations related to the use of non-GAAP financial measures, and these non-GAAP measures should be considered in addition to, not as a substitute for or in isolation from, our financial results prepared in accordance with GAAP. Other companies, including companies in our industry, may calculate these non-GAAP financial measures differently or not at all, which reduces their usefulness as comparative measures. x

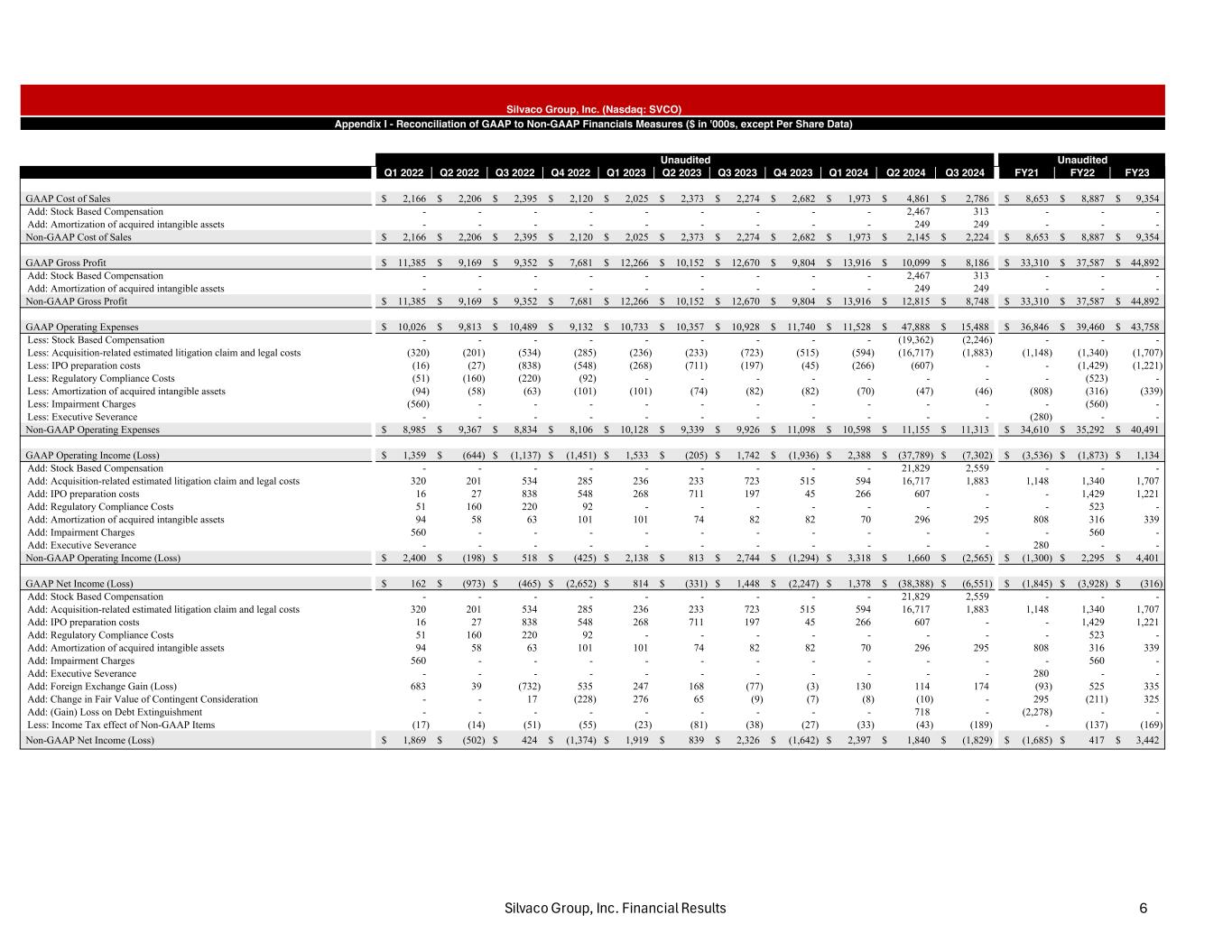

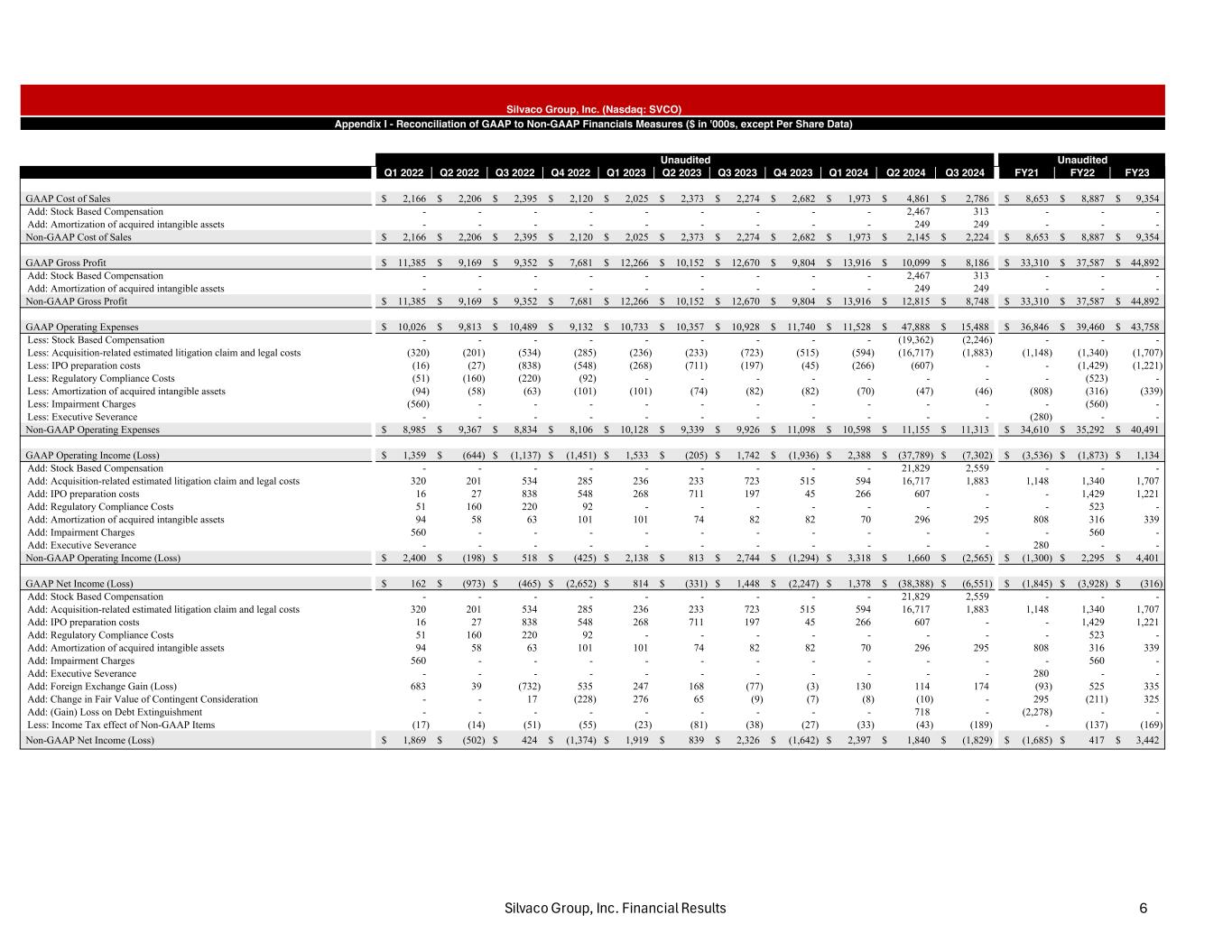

Silvaco Group, Inc. Financial Results 6 Silvaco Group, Inc. (Nasdaq: SVCO) Appendix I - Reconciliation of GAAP to Non-GAAP Financials Measures ($ in '000s, except Per Share Data) Unaudited Unaudited Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 FY21 FY22 FY23 GAAP Cost of Sales 2,166$ 2,206$ 2,395$ 2,120$ 2,025$ 2,373$ 2,274$ 2,682$ 1,973$ 4,861$ 2,786$ 8,653$ 8,887$ 9,354$ Add: Stock Based Compensation - - - - - - - - - 2,467 313 - - - Add: Amortization of acquired intangible assets - - - - - - - - - 249 249 - - - Non-GAAP Cost of Sales 2,166$ 2,206$ 2,395$ 2,120$ 2,025$ 2,373$ 2,274$ 2,682$ 1,973$ 2,145$ 2,224$ 8,653$ 8,887$ 9,354$ GAAP Gross Profit 11,385$ 9,169$ 9,352$ 7,681$ 12,266$ 10,152$ 12,670$ 9,804$ 13,916$ 10,099$ 8,186$ 33,310$ 37,587$ 44,892$ Add: Stock Based Compensation - - - - - - - - - 2,467 313 - - - Add: Amortization of acquired intangible assets - - - - - - - - - 249 249 - - - Non-GAAP Gross Profit 11,385$ 9,169$ 9,352$ 7,681$ 12,266$ 10,152$ 12,670$ 9,804$ 13,916$ 12,815$ 8,748$ 33,310$ 37,587$ 44,892$ GAAP Operating Expenses 10,026$ 9,813$ 10,489$ 9,132$ 10,733$ 10,357$ 10,928$ 11,740$ 11,528$ 47,888$ 15,488$ 36,846$ 39,460$ 43,758$ Less: Stock Based Compensation - - - - - - - - - (19,362) (2,246) - - - Less: Acquisition-related estimated litigation claim and legal costs (320) (201) (534) (285) (236) (233) (723) (515) (594) (16,717) (1,883) (1,148) (1,340) (1,707) Less: IPO preparation costs (16) (27) (838) (548) (268) (711) (197) (45) (266) (607) - - (1,429) (1,221) Less: Regulatory Compliance Costs (51) (160) (220) (92) - - - - - - - - (523) - Less: Amortization of acquired intangible assets (94) (58) (63) (101) (101) (74) (82) (82) (70) (47) (46) (808) (316) (339) Less: Impairment Charges (560) - - - - - - - - - - - (560) - Less: Executive Severance - - - - - - - - - - - (280) - - Non-GAAP Operating Expenses 8,985$ 9,367$ 8,834$ 8,106$ 10,128$ 9,339$ 9,926$ 11,098$ 10,598$ 11,155$ 11,313$ 34,610$ 35,292$ 40,491$ GAAP Operating Income (Loss) 1,359$ (644)$ (1,137)$ (1,451)$ 1,533$ (205)$ 1,742$ (1,936)$ 2,388$ (37,789)$ (7,302)$ (3,536)$ (1,873)$ 1,134$ Add: Stock Based Compensation - - - - - - - - - 21,829 2,559 - - - Add: Acquisition-related estimated litigation claim and legal costs 320 201 534 285 236 233 723 515 594 16,717 1,883 1,148 1,340 1,707 Add: IPO preparation costs 16 27 838 548 268 711 197 45 266 607 - - 1,429 1,221 Add: Regulatory Compliance Costs 51 160 220 92 - - - - - - - - 523 - Add: Amortization of acquired intangible assets 94 58 63 101 101 74 82 82 70 296 295 808 316 339 Add: Impairment Charges 560 - - - - - - - - - - - 560 - Add: Executive Severance - - - - - - - - - - - 280 - - Non-GAAP Operating Income (Loss) 2,400$ (198)$ 518$ (425)$ 2,138$ 813$ 2,744$ (1,294)$ 3,318$ 1,660$ (2,565)$ (1,300)$ 2,295$ 4,401$ GAAP Net Income (Loss) 162$ (973)$ (465)$ (2,652)$ 814$ (331)$ 1,448$ (2,247)$ 1,378$ (38,388)$ (6,551)$ (1,845)$ (3,928)$ (316)$ Add: Stock Based Compensation - - - - - - - - - 21,829 2,559 - - - Add: Acquisition-related estimated litigation claim and legal costs 320 201 534 285 236 233 723 515 594 16,717 1,883 1,148 1,340 1,707 Add: IPO preparation costs 16 27 838 548 268 711 197 45 266 607 - - 1,429 1,221 Add: Regulatory Compliance Costs 51 160 220 92 - - - - - - - - 523 - Add: Amortization of acquired intangible assets 94 58 63 101 101 74 82 82 70 296 295 808 316 339 Add: Impairment Charges 560 - - - - - - - - - - - 560 - Add: Executive Severance - - - - - - - - - - - 280 - - Add: Foreign Exchange Gain (Loss) 683 39 (732) 535 247 168 (77) (3) 130 114 174 (93) 525 335 Add: Change in Fair Value of Contingent Consideration - - 17 (228) 276 65 (9) (7) (8) (10) - 295 (211) 325 Add: (Gain) Loss on Debt Extinguishment - - - - - - - - - 718 - (2,278) - - Less: Income Tax effect of Non-GAAP Items (17) (14) (51) (55) (23) (81) (38) (27) (33) (43) (189) - (137) (169) Non-GAAP Net Income (Loss) 1,869$ (502)$ 424$ (1,374)$ 1,919$ 839$ 2,326$ (1,642)$ 2,397$ 1,840$ (1,829)$ (1,685)$ 417$ 3,442$

Silvaco Group, Inc. Financial Results 7 Silvaco Group, Inc. (Nasdaq: SVCO) Appendix I - Reconciliation of GAAP to Non-GAAP Financials Measures ($ in '000s, except Per Share Data) Unaudited Unaudited Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 FY21 FY22 FY23 GAAP Net Income (Loss) Per Share 0.01$ (0.05)$ (0.02)$ (0.13)$ 0.04$ (0.02)$ 0.07$ (0.11)$ 0.07$ (1.55)$ (0.23)$ (0.09)$ (0.20)$ (0.02)$ Add: Stock Based Compensation - - - - - - - - - 0.88 0.09 - - - Add: Acquisition-related estimated litigation claim and legal costs 0.02 0.01 0.03 0.01 0.01 0.01 0.04 0.03 0.03 0.67 0.06 0.06 0.07 0.09 Add: IPO preparation costs 0.00 0.00 0.04 0.03 0.01 0.04 0.01 0.00 0.01 0.02 - - 0.07 0.06 Add: Regulatory Compliance Costs 0.00 0.01 0.01 0.00 - - - - - - - - 0.03 - Add: Amortization of acquired intangible assets 0.00 0.00 0.00 0.01 0.01 0.00 0.00 0.00 0.00 0.01 0.01 0.04 0.02 0.02 Add: Impairment Charges 0.03 - - - - - - - - - - - 0.03 - Add: Executive Severance - - - - - - - - - - - 0.01 - - Add: Foreign Exchange Gain (Loss) 0.03 0.00 (0.04) 0.03 0.01 0.01 (0.00) (0.00) 0.01 0.00 0.01 (0.00) 0.03 0.02 Add: Change in Fair Value of Contingent Consideration - - 0.00 (0.01) 0.01 0.00 (0.00) (0.00) (0.00) (0.00) - 0.01 (0.01) 0.02 Add: (Gain) Loss on Debt Extinguishment - - - - - - - - - 0.03 - (0.11) - - Less: Income Tax effect of Non-GAAP Items (0.00) (0.00) (0.00) (0.00) (0.00) (0.00) (0.00) (0.00) (0.00) (0.00) (0.01) - (0.01) (0.01) Non-GAAP Net Income (Loss) Per Share 0.09$ (0.03)$ 0.02$ (0.07)$ 0.10$ 0.04$ 0.12$ (0.08)$ 0.12$ 0.07$ (0.06)$ (0.08)$ 0.02$ 0.17$ Shares used in GAAP and Non-GAAP Net Income (Loss) Per Share - Basic 20,000 20,000 20,000 20,000 20,000 20,000 20,000 20,000 20,000 24,811 29,048 20,000 20,000 20,000 Net Income (Loss) Per Share - Diluted 20,000 20,000 20,000 20,000 20,000 20,000 20,000 20,000 20,000 25,408 29,048 20,000 20,000 20,000

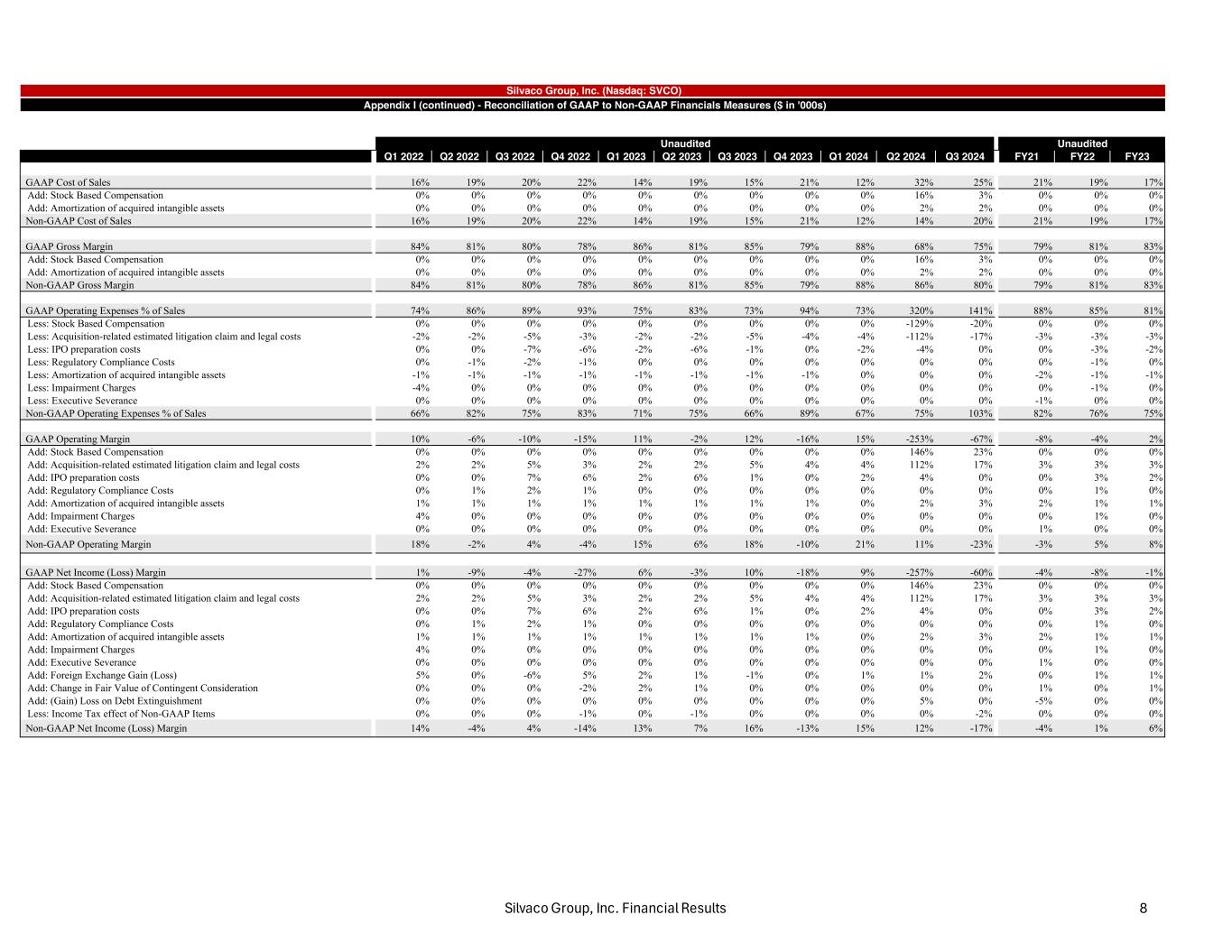

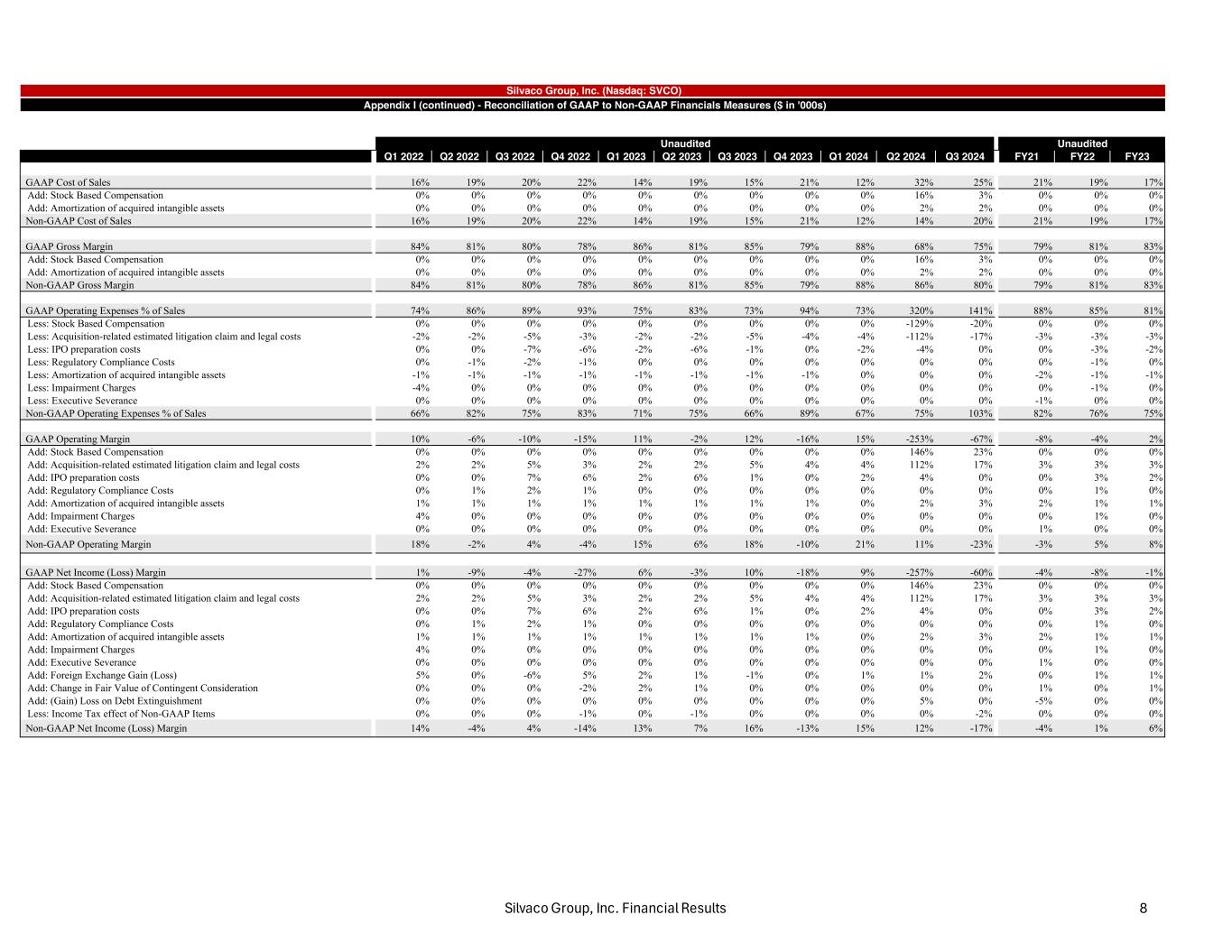

Silvaco Group, Inc. Financial Results 8 Silvaco Group, Inc. (Nasdaq: SVCO) Appendix I (continued) - Reconciliation of GAAP to Non-GAAP Financials Measures ($ in '000s) Unaudited Unaudited Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 FY21 FY22 FY23 GAAP Cost of Sales 16% 19% 20% 22% 14% 19% 15% 21% 12% 32% 25% 21% 19% 17% Add: Stock Based Compensation 0% 0% 0% 0% 0% 0% 0% 0% 0% 16% 3% 0% 0% 0% Add: Amortization of acquired intangible assets 0% 0% 0% 0% 0% 0% 0% 0% 0% 2% 2% 0% 0% 0% Non-GAAP Cost of Sales 16% 19% 20% 22% 14% 19% 15% 21% 12% 14% 20% 21% 19% 17% GAAP Gross Margin 84% 81% 80% 78% 86% 81% 85% 79% 88% 68% 75% 79% 81% 83% Add: Stock Based Compensation 0% 0% 0% 0% 0% 0% 0% 0% 0% 16% 3% 0% 0% 0% Add: Amortization of acquired intangible assets 0% 0% 0% 0% 0% 0% 0% 0% 0% 2% 2% 0% 0% 0% Non-GAAP Gross Margin 84% 81% 80% 78% 86% 81% 85% 79% 88% 86% 80% 79% 81% 83% GAAP Operating Expenses % of Sales 74% 86% 89% 93% 75% 83% 73% 94% 73% 320% 141% 88% 85% 81% Less: Stock Based Compensation 0% 0% 0% 0% 0% 0% 0% 0% 0% -129% -20% 0% 0% 0% Less: Acquisition-related estimated litigation claim and legal costs -2% -2% -5% -3% -2% -2% -5% -4% -4% -112% -17% -3% -3% -3% Less: IPO preparation costs 0% 0% -7% -6% -2% -6% -1% 0% -2% -4% 0% 0% -3% -2% Less: Regulatory Compliance Costs 0% -1% -2% -1% 0% 0% 0% 0% 0% 0% 0% 0% -1% 0% Less: Amortization of acquired intangible assets -1% -1% -1% -1% -1% -1% -1% -1% 0% 0% 0% -2% -1% -1% Less: Impairment Charges -4% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% -1% 0% Less: Executive Severance 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% -1% 0% 0% Non-GAAP Operating Expenses % of Sales 66% 82% 75% 83% 71% 75% 66% 89% 67% 75% 103% 82% 76% 75% GAAP Operating Margin 10% -6% -10% -15% 11% -2% 12% -16% 15% -253% -67% -8% -4% 2% Add: Stock Based Compensation 0% 0% 0% 0% 0% 0% 0% 0% 0% 146% 23% 0% 0% 0% Add: Acquisition-related estimated litigation claim and legal costs 2% 2% 5% 3% 2% 2% 5% 4% 4% 112% 17% 3% 3% 3% Add: IPO preparation costs 0% 0% 7% 6% 2% 6% 1% 0% 2% 4% 0% 0% 3% 2% Add: Regulatory Compliance Costs 0% 1% 2% 1% 0% 0% 0% 0% 0% 0% 0% 0% 1% 0% Add: Amortization of acquired intangible assets 1% 1% 1% 1% 1% 1% 1% 1% 0% 2% 3% 2% 1% 1% Add: Impairment Charges 4% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 1% 0% Add: Executive Severance 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 1% 0% 0% Non-GAAP Operating Margin 18% -2% 4% -4% 15% 6% 18% -10% 21% 11% -23% -3% 5% 8% GAAP Net Income (Loss) Margin 1% -9% -4% -27% 6% -3% 10% -18% 9% -257% -60% -4% -8% -1% Add: Stock Based Compensation 0% 0% 0% 0% 0% 0% 0% 0% 0% 146% 23% 0% 0% 0% Add: Acquisition-related estimated litigation claim and legal costs 2% 2% 5% 3% 2% 2% 5% 4% 4% 112% 17% 3% 3% 3% Add: IPO preparation costs 0% 0% 7% 6% 2% 6% 1% 0% 2% 4% 0% 0% 3% 2% Add: Regulatory Compliance Costs 0% 1% 2% 1% 0% 0% 0% 0% 0% 0% 0% 0% 1% 0% Add: Amortization of acquired intangible assets 1% 1% 1% 1% 1% 1% 1% 1% 0% 2% 3% 2% 1% 1% Add: Impairment Charges 4% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 1% 0% Add: Executive Severance 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 1% 0% 0% Add: Foreign Exchange Gain (Loss) 5% 0% -6% 5% 2% 1% -1% 0% 1% 1% 2% 0% 1% 1% Add: Change in Fair Value of Contingent Consideration 0% 0% 0% -2% 2% 1% 0% 0% 0% 0% 0% 1% 0% 1% Add: (Gain) Loss on Debt Extinguishment 0% 0% 0% 0% 0% 0% 0% 0% 0% 5% 0% -5% 0% 0% Less: Income Tax effect of Non-GAAP Items 0% 0% 0% -1% 0% -1% 0% 0% 0% 0% -2% 0% 0% 0% Non-GAAP Net Income (Loss) Margin 14% -4% 4% -14% 13% 7% 16% -13% 15% 12% -17% -4% 1% 6%

Silvaco Group, Inc. Financial Results 9 Silvaco Group, Inc. (Nasdaq: SVCO) Appendix I (continued) - Reconciliation of GAAP to Non-GAAP Financials Measures ($ in '000s) Unaudited Unaudited Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 FY21 FY22 FY23 Net Cash (Used In) Provided By Operating Activities (2,473)$ (152)$ (772)$ 1,300$ 501$ 1,665$ (1,835)$ 849$ (2,572)$ (6,222)$ (1,873)$ (2,636)$ (2,097)$ 1,180$ Less: Capital Expenditures - (4) (60) (25) (177) (25) (13) (124) (10) (46) (288) (99) (89) (339) Free Cash Flow (2,473)$ (156)$ (832)$ 1,275$ 324$ 1,640$ (1,848)$ 725$ (2,582)$ (6,268)$ (2,161)$ (2,735)$ (2,186)$ 841$ Silvaco Group, Inc. (Nasdaq: SVCO) Footnotes Note 1: Annual figures derived from audited consolidated financial statements which are available in our Form S-1 and draft Form S1 filings at SEC.GOV. Note 2: On April 29, 2024, the Company effected a 1-for-2 reverse split of its common stock. All of the outstanding equity amounts have been adjusted, on a retroactive basis, to reflect this 1-for-2 reverse stock split for all periods presented. On May 13, 2024, the Company completed the sale of an aggregate of 6,000,000 shares of Common Stock to the public in the IPO. Note 3: The non-GAAP measures presented should not be considered a substitute for the financial results and measures determined or calculated in accordance with GAAP. See Appendix I for more information and a reconciliation of GAAP to Non-GAAP Financials Measures.