Earlyworks Co., Ltd. Corporate Presentation January 2023 Free Writing Prospectus dated January 17, 2023 Filed Pursuant to Rule 433 of the Securities Act of 1933, as amended 0 Relating to Preliminary Prospectus dated January 13, 2023 Registration Statement No. 333-269068

Free Writing Prospectus Statement This free writing prospectus relates to the proposed public offering of American depositary shares (“ADSs”) representing ordinary shares of Earlyworks Co., Ltd. (“we,” “us,” “our,” or the “Company”) and should be read together with the Registration Statement on Form F-1 (File No. 333-269068), as amended (the Registration Statement ) we filed with the U.S. Securities and Exchange Commission (the “SEC”) for the offering to which this presentation relates and may be accessed through the following web link: https://www.sec.gov/Archives/edgar/data/1944399/000119312523007321/d400449df1a.htm The Registration Statement has not yet become effective. Before you invest, you should read the prospectus in the Registration Statement (including the risk factors described therein) and other documents we have with the SEC in their entirety for more complete information about us and the offering. You may get these documents for free by visiting EDGAR on the SEC website at http://www.sec.gov. Alternatively, we or our underwriter will arrange to send you the prospectus if you contact Univest Securities, LLC via email: info@univest.us, or contact Earlyworks Co., Ltd. via email: ir@e-arly.works. 1

Forward-Looking Statement This presentation contains forward-looking statements that reflect our current expectations and views of future events, all of which are subject to risks and uncertainties. Forward-looking statements give our current expectations or forecasts of future events. You can identify these statements by the fact that they do not relate strictly to historical or current facts. You can find many (but not all) of these statements by the use of words such as “approximates,” “believes,” “hopes,” “expects,” “anticipates,” “estimates,” “projects,” “intends,” “plans,” “will,” “would,” “should,” “could,” “may,” or other similar expressions in this presentation. These statements are likely to address our growth strategy, financial results, and financial needs. You must carefully consider any such statements and should understand that many factors could cause actual results to differ from our forward-looking statements. These factors may include inaccurate assumptions and a broad variety of other risks and uncertainties, including some that are known and some that are not. No forward-looking statement can be guaranteed, and actual future results may vary materially. Factors that could cause actual results to differ from those discussed in the forward-looking statements include, but are not limited to assumptions about our future financial and operating results, including revenue, income, expenditures, cash balances, and other financial items; our ability to execute our growth strategies, including our ability to meet our goals; current and future economic and political conditions; our capital requirements and our ability to raise any additional financing which we may require; our ability to attract customers and further enhance our brand recognition; our ability to hire and retain qualified management personnel and key employees in order to enable us to develop our business; the COVID-19 pandemic; trends and competition in the blockchain industry; and other assumptions described in this presentation underlying or relating to any forward-looking statements. We describe certain material risks, uncertainties, and assumptions that could affect our business, including our financial condition and results of operations, under “Risk Factors” in the Registration Statement. We base our forward-looking statements on our management’s beliefs and assumptions based on information available to our management at the time the statements are made. We caution you that actual outcomes and results may, and are likely to, differ materially from what is expressed, implied or forecast by our forward-looking statements. Accordingly, you should be careful about relying on any forward-looking statements. The forward-looking statements made in this presentation relate only to events or information as of the date on which the statements are made in this presentation. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events, or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. You should read our prospectus and the documents that we refer to in this presentation and have filed as exhibits to the Registration Statement completely. This presentation contains references to market data and industry forecasts and projections, which were obtained or derived from publicly available information, reports of governmental agencies, market research reports, and industry publications and surveys. These sources generally state that the information contained therein has been obtained from sources believed to be reliable, but that the accuracy and completeness of that information is not guaranteed. Although we believe such information to be accurate, we have not independently verified the data from these sources. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and additional uncertainties and risks regarding the other forward-looking statements in this presentation due to a variety of factors, including those described in this section, the section entitled “Risk Factors” in the Registration Statement and elsewhere in this presentation. These and other factors could cause results to differ materially from those expressed in the forecasts and estimates. 2

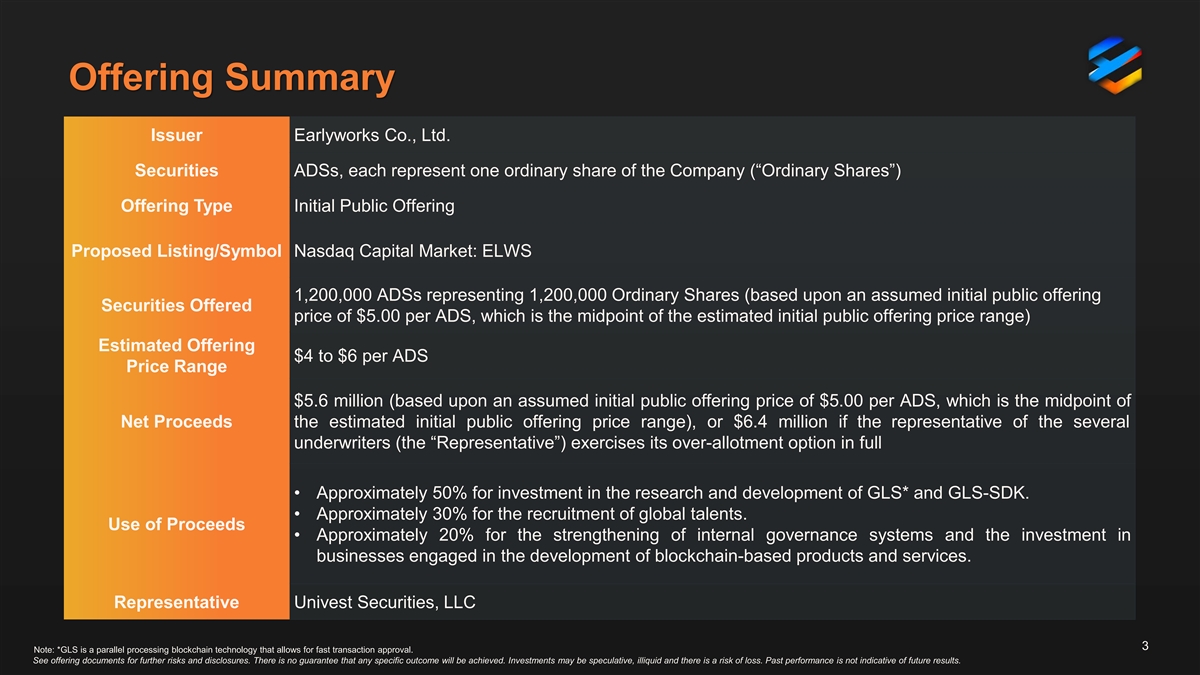

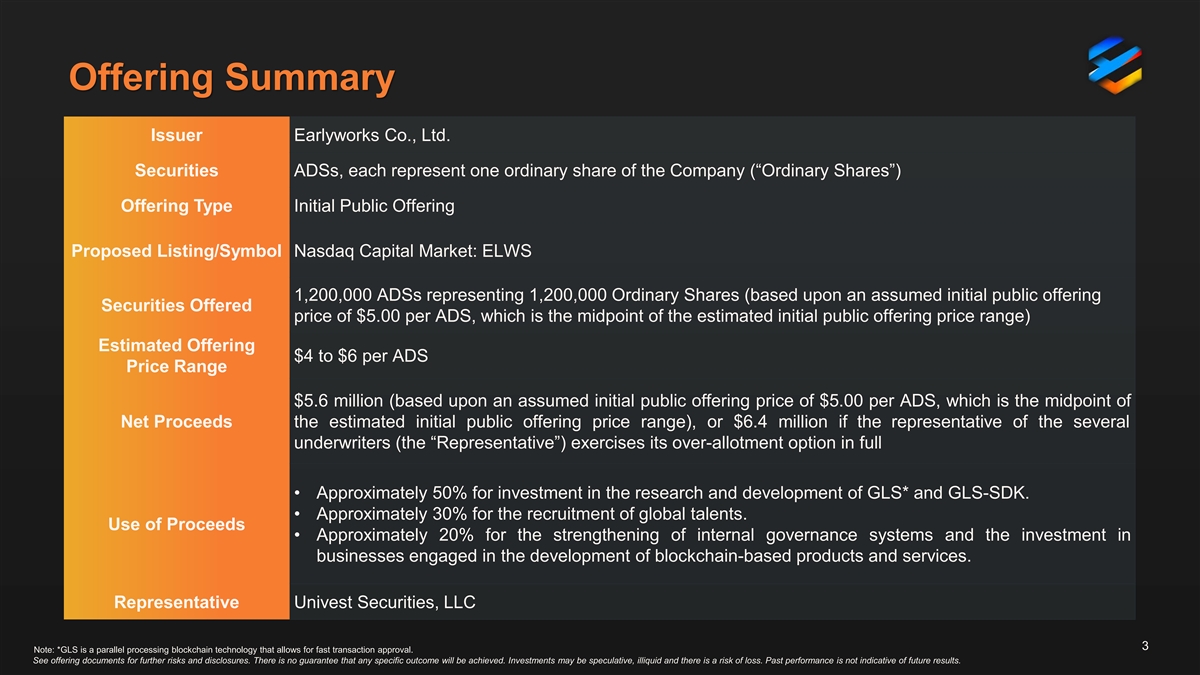

Offering Summary Issuer Earlyworks Co., Ltd. Securities ADSs, each represent one ordinary share of the Company (“Ordinary Shares”) Offering Type Initial Public Offering Proposed Listing/Symbol Nasdaq Capital Market: ELWS 1,200,000 ADSs representing 1,200,000 Ordinary Shares (based upon an assumed initial public offering Securities Offered price of $5.00 per ADS, which is the midpoint of the estimated initial public offering price range) Estimated Offering $4 to $6 per ADS Price Range $5.6 million (based upon an assumed initial public offering price of $5.00 per ADS, which is the midpoint of Net Proceeds the estimated initial public offering price range), or $6.4 million if the representative of the several underwriters (the “Representative”) exercises its over-allotment option in full • Approximately 50% for investment in the research and development of GLS* and GLS-SDK. • Approximately 30% for the recruitment of global talents. Use of Proceeds • Approximately 20% for the strengthening of internal governance systems and the investment in businesses engaged in the development of blockchain-based products and services. Representative Univest Securities, LLC 3 Note: *GLS is a parallel processing blockchain technology that allows for fast transaction approval. See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss. Past performance is not indicative of future results.

P5-10 Part 1 Company Overview P11-13 Part 2 Industry Overview P14-18 Part 3 Investment Highlights P19-20 Part 4 Financial Highlights P21-22 Part 5 Growth Strategies P23 Part 5 Corporate Structure 4

We are a Japanese company operating our proprietary private blockchain technology, , to leverage blockchain technology in various applications in a range of industries. We believe that Japan is lagging behind the international progress of blockchain system development. One reason for the slow development progress is the extremely small number of engineers in Japan who can handle blockchain technology and the high cost of learning. We aim to increase the number of use cases of GLS, and offer a general-purpose System Development Kit (“SDK”) for external engineers to improve GLS. Our mission is to keep updating GLS and make it an infrastructure in the coming . GLS Characteristics Verified Applicable Domain Our Goal Tamper-resistance Real estate Increase the number of use cases Security of GLS, and offer a general- Metaverse purpose SDK for external Reliability Financial services engineers to improve GLS. Others High-speed Processing Capacity 5 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss. Past performance is not indicative of future results.

While a conventional blockchain constitutes a transaction ledger database by connecting blocks in series, our GLS realizes a cyclic network structure for nodes (computer devices participating in the blockchain network), making it easy for multiple nodes participating in the network to simultaneously execute approval processes in parallel, thereby speeding up the transaction approval process and ensuring scalability. General Blockchain Our Blockchain 6 See Registration Statement for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss. Past performance is not indicative of future results.

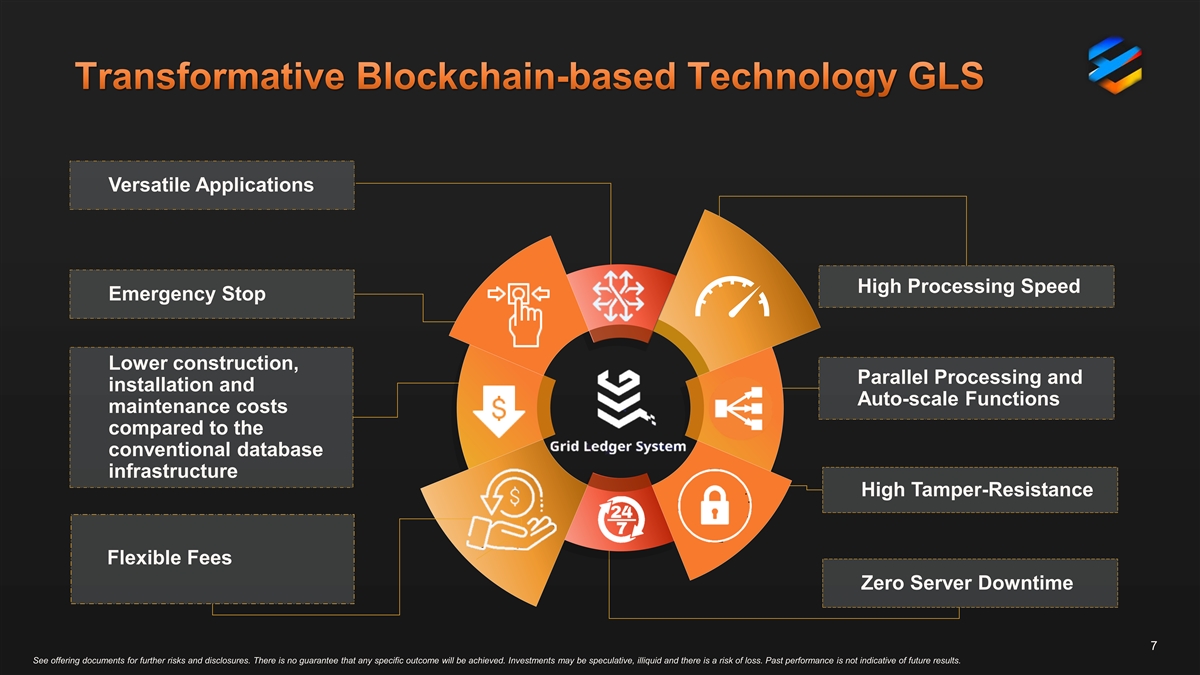

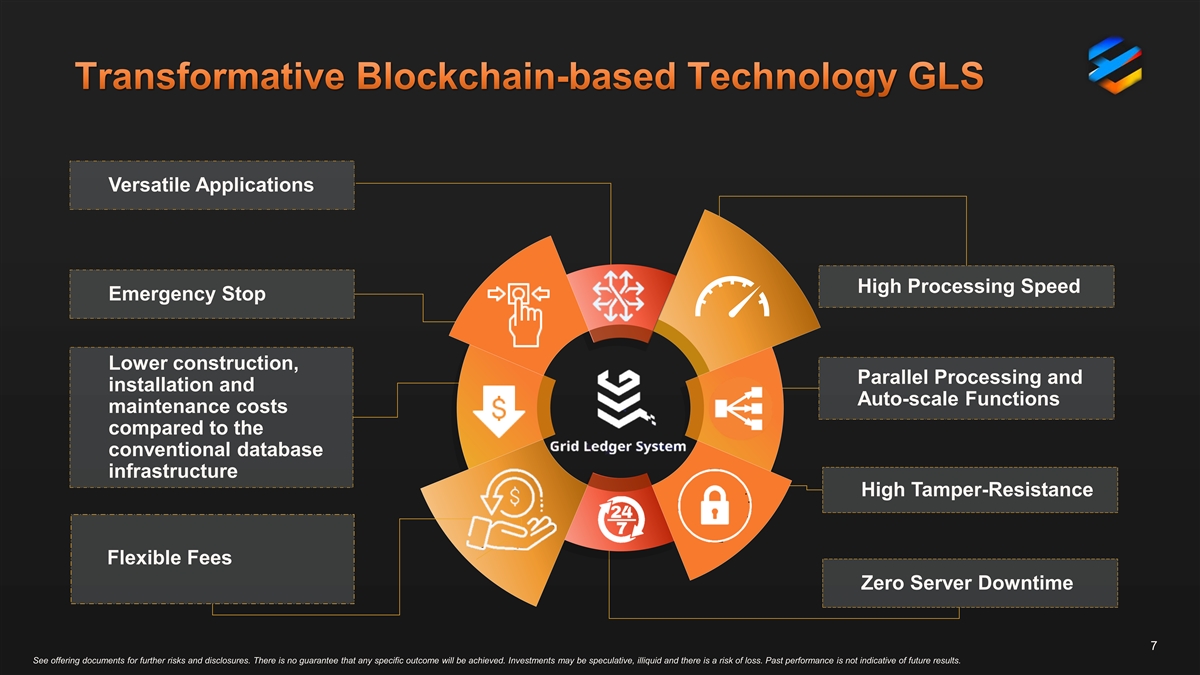

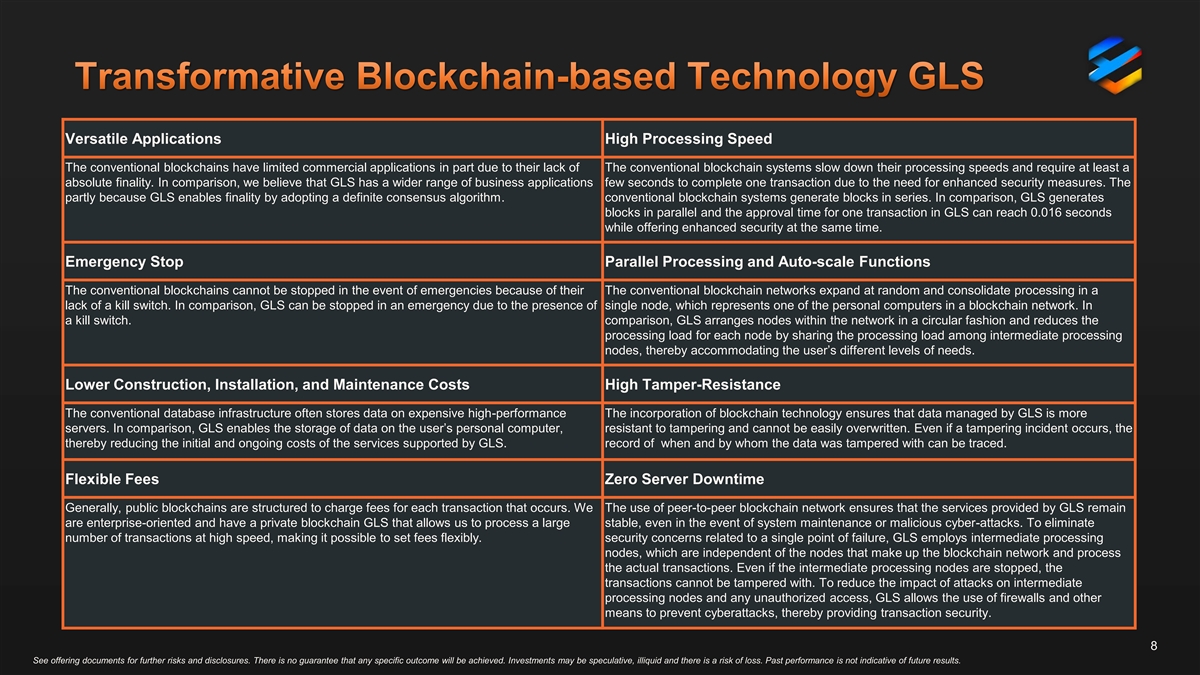

Versatile Applications High Processing Speed Emergency Stop Lower construction, Parallel Processing and installation and Auto-scale Functions maintenance costs compared to the conventional database infrastructure High Tamper-Resistance Flexible Fees Zero Server Downtime 7 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss. Past performance is not indicative of future results.

Versatile Applications High Processing Speed The conventional blockchains have limited commercial applications in part due to their lack of The conventional blockchain systems slow down their processing speeds and require at least a absolute finality. In comparison, we believe that GLS has a wider range of business applications few seconds to complete one transaction due to the need for enhanced security measures. The partly because GLS enables finality by adopting a definite consensus algorithm. conventional blockchain systems generate blocks in series. In comparison, GLS generates blocks in parallel and the approval time for one transaction in GLS can reach 0.016 seconds while offering enhanced security at the same time. Emergency Stop Parallel Processing and Auto-scale Functions The conventional blockchains cannot be stopped in the event of emergencies because of their The conventional blockchain networks expand at random and consolidate processing in a lack of a kill switch. In comparison, GLS can be stopped in an emergency due to the presence of single node, which represents one of the personal computers in a blockchain network. In a kill switch. comparison, GLS arranges nodes within the network in a circular fashion and reduces the processing load for each node by sharing the processing load among intermediate processing nodes, thereby accommodating the user’s different levels of needs. Lower Construction, Installation, and Maintenance Costs High Tamper-Resistance The conventional database infrastructure often stores data on expensive high-performance The incorporation of blockchain technology ensures that data managed by GLS is more servers. In comparison, GLS enables the storage of data on the user’s personal computer, resistant to tampering and cannot be easily overwritten. Even if a tampering incident occurs, the thereby reducing the initial and ongoing costs of the services supported by GLS. record of when and by whom the data was tampered with can be traced. Flexible Fees Zero Server Downtime Generally, public blockchains are structured to charge fees for each transaction that occurs. We The use of peer-to-peer blockchain network ensures that the services provided by GLS remain are enterprise-oriented and have a private blockchain GLS that allows us to process a large stable, even in the event of system maintenance or malicious cyber-attacks. To eliminate number of transactions at high speed, making it possible to set fees flexibly. security concerns related to a single point of failure, GLS employs intermediate processing nodes, which are independent of the nodes that make up the blockchain network and process the actual transactions. Even if the intermediate processing nodes are stopped, the transactions cannot be tampered with. To reduce the impact of attacks on intermediate processing nodes and any unauthorized access, GLS allows the use of firewalls and other means to prevent cyberattacks, thereby providing transaction security. 8 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss. Past performance is not indicative of future results.

Revenue Stream Software and Consulting and Solution System development Services Services Expected to increase by expanding the application of GLS to various industries. 9 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss. Past performance is not indicative of future results.

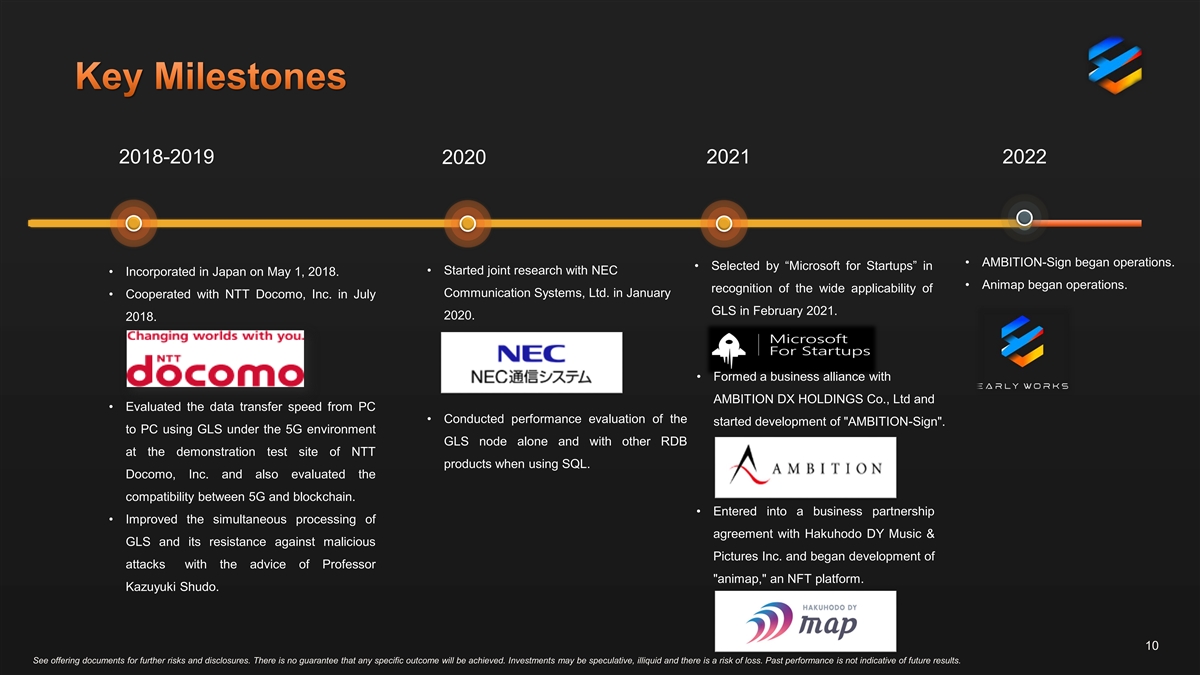

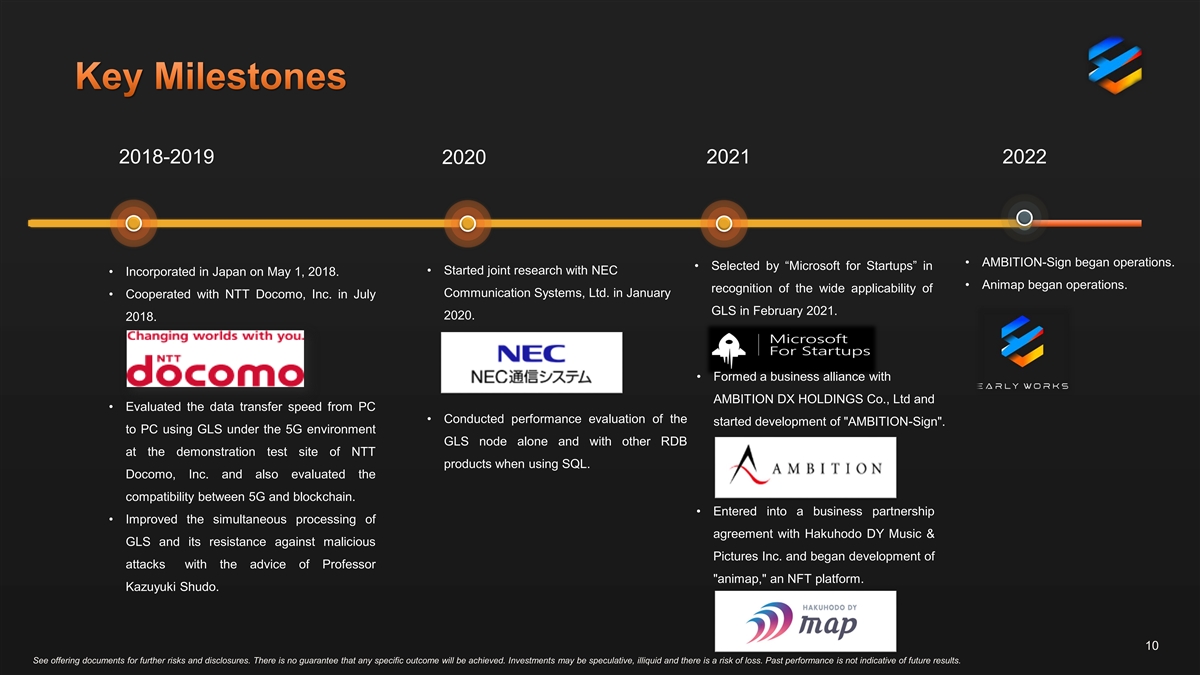

2018-2019 2021 2022 2020 • AMBITION-Sign began operations. • Selected by “Microsoft for Startups” in • Started joint research with NEC • Incorporated in Japan on May 1, 2018. • Animap began operations. recognition of the wide applicability of Communication Systems, Ltd. in January • Cooperated with NTT Docomo, Inc. in July GLS in February 2021. 2020. 2018. • Formed a business alliance with AMBITION DX HOLDINGS Co., Ltd and • Evaluated the data transfer speed from PC • Conducted performance evaluation of the started development of AMBITION-Sign . to PC using GLS under the 5G environment GLS node alone and with other RDB at the demonstration test site of NTT products when using SQL. Docomo, Inc. and also evaluated the compatibility between 5G and blockchain. • Entered into a business partnership • Improved the simultaneous processing of agreement with Hakuhodo DY Music & GLS and its resistance against malicious Pictures Inc. and began development of attacks with the advice of Professor animap, an NFT platform. Kazuyuki Shudo. 10 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss. Past performance is not indicative of future results.

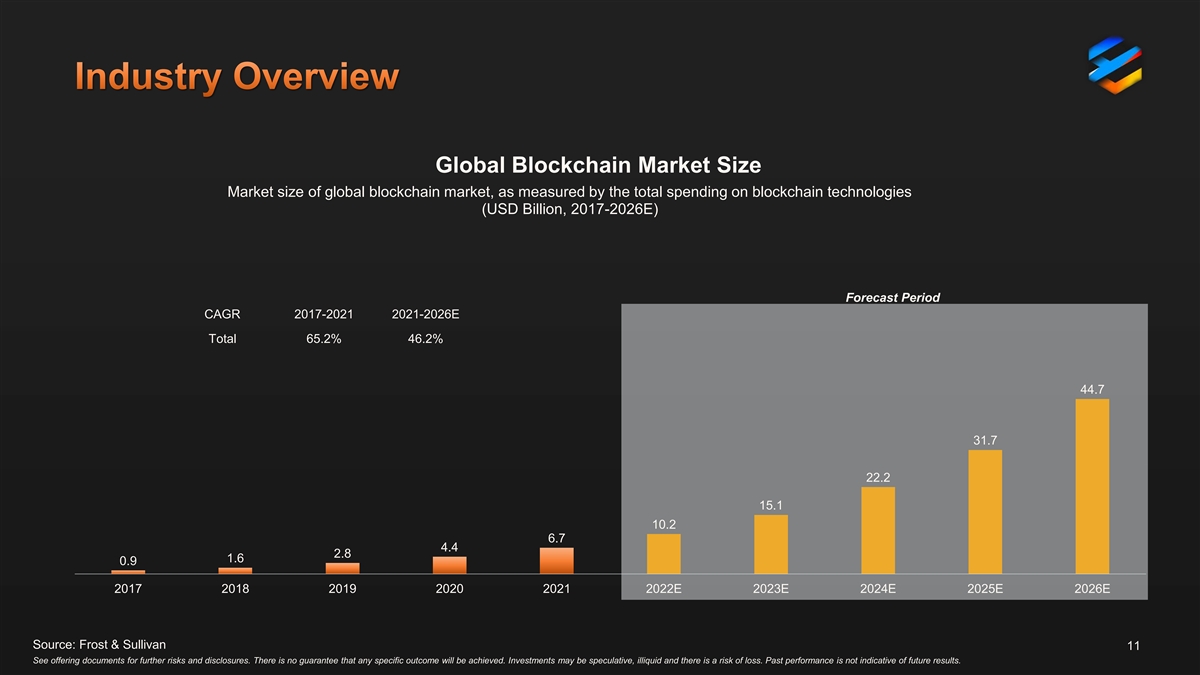

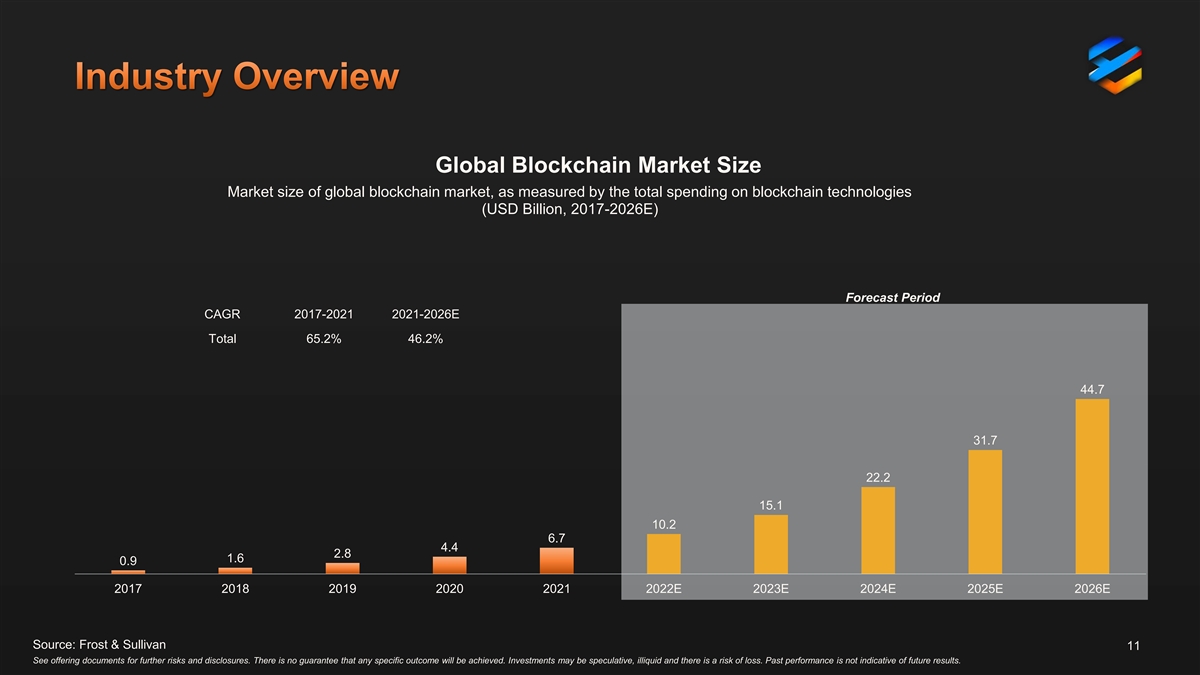

Global Blockchain Market Size Market size of global blockchain market, as measured by the total spending on blockchain technologies (USD Billion, 2017-2026E) Forecast Period CAGR 2017-2021 2021-2026E Total 65.2% 46.2% 44.7 31.7 22.2 15.1 10.2 6.7 4.4 2.8 1.6 0.9 2017 2018 2019 2020 2021 2022E 2023E 2024E 2025E 2026E Source: Frost & Sullivan 11 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss. Past performance is not indicative of future results.

Major Industries Applying Blockchain Technology and Japan Blockchain Market Size Major Application Scenarios in Japan Market size of Japan’s blockchain market, as measured by the total spending on blockchain technologies (USD Million, 2017-2026E) Financial Service Payments International transaction Insurance policy Forecast Period 8100 CAGR 2017-2021 2021-2026E Total 104.5% 63.2% Internet Real Estate Identity management Real estate transaction Intellectual property management management 5400 3400 Agriculture and Media Industrial 2000 Advertising Supply chain management Food traceability 1200 700 350 180 90 40 Energy Payments, sales, 2017 2018 2019 2020 2021 2022E 2023E 2024E 2025E 2026E trading, and distribution Source: Frost & Sullivan 12 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss. Past performance is not indicative of future results.

Driving Forces for the Blockchain Market in Japan Continuous penetration of blockchain technology in various business applications. Accelerated adoption of blockchain technology driven by digital transformation. Integration of blockchain and emerging technologies. Future Trends of the Blockchain Market in Japan Increasingly adoption of Blockchain-as-a-Service (the “BaaS”). Rise of multi-chain interoperability solutions. Source: Frost & Sullivan 13 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss. Past performance is not indicative of future results.

Trusted Relationships With Our Transformative Blockchain-based Our Transformative Blockchain-based Dedicated Talent Team Dedicated Talent Team Business Partners Technology GLS Technology GLS • Our business partners work with us for advice, • GLS constitutes our core strength and demonstrates certain • Robust R&D team members joint research, and system development. advantages compared to the conventional blockchains. • Professional management team • Some of our system development customers • Academia connection return to us for additional consulting and system • Outsourcing resources maintenance services. • System development business partners include companies in the real estate, entertainment, telecommunications, trade, e-commerce, chemical, advertising, and financial domains. Dedicated Trusted Business Talent Team Partners 14 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss. Past performance is not indicative of future results.

Robust R&D Team Members Professional Management Team Our professional management team has 195 Our robust research and development years of combined experience working with team members are dedicated to corporations of various operating scales blockchain research, operations, and across different industries. development to support the improvement of blockchain technology. Outsourcing Resources Academia Connection Academia Connection We, on occasions, consult with academia to We have an agreement with a third-party keep abreast of the most recent company for external engineers, some of advancement and technological issues of whom are graduates of Hanoi University of blockchain technology and to apply Technology, Vietnam’s leading school for IT academic perspectives to system professionals, majoring in information development. technology. 15 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss. Past performance is not indicative of future results.

Ryotaro Namba Satoshi Kobayashi Hiroki Yamamoto Akihisa Nagasaka Executive Officer CEO and Director CTO and Director CFO and Director • Mr. Namba has served as our Executive • Mr. Kobayashi has served as our CEO and • Mr. Yamamoto has served as our CTO and • Mr. Nagasaka has served as CFO and Director Officer since May 2021. Director since our inception. Director since our inception. since March 2020. • Mr. Namba has worked as a freelance • Mr. Yamamoto co-founded our Company • Mr. Nagasaka was a Section Manager with the • Mr. Kobayashi co-founded our Company in engineer after graduating from college and with CEO in May 2018. SMBC Nikko Securities Inc. from November May 2018. worked on various system development 2013 to March 2020. • Mr. Yamamoto was in charge of software projects since 2021. • Mr. Kobayashi served as the Representative development at arl-Y from August 2015 to • Mr. Nagasaka was a senior staff with the PwC • Mr. Namba joined our company as an Director with FEELO.Co. to oversee that May 2018. LLC from July 2012 to November 2013. employee in August 2018. company’s entire merchandising business • Mr. Yamamoto acted as a Software • Mr. Nagasaka was a senior staff with the PwC from August 2016 to December 2018. Developer at Sunplan Soft Co from April Arata Audit Corporation from December 2007 • Mr. Namba studied at the School of Materials Science and Engineering of 2013 to July 2015. to July 2012. • Mr. Kobayashi acted as a Manager of Tokyo Institute of Technology starting from Pasona Inc., where Mr. Kobayashi was in • Mr. Yamamoto studied Robotics Creation 2012 and obtained a Master’s degree from • Mr. Nagasaka studied at the Department of charge of temporary staff management and and obtained an Associate degree from the university in March 2018. Business Administration of Yokohama City consulting from January 2013 to December Nagoya College of Engineering in March University and obtained a Bachelor’s degree 2015. 2013. from the university in March 2006. 16 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss. Past performance is not indicative of future results.

Masahiro Tominaga Yukio Nakamura Kiyomitsu Takayama Independent Director Independent Director Independent Director • Mr. Takayama has served as our Independent Director since • Mr. Nakamura has served as our Independent Director • Mr. Tominaga has served as our Independent since February 2021. February 2021. Director since July 2019. • Mr. Nakamura has served as the Representative Director • Mr. Takayama has served as the Global Vice President and • Mr. Tominaga has served as the Representative of Office Sunrise Inc., which is engaged in the business Japan Country Manager at Pendo.io Japan, which is a Director of Dizzy Co., which is engaged in the of management consulting, since February 2017. product management company, since November 2020. business of management consulting and web-related • Mr. Nakamura acted as an Advisor to Sompo Japan consulting, since January 2016. • Mr. Takayama was the Vice President, the Global General Insurance Inc. from June 2012 to September 2014. Manager of channel sales division, and the General Manager • Mr. Tominaga was the Executive Vice President of • Mr. Nakamura was a company auditor at Sompo Japan of renewal sales department of Box, Inc., a digital solution UNIMEDIA INC., a company dedicated to digital Insurance Inc. from June 2009 to June 2012. provider from February 2014 to October 2020. innovation, from January 2003 to December 2015. • Mr. Nakamura served as the Representative Director and • Mr. Takayama was Senior Sales Manager with Cloudera, Senior Managing Executive Officer at Sompo Japan • Mr. Tominaga studied economics and obtained a Inc., a data management company from July 2012 to Insurance Inc. from April 2007 to June 2009. Bachelor’s degree from Musashi University in March February 2014. 2001. • Mr. Nakamura studied commerce and obtained a Bachelor’s degree from Waseda University in March • Mr. Takayama studied business administration and obtained 1973. a Bachelor’s degree from Aoyama College University in March 2001. 17 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss. Past performance is not indicative of future results.

Partners Alliances 18 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss. Past performance is not indicative of future results.

Gross Profit / Net profit / Net profit exc. Total Revenue Stock-based Compensation Expenses Fiscal Year Ended April 30 Fiscal Year Ended April 30 463.7 355.3 182.7 67.5 -14.5 -70.5 216.2 Gross Profit Net Profit Net Profit excluding stock-based -602.5 compensation expenses FY2021 FY2022 FY2021 FY2022 19 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss. Past performance is not indicative of future results. JPY Millions JPY Millions

Revenue Breakdown Revenues from Software and System Development Services Fiscal Year Ended April 30 Fiscal Year Ended April 30 234.7 95.3 44.1% 49.4% 50.6% 55.9% FY2021 FY2022 Revenues from Consulting and Solution Services Fiscal Year Ended April 30 229.0 Software and System Development Services Consulting and Solution Services 120.9 FY2021 FY2022 FY2021 FY2022 20 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss. Past performance is not indicative of future results. JPY Millions JPY Millions

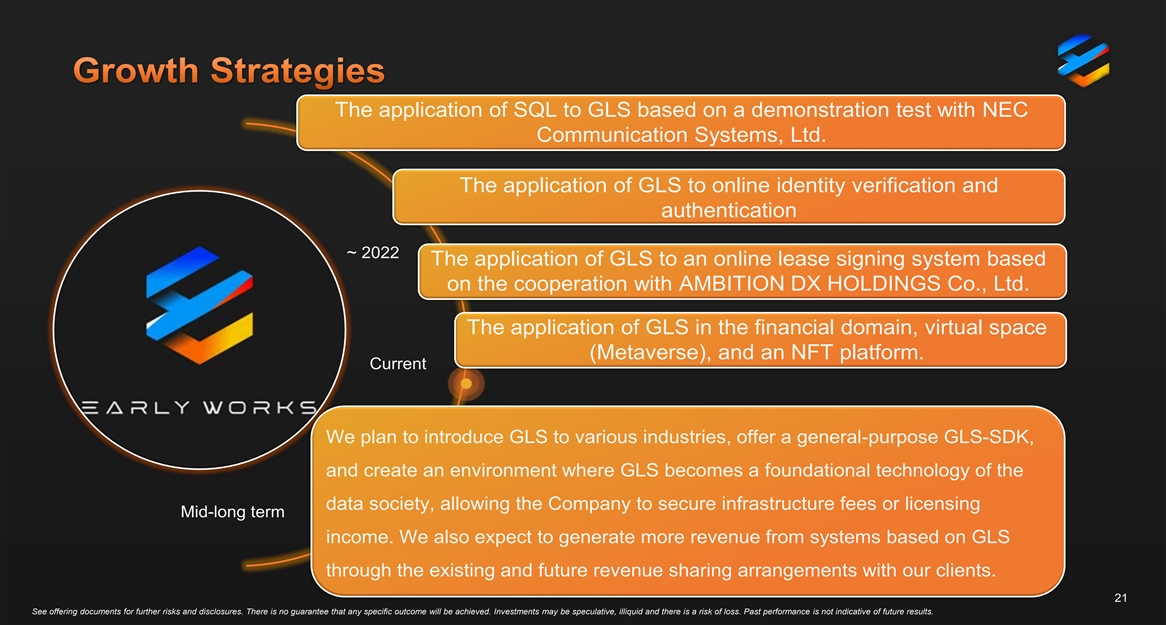

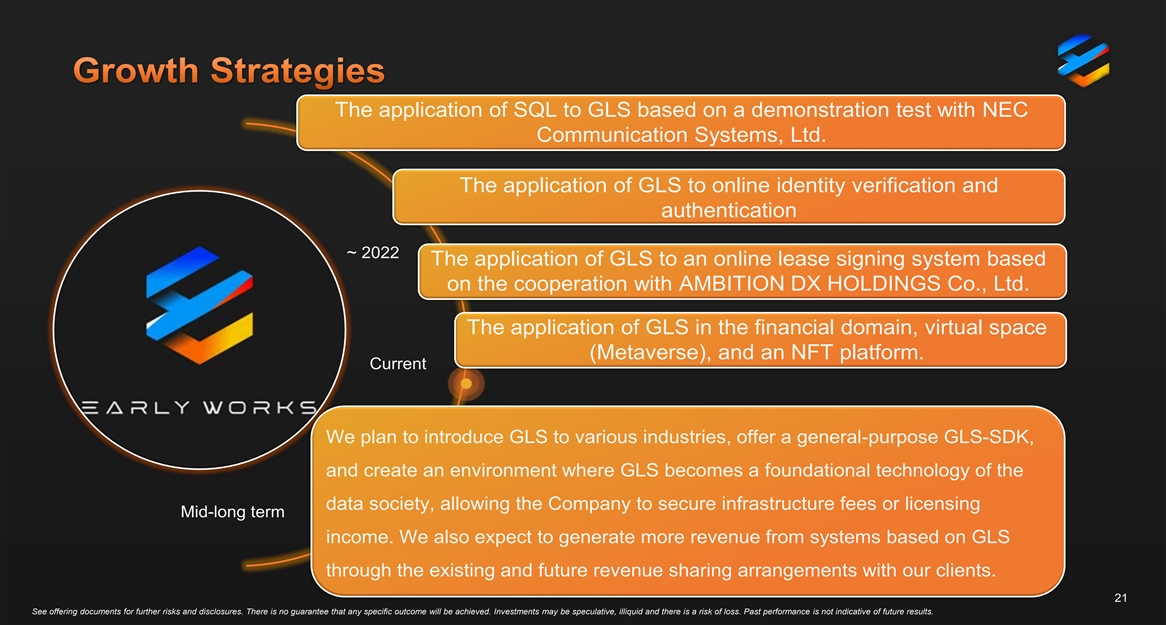

The application of SQL to GLS based on a demonstration test with NEC Communication Systems, Ltd. The application of GLS to online identity verification and authentication ~ 2022 The application of GLS to an online lease signing system based on the cooperation with AMBITION DX HOLDINGS Co., Ltd. The application of GLS in the financial domain, virtual space (Metaverse), and an NFT platform. Current We plan to introduce GLS to various industries, offer a general-purpose GLS-SDK, and create an environment where GLS becomes a foundational technology of the data society, allowing the Company to secure infrastructure fees or licensing Mid-long term income. We also expect to generate more revenue from systems based on GLS through the existing and future revenue sharing arrangements with our clients. 21 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss. Past performance is not indicative of future results.

Insurance GLS is expected to verify identity and manage contractual data, and to facilitate Entertainment the completion of insurance transactions and enable smooth, accurate, and quick GLS is expected to enable rapid processing switching of insurance policies. of a large number of transactions conducted among a large number of users, user identity verification and in-game activity Energy records. GLS is expected to enable the required rapid processing. Trade GLS is expected to provide fast real-time data management that enables companies Supply Chain involved in the trade domain to obtain meaningful information. GLS is expected to provide fast real- time data management that enables companies involved in the supply chain to obtain meaningful information. 22 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss. Past performance is not indicative of future results.

(1) (2) Satoshi Kobayashi Themis Capital GK Minority Shareholders Public Shareholders (3) Pre-IPO%/Post-IPO% 39.47%/36.32% 28.90%/26.60% 31.63%/29.10% 0%/7.98% Earlyworks Co., Ltd. Notes: All percentages reflect the equity interests held by each of our shareholders. (1)Represents 4,000,000 Ordinary Shares held by Themis Capital GK, which is 100% owned by Satoshi Kobayashi, our chief executive officer and representative director, as of January 13, 2023. (2) Represents an aggregate of 4,377,135 Ordinary Shares held by 50 shareholders of our Company, each one of which holds less than 5% of our equity interests, as of January 13, 2023. (3) The percentage of Ordinary Shares prior to this offering does not include up to an aggregate of 3,035,000 Ordinary Shares issuable upon the exercise of options outstanding as of January 13, 2023. The percentage of Ordinary Shares to be owned after the offering is based on 13,839,400 Ordinary Shares outstanding as of January 13, 2023 and the issuance of 1,200,000 Public Offering ADSs representing 1,200,000 Ordinary Shares in the offering based on the assumed initial public offering price of $5.00, the mid-point of the range set forth on Slide 3 and does not include up to an aggregate of 3,035,000 Ordinary Shares issuable upon the exercise of options outstanding as of January 13, 2023. 23 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss. Past performance is not indicative of future results.

Underwriter Univest Securities, LLC Edric Guo Email: info@univest.us Address: 75 Rockefeller Plaza Suite 1838 New York, NY 10019 24