The information contained in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED APRIL 1, 2024

PRELIMINARY PROSPECTUS

APOLLOMICS INC.

PRIMARY OFFERING OF

11,026,900 Class A Ordinary Shares

SECONDARY OFFERING OF

52,794,176 Class A Ordinary Shares

432,431 Warrants to Purchase Class A Ordinary Shares

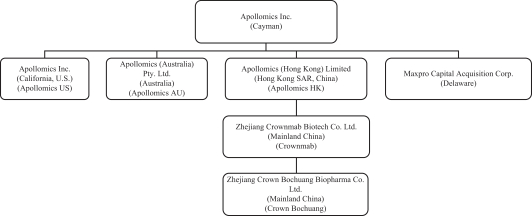

This prospectus relates to the offer and sale by Apollomics Inc., a Cayman Islands exempted company, (“us,” “we,” “Apollomics” or the “Company”), of (i) up to 464,150 of our Class A ordinary shares, par value $0.0001 per share (“Class A Ordinary Shares”) that are issuable by us upon the exercise of 464,150 Private Warrants (as defined below), (ii) up to 155,250 Class A Ordinary Shares that are issuable by us upon exercise of 155,250 warrants that were originally issued to Maxpro Sponsor (as defined below) by Maxpro (as defined below) to fund Maxpro’s extension of its deadline to consummate an initial business combination and were assumed by Apollomics at the Closing, with each whole warrant exercisable for one Class A Ordinary Share at an exercise price of $11.50 per whole share (the “Extension Warrants”), issued to MP One Investment LLC, a Delaware limited liability company (“Maxpro Sponsor”), the sponsor of Maxpro Capital Acquisition Corp., a Delaware corporation (“Maxpro”), (iii) up to 10,350,000 Class A Ordinary Shares that are issuable by us upon exercise of 10,350,000 warrants, which were included in the units sold in the Maxpro IPO (as defined below) and were assumed by us at the Closing (as defined below), with each whole warrant exercisable for one Class A Ordinary Share at an exercise price of $11.50 per whole share (“Public Warrants”), which were previously registered, (iv) up to 57,500 Class A Ordinary Shares issuable by us upon the exercise of 57,500 Penny Warrants (as defined below).

This prospectus also relates to the offer and sale from time to time, by the selling securityholders named in this prospectus (collectively, the “Selling Securityholders”) of up to (i) 1,989,339 of our Class A Ordinary Shares that were issued to Maxpro Sponsor and the former officers and directors of Maxpro who received founder shares (as defined below) in connection with Maxpro’s initial public offering (the “Maxpro IPO”) (Maxpro Sponsor and such officers and directors, the “Maxpro Founders”), (ii) 1,941 of our Class A Ordinary Shares that were issued to the underwriter of the Maxpro IPO (including its designee, the “Maxpro IPO Underwriter”), (iii) 1,204,621 of our Class A Ordinary Shares that were issued to insiders of Apollomics (such shareholders, the “Apollomics Legacy Holders”) who held securities of Apollomics prior to the closing (the “Closing”) of the business combination with Maxpro (as further described herein, the “Business Combination”), (iv) 46,409,594 of our Class A Ordinary Shares which were issued by us upon the conversion of 46,409,594 Class B ordinary shares, par value $0.0001 per share (“Class B Ordinary Shares”), held by the Apollomics Legacy Holders, (v) 30,000 Class A Ordinary Shares which were issued by us upon the conversion of 30,000 Class B Ordinary Shares that were issued by us to certain accredited investors (the “PIPE Investors”) pursuant to subscription agreements entered into on February 9, 2023, by and between Apollomics and the PIPE Investors (the “Subscription Agreements”), (vi) 57,500 Class A Ordinary Shares that are issuable by us upon the exercise of 57,500 warrants issued to certain PIPE Investors pursuant to the Subscription Agreements, each exercisable to purchase one Class A Ordinary Share at $0.01 per share (the “Penny Warrants”), (vii) 2,668,750 Class A Ordinary Shares that were issued to certain PIPE investors upon the conversion of 2,135,000 of our Series A Preferred Shares, par value $0.0001 per share (the “Series A Preferred Shares”) held by such PIPE investors pursuant to the Subscription Agreements, (viii) 432,431 Class A Ordinary Shares issuable upon exercise of warrants that were originally issued to Maxpro Sponsor in units sold in a private placement in connection with the Maxpro IPO and were assumed by us at the Closing, with each whole warrant exercisable for one Class A Ordinary Share at an exercise price of $11.50 per whole share (the “Private Warrants”, together with Public Warrants, and Penny Warrants, the “Warrants”), (ix) 432,431 Private Warrants. The 1,941 Class A Ordinary Shares were originally issued as part of the compensation for underwriting Maxpro’s initial public offering in October 2021. In addition, the aggregate of 47,614,215 Class A Ordinary Shares registered hereby on behalf of securityholders of Apollomics who held its securities prior to the Closing were issued as a portion of the consideration received by Apollomics in connection with the Business Combination.

We are registering the offer and sale of these securities to satisfy certain registration rights we have granted. The Selling Securityholders may offer all or part of the securities for resale from time to time through public or private transactions, at either prevailing market prices or at