Exhibit 99.2

OHMYHOME LIMITED

Conyers Trust Company (Cayman) Limited

Cricket Square, Hutchins Drive

PO Box 2681, Grand Cayman,

KY1-111, Cayman Islands

Attention: The Board of Directors

| SENDER’S REF | | RECIPIENT’S REF | | DATE | | PAGE |

| PCYG/SNXN/357997/00001 | | - | | 6 December 2022 | | 1/8 |

Dear Sirs

OHMYHOME LIMITED (THE “LISTCO”) – REGISTRATION STATEMENT ON FORM F-1 OF THE LISTCO

| 1. | Introduction |

| | |

| | We have acted as Malaysia legal counsel to Ohmyhome Sdn. Bhd. (the “OMH”) and Ohmyhome Realtors Sdn. Bhd. (the “OMH Realtors”) (collectively, the “Malaysia Companies), companies incorporated under the laws of Malaysia, in connection with the Offering (as defined below) and we refer to the Registration Statement on Form F-1 (the “Registration Statement”) filed by the Listco with the U.S. Securities and Exchange Commission (the “SEC”) in connection with the registration under the Securities Act of 1933, as amended (the “Securities Act”), of the public offering (the “Offering”) of (a) up to 3,250,000 ordinary shares in the capital of the Listco (the “Offer Shares”). We have taken instructions solely from the Malaysia Companies. This opinion is being rendered solely to the Malaysia Companies, in connection with the filing of the Registration Statement by the ListCo, being the indirect holding company of the Malaysia Companies. |

| | |

| 2. | Documents |

| | |

| 2.1. | In rendering this letter, we have examined the following documents but only to the extent necessary for the purposes of rendering this letter: |

| | (a) | a copy of the Registration Statement on Form F-1; |

| | | |

| | (b) | copies of the Certificate of Incorporation of Private Company of each of the Malaysia Companies, extracted from Companies Commission of Malaysia (“CCM”) on 17 January 2019; |

| | | |

| | (c) | such other documents as we have considered necessary or desirable to examine in order that we may render this letter, |

| | (collectively, the “Reviewed Documents”). |

| 2.2. | Other than the Reviewed Documents which we have reviewed for the purpose of this letter, we have not reviewed any other document or carried out any other enquiries or investigation (including without limitation, any due diligence on the business and operations of each of the Malaysia Companies) for the purposes of giving this letter. Our opinion herein is accordingly subject to there not being anything contained in any document not reviewed by us or any information not disclosed to us that may, if so reviewed by or disclosed to us, require us to vary or amend this letter or make any further inquiry or investigation which would, in our judgement, be necessary or appropriate, for the purposes of expressing the opinions set forth. |

| | |

| 3. | Scope |

| | |

| | This letter relates only to the laws of general application in Malaysia as at the date hereof and as currently applied by the Malaysia courts, and is given on the basis that it will be governed by and construed in accordance with Malaysia Laws. We have made no investigation of, and do not express or imply any views on, the laws of any country other than Malaysia. In respect of the Reviewed Documents, we have assumed due compliance with all matters concerning the laws of all other relevant jurisdictions (other than Malaysia). In particular:- |

| | (a) | we express no opinion (i) on public international law or on the rules of or promulgated under any treaty or by any treaty organisation, or on any taxation laws of any jurisdiction (including Malaysia); (ii) that the future or continued performance of a party’s obligations or the consummation of the transactions contemplated by the Reviewed Documents and/or the Offering will not contravene Malaysia Laws, its application or interpretation if altered in the future; and (iii) with regard to the effect of any systems of law (other than Malaysia Laws) even in cases where, under Malaysia Laws, any foreign law should be applied, and we therefore assume that any applicable law (other than Malaysia Laws) would not affect or qualify the opinions as set out below; |

| | | |

| | (b) | we express no opinion as to the correctness of any representation given by any of the parties (express or implied) under or by virtue of the Reviewed Documents or of facts (or statements of foreign law) or the reasonableness of any statements of opinion or intention contained in any of the Reviewed Documents, save if and insofar as the matters represented are the subject matter of a specific opinion herein; |

| | | |

| | (c) | Malaysia legal concepts are expressed in English terms; however, the concepts concerned may not be identical to the concepts described by the same English terms as they exist in the laws of other jurisdictions, this letter may, therefore, only be relied upon the express condition that any issues of the interpretation or liability arising hereunder will be governed by Malaysia Laws; and |

| | | |

| | (d) | this letter speaks as of the date hereof, no obligation is assumed to update this letter or to inform any person of any changes of law or other matters coming to our knowledge and occurring after this date, which may, affect this letter in any respect. |

| 4. | Assumptions |

| | |

| | For the purposes of this letter, we have assumed (without making any investigation) the following: |

| | (a) | each party to the Reviewed Documents (if a corporation and other than the relevant Malaysia Company) is duly incorporated and validly existing under the laws of the country of its incorporation and its place of business and, to the extent relevant in such party’s jurisdiction, is in good standing under the laws applicable to such party, and has the power to carry on its business as provided in its memorandum and articles of association or other constitutional documents; |

| | | |

| | (b) | that the copies of the Certificate of Incorporation of Private Company of each of the Malaysia Companies, submitted to us for examination are true, complete and up-to-date copies; |

| | | |

| | (c) | none of the directors of each of the Malaysia Companies have been disqualified or restrained from acting as directors of a company under the Companies Act and none of them have done any act which may lead to their office being vacated under the Companies Act; |

| | | |

| | (d) | the shareholders of each of the Malaysia Companies as registered in the respective Register of Members of the relevant Malaysia Company are the beneficial owners of such shares and have not charged or created any encumbrance on their shares; |

| | | |

| | (e) | all allotments of shares in each of the Malaysia Companies which were for cash have been validly paid for and that any other consideration for allotments of shares have been validly performed or received in full by the relevant Malaysia Company; |

| | | |

| | (f) | there have been no changes in the circumstances of each of the Malaysia Companies since the dates of our review of the Reviewed Documents; |

| | | |

| | (g) | the parties to the Reviewed Documents are not, and will not be, engaging in, nor is any such party aware of, misleading or unconscionable or improper conduct or seeking to conduct any relevant transaction or any associated activity in a manner or for a purpose not evident on the face of any of the Reviewed Documents which might render any of the Reviewed Documents or any relevant transaction or associated activity illegal, void or voidable, irregular or invalid; |

| | | |

| | (h) | each of the Malaysia Companies is not established as a vehicle for fraud or evasion of existing legal obligations; and |

| | | |

| | (i) | there are no provisions of the laws of any jurisdiction outside Malaysia which would have any implication for the opinions we express and, insofar as the laws of any jurisdiction outside Malaysia may be relevant, such laws have been and will be complied with. |

| | The making of the above assumptions does not imply that we have made any enquiry to verify any assumption (other than as expressly stated in this letter). No assumption specified above is limited by reference to any other assumption. |

| | |

| 5. | Opinion |

| | |

| | Based on the foregoing and subject to the qualifications herein, we are of the opinion, or we note (as the case may be) that the boxed statements set forth in the Registration Statement under the captions “Enforceability of Civil Liabilities - Malaysia” and “Regulatory Environment – Laws and Regulations Relating to Our Business in Malaysia”, as set out in Schedule 1 hereto, insofar as such statements constitute summaries of the Malaysia legal matters referred to therein as of the date hereof, fairly summarise the matters referred to therein as of the date hereof. |

| 6. | Qualifications |

| | |

| | Our opinion above is subject to the following qualifications: |

| | (a) | we have made no investigation into, and do not express or imply any views on, the laws or regulations of any country other than Malaysia or on any non-legal regulation or standard such as but not limited to accounting, financial or technical rules or standards. In respect of the Registration Statement, we have assumed due compliance with all matters concerning the laws of all other jurisdictions other than Malaysia; |

| | | |

| | (b) | where a party to the Reviewed Documents is vested with direction or may determine a matter in its opinion, such discretion may be required to be exercised reasonably or that such an opinion is based on reasonable grounds under the Malaysia Laws; |

| | | |

| | (c) | any provision in the Reviewed Documents providing for the severance of any provision which is illegal, invalid or unenforceable may not be binding under the Malaysia Laws as it depends on the nature of the illegality, invalidity or unenforceability in question which issue would be determined by a court of Malaysia at its discretion; |

| | | |

| | (d) | the enforcement of the Reviewed Documents in the courts of Malaysia will be subject to the application rules of civil procedure of Malaysia; |

| | | |

| | (e) | we neither give nor imply any opinion as to any tax consequences of any transactions contemplated by the Offering; |

| | | |

| | (f) | except as may be expressly described herein, we have not undertaken any independent investigation to determine the existence or absence of any facts and no inference as to our knowledge of the existence or absence of such facts should be drawn from our serving as counsel in giving this letter; |

| | | |

| | (g) | a claim for breach or enforcement of the Reviewed Documents will have to be brought within the applicable limitation period under the Limitation Act 1953 of Malaysia; and |

| | | |

| | (h) | if a person for whose benefit our letter is given is actually aware of or believes there to be a false or misleading statement or an omission of the information requested to be provided to us in connection with the work performed by us in rendering this letter, that person may not rely on this letter in relation to that statement or omission and should seek legal advice on the specific matter concerned. |

| 7. | We hold ourselves out as only having legal expertise and our statements in this letter are made only to the extent that a law firm practising Malaysia law in Malaysia, having our role in connection with the Offering, would reasonably be expected to have become aware of relevant facts and/or to have identified the implications of those facts. |

| | |

| 8. | We hereby consent to the use of our opinion as herein set forth as an exhibit to the Registration Statement. In giving this consent, we do not hereby admit that we come within the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations promulgated thereunder. |

| | |

| 9. | This opinion is only for the benefit of the person to whom it is addressed, subject to the condition that such person accepts and acknowledges that this opinion may not be appropriate or sufficient for such person’s purposes, and is strictly limited to the matters expressly stated herein and is not to be read as extending by implication to any other matter in connection with the Offering, the Registration Statement or otherwise, including without limitation any other documents which may be executed and delivered in connection with any transaction contemplated thereunder. Further, except for the purposes of filing this opinion with the Commission as an exhibit to the Registration Statement, this opinion is not to be circulated to, or relied upon by, any other person (other than persons entitled to rely on it pursuant to applicable provisions of federal securities law in the United States, if applicable), or quoted or referred to in any public document or filed with any governmental body or agency without our prior written consent. |

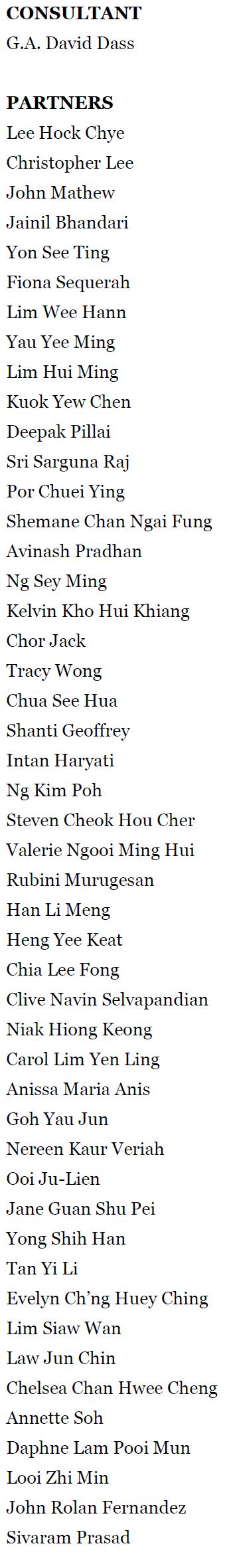

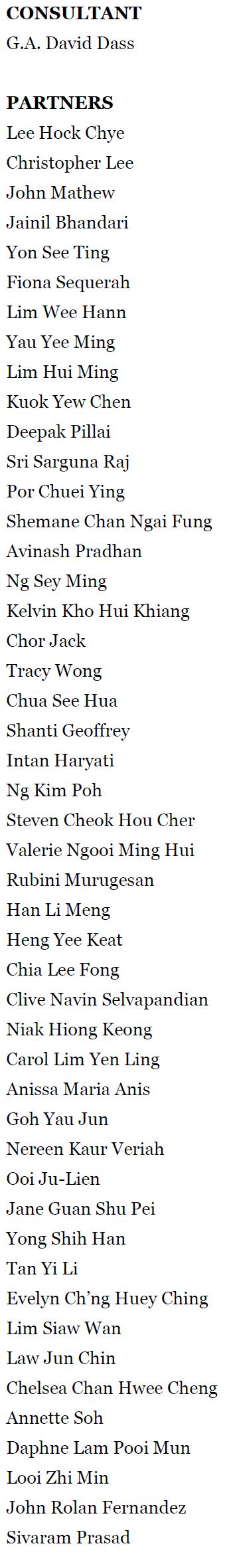

| Yours faithfully | |

| | |

| /s/ Christopher & Lee Ong | |

| | |

| Por Chuei Ying | |

| Christopher & Lee Ong | |

SCHEDULE 1

Cayman Islands

Conyers Dill & Pearman, our counsel as to Cayman Islands law, has advised us that there is uncertainty as to whether the courts of the Cayman Islands would (i) recognize or enforce judgments of the U.S. courts obtained against us or our Directors or executive officers that are predicated upon the civil liability provisions of the U.S. securities laws or any U.S. state; or (ii) entertain original actions brought in the Cayman Islands against us or our Directors or executive officers that are predicated upon the U.S. securities laws or the securities laws of any U.S. state.

We have been advised by Conyers Dill & Pearman that although there is no statutory enforcement in the Cayman Islands of judgments obtained in the federal or state courts of the United States (and the Cayman Islands are not a party to any treaties for the reciprocal enforcement or recognition of such judgments), the courts of the Cayman Islands would recognize as a valid judgment, a final and conclusive judgment in personam obtained in the federal or state courts of the United States against the Company under which a sum of money is payable (other than a sum of money payable in respect of multiple damages, taxes or other charges of a like nature or in respect of a fine or other penalty) or, in certain circumstances, an in personam judgment for non-monetary relief, and would give a judgment based thereon provided that (a) such courts had proper jurisdiction over the parties subject to such judgment; (b) such courts did not contravene the rules of natural justice of the Cayman Islands; (c) such judgment was not obtained by fraud; (d) the enforcement of the judgment would not be contrary to the public policy of the Cayman Islands; (e) no new admissible evidence relevant to the action is submitted prior to the rendering of the judgment by the courts of the Cayman Islands; and (f) there is due compliance with the correct procedures under the laws of the Cayman Islands. However, the Cayman Islands courts are unlikely to enforce a judgment obtained from United States courts under civil liability provisions of the U.S. federal securities law if such judgment is determined by the courts of the Cayman Islands to give rise to obligations to make payments that are penal or punitive in nature. Because such a determination has not yet been made by a court of the Cayman Islands, it is uncertain whether such civil liability judgments from U.S. courts would be enforceable in the Cayman Islands. A Cayman Islands court may stay enforcement proceedings if concurrent proceedings are being brought elsewhere.

Singapore

There is uncertainty as to whether the courts of Singapore would (i) recognize or enforce judgments of United States courts obtained against us or our Directors or officers predicated upon the civil liability provisions of the securities laws of the United States or any state in the United States or (ii) entertain original actions brought in Singapore against us or our directors or officers predicated upon the securities laws of the United States.

In making a determination as to enforceability of a judgment of the courts of the United States, and subject to the Singapore courts having jurisdiction over the judgment debtor, the Singapore courts would have regard to whether the judgment was final and conclusive and on the merits of the case, given by a court of law of competent jurisdiction, and was expressed to be for a fixed sum of money. In general, an in personam foreign judgment that is final and conclusive (that is, in general, a judgment that makes a final determination of rights between the parties and cannot be re-opened or altered by the court that delivered it, or be overridden by another body not being an appellate or supervisory body, although it may be subject to an appeal), given by a competent court of law having jurisdiction over the parties subject to such judgment, and for a fixed and ascertainable sum of money, may be enforceable as a debt in the Singapore courts under common law unless procured by fraud, or the proceedings in which such judgments were obtained were not conducted in accordance with principles of natural justice, or the enforcement thereof would be contrary to fundamental public policy, or if the judgment would conflict with earlier judgment(s) from Singapore or earlier foreign judgment(s) recognized in Singapore, or if the judgment would amount to the direct or indirect enforcement of foreign penal, revenue or other public laws (save where any such component of the judgment can be duly severed from the rest of the judgment sought to be enforced). Civil liability provisions of the federal and state securities law of the United States permit the award of punitive damages against us, our Directors and officers. Singapore courts would not recognize or enforce judgments against us, our Directors and officers to the extent that doing so would amount to the direct or indirect enforcement of foreign penal, revenue or other public laws. It is uncertain as to whether a judgment of the courts of the United States under civil liability provisions of the federal securities law of the United States would be regarded by the Singapore courts as being pursuant to foreign penal, revenue or other public laws. Such a determination has yet to be made by a Singapore court in a reported decision.

Malaysia

There is uncertainty as to whether the courts of Malaysia would (i) recognize or enforce judgments of United States courts obtained against us or our Directors or officers predicated upon the civil liability provisions of the securities laws of the United States or any state in the United States or (ii) entertain original actions brought in Malaysia against us or our directors or officers predicated upon the securities laws of the United States.

In making a determination as to enforceability of a judgment of the courts of the United States, and subject to the Malaysian courts having jurisdiction over the judgment debtor, the Malaysian courts would have regard to whether the judgment was final and conclusive and on the merits of the case, given by a court of law of competent jurisdiction, and was expressed to be for a fixed sum of money. In general, an in personam foreign judgment that is final and conclusive (that is, in general, a judgment that makes a final determination of rights between the parties and cannot be re-opened or altered by the court that delivered it, or be overridden by another body not being an appellate or supervisory body, although it may be subject to an appeal), given by a competent court of law having jurisdiction over the parties subject to such judgment, and for a fixed and ascertainable sum of money, may be enforceable as a debt in the Malaysian courts under common law unless procured by fraud, or the proceedings in which such judgments were obtained were not conducted in accordance with principles of natural justice, or the enforcement thereof would be contrary to fundamental public policy, or if the judgment would conflict with earlier judgment(s) from Malaysia or earlier foreign judgment(s) recognized in Malaysia, or if the judgment would amount to the direct or indirect enforcement of foreign penal, revenue or other public laws (save where any such component of the judgment can be duly severed from the rest of the judgment sought to be enforced). Civil liability provisions of the federal and state securities law of the United States permit the award of punitive damages against us, our Directors and officers. Malaysian courts would not recognize or enforce judgments against us, our Directors and officers to the extent that doing so would amount to the direct or indirect enforcement of foreign penal, revenue or other public laws. It is uncertain as to whether a judgment of the courts of the United States under civil liability provisions of the federal securities law of the United States would be regarded by the Malaysian courts as being pursuant to foreign penal, revenue or other public laws. Such a determination has yet to be made by a Malaysian court in a reported decision.

Aside from minimum benefits in respect of the aforesaid terms of employment in the Employment Act, employees in Singapore are entitled to contributions to the central provident fund by the employer as prescribed under the Central Provident Fund Act 1953 of Singapore. The specific contribution rate to be made by employers varies depending on whether the employee is a Singapore citizen or permanent resident in the private or public sector and the age group and wage band of the employee. Generally, for employees who are Singapore citizens in the private sector or non-pensionable employees in the public sector, 55 years old or below and that earn more than or equal to S$750 a month, the employer’s contribution rate is 17% of the employee’s wages.

COVID-19 (Temporary Measures) Act

The COVID-19 Act came into effect in Singapore on April 7, 2020. Under the COVID-19 Act, the Minister of Health may make regulations and make control orders for the purpose of preventing, protecting against, delaying or otherwise controlling the incidence or transmission of COVID-19 in Singapore. Control orders may make provisions including the following: (a) requiring people or certain people to stay at or in, and not leave, a specified place (whether or not a place of accommodation); (b) restricting movement of or contact between people, including prohibiting or limiting group activities or other activities of people within the specified place in paragraph (a), restricting the use of any facilities at that place and limiting movement to and from that place, whether by time or location; (c) requiring closing or limiting access to any premises or facility at a specified time, in a specified manner or to a specified extent, in relation to any premises or facility used to carry out any business, undertaking or work; (d) restricting the time, manner or extent for the carrying out of any business, undertaking or work, including prescribing restrictions on the maximum number of people, opening hours or facilities provided, for the carrying on of the business, undertaking or work.

The COVID-19 Regulations, which came into effect on April 7, 2020, contains requirements and restrictions relating to, among others, safe distancing and safe management measures relating to permitted enterprises.

LAWS AND REGULATIONS RELATING TO OUR BUSINESS IN MALAYSIA

Valuers, Appraisers, Estate Agents and Property Managers Act 1981

The Valuers, Appraisers, Estate Agents and Property Managers Act 1981 (“VAEAPM Act”) applies throughout Malaysia and provides for the registration of valuers, appraisers, estate agents and property managers with the Board of Valuers, Appraisers, Estate Agents and Property Managers (“Board”) and matters connected therewith. The Board also maintains the Register of Valuers, Appraisers, Estate Agents and Property Managers (“Register”), Register of Probationers, and Register of Firms.

The VAEAPM Act provides that no person shall practice as a valuer, appraiser, estate agent or property manager unless he has been registered with the Board and has been issued with an authority to practice by the Board. Further, such registered valuer, appraiser, estate agent or property manager shall not practice his profession unless he practices as a sole proprietor of a sole proprietorship, a partner of a partnership, a shareholder or Director of a body corporate registered with the Board, or as an employee of such sole proprietorship, partnership or body corporate. A sole proprietorship, partnership or body corporate may apply to the Board for registration to practice valuation, appraisal, estate agency or property management.

In 2017, the practice of valuation, appraisal, estate agency and property management by a partnership or body corporate was liberalized pursuant to the Valuers, Appraisers and Estate Agents (Amendment) Act 2017 to allow non-registered persons to own equity in such partnerships or bodies corporate. For a practicing body corporate comprising both registered persons and non-registered persons as shareholders, the registered persons shall always hold not less than 51% of the equity interest or ordinary shareholding in the said practicing body corporate. It is also a requirement that the 51% equity held by registered persons in a practicing body corporate shall be held solely by registered valuers in the case of a valuation practice and such requirement applies, mutatis mutandis, to the practices of appraisal, estate agency and property management.

Further, registered persons holding equity interest in a practicing body corporate shall incorporate a separate company as an investment holding company (“Approved Holding Company”) to hold such majority equity interest in the practicing body corporate. An Approved Holding Company’s Directors and shareholders shall be registered persons only, with a minimum of two (2) shareholders who must also be Directors at any given time.

Any person who, inter alia:-

| (a) | procures or attempts to procure registration or an authority to practice under the VAEAPM Act by knowingly making or producing or causing to be made or produced any false or fraudulent declaration, certificate, application or representation whether in writing or otherwise; |

| (b) | not being a person acting under the immediate personal direction and supervision of a registered valuer, registered appraiser, registered estate agent or registered property manager carries out or undertakes to carry out any valuation practice, estate agency practice or property management practice; or |

| (c) | acts in contravention of restrictions on valuation, estate agency and property management practices provided under the VAEAPM Act, |

commits an offense and shall be liable on conviction to a fine not exceeding RM300,000 or to imprisonment for a term not exceeding three (3) years or to both and shall be liable to a further penalty of RM1,000.00 for each day during the continuance of such offense.

Further, any person who:-

| (a) | acts as a valuer, appraiser, estate agent or property manager for any party or acts in any capacity as a valuer, appraiser, estate agent or property manager whether the primary or principal object of his business is valuation, appraisal, estate agency or property management or whether any incidental part of his business is valuation, appraisal, estate agency or property management; or |

| | | |

| (b) | willfully or falsely pretends to be, or takes or uses any name, title, addition or description implying that he is duly qualified or authorized to act as, a valuer, appraiser, estate agent or property manager, or that he is by law so qualified or authorized, |

commits an offence and shall be liable on conviction to a fine not exceeding RM300,000 or to imprisonment for a term not exceeding three (3) years or to both.

Personal Data Protection Act 2010

The Personal Data Protection Act 2010 (“Malaysian PDPA”) regulates the processing of personal data in the course of commercial transactions in Malaysia and is enforced by the Personal Data Protection Commissioner. The Malaysian PDPA sets out seven (7) key data protection principles which must be adhered to by data users (being a person who either alone or jointly or in common with other persons processes any personal data or has control over or authorizes the processing of any personal data, but does not include a processor) in Malaysia when processing personal data. The seven (7) key data protection principles are summarized as follows:

| (a) | The general principle – The general principle prohibits a data user from processing a data subject’s personal data without her/her consent unless such processing is necessary under the Malaysian PDPA. |

| | | |

| (b) | The notice and choice principle – The Malaysian PDPA requires a data user to inform a data subject by written notice as soon as practicable, in both the national and English languages of the matters more specifically stated under the Malaysian PDPA; |

| | | |

| (c) | The disclosure principle – Subject to exceptions under the Malaysian PDPA, the disclosure principle prohibits the disclosure of personal data without the data subject’s consent for any purpose other than that for which the data was to be disclosed at the time of collection or a purpose directly related to it and to any party other than a third party notified to the data user. |

| | | |

| (d) | The security principle – The Malaysian PDPA imposes obligations on the data user to take steps to protect the personal data during its processing from any loss, misuse, modification, unauthorized or accidental access or disclosure, alteration or destruction. |

| | | |

| (e) | The retention principle – Personal data shall not be retained longer than is necessary for the fulfillment of the purpose for which it was processed. Once the purpose has been fulfilled, it is the duty of a data user to take reasonable steps to ensure that the personal data is destroyed or permanently deleted. |

| | | |

| (f) | The data integrity principle – It is the responsibility of a data user to take reasonable steps to ensure that the personal data is accurate, complete, not misleading and kept-up-to-date, having regard to the purpose (and any directly related purpose) for which it was collected and processed. |

| | | |

| (g) | The access principle – A data subject is given the right to access his/her personal data and to correct that personal data which is inaccurate, incomplete, misleading or not up-to-date, except where compliance with a request to such access or correction is refused under the Malaysian PDPA. |

Non-compliance by a data user of any of the above principles constitutes an offense under the Malaysian PDPA and the data user is liable to a fine not exceeding RM300,000 or imprisonment for a term not exceeding 2 years or both. Non-compliance of other provisions of the Malaysian PDPA may also lead to other financial penalties, imprisonment terms or both. The Malaysian Personal Data Protection Commissioner also has broad powers to order the data user to comply with the provisions of the Malaysian PDPA.

Employment Act 1955

The Employment Act 1955 and the Employment (Amendment) Act 2022 (together, the “EA”) governs matters of employment in Peninsular Malaysia and Labuan and regulates all labor relations including contracts of service, payment of wages, employment of women, rest days, hours of work, flexible working arrangements, discrimination in employment, termination, lay-off and retirement benefits and keeping of registers of employees. Following the Employment (Amendment of First Schedule) Order 2022 which will come into force on January 1, 2023, the scope of employees covered under the EA (“EA Employees”) has been expanded from covering, inter alia, employees whose wages do not exceed RM2,000 a month to covering any person who has entered into a contract of service and any person, irrespective of his wage, who is engaged in manual labor or in the operation and maintenance of any mechanically propelled vehicle operated for the transport of passengers or goods or for reward or for commercial purposes, or who supervises or oversees other employees engaged in manual labor employed by the same employer in and throughout the performance of their work, or who is engaged in any capacity in a vessel registered in Malaysia, or who is engaged as a domestic employee. Notwithstanding the expansion of the scope of EA Employees, certain provisions in the EA such as those which govern payment for work on rest days and holidays, overtime pay, and termination, lay-off and retirement benefits shall apply only to persons whose wages do not exceed RM4,000 per month.

Section 99A of the EA provides that any person who commits any offense under, or contravenes any provision of, the EA, or any regulations, order, or other subsidiary legislation whatsoever made thereunder, in respect of which no penalty is provided, shall be liable, on conviction, to a fine not exceeding RM50,000.

Regulation on Dividend Distributions

The principal regulation governing distribution of dividends by a company incorporated in Malaysia (“Malaysian Company”) is the Malaysian Companies Act 2016 (“CA 2016”). Under the CA 2016, a Malaysian Company may only make a distribution to the shareholders out of profits of the company available if the company is solvent immediately after the distribution is made.