Filed Pursuant to Rule 433

Registration Statement No. 333-270958

Issuer Free Writing Prospectus dated September 19, 2024

Relating to Preliminary Prospectus dated September 9, 2024

HUHUTECH International Group Inc.

1,250,000 Ordinary Shares

This free writing prospectus relates to the initial public offering of ordinary shares of HUHUTECH International Group Inc. (the “Company”) and should be read together with the preliminary prospectus dated September 9, 2024 (the “Preliminary Prospectus”) that was included in Amendment No.6 to the Registration Statement on Form F-1 (File No. 333-270958), which can be accessed through the following web link:

https://www.sec.gov/Archives/edgar/data/1945415/000121390024076903/ea0206594-06.htm

The Company has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the Company has filed with the SEC for more complete information about the Company and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by contacting Craft Capital Management LLC at info@craftcm.com.

HUHUTECH International Group Inc. Proposed Nasdaq Ticker: HUHU Investor Presentation

See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss. This free writing prospectus relates to the proposed public offering of ordinary shares (“Ordinary Shares”) of HUHUTECH International Group Inc . (“we”, “us”, or “our”) and highlights basic information about us and the offering . Because it is a summary, it does not contain all of the information that you should consider before investing in our Ordinary Shares and should be read together with the registration statement on Form F - 1 (the “Registration Statement”) we filed with the U . S . Securities and Exchange Commission (“the SEC”) for the offering to which this presentation relates and may be accessed through the following web link : https://www.sec.gov/Archives/edgar/data/1945415/000121390024076903/ea0206594 - 06.htm The Registration Statement has not yet become effective . Before you invest, you should read the prospectus that forms a part of the Registration Statement (including the risk factors described therein) and other documents we have filed with the SEC in their entirety for more complete information about us and the offering . You may get these documents for free by visiting EDGAR on the SEC website at http : //www . sec . gov . Alternatively, we or the underwriters will arrange to send you the prospectus if you contact Craft Capital Management LLC at info@craftcm . com or + 1 ( 800 ) 550 - 8411 , EF Hutton LLC at syndicate@efhutton . com or + 1 ( 212 ) 404 - 7002 , or contact HUHUTECH International Group Inc . at ir@huhutech . com . cn . This presentation does not constitute an offer or invitation for the sale or purchase of securities or to engage in any other transaction with the Company or its affiliates . The information in this presentation is not targeted at the residents of any particular country or jurisdiction and is not intended for distribution to, or use by, any person in any jurisdiction or country where such distribution or use would be contrary to local law or regulation . This presentation contains estimates and other statistical data made by independent parties and by the Company relating to market size and growth and other data about our industry . This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates . In addition, projections, assumptions, and estimates of the future performance of the markets in which we operate are necessarily subject to a high degree of uncertainty and risk . We undertake no duty to update such estimates . 2 Free Writing Prospectus Disclaimer

Forward - Looking Statements This presentation contains forward - looking statements . All statements contained in this presentation other than statements of historical fact, including statements regarding our future results of operations and financial position, our business strategy and plans, and our objectives for future operations, are forward - looking statements . The words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” and similar expressions are intended to identify forward - looking statements . We have based these forward - looking statements largely on our current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, business strategy, short - term and long - term business operations and objectives, and financial needs . These forward - looking statements are subject to a number of risks, uncertainties and assumptions, including those described in the “Risk Factors” section . Moreover, we operate in a very competitive and rapidly changing environment . New risks emerge from time to time . It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward - looking statements we may make . In light of these risks, uncertainties and assumptions, the future events and trends discussed in this presentation may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward - looking statements . You should not rely upon forward - looking statements as predictions of future events . The events and circumstances reflected in the forward - looking statements may not be achieved or occur . Although we believe that the expectations reflected in the forward - looking statements are reasonable, we cannot guarantee future results, levels of activity, performance, or achievements . Except as required by applicable law, we undertake no duty to update any of these forward - looking statements after the date of this presentation or to conform these statements to actual results or revised expectations . 3 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss.

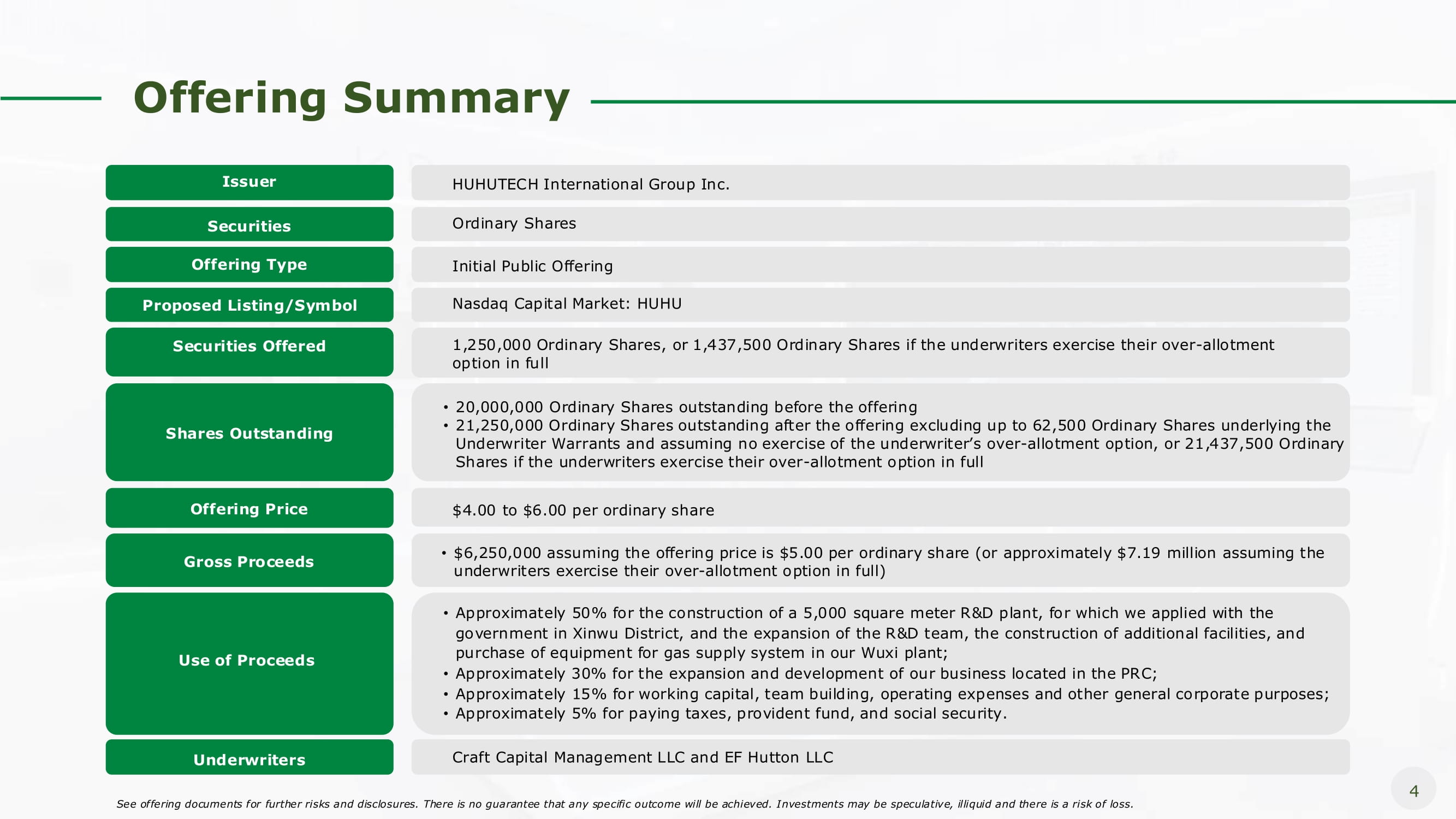

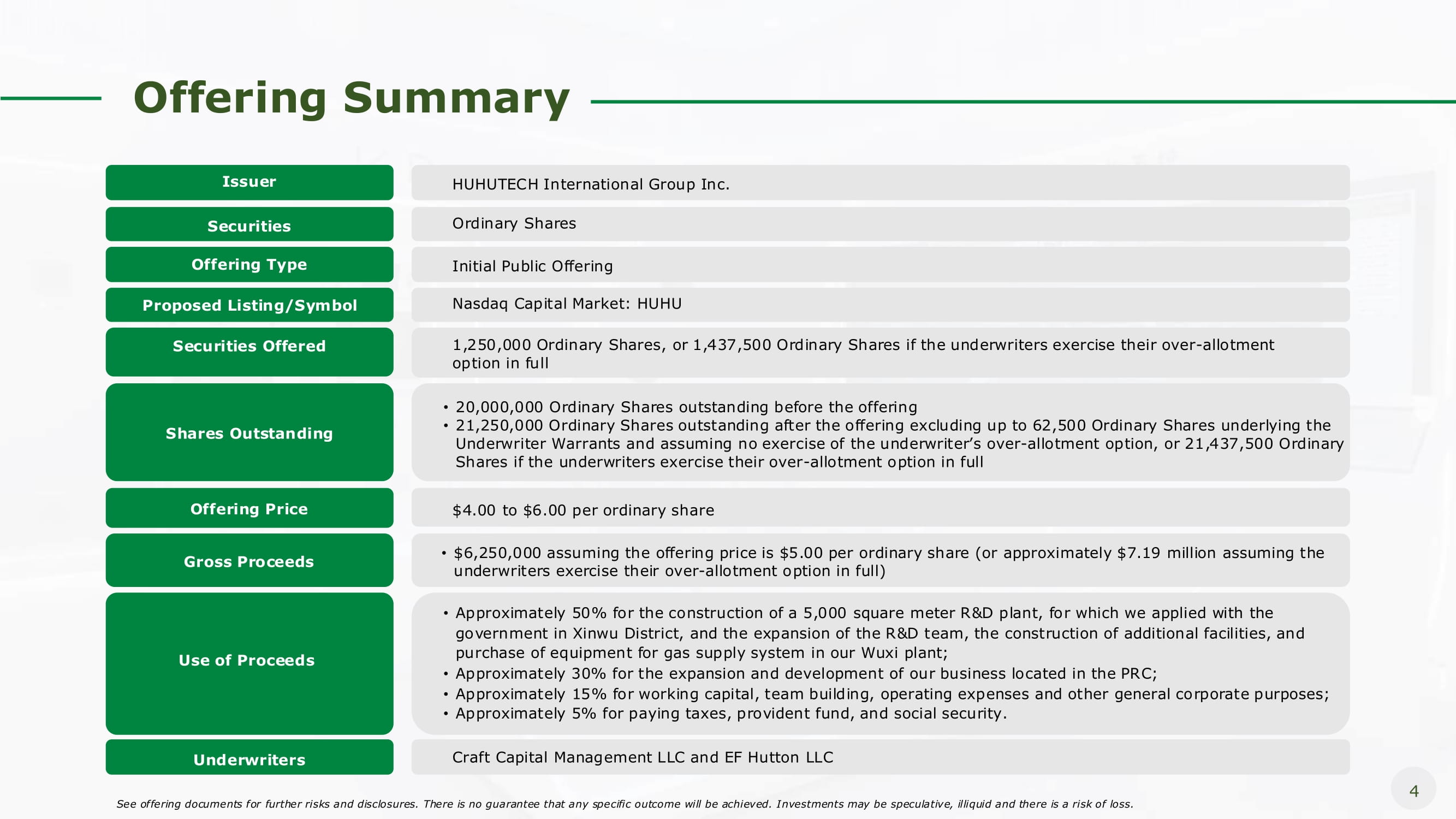

Offering Summary Issuer HUHUTECH International Group Inc. Securities Ordinary Shares Offering Type Initial Public Offering Proposed Listing/Symbol Nasdaq Capital Market: HUHU Securities Offered 1,250,000 Ordinary Shares, or 1,437,500 Ordinary Shares if the underwriters exercise their over - allotment option in full Shares Outstanding • 20,000,000 Ordinary Shares outstanding before the offering • 21,250,000 Ordinary Shares outstanding after the offering excluding up to 62,500 Ordinary Shares underlying the Underwriter Warrants and assuming no exercise of the underwriter’s over - allotment option, or 21,437,500 Ordinary Shares if the underwriters exercise their over - allotment option in full Offering Price $4.00 to $6.00 per ordinary share Gross Proceeds • $6,250,000 assuming the offering price is $5.00 per ordinary share (or approximately $7.19 million assuming the underwriters exercise their over - allotment option in full) Use of Proceeds • Approximately 50% for the construction of a 5,000 square meter R&D plant, for which we applied with the government in Xinwu District, and the expansion of the R&D team, the construction of additional facilities, and purchase of equipment for gas supply system in our Wuxi plant; • Approximately 30% for the expansion and development of our business located in the PRC; • Approximately 15% for working capital, team building, operating expenses and other general corporate purposes; • Approximately 5% for paying taxes, provident fund, and social security. Underwriters 4 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss. Craft Capital Management LLC and EF Hutton LLC

Company Overview We specialize in providing factory facility management and monitoring systems for industrial clients. Jiangsu Huhu Electromechanical Technology Co., Ltd. (HUHU China) Our Operating Subsidiaries Established in 2015 Established in 2022 HUHU Technology Co., Ltd. (HUHU JAPAN) Factory Management and Control Systems Provides instant and effective monitoring over manufacturing process through control center Our Solutions High - purity Process System Applies effective control of impurities in the production process Our Clients • Semi - conductor manufacturers • LED and micro - electronics factories • Pharmaceutical, food and beverage manufacturers 32 Effective Patents in China* 22 Registered Copyrights in China* 8 Registered Trademarks in China* $16.7M Total Revenues in Fiscal Year 2023 5 Note ヲ *As of the date of the presentation See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss.

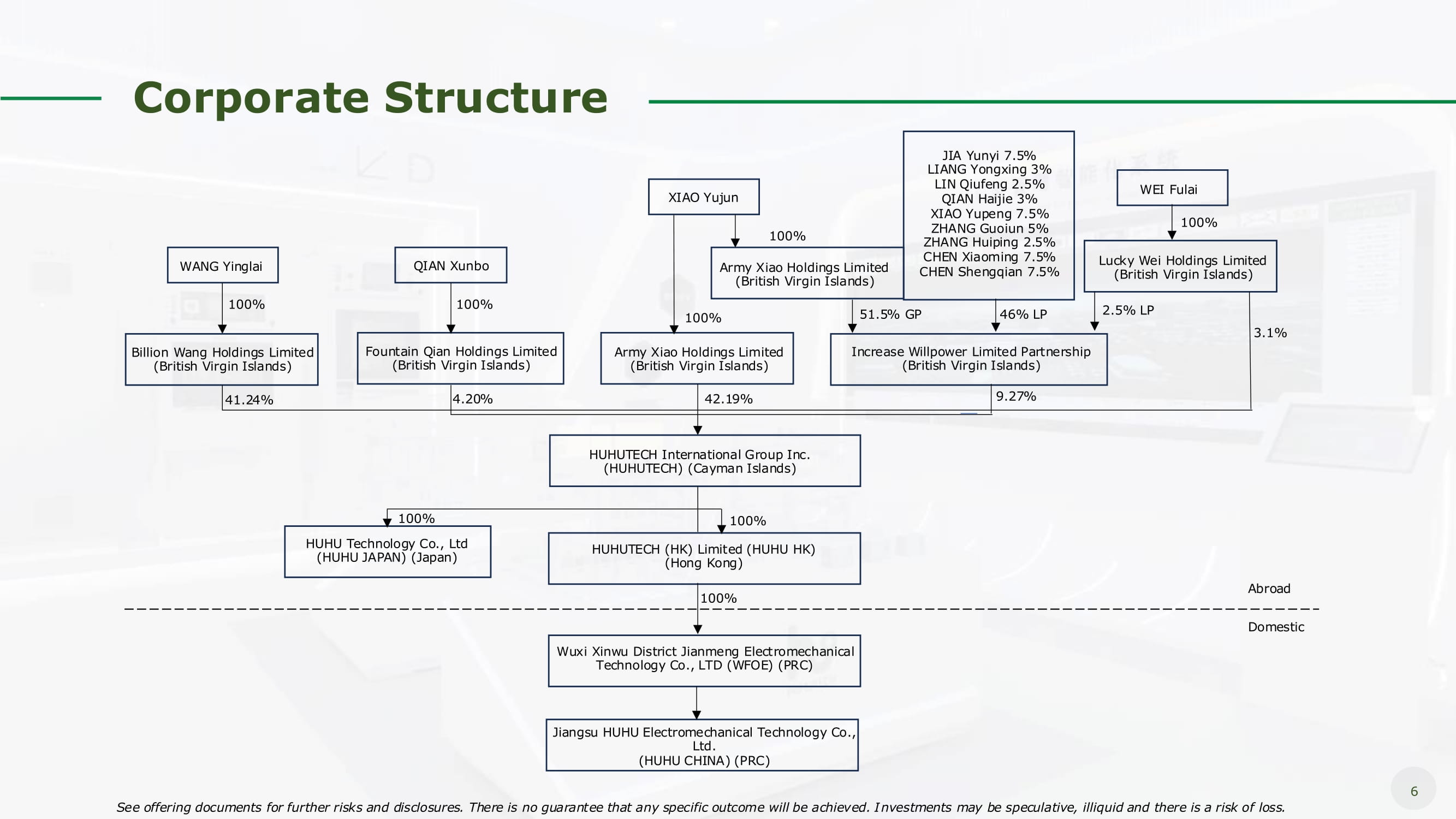

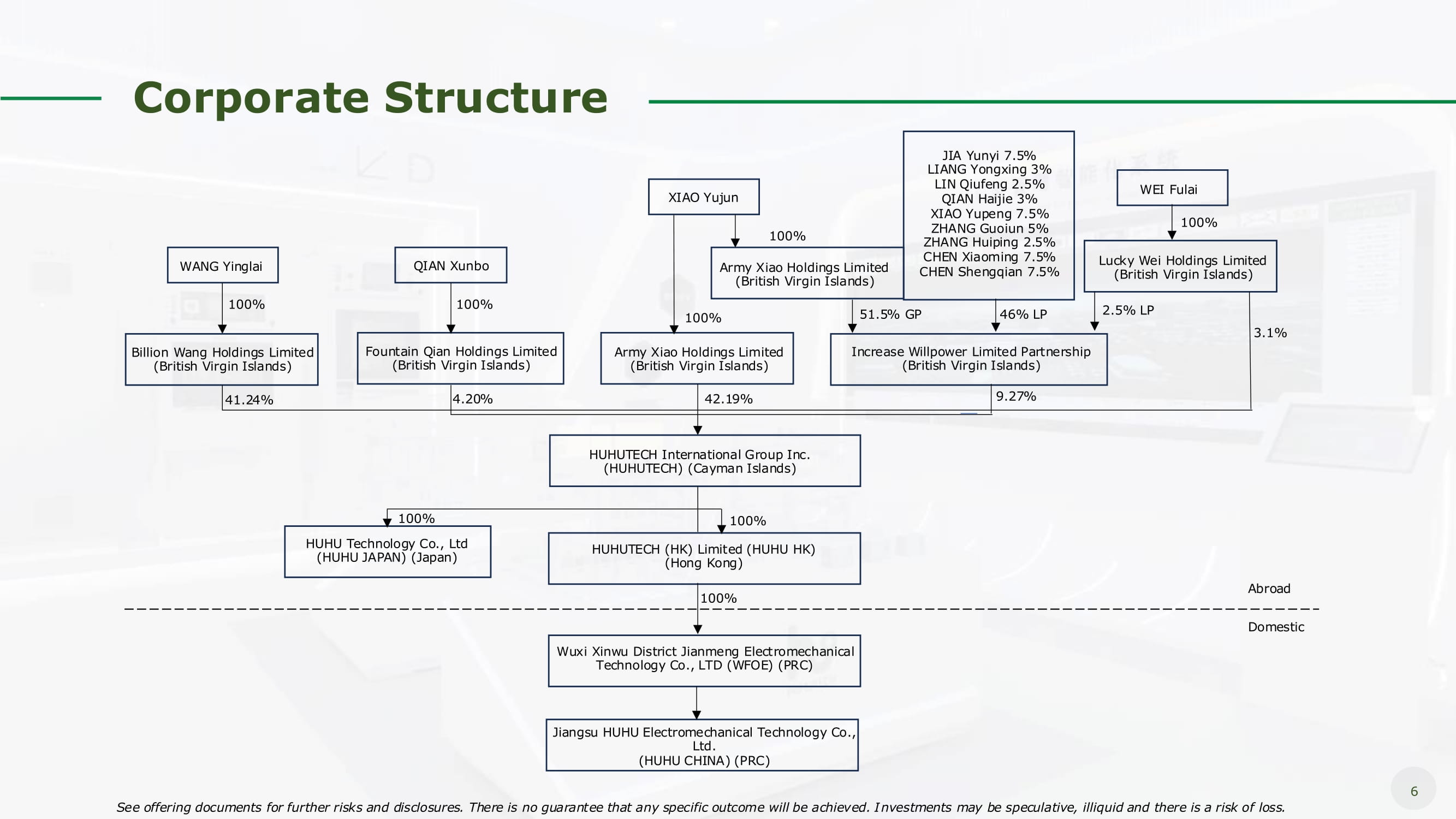

Corporate Structure WANG Yinglai Billion Wang Holdings Limited (British Virgin Islands) Fountain Qian Holdings Limited (British Virgin Islands) Army Xiao Holdings Limited (British Virgin Islands) Increase Willpower Limited Partnership (British Virgin Islands) QIAN Xunbo 100% 100% XIAO Yujun 100% 100% JIA Yunyi 7.5% LIANG Yongxing 3% LIN Qiufeng 2.5% QIAN Haijie 3% XIAO Yupeng 7.5% ZHANG Guoiun 5% ZHANG Huiping 2.5% CHEN Xiaoming 7.5% CHEN Shengqian 7.5% Army Xiao Holdings Limited (British Virgin Islands) 51.5% GP 46% LP Lucky Wei Holdings Limited (British Virgin Islands) 2.5% LP WEI Fulai 100% 4.20% 9.27% 3.1% 41.24% 42.19% Wuxi Xinwu District Jianmeng Electromechanical Technology Co., LTD (WFOE) (PRC) 100% Abroad Domestic HUHU Technology Co., Ltd (HUHU JAPAN) (Japan) 100% HUHUTECH International Group Inc. (HUHUTECH) (Cayman Islands) 100% HUHUTECH (HK) Limited (HUHU HK) (Hong Kong) Jiangsu HUHU Electromechanical Technology Co., Ltd. (HUHU CHINA) (PRC) See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss. 6

Business Overview Our Solutions We, through HUHU China, design and provide customized high - purity gas and chemical production system and equipment . Our products are customized according to the needs of our clients. • High purity gas conveyor systems. • High purity chemical conveyor systems. 7 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss. Factory Management and Control System • Consolidated factory monitoring system combines multiple factory monitoring systems on one platform. • Individual factory monitoring systems that specialize in certain aspects of factory environment, including • Gas monitoring system. • Chemical monitoring system. • Other expandable systems. High - purity Process System

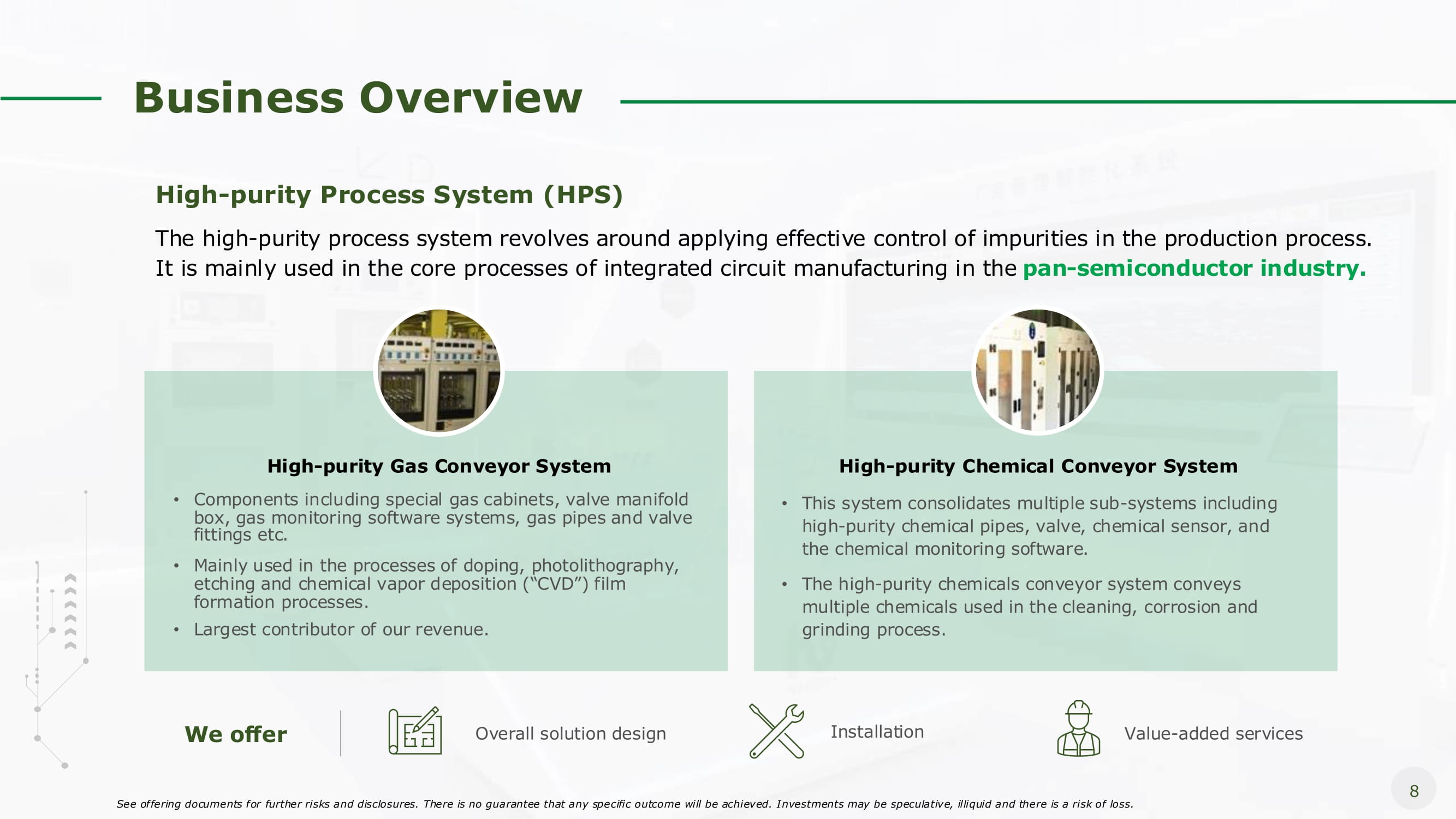

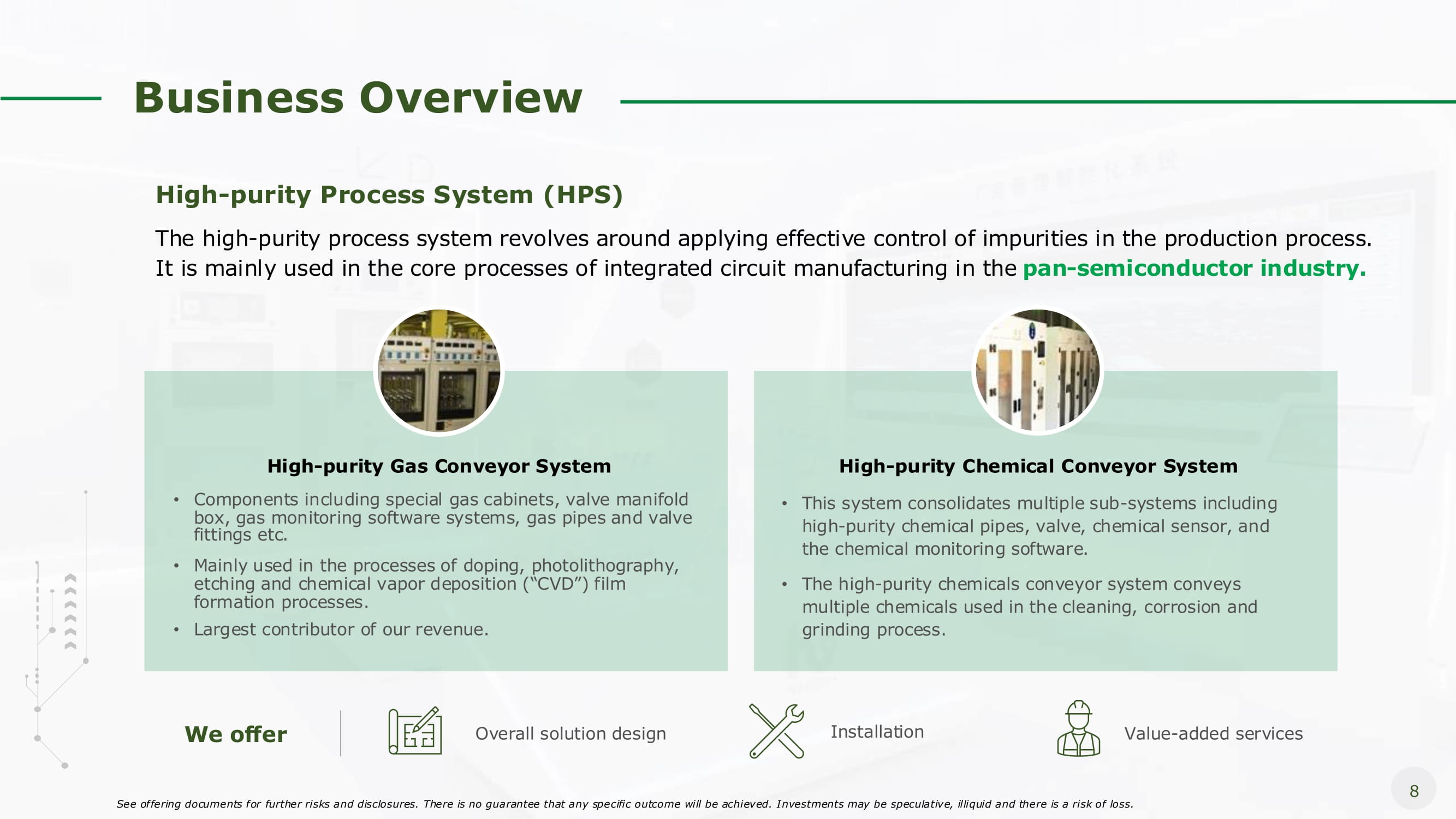

Business Overview High - purity Process System (HPS) The high - purity process system revolves around applying effective control of impurities in the production process. It is mainly used in the core processes of integrated circuit manufacturing in the pan - semiconductor industry. We offer Overall solution design Installation Value - added services High - purity Gas Conveyor System • Components including special gas cabinets, valve manifold box, gas monitoring software systems, gas pipes and valve fittings etc . • Mainly used in the processes of doping, photolithography, etching and chemical vapor deposition (“CVD”) film formation processes. • Largest contributor of our revenue. High - purity Chemical Conveyor System • This system consolidates multiple sub - systems including high - purity chemical pipes, valve, chemical sensor, and the chemical monitoring software. • The high - purity chemicals conveyor system conveys multiple chemicals used in the cleaning, corrosion and grinding process. 8 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss.

Business Overview Integrates the monitoring information of the various systems of the plant facilities into the central monitoring server. Serves as the monitoring and management center and coordinating and managing the operation of the entire facility. Uses Ethernet, controllers and communication equipment to form a factory - wide monitoring web. Factory Management and Control System (FMCS) Our FMCS provides instant and effective monitoring of our clients’ manufacturing process through the control center of the clients’ factories. All our systems are equipped with a control room where multiple monitoring screens show live status of the facility condition. We offer a consolidated factory monitoring system that combines multiple factory monitoring systems on one platform: Consolidated FMCS We prioritize the software development of the FMCS, among other aspects of the FMCS solution. 9 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss.

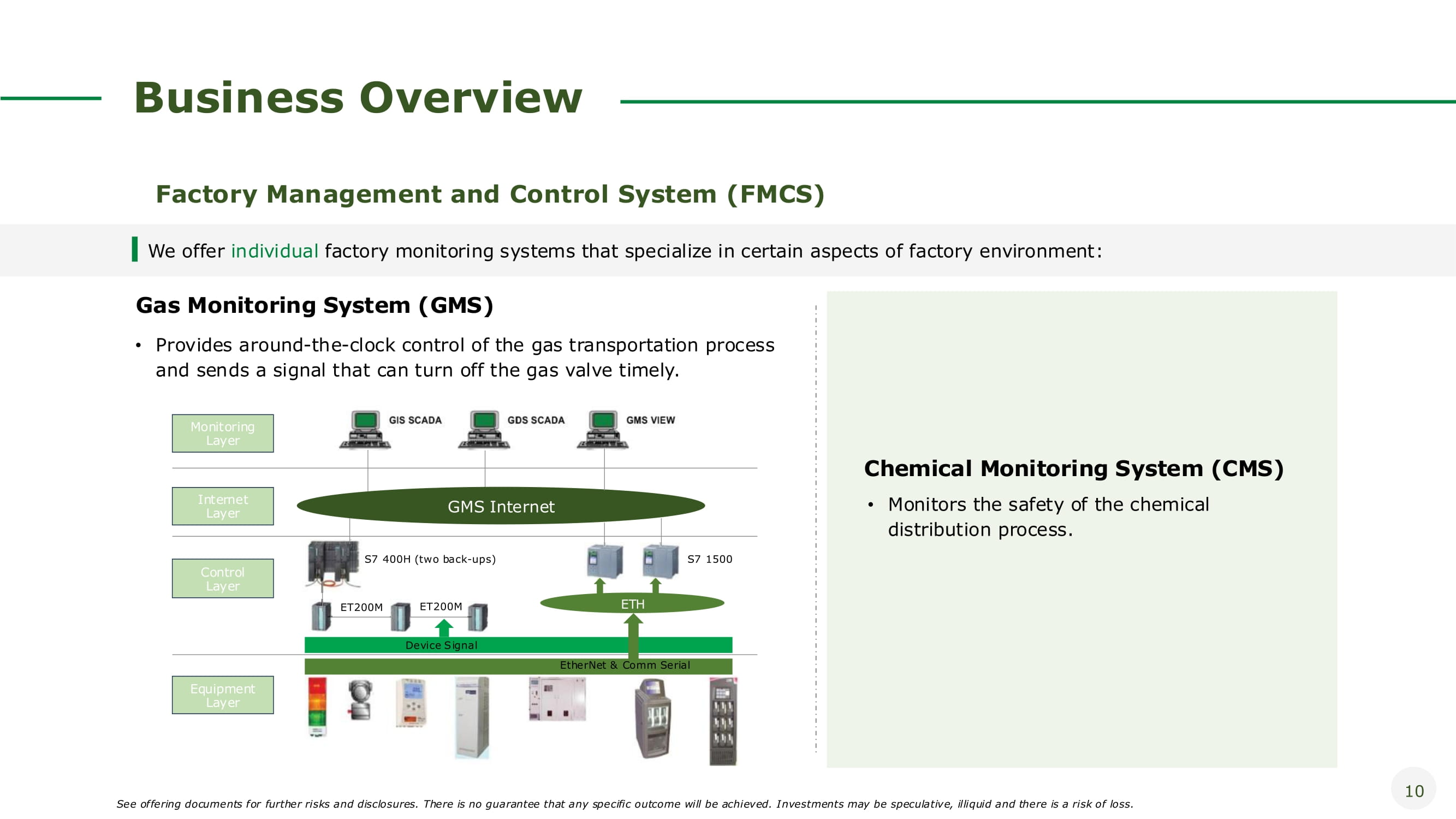

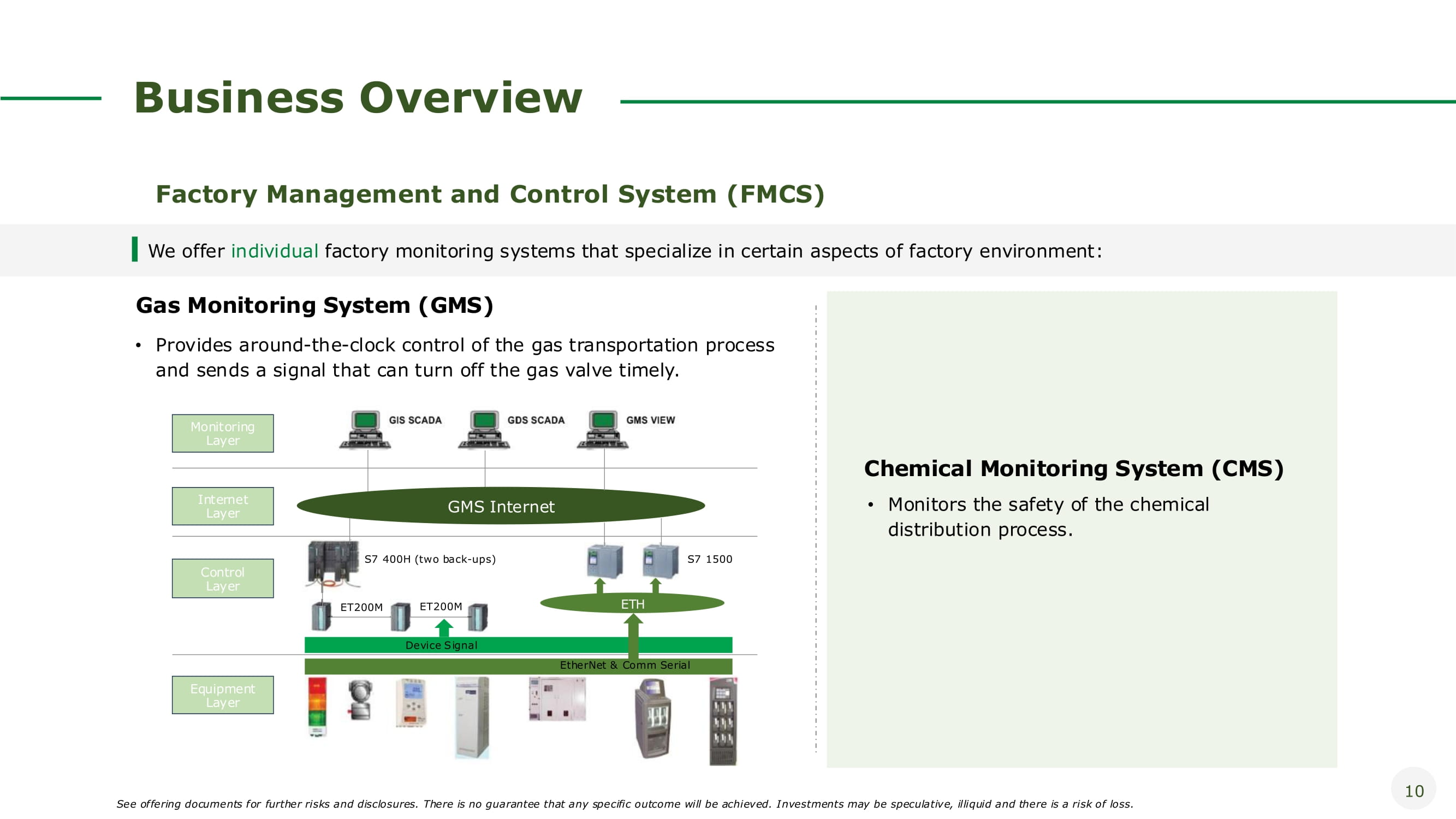

Business Overview Monitoring Layer Internet Layer Control Layer Equipment Layer GMS Internet ETH S7 400H (two back - ups) ET200M ET200M S7 1500 Device Signal EtherNet & Comm Serial Gas Monitoring System (GMS) • Provides around - the - clock control of the gas transportation process and sends a signal that can turn off the gas valve timely. Chemical Monitoring System (CMS) • Monitors the safety of the chemical distribution process. Factory Management and Control System (FMCS) We offer individual factory monitoring systems that specialize in certain aspects of factory environment: 10 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss.

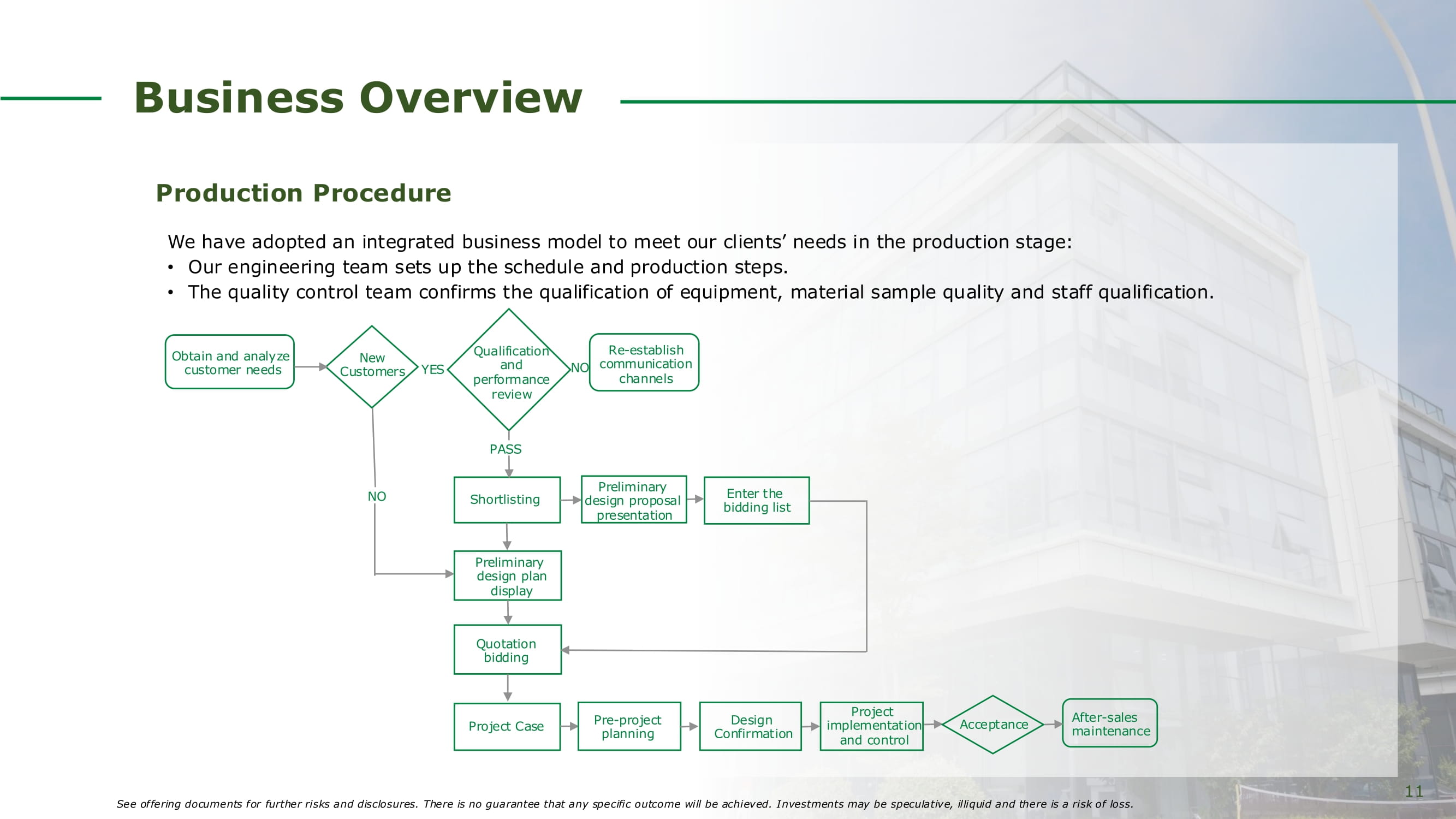

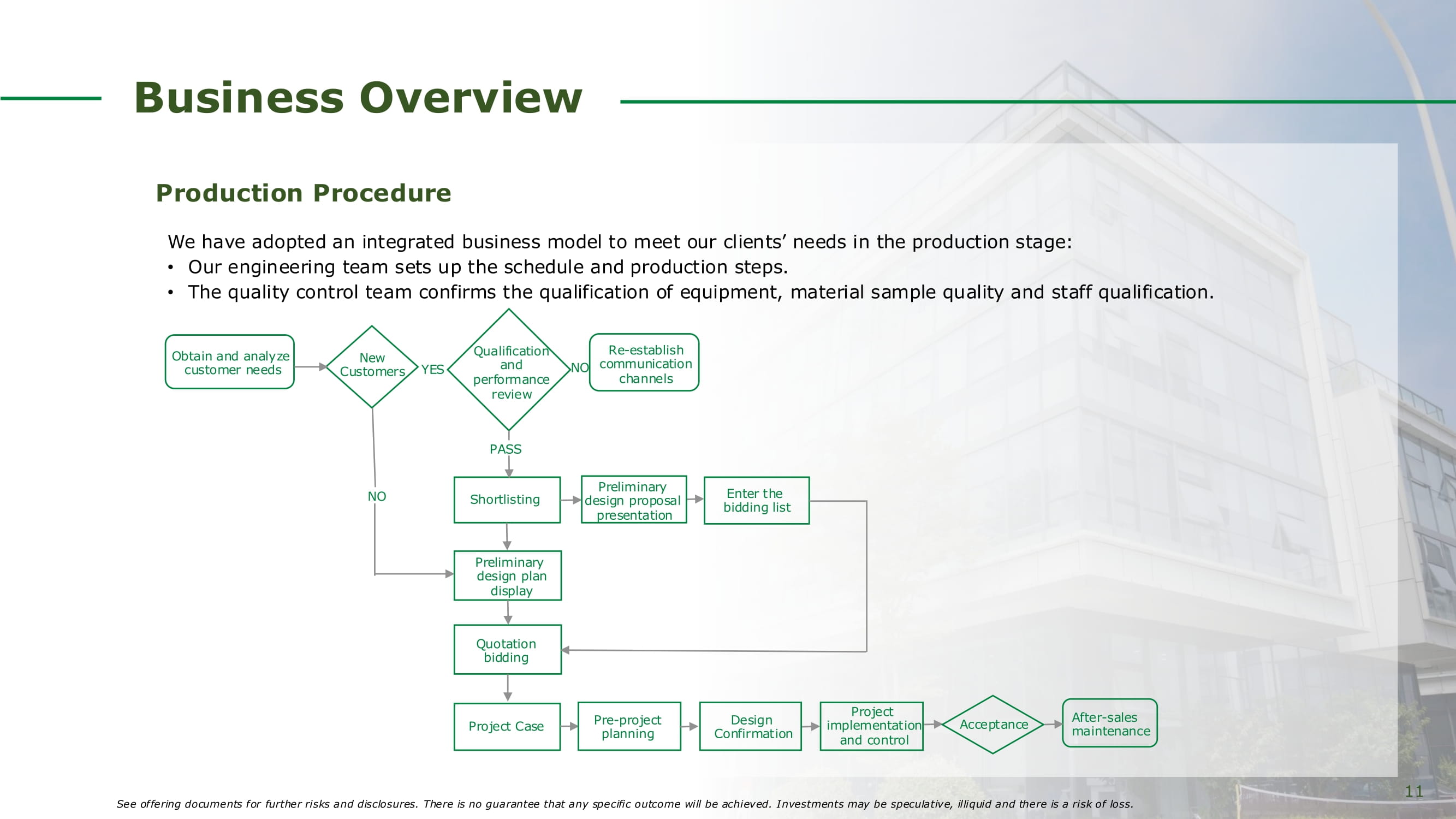

Business Overview Project implementation and control Obtain and analyze customer needs New Customers YES Qualification and performance review Re - establish NO communication channels Shortlisting Preliminary design plan display Quotation bidding Project Case Pre - project planning Design Confirmation Acceptance After - sales maintenance Preliminary design proposal presentation Enter the bidding list NO PASS Production Procedure We have adopted an integrated business model to meet our clients’ needs in the production stage: • Our engineering team sets up the schedule and production steps. • The quality control team confirms the qualification of equipment, material sample quality and staff qualification. 11 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss.

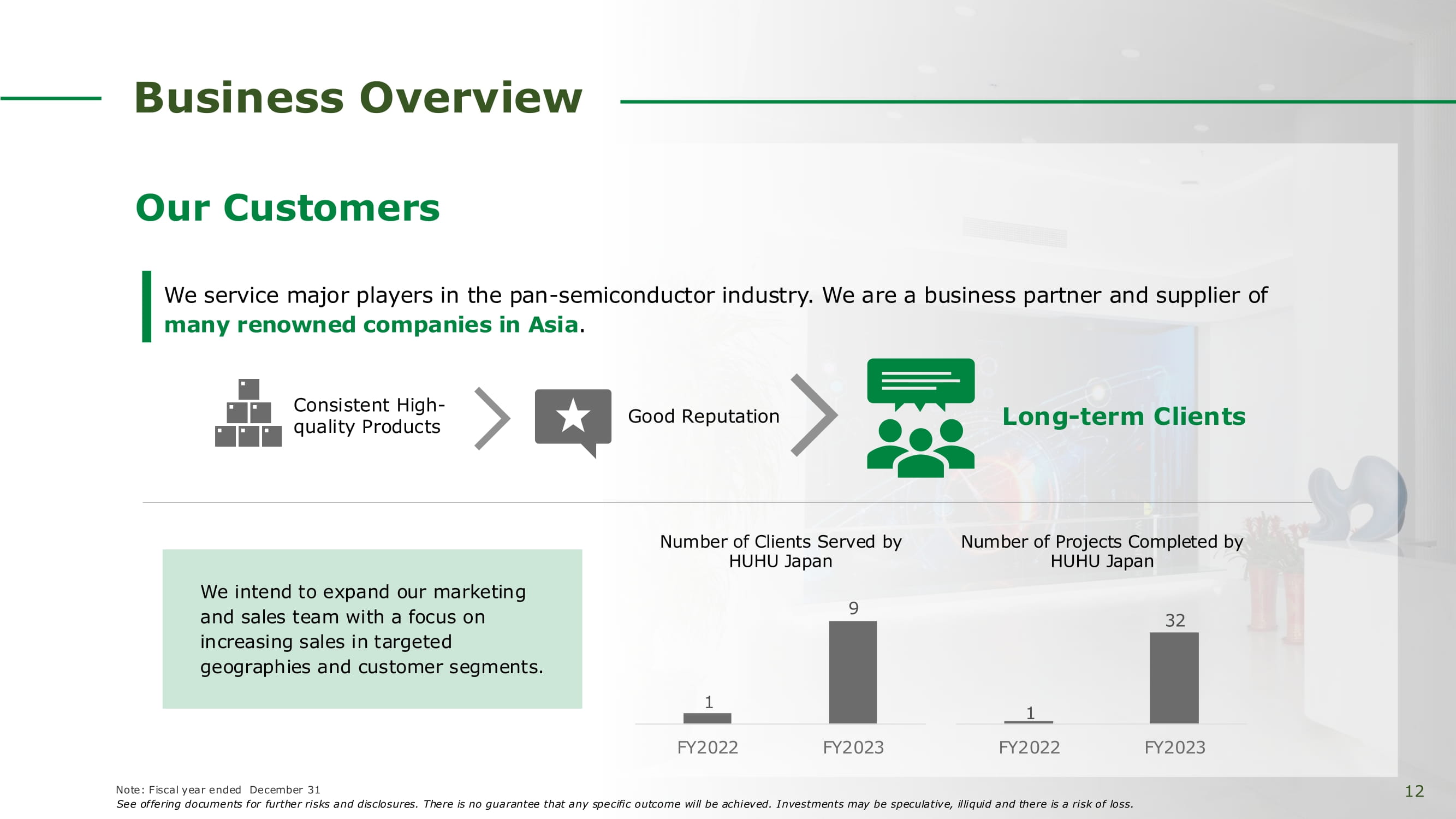

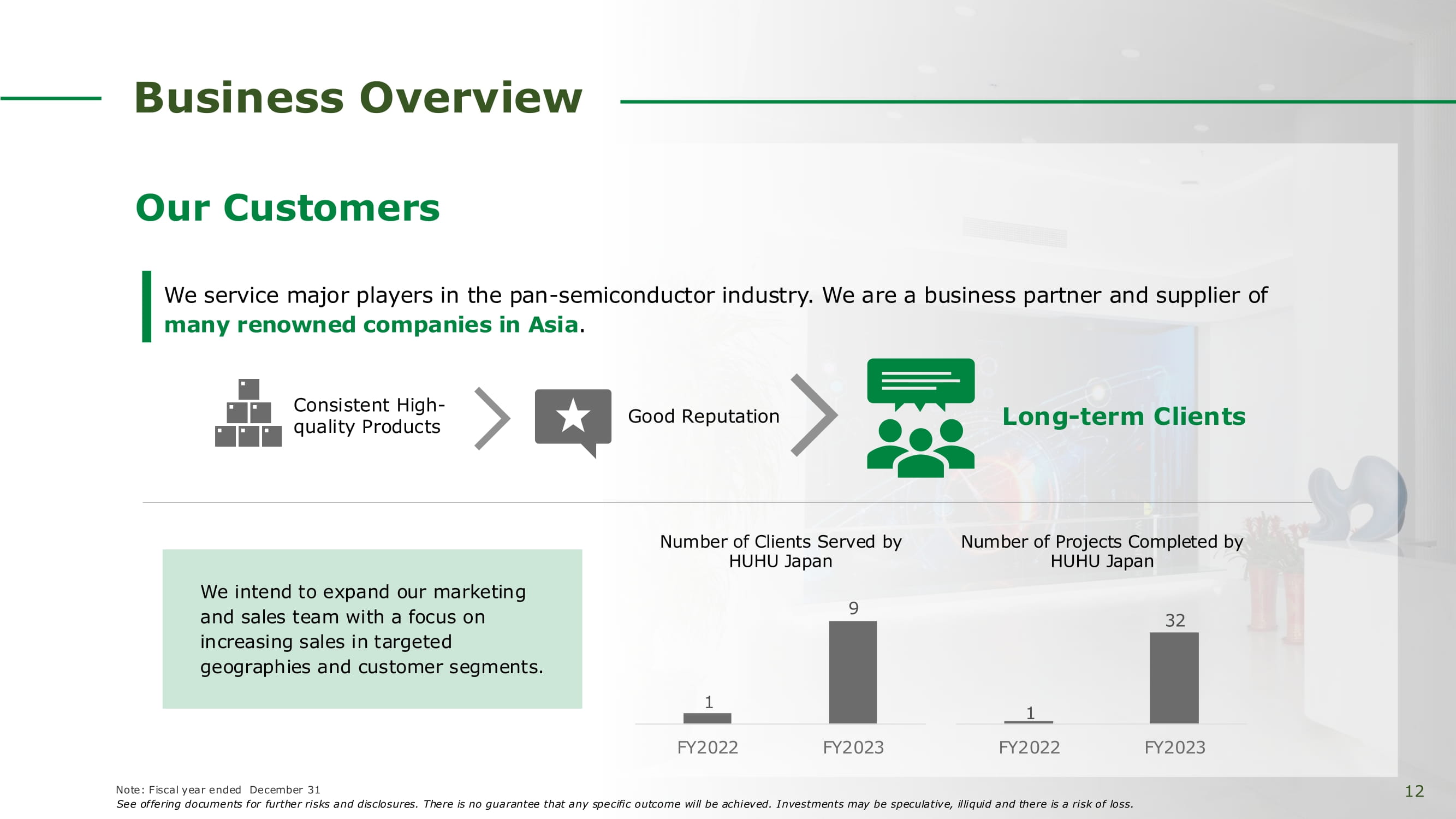

Business Overview Our Customers We service major players in the pan - semiconductor industry. We are a business partner and supplier of many renowned companies in Asia . Number of Projects Completed by HUHU Japan 1 32 FY2022 FY2023 1 9 FY2022 FY2023 Number of Clients Served by HUHU Japan Consistent High - quality Products 12 Note: Fiscal year ended December 31 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss. Good Reputation Long - term Clients We intend to expand our marketing and sales team with a focus on increasing sales in targeted geographies and customer segments.

Investment Highlights Experienced and Diverse Management Team Software Solution Modularity Technological Capacity • Our management team members have 10 years+ of experience in their respective fields. • Our management team entered the semiconductor industry relatively early 㸪 and have experienced the early development stage of the monitoring service industry for semiconductor businesses in China. 13 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss. • The PLC module in the system adopts mature algorithm. • Our software is user - friendly. • Our clients can add monitoring applications from their end. • We own software copyright over various programs in fields including facility gas supply, chemical and water processing. • FMCS software effectively increases operation efficiency by using standardized module software.

Experienced and Diverse Management Team Huiping Zhang Chief Financial Officer Ms. Zhang has been our Chief Financial officer since July 28, 2021. Ms . Zhang was the CFO at Zhongcheng Zhihui Technology Ltd . , a position she served from 2017 to 2020 . Ms . Zhang served as the Chief Financial Officer in multiple companies from 2002 to 2020 . Ms . Zhang holds a bachelor degree from Jiangsu Open University in accounting . She also has an Intermediate Accountant Certificate in China . Xiaoming Chen Chief Technology Officer Mr. Chen has been our Chief Technology officer since July 9, 2021. Mr . Chen has served as the Chief Technology officer in HUHU China since 2015 . Mr . Chen was the head of technology in Hanjin Electrical Automation System (Kunshan) Ltd . since 2011 . Mr . Chen has worked as an engineer in multiple companies since 2009 . Mr . Chen holds a college degree from Xuzhou Industry Career Technique College, specializing in electric automation . Yujun Xiao Chief Executive Officer, Director Mr. Xiao has been our Chief Executive Officer since July 28, 2021. Mr. Xiao founded HUHU China in 2015. Mr . Xiao founded Shanghai Huhu Technology Ltd . in 2010 and served as its CEO from 2010 to 2015 . Mr . Xiao was the head of the engineer department of Shentong Computer Ltd . from 2006 to 2010 . Mr . Xiao served as a senior engineer at South Asia Technology Ltd . from 2001 to 2006 . Mr . Xiao holds a bachelor’s degree from Suzhou Top Institute Of Information Technology, specializing in machinery manufacturing and automation . 14 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss.

Board of Directors Yinglai Wang Chairperson of the Board, Director Ms . Wang has served as the director and the Chairperson of the board since July 8 , 2021 . Ms . Wang co - founded Shanghai Huhu Technology Ltd . in 2010 . Ms . Wang is the spouse of Yujun Xiao, who is our CEO and director . Ms. Wang holds a bachelor’s degree in Wuxi Taihu College, specializing in business management. Xiaoqiu Zhang Independent Director Nominee Ms. Zhang founded Wuxi Xinzhan Corporate Management Consulting Limited and has served as the general manager since 2016 . Ms . Zhang served as a director at Wuxi Dongling Smart Technology Co . from June 2015 to June 2018 . Ms . Zhang holds a college degree from Nanjing Political Academy in December 2004 , and obtained her bachelor degree in business management from Northeastern Finance University in October 2020. Qi Zheng Independent Director Nominee Mr . Zheng has served as the managing director of Beijing Weiheng (Wuxi) Law Firm since September 2021 . Mr. Zheng was the senior partner from March 2020 at Beijing Weiheng (Wuxi) Law Firm. Mr . Zheng was an attorney at Jiangsu Manxiu Law Firm from April 2017 to March 2020 . Mr . Zheng holds a bachelor of law degree in Nanjing University of Finance & Economics on June 6 , 2003 , and a master of law degree from Tongji University in March 2015 . Mr. Ma worked for Deloitte Touche Tohmatsu Certified Public Motorola Accountants LLP and Solutions (China) Co., Ltd. Mr . Ma was admitted as a member of the Association of Chartered Certified Accountants in UK in 2012 and a chartered professional accountant member of the Chartered Professional Accountant of British Columbia, Canada in 2015 . Mr . Ma co - founded Brook Partners consultancy in 2008 and has been the managing partner in charge of financial consulting and risk management consulting since then . Mr . Ma graduated from Tianjin University of Finance & Economics with a bachelor’s degree in auditing in 2002 . Jin Ma Independent Director Nominee Yujun Xiao Chief Executive Officer, Director 15 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss. has been our Chief Officer since July 28, Mr . Xiao Executive 2021 . Mr. Xiao founded HUHU China in 2015. Mr . Xiao founded Shanghai Huhu Technology Ltd . in 2010 and served as its CEO from 2010 to 2015 . Mr . Xiao was the head of the engineer department of Shentong Computer Ltd . from 2006 to 2010 . Mr . Xiao served as a senior engineer at South Asia Technology Ltd . from 2001 to 2006 . Mr. Xiao holds a bachelor’s degree from Suzhou Top Institute Of Information specializing in Technology, machinery manufacturing and automation.

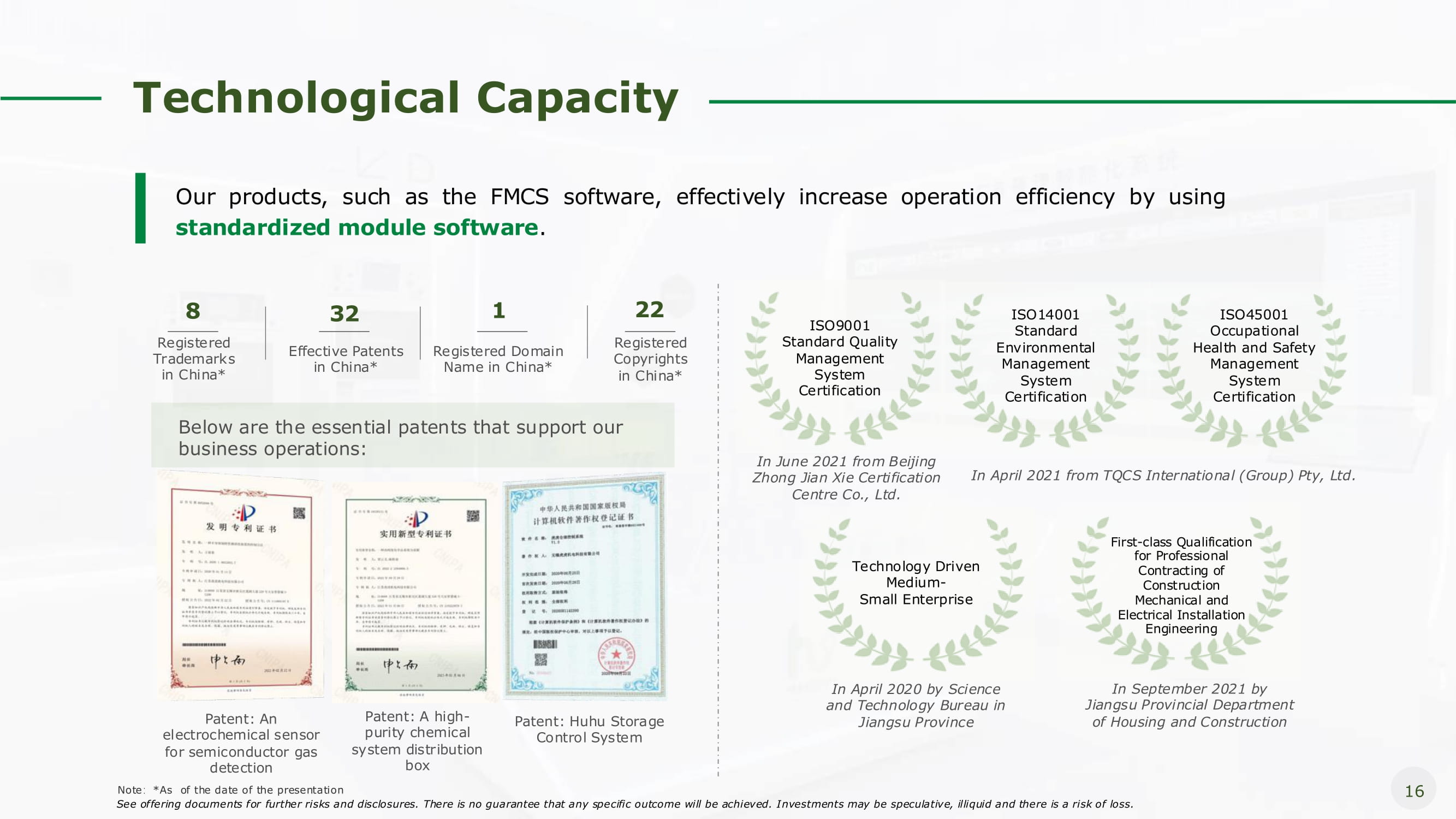

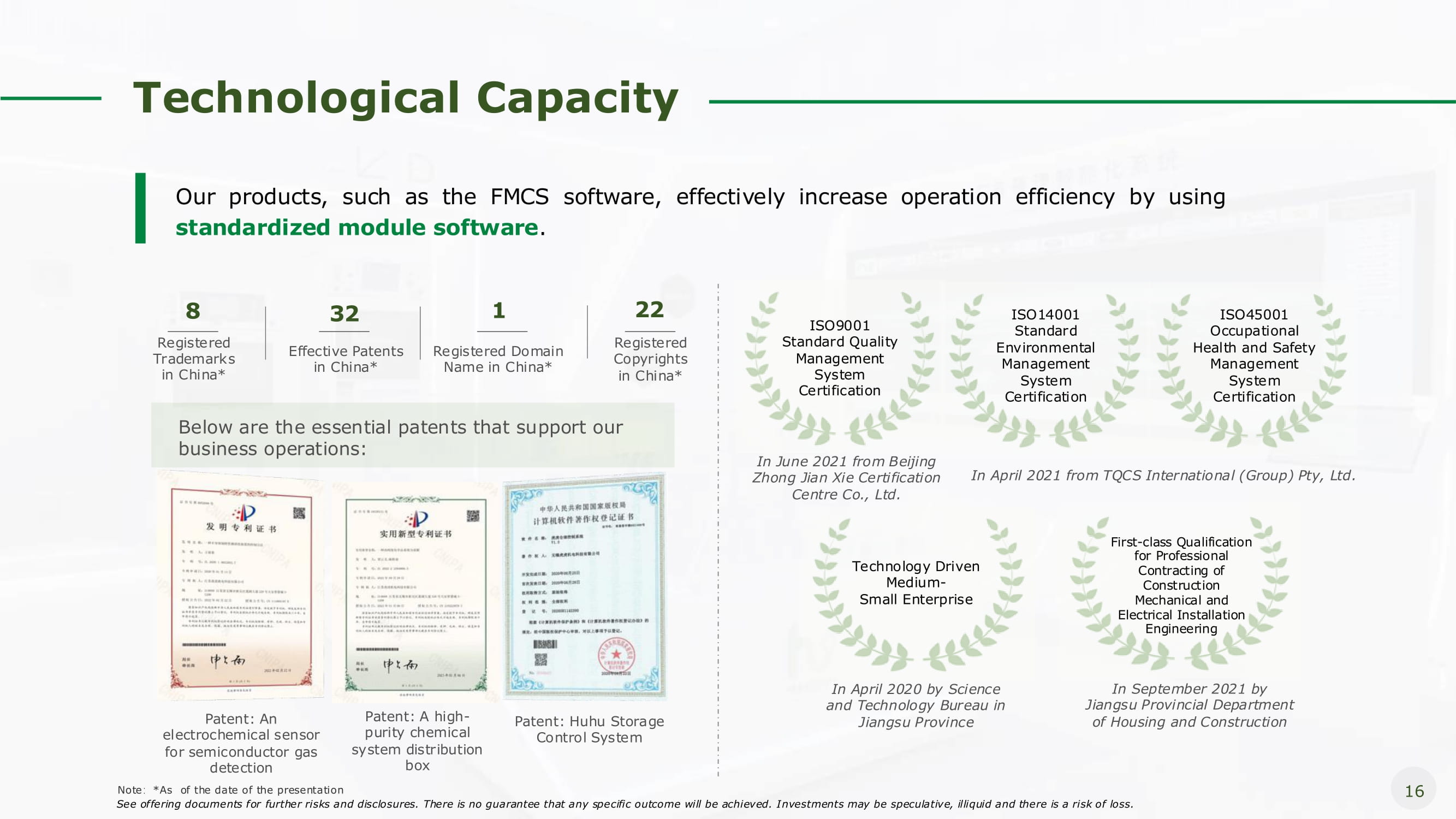

Technological Capacity Our products, such as the FMCS software, effectively increase operation efficiency by using standardized module software . Patent: An electrochemical sensor for semiconductor gas Patent: A high - purity chemical system distribution Patent: Huhu Storage Control System In June 2021 from Beijing Zhong Jian Xie Certification Centre Co., Ltd. In April 2021 from TQCS International (Group) Pty, Ltd. ISO45001 Occupational Health and Safety Management System Certification ISO9001 Standard Quality Management System Certification ISO14001 Standard Environmental Management System Certification Technology Driven Medium - Small Enterprise First - class Qualification for Professional Contracting of Construction Mechanical and Electrical Installation Engineering In April 2020 by Science and Technology Bureau in Jiangsu Province In September 2021 by Jiangsu Provincial Department of Housing and Construction 32 Effective Patents in China* 1 Registered Domain Name in China* 8 Registered Trademarks in China* 22 Registered Copyrights in China* Below are the essential patents that support our business operations: box detection Note ヲ *As of the date of the presentation 16 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss.

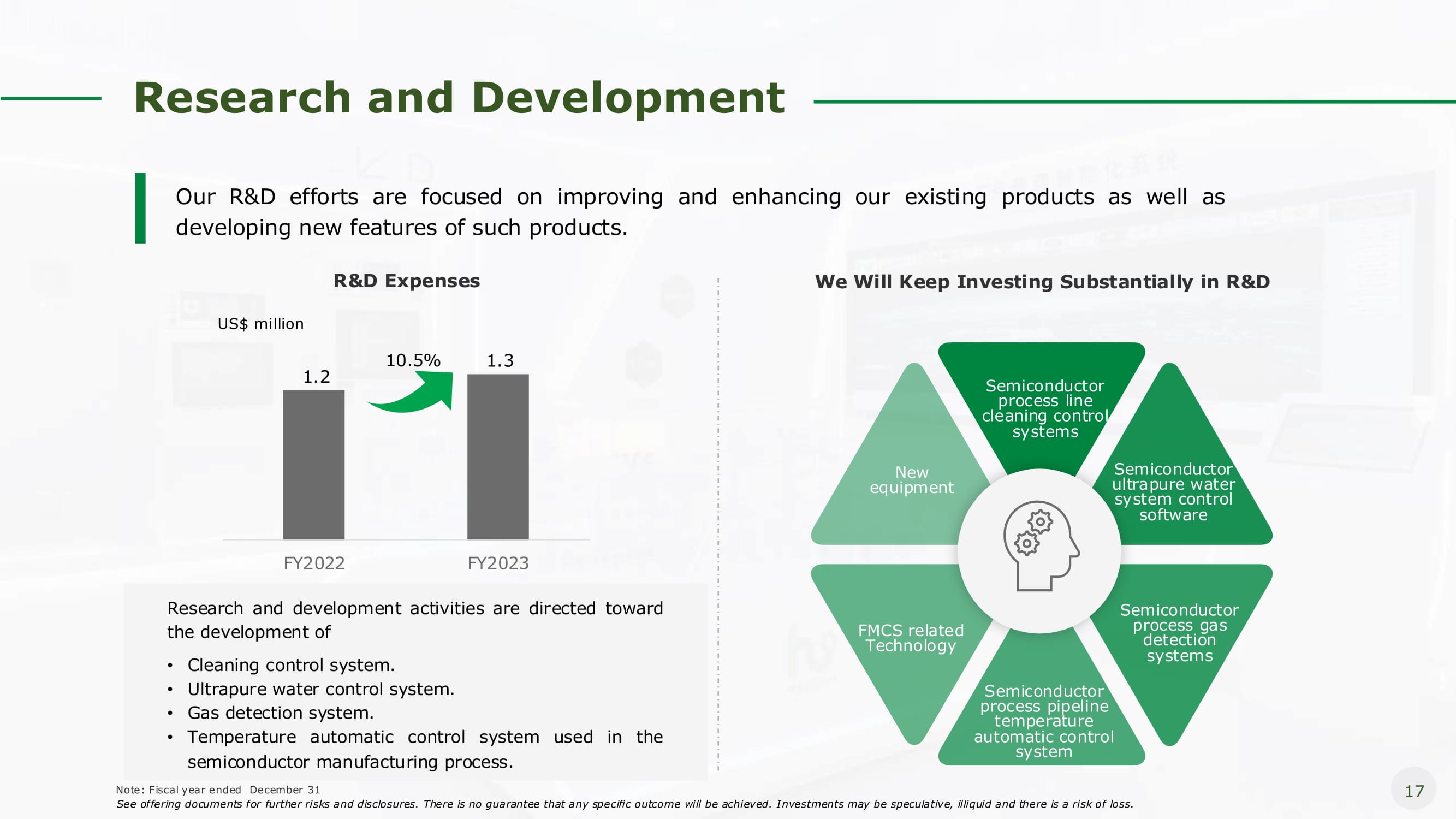

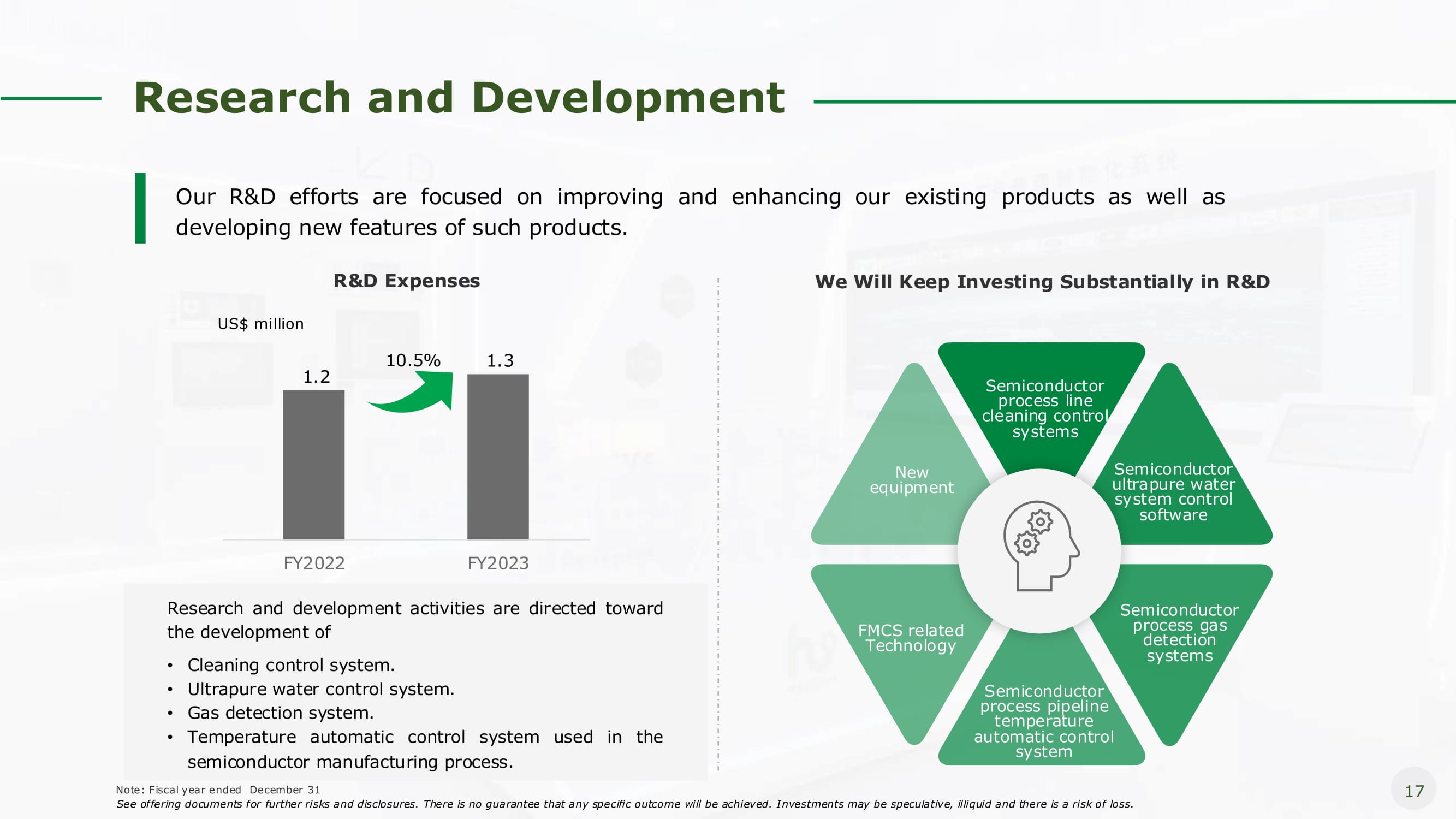

Research and Development 1.2 1.3 FY2022 FY2023 10.5% Research and development activities are directed toward the development of • Cleaning control system. • Ultrapure water control system. • Gas detection system. • Temperature automatic control system used in the semiconductor manufacturing process. Our R&D efforts are focused on improving and enhancing our existing products as well as developing new features of such products. R&D Expenses We Will Keep Investing Substantially in R&D US$ million Semiconductor process line cleaning control systems Semiconductor process pipeline temperature automatic control system Semiconductor ultrapure water system control software Semiconductor process gas detection systems New equipment FMCS related Technology 17 Note: Fiscal year ended December 31 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss.

Software Solution Modularity Programmable Logic Controllers (PLC) The PLC module in the system adopts mature algorithm. After the one - time arrangement is completed, the subsequent increase of detector gas cabinet, valve manifold box equipment does not require redownloading of the PLC program. This reduces the errors caused by frequent updates of the program (such as mistakenly shutting down the gas delivery equipment) that could cause customer downtime and lead to significant economic losses. Utilizing software simulation, we test and improve our software without interfering with the operation of the equipment. Our software solution is user - friendly and our clients can add monitoring applications from their end. 18 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss.

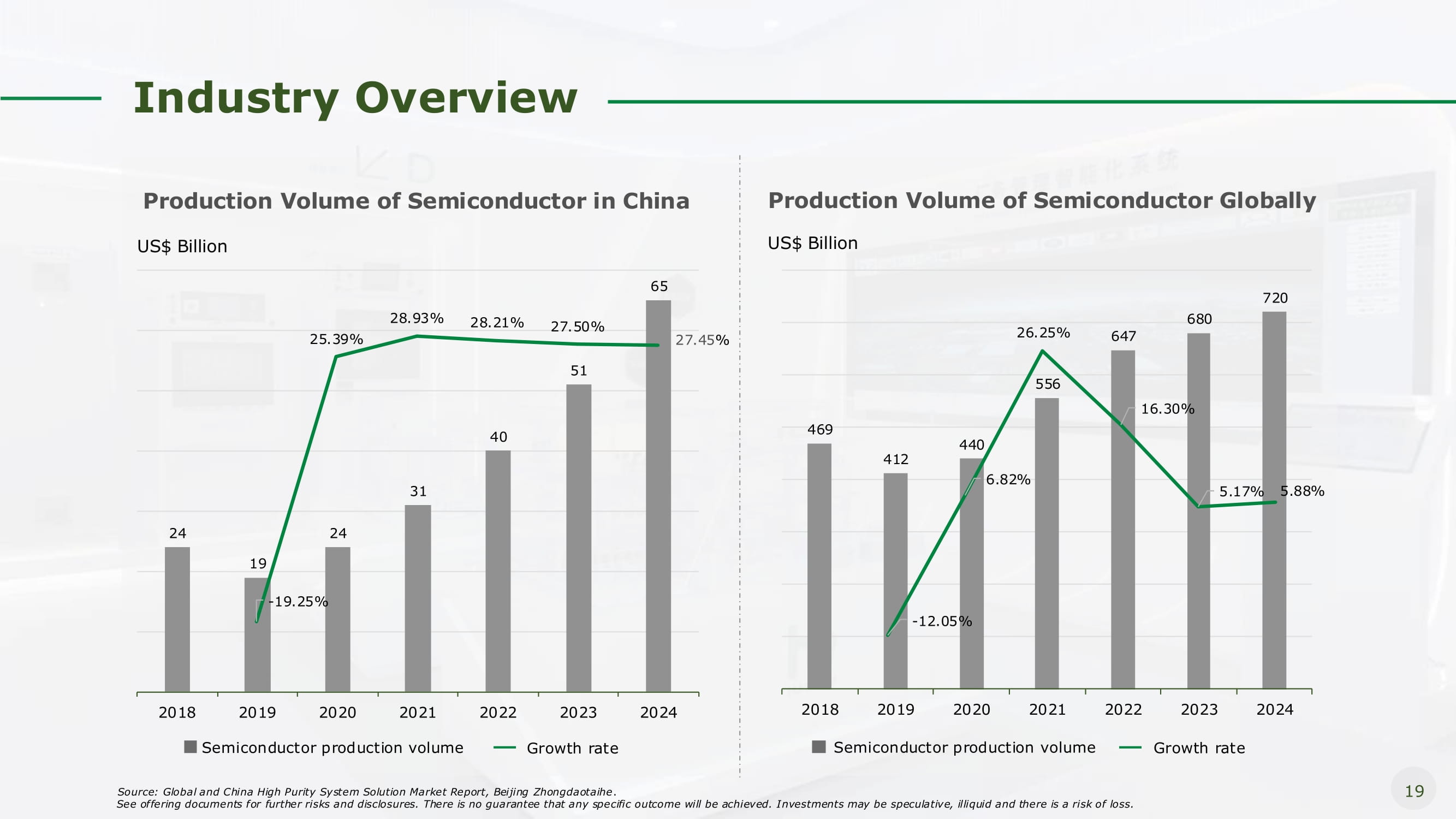

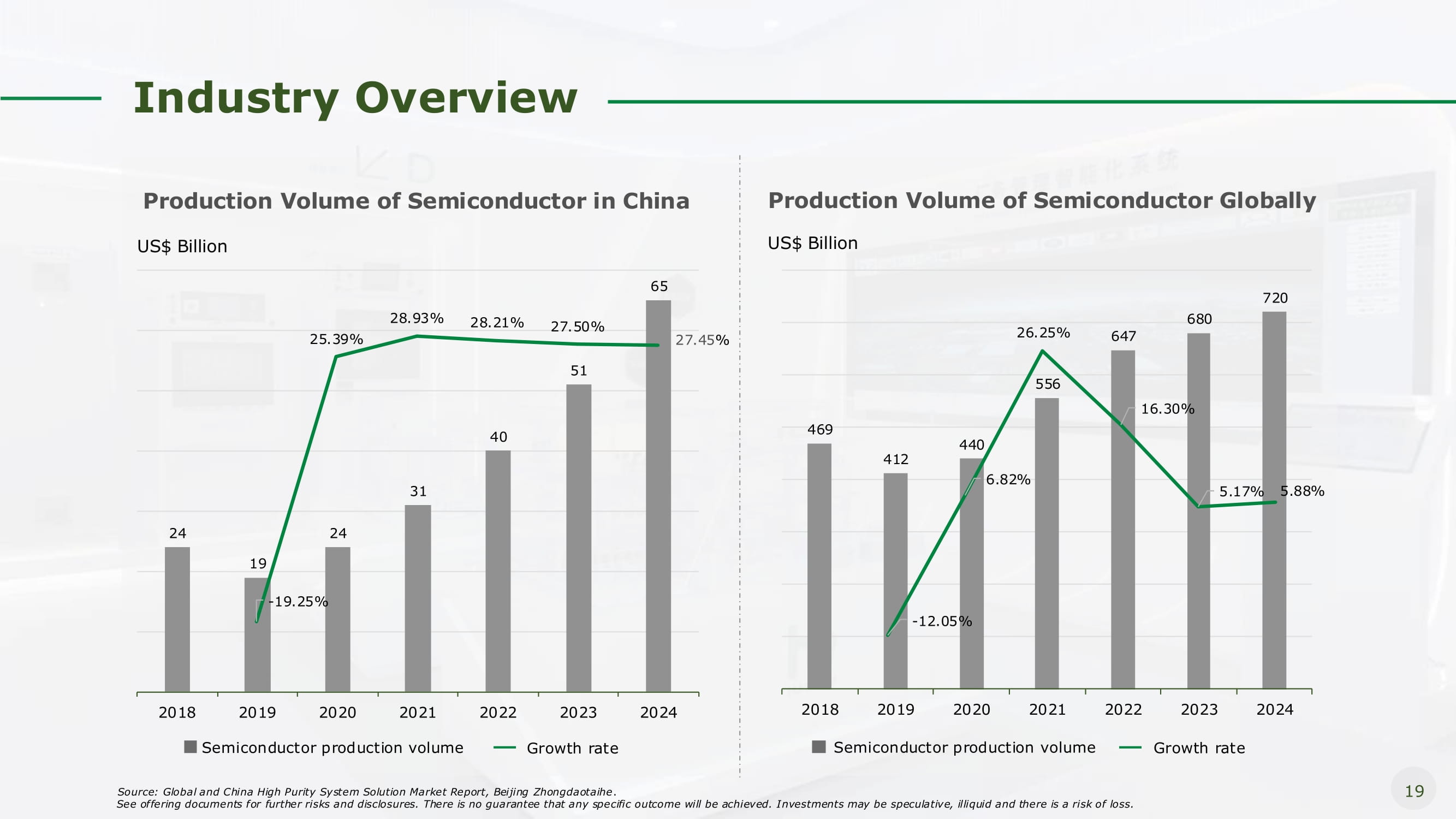

Industry Overview 469 440 647 680 720 2022 2023 2024 - 12.05% 412 6.82% 26.25% 556 16.30% 5.17% 5.88% 2018 2019 2020 2021 Semiconductor production volume Growth rate Production Volume of Semiconductor Globally US$ Billion Growth rate 24 24 31 40 51 65 2018 2019 2020 2021 Semiconductor production volume 2022 2023 2024 19 - 19.25% 19 Source: Global and China High Purity System Solution Market Report, Beijing Zhongdaotaihe . See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss. 25.39% 28.93% 28.21% 27.50% 27.45 % Production Volume of Semiconductor in China US$ Billion

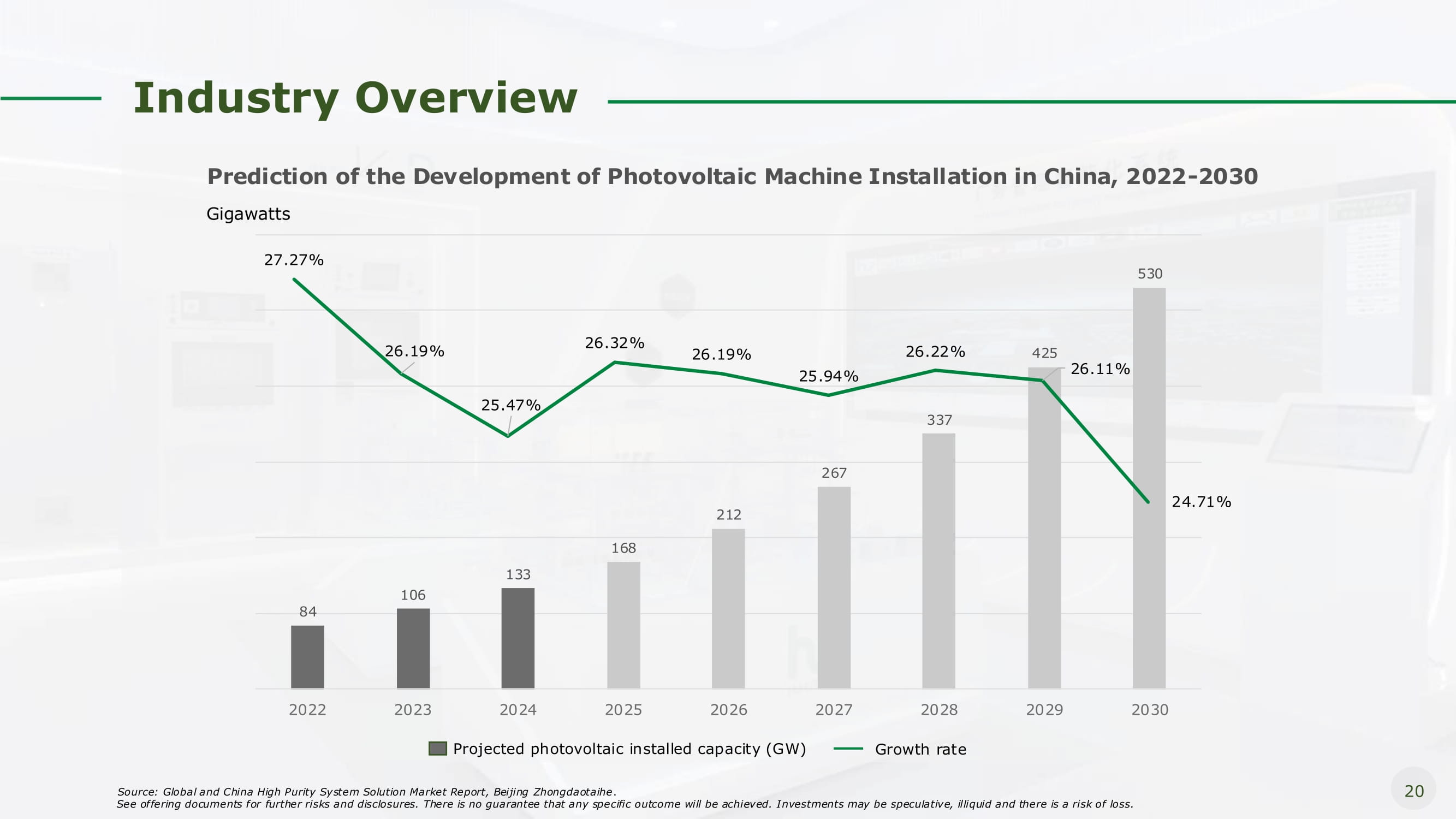

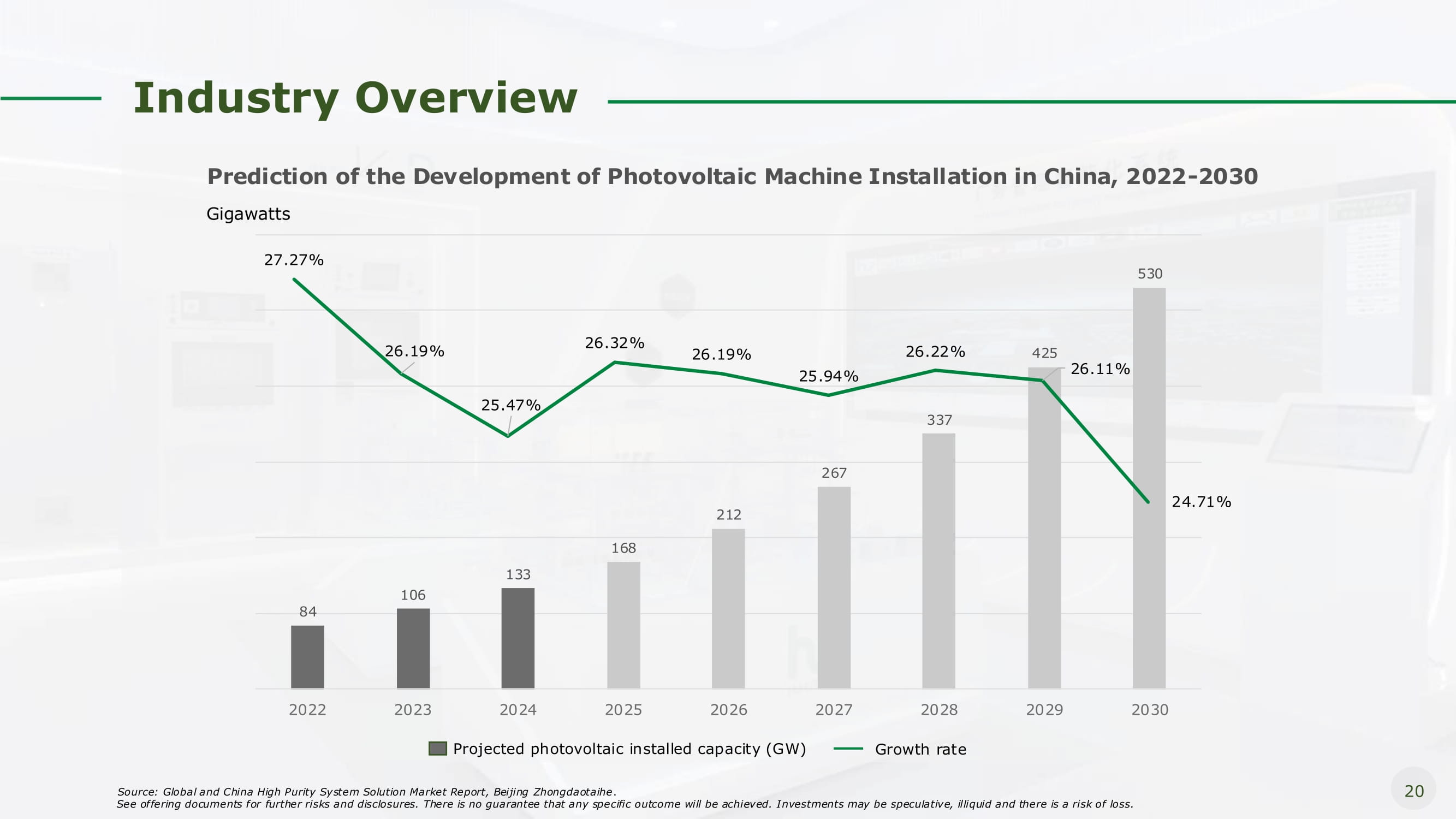

Industry Overview 84 212 168 133 106 337 267 425 2022 2023 2027 2028 2029 2030 24.71% 2024 2025 2026 Projected photovoltaic installed capacity (GW) Growth rate Prediction of the Development of Photovoltaic Machine Installation in China, 2022 - 2030 Gigawatts 27.27% 530 26.19% 25.47% 26.32% 26.19% 25.94% 26.22% 26.11% 20 Source: Global and China High Purity System Solution Market Report, Beijing Zhongdaotaihe . See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss.

Growth Strategies Client Development and Management • Team members with years of experience in the industry. • Built an excellent relationship with our suppliers and customers. Research & Development • Keep investing substantially in research and development. • Keep improving our existing technology. • Explore the development of FMCS and related new equipment. Expand Product and Service Range • Aim to expand our product range to areas including water supply systems, electricity supply systems, air conditioning and ventilation systems. • Plan to offer annual maintenance and servicing program, the software maintenance and valve and PLC module replacement for the FMCS product. 21 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss.

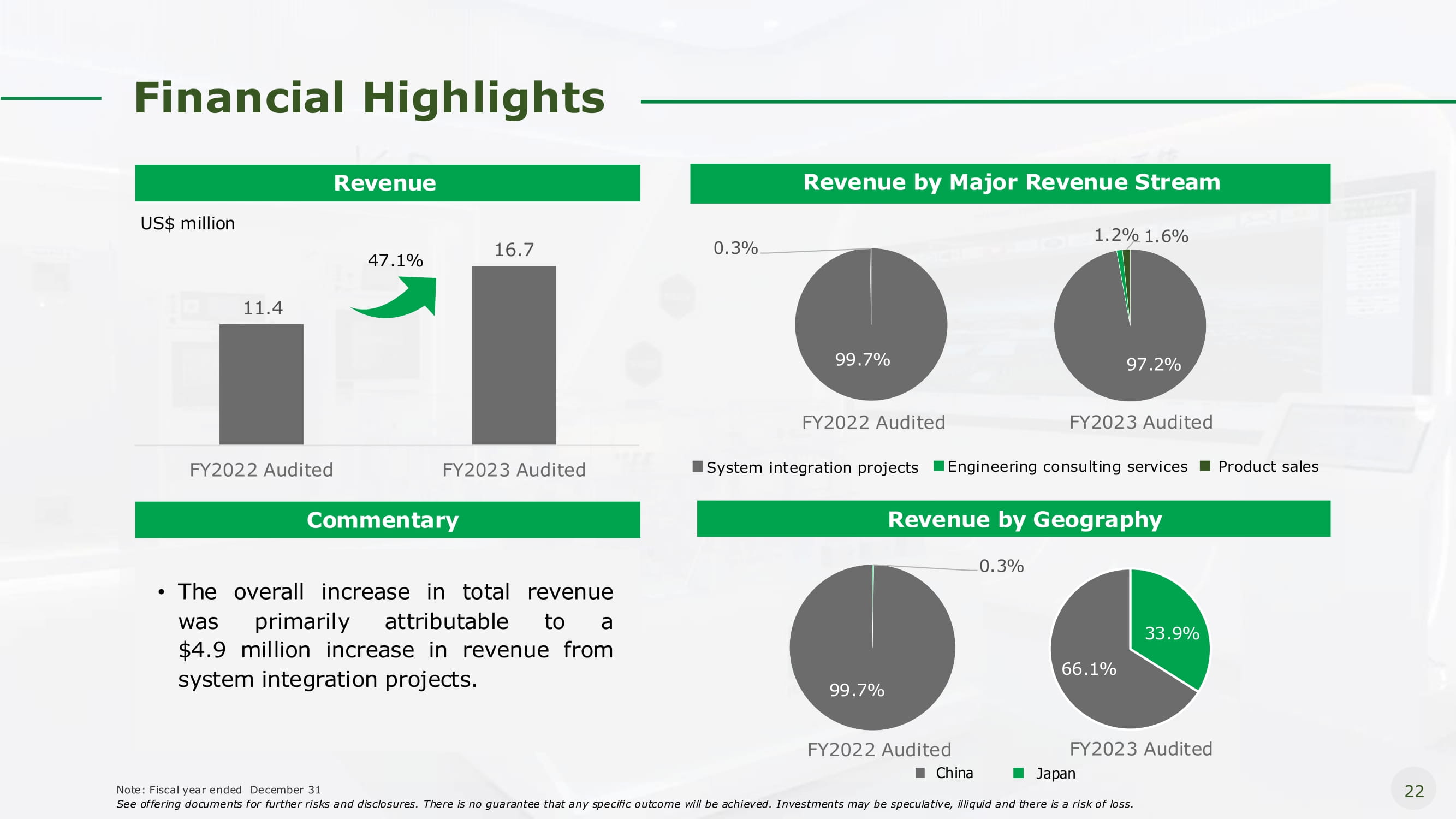

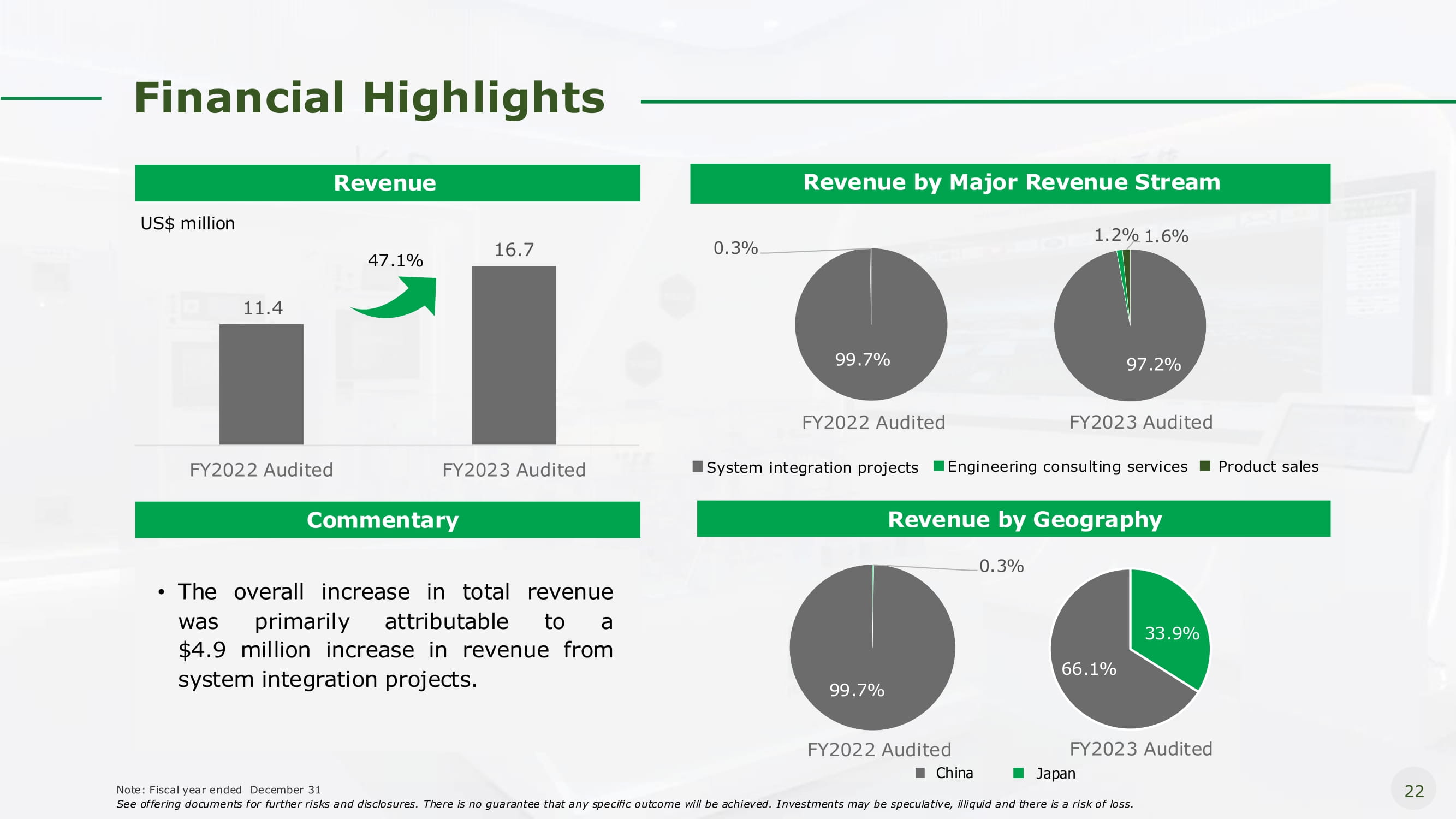

Financial Highlights 11.4 16.7 FY2022 Audited FY2023 Audited US$ million 47.1% 97.2% 1.2% 1.6% FY2023 Audited 99.7% 0.3% FY2022 Audited System integration projects Engineering consulting services Product sales 33.9% 66.1% 0.3% 99.7% FY2022 Audited China FY2023 Audited Japan Revenue Commentary • The overall increase in total revenue was primarily attributable to a $4.9 million increase in revenue from system integration projects. Revenue by Major Revenue Stream Revenue by Geography 22 Note: Fiscal year ended December 31 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss.

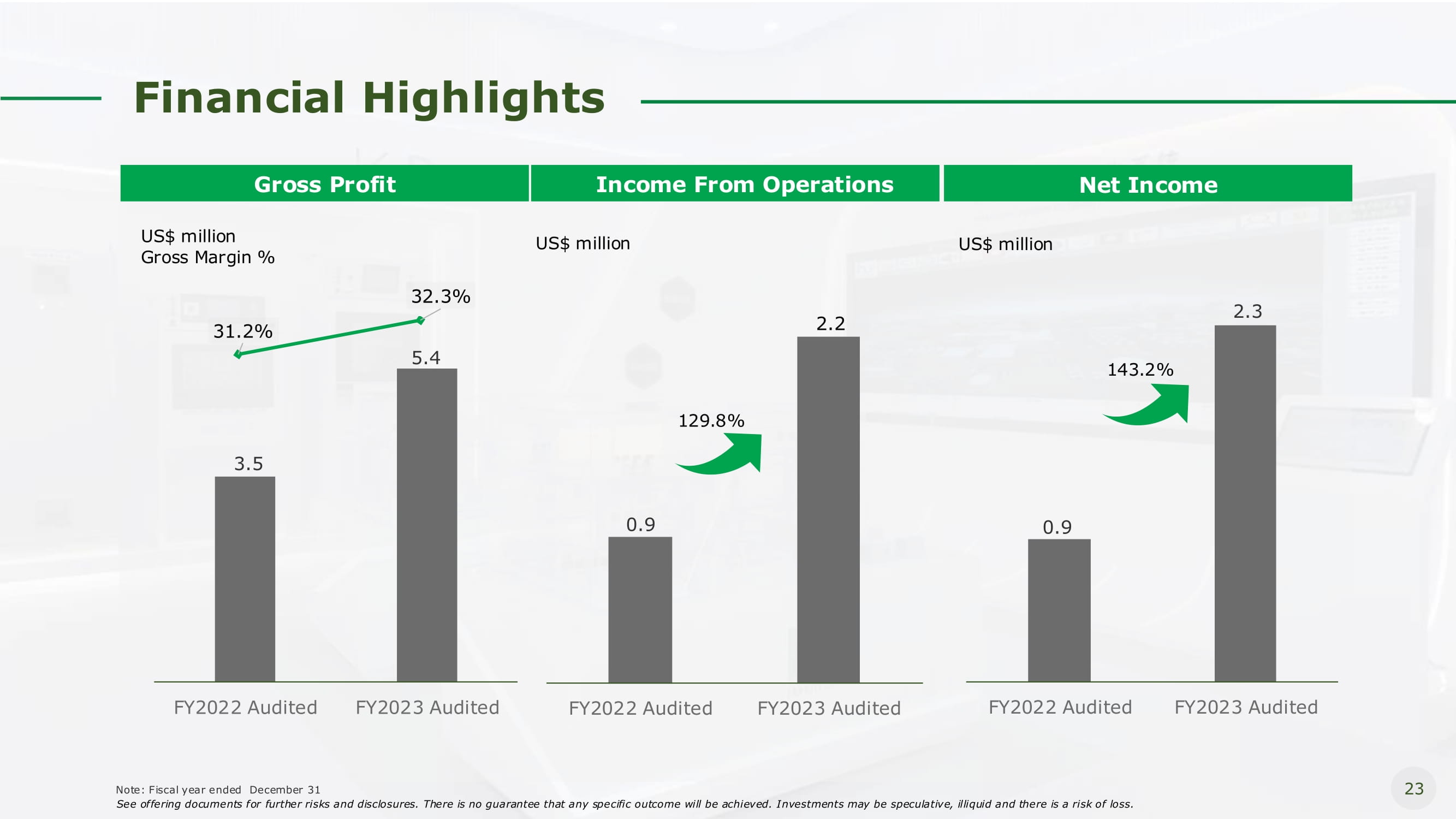

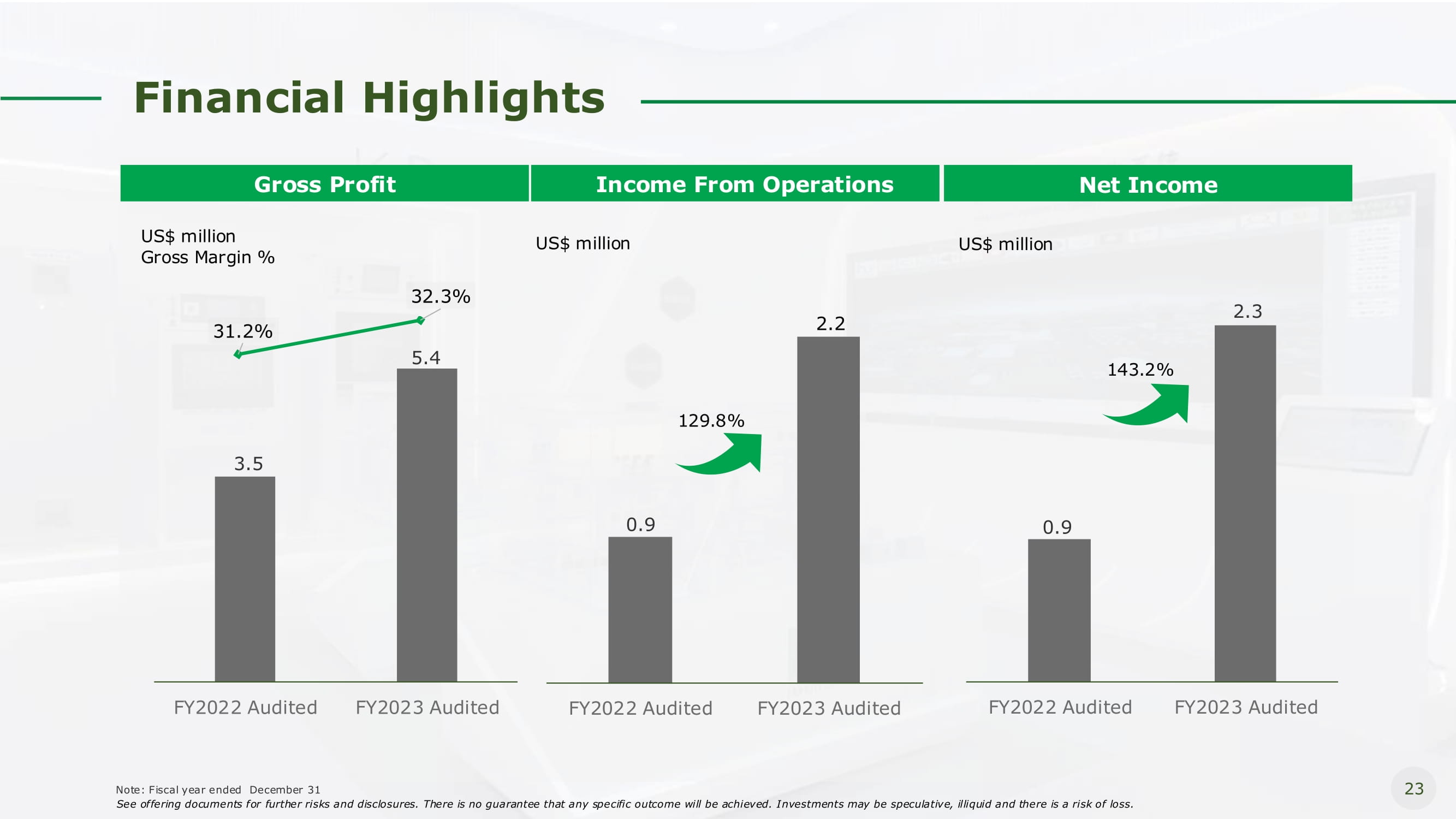

Financial Highlights 3.5 5.4 FY2022 Audited FY2023 Audited Gross Profit US$ million Gross Margin % 0.9 2.3 FY2022 Audited FY2023 Audited US$ million Net Income 143.2% 0.9 2.2 FY2022 Audited FY2023 Audited US$ million Income From Operations 129.8% 31.2% 23 Note: Fiscal year ended December 31 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss. 32.3%

Contact 377 Oak St, Lower Concourse, Garden City, NY 11530 3 - 1208 Tiananzhihui Compound 228 Linghu Road, Xinwu District Wuxi, Jiangsu, China 214135 24 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss. 590 Madison Ave 39th floor, New York, NY 10022 Underwriter Underwriter Issuer EF Hutton LLC Craft Capital Management LLC HUHUTECH International Group Inc. Email: syndicate@efhutton.com Email: info@craftcm.com Email: ir@huhutech.com.cn Tel: +1 (212) 404 - 7002 Tel: +1 (800) 550 - 8411 Tel: +86 - 0510 - 88681689 Address: Address: Address: