business and prospects. The loss of any of YS Group’s key employees, including senior executives, key research and development personnel or commercialization personnel, could materially harm its business and prospects.

YS Group does not maintain key-person insurance for members of its management team. If YS Group loses the services of any senior management, YS Group may not be able to locate suitable or qualified replacements, and may incur additional expenses to recruit and train new personnel, which could severely disrupt YS Group’s business and prospects. Furthermore, if any of YS Group’s executive officers joins a competitor or forms a competing company, YS Group may lose a significant number of its existing customers, which could have a material adverse effect on YS Group’s business and revenues. Although each of YS Group’s executive officers has entered into an agreement with YS Group that contains confidentiality and non-competition undertakings regarding their employment, disputes may arise between YS Group’s executive officers and YS Group, and these agreements may not be enforced in accordance with their terms.

YS Group may pursue collaborations, in-licensing arrangements, joint ventures, strategic alliances, partnerships or other strategic investment or arrangements, which may fail to produce anticipated benefits and adversely affect YS Group’s business.

YS Group collaborates with research organizations and government agencies to supplement its in-house efforts and advance the development of its product candidates. YS Group may pursue other opportunities for collaboration, in-licensing, joint ventures, acquisitions of products, assets or technology, strategic alliances, or partnerships that YS Group believes would be complementary to or promote its existing business. Proposing, negotiating and implementing these opportunities may be a lengthy and complex process. Other companies, including those with substantially greater financial, marketing, technology, or other business resources, may compete with YS Group for these opportunities or arrangements. YS Group may not be able to identify, secure, or complete any such transactions or arrangements in a timely manner, on a cost-effective basis, on acceptable terms, or at all.

YS Group has limited experience with respect to these business development activities. Management and integration of a licensing arrangement, collaboration, joint venture or other strategic arrangement may disrupt YS Group’s current operations, decrease YS Group’s profitability, result in significant expenses, or divert management resources that otherwise would be available for its existing business. YS Group may not realize the anticipated benefits of any such transaction or arrangement.

Furthermore, partners, collaborators or other parties to such transactions or arrangements may fail to fully, or at all, perform their obligations or meet YS Group’s expectations or cooperate with YS Group satisfactorily for various reasons, including risks or uncertainties related to their business and operations. There may be conflicts or other collaboration failures and inefficiencies between YS Group and the other parties.

Such transactions or arrangements may also require actions, consents, approvals, waivers, participation or involvement of various degrees from third parties, such as regulators, government authorities, creditors, licensors or licensees, related individuals, suppliers, distributors, shareholders or other stakeholders or interested parties. There is no assurance that such third parties will be cooperative as YS Group desires, or at all, in which case YS Group may be unable to carry out the relevant transactions or arrangements.

YS Group may not be able to complete new acquisitions successfully. Even if YS Group successfully acquires companies, products or technologies, YS Group may face integration risks and costs associated with those acquisitions that could negatively impact its business, financial condition and results from operations.

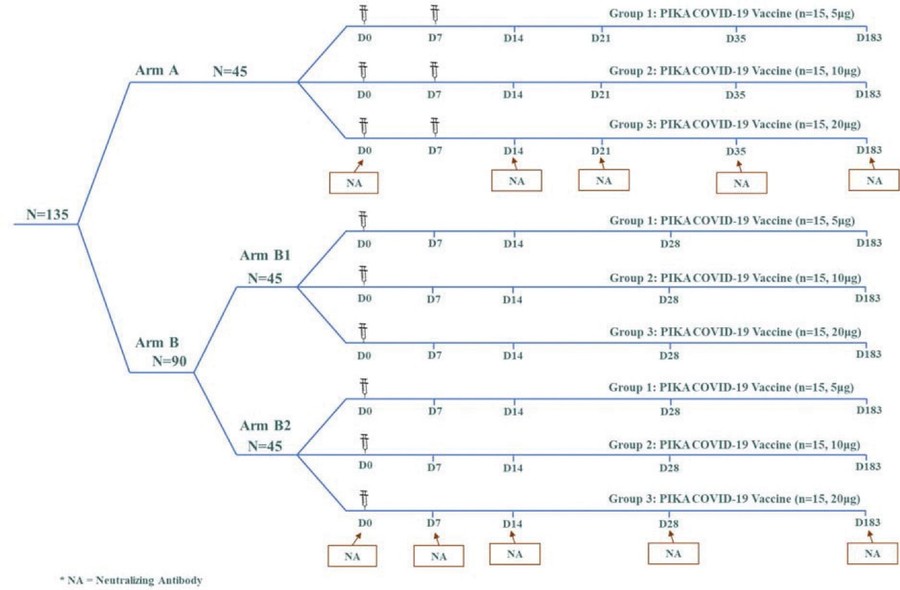

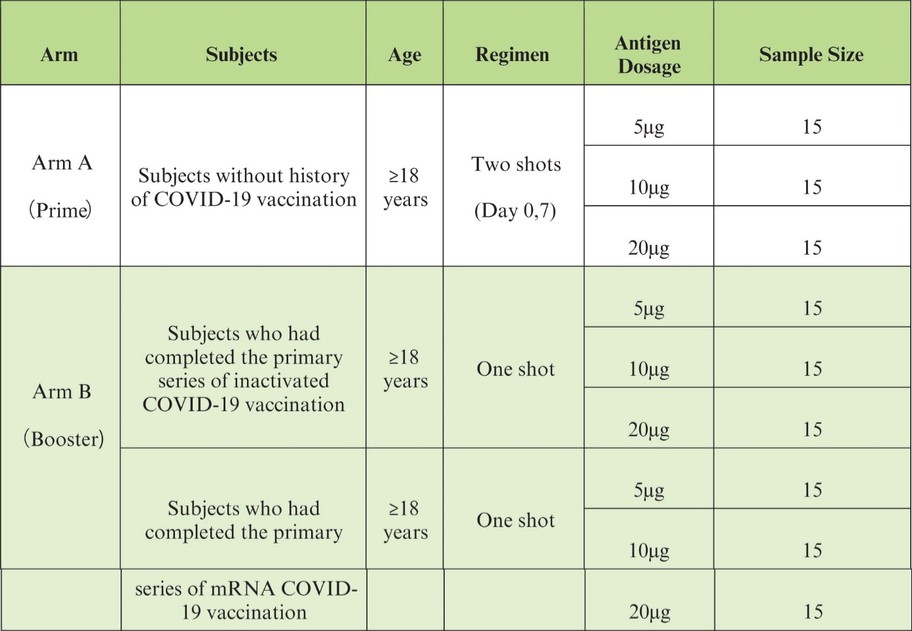

Acquisitions have been, and are expected to continue to be, an important part of YS Group’s growth strategies. For example, YS Group has established its proprietary PIKA immunomodulatory technology platform through the acquisition of NewBiomed in June 2010. If YS Group is presented with appropriate opportunities, YS Group may make additional acquisitions of complementary businesses, products, product candidates or technologies. Any such acquisitions will be dependent upon the continued availability of suitable acquisition targets at favorable prices and upon advantageous terms and conditions. Even if such opportunities are present, YS Group may not be able to successfully identify such acquisition targets. Moreover, other companies, many of which may have substantially greater financial, marketing and sales resources, are competing with YS Group for the right to acquire such businesses, products, product candidates or technologies. If an acquisition target is identified, the management and shareholders of the acquisition target may not select YS Group as a potential partner or YS Group may not be able to enter into agreements on commercially reasonable terms or at all. Furthermore, the negotiation and completion of potential acquisitions could cause significant diversion of YS Group’s management’s time and resources and potential disruption of its ongoing business.

In addition, YS Group cannot assure you that it will realize the anticipated benefit of any acquisition or investment. If YS Group acquires companies or technologies, YS Group will face risks, uncertainties and disruptions associated with the integration process, including difficulties in the integration of the operations of an acquired company, integration of acquired technology with its products, diversion of its management’s attention from other business concerns, the potential loss of key employees or customers of the acquired business, the potential involvement in any litigation related to the acquired company, and impairment charges if acquisitions are not as successful