| PROSPECTUS | Filed Pursuant to Rule 424(b)(3) Registration Statement No. 333-270624 |

HAMMERHEAD ENERGY INC.

99,176,973 Class A Common Shares

12,737,500 Warrants to Purchase Class A Common Shares

28,549,991 Class A Common Shares Underlying Warrants

This prospectus relates to the offer and sale from time to time by the selling securityholders named in this prospectus (the “Selling Securityholders”) of (A) up to 3,557,813 of our Class A Common Shares (“Common Shares”) held by the DCRD Initial Shareholders (as defined below), originally acquired for a purchase price equivalent to approximately $0.002 per share, including 3,464,323 of our Common Shares held by DCRD Sponsor (as defined below), an affiliate of the Riverstone Parties (as defined below), which Common Shares are subject to transfer restrictions in the Sponsor Support Agreement (as defined below); (B) up to 74,733,134 of our Common Shares held by the Riverstone Parties, of which 70,384,697 such Common Shares, originally acquired through various rounds of financing at purchase prices as low as approximately C$7.11 per share, are subject to transfer restrictions in the Lock-Up Agreement (as defined below) and 4,348,437 of such Common Shares, originally acquired for a purchase price equivalent to approximately $0.002 per share, are subject to transfer restrictions in the Sponsor Support Agreement; (C) 8,148,526 Common Shares issued to certain former shareholders of Hammerhead Resources Inc. (“Hammerhead”), which Common Shares were acquired by the Selling Securityholders in exchange for securities of Hammerhead that were acquired by employees, investors and others through private placements, equity award grants and other sales at prices that equate to purchase prices as low as approximately $0 per share, which are subject to transfer restrictions in the Lock-Up Agreement, (D) warrants to purchase up to 12,737,500 Common Shares held by certain Riverstone Fund V Entities (as defined below) (the “Private Placement Warrants”) received in exchange for DCRD Private Placement Warrants (as defined below) for warrants to purchase Common Shares (the “Warrants”) pursuant to the Founder Transfer, originally issued in a private placement at a price of $1.00 per DCRD Private Placement Warrant in connection with the DCRD IPO (as defined below) and (E) up to 12,737,500 Common Shares issuable upon exercise of the Private Placement Warrants, originally issued in a private placement at a price of $1.00 per DCRD Private Placement Warrant in connection with the DCRD IPO.

In addition, this prospectus relates to the issuance by us of up to (A) 15,812,491 Common Shares that are issuable by us upon the exercise of the Public Warrants, which were previously registered and (B) 12,737,500 Common Shares underlying the Private Placement Warrants.

In connection with the Business Combination, holders of 31,498,579 Common Shares exercised their right to redeem those shares for cash at a price of approximately $10.30 per share, for an aggregate price of approximately $324.5 million. The total number of Common Shares that may be offered and sold under this prospectus by the Selling Securityholders (the “Total Resale Shares”) represents a substantial percentage of the total outstanding Common Shares as of the date of this prospectus. The Total Resale Shares being offered for resale in this prospectus represent approximately 95.7% of our current total outstanding Common Shares, assuming the exercise of all Warrants. Further, certain Selling Securityholders beneficially own a significant percentage of our outstanding Common Shares. As of April 10, 2023, the Riverstone Parties beneficially owned 87,470,634 Common Shares (including 12,737,500 Common Shares issuable upon exercise of Private Placement Warrants held by certain Riverstone Fund V entities), representing approximately 84.4% of the Common Shares, of which 70,384,697 such Common Shares are subject to transfer restrictions in the Lock-Up Agreement that expire on August 23, 2023 and thereafter may be resold, and 4,348,437 of such Common Shares are subject to transfer restrictions in the Sponsor Support Agreement that expire on February 23, 2024 and thereafter may be resold, in each case for so long as the registration statement, of which this prospectus forms a part, is available for use. In addition, as of April 10, 2023, DCRD Sponsor, an entity affiliated with the Riverstone Parties, beneficially owned 3,464,323 Common Shares, representing approximately 3.8% of the Common Shares, which are subject to transfer restrictions in the Sponsor Support Agreement that expire on February 23, 2024 and thereafter may be resold, in each case for so long as the registration statement, of which this prospectus forms a part, is available for use. In the aggregate, as of April 10, 2023, the Riverstone Parties and their affiliates, including DCRD Sponsor, beneficially owned 90,934,957 Common Shares representing approximately 87.7% of the Common Shares (including 12,737,500 Common Shares issuable upon exercise of Private Placement Warrants that are held by certain Riverstone Fund V Entities). The sale of all securities being offered in this prospectus could result in a significant decline in the public trading price of our Common Shares. Even if the current trading price of the Common Shares is at or significantly below the price at which the DCRD Units (as defined below) were issued in the DCRD IPO, some of the Selling Securityholders may still have an incentive to sell because they could still profit on sales due to the lower price at which they purchased their shares compared to the public investors. The public securityholders may not experience a similar rate of return on the securities they purchase due to differences in the purchase prices and the current trading price. See “Risk Factors-Risks Related to Ownership of the Company’s Securities-A significant portion of the Company’s total outstanding securities may be sold into the market in the near future. This could cause the market price of the Common Shares and the Warrants to drop significantly, even if the Company’s business is performing well.” Based on the closing price of our Common Shares as of April 11, 2023 on the Nasdaq Capital Market (the “Nasdaq”) of $8.58, (a) the DCRD Initial Shareholders may experience a potential profit of up to approximately $8.58 per share, (b) the Riverstone Investors may experience a potential profit of up to approximately $3.32 per share, based on the daily exchange rate published by the Bank of Canada on April 11, 2023 of C$1.00 = US$0.74, and (c) certain former shareholders of Hammerhead may experience a potential profit of up to approximately $8.58 per share, in each case, if such Selling Securityholders sold their Common Shares. Public securityholders may not be able to experience the same positive rates of return on securities they purchase due to the low price at which certain Selling Securityholders acquired or purchased their Common Shares.

The Selling Securityholders may offer, sell or distribute all or a portion of the securities hereby registered publicly or through private transactions at prevailing market prices or at negotiated prices. We will not receive any of the proceeds from such sales of the Common Shares or Warrants, except with respect to amounts received by us upon the exercise of the Warrants. Whether Warrant Holders (as defined below) will exercise their Warrants, and therefore the amount of cash proceeds we would receive upon exercise, is dependent upon the trading price of the Common Shares, the last reported sales price for which was $8.15 per share on April 28, 2023 on the Nasdaq. Each Warrant is exercisable for one Common Share at an exercise price of $11.50. Therefore, if and when the trading price of the Common Shares is less than $11.50, we expect that Warrant Holders would not exercise their Warrants. We could receive up to an aggregate of approximately $328.3 million if all of the Warrants are exercised for cash, but we would only receive such proceeds if and when the Warrant Holders exercise the Warrants. The Warrants may not be or remain in the money during the period they are exercisable and prior to their expiration, and the Warrants may not be exercised prior to their maturity on February 23, 2028, even if they are in the money, and as such, the Warrants may expire worthless and we may receive minimal proceeds, if any, from the exercise of Warrants. To the extent that any of the Warrants are exercised on a "cashless basis," we will not receive any proceeds upon such exercise. As a result, we do not expect to rely on the cash exercise of Warrants to fund our operations. Instead, we intend to rely on other sources of cash discussed elsewhere in this prospectus to continue to fund our operations. See "Risk Factors-Risks Related to Ownership of the Company's Securities-There is no guarantee that the exercise price of our Warrants will ever be less than the trading price of our Common Shares on the Nasdaq, and they may expire worthless. In addition, we may reduce the exercise price of the Warrants in accordance with the provisions of the Warrant Agreement, and a reduction in exercise price of the Warrants would decrease the maximum amount of cash proceeds we could receive upon the exercise in full of the Warrants for cash" and "Management's Discussion and Analysis of Financial Condition and Results of Operations-Capital Resource and Liquidity."

We will bear all costs, expenses and fees in connection with the registration of these securities, including with regard to compliance with state securities or "blue sky" laws. The Selling Securityholders will bear all commissions and discounts, if any, attributable to their sale of Common Shares or Warrants. See "Plan of Distribution."

Our Common Shares and Warrants are listed on the Nasdaq under the symbols "HHRS" and "HHRSW", respectively, and on the Toronto Stock Exchange (the "TSX") under the symbols "HHRS" and "HHRS.WT," respectively. On April 28, 2023, the last reported sales prices of the Common Shares on the Nasdaq and the TSX were $8.15 and C$11.02, respectively, and the last reported sales prices of the Warrants were $1.13 and C$1.40, respectively.

We are a "foreign private issuer" as defined in the U.S. Securities Exchange Act of 1934, as amended (the "Exchange Act"), and are exempt from certain rules under the Exchange Act that impose certain disclosure obligations and procedural requirements for proxy solicitations under Section 14 of the Exchange Act. In addition, our officers, directors and principal shareholders are exempt from the reporting and "short-swing" profit recovery provisions under Section 16 of the Exchange Act. Moreover, we are not required to file periodic reports and financial statements with the U.S. Securities and Exchange Commission as frequently or as promptly as U.S. companies whose securities are registered under the Exchange Act. Additionally, the Nasdaq rules allow foreign private issuers to follow home country practices in lieu of certain of the Nasdaq's corporate governance rules. As a result, our shareholders may not have the same protections afforded to shareholders of companies that are subject to all the Nasdaq corporate governance requirements.

Investing in our securities involves a high degree of risk. You should review carefully the risks and uncertainties described under the heading "Risk Factors" beginning on page 5 of this prospectus, and under similar headings in any amendments or supplements to this prospectus.

None of the Securities and Exchange Commission, any state securities commission or the securities commission of any Canadian province or territory has approved or disapproved of these securities, or determined if this prospectus is accurate or adequate. Any representation to the contrary is a criminal offense.

The date of this prospectus is May 1, 2023.

TABLE OF CONTENTS

i

No one has been authorized to provide you with information that is different from that contained in this prospectus or any free writing prospectus filed by us. This prospectus is dated as of the date set forth on the cover hereof. You should not assume that the information contained in this prospectus is accurate as of any date other than that date.

Except as otherwise set forth in this prospectus, we have not taken any action to permit a public offering of these securities outside the United States or to permit the possession or distribution of this prospectus outside the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about and observe any restrictions relating to the offering of these securities and the distribution of this prospectus outside the United States.

ii

MARKET AND INDUSTRY DATA

This prospectus contains estimates, projections, and other information concerning the Company's industry and business, as well as data regarding market research, estimates, forecasts and projections prepared by the Company's management. Information that is based on market research, estimates, forecasts, projections, or similar methodologies is inherently subject to uncertainties, and actual events or circumstances may differ materially from events and circumstances that are assumed in this information. The industry in which the Company operates is subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the section titled "Risk Factors." Unless otherwise expressly stated, the Company obtained industry, business, market, and other data from reports, research surveys, studies, and similar data prepared by market research firms and other third parties, industry and general publications, government data, and similar sources. In some cases, the Company does not expressly refer to the sources from which this data is derived. In that regard, when the Company refers to one or more sources of this type of data in any paragraph, you should assume that other data of this type appearing in the same paragraph is derived from sources that the Company paid for, sponsored, or conducted, unless otherwise expressly stated or the context otherwise requires. While the Company has compiled, extracted, and reproduced industry data from these sources, the Company has not independently verified the data. Forecasts and other forward-looking information with respect to industry, business, market, and other data are subject to the same qualifications and additional uncertainties regarding the other forward-looking statements in this prospectus. See "Cautionary Note Regarding Forward-Looking Statements."

TRADEMARKS AND TRADE NAMES

The Company owns or has rights to various trademarks, service marks and trade names that we use in connection with the operation of our business. This prospectus also contains trademarks, service marks and trade names of third parties, which are the property of their respective owners. The use or display of third parties' trademarks, service marks, trade names or products in this prospectus is not intended to create, and does not imply, a relationship with the Company or an endorsement or sponsorship by or of the Company. Solely for convenience, the trademarks, service marks and trade names referred to in this prospectus may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that the Company will not assert, to the fullest extent under applicable law, their rights or the right of the applicable licensor to these trademarks, service marks and trade names.

PRESENTATION OF FINANCIAL INFORMATION

This prospectus contains:

the audited consolidated financial statements of DCRD as of December 31, 2022 and 2021 and for the year ended December 31, 2022 and the period from February 22, 2021 (inception) to December 31, 2021;

the audited consolidated financial statements of Hammerhead (as defined below) as at December 31, 2022 and 2021 and for each of the years in the three-year period ended December 31, 2022; and

the audited financial statements of the Company as of December 31, 2022 and for the period from September 1, 2022 (inception) to December 31, 2022.

Unless indicated otherwise, financial data presented in this prospectus has been taken from the audited consolidated financial statements of DCRD and Hammerhead, as applicable, included in this prospectus. Unless otherwise indicated, financial information of DCRD has been prepared in accordance with accounting principles generally accepted in the United States ("U.S. GAAP") and the financial information of Hammerhead has been prepared in accordance with International Financial Reporting Standards ("IFRS"). This prospectus does not include any explanation of the principal differences or any reconciliation between U.S. GAAP and IFRS.

As presented herein, Hammerhead presents its consolidated financial statements in Canadian dollars. DCRD publishes its consolidated financial statements in U.S. dollars. In this prospectus, unless otherwise specified, all monetary amounts are in U.S. dollars, all references to "$," "US$," "USD" and "dollars" mean U.S. dollars and all references to "C$" and "CAD" mean Canadian dollars.

iii

NON-GAAP FINANCIAL MEASURES

The Company reports certain financial information using meaningful measures commonly used in the oil and natural gas industry that are not defined under IFRS, and are referred to as non-GAAP measures. The Company believes that these measures provide information that is useful to investors in understanding the performance of the Company and facilitate a comparison of the Company's results from period to period. Non-GAAP financial measures and ratios used in the Company's financial information include capital expenditures, available funding, operating netback, operating netback per boe, funds from operations, funds from operations per boe, and funds from operations per basic share and diluted share. These measures should not be considered in isolation or as a substitute for measures prepared in accordance with IFRS, and should be read in conjunction with the audited annual consolidated financial statements of Hammerhead. Readers are cautioned that these non-GAAP financial measures and capital management measures are not standardized measures under IFRS, and may not be comparable to similar financial measures disclosed by other entities.

For more information on the non-IFRS financial measures used in this prospectus, please see the section entitled "Management's Discussion and Analysis of Financial Condition and Results of Operations-Non-GAAP and Other Specified Financial Measures."

iv

EXCHANGE RATES

The Company's reporting currency is the Canadian dollar. The determination of the functional and reporting currency of each group company is based on the primary currency in which the group company operates. The functional currency of the Company's subsidiaries is generally the local currency.

v

CERTAIN DEFINED TERMS

Unless the context otherwise requires, references in this prospectus to:

• "A&R Registration Rights Agreement" are to that certain amended and restated registration rights agreement entered into concurrently with the Closing.

• "ABCA" are to the Business Corporations Act (Alberta).

• "Adjusted EBITDA" are to a non-IFRS measure calculated as net profit (loss) before interest and financing expenses, income taxes, depletion, depreciation and amortization, adjusted for certain non-cash, extraordinary and non-recurring items.

• "AECO" are to AECO "C" hub price index for Alberta natural gas.

• "Allowable Capital Loss" are to one-half of any capital loss realized by a Canadian Holder in a taxation year that must be deducted from taxable capital gains realized by the Canadian Holder in that year.

• "AmalCo" are to 2453729 Alberta ULC, an Alberta unlimited liability corporation and wholly owned subsidiary of DCRD, which amalgamated with Hammerhead pursuant to the Company Amalgamation to form Hammerhead Resources ULC, a wholly owned subsidiary of the Company.

• "Amalgamated Company" are to Hammerhead Resources ULC, the unlimited liability corporation formed as a result of the Company Amalgamation.

• "Antitrust Division" are to the Antitrust Division of the U.S. Department of Justice.

• "Arrangement" are to an arrangement under section 193 of the ABCA on the terms and subject to the conditions set forth in the Plan of Arrangement.

• "As-Converted Hammerhead Series II Preferred Shares" are to, at any point of determination, the number of Hammerhead Common Shares (or Hammerhead Class A Common Shares, as applicable) issuable if all holders of Hammerhead Series II Preferred Shares converted such shares in accordance with the Hammerhead Articles.

• "As-Converted Hammerhead Series IX Preferred Shares" are to, at any point of determination, the number of Hammerhead Common Shares (or Hammerhead Class A Common Shares, as applicable) issuable if all holders of Hammerhead Series IX Preferred Shares converted such shares in accordance with the Hammerhead Articles.

• "Board" are to the board of directors of the Company.

• "bbl" are to barrel.

• "bbls/d" are to barrels per day.

• "boe" are to barrels of oil equivalent, as calculated by converting natural gas to oil equivalent barrels at a ratio of six Mcf of natural gas to one boe. This calculation is an energy content correlation and does not reflect a value or price relationship between the commodities.

• "boe/d" are to barrels of oil equivalent per day.

• "Business Combination" are to the transactions consummated pursuant to the Business Combination Agreement, the Plan of Arrangement and all other agreements entered into in connection therewith.

• "Business Combination Agreement" are to that certain Business Combination Agreement, dated September 25, 2022 by and between DCRD, Hammerhead, NewCo and AmalCo.

vi

• "Canadian Holder" are to a Holder who, at all relevant times, for purposes of the ITA, is or is deemed to be resident in Canada.

• "Cdn$" or "C$" are to Canadian dollars.

• "CIBC" are to the Canadian Imperial Bank of Commerce.

• "Class B Common Shares" are to the Class B common shares in the authorized share capital of the Company.

• "Closing" are to the closing of the Business Combination.

• "Closing Date" are to February 23, 2023.

• "Code" are to the U.S. Internal Revenue Code of 1986, as amended.

• "Common Shares" are to the Company's Class A Common Shares.

• "Company Amalgamation" are to the amalgamation of Hammerhead and AmalCo.

• "Company Amalgamation Effective Time" are to the effective time of the Company Amalgamation.

• "Company Articles" are to the articles of the Company (as amended).

• "Companies Act" are to the Cayman Islands Companies Act (as amended).

• "Company Bylaws" are to the bylaws of the Company.

• "Competition Act" are to the Competition Act (Canada) and the regulations promulgated thereunder.

• "Court" are to the Alberta Court of King's Bench.

• "CRA" are to the Canada Revenue Agency.

• "Credit Facility" are to the credit facilities available to Hammerhead pursuant to the then existing credit agreement between Hammerhead and the lenders thereto, as the context may require.

• "Crown" are to His Majesty the King in right of Canada or His Majesty the King in right of the Province of Alberta, as the context may require.

• "Crude oil" are to light crude oil and medium crude oil as defined in NI 51-101.

• "DCRD" are to Decarbonization Plus Acquisition Corporation IV, a Cayman Islands exempted company, which (i) transferred by way of continuation from the Cayman Islands to the Province of Alberta, Canada and domesticated as an Alberta corporation pursuant to the Domestication and (ii) amalgamated with NewCo, with NewCo surviving as the Company, pursuant to the SPAC Amalgamation.

• "DCRD Articles" are to the amended and restated memorandum and articles of association of DCRD, adopted on August 10, 2021, as amended and restated on January 23, 2023.

• "DCRD Board" are to the board of directors of DCRD.

• "DCRD Class A Common Shares" are to DCRD's Class A common shares.

• "DCRD Class A Ordinary Shares" are to DCRD's Class A ordinary shares, par value $0.0001 per share.

• "DCRD Class B Common Shares" are to DCRD's Class B common shares.

vii

• "DCRD Class B Ordinary Shares" are to DCRD's Class B ordinary shares, par value $0.0001 per share.

• "DCRD Domesticated Warrants" are to the DCRD Private Placement Warrants and the DCRD Public Warrants, collectively.

• "DCRD Founder Shareholders" are to the DCRD Initial Shareholders and, after the Founder Transfer, certain Riverstone Fund V Entities.

• "DCRD Founder Shares" are to the outstanding DCRD Class B Ordinary Shares immediately prior to the SPAC Amalgamation Effective Time.

• "DCRD Initial Shareholders" are to DCRD Sponsor and DCRD's independent directors, each in their capacity as holders of DCRD Founder Shares.

• "DCRD IPO" are to DCRD's initial public offering of DCRD Units, which closed on August 13, 2021.

• "DCRD management" are to DCRD's officers and directors.

• "DCRD Ordinary Shares" are to the DCRD Class A Ordinary Shares and the DCRD Class B Ordinary Shares.

• "DCRD Private Placement Warrants" are to the warrants issued to DCRD Sponsor and certain of DCRD's independent directors in a private placement simultaneously with the closing of the DCRD IPO.

• "DCRD Public Shareholders" are to the holders of DCRD Public Shares.

• "DCRD Public Shares" are to DCRD Class A Ordinary Shares sold as part of the DCRD Units in the DCRD IPO (whether they were purchased in the DCRD IPO or thereafter in the open market).

• "DCRD Public Warrant Holders" are to holders of DCRD Public Warrants.

• "DCRD Public Warrants" are to the warrants sold as part of the DCRD Units in the DCRD IPO (whether they were purchased in the DCRD IPO or thereafter in the open market).

• "DCRD Shareholders" are to, collectively, the DCRD Initial Shareholders and the DCRD Public Shareholders.

• "DCRD Sponsor" are to Decarbonization Plus Acquisition Sponsor IV LLC, a Cayman Islands limited liability company and an affiliate of Riverstone.

• "DCRD Units" are to the units of DCRD sold in the DCRD IPO, each of which consisted of one DCRD Class A Ordinary Share and one-half of one DCRD Public Warrant.

• "DCRD Warrant Agreement" are to the Warrant Agreement, dated August 10, 2021, between DCRD and Continental Stock Transfer and Trust Company, as warrant agent.

• "DCRD Warrants" are to the DCRD Private Placement Warrants and the DCRD Public Warrants, collectively.

• "Directors" are to the directors of the Company.

• "Domestication" are to the transfer of DCRD by way of continuation from the Cayman Islands to the Province of Alberta, Canada in accordance with the DCRD Articles and the Companies Act and the domestication of DCRD as an Alberta corporation in accordance with the applicable provisions of the ABCA, including all matters necessary or ancillary in order to effect such transfer by way of continuation and domestication, including the adoption of the Domestication Articles and Bylaws.

viii

• "Domestication Articles and Bylaws" are to the articles and bylaws of DCRD adopted in connection with the Domestication.

• "DPSP" are to a deferred profit sharing plan.

• "DTC" are to The Depository Trust Company.

• "Duff & Phelps" are to Kroll, LLC, operating through its Duff & Phelps Opinions Practice.

• "E&P" are to exploration and production.

• "EGC" are to emerging growth company, as defined in Section 2(a)(19) of the Securities Act, as modified by the JOBS Act.

• "Employee Borrowers" are to the four management employees who received loans from Hammerhead in the aggregate principal amount of C$5,793,000 pursuant to amended and restated limited recourse loan, pledge, call option and security agreements dated February 18, 2020.

• "Exchange Act" are to the U.S. Securities Exchange Act of 1934, as amended.

• "F Reorganization" are to a reorganization pursuant to Section 368(a)(1)(F) of the Code.

• "FHSA" are to a first home savings account.

• "FHSA Amendments" are to Proposed Amendments released on August 9, 2022 to implement tax measures applicable to FHSAs first proposed by the 2022 Federal Budget (Canada).

• "Final Order" are to the final order of the Court pursuant to section 193 of the ABCA, approving the Arrangement, dated February 3, 2023.

• "First Preferred Shares" are to the class of shares of the Company issuable in series, to be limited in number to an amount equal to not more than 20% of the number of issued and outstanding Common Shares at the time of issuance of any First Preferred Shares.

• "Founder Transfer" are to the transfer of DCRD Founder Shares and DCRD Private Placement Warrants pursuant to the Sponsor Side Letter.

• "G&A" are to general and administrative.

• "GAAP" are to generally accepted accounting principles.

• "GHG" are to greenhouse gases.

• "GJ" are to gigajoule.

• "Governmental Authority" are to any U.S. or non-U.S.: (1) nation, state, commonwealth, province, territory, region, county, city, municipality, district, or other jurisdiction of any nature; (2) federal, state, local, municipal, foreign or other government; or (3) governmental, quasi-governmental, public or statutory authority of any nature (including any governmental division, department, agency, regulatory or administrative authority, commission, instrumentality, official, organization, unit, body, or entity and any court, judicial or arbitral body, or other tribunal).

• "Hammerhead 2013 Warrants" are to the 6,000,000 warrants to purchase Hammerhead Common Shares issued pursuant to that certain warrant indenture dated May 1, 2013 by and between Hammerhead and Olympia Trust Company.

• "Hammerhead 2020 Warrants" are to the (i) 33,721,985 warrants to purchase Hammerhead Common Shares issued pursuant to the certain warrant certificate dated June 17, 2020 by and between Hammerhead and Riverstone V Investment Management Coöperatief U.A. (formerly, Riverstone V EMEA Holdings Coöperatief U.A.); and (ii) 1,298,296 warrants to purchase Hammerhead Common Shares issued pursuant to that certain warrant certificate dated December 8, 2020 by and between Hammerhead and HV RA II LLC.

ix

• "Hammerhead" are to Hammerhead Resources Inc., an Alberta corporation, which amalgamated with AmalCo to form Hammerhead Resources ULC pursuant to the Company Amalgamation.

• "Hammerhead Articles" are to the articles of amalgamation of Hammerhead, dated October 1, 2017, as amended from time to time.

• "Hammerhead Board" are to the board of directors of Hammerhead.

• "Hammerhead Circular" are to the information circular/proxy statement of Hammerhead in respect of the Hammerhead Shareholders meeting.

• "Hammerhead Class A Common Shares" are to the Hammerhead Common Shares after the reclassification of such Hammerhead Common Shares as "Hammerhead Class A Common Shares" pursuant to Section 3.2(a) of the Plan of Arrangement.

• "Hammerhead Class B Common Shares" are to the Class B common shares in the authorized share capital of Hammerhead created pursuant to Section 3.2(a) of the Plan of Arrangement.

• "Hammerhead Common Share Exchange Ratio" are to the quotient obtained by (A) dividing (i) $882,092,851.88 minus (a) $130,603,883.57, representing the Hammerhead Series VII Preferred Share Liquidation Preference, (b) $179,631,775.98, representing the Hammerhead Series III Preferred Share Liquidation Preference and (c) $40.00, by (ii) $10.00, representing the Issue Price, and then (B) by further dividing the resulting number of Common Shares established in (A) above by (C) the sum of (i) the As-Converted Hammerhead Series II Preferred Shares, (ii) the As-Converted Hammerhead Series IX Preferred Shares, (iii) the number of Hammerhead Common Shares that are issuable upon the exercise of Hammerhead Options that are unexpired, issued and outstanding as of immediately prior to the Company Amalgamation Effective Time minus a number of Hammerhead Common Shares with a fair market value equal to the aggregate exercise price (determined in U.S. dollars with reference to the U.S. dollar to Canadian dollar exchange rate reported by the Bank of Canada on September 23, 2022 of 1.3570) of all Hammerhead Options so exercised, in each case, assuming that the fair market value of one Hammerhead Common Share equals (x) the Hammerhead Common Share Exchange Ratio multiplied by (y) $10.00, (iv) the (1) number of Hammerhead Common Shares that are issuable upon the exercise of Hammerhead RSUs that are unexpired, issued and outstanding as of immediately prior to the Company Amalgamation Effective Time minus a number of Hammerhead Common Shares with a fair market value equal to the aggregate exercise price (determined in U.S. dollars with reference to the U.S. dollar to Canadian dollar exchange rate reported by the Bank of Canada on September 23, 2022 of 1.3570) of all Hammerhead RSUs so exercised, in each case, assuming that the fair market value of one Hammerhead Common Share equals (x) the Hammerhead Common Share Exchange Ratio multiplied by (y) $10.00; minus (2) 2,010,154 Hammerhead Common Shares, and (v) the number of Hammerhead Class A Common Shares and Hammerhead Class B Common Shares issued and outstanding immediately prior to the Company Amalgamation Effective Time, including, for greater certainty, any Hammerhead Class A Common Shares issued in connection with the Hammerhead Warrant Settlement.

• "Hammerhead Common Shares" are to the common shares in the authorized share capital of Hammerhead.

• "Hammerhead Options" are to all options to purchase Hammerhead Common Shares, whether or not exercisable and whether or not vested, granted under the Hammerhead Share Option Plan.

• "Hammerhead Preferred Shares" are to, collectively, the Hammerhead Series I Preferred Share, the Hammerhead Series II Preferred Shares, the Hammerhead Series III Preferred Shares, the Hammerhead Series IV Preferred Share, the Hammerhead Series VI Preferred Share, the Hammerhead Series VII Preferred Shares, the Hammerhead Series VIII Preferred Shares and the Hammerhead Series IX Preferred Shares.

x

• "Hammerhead RSUs" are to all share awards to purchase Hammerhead Common Shares granted under the Hammerhead Share Award Plan.

• "Hammerhead Series I Preferred Share" are to the Series I First Preferred Share in the authorized share capital of Hammerhead.

• "Hammerhead Series II Preferred Shares" are to the Series II First Preferred Shares in the authorized share capital of Hammerhead.

• "Hammerhead Series III Preferred Share Exchange Ratio" are to the quotient obtained by (A) dividing the Hammerhead Series III Preferred Share Liquidation Preference by the Issue Price, and then (B) by further dividing the resulting number of Common Shares established in (A) above by the number of Hammerhead Series III Preferred Shares issued and outstanding immediately prior the Company Amalgamation Effective Time.

• "Hammerhead Series III Preferred Share Liquidation Preference" are to $179,631,775.98.

• "Hammerhead Series III Preferred Shares" are to the Series III First Preferred Shares in the authorized share capital of Hammerhead.

• "Hammerhead Series IV Preferred Share" are to the Series IV First Preferred Share in the authorized share capital of Hammerhead.

• "Hammerhead Series VI Preferred Share" are to the Series VI First Preferred Share in the authorized share capital of Hammerhead.

• "Hammerhead Series VII Preferred Share Exchange Ratio" are to the quotient obtained by (A) dividing the Hammerhead Series VII Preferred Share Liquidation Preference by the Issue Price, and then (B) by further dividing the resulting number of Common Shares established in (A) above by the number of Hammerhead Series VII Preferred Shares issued and outstanding immediately prior the Company Amalgamation Effective Time.

• "Hammerhead Series VII Preferred Share Liquidation Preference" are to $130,603,883.57.

• "Hammerhead Series VII Preferred Shares" are to the Series VII Preferred Shares in the authorized share capital of Hammerhead.

• "Hammerhead Series VIII Preferred Shares" are to the Series VIII Preferred Shares in the authorized share capital of Hammerhead.

• "Hammerhead Series IX Preferred Shares" are to the Series IX First Preferred Shares in the authorized share capital of Hammerhead.

• "Hammerhead Share Award Plan" are to the amended and restated share award plan of Hammerhead effective August 31, 2016 as amended on November 7, 2019, December 31, 2020, March 30, 2022 and May 20, 2022.

• "Hammerhead Share Option Plan" are to the share option plan of Hammerhead effective March 21, 2011 as amended effective January 10, 2017, December 31, 2020, March 30, 2022 and May 30, 2022.

• "Hammerhead Shareholders" are to, collectively, the holders of Hammerhead Shares as of any determination time prior to the Closing.

• "Hammerhead Shares" are to, collectively, the Hammerhead Common Shares and Hammerhead Preferred Shares.

xi

• "Hammerhead Warrants" are to, collectively, the Hammerhead 2013 Warrants and the Hammerhead 2020 Warrants.

• "Hammerhead Warrant Settlement" are to the exchange of the Hammerhead Warrants for Hammerhead Class A Common Shares or cash, in either case, in accordance with the Plan of Arrangement.

• "Holder" are to a person who is a beneficial owner of the Company's Securities.

• "IFRS" are to the International Financial Reporting Standards issued by the International Accounting Standards Board, as incorporated in the CPA Canada Handbook at the relevant time.

• "IFRS 2" are to International Financial Reporting Standard 2 - Share-based Payment.

• "IFRS 3" are to International Financial Reporting Standard 3 - Business Combinations.

• "Investment Canada Act" are to the Investment Canada Act (Canada) and the regulations made thereunder.

• "IPO Letter Agreement" are to the letter agreement, dated August 10, 2021, by and among DCRD, DCRD management and DCRD Sponsor.

• "IRS" are to the U.S. Internal Revenue Service.

• "Issue Price" are to $10.00.

• "ITA" are to the Income Tax Act (Canada) and the regulations made thereunder as amended from time to time.

• "JOBS Act" are to the U.S. Jumpstart Our Business Startups Act of 2012.

• "Letter of Credit Facility" are to Hammerhead's letters of credit in both Canadian and U.S. dollars pursuant to a standby letter of credit facility agreement.

• "Liquidation" are to the voluntary or involuntary liquidation, dissolution or winding-up of the Company or any other distribution of its assets among the Shareholders for the purpose of winding up its affairs.

• "Listing Rules" are to the exchange listing rules of the Nasdaq.

• "Lock-Up Agreement" are to the lock-up agreement by which certain existing Hammerhead Shareholders, including the Riverstone Parties, became bound on the Closing Date pursuant to the Business Combination Agreement and the Plan of Arrangement.

• "Mcf" are to thousand cubic feet.

• "Mcf/d" are to thousand cubic feet per day.

• "MMBOE" are to million barrels of oil equivalent.

• "MMBtu" are to million British Thermal Units.

• "Nasdaq" are to the Nasdaq Capital Market.

• "Natural" are to conventional natural gas as defined in NI 51-101.

• "NewCo" are to Hammerhead Energy Inc., an Alberta corporation and wholly owned subsidiary of Hammerhead prior to the SPAC Amalgamation Effective Time, which amalgamated with DCRD to form the Company.

• "NI 51-101" are to National Instrument 51-101 - Standards of Disclosure for Oil and Gas Activities.

xii

• "Non-Canadian Holder" are to a Holder who, at all relevant times, for purposes of the ITA (i) is not, and is not deemed to be, resident in Canada, (ii) does not, and is not deemed to, use or hold the Company's Securities in, or in the course of carrying on, a business carried on in Canada, (iii) does not have a "permanent establishment" or "fixed base" in Canada, (iv) is not a person who carries on an insurance business in Canada and elsewhere, and (v) is not an "authorized foreign bank," as defined in the ITA.

• "Note" are to that certain promissory note evidencing the loan from DCRD Sponsor to DCRD for an aggregate amount of $300,000 to cover organizational expenses and expenses related to the DCRD IPO.

• "Options" are to options to acquire Common Shares.

• "Ordinary Resolution" are to a resolution by a simple majority of the DCRD Shareholders as, being entitled to do so, vote in person or, where proxies are allowed, by proxy at the DCRD Shareholders' Meeting.

• "PCAOB" are to the Public Company Accounting Oversight Board.

• "Peters" are to Peters & Co. Limited.

• "Plan of Arrangement" are to the Plan of Arrangement, as amended in accordance with the Business Combination Agreement and the Plan of Arrangement.

• "Proposed Amendments" are to all specific proposals to amend the ITA that have been publicly announced by or on behalf of the Minister of Finance (Canada) prior to the date hereof.

• "Private Placement Warrants" are to the Warrants into which the DCRD Private Placement Warrants were exchanged pursuant to the SPAC Amalgamation.

• "Public Warrant Holders" are to the holders of the Public Warrants.

• "Public Warrants" are to the Warrants into which the DCRD Public Warrants were exchanged pursuant to the SPAC Amalgamation.

• "RDSP" are to a registered disability savings plan.

• "Registration Statement" are to the registration statement on Form F-1 filed with the SEC by the Company, as it may be amended or supplemented from time to time, of which this prospectus forms a part.

• "RESP" are to registered education savings plan.

• "Riverstone" are to Riverstone Holdings LLC, a Delaware limited liability company, and its affiliates.

• "Riverstone Fund V" are to Riverstone Global Energy and Power Fund V (Cayman), L.P., a Cayman Islands exempted limited partnership.

• "Riverstone Fund V Entities" are to Riverstone Fund V and its direct or indirect wholly-owned subsidiaries.

• "Riverstone Investment" are to Riverstone Investment Group LLC, a Delaware limited liability company, and its affiliates.

• "Riverstone Parties" are to affiliates of Riverstone, which are shareholders of Hammerhead and affiliates of DCRD Sponsor.

• "RRIF" are to a registered retirement income fund.

• "RRSP" are to a registered retirement savings plan.

• "Sarbanes Oxley Act" are to the U.S. Sarbanes Oxley Act of 2002.

• "SEC" are to the U.S. Securities and Exchange Commission.

xiii

• "Securities" are to the Common Shares and the Warrants, collectively.

• "Securities Act" are to the U.S. Securities Act of 1933, as amended.

• "Shareholders" are to the shareholders of the Company.

• "SPAC Amalgamation" are to DCRD's amalgamation with NewCo.

• "SPAC Amalgamation Effective Time" are to the effective time of the SPAC Amalgamation.

• "Sponsor Side Letter" are to that certain letter agreement dated as of September 25, 2022, by and among DCRD, DCRD Sponsor, Riverstone Fund V and certain Riverstone Fund V Entities.

• "Sponsor Support Agreement" are to that certain letter agreement dated as of September 25, 2022, by and among DCRD Sponsor, Riverstone Fund V, DCRD, NewCo and Hammerhead.

• "Taxable Capital Gain" are to one-half of any capital gain realized by a Canadian Holder in a taxation year that must be included in the Canadian Holder's income for the year.

• "TCP Conditions" are to the conditions stating that (i) (a) the Non-Canadian Holder, (b) persons with whom the Non-Canadian Holder did not deal at arm's length, (c) partnerships in which the Non-Canadian Holder or a person described in (b) holds a membership interest directly or indirectly through one or more partnerships, or (d) any combination of the persons and partnerships described in (a) through (c), owned 25% or more of the issued shares of any class or series of the capital stock of the Company, and (ii) more than 50% of the fair market value of the Common Shares was derived directly or indirectly from one or any combination of real or immovable property situated in Canada, "Canadian resource properties" (as defined in the ITA), "timber resource properties" (as defined in the ITA), and options in respect of, or interests in or for civil law rights in, any such properties whether or not the properties exist.

• "TFSA" are to a tax-free savings account.

• "Trust Account" are to the trust account that held proceeds (including interest not previously released to DCRD to fund regulatory withdrawals or to pay its taxes, and approximately $11,068,750 previously reserved for deferred underwriting fees, which were used to pay additional transaction expenses in connection with the Business Combination) from the DCRD IPO and the concurrent private placement of the DCRD Private Placement Warrants, established by DCRD for the benefit of the DCRD Public Shareholders maintained at J.P. Morgan Chase Bank, N.A.

• "TSX" are to the Toronto Stock Exchange.

• "U.S. Holder" are to a beneficial owner of the Company's Securities that, for U.S. federal income tax purposes, is an individual who is a citizen or resident of the United States; a corporation (or other entity treated as a corporation for U.S. federal income tax purposes) created or organized in or under the laws of the United States, any state thereof, or the District of Columbia; an estate the income of which is subject to U.S. federal income tax regardless of its source; or a trust (i) the administration of which is subject to the primary supervision of a U.S. court and which has one or more "United States persons" (within the meaning of Section 7701(a)(30) of the Code) who have the authority to control all substantial decisions of the trust or (ii) that has made a valid election under applicable Treasury Regulations to be treated as a United States person.

• "Units" are to the units of the Company representing one Common Share and one-half of one Warrant.

• "Warrant Agreement" are to the Warrant Agreement, dated August 10, 2021, between DCRD and Continental Stock Transfer & Trust Company, as warrant agent, which was amended and restated in connection with the SPAC Amalgamation.

• "Warrant Holders" are to the holders of the Warrants.

• "Warrant" is to a warrant to acquire one Common Share.

xiv

• "WTI" are to West Texas Intermediate.

• "2015 Credit Agreement" are to the credit facility agreement entered into on December 18, 2015 between Hammerhead and a syndicate of banks, which replaced Hammerhead's then-existing non-syndicated credit facility.

• "2017 Credit Agreement" are to the 2015 Credit Agreement as amended and restated on July 10, 2017.

• "2020 Credit Agreement" are to the 2017 Credit Agreement as amended and restated on June 19, 2020.

• "2021 Credit Agreement" are to the 2020 Credit Agreement as amended and restated on May 31, 2021.

• "2022 Credit Agreement" are to the 2021 Credit Agreement as amended and restated on June 9, 2022.

xv

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements contained in this prospectus constitute forward-looking statements within the meaning of the federal securities laws. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. Forward-looking statements reflect the Company's current views with respect to, among other things, its capital resources, performance and results of operations. Likewise, all of the Company's statements regarding anticipated growth in operations, anticipated market conditions, demographics and results of operations are forward-looking statements. In some cases, you can identify these forward-looking statements by the use of terminology such as "outlook," "believes," "expects," "potential," "continues," "may," "will," "should," "could," "seeks," "approximately," "predicts," "intends," "plans," "estimates," "anticipates" or the negative version of these words or other comparable words or phrases.

The forward-looking statements contained in this prospectus reflect the Company's current views about future events and are subject to numerous known and unknown risks, uncertainties, assumptions and changes in circumstances that may cause actual results to differ significantly from those expressed in any forward-looking statement. In particular, this prospectus contains forward-looking statements pertaining to the consolidated capitalization of the Company; the anticipated timing of ratification of the Company's incentive plans; the number of Common Shares to be issued pursuant to the Legacy Share Option Plan (as defined below) and the Legacy Share Award Plan (as defined below); the executive compensation of the Company's executive officers; expectations relating to resource potential and the potential to add reserves; expectations relating to pipeline and facility expansions and growth of production and the anticipated timing thereof; and expectations relating to the Company's carbon capture and storage program (the "CCS Program") and the timing of same.

The Company does not guarantee that the events described will happen as described (or that they will happen at all). The following factors, among others, could cause actual results and future events to differ materially from those set forth or contemplated in the forward-looking statements:

• general economic uncertainty;

• the effects of the COVID-19 pandemic;

• the volatility of currency exchange rates;

• the Company's ability to obtain and maintain financing arrangements on attractive terms;

• the Company's ability to manage growth;

• the Company's ability to maintain the listing of the Common Shares or the Warrants on the Nasdaq, the TSX or any other national exchange;

• risks related to the rollout of the Company's business and expansion strategy;

• the effects of competition on the Company's future business;

• potential disruption in the Company's employee retention as a result of the Business Combination;

• the impact of and changes in governmental regulations or the enforcement thereof, tax laws and rates, accounting guidance and similar matters in regions in which the Company operates or will operate in the future;

• the Company's ability to reduce its greenhouse gas emissions with a target of net zero by 2030 and the anticipated timing thereof;

• the Company's ability to be free cash flow positive by 2024 and the anticipated timing and benefits therefrom;

xvi

• potential litigation, governmental or regulatory proceedings, investigations or inquiries involving the Company, including in relation to the Business Combination;

• the effects of actions by, or disputes among OPEC+ members with respect to production levels or other matters related to the price of oil, market conditions, factors affecting the level of activity in the oil and gas industry, and supply and demand of jackup rigs;

• factors affecting the duration of contracts and the actual amount of downtime;

• factors that reduce applicable dayrates, operating hazards and delays;

• international, national or local economic, social or political conditions that could adversely affect the Company and its business;

• the effectiveness of the Company's internal controls and its corporate policies and procedures;

• changes in personnel and availability of qualified personnel;

• environmental uncertainties and risks related to adverse weather conditions and natural disasters;

• potential write-downs, write-offs, restructuring and impairment or other charges required to be taken by the Company subsequent to the Business Combination;

• the limited experience of certain members of the Company's management team in operating a public company in the United States;

• the volatility of the market price and liquidity of the Common Shares and the Warrants;

• risks relating to any unforeseen liabilities of the Company;

• the tax treatment of the Common Shares in the United States and Canada;

• declines in oil or natural gas prices;

• inaccuracies of reserve estimates or assumptions underlying them;

• revisions to reserve estimates as a result of changes in commodity prices;

• international, federal, provincial and local initiatives relating to the regulation of hydraulic fracturing;

• failure of assets to yield oil or gas in commercially viable quantities;

• the ability to expand pipeline and facility capacity and grow production;

• failure of the CCS Program;

• the costs associated with the CCS Program;

• uninsured or underinsured losses resulting from oil and gas operations;

• inability to access oil and gas markets due to market conditions or operational impediments;

• the impact and costs of compliance with laws and regulations governing oil and gas operations;

• the ability to replace oil and natural gas reserves;

• the approval of construction and sequestration activity from the Alberta Department of Energy;

• the results of the testing of an acid injection well;

xvii

• failure to obtain lender consent, when necessary;

• geological, technical, drilling and processing problems and other difficulties in producing reserves;

• failure to realize anticipated benefits of acquisitions and the development of reserves;

• failure to obtain industry partner and other third-party consents and approvals, when required; and

• the need to obtain required approvals from regulatory authorities.

Additionally, statements relating to "reserves" are deemed to be forward-looking statements, as they involve the implied assessment, based on certain estimates and assumptions, that the reserves described exist in the quantities predicted or estimated and can be profitably produced in the future. Forward-looking statements are inherently uncertain. Estimates such as expected revenue, production, operating expenses, transportation expenses, EBITDA, general and administrative expenses, cash interest and financing expense, cash taxes, capital expenditures, free cash flow, net debt, reserves and other measures are preliminary in nature. There can be no assurance that the forward-looking statements will prove to be accurate and reliance should not be placed on these estimates in making your investment decision with respect to our Securities.

The forward-looking statements contained herein are subject to risks, uncertainties and other factors, which could cause actual results to differ materially from future results expressed, projected or implied by the forward-looking statements. For a further discussion of the risks and other factors that could cause the Company's future results, performance or transactions to differ significantly from those expressed in any forward-looking statements, please see the section entitled "Risk Factors." There may be additional risks that the Company does not presently know or that the Company currently believes are immaterial, that could also cause actual results to differ from those contained in the forward-looking statements. Should one or more of these risks or uncertainties materialize, or should any of the assumptions made in making these forward-looking statements prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. While such forward-looking statements reflect the Company's good faith beliefs, they are not guarantees of future performance. The Company disclaims any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, new information, data or methods, future events or other changes after the date of this prospectus, except as required by applicable law. You should not place undue reliance on any forward-looking statements, which are based only on information currently available to the Company.

xviii

SUMMARY OF PROSPECTUS

This summary highlights selected information contained in this prospectus and does not contain all of the information that is important to you. This summary is qualified in its entirety by the more detailed information included in this prospectus. Before making your investment decision with respect to our Securities, you should read carefully this entire prospectus, including the accompanying financial statements of the Company, DCRD and Hammerhead. Please see the section entitled "Where You Can Find More Information" elsewhere in this prospectus.

Unless otherwise indicated or the context otherwise requires, references in this prospectus to "Company," "we," "our," "us" and other similar terms refer to Hammerhead Energy Inc. and its consolidated subsidiaries.

General

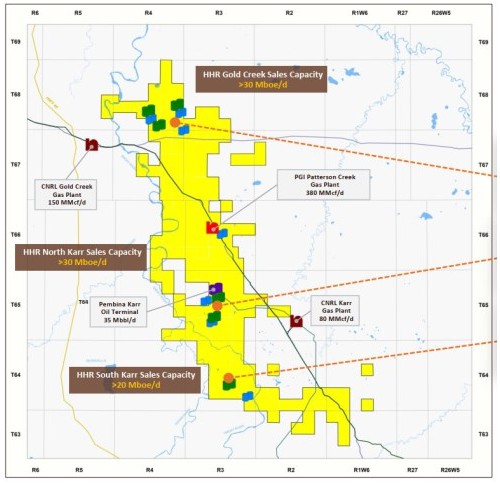

The Company is an oil and natural gas exploration, development and production company. The Company's reserves, producing properties and exploration prospects are located in the Province of Alberta in the Deep Basin of West Central Alberta where it is developing multi-zone, liquids-rich oil and gas plays.

Hammerhead was incorporated pursuant to the provisions of the ABCA on November 27, 2009 under the name 1504140 Alberta Ltd. Hammerhead changed its name to Canadian International Oil Corp. ("CIOC") on April 20, 2010. On October 1, 2017, CIOC amalgamated with its wholly owned subsidiary Canadian International Oil Operating Corp. and changed its name to "Hammerhead Resources Inc." On December 15, 2017, the Company dissolved its foreign subsidiary "Canadian International Oil (USA) Corp." On December 31, 2017, the Company dissolved its remaining foreign subsidiaries, "Canadian International Oil (Barbados) Corp." and "Canadian International Oil (Overseas) Corp." On March 11, 2019, the Company incorporated a new wholly owned subsidiary, "Prairie Lights Power GP Inc.," and formed an associated limited partnership, "Prairie Lights Power Limited Partnership," in order to initiate a power related project.

On September 25, 2022, DCRD, Hammerhead, NewCo, and AmalCo, entered into the Business Combination Agreement, pursuant to which, among other things, (i) DCRD transferred by way of continuation from the Cayman Islands to the Province of Alberta, Canada in accordance with the DCRD Articles and the Companies Act and domesticated as an Alberta corporation in accordance with the ABCA, (ii) DCRD amalgamated with NewCo, with NewCo surviving as the Company in accordance with the terms of the Plan of Arrangement and (iii) Hammerhead amalgamated with AmalCo, with the Amalgamated Company becoming a wholly owned subsidiary of the Company in accordance with the terms of the Plan of Arrangement.

Pursuant to the SPAC Amalgamation, (a) each DCRD Class A Ordinary Share issued and outstanding (which, pursuant to the Domestication, was exchanged for one Class A common share of DCRD) immediately prior to the effective time of the SPAC Amalgamation (the "SPAC Amalgamation Effective Time") was exchanged, on a one-for-one basis, for a Common Share; (b) each DCRD Class B Ordinary Share issued and outstanding (which, pursuant to the Domestication, was exchanged for one Class B common share of DCRD) immediately prior to the SPAC Amalgamation Effective Time was exchanged, on a one-for-one basis, for a Class B common share in the authorized share capital of the Company (a "Class B Common Share"); (c) each common share of NewCo outstanding was exchanged for one Common Share; (d) each DCRD Warrant issued and outstanding immediately prior to the SPAC Amalgamation Effective Time was exchanged for a Warrant; (e) each DCRD Unit issued and outstanding immediately prior to the SPAC Amalgamation Effective Time was exchanged for one unit of the Company representing one Common Share and one-half of one Warrant; and (f) the Common Share held by Hammerhead was purchased for cancellation for cash equal to the subscription price for such common share of NewCo.

On the Closing Date, prior to the Company Amalgamation, among other things: (a) the Hammerhead Articles were amended to authorize a new class of common shares in the capital of Hammerhead having the rights, privileges and restrictions set forth in the Plan of Arrangement (the "Hammerhead Class B Common Shares") and concurrently, all of the issued and outstanding Hammerhead Common Shares were re-designated as Class A Common Shares in the capital of Hammerhead (the "Hammerhead Class A Common Shares", and, together with the Hammerhead Class B Common Shares, the "Hammerhead Common Shares"); (b) each Hammerhead Class A Common Share held by Employee Borrowers was exchanged for one Hammerhead Class B Common Share; (c) each then issued and outstanding Class B Common Share was exchanged for one Common Share pursuant to the articles of the Company adopted at the Company Amalgamation Effective Time (the "Company Articles"), in accordance with the Plan of Arrangement; and (d) each warrant to purchase Hammerhead Common Shares (each, a "Hammerhead Warrant") was either exchanged for Hammerhead Class A Common Shares or cash, in each case, in accordance with the Plan of Arrangement.

On the Closing Date, pursuant to the Company Amalgamation, among other things, (a) each then issued and outstanding Hammerhead Preferred Share was exchanged for a number of Common Shares; (b) each then issued and outstanding Hammerhead Option and Hammerhead RSU was exchanged for an option to acquire a number of Common Shares; and (c) each then issued and outstanding Hammerhead Class A Common Share and Hammerhead Class B Common Share (together with the Hammerhead Preferred Shares, the "Hammerhead Shares") was exchanged for a number of Common Shares, in each case, in accordance with the Plan of Arrangement.

1

The Common Shares and Warrants are listed on the Nasdaq under the ticker symbols "HHRS" and "HHRSW," respectively, and on the TSX under the ticker symbols "HHRS" and "HHRS.WT," respectively.

The Company is controlled by the Riverstone Parties. The Company's principal place of business is located at Eighth Avenue Place, East Tower, Suite 2700, 525-8th Avenue SW, Calgary, Alberta, T2P 1G1 and its telephone number is (403) 930-0560. The mailing address of the Company's registered office is c/o Burnet, Duckworth & Palmer LLP, Suite 2400, 525-8th Avenue SW, Calgary, Alberta, T2P 1G1.

Controlled Company Exemption

The Riverstone Parties control a majority of the voting power of the outstanding Common Shares. As a result, the Company is a "controlled company" within the meaning of Nasdaq rules, and the Company may qualify for and rely on exemptions from certain corporate governance requirements. Under Nasdaq corporate governance standards, a company of which more than 50% of the voting power for the election of directors is held by an individual, a group or another company is a "controlled company" and may elect not to comply with certain corporate governance requirements, including the requirements to:

• have a board that includes a majority of "independent directors," as defined under Nasdaq rules;

• have a compensation committee of the board that is comprised entirely of independent directors with a written charter addressing the committee's purpose and responsibilities; and

• have independent director oversight of director nominations.

The Company relies on the exemption from having a board that includes a majority of "independent directors" as defined under Nasdaq rules. The Company may elect to rely on additional exemptions and it will be entitled to do so for as long as the Company is considered a "controlled company," and to the extent it relies on one or more of these exemptions, holders of the Common Shares will not have the same protections afforded to shareholders of companies that are subject to all of the Nasdaq corporate governance requirements.

Use of Proceeds

The Selling Securityholders may offer, sell or distribute all or a portion of the securities registered hereby publicly or through private transactions at prevailing market prices or at negotiated prices. We will not receive any of the proceeds from such sales of the Common Shares or Warrants, except with respect to amounts we may receive upon the exercise of the Warrants. Whether Warrant Holders will exercise their Warrants, and therefore the amount of cash proceeds we would receive upon exercise, is dependent upon the trading price of the Common Shares, the last reported sales price for which was $8.15 per share on April 28, 2023 on the Nasdaq. Each Warrant is exercisable for one Common Share at an exercise price of $11.50. Therefore, if and when the trading price of the Common Shares is less than $11.50, we expect that Warrant Holders would not exercise their Warrants. We could receive up to an aggregate of approximately $328.3 million if all of the Warrants are exercised for cash, but we would only receive such proceeds if and when the Warrant Holders exercise the Warrants. The Warrants may not be or remain in the money during the period they are exercisable and prior to their expiration, and the Warrants may not be exercised prior to their maturity on February 23, 2028, even if they are in the money, and as such, the Warrants may expire worthless and we may receive minimal proceeds, if any, from the exercise of Warrants. To the extent that any of the Warrants are exercised on a "cashless basis," we will not receive any proceeds upon such exercise. As a result, we do not expect to rely on the cash exercise of Warrants to fund our operations. Instead, we intend to rely on other sources of cash discussed elsewhere in this prospectus to continue to fund our operations. See "Risk Factors-Risks Related to Ownership of the Company's Securities-There is no guarantee that the exercise price of our Warrants will ever be less than the trading price of our Common Shares on the Nasdaq, and they may expire worthless. In addition, we may reduce the exercise price of the Warrants in accordance with the provisions of the Warrant Agreement, and a reduction in exercise price of the Warrants would decrease the maximum amount of cash proceeds we could receive upon the exercise in full of the Warrants for cash" and "Management's Discussion and Analysis of Financial Condition and Results of Operations-Capital Resource and Liquidity."

2

Risk Factor Summary

Investing in our Securities involves risks. You should carefully consider the risks described in "Risk Factors" before making a decision to invest in our Common Shares. Some of the risks related to the Company's business and industry are summarized below.

• The Company's future performance may be affected by the financial, operational, environmental and safety risks associated with the exploration, development and production of oil and natural gas.

• The prices of crude oil, NGLs and natural gas are volatile, outside of the Company's control and affect its revenues, profitability, cash flows and future rate of growth.

• Adverse general economic, business and industry conditions could have a material adverse effect on the Company's results of operations and cash flow.

• Various factors may adversely impact the marketability of oil and natural gas, affecting net production revenue, production volumes and development and exploration activities.

• The anticipated benefits of acquisitions may not be achieved and the Company may dispose of non-core assets for less than their carrying value on the financial statements as a result of weak market conditions.

• The COVID-19 pandemic continues to cause disruptions in economic activity in Canada and internationally and impact demand for oil, natural gas liquids and natural gas.

• The success of the Company's operations may be negatively impacted by factors outside of its control resulting in operational delays and cost overruns.

• Lack of capacity and/or regulatory constraints on gathering and processing facilities, pipeline systems and railway lines may have a negative impact on the Company's ability to produce and sell its oil and natural gas.

• The Company competes with other oil and gas companies, some of which have greater financial and operational resources.

• Changes to the demand for oil and natural gas products and the rise of petroleum alternatives may negatively affect the Company's financial condition, results of operations and cash flow.

• Modification to current, or implementation of additional, regulations may reduce the demand for oil and natural gas and/or increase the Company's costs and/or delay planned operations.

• The Company relies on surface and groundwater licenses, which, if rescinded or the conditions of which are amended, could disrupt its business and have a material adverse effect on its business, financial condition, results of operations and prospects.

• Breaches of the Company's cyber-security and loss of, or unauthorized access to, data may adversely impact the Company's operations and financial position.

• The Company is subject to laws, rules, regulations and policies regarding data privacy and security. Many of these laws and regulations are subject to change and reinterpretation, and could result in claims, changes to its business practices, monetary penalties, increased cost of operations or other harm to its business.

• Changes to applicable tax laws and regulations or exposure to additional tax liabilities could adversely affect the Company's business and future profitability.

• In the event that the Company expands its operations, including to jurisdictions in which the tax laws may not be favorable, the Company's effective tax rate may fluctuate, tax obligations may become significantly more complex and subject to greater risk of examination by taxing authorities or the Company may be subject to future changes in tax laws, in each case, the impacts of which could adversely affect the Company's after-tax profitability and financial results.

• The Company might be a "passive foreign investment company," or "PFIC", which could result in adverse U.S. federal income tax consequences to U.S. Holders.

• The Company will incur significant increased expenses and administrative burdens as a public company, which could have an adverse effect on its business, financial condition and results of operations.

• The Company may identify internal control weaknesses in the future or otherwise fail to develop and maintain an effective system of internal controls, which may result in material misstatements of financial statements and/or the Company's inability to meet periodic reporting obligations.

• The Company may be adversely affected by foreign currency and interest rate fluctuations.

3

• Failure to comply with anticorruption, economic sanctions, and anti-money laundering laws-including the U.S. Foreign Corrupt Practices Act of 1977, as amended, the UK Bribery Act 2010, the Canadian Corruption of Foreign Public Officials Act, Criminal Code, Special Economic Measures Act, Justice for Victims of Corrupt Foreign Officials Act, United Nations Act and Freezing of Corrupt Foreign Officials Act, and similar laws associated with activities outside of the United States or Canada-could subject the Company to penalties and other adverse consequences.

• Failure to comply with laws relating to labor and employment could subject the Company to penalties and other adverse consequences.

• As a "foreign private issuer" under the rules and regulations of the SEC, the Company is permitted to, and may, file less or different information with the SEC than a company incorporated in the United States or otherwise not filing as a "foreign private issuer," and may follow certain home country corporate governance practices in lieu of certain Nasdaq requirements applicable to U.S. issuers.

• Concentration of ownership among the Company's existing executive officers, directors and their affiliates may prevent new investors from influencing significant corporate decisions.

• A significant portion of the Company's total outstanding securities may be sold into the market in the near future. This could cause the market price of the Common Shares and the Warrants to drop significantly, even if the Company's business is performing well.

• The success of the Company depends on its business operations, which exposes investors to a concentration of risk in the limited sectors in which the Company's business is focused.

Recent Developments

On April 27, 2023, the Company commenced a substantial issuer bid (the “Offer”) to purchase for cancellation up to 20,000,000 of its Warrants at a purchase price of US$1.00 per Warrant. The Offer will remain open for acceptance until 5:00 p.m. (Eastern time) on June 2, 2023, unless withdrawn, extended or varied by the Company. The Offer will be for up to 20,000,000 of Hammerhead's Warrants, which is approximately 70% of the total number of Hammerhead's issued and outstanding Warrants. If the aggregate purchase price for Warrants validly tendered exceeds US$20,000,000 then Hammerhead will purchase the tendered Warrants on a pro rata basis according to the number of Warrants tendered, except that "odd lot" holders (being holders of Warrants (“Warrantholders”) who own fewer than 100 Warrants) will not be subject to proration. The Offer is not conditional on receipt of financing or on any minimum number of Warrants being tendered to the Offer, but is subject to other conditions, which are described in the offer to purchase. The Company expects to fund the Offer with available cash on hand or by drawing on existing Credit Facilities.

On April 27, 2023, the formal offer to purchase, issuer bid circular, letter of transmittal, notice of guaranteed delivery and other related documents (collectively, the “Offer Documents”) containing the terms and conditions of the Offer, instructions for tendering Warrants, and the factors considered by the Company and its Board in determining to approve the Offer were mailed to registered Warrantholders and filed with the applicable securities regulators in Canada. The Offer Documents are available free of charge on SEDAR at www.sedar.com. In addition, the Company has filed with the SEC a tender offer statement on Schedule TO, including the formal offer to purchase, a letter of transmittal for registered Warrantholders and related documents, which is available on EDGAR at www.sec.gov.

| THE OFFERING | |

| Securities offered by the Selling Securityholders | We are registering the resale by Selling Securityholders named in this prospectus, or their permitted transferees, of an aggregate of 99,176,973 Common Shares and Warrants to purchase 12,737,500 Common Shares. In addition, we are registering up to (i) 15,812,491 Common Shares that are issuable upon the exercise of the Public Warrants, which were previously registered and (ii) 12,737,500 Common Shares underlying Private Placement Warrants. |

| Terms of the offering | The Selling Securityholders will determine when and how they will dispose of the Common Shares and Warrants registered under this prospectus for resale. |

| Shares outstanding prior to the offering | As of April 10, 2023, we had 90,948,767 Common Shares issued and outstanding. The number of Common Shares outstanding prior to this offering excludes (i) up to 28,549,991 Common Shares issuable upon the exercise of Warrants with an exercise price of $11.50 per share and (ii) up to 3,152,493 Common Shares issuable upon the exercise of Legacy Options and Legacy RSUs. |

4

RISK FACTORS

You should carefully review and consider the following risk factors and the other information contained in this prospectus, including the financial statements and notes to the financial statements included herein before making a decision to invest in our Securities. The occurrence of one or more of the events or circumstances described in these risk factors, alone or in combination with other events or circumstances, may have a material adverse effect on the business, cash flows, financial condition and results of operations of the Company. This could cause the trading price of the Common Shares or the Warrants to decline, perhaps significantly, and you therefore may lose all or part of your investment. You should carefully consider the following risk factors in conjunction with the other information included in this prospectus, including matters addressed in the section entitled "Cautionary Note Regarding Forward-Looking Statements," "Management's Discussion and Analysis of Financial Condition and Results of Operations," the financial statements of Hammerhead, the financial statements of DCRD and notes to the financial statements included herein. The risks discussed below are not exhaustive and are based on certain assumptions made by the Company which later may prove to be incorrect or incomplete. Investors are encouraged to perform their own investigation with respect to the business, financial condition and prospects of the Company. The Company may face additional risks and uncertainties that are not presently known to it, or that are currently deemed immaterial, which may also impair its business or financial condition.

Risks Related to the Company's Business and the E&P Industry

The Company's future performance may be affected by the financial, operational, environmental and safety risks associated with the exploration, development and production of oil and natural gas.